The study involved four major activities in estimating the size of the optical transceiver market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources were used to identify and collect relevant information. These include corporate filings such as annual reports, press releases, investor presentations, and financial statements; trade, business, and professional associations; white papers, journals, and articles from recognized authors; certified publications related to optical transceiver; directories; and databases.

Secondary research was conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of key players, the segmentation of the market according to industry trends to the bottommost level, geographic markets, and key developments from the market-oriented perspective. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

In the primary research process, various primary sources, from both supply and demand sides, were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, SMEs, consultants, and related key executives from the major companies and organizations operating in the optical transceiver market.

After the complete market engineering process (which includes market statistics calculations, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical market numbers.

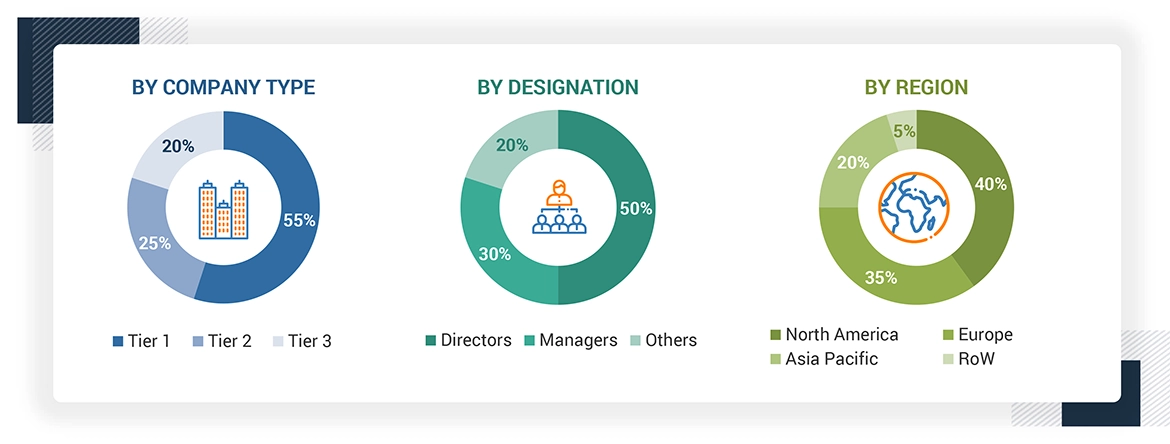

Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews were conducted with demand respondents and 75% with supply respondents. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: “Others” includes sales, marketing, and product managers.

ROW includes the GCC, Rest of Middle East and Africa, and South America

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the optical transceiver market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

H.B.,Jun

Jun, 2019

I'm interesting about the tunable DWDM Optical Transceiver Markets and expectations while 5G wireless network environment. Has this been considered? How would 5G impact the use of optical transiver market?.

Miguel

Oct, 2016

The key players in the optical transceiver market are 1. Finisar Corp. (U.S.), 2. Accelink Technologies Co., Ltd. (China), 3. Lumentum Holdings Inc. (U.S.), 4. Oclaro, Inc. (U.S.), 5. Sumitomo Electric Industries, Ltd. (Japan), 6. Foxconn Electronics Inc. (Taiwan), 7. NeoPhotonics Corp. (U.S.), 8. Fujitsu Optical Components Ltd. (Japan), 9. Reflex Photonics Inc. (Canada), and Source 10. Photonics Inc. (U.S.), among others. Which other players have you considered? How smartphones would impact the overall offerings of this market?.

Elaine

Jan, 2019

We would like to know the market research of the optical transceiver. Have you considered the market by data ranges and data rates?.

Robert

Mar, 2019

Looking for market research on optical transceiver market broken down by speed and industry vertical. Which are the major industries apart from telecom sector? How 5G impact the further adoption of optical transivers?.

Sylvia

Jan, 2019

We are going to develop connector in optical fiber industry. Can you provide us with the market scope of the same? Has connectors been included in the scope of the study?.

Carsten

Mar, 2019

I am interested in a Optical Receiver / GBIC break down ... Esp. problems with GBIC counter fits (or use of non-compliant GBIC modules in service contracts) and the resulting financial damage. Is this a major restraining factor for the Optical Transceiver Market?.