Organic Fruits & Vegetables Market by Crop (Organic Fruits and Organic Vegetables), Form (Fresh, Frozen, Puree, and Powdered), End Use (Fresh Consumption and Food Processing), Distribution Channel, and Region - Global Forecast to 2020

The organic fruits & vegetables market is rapidly growing, mainly due to the increase in food safety concerns and farming practices that contribute to a better and sustainable environment. Organic fruits and vegetables are processed to increase the shelf life and convenience of consumption.

The market for organic fruits & vegetables is segmented on the basis of crop, form, end use, distribution channel, and region. On the basis of crop, the categories included are organic fruits and organic vegetables. Organic vegetables are further subdivided into leafy greens and vegetables. These types of organic fruits and vegetables are further divided into their subtypes. On the basis of form, the market is subdivided into fresh, powdered, frozen, and puree. On the basis of end use, the market is subdivided into fresh consumption and food processing. The major distribution channels considered in the report include supermarkets/hypermarkets, variety stores, and convenience stores. The market has also been segmented on the basis of regions into North America, Europe, Asia-Pacific, Latin America, and Rest of the World (RoW).

To know about the assumptions considered for the study, download the pdf brochure

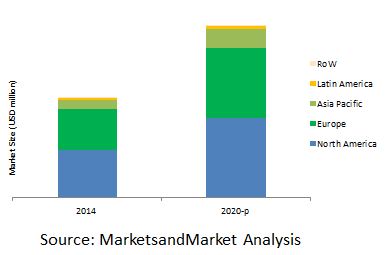

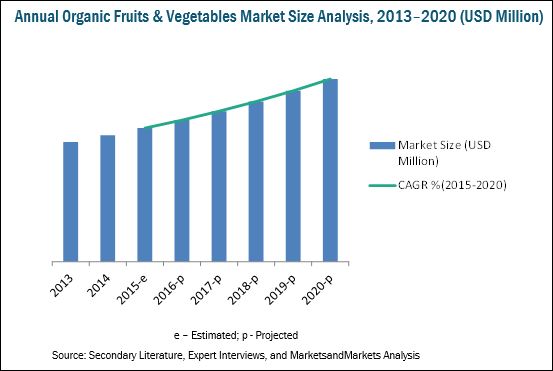

The market for organic fruits & vegetables is projected to reach USD 62.97 billion by 2020. In 2014, the market was dominated by North America, followed by Europe. The Asia-Pacific market is projected to grow at the highest CAGR, with rapid growth in developing countries such as China and India. The growing awareness about food safety and the rising consumption of processed organic fruit and vegetable products in this region are also driving the market.

This report estimates market sizes in terms of value (USD million) and volume (MT). Both top-down and bottom-up approaches were used to arrive at the market sizes and obtain the market forecast. Extensive secondary research was conducted to understand the market insights and trends, which was further validated through primary interviews. The report provides both, qualitative and quantitative analysis of the organic fruits & vegetables market, the competitive landscape, and the preferred development strategies of key players.

The key players were observed to prefer new product launches & developments, acquisitions, agreements, and expansions as strategies to garner a larger share in the market. The report also analyzes the market dynamics and challenges faced by leading players.

Scope of The Report

The research study categorizes the market on the basis of crop, form, end use, distribution channel and regions.

Organic fruits & vegetables market

On the basis of crop, the market was sub-segmented as follows:

- Organic fruits

- Banana

- Apple

- Orange

- Grapes

- Others (which include strawberries, pineapple, and mangoes)

- Organic vegetables

- Leafy greens

- Lettuce

- Spinach

- Chard

- Kale

- Others (which include collard greens, turnip greens, and mustard greens)

- Vegetables

- Broccoli & cauliflower

- Carrots

- Tomato

- Potato

- Cabbage

- Beetroot

- Cucumber

- Others (which include onion and sweet potato)

- Leafy greens

On the basis of form, the market was sub-segmented as follows:

- Fresh

- Frozen

- Puree

- Powdered

- Others (which include canned fruits, diced vegetables, and salads)

On the basis of end use, the market was sub-segmented as follows:

- Fresh consumption

- Retail

- Food Service

- Food processing

On the basis of the distribution channel, the market was sub-segmented as follows:

- Supermarkets/hypermarkets

- Variety stores

- Convenience stores

- Others (which include mom & pop stores and online grocery stores)

On the basis of region, the market was sub-segmented as follows:

- North America

- Europe

- Asia-Pacific

- Latin America

- Rest of the World (RoW)

Organic fruits & vegetables are those which are produced without the use of synthetic fertilizers, pesticides, GMOs, antibiotics, and hormones for growth. The cover crop method of farming and compost manure are used to increase the fertility of the soil. Due to the rising concerns about food safety, consumers are shifting their preference toward organic food, as it has no chemical residue.

The market for organic fruits & vegetables is segmented on the basis of crop, form, end use, distribution channel, and region. Based on crop, the market is divided into organic fruits and organic vegetables. Organic vegetables are divided into leafy greens and vegetables. The types of organic fruits and vegetables are further categorized into their subtypes. On the basis of form, the market is segmented into fresh, powdered, frozen, and puree. Based on end use, the market is subdivided into fresh consumption and food processing. The main types of distribution channels considered are supermarkets/hypermarkets, variety stores, and convenience stores. The market is segmented on the basis of regions into North America, Europe, Asia-Pacific, Latin America, and Rest of the World (RoW); these have been further segmented on the basis of their key countries. This report includes estimations of market sizes in terms of value (USD million) and volume (MT).

The global market size of organic fruits & vegetables is projected to reach about USD 62.97 Billion by 2020, at a CAGR of 9.4% from 2015, with the increasing awareness of organic fruits and vegetables. Furthermore, rising opportunities in emerging markets such as India, China, and Brazil are projected to augment the size of the market for organic fruits & vegetables during the forecast period. In 2014, North America was the largest market. The market in the Asia-Pacific region is projected to grow at the highest CAGR during the forecast period, followed by Europe.

The market for organic fruits & vegetables is highly fragmented and competitive in nature, with a large number of small-scale players operating at regional and domestic levels. The key players in the market adopted new product launches and expansions as their preferred strategies. The key players such as The WhiteWave Foods Company (U.S.), General Mills, Inc., (U.S.), H. J. Heinz Company (U.S.), and CSC Brands L.P. (U.S.) have been profiled in the report.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 24)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.3.2 Currency

1.4 Stakeholders

2 Research Methodology (Page No. - 27)

2.1 Market Share Estimation

2.2 Primary Data

2.3 Secondary Data

2.3.1.1 Key Industry Insights

2.3.1.2 Breakdown of Primaries

2.4 Market Size Estimation

2.5 Market Breakdown & Data Triangulation

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 39)

4.1 Attractive Market Opportunity for Organic Fruit & Vegetable Producers

4.2 Organic Fruits & Vegetables Market, By Region

4.3 Organic Fruits & Vegetables Market in North America

4.4 Organic Fruits & Vegetables Market, By Distribution Channel

4.5 Organic Fruits & Vegetables Market, By Crop

4.6 Organic Fruits & Vegetables Market, By End Use

4.7 Organic Fruits & Vegetables Market Attractiveness

5 Market Overview (Page No. - 45)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Crop

5.2.2 By Form

5.2.3 By End Use

5.2.4 By Distribution Channel

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rise in Demand for Organic Products From Developed Countries Due to Increasing Concerns About Food Safety

5.3.1.2 Government Support for Organic Farming

5.3.1.3 Greater Variety of Organic Foods Available

5.3.2 Restraints

5.3.2.1 Expensive Nature of Food Products

5.3.3 Opportunities

5.3.3.1 Rising Disposable Income Among the Consumers in the Developing Countries

5.3.4 Challenges

5.3.4.1 Non-Certified Organic Food Sector

6 Industry Trends (Page No. - 52)

6.1 Value Chain Analysis

6.2 Porters Five Forces Analysis

6.2.1 Intensity of Competitive Rivalry

6.2.2 Bargaining Power of Suppliers

6.2.3 Bargaining Power of Buyers

6.2.4 Threat of Substitutes

6.2.5 Threat of New Entrants

7 Organic Fruits & Vegetables Market, By Crop (Page No. - 56)

7.1 Introduction

7.2 Organic Fruits

7.2.1 Apple

7.2.2 Orange

7.2.3 Banana

7.2.4 Grapes

7.2.5 Others

7.3 Organic Vegetables

7.3.1 Organic Leafy Vegetables

7.3.1.1 Spinach

7.3.1.2 Kale

7.3.1.3 Organic Chard

7.3.1.4 Organic Lettuce

7.3.1.5 Other Organic Leafy Greens

7.3.2 Vegetables

7.3.2.1 Organic Broccoli & Cauliflower

7.3.2.2 Organic Tomatoes

7.3.2.3 Organic Carrots

7.3.2.4 Organic Beetroots

7.3.2.5 Organic Potatoes

7.3.2.6 Organic Cabbage

7.3.2.7 Organic Cucumbers

7.3.2.8 Other Organic Vegetables

8 Organic Fruits & Vegetables Market, By Form (Page No. - 98)

8.1 Introduction

8.2 Fresh

8.3 Puree

8.4 Powdered

8.5 Frozen

8.6 Others

9 Organic Fruits & Vegetables Market, By End Use (Page No. - 109)

9.1 Introduction

9.2 Fresh Consumption

9.2.1 Retail

9.2.2 Food Service

9.3 Food Processing

10 Organic Vegetable Market, By Distribution Channel (Page No. - 120)

10.1 Introduction

10.2 Supermarkets/Hypermarkets

10.3 Variety Stores

10.4 Convenience Stores

10.5 Other Distribution Channels

11 Organic Fruits & Vegetables Market, By Region (Page No. - 130)

11.1 Introduction

11.2 North America

11.2.1 North America: Organic Fruits & Vegetables Market, By Crop

11.2.1.1 North America: Organic Fruits Market, By Crop

11.2.1.2 North America: Organic Vegetables Market, By Crop

11.2.1.2.1 North America: Organic Leafy Greens Market, By Crop

11.2.1.2.2 North America: Vegetables Market, By Crop

11.2.2 North America: Organic Fruits & Vegetables Market, By Form

11.2.3 North America: Organic Fruits & Vegetables Market, By End Use

11.2.3.1 North America: Fresh Organic Fruits & Vegetables Market, By End Use

11.2.4 North America: Organic Fruits & Vegetables Market, By Distribution Channel

11.2.5 U.S.: Organic Fruits & Vegetables Market, By Form

11.2.6 Canada: Organic Fruits & Vegetables Market, By Form

11.2.7 Mexico: Organic Fruits & Vegetables Market, By Form

11.3 Europe

11.3.1 Europe: Organic Fruits & Vegetables Market, By Crop

11.3.1.1 Europe: Organic Fruits Market, By Crop

11.3.1.2 Europe: Organic Vegetables Market, By Crop

11.3.1.2.1 Europe: Organic Leafy Greens Market, By Crop

11.3.1.2.2 Europe: Organic Vegetables Market, By Crop

11.3.2 Europe: Organic Fruits & Vegetables Market, By Form

11.3.3 Europe: Organic Fruits & Vegetables Market, By End Use

11.3.3.1 Europe: Fresh Consumption of Organic Fruits & Vegetables Market, By End Use

11.3.4 Europe: Organic Fruits & Vegetables Market, By Distribution Channel

11.3.5 Germany: Organic Fruits & Vegetables Market, By Form

11.3.6 U.K.: Organic Fruits & Vegetables Market, By Form

11.3.7 France: Organic Fruits & Vegetables Market, By Form

11.3.8 Rest of Europe: Organic Fruits & Vegetables Market, By Form

11.4 Asia-Pacific

11.4.1 Asia-Pacific: Organic Fruits & Vegetables Market, By Crop

11.4.1.1 Asia-Pacific: Organic Fruits Market, By Crop

11.4.1.2 Asia-Pacific: Organic Vegetables Market, By Crop

11.4.1.2.1 Asia-Pacific: Organic Leafy Greens Market, By Crop

11.4.1.2.2 Asia-Pacific: Organic Vegetables Market, By Crop

11.4.2 Asia-Pacific: Organic Fruits & Vegetables Market, By Form

11.4.3 Asia-Pacific: Organic Fruits & Vegetables Market, By End Use

11.4.3.1 Asia-Pacific: Fresh Consumption of Organic Fruits & Vegetables Market, By End Use

11.4.4 Asia-Pacific: Organic Fruits & Vegetables Market, By Distribution Channel

11.4.5 China

11.4.6 Japan

11.4.7 India

11.4.8 Australia/New Zealand

11.4.9 Rest of Asia-Pacific

11.5 Latin America

11.5.1 Latin America: Organic Fruits & Vegetables Market, By Crop

11.5.1.1 Latin America: Organic Fruits Market, By Crop

11.5.1.2 Latin America: Organic Vegetables Market, By Crop

11.5.1.2.1 Latin America: Organic Leafy Greens Market, By Crop

11.5.1.2.2 Latin America: Vegetables Market, By Crop

11.5.2 Latin America: Organic Fruits & Vegetables Market, By Form

11.5.3 Latin America: Organic Fruits & Vegetables Market, By End Use

11.5.3.1 Latin America: Fresh Consumption of Organic Fruits & Vegetables Market, By End Use

11.5.4 Latin America: Organic Fruits & Vegetables Market, By Distribution Channel

11.5.5 Brazil.: Organic Fruits & Vegetables Market, By Form

11.5.6 Argentina: Organic Vegetables Market, By Form

11.5.7 Rest of Latin America: Organic Fruits & Vegetables Market, By Form

11.6 RoW

11.6.1 RoW: Organic Fruits & Vegetables Market, By Crop

11.6.1.1 RoW: Organic Fruits Market, By Crop

11.6.1.2 RoW: Organic Vegetables Market, By Crop

11.6.1.2.1 RoW: Organic Leafy Greens Market, By Crop

11.6.1.2.2 RoW: Organic Vegetables Market, By Crop

11.6.2 RoW: Organic Fruits & Vegetables Market, By Form

11.6.3 RoW: Organic Fruits & Vegetables Market, By End Use

11.6.3.1 RoW: Consumption of Fresh Organic Fruits & Vegetables Market, By End Use

11.6.4 RoW: Organic Fruits & Vegetables Market, By Distribution Channel

11.6.5 South Africa: Organic Fruits & Vegetables Market, By Form

11.6.6 Others in RoW: Organic Fruits & Vegetables Market, By Form

12 Competitive Landscape (Page No. - 233)

12.1 Overview

12.2 Developments, By Region

12.3 Developments, By Year

12.4 Competitive Situation and Trends

12.4.1 Mergers & Acquisitions

12.4.2 New Product Launch

12.4.3 Expansions & Investments

12.4.4 Agreements & Joint Ventures

13 Company Profiles (Page No. - 238)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 The Whitewave Foods Company

13.3 H.J. Heinz Company

13.4 CSC Brands LP (Campbell Soup Company)

13.5 General Mills, Inc.

13.6 Juices International Pty. Ltd.

13.7 Activz

13.8 Z Natural Foods, LLC.

13.9 Organic Valley Family of Farms

13.10 Iceland Foods Ltd

13.11 Green Organic Vegetable Inc.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 266)

14.1 Discussion Guide

14.2 Company Developments

14.2.1 New Product Launches

14.2.2 Mergers & Acquisitions

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (230 Tables)

Table 1 Organic Fruits & Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 2 Organic Fruits & Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 3 Organic Fruits Market Size, By Crop, 2013-2020 (USD Million)

Table 4 Organic Fruits Market Size, By Crop, 2013-2020 (KT)

Table 5 Organic Fruits Market Size, By Region, 2013-2020 (USD Million)

Table 6 Organic Fruits Market Size, By Region, 2013-2020 (KT)

Table 7 Apple Market Size, By Region, 2013-2020 (USD Million)

Table 8 Apple Market Size, By Region, 2013-2020 (KT)

Table 9 Orange Market Size, By Region, 2013-2020 (USD Million)

Table 10 Orange Market Size, By Region, 2013-2020 (KT)

Table 11 Banana Market Size, By Region, 2013-2020 (USD Million)

Table 12 Banana Market Size, By Region, 2013-2020 (KT)

Table 13 Grapes Market Size, By Region, 2013-2020 (USD Million)

Table 14 Grapes Market Size, By Region, 2013-2020 (KT)

Table 15 Others Market Size, By Region, 2013-2020 (USD Million)

Table 16 Others Market Size, By Region, 2013-2020 (KT)

Table 17 Organic Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 18 Organic Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 19 Organic Vegetables Market Size, By Region, 2013-2020 (USD Million)

Table 20 Organic Vegetables Market Size, By Region, 2013-2020 (KT)

Table 21 Leafy Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 22 Leafy Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 23 Leafy Greens Market Size, By Region, 2013-2020 (USD Million)

Table 24 Leafy Greens Market Size, By Region, 2013-2020 (KT)

Table 25 Spinach Market Size, By Region, 2013-2020 (USD Million)

Table 26 Spinach Market Size, By Region, 2013-2020 (KT)

Table 27 Kale Market Size, By Region, 2013-2020 (USD Million)

Table 28 Kale Market Size, By Region, 2013-2020 (KT)

Table 29 Organic Chard Market Size, By Region, 20132020 (USD Million)

Table 30 Organic Chards Market Size, By Region, 20132020 (KT)

Table 31 Organic Lettuce Market Size, By Region, 20132020 (USD Million)

Table 32 Organic Lettuce Market Size, By Region, 20132020 (KT)

Table 33 Other Organic Leafy Greens Market Size, By Region, 20132020 (USD Million)

Table 34 Other Organic Leafy Vegetables Market Size, By Region, 20132020 (KT)

Table 35 Vegetables Market Size, By Crop, 20132020 (USD Million)

Table 36 Vegetables Market Size, By Crop, 20132020 (KT)

Table 37 Vegetables Market Size, By Region, 20132020 (USD Million)

Table 38 Vegetables Market Size, By Region, 20132020 (KT)

Table 39 Organic Broccoli & Cauliflower Market Size, By Region, 20132020 (USD Million)

Table 40 Organic Broccoli & Cauliflower Market Size, By Region, 20132020 (KT)

Table 41 Organic Tomatoes Market Size, By Region, 20132020 (USD Million)

Table 42 Organic Tomatoes Market Size, By Region, 20132020 (KT)

Table 43 Organic Carrots Market Size, By Region, 20132020 (USD Million)

Table 44 Organic Carrots Market Size, By Region, 20132020 (KT)

Table 45 Organic Beetroots Market Size, By Region, 20132020 (USD Million)

Table 46 Organic Beetroots Market Size, By Region, 20132020 (KT)

Table 47 Organic Potatoes Market Size, By Region, 20132020 (USD Million)

Table 48 Organic Potatoes Market Size, By Region, 20132020 (KT)

Table 49 Organic Cabbage Market Size, By Region, 20132020 (USD Million)

Table 50 Organic Cabbage Market Size, By Region, 20132020 (KT)

Table 51 Organic Cucumbers Market Size, By Region, 20132020 (USD Million)

Table 52 Organic Cucumbers Market Size, By Region, 20132020 (KT)

Table 53 Other Organic Vegetables Market Size, By Region, 20132020 (USD Million)

Table 54 Other Organic Vegetables Market Size, By Region, 20132020 (KT)

Table 55 Organic Fruits & Vegetables Market Size, By Form, 2013-2020 (USD Million)

Table 56 Organic Fruits & Vegetables Market Size, By Form, 2013-2020 (KT)

Table 57 Fresh Organic Fruits & Vegetables Market Size, By Region, 2013-2020 (USD Million)

Table 58 Fresh Organic Fruits & Vegetables Market Size, By Region, 2013-2020 (KT)

Table 59 Organic Fruits & Vegetables Puree Market Size, By Region, 2013-2020 (USD Million)

Table 60 Organic Fruits & Vegetables Puree Market Size, By Region, 2013-2020 (KT)

Table 61 Powdered Organic Fruits & Vegetables Market Size, By Region, 2013-2020 (USD Million)

Table 62 Powdered Organic Fruits & Vegetables Market Size, By Region, 2013-2020 (KT)

Table 63 Frozen Organic Fruits & Vegetables Market Size, By Region, 2013-2020 (USD Million)

Table 64 Frozen Organic Fruits & Vegetables Market Size, By Region, 2013-2020 (KT)

Table 65 Others Market Size, By Region, 2013-2020 (USD Million)

Table 66 Others Market Size, By Region, 2013-2020 (KT)

Table 67 Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (USD Million)

Table 68 Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (KT)

Table 69 Fresh Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (USD Million)

Table 70 Fresh Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (KT)

Table 71 Fresh Organic Fruits & Vegetables Market Size, By Region, 2013-2020 (USD Million)

Table 72 Fresh Organic Fruits & Vegetables Market Size, By Region, 2013-2020 (KT)

Table 73 Retail Organic Fruits & Vegetables Market Size, By Region, 2013-2020 (USD Million)

Table 74 Retail Organic Fruits & Vegetables Market Size, By Region, 2013-2020 (KT)

Table 75 Organic Fruits & Vegetables in Food Service Market Size, By Region, 2013-2020 (USD Million)

Table 76 Organic Fruits & Vegetables in Food Service Market Size, By Region, 2013-2020 (KT)

Table 77 Organic Fruits & Vegetables in Food Processing Market Size, By Region, 2013-2020 (USD Million)

Table 78 Organic Fruits & Vegetables in Food Processing Market Size, By Region, 2013-2020 (KT)

Table 79 Organic Vegetables Market Size, By Distribution Channel, 20132020 (USD Million)

Table 80 Organic Vegetables Market Size, By Distribution Channel, 20132020 (KT)

Table 81 Supermarket/Hypermarket Market Size, By Region, 20132020 (USD Million)

Table 82 Supermarkets/Hypermarkets Market Size, By Region, 20132020 (KT)

Table 83 Variety Stores Market Size, By Region, 20132020 (USD Million)

Table 84 Variety Stores Market Size, By Region, 20132020 (KT)

Table 85 Convenience Stores Market Size, By Region, 20132020 (USD Million)

Table 86 Convenience Stores Market Size, By Region, 20132020 (KT)

Table 87 Other Distribution Channels Market Size, By Region, 20132020 (USD Million)

Table 88 Other Distribution Channels Market Size, By Region, 20132020 (KT)

Table 89 Organic Fruits & Vegetables Market Size, By Region, 2013-2020 (USD Million)

Table 90 Organic Fruits & Vegetables Market Size, By Region, 2013-2020 (KT)

Table 91 North America: Organic Fruits & Vegetables Market Size, By Country, 2013-2020 (USD Million)

Table 92 North America: Market Size, By Country, 2013-2020 (KT)

Table 93 North America: Organic Fruits & Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 94 North America: Organic Fruits & Vegetables (Fresh & Processed) Market Size, By Crop, 2013-2020 (KT)

Table 95 North America: Organic Fruits Market Size, By Crop, 2013-2020 (USD Million)

Table 96 North America: Organic Fruits Market Size, By Crop, 2013-2020 (KT)

Table 97 North America: Organic Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 98 North America: Organic Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 99 North America: Organic Leafy Greens Market Size, By Crop, 2013-2020 (USD Million)

Table 100 North America: Organic Leafy Greens Market Size, By Crop, 2013-2020 (KT)

Table 101 North America: Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 102 North America: Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 103 North America: Organic Fruits & Vegetables Market Size, By Form, 2013-2020 (USD Million)

Table 104 North America: Market Size, By Form, 2013-2020 (KT)

Table 105 North America: Market Size, By End Use, 2013-2020 (USD Million)

Table 106 North America: Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (KT)

Table 107 North America: Fresh Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (USD Million)

Table 108 North America: Fresh Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (KT)

Table 109 North America: Organic Fruits & Vegetables Market Size, By Distribution Channel, 2013-2020 (USD Million)

Table 110 North America: Organic Fruits & Vegetables Market Size, By Distribution Channel, 2013-2020 (KT)

Table 111 U.S.: Organic Fruits & Vegetables Market Size, By Form, 2013-2020 (USD Million)

Table 112 U.S.: Organic Fruits & Vegetables Market Size, By Form, 2013-2020 (KT)

Table 113 Canada: Organic Fruits & Vegetables Market, By Form, 2013-2020 (USD Million)

Table 114 Canada: Market, By Form, 2013-2020 (KT)

Table 115 Mexico: Organic Fruits & Vegetables Market, By Form, 2013-2020 (USD Million)

Table 116 Mexico: Market Size, By Form, 2013-2020 (KT)

Table 117 Europe: Organic Fruits & Vegetables Market Size, By Country, 2013-2020 (USD Million)

Table 118 Europe: Market Size, By Country, 2013-2020 (KT)

Table 119 Europe: Market Size, By Crop, 2013-2020 (USD Million)

Table 120 Europe: Market Size, By Crop, 2013-2020 (KT)

Table 121 Europe: Organic Fruits Market Size, By Crop, 2013-2020 (USD Million)

Table 122 Europe: Organic Fruits Market Size, By Crop, 2013-2020 (KT)

Table 123 Europe: Organic Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 124 Europe: Organic Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 125 Europe: Organic Leafy Greens Market Size, By Crop, 2013-2020 (USD Million)

Table 126 Europe: Organic Leafy Greens Market Size, By Crop, 2013-2020 (KT)

Table 127 Europe: Organic Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 128 Europe: Organic Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 129 Europe: Organic Fruits & Vegetables Market, By Form, 2013-2020 (USD Million)

Table 130 Europe: Market, By Form, 2013-2020 (KT)

Table 131 Europe: Market Size, By End Use, 2013-2020 (USD Million)

Table 132 Europe: Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (KT)

Table 133 Europe: Fresh Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (USD Million)

Table 134 Europe: Fresh Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (KT)

Table 135 Europe: Organic Fruits & Vegetables Market Size, By Distribution Channel, 2013-2020 (USD Million)

Table 136 Europe: Market Size, By Distribution Channel, 2013-2020 (KT)

Table 137 Germany: Organic Fruits & Vegetables Market Size, By Form, 2013-2020 (USD Million)

Table 138 Germany: Market Size, By Form, 2013-2020 (KT)

Table 139 U.K.: Organic Fruits & Vegetables Market, By Form, 2013-2020 (USD Million)

Table 140 U.K.: Market, By Form, 2013-2020 (KT)

Table 141 France: Organic Fruits & Vegetables Market, By Form, 2013-2020 (USD Million)

Table 142 France: Market Size, By Form, 2013-2020 (KT)

Table 143 Rest of Europe: Organic Fruits & Vegetables Market, By Form, 2013-2020 (USD Million)

Table 144 Rest of Europe: Market Size, By Form, 2013-2020 (KT)

Table 145 Asia-Pacific: Organic Fruits & Vegetables Market Size, By Country, 20132020 (USD Million)

Table 146 Asia-Pacific: Organic Vegetables Market Size, By Country, 20132020 (KT)

Table 147 Asia-Pacific: Organic Fruits & Vegetables Market Size, By Crop, 20132020 (USD Million)

Table 148 Asia-Pacific: Organic Vegetables (Fresh & Processed) Market Size, By Crop, 20132020 (KT)

Table 149 Asia-Pacific: Organic Fruits Market Size, By Crop, 20132020 (USD Million)

Table 150 Asia-Pacific: Organic Fruits Market Size, By Crop, 20132020 (KT)

Table 151 Asia-Pacific: Organic Vegetables Market Size, By Crop, 20132020 (USD Million)

Table 152 Asia-Pacific: Organic Vegetables Market Size, By Crop, 20132020 (KT)

Table 153 Asia-Pacific: Organic Leafy Greens Market Size, By Crop, 20132020 (USD Million)

Table 154 Asia-Pacific: Organic Leafy Greens Market Size, By Crop, 20132020 (KT)

Table 155 Asia-Pacific: Organic Vegetables Market Size, By Crop, 20132020 (USD Million)

Table 156 Asia-Pacific: Organic Vegetables Market Size, By Crop, 20132020 (KT)

Table 157 Asia-Pacific: Organic Vegetables Market Size, By Form, 20132020 (USD Million)

Table 158 Asia-Pacific: Organic Vegetables Market, By Form, 20132020 (KT)

Table 159 Asia-Pacific: Organic Fruits & Vegetables Market Size, By End Use, 20132020 (USD Million)

Table 160 Asia-Pacific: Market Size, By End Use, 20132020 (KT)

Table 161 Asia-Pacific: Fresh Consumption of Organic Vegetables Market Size, By End Use, 20132020 (USD Million)

Table 162 Asia-Pacific: Organic Vegetables Market Size, By End Use, 20132020 (KT)

Table 163 Asia-Pacific: Organic Vegetables Market Size, By Distribution Channel, 20132020 (USD Million)

Table 164 Asia-Pacific: Organic Fruits & Vegetables Market Size, By Distribution Channel, 20132020 (KT)

Table 165 China: Organic Vegetables Market, By Form, 20132020 (USD Million)

Table 166 China: Organic Vegetables Market, By Form, 20132020 (KT)

Table 167 Japan: Organic Fruits & Vegetables Market, By Form, 20132020 (USD Million)

Table 168 Japan: Market, By Form, 20132020 (KT)

Table 169 China: Organic Vegetables Market, By Form, 20132020 (USD Million)

Table 170 China: Organic Vegetables Market, By Form, 20132020 (KT)

Table 171 Australia/New Zealand: Organic Vegetables Market, By Form, 20132020 (USD Million)

Table 172 Australia/New Zealand: Organic Vegetables Market, By Form, 20132020 (KT)

Table 173 Rest of Asia-Pacific: Organic Vegetables Market, By Form, 20132020 (USD Million)

Table 174 Rest of Asia-Pacific: Organic Vegetables Market, By Form, 20132020 (KT)

Table 175 Latin America: Organic Fruits & Vegetables Market Size, By Country, 2013-2020 (USD Million)

Table 176 Latin America: Market Size, By Country, 2013-2020 (KT)

Table 177 Latin America: Organic Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 178 Latin America: Organic Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 179 Latin America: Organic Fruits Market Size, By Crop, 2013-2020 (USD Million)

Table 180 Latin America: Organic Fruits Market Size, By Crop, 2013-2020 (KT)

Table 181 Latin Ameria: Organic Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 182 Latin America: Organic Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 183 Latin America: Organic Leafy Greens Market Size, By Crop, 2013-2020 (USD Million)

Table 184 Latin America: Organic Leafy Greens Market Size, By Crop, 2013-2020 (KT)

Table 185 Latin America: Organic Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 186 Latin America: Organic Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 187 Latin America: Organic Fruits & Vegetables Market, By Form, 2013-2020 (USD Million)

Table 188 Latin America: Market, By Form, 2013-2020 (KT)

Table 189 Latin America: Market Size, By End Use, 2013-2020 (USD Million)

Table 190 Latin America: Organic Fruits & Vegetables Market Size, By End Use, -2020 (KT)

Table 191 Latin America: Fresh Consumption of Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (USD Million)

Table 192 Latin America: Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (KT)

Table 193 Latin America: Market Size, By Distribution Channel, 2013-2020 (USD Million)

Table 194 Latin America: Organic Fruits & Vegetables Market Size, By Distribution Channel, 2013-2020 (KT)

Table 195 Brazil: Organic Fruits & Vegetables Market Size, By Form, 2013-2020 (USD Million)

Table 196 Brazil: Market Size, By Form, 2013-2020 (KT)

Table 197 Argentina: Organic Fruits & Vegetables Market, By Form, 2013-2020 (USD Million)

Table 198 Argentina: Market, By Form, 2013-2020 (KT)

Table 199 Rest of Latin America: Organic Fruits & Vegetables Market, By Form, 2013-2020 (USD Million)

Table 200 Rest of Latin America: Market Size, By Form, 2013-2020 (KT)

Table 201 RoW: Organic Fruits & Vegetables Market Size, By Country, 2013-2020 (USD Million)

Table 202 RoW: Market Size, By Country, 2013-2020 (KT)

Table 203 RoW: Market Size, By Crop, 2013-2020 (USD Million)

Table 204 RoW: Market Size, By Crop, 2013-2020 (KT)

Table 205 RoW: Organic Fruits Market Size, By Crop, 2013-2020 (USD Million)

Table 206 RoW: Organic Fruits Market Size, By Crop, 2013-2020 (KT)

Table 207 RoW: Organic Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 208 RoW: Organic Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 209 RoW: Organic Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 210 RoW: Organic Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 211 RoW: Organic Vegetables Market Size, By Crop, 2013-2020 (USD Million)

Table 212 RoW: Organic Vegetables Market Size, By Crop, 2013-2020 (KT)

Table 213 RoW: Organic Fruits & Vegetables Market, By Form, 2013-2020 (USD Million)

Table 214 RoW: Market, By Form, 2013-2020 (KT)

Table 215 RoW: Market Size, By End Use, 2013-2020 (USD Million)

Table 216 RoW: Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (KT)

Table 217 RoW: Fresh Consumption of Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (USD Million)

Table 218 RoW: Fresh Consumption of Organic Fruits & Vegetables Market Size, By End Use, 2013-2020 (KT)

Table 219 RoW: Organic Fruits & Vegetables Market Size, By Distribution Channel, 2013-2020 (USD Million)

Table 220 RoW: Market Size, By Distribution Channel, 2013-2020 (KT)

Table 221 South Africa: Organic Fruits & Vegetables Market Size, By Form, 2013-2020 (USD Million)

Table 222 South Africa: Market Size, By Form, 2013-2020 (KT)

Table 223 Others in RoW: Organic Fruits & Vegetables Market, By Form, 2013-2020 (USD Million)

Table 224 Others in RoW: Market, By Form, 2013-2020 (KT)

Table 225 Mergers & Acquisitions, 20102015

Table 226 New Product Launches, 20112015

Table 227 Expansions & Investments, 20102015

Table 228 Agreements and Joint Ventures, 20102015

Table 229 New Product Launches, 20112015

Table 230 Mergers & Acquisitions, 20102015

List of Figures (157 Figures)

Figure 1 Research Design

Figure 2 Key Data From Primary Sources

Figure 3 Key Data From Secondary Sources

Figure 4 Breakdown of Primary Interviews, By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Breakdown & Data Triangulation

Figure 8 Organic Vegetables to Dominate the Organic Fruits and Vegetables Market

Figure 9 Fresh Organic Fruits and Vegetables to Register the Highest CAGR From 2015 to 2020

Figure 10 Consumption of Organic Fruits and Vegetables in Food Processing Led the Market By End Use in 2014

Figure 11 Organic Fruits and Vegetables Market, By Distribution Channel, 2014

Figure 12 North America is Estimated to Be the Largest Market for Organic Vegetables, 20152020 (USD Million)

Figure 13 Organic Fruits & Vegetables Market is Gaining Prominence

Figure 14 Organic Fruits & Vegetables Market is Projected to Witness High Growth During the Forecast Period

Figure 15 U.S. Emerged as the Largest Market for Organic Fruits & Vegetables in North America

Figure 16 Variety Stores and Convenience Stores are Projected to Be the Fastest-Growing Segments During the Forecast Period

Figure 17 Vegetables Dominated the Organic Fruits & Vegetables Market in 2014

Figure 18 Food Processing Dominated the Organic Fruits & Vegetables Market in 2014

Figure 19 Asia-Pacific Organic Fruits & Vegetables Market to Grow at the Highest Rate During the Forecast Period

Figure 20 Organic Fruits & Vegetables Market Segmentation, By Crop

Figure 21 Organic Fruits & Vegetables Market Segmentation, By Form

Figure 22 Organic Fruits & Vegetables Market Segmentation, By End Use

Figure 23 Organic Fruits & Vegetables Market Segmentation, By Distribution Channel

Figure 24 Increased Concern About Food Quality and Food Safety to Drive the Organic Fruits & Vegetables Market

Figure 25 Organic Production and Processing Adds Major Value to the Final Product

Figure 26 Organic Fruits & Vegetables Market: Porters Five Forces Analysis

Figure 27 Organic Fruits & Vegetables Market, By Crop

Figure 28 Organic Vegetables to Hold the Largest Market Share By 2020

Figure 29 Banana to Account for the Largest Market Share By 2020

Figure 30 North America Led the Global Organic Fruits Market in 2014

Figure 31 Apple Market to Witness the Highest Growth in Asia-Pacific

Figure 32 North America Led the Organic Orange Market in 2014

Figure 33 Banana Market to Account for Largest Market Share in North America By 2020

Figure 34 North America Dominated the Organic Grapes Market in 2014

Figure 35 Others Market to Witness Highest Growth in Asia-Pacific

Figure 36 Vegetables Market Held the Largest Market Size in 2014 and Likely to Dominate in the Near Future

Figure 37 North America to Account for the Largest Market Share By 2020

Figure 38 Organic Kale to Witness the Fastest Growth From 2015 to 2020

Figure 39 North America Led the Leafy Greens Market in 2014

Figure 40 Spinach Market to Account for the Largest Share in North America By 2020

Figure 41 North America Was the Market Leader for Organic Kale in 2014

Figure 42 North America is Projected to Be the Largest Market for Organic Chard Between 2015 & 2020

Figure 43 North America is Projected to Be the Largest Market for Organic Lettuce Between 2015 & 2020

Figure 44 Market for Other Organic Leafy Greens Was Dominated By North America in 2014

Figure 45 Broccoli & Cauliflower to Witness the Fastest Growth During 2015 to 2020

Figure 46 North America Estimated to Be the Largest Market for Vegetables By 2020

Figure 47 Europe is Projected to Have the Largest Market for Organic Broccoli & Cauliflower By 2020

Figure 48 Europe Dominated the Market for Organic Tomatoes in 2014

Figure 49 Europe Estimated to Be the Largest Market for Organic Carrots

Figure 50 North America is Projected to Be the Largest Market for Organic Beetroot

Figure 51 North America is Projected to Have the Largest Market Size By 2020

Figure 52 Organic Cabbage Market to Witness Highest Market Size in Europe

Figure 53 Asia-Pacific Estimated to Witness the Highest CAGR From 2015 to 2020

Figure 54 North America Estimated to Be the Largest Market for Others By 2020

Figure 55 Organic Fruits & Vegetables Market, By Form

Figure 56 Puree Segment to Witness the Fastest Growth

Figure 57 Fresh Segment in Europe to Lead the Market By 2020

Figure 58 Fruits & Vegetables Puree in Asia-Pacific to Grow at Highest Rate

Figure 59 North America Expected to Lead the Powdered Organic Vegetables Market

Figure 60 Frozen Organic Fruits & Vegetables in North America to Lead the Market By 2020

Figure 61 North America Expected to Lead the Other Forms of Organic Vegetables Market

Figure 62 Organic Fruits & Vegetables Market, By End Use

Figure 63 Fresh Consumption Segment to See the Faster Growth

Figure 64 Food Service Segment to Grow at Higher Rate

Figure 65 Fresh Consumption Segment in Europe to Lead the Market

Figure 66 Asia-Pacific Market for Organic Fruits & Vegetables in Retail to Grow at Highest Rate Between 2015 & 2020

Figure 67 North America Expected to Lead the Organic Fruits & Vegetables Market in Food Service, 2015 to 2020

Figure 68 Organic Fruits & Vegetables in Food Processing in Asia-Pacific are Expected to Grow at Highest Rate

Figure 69 Organic Vegetables Market, By Distribution Channel

Figure 70 Supermarkets/Hypermarkets to See the Largest Market Share By 2020

Figure 71 Asia-Pacific to Grow at the Highest Rate From 2015

Figure 72 Asia-Pacific is Projected to Lead the Organic Vegetables Market From 2015 to 2020

Figure 73 North America Was the Largest Market for Distribution of Organic Fruits and Vegetables Through Covenience Stores in 2014

Figure 74 Asia-Pacific to Witness the Fastest Growth Between 2015 & 2020

Figure 75 Organic Fruits & Vegetables Market in Asia-Pacific to Witness Significant Growth Due to Increasing Demand From Emerging Economies

Figure 76 Regional Snapshot: Asia-Pacific Driving the Growth in the Organic Fruits & Vegetables Market

Figure 77 North America: Organic Fruits & Vegetables Market Snapshot

Figure 78 The U.S. Expected to Be the Largest Market for Organic Fruits & Vegetables in the Coming Years

Figure 79 Organic Fruits Segment to Witness Fastest Growth in North American Market

Figure 80 Banana to Be the Largest Segment in North American Organic Fruits Market

Figure 81 Leafy Greens to Witness Fastest Growth in North American Organic Vegetables Market

Figure 82 Lettuce to Be the Largest Organic Leafy Greens Segment in North America

Figure 83 Potato to Be the Largest Segment in North American Vegetables Market, 2015-2020

Figure 84 Frozen Organic Fruits & Vegetables Market to Remain the Largest By 2020

Figure 85 Organic Fruits & Vegetables in Food Processing Market to Remain the Larger Segment By 2020

Figure 86 Retail Segment in Fresh Organic Fruits & Vegetables Market to Remain the Larger By 2020

Figure 87 Supermarkets/Hypermarkets Segment in Organic Fruits & Vegetables Market to Remain the Largest By 2020

Figure 88 Frozen Fruits & Vegetables Lead the U.S. Organic Fruits & Vegetables Market, By Form

Figure 89 Fresh Vegetables Lead the Organic Vegetables Market, By Form, in Canada

Figure 90 Fresh Organic Fruits & Vegetables Lead the Market in Mexico

Figure 91 France is Expected to Be the Fastest-Growing Market for Organic Fruits & Vegetables in Europe

Figure 92 Organic Vegetables to Be the Largest Segment in European Organic Fruits & Vegetables Market

Figure 93 Banana Segment to Be the Largest in European Organic Fruits Market By 2020

Figure 94 Leafy Greens Segment to Witness Fastest Growth in European Organic Vegetables Market

Figure 95 Lettuce Segment to Be the Largest Segment in Organic Leafy Greens Market By 2020

Figure 96 Broccoli and Cauliflower Segment to Witness Fastest Growth in European Organic Vegetables Market

Figure 97 Fresh Segment to Lead the European Organic Fruits & Vegetables Market

Figure 98 Organic Fruits & Vegetables for Food Processing Market to Remain the Largest Segment By 2020

Figure 99 Organic Fruit & Vegetable Consumption in Retail Segment to Remain the Highest Till 2020

Figure 100 Supermarket/Hypermarket Segment in Organic Fruits & Vegetables Market to Remain the Largest Segment By 2020

Figure 101 The Fresh Segment Leads the Organic Fruits & Vegetables Market in Germany

Figure 102 Fresh Vegetables to Lead the Organic Fruits & Vegetables Market, By Form in the U.K.

Figure 103 Fresh Form of Organic Vegetables Leads the Organic Vegetables Market in France

Figure 104 Fresh Form of Organic Fruits & Vegetables Leads the Organic Fruits & Vegetables Market in Rest of Europe

Figure 105 Asia-Pacific: Organic Vegetables Market Snapshot, 20142020

Figure 106 China Dominates the Asia-Pacific Organic Vegetables Market, 2014 vs 2020

Figure 107 Organic Vegetables Segment to Witness Fastest Growth in the Asia-Pacific Market

Figure 108 Banana Segment to Be the Largest Segment in Asia-Pacific Organic Fruits Market By 2020

Figure 109 Leafy Greens Segment to Witness Fastest Growth in Asia-Pacific Organic Vegetables Market

Figure 110 Kale Segment to Witness the Highest CAGR in Asia-Pacific Organic Vegetables Market

Figure 111 Kale Segment to Witness Fastest Growth in Asia-Pacific Organic Vegetables Market

Figure 112 Fresh Organic Vegetables to Lead the Market in Asia-Pacific, 2014 vs 2020

Figure 113 Organic Fruits & Vegetables in Food Processing Market to Remain the Largest Segment By 2020

Figure 114 Organic Fruits & Vegetables in Retail Market to Remain the Larger Segment By 2020

Figure 115 Supermarket/Hypermarket to Be the Largest Segment of Organic Fruits & Vegetables Market By 2020

Figure 116 Powdered Organic Vegetables to Be the Fastest-Growing Segment of the Market in China

Figure 117 Fresh Organic Fruits & Vegetables to Be the Largest Segment of the Market in Japan

Figure 118 Organic Vegetable Purees to Be the Fastest-Growing Segment of the Market in India

Figure 119 Powdered Organic Vegetables to Be the Fastest-Growing Segment of the Market in China

Figure 120 Fresh to Be the Largest Segment of the Market in Rest of Asia-Pacific

Figure 121 Argentina is Expected to Be the Fastest-Growing Market for Organic Fruits & Vegetables

Figure 122 Organic Fruits Segment to Witness Fastest Growth in Latin American Organic Fruits & Vegetables Market

Figure 123 Banana Segment to Grow at the Fastest CAGR in Latin American Organic Fruits Market

Figure 124 Leafy Greens Segment to Witness Fastest Growth in Latin American Organic Vegetables Market

Figure 125 Lettuce Segment to Witness Fastest Growth in Latin American Organic Vegetables Market

Figure 126 Potato Segment to Witness Fastest Growth in Latin American Organic Vegetables Market

Figure 127 Powdered Organic Fruits & Vegetables to Witness the Fastest Growth in Latin America

Figure 128 Food Processing End Use Segment to Remain the Largest Segment in Organic Fruits & Vegetables Market By 2020

Figure 129 Fresh Organic Fruits & Vegetables Consumption Through Retail Market to Remain the Largest Segment By 2020

Figure 130 Hypermarket/Supermarket to Remain the Largest Segment in Organic Fruits & Vegetables Market By Distribution Channel By 2020

Figure 131 Fresh Vegetables Dominated Organic Fruits & Vegetables Market, By Form

Figure 132 Fresh Vegetables Lead the Organic Vegetables Market, By Form in Argentina

Figure 133 Fresh Form of Organic Fruits & Vegetables Leads the Organic Fruits & Vegetables Market in Rest of Latin America

Figure 134 South Africa is Expected to Be the Largest Market for Organic Vegetables

Figure 135 Organic Fruits Segment to Witness Fastest Growth in RoW Organic Fruits & Vegetables Market

Figure 136 Orange Segment to Witness Fastest Growth in RoW Organic Fruits & Vegetables Market

Figure 137 Leafy Greens Segment to Witness Fastest Growth in RoW Organic Vegetables Market

Figure 138 Kale Segment to Witness Fastest Growth in RoW Organic Vegetables Market

Figure 139 Potato Segment to Dominate the Organic Vegetables Market Segment By 2020

Figure 140 Organic Fruits & Vegetables Puree Segment to Witness the Fastest Growth in RoW

Figure 141 Processed Organic Fruits & Vegetables Market to Remain the Largest Segment By 2020

Figure 142 Organic Fruits & Vegetables in Food Service Segment to Grow at Highest CAGR From 2015 to 2020

Figure 143 Organic Vegetables in Supermarkets/Hypermarkets Market to Remain the Largest Segment By 2020

Figure 144 The Frozen Segment Leads the South Africa Organic Fruits & Vegetables Market, By Form

Figure 145 Fresh Vegetables Lead the Organic Fruits & Vegetables Market, By Form in Others in RoW

Figure 146 Companies Adopted Mergers and Acquisitions as Their Key Growth Strategies From 2010 to 2015

Figure 147 Key Growth Strategies in the Global Organic Fruits & Vegetables Market, 2010-2015

Figure 148 Maximum Developments Were Observed in 2014

Figure 149 Geographic Revenue of Top Four Market Players

Figure 150 The Whitewave Foods Company: Company Snapshot

Figure 151 SWOT Analysis

Figure 152 H. J. Heinz Company: Company Snapshot

Figure 153 SWOT Analysis

Figure 154 CSC Brands LP: Company Snapshot

Figure 155 SWOT Analysis

Figure 156 General Mills, Inc.: Company Snapshot

Figure 157 SWOT Analysis

Growth opportunities and latent adjacency in Organic Fruits & Vegetables Market