Polyurethane Market by Raw Material (MDI, TDI, Polyols), Product (Coatings, Adhesives & Sealants, Flexible & Rigid Foams, Elastomers), End User (Building & Construction, Automotive & Transportation, Bedding & Furniture) - Global Forecast to 2021

To get the latest information, inquire now!

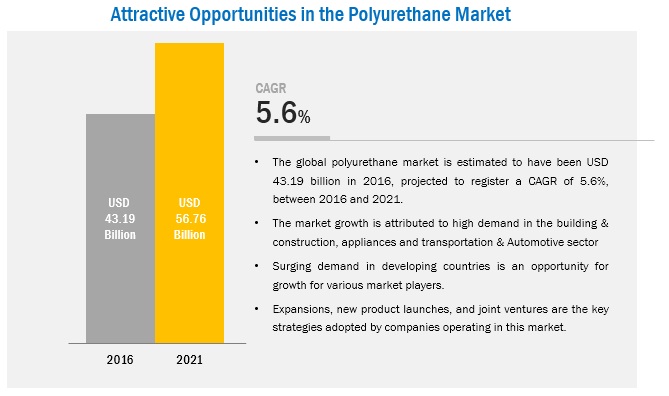

[183 Pages Report] The global polyurethane market was valued at USD 41.83 Billion in 2015 and is projected to reach USD 56.76 Billion by 2021, at a CAGR of 5.6% from 2016 to 2021. The polyurethane chemistry allows it to be molded into unusual shapes and enhance industrial and consumer products by adding comfort and convenience. Polyurethanes are formed by reacting polyols with a diisocyanate or a polymeric isocyanate in the presence of suitable catalysts and additives. A variety of products are manufactured based on wide range of polyols to meet the needs of specific applications. Polyurethane products are used in wide range of consumer goods used in day-to-day life. The uses of polyurethane ranges from flexible foam in upholstered furniture, rigid foam for insulation in walls and roofs, TPU used in medical devices and footwear, to coatings, adhesives, sealants, and elastomers used on floors and automotive interiors. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- Versatility and unique physical properties of polyurethane

- Increasing use of polyurethane in refrigeration applications

- Memory foam revived the bedding segments

Restraints

- Exposure risks and environmental concerns

- Increasing demand for acid-epoxy coatings

Opportunities

- Growing demand for low VOC, green, and sustainable polyurethane

- Expansion of polyurethane recycling and recovery

Challenges

- New bio-based feedstock for polyurethane

- Volatility in crude oil prices

Use of polyurethanes in end use industries drives the global polyurethane market

Polyurethane is a highly versatile material and can be used in a wide variety of applications ranging from insulation in building & construction to coatings and sealants in automotive applications. MDI and TDI can be mixed with polyols in a variety of methods to form rigid, semi rigid, flexible, hard, and soft polyurethane. It is durable, lightweight, safe, affordable, and recyclable. Its ability to be molded in various forms and ease of use make it suitable for use in various industries. Its broad hardness range is its most unique characteristics, which ranges from soft materials as an eraser as well as hard materials as surf boards. It offers good abrasion resistance and toughness. Its durability and toughness is higher than most of the plastics. The abovementioned properties make it commercially viable for many industrial and commercial applications, thus driving the global polyurethane market.

The following are the major objectives of the study.

- To define, describe, and forecast the polyurethane market on the basis of raw material type, product, application, and region

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market segmentation of polyurethane on the basis of major regions such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa

- To analyze the opportunities in the market for stakeholders and details of a competitive landscape for market leaders

- To analyze recent developments such as capacity expansion, new product developments, alliances, joint ventures, and mergers & acquisitions in the market

- To provide strategic profiles of the key players in the market and comprehensively analyze the core competencies

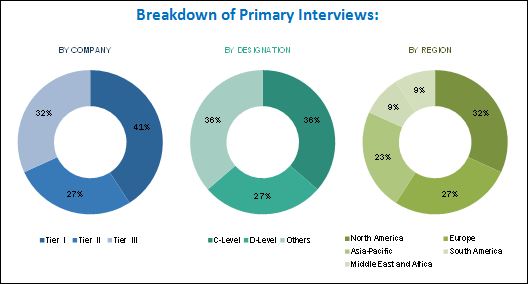

During this research study, major players operating in the polyurethane market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The polyurethane market comprises a network of players involved in the research and product development; raw material supply; product manufacturing; distribution and sale; and post-sales support. Key players considered in the analysis of the polyurethane market are Covestro AG (Germany), BASF SE (Germany), The Dow Chemical Company (U.S.), Wanhua Chemical Group Co. Ltd. (China), and Huntsman (U.S.).

Major Market Developments

- In October 2016, Covestro introduced a new waterborne polyurethane technology in its newly launched product INSQIN. This product enables wider application scope and reduction in manufacturing costs.

- In October 2016, Manali Petrochemicals acquired Notedome Limited (U.K.) for USD 18 million to tap the polyurethane market across 45 countries in the U.K..

- In September 2016, BASF expanded its polyurethane system plant in Bangpoo, Thailand to convert the site into an ASEAN hub for the production of polyurethane systems. With this expansion, BASF expanded its polyurethane production capacity to meet the growing market demands in the transportation and footwear segments in ASEAN.

Target Audience

- Polyurethane manufacturers

- Raw material suppliers

- Manufacturing technology providers

- Industry associations

- Manufacturers in applications such as coatings, adhesives & sealants, foams, elastomers, and others

- Traders, distributors, and suppliers of polyurethane

- Non-governmental organizations (NGOs), government and regional agencies, and research organizations

Report Scope:

By Raw Material Type:

- Polyol

- MDI

- TDI

- Others

By Product Type:

- Flexible foam

- Rigid foam

- Coating

- Adhesive & sealants

- Elastomers

- Others

By End User:

- Building & construction

- Automotive & transportation

- Bedding & furniture

- Footwear

- Appliances & white goods

- Others

By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa

- South America

Critical questions which the report answers

- What are new application areas which the polyurethane companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in APAC based on application

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global polyurethane market is projected to reach USD 56.76 billion by 2021, at a CAGR of 5.6% from 2016 to 2021. The use of PU in the footwear industry in the last few years has made it a worthy replacement to materials such as, Polyvinyl Chloride (PVC) and Ethylene Vinyl Acetate (EVA) because of ease of processing and designing.

Polyurethanes are synthetic resins composed of organic units connected by urethane linkage. They are mainly prepared by reacting diisocyanates, methylene diphenyl diisocyanate (MDI), and/or toluene diisocyanate (TDI) with a range of polyols (polyester and/or polyether polyols). Polyurethane products are versatile, modern, and safe. The key polyurethane products include coatings, adhesives & sealants, foams, and elastomers. These products have wide range of applications in building & construction, automotive & transportation, bedding & furniture, footwear, and appliances & white goods. They offer many solutions for energy conservation and ecodesign.

The polyurethane market has been segmented, on the basis of product type, into flexible foam, rigid foam, coatings, adhesives & sealants, elastomers and others. The market for rigid foam is expected to grow at the highest CAGR between 2016 and 2021. To maintain uniform temperature and lower noise levels in residential as well as commercial properties, builders are adopting rigid polyurethane foam. These foams are effective insulation materials that can be used in roof and wall insulation, insulated windows, doors, and air barrier sealants to save energy.

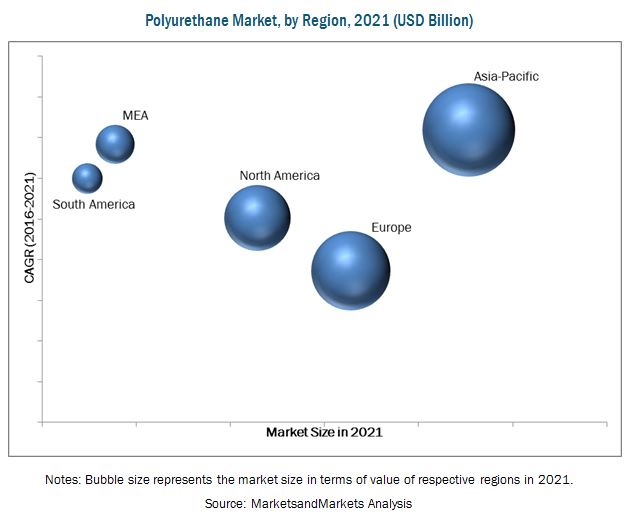

The polyurethane market in APAC is expected to grow at the highest CAGR during the forecast period. APAC is the fastest-growing market for polyurethane. Owing to increasing demand on the domestic front, increasing income levels, and cheaper raw materials, Asia Pacific has emerged as the leading consumer as well as producer of polyurethane materials. South America, especially Brazil and Argentina, have also emerged as key markets for polyurethane. Their proximity to the U.S. is expected to enable them emerge as key targets for production facilities.

The growing urbanization and improvements in living standards of populations, and increase in the usage of polyurethane in the construction industry and its ability to adhere strongly, its exceptional mechanical & insulating properties, and chemical & heat resistance are driving the market for polyurethane.

Bedding & Furniture

Bedding & furniture is the largest end user market for polyurethane. Polyurethane, in the form of flexible foam, is one of the most popular materials used in home furnishings such as furniture, bedding, and carpet underlay. As a cushioning material for upholstered furniture, flexible polyurethane foam makes furniture more durable, comfortable, and supportive. The flexible polyurethane foam is recyclable; it is recycled by various methods to remove waste stream and recover the value inherent in the material.

Polyurethane plays a key role in developing sustainable buildings. Polyurethane finds high demand in building or remodeling homes, offices, and other buildings. The high demand is backed by its lightweight, ease of installation, durability, reliability, and versatile nature.

Building & Construction

The most important application of polyurethane in buildings is insulation. The rigid foam has unique insulating properties that make it ideal for walls and roofs for new homes, as well as for remodeling of existing homes. Insulation is usually required in cavity walls, roofs, floors, around pipes, and boilers. Polyurethane is an affordable, durable, and safe method of reducing carbon emissions that lead to global warming. Polyurethanes can dramatically reduce heat loss in homes and offices in cold weather. During the summer, they play an important role in keeping buildings cool, reducing the need for air conditioning. Other than these adhesives coatings and other products are also used in huge volumes in this application

Automotive & Transportation

Polyurethane has a wide range of applications in the automotive & transportation industry. The benefits of using polyurethane are comfort, safety, lightweight, and longevity coupled with design freedom. Polyurethane foam products aid automobile designers and manufacturers to design seating that can be easily assembled, disassembled, and recycled. They have the highest performance specifications over a wide range of firmness without added weight.

The automotive industry is the largest user of RIM polyurethane parts. RIM maximizes the shock absorption of a car’s fender, bumper, and spoiler, without adding weight or bulk. The lightweight of RIM polyurethane give cars better gas mileage and provide engineers the freedom to create innovative designs.

Critical questions the report answers:

-

Where will all these developments take the industry in the mid to long term?

-

What are the upcoming industry applications for polyurethane?

The current focus of bio-based polyurethane is to develop natural oil polyols (NOPs) that are produced from renewable raw materials such as soybean and castor oil, and can be used to decrease the petrochemical content of polyurethane formulations. According to estimates by the Centre for the Polyurethane Industry (CPI) within the American Chemistry Council, make use of NOPs against conventional polyols, which reduces total energy consumption by 23%. However, NOPs have low hydroxyl functionalities and relatively high equivalent weight, which restrict their use to solid urethanes and flexible foams, making them less suitable for rigid insulating foams.

Key players in the market include Covestro AG (Germany), BASF SE (Germany), The Dow Chemical Company (U.S.), Wanhua Chemical Group Co. Ltd. (China), Huntsman Corporation (U.S.). These companies are adopting various organic and inorganic growth strategies, such as expansions, mergers & acquisitions, and new product launches to enhance their current market shares.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities for Market Players

4.2 Polyurethane Market, By End Use

4.3 Polyurethane Market: Developed vs Developing Countries Between 2016 and 2021

4.4 Asia-Pacific Polyurethane Market: Major Product Type vs Major Countries

4.5 China Dominated the Polyurethane Market

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Raw Material Type

5.2.2 By Product Type

5.2.3 By End User

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth of Automotive and Construction Industries in Emerging Countries

5.3.1.2 Memory Foam Revived the Bedding Segments

5.3.1.3 Versatility and Unique Physical Properties of Polyurethane

5.3.1.4 Increasing Use of Polyurethane in Refrigeration Applications

5.3.2 Restraints

5.3.2.1 Exposure Risks and Environmental Concerns

5.3.2.2 Increasing Demand for Acid-Epoxy Coatings

5.3.3 Opportunities

5.3.3.1 Growing Demand for Low Voc, Green, and Sustainable Polyurethane

5.3.3.2 Expansion of Polyurethane Recycling and Recovery

5.3.3.3 Growing Healthcare Industry

5.3.4 Challenges

5.3.4.1 New Bio-Based Feedstock for Polyurethane

5.3.4.2 Volatility in Crude Oil Prices

6 Industry Trends (Page No. - 53)

6.1 Introduction

6.2 Value-Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Bargaining Power of Buyers

6.3.3 Bargaining Power of Suppliers

6.3.4 Threat of Substitutes

6.3.5 Threat of New Entrants

6.4 Macro Economic Overview and Key Trends

6.5 Trends and Forecast of GDP

6.6 Trends and Forecast of Construction Industry

6.6.1 Trends and Forecast of Construction Industry in North America

6.6.2 Trends and Forecast of Construction Industry in Europe

6.6.3 Trends and Forecast of Construction Industry in the Asia-Pacific

6.6.4 Trends and Forecast of Construction Industry in ME&A

6.6.5 Trends and Forecast of Construction Industry in South America

6.7 Trends of Automotive Industry

7 Polyurethane Market, By Raw Material Type (Page No. - 62)

7.1 Introduction

7.2 Toluene Diisocyanate

7.3 Methylene Diphenyl Diisocyanate

7.4 Polyols

7.5 Others

8 Polyurethane Market, By Product Type (Page No. - 70)

8.1 Introduction

8.2 Coatings

8.3 Adhesives & Sealants

8.4 Flexible Foam

8.5 Rigid Foam

8.6 Elastomers

8.7 Others

9 Polyurethane Market, By End User (Page No. - 82)

9.1 Introduction

9.2 Bedding & Furniture

9.3 Building & Construction

9.4 Appliances & White Goods

9.5 Automotive & Transportation

9.6 Footwear

9.7 Others

10 Polyurethane Market, By Region (Page No. - 90)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 Polyurethane Market, By Raw Material Type

10.2.2 Polyurethane Market, By Product Type

10.2.3 Polyurethane Market, By Country

10.2.3.1 China

10.2.3.2 Japan

10.2.3.3 India

10.2.3.4 South Korea

10.2.3.5 Taiwan

10.2.3.6 Singapore

10.2.3.7 Thailand

10.2.3.8 Vietnam

10.2.3.9 Rest of Asia-Pacific

10.3 North America

10.3.1 Polyurethane Market, By Raw Material

10.3.2 Polyurethane Market, By Product Type

10.3.3 Polyurethane Market, By Country

10.3.3.1 U.S.

10.3.3.2 Mexico

10.3.3.3 Canada

10.4 Europe

10.4.1 Raw Material Type Market

10.4.2 Product Type Market

10.4.3 Polyurethane Market, By Country

10.4.3.1 Germany

10.4.3.2 France

10.4.3.3 U.K.

10.4.3.4 Italy

10.4.3.5 Russia

10.4.3.6 Turkey

10.4.3.7 Rest of Europe

10.5 Middle East & Africa

10.5.1 Polyurethane Market Size, By Raw Material Type

10.5.2 Polyurethane Market Size, By Product Type

10.5.3 Polyurethane Market, By Country

10.5.3.1 UAE

10.5.3.2 Saudi Arabia

10.5.3.3 Africa

10.5.3.4 Rest of Middle East & Africa

10.6 South America

10.6.1 Polyurethane Market Size, By Raw Material Type

10.6.2 Polyurethane Market Size, By Product Type

10.6.3 Polyurethane Market, By Country

10.6.3.1 Brazil

10.6.3.2 Argentina

10.6.3.3 Rest of South America

11 Competitive Landscape (Page No. - 135)

11.1 Overview

11.2 Investment & Expansion

11.3 New Product Launch

11.4 Merger & Acquisition

11.5 Partnership/Joint Venture

11.6 Market Share Analysis

11.6.1 Covestro AG Leads the Polyurethane Market Globally

12 Company Profiles (Page No. - 143)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Covestro AG

12.2 BASF SE

12.3 Huntsman Corporation

12.4 DOW Chemical Company

12.5 Wanhua Chemical Group Co., Ltd.

12.6 Mitsui Chemicals Inc.

12.7 Chemtura Corporation

12.8 Tosoh Corporation

12.9 Manali Petrochemicals Ltd.

12.10 Woodbridge Foam Corporation

*Details Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 175)

13.1 Discussion Guide

13.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.2 Introducing RT: Real-Time Market Intelligence

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (114 Tables)

Table 1 Polyurethane Market Snapshot (2016 vs 2021)

Table 2 Polyurethane Market, By Raw Material Type

Table 3 Polyurethane Market, By Product Type

Table 4 Polyurethane Market, By End User

Table 5 Trends and Forecast of GDP, USD Billion (2015–2021)

Table 6 Contribution of Construction Industry to GDP in North America, USD Billion (2014–2021)

Table 7 Contribution of Construction Industry to GDP in Europe, USD Billion (2014–2021)

Table 8 Contribution of Construction Industry to GDP in the Asia-Pacific, USD Billion (2014–2021)

Table 9 Contribution of Construction Industry to GDP in ME&A, USD Billion (2014–2021)

Table 10 Contribution of Construction Industry to GDP in South America, USD Billion (2014–2021)

Table 11 Automotive Production, Million Units (2011-2015)

Table 12 Polyurethane Market Size, By Raw Material Type, 2014–2021(USD Billion)

Table 13 Polyurethane Market Size, By Raw Material Type, 2014–2021(Kiloton)

Table 14 TDI Market Size, By Region, 2014–2021 (USD Billion)

Table 15 TDI Market Size, By Region, 2014–2021 (Kiloton)

Table 16 MDI Market Size, By Region, 2014–2021 (USD Billion)

Table 17 MDI Market Size, By Region, 2014–2021 (Kiloton)

Table 18 Poloyols Market Size, By Region, 2014–2021 (USD Billion)

Table 19 Polyols Market Size, By Region, 2014–2021 (Kiloton)

Table 20 Others Market Size, By Region, 2014–2021 (USD Million)

Table 21 Others Market Size, By Region, 2014–2021 (Kiloton)

Table 22 Polyurethane Market Size, By Product Type, 2014–2021 (USD Billion)

Table 23 Polyurethane Market Size, By Product Type, 2014–2021 (Kiloton)

Table 24 Polyurethane Market Size in Coatings, By Region, 2014–2021 (USD Billion)

Table 25 Polyurethane Market Size in Coatings, By Region, 2014–2021 (Kiloton)

Table 26 Polyurethane Market Size in Adhesives & Sealants, By Region, 2014–2021 (USD Million)

Table 27 Polyurethane Market Size in Adhesives & Sealants, By Region, 2014–2021 (Kiloton)

Table 28 Polyurethane Market Size in Flexible Foam, By Region, 2014–2021 (USD Billion)

Table 29 Polyurethane Market Size in Flexible Foam, By Region, 2014–2021 (Kiloton)

Table 30 Polyurethane Market Size in Rigid Foam, By Region, 2014–2021 (USD Billion)

Table 31 Polyurethane Market Size in Rigid Foam, By Region, 2014–2021 (Kiloton)

Table 32 Polyurethane Market Size in Elastomers, By Region, 2014–2021 (USD Million)

Table 33 Polyurethane Market Size in Elastomers, By Region, 2014–2021 (Kiloton)

Table 34 Polyurethane Market Size in Other Product Types, By Region, 2014–2021 (USD Million)

Table 35 Polyurethane Market Size in Other Product Types, By Region, 2014–2021 (Kiloton)

Table 36 Polyurethane Market Size, By End User, 2014–2021 (USD Billion)

Table 37 Polyurethane Market Size, By End User, 2014-2026 (Kiloton)

Table 38 Polyurethane Market Size, By Region, 2014–2021 (USD Billion)

Table 39 Polyurethane Market Size, By Region, 2014–2021 (Kiloton)

Table 40 Asia-Pacific: Polyurethane Market Size, By Country, 2014–2021 (USD Million)

Table 41 Asia-Pacific: Market Size, By Country,2014–2021 (Kiloton)

Table 42 Asia-Pacific: Market Size, By Raw Material, 2014–2021 (USD Billion)

Table 43 Asia-Pacific: Market Size, By Raw Material, 2014–2021 (Kiloton)

Table 44 Asia-Pacific: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 45 Asia-Pacific: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 46 China: Polyurethane Market Size, By Product Type, 2014–2021 (USD Billion)

Table 47 China: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 48 Japan: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 49 Japan: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 50 India: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 51 India: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 52 South Korea: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 53 South Korea: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 54 Taiwan: Polyurethane Market Size, By Product Type, 2014–2021

Table 55 Singapore: Polyurethane Market Size, By Product Type, 2014–2021

Table 56 Thailand: Polyurethane Market Size, By Product Type, 2014–2021

Table 57 Vietnam: Polyurethane Market Size, 2014–2021

Table 58 Rest of Asia-Pacific: Polyurethane Market Size, By Product Type, 2014–2021

Table 59 North America: Polyurethane Market Size, By Country, 2014–2021 (USD Million)

Table 60 North America: Market Size, By Country, 2014–2021 (Kiloton)

Table 61 North America: Market Size, By Raw Material, 2014–2021 (USD Billion)

Table 62 North America: Market Size, By Raw Material, 2014–2021 (Kiloton)

Table 63 North America: Market Size, By Product Type, 2014–2021 (USD Million)

Table 64 North America: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 65 U.S.: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 66 U.S.: Market Size, By Product Type,2014–2021 (Kiloton)

Table 67 Mexico: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 68 Mexico: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 69 Canada: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 70 Canada: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 71 Europe: Polyurethane Market Size, By Country, 2014–2021 (USD Billion)

Table 72 Europe: Market Size, By Country, 2014–2021 (Kiloton)

Table 73 Europe: Market Size, By Raw Material, 2014–2021 (USD Billion)

Table 74 Europe: Market Size, By Raw Material, 2014–2021 (Kiloton)

Table 75 Europe: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 76 Europe: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 77 Germany: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 78 Germany: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 79 France: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 80 France: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 81 U.K.: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 82 U.K.: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 83 Italy: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 84 Italy: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 85 Russia: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 86 Russia: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 87 Turkey: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 88 Turkey: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 89 Rest of Europe: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 90 Rest of Europe: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 91 Middle East & Africa: Polyurethane Market Size, By Country, 2014–2021 (USD Million)

Table 92 Middle East & Africa: Market Size, By Country, 2014–2021 (Kiloton)

Table 93 Middle East & Africa: Market Size, By Raw Material, 2014–2021 (USD Million)

Table 94 Middle East & Africa: Market Size, By Raw Material, 2014–2021 (Kiloton)

Table 95 Middle East & Africa: Market Size, By Product Type, 2014–2021 (USD Million)

Table 96 Middle East & Africa: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 97 UAE: Polyurethane Market Size, 2014–2021

Table 98 Saudi Arabia: Polyurethane Market Size, 2014–2021

Table 99 Africa: Polyurethane Market Size, 2014–2021

Table 100 Rest of Middle East & Africa: Polyurethane Market Size, 2014–2021

Table 101 South America: Polyurethane Market Size, By Country, 2014–2021 (USD Million)

Table 102 South America: Market Size, By Country, 2014–2021 (Kiloton)

Table 103 South America: Market Size, By Raw Material, 2014–2021 (USD Million)

Table 104 South America: Market Size, By Raw Material, 2014–2021 (Kiloton)

Table 105 South America: Market Size, By Product Type, 2014–2021 (USD Million)

Table 106 South America: Market Size, By Product Type, 2014–2021 (Kiloton)

Table 107 Brazil: Polyurethane Market Size, By Product Type, 2014–2021 (USD Million)

Table 108 Brazil: Market Size, By Product Type,2014–2021 (Kiloton)

Table 109 Argentina: Polyurethane Market Size, 2014–2021

Table 110 Rest of South America: Polyurethane Market Size, 2014–2021

Table 111 Investments & Expansions, 2012–2016

Table 112 New Product Launches, 2012–2016

Table 113 Mergers & Acquisitions, 2012–2016

Table 114 Partnerships/Joint Ventures, 2012–2016

List of Figures (52 Figures)

Figure 1 Polyurethane Market Segmentation

Figure 2 Polyurethane Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Polyurethane Market: Data Triangulation

Figure 7 Asia-Pacific to Dominate Polyurethane Market Between 2016 and 2021

Figure 8 Polyols Raw Material Segment to Account for Maximum Share in Polyurethane Market Between 2016 and 2021

Figure 9 Flexible Foam to Lead Product Type Segment Between 2016 and 2021

Figure 10 Bedding & Furniture to Dominate End-Use Segment Between 2016 and 2021

Figure 11 Asia-Pacific to Be the Fastest-Growing Polyurethane Market Between 2016 and 2021

Figure 12 Emerging Economies Will Offer Lucrative Growth Potential to Market Players Between 2016-2021

Figure 13 Automotive and Transportation to Register the Fastest CAGR in Polyurethane Market Between 2016 and 2021

Figure 14 Developing Countries to Grow Faster Than Developed Countries

Figure 15 Elastomers Segment Accounted for the Largest Share of Polyurethane Market in Asia-Pacific in 2015

Figure 16 Asia-Pacific to Show High Growth Rate During Forecast Period

Figure 17 China Accounted for the Largest Share in Polyurethane Market in 2015

Figure 18 Polyurethane Market, By Region

Figure 19 Drivers, Restraints, Opportunities, and Challenges

Figure 20 Global Automotive Production

Figure 21 Construction Industry: Emerging Country vs Developed Country

Figure 22 Impact Analysis: Drivers

Figure 23 Impact Analysis: Restraints

Figure 24 Impact Analysis: Opportunities

Figure 25 Fluctuations in Prices of Crude Oil Between 2012 and 2016

Figure 26 Impact Analysis: Challenges

Figure 27 Polyurethane Market: Value Chain Analysis

Figure 28 Polyurethane Market: Porter’s Five Forces Analysis

Figure 29 Polyols Raw Material Type to Dominate the Polyurethane Market During Forecast Period

Figure 30 Asia-Pacific Estimated to Lead the Polyurethane Market in 2016

Figure 31 High Growth in Rigid Foam Product Type to Drive the Polyurethane Market

Figure 32 Rigid Foam is the Fastest-Growing Market Between 2016 and 2021

Figure 33 Bedding & Furniture to Lead End User Segment of Polyurethane Market Between 2016-2021

Figure 34 Automotive & Transportation is the Fastest-Growing Market Between 2016-2021

Figure 35 Durability of Different Shoe Sole Material

Figure 36 Regional Snapshot: India and China are Emerging as New Strategic Locations in Polyurethane Market

Figure 37 Asia-Pacific to Register the Highest Growth in Polyurethane Market Raw Material Type Between 2016-2021

Figure 38 Asia-Pacific Market Snapshot: Rising Population and Increase in Purchasing Power to Drive the Market

Figure 39 North American Market Snapshot

Figure 40 Companies Adopted Investments & Expansions as the Key Growth Strategy Between 2012 and 2016

Figure 41 Market Evaluation Framework: Significant Number of Investments & Expansions Fueled Growth and Innovation, 2012–2016

Figure 42 Investments & Expansions Was the Key Strategy Between 2012 and 2016

Figure 43 Market Share for Top Five Players

Figure 44 Covestro AG: Company Snapshot

Figure 45 BASF SE: Company Snapshot

Figure 46 Huntsman: Company Snapshot

Figure 47 DOW Chemical Company: Company Snapshot

Figure 48 Wanhua Chemical Group: Company Snapshot

Figure 49 Mitsui Chemicals, Inc.: Company Snapshot

Figure 50 Chemtura: Company Snapshot

Figure 51 Tosoh Corporation: Company Snapshot

Figure 52 Manali Petrochemicals Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Polyurethane Market