Waterborne Polyurethane Market by Application (Coatings, Adhesives, Sealants, Elastomers, and Others), End-Use Industry (Building & Construction, Automotive & Transportation, Bedding & Furniture, Electronics, and Others), Region - Global Forecast to 2025

Updated on : April 17, 2024

Waterborne Polyurethanes Market

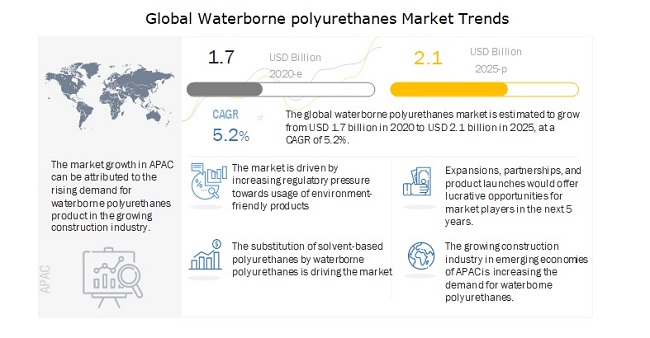

Waterborne Polyurethanes Market size was valued at USD 1.7 billion in 2020 and is projected to reach USD 2.1 billion by 2025, growing at 5.2% cagr from 2020 to 2025. The growing demand for waterborne polyurethanes is due to the growing demands for innovative, environment friendly, and cost-effective products and the growing construction industry in the emerging countries.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Global Waterborne polyurethanes Market

The waterborne polyurethanes are used in various end-use industries such as automotive & transportation, building & construction, bedding & furniture, electronics, and others. COVID-19 has impacted these industries.

- The lockdown in various countries and logistical restrictions have adversely impacted the automotive & transportation industry. Supply chain disruptions, workforce unavailability, logistical restrictions, limited availability of components, demand drop, low company liquidity, and shutdown of manufacturing due to lockdown in various countries have adversely affected the industry. OEMs, raw material suppliers, and other related businesses are forced to re-evaluate their strategies to cater to this industry during this crisis period.

- Residential and commercial construction has come to a grinding halt owing to the pandemic. Waterborne polyurethanes demand from this sector is expected to be low to the medium during this crisis period. Some major issues would be a delay in order shipments, supply chain restriction, manpower & equipment shortage, and material shortage. Post conclusion of this crisis, the market is expected to revive, and demand is likely to increase for the waterborne polyurethanes market.

- The demand for bedding has increased in the healthcare sector, owing to the pandemic. A rise in demand from various hospitals and care institutions for supplying these mattresses for the increasing number of patients is boosting the consumption of waterborne polyurethanes in the manufacturing of these devices/equipment.

Waterborne Polyurethanes Market Dynamics

Driver: Substitution of solvent-based polyurethanes

Solvent-based polyurethanes are made up of liquefying agents that evaporate when comes in contact with oxygen. Solvent-based polyurethanes emit toxic fumes that contain harmful free isocyanates, which can affect the respiratory system and be dangerous for asthma sufferers, children, and the elderly. It also emits VOCs (Volatile Organic Compounds) into the atmosphere. Breathing VOCs can irritate the eyes, nose and throat, can cause difficulty breathing and nausea, and can damage the central nervous system as well as other organs. Some VOCs can cause cancer. Owing to the harmful effects of these emissions regulatory bodies have pressurized in developing environment-friendly products. Waterborne polyurethanes were developed as a result of the regulatory pressure on harmful chemical emissions and are non-toxic. Waterborne polyurethanes are stable, easy-to-use, and exhibit properties similar to solvent-based systems.

Restrain: Volatility in the raw material prices

Raw materials used for manufacturing waterborne polyurethanes are primarily extracted from crude oil. Crude oil is one of the important sources of energy that accounted for 27.3% of the global primary energy consumption in 2015, according to the BP Statistical Review of Energy. The average crude oil spot price reached USD 52 per barrel at the end of December 2016 from a low of USD 29.8 per barrel at the end of January 2016. Crude oil price is very much on a recovery path and stabilized in the range of USD 55 to USD 60 per barrel in 2017. However, due to COVID-19 in 2020, almost all countries have banned both domestic and international travel. This has caused a huge drop in demand for transportation fuel, which has further affected the crude oil prices. Owing to such fluctuating crude oil prices, raw material prices of waterborne polyurethanes are volatile.

Opportunity: Increasing awareness about the harmful effects of chemical emissions from solvents

Various industries such as building & construction, automotive & transportation, bedding & furniture, and electronics use waterborne polyurethanes in the form of coatings, adhesives, sealants, and elastomers. The demand for waterborne polyurethanes is growing in these industries owing to the increasing awareness of the harmful effects of chemical emissions from solvent-based polyurethanes. Solvent-based polyurethanes emit VOCs and HAPs into the environment. These VOCs and HAPs harm the humans and the environments. These emissions can affect the respiratory system and be dangerous for asthma sufferers, children, and the elderly. Breathing VOCs can irritate the eyes, nose and throat, can cause difficulty breathing and nausea, and can damage the central nervous system as well as other organs. Some VOCs can also cause cancer. The increasing awareness about the negative effects of these emissions has driven a need for products that are non-toxic and environment-friendly such as waterborne polyurethanes.

Challenge: Poor performance of waterborne polyurethanes compared to solvent-based polyurethanes

Solvent-based polyurethanes use major solvents such as are butanone, cyclohexanone, ethyl acetate, and toluene. These organic solvents tend to be highly volatile and toxic, flammable and explosive, which is not only dangerous, but also a threat to the environment and human health. As a result, waterborne polyurethanes were developed that are non-toxic and environment friendly. Waterborne polyurethane coatings with low VOC emissions and good product performance have drawn wide public concern. However, due to the limitations of the molecular structure of waterborne polyurethanes, it has some disadvantages, such as heat resistance, water resistance, solvent resistance, and poor gloss. The developers are working to improvise the performance of waterborne polyurethanes.

The sealant application segment to register the fastest growth during the forecast period.

Waterborne polyurethane based sealants provide tighter seals and forms a flexible and elastomeric seam on curing. The UV resistant sealant provides excellent adhesion to most of the industrial materials. Waterborne polyurethane sealants are more suitable for various applications owing to the formation of durable waterproof seal on curing. Waterborne polyurethane sealants are used in road repair, plumbing, and construction where a high-strength, water-resistant seal is needed. They provide high stress recovery to retain shape after being bent or deformed, fast curing rates, and even adherence to non-primed concrete. These end-uses of waterborne polyurethane sealants is driving market growth.

The building & construction industry to be the largest end-use market for waterborne polyurethanes.

Waterborne polyurethanes have been at the epicenter of coating industry, providing greener solutions to modern coating problems. This chemical is polyurethane dispersed in water. This reduces the dependence on solvent-based polyurethanes, providing a better and environment-friendly replacement for existing systems. Advantages like temperature curing and good adhesion further reinforce the case for waterborne polyurethanes. It is frequently used in building and construction applications. Affordability of these versatile materials and the comfort they provide have made polyurethane components part of building & construction industry, globally. In addition, the growing residential and commercial construction activities in emerging economies such as India, China, Indonesia, Vietnam, Chile, and others are further driving consumption in this industry.

APAC is projected to be the largest waterborne polyurethanes market during the forecast period.

The waterborne polyurethanes market in APAC is projected to register the highest CAGR during the forecast period. The market in APAC is driven by the growing construction and industrial activities, increased consumer spending, and strong economic growth.

The recent COVID-19 pandemic is expected to impact the global automotive industry. The entire supply chain is disrupted due to limited supply of parts. For instance, Hubei province in China, which accounts for 8–10% of the Chinese auto production, was severely impacted by pandemic. Chinese suppliers around the globe have placed production lines on halt or shut them down completely. The legal and trade restrictions, such as sealed borders, increase the shortage of required parts. Such disruptions in supply chain is expected to affect the assembly of OEMs in Europe and North America.

To know about the assumptions considered for the study, download the pdf brochure

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

Key Market Players

The key players profiled in this report include Covestro (Germany), DSM (Netherlands), BASF (Germany), R STAHL (Germany), Chemtura (the US), Dow Inc ., (the US), H.B. Fuller (the US), Wanhua Chemical (China), SNP Inc., (the US), and KAMSONS Chemical Pvt. Ltd., (India). These companies have adopted various organic as well as inorganic growth strategies between 2015 and 2020 to enhance their regional presence and meet the growing demand for waterborne polyurethanes from emerging economies.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Billion) and Volume (Kiloton) |

|

Segments |

Application, End-use Industry, and Region |

|

Regions |

APAC, Europe, North America, South America, and Middle East & Africa. |

|

Companies |

Total of 10 major players covered: |

This research report categorizes the waterborne polyurethanes market based on type, application, and region.

On the basis of application, the waterborne polyurethanes market has been segmented as follows:

- Coating

- Sealant

- Adhesive

- Elastomer

- Others

On the basis of end-use industry, the waterborne polyurethanes market has been segmented as follows:

- Building & construction

- Automotive & transportation

- Bedding & furniture

- Electronics

- Others

On the basis of region, the waterborne polyurethanes market has been segmented as follows:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2020, BASF had increased the production capacity of water-based polyurethane dispersions by 30% in Europe This strategy will help the company to serve its customers better and meet the rising demand for water-based polyurethane dispersions.

- In June 2019, DSM had partnered with TLF (Germany), a globally operating company supplying specialty chemicals to leather and related industries. This partnership includes supply as well as R&D of cutting edge, sustainable waterborne polyurethane dispersions system. By partnering at different points in the value chain, DSM and TFL are able to further unlock the value of sustainable leather finishes and strengthen their respective market positions.

- In July 2018, Covestro had developed polyurethane dispersions named Impraperm DL 5249 and Impraperm DL 5310. These are used as textile coatings and enables effective waterproofing and breathability of coatings using the waterborne technology. This strategy has helped the company to provide eco-friendly textile production for its customers without the use of solvents.

Frequently Asked Questions (FAQ):

What is the current size of the global waterborne polyurethanes market?

Global waterborne polyurethanes market is estimated to be USD 1.7 billion in 2020 and is projected to reach USD 2.1 billion by 2025, at a CAGR of 5.2%.

Are there any regulations for waterborne polyurethanes?

Several countries in Europe and North America have introduced regulations to use products that do not harm the environment and are human friendly as well. Hence, various research is being conducted to use bio-degradable and environment friendly polyurethane products.

Who are the winners in the global waterborne polyurethanes market?

Companies such as Covestro, DSM, BASF, R STAHL, and Chemtura fall under the winner’s category. These companies cater to the requirements of their customers by providing customized products. Such advantages give these companies an edge over other companies that are component providers.

What is the COVID-19 impact on polyurethane additive manufacturers?

Industry experts believe that COVID-19 could affect vehicle production by 15–20% globally in 2020. This also translates into a snowballing effect on the waterborne polyurethanes market. Automotive & transportation industry is amongst the major end-use industry for waterborne polyurethanes. The lockdown in various countries owing to the pandemic has negatively impacted the demand for waterborne polyurethanes in the construction industry as well. However, the demand is expected to rise post pandemic.

What are some of the drivers in the market?

The increasing demand for innovative, environment friendly, and cost effective waterborne polyurethanes and the growing demand for polyurethanes in the construction industry of developing country is driving the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.3.1 WATERBORNE POLYURETHANES MARKET– FORECAST TO 2025

1.4 MARKET SCOPE

FIGURE 1 WATERBORNE POLYURETHANES: MARKET SEGMENTATION

1.4.1 REGIONS COVERED

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 WATERBORNE POLYURETHANES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 WATERBORNE POLYURETHANES MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 WATERBORNE POLYURETHANES MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 WATERBORNE POLYURETHANES MARKET: DATA TRIANGULATION

2.3.1 WATERBORNE POLYURETHANES MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

FIGURE 6 WATERBORNE POLYURETHANES MARKET ANALYSIS THROUGH SECONDARY SOURCES

FIGURE 7 WATERBORNE POLYURETHANES MARKET ANALYSIS

2.4 LIMITATIONS

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 8 COATINGS ACCOUNTED FOR THE LARGEST SHARE IN 2019

FIGURE 9 BUILDING & CONSTRUCTION WAS THE LARGEST END-USE INDUSTRY IN 2019

FIGURE 10 APAC ACCOUNTED FOR THE LARGEST SHARE OF THE WATERBORNE POLYURETHANES MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN THE WATERBORNE POLYURETHANES MARKET

FIGURE 11 INCREASING REGULATIONS ON THE USE OF ENVIRONMENT-FRIENDLY PRODUCTS TO DRIVE THE WATERBORNE POLYURETHANES MARKET

4.2 WATERBORNE POLYURETHANES MARKET, BY APPLICATION

FIGURE 12 COATINGS TO REMAIN THE LARGEST APPLICATION SEGMENT OF THE WATERBORNE POLYURETHANES MARKET

4.3 WATERBORNE POLYURETHANES MARKET, BY END-USE INDUSTRY

FIGURE 13 BUILDING & CONSTRUCTION TO BE THE LARGEST END-USE INDUSTRY OF WATERBORNE POLYURETHANES

4.4 WATERBORNE POLYURETHANES MARKET: MAJOR COUNTRIES

FIGURE 14 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4.5 APAC: WATERBORNE POLYURETHANES MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 15 BUILDING & CONSTRUCTION AND CHINA ACCOUNTED FOR THE LARGEST MARKET SHARES IN 2019

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE WATERBORNE POLYURETHANES MARKET

5.2.1 DRIVERS

5.2.1.1 Substitution of solvent-based polyurethanes

5.2.1.2 Increasing federal regulations regarding VOCs and hazardous air pollutants (HAPs)

5.2.1.3 Growing use in the construction industry

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing awareness about the harmful effects of chemical emissions from solvents

5.2.3.2 Industrial development in emerging countries

5.2.4 CHALLENGES

5.2.4.1 Poor performance of waterborne polyurethanes compared to solvent-based polyurethanes

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 WATERBORNE POLYURETHANES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN OF WATERBORNE POLYURETHANES

FIGURE 18 OVERVIEW OF WATERBORNE POLYURETHANES VALUE CHAIN

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 MANUFACTURERS

5.4.3 DISTRIBUTORS/CONVERTORS

5.4.4 END USERS

5.5 MACROECONOMIC INDICATORS

5.5.1 GLOBAL GDP TRENDS AND FORECASTS

TABLE 1 PROJECTED GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2018-2024

TABLE 2 AUTOMOBILE PRODUCTION STATISTICS, 2018 AND 2019 (UNITS PRODUCED)

6 IMPACT OF COVID-19 ON WATERBORNE POLYURETHANES MARKET (Page No. - 54)

6.1 COVID-19

6.2 CONFIRMED CASES AND DEATHS, BY REGION

FIGURE 19 UNPRECEDENTED PACE OF GLOBAL PROPAGATION

6.3 IMPACT ON END-USE INDUSTRIES

6.3.1 BUILDING & CONSTRUCTION

6.3.2 AUTOMOTIVE & TRANSPORTATION

6.3.3 OTHERS

7 WATERBORNE POLYURETHANES MARKET, BY APPLICATION (Page No. - 57)

7.1 INTRODUCTION

FIGURE 20 COATINGS TO BE LARGEST APPLICATION IN WATERBORNE POLYURETHANES MARKET

TABLE 3 WATERBORNE POLYURETHANES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 4 WATERBORNE POLYURETHANES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 5 WATERBORNE POLYURETHANES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 6 WATERBORNE POLYURETHANES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

7.2 COATINGS

7.2.1 WATERBORNE POLYURETHANES OFFER IMPROVED APPEARANCE AND LIFESPAN OF PRODUCTS

7.3 ADHESIVES

7.3.1 WATERBORNE POLYURETHANES OFFER STRONG BONDING AND GREEN STRENGTH

7.4 SEALANTS

7.4.1 WATERBORNE POLYURETHANE SEALANT USED FOR ITS HIGH STRESS RECOVERY TO RETAIN SHAPE

7.5 ELASTOMERS

7.5.1 MACHINABILITY AND LOWER WEIGHT TO DRIVE THE MARKET

7.6 OTHERS

8 WATERBORNE POLYURETHANES MARKET, BY END-USE INDUSTRY (Page No. - 62)

8.1 INTRODUCTION

FIGURE 21 BUILDING & CONSTRUCTION TO BE LARGEST END-USE INDUSTRY FOR WATERBORNE POLYURETHANES

TABLE 7 WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 8 WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (KILOTON)

TABLE 9 WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 10 WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

8.2 BUILDING & CONSTRUCTION

8.2.1 AFFORDABILITY AND ENVIRONMENT-FRIENDLY PROPERTIES OF POLYURETHANE MATERIALS TO BOOST ITS DEMAND

8.3 AUTOMOTIVE & TRANSPORTATION

8.3.1 WATERBORNE POLYURETHANES OFFER ANTI-CORROSION AND RESISTANCE TO WEATHER, TEMPERATURE, AND DUST

8.4 BEDDING & FURNITURE

8.4.1 DURABILITY OF WATERBORNE POLYURETHANES TO BOOST THEIR DEMAND

8.5 ELECTRONICS

8.5.1 ADAPTABILITY TO BASE MATERIALS OF WATERBORNE POLYURETHANES

8.6 OTHERS

9 WATERBORNE POLYURETHANES MARKET, BY REGION (Page No. - 68)

9.1 INTRODUCTION

FIGURE 22 WATERBORNE POLYURETHANES MARKET IN INDIA TO REGISTER THE HIGHEST CAGR

TABLE 11 WATERBORNE POLYURETHANES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 12 WATERBORNE POLYURETHANES MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

TABLE 13 WATERBORNE POLYURETHANES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 WATERBORNE POLYURETHANES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.2 APAC

FIGURE 23 APAC: WATERBORNE POLYURETHANES MARKET SNAPSHOT

TABLE 15 APAC: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 16 APAC: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 17 APAC: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 18 APAC: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 19 APAC: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 20 APAC: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 21 APAC: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 22 APAC: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Low production cost and availability of cheap labor to attract foreign investments

TABLE 23 CHINA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 24 CHINA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 25 CHINA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 26 CHINA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.2.2 INDIA

9.2.2.1 Industrialization and urbanization to drive the market

TABLE 27 INDIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 28 INDIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 29 INDIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 30 INDIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.2.3 JAPAN

9.2.3.1 Technological advancements in automotive components and electronic products to drive the market

TABLE 31 JAPAN: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 32 JAPAN: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 33 JAPAN: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 34 JAPAN: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 Eco-friendly vehicles to propel the automotive industry

TABLE 35 SOUTH KOREA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 36 SOUTH KOREA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 37 SOUTH KOREA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 38 SOUTH KOREA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.2.5 INDONESIA

9.2.5.1 Future automotive industry growth to drive the market

TABLE 39 INDONESIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 40 INDONESIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 41 INDONESIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 42 INDONESIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.2.6 TAIWAN

9.2.6.1 Government investments for improving infrastructure to boost the market

TABLE 43 TAIWAN: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 44 TAIWAN: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 45 TAIWAN: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 46 TAIWAN: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.2.7 REST OF APAC

TABLE 47 REST OF APAC: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 48 REST OF APAC: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 49 REST OF APAC: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 50 REST OF APAC: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.3 EUROPE

FIGURE 24 EUROPE: WATERBORNE POLYURETHANES MARKET SNAPSHOT

TABLE 51 EUROPE: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 52 EUROPE: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 53 EUROPE: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 54 EUROPE: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 55 EUROPE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 56 EUROPE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 57 EUROPE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 58 EUROPE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Residential infrastructure to drive the demand

TABLE 59 GERMANY: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 60 GERMANY: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 61 GERMANY: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 62 GERMANY: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Growing construction industry and foreign investments to drive the market

TABLE 63 FRANCE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 64 FRANCE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 65 FRANCE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 66 FRANCE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.3.3 UK

9.3.3.1 Government initiatives in the construction sector will boost the market

TABLE 67 UK: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 68 UK: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 69 UK: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 70 UK: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Investments in the construction industry and restoration projects to drive the market

TABLE 71 ITALY: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 72 ITALY: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 73 ITALY: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 74 ITALY: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Huge investments in construction projects to influence the market

TABLE 75 SPAIN: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 76 SPAIN: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 77 SPAIN: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 78 SPAIN: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.3.6 RUSSIA

9.3.6.1 Government policies to support the construction industry

TABLE 79 RUSSIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 80 RUSSIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 81 RUSSIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 82 RUSSIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.3.7 REST OF EUROPE

TABLE 83 REST OF EUROPE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 84 REST OF EUROPE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 85 REST OF EUROPE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 86 REST OF EUROPE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.4 NORTH AMERICA

FIGURE 25 NORTH AMERICA: WATERBORNE POLYURETHANES MARKET SNAPSHOT

TABLE 87 NORTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 88 NORTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 89 ORTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 90 NORTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 91 NORTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 92 NORTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 93 NORTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 94 NORTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.4.1 US

9.4.1.1 Advanced infrastructure and technology to drive the market

TABLE 95 US: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 96 US: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 97 US: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 98 US: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.4.2 CANADA

9.4.2.1 Government initiatives for the construction sector to drive the market

TABLE 99 CANADA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 100 CANADA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 101 CANADA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 102 CANADA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.4.3 MEXICO

9.4.3.1 Company partnerships and improved regulations to drive the construction industry

TABLE 103 MEXICO: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 104 MEXICO: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 105 MEXICO: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 106 MEXICO: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.5 SOUTH AMERICA

TABLE 107 SOUTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 108 SOUTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 109 SOUTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 110 SOUTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 111 SOUTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 112 SOUTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 113 SOUTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 114 SOUTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Growing infrastructure and rapid industrial growth to drive the construction industry

TABLE 115 BRAZIL: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 116 BRAZIL: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 117 BRAZIL: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 118 BRAZIL: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.5.2 ARGENTINA

9.5.2.1 Stabilizing economy is expected to boost the automotive sector

TABLE 119 ARGENTINA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 120 ARGENTINA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 121 ARGENTINA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 122 ARGENTINA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.5.3 REST OF SOUTH AMERICA

TABLE 123 REST OF SOUTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 124 REST OF SOUTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 125 REST OF SOUTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 126 REST OF SOUTH AMERICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

TABLE 127 MIDDLE EAST & AFRICA: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 128 MIDDLE EAST & AFRICA: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 129 MIDDLE EAST & AFRICA: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 130 MIDDLE EAST & AFRICA: WATERBORNE POLYURETHANES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 132 MIDDLE EAST & AFRICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 133 MIDDLE EAST & AFRICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.6.1 SAUDI ARABIA

9.6.1.1 Growth in the residential construction sector is likely to drive the market

TABLE 135 SAUDI ARABIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 136 SAUDI ARABIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 137 SAUDI ARABIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 138 SAUDI ARABIA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.6.2 UAE

9.6.2.1 Infrastructure investments to drive the waterborne polyurethanes market

TABLE 139 UAE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 140 UAE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 141 UAE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 142 UAE: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.6.3 REST OF MIDDLE EAST & AFRICA

TABLE 143 REST OF MIDDLE & AFRICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 144 REST OF MIDDLE EAST & AFRICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 145 REST OF MIDDLE EAST & AFRICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 146 REST OF MIDDLE EAST & AFRICA: WATERBORNE POLYURETHANES MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 131)

10.1 INTRODUCTION

FIGURE 26 COMPANIES ADOPTED EXPANSION AND NEW PRODUCT LAUNCH AS THE KEY GROWTH STRATEGIES BETWEEN 2015 AND 2020

10.2 COMPETITIVE LEADERSHIP MAPPING, 2019

10.2.1 STAR

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE

10.2.4 EMERGING PLAYERS

FIGURE 27 WATERBORNE POLYURETHANES MARKET: (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

10.3 WINNERS VS TAIL ENDERS

10.3.1 WINNERS

10.3.2 TAIL ENDERS

10.4 MARKET SHARE, 2019

FIGURE 28 COVESTRO LED THE WATERBORNE POLYURETHANES MARKET IN 2019

10.5 MARKET RANKING

FIGURE 29 MARKET RANKING OF KEY PLAYERS, 2019

10.5.1 COVESTRO

10.5.2 DSM

10.5.3 BASF

10.5.4 R. STAHL

10.5.5 CHEMTURA

10.6 COMPETITIVE SCENARIO

10.6.1 NEW PRODUCT LAUNCH

TABLE 147 NEW PRODUCT LAUNCHES, 2015-2020

10.6.2 EXPANSION

TABLE 148 EXPANSIONS; 2015-2020

10.6.3 PARTNERSHIP

TABLE 149 PARTNERSHIP; 2015-2020

11 COMPANY PROFILES (Page No. - 140)

(Business overview, Products offered, Recent Developments, SWOT Analysis, Winning imperatives, Current focus and strategies, Threat from competition, Right to win)*

11.1 COVESTRO

FIGURE 30 COVESTRO: COMPANY SNAPSHOT

FIGURE 31 COVESTRO: SWOT ANALYSIS

11.2 DSM

FIGURE 32 DSM: COMPANY SNAPSHOT

FIGURE 33 DSM: SWOT ANALYSIS

11.3 BASF

FIGURE 34 BASF: COMPANY SNAPSHOT

FIGURE 35 BASF: SWOT ANALYSIS

11.4 R. STAHL

FIGURE 36 R. STAHL: COMPANY SNAPSHOT

FIGURE 37 R. STAHL: SWOT ANALYSIS

11.5 CHEMTURA CORPORATION

FIGURE 38 CHEMTURA CORPORATION: SWOT ANALYSIS

11.6 DOW INC.

FIGURE 39 DOW INC.: COMPANY SNAPSHOT

11.7 H.B. FULLER

FIGURE 40 H.B. FULLER: COMPANY SNAPSHOT

11.8 WANHUA CHEMICAL CORPORATION

11.9 SNP INC.

11.10 KAMSONS CHEMICALS PVT LTD.

11.11 OTHER MARKET PLAYERS

11.11.1 HENKEL AG

11.11.2 AXALTA COATINGS

11.11.3 ALLNEX

11.11.4 PERSTORP

11.11.5 RPM INTERNATIONAL

11.11.6 UBE INDUSTRIES

11.11.7 CHASE CORPORATION

11.11.8 RUDOLF GROUP

11.11.9 LUBRIZOL

11.11.10 EMERALD KALAMA

11.11.11 HAUTHAWAY

11.11.12 SUN CHEMICAL

11.11.13 KAIYUE TECHNOLOGY

11.11.14 SIWOCHEM

12 APPENDIX (Page No. - 169)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involves four major activities in estimating the current market size of waterborne polyurethanes. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of the segments and sub segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; and databases.

Primary Research

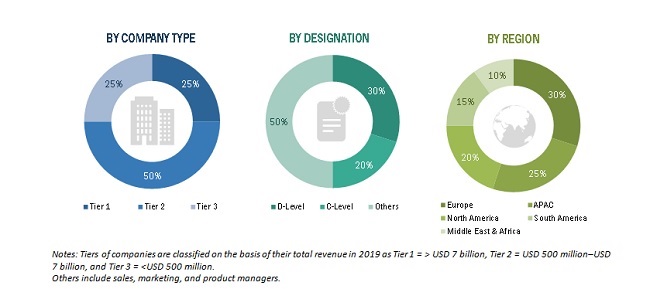

The waterborne polyurethanes market comprises several stakeholders, such as raw material suppliers, distributors of waterborne polyurethanes, industry associations, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of end-use industries such as automotive, construction, electronics, and so on, whereas the supply side consists of waterborne polyurethane manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary interviews—

To know about the assumptions considered for the study, download the pdf brochure

Notes: Tiers of companies are classified on the basis of their total revenue in 2019 as Tier 1 = > USD 7 billion, Tier 2 = USD 500 million–USD 7 billion, and Tier 3 = < USD million 500

Others include sales, marketing, and product managers.

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the waterborne polyurethanes market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study:

- To define and analyze the waterborne polyurethanes market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by application, and end-use industry

- To forecast the size of the market with respect to five regions, namely, Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets with respect to individual trends, growth prospects, and their contribution to the overall market and also analyze the Covid impact

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze the competitive developments such as new product launch and expansion in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies, along with the market data. The following customization options are available for this report:

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of APAC waterborne polyurethanes market

Company Information:

- Detailed analysis and profiles of additional market players.

Growth opportunities and latent adjacency in Waterborne Polyurethane Market