Power Management IC (PMIC) Market by Product (Linear Regulator, Switching Regulator, Voltage References, Battery Management IC, Energy Management IC, LED Driver IC, POE Controller, Wireless Charging IC), Application, and Geography - Global Forecast to 2022

The power management IC market is expected to witness a high growth during the forecast period. The market is estimated to grow from USD 20.09 Billion in 2015 to USD 34.86 Billion by 2022, at a CAGR of 8.08% from 2016 to 2022. The base year considered for the study is 2015 and the forecast period provided is between 2016 and 2022. The objective of the report is to provide a detailed analysis of the market based on product, application, and geography; information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges); and detailed value chain and Porter’s five forces analysis. In addition, its objective is to strategically profile the key players and comprehensively analyze their market ranking and core competencies, along with detailing the competitive landscape for market player, and new product launches, acquisitions, expansions, partnerships, agreements, and contracts in the power management IC market.

The power management IC market is expected to be valued at USD 34.86 Billion by 2022, at a CAGR of 8.08% between 2016 and 2022. Increasing demand for battery powered devices such as smartphones, wearable devices, tablets, digital cameras, navigation systems and others is acting as driver for the growth of the PMIC market. Moreover, technological advancement and growing trend of energy harvesting technologies are also driving the growth of this market.

This report segments the power management IC market on the basis of mounting scheme, crystal cut, general circuitry, application, and geography. The market, on the basis of product, has been segmented into linear regulators, switching regulators, voltage references, and power management ASIC/ASSP/others. The power management IC market for power management ASIC/ASSP/others which includes battery charging & management ICs, energy management ICs, LED driver ICs, power-over-Ethernet (PoE) controllers, power factor correction (PFC) controllers, hot swap controllers, and wireless charging ICs, accounted for the largest share in 2015. ASIC/ASSP/others market is also expected to witness highest growth rate during the forecast period. This market growth can be attributed to the increasing demand for power management ASICs and ASSPs used in smartphones, tablets, laptops, and other portable devices. The growing demand for battery charging & management ICs used in portable devices and LED driver ICs for lighting applications is expected to ensure a healthy growth rate for this market during the forecast period.

The market, on the basis of application, has been further segmented into automotive, wearable electronics, consumer electronics, healthcare, building control, and industry & retail. The consumer electronics application held the largest market share of the global power management IC market in 2015. The power management ICs are used in a variety of consumer electronic devices such as smartphones, tablets, wireless audio devices, laptops, portable navigation systems, and digital cameras among others. Besides their extensive usage, the PMICs allow manufacturers acquire low-cost devices while maintaining the performance of the overall systems. The PMICs are being replaced with the conventional use of voltage regulators in electronic devices such as laptops since they are available as a multi-chip-package. These factors are driving the growth of the power management IC (PMIC) market for the consumer electronics sector.

The power management IC market for the wearable electronics application sector is expected to exhibit the highest growth rate during the forecast period, due to the increasing demand for power management in the smartphones and fitness & activity trackers. Apart this, the automotive is also expected to witness considerable growth rate during the forecast period, as PMICs are being used widely in infotainment, ADAS, telematics, and automotive passive safety applications. The healthcare, building control, and industry & retail application is expected to play a key role in changing the power management IC landscape; and the market for these sectors are expected to grow during the forecast period.

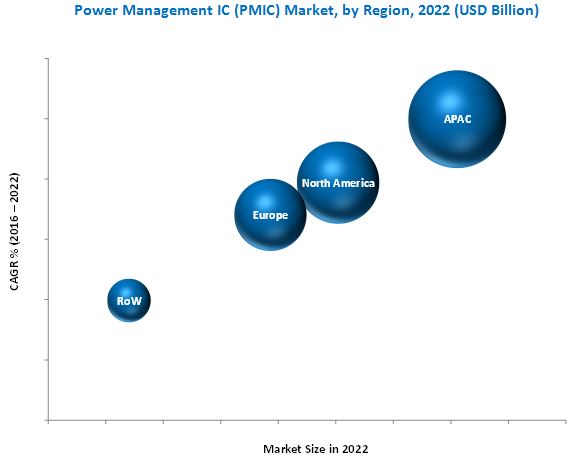

The market, on the basis of geography, has been segmented into four major geographic regions— North America, Europe, APAC, and RoW. APAC accounted for the largest share of 36.1% of the power management IC market in 2015, followed by North America and Europe. The market in APAC is expected to grow at a CAGR of 9.98% during the forecast period. This growth can be attributed to the increasing demand for power management IC components from the consumer electronics and automotive sectors in this region.

However, complex integration process for multi–power domain SOCs of PMICs is a major factor that is inhibiting the growth of the PMIC market. The multi-voltage SOCs require robust methodology and toolset for implementation and hence, a proper tool for analog and digital part is a crucial factor. Some of the major players in the PMIC market are Texas Instruments Inc. (U.S.), ON Semiconductor Corp. (U.S.), Analog Devices, Inc. (U.S.), Fairchild Semiconductor Corp. (U.S.), Dialog Semiconductor PLC (U.K.), Maxim Integrated Products, Inc. (U.S.), STMicroelectronics N.V. (Switzerland), NXP Semiconductors Netherlands B.V. (Netherlands), Linear Technology Corp. (U.S.), and Renesas Electronics Corp. (Japan). These players adopted various strategies such as new product developments, mergers & acquisitions, collaborations, and agreement to grow in the power management IC market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.3.3 Geographic Scope

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities for the Power Management IC (PMIC) Market

4.2 Power Management IC Market, By Application

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Energy-Efficient Battery-Powered Devices

5.2.1.2 Advancements in Technology

5.2.1.3 Rising Trend of Energy Harvesting Technologies

5.2.2 Restraints

5.2.2.1 Complex Integration Process for Multi-Power Domain Socs of PMICs

5.2.3 Opportunities

5.2.3.1 Increasing Application Areas of Power Management ICs

5.2.4 Challenges

5.2.4.1 to Make PMICs Highly Efficient Along With Reducing Their Size

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of Substitutes

6.3.2 Threat of New Entrants

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivarly

7 Power Management IC Market, By Product (Page No. - 48)

7.1 Introduction

7.2 Linear Regulators

7.3 Switching Regulators

7.4 Voltage References

7.5 Power Management ASIC/ASSP/Others

7.5.1 Battery Charging & Management IC

7.5.2 Energy Management IC

7.5.3 Led Driver IC

7.5.4 Power-Over-Ethernet (POE) Controller

7.5.5 Power Factor Correction (PFC) Controller

7.5.6 Hot-Swap Controller

7.5.7 Wireless Charging IC

8 Power Management IC Market, By Application (Page No. - 54)

8.1 Introduction

8.2 Building Control

8.2.1 Access, Monitoring, Security, and Management

8.2.2 HVAC

8.2.3 Others

8.3 Consumer Electronics

8.3.1 Smartphones

8.3.2 Tablets

8.3.3 Portable Navigation Systems

8.3.4 Digital Cameras

8.3.5 Laptops

8.3.6 Wireless Audio Devices

8.4 Healthcare

8.4.1 Diagnostics & Therapy

8.4.2 Health & Wellness

8.4.3 Portable/Wearable Devices

8.5 Automotive

8.5.1 Infotainment

8.5.2 Telematics

8.5.3 Advanced Driver Assistance System (ADAS)

8.5.4 Automotive Passive Safety

8.6 Industrial & Retail

8.7 Wearable Electronics

8.7.1 Sports & Activity Monitors

8.7.2 Smartwatches

9 Power Management IC Market, By Geography (Page No. - 98)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 U.K.

9.3.2 Germany

9.3.3 France

9.3.4 Rest of Europe

9.4 APAC

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Rest of APAC

9.5 Rest of the World

9.5.1 Latin America

9.5.2 Middle East & Africa

10 Competitive Landscape (Page No. - 111)

10.1 Overview

10.2 Market Ranking Analysis: Power Management IC Market, 2015

10.3 Competitive Situation

10.3.1 New Product Launches

10.3.2 Mergers & Acquisitions

10.3.3 Collaborations & Agreements

11 Company Profiles (Page No. - 118)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Introduction

11.2 Texas Instruments Inc.

11.3 Analog Devices, Inc.

11.4 Stmicroelectronics N.V.

11.5 On Semiconductor Corp.

11.6 Dialog Semiconductor PLC

11.7 NXP Semiconductors

11.8 Fairchild Semiconductor International, Inc.

11.9 Linear Technology Corp.

11.10 Renesas Electronics Corp.

11.11 Maxim Integrated Products, Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 152)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (71 Tables)

Table 1 Driver Analysis

Table 2 Restraint Analysis

Table 3 Opportunity Analysis

Table 4 Challenge Analysis

Table 5 Power Management IC Market, By Product, 2013–2022 (USD Billion)

Table 6 Market, By Application, 2013–2022 (USD Billion)

Table 7 Market for Building Control, 2013–2022 (USD Billion)

Table 8 PMIC Market for Building Control Sector, By Geography,2013–2022 (USD Million)

Table 9 Market for the Consumer Electronics Sector, By Application, 2013–2022 (USD Million)

Table 10 PMIC Market for the Consumer Electronics Sector, By Geography, 2013–2022 (USD Billion)

Table 11 PMIC Market for the Consumer Electronics Sector,2013–2022 (Million Units)

Table 12 Market for the Consumer Electronics Sector, By Geography, 2013–2022 (Million Units)

Table 13 PMIC Market for Smartphones in Terms of Value (USD Billion) & Volume (Million Units), 2013–2022

Table 14 PMIC: Market for Smartphones, By Geography, 2013–2022 (USD Billion)

Table 15 PMIC Market for Smartphones, By Geography,2013–2022 (Million Units)

Table 16 Market for Tablets in Terms of Value (USD Million) & Volume (Million Units), 2013–2022

Table 17 PMIC Market for Tablets, By Geography, 2013–2022 (USD Million)

Table 18 Market for Tablets, By Geography, 2013–2022 (Million Units)

Table 19 PMIC Market for Portable Navigation Systems in Terms of Value (USD Million) & Volume (Million Units), 2013–2022

Table 20 PMIC Market for Portable Navigation Systems, By Geography,2013–2022 (Million Units)

Table 21 Market for Digital Cameras in Terms of Value (USD Million)& Volume (Million Units), 2013–2022

Table 22 PMIC Market for Digital Cameras, By Geography,2013–2022 (Million Units)

Table 23 PMIC Market for Laptops in Terms of Value (USD Million) & Volume (Million Units), 2013–2022

Table 24 PMIC Market for Laptops, By Geography, 2013–2022 (USD Billion)

Table 25 Market for Laptops, By Geography, 2013–2022 (Million Units)

Table 26 PMIC Market for Wireless Audio Devices in Terms of Value (USD Million) & Volume (Million Units), 2013–2022

Table 27 PMIC Market for Wireless Audio Devices, By Geography,2013–2022 (USD Million)

Table 28 PMIC Market for Wireless Audio Devices, By Geography,2013–2022 (Million Units)

Table 29 Market for the Healthcare Sector, 2013–2022 (USD Billion)

Table 30 PMIC Market for the Healthcare Sector, 2013–2022 (Million Units)

Table 31 PMIC Market for the Healthcare Sector, By Geography,2013–2022 (USD Billion)

Table 32 Market for the Healthcare Sector, By Geography,2013–2022 (Million Units)

Table 33 Market for Diagnostics & Therapy in Terms of Value (USD Billion) & Volume (Million Units), 2013–2022

Table 34 PMIC Market for Diagnostics & Therapy, By Geography,2013–2022 (USD Million)

Table 35 Market for Diagnostics & Therapy, By Geography,2013–2022 (Million Units)

Table 36 Market for Health & Wellness in Terms of Value (USD Billion)& Volume (Million Units), 2013–2022

Table 37 PMIC Market for Health & Wellness, By Geography,2013–2022 (USD Billion)

Table 38 Market for Health & Wellness, By Geography,2013–2022 (Million Units)

Table 39 PMIC Market for Portable/Wearable Medical Devices in Terms of Value (USD Billion) & Volume (Million Units), 2013–2022

Table 40 PMIC Market for Portable/Wearable Medical Devices, By Geography, 2013–2022 (USD Million)

Table 41 PMIC Market for Portable/Wearable Medical Devices, By Geography, 2013–2022 (Million Units)

Table 42 Power Management IC Market for Automotive, 2013–2022 (USD Billion)

Table 43 PMIC Market for Automotive, 2013–2022 (Million Units)

Table 44 Market for Automotive, By Geography 2013–2022 (Million Units)

Table 45 PMIC Market for Automotive, By Geography, 2013–2022 (USD Billion)

Table 46 PMIC Market for Infotainment in Terms of Value (USD Billion) & Volume (Million Units), 2013–2022

Table 47 Market for Infotainment, By Geography, 2013–2022 (USD Billion)

Table 48 PMIC Market for Infotainment, By Geography, 2013–2022 (Million Units)

Table 49 PMIC for Telematics in Terms of Value (USD Billion) & Volume (Million Units), 2013–2022

Table 50 PMIC Market for Telematics, By Geography, 2013–2022 (USD Million)

Table 51 PMIC Market for Telematics, By Geography, 2013–2022 (Million Units)

Table 52 PMIC Market for Advanced Driver Assistance System (ADAS) in Terms of Value (USD Billion) & Volume (Million Units), 2013–2022

Table 53 PMIC Market for Advanced Driver Assistance Systems (ADAS),By Geography, 2013–2022 (USD Billion)

Table 54 PMIC Market for Advanced Driver Assistance Systems (ADAS),By Geography, 2013–2022 (Million Units)

Table 55 PMIC Market for Automotive Passive Safety in Terms of Value(USD Billion) & Volume (Million Units), 2013–2022

Table 56 PMIC Market for Automotive Passive Safety, By Geography,2013–2022 (USD Million)

Table 57 PMIC Market for Automotive Passive Safety, By Geography,2013–2022 (Million Units)

Table 58 PMIC Market for the Industrial & Retail Sector,2013–2022 (USD Billion)

Table 59 PMIC Marlet for the Industrial & Retail Sector, By Geography,2013–2022 (USD Billion)

Table 60 PMIC Market for the Wearable Electronics Sector,2013–2022 (USD Million)

Table 61 PMIC Market for the Wearable Electronics Sector, By Geography, 2013–2022 (USD Million)

Table 62 PMIC Market for Wearable Electronics, By Geography,2013–2022 (Million Units)

Table 63 PMIC Market for Wearable Electronics, 2013–2022 (Million Units)

Table 64 Power Management IC Market, By Geography, 2015–2022 (USD Billion)

Table 65 North America: Power Management IC Market, By Application,2013–2022 (USD Billion)

Table 66 Europe: Market, By Application,2013–2022 (USD Billion)

Table 67 APAC: Market, By Application,2013–2022 (USD Billion)

Table 68 RoW: Market, By Application,2013–2022 (USD Billion)

Table 69 New Product Launches, 2012–2016

Table 70 Mergers & Acquisitions, 2012–2015

Table 71 Collaborations & Agreements, 2012–2015

List of Figures (71 Figures)

Figure 1 PMIC Market Scope

Figure 2 Years Considered in the Report

Figure 3 Power Management IC (PMIC) Market: Research Design

Figure 4 PMIC Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 PMIC Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Power Management IC Market, 2013–2022 (USD Billion)

Figure 8 Consumer Electronics Expected to Hold the Largest SizeOf the PMIC Market During the Forecast Period

Figure 9 APAC Accounted for the Largest Share of the Power ManagementIC Market in 2015

Figure 10 Market Expected to Grow at A High CAGR During the Forecast Period

Figure 11 Wearable Electronics Expected to Witness the Highest Growth During the Forecast Period

Figure 12 Consumer Electronics Held the Largest Share of the Global Market in 2015

Figure 13 APAC Held the Largest Share of the Global Market, Segmented on the Basis of Application, in 2015

Figure 14 Drivers, Restraints, Opportunities, and Challenges for the PMIC Market

Figure 15 Value Chain Analysis of PMIC Market

Figure 16 Porter’s Five Forces Analysis, 2015

Figure 17 Intensity of Competitive Rivarly Was High in the PMIC Market in 2015

Figure 18 PMIC Market: Threats of Substitutes

Figure 19 PMIC Market: Threats of New Entrants

Figure 20 PMIC Market: Bargaining Power of Suppliers

Figure 21 PMIC Market: Bargaining Power of Buyers

Figure 22 PMIC Market: Intensity of Competitive Rivalry

Figure 23 Power Management IC: Product Segmentation

Figure 24 Power Management IC Market : Application Segmentation

Figure 25 Consumer Electronics Expected to Hold the Largest Market SizeBy 2022

Figure 26 Building Control Application Segmentation

Figure 27 Access, Monitoring, Security, and Management Applications Expected to Lead the PMIC Market for Building Control During the Forecast Period

Figure 28 APAC Expected to Dominate the PMIC Market for Consumer Electronics in 2022

Figure 29 PMIC: Consumer Electronics Applications

Figure 30 APAC Expected to Lead the PMIC Market for Smartphones in 2022

Figure 31 APAC Expected to Hold the Largest Market Size in Terms of Volume By 2022

Figure 32 APAC to Hold the Largest Market Size in Terms of Volume By 2022

Figure 33 PMIC Market for Health & Wellness Expected to Hold the Largest Market Size By 2022

Figure 34 PMIC: Healthcare Applications

Figure 35 APAC Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 36 North America Expected to Have the Largest Market Size By 2022

Figure 37 Infotainment Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 38 APAC Expected to Hold the Largest Market Size By 2022

Figure 39 PMIC: Automotive Applications

Figure 40 APAC Expected to Hold the Largest Market Size By 2022

Figure 41 APAC Expected to Hold the Largest Market Size By 2022

Figure 42 PMIC: Industrial & Retail Applications

Figure 43 Factory Automation Expected to Hold the Largest Market Size By 2022

Figure 44 APAC Expected to Hold the Largest Market Size By 2022

Figure 45 Wearable Electronics Market Segmentation

Figure 46 APAC Expected to Grow at the Highest Rate in the Market During the Forecast Period

Figure 47 Snapshot of the Market in North America

Figure 48 Snapshot of the Market in Europe

Figure 49 Snapshot of the Market in APAC

Figure 50 Companies Adopted New Product Launches and Merger & Acquisitions as the Key Growth Strategies Between 2012 and 2015

Figure 51 Market Ranking of the Top 5 Players in the Power Management IC Market, 2015

Figure 52 Market Evolution Framework: New Product Development has Fueled Growth and Innovation Between 2013 and 2015

Figure 53 Battle for Market Share: New Product Launches Was the Key Strategy Between 2013 and 2015

Figure 54 Geographic Revenue Mix of Top Five Market Players

Figure 55 Texas Instruments Inc.: Company Snapshot

Figure 56 Texas Instruments Inc.: SWOT Analysis

Figure 57 Analog Devices, Inc.: Company Snapshot

Figure 58 Analog Devices, Inc.: SWOT Analysis

Figure 59 Stmicroelectronics N.V.: Company Snapshot

Figure 60 Stmicroelectronics N.V.: SWOT Analysis

Figure 61 On Semiconductor Corp.: Company Snapshot

Figure 62 On Semiconductor Corp.: SWOT Analysis

Figure 63 Dialog Semiconductor PLC: Company Snapshot

Figure 64 Dialog Semiconductor PLC: SWOT Analysis

Figure 65 NXP Semiconductors: Company Snapshot

Figure 66 NXP Semiconductors: SWOT Analysis

Figure 67 Fairchild Semiconductor International, Inc.: Company Snapshot

Figure 68 Fairchild Semiconductor International, Inc.: SWOT Analysis

Figure 69 Linear Technology Corp.: Company Snapshot

Figure 70 Renesas Electronics Corp.: Company Snapshot

Figure 71 Maxim Integrated Products, Inc.: Company Snapshot

The research methodology used to estimate and forecast the size of the power management IC market begins with obtaining data on key vendor revenues through secondary research. Some of the secondary sources used in this research include information from various journals and databases such as IEEE journals, Factiva, Hoover’s, and OneSource. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall market size of the power management IC market from the revenue of the key players in the market. This data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The analysis of the PMIC market includes extensive primary research to gather information and verify and validate the critical conclusions arrived at after an extensive secondary research.

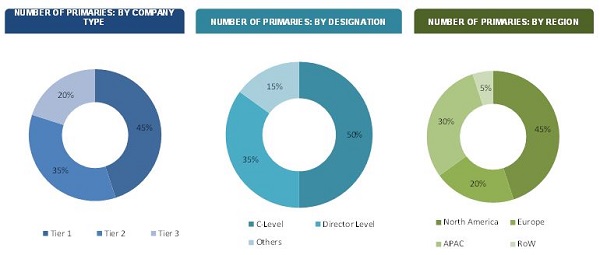

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below shows the breakdown of the primaries conducted during the research study on the basis of company, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

The PMIC ecosystem comprises several key market players such as Texas Instruments Inc. (U.S.), ON Semiconductor Corp. (U.S.), Analog Devices, Inc. (U.S.), Dialog Semiconductor PLC (U.K.), Maxim Integrated Products, Inc. (U.S.), STMicroelectronics N.V. (Switzerland), and Linear Technology Corp. (U.S.) among others. These companies are either the manufacturer or the system integrators of PMICs and provide solutions to end-users, catering their unique requirements. The end users are from a wide range of applications, including consumer electronics, wearable electronics, healthcare, building control, automotive, and industrial & retail.

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2015 |

|

Forecast period |

2016–2022 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Texas Instruments Inc. (U.S.), ON Semiconductor Corp. (U.S.), Analog Devices, Inc. (U.S.), Fairchild Semiconductor Corp. (U.S.), Dialog Semiconductor PLC (U.K.), Maxim Integrated Products, Inc. (U.S.), STMicroelectronics N.V. (Switzerland), NXP Semiconductors Netherlands B.V. (Netherlands), Linear Technology Corporation (U.S.), and Renesas Electronics Corporation (Japan) |

Key Target Audience

- Raw material and manufacturing equipment suppliers

- Electronic design automation (EDA) and design tool vendors

- Component manufacturers

- Original equipment manufacturers (OEMs)

- Integrated device manufacturers (IDMs)

- Product manufacturers (ODMs)

- ODM and OEM technology solution providers

- Assembly, testing, and packaging vendors

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Government and other regulatory bodies

- Technology investors

- Research institutes and organizations

- Market research and consulting firms

The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next two to five years for prioritizing efforts and investments.

The market covered under this report has been segmented as follows:

Power Management IC Market, By Product:

- Linear Regulators

- Switching Regulators

- Voltage References

- Power Management ASICs/ASSPs/others (including Battery Charging & Management ICs, Energy Management ICs, LED Driver ICs, Power-over-Ethernet (PoE) Controllers, Power Factor Correction (PFC) Controllers, Hot Swap Controllers, and Wireless Charging ICs)

Power Management IC Market, By Application:

- Consumer Electronics

- Wearable Electronics

- Automotive

- Healthcare

- Industrial & Retail

- Building Control

Power Management IC Market, By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Technology Analysis

- Product matrix, which gives a detailed comparison of the PMIC portfolio of each company

Geographic Analysis

- Further breakdown of the power management IC market in North America

- Further breakdown of the PMIC market in Europe

- Further breakdown of the power management IC market in APAC

- Further breakdown of the PMIC market in the MEA

- Further breakdown of the power management IC market in Latin America

Company Information

Detailed analysis and profiling of additional market players on the basis of various blocks of the value

Growth opportunities and latent adjacency in Power Management IC (PMIC) Market