Preparative and Process Chromatography Market Size, Share & Trends by Type (Preparative Chromatography (Chemicals & Reagents, Resins (Affinity, HIC, Ion Exchange), Columns, Systems, Services), Process Chromatography), End User (Pharma, Biotech) & Region - Global Forecast to 2028

Updated on : Aug 22, 2024

Preparative and Process Chromatography Market Size, Share & Trends

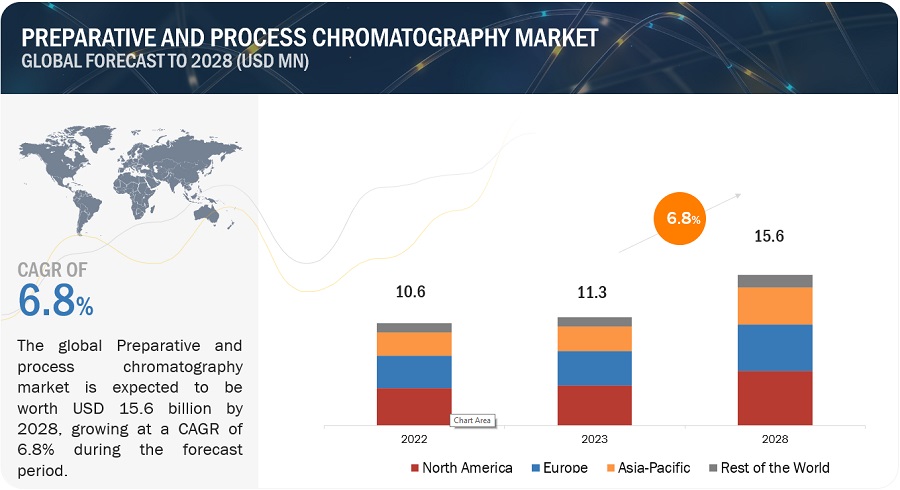

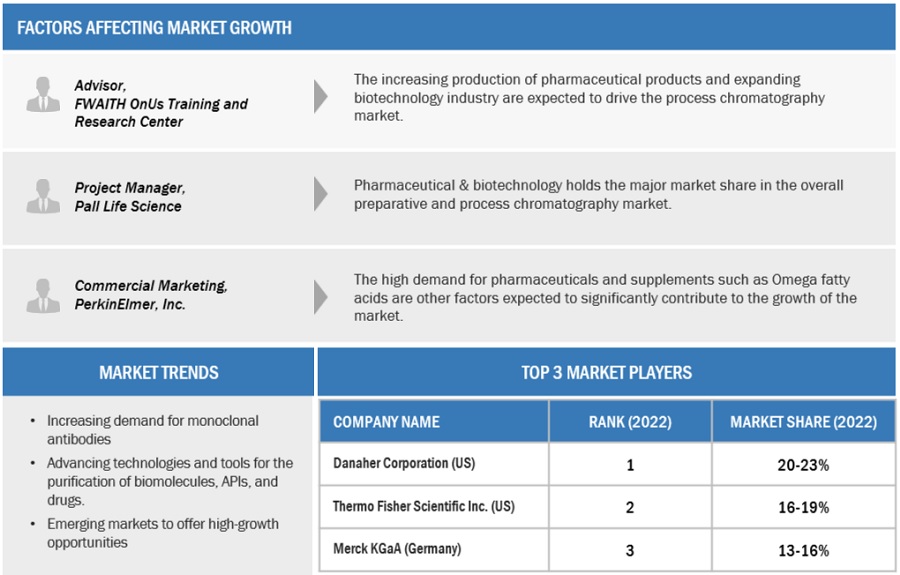

The global preparative and process chromatography market, valued at US$10.6 billion in 2022, stood at US$13.3 billion in 2023 and is projected to advance at a resilient CAGR of 6.8% from 2023 to 2028, culminating in a forecasted valuation of US$15.6 billion by the end of the period. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

The growth in this market is attributed to the increasing need for biosimilars, rising demand for insulin and monocolonal antibodies, and growing use of LCMS in research. However, alternative methods or techniques restrain the growth of this market.

Preparative and Process Chromatography Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Global Preparative and process chromatography Dynamics

DRIVER: Increasing demand for insulin and other biopharmaceutical products

In insulin purification Process chromatography plays an important role. The growing demand for insulin due to the increasing prevalence of insulin-dependent diabetes. The International Diabetes Federation (IDF) stated that over 537 million people had diabetes worldwide in 2021. The IDF has also projected that, in 2030, over 643 million people may have diabetes; by 2045, the number will escalate to 783 million. The increasing awareness about the available treatments among patients and clinicians results and rising prevalence of diabetes in a growing demand for insulin worldwide. This trend is, in turn, driving the growth of the process chromatography market.

RESTRAINT: High cost of instruments

Preparative and process chromatography systems are priced at a premium because of the features and technologies involved. The requirement of such systems in processes is crucial in SMEs in the oil & gas, food & beverage, and biotech & pharmaceutical industries and research & academic institutions. Thus, the capital cost spent on these systems increases significantly. Moreover, as academic research laboratories have controlled budgets, they find it difficult to afford such systems. The maintenance costs and other indirect expenses result in an overall increase in the total cost of ownership of these instruments. This restricts the adoption of chromatographic accessories & consumables among price-sensitive end users, such as research laboratories, academic institutes, and small companies. For instance, Merck KGaA (Germany) offers resins for USD 120–58,066 and supported fluid extraction columns, accessories, etc., for USD 146–1,001. Agilent Technologies (US) offers GC systems for USD 902–19,249, while Shimadzu Corporation (Japan) offers GC systems for USD 14,613.

OPPORTUNITY: Increasing demand for mAbs

Preparative and process chromatography plays a crucial role in purifying monoclonal antibodies (mAbs). Major biopharmaceutical players such as Pfizer Inc. (US), Novartis International AG (Switzerland), Boehringer Ingelheim International GmbH (Germany), Amgen Inc. (US), and Samsung Bioepis (South Korea) have increased their focus on mAbs with such promising opportunities. Another key factor supporting the growth of the mAbs market the rising number of mAbs approved by regulatory bodies. As of February 2023, well over 100 novel mAbs3 were approved for cancer, autoimmune and infectious diseases, and inflammatory conditions, among other indications (Source: US FDA 2023). The growing number of mAbs available in the market is expected to increase the demand for the preparative and process chromatography technique, thereby supporting the growth of the market.

CHALLENGE: Shortage of skilled professionals

Expertise with relevant experience and knowledge of the technique, mechanism, principle, resins, type of separation, and column packing is required for proper usage of chromatographic analytical technologies. Due to the lack of profound knowledge will likely incur several direct and indirect expenses, besides increasing researchers’ workload and time pressure which will also lead to inefficient practical experience and an insufficient understanding of data output. There is a significant shortage of skilled personnel for method development, validation, operation, and troubleshooting activities, which is expected to restrain the growth of the chromatography market in the coming years.

Preparative and Process Chromatography Ecosystem

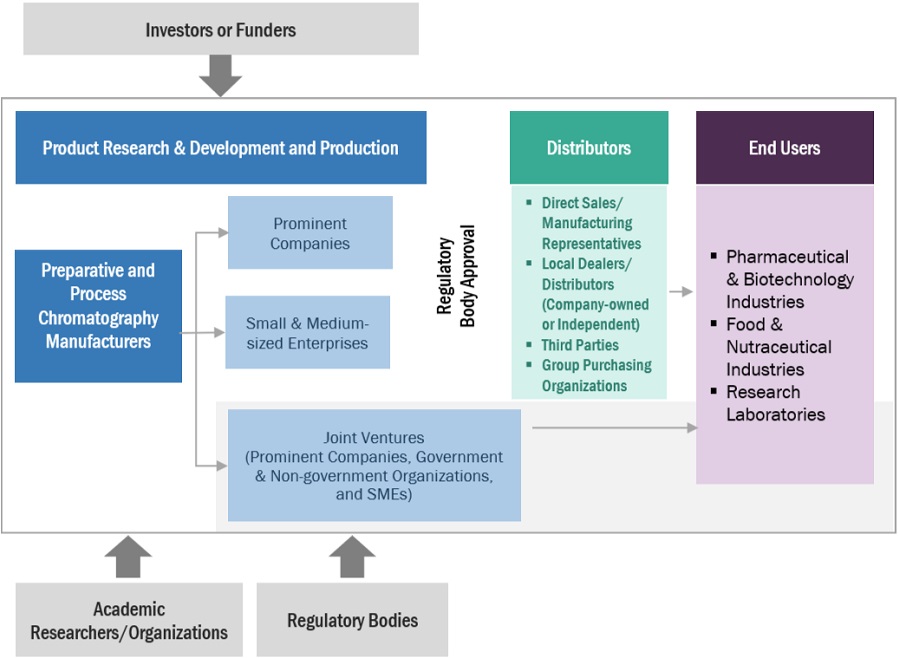

Prominent companies in this market include well-established, financially stable manufacturers of preparative and process chromatography. These companies have been operating in the market for several years and possess diversified state-of-the-art technologies, product portfolios, and strong global sales and marketing networks. Prominent companies in this market include Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Sartorius AG (Germany), and Bio-Rad Laboratories, Inc. (US).

In 2022, Process chromatography segment to observe the highest growth rate of the preparative and process chromatography industry, by type.

Based on type, the preparative and process chromatography market is classified into preparative chromatography and process chromatography. Each segment has been further divided based on product and service. The process chromatography segment dominated the market in 2022. The large share of the segment can be attributed to the growing number of players in the process chromatography products and rise in number of research projects such as proteomics and genomics.

In 2022, pharmaceutical and biotechnology industries segment to dominate the preparative and process chromatography industry, by end user.

Based on the end user, the preparative and process chromatography market is segmented into pharmaceutical & biotechnology industries, food & nutraceutical industries, and research laboratories. The pharmaceutical & biotechnology industries segment dominated the market in 2022. The large share of this segment can be primarily attributed to the growing investments in pharmaceutical manufacturing sites and growing production of mAbs and insulin in industries like biotechnology and biopharmaceuticals.

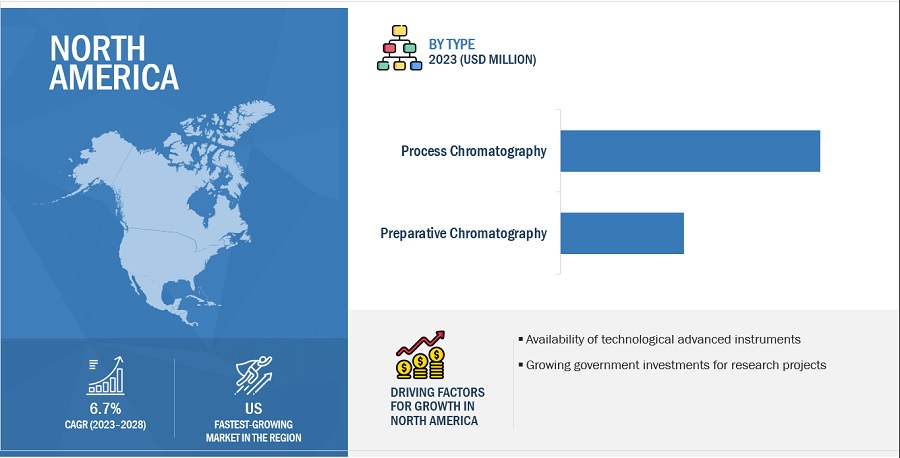

In 2022, North America to dominate in preparative and process chromatography industry.

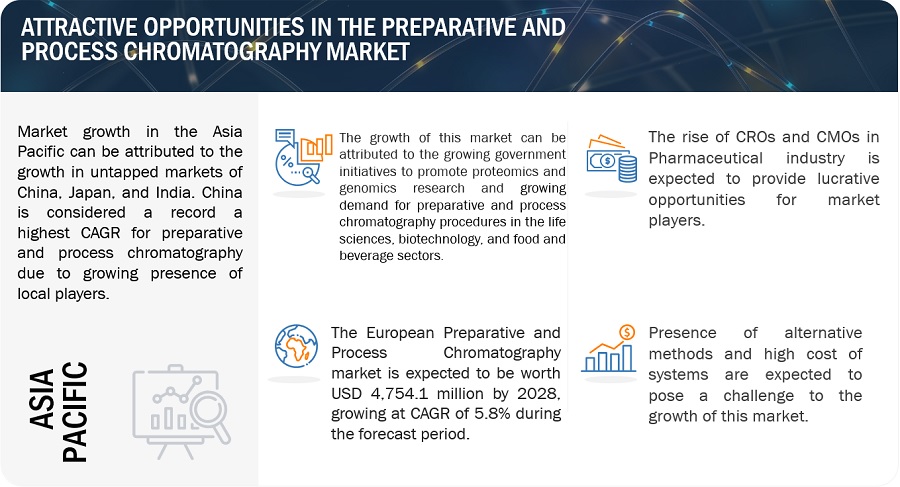

The global preparative and process chromatography market is segmented into North America, Europe, Asia Pacific, and Rest of the World. North America is expected to dominate during the forecast period, primarily due to the growing R&D expenditure by pharmaceutical & biotechnology companies, growing demand for insulin products, and rise in research funding for food safety testing.

To know about the assumptions considered for the study, download the pdf brochure

The preparative and process chromatography market is dominated by players such as Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Sartorius AG (Germany), and Bio-Rad Laboratories, Inc. (US).

Scope of the Preparative and Process Chromatography Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$11.3 billion |

|

Projected Revenue Size by 2028 |

$15.6 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 6.8% |

|

Market Driver |

Increasing demand for insulin and other biopharmaceutical products |

|

Market Opportunity |

Increasing demand for mAbs |

This research report categorizes the preparative and process chromatography market to forecast revenue and analyze trends in each of the following submarkets:

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

By Type

- Process chromatography

- Preparative chromatography

By End User

- Pharmaceutical & Biotechnology Industries

- Food & Nutraceutical Industries

- Research Laboratories

Recent Developments of Preparative and Process Chromatography Industry

- In 2023, Thermo Fisher acquired MarqMetrix, a privately held developer of Raman-based spectroscopy solutions for inline measurement. The acquisition added highly complementary Raman-based inline PAT to Thermo Fisher’s portfolio.

- In 2023, Waters Corporation and Sartorius collaborated to develop integrated analytical solutions for downstream biomanufacturing, expanding their joint agreement that began with upstream bioprocessing analytics.

- In 2022, Shimadzu Corporation developed the Brevis GC-2050. This new space-saving GC delivers high analytical performance in a rugged design to meet laboratory requirements.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global preparative and process chromatography market?

The global preparative and process chromatography market boasts a total revenue value of $15.6 billion by 2028.

What is the estimated growth rate (CAGR) of the global preparative and process chromatography market?

The global preparative and process chromatography market has an estimated compound annual growth rate (CAGR) of 6.8% and a revenue size in the region of $11.3 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for insulin and other biopharmaceutical products- High demand for omega-3 fatty acids- Increasing food safety concerns- Increasing government investments in synthetic biology and genome projects- Increasing use of LC-MS in analytics and research- Rising demand for biosimilars- Growing demand for disposable prepacked columnsRESTRAINTS- High cost of instruments- Presence of alternative methods and techniques- Availability of refurbished productsOPPORTUNITIES- Increasing demand for mAbs- Technological advancements- Growth opportunities in emerging markets- Rise of CMOs and CROs in pharmaceutical industryCHALLENGES- Shortage of skilled professionals- Technical limitations associated with chromatography

- 5.3 TECHNOLOGY ANALYSIS

- 5.4 PRICING ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM/MARKET MAPPREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: ROLE IN ECOSYSTEM

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 SUPPLY CHAIN ANALYSIS

-

5.9 TARIFF AND REGULATORY LANDSCAPEREGULATORY ANALYSIS- US- Europe- Emerging markets

-

5.10 PATENT ANALYSISLIST OF KEY PATENTS

- 5.11 TRADE ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS IN 2023/2024/2025

-

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 PROCESS CHROMATOGRAPHYPROCESS CHROMATOGRAPHY TO HOLD LARGEST SHAREPROCESS CHROMATOGRAPHY, BY PRODUCT & SERVICE- Chemicals & reagents- Resins- Columns- Systems- Services

-

6.3 PREPARATIVE CHROMATOGRAPHYPREPARATIVE CHROMATOGRAPHY, BY PRODUCT & SERVICE- Chemicals & reagents- Resins- Columns- Systems- Services

- 7.1 INTRODUCTION

-

7.2 PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRIESINCREASING PHARMA & BIOTECH MANUFACTURING TO DRIVE MARKET

-

7.3 FOOD & NUTRACEUTICAL INDUSTRIESRISING IMPORTANCE OF CHROMATOGRAPHY IN FOOD ANALYSIS & SEPARATION TO BOOST DEMAND

-

7.4 RESEARCH LABORATORIESRISING USE OF CHROMATOGRAPHY IN RESEARCH TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increasing government investments and funding in biomedical research to support the market growthCANADA- Rising use of chromatography in food safety testing to drive market

-

8.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Growing biotechnology sector and high drug research to drive marketFRANCE- Increasing investments in infrastructure development to drive marketUK- Rising academia-industry partnerships and research activities to drive marketITALY- Growing biotech sector to support market growthSPAIN- Availability of research funds and grants in Spain to boost the market growth in SpainREST OF EUROPE

-

8.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Investments by companies in innovative drugs to drive marketJAPAN- Government initiatives to drive the marketINDIA- Rising emphasis on food safety testing to support demand growthREST OF ASIA PACIFIC

-

8.5 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACTLATIN AMERICA- Growing biosimilar investments in Latin America to drive marketMIDDLE EAST & AFRICA- Economic development and high prevalence of chronic conditions to support market growth

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 9.3 REVENUE ANALYSIS

- 9.4 MARKET SHARE ANALYSIS

-

9.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

9.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING

-

9.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

10.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDANAHER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBIO-RAD LABORATORIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSARTORIUS AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGILENT TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsSHIMADZU CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsWATERS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsDAICEL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsPERKINELMER, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsHITACHI HIGH-TECH CORPORATION- Business overview- Products/Solutions/Services offeredGL SCIENCES INC.- Business overview- Products/Solutions/Services offered- Recent developmentsREPLIGEN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsTRAJAN SCIENTIFIC AND MEDICAL- Business overview- Products/Solutions/Services offered- Recent developments

-

10.2 OTHER PLAYERSHAMILTON COMPANYKNAUER WISSENSCHAFTLICHE GERÄTE GMBHJASCOGILSON, INC.RESTEK CORPORATIONSCION INSTRUMENTSOROCHEM TECHNOLOGIES INC.SRI INSTRUMENTSSEPRAGEN CORPORATIONTOSOH CORPORATIONPUROLITEBIO-WORKS TECHNOLOGIES ABBRUKER CORPORATIONACE LABORATORIES LLCTELEDYNE ANALYTICAL INSTRUMENTS

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 3 KEY DATA FROM PRIMARY SOURCES

- TABLE 4 PERFORMANCE OF COUNTRIES BASED ON FOOD SECURITY SCORE, 2022

- TABLE 5 APPLICATIONS OF LC-MS, BY INDUSTRY

- TABLE 6 KEY BIOLOGICS UNDER THREAT OF PATENT EXPIRY

- TABLE 7 ADVANTAGES OF PREPACKED COLUMNS

- TABLE 8 LIMITATIONS ASSOCIATED WITH CHROMATOGRAPHY

- TABLE 9 AVERAGE SELLING PRICES OF KEY PLAYERS (USD)

- TABLE 10 AVERAGE SELLING PRICES OF KEY PRODUCT TYPES

- TABLE 11 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 12 EXPORT DATA FOR CHROMATOGRAPHS AND ELECTROPHORESIS INSTRUMENTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 13 IMPORT DATA FOR CHROMATOGRAPHS AND ELECTROPHORESIS INSTRUMENTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 14 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF PREPARATIVE AND PROCESS CHROMATOGRAPHY PRODUCTS

- TABLE 16 KEY BUYING CRITERIA FOR PREPARATIVE AND PROCESS CHROMATOGRAPHY PRODUCTS

- TABLE 17 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 18 PROCESS CHROMATOGRAPHY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 20 PROCESS CHROMATOGRAPHY CHEMICALS & REAGENTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 PROCESS CHROMATOGRAPHY RESINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 PROCESS CHROMATOGRAPHY RESINS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 23 PROCESS CHROMATOGRAPHY AFFINITY RESINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 PROCESS CHROMATOGRAPHY PROTEIN A RESINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 PROCESS CHROMATOGRAPHY HYDROPHOBIC INTERACTION RESINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 PROCESS CHROMATOGRAPHY ION EXCHANGE RESINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 PROCESS CHROMATOGRAPHY MIXED-MODE/MULTIMODE RESINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 29 PROCESS CHROMATOGRAPHY PREPACKED COLUMNS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 EMPTY PROCESS CHROMATOGRAPHY COLUMNS OFFERED BY MARKET PLAYERS

- TABLE 31 PROCESS CHROMATOGRAPHY EMPTY COLUMNS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 PROCESS CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 PROCESS CHROMATOGRAPHY SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 PREPARATIVE CHROMATOGRAPHY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 36 PREPARATIVE CHROMATOGRAPHY CHEMICALS & REAGENTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 PREPARATIVE CHROMATOGRAPHY RESINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 PREPARATIVE CHROMATOGRAPHY RESINS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 39 PREPARATIVE CHROMATOGRAPHY AFFINITY RESINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 PREPARATIVE CHROMATOGRAPHY PROTEIN A RESINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 PREPARATIVE CHROMATOGRAPHY HYDROPHOBIC INTERACTION RESINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 PREPARATIVE CHROMATOGRAPHY ION EXCHANGE RESINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 PREPARATIVE CHROMATOGRAPHY MIXED-MODE/MULTIMODE RESINS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 44 PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 45 PREPARATIVE CHROMATOGRAPHY PREPACKED COLUMNS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 46 PREPARATIVE CHROMATOGRAPHY EMPTY COLUMNS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 PREPARATIVE CHROMATOGRAPHY SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 48 PREPARATIVE CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 LIQUID CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 50 OTHER CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 51 PREPARATIVE CHROMATOGRAPHY SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 53 R&D EXPENDITURE OF MAJOR PHARMACEUTICAL COMPANIES, 2021 VS. 2022

- TABLE 54 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 55 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FOR FOOD & NUTRACEUTICAL INDUSTRIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 56 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FOR RESEARCH LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 57 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 65 US: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 66 US: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 67 US: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 68 US: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 69 US: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 US: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 CANADA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 72 CANADA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 73 CANADA: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 CANADA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 75 CANADA: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 CANADA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 77 EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 80 EUROPE: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 EUROPE: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 82 EUROPE: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 84 GERMANY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 85 GERMANY: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 86 GERMANY: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 GERMANY: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 88 GERMANY: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 GERMANY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 90 FRANCE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 FRANCE: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 92 FRANCE: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 FRANCE: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 94 FRANCE: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 FRANCE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 UK: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 UK: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 98 UK: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 UK: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 100 UK: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 UK: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 102 ITALY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 ITALY: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 104 ITALY: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 105 ITALY: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 106 ITALY: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 ITALY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 108 SPAIN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 SPAIN: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 110 SPAIN: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 SPAIN: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 112 SPAIN: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 SPAIN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 REST OF EUROPE: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 116 REST OF EUROPE: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 117 REST OF EUROPE: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 118 REST OF EUROPE: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 REST OF EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 127 CHINA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 128 CHINA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 129 CHINA: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 CHINA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 131 CHINA: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 CHINA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 133 JAPAN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 JAPAN: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 135 JAPAN: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 JAPAN: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 137 JAPAN: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 JAPAN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 139 INDIA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 140 INDIA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 141 INDIA: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 142 INDIA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 143 INDIA: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 144 INDIA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 151 REST OF THE WORLD: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 152 REST OF THE WORLD: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 153 REST OF THE WORLD: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 154 REST OF THE WORLD: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 REST OF THE WORLD: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 156 REST OF THE WORLD: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 REST OF THE WORLD: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 158 LATIN AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 159 LATIN AMERICA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 160 LATIN AMERICA: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 LATIN AMERICA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 162 LATIN AMERICA: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 163 LATIN AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 170 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PREPARATIVE AND PROCESS CHROMATOGRAPHY COMPANIES

- TABLE 171 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: DEGREE OF COMPETITION

- TABLE 172 PRODUCT & SERVICE FOOTPRINT (29 PLAYERS)

- TABLE 173 REGIONAL FOOTPRINT (29 PLAYERS)

- TABLE 174 COMPANY FOOTPRINT (29 PLAYERS)

- TABLE 175 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 176 PRODUCT & SERVICE FOOTPRINT (START-UPS/SMES)

- TABLE 177 REGIONAL FOOTPRINT (START-UPS/SMES)

- TABLE 178 COMPANY FOOTPRINT (START-UPS/SMES)

- TABLE 179 PREPARATIVE AND PROCESS CHROMATOGRAPHY: PRODUCT LAUNCHES, JANUARY 2020– OCTOBER 2023

- TABLE 180 PREPARATIVE AND PROCESS CHROMATOGRAPHY: DEALS, JANUARY 2020–OCTOBER 2023

- TABLE 181 PREPARATIVE AND PROCESS CHROMATOGRAPHY: OTHER DEVELOPMENTS, JANUARY 2020–OCTOBER 2023

- TABLE 182 THERMO FISHER SCIENTIFIC INC: COMPANY OVERVIEW

- TABLE 183 DANAHER: COMPANY OVERVIEW

- TABLE 184 MERCK KGAA: COMPANY OVERVIEW

- TABLE 185 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 186 SARTORIUS AG: COMPANY OVERVIEW

- TABLE 187 AGILENT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 188 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 189 WATERS CORPORATION: COMPANY OVERVIEW

- TABLE 190 DAICEL CORPORATION: COMPANY OVERVIEW

- TABLE 191 PERKINELMER, INC.: COMPANY OVERVIEW

- TABLE 192 HITACHI HIGH-TECH CORPORATION: COMPANY OVERVIEW

- TABLE 193 GL SCIENCES, INC.: COMPANY OVERVIEW

- TABLE 194 REPLIGEN CORPORATION: COMPANY OVERVIEW

- TABLE 195 TRAJAN SCIENTIFIC AND MEDICAL: COMPANY OVERVIEW

- FIGURE 1 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

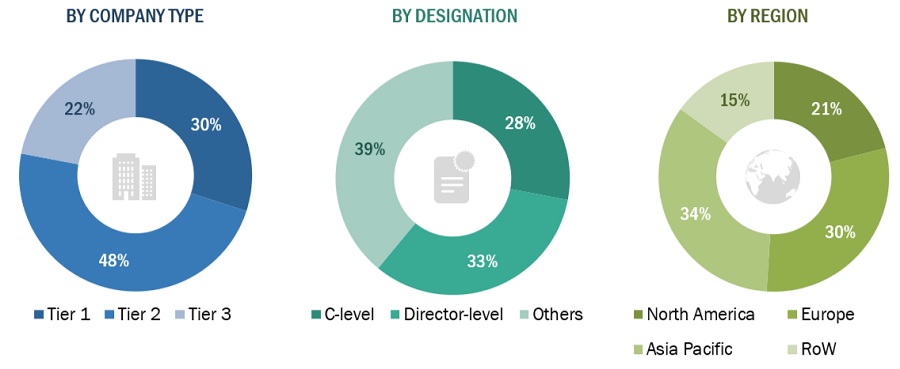

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET – REVENUE SHARE ANALYSIS ILLUSTRATION: THERMO FISHER SCIENTIFIC INC.

- FIGURE 6 BOTTOM-UP APPROACH: REVENUE-BASED APPROACH

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 8 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 11 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2023 VS. 2028 (USD BILLION)

- FIGURE 12 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 13 RISING ADVANCEMENTS IN CHROMATOGRAPHY TECHNIQUES AND INCREASING DEMAND FOR INSULIN & OTHER BIOPHARMACEUTICALS TO DRIVE MARKET

- FIGURE 14 PROCESS CHROMATOGRAPHY SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 15 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC MARKET TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 18 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET DYNAMICS

- FIGURE 19 PREPARATIVE AND PROCESS CHROMATOGRAPHY: VALUE CHAIN ANALYSIS

- FIGURE 20 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: ECOSYSTEM MARKET MAP

- FIGURE 21 KEY PLAYERS IN PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

- FIGURE 22 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 PATENT ANALYSIS FOR CHROMATOGRAPHY COLUMNS (JANUARY 2013–DECEMBER 2022)

- FIGURE 24 REVENUE SHIFT IN PREPARATIVE AND PROCESS CHROMATOGRAPHY

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF PREPARATIVE AND PROCESS CHROMATOGRAPHY PRODUCTS

- FIGURE 26 KEY BUYING CRITERIA FOR PREPARATIVE AND PROCESS CHROMATOGRAPHY PRODUCTS

- FIGURE 27 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SNAPSHOT

- FIGURE 29 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 30 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RANKING ANALYSIS, BY KEY PLAYER (2022)

- FIGURE 31 GLOBAL PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 32 GLOBAL PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 33 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- FIGURE 34 DANAHER: COMPANY SNAPSHOT (2022)

- FIGURE 35 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 36 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 37 SARTORIUS AG: COMPANY SNAPSHOT (2022)

- FIGURE 38 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT (2022)

- FIGURE 39 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 40 WATERS CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 41 DAICEL CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 42 PERKINELMER, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 43 HITACHI HIGH-TECH CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 44 GL SCIENCES, INC.: COMPANY SNAPSHOT (2020)

- FIGURE 45 REPLIGEN CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 46 TRAJAN SCIENTIFIC AND MEDICAL: COMPANY SNAPSHOT (2022)

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships of the leading players, the competitive landscape of the preparative and process chromatography market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the market. A database of the key industry leaders was also prepared using secondary research.

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as pharmaceutical & biotechnology industries, food & nutraceutical industries, and research laboratories) and supply side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing, and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

All major product manufacturers offering various preparative and process chromatography were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value preparative and process chromatography market was also split into various segments and subsegments at the region and country level based on:

- Product mapping of various manufacturers for each type of market at the regional and country-level

- Relative adoption pattern of each market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Global Preparative and process chromatography Market Size: Top Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Preparative and process chromatography Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Preparative and process chromatography industry.

Market Definition

Bioimpedance analysis (also known as bioelectric impedance analysis) is a method of assessing body composition, which measures body fat in relation to lean body mass. It determines the resistance to the flow of electric current as it passes through the body. Preparative and process chromatography are medical devices that are used to measure the impedance of biological tissues. The opposition that tissue or substance presents to the flow of an alternating electrical current is known as impedance.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- R&D Department

- End user/Operator

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To define, describe, segment, and forecast the preparative and process chromatography market by type, end-user, and region

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Rest of the world.

- To profile key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions; product launches; expansions; collaborations, agreements, & partnerships; and R&D activities of the leading players in the market.

- To benchmark players within the market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Preparative and process chromatography market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Preparative and process chromatography Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Preparative and Process Chromatography Market