Preparative and Process Chromatography Market Size, Growth, Share & Trends Analysis

Preparative and Process Chromatography Market by Product [Preparative (Columns, System), Process (Resins, Services)], Application (Vaccines, Peptides & Oligonucleotides), End User (Food & Nutraceutical Companies, Others), Region - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Preparative and Process Chromatography market, valued at US$13.36 billion in 2025, stood at US$14.32 billion in 2026 and is projected to advance at a resilient CAGR of 8.2% from 2026 to 2031, culminating in a forecasted valuation of US$21.50 billion by the end of the period. Vaccines and recombinant proteins, including new modalities such as CGT, oligos, and mRNA, are expected to increase in volume as demand for more personalized treatments rises in some developed economies. With increased volume, this diversity of biologics requires purification. These shifts make chromatography a critical unit operation, especially for capture and purification. With quality control reforms, agencies are expecting tighter control of host-cell proteins, DNA, aggregates, and residual ligands. These macro trends are projected to increase production volume in the bioprocessing niche. This will help drive demand for relevant products used in preparative and process-scale chromatography. These factors will help drive the market for preparative and process chromatography.

KEY TAKEAWAYS

-

BY REGIONBy region, Asia Pacific is projected to register the highest CAGR of 9.5%.

-

BY PRODUCT TYPEBy product type, the process chromatography segment acquired the largest share (69.4%) in the preparative and process chromatography market in 2025.

-

BY END USERBy end user, pharma & biopharma companies held the largest share of 51.0% in the preparative and process chromatography market.

-

BY APPLICATIONBy application, the monoclonal antibodies & recombinant proteins segment accounted for 39.3% in the preparative and process chromatography market.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSDanaher (US), Merck KGaA (US), Thermo Fisher Scientific (US), Waters Corporation (US), and Agilent Technologies (US) are some of the key players in the global preparative and process chromatography market, supported by their broad portfolios of bioprocess resins, process and preparative chromatography systems, columns (including large-scale pre-packed formats), and strong technical-service networks across major biopharma hubs.

-

COMPETITIVE LANDSCAPE - STARTUPSCompanies such as Bio-Works Technologies, Sunresin Life Sciences, Sykam, Inkarp Instruments, and various regional OEMs are active in niche segments of the preparative and process chromatography ecosystem, supplying specialized resins, pre-packed or empty columns, and cost-competitive systems.

Process alterations, such as multi-column continuous chromatography, increase chromatography throughput without expanding the operational footprint. Manufacturers now focus more on such approaches, as they help limit capex while serving more products from the same line, which matters as portfolios diversify and pipeline or process turnaround times decrease. These shifts help achieve higher resin density (kilograms per liter) and address bottlenecks in downstream processing workflows. Manufacturers offering such solutions in their consumable workflows will capitalize on these opportunities, helping grow the market for preparative and process chromatography. On the consumables side, demand is shifting toward higher-capacity, alkali-tolerant Protein A media and mixed-mode or advanced ion-exchange resins that can handle tougher impurity profiles or reduce the number of steps in a train. These shifts from conventional to advanced methods are expected to drive growth in the market for preparative and process chromatography.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Preparative and process chromatography is evolving from a basic purification step into a strategic platform. It helps users meet four main goals: reproducible quality, high yield, cost-effective purification, and high-resolution separations. These improvements enable better outcomes for stakeholders. For end users on the supply side of biologics and drug manufacturing (pharmaceutical, biopharmaceutical, and CDMO companies), pre-packed columns and continuous systems help produce reliable GMP-grade biologics at lower costs and with faster scale-up. This leads to high-quality therapies, shorter development timelines, and reduced risk for sponsors. Food and nutraceutical companies use the same tools to consistently eliminate contaminants and standardize active ingredients. This builds strong brand trust and improves regulatory acceptance. Academic and research organizations need high-resolution preparative platforms to quickly purify various biomolecules. This accelerates discovery and lowers risk in downstream development.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increased demand for complex biologics and advanced therapeutics modalities

-

Increased outsourcing to CDMOs driving additional chromatography capacity and utilization

Level

-

Low replacement rate due to incomplete single-use adoption

-

Operational complexity of advanced and continuous chromatography

Level

-

Innovation in media and column solutions to capture new biologic modalities

-

Expansion of integrated intensified and continuous chromatography platforms

Level

-

Shortage of skilled chromatography professionals

-

High capital and operating costs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased demand for complex biologics and advanced therapeutics modalities

As demand for established biologics such as monoclonal antibodies (mAbs) grows, manufacturing facilities face increasing pressure to achieve high-volume yields with minimal resource use. Demand for new treatments from cell and gene therapies is also driving demand for high-value biologics. Scaling up manufacturing parameters from the preparative phase to large scale, along with the associated complexity, requires automation, which is driving sales of large-scale process systems, columns, and high-capacity resins for high-titer products. The purification challenges posed by new, complex, and fragile modalities increase the need for specialized, high-resolution, single-use or flexible systems with multimodal resins to achieve extremely high purity. Finally, to stay competitive and reduce costs, the industry is accelerating the adoption of continuous chromatography, or multi-column chromatography. This trend boosts sales of advanced systems and the software needed for process control and optimization.

Restraint: Low replacement rate due to incomplete single-use adoption

The main barrier to market growth is the incomplete technical readiness and adoption of single-use and pre-packed solutions, especially at a large scale. Significant economic gains from single-use technologies, such as reduced cleaning cycles, faster validation, and quicker changeovers, can only be realized when the entire manufacturing line primarily uses single-use systems. However, many important downstream steps still lack mature single-use options. This dependence on stainless-steel or traditionally packed columns in crucial process steps limits operational efficiency, keeps labor and cleaning costs high, and weakens the economic argument for expanding capacity with newer technology. Additionally, quality assurance and engineering teams are cautious due to ongoing concerns about the performance, lifespan, pressure limits, and scalability of newer solutions with very large column sizes. Such factors cause facilities to extend the operational life of existing packed columns rather than invest in upgrades, leading to lower demand for newer chromatography systems.

Opportunity: Innovation in media and column solutions to capture new biologic modalities

The increasing complexity and volume of biologics, coupled with strong demand for new treatment modalities such as viral vectors, mRNA, and oligonucleotides, create a significant growth opportunity for the preparative and process chromatography market. These shifts drive demand for column and chromatography media solutions tailored to these modalities. Traditional purification methods such as Protein A, standard ion exchange (IEX), and hydrophobic interaction chromatography (HIC) often perform poorly with these new, complex molecules. This gap presents a valuable opportunity for suppliers who can innovate and provide better chromatography resins, membranes, and pre-packed columns that offer higher selectivity, yield, or fewer steps in the purification process. By delivering tailored solutions for these high-value modalities, chromatography suppliers can command higher prices and establish long-term supply agreements. This shift allows them to move from being basic suppliers to becoming key technology partners, capturing significant, unique revenue streams that support the overall growth of the market.

Challenge: Shortage of skilled chromatography professionals

Running complex, high-performance systems and executing demanding method development require specialized expertise. The limited availability of trained staff in many regions impedes the efficient use of high-value instruments, leading to suboptimal process performance and increased operational risk. Critically, this skill gap discourages manufacturers, particularly smaller companies and labs already facing high capital costs, from upgrading to newer, more automated, and efficient systems. Instead, companies delay upgrades or rely on simpler, sometimes less efficient, processes, which slows the adoption of advanced systems and limits the replacement demand essential for sustained market growth.

PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

ÄKTA process chromatography systems with Capto purification resins (Protein A) serve as an integrated, automated platform in manufacturing. | Integrated automation reduces manual handling and process variability, cutting scale-up and process-development timelines. |

|

Capture Select Protein A resins with Go Pure prepacked columns are tuned for high selectivity toward the Fc region of antibodies. | This eliminates 2–3 weeks of packing, column validation, and troubleshooting, allowing CDMOs to achieve faster time-to-clinic for sponsors. |

|

Co Prime continuous chromatography systems are the platforms for continuous (as opposed to batch) operation, which reduces the turnaround time with a significant margin. | Continuous multi-column operation improves resin utilization by 2–3 times compared to batch processing, helping end users to optimize the operating cost. |

|

OPUS pre-packed process columns are the single-use column platform where resin is pre-packed in disposable housings. | This platform reduces the need for specialized in-house column-packing expertise and labor, reducing the need for specialized workflow. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The preparative and process chromatography ecosystem is a multi-layered value chain that connects chromatography platform manufacturers (resins, columns, systems), specialty material suppliers, distributor partners, and end-use organizations across the biopharmaceutical, food/nutraceutical, and research sectors. Manufacturers such as Danaher (Cytiva), Thermo Fisher Scientific, Repligen, Merck KGaA, Sartorius, Waters, and Agilent Technologies deliver integrated chromatography platforms—resins, pre-packed columns, and automated systems—that enable large-scale and preparative purification of biologics and specialty chemicals. Raw material and component suppliers, such as Welch Materials (silica and polymeric supports) and Chondrex (specialty resins for research), provide feedstock, base matrices, and supporting materials that manufacturers integrate into their final chromatography offerings. Distributors and channel partners, including Chemglass Life Sciences, Thomas Scientific, Rayden, SpectraLab, and regional scientific-supply networks, extend manufacturers’ reach into mid-market and emerging-region biotech facilities. Major pharmaceutical manufacturers, biotech firms, research and academic institutions, and food/nutraceutical companies deploy preparative and process chromatography to purify their own product candidates and manufactured goods.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Preparative and Process Chromatography Market, By Product Type

By product type, the market is divided into process chromatography products and preparative chromatography products. Process chromatography products hold the largest share of the market. Global pharmaceutical and biopharmaceutical end users—which include major pharma facilities and CDMOs—are focused on commercial downstream workflows designed for process chromatography rather than preparative stages. A new plant or large-scale manufacturing facility drives recurring, multi-year demand for process resins, columns, and services. The shift of manufacturing to contract organizations means more plants are being built and optimized around process chromatography platforms. CDMOs running multi-product lines consume large volumes of process resins and systems to serve many clients simultaneously, further concentrating market value in the process segment. Manufacturers invest in optimizing and designing process workflows to improve process economics. This helps estimate the cost of the manufacturing cycle (process level) rather than the preparative level. Such efforts address concerns related to buffer consumption, shrinking footprint, and extending resin lifetime—directly targeting process chromatography. This makes it clear that capital investments are more in process chromatography, which increases the consumption of target products. All these factors have helped process chromatography acquire a larger share.

Preparative and Process Chromatography Market, By Application

By application, the market for preparative and process chromatography is categorized into monoclonal antibodies & recombinant proteins, vaccines, peptides and oligonucleotides, cell and gene therapies, and other applications. The monoclonal antibodies & recombinant proteins production application held the largest market share in 2024. Monoclonal antibodies (mAbs) have become a widely adopted biotherapeutic modality across oncology, immunology, infectious disease, and rare disease indications. Regulatory pathways are well-established, manufacturing processes are standardized, and biosimilar competition has driven market growth.

Preparative and Process Chromatography Market, By End User

By end user, the preparative and process chromatography market is categorized into pharma & biopharma companies, food & nutraceutical companies, research & academia, and other end users. Pharma & biopharma companies held the largest share in 2024. Integrated pharmaceutical and biopharmaceutical manufacturers represent the anchor customer base for preparative and process chromatography, driven by their need to produce large-scale commercial biologics with consistent quality, high yield, and regulatory compliance. These organizations operate dedicated downstream facilities optimized for mAb, recombinant protein, and vaccine purification, requiring a continuous supply of resins, columns, systems, and technical support. Large pharma companies maintain in-house process development and manufacturing expertise and invest heavily in advanced chromatography platforms. The stability and scale of these operations, combined with their strict quality and regulatory requirements, make them a key end user segment with significant demand. These factors have helped them acquire the largest share.

PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: COMPANY EVALUATION MATRIX

In the preparative and process chromatography market, Danaher (Cytiva) and Thermo Fisher Scientific are a part of the "stars" quadrant, anchored by comprehensive, integrated chromatography portfolios spanning resins, process and preparative systems, columns, and after-market services. Both vendors command dominant global market positions, maintain deep customer relationships across pharma, biopharma, and CDMOs, and lead in process-intensification technologies such as continuous multi-column systems and advanced pre-packed column platforms. Simultaneously, emerging players are targeting high-growth niches—such as continuous chromatography solutions, pre-packed single-use column systems optimized for CGT and oligonucleotide purification, and regional cost-competitiveness—to challenge established players and capture share from customers seeking specialized capabilities or cost reduction.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Agilent Technologies, Inc (US)

- Thermo Fisher Scientific, Inc (US)

- Danaher Corporation (US)

- Waters Corporation (US)

- Bio-Rad Laboratories, Inc. (US)

- Repligen (US)

- Revvity (US)

- Sartorius (Germany)

- Merck KGaA (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 13.36 Billion |

| Market Forecast in 2031 (Value) | USD 21.50 Billion |

| Growth Rate | 8.2% |

| Years Considered | 2023–2030 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

WHAT IS IN IT FOR YOU: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Biopharmaceutical Companies |

|

|

RECENT DEVELOPMENTS

- April 2025 : Danaher Corporation (US), through its subsidiary Cytiva, introduced MabSelect SuRe?70 and MabSelect PrismA?X Protein?A resins designed for clinical- and commercial-scale mAb purification.

- February 2025 : Thermo Fisher Scientific Inc. (US) acquired Solventum's (US) bioprocess filtration business to strengthen its end-to-end downstream purification offerings, complementing its chromatography lines, including protein A resins.

- June 2024 : Repligen Corporation (US) and Ecolab (US) jointly introduced DurA?Cycle Protein?A Resin, designed for large-scale mAb manufacturing with improved cleaning resistance and cost savings.

Table of Contents

Methodology

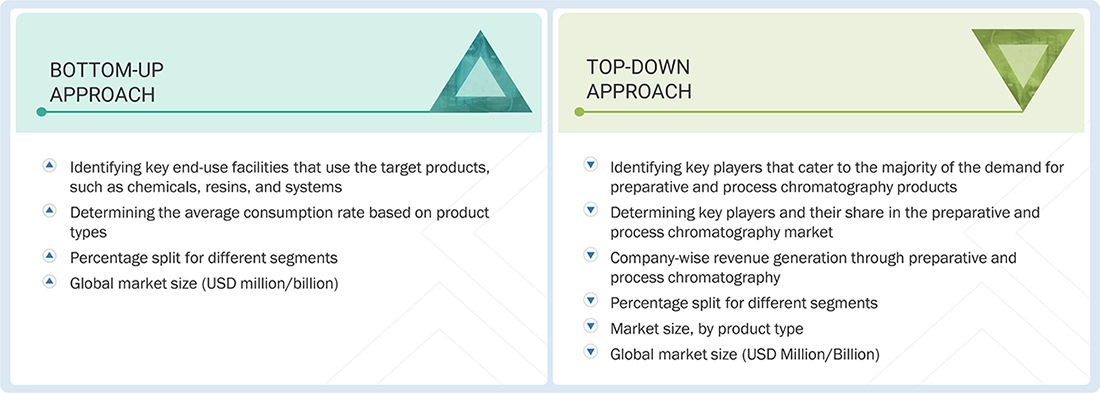

This study balanced primary and secondary research for the preparative and process chromatography market by analyzing market variables that affect small, medium, and large businesses. The next step was to conduct primary research with industry experts along the value chain to validate the findings, assumptions, and market sizing. Multiple methodologies, including both top-down and bottom-up approaches, were used to estimate the overall market size.

Secondary Research

During the study, secondary research drew on a range of sources, including directories and databases such as Bloomberg Businessweek, D&B Hoovers, and Factiva. Additional materials included white papers, annual reports, SEC filings, and investor presentations. This approach was used to collect and analyze data that provides comprehensive, technical, and market-focused insights into the preparative and process chromatography market. The findings offer insights into key players and market segmentation based on recent industry trends, as well as significant developments within the market. A database of leading industry figures was also created as part of this secondary research.

Primary Research

Primary research involved activities to gather both qualitative and quantitative data. A variety of individuals from both the supply and demand sides were questioned during this phase. On the supply side, key figures such as CEOs, vice presidents, directors of marketing and sales, directors of technology and innovation, and other important leaders were interviewed by industry experts. On the demand side, primary sources included academic institutions and research organizations. This research aimed to validate market segmentation, identify prominent market participants, and gain insights into significant industry trends and market dynamics through a real-world primary study.

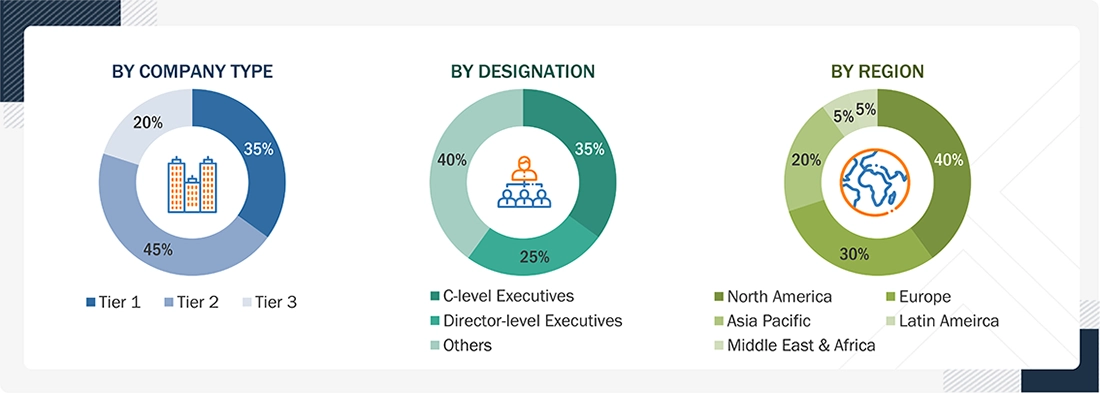

A breakdown of the primary respondents is provided below:

Note 1: Others include distributors, suppliers, product managers, business development managers, marketing managers, and sales managers.

Note 2: Companies are categorized into tiers based on their total revenue. As of 2024, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = <USD 500 million.

Market Size Estimation

This report analyzes the global preparative and process chromatography market size by reviewing the revenue shares of prominent companies. Key players with significant market shares were identified through secondary research, and their revenue from preparative and process chromatography sales was calculated and then validated through primary research. The secondary research included an analysis of annual and financial reports from leading market participants. The primary research involved in-depth interviews with key thought leaders, such as directors, CEOs, and marketing executives.

To calculate the global market value, segmental revenue was determined using revenue mapping for service and product providers. The process involved the following steps:

- Generating a list of key players that operate in the preparative and process chromatography market at the regional or global level

- Mapping the products of manufacturers of preparative and process chromatography and related product lines at the regional level

- Mapping the revenue of listed players from preparative and process chromatography and related products

- Mapping the revenue of major players to cover at least ~90% of the global market share as of 2024

- Extrapolating the mapped revenue of players to arrive at the global market value for the respective segment

- Summing up the market value for all segments and subsegments to achieve the actual value of the global preparative and process chromatography market

Data Triangulation

After estimating the overall market size, the preparative and process chromatography market was segmented into segments and subsegments. The overall market engineering process was finalized using data triangulation and market segmentation techniques to obtain accurate statistics for all segments and subsegments. This triangulation involved analyzing trends and factors from both the demand and supply sides. Furthermore, the preparative and process chromatography market data were verified and validated using both top-down and bottom-up approaches.

Market Definition

The market encompasses preparative chromatography, which targets lab-to-pilot-scale purification of high-value compounds such as APIs, peptides, and biomolecules, and process chromatography, which enables large-scale industrial purification in biopharmaceutical manufacturing. It includes essential products such as resins and chemicals (stationary phases and buffers for selective separation), columns (pre-packed or custom for holding media), systems (HPLC and LC systems), and aftermarket services (maintenance, validation, training, and optimization).

Key Stakeholders

- Pharmaceutical companies

- Biopharmaceutical companies

- CROs

- CDMOs

- Chromatography products manufacturers

- Chromatography products suppliers and distributors

- Market research and consulting firms

- Academic & research institutes

- Regulatory authorities and industry associations

- Venture capitalists and investment firms

- Research labs

Report Objectives

- To define, describe, and forecast the size of the preparative and process chromatography market based on product type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global preparative and process chromatography market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the global preparative and process chromatography market

- To analyze key growth opportunities in the global preparative and process chromatography market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions: North America (US and Canada), Europe (Germany, France, UK, Spain, Italy, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, Rest of Latin America ), and Middle East & Africa (GCC countries and Rest of Middle East & Africa)

- To profile key players in the preparative and process chromatography market and comprehensively analyze their market share and core competencies

- To analyze competitive developments, such as product launches, agreements, expansions, and mergers & acquisitions, undertaken in the global preparative and process chromatography market

Available customizations:

Based on the provided market data, MarketsandMarkets offers customizations tailored to your company’s specific needs. The following customization options are available for the current global preparative and process chromatography market report.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top fifteen companies

Company Information

- Detailed analysis and profiling of additional market players (up to 13)

Geographic Analysis

- Further breakdown of the Rest of Europe preparative and process chromatography market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal

- Further breakdown of the Rest of Asia Pacific preparative and process chromatography market into Singapore, Taiwan, New Zealand, the Philippines, Malaysia, and other Asia Pacific countries

- Further breakdown of the Rest of Latin America preparative and process chromatography market into Argentina, Chile, Peru, and Colombia

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Preparative and Process Chromatography Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Preparative and Process Chromatography Market