Prosthetic Heart Valve Market by Type (Transcatheter Heart Valve, Tissue Heart Valve, and Mechanical Heart Valve), and Region (North America, Europe, Asia-Pacific, and RoW) - Global Forecast to 2022

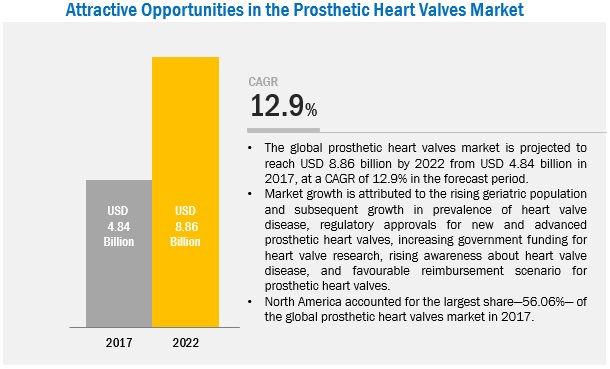

The prosthetic heart valve market is growing at a CAGR of 12.9%. Market growth can be attributed to the rising geriatric population and the subsequent increase in the prevalence of HVD, regulatory approvals for new and advanced prosthetic heart valve, increasing government funding for heart valve research, rising awareness about HVD, and favorable reimbursement scenario for prosthetic heart valve.

Years considered for this report

2016 – Base Year

2017 – Estimated Year

2022 – Projected Year

The objectives for this study are as follows:

- To define, describe, and forecast the prosthetic heart valve market on the basis of type of valve and region

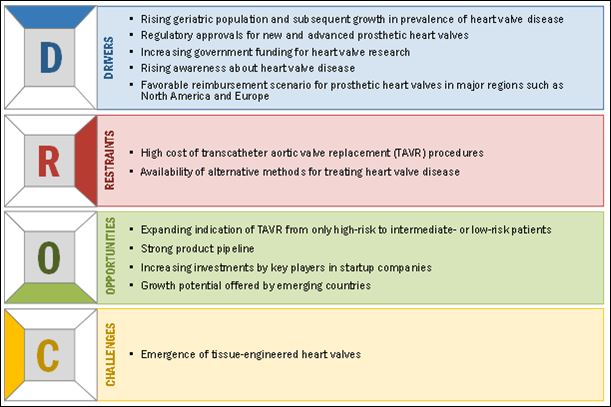

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast revenue of the market segments with respect to four main regional segments, namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their market shares and core competencies in terms of market development and growth strategies

- To track and analyze competitive developments such as marketing and promotional activities, approvals, product launches, acquisitions, agreements, collaborations, expansions, certifications, and reimbursement approvals in the prosthetic heart valve market

Research Methodology

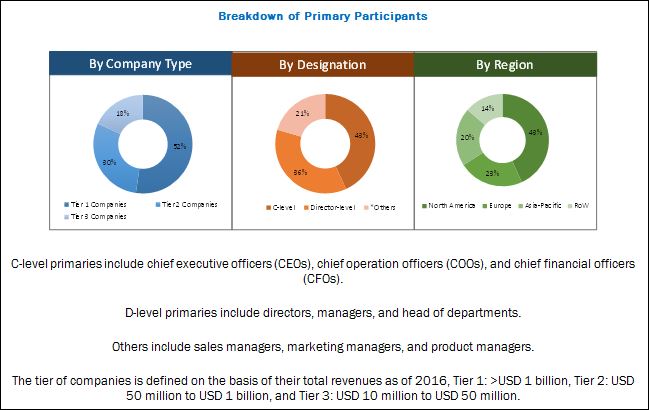

Top-down and bottom-up approaches were used to estimate and validate the size of the prosthetic heart valve market and to estimate the size of various other dependent submarkets. The overall market size was used in the top-down approach to estimate the sizes of other individual markets (mentioned in the market segmentation by type of valve and region) through percentage splits from secondary and primary research. For the calculation of each type of specific market segment, the most appropriate immediate parent market size was used for implementing the top-down approach. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues obtained. The bottom-up approach was employed to arrive at the overall size of the market from the sales of prosthetic heart valve in the respective four regions. Various secondary sources such as directories, industry journals, and databases have been used to identify and collect information useful for this extensive commercial study of the prosthetic heart valve market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the prosthetic heart valve market. The breakdown of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The key players in the artificial heart valve market are Medtronic plc (Ireland), Edwards Lifesciences Corporation (U.S.), Boston Scientific Corporation (U.S.), St. Jude Medical, Inc. (an Abbott Laboratories Company) (U.S.), LivaNova PLC (U.K.), Symetis SA (Switzerland), Jenavalve Technology, Inc. (Germany), CryoLife, Inc. (U.S.), TTK Healthcare Limited (India), Colibri Heart Valve, LLC (U.S.), Lepu Medical Technology Co., Ltd. (China), and Braile Biomédica (Brazil).

Target Audience for this Report:

- Prosthetic Heart Valve Manufacturing Companies

- Suppliers and Distributors of Prosthetic Heart Valve

- Healthcare Service Providers

- Teaching Hospitals and Academic Medical Centers (AMCs)

- Health Insurance Players

- Research and Consulting Firms

- Medical Research Institutes

- Audiology Centers

- Healthcare Institutions/Providers (Hospitals, Medical Institutes, and Governing Bodies)

- Venture Capitalists

- Community Centers

- Regulatory Authorities

Value Addition for the Buyer:

This report aims to provide insights into the global prosthetic heart valve market. It provides valuable information on the types of valve and regions in the artificial heart valve market. Leading players in the market are profiled to study their product offerings and understand the strategies undertaken by them to be competitive in this market.

The above-mentioned information would benefit the buyer by helping them understand the market dynamics. In addition, the forecasts provided in the report will enable firms to understand the trends in this market and better position themselves to capitalize the growth opportunities.

Scope of the Report:

This research report categorizes the global prosthetic heart valve market into the following segments:

Prosthetic Heart Valve Market, by Type of Valve

- Transcatheter Heart Valve

- Tissue Heart Valve

- Mechanical Heart Valve

Prosthetic Heart Valve Market, by Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- France

- U.K.

- Rest of Europe (RoE)

-

Asia-Pacific

- Japan

- China

- India

- Rest of Asia-Pacific (RoAPAC)

- Rest of the World (RoW)

Available Customizations:

Portfolio Assessment:

- Product Matrix, which gives a detailed comparison of the product portfolios of the top three companies in the market

Market Size Analysis:

- Prosthetic Heart Valve Market, by Valve Replacement (Aortic Heart Valve, Mitral Heart Valve, Pulmonary Heart Valve, and Tricuspid Heart Valve)

Company Information:

- Detailed company profiles of up to 3 market players

Transcatheter heart valve segment to grow at the highest CAGR during the forecast period

On the basis of type, the global prosthetic heart valve market is categorized into three segments transcatheter, tissue, and mechanical heart valve. In 2017, the transcatheter heart valve segment is expected to hold the largest share in the global market and grow at the highest CAGR in the forecast period (2017 to 2022). The large share and high growth of this segment can be attributed to factors such as ease of implantation (involving a minimally invasive procedure rather than an open-heart surgery), increasing prevalence of aortic stenosis, and growing patient pool.

The global prosthetic heart valve market is expected to reach USD 8,862.9 million by 2022. Factors such as rising geriatric population, regulatory approvals for new and advanced prosthetic heart valve, increasing government funding for heart valve research, rising awareness about heart valve diseases, and favourable reimbursement scenario for prosthetic heart valves are driving the growth of the prosthetic heart valve market.

High cost of transcatheter aortic valve replacement (TAVR) procedures and availability of alternative methods for treating heart valve diseases (HVDs) are the major restraints for the market.

Transcatheter aortic valve replacement (TAVR), also called as transcatheter aortic valve implantation (TAVI), is a minimally invasive surgical method used for the replacement of aortic heart valve without removing the old heart valve. TAVR is a relatively new method for heart valve replacement in patients who are aged above 80 years or in patients with a high risk of open heart surgery.

In the U.S., the cost of a transcatheter heart valve ranges from USD 25,000 to USD 30,000, which is much higher than surgical valve that cost USD 5,000 to USD 10,000. Even though the cost of hospital and ICU stay in TAVR procedures is lesser than in SAVR procedures, it does not balance out the high cost of transcatheter heart valve. Moreover, permanent Pacemakers are required to be implanted in some of the patients who have undergone TAVR procedures. The implantation of pacemakers adds up to the cost of the overall treatment.

Reimbursement for TAVR procedures is complicated as it includes patients being examined by a multidisciplinary team, which involves multiple cardiac surgeons and interventional cardiologists. These factors are expected to hinder the growth of the TAVR market in the coming years.

There are multiple alternative options available for treating heart valve diseases such as Medication and heart valve repair. Medication is used to increase the heart’s ability to pump blood, which helps compensate for the valve which is not working. Additionally, repair of heart valve can be carried out by means of open-heart surgery or minimally invasive methods. Heart valve replacement is used as a last resort.

Market Dynamics

Rapid growth in the aging population and prevalence of valvular heart diseases in the US

Valvular heart disease (VHD) places a significant burden on the U.S. healthcare system. According to the American College of Cardiology, approximately 5 million Americans are diagnosed with HVD every year. The number of people suffering from aortic stenosis is 1.5 million every year; nearly 500,000 people suffer from severe aortic stenosis. Moreover, around 4.0 million people suffer from significant mitral valve insufficiency, with nearly 250,000 incident cases of mitral regurgitation every year.

VHD mainly affects the older population as a result of calcium buildup and scarring in the valve cusp due to aging. The prevalence of VHD in population aged 18-44 and 75 years was 0.7% and 13.0%, respectively in 2012. The rapid growth in the aging population is, therefore, a key market driver in North America. According to the Administration on Aging (AoA), the population of individuals aged 65 years and older was 46.2 million in 2014, representing 14.5% of the U.S. population. This number is anticipated to rise to about 98 million by 2060. Growth in the aging population and the consequent rise in the prevalence of VHD is expected to drive the market growth for prosthetic heart valve in the U.S.

Favorable reimbursement scenario for prosthetic heart valve in the US

Heart valve are fairly costly devices, with the average cost ranging from USD 25,000 to USD 35,000. Hence, reimbursement plays a critical role in the acceptance of the procedure. The CMS reimburses the heart valve implantation procedures in the U.S. The organization approved insurance for transcatheter heart valve replacement procedures in 2012, under certain conditions. The conditions include that the patient should be pre-examined by two cardiac surgeons independently, patient should be under the care of a heart team—both before and after the operation, and an FDA-approved valve and implantation system should be used. The availability of insurance coverage increases affordability and is likely to drive the number of heart valve replacement procedures in the U.S.

Key Questions

- Detailed analysis of value and volume by country wise value & volume analysis for the US, Canada, Germany, France, the UK, Japan, China, India.

- Company share analysis by type of heart valve. Major players and their shares provided separately for each type of the heart valve.

- What trends and challenges will impact the development and sizing of Global Prosthetic Heart Valve/ Artificial Heart Valve market for the period 2017-2022

The prosthetic heart valve market is projected to reach USD 8.86 Billion by 2022 from USD 4.84 Billion in 2017, at a CAGR of 12.9%. The key factors propelling the growth of this market include the rising geriatric population and the subsequent increase in the prevalence of HVD, regulatory approvals for new and advanced prosthetic heart valve, increasing government funding for heart valve research, rising awareness about HVD, and favorable reimbursement scenario for prosthetic heart valve.

In this report, the prosthetic heart valve market has been segmented based on the type of valve and region. On the basis of the type of valve, the market is segmented into transcatheter heart valves, tissue heart valve, and mechanical heart valve. The transcatheter heart valve segment is expected to command the largest share of the global market in 2017 and is expected to register the highest CAGR of 18.0% during the forecast period. The large share and high growth rate of this segment can be attributed to the rising prevalence of aortic stenosis, increasing pool of patients owing to approvals for extended valve indications, and technological advancements. The preference for transcatheter heart valve is expected to witness high growth in the future as they are implanted through a minimally invasive procedure while the other valve types require open-heart surgery.

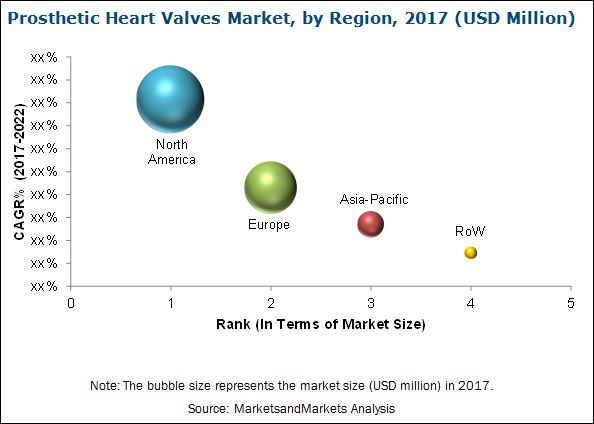

In 2017, North America is expected to dominate the prosthetic heart valve market, followed by Europe, Asia-Pacific, and the RoW. North America is also expected to register the highest CAGR during the forecast period. The large share and high growth in this regional segment can be attributed to factors such as the rapid growth in the aging population and prevalence of valvular heart diseases, favorable reimbursement scenario, and rising product approvals for heart valve are contributing to the growth of the North American prosthetic heart valve market.

A majority of the leading players in this market are focusing on marketing and promotional activities, product launches and approvals, acquisitions, agreements, collaborations, and expansions to enhance their market presence and strengthen their distribution networks, cater to the needs of a growing customer base, widen their product portfolios, and boost their production capabilities. Edwards Lifesciences Corporation (U.S.), Medtronic plc (Ireland), and St. Jude Medical, Inc. (an Abbott Laboratories Company) (U.S.) are identified as the top players in this market. These companies have a diversified product portfolio, wide geographic reach, and a strong focus on innovation and research.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Prosthetic Heart Valve Market: Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Prosthetic Heart Valve Market: Research Methodology (Page No. - 19)

2.1 Research Methodology Steps

2.2 Secondary and Primary Research Methodology

2.2.1 Secondary Research

2.2.2 Primary Research

2.2.2.1 Key Industry Insights

2.2.2.2 Key Data From Primary Sources

2.2.2.3 Key Insights From Primary Sources

2.3 Market Size Estimation Methodology

2.4 Research Design

2.5 Market Data Validation and Triangulation

2.6 Assumptions for the Study

3 Prosthetic Heart Valve Market: Executive Summary (Page No. - 32)

4 Prosthetic Heart Valve Market: Premium Insights (Page No. - 35)

4.1 Introduction

4.2 Global Prosthetic Heart Valve Market, By Type of Valve, 2017 vs 2022

4.3 Geographical Snapshot of Global Prosthetic Heart Valve Market

5 Prosthetic Heart Valve Market: Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Geriatric Population and Subsequent Growth in Prevalence of Heart Valve Disease

5.2.1.2 Regulatory Approvals for New and Advanced Prosthetic Heart Valve

5.2.1.2.1 Product Approvals for Medtronic PLC:

5.2.1.2.2 Product Approvals for Edward Lifesciences Corporation:

5.2.1.2.3 Product Approvals for Boston Scientific Corporation:

5.2.1.2.4 Product Approvals for Livanova PLC:

5.2.1.2.5 Product Approvals for St. Jude Medical, Inc.:

5.2.1.2.6 Product Approvals for Other Companies:

5.2.1.3 Increasing Government Funding for Heart Valve Research

5.2.1.4 Rising Awareness About Heart Valve Diseases

5.2.1.5 Favorable Reimbursement Scenario for Prosthetic Heart Valve

5.2.2 Restraints

5.2.2.1 High Cost of Transcatheter Aortic Valve Replacement (TAVR) Procedures

5.2.2.2 Availability of Alternative Methods for Treating Heart Valve Diseases (HVD)

5.2.3 Opportunities

5.2.3.1 Expanding Indication of TAVR From Only High-Risk to Intermediate- Or Low-Risk Patients

5.2.3.2 Strong Product Pipeline

5.2.3.3 Increasing Investments By Key Players in Startup Companies

5.2.3.4 Growth Potential Offered By Emerging Countries

5.2.4 Challenge

5.2.4.1 Emergence of Tissue-Engineered Heart Valve (TEHV)

6 Global Prosthetic Heart Valve Market, By Type of Valve (Page No. - 50)

6.1 Introduction

6.2 Transcatheter Heart Valve

6.3 Tissue Heart Valve

6.4 Mechanical Heart Valve

7 Global Prosthetic Heart Valve Market, By Region (Page No. - 65)

7.1 Introduction

7.2 North America

7.2.1 U.S.

7.2.1.1 Rapid Growth in the Aging Population and Prevalence of Valvular Heart Diseases

7.2.1.2 Rising Preference for Transcatheter Aortic Valve Replacement (TAVR)

7.2.1.3 Favorable Reimbursement Scenario for Prosthetic Heart Valves

7.2.1.4 Initiatives to Increase Awareness of Valvular Heart Diseases (VHD)

7.2.1.5 Stringent Regulations for New Prosthetic Heart Valve Approval

7.2.2 Canada

7.2.2.1 Favorable Reimbursement and Funding

7.2.2.2 Rising Approvals for Heart Valves

7.3 Europe

7.3.1 Increasing Aging Population and Valvular Heart Diseases (VHD) Prevalence

7.3.2 Growth in the Number of Research Activities

7.3.3 Germany

7.3.3.1 Favorable Reimbursement Policies

7.3.4 France

7.3.4.1 Valve for Life (VFL) Initiative

7.3.5 U.K.

7.3.5.1 Establishment of Specialty Valve Clinics

7.3.6 Rest of Europe (RoE)

7.3.6.1 Rising Initiatives and Awareness Programs in Poland and Portugal

7.4 Asia-Pacific

7.4.1 Japan

7.4.1.1 Rising Aging Population

7.4.1.2 Favorable Reimbursement Scenario

7.4.1.3 Dilution of Regulatory Stringency

7.4.2 China

7.4.2.1 Rising Aging Population and Prevalence of Valvular Heart Diseases in China

7.4.2.2 Unfavorable Reimbursements

7.4.3 India

7.4.3.1 High Patient Pool for Target Diseases

7.4.3.2 State Government Funded Insurance Schemes

7.4.4 Rest of Asia-Pacific (RoAPAC)

7.4.4.1 Growing Medical Tourism in Asian Countries

7.5 Rest of the World

7.5.1 Rise in Aging Population

7.5.2 High Prevalence of Heart Valve Disease in Brazil

7.5.3 Favorable Medical Tourism Destination

8 Prosthetic Heart Valve Market: Competitive Landscape (Page No. - 92)

8.1 Market Share Analysis (2016)

8.1.1 Introduction

8.1.2 Global Transcatheter Heart Valve Market Share, By Key Player, 2016

8.1.3 Global Tissue Heart Valve Market Share, By Key Player, 2016

8.1.4 Global Mechanical Heart Valve Market Share, By Key Player, 2016

8.1.5 Edwards Lifesciences Corporation

8.1.6 Medtronic PLC

8.1.7 St. Jude Medical, Inc.

8.2 Vendor Dive Overview

8.2.1 Vanguards

8.2.2 Innovator

8.2.3 Dynamic

8.2.4 Emerging

8.3 Competitive Benchmarking

8.3.1 Analysis of Product Portfolio of Major Players in the Prosthetic Heart Valve Market (18 Players)

8.3.2 Business Strategies Adopted By Major Players in the Prosthetic Heart Valve Market (18 Players)

*Top 13 Companies Analysed for This Study are - Edwards Lifesciences Corporation (U.S.), Medtronic PLC (Ireland), St. Jude Medical, Inc. (Abbott Laboratories Company) (U.S.), Boston Scientific Corporation (U.S.), Livanova PLC (U.K.), Symetis SA (Switzerland), Jenavalve Technology, Inc. (Germany), Cryolife, Inc. (U.S.), TTK Healthcare Limited (India), Colibri Heart Valve, LLC (U.S.), Lepu Medical Technology Co., Ltd. (China), and Braile Biomédica (Brazil). Other Players in This Market Include Micro Interventional Devices, Inc. (U.S.), Autotissue Berlin GmbH (Germany), Comed B.V. (Netherlands), Meril Life Sciences Pvt. Ltd. (India), Labcor Laboratórios Ltda. (Brazil), and Hlt Inc. (A Bracco Group Company) (U.S.)

9 Company Profiles (Page No. - 100)

(Overview, Products and Services, Financials, Strategy & Development)*

9.1 Introduction

9.2 Medtronic PLC

9.3 Edwards Lifesciences Corporation

9.4 Boston Scientific Corporation

9.5 Livanova PLC

9.6 St. Jude Medical, Inc. (An Abbott Laboratories Company)

9.7 Symetis SA

9.8 Jenavalve Technology, Inc.

9.9 Cryolife, Inc.

9.10 TTK Healthcare Limited (A TTK Group Company)

9.11 Colibri Heart Valve, LLC

9.12 Lepu Medical Technology Co., Ltd.

9.13 Braile Biomédica

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

10 Appendix (Page No. - 147)

10.1 Discussion Guide

10.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

10.3 Introducing RT: Real-Time Market Intelligence

10.4 Available Customizations

10.5 Related Reports

10.6 Author Details

List of Tables (64 Tables)

Table 1 Global Prosthetic Heart Valve Market Snapshot

Table 2 Global Prosthetic Heart Valve Market Size, By Type of Valve, 2015–2022 (USD Million)

Table 3 Global Prosthetic Heart Valve Market Size, By Type of Valve, 2015–2022 (Units)

Table 4 Global Transcatheter Heart Valve Market Size, By Region, 2015–2022 (USD Million)

Table 5 Global Transcatheter Heart Valve Market Size, By Region, 2015–2022 (Units)

Table 6 North America: Transcatheter Heart Valve Market Size, By Country, 2015–2022 (USD Million)

Table 7 North America: Transcatheter Heart Valve Market Size, By Country, 2015–2022 (Units)

Table 8 Europe: Transcatheter Heart Valve Market Size, By Country, 2015–2022 (USD Million)

Table 9 Europe: Transcatheter Heart Valve Market Size, By Country, 2015–2022 (Units)

Table 10 Asia-Pacific Transcatheter Heart Valve Market Size, By Country, 2015–2022 (USD Million)

Table 11 Asia-Pacific: Transcatheter Heart Valve Market Size, By Country, 2015–2022 (Units)

Table 12 Global Tissue Heart Valve Market Size, By Region, 2015–2022 (USD Million)

Table 13 Global Tissue Heart Valve Market Size, By Region, 2015–2022 (Units)

Table 14 North America: Tissue Heart Valve Market Size, By Country, 2015–2022 (USD Million)

Table 15 North America: Tissue Heart Valve Market Size, By Country, 2015–2022 (Units)

Table 16 Europe: Tissue Heart Valve Market Size, By Country, 2015–2022 (USD Million)

Table 17 Europe: Tissue Heart Valve Market Size, By Country, 2015–2022 (Units)

Table 18 Asia-Pacific: Tissue Heart Valve Market Size, By Country, 2015–2022 (USD Million)

Table 19 Asia-Pacific: Tissue Heart Valve Market Size, By Country, 2015–2022 (Units)

Table 20 Global Mechanical Heart Valve Market Size, By Region, 2015–2022 (USD Million)

Table 21 Global Mechanical Heart Valve Market Size, By Region, 2015–2022 (Units)

Table 22 North America: Mechanical Heart Valve Market Size, By Country, 2015–2022 (USD Million)

Table 23 North America: Mechanical Heart Valve Market Size, By Country, 2015–2022 (Units)

Table 24 Europe: Mechanical Heart Valve Market Size, By Country, 2015–2022 (USD Million)

Table 25 Europe: Mechanical Heart Valve Market Size, By Country, 2015–2022 (Units)

Table 26 Asia-Pacific: Mechanical Heart Valve Market Size, By Country, 2015–2022 (USD Million)

Table 27 Asia-Pacific: Mechanical Heart Valve Market Size, By Country, 2015–2022 (Units)

Table 28 Global Prosthetic Heart Valve Market Size, By Region, 2015–2022 (USD Million)

Table 29 Global Prosthetic Heart Valve Market Size, By Region, 2015–2022 (Units)

Table 30 North America: Artificial Heart Valve Market Size, By Country, 2015–2022 (USD Million)

Table 31 North America: Artificial Heart Valve Market Size, By Country, 2015–2022 (Units)

Table 32 North America: Artificial Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 33 North America: Artificial Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 34 Medicare National Average Coverage for Heart Valve Replacement Procedures

Table 35 U.S.: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 36 U.S.: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 37 Canada: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 38 Canada: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 39 Europe: Artificial Heart Valve Market Size, By Country, 2015–2022 (USD Million)

Table 40 Europe: Artificial Heart Valve Market Size, By Country, 2015–2022 (Units)

Table 41 Europe: Artificial Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 42 Europe: Artificial Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 43 Germany: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 44 Germany: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 45 France: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 46 France: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 47 U.K.: Artificial Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 48 U.K.: Artificial Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 49 RoE: Artificial Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 50 RoE: Artificial Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 51 Asia-Pacific: Prosthetic Heart Valve Market Size, By Country, 2015–2022 (USD Million)

Table 52 Asia-Pacific: Prosthetic Heart Valve Market Size, By Country, 2015–2022 (Units)

Table 53 Asia-Pacific: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 54 Asia-Pacific: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 55 Japan: Artificial Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 56 Japan: Artificial Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 57 China: Artificial Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 58 China: Artificial Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 59 India: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 60 India: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 61 RoAPAC: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 62 RoAPAC: Prosthetic Heart Valve Market Size, By Type, 2015–2022 (Units)

Table 63 RoW: Artificial Heart Valve Market Size, By Type, 2015–2022 (USD Million)

Table 64 RoW: Artificial Heart Valve Market Size, By Type, 2015–2022 (Units)

List of Figures (35 Figures)

Figure 1 Global Prosthetic Heart Valve Market Segmentation

Figure 2 Global Prosthetic Heart Valve Market: Research Methodology Steps

Figure 3 Key Data From Secondary Sources

Figure 4 Primary Research - Current Sampling Frame

Figure 5 Break Down of Primary Interviews: By Company Type, Designation, and Region

Figure 6 Market Size Estimation Methodology: Global Market

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach for the Transcatheter Heart Valve Market

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach for the Tissue Heart Valve Market

Figure 9 Market Size Estimation Methodology: Bottom-Up Approach for the Mechanical Heart Valve Market

Figure 10 Market Size Estimation Methodology: Bottom-Up Approach for the Global Prosthetic Heart Valve Market

Figure 11 Market Size Estimation Methodology: Top-Down Approach

Figure 12 Data Triangulation Methodology

Figure 13 Transcatheter Heart Valve Segment to Register the Highest CAGR From 2017 to 2022

Figure 14 North America to Register the Highest CAGR in the Forecast Period

Figure 15 Evolution of Prosthetic Heart Valve

Figure 16 Rising Prevalence of Heart Valve Disease is One of the Major Factors Driving the Growth of the Prosthetic Heart Valve Market

Figure 17 Transcatheter Heart Valve to Register the Highest CAGR During the Forecast Period

Figure 18 North America to Register the Highest CAGR During the Forecast Period

Figure 19 Global Prosthetic Heart Valve Market: Drivers, Restraints, Opportunities, and Challenge

Figure 20 Global Prosthetic Heart Valve Market, By Type of Valve

Figure 21 Transcatheter Heart Valve Segment to Grow at the Highest CAGR During the Forecast Period

Figure 22 North America: Prosthetic Heart Valve Market Snapshot

Figure 23 Europe: Prosthetic Heart Valve Market Snapshot

Figure 24 Asia-Pacific: Prosthetic Heart Valve Market Snapshot

Figure 25 RoW: Prosthetic Heart Valve Market Snapshot

Figure 26 Vendor Dive Comparison Matrix: Prosthetic Heart Valve Market

Figure 27 Product Mix of Key Players in Market

Figure 28 Medtronic PLC: Company Snapshot (2015)

Figure 29 Edwards Lifesciences Corporation: Company Snapshot (2016)

Figure 30 Boston Scientific Corporation: Company Snapshot (2016)

Figure 31 Neovasc Inc.: Company Snapshot (2016)

Figure 32 Livanova PLC: Company Snapshot (2016)

Figure 33 St. Jude Medical, Inc. (An Abbott Laboratories Company): Company Snapshot (2015)

Figure 34 Cryolife, Inc.: Company Snapshot (2016)

Figure 35 TTK Healthcare Limited: Company Snapshot (2015)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Prosthetic Heart Valve Market