Purging Compound Market by Type (Mechanical, Chemical/Foaming, and Liquid Purging), Process (Extrusion, Injection Molding, and Blow Molding), and Region - Global Forecast to 2022

[141 Pages Report] The purging compound market is projected to grow from an estimated USD 450.7 million in 2017 to USD 586.3 million by 2022, at a CAGR of 5.4% from 2017 to 2022. Purging compounds help reduce machine downtime, production costs, and raw material wastage, which is a major factors that is contributing to the growth of the purging compound market. Purging compound market is segmented based on type, which includes mechanical purging, chemical/foaming purging, and liquid purging. Based on process, purging compound market is segmented into extrusion, injection molding, and blow molding. In this study, 2016 has been considered the base year and 2017-2022 as the forecast period to estimate the purging compound market size.

Market Dynamics

Drivers

- Purging compounds help reduce machine downtime, production costs, and raw material wastage

Restraints

- High prices of purging compounds

Opportunities

- Compliance with various legal and administrative bodies for direct use with food products and medicines

Challenges

- Lack of awareness about the benefits offered by purging compounds in emerging economies

Purging compounds help reduce machine downtime, production costs, and raw material wastage drives the purging compound market

Purging compounds are widely used for effective cleaning of plastic processing equipment, as they consist of scrubbing granules, which penetrate into dead spots and hot spots of machines to remove carbon buildup comprising layers of separated additives and degraded polymers. Purging compounds are required for normal cleaning of plastic processing machines to eliminate color changes in the finished products, resin or raw material changes, formulation changes in machines, and routine shutdown of industrial operations. Purging compounds not only ensure effective cleaning of machines but also facilitate quality control, which is critical for extending the operating life of machines. Manual cleaning of large machines is a time-consuming process as it involves disassembling of different parts of machines. It also leads to increased pressure on the overall operational activities carried out in various industries, thereby affecting productivity. Moreover, there is always the need to manage bottom-line costs of industries to stay competitive and profitable. Thus, machine downtime is neither competitive nor profitable. Use of purging compounds for cleaning machines lessens the machine cleaning time, reduces raw material wastage, leads to minimum rejection of final products, and also enables reuse of raw materials.

The main objectives of this market study are:

- To define and segment the global purging compound market by type, process, and region

- To identify the market dynamics currently impacting the global purging compound market growth, such as drivers, restraints, challenges, and opportunities

- To analyze and forecast the demand for purging compounds, in terms of value

- To estimate, analyze, and forecast the global purging compound market, with respect to key countries

- To analyze the recent strategic initiatives, such as facility and capacity expansions, partnerships and collaborations, and new product developments

- To draw a competitive landscape of the global purging compound market

- To strategically identify and profile key players in the global purging compound market

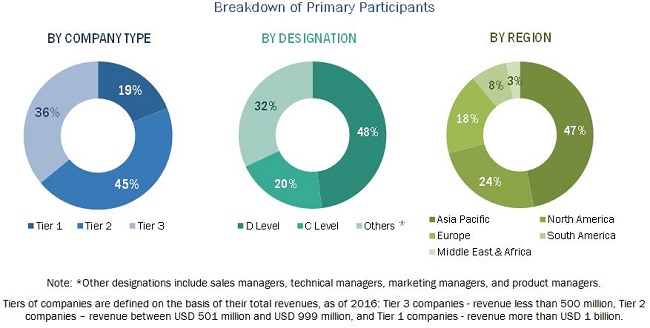

Secondary sources such as company websites, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites have been used to identify and collect information that is useful for this extensive commercial study of the purging compound market. Primary sources, which include experts from related industries, have been interviewed to verify and collect critical information as well as to assess the prospects of the market. The top-down approach has been implemented to validate the market size. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study. The breakdown of primaries conducted is shown in the figure below.

Huge investments are being made by various key companies, such as Asahi Kasei Corporation (Japan), Chem-Trend (China), Purgex (U.S.), Dyna-Purge (U.S.), 3M Company (U.S.), Clariant AG (Switzerland), VELOX GmbH (Germany), E. I. Du Pont de Nemours and Company (U.S.), Kuraray Co., Ltd. (Japan), Daicel Corporation (Japan), The Dow Chemical Company (U.S.), Formosa Plastics Corporation (Taiwan), CALSAK Corporation (U.S.), Reedy Chemical Foam & Specialty Additives (U.S.), Magna Purge (U.S.), and RapidPurge (U.S.), among others to meet the increased demand for purging compounds from the growing plastic processing equipment industry across the globe.

Target Audience of the Report:

- Purging compound manufacturers, dealers, and suppliers

- Government bodies

- End users

- Companies engaged in material R&D activities

- Application industries

- Feedstock suppliers

- Industrial associations

- Large infrastructure companies

- Investment banks

- Consulting companies/consultants in chemical and material sectors

Scope of the Report:

This research report categorizes the purging compound market based on type, process, and region, and forecasts revenue growth and provides an analysis of trends in each of the submarkets.

By Type:

- Mechanical Purging

- Chemical/Foaming Purging

- Liquid Purging

Each type is further described in detail in the report with value forecasts until 2022.

By Process:

- Extrusion

- Injection Molding

- Blow Molding

Each process is further described in detail in the report with value forecasts until 2022.

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Each region is further segmented by key countries, such as China, India, Japan, South Korea, Australia, Taiwan, the US, Mexico, Canada, Germany, the UK, Italy, France, Netherlands, Belgium, Russia, Spain, Ukraine, UAE, South Africa, Kingdom of Saudi Arabia (KSA), Iran, Iraq, Egypt, Argentina, Venezuela, and Brazil.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

New Product Analysis

- Product matrix, which gives a detailed comparison of new products and market trends in each industry

Geographic Analysis

- Further breakdown of a region with respect to a particular country and end-use industry

Company Information

- Detailed analysis and profiles of companies in end-use industries (up to five)

The purging compound market is projected to grow from an estimated USD 450.7 million in 2017 to USD 586.3 million by 2022, at a CAGR of 5.4% from 2017 to 2022. Compliance with various legal and administrative bodies for direct use with food products and medicines is expected to drive the purging compound market. Reduction in machine downtime, production costs, and raw material wastage is also expected to fuel the demand for purging compound.

The purging compound market has been segmented on the basis of type, process, and region. Based on type, the mechanical purging segment led the purging compound market in 2016 owing to the increased use of purging compounds to manufacture plastic products. Based on process, the extrusion segment led the purging compound market in 2016.

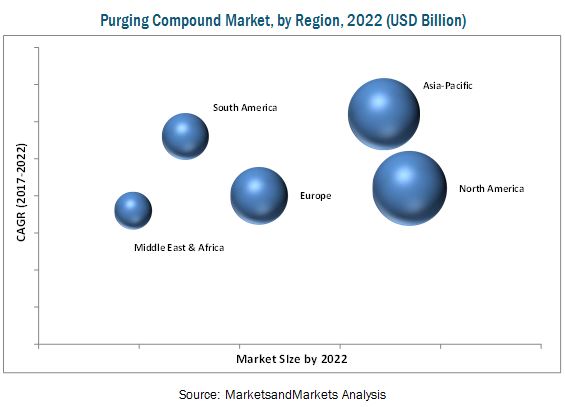

The North America region led the purging compound market in 2016, and is expected to grow at the significant rate during the forecast period, owing to the increasing demand for purging compound from countries such as the US, Canada, and Mexico. The increase in demand for purging compounds for their exceptional properties from end-use industries in the region are expected to drive the North America purging compound market.

Types such as mechanical purging, chemical/foaming purging, and liquid purging are driving the growth of purging compound market

Mechanical Purging

Mechanical purging compounds are used for cleaning of plastic processing machines. These compounds help in the removal of polymer residue by using abrasives or high viscosity plastics to mechanically scrub the contaminants from barrels and screws. The mechanical thermoplastic purging mixture contains a carrier resin and scrubbing granules, which are soft on the outside but remain solid on the inside; they clean metal surfaces safely and thoroughly, without wearing off the machine.

Chemical/Foaming Purging

Chemical/foaming purging compounds are increasingly utilized by plastic processing manufacturers, as they help minimize production costs and ensure optimal functioning of machinery. Chemicals are used to break down the polymer residue in barrels, screws, and other machines parts, to reduce the molecular weight and viscosity of polymers, which, in turn, helps in flushing them automatically from the machines. Chemical purging compounds are mostly preferred, due to their high moldability rate, as scrap generated can often be used to remold parts.

Liquid Purging

Liquid purging compounds are concentrated and water-based additives, and typically act as surfactants that help in the removal of deposits from metal surfaces. The liquid purging compounds offer no soaking procedure for quick, easy, and safe cleaning of equipment, and are non-flammable, non-toxic, non-abrasive, colorless, and odorless in nature.

Critical questions the report answers:

- Where will all the major developments take the industry in the mid to long term?

- What are the upcoming industry applications for purging compound?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Pre-mixed purging compounds are more expensive than the compounds that require formulations. Therefore, high prices of purging compounds are expected to be the major inhibiting factor for the growth of the purging compound market, especially in emerging economies, such as India and South Africa.

Huge investments are being made by various key companies, such as Asahi Kasei Corporation (Japan), Chem-Trend (China), Purgex (U.S.), Dyna-Purge (U.S.), 3M Company (U.S.), Clariant AG (Switzerland), VELOX GmbH (Germany), E. I. Du Pont de Nemours and Company (U.S.), Kuraray Co., Ltd. (Japan), Daicel Corporation (Japan), The Dow Chemical Company (U.S.), Formosa Plastics Corporation (Taiwan), CALSAK Corporation (U.S.), Reedy Chemical Foam & Specialty Additives (U.S.), Magna Purge (U.S.), and RapidPurge (U.S.), among others to meet the increased demand for purging compounds from the growing plastic processing equipment industry across the globe. New product launches and acquisitions are the key strategies adopted by leading players to strengthen their positions in the global purging compound market.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Purging Compound Market

4.2 Purging Compound Market, By Region

4.3 Purging Compound Market, By Process

4.4 North America Purging Compound Market

4.5 Purging Compound Market: Emerging Economies & Developed Economies

5 Market Overview (Page No. - 33)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Use of Purging Compounds in Various Industries Leads to Reduction in Machine Downtime, Low Production Cost, and Less Raw Material Wastage

5.1.2 Restraints

5.1.2.1 High Prices of Purging Compounds

5.1.3 Opportunities

5.1.3.1 Compliance of Purging Compounds With the Regulations Formulated By Various Legal and Administrative Bodies for Direct Use With Food Products and Medicines

5.1.4 Challenges

5.1.4.1 Lack of Awareness About the Benefits Offered By Purging Compounds in Emerging Economies as Compared to Developed Economies

5.2 Porters Five Forces Analysis

5.2.1 Threat of New Entrants

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitutes

5.2.4 Bargaining Power of Suppliers

5.2.5 Intensity of Competitive Rivalry

5.3 Macroeconomic Indicators

5.3.1 Demand Outlook for the Plastics Industry

5.3.2 Trends and Forecast Regarding Contribution of the Polymer Industry to GDP of Major Countries

5.4 Industry Outlook

5.4.1 Plastic Processing Machines Market

6 Purging Compound Market, By Type (Page No. - 45)

6.1 Introduction

6.1.1 Mechanical Purging

6.1.2 Chemical/Foaming Purging

6.1.3 Liquid Purging

7 Purging Compound Market, By Process (Page No. - 52)

7.1 Introduction

7.2 Extrusion

7.3 Injection Molding

7.4 Blow Molding

8 Purging Compound Market, By Region (Page No. - 57)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Mexico

8.2.3 Canada

8.3 Europe

8.3.1 Germany

8.3.2 France

8.3.3 Italy

8.3.4 Russia

8.3.5 Spain

8.3.6 U.K.

8.3.7 Netherlands

8.3.8 Belgium

8.3.9 Ukraine

8.3.10 Rest of Europe

8.4 Asia-Pacific

8.4.1 China

8.4.2 Japan

8.4.3 South Korea

8.4.4 Australia

8.4.5 India

8.4.6 Taiwan

8.4.7 Rest of Asia-Pacific

8.5 Middle East & Africa

8.5.1 UAE

8.5.2 Kingdom of Saudi Arabia (KSA)

8.5.3 Iran

8.5.4 South Africa

8.5.5 Iraq

8.5.6 Egypt

8.5.7 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Venezuela

8.6.4 Rest of South America

9 Competitive Landscape (Page No. - 97)

9.1 Introduction

9.1.1 Dynamics

9.1.2 Innovators

9.1.3 Vanguards

9.1.4 Emerging

9.2 Competetive Benchmarking

9.2.1 Analysis of Product Porthfolio of Major Players in the Porging Compound Market (25 Players)

9.2.2 Business Strategies Adopted By Major Players in the Purging Compound Market (25 Players)

9.3 Market Ranking of Key Players

10 Company Profiles (Page No. - 102)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

10.1 DOW Chemical Company

10.2 Formosa Plastics Corporation

10.3 3M Company

10.4 Asahi Kasei Chemicals Corporation

10.5 Clariant AG

10.6 Velox GmbH

10.7 E. I. Du Pont De Nemours and Company

10.8 Kuraray Co. Ltd.

10.9 Daicel Corporation

10.10 Dyna-Purge

10.11 Chem-Trend

10.12 Purgex

10.13 Calsak Corporation

10.14 Reedy Chemical Foam & Specialty Additives

10.15 Magna Purge

10.16 Rapidpurge

10.17 Polyplast Muller GmbH

10.18 Slide Products, Inc.

10.19 ELM Grove Industries, LLC

10.20 Ultra Plast Asia Co., Ltd

10.21 Ultra System SA

10.22 RBM Polymers

10.23 Claude Bamberger Molding Compounds Corporation

10.24 Purge Right

10.25 Z Clean

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 133)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Introducing RT: Real Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (87 Tables)

Table 1 Purging Compound Market Snapshot

Table 2 Trends and Forecast of GDP, 20152021 (USD Billion)

Table 3 Purging Compound Market, By Type, 2015-2022 (USD Million)

Table 4 Mechanical Purging Segment, By Region, 2015-2022 (USD Million)

Table 5 Chemical/Foaming Purging Segment, By Region, 2015-2022 (USD Million)

Table 6 Liquid Purging Segment, By Region, 20152022 (USD Million)

Table 7 Purging Compound Market, By Process, 20152022 (USD Million)

Table 8 Purging Compound Market in Extrusion, By Region, 20152022 (USD Million)

Table 9 Purging Compound Market in Injection Molding, By Region, 20152022 (USD Million)

Table 10 Purging Compound Market in Blow Molding, By Region, 20152022 (USD Million)

Table 11 Purging Compound Market, By Region, 20152022 (USD Million)

Table 12 North America Purging Compound Market, By Country, 20152022 (USD Million)

Table 13 North America Purging Compound Market, By Type, 20152022 (USD Million)

Table 14 North America Purging Compound Market, By Process, 20152022 (USD Million)

Table 15 U.S. Purging Compound Market, By Type, 20152022 (USD Million)

Table 16 U.S. Purging Compound Market, By Process, 20152022 (USD Million)

Table 17 Mexico Purging Compound Market, By Type, 20152022 (USD Million)

Table 18 Mexico Purging Compound Market, By Process, 20152022 (USD Million)

Table 19 Canada Purging Compound Market, By Type, 20152022 (USD Million)

Table 20 Canada Purging Compound Market, By Process, 20152022 (USD Million)

Table 21 Europe Purging Compound Market, By Country, 20152022 (USD Million)

Table 22 Europe Purging Compound Market, By Type, 20152022 (USD Million)

Table 23 Europe Purging Compound Market, By Process, 20152022 (USD Million)

Table 24 Germany Purging Compound Market, By Type, 20152022 (USD Million)

Table 25 Germany Purging Compound Market, By Process, 20152022 (USD Million)

Table 26 France Purging Compound Market, By Type, 20152022 (USD Million)

Table 27 France Purging Compound Market, By Process, 20152022 (USD Million)

Table 28 Italy Purging Compound Market, By Type, 20152022 (USD Million)

Table 29 Italy Purging Compound Market, By Process, 20152022 (USD Million)

Table 30 Russia Purging Compound Market, By Type, 20152022 (USD Million)

Table 31 Russia Purging Compound Market, By Process, 20152022 (USD Million)

Table 32 Spain Purging Compound Market, By Type, 20152022 (USD Million)

Table 33 Spain Purging Compound Market, By Process, 20152022 (USD Million)

Table 34 U.K. Purging Compound Market, By Type, 20152022 (USD Million)

Table 35 U.K. Purging Compound Market, By Process, 20152022 (USD Million)

Table 36 Netherlands Purging Compound Market, By Type, 20152022 (USD Million)

Table 37 Netherlands Purging Compound Market, By Process, 20152022 (USD Million)

Table 38 Belgium Purging Compound Market, By Type, 20152022 (USD Million)

Table 39 Belgium Purging Compound Market, By Process, 20152022 (USD Million)

Table 40 Ukraine Purging Compound Market, By Type, 20152022 (USD Million)

Table 41 Ukraine Purging Compound Market, By Process, 20152022 (USD Million)

Table 42 Rest of Europe Purging Compound Market, By Type, 20152022 (USD Million)

Table 43 Rest of Europe Purging Compound Market, By Process, 20152022 (USD Million)

Table 44 Asia-Pacific Purging Compound Market, By Country, 20152022 (USD Million)

Table 45 Asia-Pacific Purging Compound Market, By Type, 20152022 (USD Million)

Table 46 Asia-Pacific Purging Compound Market, By Process, 20152022 (USD Million)

Table 47 China Purging Compound Market, By Type, 20152022 (USD Million)

Table 48 China Purging Compound Market, By Process, 20152022 (USD Million)

Table 49 Japan Purging Compound Market, By Type, 20152022 (USD Million)

Table 50 South Korea Purging Compound Market, By Type, 20152022 (USD Million)

Table 51 South Korea Purging Compound Market, By Process, 20152022 (USD Million)

Table 52 Australia Purging Compound Market, By Type, 20152022 (USD Million)

Table 53 Australia Purging Compound Market, By Process, 20152022 (USD Million)

Table 54 India Purging Compound Market, By Type, 20152022 (USD Million)

Table 55 India Purging Compound Market, By Process, 20152022 (USD Million)

Table 56 Taiwan Purging Compound Market, By Type, 20152022 (USD Million)

Table 57 Taiwan Purging Compound Market, By Process, 20152022 (USD Million)

Table 58 Rest of Asia-Pacific Purging Compound Market, By Type, 20152022 (USD Million)

Table 59 Rest of Asia-Pacific Purging Compound Market, By Process, 20152022 (USD Million)

Table 60 Middle East & Africa Purging Compound Market, By Country, 20152022 (USD Million)

Table 61 Middle East & Africa Purging Compound Market, By Type, 20152022 (USD Million)

Table 62 Middle East & Africa Purging Compound Market, By Process, 20152022 (USD Million)

Table 63 UAE Purging Compound Market, By Type, 20152022 (USD Million)

Table 64 UAE Purging Compound Market, By Process, 20152022 (USD Million)

Table 65 KSA Purging Compound Market, By Type, 20152022 (USD Million)

Table 66 KSA Purging Compound Market, By Process, 20152022 (USD Million)

Table 67 Iran Purging Compound Market, By Type, 20152022 (USD Million)

Table 68 Iran Purging Compound Market, By Process, 20152022 (USD Million)

Table 69 South Africa Purging Compound Market, By Type, 20152022 (USD Million)

Table 70 South Africa Purging Compound Market, By Process, 20152022 (USD Million)

Table 71 Iraq Purging Compound Market, By Type, 20152022 (USD Million)

Table 72 Iraq Purging Compound Market, By Process, 20152022 (USD Million)

Table 73 Egypt Purging Compound Market, By Type, 20152022 (USD Million)

Table 74 Egypt Purging Compound Market, By Process, 20152022 (USD Million)

Table 75 Rest of Middle East & Africa Purging Compound Market, By Type, 20152022 (USD Million)

Table 76 Rest of Middle East & Africa Purging Compound Market, By Process, 20152022 (USD Million)

Table 77 South America Purging Compound Market, By Country, 20152022 (USD Million)

Table 78 South America Purging Compound Market, By Type, 20152022 (USD Million)

Table 79 South America Purging Compound Market, By Process, 20152022 (USD Million)

Table 80 Brazil Purging Compound Market, By Type, 20152022 (USD Million)

Table 81 Brazil Purging Compound Market, By Process, 20152022 (USD Million)

Table 82 Argentina Purging Compound Market, By Type, 20152022 (USD Million)

Table 83 Argentina Purging Compound Market, By Process, 20152022 (USD Million)

Table 84 Venezuela Purging Compound Market, By Type, 20152022 (USD Million)

Table 85 Venezuela Purging Compound Market, By Process, 20152022 (USD Million)

Table 86 Rest of South America Purging Compound Market, By Type, 20152022 (USD Million)

Table 87 Rest of South America Purging Compound Market, By Process, 20152022 (USD Million)

List of Figures (42 Figures)

Figure 1 Purging Compound: Market Segmentation

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews, By Company Type, Designation, & Region

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Purging Compound Market: Data Triangulation

Figure 7 The Mechanical Purging Type Segment to Lead the Purging Compound Market in 2017

Figure 8 The Extrusion Process Segment to Lead the Purging Compound Market in 2017

Figure 9 The Asia-Pacific Purging Compound Market is Expected to Offer Attractive Investment Opportunities for the Market Players From 2017 to 2022

Figure 10 Purging Compound Market Snapshot

Figure 11 Increased Use of Purging Compounds in the Plastic Processing Equipment Industry Across the Globe is Projected to Fuel the Growth of Purging Compound Market From 2017 to 2022

Figure 12 The Asia-Pacific Purging Compound Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 13 The Extrusion Process Segment is Estimated to Lead the Purging Compound Market in 2017

Figure 14 The Mechanical Purging Type Segment is Estimated to Account for the Largest Share of the North America Purging Compound Market in 2017

Figure 15 The China Purging Compound Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 16 Drivers, Restraints, Opportunities, & Challenges in the Purging Compound Market

Figure 17 Cost Analysis: Without Purging Compounds & With Purging Compounds

Figure 18 Porters Five Forces Analysis

Figure 19 Per Capita Plastic Products Consumption (Kilograms/Person), 2015

Figure 20 Injection Molding Machines Sold Worldwide, 2012

Figure 21 The Mechanical Purging Segment is Projected to Lead the Purging Compound Market During the Forecast Period

Figure 22 The Mechanical Purging Segment in the Middle East & Africa is Projected to Grow at the Highest CAGR Between 2017 and 2022

Figure 23 North America is Anticipated to Lead the Chemical/Foaming Purging Segment in 2017

Figure 24 The Liquid Purging Segment in the Asia-Pacific is Anticipated to Grow at the Highest CAGR During the Forecast Period

Figure 25 The Injection Molding Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 26 North America Accounted for the Largest Share of the Extrusion Process Segment in 2016

Figure 27 The Injection Molding Process Segment in the Asia-Pacific Region is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Asia-Pacific is Anticipated to Lead the Blow Molding Process Segment During the Forecast Period

Figure 29 China is the Fastest-Growing Country in the Purging Compound Market

Figure 30 North America Purging Compound Market Snapshot

Figure 31 Europe Purging Compound Market Snapshot

Figure 32 Asia-Pacific Purging Compound Market Snapshot

Figure 33 Dive Chart

Figure 34 Asahi Kasei Corporation (Japan) Accounted for the Largest Share of the Purging Compound Market, 2017

Figure 35 DOW Chemical Company: Company Snapshot

Figure 36 Formosa Plastics Corporation: Company Snapshot

Figure 37 3M Company: Company Snapshot

Figure 38 Asahi Kasei Chemicals Corporation: Company Snapshot

Figure 39 Clariant AG: Company Snapshot

Figure 40 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 41 Kuraray Co. Ltd.: Company Snapshot

Figure 42 Daicel Corporation: Company Snapshot

Growth opportunities and latent adjacency in Purging Compound Market