Injection Molding Machine Market by Machine Type (Hydraulic, All-electric, and Hybrid), Clamping Force (0-200, 201-500 and Above 500), Product Type (Plastic, Rubber, Metals), End-Use Industry (Automotive, Packaging) and Region - Global Forecast to 2027

Updated on : August 28, 2025

Injection Molding Machine Market

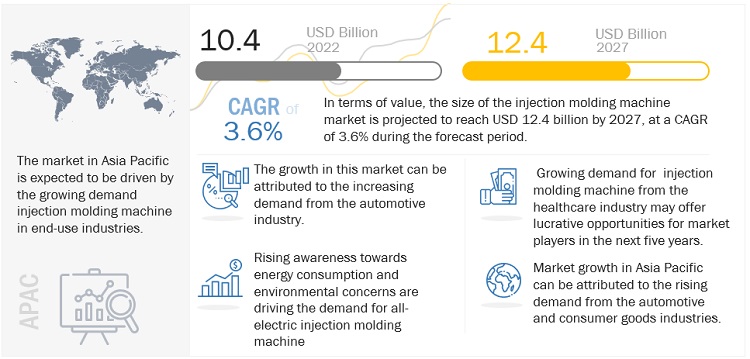

The global injection molding machine market was valued at USD 10.4 billion in 2022 and is projected to reach USD 12.4 billion by 2027, growing at 3.6% cagr from 2022 to 2027. Increased demand for injection molding equipment in end-use sectors including automotive, consumer goods, packaging, healthcare, electrical & electronics, and others is the key factor driving the market. The market for injection molding machines will be driven by elements including rising healthcare demand, quick industrialisation in developing nations like China, India, and Thailand, and rising need for plastic moulds in electric vehicle production. In terms of volume and value, the Asia Pacific region is the world's largest market for injection molding machines, followed by Europe and North America.

Attractive Opportunities in the Injection Molding Machine Market

To know about the assumptions considered for the study, Request for Free Sample Report

Injection Molding Machine Market Dynamics

Driver: High demand from the packaging industry

The packaging industry is growing at a rapid rate, owing to the developments in packaging technology and the rising demand for packaged goods and sustainable packaging. The adoption of packaged products in rural areas is increasing, and the growing middle-class population is generating demand for packaged products. These factors have increased the per capita spending on packaged products.

The increasing urban population, increased consumer spending on packaged goods, and the rise in e-commerce and organized retail are contributing to the growth of the packaging industry. The growing competition among packaging manufacturers has led to the adoption of different types of packaging. This is driving the market for rigid plastic packaging, and in turn, the demand for injection molding machines from the packaging industry. Injection molding is predominantly used in the packaging of plastic products such as cups and containers. Asia Pacific is one of the major regions driving the packaging industry.

Restraints: High initial and maintenance costs of machines

An all-electric injection molding machine provides the best acceleration performance, improved repeatability, shorter injection times due to dynamic servomotors, and less noise. The high investment costs of all-electric equipment are caused by their advanced technology. The extreme upkeep required in cases of waste is another drawback. The entire system must be replaced in the event of a motor failure, which results in extremely high maintenance costs and has an impact on the cost of manufacturing.

Opportunities: Demand from the healthcare industry

The demand for injection molding machines is growing significantly in the healthcare industry, which is mainly driven by their use in products such as drug-delivery systems for respiratory care and diabetes and improved blood-glucose test strips. These products offer mobility and convenience to the aging population. Injection molding is generally used to manufacture medical parts in large quantities with consistency. The use of injection molding process helps develop lightweight, durable, and cost-effective medical devices. The injection molding machine market in the healthcare industry is expected to grow, owing to the increased use of disposable and durable medical products. Although injection-molded disposable products are majorly used in hospitals, they are also used in over-the-counter products such as permethrin, pyrethrins, and piperonyl butoxide shampoo. The growing demand from the healthcare industry offers opportunities for injection molding machine manufacturers.

“All-electric is the fastest growing machine- type for injection molding machine during the forecast period”

The majority of the machine's operations are powered by an electric servo motor that drives gears, racks, and ball screws in an all-electric injection molding machine. In comparison to other types of injection molding machines, all-electric presses are quicker, quieter, and more precise; yet, the machine is more costly. All-electric injection molding machines are operated by servo motors, which only use power when they are in use. When compared to hydraulic injection molding machines, all-electric injection molding machines may save between 50-70% on energy. The most popular machine type at the moment is an all-electric injection molding machine since it requires less cold water, requires less cleaning and preventative maintenance, uses less energy and oil, and requires fewer repairs. Thus, the sector with the quickest growth is all-electric injection molding machines.

“Automotive was the largest end-use industry injection molding machine market, in terms of value, in 2021”

The largest end-use market in this category for injection molding machines is the automobile industry. The majority of automobile components, interior wraps, and assembly parts, such as vehicle exteriors, car lenses, interior components, under-the-hood components, and filtration components, are produced using injection molding machines. The automobile industry's significant shift toward using plastics rather than iron and steel is anticipated to fuel the market for injection molding machines throughout the course of the forecast period. Government standards that are too strict have compelled automakers to utilise plastic instead of other materials like iron and steel. The need for plastic injection molding machines has increased as a result of expanding middle class populations, better infrastructure, and rapid economic expansion in emerging nations. These factors have also increased automobile manufacturing and sales.

“Plastic was the largest product type for injection molding machine market, in terms of value, in 2021”

The method of producing plastic items and parts out of thermoplastic and thermosetting materials is known as injection molding. The plastics nylon, polypropylene, polystyrene, polyethylene, and unsaturated polyesters are often used in the injection molding process. High-grade raw materials are used in the production of plastic items to guarantee their exceptional quality. The polymer is heated until it becomes liquid during the injection molding process for plastic items, and it is then forced into the mould under pressure. The procedure is difficult and moves quickly. Injection molding is the most widely used manufacturing technique for producing plastic materials in bulk, notwithstanding the high cost of tooling. Plastic goods made with plastic injection moulding machines include needles, disposable razors, bottle lids and closures, electrical switches, phone handsets, automobile bumpers, and dashboards.

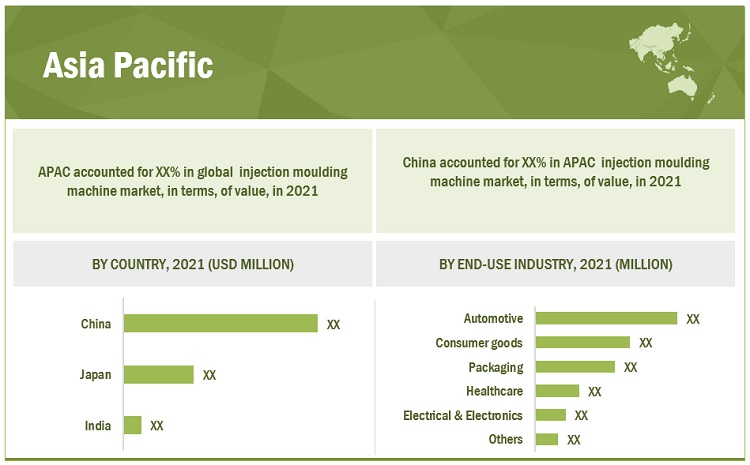

“Asia Pacific region was the largest injection molding machine market in 2021, in terms of value and volume.”

Significant growing countries like China and India are in the Asia Pacific. Because of this, the region has a lot of potential for the growth of most sectors. The market for injection molding machines is expanding quickly and has opportunity for many manufacturers. About 61.0% of the world's population lives in the Asia-Pacific area, and the manufacturing and processing industries there are expanding quickly. The largest injection molding machine market is in the Asia Pacific region, with China being the main market with the fastest predicted growth. The main factors driving this industry are growing disposable incomes and rising living standards in emerging nations in the Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Injection Molding Machine Market Players

The key players profiled in the report include Haitian International Holdings Limited (China), Chen Hsong Holdings Limited (China), Sumitomo Heavy Industries Ltd. (Japan), Engel Austria GmbH (Austria), Hillenbrand, Inc. (US), and others. They are continuously undertaking developmental strategies such as expansions, new product launches, acquisitions, and contracts & agreements to strengthen their position in the injection molding machine market.

Read More: Injection Molding Machine Companies

Injection Molding Machine Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 10.4 billion |

|

Revenue Forecast in 2027 |

USD 12.4 billion |

|

CAGR |

3.6% |

|

Years considered for the study |

2017-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Units); Value (USD Billion) |

|

Segments |

Machine Type, Clamping Force, End-Use Industry, Product Type and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa and South America |

|

Companies |

The key players in this market are as Haitian International Holdings Limited (China), Chen Hsong Holdings Ltd. (China), Engel Austria GmbH (Austria), Sumitomo Heavy Industries Limited (Japan), Hillenbrand, Inc. (U.S.). |

This report categorizes the global injection molding machine market based on machine type, end-use industry, product type and region.

Injection Molding Machine Market by Machine Type:

- Hydraulic

- Electric

- Hybrid

Injection Molding Machine Market by End-Use Industry:

- Automotive

- Consumer goods

- Packaging

- Healthcare

- Electrical & electronics

- Others

Injection Molding Machine Market by Region:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Injection Molding Machine Market by Product Type:

-

Plastic

- Thermoplastic

- Thermosets

- Rubber

-

Metal

- Powder

- Liquid

- Ceramic

- Others

Recent Developments

- In June 2022, ENGEL entered intoa partnership with the ALPA Group, Brink and IPB printing. It is expected to enable processing recycled material (rPET) with the newly developed ENGEL e-speed injection molding machine with powerful injection unit.

- In June 2022, ENGEL underwent an expansion by establishing its ow sales ad service sudsidiary in Morocco, the Austrian Ijection Moldig Machine manufacturer and system solution provider.

- In March 2022, Che Hsong Holdings Ltd. signed a strategic cooperation agreement with the Chiers electric car manufacturer YD Group Co., Ltd. It has obtained several purchase orders for injection molding machine equipment from the company.

- In January 2022, Haitian entered into a joint venture with the HCMC University of Technology & Education for the operation of the laboratory. The lab has dedicated areas for training, mold repair, and practical operations and is equipped with injection molding machines, robots and peripheral equipment from Haitian.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the injection molding machine market?

Increasing demand from the automotive and healthcare industry

What are the different types of major end-use industries of the injection molding machine market?

It is classified as automotive, consumer goods, packaging, healthcare, electrical & electronics, and others

What is the biggest Restraint for the injection molding machine market?

High initial and maintenance cost of machines

What are the major challenges for the injection molding machine market?

Less economical for small production capacities

Who was the major exporter for the injection molding machines in 2021?

Chia was the major exporter for injection molding machines in 2021 followed by Japan, Germany and South Korea. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INJECTION MOLDING MACHINE MARKET: INCLUSIONS & EXCLUSIONS

1.2.2 INJECTION MOLDING MACHINE: MARKET DEFINITION AND INCLUSIONS, BY PRODUCT TYPE

1.2.3 INJECTION MOLDING MACHINE: MARKET DEFINITION AND INCLUSIONS, BY MACHINE TYPE

1.2.4 INJECTION MOLDING MACHINE: MARKET DEFINITION AND INCLUSIONS, BY CLAMPING FORCE

1.2.5 INJECTION MOLDING MACHINE: MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

1.3 MARKET SCOPE

FIGURE 1 INJECTION MOLDING MACHINE MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 2 INJECTION MOLDING MACHINE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews – demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE REVENUE OF COMPANIES

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE): PRODUCTS SOLD

2.3 DATA TRIANGULATION

FIGURE 6 INJECTION MOLDING MACHINE MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

2.4.1 SUPPLY SIDE

FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

2.4.2 DEMAND SIDE

FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 1 INJECTION MOLDING MACHINE MARKET: RISK ASSESSMENT

2.8 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 9 PLASTIC PRODUCT TYPE SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 10 AUTOMOTIVE TO BE LEADING END-USE INDUSTRY DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC DOMINATED MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 SIGNIFICANT OPPORTUNITIES IN INJECTION MOLDING MACHINE MARKET

FIGURE 12 MARKET EXPECTED TO WITNESS HIGH GROWTH BETWEEN 2021 AND 2027

4.2 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SHARE BY MACHINE TYPE AND COUNTRY

FIGURE 13 CHINA AND HYDRAULIC SEGMENT ACCOUNTED FOR LARGEST SHARE, 2021

4.3 INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

FIGURE 14 HYDRAULIC SEGMENT TO DOMINATE MARKET BETWEEN 2022 AND 2027

4.4 INJECTION MOLDING MACHINE MARKET GROWTH, BY REGION

FIGURE 15 MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

4.5 INJECTION MOLDING MACHINE MARKET SIZE, BY REGION AND END-USE INDUSTRY, 2021

FIGURE 16 AUTOMOTIVE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.6 INJECTION MOLDING MACHINE MARKET ATTRACTIVENESS

FIGURE 17 INDIA PROJECTED TO BE FASTEST-GROWING MARKET BETWEEN 2022 AND 2027

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INJECTION MOLDING MACHINE MARKET

5.2.1 DRIVERS

5.2.1.1 High demand from packaging industry

5.2.1.2 Rising awareness about energy saving

5.2.1.3 Growth of automotive sector to drive demand for large plastic molds

FIGURE 19 TOTAL CAR PRODUCTION, BY COUNTRY, 2021 (MILLION UNITS)

5.2.1.4 Increased demand for consumer electronics

5.2.1.5 Developments in injection molding technology

5.2.2 RESTRAINTS

5.2.2.1 High initial and maintenance cost of machines

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand from healthcare industry

5.2.3.2 Rising demand for large-tonnage injection molding machines

5.2.3.3 Rising trend in electric vehicles to increase demand for injection molds

TABLE 2 KEY AUTOMAKER ANNOUNCEMENTS FOR ELECTRIC VEHICLES

5.2.4 CHALLENGES

5.2.4.1 High heating and hydraulic pressure

5.2.4.2 Less economical for small production capacities

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 INJECTION MOLDING MACHINE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 INJECTION MOLDING MACHINE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 MACROECONOMIC INDICATORS

5.4.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 4 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020 – 2027 (USD BILLION)

6 INDUSTRY TRENDS (Page No. - 73)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 21 INJECTION MOLDING MACHINE MARKET: SUPPLY CHAIN

6.1.1 RAW MATERIALS

6.1.2 MANUFACTURE OF INJECTION MOLDING MACHINES

6.1.3 DISTRIBUTION TO END USERS

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6.2.1 REVENUE SHIFT & POCKETS FOR INJECTION MOLDING MACHINES

FIGURE 22 INJECTION MOLDING MACHINE MARKET: CHANGING REVENUE MIX

6.3 CONNECTED MARKETS: ECOSYSTEM

FIGURE 23 INJECTION MOLDING MACHINE MARKET: ECOSYSTEM

TABLE 5 INJECTION MOLDING MACHINE MARKET: SUPPLY CHAIN

6.4 TECHNOLOGY ANALYSIS

6.5 CASE STUDY ANALYSIS

6.5.1 CASE STUDY ON MULTI-COMPONENT INJECTION MOLDING MACHINE

6.5.2 CASE STUDY ON INJECTION MOLDING AUTOMATION

6.5.3 CASE STUDY ON SMARTTURN SELF-OPTIMIZATION FUNCTION

6.5.4 CASE STUDY ON DAKOTA MOLDING

6.5.5 CASE STUDY ON KARL KRUMPHOLZ GMBH & CO. KG.

6.6 KEY STAKEHOLDERS AND BUYING CRITERIA

6.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

6.6.2 BUYING CRITERIA

FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

TABLE 7 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

6.7 INJECTION MOLDING MACHINE MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

FIGURE 26 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

TABLE 8 INJECTION MOLDING MACHINE MARKET FORECAST SCENARIO, 2019–2027 (USD MILLION)

6.7.1 NON-COVID-19 SCENARIO

6.7.2 OPTIMISTIC SCENARIO

6.7.3 PESSIMISTIC SCENARIO

6.7.4 REALISTIC SCENARIO

6.8 PRICING ANALYSIS

6.8.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY END-USE INDUSTRY

FIGURE 27 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE END-USE INDUSTRIES

TABLE 9 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE END-USE INDUSTRIES (USD THOUSAND/UNIT)

6.8.2 AVERAGE SELLING PRICE, BY REGION

FIGURE 28 AVERAGE SELLING PRICE OF INJECTION MOLDING MACHINE, BY REGION, 2020–2027

TABLE 10 AVERAGE SELLING PRICE OF INJECTION MOLDING MACHINE, BY REGION, 2020–2027 (USD THOUSAND/UNIT)

6.9 TRADE DATA STATISTICS

6.9.1 IMPORT SCENARIO OF INJECTION MOLDING MACHINES

FIGURE 29 INJECTION MOLDING MACHINE IMPORTS, BY KEY COUNTRIES (2013–2021)

TABLE 11 IMPORTS OF INJECTION MOLDING MACHINES, BY REGION, 2013–2021 (USD MILLION)

6.9.2 EXPORT SCENARIO OF INJECTION MOLDING MACHINES

FIGURE 30 INJECTION MOLDING MACHINE EXPORT, BY KEY COUNTRIES (2013–2021)

TABLE 12 EXPORTS OF INJECTION MOLDING MACHINES, BY REGION, 2013–2021 (USD MILLION)

6.10 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON INJECTION MOLDING MACHINE MARKET

6.10.1 REGULATIONS AND REGULATORY BODIES RELATED TO INJECTION MOLDING MACHINE

6.11 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 13 INJECTION MOLDING MACHINE MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.12 PATENT ANALYSIS

6.12.1 APPROACH

6.12.2 DOCUMENT TYPE

TABLE 14 GRANTED PATENTS ARE 33.8% OF TOTAL COUNT

FIGURE 31 PATENTS REGISTERED FOR INJECTION MOLDING MACHINES, 2011–2021

FIGURE 32 PATENT PUBLICATION TRENDS FOR INJECTION MOLDING MACHINES, 2011–2021

FIGURE 33 LEGAL STATUS OF PATENTS

6.12.3 JURISDICTION ANALYSIS

FIGURE 34 MAXIMUM PATENTS FILED BY COMPANIES IN US

6.12.4 TOP APPLICANTS

FIGURE 35 LG ELECTRONICS REGISTERED MAXIMUM PATENTS BETWEEN 2011 AND 2021

TABLE 15 LIST OF A FEW RECENT PATENTS BY LG ELECTRONICS

TABLE 16 LIST OF A FEW RECENT PATENTS BY SAMSUNG ELECTRONICS CO., LTD.

TABLE 17 LIST OF A FEW RECENT PATENTS BY SUMITOMO HEAVY INDUSTRIES LTD.

TABLE 18 LIST OF A FEW RECENT PATENTS BY FANUC LTD.

TABLE 19 TOP 10 PATENT OWNERS IN US, 2011–2021

7 INJECTION MOLDING MACHINE MARKET, BY PRODUCT TYPE (Page No. - 94)

7.1 INTRODUCTION

FIGURE 36 PLASTIC SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 20 INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 21 INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

TABLE 22 INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017–2020 (UNIT)

TABLE 23 INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021–2027 (UNIT)

7.2 PLASTIC

7.2.1 HIGHEST UTILIZED MATERIAL IN VARIOUS APPLICATIONS

TABLE 24 INJECTION MOLDING MACHINE MARKET SIZE IN PLASTIC PRODUCT TYPE, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 INJECTION MOLDING MACHINE MARKET SIZE IN PLASTIC PRODUCT TYPE, BY REGION, 2021–2027 (USD MILLION)

7.2.2 THERMOPLASTICS

7.2.2.1 Lightweight, low melting point, chemical resistance, and other properties to drive market

7.2.3 THERMOSETS

7.2.3.1 Superior esthetic appearance, cost-effectiveness, and high level of dimensional stability to propel market

7.3 RUBBER

7.3.1 MAINLY UTILIZED FOR PRODUCTS WITH THIN WALLS AND LARGE SURFACE AREAS

TABLE 26 INJECTION MOLDING MACHINE MARKET SIZE IN RUBBER PRODUCT TYPE, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 INJECTION MOLDING MACHINE MARKET SIZE IN RUBBER PRODUCT TYPE, BY REGION, 2021–2027 (USD MILLION)

7.4 METAL

7.4.1 METAL MOLDS HAVE GOOD TENSILE AND MECHANICAL PROPERTIES

TABLE 28 INJECTION MOLDING MACHINE MARKET SIZE IN METAL PRODUCT TYPE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 INJECTION MOLDING MACHINE MARKET SIZE IN METAL PRODUCT TYPE, BY REGION, 2021–2027 (USD MILLION)

7.4.2 POWDER

7.4.2.1 Cost-effective method for large-volume products

7.4.3 LIQUID

7.4.3.1 Amorphous, liquid-like atomic structure in solid state to drive demand

7.5 CERAMIC

7.5.1 CERAMIC MOLDS WIDELY USED IN ELECTRICAL INSULATION

TABLE 30 INJECTION MOLDING MACHINE MARKET SIZE IN CERAMIC PRODUCT TYPE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 INJECTION MOLDING MACHINE MARKET SIZE IN CERAMIC PRODUCT TYPE, BY REGION, 2021–2027 (USD MILLION)

7.6 OTHERS

TABLE 32 INJECTION MOLDING MACHINE MARKET SIZE IN OTHER PRODUCT TYPE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 INJECTION MOLDING MACHINE MARKET SIZE IN OTHER PRODUCT TYPES, BY REGION, 2021–2027 (USD MILLION)

8 INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE (Page No. - 105)

8.1 INTRODUCTION

FIGURE 37 HYDRAULIC INJECTION MOLDING MACHINE SEGMENT TO BE LARGEST MACHINE TYPE DURING FORECAST PERIOD

TABLE 34 INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017–2020 (USD MILLION)

TABLE 35 INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021–2027 (USD MILLION)

TABLE 36 INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017–2020 (UNIT)

TABLE 37 INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021–2027 (UNIT)

8.2 HYDRAULIC INJECTION MOLDING MACHINE

8.2.1 HYDRAULIC INJECTION MOLDING MACHINE CONSUMES SIGNIFICANT ELECTRICITY

TABLE 38 INJECTION MOLDING MACHINE MARKET SIZE IN HYDRAULIC MACHINE TYPE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 INJECTION MOLDING MACHINE MARKET SIZE IN HYDRAULIC MACHINE TYPE, BY REGION, 2021–2027 (USD MILLION)

TABLE 40 INJECTION MOLDING MACHINE MARKET SIZE IN HYDRAULIC MACHINE TYPE, BY REGION, 2017–2020 (UNIT)

TABLE 41 INJECTION MOLDING MACHINE MARKET SIZE IN HYDRAULIC MACHINE TYPE, BY REGION, 2021–2027 (UNIT)

8.3 ALL-ELECTRIC INJECTION MOLDING MACHINE

8.3.1 SAVES ENERGY SIGNIFICANTLY BUT HIGH UPFRONT COST

TABLE 42 INJECTION MOLDING MACHINE MARKET SIZE IN ALL-ELECTRIC MACHINE TYPE, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 INJECTION MOLDING MACHINE MARKET SIZE IN ALL-ELECTRIC MACHINE TYPE, BY REGION, 2021–2027 (USD MILLION)

TABLE 44 INJECTION MOLDING MACHINE MARKET SIZE IN ALL-ELECTRIC MACHINE TYPE, BY REGION, 2017–2020 (UNIT)

TABLE 45 INJECTION MOLDING MACHINE MARKET SIZE IN ALL-ELECTRIC MACHINE TYPE, BY REGION, 2021–2027 (UNIT)

8.4 HYBRID INJECTION MOLDING MACHINE

8.4.1 COMBINES ENERGY SAVING AND ACCURACY

TABLE 46 INJECTION MOLDING MACHINE MARKET SIZE IN HYBRID MACHINE TYPE, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 INJECTION MOLDING MACHINE MARKET SIZE IN HYBRID MACHINE TYPE, BY REGION, 2021–2027 (USD MILLION)

TABLE 48 INJECTION MOLDING MACHINE MARKET SIZE IN HYBRID MACHINE TYPE, BY REGION, 2017–2020 (UNIT)

TABLE 49 INJECTION MOLDING MACHINE MARKET SIZE IN HYBRID MACHINE TYPE, BY REGION, 2021–2027 (UNIT)

9 INJECTION MOLDING MACHINE MARKET, BY END-USE INDUSTRY (Page No. - 115)

9.1 INTRODUCTION

FIGURE 38 AUTOMOTIVE TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

TABLE 50 INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 51 INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 52 INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 53 INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

9.2 AUTOMOTIVE

9.2.1 WIDELY USED FOR MANUFACTURING STRUCTURAL COMPONENTS FOR VEHICLES

TABLE 54 INJECTION MOLDING MACHINE MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 INJECTION MOLDING MACHINE MARKET SIZE IN AUTOMOTIVE, BY REGION, 2021–2027 (USD MILLION)

TABLE 56 INJECTION MOLDING MACHINE MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017–2020 (UNIT)

TABLE 57 INJECTION MOLDING MACHINE MARKET SIZE IN AUTOMOTIVE, BY REGION, 2021–2027 (UNIT)

9.3 CONSUMER GOODS

9.3.1 MANUFACTURING MOLDS FOR DAILY ITEMS

TABLE 58 INJECTION MOLDING MACHINE MARKET SIZE IN CONSUMER GOODS, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 INJECTION MOLDING MACHINE MARKET SIZE IN CONSUMER GOODS, BY REGION, 2021–2027 (USD MILLION)

TABLE 60 INJECTION MOLDING MACHINE MARKET SIZE IN CONSUMER GOODS, BY REGION, 2017–2020 (UNIT)

TABLE 61 INJECTION MOLDING MACHINE MARKET SIZE IN CONSUMER GOODS, BY REGION, 2021–2027 (UNIT)

9.4 PACKAGING

9.4.1 HELPS CREATE INNOVATIVE AND UNIQUE PACKAGING FOR VARIOUS ITEMS

TABLE 62 INJECTION MOLDING MACHINE MARKET SIZE IN PACKAGING, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 INJECTION MOLDING MACHINE MARKET SIZE IN PACKAGING, BY REGION, 2021–2027 (USD MILLION)

TABLE 64 INJECTION MOLDING MACHINE MARKET SIZE IN PACKAGING, BY REGION, 2017–2020 (UNIT)

TABLE 65 INJECTION MOLDING MACHINE MARKET SIZE IN PACKAGING, BY REGION, 2021–2027 (UNIT)

9.5 HEALTHCARE

9.5.1 QUALITY AND PRECISION MEDICAL EQUIPMENT AND PRODUCTS

TABLE 66 INJECTION MOLDING MACHINE MARKET SIZE IN HEALTHCARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 INJECTION MOLDING MACHINE MARKET SIZE IN HEALTHCARE, BY REGION, 2021–2027 (USD MILLION)

TABLE 68 INJECTION MOLDING MACHINE MARKET SIZE IN HEALTHCARE, BY REGION, 2017–2020 (UNIT)

TABLE 69 INJECTION MOLDING MACHINE MARKET SIZE IN HEALTHCARE, BY REGION, 2021–2027 (UNIT)

9.6 ELECTRICAL & ELECTRONICS

9.6.1 DEMAND FOR SUPERIOR QUALITY AND PRECISION ELECTRONIC COMPONENTS

TABLE 70 INJECTION MOLDING MACHINE MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 INJECTION MOLDING MACHINE MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2021–2027 (USD MILLION)

TABLE 72 INJECTION MOLDING MACHINE MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2017–2020 (UNIT)

TABLE 73 INJECTION MOLDING MACHINE MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2021–2027 (UNIT)

9.7 OTHERS

9.7.1 PREMIUM QUALITY MOLDS FOR PIPING AND INSULATION

TABLE 74 INJECTION MOLDING MACHINE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 INJECTION MOLDING MACHINE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2027 (USD MILLION)

TABLE 76 INJECTION MOLDING MACHINE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2020 (UNIT)

TABLE 77 INJECTION MOLDING MACHINE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2027 (UNIT)

10 INJECTION MOLDING MACHINE MARKET, BY CLAMPING FORCE (Page No. - 129)

10.1 INTRODUCTION

FIGURE 39 201-500 TON-FORCE PROJECTED TO BE LARGEST CLAMPING FORCE SEGMENT DURING FORECAST PERIOD

TABLE 78 INJECTION MOLDING MACHINE MARKET SIZE, BY CLAMPING FORCE, 2017–2020 (USD MILLION)

TABLE 79 INJECTION MOLDING MACHINE MARKET SIZE, BY CLAMPING FORCE, 2021–2027 (USD MILLION)

TABLE 80 INJECTION MOLDING MACHINE MARKET SIZE, BY CLAMPING FORCE, 2017–2020 (UNIT)

TABLE 81 INJECTION MOLDING MACHINE MARKET SIZE, BY CLAMPING FORCE, 2021–2027 (UNIT)

10.2 0–200 TON-FORCE

10.3 201–500 TON-FORCE

10.4 ABOVE 500 TON-FORCE

11 INJECTION MOLDING MACHINE MARKET, BY REGION (Page No. - 133)

11.1 INTRODUCTION

FIGURE 40 ASIA PACIFIC PROJECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 82 INJECTION MOLDING MACHINE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 83 INJECTION MOLDING MACHINE MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 84 INJECTION MOLDING MACHINE MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 85 INJECTION MOLDING MACHINE MARKET SIZE, BY REGION, 2021–2027 (UNIT)

11.2 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SNAPSHOT

11.2.1 ASIA PACIFIC INJECTION MOLDING MACHINE MARKET, BY PRODUCT TYPE

TABLE 86 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 87 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

11.2.2 ASIA PACIFIC INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

TABLE 88 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017–2020 (USD MILLION)

TABLE 89 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021–2027 (USD MILLION)

TABLE 90 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017–2020 (UNIT)

TABLE 91 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021–2027 (UNIT)

11.2.3 ASIA PACIFIC INJECTION MOLDING MACHINE MARKET, BY END-USE INDUSTRY

TABLE 92 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 93 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 94 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 95 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.2.4 ASIA PACIFIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY

TABLE 96 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 97 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 99 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021–2027 (UNIT)

11.2.4.1 China

11.2.4.1.1 Automotive, electronics, and packaging industries to drive market

TABLE 100 CHINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 101 CHINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 102 CHINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 103 CHINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.2.4.2 Japan

11.2.4.2.1 Technologically developed to meet futuristic demand

TABLE 104 JAPAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 105 JAPAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 106 JAPAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 107 JAPAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.2.4.3 India

11.2.4.3.1 Dynamic medical industry boosting market

TABLE 108 INDIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 109 INDIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 110 INDIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 111 INDIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.2.4.4 South Korea

11.2.4.4.1 High potential in electrical & electronics industry

TABLE 112 SOUTH KOREA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 113 SOUTH KOREA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 114 SOUTH KOREA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 115 SOUTH KOREA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.2.4.5 Thailand

11.2.4.5.1 Lucrative foreign investment policies to drive market

TABLE 116 THAILAND: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 117 THAILAND: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 118 THAILAND: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 119 THAILAND: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.3 EUROPE

FIGURE 42 EUROPE: INJECTION MOLDING MACHINE MARKET SNAPSHOT

11.3.1 EUROPE INJECTION MOLDING MACHINE MARKET, BY PRODUCT TYPE

TABLE 120 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 121 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

11.3.2 EUROPE INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

TABLE 122 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017–2020 (USD MILLION)

TABLE 123 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021–2027 (USD MILLION)

TABLE 124 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017–2020 (UNIT)

TABLE 125 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021–2027 (UNIT)

11.3.3 EUROPE INJECTION MOLDING MACHINE MARKET, BY END-USE INDUSTRY

TABLE 126 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 127 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 128 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 129 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.3.4 EUROPE INJECTION MOLDING MACHINE MARKET, BY COUNTRY

TABLE 130 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 131 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 132 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 133 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021–2027 (UNIT)

11.3.4.1 Germany

11.3.4.1.1 Aerospace and automotive industries boosting market

TABLE 134 GERMANY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 135 GERMANY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 136 GERMANY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 137 GERMANY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.3.4.2 Italy

11.3.4.2.1 Technological advancements in healthcare industry to drive market

TABLE 138 ITALY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 139 ITALY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 140 ITALY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 141 ITALY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.3.4.3 France

11.3.4.3.1 Developing industrial sector to fuel market growth

TABLE 142 FRANCE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 143 FRANCE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 144 FRANCE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 145 FRANCE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.3.4.4 Spain

11.3.4.4.1 Growing car manufacturing to fuel market growth

TABLE 146 SPAIN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 147 SPAIN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 148 SPAIN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 149 SPAIN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.3.4.5 UK

11.3.4.5.1 Hub for automobiles to increase demand for injection molding machines

TABLE 150 UK: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 151 UK: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 152 UK: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 153 UK: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.4 NORTH AMERICA

FIGURE 43 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SNAPSHOT

11.4.1 NORTH AMERICA INJECTION MOLDING MACHINE MARKET, BY PRODUCT TYPE

TABLE 154 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 155 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

11.4.2 NORTH AMERICA INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

TABLE 156 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017–2020 (USD MILLION)

TABLE 157 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021–2027(USD MILLION)

TABLE 158 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017–2020 (UNIT)

TABLE 159 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021–2027 (UNIT)

11.4.3 NORTH AMERICA INJECTION MOLDING MACHINE MARKET, BY END-USE INDUSTRY

TABLE 160 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 161 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 162 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 163 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.4.4 NORTH AMERICA INJECTION MOLDING MACHINE MARKET, BY COUNTRY

TABLE 164 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 165 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 166 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 167 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021–2027 (UNIT)

11.4.4.1 US

11.4.4.1.1 Rising demand for medical components to boost market

TABLE 168 US: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 169 US: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 170 US: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 171 US: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.4.4.2 Canada

11.4.4.2.1 Rising demand from automotive, consumer goods, and healthcare industries

TABLE 172 CANADA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 173 CANADA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 174 CANADA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 175 CANADA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.4.4.3 Mexico

11.4.4.3.1 Growing economy to fuel market growth

TABLE 176 MEXICO: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 177 MEXICO: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 178 MEXICO: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 179 MEXICO: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA INJECTION MOLDING MACHINE MARKET, BY PRODUCT TYPE

TABLE 180 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

11.5.2 MIDDLE EAST & AFRICA INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

TABLE 182 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017–2020 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021–2027 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017–2020 (UNIT)

TABLE 185 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021–2027 (UNIT)

11.5.3 MIDDLE EAST & AFRICA INJECTION MOLDING MACHINE MARKET, BY END-USE INDUSTRY

TABLE 186 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 189 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.5.4 MIDDLE EAST & AFRICA INJECTION MOLDING MACHINE MARKET, BY COUNTRY

TABLE 190 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 193 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021–2027 (UNIT)

11.5.4.1 Saudi Arabia

11.5.4.1.1 Development of non-oil industries to boost market

TABLE 194 SAUDI ARABIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 195 SAUDI ARABIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 196 SAUDI ARABIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 197 SAUDI ARABIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.5.4.2 Iran

11.5.4.2.1 Rising government investments to fuel market growth

TABLE 198 IRAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 199 IRAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 200 IRAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 201 IRAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.5.4.3 South Africa

11.5.4.3.1 Developing automotive industry boosting market

TABLE 202 SOUTH AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 203 SOUTH AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 204 SOUTH AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 205 SOUTH AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.6 SOUTH AMERICA

11.6.1 SOUTH AMERICA INJECTION MOLDING MACHINE MARKET, BY PRODUCT TYPE

TABLE 206 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 207 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

11.6.2 SOUTH AMERICA INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

TABLE 208 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017–2020 (USD MILLION)

TABLE 209 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021–2027 (USD MILLION)

TABLE 210 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017–2020 (UNIT)

TABLE 211 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021–2027 (UNIT)

11.6.3 SOUTH AMERICA INJECTION MOLDING MACHINE MARKET, BY END-USE INDUSTRY

TABLE 212 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 213 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 214 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 215 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.6.4 SOUTH AMERICA INJECTION MOLDING MACHINE MARKET, BY COUNTRY

TABLE 216 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 217 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 218 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 219 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021–2027 (UNIT)

11.6.4.1 Brazil

11.6.4.1.1 Emerging infrastructural developments to offer lucrative opportunities

TABLE 220 BRAZIL: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 221 BRAZIL: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 222 BRAZIL: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 223 BRAZIL: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

11.6.4.2 Argentina

11.6.4.2.1 Healthcare, packaging, and consumer goods industries to drive market

TABLE 224 ARGENTINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 225 ARGENTINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 226 ARGENTINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 227 ARGENTINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

12 COMPETITIVE LANDSCAPE (Page No. - 205)

12.1 INTRODUCTION

12.2 STRATEGIES ADOPTED BY KEY PLAYERS

12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY INJECTION MOLDING MACHINE MANUFACTURERS

12.3 MARKET SHARE ANALYSIS

12.3.1 RANKING OF KEY MARKET PLAYERS, 2021

FIGURE 44 RANKING OF TOP FIVE PLAYERS IN INJECTION MOLDING MACHINE MARKET, 2021

12.3.2 MARKET SHARE OF KEY PLAYERS

TABLE 228 INJECTION MOLDING MACHINE MARKET: DEGREE OF COMPETITION

FIGURE 45 HAITIAN INTERNATIONAL HOLDINGS LIMITED LED INJECTION MOLDING MACHINE MARKET IN 2021

12.3.2.1 Haitian International Holdings Limited

12.3.2.2 Chen Hsong Holdings Limited

12.3.2.3 ENGEL Austria GmbH

12.3.2.4 Sumitomo Heavy Industries Limited

12.3.2.5 Hillenbrand, Inc.

12.3.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

FIGURE 46 REVENUE ANALYSIS OF KEY COMPANIES DURING PAST FIVE YEARS

12.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 47 INJECTION MOLDING MACHINE MARKET: COMPANY FOOTPRINT

TABLE 229 INJECTION MOLDING MACHINE MARKET: MACHINE TYPE FOOTPRINT

TABLE 230 INJECTION MOLDING MACHINE MARKET: END-USE INDUSTRY FOOTPRINT

TABLE 231 INJECTION MOLDING MACHINE MARKET: COMPANY REGION FOOTPRINT

12.5 COMPANY EVALUATION QUADRANT (TIER 1)

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 48 COMPANY EVALUATION QUADRANT FOR INJECTION MOLDING MACHINE MARKET (TIER 1)

12.6 COMPETITIVE BENCHMARKING

TABLE 232 INJECTION MOLDING MACHINE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 233 INJECTION MOLDING MACHINE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12.7 STARTUP/SME EVALUATION QUADRANT

12.7.1 RESPONSIVE COMPANIES

12.7.2 STARTING BLOCKS

FIGURE 49 STARTUP/SME EVALUATION QUADRANT FOR INJECTION MOLDING MACHINE MARKET

12.8 COMPETITIVE SCENARIOS AND TRENDS

12.8.1 NEW PRODUCT LAUNCHES

TABLE 234 INJECTION MOLDING MACHINE MARKET: NEW PRODUCT LAUNCHES (2019–2022)

12.8.2 DEALS

TABLE 235 INJECTION MOLDING MACHINE MARKET: DEALS (2019–2022)

12.8.3 OTHER DEVELOPMENTS

TABLE 236 INJECTION MOLDING MACHINE MARKET: OTHER DEVELOPMENTS (2019–2022)

13 COMPANY PROFILES (Page No. - 228)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

13.1 MAJOR PLAYERS

13.1.1 HAITIAN INTERNATIONAL HOLDINGS LIMITED

FIGURE 50 HAITIAN INTERNATIONAL HOLDINGS LIMITED: COMPANY SNAPSHOT

TABLE 237 HAITIAN INTERNATIONAL HOLDINGS LIMITED: COMPANY OVERVIEW

13.1.2 SUMITOMO HEAVY INDUSTRIES LIMITED

FIGURE 51 SUMITOMO HEAVY INDUSTRIES LIMITED: COMPANY SNAPSHOT

TABLE 238 SUMITOMO HEAVY INDUSTRIES LIMITED: COMPANY OVERVIEW

13.1.3 THE JAPAN STEEL WORKS LTD.

FIGURE 52 THE JAPAN STEEL WORKS LTD: COMPANY SNAPSHOT

TABLE 239 THE JAPAN STEEL WORKS LTD.: COMPANY OVERVIEW

13.1.4 CHEN HSONG HOLDINGS LIMITED

FIGURE 53 CHEN HSONG HOLDINGS LIMITED: COMPANY SNAPSHOT

TABLE 240 CHEN HSONG HOLDINGS LIMITED: COMPANY OVERVIEW

13.1.5 HILLENBRAND, INC.

FIGURE 54 HILLENBRAND, INC.: COMPANY SNAPSHOT

TABLE 241 HILLENBRAND, INC.: COMPANY OVERVIEW

13.1.6 NISSEI PLASTIC INDUSTRIAL CO., LTD.

FIGURE 55 NISSEI PLASTIC INDUSTRIAL CO., LTD: COMPANY SNAPSHOT

TABLE 242 NISSEI PLASTIC INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

13.1.7 ENGEL AUSTRIA GMBH

TABLE 243 ENGEL AUSTRIA GMBH: COMPANY OVERVIEW

13.1.8 ARBURG GMBH & CO. KG

TABLE 244 ARBURG GMBH & CO. KG: COMPANY OVERVIEW

13.1.9 HUSKY INJECTION MOLDING SYSTEM LTD.

TABLE 245 HUSKY INJECTION MOLDING SYSTEM LTD.: COMPANY OVERVIEW

13.1.10 KRAUSSMAFFEI GROUP GMBH

TABLE 246 KRAUSSMAFFEI GROUP GMBH: COMPANY OVERVIEW

13.1.11 FANUC CORPORATION

FIGURE 56 FANUC CORPORATION: COMPANY SNAPSHOT

13.1.12 DONGSHIN HYDRAULICS CO., LTD.

TABLE 247 DONGSHIN HYDRAULICS CO., LTD: COMPANY OVERVIEW

13.2 OTHER KEY MARKET PLAYERS

13.2.1 NIIGATA MACHINE TECHNO COMPANY, LTD.

TABLE 248 NIIGATA MACHINE TECHNO COMPANY, LTD.: COMPANY OVERVIEW

13.2.2 HUARONG PLASTIC MACHINERY CO., LTD.

TABLE 249 HUARONG PLASTIC MACHINERY CO., LTD.: COMPANY OVERVIEW

13.2.3 FU CHUN SHIN MACHINERY MANUFACTURE CO., LTD.

TABLE 250 FU CHUN SHIN MACHINERY MANUFACTURE CO., LTD.: COMPANY OVERVIEW

13.2.4 SHIBAURA MACHINE (TOSHIBA MACHINE CO., LTD.)

TABLE 251 SHIBAURA MACHINE (TOSHIBA MACHINE CO., LTD.): COMPANY OVERVIEW

13.2.5 OIMA SRL

TABLE 252 OIMA SRL: COMPANY OVERVIEW

13.2.6 R.P. INJECTION SRL

TABLE 253 R.P. INJECTION SRL: COMPANY OVERVIEW

13.2.7 TOYO MACHINERY & METAL CO., LTD.

TABLE 254 TOYO MACHINERY & METAL CO., LTD.: COMPANY OVERVIEW

13.2.8 BOCO PARDUBICE MACHINES S.R.O.

TABLE 255 BOCO PARDUBICE MACHINES S.R.O.: COMPANY OVERVIEW

13.2.9 MITSUBISHI HEAVY INDUSTRIES PLASTIC TECHNOLOGY CO., LTD.

TABLE 256 MITSUBISHI HEAVY INDUSTRIES PLASTIC TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

13.2.10 WOOJIN PLAIMM CO., LTD.

TABLE 257 WOOJIN PLAIMM CO., LTD.: COMPANY OVERVIEW

13.2.11 BORCHE NORTH AMERICA INC.

TABLE 258 BORCHE NORTH AMERICA INC.: COMPANY OVERVIEW

13.2.12 MULTIPLAS ENGINERY CO., LTD.

TABLE 259 MULTIPLAS ENGINERY CO., LTD.: COMPANY OVERVIEW

13.2.13 MOLD HOTRUNNER SOLUTIONS LTD.

TABLE 260 MOLD HOTRUNNER SOLUTIONS LTD.: COMPANY OVERVIEW

13.2.14 DR. BOY GMBH & CO. KG

TABLE 261 DR. BOY GMBH & CO. KG: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 275)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 MOLDED PLASTICS MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 MOLDED PLASTICS MARKET, BY TYPE

TABLE 262 MOLDED PLASTICS MARKET SIZE, BY TYPE, 2016–2023 (KILOTON)

TABLE 263 MOLDED PLASTICS MARKET SIZE, BY TYPE, 2016–2023 (USD MILLION)

14.3.3.1 Polyethylene

TABLE 264 POLYETHYLENE MARKET SIZE, BY REGION, 2016–2023 (KILOTON)

TABLE 265 POLYETHYLENE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

14.3.3.2 Polypropylene

TABLE 266 POLYPROPYLENE MARKET SIZE, BY REGION, 2016–2023 (KILOTON)

TABLE 267 POLYPROPYLENE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

14.3.3.3 Polyethylene Terephthalate

TABLE 268 POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY REGION, 2016–2023 (KILOTON)

TABLE 269 POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

14.3.3.4 Polystyrene

TABLE 270 POLYSTYRENE MARKET SIZE, BY REGION, 2016–2023 (KILOTON)

TABLE 271 POLYSTYRENE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

14.3.3.5 Polyurethane

TABLE 272 POLYURETHANE MARKET SIZE, BY REGION, 2016–2023 (KILOTON)

TABLE 273 POLYURETHANE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

14.3.3.6 Others

TABLE 274 OTHER MOLDED PLASTICS MARKET SIZE, BY REGION, 2016–2023 (KILOTON)

TABLE 275 OTHER MOLDED PLASTICS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

15 APPENDIX (Page No. - 283)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

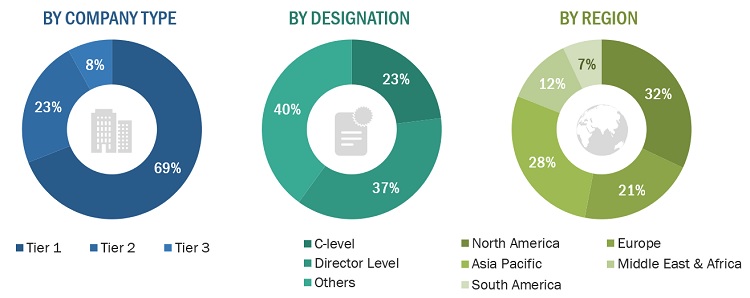

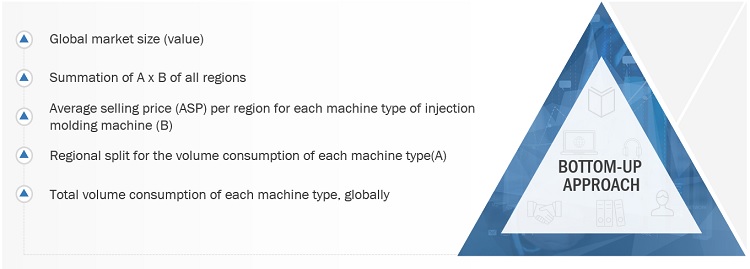

The study involved four major activities to estimate the market size for injection molding machine market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The injection molding machine market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the injection molding machine market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the injection molding machine market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the injection molding machine market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Injection Molding Machine Market: Bottum-Up Approach 1

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the injection molding machine market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on machine type, clamping force, product type, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

- Company Information

Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Injection Molding Machine Market