Radar Sensor Market by Type (Imaging, and Non-Imaging), Technology, Component, Band (HF, VHF, and UHF; L, S, C, and X; Ku, K, Ka, V, and W), Range (Short-range, Mid-range, Long-range), Application, Vertical, and Geography - Global Forecast to 2023

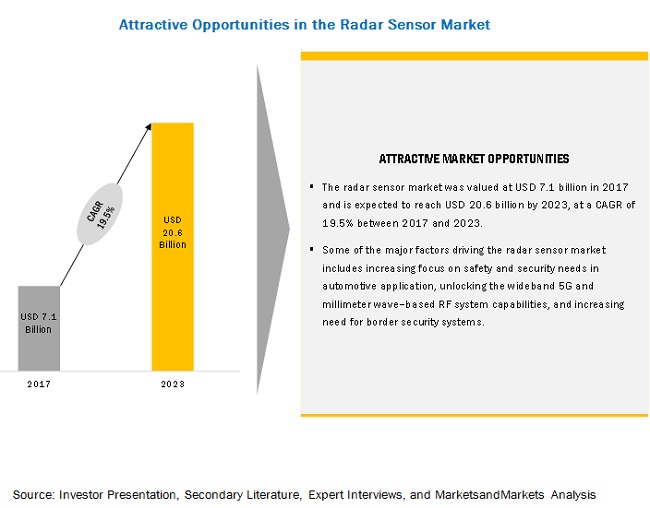

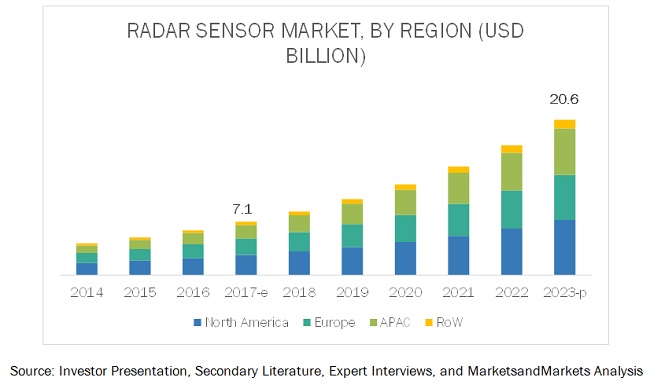

[219 Pages Report] MarketsandMarkets forecasts the radar sensor market to grow from USD 7.1 billion in 2017 to USD 20.6 billion by 2023, at a compound annual growth rate (CAGR) of 19.5% during the forecast period. The major factors that are expected to be driving the market are increasing focus on safety and security needs in automotive application, unlocking the wideband 5G and millimeter wave–based RF system capabilities, and increasing need for border security systems. The objective of the report is to define, describe, and forecast the radar sensor market size based on technology, components, type, band, range, vertical, application and region.

Radar Sensor Market By type, the non-imaging radar sensor segment is expected to grow at the highest growth rate during the forecast period

By type segment, radar sensor market has been segmented into imaging radar and non-imaging radar types. Non-imaging radar sensor segment is expected to grow at the highest CAGR during the forecast period. The growing use of non-imaging radars in adaptive cruise control (ACC), blind spot detection, lane change assist, and stop & go functionality is likely to drive the overall non-imaging radar sensor market.

Radar Sensor Market By band, Ku, K, Ka, V, and W bands holds the largest share of the market

Ku, K, Ka, V, and W bands segment is expected to hold the largest radar sensor market share. Ku (12 GHz to 18 GHz), K (18 GHz to 27 GHz), Ka (27 GHz to 40 GHz), V (40 GHz to 75 GHz), and W (75 GHz to 110 GHz) bands are mostly used in defense and automotive sectors. Initially, K-band radars were developed during World War II, centered at a frequency of 24 GHz. Later, the K band is subdivided into two bands: Ku (lower frequency band) and Ka (higher frequency band). These two bands have wide bandwidth and narrow beamwidth that can be achieved by small apertures. V is often referred as ‘very-high frequency band’ (yet another reference to VHF). In the current scenario, 24 GHz (K-band) and E-band (77 GHz) is widely used in automotive applications such as ACC, BSD, cross traffic alert, and stop-&-go functionality.

Radar Sensor Market By range, the mid-range radar segment is expected to grow at the highest growth rate during the forecast period

Among the range segment, the mid-range radar segment is expected to grow at the highest CAGR during the forecast period. Mid-range radar sensor has a presence mainly in automotive applications such as adaptive cruise control, and long-range object detections; in A&D applications such as ground proximity identification; and in industrial applications such as constructional machine zones and collision protection. Companies such as Infineon and NXP Semiconductor N.V. are focusing on mid-range radar sensors for applications.

Radar Sensor Market By application, automotive holds the largest share of the market

Automotive application segment is expected to hold the largest market share. Radar sensors are likely to witness the increasing demand in automotive applications, and some of the major reasons behind this include growing number of radar sensors in a car, increasing demand for safety, comfort, and assistance features in an automobile, and emergence of driverless car projects. Radar sensor can be incorporated in several applications such as collision avoidance system, blind spot detection, adaptive cruise control (ACC), advanced driver-assistance systems, lane departure warning, parking aid, pre-crash sensing & brake boosting, object detection system, and stop-&-go functionality.

Radar Sensor Market By vertical, the commercial segment is expected to grow at the highest growth rate during the forecast period

Among the vertical segment, the commercial segment is expected to grow at the highest CAGR during the forecast period. The commercial vertical includes automotive, civil aviation, private ships/yachts and railway, and security and surveillance activities in medical, agricultural, smart electronic devices. Radar sensor plays a significant part in automotive, civil aviation, private ships/yachts, and railway. In automotive applications, the radar sensor market will rise at a fast rate due to the emergence of issues related to safety and security of onboard passengers preventing them from road accidents/mishap. Therefore, the higher adoption rate of automotive radar sensors is observed in the coming years, as it serves in each car and vehicle and in autonomous car projects.

Radar Sensor Market in North America to account for the largest market size during the forecast period.

North America is expected to hold the largest market size in the radar sensor market during the forecast period. The presence of strong military and defense infrastructure in North American countries, such as the US and Canada, drives the market in this region. Moreover, the region has the most technologically advanced market for applications owing to the presence of prominent suppliers, major radar sensor companies such as Lockheed Martin Corporation (US) and Northdrop Grumman Corporation (US), manufacturers, and the competitiveness of OEMs.

Radar Sensor Market Dynamics

Driver: Increasing focus on safety and security needs in automotive application

Nowadays, technology has become more advanced and mainly focuses on safety and security needs in various applications such as vehicle collision assistance, industrial and public safety, and robotic assistance. Thus, radar sensors are used as they provide accuracy and offers unique safety and security solution capabilities with superior performance. These radar sensors enable low-power consumption, small size, integrated data processing, and faster response time. These features make radar sensors commercial in applications such as automotive, transportation, home automation, energy efficiency, industrial, and public safety.

In an automotive application, the main role of radar sensor is in collision avoidance system, blind spot detection, adaptive cruise control, advanced driver assistance system, and lane departure warning system. Technological advances permit proactive safety features such as collision mitigation system and vulnerable road user detection. To provide essential functions for a safety of a car, the system must distinguish more clearly between the objects on the roads. Thus, the system requires more bandwidth and narrow band frequency ranges in the 24GHz and 76 GHz bands.

Restraint: Application-specific legal issue in radar detector

A radar sensor can be installed in a vehicle while it is in production, and this vehicle can be offered for sale in almost all countries. It can be purchased separately by a person and can be misused, which may result in accidents and casualties. Thus, it is illegal in certain countries, and violating this may result in fines, seizure of the device, or both. Radar detectors are forbidden to use in many situational applications. In a military base, there are many checkpoints to ensure strict forbiddance of radar detectors. This issue is applicable for detectors that are visible and hidden. Commercial vehicles that have a weight of 10,000 pounds or more cannot be equipped with radar detectors. Some countries have already passed laws on banning the use of detectors. Some of the supporting acts of banning the usage of detectors include Wireless Telegraphy Act 1949 (the UK) and Communications Act of 1934 (the US). In Australia, radar detector is illegal in all states except Western Australia. In Canada, radar detectors are illegal in Newfoundland and Labrador, Nova Scotia, Prince Edward Island, New Brunswick, Quebec, Ontario, Manitoba, Yukon, Northwest Territories, and Nunavut. In the US, radar detectors are legal in private vehicles only under the Communications Act of 1934. Additionally, radar detectors are illegal in countries such as UAE, Switzerland, Saudi Arabia, the Netherlands, North Korea, India, France, and Brazil.

Opportunity: Developing countries increasing their military spending

There has been a shift of global power towards APAC, in terms of economy, which has an invariable impact on military spending. This is mainly due to the rapidly growing economy and an increase in military spending in countries such as China, India, and South Korea. China is the major driving force in APAC; its strong economic stability and contribution toward military spending make China the second-largest defense spender globally. With the emergence of China and its recent assertive behavior, neighboring countries such as India, Vietnam, the Philippines, and Japan are focusing on increasing their military power. Due to the recurring threats from neighboring countries, India, China, South Korea, and Vietnam have increased their military spending over time. The military expenditure of developing economies such as China, India, and South Africa is increasing, growing at a faster pace compared to their GDP growth over the past decade. Armed with higher budgets, these countries are investing substantial amounts to augment their defense power, and this involves upgrading their legacy surveillance systems. For instance, in May 2017, China has developed J–31 prototype stealth fighter planes that have improved radar systems, with supercruise capabilities, to replace the current F–35 fighters. The Indian military is seeking to upgrade its land radar surveillance technology. The Middle East defense market is expected to rise by fourfold in the coming years. The Middle Eastern countries have increased the procurement for unmanned automated vehicles (UAVs) to secure their borders and to counter the terrorist groups. Israel and the UAE have significantly developed their unmanned capability to support the increasing demand for UAVs in the Middle East. Africa, Algeria, and Angola being major oil producers have increased their military spending to safeguard themselves from terrorism.

Challenge: Electronic countermeasure (Electronic warfare)

The electromagnetic jamming of radars and noise interruptions during satellite communication are the challenges of radar-based applications. The purpose of electronic countermeasure (ECM) is to degrade the effectiveness of military radars. ECM consists of false target generation functions, noise jamming, chaff, and decoys. These functions are situation-specific with regard to the intended military applications. Jammers or ECM radiates interfering signals toward the enemy’s radar that blocks the receiver with high concentrated noise, which can affect the whole surveillance process. The other challenging factor is the noise interruption faced by space-based radar systems in recent times due to cosmic rays and other electromagnetic noise interruptions, which make the surveillance process difficult for the defense sector.

Scope of the Report

|

Report Metric |

Details |

|

Report Name |

Radar Sensor Market |

|

Base year considered |

2016 |

|

Forecast period |

2017–2023 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Technology, Components, Type, Band, Range, Vertical, Application and Region. |

|

Geographies covered |

North America, Europe, APAC, RoW (South America, Middle East, and Africa) |

|

Companies covered |

Robert Bosch GmbH (Germany), Continental AG (Germany), Lockheed Martin Corporation (US), Hella KGaA Hueck & Co (Germany), Infineon Technologies AG (Germany), Denso Corporation (Japan), Delphi Automotive LLP (UK), Autoliv Inc (Sweden), NXP Semiconductors N.V. (Netherlands), and Smart Microwave Sensors GmbH (Germany). |

Radar Sensor Market Segmentation

The research report categorizes the radar sensor to forecast the revenues and analyze the trends in each of the following sub-segments:

Radar Sensor Market By Technology

- Manufacturing technologies

- Gallium-nitride

- Silicon-germanium

- Metal-oxide semiconductor

- Brake lining

- Time domain reflectometry

- Ultra-wideband

- Others

Radar Sensor Market By Components

- Transmitter

- Duplexer

- Antenna

- Receiver

- Video amplifier

- Processing

Radar Sensor Market By Type:

- Imaging radar (primary type)

- Continuous wave (CW) radar

- Modulated CW radar

- Unmodulated CW radar

- Pulse radar

- MTI radar

- Difference between pulse Doppler radar and MTI radar

- Doppler radar

- Non-imaging radar (secondary type)

- Speed gauge

- Radar altimeter

- Aircraft related radar altimeter applications

- Radar altimeter application in spacecraft

- Radar altimeter application in military

- Radar altimeter application in remote sensing

Radar Sensor Market By Band:

- HF, VHF, and UHF bands

- HF and VHF band

- UHF-band

- L, S, C, and X bands

- L-band

- S-band

- C-band

- X-band

- KU, K, KA, V, and W bands

- KU-band

- K-band

- KA-band

- V-band

- W-band

Radar Sensor Market By Range:

- Industry wise range specifications

- Automotive industry

- Short-range radar sensor (SRR)

- Long-range radar sensor (LRR)

- LRR1 and LRR2

- LRR3

- LRR4

- Aerospace and defense industry

- Short-range

- Mid-range

- Long-range

- Other industry

- Range parameter considered under the study

- Short-range radar sensor

- Mid-range radar sensor

- Long-range radar sensor

Radar Sensor Market By Application:

- Automotive

- Collision avoidance system

- Blind spot detection

- Adaptive cruise control

- Lane departure warning system

- Object detection system

- Stop-&-go functionality

- Aerospace & defense

- Ground based

- Naval based

- Airborne based

- Space based

- Industrial

- Machine safeguarding area

- Collision protection

- Industrial robot

- Measuring working environment

- Mine inspection

- Tunnel wall Inspection

- Locating underground pipes

- Security & surveillance

- Access control system

- Perimeter security

- Transportation

- Commercial facilities

- Traffic monitoring and management

- Traffic flow analysis

- Traffic light control

- Traffic classification

- Distance measuring equipment

- Air traffic control (ATC) radar

- Ground control approach (GTC) radar

- Environmental & weather monitoring

- Weather surveillance radar system

- Weather and planetary observation

- Other applications

- Healthcare

- Agriculture

- Smart electronics devices

Radar Sensor Market By Vertical:

- Commercial

- Government

- Industrial

Radar Sensor Market By Geography

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Rest of Europe (Spain, Sweden, Switzerland, Finland, the Netherlands, Belgium, and Turkey)

- Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC (Taiwan, Indonesia, Australia, the Philippines, and Vietnam)

- Rest of the World (RoW)

- Middle East & Africa

- South America

Key Market Players

Robert Bosch GmbH (Germany), Continental AG (Germany), Lockheed Martin Corporation (US), Hella KGaA Hueck & Co (Germany), Infineon Technologies AG (Germany), Denso Corporation (Japan), Delphi Automotive LLP (UK), Autoliv Inc (Sweden), NXP Semiconductors N.V. (Netherlands), and Smart Microwave Sensors GmbH (Germany).

Robert Bosch GmbH held a leading position in the radar sensor market in 2016. Robert Bosch GmbH offers a broad portfolio of automotive, industrial, energy, and building technology products and consumer goods. The company has a strong market position in almost all the industries it operates, and a well-balanced revenue generation from all its business segments. This strong position of the company in various markets provides the company a competitive advantage. The company majorly operates in all the geographic regions and earns a large share of its revenue from the European region (53%) as of 2016.

The group's strategically balanced portfolio reduces the business risks and enables it to tap opportunities in new as well as existing markets. In terms of key business strategies of Robert Bosch GmbH in the radar sensor market, product development plays a major role. For instance, in October 2016, Bosch released its own self-driving car on Australian roads—Tesla equipped with six radars, six laser sensors, one stereo video camera, and one high-precision GPS unit. In May 2016, Bosch Engineering develops the first step toward the automated trams. Bosch uses radar and video sensors from its automotive sector in rail transport.

Recent Developments

- In April 2017, Germany's Robert Bosch (Germany) collaborated with Chinese Internet giant Baidu Inc. and domestic mapping firms AutoNavi and NavInfo Co Ltd on automated driving projects.

- In December 2016, Denso (Japan) acquired a majority of Fujitsu Ten Ltd., a Japanese information and communication technology company. This acquisition strengthens Denso's development of ADAS, millimeter-wave radar, and other technologies that underpin self-driving cars.

- In November 2016, Delphi Corp. (UK) signed a deal with Intel to buy high-powered computer processors for Delphi's future autonomous vehicle systems. Intel Corp. supplies Delphi with high-capacity computers, needed to process input from radar, cameras and laser sensors, as well as maps of roadside landmarks.

- In November 2016, Continental AG (Germany) announced that its chassis and safety division started the production of ABS and ESC units in India. A new assembly line for ABS and ESC for passenger cars and later ABS for two-wheelers set up in the Continental Automotive Brake Systems plant in Haryana. The local production start of the Electronic Control Unit (ECU) is planned for 2018 in Bangalore. Based on ESC, surrounding sensors such as radar, camera, and lidar technology are required for new predictive driver assistance systems.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the radar sensor market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Revenues of Companies in the Radar Sensor Market

2.2.1.2 Analysis of Asps for the Radar Sensors

2.2.1.3 Shipments Analysis for Radar Sensors

2.2.2 Top-Down Approach

2.2.2.1 Estimating Value and Volume From Secondary Sources

2.2.2.2 Validating Derived Results With Companies’ Revenue and Primaries

2.2.2.3 Mapping Segment–I With the Remaining Segments Individually Through the “Water–Fall Model”

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 38)

4.1 Attractive Opportunities in the Radar Sensor Market Between 2017 and 2023

4.2 Market, By Type (2017–2023)

4.3 Market, By Band (2017–2023)

4.4 Market, By Range (2017–2023)

4.5 Market, By Vertical (2017–2023)

4.6 Market, By Application (2017–2023)

4.7 Market, By Region and By Application

4.8 Market, By Geography (2017–2023)

5 Market Overview (Page No. - 44)

5.1 Introduction

5.2 Types of Sensors

5.2.1 Active Sensors

5.2.2 Passive Sensors

5.3 Types of Radar Systems

5.3.1 Synthetic Aperture Radar (SAR)

5.3.2 Interferometric SAR (INSAR)

5.3.3 Pass-To-Pass Coherent SAR

5.3.4 Ground Moving Target Indicator (GMTI)

5.3.5 Ground Penetrating Radar (GPR)

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Focus on Safety and Security Needs in Automotive Application

5.4.1.2 Unlocking the Wideband 5g and Millimeter Wave–Based RF System Capabilities

5.4.1.3 Increasing Need for Border Security Systems

5.4.2 Restraints

5.4.2.1 Application-Specific Legal Issue in Radar Detector

5.4.2.2 Higher Maintenance Cost of Radar Sensor Installed in Cars

5.4.2.3 High Development Cost

5.4.3 Opportunities

5.4.3.1 Developing Countries Increasing Their Military Spending

5.4.3.2 Acceptance of Advanced Driver Assistance Systems and Driverless Concepts in the Automotive Sector

5.4.4 Challenges

5.4.4.1 Electronic Countermeasure (Electronic Warfare)

6 Industry Trends (Page No. - 53)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Key Industry Trends in Radar Sensor Market

6.4 Radar Sensor Standards and Regulations

6.5 Start-Up Companies and Investment Scenario (2015–2017)

7 Technologies Used in Radar Sensor (Page No. - 58)

7.1 Introduction

7.2 Role of Major Manufacturing Technologies in Radar Sensor

7.2.1 Gallium-Nitride (GAN)

7.2.2 Silicon–Germanium (SI–GE)

7.2.3 Complementary Metal-Oxide Semiconductor (CMOS)

7.3 Time Domain Reflectometry (TDR)

7.4 Ultra-Wideband (UWB)

7.5 Others

7.5.1 RF MEMS-Based Radar Sensors

7.5.2 Millimeter Wave

8 Major Components Used in Radar (Page No. - 62)

8.1 Introduction

8.2 Transmitter

8.3 Duplexer

8.4 Antenna

8.5 Receiver

8.6 Video Amplifier

8.7 Processing

9 Radar Sensor Market, By Type (Page No. - 64)

9.1 Introduction

9.2 Imaging Radar (Primary Type)

9.2.1 Continuous Wave (CW) Radar

9.2.1.1 Modulated CW Radar

9.2.1.2 Unmodulated CW Radar

9.2.2 Pulse Radar

9.2.2.1 MTI Radar

9.2.2.2 Difference Between Pulse Doppler Radar and MTI Radar

9.2.2.3 Doppler Radar

9.3 Non-Imaging Radar (Secondary Type)

9.3.1 Speed Gauge

9.3.2 Radar Altimeter

9.3.2.1 Aircraft Related Radar Altimeter Applications

9.3.2.2 Radar Altimeter Application in Spacecraft

9.3.2.3 Radar Altimeter Application in Military

9.3.2.4 Radar Altimeter Application in Remote Sensing

10 Radar Sensor Market, By Band (Page No. - 76)

10.1 Introduction

10.2 HF, VHF, and HUF Bands

10.2.1 HF and VHF Band

10.2.2 HUF-Band

10.3 L, S, C, and X Bands

10.3.1 L-Band

10.3.2 S-Band

10.3.3 C-Band

10.3.4 X-Band

10.4 Ku, K, Ka, V, and W Bands

10.4.1 Ku-Band

10.4.2 K-Band

10.4.3 Ka-Band

10.4.4 V-Band

10.4.5 W-Band

11 Radar Sensor Market, By Range (Page No. - 87)

11.1 Introduction

11.2 Industry Wise Range Specifications

11.2.1 Automotive Industry

11.2.1.1 Short-Range Radar Sensor (SRR)

11.2.1.2 Long-Range Radar Sensor (LRR)

11.2.1.2.1 LRR1 and LRR2

11.2.1.2.2 LRR3

11.2.1.2.3 LRR4

11.2.2 Aerospace and Defense Industry

11.2.2.1 Short-Range

11.2.2.2 Mid-Range

11.2.2.3 Long-Range

11.2.3 Other Industry

11.3 Range Parameter Considered Under the Study

11.3.1 Short-Range Radar Sensor

11.3.2 Mid-Range Radar Sensor

11.3.3 Long-Range Radar Sensor

12 Radar Sensor Market, By Application (Page No. - 97)

12.1 Introduction

12.2 Automotive

12.2.1 Collision Avoidance System

12.2.2 Blind Spot Detection

12.2.3 Adaptive Cruise Control

12.2.4 Lane Departure Warning System

12.2.5 Object Detection System

12.2.6 Stop-&-Go Functionality

12.3 Aerospace & Defense

12.3.1 Ground Based

12.3.2 Naval Based

12.3.3 Airborne Based

12.3.4 Space Based

12.4 Industrial

12.4.1 Machine Safeguarding Area

12.4.2 Collision Protection

12.4.3 Industrial Robot

12.4.4 Measuring Working Environment

12.4.5 Mine Inspection

12.4.6 Tunnel Wall Inspection

12.4.7 Locating Underground Pipes

12.5 Security & Surveillance

12.5.1 Access Control System

12.5.2 Perimeter Security

12.5.3 Transportation

12.5.4 Commercial Facilities

12.6 Traffic Monitoring and Management

12.6.1 Traffic Flow Analysis

12.6.2 Traffic Light Control

12.6.3 Traffic Classification

12.6.4 Distance Measuring Equipment

12.6.5 Air Traffic Control (ATC) Radar

12.6.6 Ground Control Approach (GTC) Radar

12.7 Environmental & Weather Monitoring

12.7.1 Weather Surveillance Radar System

12.7.2 Weather and Planetary Observation

12.8 Other Applications

12.8.1 Healthcare

12.8.2 Agriculture

12.8.3 Smart Electronics Devices

13 Radar Sensor Market, By Vertical (Page No. - 133)

13.1 Introduction

13.2 Commercial

13.3 Government

13.4 Industrial

14 Geographic Analysis (Page No. - 141)

14.1 Introduction

14.2 North America

14.2.1 US

14.2.2 Canada

14.2.3 Mexico

14.3 Europe

14.3.1 France

14.3.2 UK

14.3.3 Italy

14.3.4 Rest of Europe

14.4 Asia Pacific (APAC)

14.4.1 China

14.4.2 Japan

14.4.3 India

14.4.4 South Korea

14.4.5 Rest of APAC

14.5 Rest of the World (RoW)

14.5.1 South America

14.5.2 Middle East & Africa

15 Competitive Landscape (Page No. - 161)

15.1 Overview

15.2 Key Players in Radar Sensor Market

15.3 Competitive Leadership Mapping

15.3.1 Visionary Leaders

15.3.2 Dynamic Differentiators

15.3.3 Innovators

15.3.4 Emerging Companies

15.4 Competitive Benchmarking

15.4.1 Business Strategy Excellence (25 Companies)

15.4.2 Strength of Product Portfolio (25 Companies)

*Top 25 Companies Analyzed for This Study are - Robert Bosch GmbH (Germany), Continental AG (Germany), Infineon Technologies AG (Germany), Hella KGaA Hueck & Co. (Germany), Autoliv Inc. (Swedan), Smart Microwave Sensors GmbH (Germany), Delphi Automotive LLP (UK), Lockheed Martin Corporation (US), Denso Corporation (Japan), NXP Semiconductors N.V. (The Netherlands), Arbe Robotics (Israel), Gryphon Sensors (US), Omniradar B.V. (The Netherlands), Echodyne, Inc. (US), Oculli Corporation (US), Airbus Group (The Netherlands), Saab AB (Swedan), BAE Systems (UK), Vega Americas Inc. (US), Terma A/S (Denmark), Selex ES (US), Brigade Electronics PLC (UK), Northrop Grumman Corporation (US), Senz2 BV (The Netherlands), ZF Friedrichshafen AG (Germany)

15.5 Competitive Situations and Trends

16 Company Profiles: Radar Sensor Market (Page No. - 170)

(Business Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments, Key Relationships)*

16.1 Introduction

16.2 Robert Bosch GmbH

16.3 Continental AG

16.4 Denso Corporation

16.5 Delphi Automotive LLP

16.6 Hella KGaA Hueck & Co

16.7 Infineon Technologies AG

16.8 Autoliv Inc.

16.9 Lockheed Martin Corporation

16.10 NXP Semiconductors N.V.

16.11 Smart Microwave Sensors GmbH

16.12 Start-Up Ecosystem

16.12.1 Oculli Corporation

16.12.2 Gryphon Sensors

16.12.3 Arbe Robotics

16.12.4 Echodyne, Inc.

16.12.5 Omniradar B.V.

*Details on Business Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments, Key Relationships Might Not Be Captured in Case of Unlisted Companies.

17 Appendix (Page No. - 208)

17.1 Insights of Industry Experts

17.2 Discussion Guide

17.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

17.4 Introducing RT: Real-Time Market Intelligence

17.5 Available Customizations

17.6 Related Reports

17.7 Author Details

List of Tables (68 Tables)

Table 1 Illegality of Radar Detectors in Certain Countries Restraining the Radar Sensor Market

Table 2 Regulation and Standards Related to Radar Sensor

Table 3 Specifications of Automotive Radar Frequencies Based on Region and Country

Table 4 Radar Sensor Market, By Type, 2014–2023 (USD Million)

Table 5 Market, By Imaging Type, 2014–2023 (USD Million)

Table 6 Imaging Market, By Application, 2014–2023 (USD Million)

Table 7 Market, By Non-Imaging Type, 2014–2023 (USD Million)

Table 8 Non-Imaging Market, By Application, 2014–2023 (USD Million)

Table 9 Market, By Band, 2014–2023 (USD Million)

Table 10 List of Radar Frequency Bands

Table 11 Market for HF, VHF, and HUF Bands, By Application, 2014–2023 (USD Million)

Table 12 Market for L, S, C, and X Bands, By Application, 2014–2023 (USD Million)

Table 13 Market for Ku, K, Ka, V, and W Bands, By Application, 2014–2023 (USD Million)

Table 14 Radar Range for Automotive Applications

Table 15 Radar Sensor Range Classification in Automotive Sector

Table 16 Market, By Range, 2014–2023 (USD Million)

Table 17 Short-Range Radar Sensor Market, By Application, 2014–2023 (USD Million)

Table 18 Mid-Range Market, By Application, 2014–2023 (USD Million)

Table 19 Long-Range Market, By Application, 2014–2023 (USD Million)

Table 20 Market, By Application, 2014–2023 (USD Million)

Table 21 Market for Automotive Application, By Value and Volume, 2014–2023

Table 22 Market for Automotive Application, By Type, 2014–2023 (USD Billion)

Table 23 Market for Automotive Application, By Band, 2014–2023 (USD Million)

Table 24 Market for Automotive Application, By Range, 2014–2023 (USD Million)

Table 25 Market for Automotive Application, By Region, 2014–2023 (USD Million)

Table 26 Market for Aerospace & Defense Application, By Value and Volume, 2014–2023

Table 27 Market, By Aerospace & Defense Application, 2014–2023 (USD Million)

Table 28 Market for Aerospace & Defense Application, By Type, 2014–2023 (USD Million)

Table 29 Market for Aerospace & Defense Application, By Band, 2014–2023 (USD Million)

Table 30 Market for Aerospace & Defense Application, By Range, 2014–2023 (USD Million)

Table 31 Market for Aerospace & Defense Application, By Region, 2014–2023 (USD Million)

Table 32 Market for Industrial Application, By Type, 2014–2023 (USD Million)

Table 33 Market for Industrial Application, By Band, 2014–2023 (USD Million)

Table 34 Market for Industrial Application, By Range, 2014–2023 (USD Million)

Table 35 Market for Security & Surveillance Application, By Type, 2014–2023 (USD Million)

Table 36 Market for Security & Surveillance Application, By Band, 2014–2023 (USD Million)

Table 37 Market for Security & Surveillance Application, By Range, 2014–2023 (USD Million)

Table 38 Market for Security & Surveillance Application, By Region, 2014–2023 (USD Million)

Table 39 Market for Traffic Monitoring & Management Application, By Type, 2014–2023 (USD Million)

Table 40 Market for Traffic Monitoring & Management Application, By Band, 2014–2023 (USD Million)

Table 41 Market for Traffic Monitoring & Management Application, By Range, 2014–2023 (USD Million)

Table 42 Market for Traffic Monitoring & Management Application, By Region, 2014–2023 (USD Million)

Table 43 Market for Environmental & Weather Monitoring Application, By Type, 2014–2023 (USD Million)

Table 44 Market for Environmental & Weather Monitoring Application, By Band, 2014–2023 (USD Million)

Table 45 Market for Environmental & Weather Monitoring Application, By Range, 2014–2023 (USD Million)

Table 46 Market for Environmental & Weather Monitoring Application, By Region, 2014–2023 (USD Million)

Table 47 Market for Other Applications, By Type, 2014–2023 (USD Million)

Table 48 Market for Other Applications, By Band, 2014–2023 (USD Million)

Table 49 Market for Other Applications, By Range, 2014–2023 (USD Million)

Table 50 Market for Other Applications, By Region, 2014–2023 (USD Million)

Table 51 Market, By Vertical, 2014–2023 (USD Million)

Table 52 Market for Commercial Vertical, By Region, 2014–2023 (USD Million)

Table 53 Market for Government Vertical, By Region, 2014–2023 (USD Million)

Table 54 Market for Industrial Vertical, By Region, 2014–2023 (USD Million)

Table 55 Market, By Region, 2014–2023 (USD Million)

Table 56 Market in North America, By Country, 2014–2023 (USD Million)

Table 57 Market in North America, By Application, 2014–2023 (USD Million)

Table 58 Market in North America, By Vertical, 2014–2023 (USD Million)

Table 59 Market in Europe, By Country, 2014–2023 (USD Million)

Table 60 Market in Europe, By Application, 2014–2023 (USD Million)

Table 61 Market in Europe, By Vertical, 2014–2023 (USD Million)

Table 62 Market in APAC, By Country, 2014–2023 (USD Million)

Table 63 Market in APAC, By Application, 2014–2023 (USD Million)

Table 64 Market in APAC, By Vertical, 2014–2023 (USD Million)

Table 65 Market, By RoW, 2014–2023 (USD Million)

Table 66 Market in RoW, By Application, 2014–2023 (USD Million)

Table 67 Market in RoW, By Vertical, 2014–2023 (USD Million)

Table 68 Top 5 Players in Radar Sensor Market, 2016

List of Figures (86 Figures)

Figure 1 Markets Covered in Radar Sensor Market

Figure 2 Research Flow

Figure 3 Radar Sensor Market: Research Design

Figure 4 Data Triangulation

Figure 5 Snapshot of Radar Sensor Market (2014–2023)

Figure 6 Market for Non-Imaging Radar Sensors Estimated to Grow at the Highest Rate Between 2017 and 2023

Figure 7 Ku, K, Ka, V, and W Bands Held the Largest Share of the Overall Market in 2016

Figure 8 Market for Mid-Range Radar Sensors Expected to Grow at the Highest Rate Between 2017 and 2023

Figure 9 Automotive Application Estimated to Hold the Largest Size of the Market Between 2017 and 2023

Figure 10 North America Led the Market in 2016

Figure 11 Increasing Focus on Safety and Security Needs in Automotive Application Will Attributes to the Growth of Market During the Forecast Period

Figure 12 Non-Imaging Radar Sensors Expected to Hold the Largest Market Size Between 2017 and 2023

Figure 13 Ku, K, Ka, V, and W Bands Likely to Dominate the Market Between 2017 and 2023

Figure 14 Short-Range Radar Sensors Estimated to Hold the Largest Market During the Forecast Period

Figure 15 Government Sector Held the Largest Share of the Market Based on Verticals in 2016

Figure 16 Automotive Application to Hold Major Share of the Market, By Application (2017–2023)

Figure 17 North America Expected to Hold the Largest Share of the Market in 2016

Figure 18 US Expected to Hold the Largest Share of the Market in 2016

Figure 19 Drivers, Restraints, Opportunities, and Challenges for the Radar Sensor Market

Figure 20 Global Military Expenditure, 2000–2016

Figure 21 Military Expenditure in Asia and Oceania Region

Figure 22 Possible Automotive Applications of Radar Sensor

Figure 23 Value Chain Analysis of the Radar Sensor Market

Figure 24 Introduction of Intelligent Radars: Leading Trend Among Key Market Players

Figure 25 Recent Investment Raised By Start-Ups

Figure 26 Core Manufacturing Technologies and Operating Principle Involved in the Radar Sensor Market

Figure 27 Radar System Block Diagram

Figure 28 Radar Sensor Market, By Type

Figure 29 Market for Continuous Wave Radar Type Expected to Grow at the Highest Rate Between 2017 and 2023

Figure 30 Environmental and Weather Monitoring Application Expected to Hold Major Share in Imaging Market, 2017

Figure 31 Block Diagram of Continuous Wave Radar

Figure 32 Block Diagram of Pulse Radar

Figure 33 Block Diagram of MTI Radar

Figure 34 Block Diagram of Pulse Doppler Radar

Figure 35 Automotive Application Likely to Grow With the Highest Rate Between 2017 and 2023

Figure 36 Market for Ku, K, Ka, V, and W Bands Expected to Grow at the Highest Rate During the Forecast Period

Figure 37 Environmental and Weather Monitoring Application Expected to Hold A Major Share in the Market for HF, VHF, and HUF Bands (2017–2023)

Figure 38 Security and Surveillance Application Likely to Grow at the Highest Rate in Market for L, S, C, and X Bands (2017–2023)

Figure 39 Market for Automotive Application Likely to Grow at the Highest Rate for Ku, K, Ka, V, and W Bands Between 2017 and 2023

Figure 40 Preference for Radar Over Other Remote Sensing Technologies

Figure 41 Long-Range Radar Sensors Likely to Dominate the Overall Market (2016)

Figure 42 Automotive Applications Expected to Hold the Largest Market Size Regarding Short-Range Radar Sensor (2017–2023)

Figure 43 Mid-Range Radar Sensors Market for Automotive Application Expected to Hold the Highest Share Between 2017 and 2023

Figure 44 Environmental and Weather Monitoring Application Expected to Hold Highest Share Long-Range Market (2017–2023)

Figure 45 Radar Sensor Market, By Application (2017–2023)

Figure 46 Radar Sensor Applications in Automotive

Figure 47 Market for Ku, K, Ka, V, and W Bands for Automotive Application Expected to Grow at the Highest Rate During the Forecast Period

Figure 48 APAC Expected to Hold the Largest Size of the Market for Automotive Application By 2023

Figure 49 Ground-Based Radar Sensors and Systems to Hold the Largest Market Share for Aerospace & Defense Application in 2016

Figure 50 L, S, C, and X Bands Expected to Hold the Largest Market Size for Aerospace & Defense Application During 2017–2023

Figure 51 North America Held the Largest Share of the Market for Aerospace & Defense Application in 2016

Figure 52 Non-Imaging Radar Sensors Expected to Dominate the Market for Industrial Application Between 2017 and 2023

Figure 53 Mid-Range Radar Sensors Held the Largest Share of the Market for Industrial Application in 2016

Figure 54 Ku, K, Ka, V, and W Bands Expected to Dominate the Market for Security & Surveillance Application Between 2017 and 2023

Figure 55 North America to Lead the Market for Security & Surveillance Application During the Forecast Period

Figure 56 Market for L, S, C, and X Bands to Hold A Major Market Share of the Traffic Monitoring & Management Application By 2023

Figure 57 North America Dominated the Market for Traffic Monitoring & Management Application in 2016

Figure 58 Imaging Radar Sensors Market for Environmental & Weather Monitoring Application Expected to Grow at the Highest Rate During the Forecast Period

Figure 59 Long-Range Radar Sensors Dominated the Market for Environmental & Weather Monitoring Application in 2016

Figure 60 APAC Market for Environmental & Weather Monitoring Application Expected to Grow at the Highest Rate During the Forecast Period

Figure 61 L, S, C, and X Bands Expected to Hold the Largest Size of the Overall Market for Other Applications Between 2017 and 2023

Figure 62 Market for Other Applications in APAC Estimated to Grow at the Highest Rate Between 2017 and 2023

Figure 63 Government Vertical for Radar Sensors Expected to Hold the Largest Market Between 2017 and 2023

Figure 64 Market for Commercial Vertical in APAC Expected to Grow at the Fastest Rate Between 2017 and 2023

Figure 65 In Government Vertical, North America Expected to Hold the Major Share in Radar Sensor in 2017

Figure 66 In Industrial Vertical, APAC Holds the Largest Share in the Market in 2017

Figure 67 Geographic Snapshot of Market (2017–2023)

Figure 68 North America: Market Snapshot

Figure 69 Market for the Commercial Vertical Expected to Grow at the Highest Rate Between 2017 and 2023

Figure 70 Europe: Market Snapshot

Figure 71 Government Vertical Held the Largest Share of the European Market in 2016

Figure 72 APAC: Radar Sensor Market Snapshot

Figure 73 Automotive Expected to Hold the Largest Size of the Market in APAC Between 2017 and 2023

Figure 74 RoW : Radar Sensor Market Snapshot

Figure 75 Companies Adopted Product Development as the Key Growth Strategy Between 2014 and 2017

Figure 76 Market Evolution Framework—New Product Development as the Major Strategy Adopted By Key Players

Figure 77 Battle for Market Share: New Product Launch and Developments Were the Key Strategy Adopted During 2014-2017

Figure 78 Robert Bosch GmbH: Company Snapshot

Figure 79 Continental AG: Company Snapshot

Figure 80 Denso Corporation: Company Snapshot

Figure 81 Delphi Automotive LLP: Company Snapshot

Figure 82 Hella KGaA Hueck & Co: Company Snapshot

Figure 83 Infineon Technologies AG: Company Snapshot

Figure 84 Autoliv Inc.: Company Snapshot

Figure 85 Lockheed Martin Corporation: Company Snapshot

Figure 86 NXP Semiconductors N.V.: Company Snapshot

Growth opportunities and latent adjacency in Radar Sensor Market

We are very interested in the market information of automotive radar. Also would like to understand the future trends such as ADAS and Driverless cars.

I am interested if the report contains information on bird strike prevention radars or other avian radars. Does the report cover these?