Patient Positioning Systems Market Size by Product (Tables (Surgical Table, Imaging Table, Examination Table), Accessories, Application (Surgery, Diagnosis, Cancer Treatment), End User (Hospitals, ASCs, Diagnostic Labs)) & Region - Global Forecast to 2027

Market Growth Outlook Summary

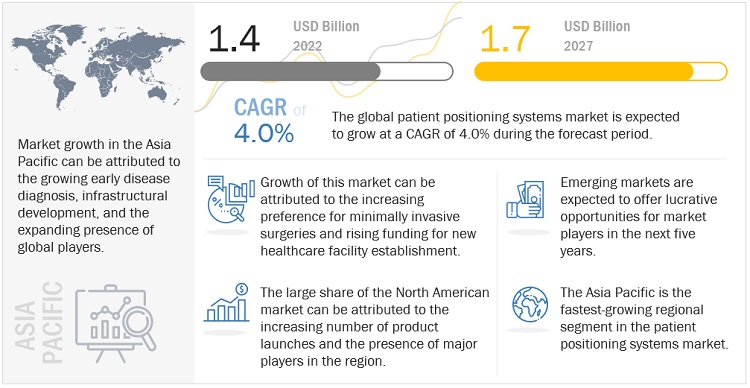

The global patient positioning systems market growth forecasted to transform from USD 1.4 billion in 2022 to USD 1.7 billion by 2027, driven by a CAGR of 4.0%. Growth of the market is attributed to the increasing preference for minimally invasive surgeries and rising funding for new healthcare facility establishment. Moreover, Emerging markets are expected to offer lucrative opportunities for market players in the next five years due to growing early disease diagnosis, infrastructural development, and the expanding presence of global players.

Global Patient Positioning Systems Market Trends

e- Estimated; p- Projected

To know about the assumptions considered for the study, Request for Free Sample Report

Patient Positioning System: Market Dynamics

Driver: Rising government funds for hospital expansions

With the rising prevalence of chronic diseases and growing preference for minimally invasive procedures, the number of hospitals offering treatments with specialized staff and equipment is increasing. Moreover, hospitals with surgical equipment aim to invest in innovative technologies and expand operating rooms to meet patient requirements. For instance:

- In May 2022, The University of Colorado Anschutz Medical Campus announced that it would make a $200 million investment over the next five years to create the Gates Institute, a research and treatment center that will focus on the development of new regenerative, cellular, and gene therapies for a variety of serious illnesses.

- In October 2021, the Scottish Government invested Euros 300 million in the winter funding package to increase the capacity of NHS hospitals and primary care centers.

Restraint: Implementation of excise duty on taxable medical devices

Under the Patient Protection and Affordable Care Act, the US government imposed an excise tax of 2.3% on the domestic sales of Class I, II, and III medical devices. This tax applies to medical devices manufactured or imported into the US. Due to this implementation, the market for patient positioning systems, which falls under Class I and II medical devices, will be affected in the US. The tax imposition will also reduce manufacturers' profit margins; as a result, the prices of medical devices are expected to increase in the country. This, in turn, will lead to a subsequent delay in purchasing new instruments, negatively impacting market growth to a certain extent.

The US is a major market for patient positioning systems and thus, the imposition of excise tax on medical devices in the country is expected to affect the patient positioning systems market on a global level.

Opportunities: Emerging markets

Emerging countries such as India, China, and Brazil are expected to offer potential growth opportunities for market players in the coming years. The large population, especially in India and China, offers a sustainable market for patient positioning systems. Lifestyle changes and poor dietary habits in these regions have increased the prevalence of chronic diseases such as cancer and CVDs. For instance, according to GLOBOCAN, China accounted for 24% of newly diagnosed cases and 30% of cancer-related deaths worldwide; this number is expected to increase by 2030. Similarly, the incidence of cancer in India has surged from 1.1 million in 2018 to 1.3 million in 2020.

Considering the potential growth opportunities in these countries, major players are focusing on undertaking various strategic developments, such as entering into distribution agreements with local players, to increase their market presence.

Challenges: Availability of refurbished patient positioning systems

The availability of refurbished patient positioning systems is considered a challenge to market growth. DRE Medical, Inc. (US), Future Health Concepts (US), and Soma Technology, Inc. (US) are some of the companies offering refurbished patient positioning systems in the market. Several end users are currently opting for refurbished systems due to the declining healthcare expenditure in major global healthcare markets. Moreover, end users prefer using cost-effective systems in developing countries, which are considered price-sensitive markets. Considering these factors, the demand for refurbished patient positioning systems is expected to increase in the coming years as these systems offer the same functionalities as new equipment at a lower cost. This, in turn, is expected to hamper the revenue of companies offering branded patient positioning systems in the market.

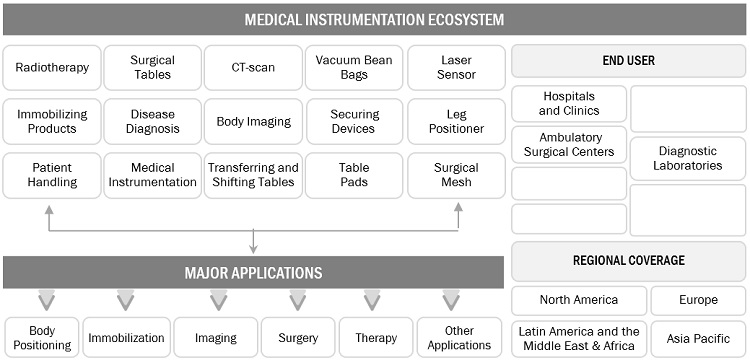

Patient positioning systems Market Ecosystem:

Source: Knowledge Store

By product type, the tables segment of the patient positioning systems industry accounted for the largest share during the forecast period.

Based on product, the patient positioning systems market is segmented into tables, accessories, and others. The tables segment accounts for the largest share of the patient positioning systems market. As minimally invasive surgery creates a demand for technologically enhanced operating tables, the rising advancements in this field are expected to provide significant growth opportunities for market players.

By application type, the cancer therapy segment of the patient positioning systems industry is expected to witness the highest growth during the forecast period.

Based on application, the patient positioning systems market is segmented into cancer therapy, surgery, and disease diagnosis. The cancer therapy segment is expected to witness the highest growth during the forecast period. Cancer therapies such as radiation therapy or proton therapy/precision therapy specifically treat the part of the body containing tumors. Using patient positioning systems in cancer therapy reduces discomfort and complications and ensures better outcomes. Thus, increasing awareness of proton therapy and other cancer therapy segments is expected to drive market growth for this application segment.

By End User, Ambulatory Surgical Centers segment of the patient positioning systems industry to grow at the fastest rate during the forecast period.

Based on end user, the global patient positioning systems market is segmented into hospitals and clinics, Ambulatory Surgical Centers, diagnostic laboratories, and other end users. ASCs significantly help improve the quality of care while simultaneously reducing the cost of procedures. As a result of these advantages, an increasing number of patients are opting to undergo procedures at ASCs, further supporting the growth of the segment.

To know about the assumptions considered for the study, download the pdf brochure

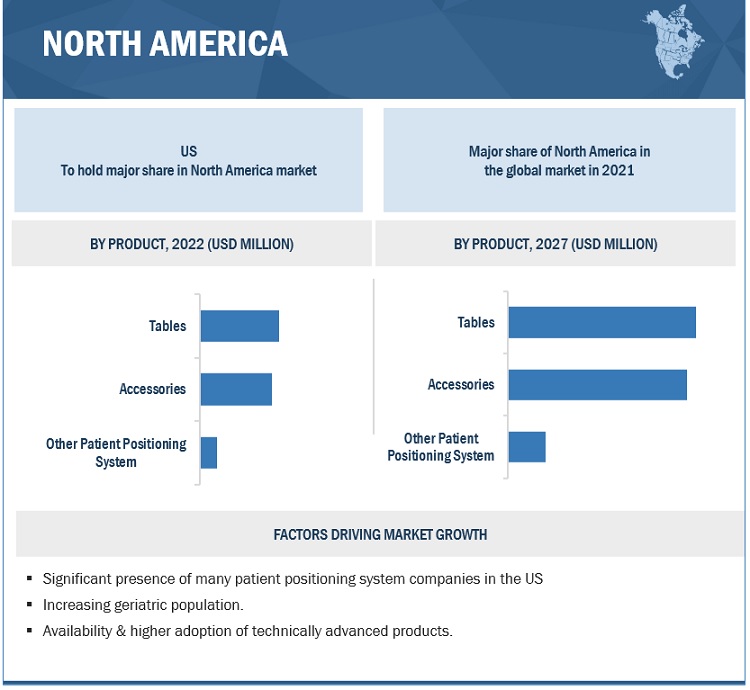

North America is expected to be the largest market of the patient positioning systems industry during the forecast period.

North America commanded the largest share of the patient positioning systems market in 2021. Its large share can be attributed to rising number of surgical procedures, growing investments by hospitals to upgrade operating rooms, and rising patient population. Moreover, growing geriatric population and rising prevalence of lifestyle diseases such as arthritis and obesity in this region are key contributors to the growth of the patient positioning system. As the increase in the number of these diseases requires patients to be hospitalized and depend on the patient positioning system, it aids in its growth.

As of 2021, prominent players in the patient positioning systems market are Stryker Corporation (US), Steris Plc. (US), Hill-Rom, Inc. (US), Getinge AB (Germany), C-RAD (Sweden), Smith & Nephew plc (UK), Guangzhou Renfu Medical Equipment CO, LTD (China), Medline Industries, LP. (US), Elekta AB (Sweden), Span America Medical Systems, Inc. (US), LEONI AG (Germany), Medtronic PLC (US), ORFIT INDUSTRIES N.V. (Belgium), Famed Zywiec Sp. z o. o (Poland), and Oncotech (Turkey) among others.

Scope of the Patient Positioning Systems Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$1.4 billion |

|

Projected Revenue by 2027 |

$1.7 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 4.0% |

|

Market Driver |

Rising government funds for hospital expansions |

|

Market Opportunity |

Emerging markets |

This report has segmented the global Patient positioning systems market to forecast revenue and analyze trends in each of the following submarkets.

By Product

-

Tables

- Surgical Table

- Radiolucent Imaging Table

- Examination Table

-

Accessories

- Radiotherapy Immobilization/ Fixation Products

- Other Accessories

- Other Patient Positioning System

By Application

- Surgery

- Disease Diagnosis

- Cancer Therapy

By End User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Patient Positioning Systems Industry

- In November 2022, C-RAD, a Swedish medical technology company, opens a precision radiation center in Faridabad, India.

- In July 2020, Hill-Rom Holdings Inc (US) launched surgical positioning innovations products named PST 500 Precision surgical table and Yellofins Apex Stirrups that provide caregivers with advanced OR technologies

- In September 2022, Getinge entered into a supply partnership with Medtronic, which recently received the CE mark for the Radiant-covered stent

- In September 2021, C-RAD and OPASCA entered collaboration. Radiation therapy departments have reached the next level of safety and accuracy with a solution combining C-RAD and OPASCA products, according to an agreement between C-RAD and OPASCA, a leader in innovative patient safety and workflow management solutions. C-RAD provides cutting-edge solutions ensuring exceptionally high precision, safety, and efficiency in advanced radiation therapy

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global patient positioning systems market?

The global patient positioning systems market boasts a total revenue value of $1.7 billion by 2027.

What is the estimated growth rate (CAGR) of the global patient positioning systems market?

The global patient positioning systems market has an estimated compound annual growth rate (CAGR) of 4.0% and a revenue size in the region of $1.4 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising technological advancements in medical devices- Increasing surgical procedures due to growing burden of chronic diseases- Rising government funds for hospital expansions- Growing incidence of sports and accident-related injuriesRESTRAINTS- Product recalls- Implementation of excise duty on taxable medical devicesOPPORTUNITIES- Emerging marketsCHALLENGES- Availability of refurbished patient positioning systems

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENTPROCUREMENT AND PRODUCT DEVELOPMENTMARKETING, SALES & DISTRIBUTION, AND POST-SALES SERVICES

-

5.5 SUPPLY CHAIN ANALYSISPROMINENT COMPANIESSMALL & MEDIUM-SIZED ENTERPRISESEND USERS

-

5.6 ECOSYSTEM COVERAGE FOR MEDICAL INSTRUMENTATION

-

5.7 PATENT ANALYSIS

-

5.8 TRADE ANALYSISPATIENT POSITIONING SYSTEMS: TRADE ANALYSIS

- 5.9 KEY CONFERENCES AND EVENTS (2022–2024)

- 5.10 PATIENT POSITIONING SYSTEMS MARKET: TECHNOLOGY ANALYSIS

- 6.1 INTRODUCTION

-

6.2 TABLESRISING DEMAND FOR SURGICAL TABLES IN CARDIOVASCULAR AND GYNECOLOGICAL PROCEDURES TO DRIVE MARKETSURGICAL TABLES- Rising MIS procedures to drive demandRADIOLUCENT IMAGING TABLES- Rising number of image-guided procedures to drive uptakeEXAMINATION TABLES- Increasing patient footfall at hospitals and clinics to drive market

-

6.3 ACCESSORIESRADIOTHERAPY/IMMOBILIZATION FIXATION PRODUCTS- Utilization of imaging cameras in radiation treatment to support market growthOTHER ACCESSORIES

- 6.4 OTHER PATIENT POSITIONING SYSTEMS

- 7.1 INTRODUCTION

-

7.2 SURGERYGROWING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET

-

7.3 DISEASE DIAGNOSISRISING USE OF DIAGNOSTIC MODALITIES FOR ACCURATE RESULTS TO DRIVE MARKET

-

7.4 CANCER THERAPYGROWING DEMAND FOR PRECISION THERAPY IN TUMOUR TREATMENT TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 HOSPITALS AND CLINICSINCREASING NUMBER OF SURGICAL PROCEDURES PERFORMED IN HOSPITALS TO DRIVE MARKET

-

8.3 AMBULATORY SURGICAL CENTERSRISING PREFERENCE FOR OUTPATIENT PROCEDURES AT LOW COST TO DRIVE MARKET

-

8.4 DIAGNOSTIC LABORATORIESINCREASING NEED FOR DIAGNOSTIC IMAGING IN EARLY DISEASE DETECTION TO SUPPORT MARKET GROWTH

- 8.5 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Increasing healthcare development activities to drive marketCANADA- Investments and government expenditure on healthcare to propel market

-

9.3 EUROPEGERMANY- Rising number of hip and knee replacements to support marketFRANCE- Rising number of road accidents to fuel uptakeUK- Increase in government healthcare expenditure to boost marketITALY- Increasing medical advancements and hospital accommodations to support market growthSPAIN- Growing hospital admission due to rising disease burden to drive marketREST OF EUROPE

-

10.1 ASIA PACIFICCHINA- Increasing incidence of non-communicable diseases to drive uptakeJAPAN- Rising healthcare spending on adoption of advanced medical devices to drive marketINDIA- Rising healthcare investments to drive marketAUSTRALIA- Accessible and affordable healthcare services to drive uptake of patient positioning systemsSOUTH KOREA- Increasing incidence of orthopedic disorders to support market growthREST OF ASIA PACIFIC

-

10.2 LATIN AMERICABRAZIL- Minimal trade barriers for laboratory equipment to support market growthMEXICO- Rising investments in advanced medical equipment to support market growthREST OF LATIN AMERICA

-

10.3 MIDDLE EAST & AFRICARISING ECONOMIC GROWTH DUE TO INCREASING INVESTMENTS IN HEALTHCARE TO DRIVE MARKET

- 11.1 OVERVIEW

-

11.2 KEY PLAYER STRATEGIESOVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN PATIENT POSITIONING SYSTEMS MARKET

- 11.3 REVENUE SHARE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2021)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.7 COMPETITIVE BENCHMARKING

- 11.8 COMPETITIVE SITUATION AND TRENDS

-

12.1 KEY PLAYERSGETINGE AB- Business overview- Products/services/solutions offered- Recent developments- MnM viewHILL-ROM HOLDINGS, INC.- Business overview- Products/services/solutions offered- Recent developments- MnM viewC-RAD- Business overview- Products/services/solutions offered- Recent developments- MnM viewSTRYKER CORPORATION- Business overview- Products/services/solutions offered- Other developments- MnM viewELEKTA AB- Business overview- Products/services/solutions offered- Recent developments- MnM viewSTERIS PLC- Business overview- Products/services/solutions offeredSMITH & NEPHEW PLC- Business overview- Products/services/solutions offeredLEONI AG- Business overview- Products/services/solutions offeredMERIVAARA CORP.- Business overview- Products/services/solutions offeredMIZUHO OSI- Business overview- Products/services/solutions offeredFAMED ZYWIEC SP. Z O.O.- Business overview- Products/services/solutions offeredONCOTECH- Business overview- Products/services/solutions offeredORFIT INDUSTRIES- Business overview- Products/services/solutions offeredGUANGZHOU RENFU MEDICAL EQUIPMENT CO, LTD- Business overview- Products/services/solutions offeredCIVCO RADIOTHERAPY- Business overview- Products/services/solutions offeredMEDLINE INDUSTRIES, LP- Business overview- Products/services/solutions offered- Recent developmentsMEDTRONIC- Business overview- Products/services/solutions offeredSPAN AMERICA.- Business overview- Products/services/solutions offered

-

12.2 OTHER COMPANIESOPT SURGISYSTEMS S.R.L.ONCOLOGY SYSTEMS LIMITED.PROBED MEDICAL TECHNOLOGIES INC.ALVO MEDICALGENDRON INC.PARAMOUNT BED CO., LTD.ESCHMANN TECHNOLOGIES LTD.MEDIFA-HESSE GMBH & CO. KGXODUS MEDICAL INC.MEDILAND ENTERPRISE CORPORATIONINNOVATIVE MEDICAL PRODUCTS INC.GF HEALTH PRODUCTS, INC.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 PATIENT POSITIONING SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 SUPPLY CHAIN ECOSYSTEM

- TABLE 3 IMPORT DATA FOR PATIENT POSITIONING SYSTEMS (HS CODE 940290) BY COUNTRY, 2017–2021 (USD)

- TABLE 4 EXPORT DATA FOR PATIENT POSITIONING SYSTEMS (HS CODE 940290) BY COUNTRY, 2017–2021 (USD)

- TABLE 5 PATIENT POSITIONING SYSTEMS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 6 PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 7 PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 8 PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 9 PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 10 PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY END USER, 2020–2027 (USD MILLION)

- TABLE 11 PATIENT POSITIONING SYSTEMS MARKET FOR SURGICAL TABLES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 12 PATIENT POSITIONING SYSTEMS MARKET FOR SURGICAL TABLES, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 13 PATIENT POSITIONING SYSTEMS MARKET FOR SURGICAL TABLES, BY END USER, 2020–2027 (USD MILLION)

- TABLE 14 PATIENT POSITIONING SYSTEMS MARKET FOR RADIOLUCENT IMAGING TABLES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 15 PATIENT POSITIONING SYSTEMS MARKET FOR RADIOLUCENT IMAGING TABLES, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 16 PATIENT POSITIONING SYSTEMS MARKET FOR RADIOLUCENT IMAGING TABLES, BY END USER, 2020–2027 (USD MILLION)

- TABLE 17 PATIENT POSITIONING SYSTEMS MARKET FOR EXAMINATION TABLES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 18 PATIENT POSITIONING SYSTEMS MARKET FOR EXAMINATION TABLES, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 19 PATIENT POSITIONING SYSTEMS MARKET FOR EXAMINATION TABLES, BY END USER, 2020–2027 (USD MILLION)

- TABLE 20 PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 21 PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 22 PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 23 PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY END USER, 2020–2027 (USD MILLION)

- TABLE 24 PATIENT POSITIONING SYSTEMS MARKET FOR RADIOTHERAPY IMMOBILIZATION/ FIXATION PRODUCTS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 25 PATIENT POSITIONING SYSTEMS MARKET FOR RADIOTHERAPY IMMOBILIZATION/ FIXATION PRODUCTS, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 26 PATIENT POSITIONING SYSTEMS MARKET FOR RADIOTHERAPY IMMOBILIZATION/ FIXATION PRODUCTS, BY END USER, 2020–2027 (USD MILLION)

- TABLE 27 PATIENT POSITIONING SYSTEMS MARKET FOR OTHER ACCESSORIES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 28 PATIENT POSITIONING SYSTEMS MARKET FOR OTHER ACCESSORIES, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 29 PATIENT POSITIONING SYSTEMS MARKET FOR OTHER ACCESSORIES, BY END USER, 2020–2027 (USD MILLION)

- TABLE 30 PATIENT POSITIONING SYSTEMS MARKET FOR OTHERS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 31 PATIENT POSITIONING SYSTEMS MARKET FOR OTHERS, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 32 PATIENT POSITIONING SYSTEMS MARKET FOR OTHERS, BY END USER, 2020–2027 (USD MILLION)

- TABLE 33 PATIENT POSITIONING SYSTEMS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 34 PATIENT POSITIONING SYSTEMS MARKET FOR SURGERY APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 35 PATIENT POSITIONING SYSTEMS MARKET FOR DISEASE DIAGNOSIS APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 36 PATIENT POSITIONING SYSTEMS MARKET FOR CANCER THERAPY APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 37 PATIENT POSITIONING SYSTEMS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 38 PATIENT POSITIONING SYSTEMS MARKET FOR HOSPITALS AND CLINICS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 39 PATIENT POSITIONING SYSTEMS MARKET FOR AMBULATORY SURGICAL CENTERS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 40 PATIENT POSITIONING SYSTEMS MARKET FOR DIAGNOSTIC LABORATORIES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 41 PATIENT POSITIONING SYSTEMS MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 42 PATIENT POSITIONING SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: PATIENT POSITIONING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 44 NORTH AMERICA: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 45 NORTH AMERICA: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 46 NORTH AMERICA: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 47 NORTH AMERICA: PATIENT POSITIONING SYSTEM MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 48 NORTH AMERICA: PATIENT POSITIONING SYSTEMS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 49 US: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 50 US: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 51 US: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 52 CANADA: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 53 CANADA: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 54 CANADA: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 55 EUROPE: PATIENT POSITIONING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 56 EUROPE: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 57 EUROPE: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 58 EUROPE: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 59 EUROPE: PATIENT POSITIONING SYSTEMS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 60 EUROPE: PATIENT POSITIONING SYSTEMS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 61 GERMANY: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 62 GERMANY: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 63 GERMANY: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 64 FRANCE: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 65 FRANCE: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 66 FRANCE: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 67 UK: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 68 UK: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 69 UK: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 70 ITALY: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 71 ITALY: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 72 ITALY: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 73 SPAIN: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 74 SPAIN: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 75 SPAIN: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 76 REST OF EUROPE: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 77 REST OF EUROPE: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 78 REST OF EUROPE: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 79 ASIA PACIFIC: PATIENT POSITIONING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 80 ASIA PACIFIC: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 81 ASIA PACIFIC: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 82 ASIA PACIFIC: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 83 ASIA PACIFIC: PATIENT POSITIONING SYSTEMS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 84 ASIA PACIFIC: PATIENT POSITIONING SYSTEMS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 85 CHINA: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 86 CHINA: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 87 CHINA: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 88 JAPAN: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 89 JAPAN: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 90 JAPAN: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 91 INDIA: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 92 INDIA: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 93 INDIA: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 94 AUSTRALIA: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 95 AUSTRALIA: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 96 AUSTRALIA: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 97 SOUTH KOREA: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 98 SOUTH KOREA: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 99 SOUTH KOREA: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 100 REST OF ASIA PACIFIC: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 101 REST OF ASIA PACIFIC: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 103 LATIN AMERICA: PATIENT POSITIONING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 104 LATIN AMERICA: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 105 LATIN AMERICA: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 106 LATIN AMERICA: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 107 LATIN AMERICA: PATIENT POSITIONING SYSTEMS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 108 LATIN AMERICA: PATIENT POSITIONING SYSTEMS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 109 BRAZIL: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 110 BRAZIL: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 111 BRAZIL: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 112 MEXICO: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 113 MEXICO: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 114 MEXICO: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 115 REST OF LATIN AMERICA: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 116 REST OF LATIN AMERICA: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 117 REST OF LATIN AMERICA: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: PATIENT POSITIONING SYSTEMS MARKET FOR TABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: PATIENT POSITIONING SYSTEMS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: PATIENT POSITIONING SYSTEMS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 123 PATIENT POSITIONING SYSTEMS MARKET: DEGREE OF COMPETITION

- TABLE 124 PATIENT POSITIONING SYSTEMS MARKET: PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS

- TABLE 125 COMPANY PRODUCT FOOTPRINT

- TABLE 126 COMPANY REGIONAL FOOTPRINT

- TABLE 127 PRODUCT LAUNCHES

- TABLE 128 DEALS

- TABLE 129 OTHER DEVELOPMENTS

- TABLE 130 GETINGE AB: COMPANY OVERVIEW

- TABLE 131 HILL-ROM HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 132 C-RAD: COMPANY OVERVIEW

- TABLE 133 STRYKER CORPORATION: COMPANY OVERVIEW

- TABLE 134 ELEKTA AB: COMPANY OVERVIEW

- TABLE 135 STERIS PLC: COMPANY OVERVIEW

- TABLE 136 SMITH & NEPHEW PLC.: COMPANY OVERVIEW

- TABLE 137 LEONI AG: COMPANY OVERVIEW

- TABLE 138 MERIVAARA CORP.: COMPANY OVERVIEW

- TABLE 139 MIZUHO OSI: COMPANY OVERVIEW

- TABLE 140 FAMED ZYWIEC SP. Z O.O.: COMPANY OVERVIEW

- TABLE 141 ONCOTECH.: COMPANY OVERVIEW

- TABLE 142 ORFIT INDUSTRIES: COMPANY OVERVIEW

- TABLE 143 GUANGZHOU RENFU MEDICAL EQUIPMENT CO, LTD: COMPANY OVERVIEW

- TABLE 144 CIVCO RADIOTHERAPY: COMPANY OVERVIEW

- TABLE 145 MEDLINE INDUSTRIES, LP: COMPANY OVERVIEW

- TABLE 146 MEDTRONIC: COMPANY OVERVIEW

- TABLE 147 SPAN AMERICA.: COMPANY OVERVIEW

- FIGURE 1 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 4 PATIENT POSITIONING SYSTEMS MARKET: BOTTOM-UP APPROACH FOR MARKET SIZE ESTIMATION

- FIGURE 5 CAGR PROJECTION: SUPPLY-SIDE ANALYSIS

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 PATIENT POSITIONING SYSTEMS MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 PATIENT POSITIONING SYSTEMS MARKET FOR ACCESSORIES, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 PATIENT POSITIONING SYSTEMS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 PATIENT POSITIONING SYSTEMS MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 RISING TECHNOLOGICAL ADVANCEMENTS IN MEDICAL DEVICES AND GROWING SURGICAL PROCEDURES TO DRIVE MARKET

- FIGURE 13 RADIOLUCENT TABLES TO REGISTER HIGH GROWTH IN NORTH AMERICAN MARKET

- FIGURE 14 CANCER THERAPY APPLICATION SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 HOSPITALS AND CLINICS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 PATIENT POSITIONING SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

- FIGURE 19 SUPPLY CHAIN ANALYSIS

- FIGURE 20 PATENT DETAILS FOR PATIENT POSITIONING SYSTEMS (JANUARY 2012–OCTOBER 2022)

- FIGURE 21 PATENT DETAILS FOR SURGICAL TABLES (JANUARY 2012–OCTOBER 2022)

- FIGURE 22 PATENT DETAILS FOR RADIOLUCENT IMAGING TABLES (JANUARY 2012–OCTOBER 2022)

- FIGURE 23 PATENT DETAILS FOR EXAMINATION TABLES (JANUARY 2012–OCTOBER 2022)

- FIGURE 24 PATENT DETAILS FOR PATIENT IMMOBILIZATION (JANUARY 2012–OCTOBER 2022)

- FIGURE 25 NORTH AMERICA: PATIENT POSITIONING SYSTEMS MARKET SNAPSHOT

- FIGURE 26 ASIA PACIFIC: PATIENT POSITIONING SYSTEMS MARKET SNAPSHOT

- FIGURE 27 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN PATIENT POSITIONING SYSTEMS MARKET

- FIGURE 28 GLOBAL PATIENT POSITIONING SYSTEMS MARKET SHARE, BY KEY PLAYER, 2021

- FIGURE 29 PATIENT POSITIONING SYSTEMS MARKET: COMPANY EVALUATION QUADRANT, 2021

- FIGURE 30 PATIENT POSITIONING SYSTEM MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2021

- FIGURE 31 GETINGE AB: COMPANY SNAPSHOT (2021)

- FIGURE 32 HILL-ROM HOLDINGS, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 33 C-RAD: COMPANY SNAPSHOT (2021)

- FIGURE 34 STRYKER CORPORATION.: COMPANY SNAPSHOT (2021)

- FIGURE 35 ELEKTA AB: COMPANY SNAPSHOT (2022)

- FIGURE 36 STERIS PLC: COMPANY SNAPSHOT (2021)

- FIGURE 37 SMITH & NEPHEW PLC: COMPANY SNAPSHOT (2021)

- FIGURE 38 LEONI AG: COMPANY SNAPSHOT (2021)

- FIGURE 39 MEDTRONIC: COMPANY SNAPSHOT (2021)

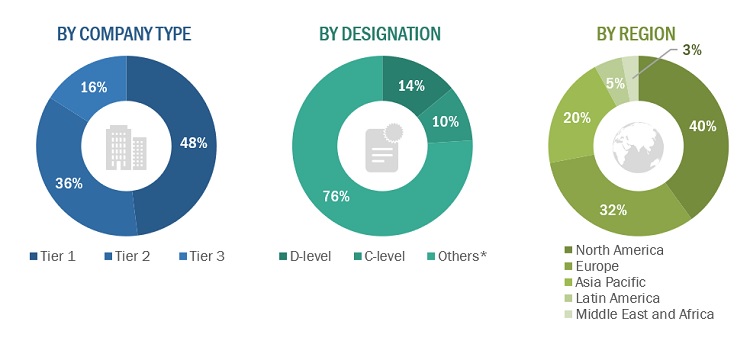

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the patient positioning system market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the patient positioning systems market. The primary sources from the demand side include medical OEMs, Analytical instrument OEMs, CDMOs, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2021, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million–1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

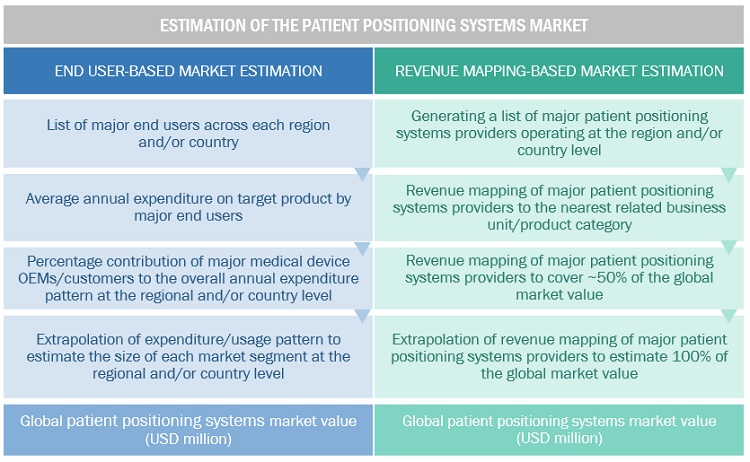

Market Estimation Methodology

In this report, the global patient positioning systems market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the patient positioning system business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the market

- Mapping annual revenues generated by major global players from the patient positioning system segment (or nearest reported business unit/product category)

- Revenue mapping of key players to cover major share of the global market , as of 2021

- Extrapolating the global value of the patient positioning system industry

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global patient positioning systems market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market was validated using both top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, and forecast the patient positioning systems market on the basis of product, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global market

- To analyze key growth opportunities in the global market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Australia, South Korea, and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

- To profile the key players in the global market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global patient positioning system market, such as product launches, agreements, expansions, and & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global patient positioning systems market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of Asia Pacific market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Latin American market into Colombia, Chile, Argentina, and Peru, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Patient Positioning Systems Market