Power Rental Market

Power Rental Market by Equipment (Generators, Transformers, Load Banks, Other Equipment), Power Rating (Up to 50 KW, 51–500 KW, 501–2,500 KW, Above 2,500 KW), Application, Fuel Type, Rental Type, End User, and Region – Global Trends & Forecast To 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

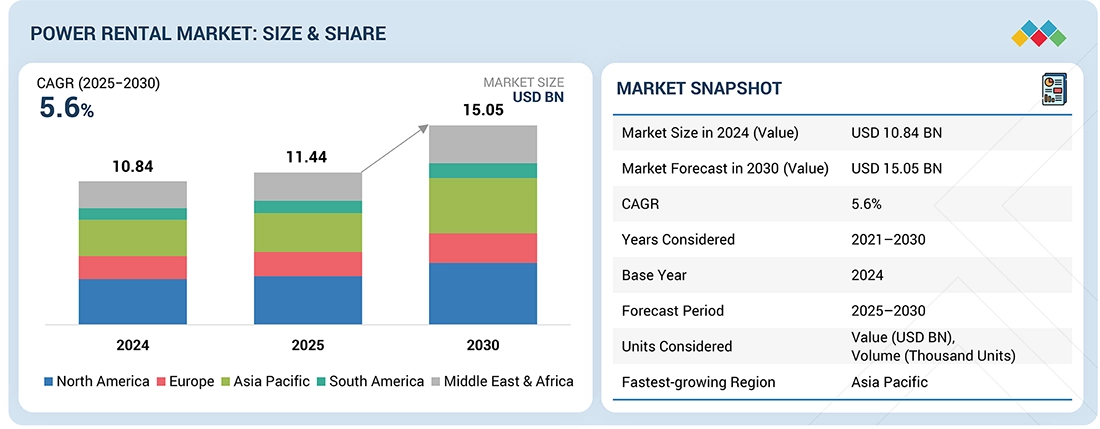

The global power rental market is projected to reach USD 15.05 billion in 2030, growing from USD 11.44 billion in 2025 at a CAGR of 5.6% during the forecast period. The market is driven an increasing demand for temporary power solutions across various industries, such as construction, events, oil and gas, and utilities, where renting equipment provides flexibility and cost-effectiveness. The increasing volume of construction activities necessitates power rental equipment for tasks like lighting up construction sites and running temporary facilities. Additionally, the need for backup power solutions is on the rise due to frequent natural disasters, power outages, and grid instability, leading businesses to invest in standby power solutions offered by rental companies. This factor is also leading to the growth of the market.

KEY TAKEAWAYS

-

By RegionAsia Pacific is projected to grow at the highest CAGR (7.1%) during forecast period.

-

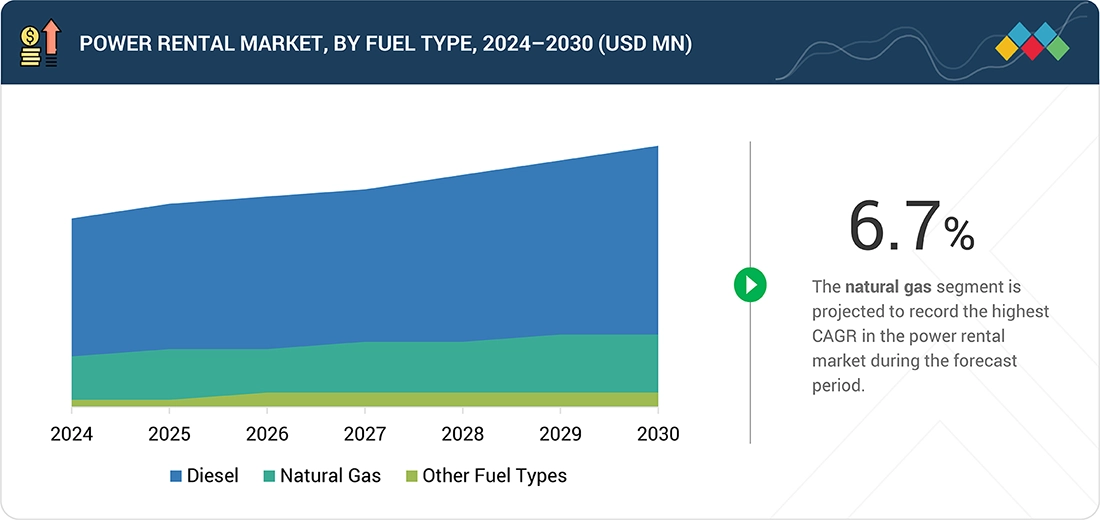

By Fuel TypeBy fuel type, the natural gas segment is projected to grow at the highest rate from 2025 to 2030.

-

By EquipmentBy equipment, the generators segment is projected to dominate the power rental market during the forecast period.

-

By Power RatingBy power rating, the 501–2,500 KW segment is projected to register the highest CAGR of 6.1% during the forecast period.

-

By ApplicationBy application, the peak shaving segment is projected to register the highest CAGR of 7.9% during the forecast period.

-

By End UserBy end user, the utilities segment is projected to dominate the power rental market during the forecast period.

-

By Rental TypeBy rental type, the retail rental segment is projected to account for a larger share than the project rental segment during the forecast period.

-

Competitive Landscape - Key PlayersCompanies such as Aggreco (UK), Ashtead Group (UK), United Rentals, Inc. (US), Herc Rentals Inc. (US), Atlas Copco (Sweden), and Caterpillar (US) were identified as star players in power rental market.

-

Competitive Landscape - Startups/SMEsGenerator Power systems, Inc. (US), ADS SOLUTIONS (India), JC Davis Power (US), and Power Northeast Ltd (UK) have distinguished themselves among SMEs and startups due to their strong product portfolio and sound business strategy.

The power rental market is witnessing steady growth, owing to the increasing demand for reliable and flexible power solutions across the industrial and commercial sectors. Frequent fluctuations in energy supply and the rising need for temporary or backup power prompt businesses to adopt rental solutions over conventional systems. The adaptability of generator fleets plays a critical role, allowing companies to quickly respond to changing operational needs and project timelines. Additionally, ongoing industrial expansion, rapid infrastructure development, and the growing emphasis on uninterrupted power supply for data centers, manufacturing, and oil & gas operations accelerate the regional market growth. Overall, the region’s focus on energy resilience, flexible power delivery, and advanced fleet technologies continues to shape the future of the global power rental market.

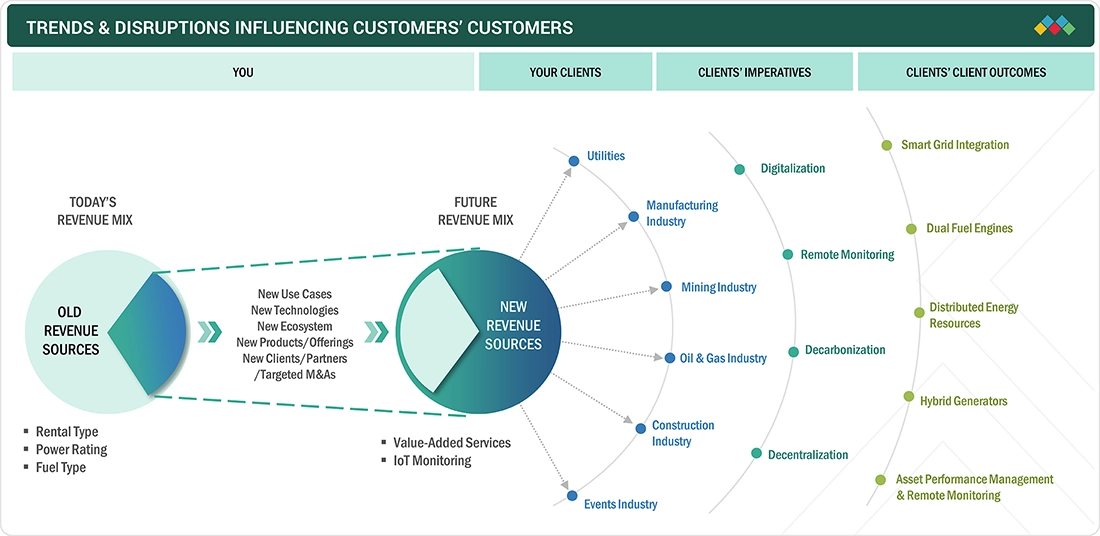

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global power rental market is estimated to record moderate-to-high growth during the forecast period. This growth can be attributed to the digitalization of utilities and increased investments in the renewable and clean energy sectors. The growth of big data analytics enables efficient processing, predictive maintenance, and advanced analysis of large datasets, enhancing reliability and efficiency in power grids and increasing investments in the offshore wind farms sector, which are likely to create lucrative opportunities for the market players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surging demand for uninterrupted and reliable power supply

-

Rapid industrialization in developing economies

Level

-

Growing adoption of renewable energy sources and energy storage technologies

-

Stringent government regulations associated with generators

Level

-

Integration of power rental generators with renewable energy sources

-

Technological advancements in power rental equipment for operations enhancement

Level

-

Increased operating expenditure on diesel generators due to high fuel prices

-

Raw material and component shortage and sudden fluctuation in demand for power rental equipment

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surging demand for uninterrupted and reliable power supply

Surging demand for uninterrupted and reliable power supply is a key driver for the power rental market, as frequent weather-related disruptions, grid congestion, and aging transmission infrastructure increasingly threaten business continuity across the region. Enterprises in sectors such as data centers, healthcare, manufacturing, oil & gas, and construction are prioritizing contingency solutions that can instantly bridge grid failures or planned outages, leading to higher adoption of temporary generators and hybrid rental power systems. At the same time, stricter uptime requirements, especially for mission-critical facilities and remote industrial sites, are pushing companies to complement their permanent installations with flexible rental capacity that can be deployed quickly, scaled with project needs, and financed on an operating-expense basis rather than capex. This combination of reliability concerns, operational risk mitigation, and financial flexibility is steadily reinforcing the role of rental power as an essential buffer against grid instability across the regions.

Restraint: Growing adoption of renewable energy sources and energy storage technologies

Growing adoption of renewable energy sources and advanced energy storage technologies is emerging as a structural restraint for the global power rental market. As utilities, commercial facilities, and large industrial users worldwide increasingly invest in grid-connected solar and wind projects paired with battery storage, their dependence on temporary diesel- and gas-fired rental generators for peak shaving and backup power is gradually declining. In addition, falling levelized costs of renewables and storage, coupled with policy incentives and decarbonization targets in many countries, make permanent clean-energy installations more attractive than short-term rental contracts over the life cycle of a project. This shift reduces the frequency and duration of rental deployments and intensifies regulatory and stakeholder pressure on high-emission rental fleets, forcing power rental providers across regions to reconfigure offerings and accept margin pressures in traditionally high-demand segments.

Opportunity: Technological advancements in power rental equipment for operations enhancement

Technological advancements, such as IoT-enabled telematics, AI-driven predictive maintenance, and hybrid generator–battery systems, are creating a major opportunity for the power rental market by significantly enhancing operational efficiency and service quality. Remote monitoring platforms allow rental providers to track fuel consumption, load profiles, and equipment health in real-time, enabling proactive fault detection, optimized dispatch, and reduced on-site staffing needs for construction, data centers, utilities, and event customers. At the same time, integration of mobile battery energy storage and smart energy management systems with Tier 4-compliant diesel and gas sets reduces fuel use, emissions, and noise, helping customers meet stringent environmental regulations and corporate sustainability targets while lowering total cost of ownership for temporary power. Providers that aggressively digitize their fleets and offer technology-rich solutions, such as hybrid microgrids, remote performance dashboards, and data-backed performance guarantees can differentiate themselves in a competitive market and capture long-term contracts from customers seeking reliable, low-carbon, and intelligently managed rental power solutions.

Challenge: Increased operating expenditure on diesel generators due to high fuel prices

Rising diesel prices have become a significant challenge for the global power rental market, as they directly inflate the operating expenditure of rental generator fleets and erode customer willingness to commit to long-term contracts. The fuel component often accounts for the largest share of total lifecycle cost for rented gensets, so sustained increases in diesel prices sharply raise per-kWh power costs, compressing margins for rental providers unless tariffs are frequently adjusted. At the same time, price-sensitive users in construction, oil & gas, events, mining, and small industrial sites across regions are increasingly reconsidering diesel-based rental solutions, delaying projects, downsizing rental capacities, or seeking alternatives such as gas, hybrid, or grid-based backup where available. This cost pressure complicates demand forecasting, contract structuring, and fleet optimization for rental companies worldwide, and forces them to invest in more fuel-efficient sets, remote monitoring, and hybrid solutions to remain competitive while managing profitability in a volatile fuel-price environment.

POWER RENTAL MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Temporary standby and backup power deployed at the NHS Nightingale Hospital London to ensure uninterrupted electricity supply for critical care operations during outages | Rapid deployment of temporary rental power by MEMS by supplying 21,850 kVA with generators, cables, and distribution equipment | Enable NHS Nightingale Hospital to operate with reliable electricity for critical care without risking outages |

|

Off-grid power solutions were required at the La Parrilla tungsten mine in Extremadura to provide a stable and reliable electricity supply in a remote location without grid access | Provided a stable, long-term and environmentally cost-effective power supply | Enabled continuous mining operations at the remote La Parrilla tungsten min |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

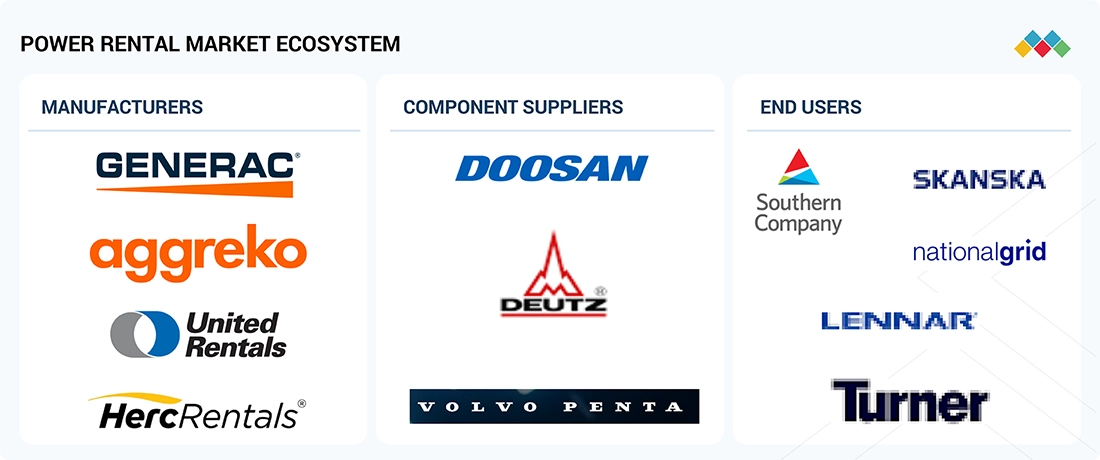

MARKET ECOSYSTEM

The power rental ecosystem connects generator manufacturers, component suppliers, and rental power companies with a wide spectrum of end users that depend on temporary or backup electricity. These end users include utilities seeking grid support and oil and gas operators in remote fields, mining projects, construction sites, and large commercial or industrial facilities. Data centers, telecom networks, and event organizers also rely on rented power solutions to ensure uninterrupted operations during outages, peak demand, commissioning, or short-term projects.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Power Rental Market, By Fuel Type

The power rental market is categorized, based on fuel type, into diesel, natural gas, and other fuel types, such as gasoline, hybrid, and heavy fuel oil (HFO). The diesel segment is estimated to dominate the market due to the high reliability, easy availability, and suitability of diesel generators for heavy-duty applications. Natural gas-powered units are also gaining popularity as cleaner and more cost-effective alternatives, driven by increasing environmental regulations and the growing availability of gas infrastructure. Other fuel types, such as gasoline, hybrid systems, and HFO-based units, serve specific niche applications where flexibility, mobility, or localized fuel availability are key factors influencing equipment selection.

Power Rental Market, By Equipment

Based on equipment, the power rental market has been segmented into generators, load banks, transformers, and other equipment (wires, clamps, transfer boxes, and fuel tanks). The generators segment is projected to lead the market during the forecast period due to increasing use of natural gas generators. Power rental solutions offered by most companies consist of a complete end-to-end solution, providing ready-to-use solutions for peak sharing, standby power, and baseload & continuous power applications. These solutions are designed to meet the specific demands of different end-use customers.

Power Rental Market, By Power Rating

The power rental market, by power rating, has been segmented into up to 50 kW, 51–500 kW, 501–2,500 kW, and above 2,500 kW. The 501–2,500 kW segment is projected to lead the market during the forecast period due to the use of diesel- and natural gas-fired power rental solutions. These generators are used in the mining, oil & gas, and construction industries, depending on the type/nature of the job.

Power Rental Market, By Application

The power rental market, by application, has been segmented into peak shaving, base load/continuous power, and standby power. Rental generators can sometimes be used during peak hours to accommodate extra demand, ensuring grid stability. Since these generators share the peak load, the application is called peak shaving. The peak shaving segment is projected to grow at the highest rate during the forecast period due to the rising use of these generators during the peak load. Power rental units that are used to meet the base load/continuous power requirements within different industries are essentially termed base load/continuous power generators. These generators and related equipment are used during mining operations at remote places where supply from the grid is unavailable. Additionally, standby load generators find applications during contingencies or planned outages by utilities or during emergencies where critical operations such as telecom and data centers require backup power.

Power Rental Market, By End User

Based on end user, the power rental market is segmented into utilities, oil & gas, metals & mining, construction, manufacturing, events, corporate & retail, IT & data centers, and others. The utilities segment is projected to dominate the market during the forecast period, as utilities increasingly depend on rental power to manage peak loads, grid maintenance, and emergency backup requirements across diverse industrial applications. Additionally, the growing demand for power from IT and data centers further fuels the growth of the segment.

Power Rental Market, By Rental Type

Based on rental type, the power rental market has been classified into retail rental and project rental. The retail rental segment is projected to grow at a higher CAGR than the project rental segment as customers prefer short-term and flexible access to generators. Besides, retail rental offers flexibility and come in handy for temporary purposes. Additionally, retail users can use power rental solutions for shorter turnaround times without worrying about the cost of owning them.

REGION

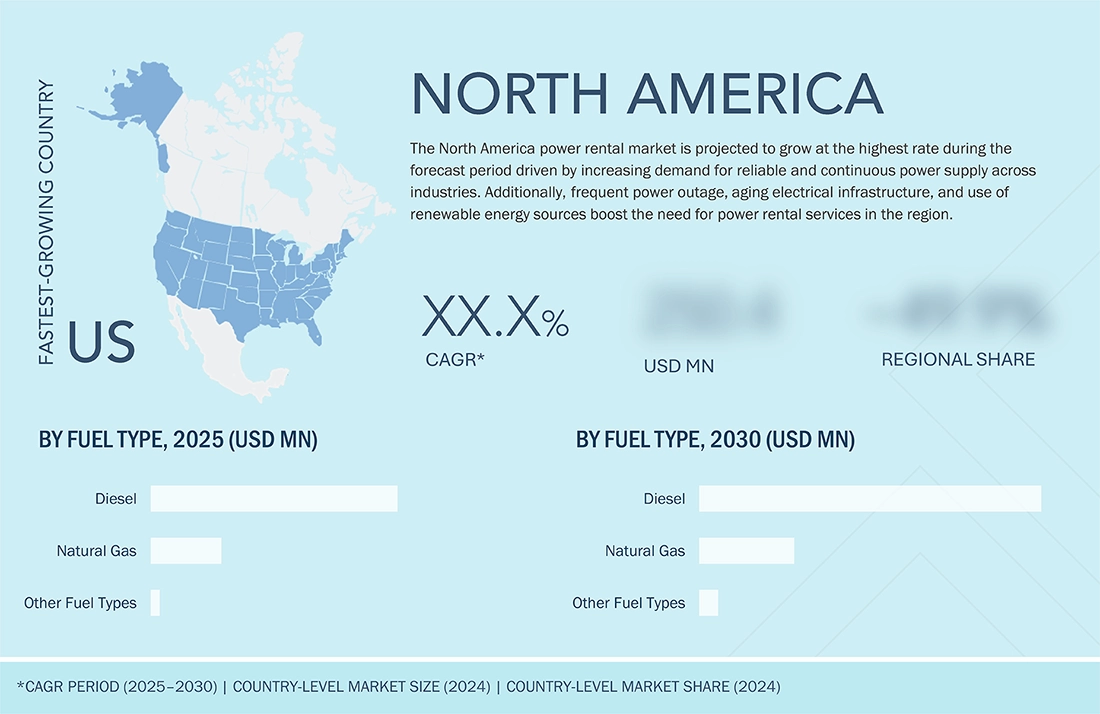

North America is projected to be the largest market for power rental during the forecast period

North America is projected to be the largest regional market during the forecast period. The region has a mature and well-established economy with a high level of industrialization, urbanization, and infrastructure development. This drives demand for temporary power solutions in various sectors, including construction, manufacturing, oil and gas, utilities, events, and entertainment. As a result, the region has a large and diverse customer base for power rental services, contributing to market growth. Moreover, North America has a robust regulatory framework and reliable power infrastructure, which makes it conducive to the adoption of power rental solutions.

POWER RENTAL MARKET: COMPANY EVALUATION MATRIX

Aggreko (STAR) differentiates itself through an extensive fleet portfolio, integrated digital and monitoring platforms, and strong reach across industries, such as manufacturing, oil and gas, and utilities. On the other hand, Kohler Co. (Emerging Leader) is steadily becoming a go-to power rental brand. Its rental power solutions are compact, energy-efficient and easy to deploy. It offers OEMs and users a practical alternative to traditional giants, especially in everyday applications like temporary HVAC systems, pumps, fans and small industrial machines.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Aggreco (UK)

- Ashtead Group plc (UK)

- United Rentals, Inc. (US)

- Herc Rentals Inc. (US)

- Generac Power Systems, Inc. (US)

- Caterpillar Inc. (US)

- Cummins Inc (US)

- Atlas Copco Group (Sweden)

- Wacker Neuson SE (Germany)

- Kohler Co. (US)

- Allmand Bros., Inc. (US)

- Perennial Technologies (India)

- Carrier (US)

- Multiquip Inc. (US)

- Trinity Power Rentals (US)

- Clifford Power Systems (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 10.84 BN |

| Market Forecast in 2030 (Value) | USD 15.05 BN |

| Growth Rate | 5.6% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, South America |

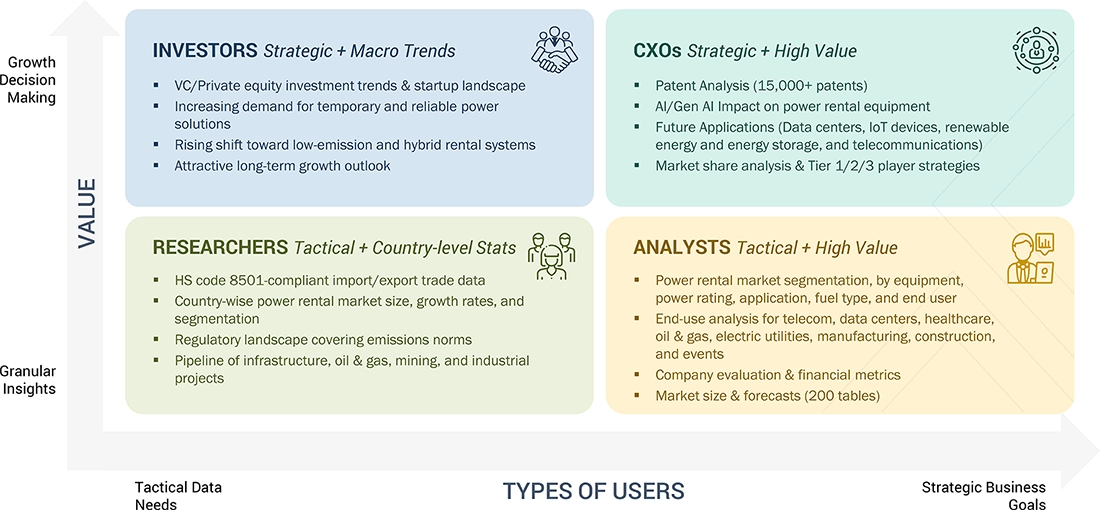

WHAT IS IN IT FOR YOU: POWER RENTAL MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Major Industrial EPC/Utility Provider |

|

|

| Oil & Gas/Mining Operator |

|

|

| Building/HVAC System Integrator |

|

|

RECENT DEVELOPMENTS

- September 2024 : Atlas Copco acquired Integrated Pump Rental (IPR), a South African enterprise that is focused on dewatering pump rentals. IPR became part of Atlas Copco’s Specialty Rental Division within Power Technique; in this way, the rental business of IPR was enhanced by adding additional dewatering pumps and complementary products like air compressors, generators, and power supplies used by customers involved in mining, construction, and wastewater.

- August 2022 : Caterpillar signed a strategic partnership with Aggreko, a global leader in temporary power and utilities rental, for joint marketing and technology collaboration. This partnership is significant in the power rental industry, which is projected to grow to USD 26.9 billion worldwide by 2027. The partnership is part of Caterpillar’s efforts to strengthen its position in the market and enhance its offerings through collaborative innovation and marketing efforts.

- July 2021 : Aggreko partnered with R&A to deliver a renewable power solution at the 149th Open Championship at Royal St George’s Golf Club in Sandwich, England, conducted between July 15 and 18. Aggreko delivered two renewable microgrids that supplied 100% reliable power without connection to the grid. The system has already generated approximately 21,000 kWh of solar power and saved 25 tons CO2 before the event since the solution was installed in March 2021 for the event.

- May 2021 : United Rentals completed the previously announced acquisition of General Finance Corporation. This is an acquisition with strong strategic and financial merits, timed to serve the increasing demand in end markets. It expands the company’s capacity for growth due to the addition of leading mobile storage and modular office solutions, including over 900 employees with complementary expertise.

Table of Contents

Methodology

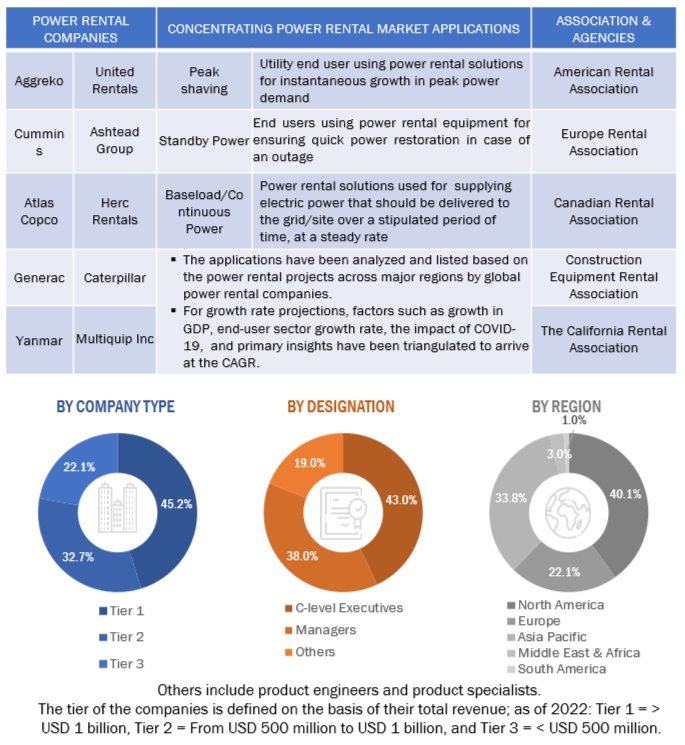

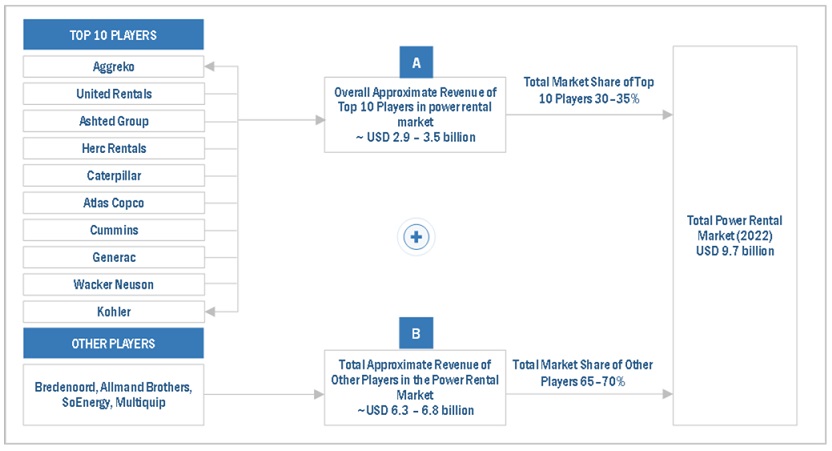

The study involved major activities in estimating the current size of the power rental market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and United States Energy Association, to identify and collect information useful for a technical, market-oriented, and commercial study of the global power rental market. The other secondary sources included annual reports of the companies involved in the market, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The power rental market comprises power rental providers, manufacturers of subcomponents of power plant, manufacturing technology providers, and technology support providers in the supply chain. The demand side of this market is characterized by the rising demand for clean energy and energy efficiency. The supply side industry experts such as vice presidents, CEOs, marketing directors, technology directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Power Rental Market Size Estimation

Both supply side and demand side analysis were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Identification of major players in the market across countries. Key players in the power rental market include Aggreko, United Rentals, Ashtead Group, Herc Rentals, Caterpillar, Atlas Copco, and Cummins.

- Determining the revenues and business strategy specifics, such as the inorganic and organic growth strategy details, of major power rental equipment providers.

- The market share of individual power rental segments, namely, equipment, fuel type, application, power rating, rental type, and end user, are determined by consolidating and evaluating the product offerings of major companies.

- In addition, country-level demand for power rental equipment from end users, such as utilities, oil & gas, mining & metals, manufacturing, construction, and IT & data centers, and supportive policy developments across regions during the forecast period has been analyzed. The analysed data then verified through primaries to determine the country-wise and regional landscape.

Global Power Rental Market Size: Supply Side Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Global Power Rental Market Size: Demand side Analysis

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. The complete market engineering process is done to arrive at the exact statistics for all the segments and subsegments, also data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by examining various factors and trends from both the demand- and supply sides. Along with this, the market has been validated through both the top-down and bottom-up approaches.

Market Definition

The power rental market is defined as the revenue generated either through providing equipment on rent such as load banks, generators, fuel tanks, cables, transformers, and power accessories or by renting temporary power plants. Power rental equipment majorly operates on diesel, gas, and other fuels such as gasoline, hybrid fuel, and heavy fuel oil (HFO). This equipment is used for peak shaving, standby power, and base load/continuous load applications by the utilities, oil & gas, events, construction, mining & metals, manufacturing, IT & data centers, corporate & retail, and other end users. Other industries include shipping, agriculture, aerospace and defense, wherein this equipment is majorly used for the generation of backup power.

Key Stakeholders

- Consulting companies in the energy and power sector

- Consulting companies in the oil & gas sector

- Generator raw materials and component manufacturers

- Engine/generator manufacturers, dealers, and suppliers

- Governments and research organizations

- Investment banks

- Petroleum companies (diesel and natural gas suppliers)

- Construction and infrastructure development companies

- Power grid infrastructure companies

- Power plant project developers

- Power rental companies

- Shareholders or investors

Objectives of the Study

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and Middle East & Africa, along with their key countries.

- To define, describe, analyze, and forecast the size of the global power rental market based on fuel type, power rating, application, equipment, end user, rental type, and region.

- To provide detailed information about key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To strategically analyze the market with respect to individual growth trends, future expansions, and contributions to the market.

- To analyze market opportunities for stakeholders in the market and draw a competitive landscape for market players.

- To analyze competitive developments such as sales contracts, agreements, investments, expansions, new product launches, mergers, partnerships, joint ventures, collaborations, and acquisitions in the market.

- To compare key market players with respect to the market share, product specifications, and applications.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Power Rental Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Power Rental Market