Light Towers Market by Market Type (Sales and Rental), Light Type (Metal Halide and LED), Fuel Type (Diesel, Solar/Hybrid and Direct Power), End-User (Oil & Gas, Mining, Construction, and Events & Sports) and Region - Global Forecast to 2025

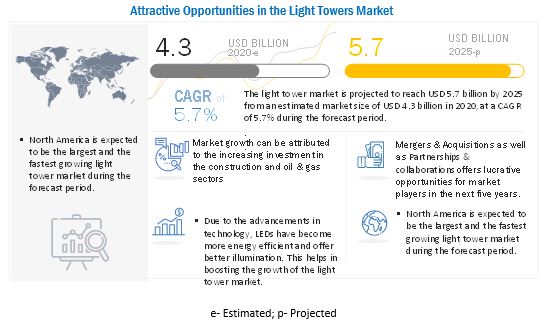

The global light towers market in terms of revenue was estimated to worth $4.3 billion in 2020 and is poised to reach $5.7 billion by 2025, growing at a CAGR of 5.7 % from 2020 to 2025. This growth is attributed to the increasing investment for light towers operation in end-use industries such as construction, mining, oil & gas, and events & sports.

The increasing adoption of LED lighting systems, growth in the construction industry, and the need for better and safer lighting solutions in emergency situations are all expected to drive demand for light towers. The market is also expected to benefit from the growing use of light towers in sports and entertainment, particularly for outdoor events.

To know about the assumptions considered for the study, Request for Free Sample Report

The rental segment is expected to be the largest contributor to the light towers market during the forecast period

The light towers industry is segmented, by market type, into sales and rental. The rental market type segment accounted for the largest market share in 2019, driven by the demand for light tower rentals in North America and Asia Pacific. The need further drives the rental market for a short time/temporary use as it requires lower capital investment.

The LED segment is expected to be the fastest-growing market, by light type, during the forecast period

The light towers market, by light type, is segmented based on the metal halide and LED type of light towers. The metal halide segment was the largest market in 2019 owing to its increased demand from the oil & gas, and mining end-users, which is the major demand-generating industry for light towers. However, in the future, the LED light tower segment is expected to the largest and fastest-growing market due to the increased energy efficiency and operational characteristics of LEDs as compared to the metal halide lights.

The diesel fuel type segment is expected to be the fastest-growing light towers industry, by fuel type, during the forecast period

The light towers market is segmented, by fuel type, into diesel, solar/hybrid, and direct power. The diesel segment holds the largest share because light towers are operated increasingly in remote off-grid regions where access to grid power is non-existent. In addition, diesel is widely available and cost-effective compared to other fuel sources, which again drives the market for diesel power light towers.

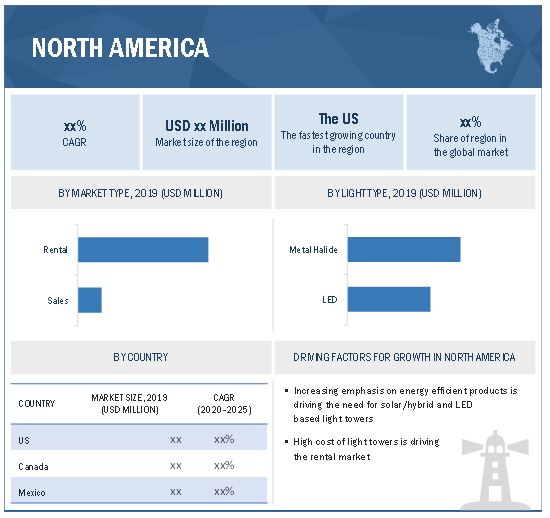

North America is expected to be the largest market during the forecast period

The market is segmented, by region, into North America, Europe, Asia Pacific, the Middle East & Africa, and South America. North America accounted for the majority of the light towers market share in 2018, and this trend is expected to continue until 2025. The North American market is driven majorly by countries, such as the US and Canada, as they are witnessing a strong investment in infrastructure development and oil & gas exploration activities.

Key Market Players

The key players profiled in this report are Generac Holding (US), Terex Corporation (US), Doosan Portable Power (US), Wacker Neuson (Germany), Atlas Copco (Sweden), and United Rental (US).

Generac Holding (US) is a key player in the diesel and LED light towers market. The company actively focuses on both organic and inorganic strategies to increase its global market share. For instance, in July 2019, Generac Mobile introduced a new product in its light tower offerings. The new MLTS LED light tower provided powerful, even lighting, simplified controls, and low maintenance requirements for maximized profit. The product boasts LED lights with a 10–year life expectancy.

Another major player in the market is United Rentals (US). United Rentals completed the acquisition of WesternOne Rentals & Sales. The acquisition helped United Rentals in enhancing its service to construction and industrial customers in the provinces of Alberta, British Columbia, and Manitoba.

Scope of the report

|

Report Metric |

Details |

|

Market size value in 2020: |

USD 4.3 Billion |

|

Projected to reach: |

USD 5.7 Billion |

|

CAGR in % |

5.7% |

|

Base year considered |

2019 |

|

Segments covered |

Market Type, Light Type, Fuel Type, End-User and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Generac Holding (US), Terex Corporation (US), Doosan Portable Power (US), Wacker Neuson (Germany), Atlas Copco (Sweden), and United Rental (US). |

This research report categorizes the light towers market by market type, light type, fuel type, end-user, and region.

By Market Type

- Sales

- Rental

By Light Type

- Metal Halide

- LED

By Fuel Type

- Diesel

- Solar/Hybrid

- Direct Power

By End-User

- Oil & Gas

- Mining

- Construction

- Events & Sports

- Others

By Region

- Europe

- North America

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In January 2019, Generac introduced its Generac Mobile and Generac Pro rental equipment industry solutions. Generac Mobile deals with mobile light towers, generators, heaters, pumps, and dust suppression solutions while Generac Pro deals with rugged outdoor power equipment for residential, commercial, and municipal needs.

- In April 2019, Doosan portable power expanded its distribution network by establishing a new branch location in Nevada, US. The authorized distributor offers, including air compressors, generators, light towers, and light compaction equipment.

- United Rentals Inc. acquired WesternOne Rentals & Sales LP in 2019, a Canadian provider of power and heating solutions, including light towers, to strengthen its position in the Canadian market.

- In September 2018, United Rentals acquired BlueLine Rental. The acquisition helped United Rentals increasing its capacity in many of the largest metropolitan areas in North America, including both US coasts, the Gulf South, and Ontario, into the commercial construction and industrial markets.

Frequently Asked Questions (FAQ):

What are the industry trends that would be seen over the next five years?

The rental industry is expected to grow with a majority of stake from the construction and the oil & gas industry. As various countires including the US, Canada, Japan, China, the UAE, the UK, Germany and others are emphasizing on developing smart cities with newer infrastructure, the need fro light towers is expected to be driven as well.

Which of the light towers market elements is likely to lead by 2024?

The LED type of light towers are expected to grow owing to the facts that they offer lower fuel consumption due to high energy efficiency and offer a low starting duration. These are the two key factors where the metal halide lights showcase their drawbacks.

Which of the end-user segments is expected to have the maximum opportunity to grow during the forecast period?

The oil & gas sector has been witnessing a good amount of growth specifically in the North American and the Middle East & African regions due to the increased shale oil & gas activities. Additionally, the events and sports sector is driving the ever growing tourism sector in the UAE and other surrounding countires which is expected to drive the market for light towers in the regions.

Which would be the leading region with the highest market share by 2025?

The North American is expected to be the leading region. As the market is driven majorly by countries, such as the US and Canada, as they are witnessing a strong investment in infrastructure development and oil & gas exploration activities.

How are companies implementing organic and inorganic strategies to gain increased market share?

Long term and short term end user contracts are one of the prominent ways through which the companies are increasing their operating share across regions. The manufacturers as well as third party rental agencies are offering different schemes and options for the end users to opt from, as per their requirement. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.2.1 MARKET, BY MARKET TYPE: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET, BY LIGHT TYPE: INCLUSIONS & EXCLUSIONS

1.2.3 MARKET, BY FUEL TYPE: INCLUSIONS & EXCLUSIONS

1.2.4 MARKET, BY END USER: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 1 LIGHT TOWER MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Break-up of primaries

2.3 SCOPE

FIGURE 3 MAIN METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING THE DEMAND FOR THE LIGHT TOWER MARKET

2.4 MARKET SIZE ESTIMATION

2.4.1 DEMAND-SIDE ANALYSIS

FIGURE 4 SPENDING ON LIGHT TOWERS IS THE KEY FACTOR CONSIDERED FOR THE MARKET SIZE ESTIMATION

2.4.1.1 Demand-Side Key assumptions

2.4.1.2 Demand-Side Calculation

2.4.2 FORECAST

2.4.3 SUPPLY-SIDE ANALYSIS

FIGURE 5 LIGHT TOWERS OPERATIONS IN END-USE INDUSTRIES IS THE KEY FACTOR CONSIDERED FOR MARKET SIZE ANALYSIS

2.4.3.1 Supply-Side Assumptions and calculation

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 1 LIGHT TOWER MARKET SNAPSHOT

FIGURE 6 NORTH AMERICA DOMINATED THE MARKET IN 2019

FIGURE 7 RENTAL SEGMENT IS EXPECTED TO HOLD THE LARGEST SHARE OF THE MARKET, BY MARKET TYPE, DURING THE FORECAST PERIOD

FIGURE 8 LED SEGMENT IS EXPECTED TO LEAD THE MARKET, BY LIGHT TYPE, DURING THE FORECAST PERIOD

FIGURE 9 DIESEL SEGMENT IS EXPECTED TO LEAD THE MARKET, BY FUEL TYPE, DURING THE FORECAST PERIOD

FIGURE 10 CONSTRUCTION SEGMENT IS EXPECTED TO LEAD THE RENTAL MARKET, BY END USER, DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN THE LIGHT TOWER MARKET

FIGURE 11 ENERGY-EFFICIENT LEDS OFFERING BETTER ILLUMINATION BOOST THE GROWTH OF THE MARKET, 2020–2025

4.2 MARKET, BY MARKET TYPE

FIGURE 12 RENTAL SEGMENT IS PROJECTED TO DOMINATE THE MARKET, BY MARKET TYPE, BY 2025

4.3 MARKET, BY LIGHT TYPE

FIGURE 13 LED SEGMENT IS PROJECTED TO DOMINATE THE MARKET, BY LIGHT TYPE, BY 2025

4.4 MARKET, BY FUEL TYPE

FIGURE 14 DIESEL SEGMENT IS PROJECTED TO DOMINATE THE MARKET, BY FUEL TYPE, BY 2025

4.5 NORTH AMERICAN MARKET, BY END USER & COUNTRY

FIGURE 15 CONSTRUCTION SECTOR (BY END USER) AND THE US (BY COUNTRY) DOMINATED THE MARKET IN 2019

4.6 MARKET, BY REGION

FIGURE 16 NORTH AMERICA MARKET TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 17 COVID-19 GLOBAL PROPAGATION

FIGURE 18 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 19 RECOVERY ROAD FOR 2020 & 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 20 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 21 LIGHT TOWER: MARKET DYNAMICS

5.5.1 DRIVERS

5.5.1.1 Increasing investments in end-use industries including oil & gas and construction

FIGURE 22 INCREASING INVESTMENTS IN THE OIL & GAS INDUSTRY (2016-2019)

5.5.1.2 Advancements in LED technology that are making the product more energy efficient

5.5.1.3 Introduction of solar and battery-powered light towers

5.5.2 RESTRAINTS

5.5.2.1 Fluctuating prices of crude oil fuels

FIGURE 23 UNSTABLE CRUDE OIL PRICES

5.5.2.2 High starting time of metal halide lights

5.5.3 OPPORTUNITIES

5.5.3.1 High potential of African market due to large proven mineral reserves

5.5.4 CHALLENGES

5.5.4.1 High installation and rental cost of light towers

5.6 ADJACENT MARKETS

6 LIGHT TOWER MARKET, BY MARKET TYPE (Page No. - 64)

6.1 INTRODUCTION

TABLE 2 COMPARISON OF SALES AND RENTALS

FIGURE 24 RENTAL SEGMENT EXPECTED TO HOLD THE LARGEST MARKET DURING THE FORECAST PERIOD

TABLE 3 MARKET, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 4 PRE-COVID-19 MARKET, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 5 POST-COVID-19 MARKET, BY MARKET TYPE, 2020–2025 (USD MILLION)

6.2 SALES

6.2.1 INVESTMENT BY CAPITAL-INTENSIVE INDUSTRIES IN LIGHT TOWERS IS LIKELY TO DRIVE THE LIGHT TOWER SALES MARKET SEGMENT

TABLE 6 MARKET, SALES MARKET TYPE, BY REGION, 2016–2019 (USD MILLION)

TABLE 7 POST-COVID-19 MARKET, SALES MARKET TYPE, BY REGION, 2020–2025 (USD MILLION)

6.3 RENTAL

6.3.1 NEED FOR REDUCTION OF CAPITAL EXPENDITURE IS LIKELY TO DRIVE THE MARKET SEGMENT

TABLE 8 MARKET, RENTAL MARKET TYPE, BY REGION, 2016–2019 (USD MILLION)

TABLE 9 POST-COVID-19 MARKET, RENTAL MARKET TYPE, BY REGION, 2020–2025 (USD MILLION)

7 LIGHT TOWER MARKET, BY LIGHT TYPE (Page No. - 69)

7.1 INTRODUCTION

FIGURE 25 LED SEGMENT IS PROJECTED TO BE THE LARGEST MARKET DURING THE FORECAST PERIOD

TABLE 10 MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 11 PRE-COVID-19 MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 12 POST-COVID-19 MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

7.2 LED LIGHT TOWER

7.2.1 EASE OF OPERATION AND REDUCED MAINTENANCE COST ARE DRIVING THE MARKET FOR LED LIGHT TOWER

TABLE 13 LED MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 POST-COVID-19LED LIGHT TOWER MARKET, BY REGION, 2020–2025 (USD MILLION)

7.3 METAL HALIDE LIGHT TOWER

7.3.1 INCREASED USE OF METAL HALIDE LIGHTS IN HIGH-INTENSITY APPLICATIONS IS EXPECTED TO DRIVE THE METAL HALIDE SEGMENT

TABLE 15 METAL HALIDE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 POST-COVID-19METAL HALIDE MARKET, BY REGION, 2020–2025 (USD MILLION)

8 LIGHT TOWER MARKET, BY FUEL TYPE (Page No. - 74)

8.1 INTRODUCTION

FIGURE 26 DIESEL SEGMENT IS EXPECTED TO HOLD THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 17 LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 18 PRE-COVID-19 MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 19 POST-COVID-19 LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

8.2 DIESEL

8.2.1 NEED FOR ILLUMINATION IN REMOTE LOCATIONS IS LIKELY TO DRIVE THE DIESEL-POWERED LIGHT TOWER SEGMENT

TABLE 20 DIESEL LIGHT TOWER MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 POST-COVID-19 DIESEL LIGHT TOWER MARKET, BY REGION, 2020–2025 (USD MILLION)

8.3 SOLAR/HYBRID

8.3.1 INCREASING NEED FOR SILENT OPERATION IS EXPECTED TO DRIVE THE SOLAR-POWERED LIGHT TOWER SEGMENT

TABLE 22 SOLAR/HYBRID-POWERED LIGHT TOWER MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 POST-COVID-19 SOLAR/HYBRID-POWERED LIGHT TOWER MARKET, BY REGION, 2020–2025 (USD MILLION)

8.4 DIRECT POWER

8.4.1 AVAILABILITY OF CHEAPER GRID POWER IS EXPECTED TO DRIVE THE DIRECT POWER LIGHT TOWER SEGMENT

TABLE 24 DIRECT POWER LIGHT TOWER MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 POST-COVID-19 DIRECT POWER LIGHT TOWER MARKET, BY REGION, 2020–2025 (USD MILLION)

9 LIGHT TOWER MARKET, BY END USER (Page No. - 80)

9.1 INTRODUCTION

FIGURE 27 CONSTRUCTION SEGMENT IS PROJECTED TO HOLD THE LARGEST MARKET DURING THE FORECAST PERIOD

TABLE 26 MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 27 PRE-COVID-19 LIGHT TOWER MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 28 POST-COVID-19 LIGHT TOWER MARKET, BY END USER, 2020–2025 (USD MILLION)

9.2 CONSTRUCTION

9.2.1 INCREASING INVESTMENTS IN INFRASTRUCTURE DEVELOPMENT PROJECTS IS EXPECTED TO DRIVE THE MARKET

TABLE 29 MARKET FOR CONSTRUCTION, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 POST-COVID-19 LIGHT TOWER MARKET FOR CONSTRUCTION, BY REGION, 2020–2025 (USD MILLION)

9.3 OIL & GAS

9.3.1 INVESTMENT IN OIL AND GAS EXPLORATION ACTIVITIES IS LIKELY TO DRIVE THE MARKET

TABLE 31 MARKET FOR OIL & GAS, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 POST-COVID-19 LIGHT TOWER MARKET FOR OIL & GAS, BY REGION, 2020–2025 (USD MILLION)

9.4 MINING

9.4.1 USE OF LIGHT TOWERS FOR SURFACE MINING OPERATIONS IS EXPECTED TO DRIVE THE DEMAND DURING THE FORECAST PERIOD

TABLE 33 MARKET FOR MINING, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 POST-COVID-19 LIGHT TOWER MARKET FOR MINING, BY REGION, 2020–2025 (USD MILLION)

9.5 EVENTS & SPORTS

9.5.1 NEED FOR LIGHT TOWERS IN SMALL EVENTS IS EXPECTED TO DRIVE THE MARKET

TABLE 35 MARKET FOR EVENTS & SPORTS, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 POST-COVID-19 MARKET FOR EVENTS & SPORTS, BY REGION, 2020–2025 (USD MILLION)

9.6 OTHERS

TABLE 37 MARKET FOR OTHERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 POST-COVID-19 LIGHT TOWER MARKET FOR OTHERS, BY REGION, 2020–2025 (USD MILLION)

10 LIGHT TOWER MARKET, BY REGION (Page No. - 88)

10.1 INTRODUCTION

FIGURE 28 NORTH AMERICA ACCOUNTED FOR THE LARGEST MARKET SHARE DURING 2019

TABLE 39 GLOBAL MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 PRE-COVID-19 LIGHT TOWER MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 41 POST-COVID-19 LIGHT TOWER MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: MARKET OVERVIEW (2019)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 43 POST-COVID-19 NORTH AMERICA: MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 45 POST-COVID-19 NORTH AMERICA: MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 47 POST-COVID-19 NORTH AMERICA: MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 49 POST-COVID-19 NORTH AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 51 POST-COVID-19 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.2.1 US

10.2.1.1 Growing investments in the construction and oil & gas exploration operations expected to drive the market for light towers in the US

TABLE 52 US: MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 53 POST-COVID-19 US: MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 54 US: MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 55 POST-COVID-19 US: MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 56 US: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 57 POST-COVID-19 US: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 58 US: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 59 POST-COVID-19 US: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing infrastructure spending and mining activities are expected to drive the market for light towers in Canada

TABLE 60 CANADA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 61 POST-COVID-19 CANADA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 62 CANADA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 63 POST-COVID-19 CANADA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 64 CANADA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 65 POST-COVID-19 CANADA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 66 CANADA: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 67 POST-COVID-19 CANADA: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Increasing demand from the oil & gas and mining sectors is driving the light tower market in Mexico

TABLE 68 MEXICO: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 69 POST-COVID-19 MEXICO: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 70 MEXICO: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 71 POST-COVID-19 MEXICO: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 72 MEXICO: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 73 POST-COVID-19 MEXICO: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 74 MEXICO: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 75 POST-COVID-19 MEXICO: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.3 EUROPE

FIGURE 30 EUROPE: LIGHT TOWER MARKET OVERVIEW (2019)

TABLE 76 EUROPE: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 77 POST-COVID-19 EUROPE: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 78 EUROPE: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 79 POST-COVID-19 EUROPE: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 80 EUROPE: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 81 POST-COVID-19 EUROPE: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 82 EUROPE: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 83 POST-COVID-19 EUROPE: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 84 EUROPE: LIGHT TOWER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 85 POST-COVID-19 EUROPE: LIGHT TOWER MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Construction sector growth is driving the demand for light towers in Germany

TABLE 86 GERMANY: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 87 POST-COVID-19 GERMANY: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 88 GERMANY: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 89 POST-COVID-19 GERMANY: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 90 GERMANY: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 91 POST-COVID-19 GERMANY: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 92 GERMANY: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 93 POST-COVID-19 GERMANY: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.3.2 UK

10.3.2.1 Demand from events and sports is expected to boost the growth of the light tower market

TABLE 94 UK: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 95 POST-COVID-19 UK: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 96 UK: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 97 POST-COVID-19 UK: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 98 UK: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 99 POST-COVID-19 UK: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 100 UK: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 101 POST-COVID-19 UK: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Increasing building and transport infrastructure spending is expected to drive the light tower market

TABLE 102 FRANCE: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 103 POST-COVID-19 FRANCE: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 104 FRANCE: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 105 POST-COVID-19 FRANCE: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 106 FRANCE: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 107 POST-COVID-19 FRANCE: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 108 FRANCE: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 109 POST-COVID-19 FRANCE: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.3.4 RUSSIA

10.3.4.1 Urban infrastructure development, mining, and oil and gas exploration activities are expected to drive the market for light towers

TABLE 110 RUSSIA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 111 POST-COVID-19 RUSSIA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 112 RUSSIA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 113 POST-COVID-19 RUSSIA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 114 RUSSIA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 115 POST-COVID-19 RUSSIA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 116 RUSSIA: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 117 POST-COVID-19 RUSSIA: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.3.5 REST OF EUROPE

10.3.5.1 Stable economic outlook and increased spending on construction developments are expected to drive the market

TABLE 118 REST OF EUROPE: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 119 POST-COVID-19 REST OF EUROPE: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 120 REST OF EUROPE: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 121 POST-COVID-19 REST OF EUROPE: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 122 REST OF EUROPE: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 123 POST-COVID-19 REST OF EUROPE: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 124 REST OF EUROPE: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 125 POST-COVID-19 REST OF EUROPE: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.4 ASIA PACIFIC

TABLE 126 ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 127 POST-COVID-19 ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 128 ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 129 POST-COVID-19 ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 130 ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 131 POST-COVID-19 ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 132 ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 133 POST-COVID-19 ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 134 ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 135 POST-COVID-19 ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Plans to develop smaller cities is expected to drive the demand for light towers

TABLE 136 CHINA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 137 POST-COVID-19 CHINA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 138 CHINA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 139 POST-COVID-19 CHINA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 140 CHINA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 141 POST-COVID-19 CHINA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 142 CHINA: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 143 POST-COVID-19 CHINA: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.4.2 AUSTRALIA

10.4.2.1 Investment in mining exploration operations and demand from infrastructure projects are driving the light tower market

TABLE 144 AUSTRALIA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 145 POST-COVID-19 AUSTRALIA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 146 AUSTRALIA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 147 POST-COVID-19 AUSTRALIA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 148 AUSTRALIA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 149 POST-COVID-19 AUSTRALIA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 150 AUSTRALIA: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 151 POST-COVID-19 AUSTRALIA: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Infrastructure development and events & sports sector are expected to drive the light tower market

TABLE 152 JAPAN: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 153 POST-COVID-19 JAPAN: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 154 JAPAN: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 155 POST-COVID-19 JAPAN: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 156 JAPAN: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 157 POST-COVID-19 JAPAN: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 158 JAPAN: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 159 POST-COVID-19 JAPAN: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.4.4 INDIA

10.4.4.1 Government policies to boost infrastructure development are expected to drive the market for light towers

TABLE 160 INDIA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 161 POST-COVID-19 INDIA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 162 INDIA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 163 POST-COVID-19 INDIA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 164 INDIA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 165 POST-COVID-19 INDIA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 166 INDIA: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 167 POST-COVID-19 INDIA: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

10.4.5.1 Improving living standards and demand for transport infrastructure development are expected to drive the market

TABLE 168 REST OF ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 169 POST-COVID-19 REST OF ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 170 REST OF ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 171 POST-COVID-19 REST OF ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 173 POST-COVID-19 REST OF ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 174 REST OF ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 175 POST-COVID-19 REST OF ASIA PACIFIC: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

TABLE 176 MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 177 POST-COVID-19 MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 179 POST-COVID-19 MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 181 POST-COVID-19 MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 183 POST-COVID-19 MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 185 POST-COVID-19 MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.5.1 SAUDI ARABIA

10.5.1.1 Focus on non-oil sectors such as construction and events are expected to drive the demand for light towers

TABLE 186 SAUDI ARABIA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 187 POST-COVID-19 SAUDI ARABIA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 188 SAUDI ARABIA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 189 POST-COVID-19 SAUDI ARABIA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 190 SAUDI ARABIA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 191 POST-COVID-19 SAUDI ARABIA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 192 SAUDI ARABIA: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 193 POST-COVID-19 SAUDI ARABIA: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.5.2 UAE

10.5.2.1 Fast-growing construction and events sectors are expected to drive the market for light towers in the UAE

TABLE 194 UAE: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 195 POST-COVID-19 UAE: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 196 UAE: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 197 POST-COVID-19 UAE: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 198 UAE: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 199 POST-COVID-19 UAE: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 200 UAE: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 201 POST-COVID-19 UAE: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.5.3 SOUTH AFRICA

10.5.3.1 Growing demand from mining operations is driving the demand for light towers

TABLE 202 SOUTH AFRICA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 203 POST-COVID-19 SOUTH AFRICA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 204 SOUTH AFRICA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 205 POST-COVID-19 SOUTH AFRICA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 206 SOUTH AFRICA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 207 POST-COVID-19 SOUTH AFRICA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 208 SOUTH AFRICA: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 209 POST-COVID-19 SOUTH AFRICA: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 210 REST OF MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 211 POST-COVID-19 REST OF MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 212 REST OF MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 213 POST-COVID-19 REST OF MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 214 REST OF MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 215 POST-COVID-19 REST OF MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 216 REST OF MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 217 POST-COVID-19 REST OF MIDDLE EAST & AFRICA: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.6 SOUTH AMERICA

TABLE 218 SOUTH AMERICA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 219 POST-COVID-19 SOUTH AMERICA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 220 SOUTH AMERICA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 221 POST-COVID-19 SOUTH AMERICA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 222 SOUTH AMERICA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 223 POST-COVID-19 SOUTH AMERICA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 224 SOUTH AMERICA: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 225 POST-COVID-19 SOUTH AMERICA: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 226 SOUTH AMERICA: LIGHT TOWER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 227 POST-COVID-19 SOUTH AMERICA: LIGHT TOWER MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 Strong focus on infrastructure projects is expected to drive the demand for light towers in Brazil

TABLE 228 BRAZIL: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 229 POST-COVID-19 BRAZIL: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 230 BRAZIL: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 231 POST-COVID-19 BRAZIL: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 232 BRAZIL: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 233 POST-COVID-19 BRAZIL: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 234 BRAZIL: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 235 POST-COVID-19 BRAZIL: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.6.2 ARGENTINA

10.6.2.1 Government-initiated infrastructure projects are expected to drive the light tower market

TABLE 236 ARGENTINA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 237 POST-COVID-19 ARGENTINA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 238 ARGENTINA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 239 POST-COVID-19 ARGENTINA: LIGHT TOWER MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 240 ARGENTINA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 241 POST-COVID-19 ARGENTINA: LIGHT TOWER MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 242 ARGENTINA: LIGHT TOWER MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 243 POST-COVID-19 ARGENTINA: LIGHT TOWER MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.6.3 REST OF SOUTH AMERICA

TABLE 244 REST OF SOUTH AMERICA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2016–2019 (USD MILLION)

TABLE 245 POST-COVID-19 REST OF SOUTH AMERICA: LIGHT TOWER MARKET SIZE, BY MARKET TYPE, 2020–2025 (USD MILLION)

TABLE 246 REST OF SOUTH AMERICA: MARKET SIZE, BY LIGHT TYPE, 2016–2019 (USD MILLION)

TABLE 247 POST-COVID-19 REST OF SOUTH AMERICA: MARKET SIZE, BY LIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 248 REST OF SOUTH AMERICA: MARKET SIZE, BY FUEL TYPE, 2016–2019 (USD MILLION)

TABLE 249 POST-COVID-19 REST OF SOUTH AMERICA: MARKET SIZE, BY FUEL TYPE, 2020–2025 (USD MILLION)

TABLE 250 REST OF SOUTH AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 251 POST-COVID-19 REST OF SOUTH AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 165)

11.1 OVERVIEW

FIGURE 31 KEY DEVELOPMENTS IN THE LIGHT TOWER MARKET, 2017–2020

11.2 COMPETITIVE LEADERSHIP MAPPING (MANUFACTURERS)

11.2.1 VISIONARY LEADERS

11.2.2 INNOVATORS

11.2.3 DYNAMIC

11.2.4 EMERGING

FIGURE 32 COMPETITIVE LEADERSHIP MAPPING (MANUFACTURERS)

11.3 COMPETITIVE LEADERSHIP MAPPING (RENTAL COMPANIES)

11.3.1 VISIONARY LEADERS

11.3.2 INNOVATORS

11.3.3 DYNAMIC

11.3.4 EMERGING

FIGURE 33 COMPETITIVE LEADERSHIP MAPPING (RENTAL COMPANIES)

11.4 MARKET SHARE, MANUFACTURERS, 2019

FIGURE 34 GENERAC HOLDING LED THE LIGHT TOWER MARKET IN 2019

11.5 COMPETITIVE SCENARIO

11.5.1 NEW PRODUCT LAUNCHES

11.5.2 MERGERS & ACQUISITIONS

11.5.3 INVESTMENTS & EXPANSIONS

12 COMPANY PROFILES (Page No. - 174)

(Business overview, Products offered, Recent Developments, SWOT Analysis)*

12.1 GENERAC HOLDING

FIGURE 35 GENERAC HOLDING: COMPANY SNAPSHOT

12.2 TEREX CORPORATION

FIGURE 36 TEREX CORPORATION: COMPANY SNAPSHOT

12.3 DOOSAN PORTABLE POWER

12.4 WACKER NEUSON

FIGURE 37 WACKER NEUSON: COMPANY SNAPSHOT

12.5 ATLAS COPCO

FIGURE 38 ATLAS COPCO: COMPANY SNAPSHOT

12.6 UNITED RENTALS

FIGURE 39 UNITED RENTALS: COMPANY SNAPSHOT

12.7 YANMAR

FIGURE 40 YANMAR HOLDINGS: COMPANY SNAPSHOT

12.8 WILL-BURT COMPANY

12.9 ALLMAND BROTHERS

12.10 COATES HIRE

12.11 BRANDON HIRE STATION

12.12 P&I GENERATORS

12.13 LAMBSON’S HIRE

12.14 NIXON HIRE

12.15 XYLEM

FIGURE 41 XYLEM: COMPANY SNAPSHOT

12.16 MULTIQUIP

12.17 QUZHOU VALIANT MACHINERY CO

12.18 WANCO

12.19 ISHIKAWA MACHINE COMPANY

12.2 HIMOINSA

12.21 MHM

12.22 JCB

12.23 THE RENTAL STORE

*Details on Business overview, Products offered, Recent Developments, SWOT Analysis might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 203)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

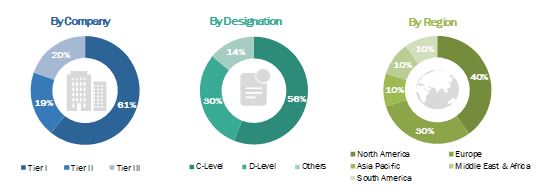

The study involved three major activities in estimating the current size of the global light towers market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as oil and gas equipment rental, construction equipment rental, industry publications, several newspaper articles, Bloomberg, Factiva, and rental associations journal to identify and collect information useful for a technical, market-oriented, and commercial study of the light towers market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The light towers market comprises several stakeholders such as companies related to the industry, consulting companies in the power sector, oil and gas, construction, mining sector, government & research organizations, forums, alliances & associations, light towers service providers, state & national energy authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by the light towers expenditure across end-use sectors across global regions, investments by oil and gas and construction equipment companies, and maturing of the mining and the energy sector. Moreover, the demand is driven by a change in rules & regulations and active participation from environmental bodies in the light towers market. The supply side is characterized by contracts & agreements, new product launches, mergers & acquisitions, and partnerships & collaborations among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global light towers market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the light towers activities.

Report Objectives

- To define, describe and forecast the global light towers market by market type, light type, fuel type, end-user, and regions

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the market

- To strategically analyze the market with respect to individual growth trends, future prospects, and the contribution of each segment to the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as contracts & agreements, expansions, new product launches, mergers & acquisitions, and partnerships & collaborations in the light towers market

Portable Light Towers & Its impact on Light Towers Market

Portable Light Towers are one of the most common types of light towers, accounting for a sizable portion of the overall Light Towers Market. The growing demand for temporary lighting solutions across various industries, such as construction, mining, oil and gas, and events, is driving the Portable Light Towers market.

The Light Towers Market includes a variety of light tower types, such as diesel, electric, solar-powered, and others. Portable Light Towers are usually diesel-powered and designed to be easily transported to different locations, making them a popular choice for temporary lighting needs.

By extending the reach of Portable Light Towers services, companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Growing Demand: The demand for Portable Light Towers is expected to grow due to their flexibility, mobility, and ease of use.

- Technological Advancements: Manufacturers of Portable Light Towers are continually working to improve the technology and design of their products.

- Cost-Effectiveness: Portable Light Towers are typically less expensive than permanent lighting solutions, making them a more cost-effective option for temporary lighting needs.

- Environmentally Friendly Options: The growing focus on sustainability and environmental responsibility is driving the development of more eco-friendly Portable Light Towers.

The top players in the Portable Light Towers market are Atlas Copco AB, Terex Corporation, Generac Mobile Products, Wacker Neuson Group, Doosan Portable Power, Allmand Bros. Inc., Chicago Pneumatic, Terex Utilities, Multiquip Inc., Yanmar Co. Ltd.

Some of the key industries that are going to get impacted because of the growth of Portable Light Towers are,

1. Construction: The construction industry is a significant user of Portable Light Towers, as they are used to provide temporary lighting on construction sites.

2. Events: Portable Light Towers are commonly used to provide lighting for outdoor events such as concerts, festivals, and sports events.

3. Oil and Gas: The oil and gas industry require a lot of temporary lighting, as many operations are carried out in remote locations with limited access to electricity.

4. Mining: The mining industry is another sector that uses Portable Light Towers to provide temporary lighting.

5. Emergency Response: Portable Light Towers are commonly used in emergency response situations, such as natural disasters, accidents, and other emergency situations that require temporary lighting.

Speak to our Analyst today to know more about Portable Light Towers Market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Light Towers Market

Hi, I am the CEO of Southern Cross Group. We purchased the report on Lighting Towers a couple of months ago. Would it be possible to upgrade our report to the latest version? I look forward to your response. My mobile is 0419 309 945