Seeds Market by Type (Genetically Modified, Conventional), Trait (Herbicide Tolerance, Insect Resistance), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), Treatment (Treated and Un-treated) and Region - Global Forecast to 2028

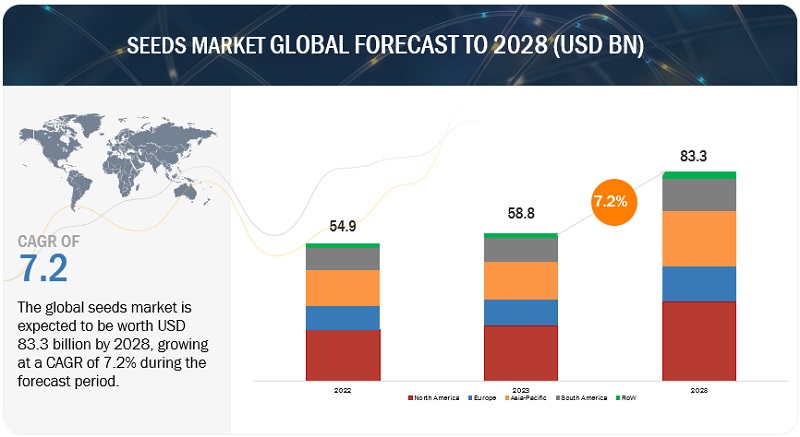

[326 Pages Report] According to MarketsandMarkets, the seeds market is projected to reach USD 83.3 billion by 2028 from USD 58.8 billion by 2023, at a CAGR of 7.2% during the forecast period in terms of value. As the world’s population continues to grow, there’s a growing need for food to feed and keep up with the ever-expanding population. This necessitates the development of improved seed varieties to improve crop yield and productivity. The market is characterized by a growing demand for high-quality seeds that exhibit traits such as disease resistance, improved yields, and enhanced nutritional value. Technological advancements and genetic engineering have further contributed to the development of genetically modified (GM) seeds, which offer unique benefits but also raise concerns regarding their impact on the environment and human health.

Key players in the seed market include multinational corporations, small-scale seed producers, and public research institutions, all striving to meet the evolving needs of farmers and consumers while ensuring sustainable agriculture practices. Overall, the seed market continues to evolve in response to changing agricultural practices, consumer preferences, and environmental challenges, playing a crucial role in shaping the future of global food production.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Growth in the usage of oilseeds by animal feed manufacturers

The co-products from refining oilseeds are used by the animal feed industry. Oilseed meal is a source of high protein content. This has led to an increase in the demand for oilseed meals from feed manufacturers. Soybean meal is the most popular soybean meal for animal feed manufacturers due to its high protein content. The growing demand for protein-rich vegetable protein meals like soybean meal, sunflower meal, cottonseed meal, etc., is expected to drive the oilseed market growth over the next few years. Only a small portion of the oilseed is fed as whole seeds to animals. However, the by-product of processing the oilseed is used extensively in animal feed.

Due to the EU ban on Meat and Bone Meal (MBM), it is largely replaced by other protein sources such as soy meal, oilseed meal, cereals, and pulses. According to Agriculture and Rural Development (European Commission), 54% of the total protein material is used in the animal feed sector, which mainly uses soybean meal as a vegetable protein source. This is increasing the demand for oilseeds in the market.

Apart from this, significant investments in plant-based protein companies and the rapid growth of the industry have resulted in increased research, development, and marketing efforts. This has led to the introduction of new and improved plant-based protein products, attracting more consumers to choose these alternatives.

Restraint: Low yield of crops in under-irrigated areas

Largely, the crops produced in developing countries include rice, corn, wheat, groundnut, rapeseed, mustard, soybean, sunflower, and safflower. These products hold a significant share in the global seeds market due to their use in the food, feed, and chemical industries. There is an increased demand for seeds of these crops, which raises the demand for productivity, drought tolerance, and better insect resistance. However, in developing countries such as India, South Africa, and Turkey, the production of crops is mainly dependent on the rains, which reduces productivity.

In order to improve crop production, the following measures are taken into consideration:

- Bringing additional areas under irrigation

- Promoting modern crop technology and better dry farming

- Strengthening the value chain

Due to uncertainty in the climatic conditions, there is an increased need for more irrigated areas for the production of cereal crops and oilseed crops. For instance, groundnut seeds require an optimum temperature of 20 °C (68 °F) to 30 °F (86 °F) and 50–75 mm rainfall. This oilseed is also highly susceptible to damage by frost, drought, continuous rain, and stagnant water. To prevent this, the crops need a typical environment and the proper amount of water for higher yield, which can be achieved through irrigation. Thus, it can be seen that there is low productivity in the fields without irrigation systems than in the fields with irrigation systems.

Opportunity: Molecular breeding in seeds

Gene-tagged markers help reduce the time consumed in selecting the desired genes in progenies and parents. Molecular breeding allows breeders to identify desirable traits more rapidly and accurately than traditional breeding methods. By using molecular markers linked to specific traits, breeders can screen and select plants with desired traits at an early stage, reducing the time required for multiple generations of crossbreeding.

By incorporating molecular markers, breeders can reduce the subjectivity and ambiguity associated with phenotypic selection, making the breeding process more accurate. Molecular breeding helps overcome challenges such as environmental influences, phenotypic plasticity, or traits that are difficult to evaluate visually.

It has been found that genetic engineering and modification are better options for developing improved, disease-resistant oilseed varieties as compared to MAS and other molecular breeding techniques. Apart from company efforts, several breeding programs have been developed for oilseeds using molecular breeding techniques and molecular markers for the gene selection process. China and India are the main countries engaged in using MAS for the development of high-yielding oilseeds. More programs are to be introduced in the near future, which can help in using other molecular breeding technologies for oilseed production.

Challenge: Commercialization of fake hybrid seeds and counterfeit products

According to ISF, there has been a rise in illegal seed practices such as falsified seeds, fraudulent labeling, intellectual property violations, and regulatory violations. Incidents of counterfeit labels and seed sacks being sold in developing countries have become more frequent in recent years. Low-income farmers cannot afford to buy seeds in large quantities. This creates an opportunity for the seller to split the bags, resell them in small batches, and sell them in bulk. This creates an opportunity for contamination. In Uganda, for example, the illegal seed industry deceives farmers by selling seeds that promise high yields but do not germinate. Fear of counterfeiting among small farmers makes commercial seeds a seemingly unviable option. As more farmers are adopting hybrid seeds for high yield and improved quality production, it has been observed that the mediators in the supply chain have been selling spurious hybrid seeds to farmers, while some of them are also being involved in dealing with counterfeit products.

Seeds Market Ecosystem

Prominent players in this market include established and financially stable seed producers. These companies have been in the market for several years, with diverse product portfolios, cutting-edge technology, and strong global sales and marketing networks.

The market for genetically modified seeds is projected to grow at the highest CAGR during the forecast period, owing to the increased demand from farmers for biotech crops, which have higher levels of productivity and profitability.

Genetically modified seeds have the potential to significantly increase crop yields compared to conventional seeds. They are engineered to produce higher yields by improving traits such as disease resistance, nutrient utilization efficiency, and overall plant health. Higher yields are crucial to meeting the growing global demand for food and ensuring food security. The seed industry invests heavily in research and development to develop new genetically modified seed varieties. These investments drive innovation in seed technologies, leading to the development of improved and more effective Genetically modified seeds. The continuous advancements in biotechnology and genetic engineering techniques contribute to the growth of the genetically modified seed segment.

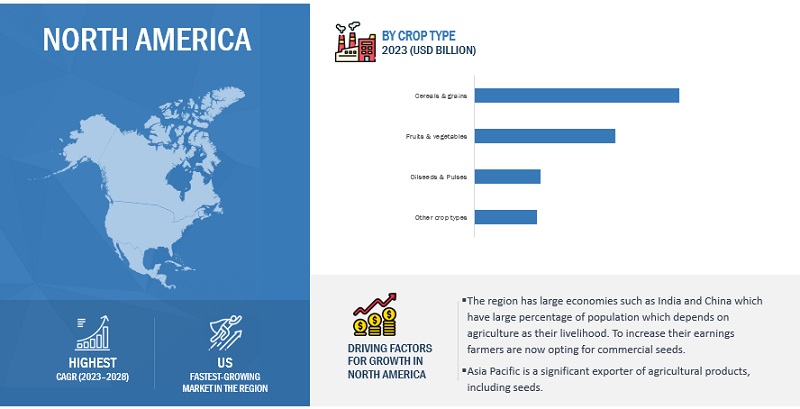

Cereals & grains accounted for the largest share in 2022 in by crop type segment, owing to the increased use of cereals & grains in Asian and Southeast Asian countries.

The market situation for cereals has been marked by an abundance of supplies and slower growth in demand. However, the growth of this market is driven by improvement in yield and increased use in food-related applications. The developed and few developing countries would continue to remain the chief exporters of cereals, thereby catering to the growing demand from the food and feed industries. The FAO reports that, in 2020–2021, the world’s grain consumption increased by 11 million tons, reaching 2.7 billion tons, or 2.4% more than in 2019–20. A significant staple food for 36% of the world’s population is cereals like wheat.

North America is expected to dominate the market during the forecast period.

North America, particularly the United States, is a global leader in agricultural research and development. The region has a strong foundation in biotechnology and genetic engineering, which has led to the development of advanced seed technologies. The presence of leading seed companies and research institutions in North America fosters innovation, enabling the development of high-quality and high-performance seeds. Also, North America is a significant exporter of agricultural products, including seeds. The region's high-quality seeds are sought after globally, and North American seed companies have established strong international market presence. The export opportunities contribute to the region's dominance in the global seeds market.

Key Market Players

The key players in this include BASF SE (Germany), Bayer AG (Germany), Syngenta (Switzerland), KWS SAAT SE & Co. KGaA (Germany), Corteva (Indiana), Limagrain (France), Advanta Seeds (India), Sakata Seed Corporation (Japan), DLF Seeds A/S (Denmark), Enza Zaden Beheer B.V. (Netherlands), Rallis India Limited (Mumbai), FMC Corporation(US), TAKII & CO., LTD. (Japan), Royal Barenbrug Group (Netherlands) and Longping High-Tech (China). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD Billion) |

|

Segments Covered |

By type, crop type, trait, and region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Key Companies studied |

|

The study categorizes the seeds market based on by type, crop type, trait, and region.

By Type

- Genetically Modified

- Conventional

By Crop Type

-

Cereals & grains

- Corn

- Wheat

- Rice

- Other cereals & grains

-

Oilseeds & pulses

- Soybean

- Canola

- Cotton

- Other oilseeds & pulses

-

Fruits & vegetables

- Solanaceae

- Cucurbits

- Brassicas

- Leafy vegetables

- Roots & bulbs

- Other fruits & vegetables

- Other crop types

By Trait

- Herbicide tolerance

- Insect resistance

- Other traits

By Region

- North America

- Europe

- Asia Pacific

- South America

- Row (Africa and Middle East)

Recent Developments

- In April 2023, Bayer revealed an investment of overall 60 million euros from 2023 onwards in its corn seed production facility in Pochuiky, Ukraine. With this, the life sciences company emphasizes its commitment to Ukraine and strengthens its Crop Science business in the country, contributing to rebuilding the economy.

- In February 2023, Corteva launched ‘Optimum GLY Conala.’ It is an advanced herbicide-tolerant trait technology for canola farmers. Optimum GLY canola will be offered for commercial planting in Canada and the United States through Corteva Agriscience seed brands Pioneer and Brevant seeds.

- In August 2022, Bayer AG, Bunge, and Chevron U.S.A. Inc. (Chevron), a subsidiary of Chevron Corporation, signed a shareholders’ agreement in connection with Bayer’s acquisition of a 65 percent majority ownership of the winter oilseed producer CoverCress, Inc. (CCI). The remaining 35 percent of CCI will continue ownership under Bunge and Chevron.

- In February 2022, BASF’s vegetable seeds business developed a tearless onion variety which was launched at supermarkets in France, Germany, Italy, and the United Kingdom.

Frequently Asked Questions (FAQ):

Which are the major companies in the seeds market? What are their major strategies to strengthen their market presence?

The key players in this include BASF SE (Germany), Bayer AG (Germany), Syngenta (Switzerland), KWS SAAT SE & Co. KGaA (Germany), Corteva (Indiana), Limagrain (France), Advanta Seeds (India), Sakata Seed Corporation (Japan), DLF Seeds A/S (Denmark), Enza Zaden Beheer B.V. (Netherlands), Rallis India Limited (Mumbai), FMC Corporation(US), TAKII & CO., LTD. (Japan), Royal Barenbrug Group (Netherlands) and Longping High-Tech (China). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

What are the drivers and opportunities for the seeds market?

The seeds market is expected to witness significant growth in the future with a growing demand for high-quality, organic, non-GMO, and specialty crops, such as heirloom varieties. Seed companies are responding to this demand by developing and marketing seeds tailored to these niche markets. However, lack of availability and access to high-quality seeds will hamper the growth of this market during the forecast period.

Which region is expected to hold the highest market share?

The market in North America will dominate the market share in 2022, showcasing strong demand for seeds in the region. Growing emphasis on sustainable agriculture practices that minimize environmental impact conserve resources, and promote biodiversity. This has led to a demand for seeds that are suited to sustainable farming methods, such as organic farming and agroecology.

Which are the key technology trends prevailing in the seeds market?

The development and use of seeds may be revolutionized by nanotechnology. Nanomaterials can be used in seed priming and coating processes to improve seed performance. Nano-sized materials, such as nanoparticles and nano clays, can be incorporated into seed priming solutions or coatings to enhance seed germination, promote early seedling growth, and provide protection against pathogens or environmental stresses. The controlled release of bioactive substances from nanomaterials can also contribute to seed vigor and crop establishment.

What is the total CAGR expected to be recorded for the seeds market during 2023-2028?

The CAGR is expected to record a CAGR of 7.2 % from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINTRODUCTION- Growing use of commercial seeds- Increasing pesticide usage globally- Rising demand for high-value and industrial crops

-

5.3 MARKET DYNAMICSDRIVERS- Rising seed replacement rate- Increasing adoption of biotech crops- Growing use of oilseeds by animal feed manufacturers- Increasing demand for rapeseed oil in biofuel industry- High demand for protein mealRESTRAINTS- Impact of climate change on agricultural crop production- Price fluctuations in oilseeds- High R&D expenses- Low yield of crops in under-irrigated areasOPPORTUNITIES- Demand for healthy and organic products- Public–private partnerships in varietal development- Use of molecular breeding technology to improve seed propertiesCHALLENGES- Unorganized new entrants with low profit-to-cost ratio- Lack of availability and access to high-quality seeds- Commercialization of fake hybrid seeds and counterfeit products

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTPRODUCTIONTESTING AND PACKAGINGDISTRIBUTIONRETAILERS

-

6.3 SUPPLY CHAIN ANALYSISPROMINENT COMPANIESSMALL AND MEDIUM-SIZED ENTERPRISESEND USERS

-

6.4 TECHNOLOGY ANALYSISNEW PLANT BREEDING TECHNOLOGIESAPICAL ROOTED CUTTING SEED TECHNOLOGY

-

6.5 PRICING ANALYSISAVERAGE SELLING PRICE, BY KEY CROP

-

6.6 MARKET MAPPING AND ECOSYSTEMSUPPLY-SIDE ANALYSISDEMAND-SIDE ANALYSISREGULATORY BODIESDISTRIBUTORS & SUPPLIERS

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 6.8 TRADE ANALYSIS

-

6.9 PATENT ANALYSIS

-

6.10 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

- 6.11 CASE STUDY ANALYSIS

- 6.12 KEY CONFERENCES & EVENTS, 2023–2024

- 6.13 TARIFFS AND REGULATORY LANDSCAPE

-

6.14 REGULATORY FRAMEWORKNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- India- ChinaSOUTH AMERICA- Brazil- South Africa

-

6.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 CONVENTIONAL SEEDSDEMAND FOR ORGANICALLY PRODUCED SEEDS WITH DIVERSE FLAVORS, COLORS, AND TEXTURES TO DRIVE MARKET

-

7.3 GENETICALLY MODIFIED SEEDSNEED FOR IMPROVED SEED QUALITY, HIGH YIELD OUTPUT, DISEASE RESISTANCE, AND HERBICIDE TOLERANCE TO BOOST MARKET

- 8.1 INTRODUCTION

-

8.2 OILSEEDS & PULSESSOYBEAN- Soybean’s ability to grow in various soil types and climate conditions to drive demand for canola seedsCANOLA/RAPESEED- Need to replace trans-fat with healthy oil to drive demand for soybean oilCOTTON- Research initiatives and commercialization of cotton plants by USDA to drive demandOTHER OILSEEDS & PULSES

-

8.3 CEREALS & GRAINSCORN- Shift in cereal demand, focus on animal feed, and use of improved conventional technology to drive demandWHEAT- Rising income levels and adoption of westernized diets to fuel demand for wheat-based productsRICE- Population growth and rising need for food use to boost demand for riceOTHER CEREALS & GRAINS

-

8.4 FRUITS & VEGETABLESSOLANACEAE- Demand for Solanaceae products to grow due to their rising utilization in processed food industryCUCURBITS- Demand for short cucumbers as convenient and healthy snacking option to propel marketBRASSICAS- Demand for Brassica crops to grow due to their ability to provide nutrition at reduced costLEAFY VEGETABLES- Integration of smart technologies to enhance productivity of leafy vegetablesROOTS & BULBS- Carrot to drive demand as rich source of beta-carotene and antioxidantsOTHER FRUITS & VEGETABLES

- 8.5 OTHER CROP TYPES

- 9.1 INTRODUCTION

- 9.2 TREATED SEEDS

- 9.3 UNTREATED SEEDS

- 10.1 INTRODUCTION

-

10.2 HERBICIDE TOLERANCENEED FOR EFFECTIVE WEED CONTROL AND PROTECTING CROP YIELDS TO DRIVE DEMAND FOR HERBICIDE-TOLERANT CROPS

-

10.3 INSECT RESISTANCEINSECT-RESISTANT SEEDS TO HELP MINIMIZE CROP DAMAGE BY MAKING PLANTS LESS SUSCEPTIBLE TO PESTS

- 10.4 OTHER TRAITS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICARECESSION IMPACT ANALYSISUS- Presence of key market players and government’s price support system to drive marketCANADA- Adoption of cutting-edge technologies for plant breeding to boost demand for seeds businessMEXICO- Favorable government policies, well-developed seeds industry, and presence of key companies to drive market

-

11.3 EUROPERECESSION IMPACT ANALYSISSPAIN- Adoption of advanced technology and expansion of GE crop cultivation to drive marketITALY- Availability of various vegetable seeds and favorable weather to drive marketGERMANY- Need for productivity and disease resistance and presence of key seed manufacturers to drive marketFRANCE- Focus on maintaining traditional, open-pollinated seed varieties and robust agricultural research sector to drive marketRUSSIA- Well-developed domestic seed industry with several seed companies to drive marketUK- Demand for seeds with disease resistance, higher yield potential, and adaptability to drive marketNETHERLANDS- Advanced horticultural practices and strong regulatory frameworks to drive seeds marketUKRAINE- Implementation of legislation and regulations to maintain seeds quality to drive marketREST OF EUROPE

-

11.4 ASIA PACIFICRECESSION IMPACT ANALYSISCHINA- Government initiatives and increased subsidies to boost production of oilseeds and other seed cropsTHAILAND- Strong export market for Solanaceae crops and focus on food value awareness to boost marketINDIA- Rising adoption of hybrid seeds and increased investment in research & development to drive marketJAPAN- Favorable agricultural policy and adoption of advanced technologies to drive marketAUSTRALIA- Increasing use of genetically modified crops and need for improved yield to drive marketVIETNAM- Dependence on agriculture and diversity in crop production to drive marketREST OF ASIA PACIFIC

-

11.5 SOUTH AMERICARECESSION IMPACT ANALYSISBRAZIL- Semi-temperate climate and fertile soil to propel crop production and export market growthARGENTINA- Adoption of genetically modified seeds, access to loan facilities for small farmers, and diverse climate conditions to drive marketCHILE- Investment from leading players and favorable and climate conditions to propel demand for seed productionREST OF SOUTH AMERICA

-

11.6 ROWSOUTH AFRICA- Subsidies and government initiatives to fuel demand for seed cultivationTURKEY- Policy of National Seed Gene Bank to conserve and protect plant genetic diversity to drive marketEGYPT- Research & development in biotechnology sector to enhance domestic production of oilseedsOTHERS IN ROW

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 12.4 MARKET SHARE ANALYSIS, 2022

- 12.5 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022

- 12.6 KEY PLAYERS’ ANNUAL REVENUE VS. GROWTH, 2020–2022

- 12.7 KEY PLAYERS’ EBITDA, 2022

-

12.8 COMPANY EVALUATION MATRIX (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.9 COMPANY EVALUATION MATRIX (OTHER PLAYERS)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBAYER AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSYNGENTA CROP PROTECTION AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKWS SAAT SE & CO. KGAA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCORTEVA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLIMAGRAIN- Business overview- Products/Solutions/Services offered- MnM viewADVANTA SEEDS- Business overview- Products/Solutions/Services offered- MnM viewSAKATA SEED CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDLF SEEDS A/S- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewENZA ZADEN BEHEER B.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRALLIS INDIA LIMITED- Business overview- Products/Solutions/Services offered- MnM viewFMC CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewTAKII & CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewROYAL BARENBRUG GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLONGPING HIGH-TECH- Business overview- Products/Solutions/Services offered- MnM view

-

13.2 OTHER PLAYERSLAND O’LAKES, INC.- Business overview- Products/Solutions/Services offeredVIKIMA SEED A/S- Business overview- Products/Solutions/Services offeredALLIED SEED, LLC- Business overview- Products/Solutions/Services offeredAMPAC SEED COMPANY- Business overview- Products/Solutions/Services offeredIMPERIAL SEED- Business overview- Products/Solutions/Services offeredSL-AGRITECHBRETTYOUNGRASI SEEDS (P) LTD.CN SEEDSMAHYCO

- 14.1 INTRODUCTION

- 14.2 RESEARCH LIMITATIONS

-

14.3 SEED TREATMENT MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.4 SEED COATING MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2022

- TABLE 2 SEEDS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 AREA FOR BIOTECH CROPS, BY COUNTRY, 2018 (MILLION HA)

- TABLE 4 PROTEIN SOURCES USED IN ANIMAL FEED

- TABLE 5 OILSEEDS USED IN BIODIESEL PRODUCTION

- TABLE 6 COUNTRY-WISE SCENARIO OF WEATHER CONDITIONS AND DISEASES IN SEEDS

- TABLE 7 SEEDS MARKET: AVERAGE SELLING PRICE (ASP), BY KEY CROP, 2020–2022 (USD/TON)

- TABLE 8 SEEDS MARKET: AVERAGE SELLING PRICE FOR KEY MARKET PLAYERS, BY KEY CROP, 2022 (USD/TON)

- TABLE 9 SEEDS MARKET: ECOSYSTEM

- TABLE 10 SEEDS MARKET: EXPORT VALUE OF SEEDS, FRUITS, AND SPORES, BY KEY COUNTRY/REGION, 2022

- TABLE 11 SEEDS MARKET: IMPORT VALUE OF SEEDS, FRUITS, AND SPORES, BY KEY COUNTRY/REGION, 2022

- TABLE 12 SEEDS MARKET: EXPORT VALUE OF SEEDS, FRUITS, AND SPORES, BY KEY COUNTRY/REGION, 2021

- TABLE 13 SEEDS MARKET: IMPORT VALUE OF SEEDS, FRUITS, AND SPORES, BY KEY COUNTRY/REGION, 2021

- TABLE 14 KEY PATENTS PERTAINING TO SEEDS MARKET, 2013–2022

- TABLE 15 SEEDS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 16 USE CASE 1: CORTEVA’S A-SERIES SOYBEAN VARIETIES WITH LIBERTYLINK GENE OFFERED FARMERS EXCEPTIONAL YIELD WITH GLYPHOSATE AND DICAMBA HERBICIDES TOLERANCE

- TABLE 17 USE CASE 2: NEW PRODUCTION FACILITY OF KWS SAAT SE & CO. KGAA INCREASED PRODUCTION CAPACITY OF SUGAR BEET SEEDS BY 30%

- TABLE 18 KEY CONFERENCES & EVENTS IN SEEDS MARKET, 2023–2024

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TYPE

- TABLE 24 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS FOR KEY TRAITS

- TABLE 25 SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 26 SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 COMPARATIVE ANALYSIS OF CONVENTIONAL AND GENETICALLY MODIFIED CROPS

- TABLE 28 ENVIRONMENTAL IMPACT OF CONVENTIONAL SOYBEAN

- TABLE 29 CONVENTIONAL: SEEDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 CONVENTIONAL: SEEDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 TOP TEN COUNTRIES THAT GRANTED REGULATORY APPROVALS TO GENETICALLY MODIFIED CROPS FOR FOOD, ANIMAL FEED, AND CULTIVATION, 2018

- TABLE 32 GENETICALLY MODIFIED: SEEDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 GENETICALLY MODIFIED: SEEDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 35 SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 36 APPLICATION AREAS OF SOYBEAN

- TABLE 37 OILSEEDS & PULSES: SEEDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 OILSEEDS & PULSES: SEEDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 OILSEEDS & PULSES: SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 40 OILSEEDS & PULSES: SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 41 SOYBEAN: SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 42 SOYBEAN: SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 COTTON: SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 44 COTTON: SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 45 CANOLA: SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 46 CANOLA: SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 CEREALS & GRAINS: SEEDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 CEREALS & GRAINS: SEEDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 CEREALS & GRAINS: SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 50 CEREALS & GRAINS: SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 51 CORN: SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 52 CORN: SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 53 FRUITS & VEGETABLES: SEEDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 FRUITS & VEGETABLES: SEEDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 FRUITS & VEGETABLES: SEEDS MARKET, BY FAMILY TYPE, 2018–2022 (USD MILLION)

- TABLE 56 FRUITS & VEGETABLES: SEEDS MARKET, BY FAMILY TYPE, 2023–2028 (USD MILLION)

- TABLE 57 FRUITS & VEGETABLES: SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 58 FRUITS & VEGETABLES: SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 59 FUNCTIONAL, RECREATIONAL, AND ORNAMENTAL BENEFITS OF TURFGRASS

- TABLE 60 OTHER CROP TYPES: SEEDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 OTHER CROP TYPES: SEEDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 SEEDS MARKET, BY TRAIT, 2018–2022 (USD MILLION)

- TABLE 63 SEEDS MARKET, BY TRAIT, 2023–2028 (USD MILLION)

- TABLE 64 SEEDS MARKET, BY TRAIT, 2018–2022 (MILLION HA)

- TABLE 65 SEEDS MARKET, BY TRAIT, 2023–2028 (MILLION HA)

- TABLE 66 COUNTRIES TO APPROVE MAJOR HERBICIDE-TOLERANT CROPS (WITH SINGLE AND STACKED GENES) FOR FOOD, FEED, AND/OR CULTIVATION

- TABLE 67 COMMERCIALIZED HERBICIDE-TOLERANT SEED PRODUCTS

- TABLE 68 HERBICIDE-TOLERANT CROPS: SEEDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 HERBICIDE-TOLERANT CROPS: SEEDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 HERBICIDE-TOLERANT CROPS: SEEDS MARKET, BY REGION, 2018–2022 (MILLION HA)

- TABLE 71 HERBICIDE-TOLERANT CROPS: SEEDS MARKET, BY REGION, 2023–2028 (MILLION HA)

- TABLE 72 INSECT-RESISTANT CROPS: SEEDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 73 INSECT-RESISTANT CROPS: SEEDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 INSECT-RESISTANT CROPS: SEEDS MARKET, BY REGION, 2018–2022 (MILLION HA)

- TABLE 75 INSECT-RESISTANT CROPS: SEEDS MARKET, BY REGION, 2023–2028 (MILLION HA)

- TABLE 76 GENE STACKING METHODS IN PRODUCTION OF BIOTECH STACKS

- TABLE 77 OTHER TRAITS: SEEDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 OTHER TRAITS: SEEDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 OTHER TRAITS: SEEDS MARKET, BY REGION, 2018–2022 (MILLION HA)

- TABLE 80 OTHER TRAITS: SEEDS MARKET, BY REGION, 2023–2028 (MILLION HA)

- TABLE 81 SEEDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 SEEDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: SEEDS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: SEEDS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: SEEDS MARKET, BY TRAIT, 2018–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: SEEDS MARKET, BY TRAIT, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: SEEDS MARKET, BY TRAIT, 2018–2022 (MILLION HA)

- TABLE 90 NORTH AMERICA: SEEDS MARKET, BY TRAIT, 2023–2028 (MILLION HA)

- TABLE 91 NORTH AMERICA: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 93 US: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 94 US: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 95 US: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 96 US: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 97 US: CORN SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 98 US: CORN SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 US: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 100 US: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 101 US: SOYBEAN SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 102 US: SOYBEAN SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 103 US: COTTON SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 104 US: COTTON SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 105 SEED CROPS GROWN IN CANADA

- TABLE 106 CANADA: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 107 CANADA: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 108 CANADA: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 109 CANADA: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 110 CANADA: CORN SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 111 CANADA: CORN SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 112 CANADA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 113 CANADA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 114 CANADA: SOYBEAN SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 115 CANADA: SOYBEAN SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 116 CANADA: CANOLA SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 117 CANADA: CANOLA SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 118 MEXICO: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 119 MEXICO: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 120 EUROPE: SEEDS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 121 EUROPE: SEEDS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 122 EUROPE: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 123 EUROPE: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 124 EUROPE: SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 125 EUROPE: SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: SEEDS MARKET, BY TRAIT, 2018–2022 (USD MILLION)

- TABLE 127 EUROPE: SEEDS MARKET, BY TRAIT, 2023–2028 (USD MILLION)

- TABLE 128 EUROPE: SEEDS MARKET, BY TRAIT, 2018–2022 (MILLION HA)

- TABLE 129 EUROPE: SEEDS MARKET, BY TRAIT, 2023–2028 (MILLION HA)

- TABLE 130 SPAIN: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 131 SPAIN: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 132 SPAIN: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 133 SPAIN: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 134 SPAIN: CORN SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 135 SPAIN: CORN SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 136 ITALY: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 137 ITALY: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 138 GERMANY: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 139 GERMANY: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 140 FRANCE: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 141 FRANCE: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 142 RUSSIA: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 143 RUSSIA: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 144 UK: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 145 UK: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 146 NETHERLANDS: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 147 NETHERLANDS: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 148 UKRAINE: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 149 UKRAINE: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 150 REST OF EUROPE: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 151 REST OF EUROPE: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: SEEDS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 153 ASIA PACIFIC: SEEDS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 157 ASIA PACIFIC: SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: SEEDS MARKET, BY TRAIT, 2018–2022 (USD MILLION)

- TABLE 159 ASIA PACIFIC: SEEDS MARKET, BY TRAIT, 2023–2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: SEEDS MARKET, BY TRAIT, 2018–2022 (MILLION HA)

- TABLE 161 ASIA PACIFIC: SEEDS MARKET, BY TRAIT, 2023–2028 (MILLION HA)

- TABLE 162 CHINA: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 163 CHINA: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 164 CHINA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 165 CHINA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 166 CHINA: COTTON SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 167 CHINA: COTTON SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 168 THAILAND: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 169 THAILAND: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 170 INDIA: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 171 INDIA: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 172 INDIA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 173 INDIA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 174 INDIA: COTTON SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 175 INDIA: COTTON SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 176 JAPAN: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 177 JAPAN: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 178 AUSTRALIA: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 179 AUSTRALIA: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 180 VIETNAM: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 181 VIETNAM: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 184 SOUTH AMERICA: SEEDS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 185 SOUTH AMERICA: SEEDS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 186 SOUTH AMERICA: SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 187 SOUTH AMERICA: SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 188 SOUTH AMERICA: SEEDS MARKET, BY TRAIT, 2018–2022 (USD MILLION)

- TABLE 189 SOUTH AMERICA: SEEDS MARKET, BY TRAIT, 2023–2028 (USD MILLION)

- TABLE 190 SOUTH AMERICA: SEEDS MARKET, BY TRAIT, 2018–2022 (MILLION HA)

- TABLE 191 SOUTH AMERICA: SEEDS MARKET, BY TRAIT, 2023–2028 (MILLION HA)

- TABLE 192 SOUTH AMERICA: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 193 SOUTH AMERICA: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 194 BRAZIL: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 195 BRAZIL: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 196 BRAZIL: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 197 BRAZIL: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 198 BRAZIL: CORN SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 199 BRAZIL: CORN SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 200 BRAZIL: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 201 BRAZIL: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 202 BRAZIL: SOYBEAN SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 203 BRAZIL: SOYBEAN SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 204 ARGENTINA: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 205 ARGENTINA: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 206 ARGENTINA: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 207 ARGENTINA: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 208 ARGENTINA: CORN SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 209 ARGENTINA: CORN SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 210 ARGENTINA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2018–2022 (USD MILLION)

- TABLE 211 ARGENTINA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2023–2028 (USD MILLION)

- TABLE 212 ARGENTINA: SOYBEAN SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 213 ARGENTINA: SOYBEAN SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 214 CHILE: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 215 CHILE: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 216 REST OF SOUTH AMERICA: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 217 REST OF SOUTH AMERICA: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 218 ROW: SEEDS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 219 ROW: SEEDS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 220 ROW: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 221 ROW: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 222 ROW: SEEDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 223 ROW: SEEDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 224 ROW: SEEDS MARKET, BY TRAIT, 2018–2022 (USD MILLION)

- TABLE 225 ROW: SEEDS MARKET, BY TRAIT, 2023–2028 (USD MILLION)

- TABLE 226 ROW: SEEDS MARKET, BY TRAIT, 2018–2022 (MILLION HA)

- TABLE 227 ROW: SEEDS MARKET, BY TRAIT, 2023–2028 (MILLION HA)

- TABLE 228 SOUTH AFRICA: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 229 SOUTH AFRICA: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 230 TURKEY: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 231 TURKEY: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 232 EGYPT: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 233 EGYPT: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 234 OTHERS IN ROW: SEEDS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 235 OTHERS IN ROW: SEEDS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 236 SEEDS MARKET: DEGREE OF COMPETITION

- TABLE 237 SEEDS MARKET: COMPANY TYPE FOOTPRINT

- TABLE 238 SEEDS MARKET: CROP TYPE FOOTPRINT

- TABLE 239 SEEDS MARKET: REGIONAL FOOTPRINT

- TABLE 240 SEEDS MARKET: COMPANIES’ OVERALL FOOTPRINT

- TABLE 241 SEEDS MARKET: DETAILED LIST OF STARTUPS/SMES

- TABLE 242 SEEDS MARKET: COMPETITIVE BENCHMARKING FOR STARTUPS/SMES, 2022

- TABLE 243 SEED MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 244 SEEDS MARKET: DEALS, 2020–2023

- TABLE 245 SEEDS MARKET: OTHERS, 2020–2023

- TABLE 246 BASF SE: COMPANY OVERVIEW

- TABLE 247 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 BASF SE: PRODUCT LAUNCHES

- TABLE 249 BASF SE: DEALS

- TABLE 250 BASF SE: OTHERS

- TABLE 251 BAYER AG: COMPANY OVERVIEW

- TABLE 252 BAYER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 BAYER AG: PRODUCT LAUNCHES

- TABLE 254 BAYER AG: DEALS

- TABLE 255 BAYER AG: OTHERS

- TABLE 256 SYNGENTA CROP PROTECTION AG: COMPANY OVERVIEW

- TABLE 257 SYNGENTA CROP PROTECTION AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 SYNGENTA CROP PROTECTION AG: DEALS

- TABLE 259 KWS SAAT SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 260 KWS SAAT SE & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 KWS SAAT SE & CO. KGAA: PRODUCT LAUNCHES

- TABLE 262 KWS SAAT SE & CO. KGAA: DEALS

- TABLE 263 KWS SAAT SE & CO. KGAA: OTHERS

- TABLE 264 CORTEVA: COMPANY OVERVIEW

- TABLE 265 CORTEVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 CORTEVA: PRODUCT LAUNCHES

- TABLE 267 CORTEVA: DEALS

- TABLE 268 LIMAGRAIN: COMPANY OVERVIEW

- TABLE 269 LIMAGRAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 ADVANTA SEEDS: COMPANY OVERVIEW

- TABLE 271 ADVANTA SEEDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 SAKATA SEED CORPORATION: COMPANY OVERVIEW

- TABLE 273 SAKATA SEED CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 SAKATA SEED CORPORATION: PRODUCT LAUNCHES

- TABLE 275 SAKATA SEED CORPORATION: DEALS

- TABLE 276 SAKATA SEED CORPORATION: OTHERS

- TABLE 277 DLF SEEDS A/S: COMPANY OVERVIEW

- TABLE 278 DLF SEEDS A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 DLF SEEDS A/S: PRODUCT LAUNCHES

- TABLE 280 DLF SEEDS A/S: DEALS

- TABLE 281 ENZA ZADEN BEHEER B.V.: COMPANY OVERVIEW

- TABLE 282 ENZA ZADEN BEHEER B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 ENZA ZADEN BEHEER B.V.: PRODUCT LAUNCHES

- TABLE 284 ENZA ZADEN BEHEER B.V.: DEALS

- TABLE 285 ENZA ZADEN BEHEER B.V.: OTHERS

- TABLE 286 RALLIS INDIA LIMITED: COMPANY OVERVIEW

- TABLE 287 RALLIS INDIA LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 FMC CORPORATION: COMPANY OVERVIEW

- TABLE 289 FMC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 290 TAKII & CO., LTD.: COMPANY OVERVIEW

- TABLE 291 TAKII & CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 TAKII & CO., LTD.: DEALS

- TABLE 293 TAKII & CO., LTD.: OTHERS

- TABLE 294 ROYAL BARENBRUG GROUP: COMPANY OVERVIEW

- TABLE 295 ROYAL BARENBRUG GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 ROYAL BARENBRUG GROUP: DEALS

- TABLE 297 LONGPING HIGH-TECH: COMPANY OVERVIEW

- TABLE 298 LONGPING HIGH-TECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 LAND O’LAKES, INC.: COMPANY OVERVIEW

- TABLE 300 LAND O'LAKES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 VIKIMA SEED A/S: COMPANY OVERVIEW

- TABLE 302 VIKIMA SEED A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 ALLIED SEED, LLC: COMPANY OVERVIEW

- TABLE 304 ALLIED SEED, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 AMPAC SEED COMPANY: COMPANY OVERVIEW

- TABLE 306 AMPAC SEED COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 IMPERIAL SEED: COMPANY OVERVIEW

- TABLE 308 IMPERIAL SEED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 ADJACENT MARKETS

- TABLE 310 SEED TREATMENT MARKET, BY FUNCTION, 2022–2027 (USD MILLION)

- TABLE 311 SEED COATING MARKET, BY FORM, 2022–2027 (USD MILLION)

- FIGURE 1 SEEDS: MARKET SEGMENTATION

- FIGURE 2 SEEDS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

- FIGURE 4 SEEDS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 SEEDS MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 ASSUMPTIONS

- FIGURE 8 SEEDS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 SEEDS MARKET, BY TRAIT, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 SEEDS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 SEEDS MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 12 DEMAND FOR HIGH-QUALITY SEEDS WITH IMPROVED DISEASE RESISTANCE TO DRIVE GROWTH

- FIGURE 13 CONVENTIONAL SEGMENT AND CHINA TO ACCOUNT FOR LARGER MARKET SHARES IN ASIA PACIFIC

- FIGURE 14 CEREALS & GRAINS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 GENETICALLY MODIFIED SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 16 OTHER TRAITS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 17 MAJOR SEED EXPORTING COUNTRIES IN ASIA PACIFIC, 2022

- FIGURE 18 MAJOR SEED IMPORTING COUNTRIES IN ASIA PACIFIC, 2022

- FIGURE 19 TOP TEN SEED-PRODUCING COUNTRIES IN EUROPE, 2019–2022 (‘000 HA)

- FIGURE 20 GLOBAL PESTICIDE TRADE IN KEY REGIONS, 2018–2020 (USD MILLION)

- FIGURE 21 AREA HARVESTED UNDER HIGH-VALUE CROPS, 2017–2021 (MILLION HA)

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SEEDS MARKET

- FIGURE 23 TOP FIVE COUNTRIES WITH AREA HARVESTED UNDER BIOTECH CROPS, 2018 (MILLION HA)

- FIGURE 24 EUROPEAN ANIMAL FEED SECTOR: USE OF PROTEIN MATERIAL, BY SOURCE, 2019-2020

- FIGURE 25 CORN USAGE IN BIOFUEL PRODUCTION, 2015–2019 (MILLION BU)

- FIGURE 26 MONTHLY BIODIESEL PRODUCTION IN US, 2019 VS. 2020 (MILLION GALLONS)

- FIGURE 27 GLOBAL PRODUCTION AND CONSUMPTION OF PROTEIN MEALS, 2022–2031 (MILLION TONS)

- FIGURE 28 OILSEED PRICES IN US, 2021 (USD/TON)

- FIGURE 29 RESEARCH AND DEVELOPMENT EXPENDITURE OF KEY MANUFACTURERS, 2022 (USD MILLION)

- FIGURE 30 NUMBER OF ORGANIC FOOD PRODUCERS IN TOP FIVE COUNTRIES, 2021

- FIGURE 31 DISTRIBUTION OF ORGANIC AGRICULTURAL AREAS, BY REGION, 2021

- FIGURE 32 SEEDS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 33 SEEDS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 34 SEEDS MARKET: GLOBAL AVERAGE SELLING PRICE, BY KEY CROP

- FIGURE 35 SEEDS MARKET: MARKET MAPPING

- FIGURE 36 SEEDS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 37 PATENTS GRANTED FOR SEEDS MARKET, 2013–2022

- FIGURE 38 REGIONAL ANALYSIS OF PATENTS GRANTED FOR SEEDS MARKET, 2013–2022

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 40 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS FOR KEY TRAITS

- FIGURE 41 GENETICALLY MODIFIED SEEDS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 42 AREA UNDER GENETICALLY MODIFIED CROPS FOR INDUSTRIALIZED AND EMERGING ECONOMIES, 2017–2018 (MILLION HA)

- FIGURE 43 CEREALS & GRAINS SEGMENT TO DOMINATE SEEDS MARKET DURING FORECAST PERIOD

- FIGURE 44 TOP TEN OILSEED-EXPORTING COUNTRIES, 2022

- FIGURE 45 GLOBAL SOYBEAN PRODUCTION IN KEY COUNTRIES, 2017–2021 (MILLION TONS)

- FIGURE 46 GLOBAL RAPESEED PRODUCTION, 2017–2020 (MILLION TONS)

- FIGURE 47 COTTON SEED PRODUCTION OF LEADING COUNTRIES, 2019–2020 (TONS)

- FIGURE 48 TOP TEN COTTON-EXPORTING COUNTRIES IN 2022

- FIGURE 49 ANNUAL PRODUCTION OF SUNFLOWER SEEDS, 2015–2020 (MILLION TONS)

- FIGURE 50 GLOBAL PRODUCTION OF CORN, 2017–2021 (MILLION TONS)

- FIGURE 51 WHEAT PRODUCTION IN INDIA, 2017–2021 (MILLION TONS)

- FIGURE 52 ANNUAL PRODUCTION OF RICE, 2019–2021 (MILLION TONS)

- FIGURE 53 GLOBAL TOMATO PRODUCTION BY REGION, 2021

- FIGURE 54 GLOBAL CARROT PRODUCTION BY REGION, 2021

- FIGURE 55 OTHER TRAITS SEGMENT TO DOMINATE GENETICALLY MODIFIED SEEDS MARKET DURING FORECAST PERIOD

- FIGURE 56 HERBICIDE-TOLERANT CORN (PERCENTAGE OF ALL CORN PLANTED) IN US, 2021–2022

- FIGURE 57 INSECT-RESISTANT BT COTTON (PERCENTAGE OF ALL UPLAND COTTON PLANTED) IN US, 2021–2022

- FIGURE 58 HERBICIDE-TOLERANT COTTON (PERCENTAGE OF ALL UPLAND COTTON PLANTED) IN US, 2021–2022

- FIGURE 59 CHINA TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 60 NORTH AMERICA: REGIONAL SNAPSHOT

- FIGURE 61 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 62 CROPS IMPORTED BY CANADA, 2021 (TONS)

- FIGURE 63 ANNUAL IMPORTS OF PRIMARY RAW MATERIALS BY FEED INDUSTRY IN MEXICO, 2019–2021

- FIGURE 64 WHEAT IMPORT IN MEXICO, 2019–2022 (TRADE YEAR)

- FIGURE 65 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 66 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 67 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 69 OILSEED PRODUCTION IN INDIA, BY OIL MEAL TYPE, 2019–2020 (‘000 TONS)

- FIGURE 70 CANOLA EXPORT IN AUSTRALIA, 2022 (‘000 TONS)

- FIGURE 71 MARKET SHARE FOR WHEAT IMPORT IN VIETNAM, 2022

- FIGURE 72 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 73 AREA HARVESTED FOR MAJOR CROPS IN BRAZIL, 2019–2021 (MILLION HA)

- FIGURE 74 AREA HARVESTED FOR MAJOR CROPS IN ARGENTINA, 2019–2021 (MILLION HA)

- FIGURE 75 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 76 AREA HARVESTED FOR CROPS IN TURKEY, 2019–2021 (MILLION HA)

- FIGURE 77 SEEDS MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 78 SEEDS MARKET: SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD BILLION)

- FIGURE 79 SEEDS MARKET: ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020–2022

- FIGURE 80 EBITDA, 2022 (USD MILLION)

- FIGURE 81 SEEDS MARKET: COMPANY EVALUATION MATRIX, 2022 (KEY PLAYERS)

- FIGURE 82 SEEDS MARKET: COMPANY EVALUATION MATRIX, 2022 (OTHER PLAYERS)

- FIGURE 83 BASF SE: COMPANY SNAPSHOT

- FIGURE 84 BAYER AG: COMPANY SNAPSHOT

- FIGURE 85 SYNGENTA CROP PROTECTION AG: COMPANY SNAPSHOT

- FIGURE 86 KWS SAAT SE & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 87 CORTEVA: COMPANY SNAPSHOT

- FIGURE 88 LIMAGRAIN: COMPANY SNAPSHOT

- FIGURE 89 ADVANTA SEEDS: COMPANY SNAPSHOT

- FIGURE 90 SAKATA SEED CORPORATION: COMPANY SNAPSHOT

- FIGURE 91 DLF SEEDS A/S: COMPANY SNAPSHOT

- FIGURE 92 RALLIS INDIA LIMITED: COMPANY SNAPSHOT

- FIGURE 93 FMC CORPORATION: COMPANY SNAPSHOT

- FIGURE 94 LAND O’LAKES, INC.: COMPANY SNAPSHOT

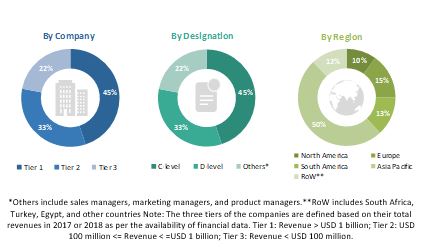

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the seeds market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

In the secondary research process, various sources, such as the US Department of Agriculture (USDA), the Food and Agriculture Organization (FAO), the European Food Safety Authority (EFSA), National Seed Association of India (NSAI), Euroseeds, International Seed Federation, International Seed Testing Association, The American Seed Trade Association (ASTA) were referred, to identify and collect information for this study. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, associations, regulatory bodies, trade directories, and paid databases.

Secondary research was mainly used to obtain vital information about the industry’s supply chain, the total pool of key players, the market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain: suppliers, manufacturers, and end-use product manufacturers. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include growers/farmers, key opinion leaders, executives, vice presidents, and CEOs of the seeds industry. The primary sources from the supply side include research institutions involved in R&D activities, key opinion leaders, and manufacturers of seeds.

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

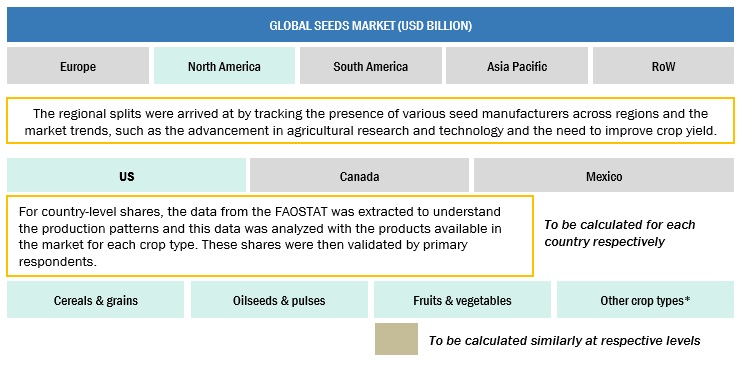

The top-down and bottom-up approaches were used to estimate and validate the total size of the seeds market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the markets were identified through extensive secondary research.

- The seeds market was determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the seeds market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Seeds Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Seeds Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the above estimation process using both top-down and bottom-up approaches, the total market was split into several segments and subsegments. To complete the overall seeds market estimation and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to FAO, "seeds are a storehouse of genetic potential for crop species and their cultivars, the result of long-term continuous improvement and selection." Botanically, a seed is the mature egg of a sexually produced crop, consisting of an intact embryo, endosperm, and cotyledons with a protective cover (seed coat) called propagating material. Hybrid seeds are seeds obtained by deliberate and controlled crossing of two parent plants.

Transgenic or genetically modified seeds are seeds created by modifying the genetic material (DNA) using recombinant DNA technology or genetic engineering. For the purposes of this study, the market includes commercially certified seeds developed by breeders and seed producers and sold to farmers for sowing through suppliers and traders along the supply chain. Self-grown seeds purchased directly from the farm the year before planting are not covered.

Key Stakeholders

- Seeds manufacturers

- Seeds importers and exporters

- Seeds traders, distributors, and suppliers

- Government and research organizations

-

Government regulatory agencies

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- European Food Safety Authority (EFSA)

- Food and Drug Administration (FDA)

- Environmental Protection Agency (EPA)

- Department of Environment, Food and Rural Affairs (DEFRA)

Report Objectives

- To determine and project the size of the seeds market with respect to by type, crop type, trait, and region

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To provide the regulatory framework for major countries related to the seeds market

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

- To analyze the value chain and products across the key regions and their impact on the prominent market players.

- To provide insights on key product innovations and investments in the global seeds market

Available Customizations

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe's seeds market into the Czech Republic and Denmark.

- Further breakdown of the Rest of Asia Pacific seeds market into Indonesia and South Korea.

- Further breakdown of the Rest of the South American seeds market into Uruguay and Paraguay.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Seeds Market