Situational Awareness Market Size, Share and Industry Growth Analysis Report by Component (Sensors, GPS, Gyroscopes), Products (Fire & Flood Alarm Systems, HMI, RFID Solutions), Applications (Robots, Smart Infrastructure Management, CBRN Systems), Industry, and Geography - Global Growth Driver and Industry Forecast to 2026

Situational Awareness Market

Situational Awareness Market and Top Companies

- General Electric (US) −The company is a technology and financial services company involved in the development and manufacture of products that are used in the generation, transmission, distribution, control, and utilization of electricity. The company operates in Power, Renewable Energy, Oil & Gas, Aviation, Healthcare, Transportation, Capital, and Lighting segments.

- Lockheed Martin Corp (US) −The company is a security and aerospace company. It is principally engaged in the research, design, development, manufacture, integration, and sustainment of advanced technology systems, products, and services. It also provides a broad range of management, engineering, technical, scientific, logistics, and information services. The company’s products and services have applications in the defense, civil, and commercial sectors.

- Honeywell (US) − The Company offers automation and control solutions; aerospace products and services; control, sensing, and security technologies for buildings; turbochargers; automotive products; specialty chemicals; electronic & advanced materials; process technology for refining and petrochemicals; and energy-efficient products and solutions for homes. The company operates in various business segments: Aerospace, Performance Materials and Technologies, Honeywell Building Solutions, and Safety and Productivity Solutions. Through the Honeywell Building Solutions segment, the company offers software, solutions, and technologies for homes and industries. Honeywell provides situational awareness products, solutions, and services such as continuous monitoring and alerting, compliance and reporting, security information and event management, security awareness training, and managed services.

- Denso (Japan) − The Company is a Japan-based automotive manufacturer that specializes in automotive electronics, electrification, thermal, and powertrain technologies. The company operates through six business segments—Thermal Systems, Powertrain Systems, Electronic Systems, Electrification Systems, Mobility Systems, and Non-Automotive Business. DENSO's interactive cockpit uses active safety "sensing" and vehicle-to-vehicle and vehicle-to-infrastructure (V2X) communication technologies that provide the vehicles a 360-degree situational awareness of the roads and help drivers and occupants to gain information about traffic congestion and avoid a potential collision with another vehicles or pedestrians.

- BAE Systems (US) – The Company is a leading manufacturer and supplier of products related to defense, security, and aerospace applications and a leading provider of the related services. The core offerings of the company include different types of services and platforms related to defense and security. The company works with global customers and local partners to develop, engineer, manufacture, and support products and systems for its clients. BAE Systems, Inc. operates as a subsidiary of BAE Systems, Plc.

- United Technologies Corp.(US) – The Company provides high-technology products and services to the aerospace and commercial building industries worldwide. In November 2018, UTC acquired Rockwell Collins for USD 30 billion. With this acquisition, Rockwell Collins will become Collins Aerospace in a combined re-structuring with UTC Aerospace Systems. UTC will remain the parent company of Collins Aerospace. The company operates in Otis, Carrier (formerly referred to as UTC Climate, Controls & Security), Pratt & Whitney, and Collins Aerospace Systems (a combination of the segment formerly referred to as UTC Aerospace Systems and Rockwell Collins) segments.

- BARCO (Belgium) – The Company is a global technology company engaged in designing and developing networked visualization products for enterprise, entertainment, and healthcare markets across the world, provides display, projection and collaboration technology for large format displays and image processing. The company engages in designing and developing visualizations solutions. Barco operates through 3 divisions — Entertainment, Enterprise, and Healthcare. The company segments its operations into 3 geographic areas—Europe, the Americas, and APAC.

Situational Awareness Market and Top End-user Industries

- Military & Defense− Situational awareness systems are widely used in the military & defense industry for safety and security purposes. Situational awareness solutions provide crucial information to military forces, which will help them to monitor and access the surrounding conditions in a fast and efficient manner. They use advanced transport technologies, which help military forces to respond quickly to emergency situations in distant locations.

- Aviation − Situational awareness systems are one of the critical and challenging systems for achieving positive performance in the aviation industry. Situational awareness systems monitor the state of an aircraft, its systems, and its environment to make decisions, revise plans, and manage aircraft. Runway situation awareness tools provide a combination of solutions, which can reduce runway excursions. Several companies are developing situational awareness systems for fulfilling the requirements in the aviation industry. There are two primary applications of situational awareness solutions in the aviation industry: in-flight situational awareness and air traffic control.

- Homeland Security− The scope of homeland security includes the protection of a nation from terrorism and critical infrastructure, the establishment of emergency management systems, and the provision of tools for emergency management. Situation awareness systems provide timely detection of cyber incidents, real-time awareness of current threats, vulnerabilities specific to organizations, and foresight on the associated business impacts. This approach has been a longstanding practice for government agencies worldwide to protect their respective countries.

- Maritime Security− Maritime situational awareness is used in detecting threats in the sea by extracting useful information from a variety of data sources using automated techniques and advanced algorithms. Situation awareness in maritime security is still in the development stage. The main goal of situational awareness in maritime security is to identify unusual events, which include the information of unexpected stopping of ships or changes in course. However, maritime surveillance systems require more developments in detecting inconsistency in natural calamities in the sea and other threats and can provide improved sensor performance and data fusion of the data, which is gathered from various sensors.

- Industrial − Situational awareness helps industries achieve their business goals. Several industrial plants monitor their underlying operations with the help of control systems such as SCADA, DCS, and EMS. Situational awareness solutions provide a high level of visibility into the control systems. They also enable system operators to effectively manage the changes in the assets such as computers, robots, and displays reducing cyber risks across their infrastructure and ensuring maximum uptime of the machines.

Situational Awareness Market and Top Products

- Command and Control Systems− A command and control system is an automated information system, which is designed to support crisis planning with the help of an integrated set of analytical tools and flexible data transfer capabilities. These types of systems are integrated with situational awareness solutions and surveillance sensors, both ground-based and airborne; they help in transmitting secure information to each level of the command chain. Command and control systems provide situational awareness for force planning, readiness assessment, and deployment applications on a battlefield.

- RFID Solutions− RFID solutions are mainly used for situational awareness in healthcare, public safety, defense, and aviation. Zebra is one of the major players offering situational awareness for military asset tracking that uses RFID solutions and barcode technologies in asset tracking. In healthcare, RFID solutions are used to provide real-time staff safety systems; one such product is offered by GuardRFID.

- CBRN Systems− CBRN are weaponized or non-weaponized chemicals, biological, radiological, and nuclear materials that are used in warfare or terror attacks and are extremely harmful. CBRN systems are mostly used in armed forces and homeland security. North America and Europe have well-developed domestic CBRN industries, which make them self-reliant. Sensors, GPS, displays and notification devices are different components used in CBRN systems for situational awareness.

Updated on : April 04, 2024

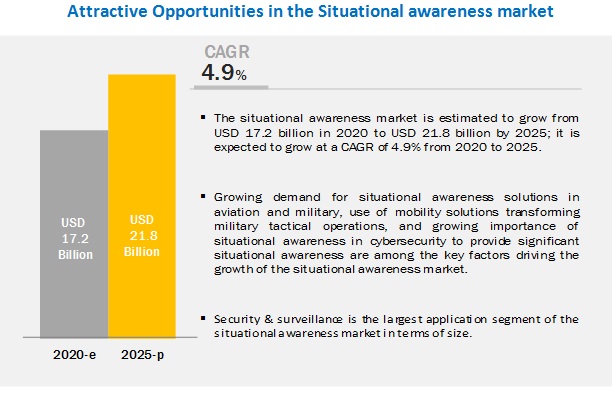

Global situational awareness market size is projected to grow from USD 17.2 billion in 2020 to USD 21.8 billion by 2025, recording a CAGR of 4.9% between 2020 and 2025.

Increasing demand for situational awareness solutions in aviation and military, use of mobility solutions transforming military tactical operations, and growing importance of situational awareness in cybersecurity to provide significant situational awareness are the major factors driving the growth of the situational awareness system market.

Situational awareness market for sensors to hold the largest market size by 2025

By component, sensors are projected to hold the largest market size. Sensors are necessary for intelligence, surveillance, platform survivability, targeting, and advanced weapon operation, across all operating environments. They are responsible for converting physical phenomena into quantities, which are further measurable by data-acquisition systems.

Situational awareness market for command & control systems to lead the market during the forecast period

By product type, the command and control systems are projected to lead the market during the forecast period. These types of systems are integrated with situational awareness solutions and surveillance sensors, both ground-based and airborne; they help in transmitting secure information to each level of the command chain. Command and control systems provide situational awareness for force planning, readiness assessment, and deploy applications on a battlefield. Thus, these systems are having the largest market share in the market.

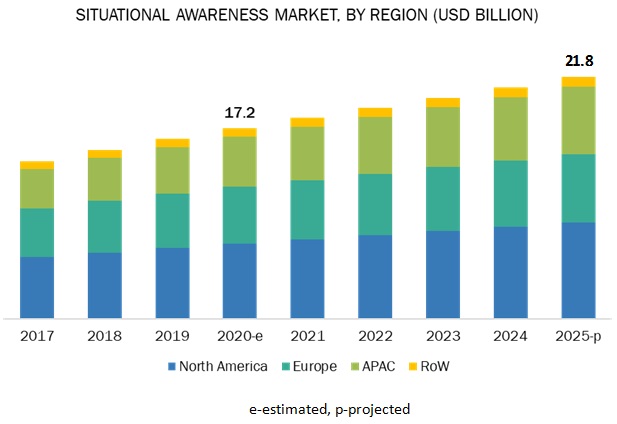

Situational awareness market in North America to account for the largest share of the market during the forecast period

By region, North America is projected to account for the largest share of the market during the forecast period. The market in this region has been studied for US, Canada, and Mexico. The North American situational awareness system market is mainly dominated by US and Canada. The market growth in this region can be attributed to the increased use of situational awareness in industries such as military & defense, aviation, maritime security, and homeland security applications.

Situational Awareness Market Key Players

General Electric (US), Lockheed Martin (US), Honeywell (US), DENSO (Japan), BAE Systems (UK), UTC (US), Microsoft (US), Barco (Belgium), AMD (US), L3Harris Technologies (US), General Dynamics (US), Xilinx (US), Qualcomm (US), Robert Bosch (Germany), Pleora Technologies (Canada), Nexvision (France), Bertin Instruments (France), Axis Communications (Sweden), Johnson Controls (Ireland), Boeing (US), Airbus (France), and Sensara (US) are some of the key players in the market.

Situational Awareness Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2020 |

USD 17.2 Billion |

| Revenue Forecast in 2025 | USD 21.8 Billion |

| Growth Rate | 4.9% |

| Base Year Considered | 2019 |

| Historical Data Available for Years | 2017–2025 |

|

Forecast Period |

2020–2025 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Largest Growing Region | North America |

| Largest Market Share Segment | RFID solutions Segment |

| Highest CAGR Segment | Military & Defense Segment |

| Largest Application Market Share | Security and Surveillance Application |

This research report categorizes the gas sensors market based on component, product, industry, application, and region

Situational Awareness Market Based on Product:

- Fire and Flood Alarm Systems

- Human-Machine Interface(HMI)

- RFID Solutions

- Access Control Solutions

- Radar Systems

- Chemical Biological Radiological Nuclear (CBRN) Systems

- Command & Control Systems

- Sonar Systems

- Physical Security Information Management (PSIM) Solutions

Situational Awareness Market Based on Components:

- Sensors

- GPS

- Cameras

- Gyroscopes

- Display & Notification Devices

- NVRs & DVRs

- Other Components

Situational Awareness Market Based on Industry:

- Military & Defense

- Aviation

- Maritime Security

- Cybersecurity

- Automotive

- Healthcare

- Construction

- Industrial

- Homeland Security

Situational Awareness Market Based on the Application:

- Robots

- Driving and Connected Cars

- Business Intelligence

- Disaster response

- Security & Surveillance

- Environmental Impacts Tracking

- Logistics

- Natural & Cultural Resources

- Smart Infrastructure Management

- Crisis Management

Based on the Regions:

- North America

- Europe

- APAC

- RoW

Key Questions Addressed by the Report

- Which are the leading applications in the situational awareness system market?

- Which technology would lead to the market during the forecast period?

- What strategies are adopted by the players to stay ahead in the market?

- What is the growth prospect for this market in different regions?

- What are the drivers, opportunities, restraints, and challenges influencing the growth of the market?

Frequently Asked Questions (FAQ):

Which are the various products used for situational awareness, of these who would held the larger share and why?

The various products used in situational awareness are - Fire and Flood Alarm Systems, Human-Machine Interface(HMI), RFID Solutions, Access Control Solutions, Radar Systems, Chemical Biological Radiological Nuclear (CBRN) Systems, Command & Control Systems, Sonar Systems, and Physical Security Information Management (PSIM) Solutions. By product, the command & control systems segment is expected to lead the situational awareness market during the forecast period. Command and control systems are widely used in aviation and military & defense sectors.

Which are the major companies in the situational awareness market? What are their major strategies to strengthen their market presence?

General Electric (US), Lockheed Martin (US), Honeywell (US), DENSO (Japan), and BAE Systems (UK), among others are some of the major companies providing situational awareness products. Product launches is one of the key strategies adopted by these players. Apart from launches, these players extend their focus on contracts, agreements, and partnerships with the public and private players.

Which region is expected to witness significant demand for situational awareness market in the coming years?

"By region, North America is projected to account for the largest share of the market during the forecast period. The market in this region has been studied for US, Canada, and Mexico. The North American situational awareness system market is mainly dominated by US and Canada. The growth in the North American region, mainly in the US is due ot the high governemnt expenditure in applications such as military & defense, aviation, maritime security, and homeland security applications. "

Which are the major end-use industries of this market?

The industries considered in this markets includes - Military & Defense, Aviation, Maritime Security, Cybersecurity, Automotive, Healthcare, Construction, Industrial, and Homeland Security. Amongst these the military & defense segment is expected to lead the situational awareness market during the forecast period owing to the high adoption of various situational awareness products. Situational awareness systems are widely used in the military & defense industry for safety and security purposes.

Which are the major driving factors and opportunities in the situational awareness market?

The major factors driving the growth of the situational awareness market include the growing demand for situational awareness solutions in aviation and military, the use of mobility solutions transforming military tactical operations, and the increasing importance of situational awareness in cybersecurity to provide significant situational awareness. The opportunities includes - rising digitization in infrastructure to provide significant opportunities for situational awareness, significance of situational awareness in energy sector to provide opportunities, and implementation of situational awareness in space projects. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Study Objectives

1.2 Market Definition and Scope

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Geographic Scope

1.3.2 Years Considered

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Sources

2.2 Market Size Estimation

2.2.1 Limitations/Assumptions

2.2.2 Bottom-Up Approach

2.2.2.1 Approach to Arrive at Market Size Using Bottom-Up Approach (Demand Side)

2.2.3 Top-Down Approach

2.2.3.1 Approach to Arrive at Market Size Using Top-Down Approach (Supply Side)

2.3 Research Assumptions and Limitations

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 38)

4.1 Attractive Opportunities in Situational Awareness Market

4.2 Situational Awareness Market, By Application and Country

4.3 Country-Wise Situational Awareness Market

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Situational Awareness in Aviation and Military

5.2.1.2 Use of Mobility Solutions Transforming Military Tactical Operations

5.2.1.3 Growing Importance of Situational Awareness in Cybersecurity

5.2.2 Restraints

5.2.2.1 Errors in Situational Awareness

5.2.3 Opportunities

5.2.3.1 Rising Digitization in Infrastructure to Provide Significant Opportunities for Situational Awareness

5.2.3.2 Significance of Situational Awareness in Energy Sector to Provide Opportunities

5.2.3.3 Implementation of Situational Awareness in Space Projects

5.2.4 Challenges

5.2.4.1 Complexity in System Design

6 Situational Awareness Market, By Component (Page No. - 50)

6.1 Introduction

6.2 Sensors

6.2.1 Network Sensors

6.2.1.1 Network Sensors Play Important Role in Monitoring and Controlling Physical Environments From Remote Locations

6.2.2 Electro-Optical/Infrared

6.2.2.1 Mainly Used for Situational Awareness in Aircraft and Military Applications

6.2.3 Proximity Sensors

6.2.3.1 Find Application in Unmanned Vehicles

6.2.4 Temperature Sensors

6.2.4.1 Provide Situational Awareness in Automotive, Power & Energy, and Defense Applications

6.3 Global Positioning Systems

6.3.1 Provides Enhanced Geospatial View of Resources and Assets

6.4 Cameras

6.4.1 Rising Importance in Surveillance Applications

6.5 Gyroscopes

6.5.1 Used for Situational Awareness in Automotive, Aerospace, and Industrial Sectors

6.6 Display & Notification Devices

6.6.1 Used in Defence and Automotive Applications

6.7 NVRS & DVRS

6.7.1 Widely Adopted in Surveillance Applications

6.8 Other Components

7 Situational Awareness Market, By Product (Page No. - 60)

7.1 Introduction

7.2 Fire and Flood Alarm Systems

7.2.1 Fire and Flood Alarm Systems are Used to Provide Situational Awareness to Notify Fire Or Flood Instances

7.3 Human–Machine Interfaces

7.3.1 Helmet-Mounted Displays

7.3.1.1 Helmet-Mounted Displays Find Wide Applications in Combat Aircraft

7.3.2 Multifunction Displays

7.3.2.1 Multifunction Displays are Significantly Adopted in Aircraft

7.4 Radio Frequency Identification Solutions

7.4.1 RFID-Based Situational Awareness is Used Widely in Healthcare, Safety, and Defence Applications

7.5 Access Control Solutions

7.5.1 Access Control Systems are Widely Adopted in Various Products Used for Security Purposes

7.6 Radar Systems

7.6.1 Radar Systems are Widely Adopted in Detection of Aircraft, Spacecraft, and Ships

7.7 Chemical Biological Radiological Nuclear Systems

7.7.1 CBRN is Mostly Used in Armed Forces and Homeland Security

7.8 Command & Control Systems

7.8.1 Command & Control Systems are Widely Used in CRISIS Planning

7.9 Sonar Systems

7.9.1 Sonar Systems are Used to Achieve Enhanced Situational Awareness About Ocean Environment

7.1 Physical Security Information Management Solutions

7.10.1 PSIM Solutions Organize, Analyze, and Manage Information That is Produced By Security Systems and Sensors

8 Situational Awareness Market, By Application (Page No. - 76)

8.1 Introduction

8.2 Robots

8.2.1 Robots Can Be Used in Multiple Missions for Military Troops and Public Safety

8.3 Driving & Connected Cars

8.3.1 Rising Adoption of Connected and Autonomous Cars to Propel Market Growth

8.4 Business Intelligence

8.4.1 Situational Awareness Can Help in Analyzing, Interpreting, and Sharing Information for Businesses, Which Would Help in Decision Making

8.5 Disaster Response

8.5.1 Situational Awareness Helps in Providing Immediate Assistance in Case of Disasters

8.6 Security & Surveillance

8.6.1 Situational Awareness in Security & Surveillance is Important for Homeland Security and Maritime Security

8.7 Environmental Impact Tracking

8.7.1 Situational Awareness Systems Enable Environmental Impact Tracking

8.8 Logistics

8.8.1 Situational Awareness Helps in Providing Advanced Systems to Protect, Enhance, and Ensure Flexibility in Entire Supply Chain Across Various Industries

8.9 Natural and Cultural Resources

8.9.1 Situational Awareness Helps in Preserving and Protecting Resources

8.10 Smart Infrastructure Management

8.10.1 Situational Awareness Helps in Infrastructure Management By Providing Real Time Data and Conditions

8.11 CRISIS Management

8.11.1 Situational Awareness Helps in CRISIS Management By Providing Actionable Insights During CRISIS

9 Other Applications of Situational Awareness (Page No. - 87)

9.1 Introduction

9.2 Integration Solutions

9.3 Risk Management

9.4 Dynamic Mapping

9.5 Data Analysis and Visualization

10 Situational Awareness Market, By Industry (Page No. - 89)

10.1 Introduction

10.2 Military & Defense

10.2.1 Situational Awareness Allows Military Troops to Better Plan and Make Decisions

10.3 Aviation

10.3.1 Situational Awareness Monitors State of Aircraft, Its Systems, and Its Environment to Make Decisions, Revise Plans, and Manage Aircraft

10.4 Maritime Security

10.4.1 Maritime Situational Awareness is Used in Detecting Threats in Sea By Extracting Useful Information From Variety of Data Sources Using Automated Techniques and Advanced Algorithms

10.5 Cybersecurity

10.5.1 Situational Awareness Solutions are Used to Predict and Respond to Potential Problems in Cyberspace

10.6 Automotive

10.6.1 Increasing Demand for Safety Measures in Automotive Industry to Spur Growth of Situational Awareness Market

10.7 Healthcare

10.7.1 Situational Awareness Solutions are Used in Healthcare Industry to Analyse Patient Safety and Healthcare Quality Issues

10.8 Construction

10.8.1 Situational Awareness Systems are Deployed in Construction Sites to Increase Safety and Productivity

10.9 Industrial

10.9.1 Situational Awareness Solutions Provide High Level of Visibility Into Control Systems

10.10 Homeland Security

10.10.1 Situational Awareness Solutions Provide Timely Detection of Cyber Incidents and Real-Time Awareness of Current Threats

11 Situational Awareness Market, By Geography (Page No. - 111)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Largest Defense Budget has Fueled the Growth of Situational Awareness Market

11.2.2 Canada

11.2.2.1 Government Initiatives Such as Masas Will Propel Growth of Situational Awareness

11.2.3 Mexico

11.2.3.1 Underdeveloped Situational Awareness Market Will Provide Significant Opportunities

11.3 Europe

11.3.1 Germany

11.3.1.1 Significant Developments in Situational Awareness Expected for Automotive Applications

11.3.2 UK

11.3.2.1 Significant Investments in Defense Sector to Propel Situational Awareness Market Growth

11.3.3 France

11.3.3.1 Aerospace Sector Plays Important Role in Driving Growth of Situational Awareness Market

11.3.4 Italy

11.3.4.1 Collaborations and Partnerships in the Aerospace Industry to Fuel Market Growth

11.3.5 Russia

11.3.5.1 Focus on Space Situational Awareness

11.3.6 Rest of Europe

11.4 APAC

11.4.1 China

11.4.1.1 Growing Military Investments to Propel the Growth of Situational Awareness Market

11.4.2 Japan

11.4.2.1 Strong Disaster Management Policies to Promote the Use of Situational Awareness Systems

11.4.3 India

11.4.3.1 Industrial and Infrastructure Domains to Lead the Situational Awareness Market

11.4.4 South Korea

11.4.4.1 Military & Defense and Aviation Sectors to Drive Situational Awareness Market

11.4.5 Rest of APAC

11.5 RoW

11.5.1 Middle East & Africa

11.5.2 South America

12 Competitive Landscape (Page No. - 131)

12.1 Overview

12.2 Market Ranking Analysis

12.2.1 Product Launches

12.2.2 Agreements/Collaborations/Partnerships/Contracts

12.2.3 Mergers & Acquisitions

12.2.4 Expansions

12.3 Competitive Leadership Mapping

12.3.1 Visionary Leaders

12.3.2 Innovators

12.3.3 Dynamic Differentiators

12.3.4 Emerging Players

13 Company Profiles (Page No. - 137)

(Business Overview, Products and Solutions Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Key Players

13.1.1 General Electric

13.1.2 Lockheed Martin

13.1.3 Honeywell

13.1.4 Denso

13.1.5 BAE Systems

13.1.6 United Technologies Corp (UTC)

13.1.7 Microsoft Corporation

13.1.8 Barco

13.1.9 Advanced Micro Devices (AMD)

13.1.10 L3harris Technologies

13.2 Right-To-Win

13.3 Other Key Players

13.3.1 General Dynamics

13.3.2 Xilinx

13.3.3 Qualcomm

13.3.4 Robert Bosch

13.3.5 Pleora Technologies

13.3.6 Nexvision

13.3.7 Bertin Instruments

13.3.8 Axis Communications

13.3.9 Johnson Controls

13.3.10 Boeing

13.3.11 Airbus

13.3.12 Sensara

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 173)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (109 Tables)

Table 1 Situational Awareness Market, By Component, 2017–2025 (USD Million)

Table 2 Situational Awareness Market for Sensors, By Product, 2017–2025 (USD Million)

Table 3 Situational Awareness Market for GPS, By Product, 2017–2025 (USD Million)

Table 4 Situational Awareness Market for Cameras, By Product, 2017–2025 (USD Million)

Table 5 Situational Awareness Market for Gyroscopes, By Product, 2017–2025 (USD Million)

Table 6 Situational Awareness Market for Display & Notification Devices, By Product, 2017–2025 (USD Million)

Table 7 Situational Awareness Market, for NVRS & DVRS, By Product, 2017–2025 (USD Million)

Table 8 Situational Awareness Market for Other Components, By Product, 2017–2025 (USD Million)

Table 9 Situational Awareness Market, By Product, 2017–2025 (USD Million)

Table 10 Situational Awareness Market for Fire & Flood Alarm Systems, By Component, 2017–2025 (USD Million)

Table 11 Situational Awareness Market for Fire & Flood Alarm Systems, By Region, 2017–2025 (USD Million)

Table 12 Situational Awareness Market for HMI, By Component, 2017–2025 (USD Million)

Table 13 Situational Awareness Market for HMI, By Region, 2017–2025 (USD Million)

Table 14 Situational Awareness Market for HMI, By Type, 2017–2025 (USD Million)

Table 15 Situational Awareness Market for HMD, By Region, 2017–2025 (USD Million)

Table 16 Situational Awareness Market for MFD, By Region, 2017–2025 (USD Million)

Table 17 Situational Awareness Market for RFID Solutions, By Component, 2017–2025 (USD Million)

Table 18 Situational Awareness Market for RFID Solutions, By Region, 2017–2025 (USD Million)

Table 19 Situational Awareness Market for Access Control Solutions, By Component, 2017–2025 (USD Million)

Table 20 Situational Awareness Market for Access Control Solutions, By Region, 2017–2025 (USD Million)

Table 21 Situational Awareness Market for Radar Systems, By Component, 2017–2025 (USD Million)

Table 22 Situational Awareness Market for Radar Systems, By Region, 2017–2025 (USD Million)

Table 23 Situational Awareness Market for CBRN Systems, By Component, 2017–2025 (USD Million)

Table 24 Situational Awareness Market for CBRN Systems, By Region, 2017–2025 (USD Million)

Table 25 Situational Awareness Market for Command & Control Systems, By Component, 2017–2025 (USD Million)

Table 26 Situational Awareness Market for Command & Control Systems, By Region, 2017–2025 (USD Million)

Table 27 Situational Awareness Market for Sonar Systems, By Component, 2017–2025 (USD Million)

Table 28 Situational Awareness Market for Sonar Systems, By Sonar Type, 2017–2025 (USD Million)

Table 29 Situational Awareness Market for Sonar Systems, By Region, 2017–2025 (USD Million)

Table 30 Situational Awareness Market for PSIM Solutions, By Component, 2017–2025 (USD Million)

Table 31 Situational Awareness Market for PSIM Solutions, By Region, 2017–2025 (USD Million)

Table 32 Situational Awareness Market, By Application, 2017–2025 (USD Million)

Table 33 Situational Awareness Market for Robots, By Region, 2017–2025 (USD Million)

Table 34 Situational Awareness Market for Driving & Connected Cars Application, By Region, 2017–2025 (USD Million)

Table 35 Situational Awareness Market for Business Intelligence Application, By Region, 2017–2025 (USD Million)

Table 36 Situational Awareness Market for Disaster Response Application, By Region, 2017–2025 (USD Million)

Table 37 Situational Awareness Market for Security & Surveillance Application, By Region, 2017–2025 (USD Million)

Table 38 Situational Awareness Market for Environmental Impact Tracking Application, By Region, 2017–2025 (USD Million)

Table 39 Situational Awareness Market for Logistics Application, By Region, 2017–2025 (USD Million)

Table 40 Situational Awareness Market for Natural & Cultural Resources Application, By Region, 2017–2025 (USD Million)

Table 41 Situational Awareness Market for Smart Infrastructure Management Application, By Region, 2017–2025 (USD Million)

Table 42 Situational Awareness Market for CRISIS Management Application, By Region, 2017–2025 (USD Million)

Table 43 Situational Awareness Market, By Industry, 2017–2025 (USD Million)

Table 44 Situational Awareness Market for Military & Defense Industry, By Region, 2017–2025 (USD Million)

Table 45 Situational Awareness Market for Military & Defense Industry in North America, By Country, 2017–2025 (USD Million)

Table 46 Situational Awareness Market for Military & Defense Industry in Europe, By Country, 2017–2025 (USD Million)

Table 47 Situational Awareness Market for Military & Defense Industry in APAC, By Country, 2017–2025 (USD Million)

Table 48 Situational Awareness Market for Military & Defense Industry in RoW, By Region, 2017–2025 (USD Million)

Table 49 Situational Awareness Market for Aviation Industry, By Region, 2017–2025 (USD Million)

Table 50 Situational Awareness Market for Aviation Industry in North America, By Country, 2017–2025 (USD Million)

Table 51 Situational Awareness Market for Aviation Industry in Europe, By Country, 2017–2025 (USD Million)

Table 52 Situational Awareness Market for Aviation Industry in APAC, By Country, 2017–2025 (USD Million)

Table 53 Situational Awareness Market for Aviation Industry in RoW, By Region, 2017–2025 (USD Million)

Table 54 Situational Awareness Market for Maritime Security Industry, By Region, 2017–2025 (USD Million)

Table 55 Situational Awareness Market for Maritime Security Industry in North America, By Country, 2017–2025 (USD Million)

Table 56 Situational Awareness Market for Maritime Security Industry in Europe, By Country, 2017–2025 (USD Million)

Table 57 Situational Awareness Market for Maritime Security Industry in APAC, By Country, 2017–2025 (USD Million)

Table 58 Situational Awareness Market for Maritime Security Industry in RoW, By Region, 2017–2025 (USD Million)

Table 59 Situational Awareness Market for Cybersecurity Industry, By Region, 2017–2025 (USD Million)

Table 60 Situational Awareness Market for Cybersecurity Industry in North America, By Country, 2017–2025 (USD Million)

Table 61 Situational Awareness Market for Cybersecurity Industry in Europe, By Country, 2017–2025 (USD Million)

Table 62 Situational Awareness Market for Cybersecurity Industry in APAC, By Country, 2017–2025 (USD Million)

Table 63 Situational Awareness Market for Cybersecurity Industry in RoW, By Region, 2017–2025 (USD Million)

Table 64 Situational Awareness Market for Automotive Industry, By Region, 2017–2025 (USD Million)

Table 65 Situational Awareness Market for Automotive Industry in North America, By Country, 2017–2025 (USD Million)

Table 66 Situational Awareness Market for Automotive Industry in Europe, By Country, 2017–2025 (USD Million)

Table 67 Situational Awareness Market for Automotive Industry in APAC, By Country, 2017–2025 (USD Million)

Table 68 Situational Awareness Market for Automotive Industry in RoW, By Region, 2017–2025 (USD Million)

Table 69 Situational Awareness Market for Healthcare Industry, By Region, 2017–2025 (USD Million)

Table 70 Situational Awareness Market for Healthcare Industry in North America, By Country, 2017–2025 (USD Million)

Table 71 Situational Awareness Market for Healthcare Industry in Europe, By Country, 2017–2025 (USD Million)

Table 72 Situational Awareness Market for Healthcare Industry in APAC, By Country, 2017–2025 (USD Million)

Table 73 Situational Awareness Market for Healthcare Industry in RoW, By Region, 2017–2025 (USD Million)

Table 74 Situational Awareness Market for Construction Industry, By Region, 2017–2025 (USD Million)

Table 75 Situational Awareness Market for Construction Industry in North America, By Country, 2017–2025 (USD Million)

Table 76 Situational Awareness Market for Construction Industry in Europe, By Country, 2017–2025 (USD Million)

Table 77 Situational Awareness Market for Construction Industry in APAC, By Country, 2017–2025 (USD Million)

Table 78 Situational Awareness Market for Construction Industry in RoW, By Region, 2017–2025 (USD Million)

Table 79 Situational Awareness Market for Industrial, By Region, 2017–2025 (USD Million)

Table 80 Situational Awareness Market for Industrial in North America, By Country, 2017–2025 (USD Million)

Table 81 Situational Awareness Market for Industrial in Europe, By Country, 2017–2025 (USD Million)

Table 82 Situational Awareness Market for Industrial in APAC, By Country, 2017–2025 (USD Million)

Table 83 Situational Awareness Market for Industrial in RoW, By Region, 2017–2025 (USD Million)

Table 84 Situational Awareness Market for Homeland Security, By Region, 2017–2025 (USD Million)

Table 85 Situational Awareness Market for Homeland Security in North America, By Country, 2017–2025 (USD Million)

Table 86 Situational Awareness Market for Homeland Security in Europe, By Country, 2017–2025 (USD Million)

Table 87 Situational Awareness Market for Homeland Security in APAC, By Country, 2017–2025 (USD Million)

Table 88 Situational Awareness Market for Homeland Security in RoW, By Region, 2017–2025 (USD Million)

Table 89 Situational Awareness Market, By Region, 2017–2025 (USD Million)

Table 90 Situational Awareness Market in North America, By Country, 2017–2025 (USD Million)

Table 91 Situational Awareness Market in North America, By Product, 2017–2025 (USD Million)

Table 92 Situational Awareness Market in North America, By Application Type, 2017–2025 (USD Million)

Table 93 Situational Awareness Market in North America, By Industry, 2017–2025 (USD Million)

Table 94 Situational Awareness Market in Europe, By Country, 2017–2025 (USD Million)

Table 95 Situational Awareness Market in Europe, By Product, 2017–2025 (USD Million)

Table 96 Situational Awareness Market in Europe, By Application Type, 2017–2025 (USD Million)

Table 97 Situational Awareness Market in Europe, By Industry, 2017–2025 (USD Million)

Table 98 Situational Awareness Market in APAC, By Country, 2017–2025 (USD Million)

Table 99 Situational Awareness Market in APAC, By Product, 2017–2025 (USD Million)

Table 100 Situational Awareness Market in APAC, By Application Type, 2017–2025 (USD Million)

Table 101 Situational Awareness Market in APAC, By Industry, 2017–2025 (USD Million)

Table 102 Automotive Sensors Market in RoW, By Region, 2017–2025 (USD Million)

Table 103 Situational Awareness Market in RoW, By Product, 2017–2025 (USD Million)

Table 104 Situational Awareness Market in RoW, By Application Type, 2017–2025 (USD Million)

Table 105 Situational Awareness Market in RoW, By Industry, 2017–2025 (USD Million)

Table 106 Product Launches, 2019

Table 107 Agreements/Collaborations/Partnerships/Contracts, 2019

Table 108 Mergers & Acquisitions, 2019

Table 109 Expansions, 2019

List of Figures (57 Figures)

Figure 1 Segmentation of Situational Awareness Market

Figure 2 Situational Awareness Market: Process Flow of Market Size Segmentation

Figure 3 Situational Awareness Market: Research Design

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Supply Side Analysis

Figure 6 Market Size Estimation Methodology: Approach 1 (Supply Side): Revenue of Products of Situational Awareness Market

Figure 7 Market Size Estimation Methodology: Approach 1 (Demand Side): Revenue of Products of Situational Awareness Market

Figure 8 Situational Awareness Market: Bottom-Up Approach

Figure 9 Situational Awareness Market: Top-Down Approach

Figure 10 Assumptions for Research Study

Figure 11 Situational Awareness Market for Sensors to Grow at Highest CAGR During Forecast Period

Figure 12 Security & Surveillance Application to Dominate Situational Awareness Market in 2025

Figure 13 Command and Control Systems to Hold Largest Size of Situational Awareness Market in 2025

Figure 14 North America to Hold Largest Share of Situational Awareness Market in 2025

Figure 15 Growing Demand for Situational Awareness Solutions in Aviation and Military Industries to Drive Market Growth

Figure 16 Security & Surveillance and US to Be Largest Shareholders of Situational Awareness Market in 2025

Figure 17 Situational Awareness Market in China to Grow at Highest CAGR During Forecast Period

Figure 18 Situational Awareness Market Dynamics

Figure 19 Situational Awareness Market Drivers and Their Impact

Figure 20 US Defence Spending, 2010–2020

Figure 21 Malware Infection in US, 2009–2018

Figure 22 Situational Awareness Market Opportunities and Its Impact

Figure 23 Regional Infrastructure Investment Needs, 2016–2040

Figure 24 Solar PV Power Generation in Sustainable Development Scenario, 2010–2024

Figure 25 Situational Awareness Market Restraints and Challenges, and Their Impact

Figure 26 Situational Awareness Market, By Component

Figure 27 Sensors to Lead Situational Awareness Component Market in 2025

Figure 28 Situational Awareness Market, By Product

Figure 29 Command and Control Systems to Lead Situational Awareness Product Market in 2025

Figure 30 Sensors to Lead Situational Awareness Market for Fire & Flood Alarm Systems in 2025

Figure 31 Three Levels of Situational Awareness

Figure 32 Sensors to Lead Situational Awareness Component Market for Command and Control Systems in 2025

Figure 33 Situational Awareness Market, By Application

Figure 34 Security and Surveillance to Hold Largest Size of Situational Awareness Market, By Application in 2025

Figure 35 Economic Losses From Natural Disaster Globally

Figure 36 Situational Awareness Market, By Industry

Figure 37 Military & Defence to Dominate Situational Awareness Market, By Industry in 2025

Figure 38 APAC to Dominate Automotive Sensors Market During Forecast Period

Figure 39 North America: Situational Awareness Market Snapshot

Figure 40 US to Lead Situational Awareness Market in North America

Figure 41 Europe: Situational Awareness Market Snapshot

Figure 42 Germany to Lead Situational Awareness Market in Europe During Forecast Period

Figure 43 APAC: Situational Awareness Market Snapshot

Figure 44 China to Lead Situational Awareness Market in APAC During Forecast Period

Figure 45 Middle East & Africa to Lead Situational Awareness Market in RoW During Forecast Period

Figure 46 Organic and Inorganic Strategies Adopted By Companies Operating in the Situational Awareness Market

Figure 47 Market Player Ranking, 2019

Figure 48 Situational Awareness (Global) Competitive Leadership Mapping, 2019

Figure 49 General Electric: Company Snapshot

Figure 50 Lockheed Martin: Company Snapshot

Figure 51 Honeywell: Company Snapshot

Figure 52 Denso: Company Snapshot

Figure 53 BAE Systems: Company Snapshot

Figure 54 UTC: Company Snapshot

Figure 55 Microsoft Corporation: Company Snapshot

Figure 56 Barco: Company Snapshot

Figure 57 Advanced Micro Devices: Company Snapshot

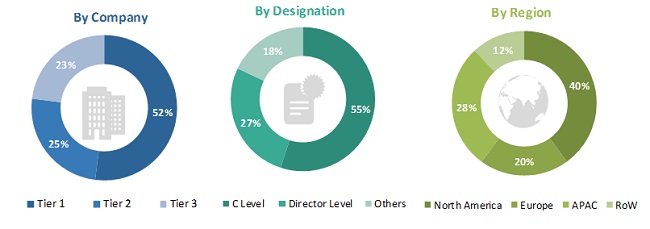

The study has involved four major activities in estimating the size of the situational awareness market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The situational awareness market comprises several stakeholders, such as product manufacturers and the system integrators of the supply chain. The demand side of this market includes product manufacturers and end-use applications, such as military & defense, aviation, maritime security, cybersecurity, automotive, healthcare, homeland security, among others.

Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the situational awareness market. These approaches have also been used to determine the size of various subsegments of the market. The research methodology used to estimate the market size is as follows:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- Players offering various types of situational awareness products are considered, their revenue for sensors has been analyzed to arrive at the global numbers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the gas sensors market.

Report Objectives

- To estimate and forecast the size of the situational awareness market based on component, product, industry, application, and region, in terms of value

- To determine and forecast the size of the market in North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the situational awareness market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market ranking in 2018 according to their revenue and core competencies2, along with a detailed competitive landscape of market leaders

- To analyze competitive developments, such as product launches, partnerships, acquisitions, and expansions, in the situational awareness market

- To benchmark players within the market using proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

1. Micro markets are defined as the further segments and subsegments of the situational awareness market included in the report.

2. The core competencies of the companies are captured in terms of their key developments and key strategies adopted by them to sustain their position in the situational awareness market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Situational Awareness Market