Solid-State and Other Energy-Efficient Lighting Market by Technology (Solid-State, HID, Fluorescent), Installation Type (New & Retrofit), Offering (Hardware, Software, & Services), Application, and Geography - Global Forecast to 2022

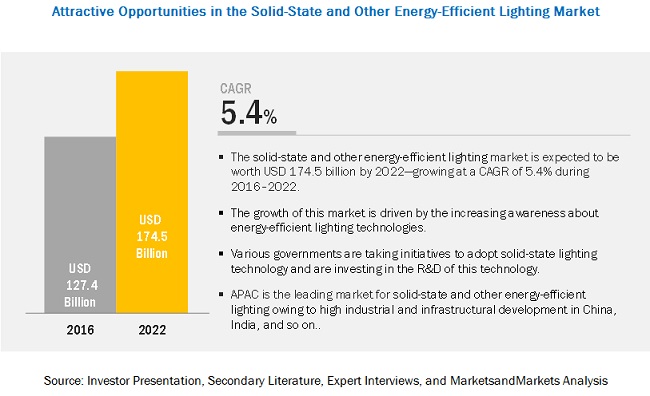

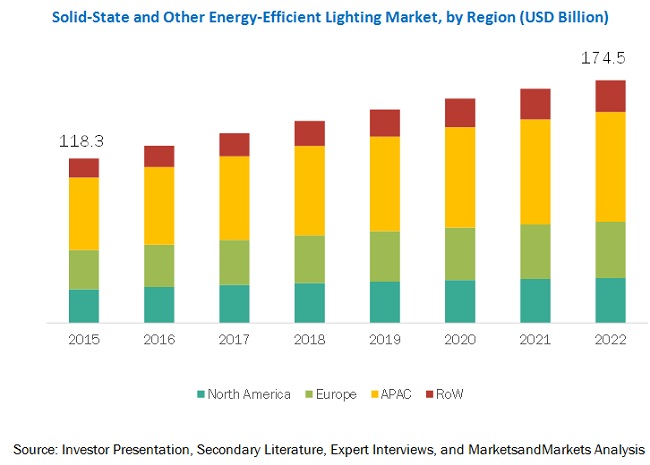

[179 Pages Report] MarketsandMarkets forecasts the Solid-State and Other Energy-Efficient Lighting market to grow from USD 118.3 billion in 2015 to USD 174.5 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 5.4% during the forecast period. The growth of this market is driven by the increasing awareness about energy-efficient lighting technologies. The objective of the report is to define, describe, and forecast the solid-state and other energy-efficient lighting market size based on technology, installation type, application, offering, and region.

Helped a leading vendor in the lighting business to target opportunities worth ~USD 500 million in Canadian industrial lighting sector

Clients Problem Statement

A leading vendor in the lighting business was keen to understand the industrial lighting market, which is one of the general lighting applications, in Canada. Moreover, the client was also looking forward to understanding the product segment of the market in the said geography.

MnM Approach

The client engaged MnM to conduct a study with multiple objectives.

A detailed list of vendors in the industrial lighting ecosystem in the North American region have been provided to the client.

A comprehensive study of products offered by key vendors and their recent developments in the targeted geography has been provided.

Market sizing and forecasting of the industrial lighting market in North America and its different products such as linear lighting, spot lighting, flood lighting, high bay lighting, and so on have been provided.

Revenue Impact (RI)

This has helped client to target opportunities worth ~USD 2 billion in the said geographies.

Market for service is expected to grow at the highest CAGR during the forecast period.

On the basis of offering, the solid-state and other energy-efficient lighting market has been segmented into hardware, software, and services. The market for services is expected to grow at the highest CAGR during the forecast period. Growing urbanization and expansion of cities are the major reasons for the growth of services in the solid-state and other energy-efficient lighting market.

The automotive lighting segment is expected to grow at the highest CAGR during the forecast period

In terms of application, the market for automotive lighting is expected to grow at the highest rate during the forecast period. Solid-state and other energy-efficient lighting technology is providing benefits such as high efficiency and long battery life to automotive manufacturers. Owing to these benefits, the automotive sector is largely adopting this technology for use in vehicles.

APAC expected to account for the largest market share during the forecast period

APAC is expected to hold the largest size of the solid-state and other energy-efficient lighting market during the forecast period. The increasing adoption of solid-state and other energy-efficient lighting in indoor and outdoor lighting in developing countries such as India and China is driving the growth of the market in APAC. Also, the increased construction activities in APAC are contributing to the growth of the market in the region

Market Dynamics

Driver: Greater Energy Savings Compared to Other Forms of Lighting

LEDs consume 50% and 85% lesser electricity than fluorescent lamps and incandescent lights, respectively. The long life of LEDs makes them the best lighting solution for museums and libraries. The impact of this driver is high since end users are inclined toward lighting devices and technologies with low energy consumption. The impact is expected to remain high for the next couple of years and will be one of the major factors for the lighting industry in terms of energy consumption. It is worth comparing the traditional tungsten incandescent light performance with new LED technology to look at energy reduction and savings potential by moving to LED lighting or solid-state lighting. The table below depicts the total cost of energy use. It includes the cost of replacing burned-out lights. Incandescent 100W light bulbs are already not in use in some countries and will soon be phased out in others.

Restraint: High Implementation and Equipment Cost

Though solid-state and other energy-efficient lighting is able to save costs in the long run, the initial cost of implementation and equipment is very high. LED lamps are approximately 20 times costlier than conventional incandescent lamps. However, the mass production of LED lamps and evolving lighting technologies are expected to reduce price and increase their demand in the future. The impact of this restraint is high across different end users. However, in the coming years, the impact is expected to be quite low.

Opportunity: Growing Adoption of LEDs in the Automotive Industry

The automotive lighting market has undergone a tremendous change in the last five years as many innovative and adaptive technologies penetrated the market. LEDs, which were first used as ambient lighting in car interiors and in indicator light applications, have become versatile backlight displays and headlamps. Similar to the evolution of microcontrollers, LEDs are being sold in module format in combination with a variety of widely used peripherals. LEDs have an adaptable design and are more energy efficient than most lighting technologies. The cost of LEDs is expected to drop in the next three years with the increase in engineering capabilities and technological advances. LEDs are expected to have the capability to replace all other types of automotive lamps. LEDs are already used in exterior lights (front and rear), brake lights, daytime running lamps (DRLs), and indicators. They are also used in ambient lighting and dashboard and instrument lighting.

Challenge: Rapidly Rising Testing Cost

With the increasing number of products and product variations entering the market, rapidly rising testing cost has become an important issue for manufacturers. While per-product testing plays a critical role in early product quality and buyers confidence in LED technology, it is becoming a hindrance to product line expansion. To meet the needs of the lighting market, testing costs will have to decrease to allow faster and more efficient lighting product line development.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20132022 |

|

Base year considered |

2015 |

|

Forecast period |

20162022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Technology, Installation Type, Application, Offering, and Region |

|

Geographies covered |

North America, Europe, APAC, RoW |

|

Companies covered |

OSRAM Licht AG (Germany), Royal Philips Electronics N.V. (Netherlands), Seoul Semiconductor Co., Ltd. (South Korea), General Electric Company (US), Nichia Corporation (Japan), AIXTRON SE (Germany), Applied Materials, Inc. (US), Applied Science and Technology Research Institute Company Limited (Hong Kong), Bridgelux, Inc. (US), Cree, Inc. (US), Acuity Brands, Inc. (US), Advanced Lighting Technologies, Inc. (US), Energy Focus, Inc. (US), Intematix Corporation (US), LED Engin, Inc. (US), Toyoda Gosei Co., Ltd. (Japan), TCP International Holdings Ltd. (Switzerland), Topanga Technologies, Inc. (US), Ceravision Ltd (UK), and Bright Light Systems, Inc. (Georgia). |

The research report categorizes the solid-state and other energy-efficient lighting market to forecast the revenues and analyze the trends in each of the following sub-segments:

Solid-State and Other Energy-Efficient Lighting Market, By Technology

- Solid-State Lighting

- HID Lighting

- Fluorescent Lighting

- Others (Plasma and Induction Lighting)

Solid-State and Other Energy-Efficient Lighting Market, By Installation Type

- New Installation

- Retrofit Installation

Solid-State and Other Energy-Efficient Lighting Market, By Application

- General Lighting

- Backlighting

- Automotive Lighting

- Medical Lighting

- Others (Projector and Emergency Lighting)

Solid-State and Other Energy-Efficient Lighting Market, by Offering

- Hardware

- Software

- Services

Geographic Analysis

- North America

- Europe

- APAC

- RoW

Key Market Players

Key players in the solid-state and other energy-efficient lighting market include OSRAM Licht AG (Germany), Royal Philips Electronics N.V. (Netherlands), Seoul Semiconductor Co., Ltd. (South Korea), General Electric Company (US), Nichia Corporation (Japan), AIXTRON SE (Germany), Applied Materials, Inc. (US), Applied Science and Technology Research Institute Company Limited (Hong Kong), Bridgelux, Inc. (US), Cree, Inc. (US), Acuity Brands, Inc. (US), Advanced Lighting Technologies, Inc. (US), Energy Focus, Inc. (US), Intematix Corporation (US), LED Engin, Inc. (US), Toyoda Gosei Co., Ltd. (Japan), TCP International Holdings Ltd. (Switzerland), Topanga Technologies, Inc. (US), Ceravision Ltd (UK), and Bright Light Systems, Inc. (Georgia).

OSRAM Licht AG (Germany) was ranked first in the solid-state and other energy-efficient lighting market. The company focuses on strategies such as new product launches and acquisitions to grow in the market. In July 2016, the company signed an agreement with LEDVANCE (China) to grow its sales and distribution network. In November 2015, the company opened a new application center in Shanghai. This brings OSRAM closer to business customers in the Asian region. The company has diversified business operations along with a strong portfolio of lighting solutions in the solid-state and other energy-efficient lighting market.

Recent Developments

- In December 2016, OSRAM launched DL 30 LED which can be used for illuminating squares, crossings, parks, and residential areas. It has a special feature of asymmetric wide light distribution.

- In December 2016, Cree, Inc. introduced the XLamp XHP50.2 LED which delivers up to 7% more lumens and 10% higher lumens per watt (LPW) than the first-generation XHP50 LED in the same package.

- In April 2016, Acuity Brands, Inc. introduced a breakthrough LED lighting innovation that aims to empower schools to use classroom lighting to improve student learning and attention. The new BLT Series Tunable White Luminaire from Lithonia Lighting allows both the light level and color temperature to be easily adjusted to optimal setting for student tasks such as reading or test-taking.

- In May 2015, Philips announced the launch of ActiveSite, a cloud-based connected lighting management platform. It allows the companys architectural LED lighting systems to be monitored, maintained, and managed remotely, and its content can be uploaded from anywhere in the world.

- In March 2015, GE announced a new technology, TriGain, which is the enhanced version of potassium fluorosilicate (PFS) phosphors. TriGain phosphors offer improved narrow red band performance and can be used in LED-based display backlight applications.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for solid-state and other energy efficient lighting market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction

1.1 Study Objective

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years considered for the study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Secondary and Primary Research

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

6 Industry Trends

6.1 Introduction

6.2 Value Chain Analysis

6.3 Key Trends

7 Solid-State and Other Energy-Efficient Lighting Market, By Technology

7.1 Introduction

7.2 Solid-State Lighting

7.2.1 LEDs

7.2.1.1 Types of LEDs

7.2.2 OLEDs and Others

7.3 High Intensity Discharge (HID) Lighting

7.4 Fluorescent Lighting

7.5 Others

8 Solid-State and Other Energy-Efficient Lighting Market, By Communication Technology (Qualitative)

8.1 Introduction

8.2 Wired Technology

8.2.1 Digital Addressable Lighting Interface

8.2.2 Power-Line Communication

8.2.3 Power Over Ethernet

8.2.4 Wired Hybrid Protocols

8.3 Wireless Technology

8.3.1 Zigbee

8.3.2 Bluetooth/Bluetooth Low Energy

8.3.3 Enocean

8.3.4 Wi-Fi

8.3.5 6lowpan

8.3.6 Wireless Hybrid Protocols

9 Solid-State and Other Energy-Efficient Lighting Market, By Installation Type

9.1 Introduction

9.2 New Installation

9.3 Retrofit Installation

10 Solid-State and Other Energy-Efficient Lighting Market, By Application

10.1 Introduction

10.2 General Lighting

10.2.1 Residential Lighting

10.2.2 Commercial Lighting

10.2.3 Industrial Lighting

10.2.4 Outdoor Lighting

10.2.5 Architectural Lighting

10.2.6 Educational Lighting

10.3 Backlighting

10.3.1 Consumer Electronics Lighting

10.3.2 Digital Signage Lighting

10.3.3 Defense and Avionics Lighting

10.4 Automotive Lighting

10.4.1 Head Lighting

10.4.2 Rear Lighting

10.4.3 Interior Lighting

10.5 Medical Lighting

10.5.1 Surgical and Treatment Lighting

10.5.2 General/Mounted Lighting

10.5.3 Examination Lighting and Other

10.6 Others

11 Solid-State and Other Energy-Efficient Lighting Market, by Offering

11.1 Introduction

11.2 Hardware

11.2.1 Lights and Bulbs

11.2.2 Luminaires

11.2.3 Control Systems

11.3 Software

11.4 Services

11.4.1 Pre-Installation

11.4.2 Post-Installation

12 Solid-State and Other Energy-Efficient Lighting Market, By Geography

12.1 Introduction

12.2 North America

12.2.1 US

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Germany

12.3.2 UK

12.3.3 France

12.3.4 Rest of Europe

12.4 APAC

12.4.1 China

12.4.2 Japan

12.4.3 South Korea

12.4.4 Rest of APAC

12.5 RoW

12.5.1 Middle East and Africa

12.5.2 South America

13 Competitive Landscape

14 Company Profiles (Overview, Products and Services, Financials, Strategy & Development)

14.1 Introduction

14.2 Osram Licht AG

14.3 Royal Philips Electronics N.V.

14.4 Seoul Semiconductor Co., Ltd.

14.5 General Electric Company

14.6 Nichia Corporation

14.7 Aixtron Se

14.8 Bridgelux, Inc.

14.9 Cree, Inc.

14.10 Acuity Brands Lighting, Inc.

14.11 Advanced Lighting Technologies, Inc.

14.12 Energy Focus, Inc.

14.13 Intematix Corporation

14.14 LED Engin, Inc.

14.15 Toyoda Gosei Co., Ltd.

14.16 TCP International Holdings Ltd.

14.17 Bright Light Systems

15 Key Innovators

15.1 Digital Lumens

15.2 Soraa

15.3 ARC Solid-State Lighting

15.4 Nanoleaf

16 Appendix

List of Tables (112 Tables)

Table 1 Solid-State and Other Energy-Efficient Lighting Market, By Technology

Table 2 Solid-State and Other Energy-Efficient Lighting Market, By Installation Type

Table 3 Solid-State and Other Energy-Efficient Lighting Market, By Offering

Table 4 Solid-State and Other Energy-Efficient Lighting Market, By Application

Table 5 Porters Five Forces Analysis: Competitive Rivalry Had Maximum Impact on the Overall Market

Table 6 Solid-State and Other Energy-Efficient Lighting Market, By Technology, 20172025(USD Billion)

Table 7 Market for Solid-State Lighting Technology, By Region, 20172025(USD Billion)

Table 8 Market for Solid-State Lighting Technology, By Type, 20172025(USD Billion)

Table 9 Market for LED Lighting in General Lighting Application, 20172025(USD Billion, Billion Units)

Table 10 Market for HID Lighting Technology, By Region, 20172025(USD Billion)

Table 11 Market for Fluorescent Lighting Technology, By Region, 20172025(USD Billion)

Table 12 Market for Other Technologies, By Region, 20172025(USD Billion)

Table 13 Solid-State and Other Energy-Efficient Lighting Market, By Installation Type, 20172025(USD Billion)

Table 14 Solid-State and Other Energy-Efficient Lighting Market for New Installation, By Region, 20172025(USD Billion)

Table 15 Solid-State and Other Energy-Efficient Lighting Market for Retrofit Installation, By Region, 20172025(USD Billion)

Table 16 Solid-State and Other Energy-Efficient Lighting Market, By Application, 20172025(USD Billion)

Table 17 Solid-State and Other Energy-Efficient Lighting Market for General Lighting, By Region, 20172025(USD Billion)

Table 18 Solid-State and Other Energy-Efficient Lighting Market for General Lighting, By Type, 20172025(USD Billion)

Table 19 Solid-State and Other Energy-Efficient Lighting Market for Residential Lighting, By Region, 20172025(USD Billion)

Table 20 Solid-State and Other Energy-Efficient Lighting Market for Commercial Lighting, By Region, 20172025(USD Billion)

Table 21 Solid-State and Other Energy-Efficient Lighting Market for Industrial Lighting, By Region, 20172025(USD Billion)

Table 22 Solid-State and Other Energy-Efficient Lighting Market for Outdoor Lighting, By Region, 20172025(USD Billion)

Table 23 Solid-State and Other Energy-Efficient Lighting Market for Architectural Lighting, By Region, 20172025(USD Billion)

Table 24 Solid-State and Other Energy-Efficient Lighting Market for Educational Lighting, By Region, 20172025(USD Billion)

Table 25 Solid-State and Other Energy-Efficient Lighting Market for Backlighting, By Region, 20172025(USD Billion)

Table 26 Solid-State and Other Energy-Efficient Lighting Market for Backlighting, By Type, 20172025(USD Billion)

Table 27 Solid-State and Other Energy-Efficient Lighting Market for Consumer Electronics Lighting, By Region, 20172025(USD Billion)

Table 28 Solid-State and Other Energy-Efficient Lighting Market for Digital Signage Lighting, By Region, 20172025(USD Billion)

Table 29 Solid-State and Other Energy-Efficient Lighting Market for Defense and Avionics Lighting, By Region, 20172025(USD Billion)

Table 30 Solid-State and Other Energy-Efficient Lighting Market for Automotive Lighting, By Region, 20172025(USD Billion)

Table 31 Solid-State and Other Energy-Efficient Lighting Market for Automotive Lighting, By Type, 20172025(USD Billion)

Table 32 Solid-State and Other Energy-Efficient Lighting Market for Head Lighting, By Region, 20172025(USD Billion)

Table 33 Solid-State and Other Energy-Efficient Lighting Market for Rear Lighting, By Region, 20172025(USD Billion)

Table 34 Solid-State and Other Energy-Efficient Lighting Market for Interior Lighting, By Region, 20172025(USD Billion)

Table 35 Solid-State and Other Energy-Efficient Lighting Market for Medical Lighting, By Region, 20172025(USD Billion)

Table 36 Solid-State and Other Energy-Efficient Lighting Market for Medical Lighting, By Type, 20172025(USD Billion)

Table 37 Solid-State and Other Energy-Efficient Lighting Market for Surgical and Treatment Lighting, By Region, 20172025(USD Billion)

Table 38 Solid-State and Other Energy-Efficient Lighting Market for General/Mounted Lighting, By Region, 20172025(USD Billion)

Table 39 Solid-State and Other Energy-Efficient Lighting Market for Examination Lighting and Others, By Region, 20172025(USD Billion)

Table 40 Solid-State and Other Energy-Efficient Lighting Market for Other Applications, By Region, 20172025(USD Billion)

Table 41 Solid-State and Other Energy-Efficient Lighting Market for Other Applications, By Type, 20172025(USD Billion)

Table 42 Solid-State and Other Energy-Efficient Lighting Market for Projector Lighting, By Region, 20172025(USD Billion)

Table 43 Solid-State and Other Energy-Efficient Lighting Market for Emergency Lighting, By Region, 20172025(USD Billion)

Table 44 Solid-State and Other Energy-Efficient Lighting Market, By Offering, 20172025(USD Billion)

Table 45 Solid-State and Other Energy-Efficient Lighting Market for Hardware, By Subcomponent, 20172025(USD Billion)

Table 46 Solid-State and Other Energy-Efficient Lighting Market for Hardware, By Region, 20172025(USD Billion)

Table 47 Solid-State and Other Energy-Efficient Lighting Market for Software, By Region, 20172025(USD Billion)

Table 48 Solid-State and Other Energy-Efficient Lighting Market for Services, By Region, 20172025(USD Billion)

Table 49 Solid-State and Other Energy-Efficient Lighting Market, By Region, 20172025(USD Billion)

Table 50 Solid-State and Other Energy-Efficient Lighting Market in North America, By Country, 20172025(USD Billion)

Table 51 Solid-State and Other Energy-Efficient Lighting Market in North America, By Technology, 20172025(USD Billion)

Table 52 Solid-State and Other Energy-Efficient Lighting Market in North America, By Offering, 20172025(USD Billion)

Table 53 Solid-State and Other Energy-Efficient Lighting Market in North America, By Installation Type, 20172025(USD Billion)

Table 54 Solid-State and Other Energy-Efficient Lighting Market in North America, By Application, 20172025(USD Billion)

Table 55 Solid-State and Other Energy-Efficient Lighting Market in US, By Technology, 20172025(USD Billion)

Table 56 Solid-State and Other Energy-Efficient Lighting Market in US, By Installation Type, 20172025(USD Billion)

Table 57 Solid-State and Other Energy-Efficient Lighting Market in US, By Application, 20172025(USD Billion)

Table 58 Solid-State and Other Energy-Efficient Lighting Market in Canada, By Technology, 20172025(USD Billion)

Table 59 Solid-State and Other Energy-Efficient Lighting Market in Canada, By Installation Type, 20172025(USD Billion)

Table 60 Solid-State and Other Energy-Efficient Lighting Market in Canada, By Application, 20172025(USD Billion)

Table 61 Solid-State and Other Energy-Efficient Lighting Market in Mexico, By Technology, 20172025(USD Billion)

Table 62 Solid-State and Other Energy-Efficient Lighting Market in Mexico, By Installation Type, 20172025(USD Billion)

Table 63 Solid-State and Other Energy-Efficient Lighting Market in Mexico, By Application, 20172025(USD Billion)

Table 64 Solid-State and Other Energy-Efficient Lighting Market in Europe, By Country, 20172025(USD Billion)

Table 65 Solid-State and Other Energy-Efficient Lighting Market in Europe, By Technology, 20172025(USD Billion)

Table 66 Solid-State and Other Energy-Efficient Lighting Market in Europe, By Offering, 20172025(USD Billion)

Table 67 Solid-State and Other Energy-Efficient Lighting Market in Europe, By Installation Type, 20172025(USD Billion)

Table 68 Solid-State and Other Energy-Efficient Lighting Market in UK, By Technology, 20172025(USD Billion)

Table 69 Solid-State and Other Energy-Efficient Lighting Market in UK, By Installation Type, 20172025(USD Billion)

Table 70 Solid-State and Other Energy-Efficient Lighting Market in UK, By Application, 20172025(USD Billion)

Table 71 Solid-State and Other Energy-Efficient Lighting Market in Germany, By Technology, 20172025(USD Billion)

Table 72 Solid-State and Other Energy-Efficient Lighting Market in Germany, By Installation Type, 20172025(USD Billion)

Table 73 Solid-State and Other Energy-Efficient Lighting Market in Germany, By Application, 20172025(USD Billion)

Table 74 Solid-State and Other Energy-Efficient Lighting Market in France, By Technology, 20172025(USD Billion)

Table 75 Solid-State and Other Energy-Efficient Lighting Market in France, By Installation Type, 20172025(USD Billion)

Table 76 Solid-State and Other Energy-Efficient Lighting Market in France, By Application, 20172025(USD Billion)

Table 77 Solid-State and Other Energy-Efficient Lighting Market in Rest of Europe, By Technology, 20172025(USD Billion)

Table 78 Solid-State and Other Energy-Efficient Lighting Market in Rest of Europe, By Installation Type, 20172025(USD Billion)

Table 79 Solid-State and Other Energy-Efficient Lighting Market in Rest of Europe, By Application, 20172025(USD Billion)

Table 80 Solid-State and Other Energy-Efficient Lighting Market in Europe, By Application, 20172025(USD Billion)

Table 81 Solid-State and Other Energy-Efficient Lighting Market in APAC, By Country, 20172025(USD Billion)

Table 82 Solid-State and Other Energy-Efficient Lighting Market in APAC, By Technology, 20172025(USD Billion)

Table 83 Solid-State and Other Energy-Efficient Lighting Market in APAC, By Offering, 20172025(USD Billion)

Table 84 Solid-State and Other Energy-Efficient Lighting Market in APAC, By Installation Type, 20172025(USD Billion)

Table 85 Solid-State and Other Energy-Efficient Lighting Market in APAC, By Application, 20172025(USD Billion)

Table 86 Solid-State and Other Energy-Efficient Lighting Market in Japan, By Technology, 20172025(USD Billion)

Table 87 Solid-State and Other Energy-Efficient Lighting Market in Japan, By Installation Type, 20172025(USD Billion)

Table 88 Solid-State and Other Energy-Efficient Lighting Market in Japan, By Application, 20172025(USD Billion)

Table 89 Solid-State and Other Energy-Efficient Lighting Market in China, By Technology, 20172025(USD Billion)

Table 90 Solid-State and Other Energy-Efficient Lighting Market in China, By Installation Type, 20172025(USD Billion)

Table 91 Solid-State and Other Energy-Efficient Lighting Market in China, By Application, 20172025(USD Billion)

Table 92 Solid-State and Other Energy-Efficient Lighting Market in South Korea, By Technology, 20172025(USD Billion

Table 93 Solid-State and Other Energy-Efficient Lighting Market in South Korea, By Installation Type, 20172025(USD Billion)

Table 94 Solid-State and Other Energy-Efficient Lighting Market in South Korea, By Application, 20172025(USD Billion)

Table 95 Solid-State and Other Energy-Efficient Lighting Market in Rest of APAC, By Technology, 20172025(USD Billion)

Table 96 Solid-State and Other Energy-Efficient Lighting Market in Rest of APAC, By Installation Type, 20172025(USD Billion)

Table 97 Solid-State and Other Energy-Efficient Lighting Market in Rest of APAC, By Application, 20172025(USD Billion)

Table 98 Solid-State and Other Energy-Efficient Lighting Market in RoW, By Region, 20172025(USD Billion)

Table 99 Solid-State and Other Energy-Efficient Lighting Market in RoW, By Technology, 20172025(USD Billion)

Table 100 Solid-State and Other Energy-Efficient Lighting Market in RoW, By Offering, 20172025(USD Billion)

Table 101 Solid-State and Other Energy-Efficient Lighting Market in RoW, By Installation Type, 20172025(USD Billion)

Table 102 Solid-State and Other Energy-Efficient Lighting Market in RoW, By Application, 20172025(USD Billion)

Table 103 Solid-State and Other Energy-Efficient Lighting Market in Middle East & Africa, By Technology, 20172025(USD Billion)

Table 104 Solid-State and Other Energy-Efficient Lighting Market in Middle East & Africa, By Installation Type, 20172025(USD Billion)

Table 105 Solid-State and Other Energy-Efficient Lighting Market in Middle East & Africa, By Application, 20172025(USD Billion)

Table 106 Solid-State and Other Energy-Efficient Lighting Market in South America, By Technology, 20172025(USD Billion)

Table 107 Solid-State and Other Energy-Efficient Lighting Market in South America, By Installation Type, 20172025(USD Billion)

Table 108 Solid-State and Other Energy-Efficient Lighting Market in South America, By Application, 20172025(USD Billion)

Table 109 Ranking of the Top 5 Players in the Solid-State and Other Energy-Efficient Lighting Market, 2019

Table 110 New Product Launches,

Table 111 Partnerships, Agreements, Expansions, Joint Ventures, and Collaborations

Table 112 Mergers and Acquisitions

List of Figures (73 Figures)

Figure 1 Solid-State and Other Energy-Efficient Lighting Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Assumptions of the Research Study

Figure 6 Growth of the Market, 20132022

Figure 7 Solid-State Lighting Technology Expected to Hold the Largest Size of the Overall Market During the Forecast Period

Figure 8 New Installation Expected to Hold the Largest Size of the Solid-State Lighting Technology Market During the Forecast Period

Figure 9 Market for Automotive Lighting Expected to Grow at the Highest Rate During the Forecast Period

Figure 10 Market for Services Expected to Grow at the Highest Rate During the Forecast Period

Figure 11 APAC Held the Largest Share of the Market in 2015

Figure 12 Adoption of Solid-State and Other Energy-Efficient Lighting Expected to Increase in RoW Between 2016 and 2022

Figure 13 Market for Services Expected to Grow at the Highest Rate During the Forecast Period

Figure 14 General Lighting Held the Largest Share of the Solid-State and Other Energy-Efficient Lighting Market in APAC in 2015

Figure 15 China Dominated the Solid-State and Other Energy-Efficient Lighting Market in 2015

Figure 16 Market for Automotive Lighting Expected to Grow at the Highest Rate During the Forecast Period

Figure 17 Market Segmentation

Figure 18 Market, By Geography

Figure 19 Increasing Government Initiatives Expected to Drive the Solid-State and Other Energy-Efficient Lighting Market

Figure 20 Value Chain Analysis: Major Value Added During Manufacturing and Distribution Phases

Figure 21 Porters Five Forces Analysis

Figure 22 Market: Porters Five Forces Analysis

Figure 23 Threat of New Entrants is Estimated to Be Moderate in 2015

Figure 24 Threat of Substitutes is Estimated to Be Moderate in 2015

Figure 25 Bargaining Power of Suppliers is Estimated to Be Moderate in 2015

Figure 26 Bargaining Power of Buyers is Estimated to Be High in 2015

Figure 27 Competitive Rivalry is Estimated to Be High in 2015

Figure 28 Market, By Technology

Figure 29 Solid-State Lighting Technology Expected to Dominate the Overall Market During the Forecast Period

Figure 30 Market for Solid-State Lighting Technology in RoW Expected to Grow at the Highest Rate During the Forecast Period

Figure 31 APAC Expected to Hold the Largest Share of the Market for Fluorescent Lighting Technology During the Forecast Period

Figure 32 Market, By Installation Type

Figure 33 New Installation Expected to Hold the Largest Share of the Market During the Forecast Period

Figure 34 Solid-State and Other Energy-Efficient Lighting Market, By Application

Figure 35 General Lighting Expected to Dominate the Market During the Forecast Period

Figure 36 General Lighting

Figure 37 APAC Expected to Hold the Largest Share of the Market for General Lighting During the Forecast Period

Figure 38 APAC Expected to Hold the Largest Share of the Solid-State and Other Energy-Efficient Lighting Market for Outdoor Lighting During the Forecast Period

Figure 39 Market for Defense and Avionics Lighting Expected to Grow at the Highest Rate During the Forecast Period

Figure 40 Market for Automotive Lighting in RoW Expected to Grow at the Highest Rate During the Forecast Period

Figure 41 APAC Expected to Lead the Market for Medical Lighting During the Forecast Period

Figure 42 Market, By Offering

Figure 43 Market for Services Expected to Grow at the Highest Rate During the Forecast Period

Figure 44 Luminaires Expected to Dominate the Solid-State and Other Energy-Efficient Lighting Market During the Forecast Period

Figure 45 Solid-State and Other Energy-Efficient Lighting Market, By Region

Figure 46 Geographic Snapshot of the Market

Figure 47 Market in North America

Figure 48 Snapshot of the Market in North America

Figure 49 Solid-State and Other Energy-Efficient Lighting Market in Europe

Figure 50 Snapshot of the Market in Europe

Figure 51 Market in APAC

Figure 52 Snapshot of the Market in APAC

Figure 53 Solid-State and Other Energy-Efficient Lighting Market in RoW

Figure 54 Snapshot of the Market in RoW

Figure 55 Companies Adopted New Product Launches as the Key Growth Strategy

Figure 56 Market Evaluation Framework: New Product Launches and Product Developments Fueled Growth and Innovation Between 2014 and 2016

Figure 57 Battle for Market Share: New Product Launches and Product Developments Were the Key Strategies Adopted Between 2013 and 2016

Figure 58 Geographic Revenue Mix of Major Companies

Figure 59 Osram Licht AG: Company Snapshot

Figure 60 Osram Licht AG: SWOT Analysis

Figure 61 Royal Philips Electronics N.V.: Company Snapshot

Figure 62 Royal Philips Electronics N.V.: SWOT Analysis

Figure 63 Seoul Semiconductor Co., Ltd.: Company Snapshot

Figure 64 Seoul Semiconductor Co., Ltd.: SWOT Analysis

Figure 65 General Electric Company: Company Snapshot

Figure 66 General Electric Company: SWOT Analysis

Figure 67 Nichia Corporation: SWOT Analysis

Figure 68 Aixtron Se: Company Snapshot

Figure 69 Cree, Inc.: Company Snapshot

Figure 70 Acuity Brands Lighting, Inc.: Company Snapshot

Figure 71 Energy Focus, Inc.: Company Snapshot

Figure 72 Toyoda Gosei Co., Ltd.: Company Snapshot

Figure 73 TCP International Holdings Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Solid-State and Other Energy-Efficient Lighting Market

Does the report provides break down of LED Panels, LED Troffers, LED Bulbs, LED Retrofits, LED Down Lights, LED Canopy, LED Pole Lights, LED Flood Lights, LED Shoe boxes etc. by application? And by region?

Interested in SSL Market: by Type, by Application, by Vertical, and by Geography from 2016-2025. Does your report include this data?

Hello - I am interested mainly in the US market - are you able to either provide me with a 2017 or 2022 value for me to get comfortable that your projections are in-line with my expectations? I need to purchase the report rapidly for my project, so appreciate the quick turn around. Thanks.

Please let me know what all policies are prevalent pertaining to the adoption of energy efficient lighting in the Europe region.

Do you have information on healthcare specific information (Surgical, Examination, MRI compliant)?

Can you provide information specific to LED technology and latest marketing trends in LED overall lighting industry including: general/ automotive/ commercial lighting?