Mining Chemicals Market by Product Type (Grinding Aids, Flocculants), Mineral Type (Base Metals, Non-Metallic Minerals), Application (Mineral Processing, Explosives & Drilling), and Region - Global Forecast to 2022

The mining chemicals market is projected to reach USD 7.54 billion by 2022, at a CAGR of 4.60%. The base year considered for the study is 2016 and the market size is projected from 2017 to 2022.

The key objective of the global mining chemicals report is to provide companies with a summary of the latest trends and lucrative business expansion opportunities for mining chemicals manufacturers, suppliers, and distributors. The report also demonstrates the key business strategies and principles adopted by the key players around the world. The segments considered for this report are based on product type, mineral type, application, and region.

Mining Chemicals Market Dynamics

Drivers

- Lower mineral concentration and increased complexity of ores

- Investments in mining projects in Asia-Pacific and South America

- Consolidation of mining industry

Restraints

- Slow growth of mining industry in developed economies

Opportunities

- Growing mining sector in Africa and Eastern Europe

- Increasing importance of water management activities in the Asia- Pacific region

Challenges

- Environmental impact of mining chemicals

- Development of ore-specific mining chemicals

Strong demand from end-use industries such as mineral processing, explosives & drilling, water & wastewater treatment, drives the global mining chemicals market

The mining industry utilizes chemicals in all stages of production. These chemicals are used to increase the efficiency and productivity of mining processes such as extraction and recovery of minerals from ores. A wide variety of general and specialty chemicals are utilized for mining. The mining chemicals market has generally been characterized by fluctuations in commodity prices, low profit margins, and increased competition from producers in less developed countries, especially China which has aggressively been manufacturing and exporting mining chemicals. Continuous changes in the landscape of ores have shifted the focus of mining chemical providers towards innovations in the technology that can ensure economical treatment of ores. Advancements in terms of product innovations and technologies are expected to create substantial investment opportunities for mining chemicals.

The following are the major objectives of the study.

To define, segment, and project the global mining chemicals market on the basis of product type, mineral type, application, and region

- To provide information about the key factors influencing the growth of the market (drivers, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders in micro-quadrant.

- To project the size of the market in terms of value and volume, with respect to four main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific, South America, and Middle East & Africa.

- To track and analyze competitive developments such as acquisitions, new product developments, agreements, and expansions & investments in the mining chemicals market.

- To strategically profile key players and comprehensively analyze their core competencies

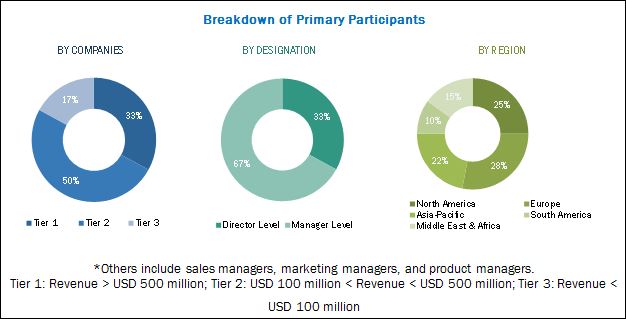

The research methodology used to forecast the market size focused on the bottom-up approach. The total market size of mining chemicals was calculated based on the shares of the various mining chemicals and products derived. Providing weightage for the shares and calculation were done on the basis of extensive primary interviews and secondary research from a variety of sources such as The Association for Mining, Chemical Association and Industrial Mining and Chemical Associations. Primary research involved in this report includes extensive interviews with key people such as CEOs, VPs, directors, and executives. After arriving at the overall market size, the total market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of profiles of primary sources is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The global market for mining chemicals is dominated by large players such as AkzoNobel N.V. (The Netherlends), BASF SE (Germany), Clariant International Ltd. (Switzerland), Cytec Industries Inc. (U.S.), Kemira OYJ (Finland), The Dow Chemical Company (U.S.), Huntsman International LLC (U.S.), Orica Limited. (Australia), ArrMaz Products, L.P. (U.S.), and SNF Floreger (France).

Major Mining Chemicals Market Developments

- In November 2016, Clariant acquired Chemical & Mining Services, Pty. Ltd (Australia), a provider of specialty chemicals and technical services to mining industry clients located primarily in Australia. This acquisition was made with an objective to improve the company’s product portfolio, customer base, and technical expertise.

- In September 2014, BASF announced the increase in production capacity of the solvent extractants range LIX at its plant in Ireland. It would help the company to meet the increase in demand.

- In July 2013, Kemira acquired 3F Chimica S.p.A. (Italy), a process chemical manufacturer. The acquisition helped Kemira implement its strategic plans.

Target Audience in Mining Chemicals Market

- Mining chemicals manufacturers

- Mining chemicals traders/distributors/suppliers

- Manufacturers of raw materials

- Regulatory bodies

- Research organizations

- Association and industry bodies

- End-use industries

Mining Chemicals Market Report Scope

- This research report segments Mining chemicals into the following submarkets:

By Product type:

- Frothers

- Flocculants

- Collectors

- Solvent extractants

- Grinding aids

By Mineral type

- Base metals

- Non-metallic minerals

- Precious metals

- Rare earth metals

By Application

- Mineral processing

- Explosives & drilling

- Water & wastewater treatment

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

Critical Questions which the Mining Chemicals Market Report Answers

- What are new application areas which the mining chemicals’ companies are exploring?

- Which are the key players in the market and how intense is the competition?

Mining Chemicals Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of markets for different recycled product types

Geographic Analysis

- Further analysis of the mining chemicals market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

MarketsandMarkets projects the mining chemicals market size is estimated to grow from USD 6.03 billion in 2017 to USD 7.54 billion by 2022, at a CAGR of 4.60%. The mining chemicals market is fairly competitive due to the presence of large players who have a strong foothold in the market. Declining mining production, fluctuating prices of commodities, and increasingly complex ores have made a significant contribution to the overall slowdown in the mining industry.

On the basis of mineral type, the mining chemicals market is segmented into base metals, non-metallic minerals, precious metals, and rare earth metals. The base metals segment will grow highest whereas, precious metals segment will have high growth rate during the forecast period. Base metals will grow due to rise in demand for these metals due to the rapid industrialization and infrastructure development in the Asia-Pacific, Middle East & Africa, South America, and Eastern European regions.

On the basis of application into mineral processing, explosives & drilling, water & wastewater treatment, and others. The explosives & drilling segment accounted for the largest share of 32.8% in 2016. Rise in the demand for deep-surface mining, which is carried out in order to extract high-quality minerals is expected to contribute significantly to the growth of this application segment.

Mining chemicals also finds wide application in mineral processing. This is due to the rising demand for concentrated grade minerals. As per International Mining Equipment (IME) 2017, mineral processing will witness a significant rise due to the high growth of the mining sector, in terms of production of minerals.

Mining chemicals are consumed in the wastewater treatment application for intercepting, diverting, and recycling the water. High demand for mining chemicals in water & wastewater treatment can be attributed to the stringent environment and legislative regulations on toxic discharge in water bodies initiated by governments of countries such as the U.S.

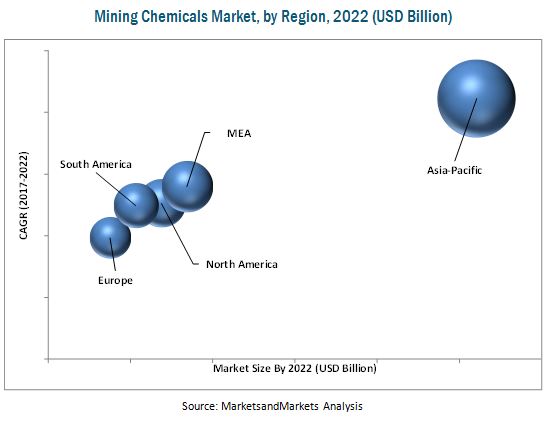

In 2016, the Asia-Pacific market accounted for the largest share of the global mining chemicals market, followed by Europe and North America. Countries such as China and Japan are expected to witness high growth in the mining chemicals market due to rapid economic expansion. The positive outlook of the economies is attracting huge investments from global mining companies. As a result, the mining capacity of various metals and minerals is increasing, thereby boosting the demand for mining chemicals.

Countries in Asia- pacific region such as China and Japan are expected to witness high growth in the mining chemicals market due to increase in mining activities in the region. The demand is primarily met by domestic players of the nations in this region. High demand for mining chemicals in the country can be credited to the continuous exploration and beneficiation of ores. Additionally, high foreign investments in China’s mining industry are expected to support the application for mining chemicals in the country.

Critical Questions the Mining Chemicals Market Report Answers

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for mining chemicals?

Key Players in Mining Chemicals Market Industry

The global market for mining chemicals is dominated by large players such AkzoNobel N.V. (The Netherlends), BASF SE (Germany), Clariant International Ltd. (Switzerland), Cytec Industries Inc. (U.S.), Kemira OYJ (Finland), The Dow Chemical Company (U.S.), Huntsman International LLC (U.S.), Orica Limited. (Australia), ArrMaz Products, L.P. (U.S.), and SNF Floreger (France). These companies use various strategies such as mergers & acquisitions, expansions, new product launches, and partnerships to strengthen their position in the market. Majorly adopted strategy by major players was Mergers & acquisition.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Years Considered for the Study

1.4 Currency Considered

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Market Size Estimation

2.5 Research Assumptions

2.5.1 Assumptions Made for This Study

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Developing Economies to Witness High Demand for Mining Chemicals

4.2 Mining Chemicals Market, By Product Type

4.3 Mining Chemicals Market, By Mineral Type

4.4 Mining Chemicals Market, By Application

4.5 Asia-Pacific: Mining Chemicals Market

4.6 Mining Chemicals Market: Regional Snapshot

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Evolution of the Mining Technology

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Lower Mineral Concentration and Increased Complexity of Ores

5.3.1.2 Investments in Mining Projects in Asia-Pacific and South America

5.3.1.3 Consolidation of Mining Industry

5.3.2 Restraints

5.3.2.1 Slow Growth of Mining Industry in Developed Economies

5.3.3 Opportunities

5.3.3.1 Growing Mining Sector in Africa and Eastern Europe

5.3.3.2 Increasing Importance of Water Management Activities in the Asia-Pacific Region

5.3.4 Challenges

5.3.4.1 Environmental Impact of Mining Chemicals

5.3.4.2 Development of Ore-Specific Mining Chemicals

5.4 Micro Economic Indicators

6 Mining Chemicals Market, By Product Type (Page No. - 44)

6.1 Introduction

6.2 Grinding Aids

6.3 Flocculants

6.4 Collectors

6.5 Frothers

6.6 Solvent Extractants

7 Mining Chemicals Market, By Mineral Type (Page No. - 48)

7.1 Introduction

7.2 Base Metals

7.3 Non-Metallic Minerals

7.4 Precious Metals

7.5 Rare Earth Metals

8 Mining Chemicals Market, By Application (Page No. - 52)

8.1 Introduction

8.2 Mineral Processing

8.3 Explosives & Drilling

8.4 Water & Wastewater Treatment

8.5 Others

9 Mining Chemicals Market, By Region (Page No. - 56)

9.1 Introduction

9.2 North America

9.3 U.S.

9.4 Canada

9.5 Mexico

9.6 Asia-Pacific

9.7 China

9.8 India

9.9 South Korea

9.10 Japan

9.11 Rest of Asia-Pacific

9.12 Europe

9.13 Russia

9.14 Germany

9.15 U.K.

9.16 France

9.17 Rest of Europe

9.18 Middle East & Africa

9.19 South Africa

9.20 Turkey

9.21 Saudi Arabia

9.22 UAE

9.23 Rest of Middle East & Africa

9.24 South America

9.25 Brazil

9.26 Peru

9.27 Chile

9.28 Rest of South America

10 Competitive Landscape (Page No. - 132)

10.1 Introduction

10.2 Dynamic, Innovators, Vanguards, and Emerging

10.2.1 Dynamic

10.2.2 Innovators

10.2.3 Vanguards

10.2.4 Emerging

10.3 Competitive Benchmarking

10.3.1 Product Offering (For All 25 Players)

10.3.2 Business Strategy (For All 25 Players)

10.4 Market Share Analysis

10.4.1 Market Share of Key Players

10.4.2 BASF SE

10.4.3 The DOW Chemical Company

10.4.4 Akzonobel N.V.

10.4.5 Cytec Industries, Inc.

10.4.6 Huntsman Corporation

11 Company Profiles (Page No. - 138)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Akzonobel N.V.

11.2 BASF SE

11.3 Clariant AG

11.4 Cytec Industries Inc.

11.5 Kemira Oyj

11.6 The DOW Chemical Company

11.7 Huntsman Corporation

11.8 Orica Limited

11.9 Arrmaz Products L.P.

11.10 Snf Floerger Sas

11.11 Chevron Phillips Chemical Company, LP

11.12 Air Products and Chemicals, Inc.

11.13 Beijing Hengju Chemical Group Corporation

11.14 Cheminova A/S

11.15 Charles Tennant & Company

11.16 Hychem, Inc.

11.17 Zinkan Enterprises

11.18 Dyno Nobel, Inc.

11.19 Nalco Company

11.20 Nasco Chemsol International FZE

11.21 SQM

11.22 Aeci Ltd.

11.23 Ashland Inc.

11.24 Exxonmobil.

11.25 Arizona Chemical Company, LP

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 169)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (180 Tables)

Table 1 Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 2 Mining Chemical Market Size, By Product Type, 2015–2022 (KT)

Table 3 Mining Chemical Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 4 Mining Chemical Market Size, By Application, 2015–2022 (KT)

Table 5 Mining Chemical Market Size, By Application, 2015–2022 (USD Million)

Table 6 Mining Chemical Market Size, By Application, 2015–2022 (KT)

Table 7 Mining Chemical Market Size, By Region, 2015–2022 (USD Million)

Table 8 Mining Chemical Market Size, By Region, 2015–2022 (KT)

Table 9 North America: Mining Chemicals Market Size, By Country, 2015–2022 (USD Million)

Table 10 North America: Market Size, By Country, 2015–2022 (KT)

Table 11 North America: Market Size, By Product Type, 2015–2022 (USD Million)

Table 12 North America: Market Size, By Product Type, 2015–2022 (KT)

Table 13 North America: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 14 North America: Market Size, By Mineral Type, 2015–2022 (KT)

Table 15 North America: Market Size, By Application, 2015–2022 (USD Million)

Table 16 North America: Market Size, By Application, 2015–2022 (KT)

Table 17 U.S.: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 18 U.S.: Market Size, By Product Type, 2015–2022 (KT)

Table 19 U.S.: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 20 U.S.: Market Size, By Mineral Type, 2015–2022 (KT)

Table 21 U.S.: Market Size, By Application, 2015–2022 (USD Million)

Table 22 U.S.: Market Size, By Application, 2015–2022 (KT)

Table 23 Canada: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 24 Canada: Market Size, By Product Type, 2015–2022 (KT)

Table 25 Canada: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 26 Canada: Market Size, By Mineral Type, 2015–2022 (KT)

Table 27 Canada: Market Size, By Application, 2015–2022 (USD Million)

Table 28 Canada: Market Size, By Application, 2015–2022 (KT)

Table 29 Mexico: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 30 Mexico: Market Size, By Product Type, 2015–2022 (KT)

Table 31 Mexico: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 32 Mexico: Market Size, By Mineral Type, 2015–2022 (KT)

Table 33 Mexico: Market Size, By Application, 2015–2022 (USD Million)

Table 34 Mexico: Market Size, By Application, 2015–2022 (KT)

Table 35 Asia-Pacific: Mining Chemicals Market Size, By Country, 2015–2022 (USD Million)

Table 36 Asia-Pacific: Market Size, By Country, 2015–2022 (KT)

Table 37 Asia-Pacific: Market Size, By Product Type, 2015–2022 (USD Million)

Table 38 Asia-Pacific: Market Size, By Product Type, 2015–2022 (KT)

Table 39 Asia-Pacific: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 40 Asia-Pacific: Market Size, By Mineral Type, 2015–2022 (KT)

Table 41 Asia-Pacific: Market Size, By Application, 2015–2022 (USD Million)

Table 42 Asia-Pacific: Market Size, By Application, 2015–2022 (KT)

Table 43 China: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 44 China: Market Size, By Product Type, 2015–2022 (KT)

Table 45 China: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 46 China: Market Size, By Mineral Type, 2015–2022 (KT)

Table 47 China: Market Size, By Application, 2015–2022 (USD Million)

Table 48 China: Market Size, By Application, 2015–2022 (KT)

Table 49 India: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 50 India: Market Size, By Product Type, 2015–2022 (KT)

Table 51 India: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 52 India: Market Size, By Mineral Type, 2015–2022 (KT)

Table 53 India: Market Size, By Application, 2015–2022 (USD Million)

Table 54 India: Market Size, By Application, 2015–2022 (KT)

Table 55 South Korea: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 56 South Korea: Market Size, By Product Type, 2015–2022 (KT)

Table 57 South Korea: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 58 South Korea: Market Size, By Mineral Type, 2015–2022 (KT)

Table 59 South Korea: Market Size, By Application, 2015–2022 (USD Million)

Table 60 South Korea: Market Size, By Application, 2015–2022 (KT)

Table 61 Japan: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 62 Japan: Market Size, By Product Type, 2015–2022 (KT)

Table 63 Japan: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 64 Japan: Market Size, By Mineral Type, 2015–2022 (KT)

Table 65 Japan: Market Size, By Application, 2015–2022 (USD Million)

Table 66 Japan: Market Size, By Application, 2015–2022 (KT)

Table 67 Rest of Asia-Pacific: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 68 Rest of Asia-Pacific: Market Size, By Product Type, 2015–2022 (KT)

Table 69 Rest of Asia-Pacific: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 70 Rest of Asia-Pacific: Market Size, By Mineral Type, 2015–2022 (KT)

Table 71 Rest of Asia-Pacific: Market Size, By Application, 2015–2022 (USD Million)

Table 72 Rest of Asia-Pacific: Market Size, By Application, 2015–2022 (KT)

Table 73 Europe: Mining Chemicals Market Size, By Country, 2015–2022 (USD Million)

Table 74 Europe: Market Size, By Country, 2015–2022 (KT)

Table 75 Europe: Market Size, By Product Type, 2015–2022 (USD Million)

Table 76 Europe: Market Size, By Product Type, 2015–2022 (KT)

Table 77 Europe: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 78 Europe: Market Size, By Mineral Type, 2015–2022 (KT)

Table 79 Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 80 Europe: Market Size, By Application, 2015–2022 (KT)

Table 81 Russia: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 82 Russia: Market Size, By Product Type, 2015–2022 (KT)

Table 83 Russia: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 84 Russia: Market Size, By Mineral Type, 2015–2022 (KT)

Table 85 Russia: Market Size, By Application, 2015–2022 (USD Million)

Table 86 Russia: Market Size, By Application, 2015–2022 (KT)

Table 87 Germany: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 88 Germany: Market Size, By Product Type, 2015–2022 (KT)

Table 89 Germany: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 90 Germany: Market Size, By Mineral Type, 2015–2022 (KT)

Table 91 Germany: Market Size, By Application, 2015–2022 (USD Million)

Table 92 Germany: Market Size, By Application, 2015–2022 (KT)

Table 93 U.K.: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 94 U.K.: Market Size, By Product Type, 2015–2022 (KT)

Table 95 U.K.: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 96 U.K.: Market Size, By Mineral Type, 2015–2022 (KT)

Table 97 U.K.: Market Size, By Application, 2015–2022 (USD Million)

Table 98 U.K.: Market Size, By Application, 2015–2022 (KT)

Table 99 France: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 100 France: Market Size, By Product Type, 2015–2022 (KT)

Table 101 France: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 102 France: Market Size, By Mineral Type, 2015–2022 (KT)

Table 103 France: Market Size, By Application, 2015–2022 (USD Million)

Table 104 France: Market Size, By Application, 2015–2022 (KT)

Table 105 Rest of Europe: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 106 Rest of Europe: Market Size, By Product Type, 2015–2022 (KT)

Table 107 Rest of Europe: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 108 Rest of Europe: Market Size, By Mineral Type, 2015–2022 (KT)

Table 109 Rest of Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 110 Rest of Europe: Market Size, By Application, 2015–2022 (KT)

Table 111 Middle East & Africa: Mining Chemicals Market Size, By Country, 2015–2022 (USD Million)

Table 112 Middle East & Africa: Market Size, By Country, 2015–2022 (KT)

Table 113 Middle East & Africa: Market Size, By Product Type, 2015–2022 (USD Million)

Table 114 Middle East & Africa: Market Size, By Product Type, 2015–2022 (KT)

Table 115 Middle East & Africa: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 116 Middle East & Africa: Market Size, By Mineral Type, 2015–2022 (KT)

Table 117 Middle East & Africa: Market Size, By Application, 2015–2022 (USD Million)

Table 118 Middle East & Africa: Market Size, By Application, 2015–2022 (KT)

Table 119 South Africa: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 120 South Africa: Market Size, By Product Type, 2015–2022 (KT)

Table 121 South Africa: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 122 South Africa: Market Size, By Mineral Type, 2015–2022 (KT)

Table 123 South Africa: Market Size, By Application, 2015–2022 (USD Million)

Table 124 South Africa: Market Size, By Application, 2015–2022 (KT)

Table 125 Turkey: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 126 Turkey: Market Size, By Product Type, 2015–2022 (KT)

Table 127 Turkey: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 128 Turkey: Market Size, By Mineral Type, 2015–2022 (KT)

Table 129 Turkey: Market Size, By Application, 2015–2022 (USD Million)

Table 130 Turkey: Market Size, By Application, 2015–2022 (KT)

Table 131 Saudi Arabia: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 132 Saudi Arabia: Market Size, By Product Type, 2015–2022 (KT)

Table 133 Saudi Arabia: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 134 Saudi Arabia: Market Size, By Mineral Type, 2015–2022 (KT)

Table 135 Saudi Arabia: Market Size, By Application, 2015–2022 (USD Million)

Table 136 Saudi Arabia: Market Size, By Application, 2015–2022 (KT)

Table 137 UAE: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 138 UAE: Market Size, By Product Type, 2015–2022 (KT)

Table 139 UAE: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 140 UAE: Market Size, By Mineral Type, 2015–2022 (KT)

Table 141 UAE: Market Size, By Application, 2015–2022 (USD Million)

Table 142 UAE: Market Size, By Application, 2015–2022 (KT)

Table 143 Rest of Middle East & Africa: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 144 Rest of Middle East & Africa: Market Size, By Product Type, 2015–2022 (KT)

Table 145 Rest of Middle East & Africa: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 146 Rest of Middle East & Africa: Market Size, By Mineral Type, 2015–2022 (KT)

Table 147 Rest of Middle East & Africa: Market Size, By Application, 2015–2022 (USD Million)

Table 148 Rest of Middle East & Africa: Market Size, By Application, 2015–2022 (KT)

Table 149 South America: Mining Chemicals Market Size, By Country, 2015–2022 (USD Million)

Table 150 South America: Market Size, By Country, 2015–2022 (KT)

Table 151 South America: Market Size, By Product Type, 2015–2022 (USD Million)

Table 152 South America: Market Size, By Product Type, 2015–2022 (KT)

Table 153 South America: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 154 South America: Market Size, By Mineral Type, 2015–2022 (KT)

Table 155 South America: Market Size, By Application, 2015–2022 (USD Million)

Table 156 South America: Market Size, By Application, 2015–2022 (KT)

Table 157 Brazil: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 158 Brazil: Market Size, By Product Type, 2015–2022 (KT)

Table 159 Brazil: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 160 Brazil: Market Size, By Mineral Type, 2015–2022 (KT)

Table 161 Brazil: Market Size, By Application, 2015–2022 (USD Million)

Table 162 Brazil: Market Size, By Application, 2015–2022 (KT)

Table 163 Peru: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 164 Peru: Market Size, By Product Type, 2015–2022 (KT)

Table 165 Peru: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 166 Peru: Market Size, By Mineral Type, 2015–2022 (KT)

Table 167 Peru: Market Size, By Application, 2015–2022 (USD Million)

Table 168 Peru: Market Size, By Application, 2015–2022 (KT)

Table 169 Chile: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 170 Chile: Market Size, By Product Type, 2015–2022 (KT)

Table 171 Chile: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 172 Chile: Market Size, By Mineral Type, 2015–2022 (KT)

Table 173 Chile: Market Size, By Application, 2015–2022 (USD Million)

Table 174 Chile: Market Size, By Application, 2015–2022 (KT)

Table 175 Rest of South America: Mining Chemicals Market Size, By Product Type, 2015–2022 (USD Million)

Table 176 Rest of South America: Market Size, By Product Type, 2015–2022 (KT)

Table 177 Rest of South America: Market Size, By Mineral Type, 2015–2022 (USD Million)

Table 178 Rest of South America: Market Size, By Mineral Type, 2015–2022 (KT)

Table 179 Rest of South America: Market Size, By Application, 2015–2022 (USD Million)

Table 180 Rest of South America: Market Size, By Application, 2015–2022 (KT)

List of Figures (36 Figures)

Figure 1 Market Segmentation

Figure 2 Mining Chemicals Market, By Region

Figure 3 Mining Chemical Market: Research Design

Figure 4 Breakdown of Primaries

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Grinding Aids is Projected to Remain the Largest Product Type Through 2022

Figure 9 Base Metals is Estimated to Account for the Largest Market Share in the Mining Chemicals Through 2022

Figure 10 Explosives & Drilling Segment is Expected to Lead the Market for Mining Chemicals Through 2022

Figure 11 Asia-Pacific Dominated the Mining Chemicals Market in 2016

Figure 12 Emerging Economies Offer Attractive Opportunities in the Mining Chemicals Market

Figure 13 Grinding Aids Segment Expected to Lead the Market of Mining Chemicals Through 2022

Figure 14 Base Metals Segment to Lead the Market During the Forecast Period

Figure 15 Explosives & Drilling to Grow at the Highest Rate During the Forecast Period

Figure 16 Base Metals Segment Captured the Largest Share in the Asia-Pacific Market, in 2016

Figure 17 Mining Chemicals Market in China is Projected to Grow at the Highest Rate From 2017 to 2022

Figure 18 Mining Technology has Evolved Significantly

Figure 19 Increased Complexity of Ores to Drive Market Growth of the Mining Chemicals

Figure 20 Market of Mining Chemicals, By Product Type, 2017 vs 2022 (USD Million)

Figure 21 Market of Mining Chemicals, By Mineral Type, 2017 vs 2022 (USD Million)

Figure 22 Explosives & Drilling Segment is Projected to Grow at the Highest Rate From 2017 to 2022

Figure 23 Geographic Snapshot: Asia-Pacific Market of Mining Chemicals Emerging as the New Hotspot

Figure 24 European Mining Chemicals Market Snapshot: Russia is Projected to Be the Fastest-Growing Market Between 2017 & 2022

Figure 25 Asia-Pacific Mining Chemicals Market Snapshot: India is Projected to Be the Fastest-Growing Market Between 2017 & 2022

Figure 26 European Mining Chemical Market Snapshot: Russia is Projected to Be the Fastest-Growing Market Between 2017 & 2022

Figure 27 Dive Chart

Figure 28 Mining Chemicals Market Share, By Key Player, 2016

Figure 29 Akzonobel N.V.: Company Snapshot

Figure 30 BASF SE: Company Snapshot

Figure 31 Clariant AG: Company Snapshot

Figure 32 Cytec Industries Inc.: Company Snapshot

Figure 33 Kemira Oyj: Company Snapshot

Figure 34 The DOW Chemical Company: Company Snapshot

Figure 35 Huntsman Corporation: Company Snapshot

Figure 36 Orica Limited: Company Snapshot

Growth opportunities and latent adjacency in Mining Chemicals Market

Information about the products included under "Blasting and Drilling" segment

Interested in the report with USD 3000 budget

Market trends, key drivers, market estimation and forecast for different applications in the market