Succinic Acid Market by Type (Bio-Based Succinic Acid, Petro-Based Succinic Acid), End-Use Industry (Industrial, Food & Beverage, Coatings, Pharmaceutical), and Region (APAC, Europe, North America, South America, Middle East & Africa) - Forecast to 2023

To get the latest information, inquire now!

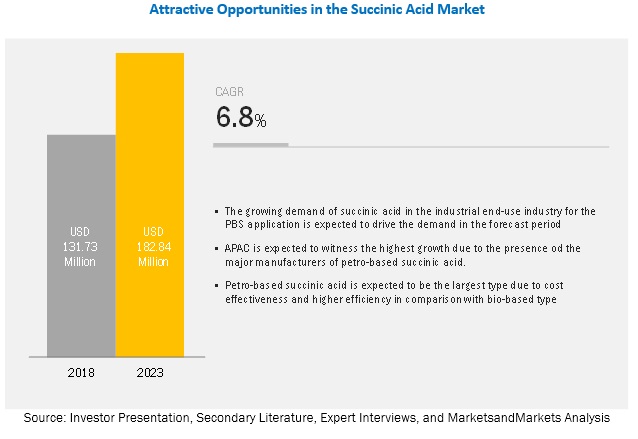

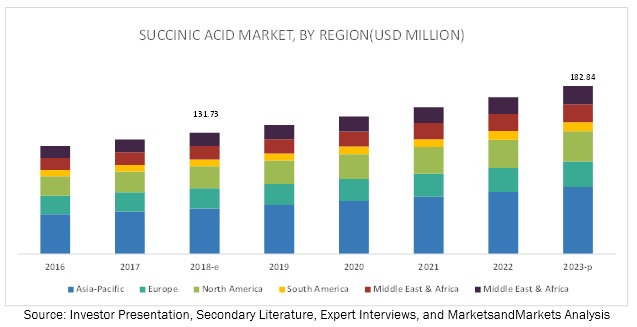

[130 Pages Report] The succinic acid market size is projected to grow from USD 131.7 million in 2018 to USD 182.8 million by 2023, at a CAGR of 6.8%. The increasing demand from the industrial, personal care and food & beverage industries fuels the succinic acid market. The increasing demand from the APAC region, and the increasing adoption of succinic acid as a substitute of adipic acid in polyurethane production are the factors driving the succinic acid market. The objective of the report is to define, describe, and forecast the succinic acid market size based on type (petro-base succinic acid and bio-based succinic acid), application (industrial, coating, food & beverages, cosmetics and pharmaceuticals) and region.

The petro-based segment is expected to be largest contributor to the market growth during the forecast period.

The growth of the segment is mainly attributed to the demand from the chemical industry for PBS/ PBST, and polyurethane. Petro-based succinic acid is cost-effective and has better efficiency in comparison with bio-based type. Additionally, it can be widely used in the food & beverage industry as a flavor enhancer and in the chemical industry for the manufacture of PBS.

Industrial application is the largest and fastest-growing end-use industry of succinic acid.

The demand for succinic acid is driven by its use for applications in the industrial applications. Succinic acid is used in PBS/PBST for food packaging, as these are non-toxic, biodegradable, and also have better heat resistance and processability in comparison to other biopolymers. The key drivers for the succinic acid market are the increasing disposable income, changing consumer lifestyle, increased use of plastics, and the growing packaging industry. These factors have fueled the demand for non-toxic, bio-degradable PET bottles, food containers, disposable syringes, blood bags, and other consumer goods in countries such as China, India, Japan, US, and Germany that have led to the growth of the succinic acid market in the PBS/PBST segment.

APAC is expected to be the largest market during the forecast period.

The growth of the market in APAC is mainly driven by the shift of production facilities from North America and Europe to this region. China, India, and Southeast Asia are the major contributors to the growth of the industrial, food & beverage, pharmaceutical, and coating industries in the region. These industries are witnessing growth owing to the increasing per capita expenditure and growing urbanization. This is further expected to create a demand for succinic acid in the region.

Market Dynamics

Driver: Increasing demand from APAC

APAC is the fastest-growing succinic acid market. Owing to the growth in the economy and increasing consumer awareness, the market in the region is growing rapidly. This region is also projected to dominate the succinic acid market by 2023 due to the growing industrial base of polyurethane, pharmaceutical, 1, 4- BDO, and food & beverage and the availability of cheap labor and low manufacturing cost. Furthermore, the growing demand for succinic acid derivatives from China has spurred the growth of the succinic acid market in the APAC region. During the last decade, the succinic acid market in China witnessed a steady growth owing to the development of downstream industries and the improvement of production technology of succinic acid.

In China, succinic acid is widely being used to produce a series of derivatives, such as dimethyl succinate (DMS) and 1,4- BDO that are further used for soldering flux and surfactants applications in the chemical industry. In the pharmaceutical industry, it is used as a raw material of ferrous succinate, succinimide, and N-bromosuccinimide (NBS), whereas in the food & beverage industry, succinic acid is used in the production of disodium succinate, which acts as a flavor enhancer for food. Thus, the use of succinic acid for the production of various derivatives in the aforementioned industries in China is increasing the demand for succinic acid in the country.

Restraint: High production costs

The succinic acid market is a capital–intensive market, and the downtime involved with the penetration of succinic acid as an intermediate to the existing material/application also causes significant loss to the end-use industries. The R&D costs associated with petro-based succinic acid, in terms of labor, and raw materials is high. The failure of bio-based succinic acid due to the lack of cost-competitiveness and performance issues as a substitute for petro-based succinic acid has increased the demand for petro-based succinic acid. The setup of succinic acid manufacturing plants for both petro-based and renewable chemicals require huge capital investment, proficient technology, and adequate supply of raw materials, along with rigorous R&D at the micro level to deliver a quality product. The manufacturer also has to achieve economies of scale by undertaking large-scale production and maintaining regular bulk purchases for their products to secure continuous cash flow for the operations. These factors have generated a significant impact on the cost of the end-use product.

Thus, it is difficult for emerging manufacturers to have access to such technology and skilled labor with high capital investment to manufacture environment-friendly, efficient, and sustainable succinic acid products at a very competitive price. These factors are restraining the growth of the succinic acid market.

Opportunity: Increasing potential applications of succinic acid

Succinic acid, also known as amber acid, is a key building block of a wide range of secondary chemicals used across applications in the industries such as pharmaceutical, food & beverage, solvents & lubricants, polyurethane, and agriculture. PBS, 1, 4 – BDO and food applications provide major opportunities for succinic acid.

Polybutylene succinate (PBS) is a biopolymer produced by the poly-condensation of succinic acid and 1, 4 - BDO. PBS is crystalline polyester with a melting temperature of above 212°F (100°C), which is important for high-temperature range applications. PBS is used in a range of applications, including single-use in food service ware (such as cutlery and cups and lids), agricultural mulching films, and compostable bags. PBS can also be made into composites by filling the fibers with other materials to augment the material properties of the substance and, thereby, diversify the potential applications. In the agriculture industry, PBS is used in the fabrication of mulching films or delayed release materials for pesticide and fertilizer. In the medical industry, PBS is used as biodegradable drug encapsulation systems and is also being investigated for application in medical implants. Hence, the increasing potential applications of PBS in different industries are expected to drive the demand for succinic acid for the manufacturing of PBS.

Challenge: Issues in commercialization of bio-based succinic acid

In the past, several succinic acid manufacturers were engaged in the process to develop commercial-scale capacities for bio-based succinic acid. However, except for a few initiations made by the leading players, few successes were reported in the bio-production of succinic acid. The production of bio-based succinic acid through renewable feedstock resulted in low yield and cost-intensive separation process. This led to reduced demand for bio-based succinic acid, eventually leading to the closure of major plants.

The major challenges for expanding the use of succinic acid as a building block include the development of low-cost fermentation routes. In order to ensure the competitiveness of bio-based-succinic acid in comparison to petroleum-based products, there is a need for the development of a cost-effective sugar fermentation process. In addition, the fermentation process needs to be improved, in terms of productivity, nutrient requirement for the process, final titer, and pH considerations. The limited success of other biochemical production initiatives prevents manufacturers from foraying into the bio-based succinic acid market.

The green credentials of bio-based processes are often challenged, as these processes require significant land and water to grow their feedstock. Moreover, the process used for the production of bio-based succinic acid is quite complex, which is limiting the use of succinic acid as a chemical building block. These are the major issues involved in the commercialization of succinic acid produced by renewable feedstock.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments covered |

Type, End-use Industry, and Region |

|

Regions covered |

North America, APAC, Europe, South America, and Middle East & Africa |

|

Companies profiled |

BioAmber (Canada), GC Innovation America (US), Succinity GmbH (Germany), Reverdia (Netherlands), Nippon Shokubai (Japan), |

This research report categorizes the succinic acid market based on type, end-use industry, and region.

Succinic acid market, by type:

- Petro-based

- Bio-based

Succinic ACID MARKET, by end-use industry:

- Industrial

- Coating

- Food & Beverage

- Cosmetics

- Pharmaceuticals

Succinic ACID MARKET, by region:

- APAC

- North America

- Europe

- Middle East & Africa

- South America

Key Market Players

Some of the key players operating in the succinic acid market are BioAmber (Canada), GC Innovation America (US), Succinity GmbH (Germany), Reverdia (Netherlands), Nippon Shokubai (Japan), Shandong Lixing Chemical (China), Kawasaki Kasei Chemicals (Japan), Anqing Hexing Chemical (China), Anhui Sunsing Chemicals (China), and Gadiv Petrochemical Industries (Israel). Diversified product portfolio, high depth in application reach, and technical assistance to customers are the factors responsible for strengthening the position of these companies in the succinic acid market. They have also been adopting various organic and inorganic growth strategies such as partnership, agreement, and expansion, to enhance their current position in the succinic acid market.

Recent Developments

- In November 2016, Reverdia entered into a strategic partnership with Hangzhou Xinfu Science & Technology (China) to adopt Biosuccinium in bio-based polymers and co-polymers for the packaging industry and for long-term supply agreement.

- In October 2016, Reverdia signed an agreement with Dezhou Xinhuarun Technology (China) to develop and promote Biosuccinium-based microcellular polyurethane foams. The foams will be used in soles for footwear and other applications.

- In August 2016, Anhui Sunsing Chemicals invented another method of producing succinic acid and other chemicals using sucrose-containing feedstock. This invention was related to the production of chemicals by fermentation with a microorganism in which, the fermentation medium contains sugar sucrose.

Key questions addressed by the report

- What are the future revenue pockets in the succinic acid market?

- Which are the key developments expected to have a long-term impact on the succinic acid market?

- Which are the product technologies expected to cannibalize existing technologies?

- How is the current regulatory framework expected to impact the market?

- What will be the future product mix of the succinic acid market?

- What are the prime strategies of leaders in the succinic acid market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table Of Contents

1 Introduction (Page No. - 14)

1.1 Objectives Of The Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered For The Study

1.3.2 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown Of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.3.1 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities In The Succinic Acid Market

4.2 Succinic Acid Market In APAC, By Type And Country, 2017

4.3 Succinic Acid Market, Regional Share

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand From APAC

5.2.2 Restraints

5.2.2.1 High Production Costs

5.2.3 Opportunities

5.2.3.1 Increasing Potential Applications Of Succinic Acid

5.2.4 Challenges

5.2.4.1 Issues In Commercialization Of Bio-Based Succinic Acid

5.2.4.2 Slow Growth Of The Bio-Based Succinic Acid Market

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power Of Suppliers

5.3.2 Threat Of New Entrants

5.3.3 Threat Of Substitutes

5.3.4 Bargaining Power Of Buyers

5.3.5 Intensity Of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 Trends Of Oil Consumption

5.4.2 Trends Of Gas Consumption

5.4.3 Trends And Forecast Of GDP

6 Succinic Acid Market, By Type (Page No. - 45)

6.1. Introduction

6.2. Petro-Based Succinic Acid

6.2.1. The Demand For Petro-Based Succinic Acid Is Rising Due To Its Use In Industrial And Coating Industries

6.3. Bio-Based Succinic Acid

6.3.1. The Demand For Bio-Based Succinic Acid Is Increasing Due To Its Use In Food & Beverage And Industrial Industries

7 Succinic Acid Market, By End-Use Industry (Page No. - 51)

7.1 Introduction

7.2 Industrial

7.2.1. The Demand Of Succinic Acid Is Rising For Pbs Application In The Industrial Segment

7.3 Coatings

7.3.1. Succinic Acid Is Widely Used In The Coatings Industry For Manufacturing Polyester Polyols

7.4 Food & Beverage

7.4.1. The Use Of Succinic Acid As A Flavouring Agent And Additive Is Driving Its Demand In The Food & Beverage Industry

7.5 Cosmetics

7.5.1. The Use Of Succinic Acid As A Multi Funtional Ingredient For Cosmetics Formulations Is Driving Its Demand In The Cosmetic Industry

7.6 Pharmaceutical

7.6.1. Succinic Acid Derivatives Are Used For Different Applications In The Pharmaceutical Industry

7.7 Others

8 Succinic Acid Market, By Region (Page No. - 61)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.1.1 The Use Of Succinic Acid In The Industrial Segment Is Likely To Boost The Market In China

8.2.2 Japan

8.2.2.1 The Coating End-Use Industry Is Expected To Propel The Market In Japan

8.2.3 South Korea

8.2.3.1 The South Korean Succinic Acid Market Is Expected To Witness High Growth Due To Demand From The Industrial Segment

8.2.4 India

8.2.4.1 High Demand From The Industrial Segment Is A Key Factor For The Market Growth In India

8.2.5 Taiwan

8.2.5.1 The Market In Taiwan Is Expected To Witness High Growth Due To The Use Of Succinic Acid In The Industrial Segment

8.2.6 Indonesia

8.2.6.1 The Market In Indonesia Is Likely To Be Driven By The Coating Industry

8.2.7 Rest Of APAC

8.3 North America

8.3.1 Us

8.3.1.1 The Demand For Succinic Acid In The Us Is Driven By Packaging And Construction Applications In The Industrial Segment

8.3.2 Canada

8.3.2.1 Canada Is Witnessing A High Demand For Succinic Acid Due To Its Use In The Industrial Segment And Coating Industry

8.3.3 Mexico

8.3.3.1 Succinic Acid Is Used For Packaging And Construction Applications In The Industrial Segment

8.4 Europe

8.4.1 Germany

8.4.1.1 The Growing Demand From The Industrial Segment Drives The Market In Germany

8.4.2 Uk

8.4.2.1 The Increased Use Of Biodegradable Coatings Materials In The Construction Industry Generates High Demand For Succinic Acid From The Coating Industry

8.4.3 France

8.4.3.1 The Increased Demand For Succinic Acid From The Industrial Segment Is Driving The Market In France

8.4.4 Spain

8.4.4.1 Succinic Acid Have The Highest Demand From The Industrial Segment Due To Increase In Pbs Consumption

8.4.5 Italy

8.4.5.1 Italy Will Have The Highest Demand For Succinic Acid From The Coatings Segment Due To Growth In Its Construction Sector

8.4.6 Netherlands

8.4.6.1 The Industrial Segment Generates High Demand For Succinic Acid For Pbs Application In The Country

8.4.7 Belgium

8.4.7.1 The Succinic Acid Demand In Belgium Is Driven By Increased Usage Of Green Chemicals Such As Pbs/Pbst

8.4.8 Turkey

8.4.8.1 The Coating Industry Is Expected To Drive The Demand For Succinic Acid In Turkey

8.4.9 Russia

8.4.9.1 The Industrial Segment Is A Major End User Of Succinic Acid In Russia

8.4.10 Rest Of Europe

8.5 South America

8.5.1 Brazil

8.5.1.1 The Demand For Succinic Acid Is Generated By The Coating Industry In Brazil

8.5.2 Argentina

8.5.2.1 The Coating Industry Is A Major Driver For The Market Growth In Argentina

8.5.3 Rest Of South America

8.6 Middle East & Africa

8.6.1 Iran

8.6.1.1 The Demand For Succinic Acid Is Driven By Its Use In The Industrial Segment

8.6.2 Saudi Arabia

8.6.2.1 The Industrial Segment Drives The Market For Succinic Acid In Saudi Arabia

8.6.3 UAE

8.6.3.1 The Industrial Segment Is Expected To Be The Fastest-Growing End User Of Succinic Acid In The Country

8.6.4 Rest Of Middle East & Africa

9 Competitive Landscape (Page No. - 107)

9.1 Overview

9.2 Market Ranking Analysis

9.3 Competitive Situation & Trends

9.3.1 New Product Development

9.3.2 Partnership & Agreement

9.3.3 Expansion

10 Company Profiles (Page No. - 110)

10.1 Nippon Shokubai

10.1.1 Overview

10.1.2 Products Offered

10.1.3 Swot Analysis

10.1.4 Mnm View

10.2 Kawasaki Kasei Chemicals

10.2.1 Overview

10.2.2 Products Offered

10.2.3 Swot Analysis

10.2.4 Mnm View

10.3 Reverdia

10.3.1 Overview

10.3.2 Products Offered

10.3.3 Recent Developments

10.3.4 Swot Analysis

10.3.5 Mnm View

10.4 Gadiv Petrochemical Industries Limited

10.4.1 Overview

10.4.2 Products Offered

10.5 Anhui Sunsing Chemicals

10.5.1 Overview

10.5.2 Products Offered

10.5.3 Recent Developments

10.6 Shandong Lixing Chemical

10.6.1 Overview

10.6.2 Products Offered

10.7 Anqing Hexing Chemical

10.7.1 Overview

10.7.2 Products Offered

10.8 Bioamber

10.8.1 Overview

10.8.2 Products Offered

10.8.3 Recent Developments

10.9 Succinity

10.9.1 Overview

10.9.2 Products Offered

10.9.3 Recent Developments

10.1 Gc Innovation America

10.10.1 Overview

10.10.2 Products Offered

10.10.3 Recent Developments

11 Additional Company Profiles (Page No. - 125)

11.1 Spectrum Chemical

11.2 Thirumalai Chemicals Limited

11.3 Shandong Chemical

11.4 Discussion Guide

12 Appendix

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List Of Tables (55 Tables)

Table 1 Trends And Forecast Of GDP, 2015 – 2022 (Usd Billion)

Table 2 Firefighting Foam Market Size, By Type , 2016–2023 (Usd Million)

Table 3 Afff Market Size, By Region, 2016–2023 (Usd Million)

Table 4 Ar-Afff Market Size, By Region, 2016–2023 (Usd Million)

Table 5 Pf Market Size , By Region, 2016–2023 (Usd Million)

Table 6 Synthetic Detergent Foam Market Size, By Region, 2016–2023 (Usd Million)

Table 7 Other Firefighting Foams Market Size, By Region, 2016–2023 (Usd Million)

Table 8 Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 9 Firefighting Foam Market Size In Oil & Gas, By Region, 2016–2023 (Usd Million)

Table 10 Firefighting Foam Market Size In Aviation, By Region, 2016–2023 (Usd Million)

Table 11 Firefighting Foam Market Size In Marine, By Region, 2016–2023 (Usd Million)

Table 12 Firefighting Foam Market Size In Mining, By Region, 2016–2023 (Usd Million)

Table 13 Firefighting Foam Market Size In Other End-Use Industries, By Region, 2016–2023 (Usd Million)

Table 14 Firefighting Foam Market Size, By Region, 2016–2023 (Usd Million)

Table 15 APAC: Firefighting Foam Market Size, By Country, 2016–2023 (Usd Million)

Table 16 APAC: Firefighting Foam Market Size, By Type, 2016–2023 (Usd Million)

Table 17 APAC: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 18 China: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 19 Japan: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 20 South Korea: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 21 India: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 22 Indonesia: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 23 Rest Of APAC: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 24 Europe: Firefighting Foam Market Size, By Country, 2016–2023 (Usd Million)

Table 25 Europe: Firefighting Foam Market Size, By Type, 2016–2023 (Usd Million)

Table 26 Europe: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 27 Germany: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 28 Uk: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 29 France: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 30 Spain: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 31 Italy: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 32 Russia: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 33 Rest Of Europe: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 34 North America: Firefighting Foam Market Size, By Country, 2016–2023 (Usd Million)

Table 35 North America: Firefighting Foam Market Size, By Type, 2016–2023 (Usd Million)

Table 36 North America: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 37 Us: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 38 Canada: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 39 Mexico: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 40 South America: Firefighting Foam Market Size, By Country, 2016–2023 (Usd Million)

Table 41 South America: Firefighting Foam Market Size, By Type, 2016–2023 (Usd Million)

Table 42 South America: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 43 Brazil: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 44 Argentina: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 45 Rest Of South America: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 46 Middle East & Africa: Firefighting Foam Market Size, By Country, 2016–2023 (Usd Million)

Table 47 Middle East & Africa: Firefighting Foam Market Size, By Type, 2016–2023 (Usd Million)

Table 48 Middle East & Africa: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 49 Iran: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 50 Saudi Arabia: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 51 UAE: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 52 Rest Of The Middle East & Africa: Firefighting Foam Market Size, By End-Use Industry, 2016–2023 (Usd Million)

Table 53 New Product Launches, 2013–2018

Table 54 Partnerships & Agreements, 2013–2018

Table 55 Mergers & Acquisitions, 2013–2018

List Of Figures (36 Figures)

Figure 1 Firefighting Foam Market Segmentation

Figure 2 Firefighting Foams Market: Research Methodology

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Firefighting Foams Market: Data Triangulation

Figure 6 Afff To Be The Largest Segment Of The Firefighting Foam Market

Figure 7 Oil & Gas To Be The Largest End-Use Industry

Figure 8 APAC Was The Largest Firefighting Foam Market In 2017

Figure 9 Firefighting Foam Market To Register Decent Growth Between 2018 And 2023

Figure 10 Oil & Gas To Be The Largest End-Use Industry During The Forecast Period

Figure 11 Afff Was The Largest Segment Of The Firefighting Foam Market

Figure 12 Firefighting Foam Market To Register High Growth In The UAE And Saudi Arabia

Figure 13 Overview Of Factors Governing The Firefighting Foam Market

Figure 14 Porter’s Five Forces Analysis

Figure 15 Trends Of Oil Production & Drilling Of Wells, 2016

Figure 16 Trends Of GDP, By Key Country, 2016

Figure 17 Afff To Remain The Largest Segment Of The Firefighting Foam Market

Figure 18 APAC To Be The Largest Market Of Afff

Figure 19 APAC To Be The Largest Ar-Afff Market

Figure 20 APAC To Be The Largest Pf Market

Figure 21 APAC To Be The Fastest-Growing Synthetic Detergent Foam (High And Medium Expansion) Market

Figure 22 North America To Be The Largest Market For Other Types Of Firefighting Foams

Figure 23 Oil & Gas To Be The Largest End-Use Industry In The Firefighting Foam Market

Figure 24 APAC To Be The Largest Firefighting Foam Market In The Oil & Gas Industry

Figure 25 APAC To Be The Largest Firefighting Foam Market In The Aviation Industry

Figure 26 APAC To Be The Largest Firefighting Foam Market In The Marine Industry

Figure 27 Middle East & Africa To Be The Largest Firefighting Foam Market In The Mining Industry

Figure 28 APAC To Be The Largest Firefighting Foam Market In Other End-Use Industries

Figure 29 APAC To Witness The Fastest Growth In The Firefighting Foam Market During The Forecast Period

Figure 30 APAC Firefighting Foam Market Snapshot

Figure 31 European Firefighting Foam Market Snapshot

Figure 32 North America: Firefighting Foam Market Snapshot

Figure 33 South America: Firefighting Foam Market Snapshot

Figure 34 The Middle East & Africa Region To Witness A Steady Growth During The Forecast Period

Figure 35 Companies Adopted Both Organic And Inorganic Growth Strategies Between 2013 And 2018

Figure 36 Ranking Of Key Market Players In 2017

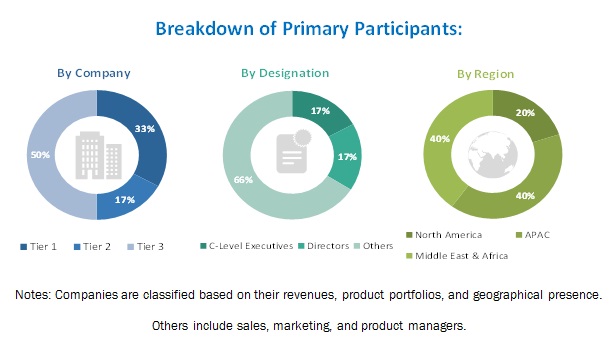

The study involved four major activities to estimate the current market size for succinic acid. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases & investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard & silver standard websites, associations, regulatory bodies, trade directories, and databases.

Primary Research

The succinic acid market comprises several stakeholders such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the developments in the industrial, coatings, food & beverage, and pharmaceutical industries. The supply side is characterized by market consolidation activities undertaken by succinic acid producers. Several primary sources from both supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following are the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

Both top-down and bottom-up approaches were used to estimate and validate the total size of the succinic acid market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides.

Report Objectives:

- To identify significant market trends and factors driving, restraining, providing opportunities, and challenging the growth of the succinic acid market

- To define, describe, and analyze the succinic acid market based on type, end-use industry, and region

- To forecast and analyze the size of the succinic acid market in key regions, namely, APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze each submarket with respect to individual growth trends and its contribution to the overall succinic acid market

- To analyze opportunities in the succinic acid market for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players in the succinic acid market and comprehensively analyze their growth strategies

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD Million), Volume (Kiloton) |

|

Segments covered |

Type, End-use Industry, and Region |

|

Regions covered |

North America, APAC, Europe, South America, and Middle East & Africa |

|

Companies covered |

BioAmber (Canada), GC Innovation America (US), Succinity GmbH (Germany), Reverdia (Netherlands), Nippon Shokubai (Japan), |

This report categorizes the succinic acid market based on type, end-use industry, and region.

On the basis of type, the succinic acid market has been segmented as follows

- Petro-based

- Bio-succinic

On the basis of end-use industry, the succinic acid market has been segmented as follows

- Industrial

- Coating

- Food & beverage

- Pharmaceutical

- Others (personal care, agriculture, and metal)

On the basis of region, the succinic acid market has been segmented as follows:

- APAC

- North America

- Europe

- South America

- Middle East & Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the regional succinic acid market to the country level by end-use industry

Country Information

- Regional market split by major countries

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Succinic Acid Market

Information on Composites, polymers, conformal coatings, ionic liquids, additive manufacturing, energy, space flight

Market information about succinic acid in Colombia

Succonic acid market in Brazil

I need information about the succinic acid market in Argentina.

Looking for "bio-derived" products in general to offer the detergent and personal care markets in Australia and New Zealand

Dear,I need information on succinic acid market in Iran.Thanks

Global Trends for Bio-succinic acid

Market information about succinic acid in Colombia

General information on succinic acid

Information on the succinic acid market