Synchronous Condenser Market by Cooling Type (Hydrogen-Cooles, Air-Cooled, Water-Cooled), Type (New & Refurbished), Starting Method (Static Frequency Converter, Pony Motor), End-User, Reactive Power Rating and Region - Global Forecast to 2030

[234 Pages Report] The global synchronous condenser market in terms of revenue was estimated to be worth $661 million in 2022 and is poised to reach $811 million by 2030, growing at a CAGR of 2.6% from 2022 to 2030. The growth of the synchronous condensers market can be attributed to the increasing investments in the power infrastructure to improve the grid reliability.

To know about the assumptions considered for the study, Request for Free Sample Report

Synchronous condenser Market Dynamics

Driver: Growing use of renewable and sustainable energy sources and increasing investments in capacity additions

Governments were implementing strategies to tackle environmental issues such as global warming, carbon emissions, and rising pollution, which have motivated countries to move toward clean energy sources. According to International Renewable Energy Agency (IRENA), renewables accounted for 38% of global installed power generation capacity in 2021. The power generation mix is expected to change over the next ten years, including the considerable increase in solar (utility-scale), distributed generation and storage, and grid-scale energy storage. According to the International Energy Agency (IEA), annual additions to global renewable power capacity will average roughly 305 GW annually between 2021 and 2026. This addition is driven by continuous government support in over 130 countries, net-zero objectives declared by countries accounting for nearly 90% of global GDP, and improved wind and solar PV competitiveness.

Investments in renewable energy technologies have risen globally in the last decade, amounting to USD 359 billion in 2020. The global capital expenditure for renewables increased by around 7% in 2020 compared to 2019, even as the COVID-19 pandemic disrupted the power industry. The rapidly declining installation cost of solar panels owing to fast-paced technological advancements is contributing to the rising demand for renewable energy technologies. Thus, the increasing adoption of renewable energy power generation technologies is expected to fuel the demand for synchronous condensers during the forecast period.

Restraint: High manufacturing and maintenance costs

Owing to the large-scale use of expensive raw materials such as aluminum and copper, the synchronous condenser cost of manufacturing is very high. The maintenance cost is generally in the range of USD 0.4/kVAr per year to USD 0.8/kVAr per year for a single synchronous condenser. In order to run without a load, it requires substantial power to function continuously. Usually, the installation cost of new synchronous condensers is more expensive ranging in hundreds of thousands of USD/MVAr, whereas the conversion cost from generators into synchronous condensers or refurbishment is between USD 20,000/MVAr and USD 50,000/MVAr. A synchronous condenser also functions as a DC-excited synchronous motor which makes it more expensive than its alternatives. Compared to other alternatives such as capacitor banks, and shunt reactors, synchronous condensers are the least popular in the market.

Opportunities: Conversion of existing synchronous generators into synchronous condensers

The growth of the conventional power generation source market is declining owing to the decommissioning of aging power generation plants, environmental regulations, growing competition from gas-fired turbines, and abundant renewable energy sources. Due to these factors, several aging coal-fired power plants across North America and Europe have been shut down. Since the Paris Agreement declaration, 21 countries have pledged to eliminate coal-fired generation from their electricity sectors. Belgium, Austria, and Sweden have phased-out coal power plants. As per the US Energy Information Administration (EIA), operators have scheduled 14.9 gigawatts (GW) of electric generating capacity to be out of service in the US during 2022. The majority of the scheduled retirements are coal-fired power plants (85%), followed by natural gas (8%) and nuclear (5%). According to the International Energy Agency (IEA), in July 2020, Japan announced its intention to phase out its less-efficient coal-fired power plants by 2030. More than two-thirds of the 140 coal-fired power plants in operation (representing ~50% of installed coal capacity) will be retired. In Germany, ~USD 4.6 billion will be awarded to lignite power plant companies to compensate them for their earlier investments and close the plants before 2030.

Retiring a power generation unit can reduce a plant’s reactive power capacity. There is a growing trend of converting aging power plants to synchronous condensers to stabilize the grid systems. These synchronous condensers provide the reactive power required for areas that were previously dependent on large thermal power plants. Converting the existing synchronous generators into synchronous condensers and re-using the foundation and building, auxiliary systems, and grid connections offer an economical source of reactive power capacity. Typically, about 30–35% more reactive power can be produced via the conversion because the unit can be overexcited in accordance with its capability curve that would not otherwise occur in power generation mode. The synchronous condenser cost is approximately USD 3–5 million and is expected to generate demand and create growth opportunities for the market players.

Challenges: Availability of low-cost substitute

Synchronous condenser are used to improve power factors by either absorbing or generating reactive power as per the requirement to strengthen and stabilize the grid systems. Various inexpensive alternatives to the synchronous condenser are available in the market, such as shunt reactors, capacitor banks, STATCOM, and static VAR compensators. These alternatives can also achieve grid stability or dynamic voltage control at a lower cost. Besides, synchronous condensers with long service life and stability are not widely adopted because of their high maintenance and equipment costs.

Market Trends

Market Ecosystem

The static frequency converter segment, by starting method, is expected to be the largest market during the forecast period

The static frequency converter segment is expected to be the largest during the forecast period. As Static converters occupy less space and generate less noise than mechanical converters with heavy machinery, which is the major reason for their high demand in the global synchronous condenser market. The requirement for low installation cost is expected to fuel the demand for static frequency converters.

By reactive power rating, the above 200 MVAr segment is expected to be the fastest market segment in the global synchronous condenser market during the forecast period

By reactive power rating, the market has been segmented into up to 100 MVAr, 101–200 MVAr, and above 200 MVAr. The above 200 MVAr, is expected to be the fastest-growing segment during the forecast period. These systems provide advantages such as cost efficiency, extremely low harmonic emission, high power quality, and short-circuit power capacity. Hydrogen is the widely used cooling system for the above 200 MVAr synchronous condensers. The rising adoption of large-sized hydrogen-cooled synchronous condensers is expected to drive the market.

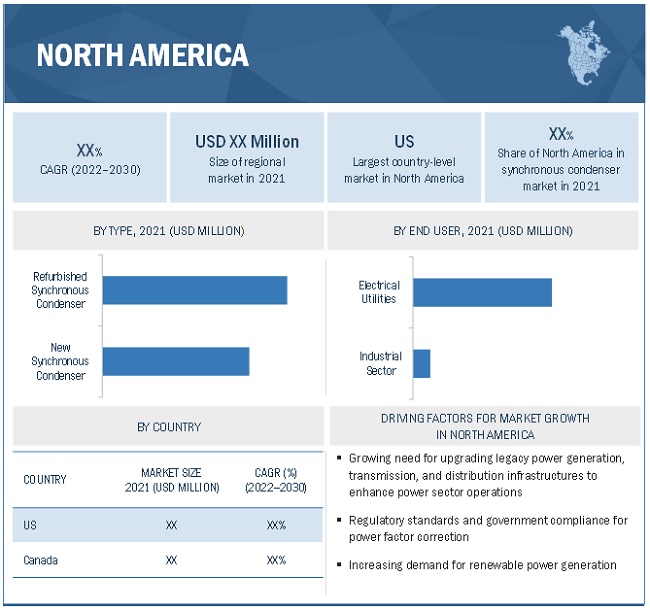

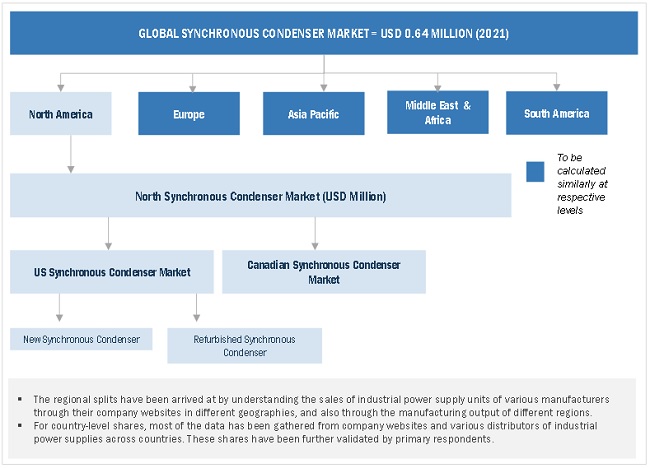

“North America: is expected to be the fastest synchronous condenser market”

North America is expected to grow fastest in the global synchronous condenser market between 2022–2030, followed by Europe and the Asia Pacific. The market in North America is due to the developments in this region actively focusing on upgrading and replacing aging infrastructures to improve grid reliability and resilience and develop smart electricity networks. The North American power sector is currently facing challenges such as meeting energy-efficiency targets, compliance with federal carbon policies and integrating various distributed generation sources in the grid. Utilities in the region are undergoing a major digital operational transformation. Their operators focus on decentralization, digitization, and decarbonization of power systems. These developments in the power infrastructure are driving the market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The synchronous condenser market is dominated by a few major players that have a wide regional presence. Contracts are among the key growth strategies adopted by a few leading synchronous condenser manufacturers, including GE (US), ABB (Switzerland), Siemens Energy (Germany), Eaton (Ireland), WEG (Brazil), Ansaldo Energia (Italy), and Mitsubishi Heavy Industries (Japan), to boost their position in the market. Companies operating in this market also focus on product launches, collaborations, acquisitions, and expansions to increase their market shares and expand their geographic presence.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2030 |

|

Forecast units |

Value (USD Million), Volume (Units) |

|

Segments covered |

Type, Cooling technology, Reactive power rating, Starting method, end user, and Region |

|

Geographies covered |

North America, South America, Asia Pacific, Middle East and Africa and Europe |

|

Companies covered |

ABB (Switzerland), Siemens Energy (Germany), GE (US), Eaton (Ireland), Voith Group (Germany), Fuji Electric (Japan), WEG (Brazil), BRUSH Group (UK), and ANDRITZ (Austria), Ansaldo Energia (Italy), Mitsubishi Heavy Industries, Ltd. (Japan), BHEL (India), Ideal Electric Power Co. (USA), Power Systems & Controls (USA), Electromechanical Engineering Associates (USA), Anhui Zhongdian (ZDDQ) Electric Co. (China), Shanghai Electric (China), Ingeteam ( Spain), Doosan Škoda Power (Czech Republic), Hangzhou Jingcheng Electrical Equipment Co. (China) |

This research report categorizes the market by Type, Cooling technology, Reactive power rating, Starting method, end user, and region

On the basis of insulation type, the Synchronous condenser market has been segmented as follows:

- New Synchronous Conder

- Refurbished Synchronous Condenser

On the basis of Cooling Technology, the market has been segmented as follows:

- Hydrogen-Cooled Synchronous Condenser

- Air-Cooled Synchronous Condenser

- Water-Cooled Synchronous Condenser

On the basis of Starting method, the market has been segmented as follows:

- Static Frequency Converter

- Pony Motor

- Others

On the basis of by Reactive Power rating, the market has been segmented as follows:

- Up to 100 MVAr

- 101–200 MVAr

- Above 200 MVAr

On the basis of End User, the market has been segmented as follows:

- Electrical Utilities

- Industrial Sector

On the basis of region, the market has been segmented as follows:

- North America

- South America

- Europe

- Middle East and Africa

- Asia Pacific

Recent Developments

- In March 2022, ANDRITZ Group received a contract from Doosan Heavy Industries and Construction Co. Ltd. to supply the hydro- and electromechanical equipment for the 216-MW Upper Trishuli 1 hydropower plant, a run-of-river plant in Nepal owned by Nepal Water & Energy Development Company Pvt. Ltd. The order for the electromechanical equipment comprises the basic and detailed design of the turbine and generator components, complete electrical power systems, balance of plant, automation, installation, and commissioning.

- In August 2021, ABB was awarded a major turnkey contract by Statkraft, Europe’s largest renewable energy generator, to design, manufacture, and install two high-inertia synchronous condenser systems for the Lister Drive Greener Grid project at Liverpool in Northwest England.

- In May 2021, Italian transmission system operator Terna. S.p.A (Terna) has ordered two static synchronous compensators (STATCOM) systems and two synchronous condensers will ensure the stability of the Italian grid.

- In January 2021, WEG acquired Industrial e Comércio de Turbinals e Transmissões Ltda. (TGM). TGM is a Brazilian provider of solutions and equipment for power generator drivers focusing on thermal and wind energy. This acquisition would expand WEG’s product portfolio related to the Industrial Electro-electronic Equipment and Energy Generation segments.

Frequently Asked Questions (FAQ):

What is the current size of the synchronous condenser market?

The current market size of global synchronous condenser market is USD 661 Million in 2022.

What is the major drivers for the synchronous condenser market?

The global synchronous condenser market is driven by the increasing focus on increasing renewable energy installations in various countries and investments in improving the power infrastructure.

Which is the fastest-growing region during the forecasted period in synchronous condenser market?

North America is the fastest-growing region during the forecasted period owing to increase in the developments in the power infrastructure to improve the grid reliability in various countries such as US and Canada.

Which is the fastest-growing segment, by end user the forecasted period in synchronous condenser market?

The electrical utilities segment is witnessing a high demand during the forecasted period owing to developments in the T&D infrastructure with heavy investments and the shift towards renewable energy sources in energy sector. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY: INCLUSIONS AND EXCLUSIONS

1.3.2 MARKET, BY REACTIVE POWER RATING: INCLUSIONS AND EXCLUSIONS

1.3.3 MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET: SEGMENTATION

1.4.2 SYNCHRONOUS CONDENSER MARKET: REGIONAL SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 SYNCHRONOUS CONDENSER MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 SCOPE OF STUDY

2.4 DEMAND-SIDE ANALYSIS

FIGURE 2 PARAMETERS CONSIDERED WHILE ASSESSING DEMAND FOR SYNCHRONOUS CONDENSERS

2.4.1 DEMAND-SIDE ANALYSIS: BOTTOM-UP APPROACH

FIGURE 3 SYNCHRONOUS CONDENSER MARKET: INDUSTRY AND REGION-/COUNTRY-WISE ANALYSIS

2.4.1.1 Demand-side analysis of market

2.4.1.2 Assumptions while calculating demand-side market size

2.4.2 SUPPLY-SIDE ANALYSIS

FIGURE 4 CALCULATION OF REVENUES OF MAJOR PLAYERS FROM SALES OF SYNCHRONOUS CONDENSERS TO IDENTIFY GLOBAL MARKET SIZE

2.4.2.1 Supply-side analysis of synchronous condenser market

FIGURE 5 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF SYNCHRONOUS CONDENSERS

2.4.2.2 Assumptions while calculating supply-side market size

FIGURE 6 COMPANY REVENUE ANALYSIS, 2021

2.4.3 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 48)

TABLE 1 SYNCHRONOUS CONDENSER MARKET: SNAPSHOT

FIGURE 7 NORTH AMERICA DOMINATED MARKET IN 2021

FIGURE 8 HYDROGEN-COOLED SYNCHRONOUS CONDENSER SEGMENT TO DOMINATE MARKET, BY COOLING TECHNOLOGY, DURING FORECAST PERIOD

FIGURE 9 STATIC FREQUENCY CONVERTER TO BE FASTEST-GROWING SEGMENT OF MARKET, BY STARTING METHOD, DURING FORECAST PERIOD

FIGURE 10 ABOVE 200 MVAR SEGMENT TO DOMINATE MARKET, BY REACTIVE POWER RATING, DURING FORECAST PERIOD

FIGURE 11 ELECTRICAL UTILITIES SEGMENT TO DOMINATE MARKET, BY END USER, DURING FORECAST PERIOD

FIGURE 12 NEW SYNCHRONOUS CONDENSER SEGMENT TO LEAD MARKET, BY TYPE, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SYNCHRONOUS CONDENSER MARKET

FIGURE 13 RISING INVESTMENTS IN DEVELOPING POWER INFRASTRUCTURES AND INTEGRATION OF RENEWABLE SOURCES INTO GRIDS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS DURING FORECAST PERIOD

4.2 SYNCHRONOUS CONDENSER MARKET, BY REGION

FIGURE 14 NORTH AMERICAN MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 NORTH AMERICA: MARKET, BY TYPE AND COUNTRY, 2021

FIGURE 15 REFURBISHED SYNCHRONOUS CONDENSER SEGMENT AND US HELD LARGER SHARES OF NORTH AMERICAN MARKET IN 2021

4.4 MARKET, BY REACTIVE POWER RATING

FIGURE 16 ABOVE 200 MVAR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2030

4.5 MARKET, BY STARTING METHOD

FIGURE 17 STATIC FREQUENCY CONVERTER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2030

4.6 MARKET, BY COOLING TECHNOLOGY

FIGURE 18 HYDROGEN-COOLED SYNCHRONOUS CONDENSER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2030

4.7 MARKET, BY TYPE

FIGURE 19 NEW SYNCHRONOUS CONDENSER SEGMENT TO DOMINATE MARKET BY 2030

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 SYNCHRONOUS CONDENSER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing use of renewable and sustainable energy sources and increasing investments in capacity additions

FIGURE 21 RENEWABLE ELECTRICITY CAPACITY ADDITION, 2014–2021

FIGURE 22 INSTALLED RENEWABLE ELECTRICITY GENERATING CAPACITY, 2020–2050

5.2.1.2 Growing requirement for power factor correction (PFC) and increasing investments in developing transmission and distribution (T&D) infrastructures

FIGURE 23 INVESTMENTS IN ELECTRICITY NETWORKS, BY REGION (2015–2021)

TABLE 2 TRANSMISSION AND DISTRIBUTION (T&D) INFRASTRUCTURE EXPANSION PLANS

5.2.2 RESTRAINTS

5.2.2.1 High manufacturing and maintenance costs

5.2.3 OPPORTUNITIES

5.2.3.1 Conversion of synchronous generators into synchronous condensers

5.2.3.2 Rising adoption of high-voltage direct current (HVDC) systems

5.2.4 CHALLENGES

5.2.4.1 Availability of low-cost substitutes

TABLE 3 COMPARISON BETWEEN SYNCHRONOUS CONDENSER AND ITS SUBSTITUTES

5.2.4.2 Shortage of components/parts used in manufacturing of synchronous condensers due to COVID-19

TABLE 4 CHANGE IN PRICES OF COMMODITIES, 2019–2020

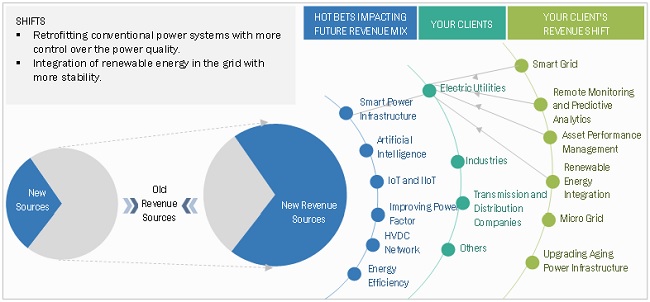

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SYNCHRONOUS CONDENSER MANUFACTURERS

FIGURE 24 REVENUE SHIFT FOR SYNCHRONOUS CONDENSER MANUFACTURERS

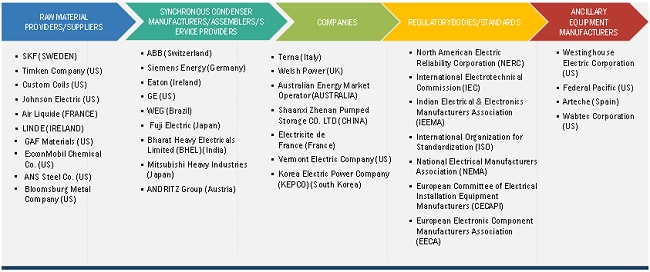

5.4 MARKET MAP

FIGURE 25 MARKET: MARKET MAP

TABLE 5 SYNCHRONOUS CONDENSER MARKET: ROLE IN ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

FIGURE 26 MARKET: VALUE CHAIN ANALYSIS

5.5.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.5.2 COMPONENT MANUFACTURERS

5.5.3 SYNCHRONOUS CONDENSER MANUFACTURERS/ASSEMBLERS/SERVICE PROVIDERS

5.5.4 DISTRIBUTORS/END USERS

5.5.5 POST-SALES SERVICE PROVIDERS

5.6 CODES AND REGULATIONS RELATED TO MARKET

TABLE 6 SYNCHRONOUS CONDENSER MARKET: CODES AND REGULATIONS

5.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.8 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 12 MARKET: INNOVATIONS AND PATENT REGISTRATIONS, FEBRUARY 2016–NOVEMBER 2021

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS

TABLE 13 SYNCHRONOUS CONDENSER MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF SUBSTITUTES

5.9.2 BARGAINING POWER OF SUPPLIERS

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 THREAT OF NEW ENTRANTS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 CASE STUDY ANALYSIS

5.10.1 USE OF GE’S SYNCHRONOUS CONDENSERS IN NORTHWEST VERMONT RELIABILITY PROJECT

5.10.1.1 Problem statement

5.10.1.2 Solution

5.10.2 REFURBISHMENT OF SYNCHRONOUS GENERATORS TO SYNCHRONOUS CONDENSERS

5.10.2.1 Problem statement

5.10.2.2 Solution

5.10.3 USE OF TERNA’S SYNCHRONOUS CONDENSERS TO STABILIZE GRID IN SARDINIA REGION

5.10.3.1 Problem statement

5.10.3.2 Solution

5.11 PRICING ANALYSIS

TABLE 14 AVERAGE SELLING PRICE OF SYNCHRONOUS CONDENSERS

5.12 TECHNOLOGY ANALYSIS

5.12.1 HIGH-TEMPERATURE SUPERCONDUCTOR (HTS) DYNAMIC SYNCHRONOUS CONDENSER

5.12.2 MODE OF OPERATION (APPLICATION)

5.12.2.1 Standalone synchronous condenser

5.12.2.2 Power plants with synchronous condensing capacity

5.12.2.3 Retrofitting of existing and decommissioned power plants

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY END USER

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY END USER (%)

5.13.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR END USERS

TABLE 16 KEY BUYING CRITERIA, BY END USER

5.14 KEY CONFERENCES AND EVENTS, 2022–2024

TABLE 17 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 SYNCHRONOUS CONDENSER MARKET, BY TYPE (Page No. - 91)

6.1 INTRODUCTION

FIGURE 30 NEW SYNCHRONOUS CONDENSER SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2021

TABLE 18 SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 19 MARKET, BY TYPE, 2022–2030 (USD MILLION)

6.2 NEW SYNCHRONOUS CONDENSER

6.2.1 EXPANSION OF HVDC NETWORKS TO INCREASE INSTALLATION OF NEW SYNCHRONOUS CONDENSERS

TABLE 20 NEW SYNCHRONOUS CONDENSER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 NEW SYNCHRONOUS CONDENSER: MARKET, BY REGION, 2022–2030 (USD MILLION)

6.3 REFURBISHED SYNCHRONOUS CONDENSER

6.3.1 LOW COST OF REFURBISHED SYNCHRONOUS CONDENSERS TO FUEL DEMAND

TABLE 22 REFURBISHED SYNCHRONOUS CONDENSER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 REFURBISHED SYNCHRONOUS CONDENSER: MARKET, BY REGION, 2022–2030 (USD MILLION)

7 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY (Page No. - 95)

7.1 INTRODUCTION

FIGURE 31 HYDROGEN-COOLED SYNCHRONOUS CONDENSER SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

TABLE 24 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 25 MARKET, BY COOLING TECHNOLOGY, 2022–2030 (USD MILLION)

7.2 HYDROGEN-COOLED SYNCHRONOUS CONDENSER

7.2.1 LOW WINDAGE LOSS AND HIGH THERMAL CONDUCTIVITY FEATURES OF HYDROGEN-COOLED SYNCHRONOUS CONDENSERS TO FUEL DEMAND

TABLE 26 HYDROGEN-COOLED SYNCHRONOUS CONDENSER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 HYDROGEN-COOLED SYNCHRONOUS CONDENSER: MARKET, BY REGION, 2022–2030 (USD MILLION)

7.3 AIR-COOLED SYNCHRONOUS CONDENSER

7.3.1 EXCELLENT COOLING FEATURE OF AIR-COOLED SYNCHRONOUS CONDENSERS TO PROPEL DEMAND

TABLE 28 AIR-COOLED SYNCHRONOUS CONDENSER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 AIR-COOLED SYNCHRONOUS CONDENSER: MARKET, BY REGION, 2022–2030 (USD MILLION)

7.4 WATER-COOLED SYNCHRONOUS CONDENSER

7.4.1 HIGHER EFFICIENCY OF WATER-COOLED SYNCHRONOUS CONDENSERS COMPARED TO HYDROGEN-COOLED CONDENSERS TO FUEL DEMAND

TABLE 30 WATER-COOLED SYNCHRONOUS CONDENSER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 WATER-COOLED SYNCHRONOUS CONDENSER: MARKET, BY REGION, 2022–2030 (USD MILLION)

8 SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD (Page No. - 101)

8.1 INTRODUCTION

FIGURE 32 STATIC FREQUENCY CONVERTER SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

TABLE 32 MARKET, BY STARTING METHOD, 2018–2021 (USD MILLION)

TABLE 33 MARKET, BY STARTING METHOD, 2022–2030 (USD MILLION)

8.2 STATIC FREQUENCY CONVERTER

8.2.1 LOW INSTALLATION COST OF STATIC FREQUENCY CONVERTER TO FUEL DEMAND

TABLE 34 STATIC FREQUENCY CONVERTER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 STATIC FREQUENCY CONVERTER: MARKET, BY REGION, 2022–2030 (USD MILLION)

8.3 PONY MOTOR

8.3.1 LOW COST AND ABILITY TO START LOW-CAPACITY SYNCHRONOUS CONDENSERS (BELOW 50 MVAR) TO FUEL DEMAND FOR PONY MOTORS

TABLE 36 PONY MOTOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 PONY MOTOR: MARKET, BY REGION, 2022–2030 (USD MILLION)

8.4 OTHERS

TABLE 38 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 OTHERS: MARKET, BY REGION, 2022–2030 (USD MILLION)

9 SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING (Page No. - 107)

9.1 INTRODUCTION

FIGURE 33 ABOVE 200 MVAR SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

TABLE 40 MARKET, BY REACTIVE POWER RATING, 2018–2021 (USD MILLION)

TABLE 41 MARKET, BY REACTIVE POWER RATING, 2022–2030 (USD MILLION)

9.2 UP TO 100 MVAR

9.2.1 RISING USE OF AIR- AND WATER-COOLED SYNCHRONOUS CONDENSERS TO FUEL MARKET GROWTH

TABLE 42 UP TO 100 MVAR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 UP TO 100 MVAR: MARKET, BY REGION, 2022–2030 (USD MILLION)

9.3 101–200 MVAR

9.3.1 GROWING NEED TO ENSURE STABILITY OF TRANSMISSION GRIDS TO FUEL DEMAND FOR 101–200 MVAR SYNCHRONOUS CONDENSERS

TABLE 44 101–200 MVAR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 101–200 MVAR: MARKET, BY REGION, 2022–2030 (USD MILLION)

9.4 ABOVE 200 MVAR

9.4.1 RISING ADOPTION OF LARGE-SIZED HYDROGEN-COOLED SYNCHRONOUS CONDENSERS TO DRIVE MARKET GROWTH

TABLE 46 ABOVE 200 MVAR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 ABOVE 200 MVAR: MARKET, BY REGION, 2022–2030 (USD MILLION)

10 SYNCHRONOUS CONDENSER MARKET, BY END USER (Page No. - 114)

10.1 INTRODUCTION

FIGURE 34 ELECTRICAL UTILITIES SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2021

TABLE 48 MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 49 MARKET, BY END USER, 2022–2030 (USD MILLION)

10.2 ELECTRICAL UTILITIES

10.2.1 RISING NEED TO IMPROVE GRID STABILITY TO BOOST MARKET GROWTH

TABLE 50 ELECTRICAL UTILITIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 ELECTRICAL UTILITIES: MARKET, BY REGION, 2022–2030 (USD MILLION)

10.3 INDUSTRIAL SECTOR

10.3.1 INCREASING NEED TO PERFORM POWER FACTOR CORRECTION OF INDUSTRIAL LOADS TO FUEL DEMAND FOR SYNCHRONOUS CONDENSERS

TABLE 52 INDUSTRIAL SECTOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 INDUSTRIAL SECTOR: MARKET, BY REGION, 2022–2030 (USD MILLION)

11 SYNCHRONOUS CONDENSER MARKET, BY REGION (Page No. - 119)

11.1 INTRODUCTION

FIGURE 35 SYNCHRONOUS CONDENSER MARKET: REGIONAL SNAPSHOT

FIGURE 36 REGIONAL ANALYSIS OF MARKET, 2021

TABLE 54 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 56 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 57 MARKET, BY REGION, 2022–2030 (UNITS)

11.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

11.2.1 BY TYPE

TABLE 58 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY TYPE, 2022–2030 (USD MILLION)

11.2.2 BY COOLING TECHNOLOGY

TABLE 60 NORTH AMERICA: MARKET, BY COOLING TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY COOLING TECHNOLOGY, 2022–2030 (USD MILLION)

11.2.3 BY STARTING METHOD

TABLE 62 NORTH AMERICA: MARKET, BY STARTING METHOD, 2018–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY STARTING METHOD, 2022–2030 (USD MILLION)

11.2.4 BY REACTIVE POWER RATING

TABLE 64 NORTH AMERICA: MARKET, BY REACTIVE POWER RATING, 2018–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY REACTIVE POWER RATING, 2022–2030 (USD MILLION)

11.2.5 BY END USER

TABLE 66 NORTH AMERICA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.2.6 BY COUNTRY

TABLE 68 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

11.2.6.1 US

11.2.6.1.1 Government-led initiatives to upgrade legacy power infrastructures and phase out coal-based power plants to fuel demand for synchronous condensers

FIGURE 38 PLANNED RETIREMENTS OF UTILITY-SCALE ELECTRICITY-GENERATING CAPACITIES IN US, 2022–2030

TABLE 70 US: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 71 US: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.2.6.2 Canada

11.2.6.2.1 Rising investments in renewable energy generation to propel market growth

TABLE 72 CANADA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 73 CANADA: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.3 EUROPE

FIGURE 39 EUROPE: SYNCHRONOUS CONDENSER MARKET SNAPSHOT

11.3.1 BY TYPE

TABLE 74 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY TYPE, 2022–2030 (USD MILLION)

11.3.2 BY COOLING TECHNOLOGY

TABLE 76 EUROPE: MARKET, BY COOLING TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY COOLING TECHNOLOGY, 2022–2030 (USD MILLION)

11.3.3 BY STARTING METHOD

TABLE 78 EUROPE: MARKET, BY STARTING METHOD, 2018–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY STARTING METHOD, 2022–2030 (USD MILLION)

11.3.4 BY REACTIVE POWER RATING

TABLE 80 EUROPE: MARKET, BY REACTIVE POWER RATING, 2018–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY REACTIVE POWER RATING, 2022–2030 (USD MILLION)

11.3.5 BY END USER

TABLE 82 EUROPE: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.3.6 BY COUNTRY

TABLE 84 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

11.3.6.1 Denmark

11.3.6.1.1 Growing need to stabilize gird transmission to fuel demand for synchronous condensers

TABLE 86 DENMARK: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 87 DENMARK: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.3.6.2 Italy

11.3.6.2.1 Rising integration of renewable sources into grids to propel demand for synchronous condensers

TABLE 88 ITALY: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 89 ITALY: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.3.6.3 Germany

11.3.6.3.1 Government-led initiatives to replace fossil fuels with renewable sources in power generation mix to drive market growth

TABLE 90 GERMANY: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 91 GERMANY: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.3.6.4 Norway

11.3.6.4.1 Rising investments in expansion of HVDC networks to fuel demand for synchronous condensers

TABLE 92 NORWAY: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 93 NORWAY: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.3.6.5 Rest of Europe

TABLE 94 REST OF EUROPE: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 95 REST OF EUROPE: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.4 SOUTH AMERICA

11.4.1 BY TYPE

TABLE 96 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 97 SOUTH AMERICA: MARKET, BY TYPE, 2022–2030 (USD MILLION)

11.4.2 BY COOLING TECHNOLOGY

TABLE 98 SOUTH AMERICA: MARKET, BY COOLING TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 99 SOUTH AMERICA: MARKET, BY COOLING TECHNOLOGY, 2022–2030 (USD MILLION)

11.4.3 BY STARTING METHOD

TABLE 100 SOUTH AMERICA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 101 SOUTH AMERICA: MARKET, BY STARTING METHOD, 2022–2030 (USD MILLION)

11.4.4 BY REACTIVE POWER RATING

TABLE 102 SOUTH AMERICA: MARKET, BY REACTIVE POWER RATING, 2018–2021 (USD MILLION)

TABLE 103 SOUTH AMERICA: MARKET, BY REACTIVE POWER RATING, 2022–2030 (USD MILLION)

11.4.5 BY END USER

TABLE 104 SOUTH AMERICA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 105 SOUTH AMERICA: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.4.6 BY COUNTRY

TABLE 106 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 107 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

11.4.6.1 Brazil

11.4.6.1.1 Government-led initiatives to develop power infrastructures to fuel demand for synchronous condensers

TABLE 108 BRAZIL: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 109 BRAZIL: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.4.6.2 Rest of South America

TABLE 110 REST OF SOUTH AMERICA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 111 REST OF SOUTH AMERICA: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET SNAPSHOT

11.5.1 BY TYPE

TABLE 112 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY TYPE, 2022–2030 (USD MILLION)

11.5.2 BY COOLING TECHNOLOGY

TABLE 114 ASIA PACIFIC: MARKET, BY COOLING TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY COOLING TECHNOLOGY, 2022–2030 (USD MILLION)

11.5.3 BY STARTING METHOD

TABLE 116 ASIA PACIFIC: MARKET, BY STARTING METHOD, 2018–2021 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET, BY STARTING METHOD, 2022–2030 (USD MILLION)

11.5.4 BY REACTIVE POWER RATING

TABLE 118 ASIA PACIFIC: MARKET, BY REACTIVE POWER RATING, 2018–2021 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY REACTIVE POWER RATING, 2022–2030 (USD MILLION)

11.5.5 BY END USER

TABLE 120 ASIA PACIFIC: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.5.6 BY COUNTRY

TABLE 122 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

11.5.6.1 China

11.5.6.1.1 Growing need to improve power reliability to fuel demand for synchronous condensers

TABLE 124 CHINA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 125 CHINA: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.5.6.2 Australia

11.5.6.2.1 Rising deployment of synchronous condensers in power infrastructures to drive market growth

TABLE 126 AUSTRALIA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 127 AUSTRALIA: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.5.6.3 Rest of Asia Pacific

TABLE 128 REST OF ASIA PACIFIC: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 129 REST OF ASIA PACIFIC: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

11.6.1 BY TYPE

TABLE 130 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2022–2030 (USD MILLION)

11.6.2 BY COOLING TECHNOLOGY

TABLE 132 MIDDLE EAST & AFRICA: MARKET, BY COOLING TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: MARKET, BY COOLING TECHNOLOGY, 2022–2030 (USD MILLION)

11.6.3 BY STARTING METHOD

TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY STARTING METHOD, 2018–2021 (USD MILLION)

TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY STARTING METHOD, 2022–2030 (USD MILLION)

11.6.4 BY REACTIVE POWER RATING

TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY REACTIVE POWER RATING, 2018–2021 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY REACTIVE POWER RATING, 2022–2030 (USD MILLION)

11.6.5 BY END USER

TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.6.6 BY COUNTRY

TABLE 140 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 141 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

11.6.6.1 Kenya

11.6.6.1.1 Increasing number of power generation projects to drive market growth

TABLE 142 KENYA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 143 KENYA: MARKET, BY END USER, 2022–2030 (USD MILLION)

11.6.6.2 Rest of Middle East & Africa

TABLE 144 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 145 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2022–2030 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 161)

12.1 KEY PLAYER STRATEGIES

TABLE 146 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP MARKET PLAYERS, JANUARY 2017–JUNE 2022

12.2 MARKET SHARE ANALYSIS

TABLE 147 MARKET: DEGREE OF COMPETITION

FIGURE 41 SYNCHRONOUS CONDENSER MARKET SHARE ANALYSIS, 2021

12.3 REVENUE SHARE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 42 TOP 5 PLAYERS DOMINATED SYNCHRONOUS CONDENSER MARKET FROM 2017 TO 2021

12.4 COMPANY EVALUATION QUADRANT

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVE PLAYERS

12.4.4 PARTICIPANTS

FIGURE 43 COMPETITIVE LEADERSHIP MAPPING: SYNCHRONOUS CONDENSER MARKET, 2021

12.5 SYNCHRONOUS CONDENSER MARKET: COMPANY FOOTPRINT

TABLE 148 TYPE: COMPANY FOOTPRINT

TABLE 149 REACTIVE POWER RATING: COMPANY FOOTPRINT

TABLE 150 REGION: COMPANY FOOTPRINT

TABLE 151 OVERALL COMPANY FOOTPRINT

12.6 COMPETITIVE SCENARIO

TABLE 152 MARKET: PRODUCT LAUNCHES, JANUARY 2017–SEPTEMBER 2021

TABLE 153 SYNCHRONOUS CONDENSER MARKET: DEALS, JANUARY 2017–SEPTEMBER 2021

13 COMPANY PROFILES (Page No. - 174)

13.1 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)*

13.1.1 ABB

TABLE 154 ABB: BUSINESS OVERVIEW

FIGURE 44 ABB: COMPANY SNAPSHOT, 2021

TABLE 155 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 156 ABB: PRODUCT LAUNCHES

TABLE 157 ABB: DEALS

TABLE 158 ABB: OTHERS

13.1.2 SIEMENS ENERGY

TABLE 159 SIEMENS ENERGY: BUSINESS OVERVIEW

FIGURE 45 SIEMENS ENERGY: COMPANY SNAPSHOT, 2021

TABLE 160 SIEMENS ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 161 SIEMENS ENERGY: OTHERS

13.1.3 GE

TABLE 162 GE: BUSINESS OVERVIEW

FIGURE 46 GE: COMPANY SNAPSHOT, 2021

TABLE 163 GE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 164 GE: OTHERS

13.1.4 WEG

TABLE 165 WEG: BUSINESS OVERVIEW

FIGURE 47 WEG: COMPANY SNAPSHOT, 2021

TABLE 166 WEG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 167 WEG: DEALS

TABLE 168 WEG: OTHERS

13.1.5 EATON

TABLE 169 EATON: BUSINESS OVERVIEW

FIGURE 48 EATON: COMPANY SNAPSHOT, 2021

TABLE 170 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.6 ANDRITZ GROUP

TABLE 171 ANDRITZ GROUP: BUSINESS OVERVIEW

FIGURE 49 ANDRITZ GROUP: COMPANY SNAPSHOT, 2021

TABLE 172 ANDRITZ GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 173 ANDRITZ GROUP: OTHERS

13.1.7 ANSALDO ENERGIA

TABLE 174 ANSALDO ENERGIA: BUSINESS OVERVIEW

FIGURE 50 ANSALDO ENERGIA: COMPANY SNAPSHOT, 2021

TABLE 175 ANSALDO ENERGIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 176 ANSALDO ENERGIA: OTHERS

13.1.8 MITSUBISHI HEAVY INDUSTRIES

TABLE 177 MITSUBISHI HEAVY INDUSTRIES: BUSINESS OVERVIEW

FIGURE 51 MITSUBISHI HEAVY INDUSTRIES: COMPANY SNAPSHOT, 2020

TABLE 178 MITSUBISHI HEAVY INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 179 MITSUBISHI HEAVY INDUSTRIES: OTHERS

13.1.9 VOITH GROUP

TABLE 180 VOITH GROUP: BUSINESS OVERVIEW

FIGURE 52 VOITH GROUP: COMPANY SNAPSHOT, 2021

TABLE 181 VOITH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 182 VOITH GROUP: OTHERS

13.1.10 FUJI ELECTRIC

TABLE 183 FUJI ELECTRIC: BUSINESS OVERVIEW

FIGURE 53 FUJI ELECTRIC: COMPANY SNAPSHOT, 2020

TABLE 184 FUJI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.11 BHARAT HEAVY ELECTRICALS LIMITED (BHEL)

TABLE 185 BHARAT HEAVY ELECTRICALS LIMITED (BHEL): BUSINESS OVERVIEW

FIGURE 54 BHARAT HEAVY ELECTRICALS LIMITED (BHEL): COMPANY SNAPSHOT, 2021

TABLE 186 BHARAT HEAVY ELECTRICALS LIMITED (BHEL): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

13.1.12 IDEAL ELECTRIC POWER (HYUNDAI IDEAL ELECTRIC CO.)

TABLE 187 IDEAL ELECTRIC POWER: BUSINESS OVERVIEW

TABLE 188 IDEAL ELECTRIC POWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.13 POWER SYSTEMS & CONTROLS

TABLE 189 POWER SYSTEMS & CONTROLS (PS&C): BUSINESS OVERVIEW

TABLE 190 POWER SYSTEMS & CONTROLS (PS&C): PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.14 BRUSH GROUP

TABLE 191 BRUSH GROUP: BUSINESS OVERVIEW

TABLE 192 BRUSH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.15 ELECTROMECHANICAL ENGINEERING ASSOCIATES

TABLE 193 ELECTROMECHANICAL ENGINEERING ASSOCIATES (EME): BUSINESS OVERVIEW

TABLE 194 ELECTROMECHANICAL ENGINEERING ASSOCIATES (EME): PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 195 ELECTROMECHANICAL ENGINEERING ASSOCIATES (EME): OTHERS

13.1.16 ANHUI ZHONGDIAN (ZDDQ) ELECTRIC CO., LTD.

TABLE 196 ANHUI ZHONGDIAN ELECTRIC CO., LTD.: BUSINESS OVERVIEW

TABLE 197 ANHUI ZHONGDIAN ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.17 SHANGHAI ELECTRIC

TABLE 198 SHANGHAI ELECTRIC: BUSINESS OVERVIEW

TABLE 199 SHANGHAI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.18 INGETEAM

TABLE 200 INGETEAM: BUSINESS OVERVIEW

TABLE 201 INGETEAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.19 DOOSAN ŠKODA POWER

TABLE 202 DOOSAN ŠKODA POWER: BUSINESS OVERVIEW

TABLE 203 DOOSAN ŠKODA POWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.20 HANGZHOU JINGCHENG ELECTRICAL EQUIPMENT CO., LTD.

TABLE 204 HANGZHOU JINGCHENG ELECTRICAL EQUIPMENT CO., LTD.: BUSINESS OVERVIEW

TABLE 205 HANGZHOU JINGCHENG ELECTRICAL EQUIPMENT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 225)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

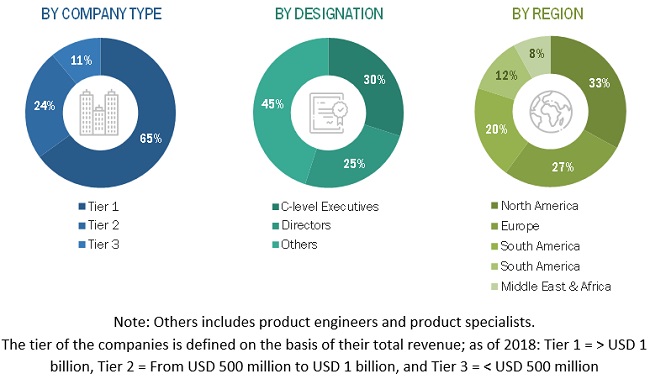

The study involved major activities in estimating the current size of the synchronous condensers market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

The research study on the Synchronous condensers market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, World Bank, Observatory of Economic Complexity (OEC), International Energy Agency, Ceicdata, Researchgate, Onepetro, International Electrotechnical Commission, US Energy Information Administration (EIA), Electrical Equipment Associations, UNESCO Institute for Statistics (UIS) Bloomberg, Businessweek, Factiva, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The synchronous condenser market comprises several stakeholders such as synchronous condenser manufacturers, raw material providers, manufacturers of subcomponents of synchronous condenser, manufacturing technology providers, technical support providers, and end users in the supply chain. The demand side of this market is characterized by the rising demand for renewable energy generation in major countries such as the US and the rapid pace of industrialization and urbanization across the globe across a wide variety of end users. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the synchronous condensers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Synchronous Condenser Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the Synchronous condenser market size, by insulation type, cooling technology, reactive power rating, starting method, and end user, in terms of value

- To define, describe, segment, and forecast the Synchronous condensers market size, by region, in terms of volume

- To provide detailed information on the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the synchronous condensers market

- To provide detailed information on market map, value chain, case studies, pricing, technologies, market ecosystem, tariff and regulatory landscape, Porter’s five forces, and trends/disruptions impacting customers’ businesses that are specific to the synchronous condensers market

- The analyze impact of COVID-19 on the market

- To strategically analyze the synchronous condensers market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to 5 main regions (along with countries), namely, North America, South America, Asia Pacific, Middle East and Africa and Europe.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as sales contracts, agreements, investments, expansions, product launches, mergers, partnerships, joint ventures, collaborations, and acquisitions, in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Synchronous Condenser Market

What are the recent developments in the Global Synchronous Condenser Market?

Need to know more about the Synchronous Condenser Market size and Scope in Asia Pacific for the forecast year.