Synchronous Condenser Market

Synchronous Condenser Market by Cooling Type (Hydrogen-cooled, Air-Cooled, Water-Cooled), Type (New & Refurbished), Starting Method (Static Frequency Converter, Pony Motor), End User, Reactive Power Rating, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The synchronous condenser market is projected to reach USD 0.84 billion by 2030, up from USD 0.72 billion in 2025, at a CAGR of 3.3% during the forecast period. The synchronous condenser market is growing due to increased investments in power infrastructure for enhancing grid reliability.

KEY TAKEAWAYS

-

BY REGIONNorth America accounts for the largest market share of 50.8% in 2025.

-

BY TYPEBy type, the new synchronous condenser segment is projected to grow at the fastest rate from 2025 to 2030.

-

BY Cooling TypeBy cooling type, the hydrogen cooled segment is estimated to register the highest CAGR of 3.4% from 2025 to 2030.

-

BY Starting MethodBy starting method, static frequency converters segment is expected to dominate the market.

-

BY POWER RATINGBy power rating, the above 200 MVAr segment is estimated to register the highest CAGR of 3.4% from 2025 to 2030.

-

BY END USERBy end user, the electrical utilities segment is estimated to register the highest CAGR of 3.4% from 2025 to 2030.

-

COMPETITIVE LANDSCAPECompanies such as Siemens Energy (Germany), Eaton (Ireland), WEG (Brazil), GE Vernova (US), and ABB (Switzerland) were identified as some of the star players in the synchronous condenser market.

The increasing demand for grid stability, voltage regulation, and inertia support, driven by the growing penetration of renewable energy, is driving the adoption of synchronous condensers in both transmission and distribution networks. These systems assist utilities in managing voltage fluctuations, enhancing short-circuit strength, and maintaining grid reliability as conventional thermal power plants are phased out. However, there are significant challenges to widespread deployment, including high capital costs, lengthy installation timelines, and ongoing maintenance requirements, as well as space and foundation constraints. Additionally, the availability of skilled engineers for commissioning, tuning, and long-term operation is limited in many regions. At the same time, government-led grid modernization programs, renewable integration mandates, and investments in transmission infrastructure are creating substantial growth opportunities, particularly in areas with high wind and solar energy penetration. Nevertheless, utilities and system operators face the ongoing challenge of managing lifecycle costs while ensuring seamless integration with advanced grid automation and protection systems.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The synchronous condenser market is poised for steady growth in the coming years, driven by the accelerating integration of renewable energy, grid modernization initiatives, and the retirement of conventional synchronous generation assets. Advanced synchronous condensers equipped with digital monitoring, real-time diagnostics, and predictive maintenance capabilities are enhancing grid stability, voltage control, and system resilience, supporting the transition toward smarter and more flexible power networks. Utilities, transmission system operators, and large renewable project developers benefit from improved power quality, higher grid reliability, and compliance with evolving grid codes. As grids become more decentralized and inverter-dominated, synchronous condensers play a critical role in providing inertia, fault-current support, and reactive-power support, thereby reducing outage risks and operational disruptions. By adopting these solutions, utilities can strengthen grid performance, enable higher renewable penetration, and unlock long-term value in an increasingly complex and dynamic energy landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid expansion of renewable energy and grid-scale capacity additions

-

Increasing emphasis on modernization aging grid infrastructure

Level

-

Lack of skilled workforce for installation of synchronous condensers

Level

-

Conversion of synchronous generators into synchronous condensers

-

Rising adoption of high-voltage direct current systems

Level

-

Availability of low-cost substitutes

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid expansion of renewable energy and grid-scale capacity additions

The global power sector is rapidly transitioning to renewable energy, driven by decarbonization, energy security, and ongoing investments. In 2024, renewable power capacity rose by about 585 GW, constituting over 90% of new power generation and pushing total installed capacity beyond 4.4 TW, predominantly from solar PV and wind. China accounted for nearly two-thirds of this growth, followed by the EU, the US, and India. This swift expansion affects grid behavior, as conventional thermal plants provide stability through inertia and voltage control that inverter-based renewable sources lack. The retirement of fossil fuel plants reduces grid inertia and heightens voltage instability, especially during periods of high renewable output. To address these issues, grid operators are increasingly utilizing synchronous condensers that enhance voltage regulation, restore inertia, and improve short-circuit strength. Demand for synchronous condensers is growing in North America and Europe as utilities modernize their infrastructure, while Asia Pacific markets deploy them to support large-scale renewable integration. Many utilities are also repurposing decommissioned synchronous generators into condensers, enabling them to meet grid stability and decarbonization goals. Hence, the shift toward renewable energy, alongside the decline of conventional generation, is driving growth in the synchronous condenser market, essential for maintaining grid stability and operational reliability in low-carbon power systems.

Restraint: Lack of skilled workforce for installation of synchronous condensers

The deployment of synchronous condensers is constrained by their high capital intensity, engineering complexity, and long project lead times, particularly when compared with power-electronics-based alternatives. Manufacturing synchronous condensers requires large quantities of copper, steel, and precision rotating components, resulting in elevated upfront costs, especially for high-MVAr ratings needed in transmission-level applications. In addition, installation often involves extensive civil works, foundation design, auxiliary systems, and grid-specific stability studies, which increase project timelines and execution risk. In many markets, utilities must also undertake detailed electromagnetic transient (EMT) and system-strength studies to ensure stable operation alongside inverter-based renewable generation. These technical requirements raise development costs and slow decision-making, particularly in regions with evolving grid codes and limited experience with synchronous condenser deployment. Operational considerations, such as continuous losses, periodic maintenance, and the need for skilled personnel, further increase lifecycle costs, reducing the attractiveness of smaller utilities and cost-sensitive projects. Overall, while synchronous condensers play a critical role in supporting voltage stability, inertia, and fault strength in renewable-heavy grids, their high cost structure, complex integration requirements, and extended commissioning cycles act as key restraints on faster market penetration. As a result, adoption is often limited to system-critical locations, with some grid operators favoring faster-to-deploy and lower-capex solutions such as STATCOMs or hybrid compensation schemes where full synchronous inertia is not mandatory.

Opportunity: Conversion of synchronous generators into synchronous condensers

The global shift towards low-carbon power systems is leading to the retirement of aging coal, oil, and nuclear plants, creating opportunities to convert synchronous generators into synchronous condensers. As utilities in North America, Europe, and parts of Asia decommission conventional generation assets due to stricter regulations and the rise of renewable energy, they face challenges maintaining grid stability from the loss of key functions such as inertia and reactive power. Converting retired generators into synchronous condensers is a cost-effective solution, as it allows utilities to reuse existing infrastructure and restore voltage support without the long permitting processes and high costs of new installations. These conversions can enhance reactive power capability by 30–40% compared to generator operations. Economically, these conversions are more attractive than new installations, costing USD 3–6 million per unit, compared with the higher costs of new projects. This, along with shorter execution timelines, makes them especially valuable in regions with urgent stability needs due to high renewable energy integration. Europe, North America, and parts of the Asia Pacific are leading the way in adopting this approach to support decarbonization targets and maintain grid reliability.

Challenge: Availability of low-cost substitutes

Synchronous condensers are specialized rotating machines that provide dynamic reactive power compensation by generating or absorbing VARs (Volt-Ampere Reactive), improving power factors, regulating voltage levels, and enhancing grid stability, particularly in modern power networks with high renewable energy sources. They offer advantages like mechanical inertia that resists frequency changes, significant short-circuit current contribution for fault ride-through, and reliable performance under low-voltage conditions. Additionally, they absorb harmonics and enable fast dynamic responses through advanced excitation systems, making them valuable in weak grids or areas prone to islanding. However, synchronous condensers face challenges that limit their adoption. High capital costs—often millions of dollars per unit—along with significant maintenance requirements for mechanical components, result in higher operational expenses. They also exhibit higher electrical losses than static alternatives, leading to slower response times and mechanical wear. Cheaper substitutes like shunt reactors, capacitor banks, Static VAR Compensators (SVCs), and Static Synchronous Compensators (STATCOMs) offer similar functions at lower costs and with less maintenance. While synchronous condensers are essential in specific high-inertia-demand scenarios during the renewable energy transition, their higher costs and operational drawbacks limit their competitiveness against more economical electronic-based solutions.

SYNCHRONOUS CONDENSER MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

SP Energy Networks has deployed synchronous condensers across its transmission network to address declining system inertia and fault levels caused by the rapid growth of wind and solar generation, particularly in Scotland | These assets are integrated with advanced digital monitoring and grid analytics to provide dynamic voltage control, reactive power support, and short-circuit strength in weak grid conditions | Improved grid stability and voltage regulation in renewable-dominated regions | Restored system inertia lost due to the retirement of conventional thermal plants | Enabled higher renewable penetration while maintaining compliance with UK grid code requirements |

|

FirstEnergy utilities are evaluating and deploying synchronous condensers to strengthen transmission networks affected by coal and nuclear plant retirements | The condensers support voltage stability, dynamic reactive power compensation, and short-circuit capacity in areas with high renewable integration and long transmission distances | Improved grid stability and voltage regulation in renewable-dominated regions | Restored system inertia lost due to the retirement of conventional thermal plants | Enabled higher renewable penetration while maintaining compliance with UK grid code requirements |

|

NTPC is deploying synchronous condensers at strategic substations to support India’s rapidly expanding renewable energy capacity, particularly solar and wind. These systems provide inertia, voltage control, and grid-strengthening services, especially in regions transitioning away from conventional generation | Improved grid stability and fault-ride-through capability in renewable-heavy corridors | Enabled smoother integration of large-scale solar and wind projects | Reduced curtailment risk and supported India’s national decarbonization and energy transition goals |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market ecosystem comprises several key players: raw material suppliers, manufacturers, distributors, end users, regulatory bodies, and standards organizations. The primary end users in this market include transmission and distribution (T&D) companies, electrical utilities, and the industrial sector. This list is not exhaustive but highlights the main participants involved in the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Synchronous Condenser Market, by Cooling Technology

Hydrogen-cooled synchronous condensers hold the largest share due to their superior thermal conductivity, which enables higher efficiency, compact design, and reliable operation at high power ratings. These systems are widely deployed in large transmission networks and renewable-heavy grids where continuous operation, high reactive power support, and improved machine lifetime are critical.

Synchronous Condenser Market, by Type

The new synchronous condenser segment accounts for the largest share, driven by large-scale grid expansion, renewable energy integration, and the retirement of conventional thermal power plants. Utilities prefer new installations over refurbished units due to higher efficiency, compliance with modern grid codes, advanced digital controls, and longer operational lifecycles.

Synchronous Condenser Market, by Starting Method

The static frequency converter (SFC) segment dominates the market as it offers smooth, reliable, and low-stress starting without requiring auxiliary motors. SFCs enable precise speed control, faster synchronization, reduced mechanical wear, and seamless integration with modern grid automation systems.

Synchronous Condenser Market, by Reactive Power Rating

Synchronous condensers with reactive power ratings above 200 MVAr represent the largest segment, reflecting growing demand for strong voltage regulation, fault-level support, and grid inertia in high-capacity transmission networks. These high-rating units are critical for stabilizing grids with large wind and solar penetration.

Synchronous Condenser Market, by End User

Electrical utilities account for the highest share of synchronous condenser deployment, as they require robust solutions for voltage stability, power-quality management, and compliance with evolving grid codes. Utilities increasingly invest in synchronous condensers to strengthen transmission infrastructure, support renewable integration, and ensure long-term grid reliability.

REGION

North America to be largest region in synchronous condenser market during forecast period

The North America synchronous condenser market is projected to grow steadily, driven by accelerating renewable energy integration, coal and nuclear plant retirements, and increasing grid instability across the US and Canada.

SYNCHRONOUS CONDENSER MARKET: COMPANY EVALUATION MATRIX

ABB is recognized as a leader in the synchronous condenser market, holding a prominent position in both market share and product range. The company sets itself apart with its extensive portfolio and strong presence across various industries, including utilities. WEG is also a key player in this market, known for its cost-effective solutions, adaptability, and commitment to efficiency in promoting sustainability goals.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ABB (Switzerland)

- Siemens (Germany)

- GE Vernova (US)

- Mitsubishi Electric Power Products, Inc. (US)

- WEG (Brazil)

- EATON (Ireland)

- ANDRITZ (Austria)

- ANSALDO ENERGIA (Italy)

- Doosan Škoda Power (Czech Republic)

- IDEAL ELECTRIC POWER CO. (US)

- Baker Hughes Company (US)

- BHEL (India)

- Voith (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.70 BN |

| Market Forecast in 2030 (Value) | USD 0.84 BN |

| Growth Rate | 3.30% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Unit) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Cooling Type (Hydrogen-Cooled, Air-Cooled, Water-Cooled), Type (New & Refurbished), Starting Method (Static Frequency Converter, Pony Motor), End User, Reactive Power Rating |

| Regions Covered | Asia Pacific, North America, South America, Middle East & Africa, Europe |

WHAT IS IN IT FOR YOU: SYNCHRONOUS CONDENSER MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Client requirement for MEA region-specific report | Market sizing for Middle East & African countries | Detailed country-level demand assessment, regulatory landscape mapping, grid modernization outlook, and application analysis of synchronous condensers across key infrastructure and renewable projects |

| Client requirement for Europe-specific report | Market sizing for Europe countries | In-depth country benchmarking, renewable integration impact analysis, policy and subsidy evaluation, and deployment potential of synchronous condensers across transmission networks |

| Client requirement for Asia Pacific region-specific report | Market sizing for Asia Pacific countries | Country-wise market attractiveness analysis, investment and grid expansion insights, competitive landscape overview, and application scope of synchronous condensers in high-growth economies |

RECENT DEVELOPMENTS

- November 2025 : ABB partnered with VoltaGrid to deliver 27 synchronous condensers with integrated flywheel and prefabricated eHouse units for stable power supply supporting growing data center demand.

- November 2025 : GE Vernova Inc. (NYSE: GEV) has signed a contract with Transgrid for the supply of synchronous condensers, highly-sought-after equipment that will assist in stabilizing the New South Wales (NSW) grid as it transitions from coal to renewables.

- May 2025 : ACEREZ, a partnership of ACCIONA, COBRA, and Endeavour Energy, has awarded Siemens Energy a contract to deploy seven synchronous condensers, marking a key milestone in strengthening grid stability across the region.

- March 2024 : ABB is continuing its collaboration with SEV, the main electrical power producer and distributor for the Faroe Islands, to deliver innovative Synchronous Condenser (SC) technology to stabilize the power grid as fossil-fueled plant is phased out in favor of renewable generation.

Table of Contents

Methodology

The study involved major activities in estimating the current size of the synchronous condenser market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the synchronous condenser market involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect valuable information for a technical, market-oriented, and commercial study of the global synchronous condenser market. The other secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

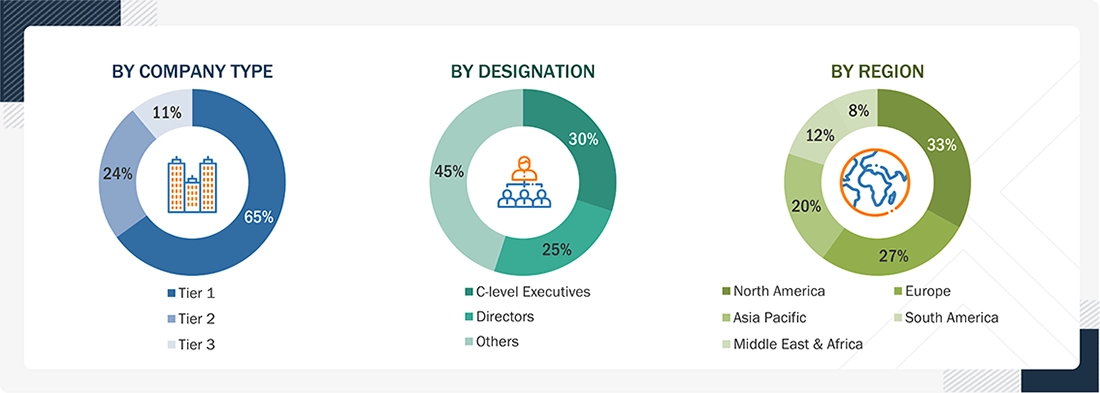

The synchronous condenser market comprises stakeholders such as synchronous condenser manufacturers, technology providers, and support providers in the supply chain. On the demand side, the market is driven by the growing adoption of synchronous condensers across sectors, including renewable energy and industrial applications, due to their high energy efficiency, ability to provide reactive power support, and superior grid stability compared to conventional systems. Rising infrastructure development and urbanization in emerging economies further fuel demand for advanced drive solutions. On the supply side, manufacturers are seeing increasing opportunities through contracts with utility and industrial distribution networks, as well as through strategic initiatives such as mergers, acquisitions, and partnerships among major players to expand their market presence and technological capabilities. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

Note: Others include sales managers, engineers, and regional managers.

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were employed to estimate and validate the size of the synchronous condenser market and its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through a combination of primary and secondary research. The research methodology involves analyzing the annual and financial reports of top market players and conducting interviews with industry experts, including chief executive officers, vice presidents, directors, sales managers, and marketing executives, to gather key quantitative and qualitative insights related to the synchronous condenser market.

Synchronous Condenser Market Size: Bottom-up Approach and Top-down Approach

Data Triangulation

After determining the overall market size through the estimation process explained above, the total market has been divided into several segments and subsegments. To complete the overall market engineering process and obtain the exact statistics for all segments and subsegments, data triangulation and market breakdown processes have been employed, where applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market has been validated using both top-down and bottom-up approaches.

Market Definition

A synchronous condenser is a direct current (DC)-excited synchronous machine whose shaft is not attached to any driven equipment or prime mover. It is a synchronous motor with an exciter system, which enables the motor to absorb excessive reactive power during overexcited or lagging conditions to maintain and stabilize the voltage as per the transmission system’s requirements. Synchronous generators and motors can be modified and used as synchronous condensers. The modified synchronous generators and motors operate on a permanent or temporary synchronous condenser basis. Existing power plant generators, such as gas, hydro, and steam turbine generators, can temporarily operate as synchronous generators with the necessary modifications. Old and decommissioned generators can also be refurbished to be used as synchronous condensers, apart from newly built synchronous condensers.

Key Stakeholders

- Government and research organizations

- Institutional investors and investment banks

- Investors/shareholders

- Environmental research institutes

- Consulting companies in the energy & power sector

- Raw material and component manufacturers

- Synchronous condenser manufacturers, dealers, and suppliers

- Synchronous motor manufacturers, dealers, and suppliers

- Synchronous generator manufacturers, dealers, and suppliers

- Power grid infrastructure companies

- Power plant project developers

- Renewable energy companies

- Manufacturers’ associations

- Process and power industry associations

- Refinery operators

- Manufacturing sector

- Energy efficiency consultant

Report Objectives

- To describe and forecast the synchronous condenser market, by cooling technology, starting method, reactive power rating, end user, and type, in terms of value

- To provide detailed information regarding the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the synchronous condenser market

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape for market leaders

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To provide a detailed overview of the synchronous condenser supply chain analysis, use case analysis, key stakeholders and buying criteria, patent analysis, trade analysis, tariff analysis, regulations, macroeconomic outlook, pricing analysis, Porter’s five forces analysis, impact of gen AI/AI, and the 2024 US tariff impact

- To analyze competitive developments, such as sales contracts, agreements, investments, expansions, product launches, and acquisitions, in the market

- To describe and forecast the synchronous condenser market for various segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, in terms of value

Available customizations:

- MarketsandMarkets offers customizations tailored to the specific needs of companies using the given market data.

-

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the synchronous condenser, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Synchronous Condenser Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Synchronous Condenser Market

Samuel

Jun, 2022

What are the recent developments in the Global Synchronous Condenser Market?.

Evelyn

Jun, 2022

Need to know more about the Synchronous Condenser Market size and Scope in Asia Pacific for the forecast year..