Termite Control Market by Species Type (Subterranean, Dry Wood, Dampwood), Control Method (Chemical, Physical & Mechanical, Biological), Application (Commercial & Industrial, Residential, Agriculture & Livestock Farms), and Region - Global Forecast to 2022

[156 Pages Report] The global termite control market is estimated at USD 3.13 billion in 2017 and is projected to reach USD 4.12 billion by 2022, at a CAGR of 5.6% during the forecast period.

The years considered for the study are as follows:

- Base year 2016

- Estimated year 2017

- Projected year 2022

- Forecast period 2017 to 2022

The objectives of the report

- To define, segment, and measure the termite control market with respect to its species, application, control method, and key region.

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific and challenges).

- To strategically profile the key players and comprehensively analyze the competitive landscape for the market leaders.

- Analyzing the demand-side factors based on the impact of macro and microeconomic factors on the market and shifts in the demand patterns across different subsegments and regions.

Research Methodology

- Major regions were identified along with countries contributing the maximum share.

- Secondary research was conducted to obtain the value of termite control market for regions such as North America, Europe, Asia Pacific, and RoW.

- Key players have been identified through secondary sources, such as the Bloomberg Businessweek, Factiva, agricultural magazines, and companies annual reports, while their market share in the respective regions has been determined through both, primary and secondary research.

- The research methodology includes the study of annual and financial reports of top market players as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the termite control market.

To know about the assumptions considered for the study, download the pdf brochure

The contributors involved in the value chain of the termite control market include raw material suppliers, R&D institutes, termite control manufacturing companies, such as BASF SE (Germany), Syngenta AG (Switzerland), Dow Chemical Company (US), Sumitomo Chemicals (Japan), and FMC Corporation (US), and government bodies & regulatory associations including EPA, WHO, and PMRA.

Target Audience

The stakeholders for the report are as follows:

- Termiticide manufacturers, suppliers, and formulators

- Professional pest control service providers

- Termiticide traders, distributors, importers, exporters, and suppliers

- Public health contractors

- Commercial research & development (R&D) institutions and financial institutions

- Trade associations and industry bodies

- Government health authorities and regulatory bodies such as World Health Organization (WHO), Environmental Protection Agency (EPA), and Pest Management Regulatory Agency (PMRA)

Scope of the Report:

This research report categorizes the market based on species, control method, application, and region.

On the basis of the termite control market has been segmented into the following:- Subterranean termites

- Drywood termites

- Dampwood termites

- Others (conehead termites and desert termites)

- Chemical

- Physical & mechanical

- Biological

- Others (radiation and environmental control)

- Commercial & industrial sector

- Residential sector

- Agriculture & livestock farms

- Others (post-harvest applications and transport facilities)

- North America

- Europe

- Asia Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakdown of the Rest of Europe termite control market into Sweden, Norway, and Greece

- Further breakdown of the Rest of Asia Pacific market into South Korea, New Zealand, and Sri Lanka

- Further breakdown of the Rest of South American market into Paraguay, Uruguay, Chile, and Cuba

Company Information

- Detailed analyses and profiling of additional market players (up to five)

The global termite control market is estimated at USD 3.13 billion in 2017 and is projected to reach USD 4.12 billion by 2022, at a CAGR of 5.62% during the forecast period. The primary factors that drive the market has been the growing presence of termite control service providers in developing economies, and many instances of insect pest attacks with respect to climate change.

Unhygienic conditions, increasing population in various countries, and improper waste management cause termite infestations. Termites are small insects, similar to ants, and eat dead plants and trees or other wooden materials. There are over 2,300 species of termites across the world. The termite control market, by species, has been segmented into subterranean termites, dampwood termites, drywood termites, and others, such as conehead termites and desert termites. Subterranean termites are found in all the regions and thus occupy major share for market. The termite control market, by control method, has been segmented into chemical, mechanical & physical, biological, and other methods, which include environmental control services and radiation. The chemical segment dominated the market in 2016, where insect growth regulators and various larvicides, such as diflubenzuron and noviflumuron are projected to gain significant market growth over the coming years. Various types of insect growth regulators (IGRs) such as anti-juvenile hormone agents are also used along with attractants in the physical and mechanical control methods, such as termite bait systems and barriers.

The termite control market, by application, was dominated by the commercial & industrial sectors. The high demand from the commercial & industrial sectors is attributed to the strict regulatory requirements to fulfil the need for keeping the threat of termites under control. Audits are mandatory by many government authorities for certifications such as ISO 9001 and ISO 22000 in commercial and industrial organizations, particularly in the food service and pharmaceutical industries. These certifications have a mandatory clause of termite control to be carried out yearly, half-yearly, or on a quarterly basis; companies that do not comply with these mandates are faced with penalties and shutdowns. Hence, the demand for termite control services is increasing globally.

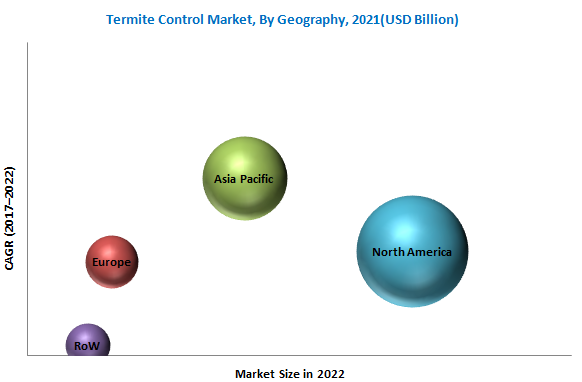

North America dominated the global termite control market in 2016. According to a global property guide article dated September 2016, the housing market in North America is witnessing an upward trend. This has led to an increased demand for termite control services in the region, as these houses are generally made of wood. Additionally, leading companies in North America are engaged in launching new products and expanding their presence across the globe to sustain their lead in the market.

For More details on this research, Request Free Sample Report

There are operational constraints for using termite control products with respect to the restrictions on the use of active ingredient content, such as frequency & maximum rate of application and potential impact on the sensitive and non-target species. In the developed countries such as the US, the UK, and Germany, these control applications are also required to be licensed and certified, while in the developing regions, the technicians are unskilled laborers, due to which the risks to them and the customers remain high. This is one of the major restraints of using termite control products globally.

The global termite control market is highly concentrated, with few of the multinational companies, accounting for a major share in the market in 2016. The market in developed countries has become saturated, and the demand is mainly accounted for by the developing countries. The key players identified have a strong presence in the global termite control market. The leading players in the market include BASF SE (Germany), Syngenta AG (Switzerland), Dow Chemical Company (US), Sumitomo Chemicals (Japan), and FMC Corporation (US).

To speak to our analyst for a discussion on the above findings, please fill up the required details by clicking on the Speak to Analyst tab Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

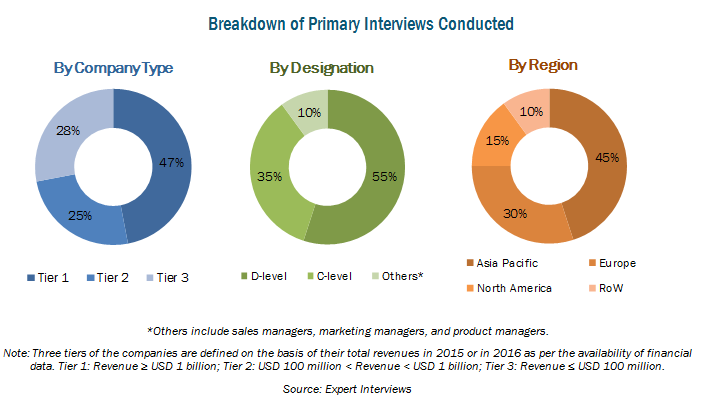

2.1.2.1 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

2.5 Micro/Macro Indicators

2.5.1 Seasonality

2.5.2 Hazardous Substances

2.5.3 Competing With Large Companies

2.5.4 Maintaining an Adequate Workforce

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in Termite Control Market

4.2 Market, By Control Method

4.3 Asia-Pacific: Fastest-Growing Termite Control Market

4.4 Termite Control Market Growth, By Country

4.5 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Economic Activities

5.2.1.2 Climate Change

5.2.2 Restraints

5.2.2.1 Absence of Uniform Guidelines for Testing and Lengthy Approval Procedure

5.2.2.2 Operating Constraints

5.2.3 Opportunities

5.2.3.1 Innovative Products Gaining Popularity

5.2.3.2 Increased Demand From Hospitality and Tourism Sectors

5.2.4 Challenges

5.2.4.1 High R&D Cost

5.2.4.2 Growing Resistance of Termites to Control Products

5.3 Value Chain Analysis

5.4 Patent Analysis

6 Termite Control Market, By Species Type (Page No. - 45)

6.1 Introduction6.2 Subterranean Termites

6.3 Drywood Termites

6.4 Dampwood Termites

6.5 Others

7 Termite Control Market, By Control Method (Page No. - 51)

7.1 Introduction7.2 Chemical Control Methods

7.2.1 Synthetic Pyrethroids

7.2.2 Chlorinated Hydrocarbons

7.2.3 Phenylpyrazole

7.2.4 Chloronicotinyl

7.2.5 Organophosphates

7.2.6 Others

7.3 Physical & Mechanical Control Methods

7.3.1 Pitfall

7.3.2 Termite Barriers

7.3.3 Bait Technology

7.4 Biological Control Methods

7.4.1 Microbials

7.4.1.1 Bacterial Control

7.4.1.2 Fungal Control

7.4.2 Botanicals

7.4.2.1 Essential Oil

7.4.2.2 Plant Extracts

7.4.2.2.1 Leaf

7.4.2.2.2 Root

7.4.2.2.3 Fruits & Seed

7.4.2.3 Wood Extract

7.4.2.4 Resin

7.4.3 Nematode Control

7.5 Other Control Methods

8 Termite Control Market, By Application (Page No. - 59)

8.1 Introduction8.2 Commercial & Industrial

8.3 Residential

8.4 Agriculture & Livestock Farms

8.5 Other Applications

9 Termite Control Market, By Region (Page No. - 65)

9.1 Introduction9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 U.K.

9.3.3 France

9.3.4 Spain

9.3.5 Rest of the Europe

9.4 Asia-Pacific

9.4.1 Japan

9.4.2 Australia

9.4.3 China

9.4.4 India

9.4.5 Rest of the Asia-Pacific

9.5 Rest of the World

9.5.1 Brazil

9.5.2 South Africa

9.5.3 Argentina

9.5.4 Others in RoW

10 Competitive Landscape (Page No. - 99)

10.1 Introduction

10.2 Vendor Dive Overview

10.2.1 Vanguards

10.2.2 Innovators

10.2.3 Dynamic

10.2.4 Emerging

10.3 Competitive Benchmarking

10.3.1 Product Offering Scorecard (For 25 Companies)

10.3.2 Business Strategy Scorecard (For 25 Companies)

FMC Corporation, Bayer CropScience AG, BASF SE, Nufarm Limited, Dow Chemical Company, Syngenta AG, Sumitomo Chemical Co, ADAMA Agricultural Solutions Ltd., United Phosphorus Limited, Rentokil Initial plc, Nippon Soda, Control solution inc, ENSYSTEX, Univar, Speckoz Inc, Nisus Corporation, Micro Flo Company, Envincio LLC, Termarid LLC, Whitmire Micro-Gen, AgrEvo Environmental Health, Quali-Pro Chemicals, Quality Borate Company, EcoScience, AMVAC Chemical Corporation.

11 Company Profiles (Page No. - 103)

(Business Overview, Products Offered, Product Portfolio, Business Strategy & Recent Developments)*

11.1 Introduction

11.2 BASF SE

11.3 The DOW Chemical Company

11.4 Bayer Cropscience AG

11.5 Syngenta AG

11.6 Sumitomo Chemical Co., Ltd.

11.7 FMC Corporation

11.8 Nufarm Limited

11.9 United Phosphorus Limited

11.10 Rentokil Initial PLC

11.11 Adama Agricultural Solutions Ltd.

11.12 Nippon Soda Co. Ltd

11.13 Control Solution Inc.

11.14 Ensystex

*Details on Business Overview, Products Offered, Product Portfolio, Business Strategy & Recent Developments might not be captured in case of unlisted companies.

12 Appendix (Page No. - 147)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (67 Tables)

Table 1 Termite Control Market Size, By Species Type, 2015-2022 (USD Million)

Table 2 Subterranean Termites Market Size, By Region, 2015-2022 (USD Million)

Table 3 Drywood Termites Market Size, By Region, 2015-2022 (USD Million)

Table 4 Dampwood Termites Market Size, By Region, 2015-2022 (USD Million)

Table 5 Other Species Market Size, By Region, 2015-2022 (USD Million)

Table 6 Termite Control Market Size, By Control Method, 20152022 (USD Million)

Table 7 Chemical Control Market Size, By Region, 20152022 (USD Million)

Table 8 Chemical Control Market Size, By Region, 20152022 (Volume Kilo Liter)

Table 9 Physical & Mechanical Control Market Size, By Region, 20152022 (USD Million)

Table 10 Biological Control Market Size, By Region, 20152022 (USD Million)

Table 11 Other Control Methods Market Size, By Region, 20152022 (USD Million)

Table 12 Termite Control Market Size, By Application, 2015-2022 (USD Million)

Table 13 Commercial & Industrial Market Size, By Region, 2015-2022 (USD Million)

Table 14 Residential Sector Market Size, By Region, 2015-2022 (USD Million)

Table 15 Agriculture & Livestock Farms Market Size, By Region, 2015-2022 (USD Million)

Table 16 Other Applications Market Size, By Region, 2015-2022 (USD Million)

Table 17 Termite Control Market Size, By Region, 2015-2022 (USD Million)

Table 18 North America: Termite Control Market Size, By Country, 20152022 (USD Million)

Table 19 North America: Market Size, By Control Method, 20152022 (USD Million)

Table 20 North America: Market Size, By Application, 20152022 (USD Million)

Table 21 North America: Market Size, By Species Type, 20152022 (USD Million)

Table 22 U.S.: Market Size, By Control Method, 20152022 (USD Million)

Table 23 U.S.: Market Size, By Application, 20152022 (USD Million)

Table 24 Canada: Market Size, By Control Method, 20152022 (USD Million)

Table 25 Canada: Market Size, By Application, 20152022 (USD Million)

Table 26 Mexico: Market Size, By Control Method, 20152022 (USD Million)

Table 27 Mexico: Market Size, By Application, 20152022 (USD Million)

Table 28 Europe: Termite Control Market Size, By Country, 20152022 (USD Million)

Table 29 Europe: Market Size, By Control Method, 20152022 (USD Million)

Table 30 Europe: Market Size, By Application, 20152022 (USD Million)

Table 31 Europe: Market Size, By Species Type, 20152022 (USD Million)

Table 32 Germany: Market Size, By Control Method, 20152022 (USD Million)

Table 33 Germany: Market Size, By Application, 20152022 (USD Million)

Table 34 U.K.: Market Size, By Control Method, 20152022 (USD Million)

Table 35 U.K.: Market Size, By Application, 20152022 (USD Million)

Table 36 France: Market Size, By Control Method, 20152022 (USD Million)

Table 37 France: Market Size, By Application, 20152022 (USD Million)

Table 38 Spain: Market Size, By Control Method, 20152022 (USD Million)

Table 39 Spain: Market Size, By Application, 20152022 (USD Million)

Table 40 Rest of Europe: Market Size, By Control Method, 20152022 (USD Million)

Table 41 Rest of Europe: Market Size, By Application, 20152022 (USD Million)

Table 42 Asia-Pacific: Termite Control Market Size, By Country, 20152022 (USD Million)

Table 43 Asia-Pacific: Market Size, By Control Method, 20152022 (USD Million)

Table 44 Asia-Pacific: Market Size, By Application, 20152022 (USD Million)

Table 45 Asia-Pacific: Market Size, By Species Type, 20152022 (USD Million)

Table 46 Japan: Market Size, By Control Method, 20152022 (USD Million)

Table 47 Japan: Market Size, By Application, 20152022 (USD Million)

Table 48 Australia: Market Size, By Control Method, 20152022 (USD Million)

Table 49 Australia: Market Size, By Application, 20152022 (USD Million)

Table 50 China: Market Size, By Control Method, 20152022 (USD Million)

Table 51 China: Market Size, By Application, 20152022 (USD Million)

Table 52 India: Market Size, By Control Method, 20152022 (USD Million)

Table 53 India: Market Size, By Application, 20152022 (USD Million)

Table 54 Rest of Asia-Pacific: Termite Control Market Size, By Control Method, 20152022 (USD Million)

Table 55 Rest of Asia-Pacific: Market Size, By Application, 20152022 (USD Million)

Table 56 RoW: Termite Control Market Size, By Country, 20152022 (USD Million)

Table 57 RoW: Market Size, By Control Method, 20152022 (USD Million)

Table 58 RoW: Market Size, By Application, 20152022 (USD Million)

Table 59 RoW: Market Size, By Species Type, 20152022 (USD Million)

Table 60 Brazil: Market Size, By Control Method, 20152022 (USD Million)

Table 61 Brazil: Market Size, By Application, 20152022 (USD Million)

Table 62 South Africa: Market Size, By Control Method, 20152022 (USD Million)

Table 63 South Africa: Market Size, By Application, 20152022 (USD Million)

Table 64 Argentina: Market Size, By Control Method, 20152022 (USD Million)

Table 65 Argentina: Market Size, By Application, 20152022 (USD Million)

Table 66 Others in RoW: Market Size, By Control Method, 20152022 (USD Million)

Table 67 Others in RoW: Market Size, By Application, 20152022 (USD Million)

List of Figures (67 Figures)

Figure 1 Market Scope

Figure 2 Regional Scope

Figure 3 Termite Control Market: Research Design

Figure 4 Termite Control Market: Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Biological Control Methods Projected to Be the Fastest-Growing During the Forecast Period(USD Million)

Figure 9 Commercial & Industrial Sectors Segment is Projected to Dominate During the Forecast Period

Figure 10 Subterranean Termites Segment is Projected to Dominate During the Forecast Period

Figure 11 Termite Control Market Trend, By Region, (2017-2022)

Figure 12 North America is the Largest Markets in 2016

Figure 13 Emerging Markets With Promising Growth Potential (20172022)

Figure 14 Chemical Control Method Accounted for the Largest Market Share in 2016

Figure 15 Commercial & Industrial Segment Accounted for Largest Share in the Asia-Pacific Market, 2016 (USD Million)

Figure 16 India to Grow at Highest CAGR in Termite Control Market, 20172022

Figure 17 Termite Control Market is Projected to Experience Strong Growth in Asia-Pacific

Figure 18 Growing Economic Activities and Changing Climate Conditions Drive the Termite Control Market

Figure 19 Value Chain Analysis: Major Value is Added During Registration and Manufacturing

Figure 20 Market: Subterranean Termites to Be the Largest Segment, 2017 vs 2022 (USD Million)

Figure 21 Subterranean Termites Market Size, By Region, 2017 vs 2022 (USD Million)

Figure 22 Termite Control Market: Chemical Control to Be the Largest Segment, 2017 vs 2022 (USD Million)

Figure 23 Chemical Control Market Size, By Region, 2017 vs 2022 (USD Million)

Figure 24 Termite Control Market: Commercial & Industrial Segment is the Largest, 2017 vs 2022 (USD Million)

Figure 25 Commercial & Industrial Market Size, By Region, 2017 vs 2022 (USD Million)

Figure 26 Geographic Snapshot (20172022): Rapidly Growing Markets are Emerging as New Hotspots

Figure 27 U.S. Dominated the Market for Termite Control in North America in 2016

Figure 28 France Dominated the Market for Termite Control in Europe in 2016

Figure 29 Japan Dominated the Market for Termite Control in Asia-Pacific in 2016

Figure 30 Termite Control Market: Dive Chart

Figure 31 BASF SE : Company Snapshot

Figure 32 BASF SE: Product Offering Scorecard

Figure 33 BASF SE: Business Strategy Scorecard

Figure 34 DOW Chemical Company: Company Snapshot

Figure 35 DOW Chemicals Company: Product Offering Scorecard

Figure 36 DOW Chemicals Company: Business Strategy Scorecard

Figure 37 Bayer Cropscience AG : Company Snapshot

Figure 38 Bayer Cropscience AG: Product Offering Scorecard

Figure 39 Bayer Cropscience AG: Business Strategy Scorecard

Figure 40 Syngenta AG: Company Snapshot

Figure 41 Syngenta AG: Product Offering Scorecard

Figure 42 Syngenta AG: Business Strategy Scorecard

Figure 43 Sumitomo Chemical Co., Ltd.: Company Snapshot

Figure 44 Sumitomo Chemical Co., Ltd.: Product Offering Scorecard

Figure 45 Sumitomo Chemical Co., Ltd.: Business Strategy Scorecard

Figure 46 FMC Corporation: Company Snapshot

Figure 47 FMC Corporation: Product Offering Scorecard

Figure 48 FMC Corporation: Business Strategy Scorecard

Figure 49 Nufarm Limited: Company Snapshot

Figure 50 Nufarm Limited: Product Offering Scorecard

Figure 51 Nufarm Limited: Business Strategy Scorecard

Figure 52 United Phosphorus Limited: Company Snapshot

Figure 53 United Phosphorus Limited: Product Offering Scorecard

Figure 54 United Phosphorus Limited: Business Strategy Scorecard

Figure 55 Rentokil Initial PLC: Company Snapshot

Figure 56 Rentokil Initial PLC: Product Offering Scorecard

Figure 57 Rentokil Initial PLC: Business Strategy Scorecard

Figure 58 Adama Agricultural Solutions Ltd: Company Snapshot

Figure 59 Adama Agricultural Solutions Ltd: Product Offering Scorecard

Figure 60 Adama Agricultural Solutions Ltd: Business Strategy Scorecard

Figure 61 Nippon Soda Co. Ltd: Company Snapshot

Figure 62 Nippon Soda Co. Ltd: Product Offering Scorecard

Figure 63 Nippon Soda Co. Ltd: Business Strategy Scorecard

Figure 64 Control Solution Inc.: Product Offering Scorecard

Figure 65 Control Solution Inc.: Business Strategy Scorecard

Figure 66 Ensystex: Product Offering Scorecard

Figure 67 Ensystex: Business Strategy Scorecard

Growth opportunities and latent adjacency in Termite Control Market

Insightful study on pest control. I am impressed by your article.