UV LED Market Size, Share & Trends

UV LED Market by UV-A, UV-B, UV-C, UV Curing (Printing, Adhesives), Disinfection, Medical & Scientific (Equipment Sterilization, Tanning, Teeth Brightening), Security, Lithography, Power Output (Less than 1w, 1W-5W, Above 5W) Global - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The UV LED market is projected to grow from USD 1.23 billion in 2025 to USD 2.16 billion by 2030, at a CAGR of 11.9%. This growth is driven by the rising demand for energy-efficient, mercury-free lighting solutions across disinfection, curing, and phototherapy applications. UV LEDs offer enhanced performance, reduced energy use, and longer lifespans. As industries prioritize sustainability and safety, the need for reliable, compact, and cost-effective UV LED solutions continues to expand globally.

KEY TAKEAWAYS

-

BY TECHNOLOGYThe market is segmented into UV-A, UV-B, UV-C technologies. UV-C technology continues to dominate adoption due to its critical role in disinfection, sterilization, and water purification; UV-A finds strong applications in curing, lithography, and counterfeit detection; while UV-B is increasingly leveraged in medical therapies and horticulture. Integration of UV LEDs with IoT-enabled monitoring systems enhances precision, while advances in AI/ML-driven controls are improving efficiency, durability, and energy optimization across sectors.

-

BY POWER OUTPUTThe market for power output is segmented into Less than 1 W, 1 W–5 W, and Above 5 W. Lower-power devices target consumer/portable and sensing applications, mid-power modules serve commercial/medical devices and small-scale curing, while high-power LEDs enable industrial curing, large-scale disinfection, and lithography/industrial processes. The above 5 W segment holds a major market share.

-

BY APPLICATIONThe market is segmented into disinfection, UV curing, medical & scientific, security, lithography, and other applications. UV Curing holds a strong share, driven by printing, adhesives, coatings, and 3D printing industries. Disinfection is the fastest-growing segment, with rising demand for water, air, and surface sterilization across healthcare, residential, and industrial uses. Medical & scientific applications are expanding with sterilization, diagnostics, and phototherapy devices.

-

BY END USERThe market is segmented into industrial, commercial, and residential. The industrial segment captures the major share including printing & packaging, automotive, electronics manufacturing, and water treatment; the commercial segment includes healthcare facilities, laboratories, and buildings; and the residential segment includes consumer disinfection and small appliances.

-

BY REGIONRegional coverage includes North America, Europe, Asia Pacific, and RoW. Asia Pacific leads the UV-LED market, driven by large-scale UV-LED manufacturing, rapid R&D and investment, strong demand for water management & sanitation tools, industrial machinery, and consumer electronics. North America follows with mature adoption and regulatory support; Europe is led by sustainability goals and standards; RoW (Latin America, MEA) are emerging adopters with growing pilot projects and subsidies.

-

COMPETITIVE LANDSCAPEKey players include Seoul Viosys Co., Ltd. (South Korea), NICHIA CORPORATION (Japan), STANLEY ELECTRIC CO., LTD. (Japan), ams-OSRAM AG (Austria), and Crystal IS, Inc. (US). Competitive activity focuses on higher power UV-C device development, system integration partnerships, production scaling, cost reductions, and channel expansion into water/air treatment, medical devices, and industrial curing segments.

The UV LED market is projected to expand significantly in the coming years, driven by the rapid adoption of UV-C LEDs in disinfection applications, strong demand for industrial UV curing, and growing integration into medical, water treatment, and HVAC systems. Rising concerns over hygiene, sustainability, and chemical-free sterilization are accelerating uptake across sectors. Continued R&D in higher-power UV LEDs, coupled with regulatory support and system-level integration, is expected to strengthen adoption across industrial, commercial, and residential markets.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The rising demand for disinfection systems in the commercial and residential sectors is expected to create an excellent opportunity for players in the UV LED market during the forecast period. UV-C technology will bring new revenue sources for players offering UV LED products. The UV LED industry presents several potential revenue pockets for companies to explore. These include water treatment, air purification, horticulture lighting, consumer electronics, and automotive applications. UV LED technology is becoming increasingly popular in water treatment and air purification due to its cost-effectiveness and energy efficiency, while horticulture lighting can increase crop yields and improve plant quality. Consumer electronics can benefit from UV LED technology's sterilization and disinfection capabilities, and the automotive industry can use it for curing coatings and adhesives and disinfecting air in vehicles. As UV LED technology continues to evolve, companies are likely to have more opportunities to generate revenue in this space.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Regulatory push and environmental bans accelerating shift to mercury-free UV disinfection solutions

-

Rising integration of UV LEDs in in-vitro diagnostics (IVD) and lab equipment

Level

-

High cost and lower output efficiency across UV LED spectrum

-

Limited standardization in performance metrics and reliability testing

Level

-

Increasing use of UV LED technology in robotic and autonomous disinfection systems

-

Surging adoption of UV LED technology in compact air and water sterilization appliances

Level

-

Limited thermal tolerance and reliability issues in high-density UV LED arrays

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Regulatory push and environmental bans accelerating shift to mercury-free UV disinfection solutions

Regulatory push and environmental mandates are accelerating the transition toward mercury-free UV disinfection technologies. Growing awareness of sustainable, chemical-free sterilization and increasing adoption of UV LEDs in water, air, and surface treatment systems are reinforcing demand across industries, such as healthcare, electronics, and food processing.

Restraint: High cost and lower output efficiency across UV LED spectrum

Despite technological progress, high initial investment and limited optical output at certain wavelengths remain key barriers. Cost-sensitive segments face slower adoption, particularly in regions with limited subsidies or financing mechanisms. Performance limitations in terms of thermal management and device lifetime also restrict deployment in some industrial and consumer applications.

Opportunity: Increasing use of UV LED technology in robotic and autonomous disinfection systems

Increasing investments in advanced healthcare infrastructure, water purification, and sustainable industrial processes are opening strong growth avenues. Integration of UV LEDs into portable disinfection products, smart HVAC systems, and next-generation medical devices offers significant potential. Advances in materials, packaging, and high-power chip designs further expand the scope of UV LED applications.

Challenge: Limited thermal tolerance and reliability issues in high-density UV LED arrays

Standardization gaps and reliability issues persist, especially for high-density UV-C arrays operating in demanding environments. Manufacturers must overcome concerns related to uniform performance, device degradation, and consistent safety standards. Achieving scalable, cost-effective production while maintaining quality remains a critical industry challenge.

UV LED Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integrated Phoseon’s UV LED curing system into PCB production lines for curing solder masks and inks. | Faster production speed with instant on/off curing | Reduced energy consumption | Eliminated mercury lamp issues | Improved workplace safety | Compliance with environmental regulations |

|

Installed UV LED-based water purification modules for decentralized clean drinking water systems. | Mercury-free disinfection | Low-maintenance | Scalable for off-grid communities | Improved public health outcomes |

|

Adopted UV-C LED modules for potable water treatment aboard spacecraft. | Compact, reliable, and chemical-free sterilization in zero-gravity | Critical for crew health and long-term missions |

|

Deployed UV-C LED disinfection modules for municipal and industrial-scale water treatment. | Chemical-free disinfection | Long lifetime | Reduced energy usage | Effective against chlorine-resistant pathogens |

|

Incorporated AquiSense’s PearlAqua Micro UV-C LED unit into decentralized SolarAQ systems powered by solar/batteries for off-grid water treatment. | Off-grid functionality | Safe chemical-free disinfection | Low power use | Extended lifespan | Adaptable for multiple water sources (fresh, rain, brackish, seawater) | Awarded global recognition |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The UV LED market operates within a dynamic and interconnected ecosystem that includes a wide array of stakeholders across the value chain. From raw material suppliers and UV LED manufacturers to OEMs, distributors, and end users, each participant plays a key role in the development, integration, and deployment of UV LED technologies. As demand grows for compact, energy-efficient, and mercury-free disinfection solutions, the ecosystem is expanding to include advanced material providers, innovative component developers, and application-specific integrators. This evolving landscape highlights the importance of collaboration across technological, commercial, and healthcare domains to drive innovation, improve performance, and unlock new growth opportunities across industries such as healthcare, water treatment, and electronics.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

UV LED Market, By Technology

The UV-A segment accounted for a significant share in 2024. Its growth is driven by widespread use in curing, counterfeit detection, and analytical instruments. UV-A modules are preferred due to their efficiency, longer lifespan, and versatility across printing, coating, adhesives, and consumer electronics applications.

UV LED Market, By Power Output

In 2024, 1W – 5W segment accounted for the largest share of the global market. These modules are suitable for medium-scale curing, water purification devices, and surface disinfection systems. Their adaptability to both industrial and commercial use cases supports continued demand.

UV LED Market, By Application

UV curing applications held the largest market share in 2024, driven by the high adoption in printing, coatings, adhesives, and industrial manufacturing. UV curing modules deliver faster processing times, reduced energy consumption, and improved product quality compared with traditional technologies, making them indispensable in production environments.

UV LED Market, By End User

The industrial segment accounted for he largest share in 2024, supported by strong demand from electronics, automotive, and packaging industries. Industrial users prefer UV LED modules for their energy efficiency, compact size, and ability to integrate into automated production lines, enabling cost savings and higher throughput.

REGION

Asia Pacific to be fastest-growing market for UV LED during the forecast period

The UV LED market in the Asia Pacific region is propelled by strong manufacturing capabilities and rising demand for food safety, water treatment, and sanitation solutions. Key growth is supported by extensive production activities in countries such as China, Japan, and South Korea. The region also benefits from proactive government initiatives, rapid industrialization, and an increasing need for water and air disinfection systems. Expanding output in the electronics and automotive sectors further drives adoption of UV curing modules. Additionally, growing investments in research and development, coupled with cost-effective production, continue to strengthen Asia Pacific’s position as a global leader in the UV LED market.

UV LED Market: COMPANY EVALUATION MATRIX

In the UV LED market matrix, Seoul Viosys Co., Ltd. (Star) leads with a strong market position and a broad portfolio of UV-A, UV-B, and UV-C LED products. The company drives large-scale adoption across disinfection, curing, and sensing applications through continuous innovation, partnerships, and strong global distribution networks. EVERLIGHT ELECTRONICS CO., LTD. (Emerging Leader) is steadily gaining traction with expanding UV LED offerings for consumer, healthcare, and industrial applications. While Seoul Viosys dominates with scale, product depth, and established relationships across key industries, EVERLIGHT shows strong growth potential to advance toward the leaders’ quadrant by enhancing its technology capabilities and widening its global footprint.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 1.08 BN |

| Revenue Forecast in 2030 | USD 2.16 BN |

| Growth Rate | 11.9% |

| Actual Data | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) and Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | • By Technology: UV-A, UV-B, and UV-C • By Power Output: Less than 1 W, 1–5 W, and more than 5 W power outputs • By Application: UV curing (printing, coating, and adhesives), medical & scientific (phototherapy, sensing, equipment sterilization, research & development, teeth brightening, and tanning), disinfection (water disinfection, air disinfection, and surface disinfection), security (counterfeit detection (money & ID), and forensic), lithography, and other applications (optical communication & data transmission, automotive lighting, backlight for consumer electronics, and horticulture) • By End User: Industrial, commercial, and residential |

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: UV LED Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based UV LED Manufacturer | • Detailed profiles of competitors (financials, product portfolios) • End-use industry mapping for curing, sterilization, and medical devices • Partnership & distribution channel analysis | • Identify potential collaboration and M&A opportunities • Highlight untapped application clusters for market entry • Support expansion into high-growth regions |

| Water Treatment Company | • Comprehensive list of UV LED module suppliers for disinfection systems • Benchmarking adoption trends across municipal & industrial water treatment • Cost-benefit analysis vs. traditional mercury lamps | • Provide clarity on ROI and technology shift • Support decision-making for replacing conventional UV lamps • Pinpoint niche suppliers for long-term contracts |

| Medical Device Manufacturer | • Technical & regulatory analysis of UV LED sterilization modules • Market adoption roadmap in diagnostics, phototherapy, and surgical tools • Forecast of UV-C adoption in healthcare up to 2035 | • Enable compliance-driven adoption • Support entry into new healthcare sterilization opportunities • Strengthening product positioning in regulated medical markets |

| Asia-based UV LED Raw Material Supplier | • Global & regional demand forecast for UV LED chips & modules • Capacity benchmarking and competitor pipeline analysis • Customer profiling across electronics, automotive, and purification | • Strengthen forward integration strategy • Identify high-demand clusters for semiconductor supply • Support long-term sales growth in UV-C adoption |

| Electronics & Consumer Goods Company | • Patent landscape & IP strength mapping in UV LED-based consumer products • Competitive innovation analysis in air purifiers, wearables, and smart appliances • Assessment of OEM adoption in IoT-enabled UV applications | • Enable competitive edge in consumer-focused UV LED products • Support backward integration into module sourcing - Identify early-mover advantage in IoT & smart home adoption |

RECENT DEVELOPMENTS

- October 2024 : ams-OSRAM AG launched OSLON UV 3535. The LED offers high wall plug efficiency, long lifetime, and superior price performance, making it ideal for applications such as air, water, and surface disinfection in industrial and consumer settings, such as point-of-use water treatment, automotive interiors, and medical environments.

- April 2024 : Amway, an entrepreneur-led health and wellbeing company, partnered with Crystal IS, Inc. for its new eSpring Water Treatment System. This partnership marks a significant advancement in water purification, as the system uses UVC LEDs to disinfect water at the point of use, ensuring reliable purification without affecting the water's temperature, taste, or smell.

- May 2024 : Luminus, Inc. launched SST-08-UV, a high-power UV-A LED available in 365 nm, 385 nm, 395 nm, and 405 nm wavelengths, featuring a compact 3.5 mm x 3.5 mm sulfur- and corrosion-resistant package. It supports drive currents up to 750 mA, offers viewing angles of 130° or 40°, and is ideal for applications such as curing, horticulture, purification, and medical or analytical instrumentation.

- March 2024 : NICHIA CORPORATION launched UV-B (308 nm) and UV-A (330 nm) LEDs, expanding its UV LED portfolio alongside its established 280 nm, 365 nm, and 405 nm products. These new LEDs are produced in the compact 3.5 mm x 3.5 mm 434 Series package, delivering industry-leading radiant outputs of 90 mW at 308 nm and 100 mW at 330 nm (both at 350 mA), with power conversion efficiencies of 5.1% and 5.7%, respectively, among the highest in the industry. This enables high-flux density in a small form factor, facilitating the replacement of traditional mercury lamps across many applications.

- November 2023 : Crystal IS, Inc. collaborated with Amway Corp. In this collaboration, Amway integrates Crystal IS’ Klaran UVC LED modules into its redesigned eSpring system. This collaboration marks the first full redesign of the eSpring in over two decades and demonstrates a clear move into next-generation UV-LED water purification systems, combining Amway’s filtration expertise with Crystal?IS' advanced UVC LED technology for enhanced microbial performance, sustainability, and user convenience.

Table of Contents

Methodology

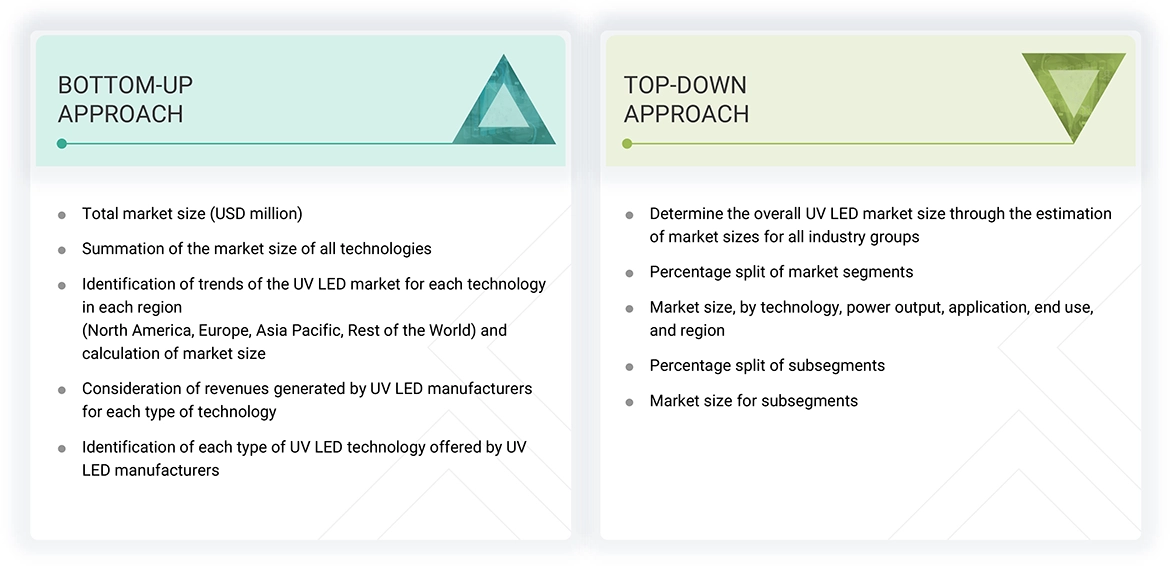

The research study involved four major steps in estimating the size of the UV LED market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. After this, the market breakdown and data triangulation approaches have been adopted to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect important information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry's supply chain, the market's value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

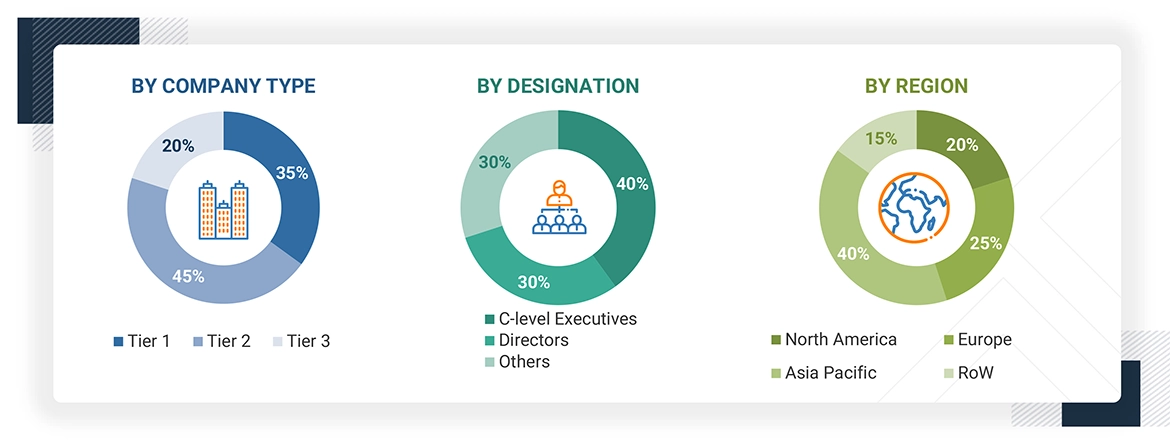

Primary Research

After understanding the UV LED market scenario through secondary research, extensive primary research has been conducted. Several primary interviews have been conducted with key opinion leaders from demand—and supply-side vendors across major regions: North America, Europe, Asia Pacific, and RoW. This primary data was collected mainly through telephonic interviews, which comprise 80% of the total primary interviews; questionnaires and emails were also used.

Note: Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the UV LED and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying the players in the UV LED market, along with their offerings

- Analyzing major manufacturers of UV technologies, studying their portfolios, and understanding several types of products based on their features and functions

- Understanding and analyzing Y-o-Y projections to derive the projected market values of each UV LED product type. Also, the market is expected to witness strong growth opportunities after considering the surging demand for UV LED technology in disinfection applications.

- Tracking ongoing and upcoming developments in the market, such as investments made, R&D activities, product launches, acquisitions, partnerships, and forecasting the market based on these developments and other critical parameters

- Conducting multiple discussions with key opinion leaders to understand different UV LED technologies, applications, and current trends in the market, thereby analyzing the breakup of the scope of work carried out by major manufacturing companies

- Arriving at the market estimates by analyzing the revenues of these companies generated from different types of products, and then combining the same to get the market estimate by region

- The pricing of various product types is calculated separately to analyze the shipment of each UV technology category.

- Verifying and cross-checking the estimates at every level by discussing with key opinion leaders, such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

UV LED Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, using the market size estimation processes explained above, the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from the demand and supply sides in the UV LED market.

Market Definition

A UV LED (Ultraviolet light-emitting diode) is a solid-state light source that emits ultraviolet radiation when an electric current passes through a semiconductor material. Unlike traditional UV lamps, UV LEDs are compact, energy-efficient, mercury-free, and capable of emitting specific UV wavelengths, typically categorized into UV-A (315–400 nm), UV-B (280–315 nm), and UV-C (200–280 nm). These properties make UV LEDs ideal for various applications, including disinfection, curing, sensing, phototherapy, printing, and counterfeit detection. Their ability to provide instant-on operation, long lifespan, low heat output, and precise wavelength control has accelerated their adoption across industrial, medical, commercial, and scientific sectors.

Key Stakeholders

- Original device manufacturers (ODMs)

- Product manufacturers

- OEMs

- LED chip manufacturers

- LED component manufacturers

- Government organizations

- System integrators

- Internal distributors

- Packaging companies

- Purification associations

Report Objectives

- To describe and forecast the size of the UV LED market by technology, power output, application, end user, and region in terms of value

- To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To assess the size of the UV LED market by technology, in terms of volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the UV LED market

- To analyze the UV LED value chain and ecosystem, along with the average selling price of UV LED systems

- To strategically analyze the regulatory landscape, tariff, standards, patents, Porter's five forces, import and export scenarios, AI/Gen AI impact, the 2025 US tariff impact, and case studies pertaining to the market under study

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To understand opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To provide details of the macroeconomic outlook for regions

- To analyze strategies such as product launches, collaborations, and acquisitions adopted by players in the UV LED market

- To profile key players in the UV LED market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Key Questions Addressed by the Report

What is the estimated market size of the UV LED market in 2025, and at what CAGR will it grow during the forecast period?

The UV LED market is estimated at USD 1.23 billion in 2025 and is expected to register a CAGR of 11.9% during the forecast period.

What is a UV LED?

UV LEDs are semiconductor devices that emit ultraviolet light when electrically energized. Unlike traditional UV lamps that use mercury vapor, UV LEDs are mercury-free, compact, energy-efficient, and environmentally friendly.

Who are the winners in the UV LED market?

Companies such as Seoul Viosys Co., Ltd. (South Korea), NICHIA CORPORATION (Japan), STANLEY ELECTRIC CO., LTD. (Japan), ams-OSRAM AG (Austria), and Crystal IS, Inc. (US) fall under the winner's category. These companies cater to the requirements of their customers by providing UV LED systems. Moreover, these companies are highly adopting inorganic growth strategies to strengthen their global market position and customer base.

Which strategies have been adopted by key players in the UV LED market?

The major strategies key players in the market adopt are collaboration and product launches.

Name the emerging players in the UV LED market.

Violumas (Taiwan), EPIGAP OSA Photonics GmbH (Germany), and Würth Elektronik eiSos GmbH & Co. (Germany) are the emerging players in the UV LED market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the UV LED Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in UV LED Market