Water-based Heating & Cooling Systems Market by Heating (Heat Pump, Convector Heater, Radiator, Boiler), Cooling (Chiller, AHU, Cooling Tower, Tank), Cooling Type (Direct, Indirect), Implementation Type, Vertical & Region - Global Forecast to 2028

Updated on : October 22, 2024

Water-based Heating & Cooling Systems Market Size & Share

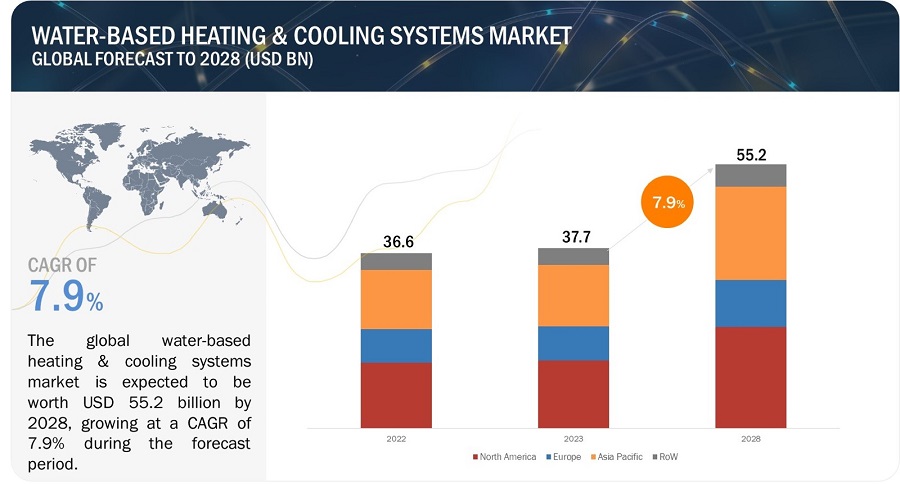

The global water-based heating & cooling systems market size is expected to be valued at USD 37.7 billion in 2023 and is projected to reach USD 55.2 billion by 2028; growing at a CAGR of 7.9% from 2023 to 2028. The water-based heating & cooling systems industry has experienced remarkable growth in recent years, driven by increasing demand for energy-efficient solutions, availability of government subsidies, and growing awareness of the environmental benefits. North America is expected to be the largest market for water-based heating and cooling systems in 2023. This is due to the high awareness of the benefits of these systems among building owners and policymakers in the region. Asia Pacific is the second-largest market for water-based heating and cooling systems and is expected to be the fastest-growing market for these systems. This is due to the rapid growth of the construction industry in the region.

Water-based Heating & Cooling Systems Market Statistics Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Water-based heating & cooling systems market key trends & dynamics

Driver: Increasing constructions activities in residential and industry sectors

The construction sector is a major driving factor behind the growth of the water-based heating and cooling industry. As construction projects continue to surge, there is a growing emphasis on energy-efficient and sustainable solutions. Water-based heating and cooling systems, such as hydronic systems, offer significant advantages in terms of energy efficiency, cost-effectiveness, and environmental friendliness. These systems utilize water as a medium to transfer heat, providing efficient heating during winters and cooling during summers. With a focus on reducing carbon emissions and achieving energy savings, developers, contractors, and building owners are increasingly adopting water-based heating and cooling systems in their projects. These systems not only offer better control over temperature and humidity but also provide opportunities for renewable energy integration, such as utilizing geothermal or solar energy sources.

The residential sector has been increasingly adopting water-based heating and cooling systems as a sustainable and energy-efficient solution for climate control. Homeowners are recognizing the benefits of these systems in terms of comfort, cost savings, and environmental impact. In the industrial sector, the demand for water-based heating and cooling systems is driven by the construction of new factories, warehouses, and commercial buildings. These buildings require water-based heating and cooling systems to maintain the temperature, and humidity levels, which are essential for the efficient functioning of machinery and equipment. Moreover, water-based heating and cooling systems can also help in reducing the energy consumption of industrial buildings, which is a major concern for the industry.

Restraint: Limited space in commercial and residential buildings for large water-based heating & cooling systems

One of the significant restraints faced by water-based heating & cooling systems is the limited space available in commercial and residential buildings for large water-based heating & cooling systems. In today’s world, people have started to opt for compact and space-saving products, including water-based heating & cooling systems, that can fit in small areas without compromising on their performance. However, this can be challenging for water-based heating & cooling manufacturers and installers, especially in densely populated urban areas where space is at a premium. Due to limited space, water-based heating & cooling systems may need to be smaller, which can affect their efficiency and performance, leading to higher energy consumption and maintenance costs.

Opportunity: Growing demand for sustainable solutions

One significant opportunity for water-based heating & cooling systems is the increasing demand for sustainable solutions. In recent years, there has been a growing awareness of environmental issues such as climate change, resource depletion, and pollution. This awareness has translated into a shift in consumer preferences towards more sustainable and eco-friendly products and services.

Water-based heating & cooling systems align well with this shift in consumer demand. These systems offer several environmental benefits compared to traditional heating and cooling methods. By utilizing water as a primary heat transfer medium, they can significantly reduce greenhouse gas emissions and contribute to a smaller carbon footprint. Water is a renewable resource, and when coupled with renewable energy sources such as solar thermal, or geothermal, water-based systems can achieve even higher levels of sustainability.

Challenge: Increase in environmental concerns and aging infrastructure

The increasing global environmental concerns, particularly related to climate change and carbon emissions, have highlighted the need for more sustainable heating and cooling solutions. Traditional heating and cooling systems often rely on fossil fuel-based energy sources, such as natural gas or oil, which contribute to greenhouse gas emissions. Additionally, older systems may use refrigerants with high global warming potential (GWP), further exacerbating their environmental impact. Many existing water-based heating & cooling systems suffer from aging infrastructure and outdated equipment. These systems may have been installed several decades ago, and over time, components such as pipes, valves, pumps, and heat exchangers can deteriorate, leading to inefficiencies, leaks, and system failures. Aging infrastructure can result in reduced system performance, increased energy consumption, and higher maintenance costs.

Water-Based Heating & Cooling Systems Market Ecosystem

The water-based heating & cooling systems market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include Anritsu, Keysight Technologies, Teradyne Inc., National Instruments Corporation, and Spirent Communications.

Based on heating component, the heat pump market to hold the highest market share during the forecast period

The heat pump market is poised to gain the highest market share for water-based heating systems due to several key factors. Firstly, heat pumps are highly efficient and environmentally friendly compared to traditional heating systems. They utilize renewable energy sources such as air, water, or the ground to extract heat and transfer it indoors, resulting in significantly lower energy consumption and reduced greenhouse gas emissions. This aligns with the increasing global focus on sustainability and the urgent need to mitigate climate change. Secondly, heat pumps offer versatility and flexibility in their applications. They can provide both heating and cooling functions, making them suitable for various climates and seasons. Additionally, heat pumps can be integrated with existing infrastructure, such as underfloor heating systems, radiators, or water heaters, making them a viable retrofit option for both residential and commercial buildings. Finally, governments and regulatory bodies worldwide are implementing supportive policies and providing financial incentives to promote the adoption of heat pumps. These initiatives, coupled with advancements in technology and decreasing installation costs, make heat pumps an attractive choice for consumers and drive the growth of the market.

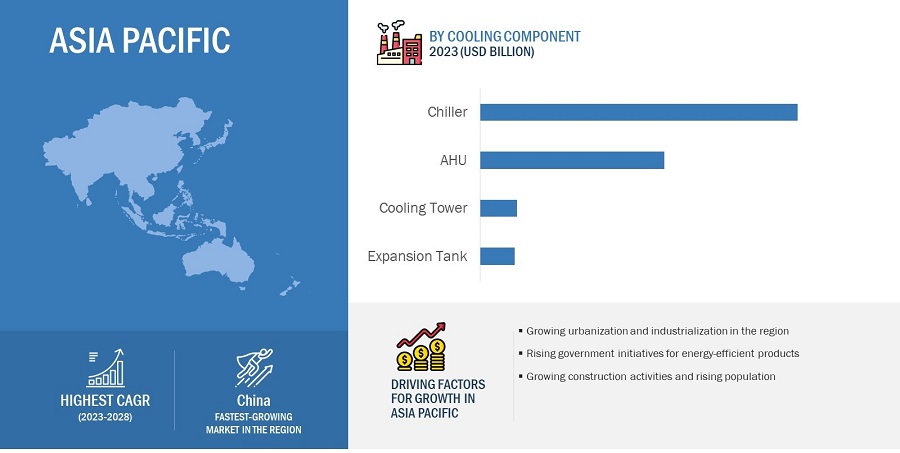

Based on cooling component, the chillers market is to grow at the highest CAGR share during the forecast period

Chillers play a pivotal role in water-based cooling systems and offer a range of significant benefits. They chillers provide efficient and reliable cooling for large-scale applications such as commercial buildings, data centers, hospitals, and industrial facilities. Additionally, chillers offer precise temperature control, allowing for customization based on specific cooling requirements. They can adapt to varying loads and ambient conditions, providing stable cooling even during peak demand. Furthermore, chillers offer energy efficiency through advanced technologies such as variable speed compressors, heat recovery, and intelligent controls. These features optimize energy usage, reduce electricity consumption, and lower operational costs. Lastly, chillers can be integrated with renewable energy sources, such as solar or geothermal, further enhancing their sustainability and reducing environmental impact. Considering their ability to provide reliable cooling, precise temperature control, energy efficiency, and compatibility with renewable energy, chillers stand as the most important component in water-based cooling systems, driving comfort, productivity, and sustainability in various applications.

Based on implementation type, the market for new constructions to hold the highest market share during the forecast period

The market for water-based heating & cooling systems in new construction projects is experiencing significant growth and is expected to continue expanding in the coming years. There is a growing awareness and emphasis on energy efficiency and sustainability in the construction industry. Water-based systems, such as hydronic heating and cooling, offer superior energy efficiency compared to traditional HVAC systems, resulting in reduced operating costs and environmental impact. Secondly, advancements in technology have made water-based systems more versatile, reliable, and easier to install. The availability of high-performance heat pumps, chillers, and radiant heating/cooling systems has expanded the range of options for designers and developers, allowing for tailored solutions to meet specific project requirements. Additionally, government regulations and initiatives aimed at reducing carbon emissions and promoting sustainable practices have provided incentives and mandates for the adoption of energy-efficient systems in new construction. These policies have accelerated the demand for water-based heating and cooling solutions thereby driving the market for new construction projects.

Commercial vertical for the water-based heating & cooling systems market to grow at the highest CAGR from 2023 to 2028

Commercial buildings, including office complexes, retail spaces, hotels, and healthcare facilities, require efficient and effective heating and cooling solutions to create comfortable environments for occupants. Water-based systems, such as hydronic heating and cooling, offer superior performance, precise temperature control, and uniform distribution of heat or cool air throughout the space, resulting in enhanced comfort levels. Moreover, the emphasis on energy efficiency and sustainability in the commercial sector is driving the adoption of water-based systems. These systems leverage renewable energy sources, advanced controls, and technologies like heat pumps and chillers to optimize energy usage and reduce operational costs.

Water-based Heating & Cooling Systems MarketRegional Analysis

Water-based heating & cooling systems market in Asia Pacific to hold the highest CAGR during the forecast period

China, Japan, and India are among a few major contributors to the water-based heating & cooling systems market share in APAC. Growing construction activities and the rising population are a few key factors boosting the growth of the water-based heating and cooling systems market in the region. There is a considerable demand for smart homes in countries such as Japan, South Korea, and China. Rapid urbanization and industrialization are also increasing the demand for water-based heating and cooling systems in the region. Moreover, the enforcement of regulatory programs such as the Commercial Building Disclosure (CBD) Program (Australia), the launch of Energy Conservation Building Codes (India), the introduction of the LEED-India project, and the formation of the Indian Society of Heating, Refrigerating, and Air-Conditioning Engineers (ISHRAE) support the adoption of water-based heating and cooling systems in the region

Water-based Heating & Cooling Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Water-based Heating & Cooling Systems Companies - Key Market Players:

The water-based heating & cooling systems companis is dominated by players such as

- Daikin (Japan),

- Johnson Controls (US),

- Carrier Global Corporation (US),

- Trane Technologies (US),

- Fujitsu (Japan), and others.

Water-based Heating & Cooling Systems Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 37.7 billion in 2023 |

| Projected Market Size | USD 55.2 billion by 2028 |

| Growth Rate | CAGR of 7.9% |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

The major market players include Daikin (Japan), Johnson Controls (US), Carrier Global Corporation (US), Trane Technologies (US), Fujitsu (Japan), Vasco Group (Belgium), JAGA N.V. (Belgium), Betherma BV (Netherlands), Purmo Group (Finland), and Castrads Ltd. (UK). (Total 25 players are profiled) |

Water-based Heating & Cooling Systems Market Highlights

The study categorizes the water-based heating & cooling systems market based on the following segments:

|

Segment |

Subsegment |

|

By Component |

|

|

By Cooling Type |

|

|

By Implementation Type |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments in Water-based Heating and Cooling System Industry

- Daikin, a Japanese multinational air conditioning and refrigeration company, launched a new water-sourced heat pump in April 2023. The new heat pump is designed to be more energy-efficient and environmentally friendly than traditional heat pumps.

- Mitsubishi Electric, a Japanese multinational conglomerate, partnered with Carrier, an American multinational corporation, on a water-based heating and cooling system in March 2023. The new system is designed to be more energy-efficient and environmentally friendly than traditional heating and cooling systems.

- Vaillant, a German multinational heating and plumbing company, launched a new water-based heat pump for commercial buildings in February 2023.

- Johnson Controls, an American multinational technology company, launched a new water-source heat pump in January 2023.

- Rheem, an American water heating, hydronic heating, and cooling company, partnered with Enercon, a Danish manufacturer of water-sourced heat pumps, in December 2022. The partnership will allow Rheem to offer Enercon's water-sourced heat pumps to its customers.

Frequently Asked Questions (FAQ):

What are the major driving factors and opportunities in the water-based heating & cooling systems market?

Some of the major driving factors for the growth of this market include increasing demand for energy-efficient and sustainable heating and cooling solutions, rising government regulations on energy efficiency, the growing popularity of green buildings, and the availability of government subsidies and tax credits. Moreover, the rise of smart home technology and the development of advanced heat pumps, solar thermal systems, and geothermal systems are some of the critical opportunities for the water-based heating & cooling systems market.

Which region is expected to hold the highest market share?

The market in North America will dominate the market share in 2023, showcasing strong demand for water-based heating & cooling systems in the region. Strong research and development, the presence of leading HVAC manufacturers, and investments and funding are key factors driving the growth of the water-based heating & cooling systems market in the region.

Who are the leading players in the global water-based heating & cooling systems market?

Companies such as Daikin (Japan), Johnson Controls (US), Carrier Global Corporation (US), Trane Technologies (US), and Fujitsu (Japan)are the leading players in the market. These companies are investing in research and development to introduce advanced and technologically superior water-based heating and cooling systems. This includes developing energy-efficient systems, integrating smart controls and automation features, and improving overall system performance. Additionally, they are also focusing on expanding their market presence geographically to tap into emerging markets and leverage growth opportunities. This can involve establishing distribution networks, entering into strategic alliances with local partners, or setting up manufacturing facilities in key regions.

What are some of the technological advancements in the market?

The latest technological advancements in hydronic heating systems include programmable thermostats, outdoor reset controls, warm-weather shutdown controls, microprocessor-based controllers, plastic PEX tubing, and new types of connection systems. These advancements make hydronic heating systems more efficient, easier to install and maintain, and more compatible with smart home devices. These advancements are making hydronic heating systems a more popular choice for homeowners.

What is the impact of the global recession on the market?

The water-based heating & cooling systems market is expected to be impacted significantly by the recession and rising inflation in 2023. The recession is expected to lead to a reduction in demand for new water-based heating and cooling systems. This is because businesses and homeowners are likely to be more cautious about spending money on new systems, especially if they are more expensive than traditional systems. Moreover, in order to compete in a declining market, manufacturers may be forced to lower prices on water-based heating and cooling systems. This could lead to lower profits for manufacturers and installers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for energy-efficient water-based heating & cooling systems- Increasing construction activities in residential and industrial sectors- Government regulatory policies and incentives to ensure energy saving and conservation of natural resources- Growing focus on enhancing indoor and outdoor air qualityRESTRAINTS- High maintenance and installation costs- Limited space in commercial and residential buildings- Lack of technical knowledge among owners and shortage of skilled laborOPPORTUNITIES- Rapid transformation of IoT within water-based heating & cooling industry- Growing demand for sustainable solutions- Efforts to develop next-generation low global warming potential refrigerants for water-based heating & coolingCHALLENGES- Lack of awareness about benefits of water-based heating & cooling systems in developing countries- Environmental concerns and aging infrastructure

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.8 CASE STUDY ANALYSISTOWER OF LONDON INSTALLS HVAC SYSTEMS FROM AIREDALETHE EBELL OF LOS ANGELES AND WILSHIRE EBELL THEATER HOUSE REPLACES OLD AND INEFFICIENT WATER-BASED HEATING & COOLING SYSTEMSSCHOOL IN GEORGIA UPGRADES WATER-BASED HEATING & COOLING SYSTEMS AND LOWERS ENERGY COSTSVIRGINIA DATA CENTER INSTALLS MODULAR HVAC SYSTEMSLIBRARY IN FLORIDA IMPLEMENTS INNOVATIVE WATER-BASED HEATING & COOLING SYSTEMS FROM ICEBANK ENERGY STORAGE SYSTEM

-

5.9 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Cooling units- Heating unitsCOMPLEMENTARY TECHNOLOGIES- Sensors- Building automation systemsADJACENT TECHNOLOGIES- Software technologies

-

5.10 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICES OF WATER-BASED HEATING & COOLING SYSTEMS COMPONENT, BY VERTICALAVERAGE SELLING PRICE TRENDS

-

5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.13 TARIFF ANALYSIS

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America: List of regulatory bodies, government agencies, and other organizations- Europe: List of regulatory bodies, government agencies, and other organizations- Asia Pacific: List of regulatory bodies, government agencies, and other organizations- RoW: List of regulatory bodies, government agencies, and other organizationsSTANDARDS AND REGULATIONS RELATED TO WATER-BASED HEATING & COOLING SYSTEMS MARKET- Environmental WHBC requirements- Water-based heating & cooling system efficiency standards- Water-based heating & cooling systems tech certifications

- 5.15 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 CONVECTOR HEATERSINNOVATIONS IN CONVECTOR DESIGNING AND MANUFACTURING TO DRIVE MARKET

-

6.3 RADIATORSRESIDENTIAL, COMMERCIAL, AND INDUSTRIAL BUILDINGS TO GENERATE SIGNIFICANT DEMAND

-

6.4 HEAT PUMPSCOST-EFFECTIVE SOLUTIONS TO DRIVE MARKET- Air-to-water heat pumps- Water-to-water heat pumps

-

6.5 BOILERSGROWING FOCUS ON SUSTAINABILITY TO DRIVE MARKET- Steam boilers- Hot water boilers

- 7.1 INTRODUCTION

-

7.2 CHILLERSNEW INFRASTRUCTURE PROJECTS TO BOOST DEMAND- Scroll chillers- Screw chillers- Centrifugal chillers- Reciprocating chillers- Absorption chillers

-

7.3 AIR HANDLING UNITSREDUCED ENERGY COSTS TO STRENGTHEN MARKET

-

7.4 COOLING TOWERSINCREASING ADOPTION OF RENEWABLE ENERGY SOURCES TO DRIVE DEMAND- Evaporative cooling towers- Dry cooling towers- Hybrid cooling towers

-

7.5 EXPANSION TANKSUSE OF EXPANSION TANKS HELP TO CONTROL PRESSURE IN COOLING SYSTEM TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 DIRECT COOLINGDATA CENTERS AND AIR CONDITIONERS TO OFFER SIGNIFICANT OPPORTUNITIES

-

8.3 INDIRECT COOLINGCAPABILITY TO MAINTAIN CLEANER AND HEALTHIER INDOOR ENVIRONMENT TO DRIVE DEMAND

- 9.1 INTRODUCTION

-

9.2 NEW CONSTRUCTIONGOVERNMENT-LED INITIATIVES TO PROMOTE ENERGY-SAVING DEVICES AND CONSUMER AWARENESS TO BOOST MARKET

-

9.3 RETROFITSGOVERNMENT REGULATIONS FOR GREEN BUILDINGS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 COMMERCIALGLOBAL TEMPERATURE RISE AND POLLUTION FROM CONSTRUCTION ACTIVITIES TO BOOST DEMAND- Office- Government- Healthcare- Education- Retail- Airport

-

10.3 RESIDENTIALGOVERNMENT REGULATIONS AND TAX CREDIT PROGRAMS TO PROMOTE BOOST DEMAND IN RESIDENTIAL SECTOR

-

10.4 INDUSTRIALWAREHOUSES, CONTROL ROOMS, AND PRODUCTION FACILITIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES- Data center- Manufacturing facility- Power plant

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: IMPACT OF RECESSIONUS- Increasing number of construction projects to drive demandCANADA- Government initiatives for energy saving to boost demandMEXICO- Increasing focus on promoting use of energy-efficient water-based heating & cooling systems to strengthen market

-

11.3 EUROPEEUROPE: IMPACT OF RECESSIONUK- High demand for energy-efficient devices from commercial and residential users to boost marketGERMANY- Increasing innovations in software solutions for water-based heating & cooling to support market growthFRANCE- Rising focus on reducing greenhouse gases to spur demandREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSIONCHINA- Growing industrialization and urbanization to fuel marketINDIA- Surging need to save energy to boost demandJAPAN- Strict regulations for energy conservation to upsurge demandREST OF ASIA PACIFIC

-

11.5 ROWROW: IMPACT OF RECESSIONSOUTH AMERICA- Strong focus on infrastructure development to boost marketMIDDLE EAST & AFRICA- Stringent regulations for enhancing energy performance of buildings to drive market

- 12.1 OVERVIEW

- 12.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYER

- 12.3 COMPANY REVENUE ANALYSIS, 2020–2022

- 12.4 MARKET SHARE ANALYSIS, 2022

-

12.5 COMPANY EVALUATION MATRIX, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

12.6 STARTUPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.7 WATER-BASED HEATING & COOLING SYSTEMS MARKET: COMPANY FOOTPRINT

-

12.8 STARTUPS/SMES EVALUATION MATRIX, 2022DETAILED LIST OF KEY STARTUPS/SMES

-

12.9 COMPETITIVE SCENARIOS AND TRENDSDEALS

-

13.1 KEY PLAYERSDAIKIN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJOHNSON CONTROLS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCARRIER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTRANE TECHNOLOGIES PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFUJITSU- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVASCO GROUP- Business overview- Products/Solutions/Services offeredPURMO GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsVERTIV HOLDINGS- Business overview- Products/Solutions/Services offeredSCHNEIDER ELECTRIC- Business overview- Products/Solutions/Services offered- Recent developmentsLENNOX INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- Recent developmentsJAGA N.V.- Business overview- Products/Services/Solutions offered- Recent developmentsBETHERMA B.V.- Business overview- Products/Services/Solutions offered- Recent developmentsCASTRADS LTD- Business overview- Products/Services/Solutions offered- Recent developmentsMHS RADIATORS- Business overview- Products/Services/Solutions offered- Recent developmentsEUCOTHERM- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSMIDEABOSCH THERMOTECHNIK GMBHELECTROLUXFERROLI S.P.ASIEMENS AGVAILLANT GROUPALFA LAVAL ABSTIEBEL ELTRONGLEN DIMPLEX GROUPSIGMA THERMAL

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 2 ASSUMPTIONS: RECESSION

- TABLE 3 ROLE OF WATER-BASED HEATING & COOLING SYSTEM MANUFACTURERS IN ECOSYSTEM

- TABLE 4 WATER-BASED HEATING & COOLING SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 7 AVERAGE SELLING PRICE OF WATER-BASED HEATING & COOLING SYSTEM COMPONENTS, BY VERTICAL

- TABLE 8 LIST OF PATENTS IN WATER-BASED HEATING & COOLING SYSTEMS, 2021–2023

- TABLE 9 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 10 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 11 MFN TARIFF FOR HS CODE: 8415 EXPORTED BY US (2022)

- TABLE 12 MFN TARIFF FOR HS CODE: 8415 EXPORTED BY CHINA (2022)

- TABLE 13 MFN TARIFF FOR HS CODE: 8415 EXPORTED BY INDIA (2022)

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 WATER-BASED HEATING & COOLING SYSTEMS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 19 WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT, 2019–2022 (USD BILLION)

- TABLE 20 WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT, 2023–2028 (USD BILLION)

- TABLE 21 WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 22 WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 23 CONVECTOR HEATERS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2019–2022 (USD BILLION)

- TABLE 24 CONVECTOR HEATERS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 25 CONVECTOR HEATERS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 26 CONVECTOR HEATERS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 27 RADIATORS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2019–2022 (USD BILLION)

- TABLE 28 RADIATORS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 29 RADIATORS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 30 RADIATORS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 31 HEAT PUMPS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2019–2022 (USD BILLION)

- TABLE 32 HEAT PUMPS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 33 HEAT PUMPS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 34 HEAT PUMPS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 35 BOILERS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2019–2022 (USD BILLION)

- TABLE 36 BOILERS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 37 BOILERS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 38 BOILERS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 39 WATER-BASED COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2019–2022 (USD BILLION)

- TABLE 40 WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2023–2028 (USD BILLION)

- TABLE 41 WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2019–2022 (THOUSAND UNITS)

- TABLE 42 WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2023–2028 (THOUSAND UNITS)

- TABLE 43 CHILLERS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2019–2022 (USD BILLION)

- TABLE 44 CHILLERS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 45 CHILLERS: WATER-BASED COOLING SYSTEMS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 46 CHILLERS: WATER-BASED COOLING SYSTEMS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 47 AIR HANDLING UNITS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2019–2022 (USD BILLION)

- TABLE 48 AIR HANDLING UNITS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 49 AIR HANDLING UNITS: WATER-BASED COOLING SYSTEMS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 50 AIR HANDLING UNITS: WATER-BASED COOLING SYSTEMS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 51 COOLING TOWERS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 52 COOLING TOWERS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 53 COOLING TOWERS: WATER-BASED COOLING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 COOLING TOWERS: WATER-BASED COOLING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 EXPANSION TANKS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 56 EXPANSION TANKS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 57 EXPANSION TANKS: WATER-BASED COOLING SYSTEMS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 EXPANSION TANKS: WATER-BASED COOLING SYSTEMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2019–2022 (USD BILLION)

- TABLE 60 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2023–2028 (USD BILLION)

- TABLE 61 NEW CONSTRUCTION: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 62 NEW CONSTRUCTION: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 63 RETROFITS: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 64 RETROFITS: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 65 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY VERTICAL, 2019–2022 (USD BILLION)

- TABLE 66 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 67 COMMERCIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY HEATING COMPONENT, 2019–2022 (USD BILLION)

- TABLE 68 COMMERCIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY HEATING COMPONENT, 2023–2028 (USD BILLION)

- TABLE 69 COMMERCIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2019–2022 (USD MILLION)

- TABLE 70 COMMERCIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2023–2028 (USD MILLION)

- TABLE 71 RESIDENTIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY HEATING COMPONENT, 2019–2022 (USD BILLION)

- TABLE 72 RESIDENTIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY HEATING COMPONENT, 2023–2028 (USD BILLION)

- TABLE 73 RESIDENTIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2019–2022 (USD MILLION)

- TABLE 74 RESIDENTIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2023–2028 (USD MILLION)

- TABLE 75 INDUSTRIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY HEATING COMPONENT, 2019–2022 (USD BILLION)

- TABLE 76 INDUSTRIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY HEATING COMPONENT, 2023–2028 (USD BILLION)

- TABLE 77 INDUSTRIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2019–2022 (USD MILLION)

- TABLE 78 INDUSTRIAL: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2023–2028 (USD MILLION)

- TABLE 79 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 80 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 81 NORTH AMERICA: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 82 NORTH AMERICA: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 83 NORTH AMERICA: WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT, 2019–2022 (USD BILLION)

- TABLE 84 NORTH AMERICA: WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT, 2023–2028 (USD BILLION)

- TABLE 85 NORTH AMERICA: WATER-BASED COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2019–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: WATER-BASED COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2019–2022 (USD BILLION)

- TABLE 88 NORTH AMERICA: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2023–2028 (USD BILLION)

- TABLE 89 EUROPE: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 90 EUROPE: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 91 EUROPE: WATER-BASED HEATING SYSTEM MARKET, BY HEATING COMPONENT, 2019–2022 (USD BILLION)

- TABLE 92 EUROPE: WATER-BASED HEATING SYSTEM MARKET, BY HEATING COMPONENT, 2023–2028 (USD BILLION)

- TABLE 93 EUROPE: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2019–2022 (USD MILLION)

- TABLE 94 EUROPE: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2019–2022 (USD BILLION)

- TABLE 96 EUROPE: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2023–2028 (USD BILLION)

- TABLE 97 ASIA PACIFIC: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 98 ASIA PACIFIC: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 99 ASIA PACIFIC: WATER-BASED HEATING SYSTEM MARKET, BY HEATING COMPONENT, 2019–2022 (USD BILLION)

- TABLE 100 ASIA PACIFIC: WATER-BASED HEATING SYSTEM MARKET, BY HEATING COMPONENT, 2023–2028 (USD BILLION)

- TABLE 101 ASIA PACIFIC: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2019–2022 (USD BILLION)

- TABLE 102 ASIA PACIFIC: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2023–2028 (USD BILLION)

- TABLE 103 ASIA PACIFIC: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2019–2022 (USD BILLION)

- TABLE 104 ASIA PACIFIC: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2023–2028 (USD BILLION)

- TABLE 105 ROW: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 106 ROW: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 107 ROW: WATER-BASED HEATING SYSTEM MARKET, BY HEATING COMPONENT, 2019–2022 (USD MILLION)

- TABLE 108 ROW: WATER-BASED HEATING SYSTEM MARKET, BY HEATING COMPONENT, 2023–2028 (USD MILLION)

- TABLE 109 ROW: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2019–2022 (USD MILLION)

- TABLE 110 ROW: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2023–2028 (USD MILLION)

- TABLE 111 ROW: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2019–2022 (USD BILLION)

- TABLE 112 ROW: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2023–2028 (USD BILLION)

- TABLE 113 OVERVIEW OF STRATEGIES DEPLOYED BY WATER-BASED HEATING & COOLING SYSTEM OEMS

- TABLE 114 WATER-BASED HEATING & COOLING SYSTEMS MARKET: DEGREE OF COMPETITION

- TABLE 115 COMPANY FOOTPRINT

- TABLE 116 VERTICAL FOOTPRINT

- TABLE 117 PRODUCT FOOTPRINT

- TABLE 118 REGION FOOTPRINT

- TABLE 119 WATER-BASED HEATING & COOLING SYSTEMS MARKET: STARTUPS/SMES

- TABLE 120 WATER-BASED HEATING & COOLING SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS

- TABLE 121 WATER-BASED HEATING & COOLING SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS, BY COMPONENT

- TABLE 122 WATER-BASED HEATING & COOLING SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- TABLE 123 WATER-BASED HEATING & COOLING SYSTEMS MARKET: DEALS, 2020–2023

- TABLE 124 WATER-BASED HEATING & COOLING SYSTEMS MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 125 WATER-BASED HEATING & COOLING SYSTEMS MARKET: OTHERS, 2022–2023

- TABLE 126 DAIKIN: BUSINESS OVERVIEW

- TABLE 127 DAIKIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 DAIKIN: PRODUCT LAUNCHES

- TABLE 129 DAIKIN: DEALS

- TABLE 130 DAIKIN: OTHERS

- TABLE 131 JOHNSON CONTROLS: BUSINESS OVERVIEW

- TABLE 132 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 JOHNSON CONTROLS: PRODUCT LAUNCHES

- TABLE 134 JOHNSON CONTROLS: DEALS

- TABLE 135 CARRIER: BUSINESS OVERVIEW

- TABLE 136 CARRIER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 CARRIER: PRODUCT LAUNCHES

- TABLE 138 CARRIER: DEALS

- TABLE 139 TRANE TECHNOLOGIES PLC: BUSINESS OVERVIEW

- TABLE 140 TRANE TECHNOLOGIES PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 TRANE TECHNOLOGIES PLC: PRODUCT LAUNCHES

- TABLE 142 TRANE TECHNOLOGIES PLC: DEALS

- TABLE 143 FUJITSU: BUSINESS OVERVIEW

- TABLE 144 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 FUJITSU: PRODUCT LAUNCHES

- TABLE 146 FUJITSU: DEALS

- TABLE 147 VASCO GROUP: BUSINESS OVERVIEW

- TABLE 148 VASCO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 PURMO GROUP: BUSINESS OVERVIEW

- TABLE 150 PURMO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 PURMO GROUP: PRODUCT LAUNCHES

- TABLE 152 PURMO GROUP: DEALS

- TABLE 153 VERTIV HOLDINGS: BUSINESS OVERVIEW

- TABLE 154 VERTIV HOLDINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- TABLE 156 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 SCHNEIDER ELECTRIC: DEALS

- TABLE 158 LENNOX INTERNATIONAL INC.: BUSINESS OVERVIEW

- TABLE 159 LENNOX INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 LENNOX INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 161 LENNOX INTERNATIONAL INC.: DEALS

- TABLE 162 LENNOX INTERNATIONAL INC.: OTHERS

- TABLE 163 JAGA N.V.: BUSINESS OVERVIEW

- TABLE 164 JAGA N.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 165 JAGA N.V.: PRODUCT LAUNCHES

- TABLE 166 JAGA N.V.: DEALS

- TABLE 167 BETHERMA B.V.: BUSINESS OVERVIEW

- TABLE 168 BETHERMA B.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 169 BETHERMA B.V.: PRODUCT LAUNCHES

- TABLE 170 BETHERMA B.V.: DEALS

- TABLE 171 CASTRADS LTD: BUSINESS OVERVIEW

- TABLE 172 CASTRADS LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 173 CASTRADS LTD: PRODUCT LAUNCHES

- TABLE 174 CASTRADS LTD: DEALS

- TABLE 175 MHS RADIATORS: BUSINESS OVERVIEW

- TABLE 176 MHS RADIATORS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 MHS RADIATORS: PRODUCT LAUNCHES

- TABLE 178 MHS RADIATORS: DEALS

- TABLE 179 EUCOTHERM: BUSINESS OVERVIEW

- TABLE 180 EUCOTHERM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 EUCOTHERM: PRODUCT LAUNCHES

- FIGURE 1 WATER-BASED HEATING & COOLING SYSTEMS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY-SIDE)—IDENTIFICATION OF REVENUE GENERATED BY COMPANIES FROM WATER-BASED HEATING & COOLING SYSTEMS MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 HEAT PUMPS TO HOLD LARGEST SHARE OF WATER-BASED HEATING SYSTEMS MARKET DURING 2023–2028

- FIGURE 8 CHILLERS TO RECORD HIGHEST CAGR DURING 2023–2028

- FIGURE 9 NEW CONSTRUCTION IMPLEMENTATION TYPE TO HOLD HIGHEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 COMMERCIAL VERTICAL TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 WATER-BASED HEATING & COOLING SYSTEMS MARKET IN ASIA PACIFIC TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 12 IMPLEMENTATION OF IOT ACROSS WATER-BASED HEATING & COOLING SYSTEMS TO TRANSFORM COMMERCIAL AND RESIDENTIAL VERTICALS

- FIGURE 13 US AND HEAT PUMPS ARE EXPECTED TO HOLD LARGEST SHARE OF NORTH AMERICAN WATER-BASED HEATING & COOLING SYSTEMS MARKET IN 2023

- FIGURE 14 CHILLERS TO SECURE LARGEST SHARE OF WATER-BASED HEATING & COOLING SYSTEMS MARKET IN ASIA PACIFIC DURING 2023–2028

- FIGURE 15 WATER-BASED HEATING & COOLING SYSTEMS MARKET IN CHINA TO DISPLAY HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 16 WATER-BASED HEATING & COOLING SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 DRIVERS AND THEIR IMPACT ON WATER-BASED HEATING & COOLING SYSTEMS MARKET

- FIGURE 18 RESTRAINTS AND THEIR IMPACT ON WATER-BASED HEATING & COOLING SYSTEMS MARKET

- FIGURE 19 OPPORTUNITIES AND THEIR IMPACT ON WATER-BASED HEATING & COOLING SYSTEMS MARKET

- FIGURE 20 CHALLENGES AND THEIR IMPACT ON WATER-BASED HEATING & COOLING SYSTEMS MARKET

- FIGURE 21 WATER-BASED HEATING & COOLING SYSTEMS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 KEY PLAYERS IN WATER-BASED HEATING & COOLING SYSTEMS MARKET

- FIGURE 23 WATER-BASED HEATING & COOLING SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 26 REVENUE SHIFT FOR PLAYERS IN WATER-BASED HEATING & COOLING SYSTEMS MARKET

- FIGURE 27 AVERAGE SELLING PRICE OF WATER-BASED HEATING & COOLING SYSTEM COMPONENTS, BY VERTICAL

- FIGURE 28 AVERAGE SELLING PRICE OF DIFFERENT COOLING COMPONENTS (USD)

- FIGURE 29 AVERAGE SELLING PRICE OF DIFFERENT HEATING COMPONENTS (USD)

- FIGURE 30 NUMBER OF PATENTS GRANTED IN WATER-BASED HEATING & COOLING SYSTEMS MARKET, 2012–2023

- FIGURE 31 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 32 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 33 HEAT PUMPS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 34 CHILLERS TO HOLD LARGEST SHARE OF WATER-BASED HEATING SYSTEMS MARKET FOR COOLING COMPONENTS IN 2028

- FIGURE 35 NEW CONSTRUCTION SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 COMMERCIAL VERTICAL TO ATTAIN HIGHEST MARKET SHARE DURING 2023–2028

- FIGURE 37 ASIA PACIFIC REGION TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: WATER-BASED HEATING & COOLING SYSTEMS MARKET SNAPSHOT

- FIGURE 39 EUROPE: WATER-BASED HEATING & COOLING SYSTEMS MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: WATER-BASED HEATING & COOLING SYSTEMS MARKET SNAPSHOT

- FIGURE 41 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS, 2020–2022

- FIGURE 42 SHARE OF MAJOR PLAYERS IN WATER-BASED HEATING & COOLING SYSTEMS MARKET, 2022

- FIGURE 43 COMPANY EVALUATION MATRIX, 2022

- FIGURE 44 STARTUPS/SMES EVALUATION QUADRANT, 2022

- FIGURE 45 DAIKIN: COMPANY SNAPSHOT

- FIGURE 46 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 47 CARRIER: COMPANY SNAPSHOT

- FIGURE 48 TRANE TECHNOLOGIES PLC: COMPANY SNAPSHOT

- FIGURE 49 FUJITSU: COMPANY SNAPSHOT

- FIGURE 50 PURMO GROUP: COMPANY SNAPSHOT

- FIGURE 51 VERTIV HOLDINGS: COMPANY SNAPSHOT

- FIGURE 52 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 53 LENNOX INTERNATIONAL INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the water-based heating & cooling systems market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

International Energy Agency (IEA) |

|

|

The Japan Refrigeration and Air-conditioning Industry Association (JRAIA) |

|

|

The American Society of Heating, Refrigerating, and Air Conditioning Engineers (ASHRAE) |

|

|

Air Conditioning Contractors of America Association (ACCA) |

|

|

Air-Conditioning, Heating, and Refrigeration Institute (AHRI) |

Primary Research

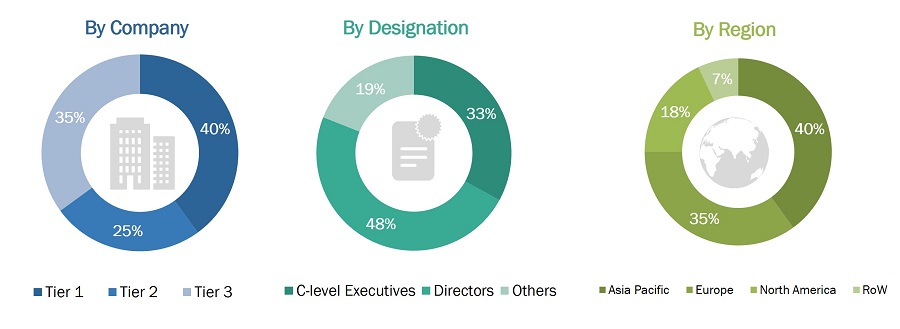

Extensive primary research was conducted after gaining knowledge about the current scenario of the water-based heating & cooling systems market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the water-based heating & cooling systems market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the water-based heating & cooling systems market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Initially, the companies offering heating and cooling equipment were identified, and their product mapping with respect to different parameters, such as implementation type and vertical, was carried out.

- The size of the water-based heating & cooling systems market was estimated based on their demand from the different application areas and the revenue of the companies operating in the water-based heating & cooling ecosystem.

- Primaries were conducted with a few major players operating in the water-based heating & cooling system market to validate the global size of the market.

- Additionally, the size of the water-based heating & cooling system market was validated through secondary sources, which included the International Energy Agency (IEA), The Japan Refrigeration and Air Conditioning Industry Association (JRAIA), The American Society of Heating, Refrigerating and Air Conditioning Engineers (ASHRAE), and Air Conditioning Contractors of America Association (ACCA). Other sources included company websites, press releases, research journals, and magazines.

- For calculating the CAGR of the water-based heating & cooling systems market, the historical and future market trend analyses were carried out by understanding the industry penetration rate of a water-based heating & cooling system and their demand and supply in different application areas.

- The estimates at every level were verified and cross-checked through discussions with key opinion leaders such as corporate executives (CXOs), directors, and sales heads, as well as with the domain experts in MarketsandMarkets.

- Various paid and unpaid information sources such as annual reports, press releases, white papers, and databases were also studied.

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Information related to revenues obtained from key manufacturers and providers of water-based heating & cooling systems was studied and analyzed to estimate the global size of the water-based heating & cooling systems market.

- The water-based heating & cooling systems market is expected to witness a linear growth trend during the forecast period owing to the fact that it is a mature market with several well-established players serving various verticals.

- Revenues, geographical presence, key verticals, and different types of offerings of all identified players in the water-based heating & cooling systems market were studied to estimate and arrive at the percentage split of different market segments.

- All major players in each category (equipment type and vertical) of the water-based heating & cooling systems market were identified through secondary research and verified through brief discussions with industry experts.

- Multiple discussions with key opinion leaders of all major companies involved in the development of the water-based heating & cooling systems were conducted to validate the market split based on heating component, cooling component, implementation type, vertical, and region.

- Geographical splits were estimated using secondary sources based on various factors, such as the number of players offering water-based heating & cooling systems in a specific country or region and the type of water-based heating & cooling equipment provided by these players.

- Impact of the recession on the steps mentioned above has also been considered

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation procedure has been employed wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

A water-based heating and cooling system, also known as a hydronic system, is an efficient and versatile solution for maintaining comfortable indoor temperatures. This system utilizes water as a medium to transfer heat, providing both warmth during cold seasons and cooling during hot weather. In this system, a network of pipes is installed throughout a building, carrying heated or chilled water to various points of use, such as radiators, fan coil units, or underfloor heating/cooling systems. The water is heated using a boiler or a heat pump and then circulated through the pipes, releasing its thermal energy to the surrounding space. By adjusting the water temperature and flow rate, the system allows for precise control over the indoor climate. The water-based heating and cooling system offers several advantages, including energy efficiency, reduced noise levels, improved air quality, and flexibility in terms of integration with renewable energy sources. Additionally, it provides a comfortable and even distribution of heating and cooling, ensuring a pleasant environment for occupants.

Key Stakeholders

- Component Manufacturers

- Government and Research Organizations

- Water-based Heating & Cooling Contractors

- Water-based Heating & Cooling System Providers

- Water-based Heating & Cooling Software and Service Providers

- Maintenance and Service Providers

- Original Equipment Manufacturers (OEMs)

- Professional Services/Solution Providers

- Research Institutions and Organizations

- System Integrators

Report Objectives

- To estimate and forecast the size of the water-based heating & cooling systems market, in terms of value, based on heating component, cooling component, vertical, implementation type, and region

- To describe and forecast the market size, in terms of volume, based on cooling component, and heating component

- To describe and forecast the market size, in terms of value, for four major regions—North America, Europe, Asia Pacific, and RoW

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the water-based heating & cooling systems market

- To strategically analyze micromarkets1 with regard to individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with a detailed competitive landscape for the market leaders

- To analyze major growth strategies such as product launches, expansions, joint ventures, agreements, and acquisitions adopted by the key market players to enhance their position in the market

- To analyze the impact of the recession on the water-based heating & cooling systems market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the water-based heating & cooling systems market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the water-based heating & cooling systems market.

Growth opportunities and latent adjacency in Water-based Heating & Cooling Systems Market