3D Mapping and Modeling Market by Offering (Software & Services), Technology (LiDAR, Photogrammetry, SLAM), Vertical (Architecture, Engineering & Construction, Media & Entertainment), and Region (North America, APAC, Europe, RoW) - Global Forecast to 2028

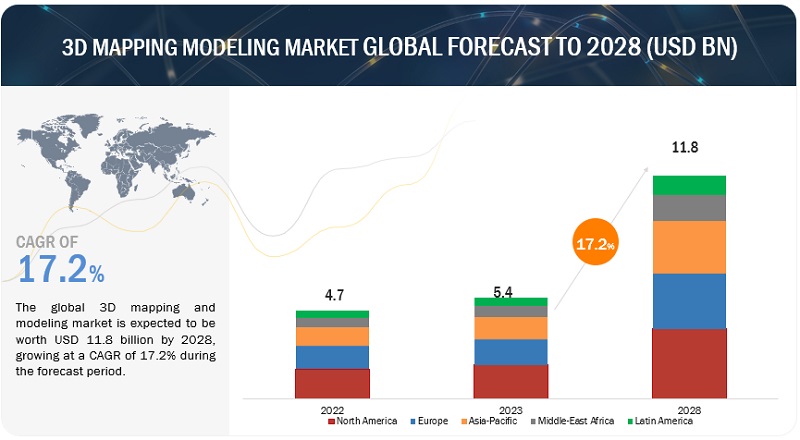

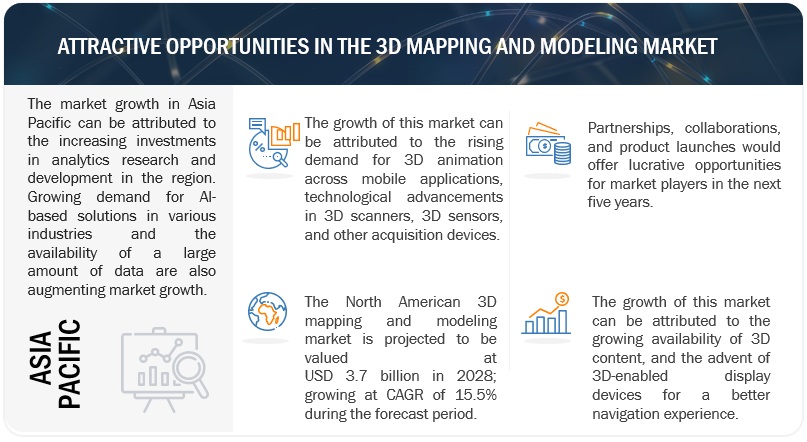

[354 Pages Report] The 3D mapping and modeling market is projected to grow from USD 5.4 billion in 2023 to USD 11.8 billion by 2028, at a compound annual growth rate (CAGR) of 17.2% during the forecast period. Due to various business drivers, the 3D mapping and modeling industry is expected to grow significantly during the forecast period. The market is experiencing significant growth as the demand for 3D animation across mobile applications and technological advancements in 3D scanners, 3D sensors, and other acquisition devices is growing. The growing availability of 3D content and the advent of 3D-enabled display devices for a better navigation experience is also responsible for driving the 3D mapping and modeling market’s growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

3D Modeling Market Dynamics

Driver: Advent of 3D-enabled display devices for a better navigation experience

Advancements in 3D maps are expected to be driven by the increasing need for an HD experience among users. 3D viewing technology has been available in the market for many years, but the quality delivered to the consumer was inadequate. Consumers always need the best viewing experience of perceived 3D images, similar to what objects look like. Innovative technologies have already started setting foot in the market, which gives users a comfortable HD viewing experience. They provide images of objects that look real and have adequate details. 3D mapping and 3D modeling technologies enable users to have real-life experiences of the surrounding buildings and terrain by viewing them through 3D-enabled devices, such as smartphones, tablets, and Personal Computers (PCs). The demand for 3D-enabled devices is expected to increase in the years to come. According to the statistics, the demand for all 3D-enabled devices is predicted to increase due to technological advancements, changing lifestyles, and the rising awareness among people regarding these advanced devices. Moreover, the increasing need for crisp and realistic image visualization, superior 3D effects, and an excellent mapping and navigation experience are driving the 3D mapping and 3D modeling market.

Restraints: Increasing corruption and piracy concerns

The animation industry continues to be exposed to corruption and piracy risks. The software installation of companies is targeted, and pirated copies are sold in the market. Consequently, the industry suffers huge financial losses. To control piracy, companies have developed surveillance and monitoring programs to inhibit the illegal downloading of 3D mapping and modeling software. This, in turn, has encouraged users to use legal digital content. In recent years, government norms and regulatory reforms have been implemented to mitigate piracy threats. However, there is a need to adopt flexible business plans to develop mitigation strategies and undertake proactive measures by forming anti-piracy cells and spreading awareness. For instance, in India, states such as Tamil Nadu and Maharashtra have taken initiatives to spread public awareness against piracy. However, in various countries, the only regulatory policy to prevent piracy is to block sites and impose a penalty on illegal users. According to statistics by DataProt, Software piracy rates worldwide dropped to 37% in 2017, down by 2% from two years earlier.

Opportunity: Integration with IoT and sensor technologies for real-time data collection and visualization

The integration of 3D mapping and modeling solutions with Internet of Things (IoT) and sensor technologies enables real-time data collection and visualization, leading to a host of benefits and applications across various industries. IoT devices and sensors gather real-time data from physical objects, equipment, and environments. These devices can capture a wide range of data, including temperature, humidity, pressure, motion, location, etc. By integrating 3D mapping and modeling solutions with IoT devices, businesses can collect vast amounts of data continuously and in real time. 3D mapping and modeling solutions provide a powerful platform for visualizing complex data from IoT devices. Instead of traditional 2D charts and graphs, 3D visualizations enable users to understand data spatially, identifying patterns, trends, and anomalies more effectively. Businesses gain enhanced situational awareness by combining IoT sensor data with 3D mapping and modeling. For example, in smart cities, sensors can monitor traffic flow, air quality, and waste management, and 3D visualizations allow city administrators to make data-driven decisions to optimize city services. Integrating 3D mapping and modeling solutions with IoT and sensor technologies presents a vast array of applications across industries. By leveraging real-time data visualization and analytics, businesses and organizations can make more informed decisions, optimize processes, improve safety, and unlock new levels of efficiency and innovation. As the IoT ecosystem continues to grow, the demand for such integrated solutions is expected to increase significantly.

Challenge: Stringent government regulations and lack of investments

The lack of capital investment hinders the growth of the 3D mapping and modeling market. Insufficient fund supply restricts R&D activities, training manpower, and purchasing innovative technologies. Investments in adopting the latest technologies ensure the work system efficiency and increase the number of opportunities for the industry. One major reason for low investor attraction is the slow Return on Investment (ROI) in the animation industry. As a result, private investors are reluctant to enter the 3D mapping and modeling market. Regarding government support, countries like the US, China, Taiwan, Singapore, and Japan provide significant development provisions to boost market growth.

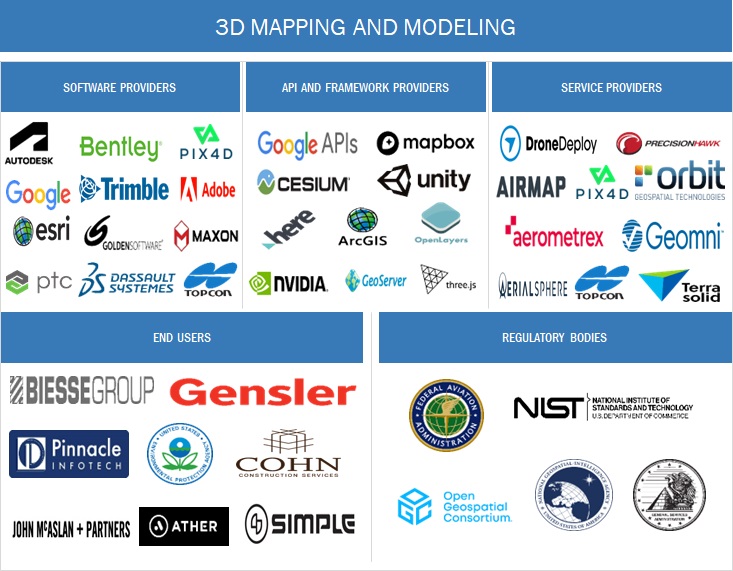

3D Mapping and Modeling Market Ecosystem

By offering, solutions segment to account for a larger market size during forecast period

The 3D mapping and modeling solutions include 3D mapping and modeling software. 3D mapping and modeling solutions comprise a set of technologies, software, and tools that enable the creation, visualization, and manipulation of three-dimensional (3D) representations of real-world objects, landscapes, environments, or virtual entities. These solutions are used in various industries and applications to generate accurate, detailed, and interactive 3D models, which provide valuable insights, support decision-making processes, and enhance user experiences. These solutions offer various visualization methods, such as 3D rendering, animation, and interactive user interfaces, to represent the 3D data and models comprehensibly and informally.

By technology, photogrammetry registers the highest CAGR during the forecast period

The photogrammetry segment is projected to grow more during the forecast period. Photogrammetry is a cutting-edge technology making significant strides in 3D mapping and modeling. It involves capturing accurate 3D data from 2D images, enabling the creation of detailed and realistic 3D models of real-world objects and environments. As technology advances, photogrammetry applications have expanded, leading to a growing demand for this innovative solution in various industries.

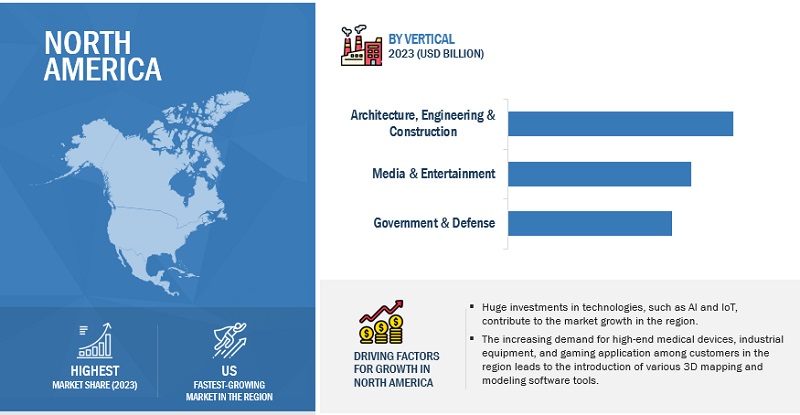

By region, North America holds the largest market size during the forecast period

North America will lead the 3D mapping and modeling market in 2023. North America, comprising the United States and Canada, is known for its advanced technology infrastructure and innovative industries, making it a hub for adopting 3D mapping and modeling technologies. In addition, North America is home to the gaming and entertainment industry, and 3D mapping and modeling solutions play a crucial role in creating visually stunning and realistic gaming environments. The adoption of 3D mapping and modeling solutions in North America is likely to continue growing as these technologies advance and find new applications in various industries. The region's strong technology ecosystem and continuous innovation make it a key player in driving the development and adoption of these solutions globally.

Top 3D Mapping and Modeling Market Companies

The 3D mapping and modeling solution and service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships, and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the 3d mapping and modeling market include Google (US), Autodesk (US), Trimble (US), Bentley Systems (US), Dassault Systemes (France), Adobe (US), Hexagon (Sweden), Esri (US), Golden Software (US), Maxon (Germany), Topcon (Japan), CyberCity 3D (US), Pix4D (Switzerland), Apple (US), Onionlab (Spain), Mapbox (US), Saab AB (Sweden), Airbus (Netherlands), Intermap Technologies (US), The Foundry Visionmongers (UK), PTC (US), MathWorks (US), Ansys (US), Blender Foundation (Netherlands), SideFX (Canada), Civil Maps (US), Hivemapper (US), lvl5 (US), Shapr3D (Hungary), Innersight (UK), Astrivis Technologies (Switzerland), Pointivo (US), Dynamic Map Platform (Japan), Archilogic (Switzerland) and MOD Tech Labs (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD (Billion) |

|

Segments covered |

Offering, Technology, Vertical, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

3D Modeling Market Companies covered |

Google (US), Autodesk (US), Trimble (US), Bentley Systems (US), Dassault Systemes (France), Adobe (US), Hexagon (Sweden), Esri (US), Golden Software (US), Maxon (Germany), Topcon (Japan), CyberCity 3D (US), Pix4D (Switzerland), Apple (US), Onionlab (Spain), Mapbox (US), Saab AB (Sweden), Airbus (Netherlands), Intermap Technologies (US), The Foundry Visionmongers (UK), PTC (US), Mathworks (US), Ansys (US), Blender Foundation (Netherlands), SideFX (Canada), Civil Maps (US), Hivemapper (US), lvl5 (US), Shapr3D (Hungary), Innersight (UK), Astrivis Technologies (Switzerland), Pointivo (US), Dynamic Map Platform (Japan), Archilogic (Switzerland) and MOD Tech Labs (US). |

This research report categorizes the 3D mapping and modeling market based on offering, technology, vertical, and region.

3D Modeling Market By Offering:

-

Software

-

3D Mapping Software

- 3D Projection Mapping

- GIS Mapping

- Drone Mapping

- Satellite and Aerial Imaging

- Other 3D Mapping Software

-

3D Modeling Software

- Solid Modeling

- Wireframe Modeling

- Surface Modeling

- Other 3D Modeling Software

-

3D Mapping Software

-

Services

-

Professional Services

- Training & Consulting

- System Integration & Implementation

- Support & Maintenance

- Managed Services

-

Professional Services

3D Modeling Market By Technology:

- LiDAR

- Photogrammetry

- Structured Light Scanning

- SLAM

- Other Technologies

3D Modeling Market By Deployment Mode:

- Cloud

- On-premises

3D Modeling Market By Vertical:

- Architecture, Engineering & Construction (AEC)

- Manufacturing

- Automotive & Transportation

- Healthcare & Life Sciences

- Media & Entertainment

- Government & Defense

- Education

- Agriculture

- Energy & Utilities

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia and New Zealand (ANZ)

- South Korea

- ASEAN Countries

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

- Egypt

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In June 2023, Dassault Systemes advanced the portfolio transformation of its GEOVIA mining software solutions to integrate them into its 3DEXPERIENCE platform.

- In May 2023, Trimble announced the latest version of Trimble Business Center includes enhancements for CenterPoint RTX corrections, mobile mapping, comparing TBC + TRW for scanning.

- In April 2023, Trimble and the University of Applied Sciences and Arts Northwestern Switzerland FHNW have collaborated to establish a state-of-the-art Trimble Technology Lab at FHNW's School of Architecture, Civil Engineering and Geomatics program in Muttenz, Switzerland.

- In February 2023, Bentley’s acquisition of EasyPower, to extend integrated and iterative power systems design and analysis for infrastructure digital twins of every type, broadens its comprehensiveness in infrastructure engineering.

- In Sptember 2022, Autodesk announced a strategic collaboration with Epic Games to accelerate immersive real-time (RT) experiences across industries, with an initial focus on Architecture, Engineering and Construction (AEC).

- In July 2022, Google has announced a partnership with Genesys International and Tech Mahindra. This new integration of street view into Google Maps offers users to access the up-to-date imagery sourced data from local partners.

Frequently Asked Questions (FAQ):

What is 3D mapping and modeling?

3D mapping and modeling is a technology used to project a 2D or 3D object onto a display surface through spatial mapping. Advertisers and artists often use 3D mapping to add dimension, movement, and depth to previously static objects, such as buildings or stages.

What is the total CAGR expected to be recorded for the 3D mapping and modeling market during forecast period?

The market is expected to record a CAGR of 17.2% during the forecast period.

Which are the key drivers supporting the growth of the 3D mapping and modeling market?

Some factors driving the growth of the 3D mapping and modeling market are rising demand for 3D animation across mobile applications, games, and movies for an enriched viewing experience, technological advancements in 3D scanners, 3D sensors, and other acquisition devices, growing availability of 3D content, and the advent of 3D-enabled display devices for a better navigation experience.

Which are the key technologies prevailing in the 3D mapping and modeling market?

The key technologies gaining a foothold in the 3D mapping and modeling market are LiDAR, photogrammetry, structured light scanning, SLAM, and SONAR.

Who are the key vendors in the 3D mapping and modeling market?

Some major players in the 3d mapping and modeling market include Google (US), Autodesk (US), Trimble (US), Bentley Systems (US), Dassault Systemes (France), Adobe (US), Hexagon (Sweden), ESRI (US), Golden Software (US), Maxon (Germany), Topcon (Japan), CyberCity 3D (US), Pix4D (Switzerland), Apple (US), Onionlab (Spain), Mapbox (US), Saab AB (Sweden), Airbus (Netherlands), Intermap Technologies (US), The Foundry Visionmongers (UK), PTC (US), MathWorks (US), Ansys (US), Blender Foundation (Netherlands), SideFX (Canada), Civil Maps (US), Hivemapper (US), lvl5 (US), Shapr3D (Hungary), Innersight (UK), Astrivis Technologies (Switzerland), Pointivo (US), Dynamic Map Platform (Japan), Archilogic (Switzerland) and MOD Tech Labs (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for 3D animation in mobile applications, gaming, and videography- Technological advancements in 3D scanners, sensors, and other acquisition devices- Widespread availability of 3D content- Advent of 3D-enabled display devicesRESTRAINTS- Increase in corruption and piracy concerns- High technological and installation costsOPPORTUNITIES- Emergence of AI and ML technologies- Rising popularity of AR and VR technologies across key industries- Integration of 3D mapping and modeling solutions with sensors and IoT devices to collect real-time dataCHALLENGES- Stringent government regulations and insufficient funding in 3D mapping and modeling technologies- Shortage of skilled workforce

-

5.3 CASE STUDY ANALYSISJAY & CO. INDIA PVT. LTD. DEPLOYED PDMC AND REVIT TO STREAMLINE DESIGN WORKFLOW AND DATA INTEROPERABILITYJOHN MCASLAN AND PARTNERS DEPLOYED 3D MODELING TO TRANSFORM KING’S CROSS STATIONSIMPLE ENERGY DEPLOYED ALIAS SURFACE SOFTWARE TO BUILD 3D MODELS OF AUTOMOTIVE DESIGNS AND REDUCE TIME TO MARKETRUMBO NORTE INGENIERIA DEPLOYED TDX8 TO CAPTURE ACCURATE DATAZURI DEPLOYED 3DEXPERIENCE TO MANUFACTURE VTOL AIRCRAFTCOHN CONSTRUCTION DEPLOYED SKETCHUP PRO TO DEVELOP ROBUST 3D DESIGNSEPA DEPLOYED 3D MAPPING TO MAKE CRITICAL DECISIONS RELATED TO CLEAN WATER ACTGRANDVIEW ENERGY DEPLOYED SURFER TO ACHIEVE PRECISE GEOLOGICAL VISUALIZATIONGENSLER DEPLOYED 3D GIS TO FACILITATE SMART URBAN PLANNINGBIESSE GROUP DEPLOYED 3D INTEROP TO RESOLVE DATA TRANSLATION ISSUE

-

5.4 REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST & AFRICALATIN AMERICA

-

5.5 ECOSYSTEM MAPPING

-

5.6 PATENT ANALYSISMETHODOLOGYPATENTS FILED, 2013–2023INNOVATION AND PATENT APPLICATIONSTOP APPLICANTS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 PRICING ANALYSIS

- 5.9 BEST PRACTICES IN 3D MAPPING AND MODELING MARKET

- 5.10 BRIEF HISTORY OF 3D MAPPING AND MODELING MARKET

- 5.11 FUTURE OF 3D MAPPING AND MODELING MARKET

-

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.13 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.16 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- LiDAR- Photogrammetry- Augmented reality- Virtual reality- 3D printing- Real-time simulation- Simultaneous localization and mappingADJACENT TECHNOLOGIES- Geographic information system- Artificial intelligence- Machine learning- Cloud computing- Digital twin- Blockchain- Big data

-

5.17 3D MAPPING AND MODELING PROCESSDATA ACQUISITIONDATA PREPROCESSINGPOINT CLOUD PROCESSING3D MODEL CREATIONPOSTPROCESSINGOUTPUT AND VISUALIZATIONAPPLICATION AND USE

-

5.18 BUSINESS MODEL ANALYSISSOFTWARE LICENSINGSOFTWARE-AS-A-SERVICE (SAAS)PLATFORM-AS-A-SERVICE (PAAS)

-

6.1 INTRODUCTION3D MAPPING AND MODELING MARKET DRIVERS

-

6.2 SOFTWARE3D MAPPING SOFTWARE- 3D projection mapping- GIS mapping- Drone mapping- Satellite and aerial imaging- Others3D MODELING SOFTWARE- Solid modeling- Wireframe modeling- Surface modeling- Others

-

6.3 SERVICESPROFESSIONAL SERVICES- Training and consulting- System integration and implementation- Support and maintenanceMANAGED SERVICES

-

7.1 INTRODUCTION3D MAPPING AND MODELING MARKET DRIVERS

-

7.2 ON-PREMISESDATA SECURITY AND LOW LATENCY TO DRIVE GROWTH

-

7.3 CLOUDSEAMLESS DATA SHARING AND REAL-TIME COLLABORATION TO DRIVE GROWTH

-

8.1 INTRODUCTION3D MAPPING AND MODELING MARKET DRIVERS

-

8.2 LIDARABILITY TO COLLECT ACCURATE DATA TO DRIVE GROWTHAIRBORNETERRESTRIALMOBILE

-

8.3 PHOTOGRAMMETRYCOST-EFFECTIVENESS TO DRIVE GROWTHAERIALCLOSE RANGESATELLITE

-

8.4 STRUCTURED LIGHT SCANNINGHIGH-PRECISION DATA CAPTURE CAPABILITIES TO DRIVE GROWTHTRIANGULATION METHODTIME-OF-FLIGHT METHODMOIRE PATTERN

-

8.5 SLAMNEED FOR REAL-TIME 3D MAPS TO DRIVE GROWTHVISUAL SLAMSENSOR FUSION SLAMLIDAR SLAM

- 8.6 OTHER TECHNOLOGIES

-

9.1 INTRODUCTION3D MAPPING AND MODELING MARKET DRIVERS

-

9.2 ARCHITECTURE, ENGINEERING, AND CONSTRUCTIONARCHITECTURAL VISUALIZATION AND WALKTHROUGHBUILDING INFORMATION MODELING (BIM)SITE ANALYSIS AND SURVEYINGARCHITECTURE AND CONSTRUCTIONOTHER APPLICATIONS

-

9.3 MEDIA AND ENTERTAINMENTCHARACTER MODELING AND ANIMATIONGAMING AND ANIMATIONENVIRONMENT AND LEVEL DESIGNVISUAL EFFECTS (VFX)OTHER APPLICATIONS

-

9.4 MANUFACTURINGPRODUCT DESIGN AND PROTOTYPINGFACTORY LAYOUT PLANNINGDEFENSE SIMULATION AND TRAININGMAINTENANCE AND REPAIR SIMULATIONOTHER APPLICATIONS

-

9.5 EDUCATIONINTERACTIVE LEARNING MATERIALSVIRTUAL LABORATORIES AND SIMULATIONHISTORICAL RECONSTRUCTIONVIRTUAL FIELD TRIPSOTHER APPLICATIONS

-

9.6 ENERGY AND UTILITIESFACILITY AND INFRASTRUCTURE MANAGEMENTRENEWABLE ENERGY SITE PLANNINGOIL AND GAS EXPLORATIONASSET MAPPING AND MANAGEMENTOTHER APPLICATIONS

-

9.7 AGRICULTURE AND FORESTRYPRECISION FARMING/AGRICULTUREFARM INFRASTRUCTURE PLANNING AND DESIGNCROP HEALTH MONITORINGSOIL ANALYSIS AND MANAGEMENTAUTONOMOUS FARMINGOTHER APPLICATIONS

-

9.8 GOVERNMENT AND DEFENSEURBAN PLANNING AND GISEMERGENCY RESPONSE AND DISASTER MANAGEMENTCULTURAL HERITAGE PRESERVATIONMILITARY SIMULATION AND TRAININGOTHER APPLICATIONS

-

9.9 HEALTHCARE AND LIFE SCIENCESMEDICAL IMAGING AND VISUALIZATIONSURGICAL PLANNING AND SIMULATIONPROSTHETICS AND IMPLANTSANATOMICAL EDUCATION AND TRAININGOTHER APPLICATIONS

-

9.10 OTHER VERTICALSRETAIL AND E-COMMERCETRAVEL AND TOURISMTELECOM

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICA3D MAPPING AND MODELING MARKET DRIVERSRECESSION IMPACT ANALYSISUS- Smart city initiatives and infrastructure development programs to drive growthCANADA- Emphasis on research and development to drive growth

-

10.3 EUROPE3D MAPPING AND MODELING MARKET DRIVERSRECESSION IMPACT ANALYSISUK- Strategic location and robust infrastructure to drive growthGERMANY- Presence of leading technology companies to drive growthFRANCE- Focus on infrastructure development to drive growthITALY- Booming tourism industry to drive growthSPAIN- High demand for advanced geospatial solutions to drive growthREST OF EUROPE

-

10.4 ASIA PACIFIC3D MAPPING AND MODELING MARKET DRIVERSRECESSION IMPACT ANALYSISCHINA- Rapid urbanization to drive growthINDIA- Deployment of 3D mapping and modeling solutions in construction and entertainment industries to drive growthJAPAN- Rising preference for AR and VR experiences to drive growthANZ- Emphasis on environmental sustainability to drive growthSOUTH KOREA- Urban planning and smart city initiatives to drive growthASEAN COUNTRIESREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICA3D MAPPING AND MODELING MARKET DRIVERSRECESSION IMPACT ANALYSISUAE- Adoption of cutting-edge technologies to drive growthSAUDI ARABIA- Rise of digitalization in businesses to drive growthSOUTH AFRICA- Continued investment in 3D mapping solutions to drive growthISRAEL- Technological advancements to drive growthREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICA3D MAPPING AND MODELING MARKET DRIVERSRECESSION IMPACT ANALYSISBRAZIL- Incorporation of AI and automation technologies to drive growthMEXICO- Rapid incorporation of 3D imaging technologies to drive growthARGENTINA- Investments in research and development to drive growthREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING

-

11.7 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.8 START-UP/SME COMPETITIVE BENCHMARKING

-

11.9 3D MAPPING AND MODELING PRODUCT LANDSCAPECOMPARATIVE ANALYSIS OF 3D MAPPING AND MODELING PRODUCTS

- 11.10 VALUATION AND FINANCIAL METRICS OF KEY 3D MAPPING AND MODELING VENDORS

-

11.11 COMPETITIVE SCENARIOPRODUCT LAUNCHES/ENHANCEMENTSDEALS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSAUTODESK- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTRIMBLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBENTLEY SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDASSAULT SYSTEMES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewADOBE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- Recent developmentsHEXAGON- Business overview- Products/Solutions/Services offered- Recent developmentsESRI- Business overview- Products/Solutions/Services offered- Recent developmentsGOLDEN SOFTWARE- Business overview- Products/Solutions/Services offered- Recent developmentsMAXON- Business overview- Products/Solutions/Services offered- Recent developments

-

12.3 OTHER PLAYERSTOPCONCYBERCITY 3DPIX4DAPPLEONIONLABMAPBOXSAABAIRBUSINTERMAP TECHNOLOGIESTHE FOUNDRY VISIONMONGERSPTCMATHWORKSANSYSSIDEFX

-

12.4 START-UPS/SMESCIVIL MAPSHIVEMAPPERSHAPR3DINNERSIGHTASTRIVIS TECHNOLOGIESPOINTIVODYNAMIC MAP PLATFORMARCHILOGICMOD TECH LABS

- 13.1 INTRODUCTION

-

13.2 3D IMAGING MARKET - GLOBAL FORECAST TO 2025MARKET DEFINITIONMARKET OVERVIEW- 3D imaging market, by component- 3D imaging market, by deployment mode- 3D imaging market, by organization size- 3D imaging market, by vertical- 3D imaging market, by region

-

13.3 3D ANIMATION MARKET - GLOBAL FORECAST TO 2022MARKET DEFINITIONMARKET OVERVIEW- 3D animation market, by component- 3D animation market, by technology- 3D animation market, by vertical- 3D animation market, by region

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2019–2021

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 IMPACT OF RECESSION ON 3D MAPPING AND MODELING MARKET

- TABLE 5 3D MAPPING AND MODELING MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y %)

- TABLE 6 3D MAPPING AND MODELING MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 PATENTS FILED, 2013–2023

- TABLE 13 TOP 20 PATENT OWNERS IN 3D MAPPING AND MODELING MARKET, 2013–2023

- TABLE 14 PATENTS IN 3D MAPPING AND MODELING MARKET, 2023

- TABLE 15 ROLE OF COMPANIES IN SUPPLY CHAIN

- TABLE 16 AVERAGE SELLING PRICE ANALYSIS, BY OFFERING

- TABLE 17 BEST PRACTICES IN 3D MAPPING AND MODELING MARKET

- TABLE 18 SHORT-TERM ROADMAP, 2023–2025

- TABLE 19 MID-TERM ROADMAP, 2026–2028

- TABLE 20 LONG-TERM ROADMAP, 2029–2030

- TABLE 21 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 24 3D MAPPING AND MODELING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 25 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 26 SOFTWARE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 27 SOFTWARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 28 SOFTWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 29 SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 3D MAPPING SOFTWARE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 31 3D MAPPING SOFTWARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 32 3D MAPPING SOFTWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 3D MAPPING SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 3D PROJECTION MAPPING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 3D PROJECTION MAPPING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 GIS MAPPING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 37 GIS MAPPING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 DRONE MAPPING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 DRONE MAPPING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 SATELLITE AND AERIAL IMAGING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 41 SATELLITE AND AERIAL IMAGING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 OTHERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 3D MODELING SOFTWARE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 45 3D MODELING SOFTWARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 46 3D MODELING SOFTWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 47 3D MODELING SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 SOLID MODELING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 49 SOLID MODELING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 WIREFRAME MODELING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 WIREFRAME MODELING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 SURFACE MODELING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 53 SURFACE MODELING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 OTHERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 55 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 SERVICES: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 57 SERVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 58 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 61 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 62 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 63 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 TRAINING AND CONSULTING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 65 TRAINING AND CONSULTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 SYSTEM INTEGRATION AND IMPLEMENTATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 67 SYSTEM INTEGRATION AND IMPLEMENTATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 69 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 MANAGED SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 71 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 73 MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 74 ON-PREMISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 75 ON-PREMISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 CLOUD: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 77 CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 79 MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 80 LIDAR: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 81 LIDAR: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 PHOTOGRAMMETRY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 83 PHOTOGRAMMETRY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 STRUCTURED LIGHT SCANNING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 85 STRUCTURED LIGHT SCANNING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 SLAM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 87 SLAM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 OTHER TECHNOLOGIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 89 OTHER TECHNOLOGIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 91 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 92 ARCHITECTURE, ENGINEERING, AND CONSTRUCTION: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 93 ARCHITECTURE, ENGINEERING, AND CONSTRUCTION: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 ARCHITECTURE, ENGINEERING, AND CONSTRUCTION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 95 ARCHITECTURE, ENGINEERING, AND CONSTRUCTION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 MEDIA AND ENTERTAINMENT: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 97 MEDIA AND ENTERTAINMENT: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 99 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 MANUFACTURING: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 101 MANUFACTURING: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 MANUFACTURING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 103 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 104 EDUCATION: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 105 EDUCATION: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 EDUCATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 107 EDUCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 108 ENERGY AND UTILITIES: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 109 ENERGY AND UTILITIES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 ENERGY AND UTILITIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 111 ENERGY AND UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 112 AGRICULTURE AND FORESTRY: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 113 AGRICULTURE AND FORESTRY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 114 AGRICULTURE AND FORESTRY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 115 AGRICULTURE AND FORESTRY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 116 GOVERNMENT AND DEFENSE: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 117 GOVERNMENT AND DEFENSE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 118 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 119 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 120 HEALTHCARE AND LIFE SCIENCES: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 121 HEALTHCARE AND LIFE SCIENCES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 123 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 124 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 125 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 126 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 127 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 128 NORTH AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: MARKET, BY 3D MAPPING SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 133 NORTH AMERICA: MARKET, BY 3D MAPPING SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: MARKET, BY 3D MODELING SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: MARKET, BY 3D MODELING SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 148 EUROPE: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 149 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 150 EUROPE: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 151 EUROPE: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 152 EUROPE: MARKET, BY 3D MAPPING SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 153 EUROPE: MARKET, BY 3D MAPPING SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 154 EUROPE: MARKET, BY 3D MODELING SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 155 EUROPE: MARKET, BY 3D MODELING SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 156 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 157 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 158 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 159 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 160 EUROPE: MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 161 EUROPE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 162 EUROPE: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 163 EUROPE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 164 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 165 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 166 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 167 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 171 ASIA PACIFIC: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: MARKET, BY 3D MAPPING SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 173 ASIA PACIFIC: MARKET, BY 3D MAPPING SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MARKET, BY 3D MODELING SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MARKET, BY 3D MODELING SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 183 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 184 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 185 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 187 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: MARKET, BY 3D MAPPING SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: MARKET, BY 3D MAPPING SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: MARKET, BY 3D MODELING SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY 3D MODELING SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 207 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 208 LATIN AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 209 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 210 LATIN AMERICA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 211 LATIN AMERICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 212 LATIN AMERICA: MARKET, BY 3D MAPPING SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 213 LATIN AMERICA: MARKET, BY 3D MAPPING SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 214 LATIN AMERICA: MARKET, BY 3D MODELING SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 215 LATIN AMERICA: MARKET, BY 3D MODELING SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 216 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 217 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 218 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 219 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 220 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 221 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 223 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 224 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 225 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 227 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 228 STRATEGIES ADOPTED BY KEY PLAYERS IN MARKET

- TABLE 229 MARKET: DEGREE OF COMPETITION

- TABLE 230 PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

- TABLE 231 PRODUCT FOOTPRINT ANALYSIS OF OTHER PLAYERS, 2022

- TABLE 232 MARKET: KEY START-UPS/SMES

- TABLE 233 PRODUCT FOOTPRINT ANALYSIS OF START-UPS/SMES, 2022

- TABLE 234 COMPARATIVE ANALYSIS OF TRENDING 3D MAPPING AND MODELING PRODUCTS

- TABLE 235 COMPARATIVE ANALYSIS OF OTHER 3D MAPPING AND MODELING PRODUCTS

- TABLE 236 PRODUCT LAUNCHES/ENHANCEMENTS, 2021–2023

- TABLE 237 DEALS, 2021–2023

- TABLE 238 AUTODESK: COMPANY OVERVIEW

- TABLE 239 AUTODESK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 AUTODESK: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 241 AUTODESK: DEALS

- TABLE 242 TRIMBLE: COMPANY OVERVIEW

- TABLE 243 TRIMBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 TRIMBLE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 245 TRIMBLE: DEALS

- TABLE 246 BENTLEY SYSTEMS: COMPANY OVERVIEW

- TABLE 247 BENTLEY SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 BENTLEY SYSTEMS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 249 BENTLEY SYSTEMS: DEALS

- TABLE 250 DASSAULT SYSTEMES: COMPANY OVERVIEW

- TABLE 251 DASSAULT SYSTEMES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 DASSAULT SYSTEMES: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 253 DASSAULT SYSTEMES: DEALS

- TABLE 254 ADOBE: COMPANY OVERVIEW

- TABLE 255 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 ADOBE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 257 ADOBE: DEALS

- TABLE 258 GOOGLE: COMPANY OVERVIEW

- TABLE 259 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 GOOGLE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 261 GOOGLE: DEALS

- TABLE 262 HEXAGON AB: COMPANY OVERVIEW

- TABLE 263 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 HEXAGON AB: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 265 HEXAGON AB: DEALS

- TABLE 266 ESRI: COMPANY OVERVIEW

- TABLE 267 ESRI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 ESRI: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 269 ESRI: DEALS

- TABLE 270 GOLDEN SOFTWARE: COMPANY OVERVIEW

- TABLE 271 GOLDEN SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 GOLDEN SOFTWARE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 273 MAXON: COMPANY OVERVIEW

- TABLE 274 MAXON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 MAXON: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 276 MAXON: DEALS

- TABLE 277 MAXON: OTHERS

- TABLE 278 3D IMAGING MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 279 3D IMAGING MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

- TABLE 280 3D IMAGING MARKET, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

- TABLE 281 3D IMAGING MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

- TABLE 282 3D IMAGING MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 283 3D ANIMATION MARKET, BY COMPONENT, 2015–2022 (USD MILLION)

- TABLE 284 3D ANIMATION MARKET, BY TECHNOLOGY, 2015–2022 (USD MILLION)

- TABLE 285 3D ANIMATION MARKET, BY VERTICAL, 2015–2022 (USD MILLION)

- TABLE 286 3D ANIMATION MARKET, BY REGION, 2015–2022 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE GENERATED FROM MARKET SOLUTIONS/SERVICES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE GENERATED FROM ALL 3D MAPPING AND MODELING SOLUTIONS/SERVICES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE GENERATED FROM ALL 3D MAPPING AND MODELING SOLUTIONS/SERVICES

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF 3D MAPPING AND MODELING MARKET THROUGH OVERALL SPENDING

- FIGURE 8 SOFTWARE TO BE LARGEST SEGMENT IN 2023

- FIGURE 9 3D MAPPING SOFTWARE TO HOLD MAXIMUM MARKET SHARE IN 2023

- FIGURE 10 DRONE MAPPING TO SECURE LEADING POSITION IN 3D MAPPING SOFTWARE MARKET IN 2023

- FIGURE 11 WIREFRAME MODELING TO SECURE LEADING POSITION IN 3D MODELING SOFTWARE MARKET IN 2023

- FIGURE 12 PROFESSIONAL SERVICES TO ACQUIRE LARGEST MARKET SHARE IN 2023

- FIGURE 13 SYSTEM INTEGRATION AND IMPLEMENTATION TO LEAD PROFESSIONAL SERVICES MARKET IN 2023

- FIGURE 14 LIDAR TO SURPASS OTHER TECHNOLOGIES IN 2023

- FIGURE 15 ON-PREMISES SEGMENT TO ACQUIRE LARGER MARKET SHARE IN 2023

- FIGURE 16 HEALTHCARE AND LIFE SCIENCES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 18 ADVENT OF MACHINE LEARNING AND ARTIFICIAL INTELLIGENCE TO OFFER REALISTIC AND IMMERSIVE VISUALIZATIONS

- FIGURE 19 3D MAPPING AND MODELING MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH RATE IN 2022

- FIGURE 20 MEDIA AND ENTERTAINMENT TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 21 SOFTWARE AND ARCHITECTURE, ENGINEERING, AND CONSTRUCTION TO BE KEY STAKEHOLDERS IN 2023

- FIGURE 22 NORTH AMERICA TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 23 3D MAPPING AND MODELING MARKET DYNAMICS

- FIGURE 24 3D MAPPING AND MODELING MARKET ECOSYSTEM

- FIGURE 25 TOTAL NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 26 TOP 10 PATENT APPLICANTS, 2013–2023

- FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013–2023

- FIGURE 28 SUPPLY CHAIN ANALYSIS

- FIGURE 29 EVOLUTION OF 3D MAPPING AND MODELING TECHNOLOGIES

- FIGURE 30 3D MAPPING AND MODELING ROADMAP, 2020–2030

- FIGURE 31 REVENUE SHIFT FOR PLAYERS IN 3D MAPPING AND MODELING MARKET

- FIGURE 32 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 35 SOFTWARE SEGMENT TO LEAD MARKET IN 2023

- FIGURE 36 3D MODELING SOFTWARE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 37 SATELLITE AND AERIAL IMAGING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 38 WIREFRAME MODELING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 39 MANAGED SERVICES TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 40 TRAINING AND CONSULTING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 41 CLOUD IS THE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 42 PHOTOGRAMMETRY TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 43 HEALTHCARE AND LIFE SCIENCES TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 BUILDING INFORMATION MODELING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 45 GAMING AND ANIMATION TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 46 FACTORY LAYOUT PLANNING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 47 VIRTUAL LABORATORIES AND SIMULATIONS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 48 RENEWABLE ENERGY SITE PLANNING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 49 FARM INFRASTRUCTURE PLANNING AND DESIGN TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 50 EMERGENCY RESPONSE AND DISASTER MANAGEMENT TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 51 SURGICAL PLANNING AND SIMULATION TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 52 3D MAPPING AND MODELING MARKET, BY REGION, 2023–2028

- FIGURE 53 INDIA TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 54 NORTH AMERICA: 3D MAPPING AND MODELING MARKET SNAPSHOT

- FIGURE 55 ASIA PACIFIC: 3D MAPPING AND MODELING MARKET SNAPSHOT

- FIGURE 56 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 57 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 58 COMPANY EVALUATION MATRIX, 2022

- FIGURE 59 START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 60 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 61 YEAR-T0-DATE (YTD) PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

- FIGURE 62 AUTODESK: COMPANY SNAPSHOT

- FIGURE 63 TRIMBLE: COMPANY SNAPSHOT

- FIGURE 64 BENTLEY SYSTEMS: COMPANY SNAPSHOT

- FIGURE 65 DASSAULT SYSTEMES: COMPANY SNAPSHOT

- FIGURE 66 ADOBE: COMPANY SNAPSHOT

- FIGURE 67 GOOGLE: COMPANY SNAPSHOT

- FIGURE 68 HEXAGON AB: COMPANY SNAPSHOT

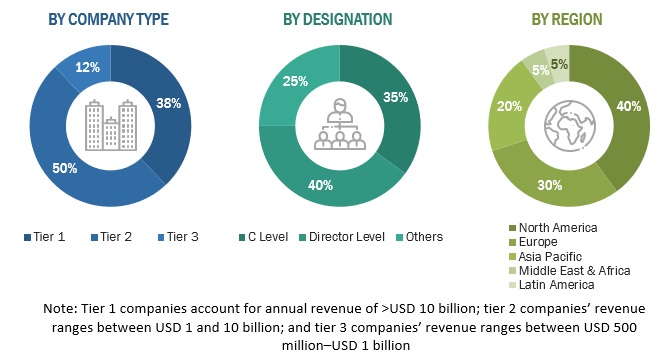

The 3D mapping and modeling market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred 3D mapping and modeling providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors websites. Additionally, 3D mapping and modeling spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, mode of channel, business functions, conversational interfaces, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and 3D mapping and modeling expertise; related key executives from 3D mapping and modeling solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using 3D mapping and modeling solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of 3D mapping and modeling solutions and services, which would impact the overall 3D mapping and modeling market.

The breakup of Primary Research

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Bentley Systems |

Business Development Director |

|

Excel Geomatics |

CEO and Co-Founder |

|

DroneView Technologies |

CEO and Founder |

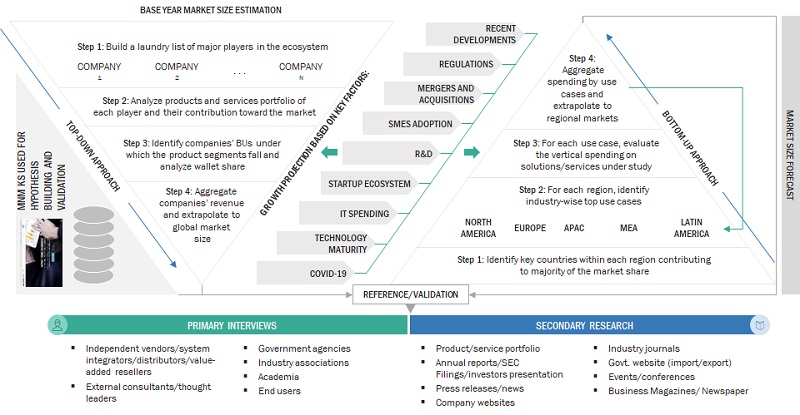

3D Modeling Market Size Estimation

In the bottom-up approach, the adoption rate of 3D mapping and modeling solutions and services among different end users in key countries concerning their regions contributing the most to the market share was identified. For cross-validation, the adoption of 3D mapping and modeling solutions and services among industries and different use cases concerning their regions was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the 3D mapping and modeling market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major 3D mapping and modeling providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall 3D mapping and modeling market size and segments’ size were determined and confirmed using the study.

Global 3D Mapping and Modeling Market Size: Bottom-Up and Top-Down Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation:

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the 3D mapping and modeling market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major 3D mapping and modeling providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall 3D mapping and modeling market size and segments’ size were determined and confirmed using the study.

Market Definition

3D mapping and modeling software can be used to create, maintain, analyze, and share geospatial, engineering, and business information in a powerful MicroStation environment. Moreover, the software analyzes data with tools for buffering, overlays, thematic maps, and 3D clash detection and is used to perform shadow and solar analysis.

Stakeholders

- Distributors and Value-added Resellers (VARs)

- System Integrators (SIs)

- Independent Software Vendors (ISVs)

- Cloud Service Providers (CSPs)

- 3D mapping and modeling solution providers

- Research organizations

- 3D imaging solutions vendors

- Marketing analytics executives

- Predictive analytics providers

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and forecast the 3D mapping and modeling market by offering (software and services), technology, software by deployment mode, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments concerning five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as Mergers and Acquisitions (M&A), new product developments, and Research and Development (R&D) activities, in the market

- To analyze the impact of recession across all the regions across the Embedded AI market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American 3D mapping and modeling market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle Eastern & African market

- Further breakup of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in 3D Mapping and Modeling Market

Unerstanding of the 3d object capture products for non-professional geomaticians.

Detailed understanding of the 3D pojection mapping in perspective of different factors.

Looking for Media and Entertainment 3D Mapping Market Size by Region 2013-2020.

Gather insights into 3D HD maps market and the immediate needs of that market

Gather insights into TurboSquid, 3Docean and similar 3D models.

Need vertical specific insights on 3D Mapping and 3D Modeling Market

Gather insights into 3D Mapping and 3D Modeling Market by Application, by vertical, by Geography

Gather insights into 2D and 3D mapping, surface modeling, 3D volume rendering/modeling, thematic mapping, spatial analysis, well borehole plotting, general plotting and graphing.