Shotcrete/Sprayed Concrete Market by Process (Wet & Dry), Application (Underground Construction, Water Retaining Structures, Protective Coatings, Repair Works), System (Robotic and Manual), and Region - Global Forecasts to 2021

The shotcrete/sprayed concrete market is projected to reach USD 8.30 Billion by 2021, registering a CAGR of 8.0%. In this study, 2015 has been considered as the base year and 2021 as the forecast year for estimating market size of shotcrete/sprayed concrete.

Objectives of the Shotcrete/Sprayed Concrete Market Study

- To analyze and forecast the global shotcrete/sprayed concrete market, in terms of value (USD million) and volume (thousand cubic meter).

- To estimate and forecast the market size on the basis of four regions, namely, Europe, Asia Pacific, North America, and Rest of the World.

- To provide detailed information about the key growth factors (drivers, restraints, opportunities, and challenges) influencing the growth of the shotcrete sprayed concrete market.

- To analyze and forecast the size of the market on the basis of process, system, and application.

- To estimate and forecast the shotcrete/sprayed concrete market at the country-level in each of the regions

- To analyze the market opportunities and competitive landscapes of the stakeholders and market leaders

- To analyze competitive developments such as new product developments, expansions, mergers & acquisitions, and joint ventures & partnerships in the shotcrete sprayed concrete market

- To strategically identify and profile the key market players and analyze their core competencies*

Core competencies* of the companies are determined in terms of their key developments and key strategies to sustain in the market.

This research study involves extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, BusinessWeek, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the shotcrete/sprayed concrete market. The primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to different segments of the industry’s supply chain. The bottom-up approach has been used to estimate the size of the shotcrete sprayed concrete market on the basis of process, system, and application, and region in terms of value. The top-down approach has been implemented to validate the market size in terms of value. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

Major Players in Shotcrete/Sprayed Concrete Market

The shotcrete/sprayed concrete is led by major players such as BASF SE (Germany), Sika AG (Switzerland), HeidelbergCement AG (Germany), Cemex S.A.B. de C.V. (Mexico), KPM Industries Ltd (Canada), Euclid Chemical Company (U.S.), LKAB Berg & Betong AB (Sweden), Quikrete Companies Inc. (U.S.), U.S. Concrete, Inc. (U.S.) and LafargeHolcim (Switzerland).

Target Audience in Shotcrete/Sprayed Concrete Market

Manufacturers of Shotcrete/Sprayed Concrete

- Traders, Distributors, and Suppliers of Shotcrete/Sprayed Concrete End-use market participants of different segments of Shotcrete/SprayedConcrete

- Government and research organizations

- Associations and industrial bodies

- Regional manufacturer associations and general shotcrete associations

- Research and consulting firms

- R&D institutions

- Environment support agencies

- Investment banks and private equity firms

“This study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years for prioritizing efforts, and investments and competitive landscape of the market”

Shotcrete/Sprayed Concrete Market Report Scope

This research report categorizes the shotcrete/sprayed concrete market based on system, process, application, and region, and forecasts revenue growth and analyzes the trends in each of the submarkets.

Shotcrete/Sprayed Concrete Market, By Process:

- Dry Mix

- Wet Mix

Shotcrete Sprayed Concrete Market, By System:

- Robotic System

- Manual System

Shotcrete/Sprayed Concrete Market, By Application:

- Underground Construction

- Protective Coatings

- Water Retaining structures

- Repair works

- Others

Sprayed/Shotcrete Concrete Market, By Region:

-

Europe

- Germany

- Italy

- Norway

- Sweden

- Austria

- Switzerland

- U.K.

- Rest of Europe

-

North America

- U.S.

- Canada

- Mexico

-

Asia-Pacific

- China

- Japan

- Australia

- India

- Rest of Asia Pacific

-

Rest of the world

- U.A.E

- Peru

- Chile

- Qatar

- Columbia

- Brazil

- Others

These segments are further described in detail with their sub segments in the report with value and volume forecasts till 2021.

Shotcrete/Sprayed Concrete Market Report Available Customizations

The following customization options are available for the report:

- Shotcrete/Sprayed Concrete Market Company information

- Analysis and profiling of additional global as well as regional market players (Up to three)

The market size of shotcrete/sprayed concrete is projected to reach USD 8.30 Billion by 2021, at a CAGR of 8.0%. Rapid developments in technology and raw materials, economic and technical efficiency of shotcrete, increase in underground constructions activities such as mining and tunneling are the key drivers for the growing shotcrete demand.

Wet mix and dry mix are the two major processes of shotcrete. These processes are used by many end-use industries to fulfill the growing demand for quality low-cost housing. The wet mix process dominates the global shotcrete market, in terms of value, and is projected to remain the fastest-growing segment by 2021.

Underground construction is the largest application of the shotcrete/sprayed concrete market, followed by water retaining structures, repair works, protective coatings, and others (free formed structures and new constructions). Growth in underground construction is primarily driven by increasing urbanization, fast growing economic development, and underground transportation, mainly in developing countries such as India, the Philippines, Egypt, and Indonesia.

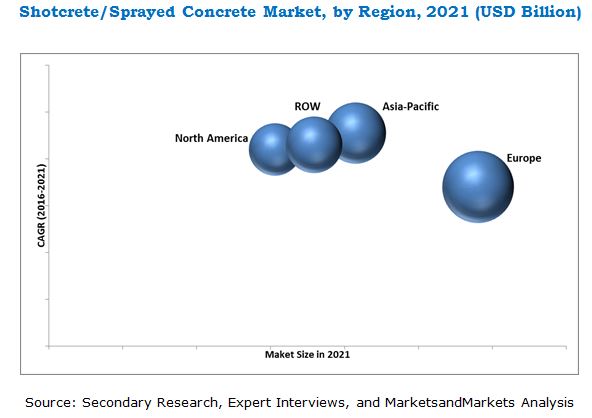

Europe is the largest market for shotcrete, which accounted for the maximum share of the overall market, in terms of value, in 2015. This market share of Europe is attributed to rapid developments in shotcrete technology and raw materials, and increase in tunneling and mining activities. Asia-Pacific is the fastest-growing market, which is projected to register the highest CAGR of 9.1%, in terms of value, during the forecast period, owing to the growth in population, increase in consumer preferences, and changing lifestyle, which result in construction of dams, subways, highways, bridges, tunnels, and other infrastructure, thus driving the shotcrete market.

The shotcrete industry is seeing high research activities to create new equipment and minimize human intervention. One of the major inhibitor is the lack of technical expertise in the industry, which raises health and safety issues.

Key Players in Shotcrete/Sprayed Concrete Market

BASF SE (Germany), U.S. Concrete, Inc. (U.S.), Sika AG (Switzerland), HeidelbergCement AG (Germany), and Cemex S.A.B. de C.V. (Mexico) are some of the key players of the market. The diverse product portfolio, strategically positioned R&D centers, continuous adoption of development strategies, and technological advancements are some of the factors that strengthen the market position of these companies in the shotcrete/sprayed concrete market .They have been adopting various organic and inorganic growth strategies to enhance the current market scenario of the market.

Frequently Asked Questions (FAQ):

What is the Shotcrete/Sprayed Concrete Market growth?

Growth of Shotcrete/Sprayed Concrete Market - Registering a CAGR of 8.0% between 2016 and 2021.

Who leading market players in Shotcrete/Sprayed Concrete industry?

Shotcrete/sprayed concrete has a diversified and established ecosystem of its upstream players such as raw material suppliers, including BASF SE (Germany), Sika AG (Switzerland), HeidelbergCement AG (Germany), Cemex S.A.B. de C.V. (Mexico), KPM Industries Ltd. (Canada), The Euclid Chemical Company (U.S.), LKAB Berg & Betong AB (Sweden), Quikrete Companies Inc. (U.S.), U.S. Concrete, Inc. (U.S.), and LafargeHolcim (Switzerland).

How big is the Shotcrete/Sprayed Concrete Market?

The shotcrete/sprayed concrete market is projected to reach USD 8.30 Billion by 2021.

Which segments are covered in Shotcrete/Sprayed Concrete Market report?

By Process (Wet & Dry), Application (Underground Construction, Water Retaining Structures, Protective Coatings, Repair Works), System (Robotic and Manual) & Region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

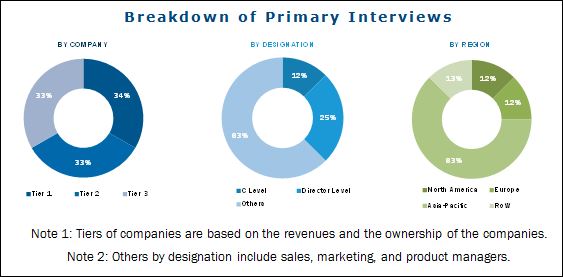

2.1.2.3 Breakdown of Primaries Interviews

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in Shotcrete/Sprayed Concrete Market

4.2 Shotcrete Sprayed Concrete Market Growth, By Process

4.3 Shotcrete/Sprayed Concrete Market Share, By Region and Application

4.4 Shotcrete Sprayed Concrete Market Attractiveness

4.5 Shotcrete/Sprayed Concrete Market, By Region

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Process

5.2.2 By System

5.2.3 By Application

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rapid Developments in Shotcrete Technology and Raw Materials

5.3.1.2 Economic and Technical Efficiency of Shotcrete

5.3.1.3 Sustainability of Shotcrete Materials

5.3.2 Restraints/Challanges

5.3.2.1 Transport of Concrete Mix

5.3.3 Opportunities

5.3.3.1 Presence of Decision-Making Bodies

5.3.3.2 Growing Demand for Low-Cost Housing

5.3.4 Challenges

5.3.4.1 Shortage of Skilled Workforce

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Raw Material Analysis

6.3.1 Cement

6.3.2 Additives

6.3.2.1 Silica Fume

6.3.2.2 Aggregates

6.3.3 Accelerators

6.3.4 Plasticizers

6.3.5 Fibers

6.3.6 Water

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

7 Shotcrete/Sprayed Concrete Market, By Process (Page No. - 55)

7.1 Introduction

7.2 Wet Mix Shotcrete Process

7.3 Dry Mix Shotcrete Process

8 Shotcrete/Sprayed Concrete Market, By Application (Page No. - 61)

8.1 Introduction

8.2 Underground Construction

8.3 Water Retaining Structures

8.4 Repair Works

8.5 Protective Coatings

8.6 Others

9 Shotcrete/Sprayed Concrete Market, By System (Page No. - 74)

9.1 Introduction

9.2 Robotic Spraying System

9.3 Manual System

10 Shotcrete Sprayed Concrete Market, By Region (Page No. - 82)

10.1 Introduction

10.2 Europe

10.2.1 Germany

10.2.2 Italy

10.2.3 Switzerland

10.2.4 Austria

10.2.5 Norway

10.2.6 Sweden

10.2.7 U.K.

10.2.8 Russia

10.2.9 Turkey

10.2.10 Rest of Europe

10.3 Asia-Pacific

10.3.1 China

10.3.2 Japan

10.3.3 Australia

10.3.4 India

10.3.5 Rest of Asia-Pacific

10.4 North America

10.4.1 U.S.

10.4.2 Canada

10.4.3 Mexico

10.5 RoW

10.5.1 UAE

10.5.2 Brazil

10.5.3 Peru

10.5.4 Qatar

10.5.5 Colombia

10.5.6 Chile

10.5.7 Others

11 Competitive Landscape (Page No. - 131)

11.1 Introduction

11.2 Competitive Situation and Trends

11.3 New Product Launch

11.4 Merger & Acquisition

11.5 Agreement & Joint Venture

11.6 Expansion

12 Company Profiles (Page No. - 137)

12.1 BASF SE

12.1.1 Business Overview

12.1.2 Products Offered

12.1.3 Recent Developments

12.1.4 SWOT Analysis

12.1.5 MnM View

12.2 Cemex S.A.B. De C.V.

12.2.1 Business Overview

12.2.2 Products Offered

12.2.3 Recent Developments

12.2.4 SWOT Analysis

12.2.5 MnM View

12.3 Sika AG

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 Recent Developments

12.3.4 SWOT Analysis

12.3.5 MnM View

12.4 Heidelbergcement AG

12.4.1 Business Overview

12.4.2 Product Offered

12.4.3 Recent Developments

12.4.4 MnM View

12.5 Lkab Berg & Betong AB

12.5.1 Products Offered

12.5.2 Recent Developments

12.5.3 MnM View

12.6 GCP Applied Technologies, Inc.

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments

12.6.4 SWOT Analysis

12.6.5 MnM View

12.7 The Euclid Chemical Company

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments

12.8 KPM Industries Ltd.

12.8.1 Business Overview

12.8.2 Products Offered

12.8.3 Recent Developments

12.9 U.S. Concrete, Inc.

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Developments

12.10 Quikrete Companies, Inc.

12.10.1 Business Overview

12.10.2 Products Offered

12.11 Lafargeholcim

12.11.1 Business Overview

12.11.2 Recent Development

13 Appendix (Page No. - 171)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (114 Tables)

Table 1 Shotcrete/Sprayed Concrete Market, By Process

Table 2 Shotcrete Sprayed Concrete Market, By System

Table 3 Shotcrete/Sprayed Concrete Market, By Application

Table 4 Shotcrete Sprayed Concrete Market Size, By Process, 2014–2021 (Thousand Cubic Meter)

Table 5 Shotcrete/Sprayed Concrete Market Size in Wet Mix Shotcrete Process, By Region, 2014–2021 (USD Million)

Table 6 Shotcrete Sprayed Concrete Market Size in Wet Mix Shotcrete Process, By Region, 2014–2021 (Thousand Cubic Meter)

Table 7 Shotcrete/Sprayed Concrete Market Size in Dry Mix Process, By Region, 2014–2021 (USD Million)

Table 8 Shotcrete Sprayed Concrete Market Size in Dry Mix Process, By Region, 2014–2021 (Thousand Cubic Meter)

Table 9 Shotcrete/Sprayed Concrete Applications

Table 10 Shotcrete/Sprayed Concrete Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 11 Shotcrete Sprayed Concrete Market Size in Underground Construction Application, By Region, 2014–2021 (USD Million)

Table 12 Shotcrete/Sprayed Concrete Market Size in Underground Construction Application, By Region, 2014–2021 (Thousand Cubic Meter)

Table 13 Shotcrete Sprayed Concrete Market Size in Water Retaining Structure Application, By Region, 2014–2021 (USD Million)

Table 14 Shotcrete/Sprayed Concrete Market Size in Water Retaining Structure Application, By Region, 2014–2021 (Thousand Cubic Meter)

Table 15 Shotcrete Sprayed Concrete Market Size in Repair Works Application, By Region, 2014–2021 (USD Million)

Table 16 Shotcrete/Sprayed Concrete Market Size in Repair Works Application, By Region, 2014–2021 (Thousand Cubic Meter)

Table 17 Shotcrete Sprayed Concrete Market Size in Protective Coating Application, By Region, 2014–2021 (USD Million)

Table 18 Shotcrete/Sprayed Concrete Market Size in Protective Coating Application, By Region, 2014–2021 (Thousand Cubic Meters)

Table 19 Shotcrete/Sprayed Concrete Market Size in Other Applications, By Region, 2014–2021 (USD Million)

Table 20 Shotcrete Sprayed Concrete Market Size in Other Applications, By Region, 2014–2021 (Thousand Cubic Meter)

Table 21 Shotcrete/Sprayed Concrete Market Size, By System, 2014–2021 (USD Million)

Table 22 Shotcrete Sprayed Concrete Market Size, By System, 2014–2021 (Thousand Cubic Meter)

Table 23 Shotcrete/Sprayed Concrete Market Size in Robotic System, By Region, 2014–2021 (USD Million)

Table 24 Shotcrete Sprayed Concrete Market Size in Robotic System, By Region, 2014–2021 (Thousand Cubic Meter)

Table 25 Shotcrete/Sprayed Concrete Market Size in Manual System, By Region, 2014–2021 (USD Million)

Table 26 Shotcrete Sprayed Concrete Market Size in Manual System, By Region, 2014–2021 (Thousand Cubic Meter)

Table 27 Shotcrete/Sprayed Concrete Market Size, By Region, 2014–2021 (USD Million)

Table 28 Shotcrete Sprayed Concrete Market Size, By Region, 2014–2021 (Thousand Cubic Meter)

Table 29 Europe: Shotcrete/Sprayed Concrete Market Size, By Country, 2014–2021 (USD Million)

Table 30 Europe: Market Size, By Country, 2014–2021 (Thousand Cubic Meter)

Table 31 Europe: Market Size, By Process, 2014–2021 (USD Million)

Table 32 Europe: Market Size, By Process, 2014–2021 (Thousand Cubic Meter)

Table 33 Europe: Market Size, By System, 2014–2021 (USD Million)

Table 34 Europe: Market Size, By System, 2014–2021 (Thousand Cubic Meter)

Table 35 Europe: Market Size, By Application, 2014–2021 (USD Million)

Table 36 Europe: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 37 Germany: Shotcrete/Sprayed Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 38 Germany: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 39 Italy: Shotcrete/Sprayed Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 40 Italy: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 41 Switzerland: Shotcrete/Sprayed Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 42 Switzerland: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 43 Austria: Shotcrete/Sprayed Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 44 Austria: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 45 Norway: Shotcrete/Sprayed Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 46 Norway: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 47 Sweden: Shotcrete/Sprayed Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 48 Sweden: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 49 U.K.: Shotcrete/Sprayed Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 50 U.K.: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 51 Russia: Shotcrete/Sprayed Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 52 Russia: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 53 Turkey Shotcrete/Sprayed Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 54 Turkey: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 55 Rest of the Europe: Shotcrete/Sprayed Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 56 Rest of the Europe: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 57 Asia-Pacific: Shotcrete/Sprayed Concrete Market Size, By Country, 2014–2021 (USD Million)

Table 58 Shotcrete/Sprayed Concrete Market Size, By Country, 2014–2021 (Thousand Cubic Meter)

Table 59 Shotcrete Sprayed Concrete Market Size, By Process, 2014–2021 (USD Million)

Table 60 Sprayed/Shotcrete Concrete Market Size, By Process, 2014–2021 (Thousand Cubic Meter)

Table 61 Asia-Pacific: Sprayed/Shotcrete Concrete Market Size, By System, 2014–2021 (USD Million)

Table 62 Asia-Pacific: Market Size, By System, 2014–2021 (Thousand Cubic Meter)

Table 63 Asia -Pacific: Market Size, By Application, 2014–2021 (USD Million)

Table 64 Asia-Pacific: Sprayed/Shotcrete prayed Concrete Market Size, By Application, 2014–2021(Thousand Cubic Meter)

Table 65 China: Sprayed Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 66 China: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 67 Japan: Sprayed/Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 68 Japan: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 69 Australia: Sprayed Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 70 Australia: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 71 India: Sprayed/Shotcrete Concrete Market Size, By Application, 2014–2021(USD Million)

Table 72 India: Market Size, By Application, 2014–2021(Thousand Cubic Meter)

Table 73 Rest of Asia-Pacific: Sprayed Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 74 Rest of Asia-Pacific: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 75 North America: Sprayed/Shotcrete Concrete Market Size, By Country, 2014–2021 (USD Million)

Table 76 North America: Market Size, By Country, 2014–2021 (Thousand Cubic Meter)

Table 77 North America: Market Size, By Process, 2014–2021 (USD Million)

Table 78 North America: Market Size, By Process, 2014–2021 (Thousand Cubic Meter)

Table 79 North America: Market Size, By System, 2014–2021 (USD Million)

Table 80 North America: Market Size, By System, 2014–2021 (Thousand Cubic Meter)

Table 81 North America: Market Size, By Application, 2014–2021 (USD Million)

Table 82 North America: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 83 U.S.: Sprayed/Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 84 U.S.: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 85 Canada: Sprayed/Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 86 Canada: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 87 Mexico: Sprayed/Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 88 Mexico: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 89 RoW: Sprayed/Shotcrete Concrete Market Size, By Country, 2014–2021 (USD Million)

Table 90 RoW: Market Size, By Country, 2014–2021 (Thousand Cubic Meter)

Table 91 RoW: Market Size, By Process, 2014–2021 (USD Million)

Table 92 RoW: Market Size, By Process, 2014–2021 (Thousand Cubic Meter)

Table 93 RoW: Market Size, By System, 2014–2021 (USD Million)

Table 94 RoW: Market Size, By System, 2014–2021 (Thousand Cubic Meter)

Table 95 RoW: Market Size, By Application, 2014–2021 (USD Million)

Table 96 RoW: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 97 UAE: Sprayed/Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 98 UAE: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 99 Brazil: Sprayed/Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 100 Brazil: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 101 Peru: Sprayed/Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 102 Peru: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 103 Qatar: Sprayed/Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 104 Qatar: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 105 Colombia: Sprayed/Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 106 Colombia: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 107 Chile: Sprayed/Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 108 Chile: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 109 Others: Sprayed/Shotcrete Concrete Market Size, By Application, 2014–2021 (USD Million)

Table 110 Others: Market Size, By Application, 2014–2021 (Thousand Cubic Meter)

Table 111 New Product Launches, 2011–2016

Table 112 Mergers & Acquistions, 2011–2016

Table 113 Agreements & Collaborations, 2011–2016

Table 114 Expansions, 2011–2016

List of Figures (53 Figures)

Figure 1 Sprayed/Shotcrete Concrete Market Segmentation

Figure 2 Sprayed Shotcrete Concrete Market: Research Design

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Data Triangulation Methodology

Figure 6 Europe Dominated Shotcrete/Sprayed Concrete Market in 2015

Figure 7 Underground Constructions to Dominate Shotcrete Sprayed Concrete Market During Forecast Period

Figure 8 Wet Mix Process to Dominate Shotcrete/Sprayed Concrete Market During Forecast Period

Figure 9 Robotics System Dominated Shotcrete Sprayed Concrete Market in 2015

Figure 10 Significant Growth in Shotcrete/Sprayed Concrete Market

Figure 11 Wet Mix Process to Be the Fastest-Growing Segment Between 2016 and 2021

Figure 12 Underground Construction Accounted for the Largest Share in the Shotcrete Sprayed Concrete Market in 2015

Figure 13 Shotcrete/Sprayed Concrete Market to Register High Growth in Emerging Economies Between 2016 and 2021

Figure 14 Asia-Pacific to Emrge as A Lucrative Market Between 2016 and 2021

Figure 15 High Growth Potential in Asia-Pacific for Shotcrete/Sprayed Concrete Market

Figure 16 Drivers, Restraints, Opportunities, and Challenges in Shotcrete Sprayed Concrete Market

Figure 17 Supply Chain Analysis: Shotcrete/Sprayed Concrete Market

Figure 18 Porter’s Five Forces Analysis: Shotcrete Sprayed Concrete Market

Figure 19 Wet Mix Process Dominates Shotcrete/Sprayed Concrete Market

Figure 20 Europe to Be the Largest Market for Wet Mix Process

Figure 21 North America to Be the Fastest-Growing Region for Dry Mix Process (USD Million)

Figure 22 Underground Construction to Account for the Highest Share in Shotcrete Sprayed Concrete Market, 2016–2021

Figure 23 Europe to Be the Largest Market for Shotcrete/Sprayed Concrete in Underground Construction Application

Figure 24 North America: the Largest and Fastest-Growing Market for Shotcrete/Sprayed Concrete in Water Retaining Structure Application, 2016–2021

Figure 25 Europe to Be the Largest Market for Shotcrete/Sprayed Concrete in Repair Works Application

Figure 26 Asia-Pacific: the Fastest-Growing Market for Shotcrete/Sprayed Concrete in Protective Coatings Application, 2016-2021

Figure 27 Robotic System to Drive Shotcrete/Sprayed Concrete Market, By System (USD Million) Between 2016-2021

Figure 28 Asia-Pacific to Emerge as the Fastest-Growing Market for Robotic System, 2016- 2021 (Thousand Cubic Meter)

Figure 29 Asia-Pacific to Account for the Largest Share in Manual System (USD Million)

Figure 30 Regional Snapshot: Emerging Economies are New Market Hot Spots

Figure 31 Asia-Pacific: Emerging Market for Shotcrete/Sprayed Concrete

Figure 32 Europe: the Largest Market for Shotcrete/Sprayed Concrete

Figure 33 Asia-Pacific: Shotcrete Sprayed Concrete Market Snapshot

Figure 34 North America: Shotcrete/Sprayed Concrete Market Snapshot

Figure 35 Mergers & Acquisitions: the Most Prefered Strategy Adopted By Key Companies in Past Four Years

Figure 36 Mergers & Acquisitions: the Key Growth Strategy Adopted By Major Players 2011–2016

Figure 37 BASF SE: Company Snapshot

Figure 38 BASF SE: SWOT Analysis

Figure 39 Cemex S.A.B. De C.V.: Company Snapshot

Figure 40 Cemex S.A.B. De C.V.: SWOT Analysis

Figure 41 Sika AG: Company Snapshot

Figure 42 Sika AG: SWOT Analysis

Figure 43 Heidelbergcement AG: Company Snapshot

Figure 44 Heidelbergcement AG: SWOT Analysis

Figure 45 Lkab Berg & Betong AB: Company Snapshot

Figure 46 Lkab Berg & Betong AB: SWOT Analysis

Figure 47 GCP Applied Technologies, Inc.: Company Snapshot

Figure 48 GCP Applied Technologies Inc.: SWOT Analysis

Figure 49 The Euclid Chemical Company: Company Snapshot

Figure 50 KPM Industries Ltd.: Company Snapshot

Figure 51 U.S. Concrete, Inc.: Company Snapshot

Figure 52 Quikrete Companies, Inc.: Company Snapshot

Figure 53 Lafarargeholcim: Company Snapshot

Growth opportunities and latent adjacency in Shotcrete/Sprayed Concrete Market

Looking for informartion on construction material market

Market segmented on various types, applications, key manufacturers, competitive benchmarking present in the market

Building Construction Industry: Residential, Commercial and Institutional applications.

General inquiry on construction chemicals and its applications

Shotcrete machinery statistics details.

General information on shortcrete market and equipment used

General information on shortcrete market

want to buy Shotcrete/Sprayed Concrete Market report.

Current market size and growth rates for Ultra High-Performance Concrete by region or application.

Market sizing required for Ultra high-performance concrete (UHPC)

Ultra high performance concrete market with regional share and application

Interested in the Sprayed Concrete Shotcrete Market with market breakdown of High-Performance Concrete (HPC) or Ultra High-Performance Concrete (UHPC).

General information on High-Performance Concrete (HPC) and Ultra High-Performance Concrete (UHPC) market

Market dynamics, growth trends, key manufacturers, and raw material analysis, different applications present in the market

Market share analysis for tunneling and concrete spraying.

Interested in Eastern & Central Europe fire resistant concrete/Cement/Plaster