Concrete Fiber Market by Type (Synthetic Fiber, Steel Fiber, Glass Fiber, Natural Fiber, Basalt Fiber), End-Use Industry (Transport Infrastructure, Building & Construction, Mining & Tunnel, Industrial Flooring), and Region - Global Forecast to 2021

To get the latest information, inquire now!

The global concrete fiber market is projected to reach USD 3.09 billion by 2021 at a CAGR of 8.2% from 2016 to 2021. In this study, the years considered to estimate the market size of concrete fiber are:

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2021

2015 has been considered the base year for company profiles. Whenever information was unavailable for the base year, the prior year has been considered.

Market Dynamics

Drivers

- Upward penetration in end-use industries

- Flourishing urbanization trend

- Upsurge in demand for non-corrosive materials

Restraints

- High operating costs

Opportunities

- Utilization of ready-to-mix concrete (RMC) fiber in developing countries

Challenges

- Cost reduction through new production process and economy of scale

- High entry barriers for new players

Upward penetration in end-use industries

The overall concrete fiber market is still small in comparison to the market for other composite materials. However, the market is expected to witness high growth in the next five to ten years. The demand for fiber reinforced concrete is expected to be driven by the existing as well as emerging applications, innovative industrialized practices, and competitive costs against alternate core materials. The low weight of concrete fiber is suitable for producing various components in the transport infrastructure, building & construction, and mining & tunnel end-use industries.

Objectives of the Study

- To forecast the market sizes in terms of values of segments with respect to the five key regions (along with the countries) which are, North America, Europe, Asia-Pacific, Middle East & Africa, and South America

- To strategically analyze the market segments with respect to the type and end-use industry

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and draw the competitive landscape for market leaders

- To track and analyze competitive developments, such as agreements & partnerships, mergers & acquisitions, new product launches, and investments & expansions in the concrete fiber market

- To strategically profile key players and their core competencies in the market

In the secondary research process, various sources have been referred to for the identification and collection of information for this study. These secondary sources include annual reports, press releases, and investor presentations of companies, white papers & certified publications, Factiva, Bloomberg, Businessweek, Fiber Reinforced Concrete Association (FRCA) ingredients certifications, and articles from recognized authors. In the primary research process, sources from both, the supply and demand sides have been interviewed to obtain qualitative and quantitative information. The bottom-up approach has been used to estimate the market size of concrete fiber, in terms of value, on the basis of the type, end-use industry, and region. The top-down approach has been implemented to validate the market size, in terms of value. Through the data triangulation procedure and validation of data via primary interviews, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in the study.

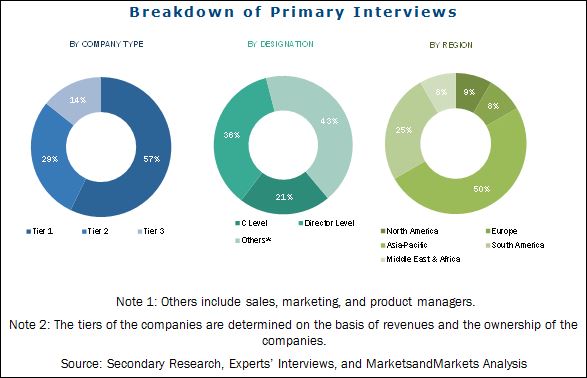

The figure below provides a break-up of the primaries.

To know about the assumptions considered for the study, download the pdf brochure

Concrete fiber follows a chain of independent activities that add greater value to the final product. The value chain covers all stages beginning from the sourcing of raw materials to the delivery of the finished product, which is finally used in various end-use industries. Concrete fibers are used directly or are mixed with concrete. The fiber is transformed into different products, such as fabrics, mesh, yarn, and chopper fiber for different applications. The next node is concrete fiber material type. The leading players who manufacture almost all varieties of concrete fibers type include BASF SE (Germany), Sika AG (Switzerland), and Propex Global (U.S.). The third node of the value chain comprises of concrete fiber manufacturers. The major manufacturers of concrete fibers include- Bekaert SA (Belgium), Owen Corning (U.S.), ABC Polymer Industries (U.S.), Sika AG (Switzerland), and Propex Global (U.S.). These companies entered into agreements and partnerships with other small/medium organizations to expand their business and serve various end-use industries.

“This study answers several questions for stakeholders, primarily which market segments to focus upon during the next two to five years to prioritize their efforts and investments”

Target audience:

- Concrete Fiber Manufacturers

- Concrete Fibers Traders, Distributors, and Suppliers

- Industry Associations

- Raw Material Suppliers

- Government and Research Organizations

Scope of the Report:

The report segments the global market of concrete fiber on the basis of type, end use-industry, and region. It provides a forecast of the market size, in terms of value and volume, and an analysis of trends in each of the submarkets.

On the basis of end use industry:

-

Transport infrastructure

- Roadways

- Highways

- Bridges

- Railways

- Ports & Airports

-

Building & construction

- Residential

- Non-residential

-

Mining & tunnel

- Shafts And Tunnel lining

- Slope Stabilization

- Underground Mining

- Industrial flooring

-

Others

- Agriculture

- Waterways

On the basis of type:

- Synthetic Concrete Fiber

- Steel Concrete Fiber

- Glass Concrete Fiber

- Natural Fiber

- Basalt Fiber

>On the basis of region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

Available Customizations: The following customization options are available for this report:

Company information

- Analysis and profiles of additional global as well as regional market players (Up to three)

Country-level information

- Market analysis for additional countries

- Pricing analysis

- Detailed pricing analysis for each type of concrete fiber product

The global concrete fiber market, in terms of value, is projected to reach USD 3.09 billion by 2021, at a CAGR of 8.2%, from 2016 to 2021. Increasing demand of synthetic concrete fiber across various end-use industries such as transport infrastructure, building & construction, and mining & tunnel is driving the global concrete fiber market.

The steel concrete fiber type segment dominates the concrete fiber market. It has excellent tensile & flexural strength, shock & fatigue resistance, ductility, and high durability. These properties enable it to provide enhanced toughness and post-crack load carrying capacity to the concrete. The leading companies manufacturing steel concrete fiber include Bekaert SA (Belgium), BASF SE (Germany), and Sika AG (Switzerland)

The transport infrastructure is the largest end-use industry segment of the global concrete fiber market. This is due to the increasing demand of concrete fibers in the road industry. In transport industry concrete fibers are used to manufacture roads, highways, bridges, railways, and ports & airports.

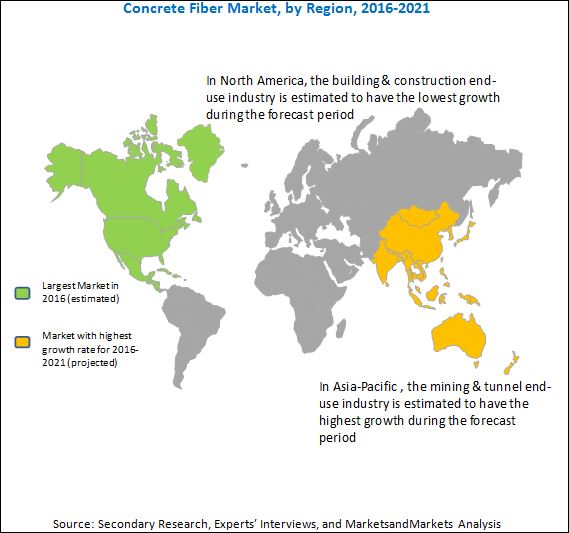

North America is one of the key concrete fiber markets. Globally, it is the largest market respect to demand as well as product innovation in terms of quality and application development. The U.S. is the largest country in North America and one of the key consumers of concrete fiber, accounting for a major share of the North American market. The country’s concrete fiber market is witnessing growth in demand due to the increasing use and expanding. There are many concrete fiber manufacturing companies like ABC Polymer Industries (U.S.), Cemex (Mexico), Nycon Corporation (U.S.), and Owens Corning (U.S.).

The Asia-Pacific is the fastest-growing market, with countries like China, India, Japan, South Korea, and others witnessing an increase in the demand for concrete fiber. Major global manufacturers are focusing on setting up distribution networks and R&D centers in this region. In Asia-Pacific, China is the leading market having accounted for a share of 55.7% of the total market share in 2015. There are many domestic players such are Reliance (India) and Ultratech Cement (India), which market and supply concrete fiber products globally.

Although the concrete fiber market is growing at a significant rate, certain factors could hinder market growth. High operating cost is restricting the growth of the market. Obstruction for new players is a major challenge for the concrete fiber market.

Transport Infrastructure

Transport infrastructure is the largest end-use industry of concrete fiber. Concrete fiber is used in highways, bridges, roadways, conventional concrete paving, barrier rails, curb work, truck or containers terminals in the logistics center, and sound attenuation barriers. Concrete fiber used in this end-use industry has enhanced properties such as high durability, strong impact resistance, and mechanical, chemical, and thermal resistance.

Building & Construction

In the construction industry, concrete fiber is widely used in both residential and non-residential (commercial/institutional) buildings. Majorly, steel fiber, glass fiber, natural fiber, synthetic fiber, basalt fiber, and carbon fiber are used in different application areas of the building & construction industry. Synthetic fiber is primarily used in the construction industry to prevent early age cracking and plastic shrinkage. Steel fiber is used in construction applications where properties of concrete, namely, post crack flexural strength, abrasion resistance, impact resistance, and shatter resistance in the hardened stage have to be modified. In the recent years, basalt fiber reinforced rebars significantly improve the durability of civil engineering structures, especially under corrosion environment. The growth in the construction industry can be attributed to various factors, such as a young and vibrant population with significant change in the lifestyle and a corresponding shortage in affordable housing. These factors are fueling the demand for concrete fiber.

Mining & Tunnel

Mining & tunnel is one of the fastest-growing segments of the concrete fiber market. Concrete fiber is used in tunnel lining and shafts, slope stabilization, and underground mines applications. Reinforcement is added to shotcrete to give some pseudo-ductility as well as post-crack load bearing capacity, especially in high-deformation applications, such as those in the mining industry.

Furthermore, mines are becoming deeper that poses a big challenge to the industry, in terms of ground control due to increased heat and deformation. The increasing use of lightweight and high temperature and impact-resisting components in the mining industry is driving the market for concrete fiber.

Companies such as Bekaert SA (Belgium), Cemex (Mexico), ABC Polymer Industries (U.S.), Sika AG (Switzerland), and Propex Operating Company, LLC (U.S.), contribute about 70% share in the concrete fiber market. They have strengthened their market positions through diverse product portfolios, strategically positioned R&D centers, consistent strategic development activities, and technological advancements. They have been adopting various organic and inorganic growth strategies, such as investments & expansions, mergers & acquisitions, and new product launches & developments to increase their market shares.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Concrete Fiber Market, By Region

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Research

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Research

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Concrete Fiber Market Overview, 2016 vs 2021

4.2 Concrete Fiber Market, By End-Use Industry

4.3 Concrete Fiber Market, By Type

4.4 Concrete Fiber Market Share in Asia-Pacific, By End-Use Industry and Country

4.5 Concrete Fiber Market Attractiveness

4.6 Concrete Fiber Market Share, By End-Use Industry and Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Concrete Fiber Market, By Type

5.2.2 Concrete Fiber Market, By End-Use Industry

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Upward Penetration in End-Use Industries

5.3.1.2 Flourishing Urbanization Trend

5.3.1.3 Upsurge in Demand for Non-Corrosive Materials

5.3.2 Restraints

5.3.2.1 High Operating Costs

5.3.3 Opportunities

5.3.3.1 Utilization of Ready-Mix Concrete (RMC) Fiber in Developing Countries

5.3.4 Challenges

5.3.4.1 Cost Reduction Through New Production Process and Economy of Scale

5.3.4.2 High Entry Barriers for New Players

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Raw Materials

6.2.2 Concrete Fibers Types

6.2.3 Concrete Fiber Manufacturers/Formulators

6.2.4 Concrete Fiber Suppliers/Distributors

6.2.5 End-Use Industries

6.3 Porter’s Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Bargaining Power of Buyers

6.3.3 Threat of Substitutes

6.3.4 Threat of New Entrants

6.3.5 Intensity of Competitive Rivalry

7 Macro Economic Overview and Key Trends (Page No. - 46)

7.1 Introduction

7.2 Trends and Forecast of GDP

7.3 Trends and Forecast of Construction Industry

7.3.1 Trends and Forecast of Construction Industry in North America

7.3.2 Trends and Forecast of Construction Industry in Europe

7.3.3 Trends and Forecast of Construction Industry in Asia-Pacific

7.3.4 Trends and Forecast of Construction Industry in ME&A

7.3.5 Trends and Forecast of Construction Industry in South America

8 Concrete Fiber Market, By Type (Page No. - 50)

8.1 Introduction

8.2 Synthetic Concrete Fiber

8.2.1 Micro-Synthetic Fiber

8.2.1.1 Polypropylene (PP) Fiber

8.2.1.2 Polyethylene (PE) Fiber

8.2.1.3 Polyester Fiber

8.2.1.4 Nylon

8.2.1.5 Others

8.2.2 Macro-Synthetic Fiber

8.2.2.1 Polymer Blends

8.3 Steel Concrete Fiber

8.4 Glass Concrete Fiber

8.5 Natural Concrete Fiber

8.6 Basalt Fiber Reinforced Concrete

9 Concrete Fiber Market, By End-Use Industry (Page No. - 55)

9.1 Introduction

9.2 Transport Infrastructure

9.2.1 Roadways

9.2.2 Highways

9.2.3 Bridges

9.2.4 Railways

9.2.5 Ports & Airports

9.3 Building & Construction

9.3.1 Residential

9.3.2 Non-Residential

9.4 Mining & Tunnel

9.4.1 Shafts and Tunnel Lining

9.4.2 Slope Stabilization

9.4.3 Underground Mining

9.5 Industrial Flooring

9.6 Others

9.6.1 Agriculture

9.6.2 Waterways

10 Concrete Fiber Market, By Region (Page No. - 60)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Italy

10.3.5 Netherlands

10.3.6 Russia

10.3.7 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Australia

10.4.6 Thailand

10.4.7 Rest of Asia-Pacific

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 Egypt

10.5.3 South Africa

10.5.4 Nigeria

10.5.5 Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Chile

10.6.4 Rest of South America

11 Competitive Landscape (Page No. - 102)

11.1 Overview

11.2 Market Share Analysis

11.2.1 Bekaert SA (Belgium)

11.2.2 Propex Operating Company, LLC (U.S.)

11.2.3 Sika AG (Switzerland)

11.2.4 ABC Polymer Industries (U.S.)

11.2.5 Cemex (Mexico)

11.3 Competitive Situation and Trends

11.3.1 Investments & Expansions

11.3.2 New Product Launches

11.3.3 Mergers & Acquisitions

11.3.4 Agreements & Partnerships

12 Company Profiles (Page No. - 107)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Bekaert SA

12.2 Propex Operating Company, LLC

12.3 Sika AG

12.4 ABC Polymer Industries

12.5 Cemex S.A.B. De C.V.

12.6 Fibercon International Inc.

12.7 BASF SE

12.8 Nycon Corporation

12.9 The Euclid Chemical Company

12.10 Owens Corning

12.11 Other Players

12.11.1 GCP Applied Technologies

12.11.2 Ultratech Cement

12.11.3 Reliance

12.11.4 Forta Corporation

12.11.5 Helix Steel

12.11.6 Elasto Plastics

*Details Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 127)

13.1 Knowledge Store: Marketsandmarkets Subscription Portal

13.2 Introducing RT: Real-Time Market Intelligence

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (88 Tables)

Table 1 Trends and Forecast of GDP, USD Billion (2015–2021)

Table 2 Contribution of Construction Industry to GDP in North America, USD Billion (2014–2021)

Table 3 Contribution of Construction Industry to GDP in Europe, USD Billion (2014–2021)

Table 4 Contribution of Construction Industry to GDP in Asia-Pacific, USD Billion (2014–2021)

Table 5 Contribution of Construction Industry to GDP in ME&A, USD Billion (2014–2021)

Table 6 Contribution of Construction Industry to GDP in Latin America, USD Billion (2014–2021)

Table 7 Concrete Fiber Market Size, By Type, 2014–2021 (USD Million)

Table 8 Market Size, By Type, 2014–2021 (Kiloton)

Table 9 Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 10 Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 11 Concrete Fiber Market Size, By Region, 2014–2021 (USD Million)

Table 12 Market Size, By Region, 2014–2021 (Kiloton)

Table 13 North America: Concrete Fiber Market Size, By Country, 2014–2021 (USD Million)

Table 14 North America: Market Size, By Country, 2014–2021 (Kiloton)

Table 15 North America: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 16 North America: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 17 U.S.: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 18 U.S.: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 19 Canada: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 20 Canada: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 21 Mexico: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 22 Mexico: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 23 Europe: Concrete Fiber Market Size, By Country, 2014–2021 (USD Million)

Table 24 Europe: Market Size, By Country, 2014–2021 (Kiloton)

Table 25 Europe: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 26 Europe: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 27 Germany: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 28 Germany: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 29 France: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 30 France: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 31 U.K.: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 32 U.K.: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 33 Italy: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 34 Italy: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 35 Netherlands: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 36 Netherlands: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 37 Russia: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 38 Russia: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 39 Rest of Europe: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 40 Rest of Europe: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 41 Asia-Pacific: Concrete Fiber Market Size, By Country, 2014–2021 (USD Million)

Table 42 Asia-Pacific: Market Size, By Country, 2014–2021 (Kiloton)

Table 43 Asia-Pacific: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 44 Asia-Pacific: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 45 China: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 46 China: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 47 Japan: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 48 Japan: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 49 India: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 50 India: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 51 South Korea: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 52 South Korea: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 53 Australia: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 54 Australia: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 55 Thailand: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 56 Thailand: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 57 Rest of Asia-Pacific: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 58 Rest of Asia-Pacific: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 59 Middle East & Africa: Concrete Fiber Market Size, By Country, 2014–2021 (USD Million)

Table 60 Middle East & Africa: Market Size, By Country, 2014–2021 (Kiloton)

Table 61 Middle East & Africa: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 62 Middle East & Africa: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 63 Saudi Arabia: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 64 Saudi Arabia: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 65 Egypt: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 66 Egypt: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 67 South Africa: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 68 South Africa: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 69 Nigeria: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 70 Nigeria: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 71 Rest of Middle East & Africa: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 72 Rest of Middle East & Africa: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 73 South America: Concrete Fiber Market Size, By Country, 2014–2021 (USD Million)

Table 74 South America: Market Size, By Country, 2014–2021 (Kiloton)

Table 75 South America: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 76 South America: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 77 Brazil: Concrete Fiber Market Size, By End Use Industry, 2014–2021 (USD Million)

Table 78 Brazil: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 79 Argentina: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 80 Argentina: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 81 Chile: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 82 Chile: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 83 Rest of South America: Concrete Fiber Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 84 Rest of South America: Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 85 Investments & Expansions, 2011–2016

Table 86 New Product Launches, 2011–2016

Table 87 Mergers & Acquisitions, 2011–2016

Table 88 Agreements & Partnerships, 2011–2016

List of Figures (36 Figures)

Figure 1 Concrete Fiber: Market Segmentation

Figure 2 Concrete Fiber: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Concrete Fiber Market: Data Triangulation

Figure 6 Synthetic Fiber Accounted for the Largest Share of the Concrete Fiber Market

Figure 7 Mining & Tunnel Segment to Register the Highest CAGR During the Forecast Period

Figure 8 Concrete Fiber Market Share, By Region

Figure 9 Concrete Fiber Market to Witness Rapid Growth Between 2016 and 2021

Figure 10 Mining & Tunnel Segment to Register the Highest CAGR During the Forecast Period

Figure 11 Synthetic Fiber to Dominate the Market During the Forecast Period

Figure 12 China Accounted for the Largest Market Share in 2015

Figure 13 Asia-Pacific to Be the Fastest-Growing Market Between 2016 and 2021

Figure 14 Transport Infrastructure Segment Accounted for the Largest Market Share in 2015

Figure 15 Impact Analysis of Short-, Medium-, and Long-Term Drivers and Restraints

Figure 16 Upward Penetration in End-Use Industries is Driving the Concrete Fiber Market

Figure 17 Overview of Concrete Fiber Value Chain

Figure 18 Porter’s Five Force Analysis

Figure 19 Transport Infrastructure to Dominate the Concrete Fiber Market

Figure 20 Regional Snapshot: North America to Lead the Concrete Fiber Market, 2016–2021

Figure 21 North America Market Snapshot: U.S. Accounted for the Largest Share of the Market

Figure 22 Germany to Dominate the Market in Europe

Figure 23 Asia-Pacific Market Snapshot: China and India are the Major Markets

Figure 24 Saudi Arabia Accounted for the Largest Share of the Market in 2015

Figure 25 Brazil Dominates theMarket in South America

Figure 26 New Product Launches Was the Key Growth Strategy Adopted By Leading Companies, 2011–2016

Figure 27 Bekaert SA Accounted for the Largest Share of the Concrete Fiber Market

Figure 28 Developmental Market Share: Investments & Expansions is the Key Strategy

Figure 29 Bekaert SA: Company Snapshot

Figure 30 Bekaert SA: SWOT Analysis

Figure 31 Sika AG: Company Snapshot

Figure 32 Sika AG: SWOT Analysis

Figure 33 Cemex S.A.B. De C.V.: Company Snapshot

Figure 34 Cemex: SWOT Analysis

Figure 35 BASF SE: Company Snapshot

Figure 36 Owens Corning: Company Snapshot

Growth opportunities and latent adjacency in Concrete Fiber Market

Data on market size and share by region of Macro Synthetic Fibres, Micro Synthetic Fibres.

specific information on macro synthetic fibres and micro synthetic fibres and the size of the market in the different regions

To conduct market research on hemp

Need information on polypropylene macro synthetic fibers for concrete reinforcement and steel fibers.

synthetic macro fiber market