Agricultural Fumigants Market by Product Type (Methyl Bromide, Phosphine, Chloropicrin), Crop Type (Cereals, Oilseeds, Fruits), Application (Soil, Warehouse), Pest Control Method (Tarpaulin, Non-Tarp, Vacuum), and Region - Global Forecast to 2026

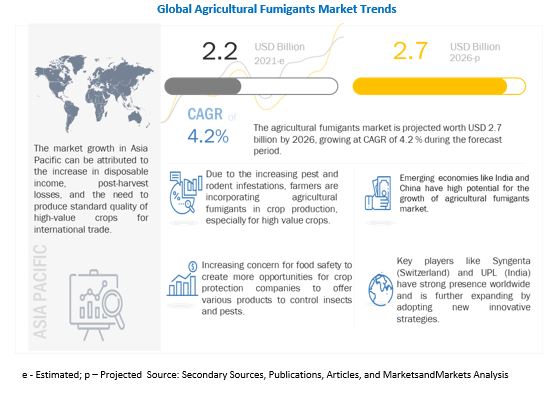

The global agricultural fumigants market was valued from $2.2 billion in 2021 to reach $2.7 billion by 2026, at a CAGR of 4.2%. The rise in the popularity of agricultural fumigants can be attributed to the increasing infestation of pests & insects in warehouses and other crop storage rooms due to biotic and abiotic factors, awareness about crop protection chemicals, and urbanization in developing markets. Markets such as China and India are among the key markets targeted by agricultural fumigants service providers due to occurrence of the post-harvest losses every year, causing loss to the farmers and other stakeholders involved. These factors are leading to the adoption of agricultural fumigants services in the region.

To know about the assumptions considered for the study, Request for Free Sample Report

Several drivers such as growing usage of fumigants for the production and storage of cereals, increase in focus on the reduction of post-harvest losses, advancements in storage technology and change in farming practices, and shift in focus on increasing agricultural production will drive the agricultural fumigants market.

The demand for food is estimated to rise in Eastern Europe, South America, and Asia. The rise in population and the subsequent increase in demand for food drives the need for increasing agricultural productivity. Increase in agricultural production can be obtained by controlling agricultural losses and with the adoption of technologies, such as fumigation. Agricultural fumigants help improve crop quality by preventing crop losses due to pest attacks. Hence, the global focus on increasing the quantity and quality of agricultural output is expected to increase the demand for agricultural fumigants.

Agricultural Fumigants Market Growth Dynamics

Drivers: Increase in focus on the reduction of post-harvest losses

Reduction of post-harvest food losses is a critical component for ensuring food security. Post-harvest losses arise from freshly harvested agricultural produce undergoing changes during handling. Post-harvest losses can be avoided by undertaking fumigation for pest prevention. For example, the decay of citrus post-harvest is controlled by ammonia gas fumigation. Post-harvest green mold and blue mold, caused by Penicillium digitatum and Penicillium italicum, respectively, are effectively controlled by ammonia gas fumigation of lemons and oranges. Thus, fumigation technology helps in preventing post-harvest losses to maintain the quality of agricultural commodities. In addition, fumigation helps in the thorough cleaning of storage areas, silos, or warehouses. This is employed as a further preventative method in pre-harvest cleaning for the storage of grains.

Restraints: Accumulation of residue during fumigation

The amount of residue that remains in the materials treated with fumigants is determined by the conditions existing during fumigation and by the treatment of the material thereon. In some cases, residue levels may be held to a minimum if various factors that lead to residue accumulation are considered before the treatment. Fumigants with high boiling points remain present as residues for a longer time than the more volatile compounds. For example, acrylonitrile was found to remain in wheat for several days, whereas methyl bromide dissipates in a few hours. Fumigants that react with plant or animal constituents may also leave a considerable residue.

Opportunities: New product launches as alternatives for methyl bromide fumigation

Increasing tolerance of pests toward methyl bromide fumigation, followed by its phasing out, has resulted in the adoption of suitable alternatives for methyl bromide for the management of stored products and to quarantine pests. The alternatives for methyl bromide fumigant include phosphine, sulfuryl fluoride, carbonyl sulfide, ethyl formate, hydrogen cyanide, carbon disulfide, methyl iodide, and methyl isothiocyanate. Hence, manufacturers are focusing on new product developments by investing in R&D activities for active ingredients that can inhibit resistant insects by using these alternative fumigants.

Challenges: Increasing labor costs and other expenses

Soil fumigation with volatile chemical content is regulated by various governing bodies. It is necessary to find the appropriate fumigant for the varied application base. Further, high labor costs are involved in applying these fumigants with handheld or manual injectors. The main costs associated with fumigation are the costs required for equipment and labor. Only pest control experts that are certified fumigators are permitted to provide fumigation treatment. Fumigation is a highly technical procedure that requires skilled operators using special materials and gas measurement devices.

Market Ecosystem

Agricultural Fumigants Market Segmentation

By application, the structural fumigation segment is the fastest growing segment in the market during the forecast period

Structural fumigation is an effective solution as it seals the entire area to ensure the proper action of fumigants. It is usually used to control pests in soil, grains, and also during the processing of goods to be imported or exported to eliminate the transfer of any exotic organisms. Although it is expensive, it is gaining popularity due to its efficiency in function.

By application, the warehouse segment is the fastest growing segment in the market during the forecast period

Warehouses are important as the agricultural produce can be stored there as long as the farmers is not willing to sell his produce. In warehouses, the efficient use of fumigants results in maintaining crop quality and productivity, which leads to market competitiveness. Various methods of pest control are deployed to kill, repel, or suppress insects, nematodes, and other pests that damage infrastructure, stored food in warehouses. The agricultural fumigants market is gaining traction due to the severe pest infestation caused in warehouses.

Agricultural Fumigants Market Trends

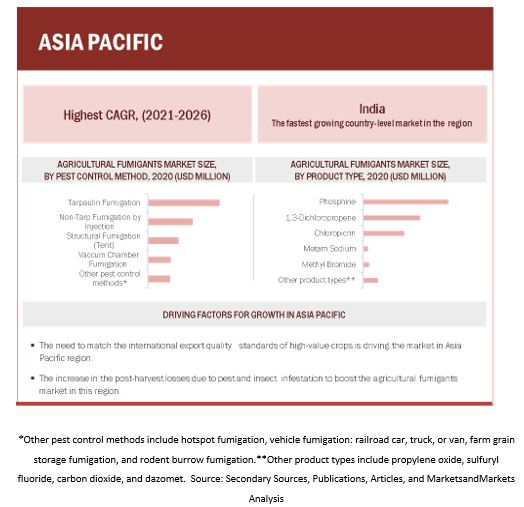

Asia Pacific is projected to account for the largest market size during the forecast period

The Asia Pacific agricultural fumigants market is projected to be the largest between 2021 and 2026, while the Asia Pacific market is projected to grow at the highest CAGR. Asia Pacific was the largest consumer of agricultural fumigants in 2020, mainly because of the conducive climatic conditions, there is high outbreak of pest and insects witnessed in warehouses and other storage places. In order to prevent post-harvest losses, farmers opt for agricultural fumigants to obtain profits.

Key Market Players

The key service providers in this market include BASF SE (Germany), Syngenta (Switzerland), ADAMA (Israel), ARKEMA (Germany), Nufarm (Australia), Solvay (Belgium), Tessenderlo Kerley, Inc. (Belgium), SGS SA (Switzerland), UPL (India), AMVAC (US), Trinity Manufacturing, Inc. (Germany), Douglas products (US), Intertek (UK), Nippon Chemical Industrial Co., LTD. (Japan), and MustGrow Biologics, Inc (Canada). These players are undertaking strategies such as collaborations and divestments to improve their market positions and extend their competitive advantage.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2021 |

USD 2.2 billion |

|

Market size value in 2026 |

USD 2.7 billion |

|

Market growth rate |

CAGR of 4.2% |

|

Market size estimation |

2015–2026 |

|

Base year considered |

2020 |

|

Forecast period considered |

2021–2026 |

|

Units considered |

Value (USD) & Volume (Tons) |

|

Segments covered |

Product Type, Pest Control Method, Application, Crop Type, Application, Form, Function and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies studied |

BASF SE (Germany), Syngenta (Switzerland), ADAMA (Israel), ARKEMA (Germany), Nufarm (Australia), Solvay (Belgium), Tessenderlo Kerley, Inc. (Belgium), SGS SA (Switzerland), UPL (India), AMVAC (US), Trinity Manufacturing, Inc. (Germany), Douglas products (US), Intertek (UK), Nippon Chemical Industrial Co., LTD. (Japan), DEGESCH America, Inc. (US), MustGrow Biologics, Inc (Canada), Royal Agro (India), Imtrade CropScience (Australia), The Draslovka Group (Australia), Douglas Products (US), and Ecotec Fumigation (Argentina). |

This research report categorizes the agricultural fumigants market, based on product type, pest control method, crop type, application, form, function, and region

Target Audience

- Agricultural fumigants producers and suppliers

- Agricultural fumigants distributors, importers, and exporters

- Research institutions

- Government bodies

- Distributors

- End users (Farmers, farming organizations, and contract farmers)

Market by Product Type

- Methyl bromide

- Phosphine

- Chloropicrin

- Metam sodium

- 1,3-Dichloropropene

- Other product types ( propylene oxide, sulfuryl fluoride, carbon dioxide, and dazomet)

Market by Crop Type

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

- Other crop types (alfalfa, turf grasses, flower seeds, clovers, and other forage & ornamental plant seeds)

Market by Pest control Method

- Vacuum chamber fumigation

- Tarpaulin

- Structural

- Non-tarp fumigation by injection

- Other pest control methods (hotspot fumigation, vehicle fumigation: railroad car, truck, or van, farm grain storage fumigation, and rodent burrow fumigation)

Market by Application:

-

Soil

- Field

- Nursery

- Greenhouse

- Transplant bed

-

Warehouse

- Silo

- Stack

Market by Form:

- Solid

- Liquid

- Gaseous

Market by Function:

- Insecticides

- Fungicides

- Nematicides

- Herbicides

Market by Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In January 2021, UPL formed a strategic alliance with TeleSense to introduce monitoring solutions for post-harvest commodity transport and storage. This will facilitate progress toward food wastage by detecting and mitigating potential issues such as hotspots, excess moisture, and pests. This will complement the company’s robust range of gas monitoring, safety, and detection devices as well as fumigants.

- In November 2020, MustGrow secured an exclusive patent licensing from the University of Idaho for the fumigation of stored vegetables and grains.

- In December 2019, SGS SA disposed of its pest management and fumigation operations in Belgium and the Netherlands to Anticimex for a total purchase price of CHF 68 million, generating a gain on the disposal of CHF 63 million.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the agricultural fumigants market?

Asia Pacific accounted for the largest share of the agricultural fumigants market in 2020, owing to the rapid growth of the grain protection market which boosts the demand for insects & pests control products, and also rodents.

How big is the global agricultural fumigants market?

The global agricultural fumigants market is projected to grow from USD 2.2 billion in 2021 to USD 2.7 billion by 2026, at a CAGR of 4.2%. during the forecast period, in terms of value.

How would COVID-19 impact the fluctuations in active ingredient raw material prices of chemical agricultural fumigants products?

Based on inputs from industry experts, the prices of different types of agricultural fumigants products such as rodenticides, insecticides, etc. were considered to be lower than their regular ranges due to the COVID-19 impact on the agricultural fumigants market.

Which are the key players in the market, and how intense is the competition?

The key market players include BASF SE (Germany), Syngenta (Switzerland), ADAMA (Israel), UPL (India), Arkema (France), Degesch America (US), Nufarm (Australia), AMVAC (US), Nippon Chemical Industrial CO., LTD (Japan), and R Tessenderlo Kerley, Inc. (Belgium). These companies cater to the requirements of the different end-user industries. Moreover, these companies have effective global manufacturing operations and supply chain strategies.

What is the COVID-19 impact on the agricultural fumigants market?

COVID-19 has created high awareness among consumers regarding food safety. On the other hand, due to frequent lockdowns, there has been disruption of supply chain due to which farmers are forced to store their food grains. The stored grains can be sustained only if they are treated with fumigants. These factors are boosting the growth of agricultural fumigants market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 AGRICULTURAL FUMIGANTS MARKET SEGMENTATION

1.4 INCLUSIONS AND EXCLUSIONS

FIGURE 2 AGRICULTURAL FUMIGANTS: GEOGRAPHIC SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2020

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 3 AGRICULTURAL FUMIGANTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

2.5 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.5.1 SCENARIO-BASED MODELLING

2.6 COVID-19 HEALTH ASSESSMENT

FIGURE 7 COVID-19: GLOBAL PROPAGATION

FIGURE 8 COVID-19 PROPAGATION: SELECT COUNTRIES

2.7 COVID-19 ECONOMIC ASSESSMENT

FIGURE 9 REVISED GROSS DOMESTIC PRODUCT (GDP) FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.7.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 10 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 11 SCENARIOS IN TERMS OF GLOBAL ECONOMY RECOVERY

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 2 AGRICULTURAL FUMIGANTS MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 12 IMPACT OF COVID-19 ON THE AGRICULTURAL FUMIGANTS MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD BILLION)

FIGURE 13 AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 14 MARKET SIZE, BY CROP TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 15 MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 16 MARKET SIZE, BY PEST CONTROL METHOD, 2021 VS. 2026 (USD MILLION)

FIGURE 17 MARKET SHARE (VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 BRIEF OVERVIEW OF THE GLOBAL MARKET

FIGURE 18 GROWING DEMAND FOR FOOD SAFETY DRIVES THE MARKET FOR AGRICULTURAL FUMIGANTS

4.2 NORTH AMERICA: AGRICULTURAL FUMIGANTS MARKET, BY CROP TYPE AND COUNTRY

FIGURE 19 FRUITS & VEGETABLES WAS THE LARGEST SEGMENT IN THE NORTH AMERICAN AGRICULTURAL FUMIGANTS MARKET

4.3 AGRICULTURAL FUMIGANTS MARKET, BY PRODUCT TYPE

FIGURE 20 PHOSPHINE SEGMENT DOMINATED THE AGRICULTURAL FUMIGANTS MARKET ACROSS ALL REGIONS IN 2020

4.4 AGRICULTURAL FUMIGANTS MARKET, BY PEST CONTROL METHOD

FIGURE 21 TARPAULIN FUMIGATION IS PROJECTED TO DOMINATE THE AGRICULTURAL FUMIGANTS MARKET, 2021 VS. 2026

4.5 AGRICULTURAL FUMIGANTS MARKET, BY APPLICATION

FIGURE 22 SOIL SEGMENT IS PROJECTED TO DOMINATE THE AGRICULTURAL FUMIGANTS MARKET, 2021 VS. 2026

4.6 AGRICULTURAL FUMIGANTS MARKET, BY REGION

FIGURE 23 CHINA ACCOUNTED FOR THE LARGEST SHARE OF THE GLOBAL AGRICULTURAL FUMIGANTS MARKET

4.7 COVID-19 IMPACT ON THE AGRICULTURAL FUMIGANTS MARKET

FIGURE 24 PRE- & POST-COVID SCENARIOS IN THE AGRICULTURAL FUMIGANTS MARKET

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 AGRICULTURAL FUMIGANTS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing usage of fumigants for the production and storage of cereals

TABLE 3 GLOBAL CEREAL PRODUCTION, 2010—2019 (KILO TONS)

5.2.1.2 Increase in focus on the reduction of post-harvest losses

FIGURE 26 PERCENTAGE OF GLOBAL FOOD LOSS FROM POST-HARVEST TO DISTRIBUTION, BY COMMODITY GROUP (2016)

5.2.1.3 Advancements in storage technology and change in farming practices

5.2.1.4 Improved fumigant efficiency in terms of application

5.2.1.5 Shift in focus on increasing agricultural production

FIGURE 27 GLOBAL AGRICULTURAL PRODUCTION, BY CROP TYPE, 2010 VS. 2019 (KT)

5.2.1.6 Increase in insect population due to climate change

FIGURE 28 PERCENTAGE OF PRODUCTION LOSSES OF CROPS DUE TO INSECT DAMAGE IN MAJOR COUNTRIES

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulations

5.2.2.2 Accumulation of residue during fumigation

5.2.2.3 Increasing tolerance and proposed ban for methyl bromide

TABLE 4 TECHNOLOGIES SELECTED BY UNIDO FOR METHYL BROMIDE PHASE-OUT PROJECTS IN MAJOR COUNTRIES

5.2.2.4 Volatile nature and potential hazards of application methods of fumigants

5.2.3 OPPORTUNITIES

5.2.3.1 Developing countries are expected to witness strong demand for fumigants

5.2.3.2 New product launches as alternatives for methyl bromide fumigation

5.2.4 CHALLENGES

5.2.4.1 Licenses or special permits required to handle fumigation services

5.2.4.2 Increasing labor costs and other expenses

TABLE 5 LABOR RATE (USD/HOUR) USED IN CALCULATING THE COST OF FUMIGATING 1 MILLION FT3 FOOD PROCESSING FACILITY IN 2016

6 INDUSTRY TRENDS (Page No. - 67)

6.1 INTRODUCTION

6.2 VALUE CHAIN

FIGURE 29 R&D AND MANUFACTURING CONTRIBUTE MAJOR VALUE TO THE OVERALL PRICE OF AGRICULTURAL FUMIGANTS

6.3 TECHNOLOGY ANALYSIS

6.3.1 FOGGING MACHINES

6.3.2 FUMIGATION GAS MONITORS

6.4 PRICING ANALYSIS: AGRICULTURAL FUMIGANTS MARKET

FIGURE 30 AGRICULTURAL FUMIGANTS MARKET: GLOBAL AVERAGE SELLING PRICE (ASP), BY REGION, 2017-2020 (USD/TON)

FIGURE 31 AGRICULTURAL FUMIGANTS MARKET: GLOBAL AVERAGE SELLING PRICE (ASP), BY KEY PRODUCT TYPE, 2017-2020 (USD/TON)

6.5 MARKET MAP AND ECOSYSTEM OF AGRICULTURAL FUMIGANTS

6.5.1 DEMAND SIDE

6.5.2 SUPPLY SIDE

FIGURE 32 CROP PROTECTION AND PEST CONTROL: ECOSYSTEM VIEW

FIGURE 33 AGRICULTURAL FUMIGANTS: MARKET MAP

TABLE 6 AGRICULTURAL FUMIGANTS MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.6 REGULATORY FRAMEWORK

6.6.1 NORTH AMERICA

6.6.1.1 US

6.6.1.2 Canada

6.6.1.3 Data requirements for plant protection products

6.6.2 ASIA PACIFIC

6.6.2.1 China

6.6.2.2 Australia

6.6.2.3 India

6.6.3 ROW

6.6.3.1 Brazil

6.6.3.2 South Africa

6.7 YC-YCC SHIFT

FIGURE 34 REVENUE SHIFT FOR THE AGRICULTURAL FUMIGANTS MARKET

6.8 PATENT ANALYSIS

FIGURE 35 NUMBER OF PATENTS GRANTED BETWEEN 2011 AND 2020

FIGURE 36 TOP 10 APPLICANTS WITH THE HIGHEST NO. OF PATENT DOCUMENTS

FIGURE 37 TOP 10 INVESTORS WITH THE HIGHEST NO. OF PATENT DOCUMENTS

TABLE 7 SOME OF THE PATENTS PERTAINING TO AGRICULTURAL FUMIGANTS, 2019-2020

6.9 TRADE ANALYSIS

TABLE 8 EXPORT DATA OF AGRICULTURAL FUMIGANTS FOR KEY COUNTRIES, 2020 (VALUE AND VOLUME)

TABLE 9 IMPORT DATA OF AGRICULTURAL FUMIGANTS FOR KEY COUNTRIES, 2020 (VALUE AND VOLUME)

6.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 AGRICULTURAL FUMIGANTS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.11 DEGREE OF COMPETITION

6.12 CASE STUDY

TABLE 11 BOOMING RESIDENTIAL SECTOR IN FLORIDA, US

TABLE 12 RISE IN TRADE AND QUARANTINE SHIPMENTS IN BENELUX

6.13 COVID-19 IMPACT ANALYSIS

7 AGRICULTURAL FUMIGANTS MARKET, BY PRODUCT TYPE (Page No. - 87)

7.1 INTRODUCTION

FIGURE 38 AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 13 MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 14 MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 15 MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (KT)

TABLE 16 MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (KT)

7.1.1 COVID-19 IMPACT ON THE AGRICULTURAL FUMIGANTS MARKET, BY PRODUCT TYPE

7.1.1.1 Optimistic Scenario

TABLE 17 OPTIMISTIC SCENARIO: AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

7.1.1.2 Realistic Scenario

TABLE 18 REALISTIC SCENARIO: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

7.1.1.3 Pessimistic Scenario

TABLE 19 PESSIMISTIC SCENARIO: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

7.2 PHOSPHINE

7.2.1 LOWER TOXIC RESIDUE SPURS PHOSPHINE’S APPLICATION RATE

TABLE 20 PHOSPHINE MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 21 PHOSPHINE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 1,3-DICHLOROPROPENE

7.3.1 POTENTIAL TO REPLACE METHYL BROMIDE WILL FUEL THE DEMAND FOR 1,3-DICHLOROPROPENE

TABLE 22 1,3-DICHLOROPROPENE MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 23 1,3-DICHLOROPROPENE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 CHLOROPICRIN

7.4.1 BROAD-SPECTRUM FUNCTIONALITY FOR MANY TYPES OF PESTS HAS BOOSTED THE DEMAND FOR CHLOROPICRIN

TABLE 24 CHLOROPICRIN MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 25 CHLOROPICRIN MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.5 METHYL BROMIDE

7.5.1 NEGATIVE IMPACT ON THE OZONE LAYER HAS LIMITED THE USE OF METHYL BROMIDE

TABLE 26 METHYL BROMIDE MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 27 METHYL BROMIDE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.6 METAM SODIUM

7.6.1 METAM SODIUM IS EXTREMELY ADVANTAGEOUS IN POTATO AND TUBER CULTIVATION

TABLE 28 METAM SODIUM MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 29 METAM SODIUM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.7 OTHER PRODUCT TYPES

7.7.1 GROWING MARKET FOR STRUCTURAL FUMIGATION WILL SUPPORT THE DEMAND FOR SULFURYL FLUORIDE

TABLE 30 AGRICULTURAL FUMIGANTS MARKET SIZE FOR OTHER PRODUCT TYPES, BY REGION, 2015–2020 (USD MILLION)

TABLE 31 MARKET SIZE FOR OTHER PRODUCT TYPES, BY REGION, 2021–2026 (USD MILLION)

8 AGRICULTURAL FUMIGANTS MARKET, BY PEST CONTROL METHOD (Page No. - 99)

8.1 INTRODUCTION

FIGURE 39 AGRICULTURAL FUMIGANTS MARKET SIZE, BY PEST CONTROL METHOD, 2021 VS. 2026 (USD MILLION)

TABLE 32 MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 33 MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

8.1.1 COVID-19 IMPACT ON THE AGRICULTURAL FUMIGANTS MARKET, BY PEST CONTROL METHOD

8.1.1.1 Optimistic Scenario

TABLE 34 OPTIMISTIC SCENARIO: AGRICULTURAL FUMIGANTS MARKET SIZE, BY PEST CONTROL METHOD, 2018–2021 (USD MILLION)

8.1.1.2 Realistic Scenario

TABLE 35 REALISTIC SCENARIO: MARKET SIZE, BY PEST CONTROL METHOD, 2018–2021 (USD MILLION)

8.1.1.3 Pessimistic Scenario

TABLE 36 PESSIMISTIC SCENARIO: MARKET SIZE, BY PEST CONTROL METHOD, 2018–2021 (USD MILLION)

8.2 VACUUM CHAMBER FUMIGATION

8.2.1 PHOSPHINE IS HIGHLY RECOMMENDED IN THE VACUUM CHAMBER FUMIGATION METHOD

TABLE 37 VACUUM CHAMBER FUMIGATION MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 38 VACUUM CHAMBER FUMIGATION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 TARPAULIN FUMIGATION

8.3.1 TAILORED COVERS ARE PREPARED AS PER REQUIREMENTS

TABLE 39 TARPAULIN FUMIGATION MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 40 TARPAULIN FUMIGATION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 STRUCTURAL FUMIGATION (TENT)

8.4.1 RISING TRADE OF AGRICULTURAL COMMODITIES TO FUEL THE GROWTH OF THIS SEGMENT

TABLE 41 STRUCTURAL FUMIGATION MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 42 STRUCTURAL FUMIGATION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.5 NON-TARP FUMIGATION BY INJECTION

8.5.1 DEMAND FOR LIQUID FUMIGANTS TO DRIVE THE MARKET FOR NON-TARP FUMIGATION BY INJECTION

TABLE 43 NON-TARP FUMIGATION BY INJECTION MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 44 NON-TARP FUMIGATION BY INJECTION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.6 OTHER PEST CONTROL METHODS

8.6.1 ALUMINUM PHOSPHIDE IS POPULARLY USED TO CONTROL RODENTS

TABLE 45 AGRICULTURAL FUMIGANTS MARKET SIZE FOR OTHER PEST CONTROL METHODS, BY REGION, 2015–2020 (USD MILLION)

TABLE 46 MARKET SIZE FOR OTHER PEST CONTROL METHODS, BY REGION, 2021–2026 (USD MILLION)

9 AGRICULTURAL FUMIGANTS MARKET, BY CROP TYPE (Page No. - 109)

9.1 INTRODUCTION

FIGURE 40 AGRICULTURAL FUMIGANTS MARKET SIZE, BY CROP TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 47 MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 48 MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

9.1.1 COVID-19 IMPACT ON THE AGRICULTURAL FUMIGANTS MARKET, BY CROP TYPE

9.1.1.1 Optimistic Scenario

TABLE 49 OPTIMISTIC SCENARIO: MARKET SIZE, BY CROP TYPE, 2018–2021 (USD MILLION)

9.1.1.2 Realistic Scenario

TABLE 50 REALISTIC SCENARIO: MARKET SIZE, BY CROP TYPE, 2018–2021 (USD MILLION)

9.1.1.3 Pessimistic Scenario

TABLE 51 PESSIMISTIC SCENARIO: MARKET SIZE, BY CROP TYPE, 2018–2021 (USD MILLION)

9.2 CEREALS & GRAINS

9.2.1 PHOSPHINE GAS IS COMMONLY USED TO FUMIGATE INFESTED GRAINS AND CEREALS

TABLE 52 CEREALS & GRAINS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 53 CEREALS & GRAINS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 OILSEEDS & PULSES

9.3.1 ROOT-KNOT NEMATODE IS A SERIOUS ISSUE OBSERVED IN SOYBEAN

TABLE 54 OILSEEDS & PULSES MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 55 OILSEEDS & PULSES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 FRUITS & VEGETABLES

9.4.1 FRUITS & VEGETABLES ARE HIGH-VALUE CROPS THAT DEMAND THE INCLUSION OF INSECT CONTROL PRODUCTS

TABLE 56 FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 57 FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 OTHER CROP TYPES

9.5.1 TURF LAWNS ARE IN GREAT DEMAND, WHICH DRIVES THE MARKET GROWTH

TABLE 58 AGRICULTURAL FUMIGANTS MARKET SIZE FOR OTHER CROP TYPES, BY REGION, 2015–2020 (USD MILLION)

TABLE 59 MARKET SIZE FOR OTHER CROP TYPES, BY REGION, 2021–2026 (USD MILLION)

10 AGRICULTURAL FUMIGANTS MARKET, BY APPLICATION (Page No. - 117)

10.1 INTRODUCTION

FIGURE 41 AGRICULTURAL FUMIGANTS MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 60 MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 61 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.1.1 COVID-19 IMPACT ON THE AGRICULTURAL FUMIGANTS MARKET, BY APPLICATION

10.1.1.1 Optimistic Scenario

TABLE 62 OPTIMISTIC SCENARIO: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

10.1.1.2 Realistic Scenario

TABLE 63 REALISTIC SCENARIO: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

10.1.1.3 Pessimistic Scenario

TABLE 64 PESSIMISTIC SCENARIO: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

10.2 SOIL

TABLE 65 SOIL: AGRICULTURAL FUMIGANTS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 66 SOIL: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2.1 FIELDS

10.2.2 NURSERIES

TABLE 67 SCHEDULE OF NURSERY SOIL FUMIGATION

10.2.3 GREENHOUSES

10.2.4 TRANSPLANT BEDS

10.3 WAREHOUSE

10.3.1 SILO

10.3.2 STACK

TABLE 68 WAREHOUSE: AGRICULTURAL FUMIGANTS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 69 WAREHOUSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 AGRICULTURAL FUMIGANTS MARKET, BY FORM (Page No. - 125)

11.1 OVERVIEW

11.1.1 SOLID

11.1.1.1 Aluminum phosphide helps in eliminating pests and insects in all stages of development

11.1.1.2 Aluminum phosphide

11.1.1.3 Calcium cyanide

11.1.2 LIQUID

11.1.2.1 Liquid fumigation is quick in action than solid fumigation

11.1.2.2 Carbon disulfide

11.1.2.3 Ethyl acetate

11.1.2.4 Carbon tetrachloride

11.1.2.5 1,3-Dichloropropene

11.1.2.6 Chloropicrin

11.1.3 GASEOUS

11.1.3.1 Gas fumigation ensures the non-dispersal of gas into the external environment

11.1.3.2 Methyl bromide

11.1.3.3 Sulfuryl fluoride

11.2 BY FUNCTION

11.2.1 NEMATICIDES

11.2.1.1 INCREASE IN ORGANIC CULTIVATION WILL SPUR THE GROWTH OF THE NEMATICIDES SEGMENT

11.2.2 INSECTICIDES

11.2.2.1 GROWING CROP LOSS DUE TO INSECTS IN TROPICAL CLIMATE WILL DRIVE THE DEMAND FOR INSECTICIDES

11.2.3 FUNGICIDES

11.2.3.1 EMERGING STRAINS OF LETHAL FUNGUS IN AGRICULTURE HAVE BOOSTED THE DEMAND FOR FUNGICIDES IN THE MARKET

11.2.4 HERBICIDES

11.2.4.1 DUE TO WEED RESISTANCE TO MILD HERBICIDES, FUMIGANTS WITH POWERFUL ACTIVE INGREDIENTS WILL WITNESS A HIGHER DEMAND

12 AGRICULTURAL FUMIGANTS MARKET, BY REGION (Page No. - 129)

12.1 INTRODUCTION

FIGURE 42 AGRICULTURAL FUMIGANTS MARKET SHARE (VALUE), BY KEY COUNTRY/REGION, 2020

TABLE 70 AGRICULTURAL FUMIGANTS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 71 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.1.1 COVID-19 IMPACT ON THE AGRICULTURAL FUMIGANTS MARKET, BY REGION

12.1.1.1 Optimistic Scenario

TABLE 72 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE AGRICULTURAL FUMIGANTS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

12.1.1.2 Realistic Scenario

TABLE 73 REALISTIC SCENARIO: COVID-19 IMPACT ON THE AGRICULTURAL FUMIGANTS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

12.1.1.3 Pessimistic Scenario

TABLE 74 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE AGRICULTURAL FUMIGANTS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

12.2 NORTH AMERICA

TABLE 75 NORTH AMERICA: AGRICULTURAL FUMIGANTS MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 Increase in agricultural exports to drive the growth of the agricultural fumigants market in the US

TABLE 85 US: MARKET SIZE FOR AGRICULTURAL FUMIGANTS, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 86 US: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 87 US: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 88 US: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 89 US: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 90 US: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 91 US: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 92 US: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Strategic efforts to boost agricultural activities by the government to enhance the market growth in Canada

TABLE 93 CANADA: AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 94 CANADA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 95 CANADA: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 96 CANADA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 97 CANADA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 98 CANADA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 99 CANADA: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 100 CANADA: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Improvement in storage technologies to drive the growth in this country

TABLE 101 MEXICO: MARKET SIZE FOR AGRICULTURAL FUMIGANTS, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 102 MEXICO: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 103 MEXICO: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 104 MEXICO: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 105 MEXICO: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 106 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 107 MEXICO: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 108 MEXICO: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.3 EUROPE

FIGURE 43 EUROPE: AGRICULTURAL FUMIGANTS MARKET SNAPSHOT, 2020

TABLE 109 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Rise in industrialized farming and storage technology will support market growth

TABLE 119 GERMANY: MARKET SIZE FOR AGRICULTURAL FUMIGANTS, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 120 GERMANY: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 121 GERMANY: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 122 GERMANY: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 123 GERMANY: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 124 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 125 GERMANY: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 126 GERMANY: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.3.2 FRANCE

12.3.2.1 Shift to safer fumigant alternatives due to restrictions by the French government

TABLE 127 FRANCE: AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 128 FRANCE: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 129 FRANCE: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 130 FRANCE: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 131 FRANCE: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 132 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 133 FRANCE: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 134 FRANCE: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.3.3 ITALY

12.3.3.1 Health risks to workers have compelled Italian consumers to opt for safer alternatives for fumigants

TABLE 135 ITALY: MARKET SIZE FOR AGRICULTURAL FUMIGANTS, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 136 ITALY: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 137 ITALY: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 138 ITALY: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 139 ITALY: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 140 ITALY: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 141 ITALY: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 142 ITALY: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.3.4 UK

12.3.4.1 Usage of high-yielding seeds will demand greater application of fumigation

TABLE 143 UK: AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 144 UK: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 145 UK: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 146 UK: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 147 UK: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 148 UK: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 149 UK: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 150 UK: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.3.5 SPAIN

12.3.5.1 High application rate and effectivity of fumigants to drive the growth of the market

TABLE 151 SPAIN: MARKET SIZE FOR AGRICULTURAL FUMIGANTS, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 152 SPAIN: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 153 SPAIN: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 154 SPAIN: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 155 SPAIN: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 156 SPAIN: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 157 SPAIN: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 158 SPAIN: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.3.6 NETHERLANDS

12.3.6.1 To bolster and maintain its global position in trade, the Netherlands is robustly investing in upgrading its storage facilities

TABLE 159 NETHERLANDS: MARKET SIZE FOR AGRICULTURAL FUMIGANTS, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 160 NETHERLANDS: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 161 NETHERLANDS: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 162 NETHERLANDS: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 163 NETHERLANDS: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 164 NETHERLANDS: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 165 NETHERLANDS: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 166 NETHERLANDS: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.3.7 REST OF EUROPE

TABLE 167 REST OF EUROPE: AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 168 REST OF EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 169 REST OF EUROPE: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 170 REST OF EUROPE: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 171 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 172 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 173 REST OF EUROPE: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 174 REST OF EUROPE: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: AGRICULTURAL FUMIGANTS MARKET SNAPSHOT

TABLE 175 APAC: MARKET SIZE FOR AGRICULTURAL FUMIGANTS, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 176 APAC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 177 APAC: MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 178 APAC: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 179 APAC: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 180 APAC: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 181 APAC: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 182 APAC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 183 APAC: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 184 APAC: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Initiatives to control and eradicate pests have paved the way for the market growth of agricultural fumigants

TABLE 185 CHINA: AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 186 CHINA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 187 CHINA: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 188 CHINA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 189 CHINA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 190 CHINA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 191 CHINA: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 192 CHINA: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.4.2 INDIA

12.4.2.1 Export of agricultural produce is expected to match the international quality, which is driving the market

TABLE 193 INDIA: MARKET SIZE FOR AGRICULTURAL FUMIGANTS, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 194 INDIA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 195 INDIA: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 196 INDIA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 197 INDIA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 198 INDIA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 199 INDIA: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 200 INDIA: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.4.3 JAPAN

12.4.3.1 Urban agriculture is more productive than rural agriculture

TABLE 201 JAPAN: AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 202 JAPAN: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 203 JAPAN: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 204 JAPAN: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 205 JAPAN: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 206 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 207 JAPAN: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 208 JAPAN: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.4.4 AUSTRALIA

12.4.4.1 Climate change has provided a conducive environment for the growth of invasive pests

TABLE 209 AUSTRALIA: MARKET SIZE FOR AGRICULTURAL FUMIGANTS, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 210 AUSTRALIA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 211 AUSTRALIA: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 212 AUSTRALIA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 213 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 214 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 215 AUSTRALIA: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 216 AUSTRALIA: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.4.5 NEW ZEALAND

12.4.5.1 Research is being conducted to replace methyl bromide with other alternatives

TABLE 217 NEW ZEALAND: AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 218 NEW ZEALAND: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 219 NEW ZEALAND: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 220 NEW ZEALAND: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 221 NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 222 NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 223 NEW ZEALAND: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 224 NEW ZEALAND: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.4.6 THAILAND

12.4.6.1 Need to avoid post-harvest losses to create a demand for fumigation

TABLE 225 THAILAND: MARKET SIZE FOR AGRICULTURAL FUMIGANTS, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 226 THAILAND: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 227 THAILAND: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 228 THAILAND: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 229 THAILAND: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 230 THAILAND: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 231 THAILAND: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 232 THAILAND: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.4.7 REST OF ASIA PACIFIC

12.4.7.1 Growing economies have created a market for high agricultural inputs

TABLE 233 REST OF APAC: AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 234 REST OF APAC: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 235 REST OF APAC: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 236 REST OF APAC: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 237 REST OF APAC: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 238 REST OF APAC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 239 REST OF APAC: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 240 REST OF APAC: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.5 REST OF THE WORLD (ROW)

TABLE 241 ROW: MARKET SIZE FOR AGRICULTURAL FUMIGANTS, BY REGION, 2015–2020 (USD MILLION)

TABLE 242 ROW: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 243 ROW: MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 244 ROW: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 245 ROW: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 246 ROW: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 247 ROW: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 248 ROW: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 249 ROW: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 250 ROW: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.5.1 AFRICA

12.5.1.1 Government regulations and hygiene requirements to drive the demand for agricultural fumigation

TABLE 251 AFRICA: AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 252 AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 253 AFRICA: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 254 AFRICA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 255 AFRICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 256 AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 257 AFRICA: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 258 AFRICA: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.5.2 SOUTH AMERICA

12.5.3 RISE IN RODENT INFESTATION TO BOOST THE MARKET GROWTH

TABLE 259 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL FUMIGANTS, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 260 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 261 SOUTH AMERICA: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 262 SOUTH AMERICA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 263 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 264 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 265 SOUTH AMERICA: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 266 SOUTH AMERICA: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

12.5.4 MIDDLE EAST

12.5.4.1 Change in climate conditions to increase the prevalence of insects

TABLE 267 MIDDLE EAST: AGRICULTURAL FUMIGANTS MARKET SIZE, BY PRODUCT TYPE, 2015–2020 (USD MILLION)

TABLE 268 MIDDLE EAST: MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 269 MIDDLE EAST: MARKET SIZE, BY CROP TYPE, 2015–2020 (USD MILLION)

TABLE 270 MIDDLE EAST: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 271 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 272 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 273 MIDDLE EAST: MARKET SIZE, BY PEST CONTROL METHOD, 2015–2020 (USD MILLION)

TABLE 274 MIDDLE EAST: MARKET SIZE, BY PEST CONTROL METHOD, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 218)

13.1 OVERVIEW

TABLE 275 MARKET FOR AGRICULTURAL FUMIGANTS: DEGREE OF COMPETITION

13.2 KEY PLAYER STRATEGIES

13.3 REVENUE ANALYSIS OF KEY PLAYERS, 2019-2020

13.4 COVID-19-SPECIFIC COMPANY RESPONSE

13.4.1 BASF SE

13.4.2 SYNGENTA

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.5.1 STARS

13.5.2 PERVASIVE

13.5.3 EMERGING LEADERS

13.5.4 PARTICIPANTS

FIGURE 45 AGRICULTURAL FUMIGANTS MARKET, COMPANY EVALUATION QUADRANT (2020) (OVERALL MARKET)

13.5.5 PRODUCT FOOTPRINT

TABLE 276 AGRICULTURAL FUMIGANTS: TYPE FOOTPRINT

TABLE 277 AGRICULTURAL FUMIGANTS: FUNCTION FOOTPRINT

TABLE 278 AGRICULTURAL FUMIGANTS: REGIONAL FOOTPRINT

TABLE 279 AGRICULTURAL FUMIGANTS: OVERALL FOOTPRINT

13.6 MARKET FOR AGRICULTURAL FUMIGANTS, START-UP/SME EVALUATION QUADRANT, 2020

13.6.1 PROGRESSIVE COMPANIES

13.6.2 STARTING BLOCKS

13.6.3 RESPONSIVE COMPANIES

13.6.4 DYNAMIC COMPANIES

FIGURE 46 MARKET FOR AGRICULTURAL FUMIGANTS: COMPANY EVALUATION QUADRANT, 2020 (START-UP/SME)

13.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

13.7.1 DEALS

TABLE 280 MARKET FOR AGRICULTURAL FUMIGANTS: DEALS, JUNE 2019-FEBRUARY 2021

13.7.2 OTHERS

TABLE 281 MARKET: OTHERS, JUNE 2019-FEBRUARY 2021

14 COMPANY PROFILES (Page No. - 231)

14.1 KEY COMPANIES

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

14.1.1 BASF SE

TABLE 282 BASF SE: BUSINESS OVERVIEW

FIGURE 47 BASF SE: COMPANY SNAPSHOT

14.1.2 SYNGENTA

TABLE 283 SYNGENTA: BUSINESS OVERVIEW

FIGURE 48 SYNGENTA: COMPANY SNAPSHOT

14.1.3 ARKEMA

TABLE 284 ARKEMA: BUSINESS OVERVIEW

FIGURE 49 ARKEMA: COMPANY SNAPSHOT

14.1.4 ADAMA

TABLE 285 ADAMA: BUSINESS OVERVIEW

FIGURE 50 ADAMA: COMPANY SNAPSHOT

TABLE 286 ADAMA AGRICULTURAL SOLUTIONS: DEALS

14.1.5 UPL

TABLE 287 UPL: BUSINESS OVERVIEW

FIGURE 51 UPL: COMPANY SNAPSHOT

TABLE 288 UPL: DEALS

14.1.6 SOLVAY

TABLE 289 SOLVAY: BUSINESS OVERVIEW

FIGURE 52 SOLVAY: COMPANY SNAPSHOT

14.1.7 NUFARM

TABLE 290 NUFARM: BUSINESS OVERVIEW

FIGURE 53 NUFARM: COMPANY SNAPSHOT

14.1.8 AMERICAN VANGUARD CORPORATION (AMVAC)

TABLE 291 AMERICAN VANGUARD CORPORATION: BUSINESS OVERVIEW

FIGURE 54 AMERICAN VANGUARD CORPORATION: COMPANY SNAPSHOT

14.1.9 INTERTEK

TABLE 292 INTERTEK: BUSINESS OVERVIEW

FIGURE 55 INTERTEK: COMPANY SNAPSHOT

14.1.10 SGS SA

TABLE 293 SGS: BUSINESS OVERVIEW

FIGURE 56 SGS SA: COMPANY SNAPSHOT

14.1.11 TESSENDERLO KERLEY, INC.

TABLE 294 TESSENDERLO KERLEY, INC.: BUSINESS OVERVIEW

FIGURE 57 TESSENDERLO KERLEY, INC.: COMPANY SNAPSHOT

14.1.12 NIPPON CHEMICAL INDUSTRIAL CO., LTD.

TABLE 295 NIPPON CHEMICAL INDUSTRIAL CO., LTD.: BUSINESS OVERVIEW

FIGURE 58 NIPPON CHEMICAL INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT

14.1.13 DEGESCH AMERICA, INC.

TABLE 296 DEGESCH AMERICA, INC.: BUSINESS OVERVIEW

14.1.14 MUSTGROW BIOLOGICS, INC

TABLE 297 MUSTGROW BIOLOGICS, INC: COMPANY OVERVIEW

14.1.15 TRINITY MANUFACTURING, INC.

TABLE 298 TRINITY MANUFACTURING, INC.: BUSINESS OVERVIEW

14.2 OTHER PLAYERS

14.2.1 IMTRADE CROPSCIENCE – AGRICULTURAL FUMIGANTS MARKET

TABLE 299 IMTRADE CROPSCIENCE: COMPANY OVERVIEW

14.2.2 THE DRASLOVKA GROUP – AGRICULTURAL FUMIGANTS MARKET

TABLE 300 THE DRASLOVKA GROUP: COMPANY OVERVIEW

14.2.3 DOUGLAS PRODUCTS – AGRICULTURAL FUMIGANTS MARKET

TABLE 301 DOUGLAS PRODUCTS: COMPANY OVERVIEW

14.2.4 ECOTEC FUMIGATION – AGRICULTURAL FUMIGANTS MARKET

TABLE 302 ECOTEC FUMIGATION: COMPANY OVERVIEW

14.2.5 ROYAL AGRO – AGRICULTURAL FUMIGANTS MARKET

TABLE 303 ROYAL AGRO: BUSINESS OVERVIEW

14.2.6 LIST OF 25 COMPANIES – AGRICULTURAL FUMIGANTS MARKET

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 270)

15.1 INTRODUCTION

TABLE 304 ADJACENT MARKETS TO AGRICULTURAL FUMIGANTS

15.2 LIMITATIONS

15.3 CROP PROTECTION CHEMICALS MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 305 CROP PROTECTION CHEMICALS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

15.4 AGROCHEMICALS MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

TABLE 306 AGROCHEMICALS MARKET SIZE, BY PESTICIDE TYPE, 2018–2025 (USD MILLION)

15.5 AGRICULTURAL ADJUVANTS MARKET

15.5.1 MARKET DEFINITION

15.5.2 MARKET OVERVIEW

TABLE 307 AGRICULTURAL ADJUVANTS MARKET SIZE, BY FUNCTION, 2020–2026 (USD MILLION)

16 APPENDIX (Page No. - 275)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities in estimating the agricultural fumigants market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports; press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors, gold & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

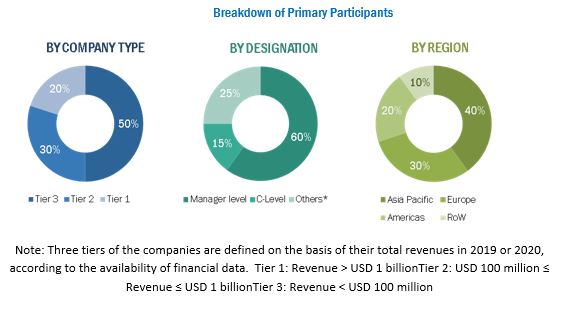

The market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of new chemicals that can be applied in warehouses or in soil. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of the primary respondents.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Hyothetical Chanllenges that the Soil Fumigants Market May Face in the Future

Soil fumigants are chemical compounds used to control soil-borne pests and diseases in agriculture. While they are effective in managing pests, they also have potential negative impacts on human health and the environment. Here are some hypothetical challenges that the soil fumigants market may face in the future:

1. Environmental regulations: The use of soil fumigants is regulated by environmental agencies, and there is growing concern about their potential impact on the environment. Future regulations could impose stricter limits on the use of soil fumigants, which could reduce their availability and increase costs.

2. Public perception: There is growing public concern about the use of chemical pesticides in agriculture, including soil fumigants. As consumers become more aware of the potential health and environmental risks associated with soil fumigants, they may demand more sustainable and eco-friendly alternatives.

3. Resistance development: The overuse of soil fumigants can lead to the development of pest and disease resistance, which could reduce their effectiveness over time. If this happens, farmers may need to use more toxic chemicals or turn to alternative pest control methods, which could reduce demand for soil fumigants.

4. Alternative technologies: There are several emerging technologies that offer alternatives to soil fumigants, such as biofumigation and cover cropping. If these technologies prove to be effective and cost-competitive, they could reduce demand for soil fumigants.

5. Cost and availability: Soil fumigants can be expensive, and their availability can be limited in some regions. If the cost of soil fumigants continues to rise, or if they become less available due to regulations or other factors, farmers may need to seek out alternative pest control methods.

Overall, the soil fumigants market may face several hypothetical challenges in the future, including stricter environmental regulations, public perception concerns, resistance development, emerging alternative technologies, and cost and availability issues. As a result, the market may need to adapt to these challenges by developing more sustainable and eco-friendly alternatives or by investing in emerging technologies that can reduce reliance on soil fumigants.

Market Scope of Soil Solarization Market

Soil solarization is a process that uses solar energy to control soil-borne pests and diseases in agriculture. This technique involves covering the soil with a transparent plastic sheet, which traps solar energy and raises the temperature of the soil, killing pests, weed seeds, and disease-causing microorganisms. Here are some key factors that are driving the market scope of the soil solarization market:

1. Growing demand for sustainable pest control methods: There is increasing demand for sustainable and eco-friendly pest control methods in agriculture, driven by concerns about the negative impacts of chemical pesticides on human health and the environment. Soil solarization is a preferred method for many farmers because it is a natural, chemical-free way to control pests and diseases.

2. Increased awareness about the benefits of soil solarization: There is growing awareness about the benefits of soil solarization among farmers and agricultural experts. This technique has been shown to improve soil health, increase crop yields, and reduce the need for chemical pesticides, making it an attractive option for many growers.

3. Availability of low-cost plastic films: The availability of low-cost plastic films is making soil solarization more accessible and affordable for farmers. Advances in plastic technology have led to the development of high-quality, durable plastic films that are specifically designed for soil solarization, making it easier and more cost-effective for farmers to implement this technique.

4. Growing adoption in developing countries: Soil solarization is gaining popularity in developing countries where pest and disease pressures are high, and access to chemical pesticides is limited. The technique is relatively simple to implement and requires minimal equipment, making it a practical and cost-effective solution for many small-scale farmers.

5. Government support and funding: Governments around the world are providing support and funding for sustainable agriculture practices, including soil solarization. This is driving investment in research and development, as well as education and training programs, to help farmers adopt this technique and improve their crop yields and profitability.

Overall, the soil solarization market is expected to grow in the coming years, driven by the increasing demand for sustainable and eco-friendly pest control methods, growing awareness about the benefits of soil solarization, the availability of low-cost plastic films, growing adoption in developing countries, and government support and funding. As more farmers adopt this technique, the market is expected to expand and create new opportunities for companies that provide soil solarization products and services.

Industries that will be Impacted Heavily in the Future by Fumigation Market

Fumigation is a process of using chemicals to control pests in agriculture, stored products, and buildings. In the future, the fumigation industry is expected to impact several sectors, including agriculture, food processing, and construction. Here are some specific examples:

1. Agriculture: Fumigation is essential in agriculture to control pests that can damage crops and reduce yields. For example, the strawberry industry heavily relies on fumigation to control soil-borne pests such as nematodes. Fumigation is also used in citrus and vegetable production to control pests and diseases.

2. Stored products: Fumigation is used to control pests that infest stored products such as grain, seeds, and dried fruits. For example, the cocoa industry uses fumigation to control pests such as the cocoa moth, which can damage cocoa beans during storage.

3. Construction: Fumigation is used in construction to control pests such as termites and wood borers that can damage wooden structures. For example, the construction industry in many countries requires fumigation of wooden packaging materials used in international trade to prevent the introduction of invasive pests.

In conclusion, the fumigation industry is expected to play a significant role in several sectors in the future, including agriculture, stored products, and construction.

Types of Crop Fumigants

There are different types of crop fumigants used in agriculture, including:

1. Chloropicrin: This is a broad-spectrum fumigant used to control soil-borne pests such as nematodes, fungi, and bacteria. It is often used in combination with other fumigants to enhance efficacy.

2. Methyl bromide: This is a highly effective fumigant used to control a wide range of pests in soil, stored products, and buildings. However, it is also a potent ozone-depleting substance and has been phased out in many countries.

3. 1,3-Dichloropropene: This is a soil fumigant used to control nematodes, weeds, and soil-borne diseases. It is often used in combination with other fumigants to enhance efficacy.

4. Metam sodium/potassium: This is a soil fumigant used to control soil-borne pests such as nematodes, fungi, and bacteria. It is often used in high-value crops such as strawberries, tomatoes, and peppers.

5. Sulfuryl fluoride: This is a fumigant used to control pests in stored products, such as grain, dried fruits, and nuts.

The use of fumigants in agriculture is regulated and subject to strict guidelines to ensure human and environmental safety. In recent years, there has been a shift towards the use of non-fumigant alternatives, such as biological control and crop rotation, to reduce the dependence on chemical fumigants. However, the most commonly used crop fumigant worldwide is metam sodium/potassium.

Agricultural Fumigants Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The parent market, that is, the global crop protection chemicals market, was used to further validate the market details of agricultural fumigants.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the agricultural fumigants market, in terms of pest control method, product type, crop type, application, application, form, function and region

- To describe and forecast the agricultural fumigants market, in terms of value, by region—Asia Pacific, Europe, North America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets, with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of agricultural fumigants

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the agricultural fumigants ecosystem

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches such as acquisitions and divestments; expansions and investments; product launches and approvals; agreements; and collaborations and partnerships in the agricultural fumigants market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific agricultural fumigants market, by key country

- Further breakdown of the Rest of European agricultural fumigants market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to eight)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agricultural Fumigants Market