Agriculture Adjuvants Market by Formulation (Suspension Concentrates, Emulsified Concentrates), Adoption Stage (In-Formulation, Tank Mix), Function (Activator Adjuvants, Utility Adjuvants), Application (Insecticide), Region - Global Forecast to 2028

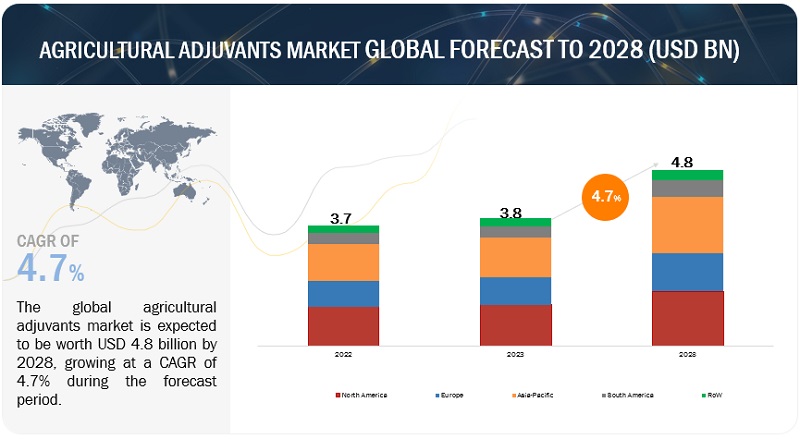

[336 Pages Report] The global agriculture adjuvants market is projected to grow from USD 3.8 billion in 2023 to USD 4.8 billion by 2028 growing at a CAGR of 4.7% during the forecast period. Adjuvants improve crop protection chemicals’ solubility, stability, and spreadability. The potential for developing and enhancing agriculture adjuvants is rising because of the increasing demand for sustainable agriculture. Adjuvants help increase the efficacy of a pesticide spray, which reduces the amount of pesticide needed. Thus, it helps farmers reduce the amount of crop protection chemicals they use, ensuring the sustainability of farming.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Agriculture AdjuvantsMarket Dynamics

Driver: Increase in the use of natural & sustainable adjuvants

There has been growing awareness of the environmental and health risks associated with chemically derived adjuvants. As a result, government authorities and adjuvant manufacturers have shifted their focus to renewable and sustainable products. Companies are taking steps to fulfill the customer’s need for natural adjuvants. For instance, in March 2020, Stepan Company completed the acquisition of Logos Technologies LLC’s NatSurFact business. NatSurFact is a rhamnolipid-based line of bio-surfactants derived from renewable sources.

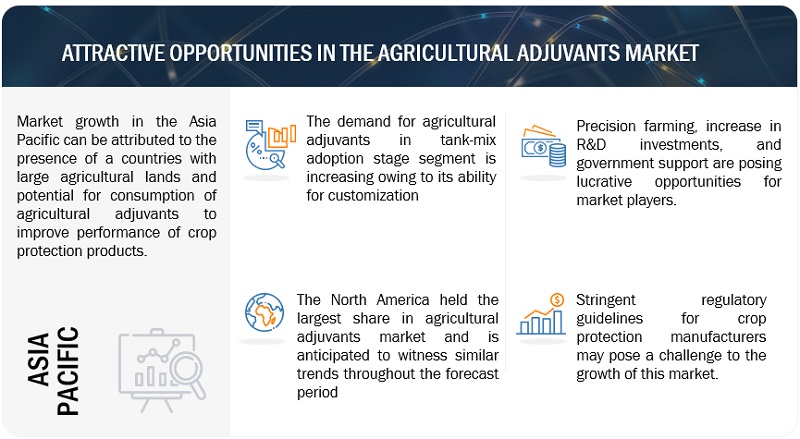

Restraint: Stringent regulatory guidelines for manufacturers

Agriculture adjuvants are regulated by the Environmental Protection Agency (EPA) under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). FIFRA requires all adjuvants to be registered with the EPA before being sold or used in the US to ensure they are safe for human health and the environment. EPA has set tolerances for all agriculture adjuvants used in conjunction with pesticides registered for food use. Europen Union’s REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) that authorizes organic adjuvant products in EU is another regulatory body.

Opportunity: Precision farming techniques to boost the application of adjuvants

Precision farming techniques, such as aerial spraying, smart irrigation, and variable rate application, are gaining popularity worldwide. Agriculture adjuvants optimize the performance of these techniques by ensuring better coverage, absorption, and penetration of agrochemicals, thereby creating opportunities for adjuvant manufacturers.

Challenge: Increase in the cost of Agricultural plantation

Adjuvants increase the cost of agricultural production. Even though the use of adjuvants shortens pesticide application cycles, the expense of adjuvants significantly impacts agricultural production costs. The higher expense of adjuvants reduces farmers’ profit margins, hampering market growth.

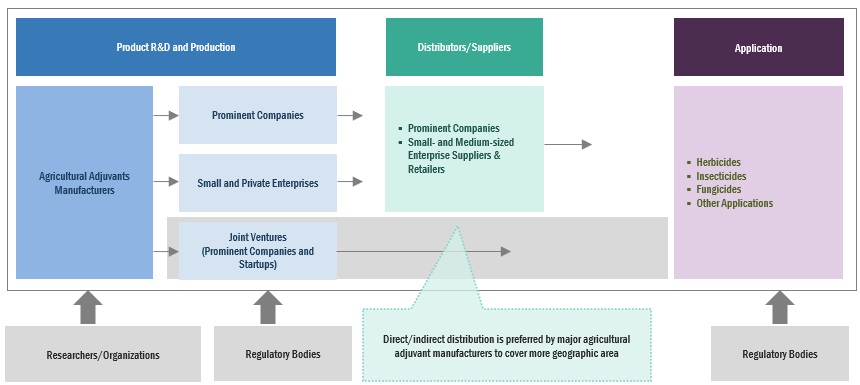

Agriculture Adjuvants Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of agriculture adjuvants. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks.

- The key players in the agriculture adjuvants market include Corteva Agriscience (US), Evonik Industries AG (Germany), Croda International Plc (UK), Nufarm Limited (Australia), Solvay SA (Belgium), BASF SE (Germany), Huntsman International LLC. (US), Clariant AG (Switzerland), Helena Agri-Enterprises, LLC (US), and CHS Inc. (US)

Based on function, the utility adjuvants segment is growing at a high growth rate.

Utility adjuvants, also known as spray modifiers, change the physical or chemical properties of spray mixes to improve their application qualities and capacity to remain on the plant surface. These are also known as special-purpose adjuvants. To increase the application of the formulation to the target plant, utility adjuvants are added to agrochemicals.

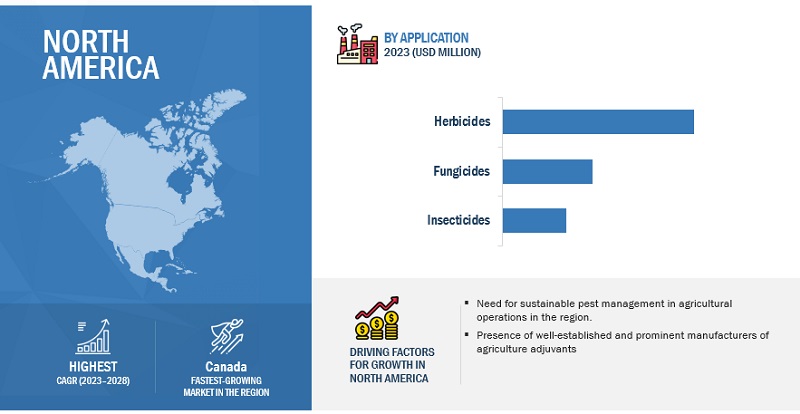

Based on application, the herbicides segment accounted for the largest share of the agriculture adjuvants market.

Herbicides are widely used in agriculture for weed control. Weeds compete with crops for resources such as nutrients, sunlight, and water, leading to reduced crop yields. The rise of herbicide-resistant weeds is a significant concern in agriculture. Herbicide-resistant weed populations have been increasing globally, making weed control more challenging. To manage these challenges, agricultural adjuvants are increasingly being used.

Based on crop type, cereal & grain accounted for the fastest market share of the agriculture adjuvants market.

Cereal and grain crops, such as wheat, corn, rice, barley, and oats, are staple food crops cultivated extensively worldwide. Cereal and grain crops have high commercial value due to their widespread consumption as food, animal feed, and raw materials for various industries. The large-scale cultivation of these crops leads to significant demand for crop protection products, including adjuvants, to ensure optimal yield and quality.

North America: Agriculture Adjuvants Market Snapshot

The North American market is projected to contribute the largest share of the agricultural adjuvants market.

The demand for agriculture adjuvants in North America is experiencing notable growth due to the increasing use of precision farming in the region. This creates a favorable business environment for adjuvants manufacturers and consumers in the region. North America has the presence of major agricultural adjuvants companies, that offer a wide range of products catering to different crop types and application requirements.

Key Market Players

The key players in the agriculture adjuvants market include Corteva Agriscience (US), Evonik Industries AG (Germany), Croda International Plc (UK), Nufarm Limited (Australia), Solvay SA (Belgium), BASF SE (Germany), Huntsman International LLC. (US), Clariant AG (Switzerland), Helena Agri-Enterprises, LLC (US), and CHS Inc. (US)

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2023 |

USD 3.8 billion |

|

Revenue forecast in 2028 |

USD 4.8 billion |

|

Growth Rate |

CAGR of 4.7% from 2023 to 2028 |

|

Base year considered |

2022 |

|

Agriculture Adjuvants Market Forecast period |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Formulation, Adoption Stage, Function, Crop Type, Application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Key Companies Profiled |

|

This research report categorizes the agricultural adjuvants market based on formulation, adoption stage, function, crop type, application, and region.

By Formulation

- Suspension Concentrates

- Emulsifiable Concentrates

By Adoption Stage

- In-Formulation

- Tank Mix

By Function

-

Activator Adjuvants

- Surfactants

- Oil-Based Adjuvants

-

Utility Adjuvants

- Compatibility Agents

- Buffers/ Acidifiers

- Antifoaming Agents

- Water Conditioners

- Drift Control Agents

- Other Utility Agents

By Crop Type

-

Cereals & Grains

- Corn

- Wheat

- Rice

- Other Cereal & Grains

-

Oilseeds & Pulses

- Soybean

- Sunflower

- Other Oilseeds & Pulses

- Fruits & Vegetables

- Other Crop Types

By Application

- Herbicides

- Insecticides

- Fungicides

- Other Applications

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Target Audience

- Agriculture producers, suppliers, distributors, importers, and exporters

- Related government authorities, commercial research & development (R&D) institutions, FDA, EPA, USDA, DPR, PMRA, REACH, government agencies & NGOs, and other regulatory bodies

- Framers

- Commercial research & development (R&D) institutions and financial institutions

- Government and research organizations

Recent Developments

- In April 2022, Lamberti SPA acquired UK-based Turftech International, a company developing and selling special surfactants for applications in horticulture and turf. The acquisition helps Lamberti to expand and diversify its product portfolio and market share in the region.

- In June 2021, Evonik and Tropfen commercialized BREAK-THRU® and launched BREAK-THRU® MSO MAX adjuvants in Argentina. The successful partnership between Evonik and the Argentina-based company Tropfen aims to connect and enable growers’ needs in South America.

- In April 2021, Nufarm Group partnered with Attune Agriculture to distribute Ampersand adjuvant in Mexico.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share of the agriculture adjuvants market?

North America accounted for the largest market in 2023 and is expected to dominate throughout the forecast period. The United States has the largest share inNorth American region, whereas Canada is the fastest-growing country. The area benefits from a robust R&D infrastructure, advanced manufacturing capabilities, and a significant market demand for adjuvant-based solutions, contributing to the industry’s growth.

What is the forecasted size of the global agriculture adjuvants market?

The global agriculture adjuvants market is projected to reach USD 4.8 Billion by 2028 growing at a CAGR of 4.7% from 2023 to 2028.

Which are the major agriculture adjuvants function considered in the study, and which segments are projected to have favorable growth rates in the future?

Agriculture adjuvants by function are segmented as activator adjuvant & utility adjuvant. Activator adjuvant holds the maximum share, while utility adjuvants are witnessing the fastest growth rate.

Which crop type accounts for largest consumption of agriculture adjuvants?

Cereals & grains crop type accounted for the largest market share and anticipated to witness similar trends throughout the forecast period.

Which are the key players in the market, and how intense is the competition?

The key players in the agriculture adjuvants market include Corteva Agriscience (US), Evonik Industries AG (Germany), Croda International Plc (UK), Nufarm Limited (Australia), Solvay SA (Belgium), BASF SE (Germany), Huntsman International LLC. (US), Clariant AG (Switzerland) and CHS Inc. (US)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rise in demand for green adjuvants owing to growing focus on health and consumption of organically produced food- Limiting pesticide wastage by improving usage efficiencyRESTRAINTS- Stringent regulations for manufacturing adjuvants- Increase in oil pricesOPPORTUNITIES- Increasing need to develop adjuvants in biological products- Increase in investment on innovation of adjuvant products- Drift potential of UAVs with adjuvants in aerial applicationsCHALLENGES- Impact on production cost of farmers

- 6.1 INTRODUCTION

-

6.2 VALUE CHAINRESEARCH & PRODUCT DEVELOPMENTMANUFACTURINGPRODUCTION AND MANUFACTURINGMARKETING, SALES, LOGISTICS, AND RETAIL

- 6.3 TRENDS IMPACTING BUYERS

-

6.4 REGULATORY FRAMEWORKNORTH AMERICA- US- Canada- Europe- UK- GermanyASIA PACIFIC- Australia- South Africa

-

6.5 PATENT ANALYSIS

- 6.6 TRADE DATA

- 6.7 PRICING ANALYSIS

-

6.8 MARKET MAP AND ECOSYSTEMDEMAND-SIDE COMPANIESSUPPLY-SIDE COMPANIES

-

6.9 TECHNOLOGY ANALYSISTECHNOLOGICAL ADVANCEMENTS FOR LIQUID BIOFERTILIZERS

-

6.10 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT FROM SUBSTITUTESTHREAT FROM NEW ENTRANTS

-

6.11 CASE STUDIESADJUVANT TOXICITY IGNORANCE IMPACTED SAFETY FACTOR OF COMMERCIAL PESTICIDE FORMULATIONSEVONIK DEVELOPED SUSTAINABLE SURFACTANTS FOR CROP PROTECTION SOLUTIONS

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.13 KEY CONFERENCES AND EVENTS

- 7.1 INTRODUCTION

-

7.2 IN-FORMULATIONNEED TO IMPROVE RAINFASTNESS, MINIMIZE RUNOFF, AND ENHANCE RETENTION TO BOOST DEMAND FOR IN-FORMULATION ADJUVANTS

-

7.3 TANK-MIXTANK-MIX ADJUVANTS TO IMPROVE OVERALL PERFORMANCE OF PLANT PROTECTION PRODUCTS AND EFFICACY OF PESTICIDES

- 8.1 INTRODUCTION

-

8.2 INSECTICIDESDEMAND FOR BOTANICAL INSECTICIDES TO INCREASE DUE TO THEIR COMPATIBILITY WITH IPM STRATEGIES

-

8.3 HERBICIDESNEED FOR WEED CONTROL AND INCREASED AGRICULTURAL PRODUCTIVITY TO PROPEL DEMAND FOR HERBICIDES

-

8.4 FUNGICIDESADJUVANTS TO MAKE FUNGICIDE POWDERS EASILY WETTABLE AND EVENLY DISPERSED IN TANK.

- 8.5 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 CEREALS & GRAINSCORN- Need to reduce pesticide usage and increase efficiency to drive demand for agricultural adjuvants in cornWHEAT- Growing use of crop protection chemicals to boost demand for agricultural adjuvants in wheat productionRICE- Demand for fungicides to grow as they help prevent rice diseases and reduce severe damageOTHER CEREALS & GRAINS

-

9.3 OILSEEDS & PULSESSOYBEAN- Incorporation of lauryl ether sodium sulfate to fungicides to help reduce foliar diseases in soybean cultivationOTHER OILSEEDS & PULSES

- 9.4 FRUITS & VEGETABLES

- 9.5 OTHER CROP TYPES

- 10.1 INTRODUCTION

-

10.2 ACTIVATOR ADJUVANTSSURFACTANTS- Common use of nonionic surfactants and their increasing compatibility with agrochemicals to drive demand for agricultural adjuvantsOIL-BASED ADJUVANTS- Oil-based adjuvants to lower surface tension of spray solution and help increase herbicide absorption rate

-

10.3 UTILITY ADJUVANTSCOMPATIBILITY AGENTS- Rising demand for compatibility agents to make mixture homogeneous and sprayableBUFFERS/ACIDIFIERS- Buffers to control pH changes in tank-mix and prevent herbicides from being degraded by acidsANTIFOAM AGENTS- Antifoam agents to help eliminate oil spills in foaming tanks, reduce pesticide wastage, and limit occupational hazardsWATER CONDITIONERS- Water conditioners to enhance efficacy of pest control and minimize sediment and other impurities in waterDRIFT CONTROL AGENTS- Drift control agents to enhance biological performance of drones and make drone spraying more sustainable and eco-friendlyOTHER UTILITY ADJUVANTS

- 11.1 INTRODUCTION

-

11.2 SUSPENSION CONCENTRATESABSENCE OF DUST AND FLAMMABLE LIQUIDS, EASE OF USE, AND EFFECTIVENESS TO DRIVE DEMAND FOR SUSPENSION CONCENTRATES

-

11.3 EMULSIFIABLE CONCENTRATESEMULSIFIABLE CONCENTRATES TO OFFER EFFECTIVE PEST CONTROL

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAUS- Increasing demand for high-quality & uniform products and adoption of modern farming practices to drive marketCANADA- Easy availability of agricultural commodities, strong government research system, and proximity to US to drive marketMEXICO- Initiatives from regulatory organizations to ensure safety and efficacy of agricultural adjuvants to propel market

-

12.3 EUROPEGERMANY- Innovative farming techniques, robust agrarian practices, and need to maximize agricultural inputs to drive marketUK- Rising demand for effective pest management and environmentally sustainable agricultural practices to drive marketFRANCE- Advanced R&D and use of modern and innovative solutions to drive marketSPAIN- Need for larger crop yields, better crop quality, and pesticides reduction to propel demand for agricultural adjuvantsITALY- Growing use of precision farming technology and demand for higher yield crops to drive marketREST OF EUROPE

-

12.4 ASIA PACIFICCHINA- Government initiatives, adoption of precision agriculture technology, and increased awareness to drive marketINDIA- Growing agrochemical market and need to improve farm yield and reduce crop losses to drive demand for agricultural adjuvantsJAPAN- Increasing demand for high-quality and secure agricultural products to drive marketAUSTRALIA & NEW ZEALAND- Increasing demand for higher crop yields, better agricultural productivity, and rising awareness to drive marketREST OF ASIA PACIFIC

-

12.5 SOUTH AMERICABRAZIL- Increasing cultivation of stacked trait crops to drive market growthARGENTINA- Availability of government funds to increase use of pesticides to drive demand for agricultural adjuvantsREST OF SOUTH AMERICA

-

12.6 REST OF THE WORLD (ROW)AFRICA- Growing need to expand agricultural land and increasing awareness regarding agricultural adjuvants to drive marketMIDDLE EAST- Expanding farm areas and focus on enhancing crop yields to meet growing food demand to drive market

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS

- 13.3 REVENUE ANALYSIS FOR KEY PLAYERS

- 13.4 STRATEGIES ADOPTED BY KEY PLAYERS

-

13.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

13.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

-

13.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY PLAYERSCORTEVA AGRISCIENCE- Business overview- Products/Solutions/Services offered- MnM viewEVONIK INDUSTRIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCRODA INTERNATIONAL PLC (UK)- Business overview- Products/Solutions/Services offered- MnM viewNUFARM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOLVAY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSTEPAN COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINNVICTIS- Business overview- Products/Solutions/Services offered- MnM viewMILLER CHEMICAL & FERTILIZER, LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPRECISION LABORATORIES, LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWINFIELD UNITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKALO- Business overview- Products/Solutions/Services offered- MnM viewADJUVANTS PLUS- Business overview- Products/Solutions/Services offered- MnM viewWILBUR-ELLIS COMPANY LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBRANDT, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHELENA AGRI-ENTERPRISES, LLC- Business overview- Products/Solutions/Services offered- MnM view

-

14.2 STARTUPS/SMESNOURYONINTERAGRO LTD.LAMBERTI S.P.A.GARRCO PRODUCTS, INC.DREXEL CHEMICALLOVELAND PRODUCTS, INC.

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

-

15.3 AGROCHEMICALS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

15.4 SPECIALTY FERTILIZERS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2022

- TABLE 2 AGRICULTURAL ADJUVANTS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 COMPARISON OF SURFACTANT-TREATED AND UNTREATED CORN

- TABLE 4 PRICE OF PESTICIDES AND ADJUVANTS, 2019 (USD/GALLON)

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LIST OF MAJOR PATENTS PERTAINING TO AGRICULTURAL ADJUVANTS, 2020–2023

- TABLE 11 IMPORT VALUE OF AGRICULTURAL ADJUVANTS FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 12 EXPORT VALUE OF AGRICULTURAL ADJUVANTS FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 13 AGRICULTURAL ADJUVANTS MARKET: AVERAGE SELLING PRICE (ASP), BY FUNCTION, 2020–2022 (USD/TON)

- TABLE 14 AGRICULTURAL ADJUVANTS MARKET: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

- TABLE 15 AGRICULTURAL ADJUVANTS MARKET: AVERAGE SELLING PRICE (ASP), BY KEY PLAYER, 2023, (USD/KG)

- TABLE 16 AGRICULTURAL ADJUVANTS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 17 AGRICULTURAL ADJUVANTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- TABLE 19 KEY BUYING CRITERIA FOR GUMMY SUPPLEMENT TYPES

- TABLE 20 AGRICULTURAL ADJUVANTS MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 21 AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2019–2022 (USD MILLION)

- TABLE 22 AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 23 IN-FORMULATION: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 IN-FORMULATION: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 TANK-MIX: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 TANK-MIX: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 28 AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 29 INSECTICIDES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 INSECTICIDES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 HERBICIDES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 HERBICIDES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 FUNGICIDES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 FUNGICIDES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 OTHER APPLICATIONS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 OTHER APPLICATIONS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 38 AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 39 CEREALS & GRAINS: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 40 CEREALS & GRAINS: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 41 OILSEEDS & PULSES: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 42 OILSEEDS & PULSES: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 43 CEREALS & GRAINS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 CEREALS & GRAINS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 CORN: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 CORN: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 WHEAT: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 WHEAT: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 RICE: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 RICE: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 OTHER CEREALS & GRAINS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 OTHER CEREALS & GRAINS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 OILSEEDS & PULSES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 OILSEEDS & PULSES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 SOYBEAN: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 SOYBEAN: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 OTHER OILSEEDS & PULSES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 OTHER OILSEEDS & PULSES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 FRUITS & VEGETABLES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 FRUITS & VEGETABLES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 OTHER CROP TYPES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 OTHER CROP TYPES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 64 AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 65 ACTIVATOR ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 66 ACTIVATOR ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 67 UTILITY ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 68 UTILITY ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 69 AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 70 AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 71 ACTIVATOR ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 ACTIVATOR ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 ACTIVATOR ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 74 ACTIVATOR ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 75 SURFACTANTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 SURFACTANTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 OIL-BASED ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 OIL-BASED ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 UTILITY ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 UTILITY ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 COMPATIBILITY AGENTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 COMPATIBILITY AGENTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 BUFFERS/ACIDIFIERS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 BUFFERS/ACIDIFIERS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 ANTIFOAM AGENTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 ANTIFOAM AGENTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 WATER CONDITIONERS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 WATER CONDITIONERS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 DRIFT CONTROL AGENTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 DRIFT CONTROL AGENTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 OTHER UTILITY ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 92 OTHER UTILITY ADJUVANTS: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 AGRICULTURAL ADJUVANTS MARKET, BY FORMULATION, 2019–2022 (USD MILLION)

- TABLE 94 AGRICULTURAL ADJUVANTS MARKET, BY FORMULATION, 2023–2028 (USD MILLION)

- TABLE 95 SUSPENSION CONCENTRATES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 SUSPENSION CONCENTRATES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 EMULSIFIABLE CONCENTRATES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 98 EMULSIFIABLE CONCENTRATES: AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 100 AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 102 AGRICULTURAL ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 103 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 106 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 107 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: ACTIVATOR ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: ACTIVATOR ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: UTILITY ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: UTILITY ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 114 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 115 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 116 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: CEREALS & GRAINS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: CEREALS & GRAINS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: OILSEEDS & PULSES MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 120 NORTH AMERICA: OILSEEDS & PULSES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 121 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 122 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2019–2022 (USD MILLION)

- TABLE 124 NORTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 125 US: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 126 US: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 US: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 128 US: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 129 US: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 130 US: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 131 CANADA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 132 CANADA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 133 CANADA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 134 CANADA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 135 CANADA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 136 CANADA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 137 MEXICO: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 138 MEXICO: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 MEXICO: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 140 MEXICO: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 141 MEXICO: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 142 MEXICO: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 143 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 144 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 145 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 146 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 147 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 148 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 149 EUROPE: ACTIVATOR ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 150 EUROPE: ACTIVATOR ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 151 EUROPE: UTILITY ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 152 EUROPE: UTILITY ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 153 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 154 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 155 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 156 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 157 EUROPE: CEREALS & GRAINS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 158 EUROPE: CEREALS & GRAINS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 159 EUROPE: OILSEEDS & PULSES MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 160 EUROPE: OILSEEDS & PULSES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 161 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 162 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 163 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2019–2022 (USD MILLION)

- TABLE 164 EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 165 GERMANY: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 166 GERMANY: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 167 GERMANY: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 168 GERMANY: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 169 GERMANY: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 170 GERMANY: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 171 UK: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 172 UK: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 173 UK: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 174 UK: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 175 UK: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 176 UK: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 177 FRANCE: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 178 FRANCE: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 179 FRANCE: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 180 FRANCE: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 181 FRANCE: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 182 FRANCE: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 183 SPAIN: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 184 SPAIN: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 185 SPAIN: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 186 SPAIN: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 187 SPAIN: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 188 SPAIN: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 189 ITALY: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 190 ITALY: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 191 ITALY: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 192 ITALY: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 193 ITALY: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 194 ITALY: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 195 REST OF EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 196 REST OF EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 197 REST OF EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 198 REST OF EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 199 REST OF EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 200 REST OF EUROPE: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 201 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 202 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 203 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 204 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 205 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 206 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 207 ASIA PACIFIC: ACTIVATOR ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 208 ASIA PACIFIC: ACTIVATOR ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 209 ASIA PACIFIC: UTILITY ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 210 ASIA PACIFIC: UTILITY ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 211 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 212 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 213 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 214 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 215 ASIA PACIFIC: CEREALS & GRAINS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 216 ASIA PACIFIC: CEREALS & GRAINS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 217 ASIA PACIFIC: OILSEEDS & PULSES MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 218 ASIA PACIFIC: OILSEEDS & PULSES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 219 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 220 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 221 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2019–2022 (USD MILLION)

- TABLE 222 ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 223 CHINA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 224 CHINA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 225 CHINA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 226 CHINA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 227 CHINA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 228 CHINA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 229 INDIA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 230 INDIA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 231 INDIA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 232 INDIA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 233 INDIA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 234 INDIA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 235 JAPAN: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 236 JAPAN: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 237 JAPAN: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 238 JAPAN: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 239 JAPAN: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 240 JAPAN: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 241 AUSTRALIA & NEW ZEALAND: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 242 AUSTRALIA & NEW ZEALAND: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 243 AUSTRALIA & NEW ZEALAND: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 244 AUSTRALIA & NEW ZEALAND: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 245 AUSTRALIA & NEW ZEALAND: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 246 AUSTRALIA & NEW ZEALAND: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 247 REST OF ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 248 REST OF ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 249 REST OF ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 250 REST OF ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 251 REST OF ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 252 REST OF ASIA PACIFIC: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 253 SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 254 SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 255 SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 256 SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 257 SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 258 SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 259 SOUTH AMERICA: ACTIVATOR ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 260 SOUTH AMERICA: ACTIVATOR ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 261 SOUTH AMERICA: UTILITY ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 262 SOUTH AMERICA: UTILITY ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 263 SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 264 SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 265 SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 266 SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 267 SOUTH AMERICA: CEREALS & GRAINS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 268 SOUTH AMERICA: CEREALS & GRAINS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 269 SOUTH AMERICA: OILSEEDS & PULSES MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 270 SOUTH AMERICA: OILSEEDS & PULSES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 271 SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 272 SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 273 BRAZIL: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 274 BRAZIL: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 275 BRAZIL: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 276 BRAZIL: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 277 BRAZIL: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 278 BRAZIL: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 279 ARGENTINA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 280 ARGENTINA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 281 ARGENTINA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 282 ARGENTINA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 283 ARGENTINA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 284 ARGENTINA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 285 REST OF SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 286 REST OF SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 287 REST OF SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 288 REST OF SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 289 REST OF SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 290 REST OF SOUTH AMERICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 291 ROW: AGRICULTURAL ADJUVANTS MARKET, BY SUBREGION, 2019–2022 (USD MILLION)

- TABLE 292 ROW: AGRICULTURAL ADJUVANTS MARKET, BY SUBREGION, 2023–2028 (USD MILLION)

- TABLE 293 ROW: AGRICULTURAL ADJUVANTS MARKET, BY SUBREGION, 2019–2022 (KT)

- TABLE 294 ROW: AGRICULTURAL ADJUVANTS MARKET, BY SUBREGION, 2023–2028 (KT)

- TABLE 295 ROW: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 296 ROW: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 297 ROW: ACTIVATOR ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 298 ROW: ACTIVATOR ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 299 ROW: UTILITY ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 300 ROW: UTILITY ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 301 ROW: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 302 ROW: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 303 ROW: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 304 ROW: AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 305 ROW: CEREALS & GRAINS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 306 ROW: CEREALS & GRAINS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 307 ROW: OILSEEDS & PULSES MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 308 ROW: OILSEEDS & PULSES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 309 ROW: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 310 ROW: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 311 AFRICA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 312 AFRICA: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 313 AFRICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 314 AFRICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 315 AFRICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 316 AFRICA: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 317 MIDDLE EAST: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 318 MIDDLE EAST: AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 319 MIDDLE EAST: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 320 MIDDLE EAST: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 321 MIDDLE EAST: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2019–2022 (KT)

- TABLE 322 MIDDLE EAST: AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023–2028 (KT)

- TABLE 323 AGRICULTURE ADJUVANTS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 324 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 325 COMPANY FUNCTION FOOTPRINT

- TABLE 326 COMPANY APPLICATION FOOTPRINT

- TABLE 327 COMPANY REGIONAL FOOTPRINT

- TABLE 328 OVERALL COMPANY FOOTPRINT

- TABLE 329 DETAILED LIST OF STARTUPS/SMES

- TABLE 330 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 331 AGRICULTURE ADJUVANTS MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 332 AGRICULTURE ADJUVANTS MARKET: DEALS, 2019–2021

- TABLE 333 AGRICULTURE ADJUVANTS MARKET: OTHERS, 2022

- TABLE 334 CORTEVA AGRISCIENCE: BUSINESS OVERVIEW

- TABLE 335 CORTEVA AGRISCIENCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 EVONIK INDUSTRIES: BUSINESS OVERVIEW

- TABLE 337 EVONIK INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 338 EVONIK INDUSTRIES: OTHERS

- TABLE 339 CRODA INTERNATIONAL PLC: BUSINESS OVERVIEW

- TABLE 340 CRODA INTERNATIONAL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 341 NUFARM: BUSINESS OVERVIEW

- TABLE 342 NUFARM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 NUFARM: DEALS

- TABLE 344 SOLVAY: BUSINESS OVERVIEW

- TABLE 345 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 346 SOLVAY: PRODUCT DEVELOPMENTS

- TABLE 347 BASF SE: BUSINESS OVERVIEW

- TABLE 348 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 349 BASF SE: PRODUCT LAUNCHES

- TABLE 350 STEPAN COMPANY: BUSINESS OVERVIEW

- TABLE 351 STEPAN COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 STEPAN COMPANY: PRODUCT LAUNCHES

- TABLE 353 INNVICTIS: BUSINESS OVERVIEW

- TABLE 354 INNVICTIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 INNVICTIS: OTHERS

- TABLE 356 MILLER CHEMICAL & FERTILIZER, LLC: BUSINESS OVERVIEW

- TABLE 357 MILLER CHEMICAL & FERTILIZER, LLC: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 358 MILLER CHEMICAL & FERTILIZER, LLC: DEALS

- TABLE 359 PRECISION LABORATORIES, LLC: BUSINESS OVERVIEW

- TABLE 360 PRECISION LABORATORIES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 361 PRECISION LABORATORIES, LLC: PRODUCT LAUNCHES

- TABLE 362 CHS INC.: BUSINESS OVERVIEW

- TABLE 363 CHS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 364 CHS INC.: PRODUCT LAUNCHES

- TABLE 365 WINFIELD UNITED: BUSINESS OVERVIEW

- TABLE 366 WINFIELD UNITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 367 WINFIELD UNITED: PRODUCT LAUNCHES

- TABLE 368 KALO: BUSINESS OVERVIEW

- TABLE 369 KALO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 370 ADJUVANTS PLUS: BUSINESS OVERVIEW

- TABLE 371 ADJUVANTS PLUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 372 WILBUR-ELLIS COMPANY LLC: BUSINESS OVERVIEW

- TABLE 373 WILBUR-ELLIS COMPANY LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 374 WILBUR-ELLIS COMPANY LLC: PRODUCT LAUNCHES

- TABLE 375 BRANDT, INC.: BUSINESS OVERVIEW

- TABLE 376 BRANDT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 377 BRANDT INC.: PRODUCT LAUNCHES

- TABLE 378 HELENA AGRI-ENTERPRISES, LLC: BUSINESS OVERVIEW

- TABLE 379 HELENA AGRI-ENTERPRISES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 380 MARKETS ADJACENT TO FILLINGS MARKET

- TABLE 381 AGROCHEMICALS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 382 AGROCHEMICALS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 383 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

- TABLE 384 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- FIGURE 1 AGRICULTURAL ADJUVANTS MARKET: RESEARCH DESIGN

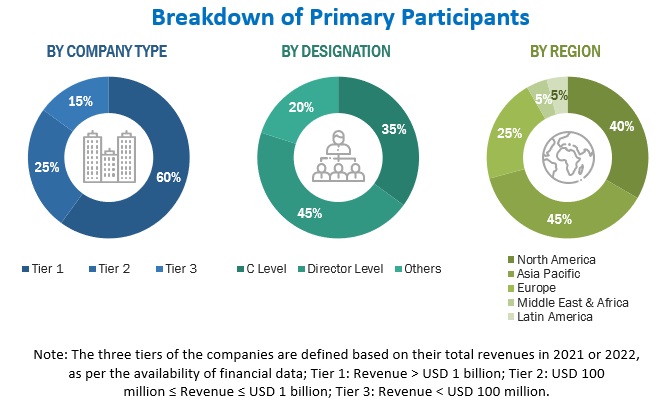

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- FIGURE 4 AGRICULTURAL ADJUVANTS MARKET, BY FORMULATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 5 AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2023 VS. 2028 (USD MILLION)

- FIGURE 6 AGRICULTURAL ADJUVANTS MARKET, BY FUNCTION, 2023 VS. 2028 (USD MILLION)

- FIGURE 7 AGRICULTURAL ADJUVANTS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 AGRICULTURAL ADJUVANTS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 AGRICULTURAL ADJUVANTS MARKET: REGIONAL ANALYSIS

- FIGURE 10 INCREASING APPLICATION OF PESTICIDES FOR CROP PROTECTION TO DRIVE MARKET

- FIGURE 11 ACTIVATOR ADJUVANTS SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT SHARES IN 2023

- FIGURE 12 US TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 13 SUSPENSION CONCENTRATES SEGMENT TO LEAD MARKET IN 2023

- FIGURE 14 IN-FORMULATION SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 15 ACTIVATOR ADJUVANTS SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 16 CEREALS & GRAINS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 17 HERBICIDES SEGMENT TO LEAD MARKET IN 2023

- FIGURE 18 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF INSECTICIDES SEGMENT DURING FORECAST PERIOD

- FIGURE 19 AGRICULTURAL ADJUVANTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 STRONG MARKET GROWTH FOR BIOSURFACTANTS IN EUROPEAN MARKET TILL 2030

- FIGURE 21 PRICE COMPARISON BETWEEN VEGETABLE OIL AND CRUDE OIL, 2018–2021

- FIGURE 22 VALUE CHAIN ANALYSIS OF AGRICULTURAL ADJUVANTS MARKET

- FIGURE 23 AGRICULTURAL ADJUVANTS MARKET: TRENDS IMPACTING BUYERS

- FIGURE 24 NUMBER OF PATENTS APPROVED FOR AGRICULTURAL ADJUVANTS IN GLOBAL MARKET, 2013–2023

- FIGURE 25 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR AGRICULTURAL ADJUVANTS, 2013–2023

- FIGURE 26 IMPORT DATA OF DISINFECTANTS FOR KEY COUNTRIES, 2018–2022 (‘000 USD)

- FIGURE 27 EXPORT DATA OF DISINFECTANTS FOR KEY COUNTRIES, 2018–2022 (‘000 USD)

- FIGURE 28 AGRICULTURAL ADJUVANTS MARKET: MARKET MAP

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING FOR KEY TYPES

- FIGURE 30 KEY BUYING CRITERIA FOR TOP TYPES

- FIGURE 31 IN-FORMULATION SEGMENT TO HOLD ACCOUNT FOR MARKET SIZE DURING FORECAST PERIOD

- FIGURE 32 HERBICIDES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 35 SUSPENSION CONCENTRATES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: REGIONAL SNAPSHOT

- FIGURE 38 REVENUE ANALYSIS FOR KEY PLAYERS, 2020–2022 (USD BILLION)

- FIGURE 39 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 40 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 41 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

- FIGURE 42 EVONIK INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 43 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

- FIGURE 44 NUFARM: COMPANY SNAPSHOT

- FIGURE 45 SOLVAY: COMPANY SNAPSHOT

- FIGURE 46 BASF SE: COMPANY SNAPSHOT

- FIGURE 47 STEPAN COMPANY: COMPANY SNAPSHOT

- FIGURE 48 CHS INC.: COMPANY SNAPSHOT

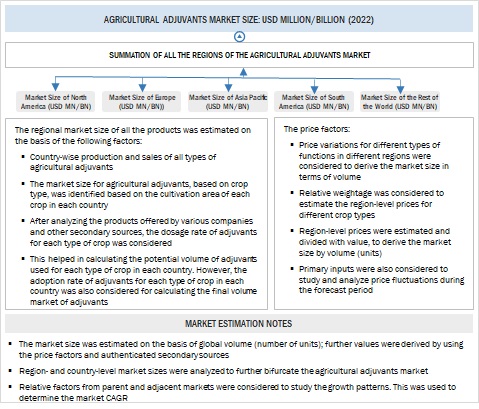

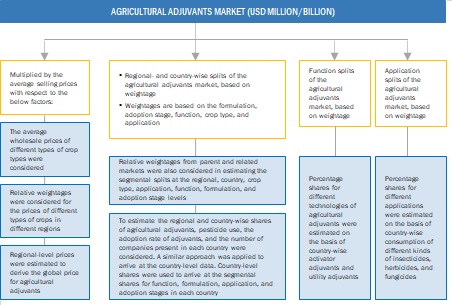

The study involved four major activities in estimating the current size of the agricultural adjuvants market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect valuable information for a technical, market-oriented, and commercial study of the agricultural adjuvants market.

In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the agricultural adjuvants market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the agricultural adjuvants market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the formulation, adoption stage, functions, crop types, application, and regional trends. Stakeholders from the demand side, such as dealers, distributors, farmers, and government authorities who are using agricultural adjuvants, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of agricultural adjuvants and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

designation |

|

BASF SE |

General Manager |

|

Corteva Agriscience |

Sales Manager |

|

Croda International Plc |

Director |

|

Solvay SA |

Individual Industry Expert |

|

Nufarm Limited |

Marketing Manager |

|

Clariant AG |

Sales Executive |

|

Evonik Industries AG |

Sales Manager |

|

WinField United |

Individual Industry Expert |

|

Huntsman International LLC. |

Manager |

|

Helena Agri-Enterprises, LLC |

Individual Industry Expert |

Agricultural Adjuvants Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the agricultural adjuvants market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- The revenues of the significant agricultural adjuvants players were determined through primary and secondary research, which were used as the basis for market sizing and estimation.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the agricultural adjuvants market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Agricultural Adjuvants Market: Bottom-Up Approach

Global Agricultural Adjuvants Market: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures described below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying different factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to the Australian Pesticides and Veterinary Medicines Authority (APVM), an agricultural adjuvant is described as “any substance (other than water) that is added to an agricultural chemical product to alter its physicochemical properties and/or improve its efficacy.”

Agricultural adjuvants are classified into two main categories depending on their functional properties:

- Adjuvants that enhance the efficacy of the pesticide-active ingredients

- Adjuvants that improve the ease of application

Key Stakeholders

- Manufacturers of Agricultural Adjuvants

- Traders, Distributors, and Suppliers of Agricultural Adjuvants

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Report Objectives

- Determining and projecting the size of the agricultural adjuvants market, with respect to the formulation, adoption stage, function, crop type, application, and regions, over five years, ranging from 2023 to 2028

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the agriculture adjuvants market growth (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- Shifts in demand patterns across different subsegments and regions

- Identifying and profiling the key market players in the agricultural adjuvants market

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe into Poland, Belgium, Sweden, and other EU & non-EU countries

- Further breakdown of the Rest of Asia Pacific into Taiwan, Indonesia, Thailand, and Bangladesh.

- Further breakdown of the Rest of South America into Chile, Uruguay, Peru, and other South American countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agriculture Adjuvants Market