Post-Harvest Treatment Market Size, Share, Industry Growth, Trends Report by Type (Coatings, Ethylene Blockers, Cleaners, Fungicides, Sprout Inhibitors, Sanitizers), Crop Type (Fruits, Vegetables and Flowers & Ornamentals), Origin (Natural and Synthetic), and Region - Global Forecast to 2028

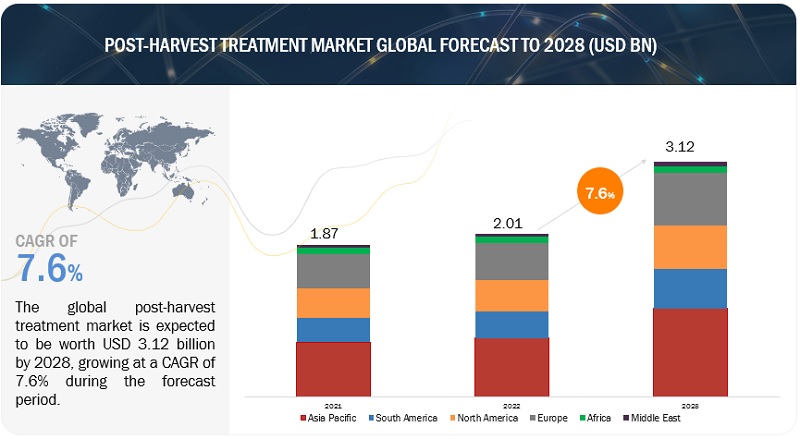

The global post-harvest treatment market size was estimated at USD 2.01 billion in 2022 and is projected to reach USD 3.12 billion by 2028, growing at a CAGR of 7.6%, during the study period. Fruit and vegetable post-harvest losses are estimated to range between 30 and 40%. This is a considerable amount of food that has been thrown away, implying a loss of both food and money. Post-harvest treatments can assist to decrease these losses by prolonging the shelf life of fruits and vegetables and making them less prone to rotting and deterioration. Post-harvest treatments can have a number of economic advantages, including reduced food waste, increased earnings, and improved market access. Apart from this it also creates opportunities for the export of the exotic fruits such as avocados, dragon fruits and jack fruit among others. These advantages may contribute to the post-harvest treatment business being more sustainable and lucrative. These are some of the reasons behind post-harvest treatment market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Post-Harvest Treatment Market Report Dynamics

Drivers: Increasing need to reduce post-harvest losses

Fruits and vegetables are two of the most important dietary commodities consumed worldwide. They are also perishable, making them more vulnerable to post-harvest losses. Post-harvest losses of fruits and vegetables are caused by a variety of reasons, including physical, physiological, and mechanical circumstances, as well as cleanliness. These horticulture crops have a high metabolic rate, which results in a shorter shelf life than other crops. As a result, certain losses occur between harvest and eating of these crops. Fruits and vegetables are vulnerable to abiotic and biotic stressors, resulting in significant losses after harvest owing to bacteria, insects, moisture loss, and respiration. External influences, on the other hand, such as exposure to oxygen and carbon dioxide, and increased ethylene levels also lead to losses of fruits and vegetables.

Restraints: Lack of infrastructure and improper post-harvest handling

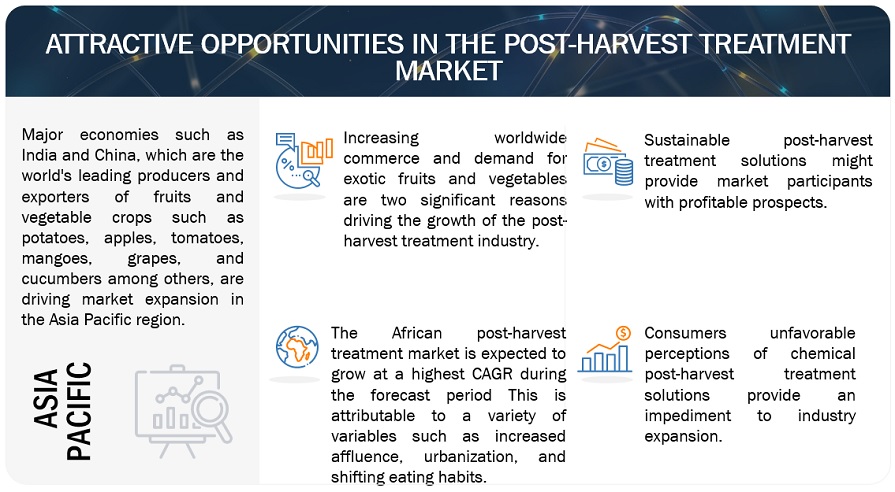

Mechanisation of practises such as harvesting, handling, and processing to adapt to weather conditions, production practises, management decisions, transportation facilities, grading issues, infrastructure, consumer preferences/attitudes, and the availability of financial markets are all part of post-harvest handling. Because of inappropriate crop management, losses occur at each level of post-harvest processing. For example, losses occur during steps such as drying, storage, and chemical application in less-developed and emerging nations when the supply chain is not entirely mechanized. One of the primary problems limiting market expansion is a lack of infrastructure and understanding in emerging countries about how to protect fruits and vegetables after harvesting. This is the case in emerging regions such as Asia Pacific, Africa, and South America.

Opportunities in the post-harvest treatment market: Development of organic and bio-based post-harvest products

Post-harvest treatment of fruits and vegetables using environmentally friendly technologies is a developing field. Growing consumer desire for higher food quality and safety, as well as a greater emphasis on maintaining healthy diets, are boosting demand for organic food items. Demand for organic fruits and vegetables is large in established countries such as North America and Europe, and is rising in other developing regions such as Asia Pacific. While traditional fruits and vegetables have remained consistent, demand for organic fruits and vegetables is predicted to increase rapidly in the future years. Organic fruits and vegetables necessitate chemical-free and environmentally friendly post-harvest treatment procedures.

To know about the assumptions considered for the study, download the pdf brochure

Challenges: Low awareness of post-harvest losses and product applications

Farmers, particularly in underdeveloped nations, are less aware of the advantages of post-harvest treatment. Farmers' perceptions of these compounds must shift in order for them to obtain knowledge. This will have a significant impact on the market dynamics for post-harvest treatment goods. Farmers and other stakeholders, such as distributors and merchants, face challenges due to a lack of understanding. knowledge programs are needed in the Asia Pacific area to raise knowledge about the cost of investment in post-harvest treatment and post-harvest losses in countries such as India, Iran, and Cambodia.

Market Ecosystem

Key players in global post-harvest treatment market have strong distribution network and have strong financial records. These firms have experience of several years, well established manufacturing facilities, r&d centers, and skilled workforce. Prominent players in this market include JBT (US), AgroFresh (US), Syngenta Crop Protection AG (Switzerland), DECCO (US), and BASF (Germany).

By type, coatings is projected to gain largest share in the post-harvest treatment market during the study period

The global commerce in fruits and vegetables is rapidly expanding. This necessitates the development of post-harvest treatments to assist preserve the freshness and safety of fruits and vegetables throughout transportation and storage. Organic and sustainable products are becoming increasingly popular among consumers. This is increasing demand for post-harvest treatments derived from natural and sustainable chemicals. Convenience foods, such as pre-cut and pre-washed fruits and vegetables, are growing popular among the consumers. This is creating a demand for coatings that can assist to increase the shelf life of these items while also making them more user-friendly. Thus, driving the growth of segment in the market.

By crop type, fruits is forecasted to be the largest segment in the market during the research period

Fruits are frequently consumed raw, which means they are not cooked or treated before consumption. As a result, they are more prone to deterioration and loss during post-harvest processing. Fruits are a seasonal crop, which means they are only accessible for a short period of time each year. This may raise the demand for post-harvest treatments, as producers and merchants seek ways to extend the shelf life of fruits in order to keep them available for extended periods of time.

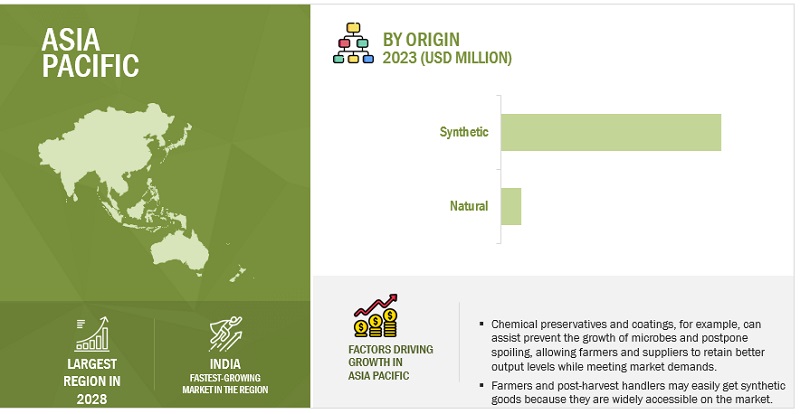

By origin, synthetic segment is anticipated to occupy major share in the post-harvest treatment market during the study period

This is because they are less expensive to create and use, synthetic items are frequently more cost-effective than natural products. Synthetic products are often more easy to use than natural treatments since they are easier to apply and do not necessitate as much specialized equipment. A substantial corpus of research is being conducted to produce novel and creative synthetic post-harvest treatments. This is resulting in the creation of more effective, cost-efficient, and user-friendly goods.

Several major countries in Asia Pacific region such as India are still agricultural economies with most of the population having agriculture as their main occupations. The governments in the region are promoting soil testing so that the farmers can supplement essential nutrients to crops which are not present in soil in sufficient quantities. The increasing modern agricultural practices and requirement of high-quality agricultural produce are expected to drive the post-harvest treatment market growth in the region.

Key Market Players:

Key players in this market include JBT (US), Syngenta Crop Protection AG (Switzerland), Nufarm (Australia), AgroFresh (US), Bayer AG (Germany), BASF (Germany), Citrosol (Spain), Hazel Technologies, Inc. (US), Lytone Enterprise, Inc. (Taiwan), Shandong Aoweite Biotechnology Co.,Ltd (China), Fine Chemicals Inc. (US), Apeel Sciences (US), Janssen PMP (Belgium), COLIN CAMPBELL (CHEMICALS) PTY LTD (Australia), Futureco Bioscience (Barcelona), DECCO (US), Pace International, LLC (US), and Xeda International S. A. S. (France).

Scope of the Post-Harvest Treatment Market Report

|

Report Metric |

Details |

|

Market size valuation in 2022 |

USD 2.01 billion |

|

Market size prediction in 2028 |

USD 3.12 billion |

|

Growth Rate |

CAGR of 7.6% |

|

Units considered |

Value (USD Million/Billion) and Volume (KT) |

|

Segments covered |

By type, by crop type, by origin, and region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, Africa and Middle East |

|

Key Companies studied |

|

Post-Harvest Treatment Market Report Segmentation

The study categorizes the global market based on by type, by crop type, by origin, and region.

|

Report Metric |

Details |

|

By Type |

|

|

By Crop type |

|

|

By Origin |

|

|

By Region |

|

Post-Harvest Treatment Market Recent Developments

- In May 2023, Janssen PMP (Belgium) partnered with Kitozyme, LLC. (Belgium). This collaboration intends to investigate and develop cutting-edge technology from Kitozyme, LLC (Belgium) for post-harvest application on fresh fruit, utilizing Janssen PMP's knowledge and resources in this space.

- In January 2022, Syngenta Crop Protection AG (Switzerland) launched a new fungicide by the name Archive to control the diseases occurring during the post-harvest.

- In January 2022, Hazel Technologies, Inc. (US) announced an expansion in Asia Pacific region. The company expanded their presence and started the product offering in countries like New Zealand and Singapore.

Frequently Asked Questions (FAQ):

Which crop varieties are evaluated in this study, and which crop types are expected to have promising future growth rates?

Fruits, vegetables, and flowers and ornamentals are the principal crop kinds investigated in this study. Fruits are expected to increase at a faster pace in the future, followed by vegetables.

I'm interested in the post-harvest treatment sector in Europe. Which nations are part of this region?

Exclusive insights on below Europe countries will be provided:

- Spain

- Italy

- Netherlands

- Belgium

- Germany

- UK

- Poland

- Turkey

- Russia

- Greece

- Portugal

- Bulgaria

- Rest of Europe

Can you elaborate on any additional factors driving the growth of the post-harvest treatment market?

Global post-harvest treatment market is characterized by the following driver:

- Availability of Wide range of crop particular products

What is the overall CAGR projected for the post-harvest treatment market between 2023 and 2028?

The Overall CAGR is projected to record a CAGR of 7.6% between 2023 and 2028.

What information is included in the competitive landscape section?

Company profiles for significant players include information such as a business overview including the company's business segments, financials, regional presence, revenue mix, and business revenue mix. The company profiles section also includes information on product offerings, important developments linked with the firm, and MnM opinion, which gives an in-depth analyst perspective on the company.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSASIA’S SHARE IN GLOBAL MIDDLE-CLASS CONSUMPTION TO GROW RAPIDLYINCREASING FOOD & BEVERAGE INDUSTRY TO DRIVE DEMAND FOR FRUITS AND VEGETABLES

-

5.3 MARKET DYNAMICSDRIVERS- Increasing need to reduce post-harvest losses- Growing trade and demand for exotic fruits and vegetables- Increasing government support and FDI in agriculture and food sectorRESTRAINTS- Stringent regulations in post-harvest treatment market- Lack of infrastructure and improper post-harvest handlingOPPORTUNITIES- Development of organic and bio-based post-harvest products- Sustainable post-harvest treatment products to propel marketCHALLENGES- Low awareness of post-harvest losses and product applications

- 6.1 INTRODUCTION

-

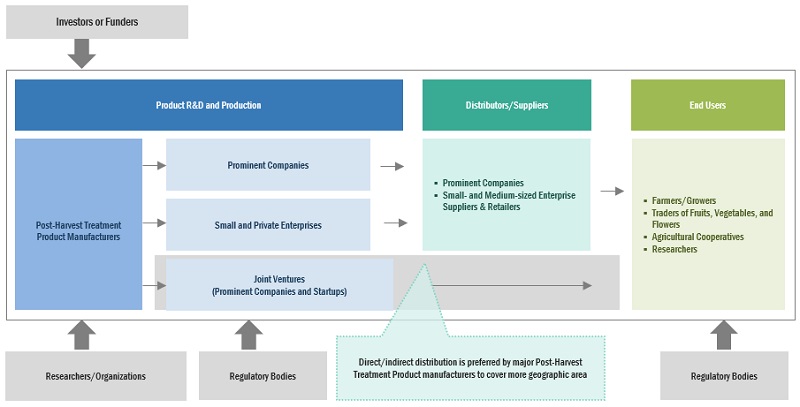

6.2 VALUE CHAINRESEARCH & DEVELOPMENT AND RAW MATERIAL SOURCINGMANUFACTURINGDISTRIBUTIONEND USERS

- 6.3 SUPPLY CHAIN ANALYSIS

-

6.4 MARKET MAP AND ECOSYSTEM OF POST-HARVEST TREATMENT MARKETDEMAND SIDESUPPLY SIDEECOSYSTEM MAP

-

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS IN POST-HARVEST TREATMENT MARKET

- 6.6 TECHNOLOGICAL ANALYSIS

-

6.7 PRICING ANALYSISSELLING PRICE CHARGED BY KEY PLAYERS IN TERMS OF TYPE

-

6.8 POST-HARVEST TREATMENT MARKET: PATENT ANALYSISLIST OF MAJOR PATENTS

-

6.9 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

- 6.10 KEY CONFERENCES AND EVENTS

-

6.11 CASE STUDIESAGROFRESH: POST-HARVEST TREATMENT TO MAINTAIN FRESHNESS FOR LONGER DURATIONSUFRESCA: INCREASED SHELF-LIFE WITH EDIBLE COATING

-

6.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.13 REGULATORY FRAMEWORKNORTH AMERICA- USEUROPEASIA PACIFIC- India- JapanSOUTH AMERICA- Brazil- ArgentinaAFRICA- TanzaniaMIDDLE EAST- Abu Dhabi

-

6.14 PORTER’S FIVE FORCES ANALYSISPOST-HARVEST TREATMENT MARKET: PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS

-

6.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.16 RECESSION IMPACT ON POST-HARVEST TREATMENT MARKETMACRO INDICATORS OF RECESSION

- 7.1 INTRODUCTION

-

7.2 COATINGSPOLYSACCHARIDES- Increase in demand for edible films and coatings made of bio-based materialPROTEINS- Use of protein-based coatings to extend shelf-life of fruitsLIPIDS- Lipid-based coatings of plums, apples, and bell peppersOTHER COATINGS

-

7.3 ETHYLENE BLOCKERSETHYLENE BLOCKERS TO INHIBIT RIPENING OF FRUITS & VEGETABLES

-

7.4 CLEANERSUSE OF CHLORINE-BASED CLEANERS FOR POST-HARVEST TREATMENT

-

7.5 FUNGICIDESFLUDIOXONIL- Ease of cross-border licensing for fludioxonil to foster its saleIMAZALIL- Imazalil to inhibit rotting and decompositionPYRIMETHANIL- Application of pyrimethanil to citrus fruitsTHIABENDAZOLE- Use of thiabendazole as an ingredient in waxes coated on fruits and vegetablesOTHER FUNGICIDES

-

7.6 SPROUT INHIBITORSUSE OF SPROUT INHIBITORS FOR POST-HARVEST TREATMENT OF VEGETABLES SUCH AS POTATOES AND ONIONS

-

7.7 SANITIZERSGROWING CONCERNS TOWARD FOOD SAFETY TO SUPPORT DEMAND FOR SANITIZERS

-

7.8 OTHER TYPESSO2 GENERATING PADS- Increased berries trade to drive marketMAP BAGS- Cost effective nature of MAP bags to propel marketABSORBERS- Absorbers' small size to drive market

- 8.1 INTRODUCTION

-

8.2 FRUITSAPPLES- Growing demand for apples to drive marketBANANAS- Increasing consumption of bananas to fuel growthGRAPES- High perishable nature of grapes to drive demand for post-harvest treatmentCITRUS FRUITS- Favourable climate in Asia pacific to drive marketSTONE FRUITS- High demand from Europe and highly perishable nature of stone fruit to drive market- Avocados- MANGOES- DATES- LYCHEE- CHERRY- Other Stone FruitsPEAR- Pears to require post-harvest treatment due to their climacteric naturePINEAPPLES- Increase in export of pineapples to drive growthBERRIES- STRAWBERRIES- BLACKBERRIES- BLUEBERRIES- RASPBERRIES- RED CURRANTS- Other BerriesPAPAYAS- Popularity of tropical fruits to drive marketKIWI- Extreme sensitivity of ethylene blockers to raise demand for post-harvest ethylene blockers in kiwifruitsFIGS- Modified atmosphere technology to spur growthOTHER FRUITS- High fruit losses to fuel growth of post-harvest treatment

-

8.3 VEGETABLESTOMATOES- Rise in demand for tomatoes in processed food industry to drive need for post-harvest treatmentPOTATOES- Sprout inhibitors to be used for potato post-harvest treatmentBROCCOLI- Steady rise in production rate of broccoli to increases demand for post-harvest treatmentCAULIFLOWER- High consumption of cauliflower to drive demand for post-harvest treatmentPEPPERS- Growing demand for bell peppers to surge market growthASPARAGUS- High perishability of asparagus contributes to growth of post-harvest treatment marketGINGER- Decrease in winter temperature to fuel growth of post-harvest treatment market of gingerONIONS- Market for onion’s post-harvest treatment to be lowOTHER VEGETABLES

-

8.4 FLOWERS AND ORNAMENTALSROSES- Ethylene absorbers to drive demand to maintain freshnessOTHER FLOWERS AND ORNAMENTALS

- 9.1 INTRODUCTION

-

9.2 NATURALDEMAND FOR BIO-BASED COATING TREATMENTS TO TRIGGER MARKET GROWTH

-

9.3 SYNTHETICSYNTHETIC CHEMICALS TO GAIN MARKET SHARE TO REDUCE MICROBIAL SPOILAGE OF FRUITS & VEGETABLES

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Bio-based post-harvest solutions to drive marketCANADA- Growing research activities in organic post-harvest treatment to offer growth opportunitiesMEXICO- Higher fruit exports to US to drive market

-

10.3 EUROPEEUROPE: RECESSION IMPACTSPAIN- Growth in exports of fruits & vegetables to fuel marketNETHERLANDS- Netherlands exports fruits and vegetables on a large scaleITALY- Advancements in post-harvest processing technology to support market growthBELGIUM- High demand from processed food industry to drive production of fruits and vegetablesGERMANY- Increasing consumer awareness of fresh and organic fruits & vegetables to drive market growthTURKEY- Increasing exports to drive post-harvest treatment market growthUK- Focus on creating self-sufficiency of fruits and vegetables to drive market growthGREECE- Focus of government on post-harvest smart fresh technology to drive marketPORTUGAL- Increasing production of fruits & vegetables to drive market growthRUSSIA- Ban on imports from various countries to make Russia self-sufficient nationPOLAND- Interest of consumers toward Polish apples to drive market growthBULGARIA- Internal demand for fruits and vegetables to drive market.REST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Government to implement laws and regulations for correct use of post-harvest treatmentINDIA- Increased exports of fruits and vegetables to drive marketJAPAN- Increasing government focus on production of fresh domestic fruits and vegetables to drive marketAUSTRALIA- Rapid surge in export of horticultural produce to fuel market growthNEW ZEALAND- Increase in export of fruits and vegetables to drive marketREST OF ASIA PACIFIC

-

10.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- High export of fruits to China to drive market growth in BrazilARGENTINA- Increase in organic fruit and vegetable exports to drive market growthCOSTA RICA- Rise in export opportunities to drive market growthECUADOR- Middle-income country and high climatic changes to lead post-harvest treatment marketCHILE- Increasing need to prevent post-harvest losses to drive marketPERU- High production/exports of fruits and vegetables to drive marketCOLOMBIA- Increasing growth rate of Colombia to increase growth of marketREST OF SOUTH AMERICA

-

10.6 AFRICAAFRICA: RECESSION IMPACT ANALYSISSOUTH AFRICA- Climate conditions and export demand to drive marketEGYPT- Government program to strengthen agribusiness and drive market for post-harvest treatmentMOROCCO- New collaborations to drive market for post-harvest treatmentKENYA- Agriculture to be main economic driver for opportunities in post-harvest treatment marketETHIOPIA- Huge potential for production and export of fresh produce to drive marketREST OF AFRICA

-

10.7 MIDDLE EASTMIDDLE EAST: RECESSION IMPACT ANALYSISKUWAIT- Increased demand for fungicide and coating to drive marketAZERBAIJAN- Increased export to boost demand for post-harvest productsREST OF MIDDLE EAST

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

- 11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021

- 11.4 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 11.6 COMPANY FOOTPRINT

-

11.7 POST-HARVEST TREATMENT MARKET: START-UP/ SME EVALUATION QUADRANT, 2021PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES- COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

- 12.1 INTRODUCTION

-

12.2 KEY COMPANIESJBT CORPORATION- Business overview- Products/Solutions offered- Recent developments- MnM viewSYNGENTA CROP PROTECTION AG- Business overview- Products/Solutions offered- Recent developments- MnM viewNUFARM- Business overview- Products/Solutions offered- MnM viewBAYER AG- Business overview- Products/Solutions offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions offered- Recent developments- MnM viewAGROFRESH- Business overview- Products/Solutions offered- Recent developments- MnM viewDECCO- Business overview- Products/Solutions offered- Recent developments- MnM viewPACE INTERNATIONAL LLC- Business overview- Products/Solutions offered- Recent developments- MnM viewXEDA INTERNATIONAL- Business overview- Products/Solutions offered- Recent developments- MnM viewFOMESA FRUITECH- Business overview- Products/Solutions offered- Recent developments- MnM viewCITROSOL- Business overview- Products/Solutions offered- Recent developments- MnM viewAPEEL SCIENCES- Business overview- Products/Solutions offered- Recent developments- MnM viewJANSSEN PMP- Business overview- Products/Solutions offered- Recent developments- MnM viewCOLIN CAMPBELL (CHEMICALS) PTY LTD- Business overview- Products/Solutions offered- Recent developments- MnM viewFUTURECO BIOSCIENCE- Business overview- Products/Solutions offered- Recent developments- MnM view

-

12.3 OTHER PLAYERSSUFRESCA- Business overview- Products/Solutions offered- Recent developments- MnM viewCERADIS- Business overview- Products/Solutions offered- Recent developments- MnM viewPOLYNATURAL- Business overview- Products/Solutions offered- Recent developments- MnM viewPOST-HARVEST SOLUTIONS LTD- Business overview- Products/Solutions offered- Recent developments- MnM viewAGRICOAT NATURESEAL LTD- Business overview- Products/Solutions offered- Recent developments- MnM viewGREENPOD LABS PVT LTD.MORIAGROSUSTAIN S.A.HAZEL TECHNOLOGIESNAT4BIO

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 CROP PROTECTION CHEMICALS MARKETMARKET DEFINITIONMARKET OVERVIEWCROP PROTECTION MARKET, BY TYPECROP PROTECTION MARKET, BY REGION

-

13.4 FUNGICIDE MARKETMARKET DEFINITIONMARKET OVERVIEWFUNGICIDE MARKET, BY TYPEFUNGICIDE MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2021

- TABLE 2 POST-HARVEST TREATMENT MARKET SHARE SNAPSHOT, 2022 VS. 2028 (USD MILLION)

- TABLE 3 POST-HARVEST TREATMENT MARKET: ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE FOR TYPE, 2022 (USD/KG)

- TABLE 5 COATINGS: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

- TABLE 6 ETHYLENE BLOCKERS: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

- TABLE 7 CLEANERS: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

- TABLE 8 FUNGICIDES: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

- TABLE 9 SPROUT INHIBITORS: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

- TABLE 10 SANITIZERS: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

- TABLE 11 OTHER TYPES: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

- TABLE 12 LIST OF FEW PATENTS IN POST-HARVEST TREATMENT, 2019–2022

- TABLE 13 EXPORT DATA OF POST-HARVEST TREATMENT FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 14 IMPORT DATA OF POST-HARVEST TREATMENT FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 15 KEY CONFERENCES AND EVENTS IN POST-HARVEST TREATMENT, 2022–2023

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- TABLE 21 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 22 POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 23 POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 24 POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 25 POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (KT)

- TABLE 26 COATINGS: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 27 COATINGS: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 28 COATINGS: POST-HARVEST MARKET, BY REGION, 2017–2021 (KT)

- TABLE 29 COATINGS: POST-HARVEST MARKET, BY REGION, 2022–2028 (KT)

- TABLE 30 POLYSACCHARIDES: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 31 POLYSACCHARIDES: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 32 PROTEINS: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 33 PROTEINS: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 34 LIPIDS: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 35 LIPIDS: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 36 OTHER COATINGS: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 37 OTHER COATINGS: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 38 ETHYLENE BLOCKERS: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 39 ETHYLENE BLOCKERS: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 40 ETHYLENE BLOCKERS: POST-HARVEST MARKET, BY REGION, 2017–2021 (KT)

- TABLE 41 ETHYLENE BLOCKERS: POST-HARVEST MARKET, BY REGION, 2022–2028 (KT)

- TABLE 42 CLEANERS: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 43 CLEANERS: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 44 CLEANERS: POST-HARVEST MARKET, BY REGION, 2017–2021 (KT)

- TABLE 45 CLEANERS: POST-HARVEST MARKET, BY REGION, 2022–2028 (KT)

- TABLE 46 FUNGICIDES: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 47 FUNGICIDES: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 48 FUNGICIDES: POST-HARVEST MARKET, BY REGION, 2017–2021 (KT)

- TABLE 49 FUNGICIDES: POST-HARVEST MARKET, BY REGION, 2022–2028 (KT)

- TABLE 50 FLUDIOXONIL: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 51 FLUDIOXONIL: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 52 IMAZALIL: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 53 IMAZALIL: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 54 PYRIMETHANIL: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 55 PYRIMETHANIL: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 56 THIABENDAZOLE: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 57 THIABENDAZOLE: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 58 OTHER FUNGICIDES: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 59 OTHER FUNGICIDES: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 60 SPROUT INHIBITORS: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 61 SPROUT INHIBITORS: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 62 SPROUT INHIBITORS: POST-HARVEST MARKET, BY REGION, 2017–2021 (KT)

- TABLE 63 SPROUT INHIBITORS: POST-HARVEST MARKET, BY REGION, 2022–2028 (KT)

- TABLE 64 SANITIZERS: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 65 SANITIZERS: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 66 SANITIZERS: POST-HARVEST MARKET, BY REGION, 2017–2021 (KT)

- TABLE 67 SANITIZERS: POST-HARVEST MARKET, BY REGION, 2022–2028 (KT)

- TABLE 68 OTHER TYPES: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 69 OTHER TYPES: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 70 OTHER TYPES: POST-HARVEST MARKET, BY REGION, 2017–2021 (KT)

- TABLE 71 OTHER TYPES: POST-HARVEST MARKET, BY REGION, 2022–2028 (KT)

- TABLE 72 SO2 GENERATING PADS: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 73 SO2 GENERATING PADS: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 74 MAP BAGS: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 75 MAP BAGS: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 76 ABSORBERS: POST-HARVEST MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 77 ABSORBERS: POST-HARVEST MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 78 POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 79 POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2022–2028 (USD MILLION)

- TABLE 80 POST-HARVEST TREATMENT MARKET, BY FRUIT CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 81 POST-HARVEST TREATMENT MARKET, BY FRUIT CROP TYPE, 2022–2028 (USD MILLION)

- TABLE 82 POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 83 POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 84 POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2017–2021 (USD MILLION)

- TABLE 85 POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2022–2028 (USD MILLION)

- TABLE 86 POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2017–2021 (USD MILLION)

- TABLE 87 POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2022–2028 (USD MILLION)

- TABLE 88 POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2017–2021 (USD MILLION)

- TABLE 89 POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2022–2028 (USD MILLION)

- TABLE 90 FRUITS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 91 FRUITS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 92 APPLES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 93 APPLES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 94 BANANAS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 95 BANANAS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 96 GRAPES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 97 GRAPES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 98 CITRUS FRUITS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 99 CITRUS FRUITS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 100 STONE FRUITS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 101 STONE FRUITS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 102 AVOCADOS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 103 AVOCADOS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 104 MANGO: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 105 MANGO: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 106 DATES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 107 DATES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 108 LYCHEE: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 109 LYCHEE: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 110 CHERRY: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 111 CHERRY: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 112 OTHER STONE FRUITS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 113 OTHER STONE FRUITS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 114 PEARS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 115 PEARS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 116 PINEAPPLES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 117 PINEAPPLES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 118 BERRIES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 119 BERRIES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 120 STRAWBERRIES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 121 STRAWBERRIES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 122 BLACKBERRIES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 123 BLACKBERRIES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 124 BLUEBERRIES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 125 BLUEBERRIES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 126 RASPBERRIES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 127 RASPBERRIES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 128 RED CURRANTS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 129 RED CURRANTS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 130 OTHER BERRIES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 131 OTHER BERRIES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 132 PAPAYAS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 133 PAPAYAS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 134 KIWI: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 135 KIWI: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 136 FIGS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 137 FIGS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 138 OTHER FRUITS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 139 OTHER FRUITS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 140 VEGETABLES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 141 VEGETABLES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 142 TOMATOES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 143 TOMATOES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 144 POTATOES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 145 POTATOES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 146 BROCCOLI: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 147 BROCCOLI: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 148 CAULIFLOWER: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 149 CAULIFLOWER: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 150 PEPPERS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 151 PEPPERS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 152 ASPARAGUS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 153 ASPARAGUS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 154 GINGER: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 155 GINGER: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 156 ONIONS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 157 ONIONS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 158 POST-HARVEST LOSSES IN VEGETABLES

- TABLE 159 OTHER VEGETABLES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 160 OTHER VEGETABLES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 161 FLOWERS & ORNAMENTALS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 162 FLOWERS & ORNAMENTALS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 163 ROSES: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 164 ROSES: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 165 OTHER FLOWERS & ORNAMENTALS: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 166 OTHER FLOWERS & ORNAMENTALS: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 167 POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2017–2021 (USD MILLION)

- TABLE 168 POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2022–2028 (USD MILLION)

- TABLE 169 NATURAL: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 170 NATURAL: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 171 SYNTHETIC: POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 172 SYNTHETIC: POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 173 GLOBAL POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 174 GLOBAL POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 175 GLOBAL POST-HARVEST TREATMENT MARKET, BY REGION, 2017–2021 (KT)

- TABLE 176 GLOBAL POST-HARVEST TREATMENT MARKET, BY REGION, 2022–2028 (KT)

- TABLE 177 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 178 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 179 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 180 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2022–2028 (USD MILLION)

- TABLE 181 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 182 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 183 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 184 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 185 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2017–2021 (USD MILLION)

- TABLE 186 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2022–2028 (USD MILLION)

- TABLE 187 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2017–2021 (USD MILLION)

- TABLE 188 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2022–2028 (USD MILLION)

- TABLE 189 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2017–2021 (USD MILLION)

- TABLE 190 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2022–2028 (USD MILLION)

- TABLE 191 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2017–2021 (USD MILLION)

- TABLE 192 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2022–2028 (USD MILLION)

- TABLE 193 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 194 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 195 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 196 NORTH AMERICA: POST-HARVEST TREATMENT MARKET SIZE, BY TYPE, 2022–2028 (KT)

- TABLE 197 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY COATING TYPE, 2017–2021 (USD MILLION)

- TABLE 198 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY COATING TYPE, 2022–2028 (USD MILLION)

- TABLE 199 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY FUNGICIDE TYPE, 2017–2021 (USD MILLION)

- TABLE 200 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY FUNGICIDE TYPE, 2022–2028 (USD MILLION)

- TABLE 201 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY OTHER TYPE, 2017–2021 (USD MILLION)

- TABLE 202 NORTH AMERICA: POST-HARVEST TREATMENT MARKET, BY OTHER TYPE, 2022–2028 (USD MILLION)

- TABLE 203 US: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 204 US: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 205 CANADA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 206 CANADA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 207 MEXICO: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 208 MEXICO: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 209 EUROPE: POST-HARVEST TREATMENT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 210 EUROPE: POST-HARVEST TREATMENT MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 211 EUROPE: POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 212 EUROPE: POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2022–2028 (USD MILLION)

- TABLE 213 EUROPE: POST-HARVEST TREATMENT MARKET, BY FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 214 EUROPE: POST-HARVEST TREATMENT MARKET, BY FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 215 EUROPE: POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 216 EUROPE: POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 217 EUROPE: POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2017–2021 (USD MILLION)

- TABLE 218 EUROPE: POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2022–2028 (USD MILLION)

- TABLE 219 EUROPE: POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2017–2021 (USD MILLION)

- TABLE 220 EUROPE: POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2022–2028 (USD MILLION)

- TABLE 221 EUROPE: POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2017–2021 (USD MILLION)

- TABLE 222 EUROPE: POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2022–2028 (USD MILLION)

- TABLE 223 EUROPE: POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2017–2021 (USD MILLION)

- TABLE 224 EUROPE: POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2022–2028 (USD MILLION)

- TABLE 225 EUROPE: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 226 EUROPE: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 227 EUROPE: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 228 EUROPE: POST-HARVEST TREATMENT MARKET SIZE, BY TYPE, 2022–2028 (KT)

- TABLE 229 EUROPE: POST-HARVEST TREATMENT MARKET, BY COATING TYPE, 2017–2021 (USD MILLION)

- TABLE 230 EUROPE: POST-HARVEST TREATMENT MARKET, BY COATING TYPE, 2022–2028 (USD MILLION)

- TABLE 231 EUROPE: POST-HARVEST TREATMENT MARKET, BY FUNGICIDE TYPE, 2017–2021 (USD MILLION)

- TABLE 232 EUROPE: POST-HARVEST TREATMENT MARKET, BY FUNGICIDE TYPE, 2022–2028 (USD MILLION)

- TABLE 233 EUROPE: POST-HARVEST TREATMENT MARKET, BY OTHER TYPE, 2017–2021 (USD MILLION)

- TABLE 234 EUROPE: POST-HARVEST TREATMENT MARKET, BY OTHER TYPE, 2022–2028 (USD MILLION)

- TABLE 235 SPAIN: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 236 SPAIN: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 237 NETHERLANDS: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 238 NETHERLANDS: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 239 ITALY: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 240 ITALY: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 241 BELGIUM: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 242 BELGIUM: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 243 GERMANY: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 244 GERMANY: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 245 TURKEY: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 246 TURKEY: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 247 UK: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 248 UK: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 249 GREECE: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 250 GREECE: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 251 PORTUGAL: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 252 PORTUGAL: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 253 RUSSIA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 254 RUSSIA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 255 POLAND: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 256 POLAND: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 257 BULGARIA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 258 BULGARIA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 259 REST OF EUROPE: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 260 REST OF EUROPE: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 261 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 262 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 263 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 264 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2022–2028 (USD MILLION)

- TABLE 265 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 266 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 267 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 268 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 269 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2017–2021 (USD MILLION)

- TABLE 270 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2022–2028 (USD MILLION)

- TABLE 271 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2017–2021 (USD MILLION)

- TABLE 272 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2022–2028 (USD MILLION)

- TABLE 273 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2017–2021 (USD MILLION)

- TABLE 274 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2022–2028 (USD MILLION)

- TABLE 275 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2017–2021 (USD MILLION)

- TABLE 276 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2022–2028 (USD MILLION)

- TABLE 277 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 278 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 279 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 280 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (KT)

- TABLE 281 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY COATING TYPE, 2017–2021 (USD MILLION)

- TABLE 282 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY COATING TYPE, 2022–2028 (USD MILLION)

- TABLE 283 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY FUNGICIDE TYPE, 2017–2021 (USD MILLION)

- TABLE 284 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY FUNGICIDE TYPE, 2022–2028 (USD MILLION)

- TABLE 285 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY OTHER TYPE, 2017–2021 (USD MILLION)

- TABLE 286 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY OTHER TYPE, 2022–2028 (USD MILLION)

- TABLE 287 CHINA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 288 CHINA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 289 INDIA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 290 INDIA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 291 JAPAN: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 292 JAPAN: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 293 AUSTRALIA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 294 AUSTRALIA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 295 NEW ZEALAND: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 296 NEW ZEALAND: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 297 REST OF ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 298 REST OF ASIA PACIFIC: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 299 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 300 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 301 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 302 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2022–2028 (USD MILLION)

- TABLE 303 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 304 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 305 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 306 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 307 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2017–2021 (USD MILLION)

- TABLE 308 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2022–2028 (USD MILLION)

- TABLE 309 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2017–2021 (USD MILLION)

- TABLE 310 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2022–2028 (USD MILLION)

- TABLE 311 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY FLOWERS & ORNAMENTAL TYPE, 2017–2021 (USD MILLION)

- TABLE 312 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2022–2028 (USD MILLION)

- TABLE 313 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2017–2021 (USD MILLION)

- TABLE 314 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2022–2028 (USD MILLION)

- TABLE 315 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 316 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 317 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 318 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET SIZE, BY TYPE, 2022–2028 (KT)

- TABLE 319 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY COATING TYPE, 2017–2021 (USD MILLION)

- TABLE 320 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY COATING TYPE, 2022–2028 (USD MILLION)

- TABLE 321 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY FUNGICIDES TYPE, 2017–2021 (USD MILLION)

- TABLE 322 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY FUNGICIDE TYPE, 2022–2028 (USD MILLION)

- TABLE 323 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY OTHER TYPE, 2017–2021 (USD MILLION)

- TABLE 324 SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY OTHER TYPE, 2022–2028 (USD MILLION)

- TABLE 325 BRAZIL: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 326 BRAZIL: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 327 ARGENTINA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 328 ARGENTINA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 329 COSTA RICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 330 COSTA RICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 331 ECUADOR: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 332 ECUADOR: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 333 CHILE: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 334 CHILE: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 335 PERU: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 336 PERU: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 337 COLOMBIA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 338 COLOMBIA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 339 REST OF SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 340 REST OF SOUTH AMERICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 341 AFRICA: POST-HARVEST TREATMENT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 342 AFRICA: POST-HARVEST TREATMENT MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 343 AFRICA: POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 344 AFRICA: POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2022–2028 (USD MILLION)

- TABLE 345 AFRICA: POST-HARVEST TREATMENT MARKET, BY FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 346 AFRICA: POST-HARVEST TREATMENT MARKET, BY FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 347 AFRICA: POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 348 AFRICA: POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 349 AFRICA: POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2017–2021 (USD MILLION)

- TABLE 350 AFRICA: POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2022–2028 (USD MILLION)

- TABLE 351 AFRICA: POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2017–2021 (USD MILLION)

- TABLE 352 AFRICA: POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2022–2028 (USD MILLION)

- TABLE 353 AFRICA: POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2017–2021 (USD MILLION)

- TABLE 354 AFRICA: POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2022–2028 (USD MILLION)

- TABLE 355 AFRICA: POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2017–2021 (USD MILLION)

- TABLE 356 AFRICA: POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2022–2028 (USD MILLION)

- TABLE 357 AFRICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 358 AFRICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 359 AFRICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 360 AFRICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (KT)

- TABLE 361 AFRICA: POST-HARVEST TREATMENT MARKET, BY COATING TYPE, 2017–2021 (USD MILLION)

- TABLE 362 AFRICA: POST-HARVEST TREATMENT MARKET, BY COATING TYPE, 2022–2028 (USD MILLION)

- TABLE 363 AFRICA: POST-HARVEST TREATMENT MARKET, BY FUNGICIDE TYPE, 2017–2021 (USD MILLION)

- TABLE 364 AFRICA: POST-HARVEST TREATMENT MARKET, BY FUNGICIDE TYPE, 2022–2028 (USD MILLION)

- TABLE 365 AFRICA: POST-HARVEST TREATMENT MARKET, BY OTHER TYPE, 2017–2021 (USD MILLION)

- TABLE 366 AFRICA: POST-HARVEST TREATMENT MARKET, BY OTHER TYPE, 2022–2028 (USD MILLION)

- TABLE 367 SOUTH AFRICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)TO

- TABLE 368 SOUTH AFRICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 369 EGYPT: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 370 EGYPT: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 371 MOROCCO: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 372 MOROCCO: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 373 KENYA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 374 KENYA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 375 ETHIOPIA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 376 ETHIOPIA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 377 REST OF AFRICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 378 REST OF AFRICA: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 379 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 380 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 381 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 382 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2022–2028 (USD MILLION)

- TABLE 383 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 384 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 385 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2017–2021 (USD MILLION)

- TABLE 386 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY STONE FRUIT TYPE, 2022–2028 (USD MILLION)

- TABLE 387 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2017–2021 (USD MILLION)

- TABLE 388 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY BERRY TYPE, 2022–2028 (USD MILLION)

- TABLE 389 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2017–2021 (USD MILLION)

- TABLE 390 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY VEGETABLE TYPE, 2022–2028 (USD MILLION)

- TABLE 391 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2017–2021 (USD MILLION)

- TABLE 392 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY FLOWER & ORNAMENTAL TYPE, 2022–2028 (USD MILLION)

- TABLE 393 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2017–2021 (USD MILLION)

- TABLE 394 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2022–2028 (USD MILLION)

- TABLE 395 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 396 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 397 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 398 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (KT)

- TABLE 399 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY COATING TYPE, 2017–2021 (USD MILLION)

- TABLE 400 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY COATING TYPE, 2022–2028 (USD MILLION)

- TABLE 401 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY FUNGICIDE TYPE, 2017–2021 (USD MILLION)

- TABLE 402 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY FUNGICIDE TYPE, 2022–2028 (USD MILLION)

- TABLE 403 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY OTHER TYPE, 2017–2021 (USD MILLION)

- TABLE 404 MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY OTHER TYPE, 2022–2028 (USD MILLION)

- TABLE 405 KUWAIT: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 406 KUWAIT: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 407 AZERBAIJAN: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 408 AZERBAIJAN: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 409 REST OF MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 410 REST OF MIDDLE EAST: POST-HARVEST TREATMENT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 411 POST-HARVEST TREATMENT MARKET: DEGREE OF COMPETITION

- TABLE 412 TYPE FOOTPRINT

- TABLE 413 CROP TYPE FOOTPRINT

- TABLE 414 REGIONAL FOOTPRINT

- TABLE 415 OVERALL, COMPANY FOOTPRINT

- TABLE 416 POST HARVEST TREATMENT MARKET: DETAILED LIST OF KEY STARTUP/SME

- TABLE 417 POST HARVEST TREATMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- TABLE 418 POST-HARVEST TREATMENT MARKET: PRODUCT LAUNCHES, 2021-2022

- TABLE 419 POST-HARVEST TREATMENT MARKET: DEALS, 2018-2022

- TABLE 420 JBT CORPORATION: COMPANY OVERVIEW

- TABLE 421 JBT CORPORATION: PRODUCT LAUNCHES

- TABLE 422 SYNGENTA CROP PROTECTION AG: BUSINESS OVERVIEW

- TABLE 423 SYNGENTA CROP PROTECTION AG: PRODUCT LAUNCHES

- TABLE 424 NUFARM: BUSINESS OVERVIEW

- TABLE 425 BAYER AG: BUSINESS OVERVIEW

- TABLE 426 ALFA LAVAL: DEALS

- TABLE 427 BASF SE: BUSINESS OVERVIEW

- TABLE 428 AGROFRESH: BUSINESS OVERVIEW

- TABLE 429 AGROFRESH: PRODUCT LAUNCHES

- TABLE 430 AGROFRESH: DEALS

- TABLE 431 DECCO: BUSINESS OVERVIEW

- TABLE 432 DECCO: DEALS

- TABLE 433 PACE INTERNATIONAL LLC: BUSINESS OVERVIEW

- TABLE 434 PACE INTERNATIONAL LLC: PRODUCT LAUNCHES

- TABLE 435 XEDA INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 436 FOMESA FRUITECH: BUSINESS OVERVIEW

- TABLE 437 CITROSOL: BUSINESS OVERVIEW

- TABLE 438 CITROSOL: PRODUCT LAUNCHES

- TABLE 439 APEEL SCIENCES: BUSINESS OVERVIEW

- TABLE 440 JANSSEN PMP: BUSINESS OVERVIEW

- TABLE 441 JANSSEN PNP: DEALS

- TABLE 442 COLIN CAMPBELL (CHEMICALS) PTY LTD: BUSINESS OVERVIEW

- TABLE 443 COLIN CAMPBELL (CHEMICALS) PTY LTD: PRODUCT LAUNCHES

- TABLE 444 FUTURECO BIOSCIENCE: BUSINESS OVERVIEW

- TABLE 445 SUFRESCA: BUSINESS OVERVIEW

- TABLE 446 CERADIS: BUSINESS OVERVIEW

- TABLE 447 CERADIS: DEALS

- TABLE 448 POLYNATURAL: BUSINESS OVERVIEW

- TABLE 449 POST-HARVEST SOLUTIONS LTD: BUSINESS OVERVIEW

- TABLE 450 AGRICOAT NATURESEAL LTD: BUSINESS OVERVIEW

- TABLE 451 GREENPOD LABS PVT LTD.: COMPANY OVERVIEW

- TABLE 452 MORI: COMPANY OVERVIEW

- TABLE 453 AGROSUSTAIN S.A.: COMPANY OVERVIEW

- TABLE 454 HAZEL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 455 NAT4BIO: COMPANY OVERVIEW

- TABLE 456 ADJACENT MARKETS TO POST-HARVEST TREATMENT

- TABLE 457 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2016–2019 (USD MILLION)

- TABLE 458 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2020–2025 (USD MILLION)

- TABLE 459 CROP PROTECTION CHEMICALS MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 460 CROP PROTECTION CHEMICALS MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 461 FUNGICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 462 FUNGICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 463 FUNGICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 464 FUNGICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 POST-HARVEST TREATMENT: MARKET SEGMENTATION

- FIGURE 2 POST-HARVEST TREATMENT: GEOGRAPHIC SEGMENTATION

- FIGURE 3 POST-HARVEST TREATMENT MARKET: RESEARCH DESIGN

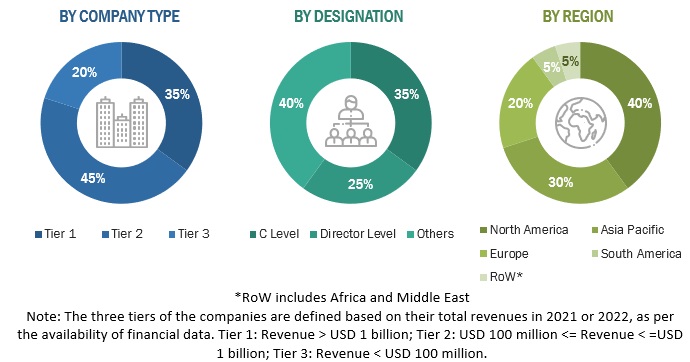

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 POST-HARVEST TREATMENT MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 POST-HARVEST TREATMENT MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 POST-HARVEST TREATMENT MARKET SIZE ESTIMATION, BY SIZE (SUPPLY SIDE)

- FIGURE 8 POST-HARVEST TREATMENT MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 POST-HARVEST TREATMENT MARKET, BY TYPE, 2022 VS. 2028 (USD MILLION)

- FIGURE 11 POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2022 VS. 2028 (USD MILLION)

- FIGURE 12 POST-HARVEST TREATMENT MARKET SHARE, BY ORIGIN, 2022 VS. 2028

- FIGURE 13 POST-HARVEST TREATMENT MARKET SHARE & GROWTH, BY REGION

- FIGURE 14 REDUCTION IN POST-HARVEST LOSSES THROUGH INNOVATIVE TECHNOLOGY TO DRIVE GROWTH

- FIGURE 15 COATINGS ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 16 SYNTHETIC SEGMENT ACCOUNTED FOR LARGER SHARE IN 2022

- FIGURE 17 ASIA PACIFIC: DEMAND FOR HIGH-QUALITY CROPS TO SPUR MARKET GROWTH

- FIGURE 18 CHINA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 20 ASIA: MIDDLE-CLASS POPULATION (BILLION)

- FIGURE 21 POST-HARVEST TREATMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 SHARE OF FOOD LOST IN POST-HARVEST PROCESSES BY REGION, 2020

- FIGURE 23 IMPORT VALUE OF FRESH FRUITS AND VEGETABLES IN EUROPE, 2021 (RE-IMPORTED PRODUCTS)

- FIGURE 24 POST-HARVEST TREATMENT MARKET: VALUE CHAIN

- FIGURE 25 POST-HARVEST TREATMENT MARKET: SUPPLY CHAIN

- FIGURE 26 POST-HARVEST TREATMENT MARKET: ECOSYSTEM MAP

- FIGURE 27 REVENUE SHIFT IMPACTING TRENDS/DISRUPTIONS IN POST-HARVEST TREATMENT MARKET

- FIGURE 28 SELLING PRICE OF KEY PLAYERS FOR POST-HARVEST TREATMENT TYPE

- FIGURE 29 AVERAGE SELLING PRICE, BY TYPE, 2017–2021 (USD/KG)

- FIGURE 30 NUMBER OF PATENTS GRANTED FOR POST-HARVEST TREATMENT, 2011–2022

- FIGURE 31 REGIONAL ANALYSIS OF PATENTS GRANTED FOR POST-HARVEST TREATMENT, 2019–2022

- FIGURE 32 POST-HARVEST TREATMENT EXPORTS, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 33 POST-HARVEST TREATMENT IMPORTS, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- FIGURE 35 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 36 INDICATORS OF RECESSION

- FIGURE 37 WORLD INFLATION RATE: 2011-2021

- FIGURE 38 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 39 RECESSION INDICATORS AND THEIR IMPACT ON POST-HARVEST TREATMENT MARKET

- FIGURE 40 POST-HARVEST TREATMENT MARKET: EARLIER FORECAST VS RECESSION FORECAST

- FIGURE 41 POST-HARVEST TREATMENT MARKET, BY TYPE, 2022 VS. 2028 (USD MILLION)

- FIGURE 42 POST-HARVEST TREATMENT MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 43 GLOBAL POTATO PRODUCTION, 2020

- FIGURE 44 POST-HARVEST TREATMENT MARKET, BY ORIGIN, 2022 VS. 2028 (USD MILLION)

- FIGURE 45 POST-HARVEST TREATMENT MARKET, BY REGION, 2022 VS. 2028 (USD MILLION)

- FIGURE 46 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN ASIA PACIFIC, 2021–2028

- FIGURE 47 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 48 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 49 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 50 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 51 AGRICULTURAL OUTPUT IN SPAIN, 2018-2020 (USD MILLION)

- FIGURE 52 PRODUCTION OF FRUITS & VEGETABLES IN PORTUGAL, 2018-2020 (THOUSAND TONS)

- FIGURE 53 EXPORT OF FRESH FRUITS & VEGETABLES ,POLAND, 2018-2020 (USD MILLION)

- FIGURE 54 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 55 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 56 ASIA PACIFIC: POST-HARVEST TREATMENT MARKET SNAPSHOT

- FIGURE 57 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 58 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 59 AFRICA: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 60 AFRICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 61 AFRICA: POST-HARVEST TREATMENT MARKET SNAPSHOT

- FIGURE 62 MIDDLE EAST: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 63 MIDDLE EAST: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 64 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2017–2021 (USD BILLION)

- FIGURE 65 POST-HARVEST TREATMENT MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2021

- FIGURE 66 POST-HARVEST TREATMENT MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2021

- FIGURE 67 JBT CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 SYNGENTA CROP PROTECTION AG: COMPANY SNAPSHOT

- FIGURE 69 NUFARM: COMPANY SNAPSHOT (2022)

- FIGURE 70 BAYER AG: COMPANY SNAPSHOT

- FIGURE 71 BASF SE: COMPANY SNAPSHOT

- FIGURE 72 AGROFRESH: COMPANY SNAPSHOT

- FIGURE 73 DECCO: COMPANY SNAPSHOT

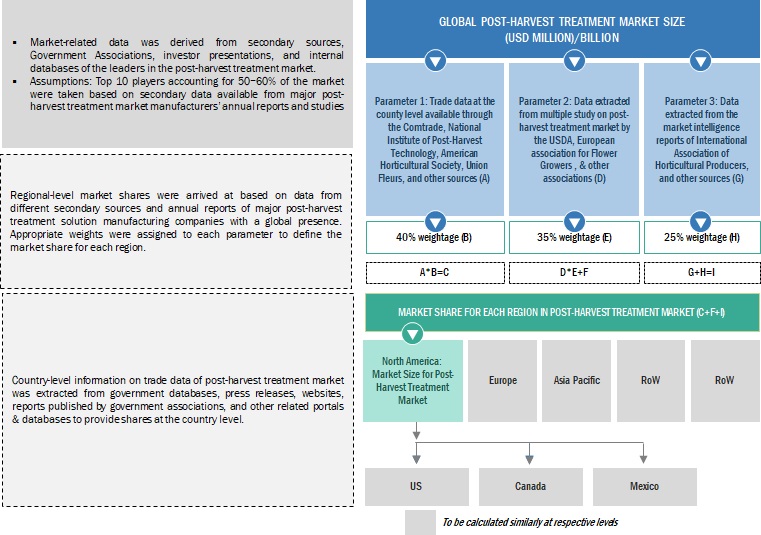

This study makes considerable use of secondary sources, directories, and databases (Bloomberg and Factiva) to find and collect data for a technical, market-oriented, and commercial assessment of the post-harvest treatment market. To acquire and verify crucial qualitative and quantitative information and to analyze prospects, in-depth interviews were performed with a variety of primary respondents, including major industry participants, Subject Matter Experts (SMEs), C-level executives of significant market companies, and industry consultants.

Secondary Research

Various sources, including the Food and Agricultural Organisation (FAO), the International Society for Horticulture Sciences (ISHS), the Portuguese Association for Horticulture, the Confederation of Horticulture Associations of India, the National Institute of Post-Harvest Technology, the American Horticulture Society, the Indian Academy of Horticulture Science (IAHS), the International Association of Horticultural Producers (AIPH), and Union Fleurs-International Flower Union, were used in the secondary research process Journals, press releases, company investor presentations, whitepapers, certified publications, articles by recognized authors and regulatory agencies, trade directories, and paid databases are further examples of secondary sources.

Secondary research was undertaken to collect important information about the industry's supply chain, the complete pool of significant players, and market categorization and segmentation based on industry trends and regional marketplaces. It was also utilised to gather information about major developments from a market standpoint.

Primary Research

The post-harvest treatment market includes a diverse set of players, including post-harvest treatment solution manufacturers and suppliers, agrochemical manufacturers, floriculture and horticulture organizations, and regulatory agencies participating in the supply chain. Interviews with numerous primary sources covering both the supply and demand sides of the industry were done to collect complete data. The supply side interviewees included research institutes involved in technical breakthroughs, post-harvest treatment solution distributors and wholesalers, importers and exporters, post-harvest treatment solution manufacturers, and technology suppliers. On the demand side, important opinion leaders, executives, vice presidents, and CEOs of horticulture and floriculture firms were polled via surveys, emails, and phone interviews.

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Post-Harvest Treatment Market Size Estimation

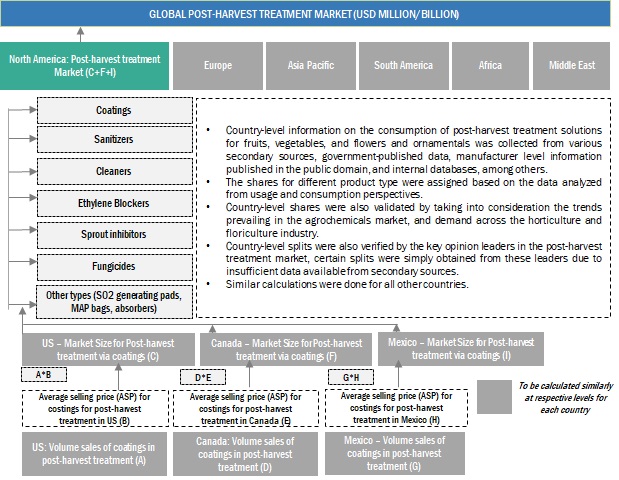

To estimate and validate the entire size of the post harvest treatment market, both top-down and bottom-up methodologies were applied. These methodologies were widely employed to estimate the size of market subsegments. The following information is included in the research approach used to estimate market size:

- The key players in the industry and the markets were identified through extensive secondary research.

- The market was determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Post-Harvest Treatment Market Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Post-Harvest Treatment Market Market Size: Top Down Approach

Data Triangulation

Following the estimating procedure described above, the whole market was divided into many segments and subsegments. Wherever possible, data triangulation and market breakdown processes were used to estimate the entire post-harvest treatment market and get accurate statistics for all categories and subsegments. The data was triangulated by examining numerous aspects and trends on both the demand and supply sides. In addition, the market size was confirmed using both the top-down and bottom-up methodologies.

Market Definition

Post-harvest handling is a vital stage in the total crop production process in agriculture. Harvested items are metabolically active and go through numerous ripening and senescence processes that must be regulated in order to maintain the produce's post-harvest quality.

"Post-harvest treatments deal with fruit protection and enhance fruit quality," says Decco, a key player in the post-harvest treatment business. The invention of post-harvest treatments enabled the establishment of the current worldwide fruit and vegetable trade."

Key Stakeholders

- Manufacturers of chemicals used as raw materials for fungicides, coatings, and cleaners

- Manufacturers & processors of end-products, such as fruits and vegetables

- Post-harvest treatment solution manufacturers

- R&D laboratories

- Intermediary suppliers such as traders and distributors of fruits and vegetables

- Government and research organizations

-

Associations and industry bodies:

- Food and Agriculture Organization (FAO)

- FAO Food Safety Council (FSC)

- International Society for Horticulture Sciences (ISHS)

- The Portuguese Association for Horticulture

- The Confederation of Horticulture Associations of India

- Venture capitalists and investors

Post-Harvest Treatment Market Report Objectives

- To determine and project the size of the post harvest treatment industry with respect to by type, by crop type, by origin, and region

- To identify the attractive opportunities in the market by determining the largest and fastest growing segments across regions

- To provide detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To provide the regulatory framework for major countries related to the post harvest treatment market

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To understand the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- To analyze the value chain and products across the key regions and their impact on the prominent market players

- To provide insights on key product innovations and investments in the global post-harvest treatment market

Available Customizations

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe's post-harvest treatment market into Sweden, Norway, and Denmark.

- Further breakdown of the Rest of Asia Pacific market into Vietnam, Malaysia, Thailand, and Indonesia.

- Further breakdown of the Rest of the South American market into Gautamala, Honduras, and Venezuela.

- Further breakdown of the Rest of the Africa market into Madagascar and Uganda.

- Further breakdown of the Rest of the Middle East market Israel and Oman.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Post-Harvest Treatment Market

I would like to know if the Post-harvest treatment market analysis; market size could be segmented according to the various drying process, such as open air / sun drying, forced air drying, infused drying etc., Extrusion process and the market size segmented by product ?

Which are the new technologies used in post-harvest storage?

Which are the new technologies used in post-harvest storage?