Antifog Additives Market by Type (Glycerol Esters, Polyglycerol Esters, Sorbitan Esters of Fatty Acids, Ethoxylated Sorbitan Esters), Application (Food Packaging Films, Agricultural Films), Geography - Global Forecast to 2024

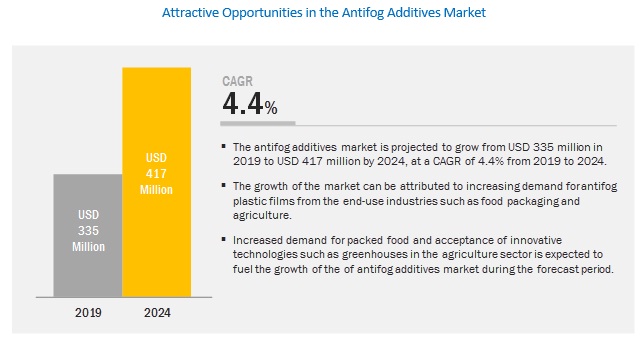

[166 Pages Report] The antifog additives market is projected to grow from USD 335 million in 2019 to USD 417 million by 2024, at a CAGR of 4.4% from 2019 to 2024. Surging demand for antifog films from the end use industries such as food packaging and agriculture is fueling the growth of the market across the globe. Increasing demand for packaged food from emerging economies acts as an opportunity for the growth of the antifog additives market, worldwide.

Based on application, the food packaging segment of the antifog additives market is projected to grow at the highest CAGR in terms of both value and volume from 2019 to 2024.

Based on application, the food packaging segment of the market is projected to grow at the highest CAGR during the forecast period in terms of both value and volume. Antifog additives are primarily used in the production of polymer films to induce antifogging property in them, which are further used in the packaging of food items such as vegetables, fruits, breads, among others.

Based on type, the glycerol ester segment of the antifog additives market is projected to grow at a higher CAGR from 2019 to 2024 in terms of both value and volume.

Based on type, the antifog additives market has been segmented into glycerol esters, polyglycerol esters, sorbitan esters of fatty acids, ethoxylated sorbitan esters, polyoxyethylene esters of oleic acid, gelatin, titanium dioxide, and others. The glycerol esters type segment is projected to lead the market during the forecast period in terms of both value and volume. Glycerol ester type antifog additives have the largest market share in the global antifog additives market, followed by polyglycerol and sorbitan esters. The demand for glycerol ester antifog additives will continue to rise as these are safe to use in the food packaging films application and are cheaply available.

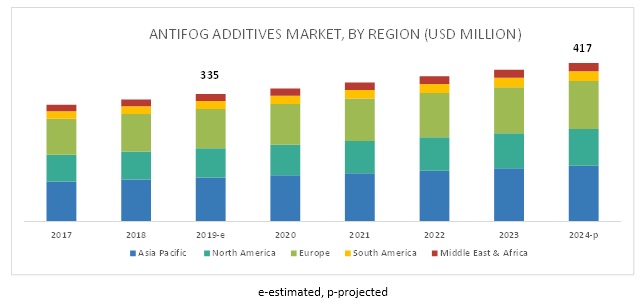

The Asia Pacific region is projected to lead the antifog additives market during the forecast period in terms of both value and volume.

The Asia Pacific region is estimated to be the largest market for antifog additives in 2019. China, India, Japan, and South Korea are the major consumers of antifog additives in this region. This high demand is mainly attributed to the growing affluence of the middle-class population in this region, coupled with rapid urbanization that has further led to rise in consumerism opportunities, which ultimately drives the antifog additives market in this country.

Key Market Players

Nouryon (Netherlands), Croda International Plc. (U.K.), Clariant AG (Switzerland), A. Schulman (U.S.), PolyOne Corporation (U.S.), Evonik Industries (Germany), DuPont (U.S.), Ashland Inc. (U.S.) and Corbion N.V. (Netherlands) are some of the leading players operating in the antifog additives market. These players have adopted the strategies of expansions, new product developments, acquisitions, and investments to enhance their position in the market.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2024 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2024 |

|

Forecast Units |

Volume (Kilotons) and Value (USD Million) |

|

Segments Covered |

Application, Type, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

|

Companies Covered |

Nouryon (Netherlands), Croda International Plc. (U.K.), Clariant AG (Switzerland), A. Schulman (U.S.), PolyOne Corporation (U.S.), Evonik Industries (Germany), DuPont (U.S.), Ashland Inc. (U.S.) and Corbion N.V. (Netherlands) |

This research report categorizes the antifog additives market based on application, type, and region and forecasts revenues as well as analyzes trends in each of these submarkets.

Based on application, the antifog additives market has been segmented into:

- Agricultural Films

- Food Packaging

- Others (coating films for helmets, goggles, mirrors)

Based on type the antifog additives market has been segmented into:

- Glycerol Esters

- Polyglycerol Ester

- Sorbitan Esters of fatty acids

- Ethoxylated Sorbitan Esters

- Polyoxyethylene esters of oleic acid

- Gelatin

- Titanium Dioxide

Based on region, the antifog additives market has been segmented into:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In January 2018, PolyOne Corporation acquired the IQAP Master batch Group S.L., a privately owned and innovative provider of specialty colorants and additives based in Spain with customers throughout Europe. IQAP has built a technical and broad solutions portfolio that serves high-growth end markets consistent with PolyOne's focus, including transportation, packaging, consumer, wire & cable, and textiles. With two production facilities and a technology lab located in Spain, plus additional manufacturing capability in the Czech Republic, PolyOne will implement its proven invest-to-grow approach to integration and customer service.

- In January 2018, Clariant Ag opened its new state-of-the-art masterbatch production site in Yanbu, Saudi Arabia. The site is owned by Clariant Masterbatches Saudi Arabia, a joint venture between Clariant and Rowad, a leading plastic products manufacturer in the Middle East and part of Tasnee, Saudi Arabia's second largest industrial company. The location provides the site easy access to key raw materials and enables it to supply customers in Saudi Arabia as well as expands their global network with a stronger position in the Middle East and Africa region, one of the important growth markets for plastic applications.

Key Questions Addressed by the Report:

- How developments undertaken by various companies are expected to affect the antifog additives market in the mid- to long-term?

- What are the upcoming industry applications of antifog additives?

- What is the impact of changes in government policies on the antifog additives market?

- What is the estimated size of the antifog additives market in 2019?

- What are the different applications of antifog additives?

Frequently Asked Questions (FAQ):

What are antifog additives?

What are the different applications of antifog-additives?

What are the different types of antifog-additives?

What are the key driving factors for the growth of global antifog additives market?

What is the biggest challenge for the growth of antifog additives market?

What are the key regions in the global antifog additives market?

Who are the key players of the global antifog additives market and what strategic initiatives are being implemented by them for business growth?

What is the degree of competition in the global antifog additives market?

What is the key restraint which may hinder the growth of this market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

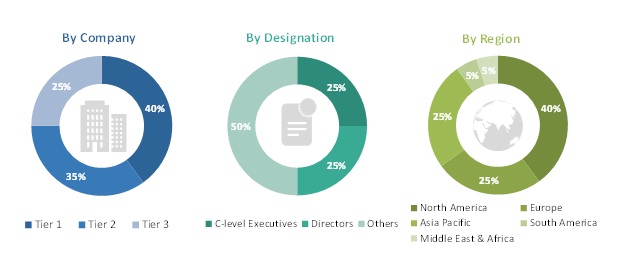

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in Antifog Additives Market

4.2 Antifog Additives Market, By Region

4.3 Antifog Additives Market in Asia Pacific, By Type and Country

4.4 Antifog Additives Market: Major Countries

5 Market Overview (Page No. - 39)

5.1 Introduction

5.1.1 Antifog Additives

5.1.2 Drivers

5.1.2.1 Increasing Income of the Middle-Class Population in Emerging Economies

5.1.2.2 Low-Cost Production of Antifog Additives in Asia Pacific Due to the Easy Availability of Cheap Labor and Raw Materials

5.1.2.3 Growth of the Food Processing and Food Packaging Sectors in India and China

5.1.3 Restraints

5.1.3.1 Stringent Governmental Regulations Related to the Use of Antifog Additives in Food Packaging Films

5.1.3.2 Dependence on Industries Manufacturing Agricultural and Food Packaging Films

5.1.4 Opportunities

5.1.4.1 Innovations in the Field of Antifog Additives

5.1.5 Challenges

5.1.5.1 Managing Waste From the Industries Manufacturing Food Packaging and Agricultural Films

5.1.5.2 Requirement of Heavy Investments in R&D to Understand Chemistry and Develop New Products

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Porter’s Five Forces Analysis

6.2.1 Threat of New Entrants

6.2.2 Threat of Substitutes

6.2.3 Bargaining Power of Suppliers

6.2.4 Bargaining Power of Buyers

6.2.5 Intensity of Competitive Rivalry

6.3 Economic Indicators

6.3.1 Industry Outlook

6.3.1.1 Agriculture Industry

6.3.1.2 Plastic Packaging Industry

7 Antifog Additives Market, By Type (Page No. - 49)

7.1 Introduction

7.2 Glycerol Esters

7.2.1 Glycerol Esters is the Largest and Fastest Growing Application Segment

7.3 Polyglycerol Esters

7.3.1 Polyglyceral Esters Accounted for the Second Largest Share in the Global Antifog Addtives Market

7.4 Sorbitan Esters of Fatty Acids

7.4.1 Sorbitan Esters Due to their Compatilibilty With Pvc are Growing in Demand

7.5 Ethoxylated Sorbitan Esters

7.5.1 Ethoxylated Sorbitan Esters Accounted for A Major Share in the Global Antifog Additives Market

7.6 Polyoxyethylene Esters of Oleic Acid

7.6.1 Polyoxyethylene Esters of Oleic Acid Accounted for A Major Share in the Global Antifog Additives Market

7.7 Gelatin

7.7.1 Gelatin Antifog Addtives are Majorly Used in the Food Packaging Application Segment

7.8 Titanium Dioxide

7.8.1 Titanium Dioxide is Majorly Used as an Antifog Additive for Coating Mirrors and Glasses

7.9 Others

8 Antifog Additives Market, By Application (Page No. - 60)

8.1 Introduction

8.2 Food Packaging Films

8.2.1 Food Packaging Films Application Segment Accounted for the Largest Share in the Global Antifog Additives Market

8.3 Agricultural Films

8.3.1 High Demand for Antifog Films From the Agriculture Sector in Developing Countries is Expected to Drive the Agricultural Film Application Segment 64

8.4 Others

9 Antifog Additives Market, By Region (Page No. - 67)

9.1 Introduction

9.2 Asia Pacific

9.2.1 China

9.2.1.1 China Accounted for the Highest Share in the Global Market of Antifog Additives

9.2.2 India

9.2.2.1 High Demand for Food Packaging Films and Agricultural Films is Expected to Drive the Indian Market of Antifog Additives

9.2.3 Japan

9.2.3.1 Japan Accounted for the Third Largest Share in the Asia Pacific Antifog Additives Market

9.2.4 South Korea

9.2.4.1 High Demand for Agricultural Films is Expected to Drive the South Korean Antifog Additives Market

9.2.5 Indonesia

9.2.5.1 Rapid Economic Development has Created A High Demand for Food Packaging and Agricultural Films has Resulted in High Demand for Antifog Additives 77

9.2.6 Malaysia

9.2.6.1 High Demand for Food Packaging and Agricultural Films is Expected to Drive the Malaysian Antifog Additives Market

9.2.7 Rest of APAC

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany Accounted for the Highest Share in the Europe Antifog Additives Market

9.3.2 UK

9.3.2.1 UK Accounted for the Third Largest Share in the European Antifog Additives Market

9.3.3 France

9.3.3.1 France Accounted for the Fourth Largest Share in the European Antifog Additives Market

9.3.4 Italy

9.3.4.1 High Demand for Antifog Agricultural Films From the Growing Horticulture Industry is Expected to Drive the Italian Antifog Additives Market

9.3.5 Russia

9.3.5.1 Russia Accounted for A Major Share in the European Antifog Additives Market

9.3.6 Spain

9.3.6.1 High Demand for Antifog Agricultural Films From the Horticulture Industry is Expected to Drive the Antifog Additives Market in Spain

9.3.7 Rest of Europe

9.4 North America

9.4.1 US

9.4.1.1 US Accounted for the Highest Share in the North American Antifog Additives Market

9.4.2 Canada

9.4.2.1 Canada Accounted for the Second Largest Share in the North American Antifog Additives Market

9.4.3 Mexico

9.4.3.1 Rising Demand for Agricultural and Food Packaging Films is Expected to Drive the Antifog Additives Market in Mexico

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.1.1 Saudi Arabia Accounted for the Largest Share in the Middle East & Africa Antifog Additives Market

9.5.2 UAE

9.5.2.1 UAE Accounted for the Second Largest Share in the Middle East & Africa Antifog Additives Market

9.5.3 Rest of Mea

9.6 South America

9.6.1 Brazil

9.6.1.1 Brazil Accounted for the Highest Share in the South American Antifog Additives Market

9.6.2 Argentina

9.6.2.1 Growing Demand for Agricultural Films and Food Packaging Films is Expected to Drive the Argentina Antifog Additives Market

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 110)

10.1 Introduction

10.2 Competitive Landscape Mapping

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging Companies

10.3 Competitive Benchmarking

10.3.1 Strength of Product Portfolio

10.3.2 Business Strategy Excellence

10.4 Overview

10.5 Competitive Situation & Trends

10.5.1 Product Developments

10.5.2 Investments

10.5.3 Acquisitions

10.5.4 Expansions

10.6 Market Share Analysis

11 Company Profiles (Page No. - 120)

11.1 Nouryon

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 MnM View

11.2 Croda International Plc.

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Clariant AG

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Evonik Industries AG

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 Ashland Inc.

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 SWOT Analysis

11.5.4 MnM View

11.6 Dowdupont Inc.

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 SWOT Analysis

11.7 Polyone Corporation

11.7.1 Business Overview

11.7.2 Product Portfolio

11.7.3 Recent Developments

11.7.4 SWOT Analysis

11.7.5 MnM View

11.8 Corbion N.V.

11.8.1 Business Overview

11.8.2 Product Portfolio

11.8.3 SWOT Analysis

11.8.4 MnM View

11.9 PCC SE

11.9.1 Business Overview

11.9.2 Product Portfolio

11.10 Fine Organics Industries Ltd

11.10.1 Business Overview

11.10.2 Product Portfolio

11.10.3 Recent Developments

11.11 Riken Vitamin Co., Ltd.

11.11.1 Business Overview

11.11.2 Product Portfolio

11.12 Ampacet Corporation

11.12.1 Business Overview

11.12.2 Product Portfolio

11.12.3 Recent Developments

11.13 Byk Netherlands B.V.

11.13.1 Business Overview

11.13.2 Product Portfolio

11.13.3 Recent Developments

11.14 Polyvel Inc.

11.14.1 Business Overview

11.14.2 `Product Portfolio

11.15 Palsgaard A/S

11.15.1 Business Overview

11.15.2 Product Portfolio

11.16 Emery Oleochemicals

11.16.1 Business Overview

11.16.2 Product Portfolio

11.16.3 Recent Developments

11.17 Tosaf Compounds Ltd.

11.17.1 Business Overview

11.17.2 Product Portfolio

11.17.3 Recent Developments

11.18 Jj Plastalloy Pvt Ltd

11.18.1 Business Overview

11.18.2 Product Portfolio

11.19 High Technology Masterbatches S.L.

11.19.1 Business Overview

11.19.2 Product Portfolio

11.20 Nassolkem (P) Ltd.

11.20.1 Business Overview

11.20.2 Product Portfolio

11.21 Ilshinwells

11.21.1 Business Overview

11.21.2 Product Portfolio

11.22 Ioi Oleo GmbH

11.22.1 Business Overview

11.22.2 Product Portfolio

11.23 Kafrit Industries (1993) Ltd

11.23.1 Business Overview

11.23.2 Product Portfolio

11.24 Viba S.P.A

11.24.1 Business Overview

11.24.2 Product Portfolio

11.25 Gabriel-Chemie Gesellschaft Mbh

11.25.1 Business Overview

11.25.2 Product Portfolio

11.25.3 Recent Developments

11.26 Ehmann&Voss&Co.

11.26.1 Business Overview

11.26.2 Product Portfolio

11.27 Sabo S.P.A.

11.27.1 Business Overview

11.27.2 Product Portfolio

12 Appendix (Page No. - 160)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (111 Tables)

Table 1 Antifog Additives Market Snapshot

Table 2 World Flexible Packaging Data

Table 3 Factors Impacting the Plastic Packaging Market

Table 4 Market, By Type, 2017–2024 (Kilotons)

Table 5 Market, By Type, 2017–2024 (USD Million)

Table 6 Market of Glycerol Esters Antifog Additives, By Region, 2017–2024 (Kilotons)

Table 7 Market of Glycerol Esters Antifog Additives, By Region, 2017–2024 (USD Million)

Table 8 Market of Polyglycerol Esters Antifog Additives, By Region, 2017–2024 (Kilotons)

Table 9 Market of Polyglycerol Esters Antifog Additives, By Region, 2017–2024 (USD Million)

Table 10 Market of Sorbitan Esters of Fatty Acids Antifog Additives, By Region, 2017–2024 (Kilotons)

Table 11 Market of Sorbitan Esters of Fatty Acids Antifog Additives, By Region, 2017–2024 (USD Million)

Table 12 Market of Ethoxylated Sorbitan Esters Antifog Additives, By Region, 2017–2024 (Kilotons)

Table 13 Market of Ethoxylated Sorbitan Esters Antifog Additives, By Region, 2017–2024 (USD Million)

Table 14 Market of Polyoxyethylene Esters of Oleic Acid Antifog Additives, By Region, 2017–2024 (Kilotons)

Table 15 Market of Polyoxyethylene Esters of Oleic Acid Antifog Additives, By Region, 2017–2024 (USD Million)

Table 16 Market of Gelatin Antifog Additives, By Region, 2017–2024 (Kilotons)

Table 17 Market of Gelatin Antifog Additives, By Region, 2017–2024 (USD Million)

Table 18 Market of Titanium Dioxide Additives, By Region, 2017–2024 (Kilotons)

Table 19 Market of Titanium Dioxide Additives, By Region, 2017–2024 (USD Million)

Table 20 Market of Other Additives, By Region, 2017–2024 (Kilotons)

Table 21 Market of Other Additives, By Region, 2017–2024 (USD Million)

Table 22 Antifog Additives Market, By Application, 2017–2024 (Kilotons)

Table 23 Market, By Application, 2017–2024 (USD Million)

Table 24 Market in Food Packaging Films, By Region, 2017–2024 (Kilotons)

Table 25 Market in Food Packaging Films, By Region, 2017–2024 (USD Million)

Table 26 Market in Agricultural Films, By Region, 2017–2024 (Kilotons)

Table 27 Market in Agricultural Films, By Region, 2017–2024 (USD Million)

Table 28 Market in Other Applications, By Region, 2017–2024 (Kilotons)

Table 29 Market in Other Applications, By Region, 2017–2024 (USD Million)

Table 30 Market, By Region, 2017–2024 (Kilotons)

Table 31 Market, By Region, 2017–2024 (USD Million)

Table 32 Asia Pacific Antifog Additives Market, By Type, 2017–2024 (Kilotons)

Table 33 Asia Pacific Market, By Type, 2017–2024 (USD Million)

Table 34 Asia Pacific Market, By Country, 2017–2024 (Kilotons)

Table 35 Asia Pacific Market, By Country, 2017–2024 (USD Million)

Table 36 Asia Pacific Market, By Application, 2017–2024 (Kilotons)

Table 37 Asia Pacific Market, By Application, 2017–2024 (USD Million)

Table 38 China Market, By Application, 2017–2024 (Kilotons)

Table 39 China Market, By Application, 2017–2024 (USD Million)

Table 40 India Market, By Application, 2017–2024 (Kilotons)

Table 41 India Market, By Application, 2017–2024 (USD Million)

Table 42 Japan Market, By Application, 2017–2024 (Kilotons)

Table 43 Japan Market, By Application, 2017–2024 (USD Million)

Table 44 South Korea Market, By Application, 2017–2024 (Kilotons)

Table 45 South Korea Market, By Application, 2017–2024 (USD Million)

Table 46 Indonesia Market, By Application,2017–2024 (Kilotons)

Table 47 Indonesia Market, By Application,2017–2024 (USD Million)

Table 48 Malaysia Market, By Application, 2017–2024 (Kilotons)

Table 49 Malaysia Market, By Application, 2017–2024 (USD Million)

Table 50 Rest of APAC Market, By Application, 2017–2024 (Kilotons)

Table 51 Rest of APAC Market, By Application, 2017–2024 (USD Million)

Table 52 Europe Antifog Additives Market, By Type, 2017–2024 (Kilotons)

Table 53 Europe Market, By Type, 2017–2024 (USD Million)

Table 54 Europe Market, By Country, 2017–2024 (Kilotons)

Table 55 Europe Market, By Country, 2017–2024 (USD Million)

Table 56 Europe Market, By Application, 2017–2024 (Kilotons)

Table 57 Europe Market, By Application, 2017–2024 (USD Million)

Table 58 Germany Market, By Application, 2017–2024 (Kilotons)

Table 59 Germany Market, By Application,2017–2024 (USD Million)

Table 60 UK Market, By Application, 2017–2024 (Kilotons)

Table 61 UK Market, By Application, 2017–2024 (USD Million)

Table 62 France Market, By Application, 2017–2024 (Kilotons)

Table 63 France Market, By Application, 2017–2024 (USD Million)

Table 64 Italy Market, By Application, 2017–2024 (Kilotons)

Table 65 Italy Market, By Application, 2017–2024 (USD Million)

Table 66 Russia Market, By Application, 2017–2024 (Kilotons)

Table 67 Russia Market, By Application, 2017–2024 (USD Million)

Table 68 Spain Market, By Application, 2017–2024 (Kilotons)

Table 69 Spain Market, By Application, 2017–2024 (USD Million)

Table 70 Rest of Europe Market, By Application, 2017–2024 (Kilotons)

Table 71 Rest of Europe Market, By Application, 2017–2024 (USD Million)

Table 72 North America Antifog Additives Market, By Type, 2017–2024 (Kilotons)

Table 73 North America Market, By Type, 2017–2024 (USD Million)

Table 74 North America Market, By Country, 2017–2024 (Kilotons)

Table 75 North America Market, By Country, 2017–2024 (USD Million)

Table 76 North America Market, By Application, 2017–2024 (Kilotons)

Table 77 North America Market, By Application, 2017–2024 (USD Million)

Table 78 US Market, By Application, 2017–2024 (Kilotons)

Table 79 US Market, By Application, 2017–2024 (USD Million)

Table 80 Canada Market, By Application, 2017–2024 (Kilotons)

Table 81 Canada Market, By Application, 2017–2024 (USD Million)

Table 82 Mexico Market, By Application, 2017–2024 (Kilotons)

Table 83 Mexico Market, By Application, 2017–2024 (USD Million)

Table 84 Middle East & Africa Antifog Additives Market, By Type, 2017–2024 (Kilotons)

Table 85 Middle East & Africa Market, By Type, 2017–2024 (USD Million)

Table 86 Middle East & Africa Market, By Country, 2017–2024 (Kilotons)

Table 87 Middle East & Africa Market, By Country, 2017–2024 (USD Million)

Table 88 Middle East & Africa Market, By Application, 2017–2024 (Kilotons)

Table 89 Middle East & Africa Market, By Application, 2017–2024 (USD Million)

Table 90 Saudi Arabia Market, By Application, 2017–2024 (Kilotons)

Table 91 Saudi Arabia Market, By Application, 2017–2024 (USD Million)

Table 92 UAE Market, By Application, 2017–2024 (Kilotons)

Table 93 UAE Market, By Application, 2017–2024 (USD Million)

Table 94 Rest of Mea Market, By Application, 2017–2024 (Kilotons)

Table 95 Rest of Mea Market, By Application, 2017–2024 (USD Million)

Table 96 South America Antifog Additives Market, By Type, 2017–2024 (Kilotons)

Table 97 South America Market, By Type, 2017–2024 (USD Million)

Table 98 South America Market, By Country, 2017–2024 (Kilotons)

Table 99 South America Market, By Country, 2017–2024 (USD Million)

Table 100 South America Market, By Application, 2017–2024 (Kilotons)

Table 101 South America Market, By Application, 2017–2024 (USD Million)

Table 102 Brazil Market, By Application, 2017–2024 (Kilotons)

Table 103 Brazil Market, By Application, 2017–2024 (USD Million)

Table 104 Argentina Market, By Application, 2017–2024 (Kilotons)

Table 105 Argentina Market, By Application, 2017–2024 (USD Million)

Table 106 Rest of South America Market, By Application, 2017–2024 (Kilotons)

Table 107 Rest of South America Market, By Application, 2017–2024 (USD Million)

Table 108 Product Developments, 2014–2019

Table 109 Product Developments, 2014–2019

Table 110 Acquisitions, 2014–2019

Table 111 Expansions, 2014–2019

List of Figures (42 Figures)

Figure 1 Antifog Additives Market: Research Design

Figure 2 Breakdown of Primary Interviews, By Company, Designation, and Region

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Antifog Additives Market: Research Design

Figure 6 Glycerol Esters Type Segment to Register Highest Growth Between 2019 and 2024

Figure 7 Food Packaging Films Application Segment to Register Highest Growth Between 2019 and 2024

Figure 8 Asia Pacific to Lead Market of Antifog Additives in 2019 and Grow at Highest CAGR During Forecast Period

Figure 9 Glycerol Esters Type Segment to Lead Market of Antifog Additives in 2019 in Terms of Value

Figure 10 Growing Demand for Food Packaging Films is Expected to Drive Market Growth During the Forecast Period

Figure 11 Market of Antifog Additives in Asia Pacific Projected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Glycerol Esters and China to Account for the Largest Market Share of Antifog Additives in Asia Pacific in 2019

Figure 13 Market of Antifog Additives in China to Grow at the Highest Rate During the Forecast Period

Figure 14 Drivers, Restraints, Opportunities, and Challenges for the Antifog Additives Market

Figure 15 Middle-Class Population, By Region, 2015 vs, 2030 (Million)

Figure 16 Global Consumption of Agricultural Films

Figure 17 Market of Antifog Additives, By Type, 2019 & 2024 (USD Million)

Figure 18 Market of Antifog Additives , By Application, 2019 & 2024 (USD Million)

Figure 19 Regional Snapshot (2019–2024): India and China are Emerging as New Hotspots

Figure 20 Asia Pacific Market Snapshot

Figure 21 Europe Market Snapshot

Figure 22 North America Market Snapshot

Figure 23 Competitive Landscape Mapping

Figure 24 Key Growth Strategies Adopted By Companies in Antifog Additives Market Between 2014 and 2019

Figure 25 Antifog Additives Market Ranking, By Company, 2018

Figure 26 Croda International Plc.: Company Snapshot

Figure 27 Croda International Plc.: SWOT Analysis

Figure 28 Clariant AG: Company Snapshot

Figure 29 Clariant AG: SWOT Analysis

Figure 30 Evonik Industries AG: Company Snapshot

Figure 31 Evonik Industries AG: SWOT Analysis

Figure 32 Ashland Inc.: Company Snapshot

Figure 33 Ashland Inc.: SWOT Analysis

Figure 34 Dowdupont Inc.: Company Snapshot

Figure 35 Dowdupont Inc.: SWOT Analysis

Figure 36 Polyone Corporation: Company Snapshot

Figure 37 Polyone Corporation: SWOT Analysis

Figure 38 Corbion N.V.: Company Snapshot

Figure 39 Corbion N.V.: SWOT Analysis

Figure 40 PCC Chemax Inc.: Company Snapshot

Figure 41 Fine Organics Industries Ltd: Company Snapshot

Figure 42 Riken Vitamin Co., Ltd.: Company Snapshot

The study involved 4 major activities in estimating the current size of the antifog additives market. Exhaustive secondary research was undertaken to collect information on the antifog additives market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the antifog additives value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the overall size of the market. Thereafter, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and sub segments of the antifog additives market.

Secondary Research

As a part of the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet were referred to for identifying and collecting information for this study on the antifog additives market. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, monetary chain of the market, total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology-oriented perspectives.

Primary Research

As a part of the primary research process, various primary sources from both, supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the antifog additives market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the antifog additives market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the antifog additives market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both, demand and supply sides. In addition to this, the market size was validated using both, top-down and bottom-up approaches.

Objectives of the Report

- To define, describe, and forecast the antifog additives market based on application, type, and region

- To forecast the size of the market and its segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their respective key countries

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to the individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as expansions, new product developments, acquisitions, and joint ventures in the antifog additives market

The following customization options are available for the report:

- Further breakdown of the Asia Pacific and Europe antifog additives markets

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Detailed analysis and profiles of additional market players (up to 3)

Growth opportunities and latent adjacency in Antifog Additives Market

Volume and value wise market size for US of anti-fog films maket. This is required since 2013 to 2020