Artificial Lift Market by Type (Electrical Submersible Pumps, Progressive Cavity Pumps, Rod Lift, Gas Lift), Mechanism (Pump Assisted, Gas Assisted), Well Type (Horizontal, Vertical), Application (Onshore, Offshore), and Region - Global Forecast to 2028

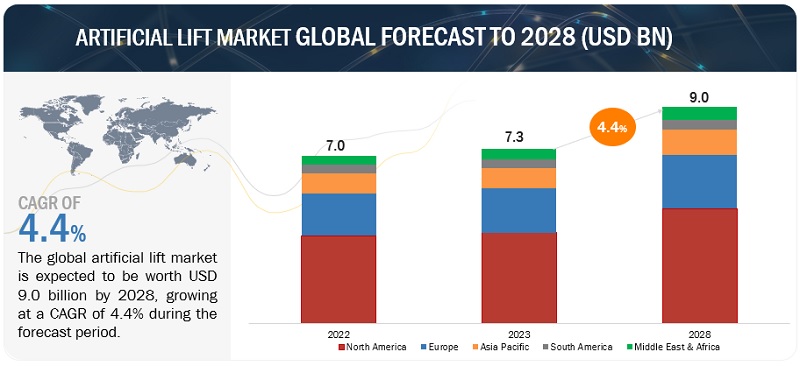

[270 Pages Report] The global artificial lift market size is estimated to grow from USD 7.3 billion in 2023 to USD 9.0 billion by 2028; it is expected to record a CAGR of 4.4% during the forecast period. Advancements in upstream activities concerning unconventional oil & gas reserves, the growing requirement to maximize the production potential of mature fields, and a rise in heavy oil production are leading to a surge in demand for artificial lift services.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Artificial Lift Market Dynamics

Driver: Growing requirement to maximize the production potential of mature fields

As per Halliburton's survey, a prominent figure in the artificial lift market, approximately 70.0% of the global oil & gas production arises from mature fields, many of which are in secondary or tertiary production phases. Gas holds an average recovery factor of 70.0%, while oil stands at 35.0%. These recovery rates might dwindle due to geological attributes, resource constraints, or inefficiencies in outdated technologies. Mature fields witness declining production post-initial recovery efforts or after tapping into easily accessible hydrocarbons. Despite this, mature fields remain a valuable resource, projected to meet future energy demands. The prime issues include uneconomical oil production and technological limits in recovery. With new fields depleting swiftly due to heightened production, mature field numbers have surged. The potential for recovery remains substantial, notably with 80.0% of reserves in the Middle East and North Africa, 43.0% in Asia Pacific, and 24.0% in Latin America. Major oil & gas firms are directing their efforts toward innovative methods for exploiting untapped reserves in mature fields, surpassing the need for new wells and their high costs. Their focus lies in enhancing recovery and extending the life of these fields beyond natural levels. Artificial lift stands as a crucial element in this endeavor, boosting recovery and prolonging the life of mature fields.

Restraint: Decreasing CAPEX of oilfield operators and upstream service providers

The demand for artificial lift is intricately tied to oil and natural gas companies' exploration, development, and production undertakings, as well as their capital expenditures. Variations in oil and gas prices have a direct impact on these activities, influenced by supply and demand shifts, governmental regulations, weather, and more. Companies might cut or delay major spending due to long-term expectations of low prices, especially as many substantial projects span extended periods. Sustained low crude oil prices, or the anticipation thereof, could impede the artificial lift market's growth. This growth is notably swayed by reductions in capital spending by oilfield operators and service providers, potentially leading to diminished demand for artificial lift systems market.

Opportunities: New oilfield discoveries to promote production activities

Companies within the oil and gas sector are directing efforts towards exploration, driven by the challenges posed by existing fields that struggle to yield hydrocarbons economically and may eventually need abandonment. Significant discoveries have been made both onshore and offshore, with the BP Statistical Review of 2020 indicating a vast reserve potential of ~1,733.9 billion barrels of oil by the end of 2019. This trend is anticipated to escalate upstream activities, thereby propelling demand for artificial lift solutions. Prominent players have recently unveiled a series of discoveries. Notable examples include Talos Energy's Zama field find in Mexico's offshore Block 7 in 2017 and ExxonMobil's billion-barrel discoveries in Guyana in 2018. Such breakthroughs, like Gazprom's Arctic gas discovery and Wintershall Dea's North Sea oil find, demonstrate the industry's vigor in uncovering valuable resources. These discoveries pave the way for substantial, long-term growth opportunities within the artificial lift market.

Challenges: Transition toward adoption of renewable energy sources

The global push to decrease carbon emissions and adopt eco-friendly energy alternatives has spurred the uptake of clean and sustainable sources. Economies are increasingly turning to renewables like solar, onshore and offshore wind, biomass, hydroelectric, and geothermal power for energy generation. Escalated by rapid industrialization and urbanization, the renewable sector is now the fastest-growing globally, witnessing heightened funding for numerous projects. As the need for cleaner energy rises and renewable technologies advance, a surge in project initiations is expected. Notable examples include China's Wudongde Hydropower Station and the UK's Hornsea Project 2, demonstrating substantial clean energy capacity.

Countries such as Canada, the US, India, and the UAE are proactively investing in renewables, further propelling the shift. While governmental investments drive this transition, they might concurrently lead to reduced activities in upstream, midstream, and downstream sectors. This evolving landscape could impact market players to some extent.

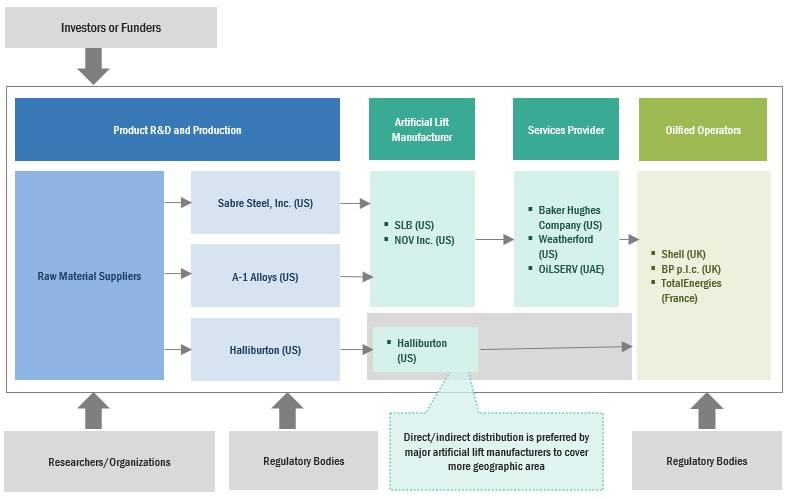

Artificial lift Market Ecosystem

In this artificial lift system market, prominent companies stand out as well-established and financially stable providers of artificial lift products and services. With years of experience, these companies boast a diverse product portfolio, cutting-edge technologies, and robust global sales and marketing networks. Their proven track record in the industry positions them as reliable and trusted partners for customers seeking artificial lift solutions. These companies have demonstrated their ability to adapt to market dynamics and consistently deliver high-quality products and services, making them leaders in meeting the demands of the oil and gas sector. Prominent companies in this market include SLB (US), Baker Hughes Company (US), Halliburton (US), Weatherford (US), and ChampionX (US).

The electric submersible pumps segment, by type, is expected to be the second-largest market during the forecast period.

This report segments the artificial lift market based on type into different types: electric submersible pumps, progressive cavity pumps, gas lift systems, rod lift systems, and others. The electric submersible pumps segment is expected to be the second-largest market during the forecast period. ESPs are a reliable and efficient artificial lift method for lifting moderate-to-large volumes of fluids from wellbores. The volumes range from as low as 150 B/D to as much as 150,000 B/D. ESPs are multistage dynamic displacement centrifugal pumps. Such pumps are typically used when well depths range from 1,000 to 5,000 ft. ESP systems are the most rapidly expanding type of artificial lift-pumping technology.

By application, offshore is expected to be the fastest growing during the forecast period.

This report segments the artificial lift market based on application into two segments: onshore and offshore. The offshore segment is expected to be the fastest growing during the forecast period. Artificial lift methods such as hydraulic pumping, gas lift, ESP, and PCP are most prominently used in offshore oil wells. Companies have been exploring offshore locations for oil & gas production because offshore have huge untapped reserves. Offshore activities require advanced technologies to make offshore well conditions safer. Thus, the offshore market is a more capital-intensive segment as compared to onshore.

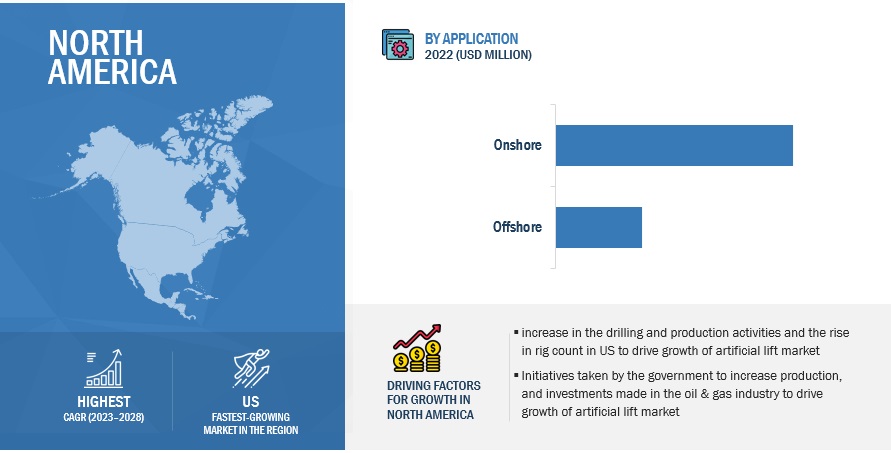

“North America: The largest in the artificial lift market.”

North America is expected to be the largest region in the global artificial lift market between 2023–2028, followed by Europe and Asia Pacific. North America has been leading the market. The regional artificial lift market is experiencing growth due to the presence of leading solution providers like SLB (US), Halliburton (US), Baker Hughes Company (US), Weatherford (US), and ChampionX (US). Notably, Tenaris invested around USD 5 million in August 2023 to enhance rod lift production, catering to North America's expanding market. Major oilfield operators, including Chevron (US), Anadarko Petroleum (US), BP plc (UK), Shell (Netherlands), ConocoPhillips (US), and ExxonMobil Corporation (US), also contribute to the market's development by creating opportunities for artificial lift projects.

Key Market Players

The market is dominated by a few major players that have a wide regional presence. The major players in the artificial lift market include SLB (US), Baker Hughes Company (US), Halliburton (US), Weatherford (US), and ChampionX (US). Between 2018 and 2023, Strategies such as new product launches, contracts, agreements, acquisitions, and expansions are followed by these companies to capture a larger share of the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Artificial lift market by Type, Mechanism, Well Type, Application, and Region. |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies covered |

SLB (US), Baker Hughes Company (US), Halliburton (US), NOV Inc. (US), Weatherford (US), ChampionX (US), Levare (UAE), DistributionNow (US), LUFKIN (US), Tenaris (Luxembourg), JJ Tech (US), OilSERV (UAE), Novomet (Russia), Cairn Oil and Gas (India), Alkhorayef Petroleum (Saudi Arabia), Rimera Group (Russia), Penguin Petroleum Services (P) Limited (India), Valiant Artificial Lift Solutions (US), Endurance Lift Solutions (US), National Energy Services Reunited Corp. (US), Liberty Lift Solutions LLC (US), Geolis (Mexico), Lift Well International (US) |

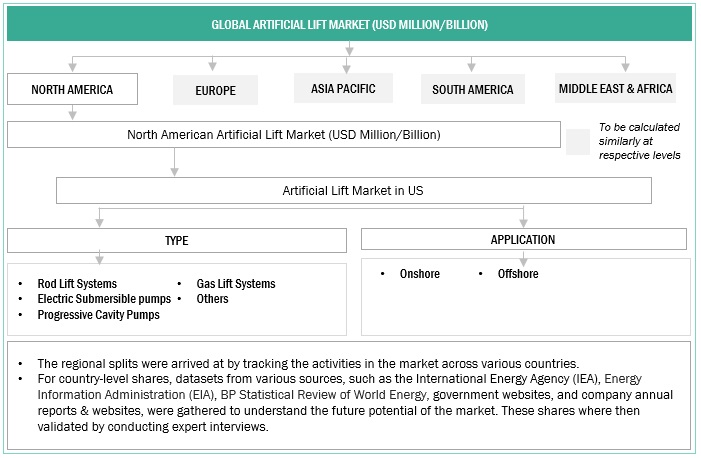

This research report categorizes the market based on type, mechanism, application, well type, and region.

On the basis of type, the artificial lift market has been segmented as follows:

- Rod Lift Systems

- Electric Submersible Pumps

- Progressive Cavity Pumps

- Gas Lift Systems

- Others

On the basis of mechanism, the market has been segmented as follows:

-

Pump Assisted

- Positive Displacement

- Dynamic Displacement

- Gas Assisted

On the basis of application, the market has been segmented as follows:

- Onshore

- Offshore

On the basis of well type, the market has been segmented as follows:

- Horizontal

- Vertical

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In November 2022, Halliburton deployed the first single trip, electro-hydraulic wet connects in deepwater for Petrobras in Brazil. The Halliburton Fuzion EH electro-hydraulic downhole wet-mate connector contributes to higher well recovery factors by ensuring the integrity of Halliburton's SmartWell completion technologies throughout the well's lifecycle.

- In July 2022, Baker Hughes Company acquired AccessESP, one of the leading providers of technological solutions used in ESP systems. This acquisition will broaden the artificial lift portfolio of Baker Hughes Company and improve its position globally.

- In April 2022, Weatherford was awarded two five-year artificial lift contracts by Tatweer Petroleum in Bahrain to supply, install, and service beam pumping units and downhole pumps.

- In December 2021, LUFKIN acquired the US Rod and Patriot Pump. US Rod is an API-licensed manufacturer and distributor of artificial lift items such as sucker rods, rod guides, couplings, pony rods, stabilizers, and sinker bars. This acquisition would enhance the product portfolio of LUFKIN and position the company higher in North America in terms of artificial lift technologies.

Frequently Asked Questions (FAQ):

What is the current size of the artificial lift market?

The current market size of the artificial lift market is 7.3 billion in 2023.

What are the major drivers for the artificial lift market?

Growing requirements to maximize the production potential of mature fields will be major drivers for the artificial lift market.

Which is the largest region during the forecasted period in the artificial lift market?

North America is expected to dominate the artificial lift market between 2023–2028, followed by Europe and Asia Pacific.

Which is the largest segment, by type, during the forecasted period in the artificial lift market?

The rod lift systems segment is expected to be the largest market during the forecast period, owing to the rising demand for oil on a global scale, supported by increased transportation activity and industrial development.

Which is the fastest segment, by application, during the forecasted period in the artificial lift market?

Offshore is expected to be the fastest market during the forecast period. Maturing shallow oilfields is attributed to driving the market of artificial lifts for offshore applications in the forecasted period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Advancements in upstream activities concerning unconventional oil & gas reserves- Growing requirement to maximize production potential of mature fields- Increase in global oil demand- Rise in heavy oil productionRESTRAINTS- Decreasing CapEX of oilfield operators and upstream service providersOPPORTUNITIES- New oilfield discoveries to promote upstream activities- Digitalization and automation to better analyze well conditionsCHALLENGES- Transition toward renewable energy sources- Application of artificial lift methods in horizontal wells

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 SUPPLY CHAIN ANALYSISRAW MATERIAL SUPPLIERSARTIFICIAL LIFT EQUIPMENT MANUFACTURERSARTIFICIAL LIFT SERVICE PROVIDERSOILFIELD OPERATORS

-

5.5 ECOSYSTEM MAPPING

- 5.6 TECHNOLOGY ANALYSIS

- 5.7 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.8 PATENT ANALYSIS

-

5.9 REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS AND REGULATIONS

-

5.10 PRICING ANALYSISINDICATIVE PRICING ANALYSIS, BY TYPEAVERAGE PRICING ANALYSIS, BY REGION

-

5.11 CASE STUDY ANALYSISNOVOMET’S IMPACTFUL PERFORATION SOLUTION REDUCED POWER CONSUMPTION FOR ECUADOR-BASED OIL & GAS PRODUCER- Problem statement- Solution

-

5.12 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

-

5.13 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 ROD LIFT SYSTEMSABILITY TO HARNESS SUBSURFACE POWER FOR OIL DRILLING TO DRIVE MARKET

-

6.3 ELECTRICAL SUBMERSIBLE PUMPSEFFICIENT DESIGN AND OPERATIONAL CHARACTERISTICS TO SUPPORT MARKET GROWTH

-

6.4 GAS LIFT SYSTEMSLOW OPERATING COSTS TO BOOST MARKET

-

6.5 PROGRESSIVE CAVITY PUMPSBENEFITS OF DEPLOYMENT IN RECOVERY PROCESSES TO PROPEL MARKET

- 6.6 OTHERS

- 7.1 INTRODUCTION

-

7.2 PUMP-ASSISTEDPOSITIVE DISPLACEMENT- Capability to reduce liquid-producing gas wells to their lowest abandonment pressure to drive marketDYNAMIC DISPLACEMENT- Deployment in multistage drilling operations to support market growth

-

7.3 GAS-ASSISTEDUSE IN VERTICAL GAS WELLS WITH MINIMUM MAINTENANCE TO FUEL MARKET

- 8.1 INTRODUCTION

-

8.2 HORIZONTALINCREASED OIL FIELD PRODUCTION AND ABILITY TO ACCESS SUBSURFACE RESERVOIRS TO BOOST SEGMENT

-

8.3 VERTICALCOST-EFFECTIVE EXTRACTION OF HYDROCARBONS TO DRIVE SEGMENT

- 9.1 INTRODUCTION

-

9.2 ONSHOREREDEVELOPMENT OF MATURE ONSHORE OILFIELDS AND GROWING SHALE ACTIVITIES TO DRIVE MARKET

-

9.3 OFFSHOREMATURING SHALLOW OILFIELDS TO PROPEL OFFSHORE ARTIFICIAL LIFT MARKET

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAIMPACT OF RECESSION ON ARTIFICIAL LIFT MARKET IN NORTH AMERICABY TYPEBY MECHANISM- By pump-assisted mechanismBY WELL TYPEBY APPLICATIONBY COUNTRY- US- Canada- Mexico

-

10.3 EUROPEIMPACT OF RECESSION ON ARTIFICIAL LIFT MARKET IN EUROPEBY TYPEBY MECHANISM- By pump-assisted mechanismBY WELL TYPEBY APPLICATIONBY COUNTRY- Russia- UK- Norway- Rest of Europe

-

10.4 ASIA PACIFICIMPACT OF RECESSION ON ARTIFICIAL LIFT MARKET IN ASIA PACIFICBY TYPEBY MECHANISM- By pump-assisted mechanismBY WELL TYPEBY APPLICATIONBY COUNTRY- China- Malaysia- India- Indonesia- Rest of Asia Pacific

-

10.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON ARTIFICIAL LIFT MARKET IN MIDDLE EAST & AFRICABY TYPEBY MECHANISM- By pump-assisted mechanismBY WELL TYPEBY APPLICATIONBY COUNTRY- UAE- Kuwait- Saudi Arabia- Angola- Oman- Nigeria- Rest of Middle East & Africa

-

10.6 SOUTH AMERICAIMPACT OF RECESSION ON ARTIFICIAL LIFT MARKET IN SOUTH AMERICABY TYPEBY MECHANISM- By pump-assisted mechanismBY WELL TYPEBY APPLICATIONBY COUNTRY- Venezuela- Brazil- Colombia- Ecuador- Rest of South America

- 11.1 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2 MARKET SHARE ANALYSIS, 2022

- 11.3 MARKET EVALUATION FRAMEWORK, 2019–2023

- 11.4 REVENUE ANALYSIS, 2018–2022

-

11.5 KEY COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPANY FOOTPRINT

-

11.7 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.8 COMPETITIVE BENCHMARKING

-

11.9 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSSLB- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHALLIBURTON- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBAKER HUGHES COMPANY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewWEATHERFORD- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCHAMPIONX- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNOV INC.- Business overview- Products/Services/Solutions offered- Recent developmentsTENARIS- Business overview- Products/Services/Solutions offered- Recent developmentsDISTRIBUTIONNOW- Business overview- Products/Services/Solutions offered- Recent developmentsLEVARE- Business overview- Products/Services/Solutions offered- Recent developmentsOILSERV- Business overview- Products/Services/Solutions offeredNOVOMET- Business overview- Products/Services/Solutions offered- Recent developmentsJJ TECH- Business overview- Products/Services/Solutions offeredRIMERA GROUP- Business overview- Products/Services/Solutions offered- Recent developmentsLUFKIN- Business overview- Products/Services/Solutions offered- Recent developmentsALKHORAYEF PETROLEUM- Business overview- Products/Services/Solutions offered

-

12.2 OTHER PLAYERSNATIONAL ENERGY SERVICES REUNITED CORP.CAIRN OIL & GASPENGUIN PETROLEUM SERVICES (P) LIMITEDENDURANCE LIFT SOLUTIONSVALIANT ARTIFICIAL LIFT SOLUTIONS

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 ARTIFICIAL LIFT MARKET SNAPSHOT

- TABLE 2 GLOBAL OIL DEMAND (OECD VS. NON-OECD), 2021–2028

- TABLE 3 HORIZONTAL WELL: ARTIFICIAL LIFT METHODS

- TABLE 4 PARTICIPANTS AND THEIR ROLE IN ARTIFICIAL LIFT ECOSYSTEM

- TABLE 5 ARTIFICIAL LIFT MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 6 ARTIFICIAL LIFT: INNOVATIONS AND PATENT REGISTRATIONS, 2018–2023

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ARTIFICIAL LIFT MARKET: STANDARDS AND REGULATIONS

- TABLE 13 INDICATIVE PRICING ANALYSIS, BY TYPE, 2022 (USD)

- TABLE 14 AVERAGE PRICING ANALYSIS, BY REGION, 2022 (USD)

- TABLE 15 EXPORT SCENARIO FOR HS CODE 841360, BY COUNTRY, 2020–2022 (USD)

- TABLE 16 IMPORT SCENARIO FOR HS CODE 841360, BY COUNTRY, 2020–2022 (USD)

- TABLE 17 ARTIFICIAL LIFT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 19 KEY BUYING CRITERIA FOR ARTIFICIAL LIFT TYPES

- TABLE 20 COMPARISON OF ARTIFICIAL LIFT METHODS

- TABLE 21 ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 22 ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 ROD LIFT SYSTEMS: ARTIFICIAL LIFT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 24 ROD LIFT SYSTEMS: ARTIFICIAL LIFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 ELECTRICAL SUBMERSIBLE PUMPS: ARTIFICIAL LIFT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 ELECTRICAL SUBMERSIBLE PUMPS: ARTIFICIAL LIFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 GAS LIFT SYSTEMS: ARTIFICIAL LIFT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 GAS LIFT SYSTEMS: ARTIFICIAL LIFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 PROGRESSIVE CAVITY PUMPS: ARTIFICIAL LIFT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 PROGRESSIVE CAVITY PUMPS: ARTIFICIAL LIFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 OTHERS: ARTIFICIAL LIFT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 32 OTHERS: ARTIFICIAL LIFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 ARTIFICIAL LIFT MARKET, BY MECHANISM, 2017–2022 (USD MILLION)

- TABLE 34 ARTIFICIAL LIFT MARKET, BY MECHANISM, 2023–2028 (USD MILLION)

- TABLE 35 PUMP-ASSISTED: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 36 PUMP-ASSISTED: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 PUMP-ASSISTED: ARTIFICIAL LIFT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 PUMP-ASSISTED: ARTIFICIAL LIFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 POSITIVE DISPLACEMENT: ARTIFICIAL LIFT MARKET FOR PUMP-ASSISTED MECHANISM, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 POSITIVE DISPLACEMENT: ARTIFICIAL LIFT MARKET FOR PUMP-ASSISTED MECHANISM, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 DYNAMIC DISPLACEMENT: ARTIFICIAL LIFT MARKET FOR PUMP-ASSISTED MECHANISM, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 DYNAMIC DISPLACEMENT: ARTIFICIAL LIFT MARKET FOR PUMP-ASSISTED MECHANISM, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 GAS-ASSISTED: ARTIFICIAL LIFT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 GAS-ASSISTED: ARTIFICIAL LIFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2017–2022 (USD MILLION)

- TABLE 46 ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 47 HORIZONTAL: ARTIFICIAL LIFT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 HORIZONTAL: ARTIFICIAL LIFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 VERTICAL: ARTIFICIAL LIFT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 VERTICAL: ARTIFICIAL LIFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 52 ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 53 ONSHORE: ARTIFICIAL LIFT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 ONSHORE: ARTIFICIAL LIFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 OFFSHORE: ARTIFICIAL LIFT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 OFFSHORE: ARTIFICIAL LIFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 ARTIFICIAL LIFT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 ARTIFICIAL LIFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2017–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2017–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2017–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 71 US: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 72 US: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 73 US: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 74 US: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 CANADA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 76 CANADA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 77 CANADA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 78 CANADA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 79 MEXICO: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 80 MEXICO: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 81 MEXICO: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 82 MEXICO: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 84 EUROPE: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2017–2022 (USD MILLION)

- TABLE 86 EUROPE: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2017–2022 (USD MILLION)

- TABLE 88 EUROPE: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2017–2022 (USD MILLION)

- TABLE 90 EUROPE: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 92 EUROPE: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 94 EUROPE: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 95 RUSSIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 96 RUSSIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 97 RUSSIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 98 RUSSIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 UK: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 100 UK: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 101 UK: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 102 UK: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 NORWAY: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 104 NORWAY: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 105 NORWAY: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 106 NORWAY: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 REST OF EUROPE: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 108 REST OF EUROPE: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 110 REST OF EUROPE: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2017–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2017–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2017–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 122 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 123 CHINA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 124 CHINA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 125 CHINA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 126 CHINA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 MALAYSIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 128 MALAYSIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 129 MALAYSIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 130 MALAYSIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 INDIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 132 INDIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 133 INDIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 134 INDIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 INDONESIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 136 INDONESIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 137 INDONESIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 138 INDONESIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2017–2022 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2023–2028 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2017–2022 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2023–2028 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2017–2022 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 155 UAE: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 156 UAE: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 157 UAE: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 158 UAE: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 159 KUWAIT: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 160 KUWAIT: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 161 KUWAIT: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 162 KUWAIT: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 163 SAUDI ARABIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 164 SAUDI ARABIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 165 SAUDI ARABIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 166 SAUDI ARABIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 167 ANGOLA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 168 ANGOLA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 169 ANGOLA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 170 ANGOLA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 171 OMAN: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 172 OMAN: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 173 OMAN: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 174 OMAN: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 175 NIGERIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 176 NIGERIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 177 NIGERIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 178 NIGERIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 179 REST OF MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 183 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 184 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 185 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2017–2022 (USD MILLION)

- TABLE 186 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2023–2028 (USD MILLION)

- TABLE 187 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2017–2022 (USD MILLION)

- TABLE 188 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2023–2028 (USD MILLION)

- TABLE 189 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2017–2022 (USD MILLION)

- TABLE 190 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 191 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 192 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 193 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 194 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 195 VENEZUELA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 196 VENEZUELA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 197 VENEZUELA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 198 VENEZUELA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 199 BRAZIL: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 200 BRAZIL: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 201 BRAZIL: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 202 BRAZIL: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 203 COLOMBIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 204 COLOMBIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 205 COLOMBIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 206 COLOMBIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 207 ECUADOR: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 208 ECUADOR: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 209 ECUADOR: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 210 ECUADOR: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 211 REST OF SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 212 REST OF SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 213 REST OF SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 215 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ARTIFICIAL LIFT MARKET

- TABLE 216 ARTIFICIAL LIFT MARKET: DEGREE OF COMPETITION

- TABLE 217 MARKET EVALUATION FRAMEWORK, 2019–2023

- TABLE 218 TYPE: COMPANY FOOTPRINT

- TABLE 219 MECHANISM: COMPANY FOOTPRINT

- TABLE 220 APPLICATION: COMPANY FOOTPRINT

- TABLE 221 WELL TYPE: COMPANY FOOTPRINT

- TABLE 222 REGION: COMPANY FOOTPRINT

- TABLE 223 ARTIFICIAL LIFT MARKET: LIST OF KEY START-UPS/SMES

- TABLE 224 TYPE: START-UPS/SMES FOOTPRINT

- TABLE 225 MECHANISM: START-UPS/SMES FOOTPRINT

- TABLE 226 APPLICATION: START-UPS/SMES FOOTPRINT

- TABLE 227 WELL TYPE: START-UPS/SMES FOOTPRINT

- TABLE 228 REGION: START-UPS/SMES FOOTPRINT

- TABLE 229 ARTIFICIAL LIFT MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 230 ARTIFICIAL LIFT MARKET: DEALS, 2019–2023

- TABLE 231 ARTIFICIAL LIFT MARKET: OTHERS, 2019–2023

- TABLE 232 SLB: COMPANY OVERVIEW

- TABLE 233 SLB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 234 SLB: DEALS

- TABLE 235 SLB: OTHERS

- TABLE 236 HALLIBURTON: COMPANY OVERVIEW

- TABLE 237 HALLIBURTON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 238 HALLIBURTON: DEALS

- TABLE 239 HALLIBURTON: OTHERS

- TABLE 240 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 241 BAKER HUGHES COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 242 BAKER HUGHES COMPANY: DEALS

- TABLE 243 BAKER HUGHES COMPANY: OTHERS

- TABLE 244 WEATHERFORD: COMPANY OVERVIEW

- TABLE 245 WEATHERFORD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 246 WEATHERFORD: PRODUCT LAUNCHES

- TABLE 247 WEATHERFORD: DEALS

- TABLE 248 CHAMPIONX: COMPANY OVERVIEW

- TABLE 249 CHAMPIONX: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 250 CHAMPIONX: PRODUCT LAUNCHES

- TABLE 251 CHAMPIONX: DEALS

- TABLE 252 NOV INC.: COMPANY OVERVIEW

- TABLE 253 NOV INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 254 NOV INC.: PRODUCT LAUNCHES

- TABLE 255 TENARIS: COMPANY OVERVIEW

- TABLE 256 TENARIS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 257 TENARIS: PRODUCT LAUNCHES

- TABLE 258 TENARIS: DEALS

- TABLE 259 TENARIS: OTHERS

- TABLE 260 DISTRIBUTIONNOW: COMPANY OVERVIEW

- TABLE 261 DISTRIBUTIONNOW: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 262 DISTRIBUTIONNOW: DEALS

- TABLE 263 LEVARE: COMPANY OVERVIEW

- TABLE 264 LEVARE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 265 LEVARE: DEALS

- TABLE 266 OILSERV: COMPANY OVERVIEW

- TABLE 267 OILSERV: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 268 NOVOMET: COMPANY OVERVIEW

- TABLE 269 NOVOMET: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 270 NOVOMET: DEALS

- TABLE 271 JJ TECH: COMPANY OVERVIEW

- TABLE 272 JJ TECH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 273 RIMERA GROUP: COMPANY OVERVIEW

- TABLE 274 RIMERA GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 275 RIMERA GROUP: PRODUCT LAUNCHES

- TABLE 276 RIMERA GROUP: DEALS

- TABLE 277 LUFKIN: COMPANY OVERVIEW

- TABLE 278 LUFKIN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 279 LUFKIN: DEALS

- TABLE 280 LUFKIN: OTHERS

- TABLE 281 ALKHORAYEF PETROLEUM: COMPANY OVERVIEW

- TABLE 282 ALKHORAYEF PETROLEUM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 1 ARTIFICIAL LIFT MARKET SEGMENTATION

- FIGURE 2 ARTIFICIAL LIFT MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- FIGURE 4 BREAKDOWN OF PRIMARIES

- FIGURE 5 ARTIFICIAL LIFT MARKET: BOTTOM-UP APPROACH

- FIGURE 6 ARTIFICIAL LIFT MARKET: TOP-DOWN APPROACH

- FIGURE 7 CRUDE OIL PRICE VS. RIG COUNT

- FIGURE 8 OPERATIONAL WELL COUNT VS. CRUDE OIL PRODUCTION

- FIGURE 9 CRUDE OIL PRICE TREND

- FIGURE 10 METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR ARTIFICIAL LIFT SYSTEMS

- FIGURE 11 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF ARTIFICIAL LIFT SOLUTIONS

- FIGURE 12 ARTIFICIAL LIFT MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 13 ROD LIFT SYSTEMS SEGMENT TO HOLD LARGEST SHARE OF ARTIFICIAL LIFT MARKET, BY TYPE, IN 2028

- FIGURE 14 PUMP-ASSISTED SEGMENT DOMINATED ARTIFICIAL LIFT MARKET, BY MECHANISM, IN 2023

- FIGURE 15 VERTICAL SEGMENT TO LEAD ARTIFICIAL LIFT MARKET, BY WELL TYPE, IN 2028

- FIGURE 16 ONSHORE SEGMENT HELD LARGER SHARE OF ARTIFICIAL LIFT MARKET, BY APPLICATION, IN 2023

- FIGURE 17 NORTH AMERICA DOMINATED ARTIFICIAL LIFT MARKET, BY REGION, IN 2022

- FIGURE 18 RISING EXPLORATION AND PRODUCTION OF UNCONVENTIONAL OIL & GAS RESOURCES TO DRIVE ARTIFICIAL LIFT MARKET FROM 2023 TO 2028

- FIGURE 19 NORTH AMERICA TO REGISTER HIGHEST CAGR IN ARTIFICIAL LIFT MARKET DURING FORECAST PERIOD

- FIGURE 20 ONSHORE SEGMENT AND US HELD LARGEST SHARES OF ARTIFICIAL LIFT MARKET IN NORTH AMERICA IN 2022

- FIGURE 21 ROD LIFT SYSTEMS HELD LARGEST SHARE OF ARTIFICIAL LIFT MARKET IN 2022

- FIGURE 22 ONSHORE APPLICATIONS CAPTURED MAJOR MARKET SHARE IN 2022

- FIGURE 23 VERTICAL SEGMENT ACCOUNTED FOR LARGER SHARE OF ARTIFICIAL LIFT MARKET IN 2022

- FIGURE 24 PUMP-ASSISTED SEGMENT DOMINATED ARTIFICIAL LIFT MARKET IN 2022

- FIGURE 25 ARTIFICIAL LIFT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 GLOBAL OIL DEMAND, 2019–2028

- FIGURE 27 CAPITAL EXPENDITURE OF OILFIELD OPERATORS, 2017–2022

- FIGURE 28 CAPITAL EXPENDITURE OF OIL & GAS SERVICE PROVIDERS, 2017–2022

- FIGURE 29 RENEWABLE CAPACITY ADDITIONS, BY COUNTRY/REGION, 2019–2022

- FIGURE 30 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR ARTIFICIAL LIFT PROVIDERS

- FIGURE 31 ARTIFICIAL LIFT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 32 ECOSYSTEM ANALYSIS

- FIGURE 33 EXPORT DATA FOR HS CODE 841360 OF TOP FIVE COUNTRIES, 2020–2022 (USD)

- FIGURE 34 IMPORT DATA FOR HS CODE 841360 OF TOP FIVE COUNTRIES, 2020–2022 (USD)

- FIGURE 35 ARTIFICIAL LIFT MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 37 KEY BUYING CRITERIA FOR ARTIFICIAL LIFT TYPES

- FIGURE 38 ARTIFICIAL LIFT MARKET, BY TYPE, 2022

- FIGURE 39 ARTIFICIAL LIFT MARKET, BY MECHANISM, 2022

- FIGURE 40 ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2022

- FIGURE 41 ARTIFICIAL LIFT MARKET, BY APPLICATION, 2022

- FIGURE 42 ARTIFICIAL LIFT MARKET IN NORTH AMERICA TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 43 ARTIFICIAL LIFT MARKET, BY REGION, 2022

- FIGURE 44 NORTH AMERICA: ARTIFICIAL LIFT MARKET SNAPSHOT, 2022

- FIGURE 45 EUROPE: ARTIFICIAL LIFT MARKET SNAPSHOT, 2022

- FIGURE 46 ARTIFICIAL LIFT MARKET SHARE ANALYSIS, 2022

- FIGURE 47 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST FIVE YEARS

- FIGURE 48 ARTIFICIAL LIFT MARKET: KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 49 ARTIFICIAL LIFT MARKET: START-UPS /SMES EVALUATION MATRIX, 2022

- FIGURE 50 SLB: COMPANY SNAPSHOT

- FIGURE 51 HALLIBURTON: COMPANY SNAPSHOT

- FIGURE 52 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- FIGURE 53 WEATHERFORD: COMPANY SNAPSHOT

- FIGURE 54 CHAMPIONX: COMPANY SNAPSHOT

- FIGURE 55 NOV INC.: COMPANY SNAPSHOT

- FIGURE 56 TENARIS: COMPANY SNAPSHOT

- FIGURE 57 DISTRIBUTIONNOW: COMPANY SNAPSHOT

The study involved major activities in estimating the current size of the artificial lift market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the artificial lift market involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify information useful for a technical, market-oriented, and commercial study of the market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

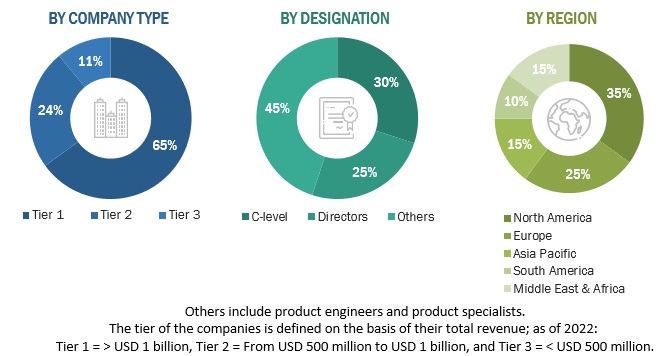

The artificial lift market comprises several stakeholders, such as artificial lift manufacturers, technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for types of artificial lifts such as rod lift systems, electric submersible pumps, progressive cavity pumps, and gas lift systems. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the artificial lift market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Artificial Lift Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Artificial Lift Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Artificial lift methods are used to increase the pressure within oil & gas reservoirs to increase crude oil production rates from producing wells. These methods are used when the natural drive energy of the reservoir is not strong enough to push the oil to the surface.

The market for artificial lift is defined as the sum of revenues generated by global companies offering artificial lift solutions, such as rod lift systems, gas lift systems, electric submersible pumps (ESPs), and progressive cavity pumps (PCPs). Artificial lifts can be deployed on horizontal and vertical wells for onshore and offshore applications.

Key Stakeholders

- Artificial Lift Equipment Manufacturers

- Associations (American Petroleum Institute, Canadian Association of Petroleum Producers, and Others)

- Drilling Contractors and Production Planning Consultancies

- Government and Research Organizations

- Institutional Investors

- National and Local Government Organizations

- National Oil Companies (NOCs)

- Oilfield Service Companies

- Private E&P Companies

Objectives of the Study

- To define, describe, segment, and forecast the artificial lift market on the basis of type, mechanism, well type, application, and region, in terms of value

- To describe and forecast the market for five key regions, namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their country-level market sizes, in terms of value

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the market’s growth

- To provide the supply chain analysis, trends/disruptions impacting customers’ businesses, market map, pricing analysis, and regulatory analysis of the artificial lift market

- To analyze opportunities for stakeholders and draw a competitive landscape of the artificial lift market

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, Porter’s five forces, and case studies pertaining to the market under study

- To benchmark market players using the company evaluation matrix, which analyzes market players on broad categories of business and product strategies adopted by them

- To compare key market players with respect to product specifications and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, product launches, partnerships, and joint ventures & collaborations, in the artificial lift market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Lift Market