Offshore Wind Market by Component (Turbines (Nacelle, Rotors & Blades, Tower), Substructure, Electrical Infrastructure), Location (Shallow Water, Transitional Water, & Deepwater) and Region (North America, Asia Pacific, & Europe) - Global forecast to 2026

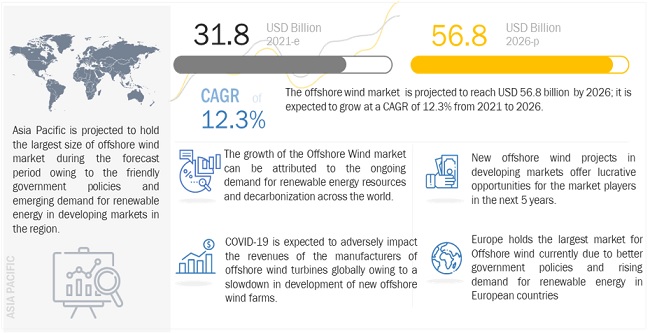

[232 Pages Report] The global offshore wind market in terms of revenue was estimated to be worth $31.8 billion in 2021 and is poised to reach $56.8 billion by 2026, growing at a CAGR of 12.3% from 2021 to 2026. Offshore wind turbines are increasingly being installed and is showing robust growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Offshore wind Market Dynamics

Driver: Increasing global investments in renewable energy are likely to drive the offshore wind market

There has been a noticeable shift in the energy sector toward renewable and green energy due to factors such as the need to reduce carbon emissions, depletion of fossil fuels, climatic change, etc. Various government policies are in place to support the initiative toward greener energy. Many multinational companies are taking initiatives to cut down their carbon footprint to contribute to a greener planet and sustainability. For instance, Equinor (Norway) aims to cut its carbon emissions by half by 2050. A part of the plan is to develop its renewable energy businesses, particularly offshore wind, which may reach 6,000 megawatts in six years and 16,000 megawatts in 15 years. Another example is of the energy giant Total, which has entered into an agreement with SSE Renewables to acquire a 51% stake of its Seagreen 1 offshore wind farm project. Total is anticipated to invest Euro 70 million for this project. According to analysts, offshore wind may create USD 166 billion in new investments and USD 1.7 billion in new tax revenue for the US Treasury by 2022 while also supporting 80,000 jobs yearly by 2035.

Restraints: High capital cost and logistics issues

Offshore wind is one of the most promising and eco-friendly energy-producing technologies. Though it has a high-capacity factor compared with related technologies, such as solar and onshore wind, its huge capital cost is deterring its implementation. Offshore wind turbines are susceptible to erosion, as they operate for decades in harsh marine environments. Sometimes, even the most advantageous features, such as high wind speeds, become a negative factor for offshore wind turbines. For instance, the turbines tend to shut down when the wind speed exceeds 25 m/s. As the size of offshore wind farms has increased over time, challenges related to construction, transportation, installation, and operation have also increased. Challenges associated with logistics, in general, are a greater task in offshore wind farms. Wind farms are usually located very far from the shore and are difficult to access, especially in bad weather conditions. Hence, rectifying even the smallest technical issue could be tricky and costly. Other challenging factors in offshore wind power deployment relate to resource characterization, grid interconnection and operation, and development of transmission infrastructure, which are much simpler in other technologies, such as solar and onshore wind. Thus, the high capital costs and issues associated with the operations, maintenance, transportation, and logistics restrain the global market.

Opportunities: Initiatives by governments and companies to reduce carbon emissions

Renewable energy demand will continue to rise, owing to the falling technology costs, growing need to reduce CO2 emissions, and increasing energy consumption in developing and undeveloped countries. According to the International Renewable Energy Agency (IRENA), the share of renewables in yearly worldwide energy generation must rise from the current 25% to 86% by 2050 to satisfy the Paris Agreement's targets. To achieve this, the world must invest USD 110 trillion in the sector by 2050, up from the USD 95 trillion anticipated to be invested by 2030. This change will result in a perceptible movement from fossil fuels to renewable energy sources. Between 2019 and 2050, Bloomberg BNEF projects that USD 13.3 trillion would be spent in new power production assets, with 15,145 GW of carbon-free plants likely to be built. Wind and solar, according to the BNEF, would account for 50% of the global electricity generation by 2050.

Challenges: Impact of COVID 19

The global economic slowdown due to the COVID-19 pandemic has put the wind power industry’s resilience and flexibility to test. The pandemic continues to wreak havoc on the supply chain of the wind power industry. Europe is one of the main markets for offshore wind energy, and it is also one of the most heavily impacted by COVID-19, which has slowed the continued expansion owing to project delays. Because of the interruptions to European and global trade, the projects under construction were delayed, resulting in higher CAPEX for such projects. According to the International Energy Agency, post-pandemic offshore wind energy is predicted to expand faster than onshore wind.

To know about the assumptions considered for the study, download the pdf brochure

By component, the turbine segment is the largest contributor in the offshore wind market in 2020.

The turbine segment accounted for the largest share of the market, by component, in 2020. The turbine segment of offshore wind market is further classified into – nacelle, rotors and blades, and tower. Turbines are placed on the tower and is mainly responsible for harnessing the wind energy to produce power.

By location, the shallow water segment is the largest contributor in the offshore wind market in 2020.

The shallow water segment accounted for the largest share of the market, by location, in 2020. Majority of projects are undertaken in this segment. The presence of comparatively less challenging weather and ease of maintenance make this segment the proffered choice for development of offshore wine farm. Also, while setting up a wind turbine, the establishment of electrical infrastructure is comparatively easier in shallow water. Due to comparatively less wind speed available in shallow water, the turbines with less MW capacity are installed in this region.

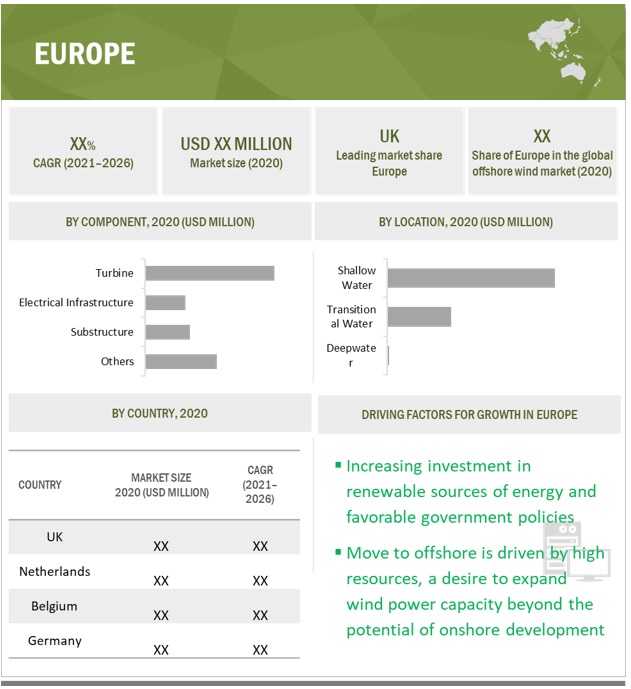

Europe has developed market for offshore wind which is further growing due to strong policies and political will

Europe accounted for the largest share of the offshore wind market amongst all regions in 2020. The European market is further segmented into UK, Germany, Denmark, Belgium, Netherlands, Sweden, Finland, Ireland, and Rest of Europe. The European region is home to several major offshore wind companies such as Siemens (Germany), Nordex SE(Germany), Vestas (Denmark), ABB (Switzerland) and many more. European region has been a pioneer in offshore wind technology and offshore wind farm development. This development of offshore wind energy is supported by the European Wind Initiative (EWI), a wind energy R&D program, developed to take the wind industry to the next level in Europe. The countries in the EU are primarily focusing on upgrading their aging electrical infrastructure, and governments of these countries are promoting power generation through renewable energy sources and are building networks, from generation to end-users, to allow for efficient power and energy trading.

The leading players in the offshore wind market include Siemens Gamesa (Spain), Vestas (Denmark), General Electric (US), Shanghai Electric Wind Power (China).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Component, and Location |

|

Geographies covered |

Asia Pacific, North America, and Europe |

|

Companies covered |

General Electric (US), Vestas (Denmark), Siemens Gamesa (Spain), Goldwind (China), Shanghai Electric Wind Power Equipment Co. (China), ABB (Switzerland), Doosan Heavy Industries and Construction (South Korea), Hitachi (Japan), Nordex SE (Germany), EEW (Germany), Nexans (France), DEME (Belgium), Ming Yang Smart Energy Group Co (China), Envision (China), Rockwell Automation (US), Hyundai Motor Group (South Korea), Schneider Electric (France), Zhejiang Windey Co.(China), Taiyuan Heavy Industry Co., (China), Sinovel(China) |

This research report categorizes the offshore wind market-based by component and location.

Based on component, the market has been segmented as follows:

- Turbines

- Electrical Infrastructure

- Substructure

- Others

Based on Location, the market has been segmented as follows:

- Shallow Water

- Transitional Water

- Deep Water

Based on the region, the market has been segmented as follows:

- North America

- Asia Pacific

- Europe

Recent Developments

- In May 2021, GE Renewable Energy announced that it has finalized the Turbine Supply and Service and Warranty contracts for the third and final phases of the Dogger Bank offshore wind farm.

- In May 2021, Siemens Gamesa has been confirmed as a preferred supplier for full 1,044 MW Hai Long offshore (in Taiwan) wind projects.

- In May 2020, Siemens Gamesa launched SG 14-222 DD offshore wind turbine with nameplate capacity of 14 MW which can reach 15 MW with Power Boost. Its 222-meter rotor diameter uses massive 108-meter long B108 blades.

- In October 2020, MHI Vestas Offshore Wind has been selected as the preferred wind turbine supplier for the EolMed floating project and contracted to supply three V164-10.0 MW turbines.

- In October 2020, Goldwind launched GW1S turbine which is highly efficient compared to previous models.

Frequently Asked Questions (FAQ):

What is the current size of the offshore wind market?

The current market size of global Offshore Wind market is estimated to be USD 31.8 billion in 2021.

What is the major drivers for offshore wind market?

There has been a noticeable shift in the energy sector toward renewable and green energy due to factors such as the need to reduce carbon emissions, depletion of fossil fuels, climatic change, etc. Various government policies are in place to support the initiative toward greener energy. Many multinational companies are taking initiatives to cut down their carbon footprint to contribute to a greener planet and sustainability. For instance, Equinor (Norway) aims to cut its carbon emissions by half by 2050. A part of the plan is to develop its renewable energy businesses, particularly offshore wind, which may reach 6,000 megawatts in six years and 16,000 megawatts in 15 years.

Which is the fastest-growing region during the forecasted period in offshore wind market?

North America is the fastest-growing region during the forecasted period. The net zero goal of carbon emission and increasing participation of private players is driving the market for offshore wind in US. The abundance of seacoast and natural offshore wind along with government’s friendly offshore wind policy is attracting many large offshore wind developers. The developments in offshore wind technology as floating wind farms, larger and more efficient turbines are some factors which encourages the installation of new offshore wind farms in this region. The strong political will in US for growth of renewable energy resources is likely to give boost to offshore wind sector. The North American market has started late in offshore industry but catching up at a very fast rate which is fueled by the government policies as well as research and development in offshore wind market.

Which is the fastest-growing segment, by component during the forecasted period in offshore wind market?

Turbine is to be the fastest-growing segment by component. Turbines are most valuable part of the entire value chain of offshore wind market. Offshore wind turbines are essentially same as the onshore wind turbines in mechanism apart from the fact that they are bigger and larger in size and are equipped with additional features to withstand the harsh climatic challenges presented by offshore seas. A wind turbine consists of three main parts which are nacelle, rotors and blades and tower .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 OFFSHORE WIND MARKET, BY COMPONENT: INCLUSIONS AND EXCLUSIONS

1.3.2 MARKET, BY LOCATION: INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARIES

2.3 IMPACT OF COVID-19

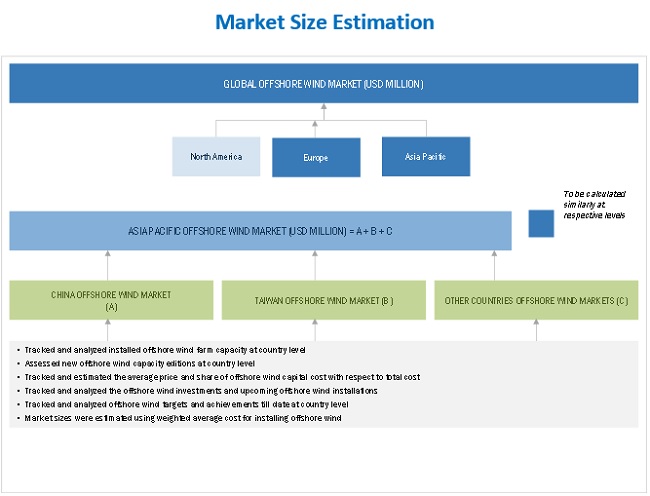

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.3 DEMAND SIDE ANALYSIS

FIGURE 6 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR OFFSHORE WIND

2.4.3.1 Demand side calculation

2.4.3.2 Assumptions for demand side analysis

2.4.4 SUPPLY SIDE ANALYSIS

FIGURE 7 MAIN METRICS CONSIDERED IN ASSESSING SUPPLY FOR OFFSHORE WIND

FIGURE 8 MARKET: SUPPLY SIDE ANALYSIS

2.4.4.1 Supply side calculation

2.4.4.2 Assumptions for supply side

2.4.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 1 SNAPSHOT OF OFFSHORE WIND MARKET

FIGURE 9 TURBINES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY COMPONENT, DURING FORECAST PERIOD

FIGURE 10 NACELLE TO HOLD LARGEST SHARE OF MARKET FOR TURBINES, BY MODULE, DURING FORECAST PERIOD

FIGURE 11 MONOPILE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY SUBSTRUCTURE, DURING FORECAST PERIOD

FIGURE 12 SUBSTATION SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET, BY ELECTRICAL INFRASTRUCTURE, DURING FORECAST PERIOD

FIGURE 13 SHALLOW WATER SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY LOCATION, DURING FORECAST PERIOD

FIGURE 14 NORTH AMERICA MARKET TO EXHIBIT HIGHEST CAGR DURING 2021–2026

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN OFFSHORE WIND MARKET

FIGURE 15 RISING DEMAND FOR RENEWABLE ENERGY TO DRIVE GROWTH OF MARKET DURING FORECAST PERIOD

4.2 MARKET, BY REGION

FIGURE 16 MARKET IN NORTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY COMPONENT

FIGURE 17 TURBINES SEGMENT HELD LARGEST SHARE OF MARKET IN 2020

4.4 MARKET FOR TURBINES, BY MODULE

FIGURE 18 NACELLE SEGMENT HELD LARGEST SHARE OF OFFSHORE WIND MARKET IN 2020

4.5 MARKET, BY SUBSTRUCTURE

FIGURE 19 MONOPILE SEGMENT HELD LARGEST SHARE OF MARKET IN 2020

4.6 MARKET, BY ELECTRICAL INFRASTRUCTURE

FIGURE 20 SUBSTATION SEGMENT HELD LARGER SHARE OF ELECTRICAL INFRASTRUCTURE IN 2020

4.7 MARKET, BY LOCATION

FIGURE 21 SHALLOW WATER SEGMENT HELD LARGEST SHARE OF MARKET, BY LOCATION, IN 2020

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COVID-19 GLOBAL PROPAGATION

FIGURE 23 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 GLOBAL ROAD TO RECOVERY FROM COVID-19

FIGURE 24 GLOBAL RECOVERY ROAD FROM COVID-19 FROM 2020 TO 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 25 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 26 OFFSHORE WIND MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Increasing global investments in renewable energy are likely to drive offshore wind market

FIGURE 27 ANNUAL GLOBAL INVESTMENTS IN POWER PLANTS, 2010–2020 (USD BILLION)

5.5.1.2 Favorable government policies across all regions

FIGURE 28 TOTAL INSTALLED CAPACITY OF OFFSHORE WIND IN MW, BY COUNTRY, 2020

5.5.2 RESTRAINTS

5.5.2.1 High capital costs and logistic issues

5.5.2.2 Low cost of conventional electricity generation

FIGURE 29 AVERAGE CAPITAL COST INCURRED PER KW FOR VARIOUS TECHNOLOGIES

5.5.3 OPPORTUNITIES

5.5.3.1 Initiatives by governments and companies to reduce carbon emissions

FIGURE 30 GLOBAL ENERGY-RELATED CO2 EMISSIONS, 2005–2020

5.5.3.2 Floating foundation wind farms are permitting access to better wind resources

5.5.4 CHALLENGES

5.5.4.1 Lack of technical expertise needed to develop an offshore wind farm

5.5.4.2 Climatic challenges during operations of wind farm

5.5.4.3 Impact of COVID-19

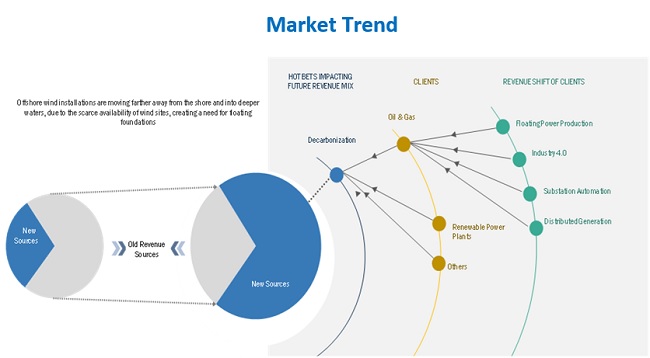

5.6 YC-SHIFT

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS

FIGURE 31 REVENUE SHIFT FOR MARKET

5.7 MARKET MAP

FIGURE 32 MARKET MAP OF MARKET

5.8 AVERAGE COST TRENDS ANALYSIS

TABLE 2 WEIGHTED AVERAGE TOTAL INSTALLED COST TREND FOR OFFSHORE WIND ENERGY, 2010 & 2019 (USD/KW)

5.9 VALUE CHAIN ANALYSIS

FIGURE 33 MARKET: VALUE CHAIN ANALYSIS

5.9.1 RAW MATERIAL SUPPLIERS

5.9.2 COMPONENT MANUFACTURERS/TURBINE SUPPLIERS

5.9.3 SYSTEM INTEGRATORS/ASSEMBLERS

5.9.4 WIND FARM OPERATORS

5.9.4.1 Operations and Maintenance Services

TABLE 3 MARKET: ECOSYSTEM

5.10 TECHNOLOGY ANALYSIS

5.11 MARKET: CODES AND REGULATIONS

TABLE 4 MARKET: CODES AND REGULATIONS

5.12 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 5 INNOVATIONS AND PATENTS RELATED TO MARKET

5.13 CASE STUDY ANALYSIS

5.13.1 OFFSHORE WIND FARM CHANGES MUNICH’S ENERGY MIX

5.13.1.1 Problem statement

5.13.1.2 Solution

5.13.2 GENERATING RENEWABLE ENERGY FROM UK’S OFFSHORE WIND FARMS

5.13.2.1 Problem statement

5.13.2.2 Solution

5.14 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 OFFSHORE WIND MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 THREAT OF NEW ENTRANTS IS LOW IN MARKET

5.14.1 THREAT OF SUBSTITUTES

5.14.2 BARGAINING POWER OF SUPPLIERS

5.14.3 BARGAINING POWER OF BUYERS

5.14.4 THREAT OF NEW ENTRANTS

5.14.5 DEGREE OF COMPETITION

6 OFFSHORE WIND MARKET, BY COMPONENT (Page No. - 73)

6.1 INTRODUCTION

TABLE 7 OFFSHORE WIND MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

6.2 TURBINES

TABLE 8 MARKET FOR TURBINES, BY MODULE, 2019–2026 (USD MILLION)

TABLE 9 MARKET FOR TURBINES, BY REGION, 2019–2026 (USD MILLION)

TABLE 10 MARKET FOR NACELLE, BY REGION, 2019–2026 (USD MILLION)

TABLE 11 MARKET FOR ROTORS AND BLADES, BY REGION, 2019–2026 (USD MILLION)

TABLE 12 MARKET FOR TOWER, BY REGION, 2019–2026 (USD MILLION)

6.3 ELECTRICAL INFRASTRUCTURE

TABLE 13 MARKET FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 14 MARKET FOR ELECTRICAL INFRASTRUCTURE, BY REGION, 2019–2026 (USD MILLION)

TABLE 15 MARKET FOR WIRES & CABLES, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 MARKET FOR SUBSTATION, BY REGION, 2019–2026 (USD MILLION)

6.4 SUBSTRUCTURE

TABLE 17 MARKET FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 18 MARKET FOR SUBSTRUCTURE, BY REGION, 2019–2026 (USD MILLION)

TABLE 19 MARKET FOR MONOPILE, BY REGION, 2019–2026 (USD MILLION)

TABLE 20 MARKET FOR JACKET AND GRAVITY-BASED, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 MARKET FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

6.5 OTHERS

TABLE 22 OFFSHORE WINDMARKET FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

7 OFFSHORE WIND MARKET, BY LOCATION (Page No. - 85)

7.1 INTRODUCTION

TABLE 23 MARKET, BY LOCATION, 2019–2026 (USD MILLION)

7.2 SHALLOW WATER (<30 M DEPTH)

TABLE 24 SHALLOW WATER: MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3 TRANSITIONAL WATER (30–60 M DEPTH)

TABLE 25 TRANSITIONAL WATER: MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4 DEEPWATER (MORE THAN 60 M DEPTH)

TABLE 26 DEEPWATER: MARKET, BY REGION, 2019–2026 (USD MILLION)

8 GEOGRAPHIC ANALYSIS (Page No. - 90)

8.1 INTRODUCTION

FIGURE 37 MARKET IN NORTH AMERICA TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

FIGURE 38 OFFSHORE WIND MARKET SHARE, BY REGION, 2020 (%)

TABLE 27 GLOBAL MARKET, BY REGION, 2019–2026 (USD MILLION)

8.2 ASIA PACIFIC

FIGURE 39 SNAPSHOT: MARKET IN ASIA PACIFIC

8.2.1 BY COMPONENT

TABLE 28 OFFSHORE WIND MARKET IN APAC, BY COMPONENT, 2019–2026 (USD MILLION)

8.2.2 BY TURBINES

TABLE 29 MARKET IN APAC, FOR TURBINES, BY MODULE, 2019–2026 (USD MILLION)

8.2.3 BY SUBSTRUCTURE

TABLE 30 MARKET IN APAC FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

8.2.4 BY ELECTRICAL INFRASTRUCTURE

TABLE 31 MARKET IN APAC FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

8.2.5 BY LOCATION

TABLE 32 MARKET IN APAC, BY LOCATION, 2019–2026 (USD MILLION)

8.2.6 BY COUNTRY

TABLE 33 MARKET IN APAC, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.6.1 China

8.2.6.1.1 Strong political commitment and decarbonization measures to drive growth of offshore wind market in China

TABLE 34 MARKET IN CHINA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 35 MARKET IN CHINA FOR TURBINES, BY MODULE, 2019–2026 (USD MILLION)

TABLE 36 MARKET IN CHINA FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 37 MARKET IN CHINA FOR ELECTRICAL INFRASTRUCTURE, BY TYPE,2019–2026 (USD MILLION)

TABLE 38 MARKET IN CHINA BY LOCATION, 2019–2026 (USD MILLION)

8.2.6.2 Japan

8.2.6.2.1 Active participation of government and participation of wind farm developers is likely to drive offshore wind market in Japan

TABLE 39 MARKET IN JAPAN, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 40 MARKET IN JAPAN FOR TURBINE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 41 MARKET IN JAPAN FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 42 MARKET IN JAPAN FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 MARKET IN JAPAN BY LOCATION, 2019–2026 (USD MILLION)

8.2.6.3 South Korea

8.2.6.3.1 Aggressive plans by South Korean government and strong partnerships with other countries is going to drive offshore wind market in South Korea

TABLE 44 OFFSHORE WIND MARKET IN SOUTH KOREA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 45 MARKET IN SOUTH KOREA FOR TURBINE, BY MODULE, 2019–2026 (USD MILLION)

TABLE 46 MARKET IN SOUTH KOREA FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 47 MARKET IN SOUTH KOREA FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 48 MARKET IN SOUTH KOREA, BY LOCATION, 2019–2026 (USD MILLION)

8.2.6.4 Taiwan

8.2.6.4.1 Optimal wind energy conditions favor market growth in Taiwan

TABLE 49 MARKET IN TAIWAN, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 50 MARKET IN TAIWAN FOR TURBINE, BY MODULE, 2019–2026 (USD MILLION)

TABLE 51 MARKET IN TAIWAN FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 52 MARKET IN TAIWAN FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 MARKET IN TAIWAN, BY LOCATION, 2019–2026 (USD MILLION)

8.2.6.5 Vietnam

8.2.6.5.1 Move towards reducing dependency on fossil fuel and presence of wind resources to help in growth of offshore wind market

TABLE 54 MARKET IN VIETNAM, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 55 MARKET IN VIETNAM FOR TURBINE, BY MODULE, 2019–2026 (USD MILLION)

TABLE 56 MARKET IN VIETNAM FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 57 MARKET IN VIETNAM FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 58 MARKET IN VIETNAM, BY LOCATION, 2019–2026 (USD MILLION)

8.3 EUROPE

FIGURE 40 EUROPE: MARKET SNAPSHOT

8.3.1 BY COMPONENT

TABLE 59 OFFSHORE WIND MARKET IN EUROPE, BY COMPONENT, 2019–2026 (USD MILLION)

8.3.2 BY TURBINE

TABLE 60 MARKET IN EUROPE FOR TURBINES, BY MODULE, 2019–2026 (USD MILLION)

8.3.3 BY SUBSTRUCTURE

TABLE 61 MARKET IN EUROPE FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

8.3.4 BY ELECTRICAL INFRASTRUCTURE

TABLE 62 MARKET IN EUROPE FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

8.3.5 BY LOCATION

TABLE 63 MARKET IN EUROPE, BY LOCATION, 2019–2026 (USD MILLION)

8.3.6 BY COUNTRY

TABLE 64 MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

8.3.6.1 Germany

8.3.6.1.1 Government-led efforts and energy transition to lead way for offshore wind market

TABLE 65 MARKET IN GERMANY, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 66 MARKET IN GERMANY FOR TURBINE, BY MODULE, 2019–2026 (USD MILLION)

TABLE 67 MARKET IN GERMANY FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 68 MARKET IN GERMANY FOR BY ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 69 MARKET IN GERMANY, BY LOCATION, 2019–2026 (USD MILLION)

8.3.6.2 UK

8.3.6.2.1 Government policies and favorable conditions for offshore wind farms to drive market growth

TABLE 70 MARKET IN UK, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 71 MARKET IN UK FOR BY TURBINES, BY MODULE, 2019–2026 (USD MILLION)

TABLE 72 MARKET IN UK FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 MARKET IN UK FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 MARKET IN UK, BY LOCATION, 2019–2026 (USD MILLION)

8.3.6.3 Denmark

8.3.6.3.1 High government support and developed market for offshore winds to create lucrative opportunities for market players

TABLE 75 OFFSHORE WIND MARKET IN DENMARK, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 76 MARKET IN DENMARK FOR TURBINES, BY MODULE, 2019–2026 (USD MILLION)

TABLE 77 MARKET IN DENMARK FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 MARKET IN DENMARK FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 MARKET IN DENMARK, BY LOCATION, 2019–2026 (USD MILLION)

8.3.6.4 Belgium

8.3.6.4.1 Commercial lending to drive growth of offshore wind market

TABLE 80 MARKET IN BELGIUM, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 81 MARKET IN BELGIUM FOR TURBINE, BY MODULE, 2019–2026 (USD MILLION)

TABLE 82 MARKET IN BELGIUM FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 MARKET IN BELGIUM FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 MARKET IN BELGIUM, BY LOCATION, 2019–2026 (USD MILLION)

8.3.6.5 Netherlands

8.3.6.5.1 High government support to drive growth of offshore wind market

TABLE 85 MARKET IN NETHERLANDS, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 86 MARKET IN NETHERLANDS FOR TURBINE, BY MODULE, 2019–2026 (USD MILLION)

TABLE 87 MARKET IN NETHERLANDS FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 MARKET IN NETHERLANDS FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 89 MARKET IN NETHERLANDS, BY LOCATION, 2019–2026 (USD MILLION)

8.3.6.6 Sweden

8.3.6.6.1 Government-led plans to achieve 100% renewable energy by 2040 to drive growth of offshore wind market

TABLE 90 MARKET IN SWEDEN, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 91 MARKET IN SWEDEN FOR TURBINES, BY MODULE, 2019–2026 (USD MILLION)

TABLE 92 MARKET IN SWEDEN FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 MARKET IN SWEDEN FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 MARKET IN SWEDEN, BY LOCATION, 2019–2026 (USD MILLION)

8.3.6.7 Finland

8.3.6.7.1 Government initiatives to develop offshore wind industry to boost market growth

TABLE 95 MARKET IN FINLAND, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 96 MARKET IN FINLAND FOR TURBINES, BY MODULE, 2019–2026 (USD MILLION)

TABLE 97 MARKET IN FINLAND FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 MARKET IN FINLAND FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 MARKET IN FINLAND, BY LOCATION, 2019–2026 (USD MILLION)

8.3.6.8 Ireland

8.3.6.8.1 Upcoming offshore wind projects to help country achieve its renewable energy goals and drive market growth

TABLE 100 OFFSHORE WIND MARKET IN IRELAND, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 101 MARKET IN IRELAND FOR TURBINES, BY MODULE, 2019–2026 (USD MILLION)

TABLE 102 MARKET IN IRELAND FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 MARKET IN IRELAND FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 MARKET IN IRELAND, BY LOCATION, 2019–2026 (USD MILLION)

8.3.6.9 Rest of Europe

TABLE 105 MARKET IN REST OF EUROPE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 106 MARKET IN REST OF EUROPE FOR TURBINES, BY MODULE, 2019–2026 (USD MILLION)

TABLE 107 MARKET IN REST OF EUROPE FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 MARKET IN REST OF EUROPE FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 MARKET IN REST OF EUROPE, BY LOCATION, 2019–2026 (USD MILLION)

8.4 NORTH AMERICA

FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT, 2020

8.4.1 BY COMPONENT

TABLE 110 OFFSHORE WIND MARKET IN NORTH AMERICA, BY COMPONENT, 2019–2026 (USD MILLION)

8.4.2 BY TURBINES

TABLE 111 MARKET IN NORTH AMERICA FOR TURBINES, BY MODULE, 2019–2026 (USD MILLION)

8.4.3 BY SUBSTRUCTURE

TABLE 112 MARKET IN NORTH AMERICA FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

8.4.4 BY ELECTRICAL INFRASTRUCTURE

TABLE 113 MARKET IN NORTH AMERICA FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

8.4.5 BY LOCATION

TABLE 114 MARKET IN NORTH AMERICA, BY LOCATION, 2019–2026 (USD MILLION)

8.4.6 BY COUNTRY

TABLE 115 MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

8.4.6.1 US

8.4.6.1.1 Favorable government policies to drive growth of US offshore wind market

TABLE 116 MARKET IN US, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 117 MARKET IN US FOR TURBINES, BY MODULE, 2019–2026 (USD MILLION)

TABLE 118 MARKET IN US FOR SUBSTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 MARKET IN US FOR ELECTRICAL INFRASTRUCTURE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 MARKET IN US, BY LOCATION, 2019–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 136)

9.1 OVERVIEW

TABLE 121 OVERVIEW OF TOP PLAYERS, JANUARY 2017–JULY 2021

9.2 MARKET SHARE ANALYSIS

TABLE 122 OFFSHORE WIND MARKET: DEGREE OF COMPETITION

FIGURE 42 LEADING PLAYERS IN MARKET

9.3 MARKET EVALUATION FRAMEWORK

TABLE 123 MARKET EVALUATION FRAMEWORK

9.4 COMPETITIVE SCENARIO

TABLE 124 MARKET: PRODUCT LAUNCHES, JANUARY 2017–JULY 2021

TABLE 125 MARKET: DEALS, JANUARY 2017–JULY 2021

TABLE 126 MARKET: OTHERS, JANUARY 2017–JULY 2021

9.5 COMPANY EVALUATION QUADRANT

9.5.1 STAR

9.5.2 EMERGING LEADER

9.5.3 PERVASIVE

9.5.4 PARTICIPANT

FIGURE 43 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2020

9.5.5 COMPANY FOOTPRINT

TABLE 127 COMPANY FOOTPRINT

TABLE 128 COMPANY COMPONENT FOOTPRINT

TABLE 129 COMPANY LOCATION FOOTPRINT

TABLE 130 COMPANY REGIONAL FOOTPRINT

10 COMPANY PROFILES (Page No. - 150)

10.1 MAJOR PLAYERS

(Business overview, Products/solutions offered, Recent Developments, MNM view)*

10.1.1 GENERAL ELECTRIC

TABLE 131 GENERAL ELECTRIC: COMPANY OVERVIEW

FIGURE 44 GENERAL ELECTRIC: COMPANY SNAPSHOT

TABLE 132 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 133 GENERAL ELECTRIC: PRODUCT LAUNCHES

TABLE 134 GENERAL ELECTRIC: DEALS

TABLE 135 GENERAL ELECTRIC: OTHERS

10.1.2 VESTAS

TABLE 136 VESTAS: COMPANY OVERVIEW

FIGURE 45 VESTAS: COMPANY SNAPSHOT

TABLE 137 VESTAS: PRODUCTS/SOLUTIONS OFFERED

TABLE 138 VESTAS: PRODUCT LAUNCHES

TABLE 139 VESTAS: DEALS

TABLE 140 VESTAS: OTHERS

10.1.3 SIEMENS GAMESA

TABLE 141 SIEMENS GAMESA: COMPANY OVERVIEW

FIGURE 46 SIEMENS GAMESA: COMPANY SNAPSHOT

TABLE 142 SIEMENS GAMESA: PRODUCTS/SOLUTIONS OFFERED

TABLE 143 SIEMENS GAMESA: PRODUCT LAUNCHES

TABLE 144 SIEMENS GAMESA: DEALS

10.1.4 ABB

TABLE 145 ABB: COMPANY OVERVIEW

FIGURE 47 ABB: COMPANY SNAPSHOT

TABLE 146 ABB: PRODUCTS/SOLUTIONS OFFERED

TABLE 147 ABB: DEALS

10.1.5 GOLDWIND

TABLE 148 GOLDWIND: COMPANY OVERVIEW

FIGURE 48 GOLDWIND: COMPANY SNAPSHOT

TABLE 149 GOLDWIND: PRODUCTS/SOLUTIONS OFFERED

TABLE 150 GOLDWIND: PRODUCT LAUNCHES

TABLE 151 GOLDWIND: DEALS

10.1.6 DOOSAN HEAVY INDUSTRIES AND CONSTRUCTION

TABLE 152 DOOSAN HEAVY INDUSTRIES AND CONSTRUCTION: COMPANY OVERVIEW

FIGURE 49 DOOSAN HEAVY INDUSTRIES AND CONSTRUCTION: COMPANY SNAPSHOT

TABLE 153 DOOSAN HEAVY INDUSTRIES AND CONSTRUCTION: PRODUCTS/SOLUTIONS OFFERED

TABLE 154 DOOSAN HEAVY INDUSTRIES AND CONSTRUCTION

10.1.7 NORDEX

TABLE 155 NORDEX: COMPANY OVERVIEW

FIGURE 50 NORDEX SE: COMPANY SNAPSHOT

TABLE 156 NORDEX: PRODUCTS/SOLUTIONS OFFERED

TABLE 157 NORDEX: DEALS

10.1.8 SHANGHAI ELECTRIC WIND POWER EQUIPMENT CO.

TABLE 158 SHANGHAI ELECTRIC WIND POWER EQUIPMENT CO.: COMPANY OVERVIEW

FIGURE 51 SHANGHAI ELECTRIC WIND POWER EQUIPMENT CO.: COMPANY SNAPSHOT

TABLE 159 SHANGHAI ELECTRIC WIND POWER EQUIPMENT CO.: PRODUCTS/SOLUTIONS OFFERED

TABLE 160 SHANGHAI ELECTRIC WIND POWER EQUIPMENT CO.: PRODUCT LAUNCHED

TABLE 161 SHANGHAI ELECTRIC WIND POWER EQUIPMENT CO.: DEALS

10.1.9 EEW GROUP

TABLE 162 EEW GROUP: COMPANY OVERVIEW

TABLE 163 EEW GROUP: PRODUCTS/SOLUTIONS OFFERED

TABLE 164 EEW GROUP: DEALS

10.1.10 NEXANS

TABLE 165 NEXANS: COMPANY OVERVIEW

FIGURE 52 NEXANS: COMPANY SNAPSHOT

TABLE 166 NEXANS: PRODUCTS/SOLUTIONS OFFERED

TABLE 167 NEXANS: PRODUCT LAUNCHES

TABLE 168 NEXANS: DEALS

10.1.11 DEME

TABLE 169 DEME: COMPANY OVERVIEW

FIGURE 53 DEME: COMPANY SNAPSHOT

TABLE 170 DEME: PRODUCTS/SOLUTIONS OFFERED

TABLE 171 DEME: DEALS

10.1.12 HITACHI

TABLE 172 HITACHI: COMPANY OVERVIEW

FIGURE 54 HITACHI: COMPANY SNAPSHOT

TABLE 173 HITACHI: PRODUCTS/SOLUTIONS OFFERED

TABLE 174 HITACHI: DEALS

10.1.13 MING YANG SMART ENERGY GROUP CO.

TABLE 175 MING YANG SMART ENERGY GROUP CO.: COMPANY OVERVIEW

TABLE 176 MING YANG SMART ENERGY GROUP CO.: PRODUCTS/SOLUTIONS OFFERED

TABLE 177 MING YANG SMART ENERGY GROUP CO.: PRODUCT LAUNCHES

TABLE 178 MING YANG SMART ENERGY GROUP CO.: DEALS

10.1.14 ENVISION ENERGY

TABLE 179 ENVISION: COMPANY OVERVIEW

TABLE 180 ENVISION: PRODUCTS/SOLUTIONS OFFERED

TABLE 181 ENVISION: DEALS

10.1.15 ROCKWELL AUTOMATION

TABLE 182 ROCKWELL AUTOMATION: COMPANY OVERVIEW

FIGURE 55 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

TABLE 183 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS OFFERED

TABLE 184 ROCKWELL AUTOMATION: DEALS

10.2 OTHER KEY PLAYERS

10.2.1 HYUNDAI MOTOR GROUP

TABLE 185 HYUNDAI MOTOR GROUP COMPANY SNAPSHOT

10.2.2 SCHNEIDER ELECTRIC

TABLE 186 SCHNEIDER ELECTRIC COMPANY SNAPSHOT

10.2.3 ZHEJIANG WINDEY CO

TABLE 187 ZHEJIANG WINDEY CO COMPANY SNAPSHOT

10.2.4 TAIYUAN HEAVY INDUSTRY CO., LTD

TABLE 188 TAIYUAN HEAVY INDUSTRY CO., LTD COMPANY SNAPSHOT

10.2.5 SINOVEL

TABLE 189 SINOVEL COMPANY SNAPSHOT

*Details on Business overview, Products/solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11 ADJACENT & RELATED MARKETS (Page No. - 221)

11.1 INTRODUCTION

11.2 LIMITATIONS

11.3 OFFSHORE WIND TURBINE EQUIPMENT MARKET

11.3.1 MARKET DEFINITION

11.3.2 LIMITATIONS

TABLE 190 OFFSHORE WIND TURBINE MARKET, BY UNITS (CUMULATIVE), 2017–2030 (UNIT)

TABLE 191 OFFSHORE WIND TURBINE MARKET, BY UNITS (NEW INSTALLATION), 2017–2030 (UNIT)

TABLE 192 OFFSHORE WIND TURBINE MARKET, BY OFFSHORE WIND POWER CAPACITY (CUMULATIVE CAPACITY-), 2017–2030 (MW)

TABLE 193 OFFSHORE WIND TURBINE MARKET, BY OFFSHORE WIND POWER CAPACITY (NEW INSTALLATION-), 2017–2030 (MW)

TABLE 194 FARM DATA ALONG WITH NUMBER OF WIND POWER COLLECTION TRANSFORMERS (2018)

TABLE 195 NUMBER OF OFFSHORE INSTALLED WIND TURBINE UNITS BY COUNTRY (2018)

12 APPENDIX (Page No. - 225)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

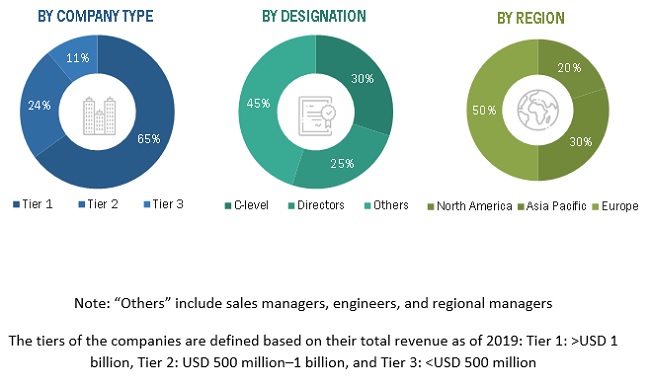

This study involved major activities in estimating the current size of the offshore wind market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Country-wise analysis were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global offshore wind market. The other secondary sources included press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The offshore wind market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by its industrial end-user industries. Moreover, the demand is also driven by the rising demand of renewable power. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the offshore wind market ecosystem.

Report Objectives

- To define, describe, and forecast the size of the offshore wind market by component, and location.

- To estimate and forecast the global market for various segments with respect to 3 main regions, namely, North America, Europe, and Asia Pacific (APAC) in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and industry-specific challenges that influence the market growth

- To provide a detailed overview of the offshore wind value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the market size in terms of value.

Available Customization

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Offshore Wind Market