Automated Optical Inspection System Market by Type (2D AOI, 3D AOI), Technology (Inline AOI, Offline AOI), Industry, Application (Fabrication Phase, Assembly Phase), Elements of AOI, and Region (2020-2026)

Updated on : October 23, 2024

Automated Optical Inspection System Market Size & Growth

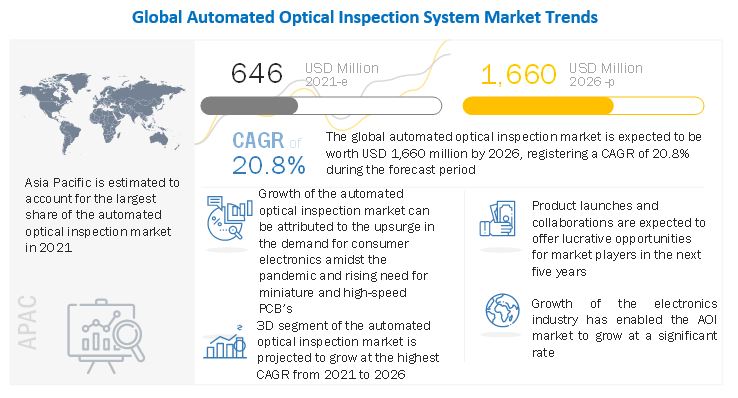

The global automated optical inspection system market size is estimated to be USD 646 million in 2021 and projected to reach USD 1,660 million by 2026, growing at a CAGR of 20.8% during the forecast period from 2021 to 2026.

The rising demand for higher productivity by electronics manufacturing services (EMS) companies and growing demand for electronics in automotive sector is driving the growth of the automated optical inspection system market. Moreover, the emergence of smart technology as well as utilization of AOI system in newer applications is alsoexpected to drive the growth of the market in the near future.

Impact of AI on Automated Optical Inspection System Market

Artificial Intelligence (AI) is revolutionizing the Automated Optical Inspection (AOI) system market by enhancing defect detection accuracy, reducing false positives, and enabling adaptive learning in inspection processes. By integrating machine learning algorithms and computer vision, AI-powered AOI systems can analyze complex patterns, detect micro-defects, and make real-time decisions with minimal human intervention. This advancement is particularly crucial in high-precision industries like semiconductor manufacturing, electronics assembly, and automotive, where quality assurance is critical. As a result, AI is driving greater efficiency, faster inspection cycles, and improved product quality, solidifying its role as a game-changer in the AOI market.

To know about the assumptions considered for the study, Request for Free Sample Report

Automated Optical Inspection System Market Dynamics

DRIVERS: Rising need for miniature, high speed PCBs

Today's world is incredibly fast-paced, demanding that people and technology move quickly as well. As the years' pass, we expect things to get even faster, and this includes electronics. To allow the devices to keep up with this growing demand for speed, PCB technology will need to adapt accordingly. High-speed PCBs are a unique subject for designers as it increases the complexity while designing. A high-speed PCB is one where the integrity of the signal is affected by the circuit layout. PCBs are the essential building block for nearly everything electronic.

RESTRAINT: False call rate of image-based AOI systems

The false call rate (FCR) is defined as the number of good components found as defective, while parts-per-million (ppm) is a measure for the false call rate. False calls are the most critical factors when considering image-based AOI systems. The image-based AOI system uses a number of images to segregate defective components from good ones. At the same time, this system mostly depends on the operator who captures these images and feeds them into the database. Sometimes, falsely classified images can be put in the image database, which makes parameter optimization impossible.

OPPORTUNITIES: Growing Demand for AOI systems for inspection of IC substrates

The introduction of nanotechnology has triggered the miniaturization and use of high-density PCBs in electronics manufacturing. However, with these advancements, many problems are arising. As the size of the PCB is shrinking, the ball grid array (BGA) gap is also decreasing, which gives rise to various defects in the PCB. Few of these defects include substrate corrosion, material mismatch, solder paste defects, and susceptibility to EMI interference. These defects cannot be precisely identified using manual inspection. Hence, there is a rising demand for the use of AOI systems in the detection of IC substrate defects.

CHALLENGES: Availability of superior inspection technology as the substitute

An AOI system works efficiently while inspecting PCBs where solder joints are visible. However, with the advent of new PCB and IC manufacturing technology such as ball grid array (BGA), where solder joints are not visible, AOI systems are not capable of finding soldering defects. On the other hand, other inspection technology, such as automated x-ray inspection (AXI), can inspect a wide range of assembly defects of PCBs with BGA technology. AXI uses X-rays instead of light imaging to inspect the PCBs. Companies often use AXI to evaluate particularly complex or densely constructed boards.

Automated Optical Inspection Market Segmentation

3D AOI system to dominate the market in forecast period

3DAOI systems inspectassembled PCBs and other electronics in three dimensions. This is in contrast to2D AOIsystems. 3D AOI system typically uses a camera to verify that the items meet quality standards, making sure they are of the right size or their proper locations.3D AOI technology has emerged as a viable technology for the detection of a variety of manufacturing defects. A 3D AOI system is used where there is a requirement for more rigorous standards for surface mount devices (SMDs), and high precision for defect detection is required. Thus, 3D AOI system market is expected to be dominant during the forecast period.

Inline AOI system to have largest market share in 2021

Inline AOI systems are a valuable part of the manufacturing workstation process. Inline AOI is part of the production line and is more suitable for inspecting components on a fast-moving production line. In an inline AOI technology, the boards are loaded and unloaded automatically, making the inspection of PCBs faster. Inline AOI systems can be strategically placed before or after the reflow process, depending on the requirements of manufacturers. Hence, most of the large manufacturing companies install multiple inline AOI systems in their production lines to speed up the inspection process.

Automotive industry to hold largest CAGR during the forecast period

The growing share of advanced electronics to support various functionalities of automobiles is expected to boost the automated optical inspection system market for automotive. The industry needs critical inspection of PCBs to ensure consumer safety and reliable working of the vehicle. AOI, conformal coating, and solder paste inspection offer non-invasive inspection solutions, providing real-time process data for accurate detection of faults and improvement in yield.The advent of new technologies such as autonomous driving, connected vehicles, electric vehicles, automotive sensors, and advanced navigation and infotainment systems has increased the share of electronics in automobiles to a higher level. There is rising adoption of Industrial IoT (IIoT) in the automotive sector.

Automated Optical Inspection Industry Regional Analysis

North America region is fastest growing in the automated optical inspection system market

The presence of a tech-savvy population with a high disposable income and a huge demand for consumer electronics has led to advancements in PCBs, which further drive the AOI market in North America. The recent surge in domestic manufacturing in the US, a highly developed economy, and presence of a population with a high disposable income with high demand for consumer electronics make the North American region an attractive market for automated optical inspection systems.

To know about the assumptions considered for the study, download the pdf brochure

Integration of Artificial Intelligence with Automated Optical Inspection

AOI systems have been widely used for the real-time detection of defects and quality control of PCBs on the production line. By incorporating AI and deep learning, not only can the automated optical inspection industry process images of the already produced products but also identify the defects and, over time, learn more about different types of defects without explicit programming.

Top Automated Optical Inspection Companies - Key Market Players

The automated optical inspection system companies is dominated by a few globally established players such as

- Koh Young (South Korea),

- Test Research, Inc. (TRI) (Taiwan),

- Omron Corporation (Japan),

- Camtek (Israel), and Viscom AG (Germany).

Automated Optical Inspection Market Report Scope

|

Report Metric |

Detail |

|

Estimated Market Size |

USD 646 million |

|

Expected Market Size |

USD 1,660 million |

|

Growth Rate |

CAGR of 20.8% |

|

Market Size Availability for Years |

2017–2026 |

|

Base Year |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By application, elements of AOI, type, technology, industry, and region |

|

Geographies Covered |

North America, Europe, APAC, and RoW |

|

Companies Covered |

Koh Young Technology, Test Research Inc, Omron, Camtek, and Viscom. |

This research report categorizes the automated optical inspection market, by application, elements of AOI, type, technology, industry, and region

Based on Application:

- Fabrication Phase

- Assembly Phase

Elements of AOI:

-

Elements of AOI

- Camera System

- Lighting System

- Computer System

- Software

- Defect Detection Process

- Types of PCB used for Defect Detection

Based on Type:

- 2D AOI System

- 3D AOI System

Based on Technology:

- Inline AOI System

- Offline AOI System

Based on Industry:

- Consumer Electronics

- Telecommunications

- Automotive

- Medical Devices

- Aerospace & Defense

- Industrial Electroncis

- Energy & Power

Based on the Region:

- North America

- Europe

- APAC

- RoW (South America, Middle East & Africa)

Recent Developments in Automated Optical Inspection Industry

- In March 2021,Viscom developed a new Heavy Flex handling solution to meet the need for flexible handling of large and heavy objects. Heavy Flex handling options are available for Viscom's S3016 ultra system for optical inline 3D inspection.

- In March 2021, Saki Corporation enhanced the 3Di Series AOI system with its new Z-axis solution to accelerate inspection of tall components, press-fit components, and PCBAs in jigs. The new Z-axis package for 3Di Series achieves a maximum height-measurement range in 3D mode to 40 mm. The maximum focus height in 2D is also increased to 40 mm

- In December 2020, Test Research, Inc. (TRI) announced the release of the high-reliability TR77000QMSII 3D AOI. The TR7700QMSII is built on a high precision platform with 5.5 μm high resolution 12 MP imaging technology for the semiconductor & packaging and other high-reliability industries.

- In July 2020, Test Research, Inc. (TRI) joined the NEPCON Asia held at the Shenzhen Exhibition & Convention Center to launch the 3D AOI TR7700Q SII with an improved optical system that increases stability and speed up to 25%, compared to the last model. TRI also presented the Multi-Angle 3D AOI TR7500QE offering high-quality imaging designed for Zero-Escape industry applications.

Frequently Asked Questions (FAQs):

What is the total CAGR expected to be recorded for the automated optical inspection system market during 2021-2026?

The global automated optical inspectionsystem market is expected to record a CAGR of 20.8% from 2021–2026.

What are the driving factors for the automated optical inspection?

Advantages of AOI over other inspection methods, upsurge in demand for consumer electronics amidst pandemic, rising need for miniature, high-speed PCBs; demand for higher productivity by electronics manufacturing services (EMS) companies,and growing demand for electronics in automotive sector

Which are the significant players operating in the automated optical inspection system market?

Koh Young (South Korea), Test Research, Inc. (TRI) (Taiwan), Omron Corporation (Japan), Camtek (Israel), and Viscom AG (Germany) are some of the major companies operating in the automated optical inspectionsystem market.

Which region will lead theautomated optical inspection system market in the future?

Asia Pacific is expected to lead the automated optical inspection system market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AUTOMATED OPTICAL INSPECTION MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 VOLUME UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 AOI SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at the market size through bottom-up analysis (demand side)

FIGURE 3 BOTTOM-UP APPROACH TO ARRIVE AT THE MARKET SIZE

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at the market size through top-down analysis (supply side)

FIGURE 4 TOP-DOWN APPROACH TO ARRIVE AT THE MARKET SIZE

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY FOR AOI MARKET USING SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENTS

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 7 EFFECT OF COVID-19 ON AUTOMATED OPTICAL INSPECTION MARKET

3.1 POST-COVID-19 SCENARIO

TABLE 2 POST-COVID-19 SCENARIO: AOI SYSTEM MARKET, 2021–2026 (USD MILLION)

3.2 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 3 OPTIMISTIC SCENARIO (POST-COVID-19): AOI SYSTEM MARKET, 2021–2026 (USD MILLION)

3.3 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 4 PESSIMISTIC SCENARIO (POST-COVID-19): AOI SYSTEM MARKET, 2021–2026 (USD MILLION)

FIGURE 8 3D AOI SYSTEMS TO LEAD THE MARKET FROM 2021 TO 2026

FIGURE 9 INLINE AOI SYSTEMS TO HOLD LARGER SHARE OF MARKET FROM 2021 TO 2026

FIGURE 10 CONSUMER ELECTRONICS INDUSTRY TO HOLD LARGEST SHARE OF MARKET IN 2021

FIGURE 11 ASIA PACIFIC TO BE THE LARGEST MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN AUTOMATED OPTICAL INSPECTION MARKET

FIGURE 12 UPSURGE IN DEMAND FOR CONSUMER ELECTRONICS AND NEED FOR MINIATURE AND HIGH-SPEED PCB TO FUEL THE AUTOMATED OPTICAL INSPECTION MARKET FROM 2021 TO 2026

4.2 AUTOMATED OPTICAL INSPECTION MARKET, BY TYPE

FIGURE 13 3D AOI SYSTEMS TO BE LARGER SEGMENT OF THE MARKET FROM 2021 TO 2026

4.3 AUTOMATED OPTICAL INSPECTION MARKET, BY TECHNOLOGY

FIGURE 14 INLINE AOI SEGMENT TO LEAD THE MARKET FROM 2021 TO 2026

4.4 AUTOMATED OPTICAL INSPECTION MARKET, BY INDUSTRY

FIGURE 15 CONSUMER ELECTRONICS TO BE THE LARGEST END-USE INDUSTRY OF AOI MARKET BY 2026

4.5 AUTOMATED OPTICAL INSPECTION MARKET, BY COUNTRY

FIGURE 16 CHINA TO LEAD THE AUTOMATED OPTICAL INSPECTION MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 AUTOMATED OPTICAL INSPECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Advantages of AOI over other inspection methods

5.2.1.2 Upsurge in demand for consumer electronics amidst pandemics

5.2.1.3 Rising need for miniature, high-speed PCBs

5.2.1.4 Demand for higher productivity by electronics manufacturing services (EMS) companies

5.2.1.5 Growing demand for electronics in automotive sector

FIGURE 18 IMPACT OF DRIVERS ON AUTOMATED OPTICAL INSPECTION MARKET

5.2.2 RESTRAINTS

5.2.2.1 False call rate of image-based AOI systems

5.2.2.2 Requirement of highly skilled personnel

FIGURE 19 IMPACT OF RESTRAINTS ON AUTOMATED OPTICAL INSPECTION MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Advent of SMART technology

5.2.3.2 Newer applications for AOI systems apart from PCB inspection

5.2.3.3 Growing demand for AOI systems for inspection of IC substrates

FIGURE 20 IMPACT OF OPPORTUNITIES ON AUTOMATED OPTICAL INSPECTION MARKET

5.2.4 CHALLENGES

5.2.4.1 Requirement of sophisticated hardware and software systems to handle large amount of data

5.2.4.2 Availability of superior inspection technology as a substitute

FIGURE 21 IMPACT OF CHALLENGES ON AUTOMATED OPTICAL INSPECTION MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS OF AOI

5.4 ECOSYSTEM ANALYSIS

TABLE 5 ECOSYSTEM: AOI SYSTEMS

5.5 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AOI MARKET

5.6 CASE STUDY ANALYSIS

5.6.1 MICROART SERVICES INC USED CYBEROPTICS’ QX250I 2D AOI SYSTEM FOR POST SOLDER INSPECTION

5.6.2 LARITECH CHOSE KOH YOUNG TECHNOLOGY AS THEIR INSPECTION PARTNER

5.6.3 E.D.&A. INVESTS IN VISCOM 3D AOI FOR THT LINE

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 IMPACT OF EACH FORCE ON MARKET (2020)

5.8 TECHNOLOGY ANALYSIS

5.8.1 ARTIFICIAL INTELLIGENCE (AI) IN AOI

5.8.2 AOI TO HELP ACCELERATE INDUSTRY 4.0 TRANSFORMATION

5.9 PRICING ANALYSIS

TABLE 7 AVERAGE SELLING PRICES OF AOI SYSTEMS OFFERED BY TOP COMPANIES, 2020

TABLE 8 INDICATIVE PRICES OF AOI SYSTEM

5.10 TRADE ANALYSIS

FIGURE 23 IMPORT DATA, BY COUNTRY, 2016–2020 (USD BILLION)

FIGURE 24 EXPORT DATA, 2016–2020 (USD BILLION)

5.11 PATENT ANALYSIS

FIGURE 25 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 9 TOP 20 PATENT OWNERS IN LAST 10 YEARS

FIGURE 26 NUMBER OF PATENTS GRANTED PER YEAR FROM 2010 TO 2020

TABLE 10 LIST OF KEY PATENTS AND INNOVATIONS IN AOI MARKET

5.12 REGULATORY LANDSCAPE

5.12.1 REGULATORY LANDSCAPE

5.12.2 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS)

5.12.3 WASTE OF ELECTRONIC AND ELECTRICAL EQUIPMENT (WEEE)

5.12.4 EUROPEAN CONFORMITY (CE)

5.12.5 ELECTRONIC COMPONENTS INDUSTRY ASSOCIATION (ECIA)

6 AUTOMATED OPTICAL INSPECTION MARKET, BY APPLICATION (Page No. - 76)

6.1 INTRODUCTION

6.2 FABRICATION PHASE

6.3 ASSEMBLY PHASE

7 ELEMENTS OF AOI SYSTEM (Page No. - 79)

7.1 INTRODUCTION

FIGURE 27 ELEMENTS OF AN AOI SYSTEM

7.2 ELEMENTS OF AOI SYSTEM

7.2.1 CAMERA SYSTEM

7.2.1.1 Monochrome camera

7.2.1.2 Color camera

TABLE 11 MONOCHROME CAMERA VS. COLOR CAMERA

7.2.2 LIGHTING SYSTEM

7.2.2.1 Fluorescent lighting

7.2.2.2 LED lighting

7.2.2.3 UV (ultraviolet) or IR (infrared) lighting

7.2.3 COMPUTER SYSTEM

7.2.4 SOFTWARE

7.3 DEFECT DETECTION PROCESS

7.3.1 IMAGE COMPARISON

7.3.1.1 CAD data

7.3.1.2 Golden board image

7.3.1.3 Classification process of an image

7.3.2 ALGORITHM-BASED DETECTION

7.4 TYPES OF PCBS USED FOR DEFECT DETECTION

7.4.1 SINGLE-SIDED PCB

7.4.1.1 Application of single-sided PCB

7.4.2 DOUBLE-SIDED PCB

7.4.2.1 Application of double-sided PCB

7.4.3 MULTILAYER PCB

7.4.3.1 Application of multilayer PCB

7.4.4 HIGH-DENSITY INTERCONNECT (HDI) BOARDS

7.4.4.1 Application of HDI boards

7.4.5 FLEXIBLE PCB

7.4.5.1 Application of flexible PCBs

7.4.6 RIGID FLEXIBLE PCB

7.4.6.1 Application of rigid flexible PCB

7.4.7 IC SUBSTRATE

7.4.7.1 Application of IC substrate

8 AOI SYSTEM MARKET, BY TYPE (Page No. - 86)

8.1 INTRODUCTION

FIGURE 28 AOI SYSTEM MARKET, BY TYPE

TABLE 12 AOI SYSTEM MARKET, IN TERMS OF VALUE AND VOLUME, 2017–2026

FIGURE 29 3D AOI SYSTEMS TO BE DOMINANT AND GROW FASTER DURING FORECAST PERIOD

TABLE 13 AOI SYSTEM MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 14 AOI SYSTEM MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2 3D AOI SYSTEMS

8.2.1 ABILITY TO INSPECT COPLANARITY OF COMPONENTS AND PROVIDE VOLUMETRIC MEASUREMENT DATA TO DRIVE DEMAND

8.2.2 METHODOLOGIES OF 3D AOI INSPECTION

8.2.2.1 Laser measurement

8.2.2.2 Multi-frequency moiré phase shift image processing

FIGURE 30 FUNCTIONAL DIAGRAM: 3D AOI SYSTEM

TABLE 15 3D AOI SYSTEM ADVANTAGES VS. DISADVANTAGES

TABLE 16 3D AOI SYSTEM MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 17 3D AOI SYSTEM MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 18 3D AOI SYSTEM MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 19 3D AOI SYSTEM MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 20 3D AOI SYSTEM MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 3D AOI SYSTEM MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3 2D AOI SYSTEMS

8.3.1 HIGHER RATE OF FALSE CALLS WILL LEAD TO SHRINKING DEMAND

FIGURE 31 FUNCTIONAL DIAGRAM: 2D AOI SYSTEM

TABLE 22 2D AOI SYSTEM ADVANTAGES VS. DISADVANTAGES

TABLE 23 2D AOI SYSTEM MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 24 2D AOI SYSTEM MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 25 2D AOI SYSTEM MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 26 2D AOI SYSTEM MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 27 2D AOI SYSTEM MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 2D AOI SYSTEM MARKET, BY REGION, 2021–2026 (USD MILLION)

9 AOI SYSTEM MARKET, BY TECHNOLOGY (Page No. - 97)

9.1 INTRODUCTION

FIGURE 32 AOI SYSTEM MARKET SEGMENTATION, BY TECHNOLOGY

FIGURE 33 INLINE AOI EXPECTED TO LEAD THE MARKET DURING FORECAST PERIOD

TABLE 29 AOI SYSTEM MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 30 AOI SYSTEM MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.2 INLINE AOI

9.2.1 NEED FOR FASTER PCB INSPECTION TO DRIVE DEMAND

FIGURE 34 PROCESS FLOW OF AN INLINE AOI SYSTEM

TABLE 31 INLINE AOI SYSTEM ADVANTAGES VS. DISADVANTAGES

TABLE 32 INLINE AOI SYSTEM MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 33 INLINE AOI SYSTEM MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.3 OFFLINE AOI

9.3.1 LESS ACCURACY IN FAULT DETECTION WILL LEAD TO MODERATE DEMAND

FIGURE 35 PROCESS FLOW OF AN OFFLINE AOI SYSTEM

TABLE 34 OFFLINE AOI SYSTEM ADVANTAGES VS. DISADVANTAGES

TABLE 35 OFFLINE AOI SYSTEM MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 36 OFFLINE AOI SYSTEM MARKET, BY TYPE, 2021–2026 (USD MILLION)

10 AOI SYSTEM MARKET, BY INDUSTRY (Page No. - 104)

10.1 INTRODUCTION

FIGURE 36 AOI SYSTEM MARKET, BY INDUSTRY

TABLE 37 AOI SYSTEM MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 38 AOI SYSTEM MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

FIGURE 37 CONSUMER ELECTRONICS TO LEAD AOI SYSTEM MARKET DURING FORECAST PERIOD

10.2 CONSUMER ELECTRONICS

10.2.1 RISING NEED FOR SMART DEVICES TO DRIVE DEMAND

TABLE 39 AOI SYSTEM MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 40 AOI SYSTEM MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 41 AOI SYSTEM MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 AOI SYSTEM MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

10.3 TELECOMMUNICATIONS

10.3.1 EMERGING WIRELESS COMMUNICATION TECHNOLOGIES CONTRIBUTE TO DRIVE DEMAND

TABLE 43 AOI SYSTEM MARKET FOR TELECOMMUNICATIONS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 44 AOI SYSTEM MARKET FOR TELECOMMUNICATIONS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 45 AOI SYSTEM MARKET FOR TELECOMMUNICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 AOI SYSTEM MARKET FOR TELECOMMUNICATIONS, BY REGION, 2021–2026 (USD MILLION)

10.4 AUTOMOTIVE

10.4.1 INDUSTRIAL IOT ENABLES AUTOMOTIVE INDUSTRY TO ADOPT AOI SYSTEMS

TABLE 47 AOI SYSTEM MARKET FOR AUTOMOTIVE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 48 AOI SYSTEM MARKET FOR AUTOMOTIVE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 49 AOI SYSTEM MARKET FOR AUTOMOTIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 AOI SYSTEM MARKET FOR AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

10.5 MEDICAL DEVICES

10.5.1 RISING DIGITIZATION IN MEDICAL DEVICES TO DRIVE DEMAND

TABLE 51 AOI SYSTEM MARKET FOR MEDICAL DEVICES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 52 AOI SYSTEM MARKET FOR MEDICAL DEVICES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 53 AOI SYSTEM MARKET FOR MEDICAL DEVICES, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 AOI SYSTEM MARKET FOR MEDICAL DEVICES, BY REGION, 2021–2026 (USD MILLION)

10.6 AEROSPACE & DEFENSE

10.6.1 NEED FOR HIGH-QUALITY ELECTRONIC COMPONENTS TO DRIVE DEMAND

TABLE 55 AOI SYSTEM MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 56 AOI SYSTEM MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 57 AOI SYSTEM MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 AOI SYSTEM MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2021–2026 (USD MILLION)

10.7 INDUSTRIAL ELECTRONICS

10.7.1 INCREASING INDUSTRIAL DIGITIZATION TO DRIVE DEMAND

TABLE 59 AOI SYSTEM MARKET FOR INDUSTRIAL ELECTRONICS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 60 AOI SYSTEM MARKET FOR INDUSTRIAL ELECTRONICS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 61 AOI SYSTEM MARKET FOR INDUSTRIAL ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 AOI SYSTEM MARKET FOR INDUSTRIAL ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

10.8 ENERGY & POWER

10.8.1 UPGRADE OF ENERGY INFRASTRUCTURE TO DRIVE DEMAND

TABLE 63 AOI SYSTEM MARKET FOR ENERGY & POWER, BY TYPE, 2017–2020 (USD MILLION)

TABLE 64 AOI SYSTEM MARKET FOR ENERGY & POWER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 65 AOI SYSTEM MARKET FOR ENERGY & POWER, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 AOI SYSTEM MARKET FOR ENERGY & POWER, BY REGION, 2021–2026 (USD MILLION)

11 AOI MARKET, BY REGION (Page No. - 120)

11.1 INTRODUCTION

FIGURE 38 MEXICO TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 67 AOI MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 AOI MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: AOI MARKET SNAPSHOT

TABLE 69 AOI MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 70 AOI MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 71 AOI MARKET IN NORTH AMERICA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 72 AOI MARKET IN NORTH AMERICA, BY TYPE, 2021–2026 (USD MILLION)

11.2.1 US

11.2.1.1 Surge in domestic manufacturing to drive demand

TABLE 73 AOI MARKET IN US, BY TYPE, 2017–2020 (USD MILLION)

TABLE 74 AOI MARKET IN US, BY TYPE, 2021–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing automotive and energy & power industries to drive the market

TABLE 75 AOI MARKET IN CANADA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 76 AOI MARKET IN CANADA, BY TYPE, 2021–2026 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Increasing manufacturing of electronics to drive the market

TABLE 77 AOI MARKET IN MEXICO, BY TYPE, 2017–2020 (USD MILLION)

TABLE 78 AOI MARKET IN MEXICO, BY TYPE, 2021–2026 (USD MILLION)

11.3 EUROPE

FIGURE 40 EUROPE: AOI MARKET SNAPSHOT

TABLE 79 AOI MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 80 AOI MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 81 AOI MARKET IN EUROPE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 82 AOI MARKET IN EUROPE, BY TYPE, 2021–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Flourishing automotive industry to drive the market

TABLE 83 AOI MARKET IN GERMANY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 84 AOI MARKET IN GERMANY, BY TYPE, 2021–2026 (USD MILLION)

11.3.2 UK

11.3.2.1 Government push for enhancing telecommunications industry to drive the market

TABLE 85 AOI MARKET IN THE UK, BY TYPE, 2017–2020 (USD MILLION)

TABLE 86 AOI MARKET IN THE UK, BY TYPE, 2021–2026 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Increased production of electric vehicles to drive the market

TABLE 87 AOI MARKET IN FRANCE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 88 AOI MARKET IN FRANCE, BY TYPE, 2021–2026 (USD MILLION)

11.3.4 REST OF EUROPE

11.3.4.1 Expansion of manufacturing capabilities to drive the market

TABLE 89 AOI MARKET IN THE REST OF EUROPE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 90 AOI MARKET IN THE REST OF EUROPE, BY TYPE, 2021–2026 (USD MILLION)

11.4 APAC

FIGURE 41 APAC: AOI MARKET SNAPSHOT

TABLE 91 AOI MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 92 AOI MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 93 AOI MARKET IN APAC, BY TYPE, 2017–2020 (USD MILLION)

TABLE 94 AOI MARKET IN APAC, BY TYPE, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Government initiatives for expansion of domestic electronics manufacturing to drive the market

TABLE 95 AOI MARKET IN CHINA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 96 AOI MARKET IN CHINA, BY TYPE, 2021–2026 (USD MILLION)

11.4.2 TAIWAN

11.4.2.1 Growing use of advanced electronics devices to drive the market

TABLE 97 AOI MARKET IN TAIWAN, BY TYPE, 2017–2020 (USD MILLION)

TABLE 98 AOI MARKET IN TAIWAN, BY TYPE, 2021–2026 (USD MILLION)

11.4.3 SOUTH KOREA

11.4.3.1 Presence of world-class manufacturing infrastructure to drive the market

TABLE 99 AOI MARKET IN SOUTH KOREA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 100 AOI MARKET IN SOUTH KOREA, BY TYPE, 2021–2026 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Strong domestic demand for consumer electronics to drive the market

TABLE 101 AOI MARKET IN JAPAN, BY TYPE, 2017–2020 (USD MILLION)

TABLE 102 AOI MARKET IN JAPAN, BY TYPE, 2021–2026 (USD MILLION)

11.4.5 REST OF APAC

11.4.5.1 Emerging economies with low-cost electronics manufacturing capabilities to drive the market

TABLE 103 AOI MARKET IN THE REST OF APAC, BY TYPE, 2017–2020 (USD MILLION)

TABLE 104 AOI MARKET IN THE REST OF APAC, BY TYPE, 2021–2026 (USD MILLION)

11.5 ROW

TABLE 105 AOI MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 106 AOI MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 107 AOI MARKET IN ROW, BY TYPE, 2017–2020 (USD MILLION)

TABLE 108 AOI MARKET IN ROW, BY TYPE, 2021–2026 (USD MILLION)

11.5.1 SOUTH AMERICA

11.5.1.1 Rising FDIs to promote domestic manufacturing to drive the market

TABLE 109 AOI MARKET IN SOUTH AMERICA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 110 AOI MARKET IN SOUTH AMERICA, BY TYPE, 2021–2026 (USD MILLION)

11.5.2 MIDDLE EAST

11.5.2.1 Growing aerospace industry to drive the market

TABLE 111 AOI MARKET IN MIDDLE EAST, BY TYPE, 2017–2020 (USD MILLION)

TABLE 112 AOI MARKET IN MIDDLE EAST, BY TYPE, 2021–2026 (USD MILLION)

11.5.3 AFRICA

11.5.3.1 Emergence of African economies as an automotive manufacturing hub to drive the market

TABLE 113 AOI MARKET IN AFRICA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 114 AOI MARKET IN AFRICA, BY TYPE, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 144)

12.1 OVERVIEW

12.2 TOP FIVE COMPANY REVENUE ANALYSIS

FIGURE 42 AOI MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2016–2020

12.3 MARKET SHARE ANALYSIS, 2020

TABLE 115 AOI MARKET SHARE ANALYSIS (2020)

12.4 COMPETITIVE LEADERSHIP MAPPING

12.4.1 STAR

12.4.2 EMERGING LEADER

12.4.3 PERVASIVE

12.4.4 PARTICIPANT

FIGURE 43 AOI MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

12.5 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION MATRIX, 2020

12.5.1 PROGRESSIVE COMPANIES

12.5.2 RESPONSIVE COMPANIES

12.5.3 DYNAMIC COMPANIES

12.5.4 STARTING BLOCKS

FIGURE 44 AOI MARKET (GLOBAL), SME EVALUATION QUADRANT, 2020

12.6 AOI MARKET: PRODUCT FOOTPRINT

TABLE 116 COMPANY FOOTPRINT

TABLE 117 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 118 REGIONAL FOOTPRINT OF COMPANIES

12.7 COMPETITIVE SITUATIONS AND TRENDS

12.7.1 AOI MARKET: PRODUCT LAUNCHES, APRIL 2019–MARCH 2021

12.7.2 AOI MARKET: DEALS, MAY 2019–JANUARY 2021

13 COMPANY PROFILES (Page No. - 157)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 KOH YOUNG TECHNOLOGY

FIGURE 45 KOH YOUNG TECHNOLOGY: COMPANY SNAPSHOT

13.2.2 TEST RESEARCH

FIGURE 46 TEST RESEARCH: COMPANY SNAPSHOT

13.2.3 OMRON

FIGURE 47 OMRON: COMPANY SNAPSHOT

13.2.4 VISCOM

FIGURE 48 VISCOM: COMPANY SNAPSHOT

13.2.5 SAKI CORPORATION

13.2.6 NORDSON

FIGURE 49 NORDSON: COMPANY SNAPSHOT

13.2.7 KLA

FIGURE 50 KLA: COMPANY SNAPSHOT

13.2.8 CAMTEK

FIGURE 51 CAMTEK: COMPANY SNAPSHOT

13.2.9 CYBEROPTICS

FIGURE 52 CYBEROPTICS: COMPANY SNAPSHOT

13.2.10 GOEPEL ELECTRONIC

13.3 OTHER PLAYERS

13.3.1 MIRTEC

13.3.2 MARANTZ ELECTRONICS

13.3.3 MACHINE VISION PRODUCTS

13.3.4 MYCRONIC AB (VI TECHNOLOGY)

13.3.5 AOI SYSTEMS

13.3.6 DCB AUTOMATION

13.3.7 PEMTRON

13.3.8 PARMI

13.3.9 STRATUS VISION

13.3.10 ASC INTERNATIONAL

13.3.11 MANNCORP

13.3.12 ASCEN TECHNOLOGY

13.3.13 SCREEN PE SOLUTIONS

13.3.14 AOI VISION PTE

13.3.15 SEHO SYSTEMS

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 197)

14.1 MACHINE VISION MARKET, BY END-USER INDUSTRY

14.1.1 INTRODUCTION

14.1.2 COVID-19 IMPACT ON END-USER INDUSTRY

FIGURE 53 AUTOMOTIVE SEGMENT TO HOLD LARGEST SIZE OF MACHINE VISION MARKET IN 2020

TABLE 119 PRE-COVID-19: MACHINE VISION MARKET, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

TABLE 120 POST-COVID-19: MACHINE VISION MARKET, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

14.1.3 AUTOMOTIVE

14.1.3.1 Machine vision systems offer high accuracy in critical activities such as bin picking and positioning of parts for assembly

14.1.3.2 Impact of COVID-19

TABLE 121 MACHINE VISION MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 122 MACHINE VISION MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 123 MACHINE VISION MARKET FOR AUTOMOTIVE INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 124 MACHINE VISION MARKET FOR AUTOMOTIVE INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

14.1.4 ELECTRONICS AND SEMICONDUCTOR

14.1.4.1 Main objectives of deploying machine vision systems are to improve product quality and increase production volume in a short period of time.

14.1.4.2 Impact of COVID-19

TABLE 125 MACHINE VISION MARKET FOR ELECTRONICS AND SEMICONDUCTOR INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 126 MACHINE VISION MARKET FOR ELECTRONICS AND SEMICONDUCTOR INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 127 MACHINE VISION MARKET FOR ELECTRONICS AND SEMICONDUCTOR INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 128 MACHINE VISION MARKET FOR ELECTRONICS AND SEMICONDUCTOR INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

14.1.5 CONSUMER ELECTRONICS

14.1.5.1 2D and 3D machine vision systems are emerging as powerful technologies for electronics assembly applications

14.1.5.2 Impact of COVID-19

TABLE 129 MACHINE VISION MARKET FOR CONSUMER ELECTRONICS INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 130 MACHINE VISION MARKET FOR CONSUMER ELECTRONICS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 131 MACHINE VISION MARKET FOR CONSUMER ELECTRONICS INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 132 MACHINE VISION MARKET FOR CONSUMER ELECTRONICS INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

14.1.6 GLASS

14.1.6.1 Modern machine vision technology improves operational efficiency, traces defects, reduces wastage, and provides detailed statistical information

FIGURE 54 GLASS PRODUCTION IN EUROPE

14.1.6.2 Impact of COVID-19

TABLE 133 MACHINE VISION MARKET FOR GLASS INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 134 MACHINE VISION MARKET FOR GLASS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 135 MACHINE VISION MARKET FOR GLASS INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 136 MACHINE VISION MARKET FOR GLASS INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

14.1.7 METALS

14.1.7.1 Machine vision system enhances product quality by 3D inspection and can be easily incorporated into existing manufacturing systems to enhance the quality of the overall production process

14.1.7.2 Impact of COVID-19

TABLE 137 MACHINE VISION MARKET FOR METALS INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 138 MACHINE VISION MARKET FOR METALS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 139 MACHINE VISION MARKET FOR METALS INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 140 MACHINE VISION MARKET FOR METALS INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

14.1.8 WOOD & PAPER

14.1.8.1 Machine vision systems can work efficiently in different environmental conditions

14.1.8.2 Impact of COVID-19

TABLE 141 MACHINE VISION MARKET FOR WOOD & PAPER INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 142 MACHINE VISION MARKET FOR WOOD & PAPER INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 143 MACHINE VISION MARKET FOR WOOD & PAPER INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 144 MACHINE VISION MARKET FOR WOOD & PAPER INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

14.1.9 PHARMACEUTICAL

14.1.9.1 Machine vision systems are used in detecting defects to ensure product quality

14.1.9.2 Impact of COVID-19

TABLE 145 MACHINE VISION MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 146 MACHINE VISION MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 147 MACHINE VISION MARKET FOR PHARMACEUTICAL INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 148 MACHINE VISION MARKET FOR PHARMACEUTICAL INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

14.1.10 FOOD AND PACKAGING

14.1.10.1 Food

14.1.10.1.1 Machine vision systems are pre-trained with the required algorithms that help them understand characteristics such as size, stage of growth, and variety

14.1.10.2 Packaging

14.1.10.2.1 Machine vision helps in inspection of packaging processes and reduction of errors by carrying out multiple inspections at a single time

14.1.10.3 Impact of COVID-19

TABLE 149 MACHINE VISION MARKET FOR FOOD AND PACKAGING INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 150 MACHINE VISION MARKET FOR FOOD AND PACKAGING INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 151 MACHINE VISION MARKET FOR FOOD AND PACKAGING INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 152 MACHINE VISION MARKET FOR FOOD AND PACKAGING INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

14.1.11 RUBBER AND PLASTICS

14.1.11.1 Machine vision systems are designed to examine and evaluate parts and determine if the parts are good, bad, or undefined

14.1.11.2 Impact of COVID-19

TABLE 153 MACHINE VISION MARKET FOR RUBBER AND PLASTICS INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 154 MACHINE VISION MARKET FOR RUBBER AND PLASTICS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 155 MACHINE VISION MARKET FOR RUBBER AND PLASTICS INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 156 MACHINE VISION MARKET FOR RUBBER AND PLASTICS INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

14.1.12 PRINTING

14.1.12.1 Machine vision systems used in digital printing applications check for readable texts and correct number of collated pages

14.1.12.2 Impact of COVID-19

TABLE 157 MACHINE VISION MARKET FOR PRINTING INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 158 MACHINE VISION MARKET FOR PRINTING INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 159 MACHINE VISION MARKET FOR PRINTING INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 160 MACHINE VISION MARKET FOR PRINTING INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

14.1.13 MACHINERY

14.1.13.1 Machine vision systems help in completing processes much faster and help in detecting defects and validating quality

TABLE 161 MACHINE VISION MARKET FOR MACHINERY INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 162 MACHINE VISION MARKET FOR MACHINERY INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 163 MACHINE VISION MARKET FOR MACHINERY INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 164 MACHINE VISION MARKET FOR MACHINERY INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

14.1.14 SOLAR PANEL MANUFACTURING

14.1.14.1 Industrial machine vision-based inspection is an important tool for inspecting quality of solar panels

14.1.14.2 Impact of COVID-19

TABLE 165 MACHINE VISION MARKET FOR SOLAR PANEL MANUFACTURING INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 166 MACHINE VISION MARKET FOR SOLAR PANEL MANUFACTURING INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 167 MACHINE VISION MARKET FOR SOLAR PANEL MANUFACTURING INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 168 MACHINE VISION MARKET FOR SOLAR PANEL MANUFACTURING INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

14.1.15 TEXTILE

14.1.15.1 Machine vision systems help manufacturers produce high-quality textiles while minimizing the costs and maximizing the profits

14.1.15.2 Impact of COVID-19

TABLE 169 MACHINE VISION MARKET FOR TEXTILE INDUSTRY, BY REGION, 2017–2019 (USD MILLION)

TABLE 170 MACHINE VISION MARKET FOR TEXTILE INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 171 MACHINE VISION MARKET FOR TEXTILE INDUSTRY, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 172 MACHINE VISION MARKET FOR TEXTILE INDUSTRY, BY PRODUCT, 2020–2025 (USD MILLION)

15 APPENDIX (Page No. - 224)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study has involved four major activities in estimating the size of the automated optical inspection market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods have been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the automated optical inspection market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand-side and supply-side vendors across four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were followed to estimate and validate the size of the AOI system market and other dependent submarkets. Key players in the market were identified through secondary research, and their contribution to the market was determined through primary and secondary research. This entire research methodology is based on the study of annual and financial reports of top players, as well as on the interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters affecting the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets. The research methodology used to estimate the market size is as follows:

- Identifying various electronics manufacturing service (EMS) companies that use or are expected to implement AOI systems at their PCB production lines and analyze their implementation patterns

- The size of the AOI system market was estimated based on the demand for AOI systems from EMS companies

- Primaries were conducted with a few major players operating in the AOI system market for validating the global size of the market

- Additionally, the size of the AOI system market was validated through secondary sources, which include Surface-Mount Technology Association (SMTA), Institute for Printed Circuits (IPC), as well as company websites, press releases, research journals, and magazines

- For calculating the CAGR of the AOI system market, the historical and future market trend analyses were carried out by understanding the industry penetration rate of 2D and 3D AOI systems and their demand and supply in different industries

- The estimates at every level were verified and cross-checked through discussions with key opinion leaders such as corporate executives (CXOs), directors, and sales heads, as well as with the domain experts in MarketsandMarkets

- Various paid and unpaid information sources such as annual reports, press releases, white papers, and databases were also studied

Data Triangulation

After arriving at the overall market size from the estimation process explained earlier, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the automated optical inspection market has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To define and forecast the size of the automated optical inspection market based on type, technology, and industry in terms of value

- To describe and forecast the size of the automated optical inspection market in four key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the automated optical inspection market

- To provide a detailed impact of the COVID-19 on the automated optical inspection market

- To provide the impact of the COVID-19 on the market segments and players operating in the automated optical inspection market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the automated optical inspection ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of their ranking and core competencies2 and provide their detailed competitive landscape

- To analyze competitive developments such as new product launches, acquisitions, collaborations, and agreements in the automated optical inspection market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automated Optical Inspection System Market