Automotive Seats Market by Type & Technology (Powered, Heated, Ventilated, Memory, Massage), Seat Trim OE & Aftermarket (Synthetic & Genuine Leather, Fabric), Frame, Component, Vehicle EV, OHV, ATV, LSV) - Global Forecast to 2030

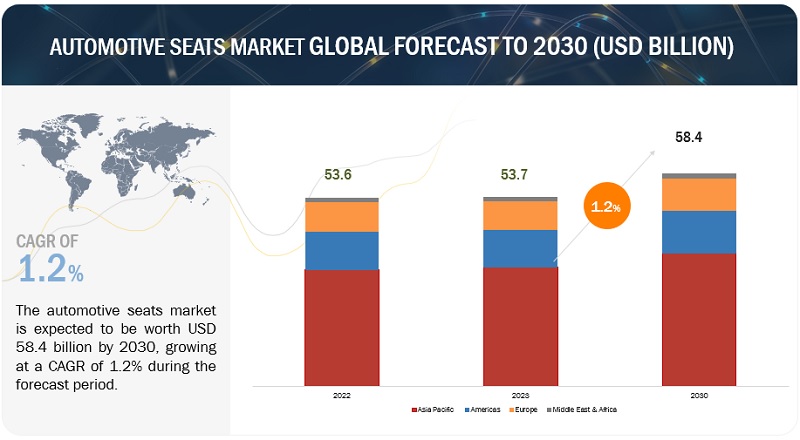

[340 Pages Report] The global automotive seat market is estimated to grow from USD 53.7 billion in 2023 to USD 58.4 billion by 2030 at a CAGR of 1.2% over the forecast period. The increasing stringency in safety regulations and industry standards, demand for quality, advanced features and cost-effectiveness, innovations & customization options in the seating segment, and increasing focus on electric vehicles are driving the automotive seats market. Asia Pacific and the Americas will remain the top regional market for this product.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Rising demand for powered seats in mid-segment cars & SUVs

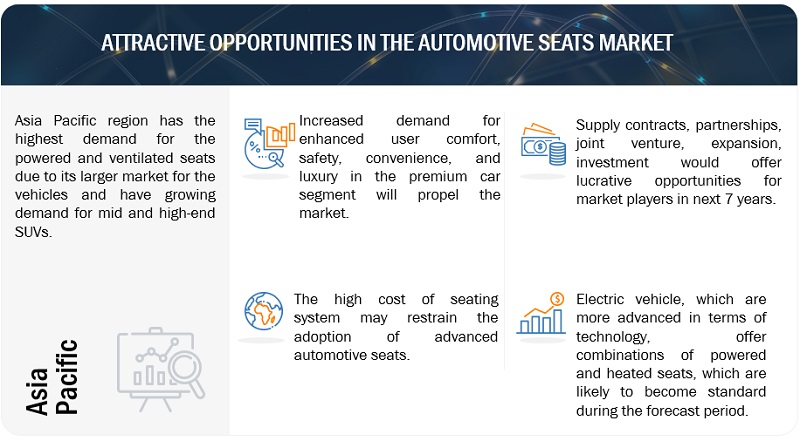

Powered seats are often seen as a luxury feature, and they can add to the overall appeal of a mid-segment car. As technology advances, this feature is becoming more affordable in terms of cost, so it has a higher reach with a broader range of customers. For instance, SUVs are becoming increasingly popular, and many vehicles have powered seats. This drives the demand for powered seats in the mid-segment car market, as many buyers are looking for SUVs with the same level of comfort and luxury as a premium car. According to the MarketsandMarkets analysis, the global market for SUVs is projected to grow from USD 949.3 billion in 2023 to USD 1,221.7 billion in 2027 at a CAGR of 6.6% in terms of value.

Carpooling and sharing is growing rapidly, which has led to an increase in demand for cars, which is easy to get in and out of the cars. Powered seats can make it easier for people with disabilities or limited mobility to get in and out of a vehicle, which is why they are becoming increasingly popular among car-sharing companies. According to the demand for carpooling and car sharing, car seat manufacturers are developing and offering seats that cater to the unique requirements of carpooling and car-sharing services, ultimately driving the evolution of the automotive seating market.

RESTRAINT: High cost of advanced modular seats compared to conventional seats

Modular seats comprise several components that need to be assembled, which adds to the cost. These modular seats are often used with advanced materials, and manufacturing processes add cost. This high cost of modular automotive seats challenges OEMs as they need to balance the cost of modular seats with their benefits, such as increased flexibility, customization, and weight savings. The major features, such as powered, heated, and ventilated applications, are now being offered commercially in most vehicles, and massage seats are an option in high-end vehicles. For instance, for massage seats, Mercedes-Benz, BMW, Jaguar, and Cadillac. The top-end variants and premium passenger cars offer memory seats as a standard feature in developing countries.

Standard seats are commonly offered in the A, B, and C segment cars, which comprise compact and inexpensive cars. Heated seats, offered in most D, E, and F models, are more prevalent in the developed nations of North America and Europe. Ventilated seats are an option for various high-end car classes, including E, F, SUV-D, and SUV E. They are also an option for the back seats. Only a few high-end automakers, like Mercedes-Benz, BMW, and Jaguar, offer massage seats in their models. Most medium and premium passenger car models in developed nations have memory seats as standard equipment. Mercedes-Benz, Audi, Porsche, and other automobile manufacturers offer memory seats for the driver. The economic segment rules the market, especially in underdeveloped countries. As a result, the market for modular seats might suffer.

OPPORTUNITY: Growing focus on autonomous cars and increasing preference for ride sharing

With the advancement of automated driving, the automotive industry is focused on research and development with driver assistance technologies. Furthermore, autonomous vehicles are less likely to be involved in accidents. Still, the OEMs offer more safety features and components in the automotive seats of a vehicle such as airbags, seatbelts, and headrests that can better protect passengers in the event of an accident. According to a study by the Victoria Transport Policy Institute (VTPI), more than 70% of fully autonomous vehicles will be used for ride-sharing, with only 30% likely to be privately owned.

In IAS L4 & L5 autonomous vehicles, the steering wheel will be replaced by various interiors more focused on the passenger and requiring little to no driver input. The durability of seats will be important as car sharing grows in popularity. Privacy will be crucial when several commuters are in the same car simultaneously. This will lead to adopting multizone climate control or separate listening zones with speakers mounted to each headrest. Seats must be secure and comfy and have the most recent technological features. Seat makers will be forced to invent or acquire new, appealing products that leverage emerging technology due to OEM and consumer preferences. For instance, Lear Corporation Intu™ Intelligent Seating System uses various sensors to monitor the driver's or passenger's body position, including seat pressure, respiration, and heart rate sensors. The system uses this data to adjust the seat for optimal comfort and support. For example, if the driver is sitting in a slumped position, the system automatically adjusts the seat back to a more upright position.

CHALLENGE: Challenges faced by textile & seat trim material suppliers

The interiors of automobiles frequently feature textiles and trim materials, which can be used in many applications. Polyamide, rayons, and polypropylene, which have a polyester foundation, make polyester fabrics. Alternative materials like nonwoven polyesters are also being considered to replace foam in body fabric and car interiors instead of laminate composites. These accessories lighten the entire seat while enhancing comfort. The fabric is mainly used throughout the vehicle's interior, and the upholstery or body cloth is mostly used in vehicle seats. Each car uses 9 billion yards of cloth, or 100 yards on average, for seat interiors. Almost two-thirds of the textiles used in cars are found in the interior trim, including seat covers, carpets, roofs, and door liners. The remaining material is employed to strengthen tires, hoses, airbags, safety belts, and other parts. According to Automotive World magazine observations, the fabrics required to upholster a standard car's interior, including the seat coverings, weigh roughly 30 kg (651 lbs). According to forecasts, demand for polyester fabrics as seat trim material will increase. The rise in demand for fabrics and trim materials is fueling competition in these businesses.

OEMs and Tier-I suppliers frequently launch new seat designs to satisfy consumer demand. These unique shapes can call for using cutting-edge trim materials and building methods. As a result, the providers of trim materials put forth endless effort to meet the requirements of OEM and seat suppliers.

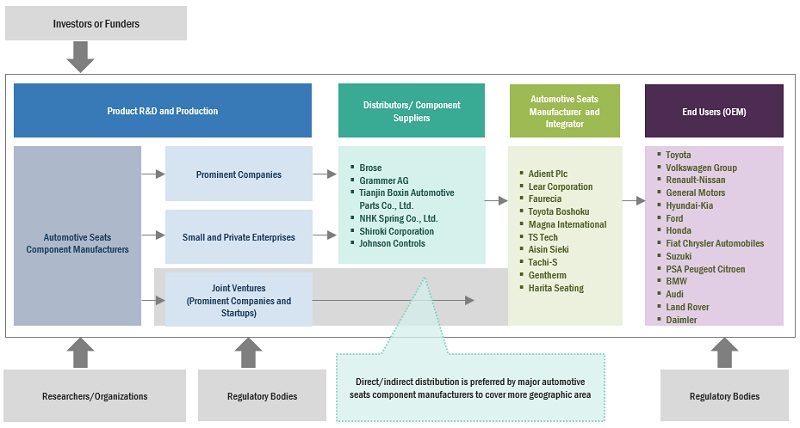

Automotive Seats Market Ecosystem.

The major OEMs of the automotive seats market have the latest technologies, diversified portfolios, and strong distribution networks globally. The major players in the automotive seat market are Adient Plc (US), Faurecia (France), Lear Corporation (US), Toyota Boshoku Corporation (Japan), and Magna International (Canada).

Powered seat technology has the highest market in the Asia Pacific region

Powered seats can be adjusted with a button, making it easy to find a comfortable position. This is especially helpful for people with limited mobility or back pain. It can be customized to fit the individual needs of the driver or passenger. These powered seats often have additional advanced features such as memory settings, heated and ventilated options, massage functions, and integrated lumbar support. Furthermore, technological advancements and the decreasing cost of powered seat systems have played a crucial role in their wider adoption.

Powered seats have become increasingly popular in the SUV market in the Asia Pacific area. SUVs are becoming increasingly popular with consumers because of their roominess, adaptability, and capacity to travel through various terrains. SUVs often come equipped with powered seats, which raises the level of comfort and luxury in these vehicles overall. Additionally, cost reductions from economies of scale and improved manufacturing techniques have increased the affordability of powered seats for consumers. According to MarketsandMarkets analysis, the Asia Pacific region has the highest market share, accounting for about ~47% of powered seats, and is growing gradually due to increasing demand for premium and luxurious vehicles. The Asia Pacific market for passenger vehicles and SUVs is expanding significantly, which will cause the need for powered seats to rise. This will create profitable prospects for regional automakers and suppliers.

Synthetic leather will dominate the automotive seat trim material market

Synthetic leather gives a luxurious appeal and provides more comfort than traditional leather, so it is used mainly in mid-segment to high-variant vehicles. According to MarketsandMarkets analysis, synthetic leather contributes to ~56% of the seat trim material market, and the Asia Pacific region has the highest market share. This leather gives more personalized and customizable options, fulfilling the demand for unique and stylish interiors in automotive vehicles.

OEMs are focused on the used and recycled materials in vehicle trim, and synthetic leather can be made from used & recycled materials. Numerous OEMs are developing sustainable materials for the automotive industry. For instance, Toray showcased their new synthetic leather made from recycled plastics and named it "Eco-Leather" in February 2022, less costly than traditional leather. On the same, DuPont also introduced a new synthetic leather generated from the plant-based components named "Sorona Performance Leather" in 2021. Some key players for the synthetic leathers are Covestro Ag (Germany), Asahi Keasei (Japan), and JSR Corporation (Japan). The demand from the automotive industry will continue to grow with the upcoming EV and Hybrid vehicles trend.

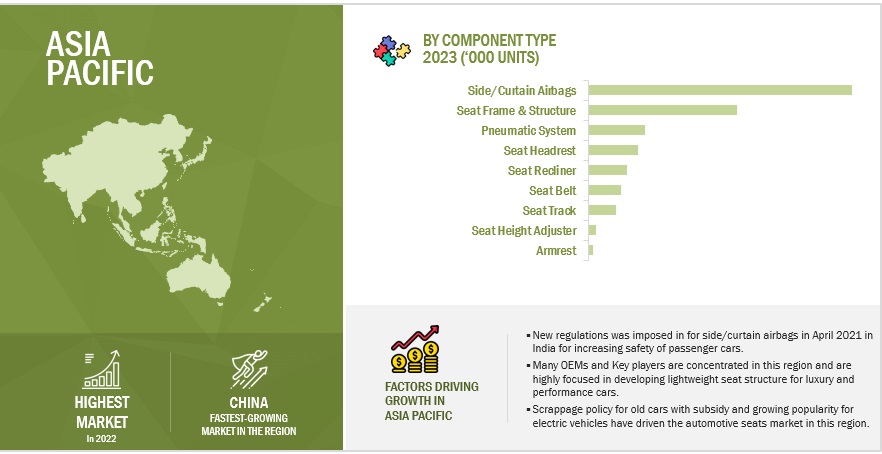

Asia Pacific is the fastest-growing region for the side curtain airbags market

Side curtain airbags are safety features that can help to protect passengers in the event of a side impact or rollover. Due to rising traffic accidents and increased government mandates, the demand for safety features like side curtain airbags has been made compulsory in this region. According to MarketsandMarkets analysis, the side curtain airbags market is the fastest growing market with a CAGR of 17.7% from 2023 to 2030, and it holds the largest market share of ~41% in terms of value in component type. In 2020, new regulations were assigned by the governing body for side curtain airbags to increase safety. For instance, the Ministry of Road Transport and Highways (MoRTH) issued a notification in 2020 making side curtain airbags compulsory for all passenger cars, vans, and SUVs manufactured after October 1, 2022. The regulation also states that all new cars manufactured after October 1, 2023, must have a minimum of six airbags, including two side airbags and two curtain airbags.

Furthermore, the countries such as Indonesia, Malaysia, and the Philippines have also started installing side and curtain airbags in all passenger cars to increase safety. Side curtain airbags are typically installed in the seats of vehicles. As a result, the increasing demand for side curtain airbags is expected to drive the demand for the side curtain airbag equipped seats.

The OEM has the highest market in seat trim by sales channel market.

OEM sales channel focuses on supplying seat trims to automotive manufacturers to ensure consistency in quality and design for mass-produced vehicles. The OEM sales channel involves the direct supply of automotive seat trims to original equipment manufacturers. OEMs directly install the seat trims during the production process. The OEM sales channel operates through contracts and agreements between seat trim manufacturers and automotive OEMs. These manufacturers typically produce seat trims in large quantities and deliver them directly to the OEM assembly lines for installation during vehicle production. Each vehicle model's requirements and specifications are considered in the design and production of these seat trims. According to MarketsandMarkets analysis, the OEM sales channel will grow at a CAGR of 2.4%.

Also, the Asia Pacific region has the highest market share of 59% in the year 2023 for OEM sales channels, according to MarketsandMarkets analysis. This region has the highest number of OEMs and key players, which has boosted the sales of seat trim material for OEMs. For example, OEMs like Toyota (Japan), Nissan (Japan), Hyundai Motors (South Korea), and Tata (India), etc., and seat trim manufacturers such as Suminoe Textile / Suminoe Teijin Techno (Japan) and TB Kawashima (Japan). All these players have the highest sales for passenger cars and SUVs due to a rise in customer demand, which has increased the OE sales for the automotive seat trim market.

Key Market Players

The automotive seat market is consolidated with the players such as Adient Plc (US), Faurecia (France), Lear Corporation (US), Toyota Boshoku Corporation (Japan), and Magna International (Canada) are the key companies operating in the automotive seats manufacturing. These companies adopted new product launches, partnerships, and joint ventures to gain traction in the seat market.

Scope of the Report

|

Report Attribute |

Details |

|

Base year for estimation |

2022 |

|

Forecast period |

2023 - 2030 |

|

Market Growth forecast |

USD 58.4 Billion by 2030 from USD 53.7 Billion in 2023 at 1.2% CAGR |

|

Top Players |

Adient Plc (US), Faurecia (France), Lear Corporation (US), Toyota Boshoku Corporation (Japan), and Magna International (Canada) |

|

By Technology |

Heated Seats; Heated and Powered Seats; Standard Seats; Powered Seats; Powered, Heated and Memory Seats; Powered, Heated, and Ventilated Seats; Powered, Heated, Ventilated, and Memory Seats; Powered, Heated, Ventilated, Massage and Memory Seats. |

|

By Seat Type |

Bucket And Split Bench |

|

By Trim Material |

Fabrics, Genuine Leather, Polyurethan Foam, And Synthetic Leather |

|

By Component |

Armrests, Pneumatic Systems, Seat Belts, Seat Frames and Structures, Seat Headrests, Seat Height Adjusters, Seat Recliners, Seat Tracks, and Side Curtain Airbags |

|

By Vehicle Type |

Passenger Cars, Light Commercial Vehicles, Heavy Trucks, And Buses |

|

By Material |

Steel, Aluminium, and Carbon-Amide-Metal |

|

Off-Highway Vehicles Seat Market, By Vehicle Type |

Construction and Mining Equipment and Agricultural Tractors |

|

Electric vehicles seats market, By Propulsion |

Battery Electric Vehicles, Fuel Cell Electric Vehicles, and Plug-In Hybrid Electric Vehicles |

|

LSV Seats Market, By Vehicle type |

Golf Carts, Commercial Turf Utility Vehicles, Industrial Utility Vehicles, and Personal Mobility Vehicles |

|

Automotive Seat Trim Material, By Sales Channel |

OEM And Aftermarket |

|

ATVs Seats Market, By Seating Capacity |

One-seater and Two-seater |

|

By Region |

Asia Pacific, Americas, Europe, and Middle East & Africa |

Recent Developments

- In April 2023, Faurecia announced the development of its Zero-Gravity Captain Chair, a rear passenger seating solution that delivers advanced well-being tailored for the Chinese market. Inspired by NASA’s space exploration, the seat can be set to a “zero gravity” position, which reclines it to an almost flat angle.

- In April 2023, Faurecia introduced the new “Skin Light Panel” that offers weight reduction, extra room for rear passengers, improved recyclability, and cost savings. This new Skin Light Panel also delivers perfect integration into the complete seat, including rear airbag management. The seating panel has a smooth finish, high-performance scratch-resistance material, and life-long durability.

- Lear Corporation has announced the strategic acquisition of InTouch Automation, a supplier of Industry 4.0 technologies and complex automated testing equipment critical in producing automotive seats. InTouch’s product portfolio allows Lear Corporation to collect and analyze real-time data while standardizing testing procedures throughout its just-in-time (JIT) seating production process.

- In October 2022, Lear Corporation announced that the company's premium and fully recyclable ReNewKnit sueded material will launch in seating and door panel applications with a global automaker in 2024. ReNewKnit is a Lear Corporation exclusive, first-to-market automotive textile that is fully recyclable at its end of life. ReNewKnit will strengthen the company's sustainable solutions technology portfolio while supporting our carbon reduction goals.

- In April 2022, Toyota Boshoku developed an IoT (Internet of Things) seat cover equipped with a system that assesses the driver’s fatigue and mitigates sleepiness during driving and started a demonstration test for transport companies.

Frequently Asked Questions (FAQ):

What are the leading technologies and trends being adopted in automotive seats?

Eco-friendly and sustainable materials, lightweight materials, connected seats, active safety features, etc., are the recent trend and technology in automotive seats.

What are the new revenue opportunities in the automotive seat market?

Customization and personalization seats, electric and autonomous vehicle seating, and Luxury features are the new revenue opportunities in the automotive seat market.

What is the new material-wise opportunities in the automotive seats market?

Bio-based materials, natural fibers, advanced composites, 3d printing and additive manufacturing, natural and vegan leather alternatives, acoustic and noise-reducing materials, smart and active materials, and lightweight materials have new opportunities in the trim material market for automotive seats.

Many companies are operating in the automotive seat market across the globe. Do you know who the front leaders are and what strategies they have adopted?

Established seat manufacturers such as Adient Plc lead the automotive seat market. (US), Lear Corporation (US), Faurecia (France), Toyota Boshoku Corporation (Japan), and Magna International (Canada). These companies adopted several strategies to gain traction in the market. New product development, partnership, and joint venture strategy have been the most dominating strategy adopted by major players from 2018 to 2022, which helped them to innovate their offerings and broaden their customer base.

How does the demand for passenger cars vary by region?

The market growth in Asia Pacific countries such as China, Japan, and India can be attributed to the increasing demand for vehicles. Due to the increased vehicle production and sales, China is estimated to be the region's fastest-growing market for automotive seats. The need for powered and heated seats is expected to grow in this region, owing to the increasing demand for mid and high-end SUVs.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for premium passenger cars- Growing preference for SUVsRESTRAINTS- High cost of advanced modular seats compared with conventional seatsOPPORTUNITIES- Rising emphasis on autonomous cars and ridesharing services- Growing demand for lightweight seating materials in electric vehiclesCHALLENGES- High investment in lightweight materials for automotive seats

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.6 AVERAGE SELLING PRICE ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 TRADE ANALYSISIMPORT DATAEXPORT DATA

-

5.9 PATENT ANALYSIS

-

5.10 CASE STUDY ANALYSISCASE STUDY 1CASE STUDY 2CASE STUDY 3CASE STUDY 4

- 5.11 REGULATORY LANDSCAPE

-

5.12 TECHNOLOGY TRENDSADIENT AI18 SEATING SOLUTION FOR RIDESHARINGGENTHERM CLIMATE CONTROL SEATFORD RECONFIGURABLE SEATLEAR CONFIGURE+LEAR PROACTIVE POSTUREADIENT COMFORTTHIN SEATADIENT PRE-ADJUST SEATLEAR INTU INTELLIGENT SEATING SYSTEMMERCEDES-BENZ MBUX INTERIOR ASSISTANTFORD KINETIC SEAT

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

6.1 INTRODUCTIONINDUSTRY INSIGHTS

-

6.2 STANDARD SEATSWIDESPREAD ADOPTION IN LOW AND MID-VARIANT CARS TO DRIVE GROWTH

-

6.3 POWERED SEATSRISING INSTALLATION IN SUVS TO DRIVE GROWTH

-

6.4 HEATED AND POWERED SEATSINCREASING DEMAND FOR COMFORT AND CONVENIENCE TO DRIVE GROWTH

-

6.5 HEATED SEATSCOLD WEATHER CONDITIONS IN AMERICAS AND EUROPE TO DRIVE GROWTH

-

6.6 POWERED, HEATED, AND MEMORY SEATSLARGE-SCALE INTEGRATION IN PREMIUM VEHICLES TO DRIVE GROWTH

-

6.7 POWERED, HEATED, AND VENTILATED SEATSEXPANDING INSTALLATION IN MID AND HIGH-END PASSENGER CARS TO DRIVE GROWTH

-

6.8 POWERED, HEATED, VENTILATED, AND MEMORY SEATSEXTENSIVE USE IN PREMIUM COUPES TO DRIVE GROWTH

-

6.9 POWERED, HEATED, VENTILATED, MASSAGE, AND MEMORY SEATSRAPID DEPLOYMENT IN LUXURY VEHICLES TO DRIVE GROWTH

-

7.1 INTRODUCTIONINDUSTRY INSIGHTS

-

7.2 SYNTHETIC LEATHERFLEXIBILITY AND BETTER AESTHETIC APPEAL TO DRIVE GROWTH

-

7.3 GENUINE LEATHERINCREASING DEPLOYMENT IN PREMIUM AND HIGH-END VEHICLES TO DRIVE GROWTH

-

7.4 FABRICLOW COST AND EASE OF MAINTENANCE TO DRIVE GROWTHPOLYESTER WOVEN FABRICWOVEN VELOUR FABRICPVC AND OTHERS

- 7.5 POLYURETHANE FOAM

-

8.1 INTRODUCTIONINDUSTRY INSIGHTS

- 8.2 ARMRESTS

- 8.3 PNEUMATIC SYSTEMS

- 8.4 SEAT BELTS

- 8.5 SEAT FRAMES AND STRUCTURES

- 8.6 SEAT HEADRESTS

- 8.7 SEAT HEIGHT ADJUSTERS

- 8.8 SEAT RECLINERS

- 8.9 SEAT TRACKS

- 8.10 SIDE CURTAIN AIRBAGS

- 9.1 INTRODUCTION

-

9.2 PASSENGER CARSEVOLVING CONSUMER EXPECTATIONS TO DRIVE GROWTH

-

9.3 LIGHT COMMERCIAL VEHICLESGROWING PREVALENCE OF LAST-MILE DELIVERY SERVICES TO DRIVE GROWTH

-

9.4 HEAVY TRUCKSBOOMING E-COMMERCE SECTOR TO DRIVE GROWTH

-

9.5 BUSESSOARING TOURISM AND SHUTTLE SERVICES TO DRIVE GROWTH

-

10.1 INTRODUCTIONINDUSTRY INSIGHTS

-

10.2 BATTERY ELECTRIC VEHICLESINCREASED INVESTMENTS IN BATTERY TECHNOLOGY TO DRIVE GROWTH

-

10.3 PLUG-IN HYBRID ELECTRIC VEHICLESSTRINGENT EMISSION REGULATIONS TO DRIVE GROWTH

-

10.4 FUEL CELL ELECTRIC VEHICLESIMPROVEMENTS IN FUEL CELL TECHNOLOGY TO DRIVE GROWTH

-

11.1 INTRODUCTIONINDUSTRY INSIGHTS

-

11.2 BUCKETINCREASING ADOPTION IN HIGH-PERFORMANCE CARS TO DRIVE GROWTH

-

11.3 SPLIT BENCHGROWING DEMAND FOR SUVS TO DRIVE GROWTH

-

12.1 INTRODUCTIONINDUSTRY INSIGHTS

-

12.2 STEELRISING FOCUS ON SAFETY TO DRIVE GROWTH

-

12.3 ALUMINUMINCREASING PREFERENCE FOR LIGHTWEIGHT MATERIALS TO DRIVE GROWTH

-

12.4 CARBON-AMIDE-METALLOW COST AND LIGHTWEIGHT PROPERTIES TO DRIVE GROWTH

-

13.1 INTRODUCTIONINDUSTRY INSIGHTS

- 13.2 CONSTRUCTION AND MINING EQUIPMENT

- 13.3 AGRICULTURAL TRACTORS

-

14.1 INTRODUCTIONINDUSTRY INSIGHTS

-

14.2 GOLF CARTSIMPROVEMENTS IN CHARGING INFRASTRUCTURE TO DRIVE GROWTH

-

14.3 COMMERCIAL TURF UTILITY VEHICLESHIGH DEMAND FROM HOTELS AND RESORTS TO DRIVE GROWTH

-

14.4 INDUSTRIAL UTILITY VEHICLESWIDESPREAD USE IN CONSTRUCTION INDUSTRY TO DRIVE GROWTH

-

14.5 PERSONAL MOBILITY VEHICLESGOVERNMENT SUBSIDIES AND INCENTIVES TO DRIVE GROWTH

-

15.1 INTRODUCTIONINDUSTRY INSIGHTS

- 15.2 ONE-SEATER

- 15.3 TWO-SEATER

-

16.1 INTRODUCTIONINDUSTRY INSIGHTS

- 16.2 OEM

- 16.3 AFTERMARKET

-

17.1 INTRODUCTIONINDUSTRY INSIGHTS

-

17.2 AMERICASAMERICAS: RECESSION IMPACTUS- Increased investments in advanced seating technologies to drive growthMEXICO- Free trade agreements to drive growthCANADA- Government incentives on electric vehicles to drive growthBRAZIL- Availability of alternate fuel sources to drive growthARGENTINA- Scrappage programs for old vehicles to drive growthOTHER COUNTRIES

-

17.3 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Emission control mandates to drive growthINDIA- High import duty tax on vehicles to drive growthINDONESIA- Limited domestic public transportation to drive growthJAPAN- Growing trend of carpooling and ridesharing to drive growthSOUTH KOREA- Tax incentives on eco-friendly vehicles to drive growthTHAILAND- Booming tourism industry to drive growthREST OF ASIA PACIFIC

-

17.4 EUROPEEUROPE: RECESSION IMPACTFRANCE- Presence of renowned automakers to drive growthGERMANY- Increasing charging infrastructure to drive growthITALY- Large-scale production of SUVs to drive growthRUSSIA- Exemption in import duties to drive growthSPAIN- New safety regulations to drive growthTURKEY- Low operating cost of vehicles to drive growthUK- Stringent emission regulations to drive growthREST OF EUROPE

-

17.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTIRAN- Government subsidies to reduce car shortage to drive growthSOUTH AFRICA- Vast production of passenger cars to drive growthREST OF MIDDLE EAST & AFRICA

- 18.1 OVERVIEW

- 18.2 REVENUE ANALYSIS OF KEY PLAYERS, 2020 VS. 2022

-

18.3 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

18.4 COMPANY EVALUATION MATRIX: AUTOMOTIVE SEAT COMPONENT MANUFACTURERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

18.5 COMPETITIVE SCENARIOPRODUCT DEVELOPMENTSDEALSOTHERS

- 18.6 STRATEGIES ADOPTED BY KEY PLAYERS, 2022–2023

- 18.7 COMPETITIVE BENCHMARKING

-

19.1 KEY PLAYERSADIENT PLC- Business overview- Products offered- Recent developments- MnM viewFAURECIA- Business overview- Products offered- Recent developments- MnM viewLEAR CORPORATION- Business overview- Products offered- Recent developments- MnM viewTOYOTA BOSHOKU CORPORATION- Business overview- Products offered- Recent developments- MnM viewMAGNA INTERNATIONAL- Business overview- Products offered- Recent developments- MnM viewTS TECH CO., LTD.- Business overview- Products offered- Recent developmentsAISIN CORPORATION- Business overview- Products offeredNHK SPRING CO., LTD.- Business overview- Products offeredTACHI-S CO., LTD.- Business overview- Products offered- Recent developmentsGENTHERM- Business overview- Products offered

-

19.2 OTHER PLAYERSBROSE FAHRZEUGTEILE SE & CO. KGGRAMMER AGC.I.E.B. KAHOVECPHOENIX SEATING LIMITEDIG BAUERHIN GMBHSABELTGUELPH MANUFACTURINGCAMACO-AMVIANFREEDMAN SEATING COMPANYDAE WON KANG UPTATA AUTOCOMP SYSTEMSSUMMIT AUTO SEATSHARITA SEATING SYSTEMS LTD.DELTA KOGYO CO. LTD.BHARAT SEATS LIMITED (BSL)

- 20.1 ASIA PACIFIC TO BE KEY MARKET FOR AUTOMOTIVE SEATS

- 20.2 RISING INTEGRATION OF POWERED SEATS IN SUVS TO DRIVE GROWTH

- 20.3 CONCLUSION

- 21.1 KEY INDUSTRY INSIGHTS

- 21.2 DISCUSSION GUIDE

- 21.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

21.4 CUSTOMIZATION OPTIONSAUTOMOTIVE SEAT SEATS MARKET, BY VEHICLE BODY TYPE- Sedans- SUVs- HatchbacksAUTOMOTIVE SEATS MARKET, BY INTEGRATED INFOTAINMENT SYSTEM- Built-in screen- Speakers- Headphone jacksDETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS

- 21.5 RELATED REPORTS

- 21.6 AUTHOR DETAILS

- TABLE 1 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- TABLE 2 VEHICLES OFFERING GENUINE LEATHER SEATS, 2022

- TABLE 3 AVERAGE COST OF SEATS, BY TECHNOLOGY, 2022 (USD)

- TABLE 4 ROLE OF COMPANIES IN SUPPLY CHAIN

- TABLE 5 AVERAGE PRICE TREND OF AUTOMOTIVE SEATS, BY REGION, 2022 (USD)

- TABLE 6 AVERAGE PRICE TREND OF AUTOMOTIVE SEATS, BY TRIM MATERIAL, 2022 (USD/METER)

- TABLE 7 AVERAGE PRICE TREND OF AUTOMOTIVE SEATS, BY SEAT FRAME MATERIAL, 2022 (USD/METRIC TON)

- TABLE 8 US: IMPORT, BY COUNTRY (%)

- TABLE 9 FRANCE: IMPORT, BY COUNTRY (%)

- TABLE 10 GERMANY: IMPORT, BY COUNTRY (%)

- TABLE 11 MEXICO: IMPORT, BY COUNTRY (%)

- TABLE 12 BELGIUM: IMPORT, BY COUNTRY (%)

- TABLE 13 GERMANY: EXPORT, BY COUNTRY (%)

- TABLE 14 POLAND: EXPORT, BY COUNTRY (%)

- TABLE 15 CZECH REPUBLIC: EXPORT, BY COUNTRY (%)

- TABLE 16 CHINA: EXPORT, BY COUNTRY (%)

- TABLE 17 MEXICO: EXPORT, BY COUNTRY (%)

- TABLE 18 INNOVATION AND PATENT REGISTRATIONS, 2018–2022

- TABLE 19 SAFETY REGULATIONS, BY COUNTRY/REGION

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AUTOMOTIVE SEATS

- TABLE 21 KEY BUYING CRITERIA FOR AUTOMOTIVE SEATS

- TABLE 22 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 23 AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 24 MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 25 STANDARD SEATS MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 26 STANDARD SEATS MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 27 SELECT MODELS WITH POWERED SEATS, 2022

- TABLE 28 POWERED SEATS MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 29 POWERED SEATS MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 30 SELECT MODELS WITH HEATED AND POWERED SEATS, 2022

- TABLE 31 HEATED AND POWERED SEATS MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 32 HEATED AND POWERED SEATS MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 33 SELECT MODELS WITH HEATED SEATS, 2022

- TABLE 34 HEATED SEATS MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 35 HEATED SEATS MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 36 SELECT MODELS WITH POWERED, HEATED, AND MEMORY SEATS, 2022

- TABLE 37 POWERED, HEATED, AND MEMORY SEATS MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 38 POWERED, HEATED, AND MEMORY SEATS MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 39 SELECT MODELS WITH POWERED, HEATED, AND VENTILATED SEATS, 2022

- TABLE 40 POWERED, HEATED, AND VENTILATED SEATS MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 41 POWERED, HEATED, AND VENTILATED SEATS MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 42 SELECT MODELS WITH POWERED, HEATED, VENTILATED, AND MEMORY SEATS, 2022

- TABLE 43 POWERED, HEATED, VENTILATED, AND MEMORY SEATS MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 44 POWERED, HEATED, VENTILATED, AND MEMORY SEATS MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 45 SELECT MODELS WITH POWERED, HEATED, VENTILATED, MASSAGE, AND MEMORY SEATS, 2022

- TABLE 46 POWERED, HEATED, VENTILATED, MASSAGE, AND MEMORY SEATS MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 47 POWERED, HEATED, VENTILATED, MASSAGE, AND MEMORY SEATS MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 48 MARKET, BY TRIM MATERIAL, 2018–2022 (THOUSAND SQUARE METERS)

- TABLE 49 MARKET, BY TRIM MATERIAL, 2023–2030 (THOUSAND SQUARE METERS)

- TABLE 50 MARKET, BY TRIM MATERIAL, 2018–2022 (USD MILLION)

- TABLE 51 MARKET, BY TRIM MATERIAL 2023–2030 (USD MILLION)

- TABLE 52 MODELS WITH SYNTHETIC LEATHER SEATS, 2022

- TABLE 53 SYNTHETIC LEATHER SEATS MARKET, BY REGION, 2018–2022 (THOUSAND SQUARE METERS)

- TABLE 54 SYNTHETIC LEATHER SEATS MARKET, BY REGION, 2023–2030 (THOUSAND SQUARE METERS)

- TABLE 55 SYNTHETIC LEATHER SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 SYNTHETIC LEATHER SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 57 MODELS WITH GENUINE LEATHER SEATS, 2022

- TABLE 58 GENUINE LEATHER SEATS MARKET, BY REGION, 2018–2022 (THOUSAND SQUARE METERS)

- TABLE 59 GENUINE LEATHER SEATS MARKET, BY REGION, 2023–2030 (THOUSAND SQUARE METERS)

- TABLE 60 GENUINE LEATHER SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 GENUINE LEATHER SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 62 MODELS WITH FABRIC SEATS, 2022

- TABLE 63 FABRIC SEATS MARKET, BY REGION, 2018–2022 (THOUSAND SQUARE METERS)

- TABLE 64 FABRIC SEATS MARKET, BY REGION, 2023–2030 (THOUSAND SQUARE METERS)

- TABLE 65 FABRIC SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 FABRIC SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 67 POLYESTER WOVEN FABRIC SEATS MARKET, BY REGION, 2018–2022 (THOUSAND SQUARE METERS)

- TABLE 68 POLYESTER WOVEN FABRIC SEATS MARKET, BY REGION, 2023–2030 (THOUSAND SQUARE METERS)

- TABLE 69 POLYESTER WOVEN FABRIC SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 POLYESTER WOVEN FABRIC SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 71 WOVEN VELOUR FABRIC SEATS MARKET, BY REGION, 2018–2022 (THOUSAND SQUARE METERS)

- TABLE 72 WOVEN VELOUR FABRIC SEATS MARKET, BY REGION, 2023–2030 (THOUSAND SQUARE METERS)

- TABLE 73 WOVEN VELOUR FABRIC SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 WOVEN VELOUR FABRIC SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 75 PVC AND OTHER SEATS MARKET, BY REGION, 2018–2022 (THOUSAND SQUARE METERS)

- TABLE 76 PVC AND OTHER SEATS MARKET, BY REGION, 2023–2030 (THOUSAND SQUARE METERS)

- TABLE 77 PVC AND OTHER SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 PVC AND OTHER SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 79 POLYURETHANE FOAM SEATS MARKET, BY REGION, 2018–2022 (THOUSAND KILOGRAMS)

- TABLE 80 POLYURETHANE FOAM SEATS MARKET, BY REGION, 2023–2030 (THOUSAND KILOGRAMS)

- TABLE 81 POLYURETHANE FOAM SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 POLYURETHANE FOAM SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 83 MARKET, BY COMPONENT, 2018–2022 (MILLION UNITS)

- TABLE 84 MARKET, BY COMPONENT, 2023–2030 (MILLION UNITS)

- TABLE 85 MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 86 MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 87 MODELS WITH ARMRESTS, 2022

- TABLE 88 ARMRESTS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 89 ARMRESTS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 90 ARMRESTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 91 ARMRESTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 92 PNEUMATIC SYSTEMS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 93 PNEUMATIC SYSTEMS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 94 PNEUMATIC SYSTEMS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 95 PNEUMATIC SYSTEMS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 96 SEAT BELT LAWS, BY COUNTRY

- TABLE 97 SEAT BELTS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 98 SEAT BELTS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 99 SEAT BELTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 100 SEAT BELTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 101 SEAT FRAMES AND STRUCTURES MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 102 SEAT FRAMES AND STRUCTURES MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 103 SEAT FRAMES AND STRUCTURES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 104 SEAT FRAMES AND STRUCTURES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 105 SEAT HEADRESTS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 106 SEAT HEADRESTS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 107 SEAT HEADRESTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 108 SEAT HEADRESTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 109 SEAT HEIGHT ADJUSTERS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 110 SEAT HEIGHT ADJUSTERS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 111 SEAT HEIGHT ADJUSTERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 112 SEAT HEIGHT ADJUSTERS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 113 SEAT RECLINERS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 114 SEAT RECLINERS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 115 SEAT RECLINERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 116 SEAT RECLINERS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 117 SEAT TRACKS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 118 SEAT TRACKS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 119 SEAT TRACKS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 120 SEAT TRACKS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 121 SIDE CURTAIN AIRBAGS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 122 SIDE CURTAIN AIRBAGS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 123 SIDE CURTAIN AIRBAGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 124 SIDE CURTAIN AIRBAGS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 125 MARKET, BY VEHICLE TYPE, 2018–2022 (MILLION UNITS)

- TABLE 126 MARKET, BY VEHICLE TYPE, 2023–2030 (MILLION UNITS)

- TABLE 127 MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 128 MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 129 PASSENGER CAR SEATS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 130 PASSENGER CAR SEATS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 131 PASSENGER CAR SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 132 PASSENGER CAR SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 133 LIGHT COMMERCIAL VEHICLE SEATS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 134 LIGHT COMMERCIAL VEHICLE SEATS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 135 LIGHT COMMERCIAL VEHICLE SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 136 LIGHT COMMERCIAL VEHICLE SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 137 HEAVY TRUCK SEATS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 138 HEAVY TRUCK SEATS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 139 HEAVY TRUCK SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 140 HEAVY TRUCK SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 141 BUS SEATS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 142 BUS SEATS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 143 BUS SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 144 BUS SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 145 ELECTRIC VEHICLE SEATS MARKET, BY PROPULSION TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 146 ELECTRIC VEHICLE SEATS MARKET, BY PROPULSION TYPE, 2023–2030 (THOUSAND UNITS)

- TABLE 147 BEV SEATS MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 148 BEV SEATS MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 149 PHEV SEATS MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 150 PHEV SEATS MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 151 FCEV SEATS MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 152 FCEV SEATS MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 153 MARKET, BY SEAT TYPE, 2018–2022 (MILLION UNITS)

- TABLE 154 MARKET, BY SEAT TYPE, 2023–2030 (MILLION UNITS)

- TABLE 155 MARKET, BY SEAT TYPE, 2018–2022 (USD BILLION)

- TABLE 156 MARKET, BY SEAT TYPE, 2023–2030 (USD BILLION)

- TABLE 157 SAFETY REGULATION FOR BUCKET SEATS

- TABLE 158 MODELS WITH BUCKET SEATS, 2022

- TABLE 159 BUCKET SEATS MARKET, BY VEHICLE TYPE, 2018–2022 (MILLION UNITS)

- TABLE 160 BUCKET SEATS MARKET, BY VEHICLE TYPE, 2023–2030 (MILLION UNITS)

- TABLE 161 BUCKET SEATS MARKET, BY VEHICLE TYPE, 2018–2022 (USD BILLION)

- TABLE 162 BUCKET SEATS MARKET, BY VEHICLE TYPE, 2023–2030 (USD BILLION)

- TABLE 163 SAFETY REGULATIONS FOR SPLIT BENCH SEATS

- TABLE 164 MODELS WITH SPLIT BENCH SEATS, 2022

- TABLE 165 SPLIT BENCH SEATS MARKET, BY VEHICLE TYPE, 2018–2022 (MILLION UNITS)

- TABLE 166 SPLIT BENCH SEATS MARKET, BY VEHICLE TYPE, 2023–2030 (MILLION UNITS)

- TABLE 167 SPLIT BENCH SEATS MARKET, BY VEHICLE TYPE, 2018–2022 (USD BILLION)

- TABLE 168 SPLIT BENCH SEATS MARKET, BY VEHICLE TYPE, 2023–2030 (USD BILLION)

- TABLE 169 MARKET, BY MATERIAL, 2018–2022 (METRIC TONS)

- TABLE 170 MARKET, BY MATERIAL, 2023–2030 (METRIC TONS)

- TABLE 171 MARKET, BY MATERIAL, 2018–2022 (USD THOUSAND)

- TABLE 172 MARKET, BY MATERIAL, 2023–2030 (USD THOUSAND)

- TABLE 173 STRENGTH VS. DENSITY CHART

- TABLE 174 STEEL: MARKET, BY REGION, 2018–2022 (METRIC TONS)

- TABLE 175 STEEL: MARKET, BY REGION, 2023–2030 (METRIC TONS)

- TABLE 176 STEEL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 177 STEEL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 178 ALUMINUM: MARKET, BY REGION, 2018–2022 (METRIC TONS)

- TABLE 179 ALUMINUM: MARKET, BY REGION, 2023–2030 (METRIC TONS)

- TABLE 180 ALUMINUM: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 181 ALUMINUM: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 182 CARBON-AMIDE-METAL: MARKET, BY REGION, 2018–2022 (METRIC TONS)

- TABLE 183 CARBON-AMIDE-METAL: MARKET, BY REGION, 2023–2030 (METRIC TONS)

- TABLE 184 CARBON-AMIDE-METAL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 185 CARBON-AMIDE-METAL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 186 OFF-HIGHWAY VEHICLE SEATS MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 187 OFF-HIGHWAY VEHICLE SEATS MARKET, BY VEHICLE TYPE, 2023–2030 (THOUSAND UNITS)

- TABLE 188 CONSTRUCTION AND MINING EQUIPMENT WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 189 CONSTRUCTION AND MINING EQUIPMENT SEATS MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 190 CONSTRUCTION AND MINING EQUIPMENT SEATS MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 191 AGRICULTURAL TRACTOR SEATS MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 192 AGRICULTURAL TRACTOR SEATS MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 193 LSV SEATS MARKET, BY VEHICLE TYPE, 2018–2022 (UNITS)

- TABLE 194 LSV SEATS MARKET, BY VEHICLE TYPE, 2023–2030 (UNITS)

- TABLE 195 GOLF CARTS: FOUR-SEATER MODELS, 2022–2023

- TABLE 196 GOLF CART SEATS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 197 GOLF CART SEATS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 198 COMMERCIAL TURF UTILITY VEHICLES: TWO-SEATER MODELS, 2022–2023

- TABLE 199 COMMERCIAL TURF UTILITY VEHICLE SEATS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 200 COMMERCIAL TURF UTILITY VEHICLE SEATS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 201 INDUSTRIAL UTILITY VEHICLES: TWO-SEATER MODELS, 2022–2023

- TABLE 202 INDUSTRIAL UTILITY VEHICLE SEATS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 203 INDUSTRIAL UTILITY VEHICLE SEATS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 204 PERSONAL MOBILITY VEHICLES: TWO-SEATER MODELS, 2022–2023

- TABLE 205 PERSONAL MOBILITY VEHICLE SEATS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 206 PERSONAL MOBILITY VEHICLE SEATS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 207 ATV SEATS MARKET, BY SEATING CAPACITY, 2018–2022 (THOUSAND UNITS)

- TABLE 208 ATV SEATS MARKET, BY SEATING CAPACITY, 2023–2030 (THOUSAND UNITS)

- TABLE 209 ATV SEATS MARKET, BY SEATING CAPACITY, 2018–2022 (USD MILLION)

- TABLE 210 ATV SEATS MARKET, BY SEATING CAPACITY, 2023–2030 (USD MILLION)

- TABLE 211 ONE-SEATER ATV SEATS MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 212 ONE-SEATER ATV SEATS MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 213 ONE-SEATER ATV SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 214 ONE-SEATER ATV SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 215 TWO-SEATER ATV SEATS MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 216 TWO-SEATER ATV SEATS MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 217 TWO-SEATER ATV SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 218 TWO-SEATER ATV SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 219 AUTOMOTIVE SEATS TRIM MARKET, BY SALES CHANNEL, 2018–2022 (USD MILLION)

- TABLE 220 AUTOMOTIVE SEATS TRIM MARKET, BY SALES CHANNEL, 2023–2030 (USD MILLION)

- TABLE 221 AUTOMOTIVE SEATS TRIM OE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 222 AUTOMOTIVE SEATS TRIM OE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 223 AUTOMOTIVE SEATS TRIM AFTERMARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 224 AUTOMOTIVE SEATS TRIM AFTERMARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 225 AUTOMOTIVE SEATS MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 226 MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 227 AMERICAS: MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 228 AMERICAS: MARKET, BY COUNTRY, 2023–2030 (THOUSAND UNITS)

- TABLE 229 US: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 230 US: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 231 US: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 232 MEXICO: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 233 MEXICO: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 234 MEXICO: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 235 CANADA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 236 CANADA: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 237 CANADA: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 238 BRAZIL: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 239 BRAZIL: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 240 BRAZIL: AUTOMOTIVE MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 241 ARGENTINA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 242 ARGENTINA: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 243 ARGENTINA: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 244 OTHER COUNTRIES: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 245 OTHER COUNTRIES: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 246 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 247 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (THOUSAND UNITS)

- TABLE 248 CHINA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 249 CHINA: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 250 CHINA: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 251 INDIA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 252 INDIA: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 253 INDIA: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 254 INDONESIA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 255 INDONESIA: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 256 JAPAN: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 257 JAPAN: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 258 JAPAN: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 259 SOUTH KOREA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 260 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 261 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 262 THAILAND: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 263 THAILAND: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 264 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 265 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 266 EUROPE: MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 267 EUROPE: MARKET, BY COUNTRY, 2023–2030 (THOUSAND UNITS)

- TABLE 268 FRANCE: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 269 FRANCE: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 270 FRANCE: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 271 GERMANY: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 272 GERMANY: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 273 GERMANY: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 274 ITALY: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 275 ITALY: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 276 ITALY: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 277 RUSSIA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 278 RUSSIA: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 279 RUSSIA: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 280 SPAIN: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 281 SPAIN: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 282 SPAIN: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 283 TURKEY: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 284 TURKEY: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 285 UK: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 286 UK: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 287 UK: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 288 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 289 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 290 MIDDLE EAST & AFRICA: AUTOMOTIVE SEATS MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 291 MIDDLE EAST & AFRICA: AUTOMOTIVE SEATS MARKET, BY COUNTRY, 2023–2030 (THOUSAND UNITS)

- TABLE 292 IRAN: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 293 IRAN: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 294 IRAN: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 295 SOUTH AFRICA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 296 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 297 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 298 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 299 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2023–2030 (THOUSAND UNITS)

- TABLE 300 KEY GROWTH STRATEGIES, 2022–2023

- TABLE 301 MARKET: PRODUCT DEVELOPMENTS, 2022–2023

- TABLE 302 MARKET: DEALS, 2022–2023

- TABLE 303 MARKET: EXPANSIONS, 2022–2023

- TABLE 304 STRATEGIES ADOPTED BY KEY PLAYERS, 2022–2023

- TABLE 305 AUTOMOTIVE SEAT MANUFACTURERS: KEY START-UPS/SMES

- TABLE 306 ADIENT PLC: COMPANY OVERVIEW

- TABLE 307 ADIENT PLC: PRODUCTS OFFERED

- TABLE 308 ADIENT PLC: PRODUCT DEVELOPMENTS

- TABLE 309 ADIENT PLC: DEALS

- TABLE 310 ADIENT PLC: OTHERS

- TABLE 311 FAURECIA: COMPANY OVERVIEW

- TABLE 312 FAURECIA: PRODUCTS OFFERED

- TABLE 313 FAURECIA: PRODUCT DEVELOPMENTS

- TABLE 314 FAURECIA: DEALS

- TABLE 315 FAURECIA: OTHERS

- TABLE 316 LEAR CORPORATION: COMPANY OVERVIEW

- TABLE 317 LEAR CORPORATION: PRODUCTS OFFERED

- TABLE 318 LEAR CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 319 LEAR CORPORATION: DEALS

- TABLE 320 LEAR CORPORATION: OTHERS

- TABLE 321 TOYOTA BOSHOKU CORPORATION: COMPANY OVERVIEW

- TABLE 322 TOYOTA BOSHOKU CORPORATION: PRODUCTS OFFERED

- TABLE 323 TOYOTA BOSHOKU CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 324 TOYOTA BOSHOKU CORPORATION: DEALS

- TABLE 325 TOYOTA BOSHOKU CORPORATION: OTHERS

- TABLE 326 MAGNA INTERNATIONAL: COMPANY OVERVIEW

- TABLE 327 MAGNA INTERNATIONAL: PRODUCTS OFFERED

- TABLE 328 MAGNA INTERNATIONAL: PRODUCT DEVELOPMENTS

- TABLE 329 MAGNA INTERNATIONAL: DEALS

- TABLE 330 MAGNA INTERNATIONAL: OTHERS

- TABLE 331 TS TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 332 TS TECH CO., LTD.: PRODUCTS OFFERED

- TABLE 333 TS TECH CO., LTD.: PRODUCT DEVELOPMENTS

- TABLE 334 TS TECH CO., LTD.: OTHERS

- TABLE 335 AISIN CORPORATION: COMPANY OVERVIEW

- TABLE 336 AISIN CORPORATION: PRODUCTS OFFERED

- TABLE 337 NHK SPRING CO., LTD.: COMPANY OVERVIEW

- TABLE 338 NHK SPRING CO., LTD.: PRODUCTS OFFERED

- TABLE 339 NHK SPRING CO., LTD.: OTHERS

- TABLE 340 TACHI-S CO., LTD.: COMPANY OVERVIEW

- TABLE 341 TACHI-S CO., LTD.: PRODUCTS OFFERED

- TABLE 342 TACHI-S CO., LTD.: DEALS

- TABLE 343 TACHI-S CO., LTD.: OTHERS

- TABLE 344 GENTHERM: COMPANY OVERVIEW

- TABLE 345 GENTHERM: PRODUCTS OFFERED

- TABLE 346 BROSE FAHRZEUGTEILE SE & CO. KG: COMPANY OVERVIEW

- TABLE 347 GRAMMER AG: COMPANY OVERVIEW

- TABLE 348 C.I.E.B. KAHOVEC: COMPANY OVERVIEW

- TABLE 349 PHOENIX SEATING LIMITED: COMPANY OVERVIEW

- TABLE 350 IG BAUERHIN GMBH: COMPANY OVERVIEW

- TABLE 351 SABELT: COMPANY OVERVIEW

- TABLE 352 GUELPH MANUFACTURING: COMPANY OVERVIEW

- TABLE 353 CAMACO-AMVIAN: COMPANY OVERVIEW

- TABLE 354 FREEDMAN SEATING COMPANY: COMPANY OVERVIEW

- TABLE 355 DAE WON KANG UP: COMPANY OVERVIEW

- TABLE 356 TATA AUTOCOMP SYSTEMS: COMPANY OVERVIEW

- TABLE 357 SUMMIT AUTO SEATS: COMPANY OVERVIEW

- TABLE 358 HARITA SEATING SYSTEMS LTD: COMPANY OVERVIEW

- TABLE 359 DELTA KOGYO CO., LTD.: COMPANY OVERVIEW

- TABLE 360 BHARAT SEATS LIMITED (BSL): COMPANY OVERVIEW

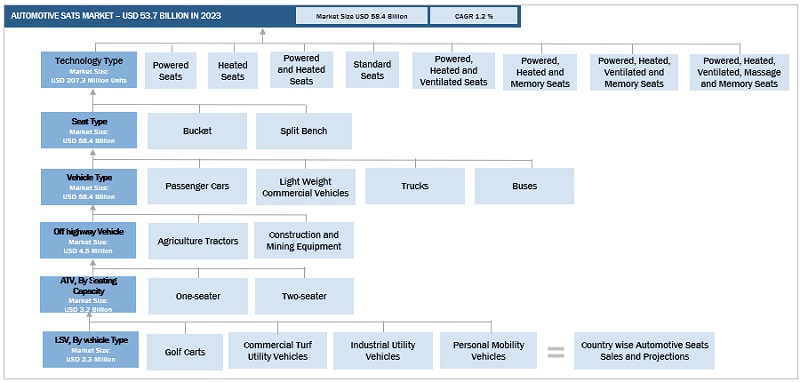

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 BOTTOM-UP APPROACH, BY TECHNOLOGY

- FIGURE 6 TOP-DOWN APPROACH, BY COMPONENT

- FIGURE 7 TOP-DOWN APPROACH, BY TRIM MATERIAL

- FIGURE 8 TOP-DOWN APPROACH, BY MATERIAL

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 REPORT SUMMARY

- FIGURE 11 AUTOMOTIVE SEATS MARKET, BY REGION, 2023 VS. 2030 (THOUSAND UNITS)

- FIGURE 12 GROWING CUSTOMER INCLINATION TOWARD COMFORT AND LUXURY FEATURES

- FIGURE 13 BUCKET SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY VALUE IN 2023

- FIGURE 14 STEEL TO BE LARGEST SEGMENT BY VALUE DURING FORECAST PERIOD

- FIGURE 15 SYNTHETIC LEATHER TO SECURE LEADING MARKET POSITION BY VALUE IN 2023

- FIGURE 16 STANDARD SEATS TO SURPASS OTHER SEGMENTS BY VOLUME DURING FORECAST PERIOD

- FIGURE 17 SIDE CURTAIN AIRBAGS TO HOLD MAXIMUM SHARE BY VALUE IN 2023

- FIGURE 18 PASSENGER CARS TO LEAD MARKET BY VALUE DURING FORECAST PERIOD

- FIGURE 19 BEVS TO EXCEED OTHER SEGMENTS BY VOLUME BETWEEN 2023 AND 2030

- FIGURE 20 AGRICULTURAL TRACTORS TO HOLD MAJORITY SHARE BY VOLUME IN 2030

- FIGURE 21 ONE-SEATER TO BE LARGEST SEGMENT BY VALUE DURING FORECAST PERIOD

- FIGURE 22 GOLF CARTS TO DOMINATE MARKET BY VOLUME IN 2030

- FIGURE 23 AFTERMARKET TO BE FASTEST-GROWING SEGMENT BY VALUE DURING FORECAST PERIOD

- FIGURE 24 ASIA PACIFIC TO BE LARGEST MARKET IN 2023

- FIGURE 25 AUTOMOTIVE SEATS MARKET: DRIVER, CHALLENGES, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 GLOBAL PREMIUM PASSENGER CAR PRODUCTION, 2018–2022 (MILLION UNITS)

- FIGURE 27 NEW REGISTRATIONS OF SUVS, BY COUNTRY, 2018–2022 (MILLION UNITS)

- FIGURE 28 SUPPLY CHAIN ANALYSIS

- FIGURE 29 AUTOMOTIVE SEATS MARKET ECOSYSTEM

- FIGURE 30 AUTONOMOUS CAR AND RIDESHARING PRESENT NEW REVENUE SHIFT FOR AUTOMOTIVE SEAT MANUFACTURERS

- FIGURE 31 VALUE CHAIN ANALYSIS

- FIGURE 32 KEY BUYING CRITERIA FOR AUTOMOTIVE SEATS

- FIGURE 33 AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023 VS. 2030 (THOUSAND UNITS)

- FIGURE 34 AUTOMOTIVE SEATS MARKET, BY TRIM MATERIAL, 2023 VS. 2030 (USD MILLION)

- FIGURE 35 MARKET, BY COMPONENT, 2023 VS. 2030 (USD MILLION)

- FIGURE 36 MARKET, BY VEHICLE TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 37 ELECTRIC VEHICLE SEATS MARKET, BY PROPULSION TYPE, 2023 VS. 2030 (THOUSAND UNITS)

- FIGURE 38 MARKET, BY SEAT TYPE, 2023 VS. 2030 (USD BILLION)

- FIGURE 39 MARKET, BY MATERIAL, 2023 VS. 2030 (USD THOUSAND)

- FIGURE 40 OFF-HIGHWAY VEHICLE SEATS MARKET, BY VEHICLE TYPE, 2023 VS. 2030 (THOUSAND UNITS)

- FIGURE 41 LSV SEATS MARKET, BY VEHICLE TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 42 ATV SEATS MARKET, BY SEATING CAPACITY, 2023 VS. 2030 (USD MILLION)

- FIGURE 43 AUTOMOTIVE SEATS TRIM MARKET, BY SALES CHANNEL, 2023 VS. 2030 (USD MILLION)

- FIGURE 44 MARKET, BY REGION, 2023 VS. 2030 (THOUSAND UNITS)

- FIGURE 45 AMERICAS: MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 47 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 48 REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022

- FIGURE 49 COMPANY EVALUATION MATRIX, 2022

- FIGURE 50 COMPANY EVALUATION MATRIX: AUTOMOTIVE SEAT COMPONENT MANUFACTURERS, 2022

- FIGURE 51 ADIENT PLC: COMPANY SNAPSHOT

- FIGURE 52 FAURECIA: COMPANY SNAPSHOT

- FIGURE 53 LEAR CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 TOYOTA BOSHOKU CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 MAGNA INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 56 TS TECH CO., LTD.: COMPANY SNAPSHOT

- FIGURE 57 AISIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 NHK SPRING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 59 TACHI-S CO., LTD.: COMPANY SNAPSHOT

- FIGURE 60 GENTHERM: COMPANY SNAPSHOT

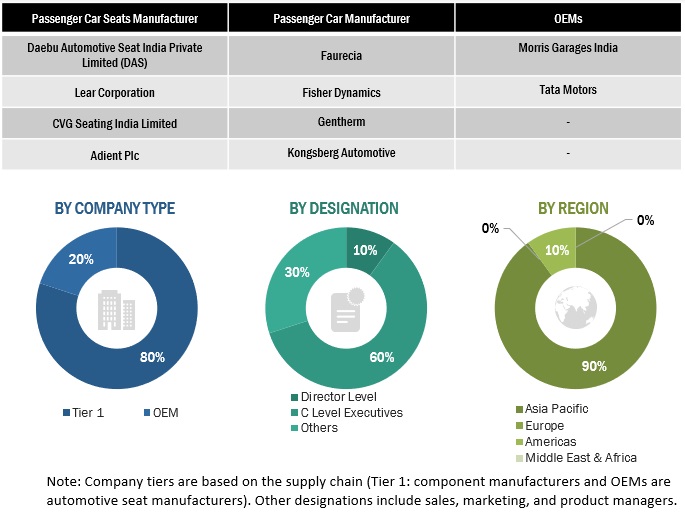

The research study involved various secondary sources, such as company annual reports/presentations, industry association publications, automotive seats magazine articles, directories, technical handbooks, world economic outlook, trade websites, technical articles, and databases, which were used to identify and collect information for an extensive study of the automotive seats market. Primary sources—experts from related industries, automobile OEMs, and suppliers—were interviewed to obtain and verify critical information and assess prospects and market estimations.

Secondary Research

Secondary sources in this research study include automotive industry organizations such as the Organization Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive seat associations. The secondary data was collected and analysed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted through secondary research after understanding the automotive seat market scenario. Approximately 70% of the primary interviews were conducted from the automotive seat and component/system providers, and 30% from the end users across the Americas, Europe, Asia Pacific, and Middle East and Africa. The primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administration, were contacted to provide a holistic viewpoint in the report while canvassing primaries.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This and the opinions of in-house subject matter experts led to the findings delineated in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the automotive seat market by region, vehicle type, technology, and seat type. To determine the market size, in terms of volume, for the market, by technology, country-level production numbers of each vehicle type (passenger cars, LCVs, trucks, and buses) were multiplied by the country-level penetration of each seat technology (derived from model mapping) to obtain the country-level seat market, by vehicle type and technology. The country-level market size, by technology in terms of volume, was added to derive the regional and, further, the global market, by technology (heated seats; heated and powered seats; standard seats; powered seats; powered, heated, and memory seats; powered, heated, and ventilated seats; powered, heated, ventilated, and memory seats; powered, heated, ventilated, massage and memory seats) in terms of volume. A similar approach was followed to derive the market by seat type (bucket and split bench seats), vehicle type (passenger cars, LCVs, heavy trucks, and buses), Electric vehicle seats market, by propulsion type (BEVs, FCEVs and PHEVs), LSV automotive seats market, by vehicle type (golf carts, commercial turf utility vehicles, industrial utility vehicles, and personal mobility vehicles), ATV automotive seats market, by seating capacity (one-seater and two-seater), automotive seat trim market, by sales channel (OEM and aftermarket) and off-highway vehicle seats market, by vehicle type (construction and mining equipment and agricultural tractors). Used to estimate and validate the market size by seat type, in terms of volume & value, was derived by multiplying the country-level penetration of bucket and split bench with the production numbers.

Automotive Seat Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

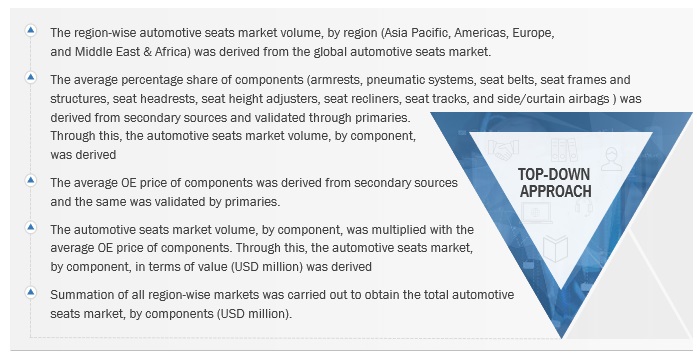

Automotive Seat Market: Top-Down Approach

While estimating the regional market size for automotive seats by component, the regional share of armrests, pneumatic systems, seat belts, seat frames and structures, seat headrests, seat height adjusters, seat recliners, seat tracks, and side curtain airbags were identified and multiplied with the regional market size, in terms of volume. In terms of volume, the regional market size was then multiplied by the regional-level average OE price (AOP) of components. This resulted in the regional market size of the automotive seats market, by component, in terms of value.

Top-Down Approach

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by the primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analysed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Market Definition

An automotive seat is a product that provides support and a comfortable seating posture to the driver and co-passengers while maintaining their safety. The seat structure consists of several components, including the armrest, pneumatic system, seat belt, seat frame & design, seat headrest, seat height adjuster, seat recliner, and seat track. Its primary function is to provide occupant support, occupant position, and occupant safety.

Stakeholders

- Automotive Original Equipment Manufacturers (OEMs)

- Manufacturers of Automotive Seat Systems

- Component Suppliers for Automotive Seat Systems

- Raw Material Suppliers of Automotive Seats and Components

- Raw Material Suppliers of Automotive Seat Fabrics/Trims

- Regional Manufacturer Associations and Automobile Associations

- Traders, Distributors, and Suppliers of Automotive Seat Systems

- Automotive Industry as an End-use Industry and Regional Automobile Associations

Report Objectives

-

To define, describe, and forecast the size of the global automotive seats market in terms of value (USD million) and volume (million units)

- By technology (heated seats; heated and powered seats; standard seats; powered seats; powered, heated, and memory seats; powered, heated, and ventilated seats; powered, heated, ventilated, and memory seats; powered, heated, ventilated, massage and memory seats) at the country and regional level.

- By seat type (bucket and split bench) at the regional level.

- By trim material (fabric, genuine leather, polyurethan foam, and synthetic leather) at the regional level.

- By component (armrests, pneumatic systems, seat belts, seat frames and structures, seat headrests, seat height adjusters, seat recliners, seat tracks, and side curtain airbags) at the regional level.

- By vehicle type (passenger cars, light commercial vehicles, heavy trucks, and buses) at the regional level.

- By material (steel, aluminum, and carbon-amide-metal) at the regional level

- Off-highway vehicle seats market, by vehicle type (construction and mining equipment, and agricultural tractors) at the regional level.

- Electrical vehicle seats market, by propulsion (battery electric vehicle, fuel cell electric vehicle and plug-in hybrid electric vehicle) at the regional level.

- LSV seats market, by vehicle type (golf carts, commercial turf utility vehicles, industrial utility vehicles, and personal mobility vehicles) at the regional level.

- Automotive seats trim material, by sales channel (OEM and aftermarket).

- ATV seats market, by seating capacity (one-seater and two-seater) at the regional level.

- By region (Asia Pacific, Europe, Americas, and Middle East and Africa).

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market.

- To analyze the competitive landscape of the global players in the market, along with their market share/ranking.

- To analyze the competitive leadership mapping of the global automotive seats manufacturers and automotive seats component suppliers in the market.

- To analyze recent developments, including expansions and new product launches, undertaken by key industry participants in the market

- To strategically analyze the market with trade analysis, case studies, patent analysis, supply chain analysis, market ecosystem, pricing analysis, and the recession impact.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Automotive Seat Market By Vehicle Body Type

- Sedan

- Hatchback

- SUVs

Automotive Seat Market, By Integrated System

- Build-in Multimedia Screen

- Speaker

- Headphone Jacks

Detailed Analysis And Profiling Of Additional Market Players

Note: This will be further segmented by region.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Seats Market

I would like to explore the various conditions and situations rising in PVC Leather for Automotive (Car Seat ) in UAE and Sudan for official purposes.