Airport Baggage Handling System Market by Airport Class (A, B, C), Identification Technology (Barcode, RFID), Service (Self-Service, Assisted-Service), Type (Conveyors, Destination-Coded Vehicles), Efficiency, Geography - Global Forecast to 2020

The airport baggage handling system market is estimated at USD 6.45 billion in 2015. It is projected to grow at a CAGR of 7.72% to reach USD 9.36 billion by 2020. The factors that are expected to fuel the growth of the airport baggage handling system market are the increase in air travel by people all over the world, modernization of airports, enhancement of airports’ efficiency and customer satisfaction, and improvement of aircraft turnaround time, and others. On the other hand, factors, such as complex architecture and high level of initial investment, are restricting the growth of this market. However, an increase in the passenger and cargo traffic with a limited airport space provides new growth opportunities for the market players.

By identification technology, the RFID segment is expected to grow at the highest CAGR during the forecast period.

Based on identification technology, the RFID segment is estimated to lead the airport baggage handling system market during the forecast period. Radio Frequency-Identification technology (RFID) consists of a tag, which identifies and tracks the product via radio waves. These tags, on an average, can carry up to 2,000 bytes of data. RFID systems consist of three parts, namely, a scanning antenna; a transceiver with a decoder to interpret the data; and a transponder (RFID tag) that is pre-set with information.

Self-service bag check-in segment expected to register the highest CAGR during the forecast period.

Based on service type, the self-service bag check-in segment is estimated to lead the airport baggage handling system market during the forecast period. Innovative self-service bag check-in solutions have been developed to enhance the passenger experience. The airport adopted the self-service bag check-in system in 2008 along with KLM airlines and since then, it has been following a successful trial period along with KLM. After the successful trial period, this airport implemented permanently this system. When an airport installs a self-service bag check-in system, a larger capacity for check-in is available to the passengers, thereby providing a higher operational efficiency at these airports.Destination coded vehicles segment expected to register the highest CAGR during the forecast period.

Based on type, the destination coded vehicles segment is estimated to lead the airport baggage handling system market during the forecast period. Destination coded vehicles helps in moving the baggage quickly to its destination. Destinations coded vehicles have inbuilt tilt tray sorters. The DCVs are generally driven by linear induction motor and can travel up to five times faster than a conveyor system

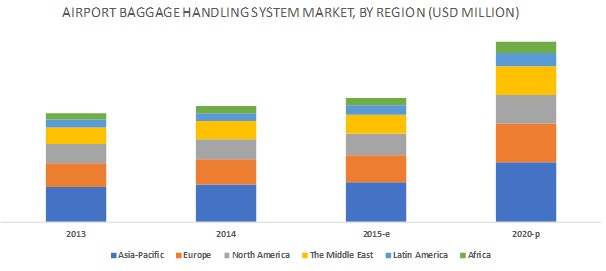

The Asia Pacific region is expected to lead from 2015 to 2020

The Asia Pacific airport baggage handling system market is projected to grow at the highest CAGR during the forecast period. The growth in middle class population, government investment in infrastructure, and implementation of stringent safety regulations is expected to have a positive impact on the baggage handling system market in the region. According to Boeing’s Current Market Outlook 2014, more than 100 million passengers are expected to travel annually, which will make Asia Pacific the largest travel market in the near future, projected to grow at 6.1% annually.

Key Market Players

The major players in the airport baggage handling system market include Siemens (Germany), Vanderlande Industries (Netherland), Daifuku Company (Japan), Pteris Global (Singapore), Beumer Group (Germany), Grenzebach Maschinenbau (Germany), BCS Group (New Zealand), Logplan (US), G&S Airport Conveyor (US), and Fives Group (France), among others.

Recent Developments

- In May 2015, Siemens Postal, Parcel & Airport Logistics GmbH (SPPAL- Germany) renewed its contract with Abu Dhabi International Airport (AUH) to continue operation and maintenance services for the baggage handling systems at its Terminal 1, 3, and cargo hub. The installation and renovation of the BHS systems at Terminal 1 and 3 now offer a capacity of more than 4,800 bags per hour.

- In July 2015, Vanderlande signed a one-year contract with AENA, the semipublic body in charge of Spain’s 46 airports, to provide operations and maintenance for the baggage handling system at all the terminals of Barcelona-El Prat Airport (Spain).

- In July 2015, Jervis B. Webb Co., a Farmington Hills subsidiary of Daifuku North America Holding Co. and a provider of airport baggage handling systems, signed a USD 17 million contract with the Greater Toronto Airports Authority (Toronto) to modify baggage handling systems that enables reduced transfer time and congestion.

Key Questions addressed by the report

- What are your views on the growth perspective of the airport baggage handling system market? What are the key dynamics and trends that govern the market such as drivers, and opportunities?

- What are the key sustainability strategies adopted by leading players operating in the airport baggage handling system market?

- What are the key trends and opportunities in the airport baggage handling system market across different regions and respective countries?

- Who are the key players and innovators in the partnership ecosystem?

- How is the competitive landscape changing in the client ecosystem and impacting their revenue shares?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Geographic Scope

1.4 Study Years

1.5 Currency & Pricing

1.6 Distribution Channel Participants

1.7 Study Limitations

1.8 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Variables Considerd for Factor Analysis

2.2.1 Introduction

2.3 Demand Side Analysis

2.3.1 Increase in Air-Travel

2.3.2 Reduction in Number of Mishandled Bags

2.4 Supply Side Analysis

2.4.1 Improvement in Baggage Handling Capacity of the ABHS System

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach

2.5.2 Top-Down Approach

2.5.3 Market Breakdown and Data Triangulation

2.6 Research Assumptions and Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in Airport Baggage Handling System Market

4.2 ABHS Market, By Technology

4.3 ABHS Market, By Airport Class

4.4 Asia-Pacific: Airport Baggage Handling Market, By Technology

4.5 ABHS Market, By Service Type

4.6 ABHS Market, By System Type

4.7 ABHS Market Share Analysis, By Region

4.8 ABHS Market, By Efficiency

4.9 ABHS Market Life Cycle Analysis, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 ABHS Market Segmentation, By Technology

5.2.2 ABHS Market: By Airport Class

5.2.3 ABHS Market, By Service Type

5.2.4 ABHS Market, By Type of ABHS

5.2.5 ABHS Market, By Efficiency

5.2.6 ABHS Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Air Travel

5.3.1.2 Modernization of Airports

5.3.1.3 Enhancing Airport Efficiency and Customer Satisfaction

5.3.1.4 Improving Aircraft Turnaround Time

5.3.2 Restraints

5.3.2.1 Complex Architecture

5.3.2.2 High Level of Initial Investment

5.3.3 Opportunities

5.3.3.1 Increasing Passenger and Cargo Traffic With Limited Airport Space

5.3.4 Challenges

5.3.4.1 Need to Decrease the Rate of Baggage Mishandled

5.3.4.2 Highly Efficient System During Peak and Non-Peak Hours

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Key Influencers

6.4 Industry Trends

6.5 Porter’s Five Forces Analysis

6.5.1 Threat From New Entrants

6.5.2 Threat From Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

6.6 Pestle Analysis

7 Airport Baggage Handling System Market, By Identification Technology (Page No. - 59)

7.1 Introduction

7.2 Barcode System

7.3 RFID System

8 Airport Baggage Handling System Market, By Airport Class (Page No. - 64)

8.1 Introduction

8.2 Class A Airport

8.3 Class B Airport

8.4 Class C Airport

9 Airport Baggage Handling System Market, By Service Type (Page No. - 69)

9.1 Introduction

9.2 Assisted Service Bag Check-In

9.3 Self-Service Bag Check-In

10 Airport Baggage Handling System Market, By Type (Page No. - 74)

10.1 Introduction

10.2 Conveyor System

10.3 Destination Coded Vehicle

11 Airport Baggage Handling Systems Market, By Efficiency (Page No. - 78)

11.1 Introduction

11.2 Below 3000

11.3 3000 to 6000

11.4 Above 6000 Segment

12 Airport Baggage Handling System Market, By Region (Page No. - 83)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.2 Canada

12.3 Asia-Pacific

12.3.1 China

12.3.2 Japan

12.3.3 India

12.3.4 Singapore

12.3.5 Thailand

12.4 Europe

12.4.1 Germany

12.4.2 France

12.4.3 U.K

12.4.4 Netherlands

12.4.5 Germany

12.4.6 France

12.5 Middle East

12.5.1 UAE

12.5.2 Qatar

12.6 Rest of the World

12.6.1 Brazil

12.7.1 South Africa

13 Airport Baggage Handling System Market, By Cost Analysis (Page No. - 109)

13.1 Introduction

13.3 Operational Cost Analysis

13.4 Installation Cost Analysis

14 Competitive Landscape (Page No. - 113)

14.1 Introduction

14.2 Market Share Analysis of Bagagge Handling System Market

14.3 Competitive Situation and Trends

14.3.1 Contracts

14.3.2 New Product Launches

14.3.3 Partnerships, Collborations, and Acquisitions

14.3.4 Other Developments

15 Company Profiles (Page No. - 121)

15.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

15.2 Siemens

15.3 Vanderlande Industries

15.4 Daifuku Company.

15.5 Pteris Global

15.6 Beumer Group

15.7 Fives Group

15.8 G&S Airport Conveyer

15.9 Grenzebach Maschinenbau

15.10 BCS Group

15.11 Logplan

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 147)

16.1 Discussion Guide

16.2 Introducing RT : Real Time Market Intelligence

16.3 Available Customization

16.4 Related Reports

List of Tables (71 Tables)

Table 1 Improving on Passenger and Baggage Processes at Airports With Rfid

Table 2 ABHS Market, By Identification Technology 2015-2020 (USD Million)

Table 3 Barcode System for ABHS Market, By Region 2015-2020 (USD Million)

Table 4 RFID System for ABHS Market, By Region

Table 5 ABHS Market, By Airport Class 2015-2020 (USD Million)

Table 6 Class A Airport ABHS Market, By Region 2015-2020 (USD Million)

Table 7 Class B Airport ABHS Market, By Region 2015-2020 (USD Million)

Table 8 Class C Airport ABHS Market, By Region 2015-2020 (USD Million)

Table 9 ABHS Market, By Service Type, 2013-2015 (USD Million)

Table 10 Assisted Service Bag Check-In Segment, By Region, 2013-2015 (USD Million)

Table 11 Self-Service Bag Check-In Segment, By Region, 2013-2015 (USD Million)

Table 12 ABHS Market, By Type, 2013-2020 (USD Million)

Table 13 Conveyor System Market, By Region, 2013-2020 (USD Million)

Table 14 Destination Coded Vehicle Market, By Region, 2013-2020 (USD Million)

Table 15 ABHS Market, By Efficiency, 2013-2015 (USD Million)

Table 16 Below 3000 Market, By Region, 2013-2015 (USD Million)

Table 17 3000 to 6000 Segment, By Region, 2013-2015 (USD Million)

Table 18 Above 6000 Segment, By Region, 2013-2015 (USD Million)

Table 19 ABHS Market, By Region, 2013-2020 (USD Million)

Table 20 U.S.: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 21 Canada: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 22 U.S.: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 23 Canada: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 24 U.S.: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 25 Canada: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 26 China: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 27 Japan: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 28 India: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 29 Singapore: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 30 Thailand: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 31 China: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 32 Japan: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 33 India: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 34 Singapore: ABHS Market, By Service Type , 2013-2020 (USD Million)

Table 35 Thailand: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 36 China: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 37 Japan: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 38 India: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 39 Singapore: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 40 Thailand: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 41 Germany: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 42 France: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 43 U.K.: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 44 Netherlands: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 45 Germany: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 46 France: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 47 U.K.: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 48 Netherlands: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 49 Germany: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 50 France: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 51 U.K.: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 52 Netherlands: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 53 U.A.E.: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 54 Qatar: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 55 U.A.E.: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 56 Qatar: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 57 U.A.E.: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 58 Qatar: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 59 Brazil: ABHS Market, By Identification Technology, 2013-2020 (USD Million)

Table 60 Brazil: ABHS Market, By Service Type, 2013-2020 (USD Million)

Table 61 Brazil: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 62 South Africa: ABHS Market, By Identification Technology, 2013 -2020 (USD Million)

Table 63 South Africa: ABHS Market, By Service Type, 2013 – 2020 (USD Million)

Table 64 South Africa: ABHS Market, By Airport Class, 2013-2020 (USD Million)

Table 65 ABHS Market, By Cost Analysis

Table 66 Operational Cost Analysis of ABHS Market, By Region 2015-2020 (USD Million)

Table 67 Installation Cost Analysis of ABHS Market, By Region 2015-2020 (USD Million)

Table 68 Contracts, 2011-2015

Table 69 New Product Launches, 2011-2015

Table 70 Partnerships, Collaborations, and Acquisitions, 2011–2015

Table 71 Other Developments, 2011-2015

List of Figures (75 Figures)

Figure 1 ABHS Market Segmentation

Figure 2 Research Design

Figure 3 World Air-Travel Growth, 1969-2014 (Rpk Trillion)

Figure 4 Growth in Middle Class, By Region, 2004-2014 (Millions of People)

Figure 5 Mishandled Bags, 2012 vs 2013

Figure 6 Mishandled Bags, 2003 vs 2013

Figure 7 Spent on RFID Systems in the Civil Air Industry, 2010

Figure 8 Bottom-Up Approach

Figure 9 Top-Down Approach

Figure 10 Market Breakdown and Data Triangulation

Figure 11 Assumptions

Figure 12 Geographic Analysis: ABHS Market Share, 2015

Figure 13 Need for Efficient Passenger Service is Expected to Drive the Self-Service Bag Check-In Segment

Figure 14 Siemens AG is the Market Leader

Figure 15 Rapidly Increasing Passenger Traffic Provide Untapped Market Opportunities in Airport Baggage Handling Systems Market, 2015-2020

Figure 16 Barcode Method is the Most Productive Technology Among Airport Baggage Handling Systems, 2015-2020

Figure 17 Class A Airports are the Most Lucrative Division for the ABHS Market, 2015-2020

Figure 18 Barcode Technology is Estimated to Capture the Major Share in Asia-Pacific, 2015

Figure 19 Assisted Service Bag Check-In is Anticipated to Drive the ABHS Market, 2015-2020

Figure 20 Conveyers Have Huge Potential to Drive the ABHS Market, 2015-2020

Figure 21 Asia-Pacific and Middle East to Grow at the Highest CAGR During the Forecast Period

Figure 22 Asia-Pacific is to Witness A Favorable Growth By 2020

Figure 23 Asia-Pacific Market to Witness A Remarkable Growth

Figure 24 ABHS Market Segmentation

Figure 25 ABHS Market Segmentation: By Technology

Figure 26 ABHS Market: By Airport Class

Figure 27 ABHS Market, By Service Type

Figure 28 ABHS Market, By Type of ABHS

Figure 29 ABHS Market, By Efficiency

Figure 30 Market Dynamics for ABHS Market

Figure 31 Value Chain Analysis: Airport Baggage Handling System

Figure 32 Supply Chain Analysis: ABHS Market

Figure 33 Technological Advancements Constitute the Latest Trend in the ABHS Market

Figure 34 Porter’s Five Force Analysis: ABHS Market

Figure 35 Pestle Analysis: ABHS Market

Figure 36 ABHS Market, By Identification Technology 2015-2020 (USD Million)

Figure 37 Barcode System for ABHS Market, By Region

Figure 38 RFID System for ABHS Market, By Region

Figure 39 ABHS Market, By Airport Class 2015-2020 (USD Million)

Figure 40 Class A Airport ABHS Market, By Region 2015-2020 (USD Million)

Figure 41 Class B Airport ABHS Market, By Region 2015-2020 (USD Million)

Figure 42 Class C Airport ABHS Market, By Region 2015-2020 (USD Million)

Figure 43 Self-Service Bag Check-In ABHS Will Be the Trend in the Years to Come

Figure 44 Asia Pacific Market Will Exhibit the Highest Growth on Account of Construction of New Airports

Figure 45 The Growth of Self-Service Bag Check-In Will Depend on the Passengers Inclination Towards Technology Adaptation

Figure 46 The Market for DCV is Expected to Grow at A Faster Rate Owing to the Speed of Operation and Efficiency of DCV

Figure 47 Conveyor System Market, By Region (USD Million)

Figure 48 Destination Coded Vehicle Market, By Region (USD Million)

Figure 49 ABHS Market, By Efficiency (USD Million)

Figure 50 Below 3000 Segment, By Region (USD Million)

Figure 51 3000 to 6000 Segment, By Region (USD Million)

Figure 52 Above 6000 Segment, By Region (USD Million)

Figure 53 Influencing Factors and Their Impact in Different Regions for the ABHS Market, 2014

Figure 54 ABHS Market Share, By Region, 2015

Figure 55 The Growth of ABHS North America is Projected to Be Driven By Upgradation of Existing Airports

Figure 56 Asia Pacific is Projected to Grow at the Highest CAGR of 8.26% During the Forecast Period

Figure 57 Strict Safety Standards Will Have A Positive Impact on the ABHS Market in Europe

Figure 58 FIFA World Cup 2022 Will Boost the ABHS Market in Middle East

Figure 59 The ABHS Market in Latin America Will Be Majorly Driven By Brazil

Figure 60 The ABHS Market in Africa is Expected to Be Driven By Tourism and Growing Trade in the Region

Figure 61 ABHS Market, By Cost Analysis

Figure 62 Operational Cost Analysis of ABHS Market, By Region

Figure 63 Installation Cost Analysis of ABHS Market, By Region

Figure 64 Companies Adopted Business Expansions and New Product Launches as Key Growth Strategies From 2012 to 2015

Figure 65 ABHS Market Share Analysis, 2014

Figure 66 ABHS Market has Witnessed Significant Growth From 2013 to 2015

Figure 67 Contracts Were the Most Actively Adopted Growth Strategy During 2013-2015

Figure 68 Matrix for Investment Attractiveness in ABHS Market

Figure 69 Region-Wise Presence of Top Five Players

Figure 70 Siemens AG : Company Snapshot

Figure 71 Vanderlande Industries: Company Snapshot

Figure 72 Daifuku Company, Ltd.: Company Snapshot

Figure 73 Pteris Global Limited: Company Snapshot

Figure 74 Fives Group: Company Snapshot

Figure 75 Grenzebach Maschinenbau GmbH: Business Overview

The study considered four major activities to estimate the current market size for airport baggage handling system. Exhaustive secondary research was undertaken to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, and magazines have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and airport databases.

Primary Research

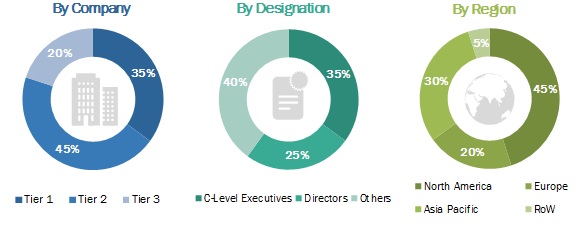

The report comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by various end users, such as airport administration as well as Maintenance, Repair and Operations (MRO) and leasing companies. The supply side is characterized by advancements in airport baggage handling system technology, development of airport baggage handling system, and software development. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the airport baggage handling system market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the airport baggage handling system industry.

Report Objectives

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the report

- To analyze macro and micro indicators of the report

- To forecast the market size of segments based on 4 regions, including North America, Europe, Asia Pacific, and Rest of the World, along with major countries in each of these regions

- To strategically analyze micromarkets1 with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market shares and core competencies

- To provide a detailed competitive landscape of the airport baggage handling system market, along with an analysis of business and corporate strategies such as new product development, providing customized solutions, and mergers & acquisitions

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the airport baggage handling system market

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2013 to 2020 |

|

Base year considered |

2014 |

|

Forecast period |

2015 to 2020 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Identification Technology, Service, Type, Airport Class, Efficiency and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East, Latin America, Africa |

|

Companies covered |

Siemens AG (Germany), Vanderlande Industries (Netherland), Daifuku Company (Japan), Pteris Global (Singapore), Beumer Group (Germany), Grenzebach Maschinenbau (Germany), BCS Group (New Zealand), Logplan (US), G&S Airport Conveyor (US), and Fives Group (France) among others |

This research report categorizes the airport baggage handling system market based on identification technology, service, type, airport class, efficiency and region.

On the basis of identification technology, the airport baggage handling system market has been segmented as follows:

- Barcode

- RFID

- Others

On the basis of service type, the report has been segmented as follows:

- Assisted Service Bag Check-In

- Self-Service Bag Check-In

On the basis of type, the report has been segmented as follows:

- Conveyors

- Destination Coded Vehicles

- Others

On the basis of efficiency, the report has been segmented as follows:

- Below 3000

- 3000 to 6000

- Above 6000

On the basis of airport class, the report has been segmented as follows:

- A

- B

- C

On the basis of Region, the report has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

- Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Airport Baggage Handling System Market

I require a marketing strategy report for baggage handling systems for SAARC, SE Asian countries, and the Middle East.