Baggage Handling System Market by Mode (Airport, Marine, Rail), Solution (Check-In, Screening & Load, Conveying & Sorting, Unload & Reclaim), Check-In (Assisted, Self), Conveying (Conveyor, DCV), Tracking (Barcode, RFID), Region - Global Forecast to 2025

[189 Pages Report] The baggage handling system market is projected to grow at a CAGR of 6.6%, from USD 7.5 billion in 2020 to USD 10.3 billion by 2025. The increasing focus on improving operational efficiency at airports, growing air passenger volume, and significant developments in intermodal transport are the major factors which will drive the baggage handling system market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the baggage handling system market

The COVID-19 pandemic has deeply impacted the baggage handling system market. Almost all countries underwent lockdowns, and airport, marine, and railway operations were stopped due to the pandemic. Also, most of the ongoing airport construction projects were canceled or delayed. Along with the other industries, the aviation industry was also hit by the pandemic, and the supply chain was considerably affected. However, with the resumption of few airport construction projects and terminal expansion activities in the second half of the year, the market is expected to witness positive growth going forward.

Also, Containment measures are leading to a substantial reduction in economic activities. This has resulted in disruption of ongoing airport construction projects and reduction in air passenger traffic, ultimately impacting the cash flow of airlines and airports. Most of the projects have been delayed, and few were called off. The market for baggage handling systems is estimated to undergo a phase of decline in 2020. Furthermore, in the marine industry, many countries in Southeast Asia banned cruise ships from disembarking their passengers for fear of importing the virus through infected passengers and crew. In addition, considerable drop in global Chinese exports in container volumes has affected the European and American trade routes. Similarly, in railways, the unprecedented impact of COVID-19 and adverse effects on public transport have decreased the operation of railways and is expected to be a major concern for baggage handling system manufacturers

The conveying and sorting segment is expected to be the largest contributor in the baggage handling system market, by solution, during the forecast period.

The conveying and sorting segment is projected to lead the baggage handling system market, by solution. According to primary insights, sorting is the heart of the total baggage handling system. The exponential increase in air and marine passenger volume for domestic and international travels worldwide has encouraged baggage handling system manufacturers to find ways to improve existing baggage handling technologies with automated sorting. According to Société Internationale de Télécommunications Aéronautiques (SITA), with a rise in automation reflected in increasing use of conveyor systems, the rate of baggage mishandling reduced in 2018 compared to 2017.

The conveyor type of baggage handling system is estimated to be the largest market during the forecast period.

The conveyor segment is projected to the lead the baggage handling conveyor system market, by type. Airports with low passenger traffic use conveyors as the prime transportation medium for baggage. Class C and a few class B airports use the conveyor type baggage handling system. Destination coded vehicle (DCV) is a relatively new technology used in bigger airports with multiple terminals. According to primary insights, DCV is currently the fastest way to transport luggage. The growth in the adoption of DCVs can be attributed to the interlinking of terminals, increase in passenger traffic, and upgrading of airports.

In mode of transport, the airport segment is projected to be the largest contributor during the forecast period.

The baggage handling system market for airports is estimated to account for the largest market share during the forecast period. Airports contribute almost 95% share of the market. According to primary insights, the airport segment will continue to dominate the market in the next 20–30 years. With aggressive incentives and mandates from the government, India and China have established themselves as leaders in the airport industry. Airport baggage handling systems play an important role in the global economy as they attract many suppliers and manufacturers for business investments. The growth of this market can also be attributed to the increasing percentage of air passenger traffic worldwide. According to the International Air Transport Association (IATA), the global annual average air passenger journeys are projected to grow by about 3.8% from 2014 to 2034. The airports must be equipped with the latest technologies of baggage handling systems, which can manage the movement of baggage in and out of the check-in and checkout points at airports.

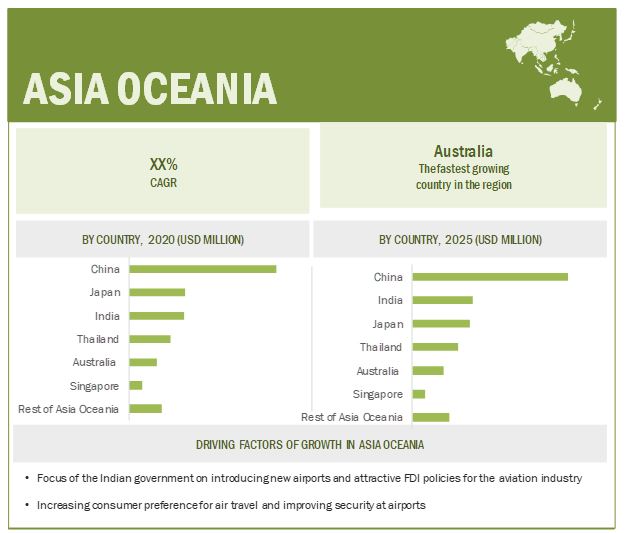

Asia Oceania is expected to account for the largest market size during the forecast period.

Asia Oceania is projected to hold the largest market share. Factors such as growing air passenger volume, upcoming airport projects, presence of cruise industry, scope for multimodal transport, economy of countries, government investments in railway, marine, and airport projects, consumer acceptance, and government regulations have triggered the demand for baggage handling systems in the region. Due to the ever-growing air passenger traffic, China accounts for the highest market share of the Asia Oceania baggage handling system market. Additionally, China has curbed the spread of the virus in the early second quarter of 2020, and hence, the recovery started than other countries like India and Southeast Asian countries. In India, Delhi’s IGI airport terminal expansion project has been delayed. The timeline of terminal expansion plan has been impacted by COVID-19 due to lockdown and shortage of workers. Therefore, the deadline is likely to shift from mid-2020 to the end of 2023. Thus, the demand for baggage handling systems is expected to increase post-COVID-19 after the resumption of projects. According to the IATA, India is expected to be the third largest aviation market (in terms of passengers) by 2024, which will make Asia Oceania the largest travel market in the near future. Such developments are expected to help Asia Oceania dominate the market in the near future as well.

Some of the key players in the high voltage battery market are Siemens (Germany), Vanderlande Industries (Netherlands), Daifuku (Japan), Pteris Global Limited (Singapore), BEUMER (Germany), and SITA (Switzerland). Vanderlande Industries (Netherlands) is identified as the leading player in the baggage handling system market. The company is one of the established players and a globally renowned supplier of baggage handling systems to airways and railways. The company follows the strategies of supply contracts/collaborations/partnerships/joint ventures to gain a competitive edge in the market. In February 2019, Vanderlande Industries signed a landmark innovation partnership agreement with Airport Authority Hong Kong (AAHK) to further develop and apply its future-proof baggage logistics solution, FLEET, in the real-world environment at one of the world’s busiest passenger airports.

Key Market Players

The baggage handling system market is dominated by few global players and comprises several regional players as well. The key players in the market are Siemens (Germany), Vanderlande Industries (Netherlands), Daifuku (Japan), Pteris Global Limited (Singapore), BEUMER (Germany), and SITA (Switzerland).

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2020–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD million/billion) |

|

Segments Covered |

Mode of transport, Tracking Technology, Check-in Service Type, Type, Solution, and Region |

|

Geographies Covered |

Asia Oceania, Europe, Americas, and MEA |

|

Companies Covered |

The key players in the baggage handling system market are Siemens (Germany), Vanderlande Industries (Netherlands), Daifuku (Japan), Pteris Global Limited (Singapore), Fives (France), and SITA (Switzerland). Additionally, the report covered 20 major players. |

This research report categorizes the baggage handling system market based on mode of transport, tracking technology, check-in service type, type, solution, and region.

Baggage handling system market, by Mode of Transport

- Airport

- Railway

- Marine

Baggage handling system market, by Tracking Technology

- Barcode System

- RFID System

Baggage handling system market, by Check-in Service Type

- Assisted Service

- Self-service

Baggage handling conveyor system market, by Type

- Conveyor

- Destination Coded Vehicle (DCV)

Baggage handling system market, by Solution

- Check-in, Screening, and Loading

- Conveying and Sorting

- Unloading and Reclaim

Baggage handling system market, by Region

-

Asia Oceania

- China

- Australia

- India

- Singapore

- Japan

- Thailand

- Rest of Asia Oceania

-

Europe

- Germany

- Italy

- Spain

- UK

- France

- The Netherlands

- Rest of Europe

-

Americas

- US

- Brazil

- Canada

- Mexico

- Rest of Americas

-

MEA

- South Africa

- UAE

- Qatar

- Rest of MEA

Recent Developments

- In September 2019, Vanderlande introduced its new UV-C Tray Disinfection solution, designed to help airports make security checkpoints safer for both passengers and employees. Using short wavelength UV light, the solution is capable of killing and deactivating 99.9% of bacteria and viruses on trays between each use. Disinfecting high-touch surfaces has become a priority for airports as the industry is preparing for air traffic to pick up again. It is well known that the trays used at security checkpoints pose a concern as each bin can be touched by hundreds of passengers every day. Without an automated sanitizing solution, this would result in a significant increase in the need for manual cleaning of trays as well as a decrease in throughput at the checkpoint.

- In January 2020, Siemens Logistics was successful in its bid to integrate a new hold baggage screening system (HBS) at Dublin Airport, Terminal 2. The contract includes replacing the existing HBS and installing an additional line to further increase capacity. A special challenge presented by this project is to conduct the work without causing any restrictions to normal flight plan or passenger operations.

- In April 2020, Vanderlande was formally selected as Heathrow Airport’s strategic baggage partner for the next ten years. The recently signed ‘pan-airport’ agreement will encompass the design, build, operation, and maintenance programs across the Terminals, as well as the baggage control room operations. The partnership will see both organizations further develop an integrated approach, which will build on their existing relationship.

- In October 2019, BEUMER Group signed an agreement covering future baggage handling projects as part of the Group’s objective to expand, replace and/or modify Amsterdam Schiphol Airport’s BHS over the coming years. The agreement forms part of long-term cooperation with two different strategic contractors, both of whom met the requirements and demands set out by the Royal Schiphol Group.

- In November 2018, Daifuku installed a state-of-the-art BHS at the international passenger terminal of New Chitose Airport in line with the airport’s renewal plans to meet the 2020 Tokyo Olympics and Paralympics and the Rugby World Cup Japan 2019. This installation marks Daifuku’s first domestic order for a BHS.

Frequently Asked Questions (FAQ):

What are the upcoming trends and technologies in the baggage handling system market?

A self-service bag check-in kiosk is currently the trending technology at all the major airports. Passenger IT Insights 2019 reports that passengers are more satisfied when they are using technology. Hence, the self-service bag check-in market is projected to grow at the highest CAGR of 11.88% during the forecast period.

How important is the role of the government in your region in the development of baggage handling systems?

Growing urbanization provides a thrust to the evolution of smart cities. Governments of different regions have started initiating smart city projects to provide better infrastructure, services, and speed up operational activities in the public and transportation services (includes railway, airports, and roadway) thus, impacting the demand for baggage handling system market.

What would be the share of metros and railways in the total baggage handling system market?

The share of railways in total baggage handling system market is expected to be 4.6% by 2025 during the forecast period.

How will Resolution 753 change the business landscape of baggage handling tracking technology?

Norms like resolution 753 are expected to create significant opportunities for RFID technology. Hence, factors such as an increase in safety norms at the workplace, cost optimization, and flight traffic security would drive the usage of DCVs and robots in airport, railway, and marine baggage handling systems in the near future

Which are the key players in the baggage handling system market?

The key players operating in the global baggage handling system market include a few globally established players such as Vanderlande Industries, BEUMER, Daifuku, SITA, Pteris Global Limited, and Siemens. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES

1.2 PRODUCT AND MARKET DEFINITION

1.2.1 BAGGAGE HANDLING SYSTEM

1.3 SUMMARY OF CHANGES

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTS OF BAGGAGE HANDLING SYSTEM MARKET

1.4.2 YEARS CONSIDERED IN THE STUDY

1.5 CURRENCY

TABLE 1 CURRENCY EXCHANGE RATES (WRT USD)

1.6 PACKAGE SIZE

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 2 BAGGAGE HANDLING SYSTEM MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources for baggage handling system

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.1 Sampling techniques & data collection methods

2.1.2.2 Primary participants

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 5 BAGGAGE HANDLING SYSTEM: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

3.1 PRE- VS POST-COVID-19 SCENARIO

FIGURE 7 PRE- VS POST-COVID-19 SCENARIO: BAGGAGE HANDLING SYSTEM MARKET, 2018–2025 (USD MILLION)

TABLE 2 MARKET: PRE- VS. POST-COVID-19 SCENARIO, 2018–2025 (USD MILLION)

FIGURE 8 MARKET: MARKET OUTLOOK

FIGURE 9 MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 BAGGAGE HANDLING SYSTEM – GLOBAL MARKET TRENDS

FIGURE 10 RESUMPTION OF AIRPORT DEVELOPMENT PROJECTS IS LIKELY TO BOLSTER THE DEMAND OF BAGGAGE HANDLING SYSTEM

4.2 BAGGAGE HANDLING SYSTEM MARKET, BY CHECK-IN SERVICE TYPE

FIGURE 11 INCREASING PREFERENCE FOR PRIVILEGE ASSISTANCE OVER SELF-SERVICE IS DRIVING THE MARKET FOR ASSISTED CHECK-IN SERVICE, 2025 (USD MILLION)

4.3 MARKET, BY TRACKING TECHNOLOGY, 2020 VS 2025

FIGURE 12 BARCODE IS ESTIMATED TO BE THE DOMINATING TRACKING TECHNOLOGY IN 2020 (USD MILLION)

4.4 MARKET, BY SOLUTION

FIGURE 13 CONVEYING AND SORTING IS EXPECTED TO BE THE LARGEST MARKET SEGMENT, 2020 VS. 2025 (USD MILLION)

4.5 MARKET, BY MODES OF TRANSPORT

FIGURE 14 HIGHER DEMAND FOR BAGGAGE HANDLING SYSTEM IN AIRPORTS IS EXPECTED TO DRIVE THE MARKET DURING THE FORECAST PERIOD

4.6 BAGGAGE HANDLING CONVEYOR SYSTEM MARKET, BY TYPE

FIGURE 15 CONVEYOR SEGMENT IS PROJECTED TO DOMINATE THE BAGGAGE HANDLING CONVEYOR SYSTEM MARKET, 2020 VS. 2025 (USD MILLION)

4.7 BAGGAGE HANDLING SYSTEM MARKET, BY COUNTRY

FIGURE 16 CHINA AND US ARE EXPECTED TO DOMINATE THE MARKET IN 2020 (USD MILLION)

4.8 MARKET, BY REGION

FIGURE 17 ASIA OCEANIA IS PROJECTED TO BE THE LARGEST MARKET, 2020 VS. 2025 (USD MILLION)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in air travel

TABLE 3 UPCOMING AIRPORTS

TABLE 4 AIRPORT-WISE PASSENGER TRAFFIC, 2019

5.2.1.2 Rising smart city projects

5.2.1.3 Growing maritime tourism industry

FIGURE 19 CRUISE FLEETS ACROSS THE GLOBE, BY SHIP AND BERTH, 2015–2020

5.2.2 RESTRAINTS

5.2.2.1 High initial and maintenance cost

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing usage of destination coded vehicles and robotics

5.2.4 CHALLENGES

5.2.4.1 Baggage mishandling

5.2.4.2 Fail-safe systems in peak hours

5.2.4.3 Impact of COVID-19 on demand for baggage handling systems

5.3 IMPACT OF COVID-19 ON THE AVIATION SECTOR

FIGURE 20 ESTIMATED AIRPORT REVENUE LOSSES FOR 2020, BY REGION

5.4 IMPACT OF COVID-19 ON GROUND OPERATORS

TABLE 5 IMPACT OF COVID-19 ON GROUND OPERATORS

5.5 BAGGAGE HANDLING SYSTEM MARKET SCENARIO

FIGURE 21 MARKET SCENARIO, 2018–2025 (USD MILLION)

5.5.1 MOST LIKELY/REALISTIC SCENARIO

TABLE 6 MARKET (REALISTIC SCENARIO), BY REGION, 2020–2025 (USD MILLION)

5.5.2 HIGH COVID-19 IMPACT SCENARIO

TABLE 7 MARKET (HIGH COVID-19 IMPACT SCENARIO), BY REGION, 2020–2025 (USD MILLION)

5.5.3 LOW COVID-19 IMPACT SCENARIO

TABLE 8 MARKET (LOW COVID-19 IMPACT SCENARIO), BY REGION, 2020–2025 (USD MILLION)

6 INDUSTRY TRENDS (Page No. - 54)

6.1 INTRODUCTION

6.1.1 CONVENTIONAL TECHNOLOGIES

6.1.1.1 Tri planar conveyor system

6.1.1.2 Crescent conveyor system

6.1.1.3 Belt conveyor system

6.1.1.4 Baggage tray system

6.1.1.5 Tilt tray sorter system

6.1.2 ADVANCED TECHNOLOGIES

6.1.2.1 LEO

6.1.2.2 KATE

6.1.2.3 Baggage vision technology

6.1.2.4 GENI-beltTM

6.1.2.5 RFID system

6.1.2.6 TOTE screening systems

6.2 PESTLE ANALYSIS

6.2.1 POLITICAL

6.2.2 ECONOMIC

6.2.3 SOCIAL

6.2.4 TECHNOLOGICAL

6.2.5 LEGAL

6.2.6 ENVIRONMENTAL

6.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS: BAGGAGE HANDLING SYSTEM MARKET

6.4 REVENUE IMPACT

TABLE 9 REVENUE IMPACT ANALYSIS: KEY PLAYERS IN BAGGAGE HANDLING SYSTEM

7 BAGGAGE HANDLING SYSTEM MARKET, BY MODES OF TRANSPORT (Page No. - 61)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS/LIMITATIONS

FIGURE 23 BY MODES OF TRANSPORT: INDUSTRY INSIGHTS

FIGURE 24 MARKET, BY MODES OF TRANSPORT, 2020 VS. 2025 (USD MILLION)

TABLE 10 MARKET, BY MODES OF TRANSPORT, 2016–2019 (USD MILLION)

TABLE 11 MARKET, BY MODES OF TRANSPORT, 2020–2025 (USD MILLION)

7.2 AIRPORT

7.2.1 AIRPORT SEGMENT BEING THE LARGEST APPLICATION FOR BAGGAGE HANDLING SYSTEMS, IS ALSO THE MOST IMPACTED INDUSTRY

TABLE 12 AIRPORT: BAGGAGE HANDLING SYSTEM MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 AIRPORT: MARKET, BY REGION, 2020–2025 (USD MILLION)

7.3 MARINE

7.3.1 STEADY GROWTH IN CRUISE INDUSTRY DRIVES THE MARINE BAGGAGE HANDLING SYSTEM MARKET

TABLE 14 MARINE: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 MARINE: MARKET, BY REGION, 2020–2025 (USD MILLION)

7.4 RAILWAY

7.4.1 GROWING METRO PROJECTS HAVE RAISED THE DEMAND FOR EFFICIENT PASSENGER LUGGAGE HANDLING SYSTEMS

TABLE 16 RAILWAY MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 RAILWAY: MARKET, BY REGION, 2020–2025 (USD MILLION)

8 BAGGAGE HANDLING SYSTEM MARKET, BY SOLUTION (Page No. - 69)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS/LIMITATIONS

FIGURE 25 BY SOLUTION: INDUSTRY INSIGHTS

FIGURE 26 MARKET, BY SOLUTION, 2020 VS. 2025 (USD MILLION)

TABLE 18 MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 19 MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

8.2 CHECK-IN, SCREENING, AND LOADING

8.2.1 SELF-SERVICE CHECK-IN AND ADVANCED TRACKING TECHNOLOGIES ACCELERATE THE MARKET FOR CHECK-IN, SCREENING, AND LOADING (INPUT) SEGMENT

8.2.1.1 Check-in

8.2.1.1.1 Smart Boarding Systems

8.2.1.2 Screening

8.2.1.2.1 Baggage Scanners

8.2.1.3 Loading

TABLE 20 CHECK-IN, SCREENING, AND LOADING: BAGGAGE HANDLING SYSTEM MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 CHECK-IN, SCREENING, AND LOADING: MARKET, BY REGION, 2020–2025 (USD MILLION)

8.3 CONVEYING AND SORTING

8.3.1 SORTING IS THE HEART OF THE BAGGAGE HANDLING SYSTEM

8.3.1.1 Conveying

8.3.1.2 Sorting

TABLE 22 CONVEYING AND SORTING: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 CONVEYING AND SORTING: MARKET, BY REGION, 2020–2025 (USD MILLION)

8.4 UNLOADING AND RECLAIM

8.4.1 UNLOADING AND RECLAIM CONTRIBUTES 25–30% SHARE OF THE TOTAL BAGGAGE HANDLING SYSTEM MARKET

8.4.1.1 Unloading

8.4.1.2 Reclaim

TABLE 24 UNLOADING AND RECLAIM: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 UNLOADING AND RECLAIM: MARKET, BY REGION, 2020–2025 (USD MILLION)

9 BAGGAGE HANDLING SYSTEM MARKET, BY TRACKING TECHNOLOGY (Page No. - 78)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS/LIMITATIONS

FIGURE 27 BY TRACKING TECHNOLOGY: INDUSTRY INSIGHTS

FIGURE 28 MARKET, BY TRACKING TECHNOLOGY, 2020 VS. 2025 (USD MILLION)

TABLE 26 MARKET, BY TRACKING TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 27 MARKET, BY TRACKING TECHNOLOGY, 2020–2025 (USD MILLION)

9.2 BARCODE SYSTEM

9.2.1 SIGNIFICANT DEVELOPMENT IN SMALL AIRPORTS IS EXPECTED TO DRIVE THE BARCODE SYSTEM MARKET GROWTH

TABLE 28 BARCODE SYSTEM: BAGGAGE HANDLING SYSTEM MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 BARCODE SYSTEM: MARKET, BY REGION, 2020–2025 (USD MILLION)

9.3 RFID SYSTEM

9.3.1 RESOLUTION 753 IS EXPECTED TO ACCELERATE THE GROWTH OF THE RFID SYSTEM

TABLE 30 RFID SYSTEM: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 RFID SYSTEM: MARKET, BY REGION, 2020–2025 (USD MILLION)

10 BAGGAGE HANDLING SYSTEM MARKET, BY CHECK-IN SERVICE TYPE (Page No. - 85)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS/LIMITATIONS

FIGURE 29 BY CHECK-IN SERVICE TYPE: INDUSTRY INSIGHTS

FIGURE 30 MARKET, BY CHECK-IN SERVICE TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 32 MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 33 MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

10.2 ASSISTED SERVICE

10.2.1 HIGH NUMBER OF NON-FREQUENT FLYERS TO DRIVE THE SEGMENT

TABLE 34 ASSISTED SERVICE: BAGGAGE HANDLING SYSTEM MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 ASSISTED SERVICE: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.3 SELF-SERVICE

10.3.1 OPERATIONAL EFFICIENCY AND CONVENIENCE TO DRIVE THE SEGMENT

TABLE 36 SELF-SERVICE: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 SELF-SERVICE: MARKET, BY REGION, 2020–2025 (USD MILLION)

11 BAGGAGE HANDLING CONVEYOR SYSTEM MARKET, BY TYPE (Page No. - 91)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS/LIMITATIONS

FIGURE 31 BY TYPE: INDUSTRY INSIGHTS

FIGURE 32 BAGGAGE HANDLING CONVEYOR SYSTEM MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 38 BAGGAGE HANDLING CONVEYOR SYSTEM MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 39 BAGGAGE HANDLING CONVEYOR SYSTEM MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.2 CONVEYOR

11.2.1 WITH THE PRESENCE OF SMALL DOMESTIC AIRPORTS, ASIA OCEANIA LEADS THE CONVEYOR TYPE MARKET

TABLE 40 CONVEYOR: BAGGAGE HANDLING SYSTEM MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 CONVEYOR: BAGGAGE HANDLING CONVEYOR SYSTEM MARKET, BY REGION, 2020–2025 (USD MILLION)

11.3 DESTINATION CODED VEHICLE (DCV)

11.3.1 MAJOR AIRPORTS WITH HIGH PASSENGER VOLUME ARE EXPECTED TO USE DCV

TABLE 42 DESTINATION CODED VEHICLE: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 DESTINATION CODED VEHICLE: BAGGAGE HANDLING CONVEYOR SYSTEM MARKET, BY REGION, 2020–2025 (USD MILLION)

12 BAGGAGE HANDLING SYSTEM MARKET, BY REGION (Page No. - 97)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS/LIMITATIONS

FIGURE 33 BY REGION: INDUSTRY INSIGHTS

FIGURE 34 MARKET, BY REGION: ASIA OCEANIA ACCOUNTS FOR THE LARGEST MARKET SHARE, BY VALUE, 2020 VS. 2025 (USD MILLION)

TABLE 44 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 MARKET, BY REGION, 2020–2025 (USD MILLION)

12.2 ASIA OCEANIA

FIGURE 35 ASIA OCEANIA: MARKET SNAPSHOT

TABLE 46 ASIA OCEANIA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 47 ASIA OCEANIA: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

12.2.1 CHINA

12.2.1.1 Check-in, Screening and Loading solution projected to be most attractive segment during forecast period

TABLE 48 CHINA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 49 CHINA: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 50 CHINA: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 51 CHINA: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.2.2 INDIA

12.2.2.1 India is expected to be the third largest aviation market (in terms of passengers) by 2024

TABLE 52 INDIA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 53 INDIA: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 54 INDIA: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 55 INDIA: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.2.3 JAPAN

12.2.3.1 Government focus on metro transport is projected to drive the demand for baggage handling system market

TABLE 56 JAPAN: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 57 JAPAN: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 58 JAPAN: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 59 JAPAN: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.2.4 SINGAPORE

12.2.4.1 Conveying and sorting is the largest segment

TABLE 60 SINGAPORE: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 61 SINGAPORE: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 62 SINGAPORE: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 63 SINGAPORE: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.2.5 THAILAND

12.2.5.1 Thailand is expected to enter the top 10 markets in 2030

TABLE 64 THAILAND: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 65 THAILAND: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 66 THAILAND: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 67 THAILAND: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.2.6 AUSTRALIA

12.2.6.1 With aviation as the major contributor to Australia's overall economy, the baggage handling system market is growing significantly

TABLE 68 AUSTRALIA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 69 AUSTRALIA: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 70 AUSTRALIA: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 71 AUSTRALIA: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.2.7 REST OF ASIA OCEANIA

12.2.7.1 Assisted service is the largest check-in service segment

TABLE 72 REST OF ASIA OCEANIA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 73 REST OF ASIA OCEANIA: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 74 REST OF ASIA OCEANIA: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 75 REST OF ASIA OCEANIA: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.3 EUROPE

FIGURE 36 EUROPE: ITALY IS PROJECTED TO BE THE FASTEST GROWING MARKET, 2020 VS. 2025 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Significant focus toward modernization of existing airports drives the baggage handling system market

TABLE 78 GERMANY: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 79 GERMANY: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 80 GERMANY: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 81 GERMANY: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.3.2 UK

12.3.2.1 UK is the largest market in the European baggage handling system

TABLE 82 UK: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 83 UK: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 84 UK: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 85 UK: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Check-in, screening, and loading is the fastest growing segment

TABLE 86 FRANCE: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 87 FRANCE: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 88 FRANCE: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 89 FRANCE: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.3.4 SPAIN

12.3.4.1 Unloading and reclaim is the second fastest growing segment

TABLE 90 SPAIN: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 91 SPAIN: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 92 SPAIN: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 93 SPAIN: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.3.5 ITALY

12.3.5.1 Check-in, screening, and loading is the fastest growing segment

TABLE 94 ITALY: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 95 ITALY: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 96 ITALY: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 97 ITALY: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.3.6 NETHERLANDS

12.3.6.1 With a leading position in European airport innovation, the Netherlands baggage handling system market is growing significantly

TABLE 98 NETHERLANDS: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 99 NETHERLANDS: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 100 NETHERLANDS: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 101 NETHERLANDS: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.3.7 REST OF EUROPE

12.3.7.1 Modernization of the existing airports drives the baggage handling system market in the Rest of Europe

TABLE 102 REST OF EUROPE: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 103 REST OF EUROPE: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 104 REST OF EUROPE: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 105 REST OF EUROPE: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.4 AMERICAS

FIGURE 37 AMERICAS: MARKET SNAPSHOT

TABLE 106 AMERICAS: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 107 AMERICAS: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

12.4.1 US

12.4.1.1 Highest air passenger volume accelerates the growth of the baggage handling system market

TABLE 108 US: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 109 US: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 110 US: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 111 US: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.4.2 BRAZIL

12.4.2.1 Government focus on cost reduction of airlines will enhance demand for air travel, resulting in the growth of the Brazilian baggage handling system market

TABLE 112 BRAZIL: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 113 BRAZIL: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 114 BRAZIL: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 115 BRAZIL: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.4.3 CANADA

12.4.3.1 Introduction of multimodal transport through Public-Private Partnership (PPP) schemes is expected to drive the demand for baggage handling systems in Canada

TABLE 116 CANADA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 117 CANADA: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 118 CANADA: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 119 CANADA: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.4.4 MEXICO

12.4.4.1 Self-service check-in segment is the fastest growing segment

TABLE 120 MEXICO: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 121 MEXICO: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 122 MEXICO: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 123 MEXICO: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.4.5 REST OF AMERICAS

12.4.5.1 Check-in, screening, and loading is the fastest growing segment

TABLE 124 REST OF AMERICAS: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 125 REST OF AMERICAS: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 126 REST OF AMERICAS: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 127 REST OF AMERICAS: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.5 MEA

FIGURE 38 MEA: UAE IS PROJECTED TO BE THE LARGEST MARKET, 2020 VS. 2025 (USD MILLION)

TABLE 128 MEA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 129 MEA: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

12.5.1 UAE

12.5.1.1 Automated sorting technologies drive market growth

TABLE 130 UAE: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 131 UAE: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 132 UAE: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 133 UAE: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.5.2 QATAR

12.5.2.1 Check-in, screening, and loading is projected to be the largest segment by 2025

TABLE 134 QATAR: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 135 QATAR: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 136 QATAR: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 137 QATAR: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.5.3 SOUTH AFRICA

12.5.3.1 Assisted service is the largest check-in service segment

TABLE 138 SOUTH AFRICA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 139 SOUTH AFRICA: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 140 SOUTH AFRICA: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 141 SOUTH AFRICA: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

12.5.4 REST OF MEA

12.5.4.1 Conveying and sorting is the leading segment

TABLE 142 REST OF MEA: MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 143 REST OF MEA: MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 144 REST OF MEA: MARKET, BY CHECK-IN SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 145 REST OF MEA: MARKET, BY CHECK-IN SERVICE TYPE, 2020–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 142)

13.1 INTRODUCTION

13.2 COMPETITIVE LEADERSHIP MAPPING

13.2.1 TERMINOLOGY

13.2.1.1 Visionary leaders

13.2.1.2 Innovators

13.2.1.3 Dynamic differentiators

13.2.1.4 Emerging companies

FIGURE 39 BAGGAGE HANDLING SYSTEM PROVIDERS: COMPETITIVE LEADERSHIP MAPPING, 2019

13.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 40 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN BAGGAGE HANDLING SYSTEM MARKET

13.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 41 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

13.5 MARKET SHARE ANALYSIS, 2019

FIGURE 42 MARKET SHARE, FOR KEY PLAYERS, 2019

FIGURE 43 COMPANIES ADOPTED PARTNERSHIPS AND SUPPLY CONTRACTS AS A KEY GROWTH STRATEGY

13.6 COMPETITIVE SCENARIO

13.6.1 NEW PRODUCT DEVELOPMENTS

TABLE 146 ORGANIC DEVELOPMENTS 2018–2020

TABLE 147 INORGANIC DEVELOPMENTS, 2017–2020

14 COMPANY PROFILES (Page No. - 155)

(Overview, Products offered, Recent developments & SWOT analysis)*

14.1 SIEMENS

FIGURE 44 SIEMENS: COMPANY SNAPSHOT

TABLE 148 SIEMENS: ORGANIC DEVELOPMENTS

TABLE 149 SIEMENS: INORGANIC DEVELOPMENTS

14.2 DAIFUKU

FIGURE 45 DAIFUKU: COMPANY SNAPSHOT

TABLE 150 DAIFUKU: INORGANIC DEVELOPMENTS

14.3 VANDERLANDE INDUSTRIES

FIGURE 46 VANDERLANDE INDUSTRIES: COMPANY SNAPSHOT

TABLE 151 VANDERLANDE: ORGANIC DEVELOPMENTS

TABLE 152 VANDERLANDE: INORGANIC DEVELOPMENTS

14.4 PTERIS GLOBAL LIMITED

14.5 FIVES

FIGURE 47 FIVES: COMPANY SNAPSHOT

TABLE 153 FIVES: INORGANIC DEVELOPMENTS

14.6 GLIDEPATH LIMITED

TABLE 154 GLIDEPATH LIMITED: INORGANIC DEVELOPMENTS

14.7 LOGPLAN

14.8 GRENZEBACH GROUP

14.9 G&S AIRPORT CONVEYOR

14.1 BEUMER

TABLE 155 BEUMER GROUP: ORGANIC DEVELOPMENTS

TABLE 156 BEUMER GROUP: INORGANIC DEVELOPMENTS

*Details on Overview, Products offered, Recent developments & SWOT analysis might not be captured in case of unlisted companies.

14.11 ADDITIONAL COMPANIES

14.11.1 SICK

14.11.2 ALSTEF

14.11.3 BABCOCK INTERNATIONAL

14.11.4 SITA

14.11.5 SMITHS DETECTION

14.11.6 CAGE INC.

14.11.7 ICM AIRPORT TECHNICS

14.11.8 DIVERSIFIED CONVEYORS INTERNATIONAL

14.11.9 KINEMATIK

14.11.10 OMEGA AVIATION SERVICES

15 APPENDIX (Page No. - 181)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.4.1 BAGGAGE HANDLING SYSTEM MARKET, BY TRACKING TECHNOLOGY (AT COUNTRY LEVEL)

15.4.1.1 RFID System

15.4.1.2 Barcode System

15.4.2 BAGGAGE HANDLING CONVEYOR SYSTEM MARKET, BY TYPE (AT COUNTRY LEVEL)

15.4.2.1 Conveyor

15.4.2.2 Destination Coded Vehicle (DCV)

15.4.3 MARKET, BY MODES OF TRANSPORT (AT SELECTED COUNTRY LEVEL)

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

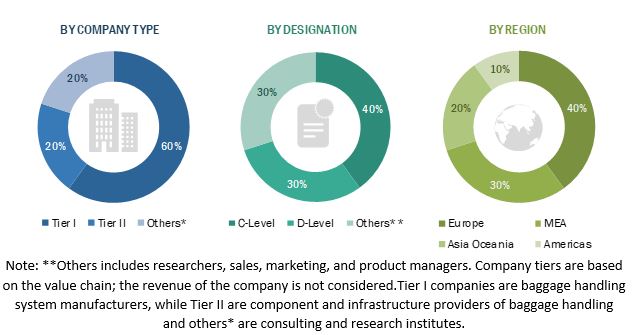

The study involves 4 main activities to estimate the current size of the baggage handling system market. Exhaustive secondary research was done to collect information on the market, such as baggage handling system types and upcoming baggage handling system model launches. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. A top-down approach was employed to estimate the complete market size for different segments considered under this study.

Secondary Research

The secondary sources referred for this research study include automotive industry organizations such as the International Air Transport Association (IATA), corporate filings (such as annual reports, investor presentations, and financial statements), Factiva, Crunchbase, Bloomberg and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the baggage handling system market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (airport, marine, and railway industry) and supply-side (baggage handling system manufacturers, infrastructure providers, and service providers) players across 4 major regions, namely, the Americas, Europe, Asia Oceania, and the Middle East and Africa. Approximately, 40% and 60% of primary interviews have been conducted from the demand and supply sides respectively. The primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with the industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach has been used to estimate and validate the size of the baggage handling system market.

The global baggage handling system market, in terms of value, is derived by considering the investments in baggage handling systems out of the total investment in the developments of new airports, airport modernization, multimodal transportation, and marine and metro luggage handling automation. Additionally, the revenue generated by the baggage handling system and service suppliers has been considered for data triangulation. The market is also corrected, validated, and confirmed through primary expert insights. The global market is further divided into regions by considering factors such as regional developments, number of airports in each region, regional airline passenger volume, regional maritime cruise passenger volume, railway industry developments, and primary insights.

The baggage handling system market, by country, has been derived by determining the penetration of different baggage handling systems in different modes of transportation considering factors such as IATA regulations, company developments, booked orders, use cases, potential use cases, airport connectivity, types of airports, metro connectivity, number of ports, and primary insights.

The overall market size has been used to estimate the sizes of other individual market segments (by tracking technology, by mode of transportation, by check-in service type, by solution, and by conveyor system type) through percentage splits from secondary and primary research. For the calculation of each type of specific market segment, the most appropriate immediate parent market size was used to implement the top-down approach.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The data was triangulated by studying various factors and trends from both the demand and supply sides in the baggage handling system market.

Report Objectives

- To analyze and forecast the baggage handling system market, in terms of value (USD million/billion), during the forecast period

- To define, describe, and forecast the market, by value, based on mode of transport (airport, marine, and railway)

- To define, describe, and forecast the market, by value, based on tracking technology (barcode system and RFID system)

- To define, describe, and forecast the baggage handling conveyor system market, by value, based on type [(conveyor and destination coded vehicle (DCV)]

- To define, describe, and forecast the market, by value, based on solution (check-in, screening, and loading; conveying and sorting; and unloading and reclaim)

- To define, describe, and forecast the market, by value, based on check-in service type (assisted service and self-service)

- To analyze and forecast the market across 4 key regions, namely, Asia Oceania, Europe, the Americas, and the MEA

- To analyze the regional markets for growth trends, prospects, and their contribution to the total market

- To strategically profile key players in the market and comprehensively analyze their market share analysis and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by the key industry players

- To define and analyze the stakeholders in the market and provide a detailed competitive landscape

- To analyze the opportunities offered by various segments of the market to the stakeholders

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Baggage Handling System Market, By Tracking Technology (At Country Level)

- Rfid System

- Barcode System

Note: The countries would be covered: Asia Oceania (China, Australia, India, Singapore, Japan and Thailand), Europe (Germany, Italy, Spain, UK, France, Netherlands and Rest of Europe), North America (US, Brazil, Mexico and Canada), and MEA (UAE, Qatar and South Africa)

Baggage Handling Conveyor System Market, By Type (At Country Level)

- Conveyor

- Destination Coded Vehicle

Note: The countries would be covered: Asia Oceania (China, Australia, India, Singapore, Japan and Thailand), Europe (Germany, Italy, Spain, UK, France, Netherlands and Rest of Europe), North America (US, Brazil, Mexico and Canada), and MEA (UAE, Qatar and South Africa)

Baggage Handling System Market, By Modes Of Transport (At Country Level)

- Airport

- Railway

- Marine

Growth opportunities and latent adjacency in Baggage Handling System Market