Airport Full Body Scanner Market by Technology (Millimeter Wave Scanner (Active Scanner, Passive Scanner) & Backscatter X-Ray), Airport Class (Class A, Class B, Class C) and Region - Global Forecast to 2021

The airport full body scanner is estimated to be USD 79.0 Million in 2016 and is projected to reach USD 118.2 million by 2021, at a CAGR of 8.40% during the forecast period. The base year considered for the study is 2016 and the forecast period is from 2017 to 2021.

Objectives of the Study:

The report analyzes the airport full body scanner on the basis of airport type (A, B, C), technology (Milimeter wave scanner, backscatter ), and region (North America, Europe, Asia-Pacific, and RoW).

The report provides in-depth market intelligence regarding the airport full body scanner and major factors, including drivers, restraints, opportunities, and challenges that may influence the growth of the market. It also provides an analysis of micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market.

The report also covers competitive developments such as long-term contracts, new product launches and developments, and research & development activities in the full body scanner market, in addition to business and corporate strategies adopted by key market players.

MILLIMETER RADIO WAVE SCANNER IS EXPECTED TO GROW THE AIRPORT FULL BODY SCANNER MARKET FROM 2016 AND 2021

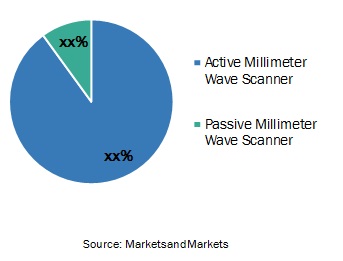

Base on technology, airport full body scanner is segmented into millimeter wave scanner,and backsactter X ray Service. Millimeter wave scanner is futher segmented into activ and passive sacanner. These scanners have high demand because of its high speed, safety, high sensitivity, and 3D high-resolution proficiency.This scanner can be used for screening concealed objects and potential threats without any interruption of smooth flow of traffic in airports, train stations, customs/immigration checkpoints and commuter terminals. These scanners are also used in military, government offices and institutions, and corporate/private security where there is a possibility of threats.

Airport Full Body Scanner, by Millimeter Wave Scanner, 2016 (%)

Airport full body scanner Market Dynamics

Drivers

- Increasing Safety Concern

- Smuggling of Narcotics

- Reduction in Passenger waiting time

Restraints

- Healthy Concerns

- Privacy Issues

Opportunities

- Low Cost Product

Challenges

- Improving the effectiveness of existing scanners

- Data Protection

KEY QUESTIONS

- How will the airport full body scanner market drivers, restraints and future opportunities affect the market dynamics and subsequent market analysis of the associated trends.

- The full body scanner is going through human body safety concern, when will this scenario ease out?

- What are the key sustainability strategies adopted by airport full body scanner market players?

- How are the industry players addressing this challenge?

Airport Full Body Scanner Market Insights

The airport full body scanner market is projected to grow to USD 118.27 million by 2021, at a CAGR of 8.40% during the forecast period. This growth can be attributed to the increasing terror attacks at airports and also the increasing investments in R&D for enhanced full body scanners.

The full body scanner market has been segmented based on airport type, technology, and region. Based on technology, the market has been segmented into millimeter-wave systems and backscatter systems. The millimeter-wave systems segment is projected to lead to grow at the highest CAGR from 2016 to 2021. This growth is mainly attributed to the wide installation of these systems in place of backscatter systems. Backscatter systems have the drawback of emitting low-energy X-rays that bounce off a passenger's body which increase the possibility of cancer, and other skin diseases in the human body.

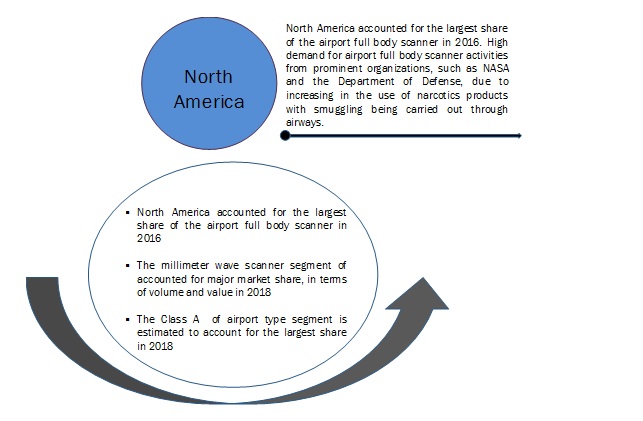

Based on region, the full body scanner market has been segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America is projected to lead the full body scanner market during the forecast period. The full body scanner market in Europe and Asia-Pacific is expected to witness high growth, owing to the regulatory mandates for the installation of full body scanners in Europe and the increase in terrorist activities in the Asia-Pacific.

Many-a-times, it was found that the machine could not detect explosives carried by a terrorist and he was able to pass through a Rapiscan’s X-ray Backscatter scanner. This has been the major weakness of the scanner. Due to this, the company may lose its contract with airport authorities. Many researches has been carried out by the scientists about the ineffectiveness of these scanners. Companies who are into manufacturing of airport full body scanners are investing huge amount of money into R&D so that they are able to solve this problem of the machines. They have to make products that are able to detect explosives that are kept under the cavity or are carried inside a human body.

Regional market analysis

The North American region is the largest market for airport full body scanner. The region has been a pioneer in adapting new technologies and has been one of the lucrative markets for technological investments. It is also the fastest-growing market, due to the high risk of security threats and criminal activities. The Europe and Asia Pacific held considerable share in the airport full body scanner market in 2016. Middle East, latin America and Africa are the key regions considered under the Rest of the World (RoW).

Leading full body scanner manufacturers are developing harmless and innovative equipment to drive the industry forward

Companies such as Smith Group Plc (U.K.), L-3 Technologies Inc (U.S.), Rapiscan Systems (U.S), American Scienice & engineering Group, Tek84 among others, are develop airport full body scanner. Worldwide adoption of airport full body scanner to prevent terror attack and drug trafficking shows the importance of these scanners. For instance, in 2016, Rapiscan systems(U.S.) developed MP100 backpack radiation detections systems, lightweight, high-performance solution that can detect radiological and nuclear materials and is housed within a compact commercial backpack.

airport full body scanner market industry analysis

|

Qualitative Market Analysis |

Quantitative Market Analysis |

|

|

|

|

|

|

|

|

|

|

Airport Full body Scanner

Backscatter Wave Systems

Backscatter full body scanners use low-intensity X-rays to scan passengers. The waves are bounced back or backscattered and captured by the detectors are placed on the same side of the full body scanner to create images of the subject within a few seconds. Backscatter systems use narrow X-ray beams to scan subjects at high speed. X-rays are relatively low energy and can penetrate through the clothing of the subject. As majority of these waves bounce off the skin surface, they are only useful for imaging objects hidden under the clothing or taped to the skin of the subject. They cannot detect objects hidden inside the body. Backscatter systems make use of these bounced off rays to identify dangerous objects.

The amount of radiation to which a person is exposed is insignificant to cause any health risk. A typical backscatter scan consists of two images, front and back. Backscatter full body scanners are growing at a moderate pace, as airports such as John F. Kennedy International Airport (U.S.), Boise Airport (U.S.) and Boston Logan International Airport (U.S.) are using them for screening processes.

Millimeter wave Systems

Millimeter waves refer to an electromagnetic spectrum that lies between radio waves and infrared waves. Millimeter wave systems project low-level radio frequency energy around the body of the subject to detect objects concealed under the clothing. Exposure to millimeter waves is harmless. These waves are then sent back to a transceiver from where they are further sent to a high-speed computer. This high-speed computer reconstructs the signals to create final 3D holographic images.

Airport full body scanners based on millimeter wave systems are efficient and convenient to use as they require only a single stationary position and can scan faster than other scanners. The data received is then processed by internal software without any human intervention. These scanners address privacy concerns and do not pose any health risk, and are therefore being deployed at most airports. L3 Technologies (U.S.) and Rohde & Schwarz GmbH & Co KG (Germany), among others, are developing enhanced airport full body scanners based

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Distribution Channel Participants

1.6 Limitations

1.7 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

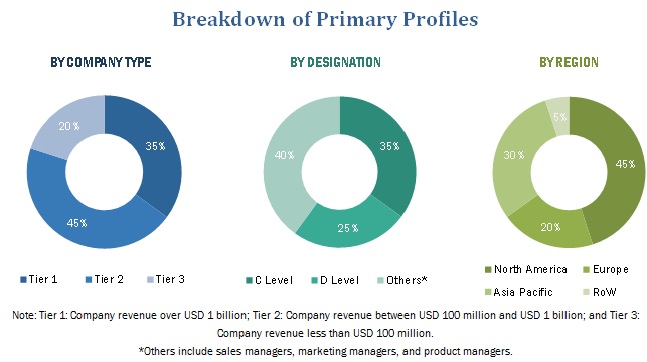

2.1.2.3 Breakdown of Primaries

2.2 Demand-Side Analysis

2.2.1 Introduction

2.2.2 Demand-Side Factors

2.2.2.1 Easy Detection of Metal and Non-Metal Objects

2.2.2.2 Need to Reduce the Passenger Average Waiting Time

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Market

4.2 Market, By Technology, 2014-2021

4.3 Market Share in Europe

4.4 North America Accounted for the Largest Market Share Amongst All the Regions

4.5 Millimeter Wave Airport Full Body Scanner Market: By Sub Type (2016 vs 2021)

4.6 Life Cycle Analysis

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Safety Concerns

5.3.1.2 Smuggling of Narcotics

5.3.1.3 Reduction in Passenger Waiting Time

5.3.2 Restraints

5.3.2.1 Health Concerns

5.3.2.2 Privacy Issues

5.3.3 Oppurtunities

5.3.3.1 Low Cost Product

5.3.4 Challenges

5.3.4.1 Improving the Effectiveness of Existing Scanners

5.3.4.2 Data Protection

6 Industry Trends (Page No. - 38)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Value Chain Analysis

6.4 Technology Trends

6.4.1 Advanced Softwares

6.5 Porter’s Five Forces Analysis

6.5.1 Threat of New Entrants

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

7 Airport Full Body Scanner Market, By Technology (Page No. - 43)

7.1 Introduction

7.2 Millimeter Wave Scanner

7.2.1 Millimeter Wave Scanner, By Sub Type

7.2.1.1 Active Millimeter Wave Scanner

7.2.1.2 Passive Millimeter Wave Scanner

7.3 Backscatter X-Ray Scanner

8 Airport Full Body Scanner Market, By Airport Class (Page No. - 50)

8.1 Introduction

8.2 Class A

8.3 Class B

8.4 Class C

9 Airport Full Body Scanner Market, By Geography (Page No. - 55)

9.1 Introduction

9.2 North America

9.2.1 By Technology

9.2.1.1 Millimeter Wave Scanner, By Sub Type

9.2.2 By Airport Class

9.2.3 By Country

9.2.3.1 U.S.

9.2.3.1.1 By Technology

9.2.3.1.2 By Sub Type

9.2.3.1.3 By Airport Class

9.2.3.2 Canada

9.2.3.2.1 By Technology

9.2.3.2.2 By Sub Type

9.2.3.2.3 By Airport Class

9.3 Europe

9.3.1 By Technology

9.3.1.1 Millimeter Wave Scanner, By Sub Type

9.3.2 By Airport Class

9.3.3 By Country

9.3.3.1 The Netherlands

9.3.3.1.1 By Technology

9.3.3.1.2 By Sub Type

9.3.3.1.3 By Airport Class

9.3.3.2 U.K.

9.3.3.2.1 By Technology

9.3.3.2.2 By Sub Type

9.3.3.2.3 By Airport Class

9.3.3.3 Germany

9.3.3.3.1 By Technology

9.3.3.3.2 By Airport Class

9.3.3.4 France

9.3.3.4.1 By Technology

9.3.3.4.2 By Airport Class

9.4 Asia-Pacific

9.4.1 By Technology

9.4.1.1 Millimeter Wave Scanner, By Sub Type

9.4.2 By Airport Class

9.4.3 By Country

9.4.3.1 The Philippines

9.4.3.1.1 By Technology

9.4.3.1.2 By Sub Type

9.4.3.1.3 By Airport Class

9.4.3.2 Australia

9.4.3.2.1 By Technology

9.4.3.2.2 By Sub Type

9.4.3.2.3 By Airport Class

9.4.3.3 Thailand

9.4.3.3.1 By Technology

9.4.3.3.2 By Airport Class

9.4.3.4 Japan

9.4.3.4.1 By Technology

9.4.3.4.2 By Airport Class

9.5 Rest of the World

9.5.1 By Technology

9.5.1.1 Millimeter Wave Scanner, By Sub Type

9.5.2 By Airport Class

9.5.3 By Country

9.5.3.1 South Africa

9.5.3.1.1 By Technology

9.5.3.1.2 By Sub Type

9.5.3.1.3 By Airport Class

9.5.3.2 Nigeria

9.5.3.2.1 By Technology

9.5.3.2.2 By Airport Class

9.5.3.3 Ghana

9.5.3.3.1 By Technology

9.5.3.3.2 By Airport Class

10 Competitive Landscape (Page No. - 82)

10.1 Overview

10.2 Market Share Analysis: By Company

10.3 Contracts & Agreements is the Key Growth Strategy

10.4 Brand Analysis

10.5 Product Portfolio

10.6 Competitive Situations and Trends

10.6.1 Contracts, 2013-2015

10.6.2 New Product Development, 2015

10.6.3 New Product Launch, 2015

10.6.4 Certification, 2013-2014

11 Company Profile (Page No. - 88)

11.1 Competitive Benchmarking, By Product Type

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.2 Smiths Group PLC

11.3 L-3 Communications Holdings, Inc.

11.4 American Science & Engineering Group

11.5 Rapiscan Systems Ltd.

11.6 Tek84 Engineering Group LLC

11.7 Millivision Inc.

11.8 Braun & Company

11.9 Brijot Imaging Systems (Microsemi)

11.10 CST Digital Communications

11.11 Morpho (Safran)

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 105)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (60 Tables)

Table 1 Market, By Technology, 2014–2021 (USD Million)

Table 2 Millimeter Wave Scanner Market, By Region, 2014–2021 (USD Million)

Table 3 Millimeter Wave Scanner Market, By Sub Type, 2014–2021 (USD Million)

Table 4 Active Millimeter Wave Scanner Market, By Region, 2014–2021 (USD Million)

Table 5 Passive Millimeter Wave Scanner Market, By Region, 2014–2021 (USD Million)

Table 6 Backscatter X-Ray Scanner Market, By Region, 2014–2021 (USD Million)

Table 7 Market, By Airport Class, 2014-2021 (USD Million)

Table 8 Class A Airport Full Body Scanner Market, By Region, 2014-2021 (USD Million)

Table 9 Class B Airport Full Body Scanner Market, By Region, 2014-2021 (USD Million)

Table 10 Class C Airport Full Body Scanner Market, By Region, 2014-2021 (USD Million)

Table 11 Market, By Region, 2014-2021 (USD Million)

Table 12 North America: Market, By Technology, 2014-2021 (USD Million)

Table 13 North America: Millimeter Wave Scanner Market, By Sub Type, 2014-2021 (USD Million)

Table 14 North America: Market, By Airport Class, 2014-2021 (USD Million)

Table 15 North America: Market, By Country, 2014-2021 (USD Million)

Table 16 U.S.: Market, By Technology, 2014-2021 (USD Million)

Table 17 U.S.: Millimeter Wave Scanner Market, By Sub Type, 2014-2021 (USD Million)

Table 18 U.S.: Market, By Airport Class, 2014-2021 (USD Million)

Table 19 Canada: Market, By Technology, 2014-2021 (USD Million)

Table 20 Canada: Millimeter Wave Scanner Market, By Sub Type, 2014-2021 (USD Million)

Table 21 Canada: Market, By Airport Class, 2014-2021 (USD Million)

Table 22 Europe: Market, By Technology, 2014-2021 (USD Million)

Table 23 Europe: Millimeter Wave Scanner Market, By Sub Type, 2014-2021 (USD Million)

Table 24 Europe: Market, By Airport Class, 2014-2021 (USD Million)

Table 25 Europe: Market, By Country, 2014-2021 (USD Million)

Table 26 The Netherlands: Market, By Technology, 2014-2021 (USD Million)

Table 27 The Netherlands: Millimeter Wave Scanner Market, By Sub Type, 2014-2021 (USD Million)

Table 28 The Netherlands: Market, By Airport Class, 2014-2021 (USD Million)

Table 29 U.K.: Market, By Technology, 2014-2021 (USD Million)

Table 30 U.K.: Millimeter Wave Scanner Market, By Sub Type, 2014-2021 (USD Million)

Table 31 U.K.: Market, By Airport Class, 2014-2021 (USD Million)

Table 32 Germany: Market, By Technology, 2014-2021 (USD Million)

Table 33 Germany: Market, By Airport Class, 2014-2021 (USD Million)

Table 34 France: Market, By Technology, 2014-2021 (USD Million)

Table 35 France: Market, By Airport Class, 2014-2021 (USD Million)

Table 36 APAC: Market, By Technology, 2014-2021 (USD Million)

Table 37 APAC: Millimeter Wave Scanner Market, By Sub Type, 2014-2021 (USD Million)

Table 38 APAC: Market, By Airport Class, 2014-2021 (USD Million)

Table 39 APAC: Market, By Country, 2014-2021 (USD Million)

Table 40 The Philippines: AirpoMarket, By Technology, 2014-2021 (USD Million)

Table 41 The Philippines: Millimeter Wave Scanner Market, By Sub Type, 2014-2021 (USD Million)

Table 42 The Philippines: Market, By Airport Class, 2014-2021 (USD Million)

Table 43 Australia: Market, By Technology, 2014-2021 (USD Million)

Table 44 Australia: Millimeter Wave Scanner Market, By Sub Type, 2014-2021 (USD Million)

Table 45 Australia: Market, By Airport Class, 2014-2021 (USD Million)

Table 46 Thailand: Market, By Technology, 2014-2021 (USD Million)

Table 47 Thailand: Market, By Airport Class, 2014-2021 (USD Million)

Table 48 Japan: Market, By Technology, 2014-2021 (USD Million)

Table 49 Japan: Market, By Airport Class, 2014-2021 (USD Million)

Table 50 RoW: Market, By Technology, 2014-2021 (USD Million)

Table 51 RoW: Millimeter Wave Scanner Market, By Sub Type, 2014-2021 (USD Million)

Table 52 RoW: Market, By Airport Class, 2014-2021 (USD Million)

Table 53 RoW: Market, By Country, 2014-2021 (USD Million)

Table 54 South Africa: Market, By Technology, 2014-2021 (USD Million)

Table 55 South Africa : Millimeter Wave Scanner Market, By Sub Type, 2014-2020 (USD Million)

Table 56 South Africa: Market, By Airport Class, 2014-2021 (USD Million)

Table 57 Nigeria: Market, By Technology, 2014-2021 (USD Million)

Table 58 Nigeria: Market, By Airport Class, 2014-2021 (USD Million)

Table 59 Ghana: Market, By Technology, 2014-2021 (USD Million)

Table 60 Ghana: Market, By Airport Class, 2014-2021 (USD Million)

List of Figures (48 Figures)

Figure 1 Markets Covered: Airport Full Body Scanner Market

Figure 2 Global Market: Study Years

Figure 3 Research Flow

Figure 4 Research Design

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 6 Global Drug Trend With the Estimated Number of Drug Users (2006-2013)

Figure 7 Market Size Estimation Methodology : Bottom-Up Approach

Figure 8 Market Size Estimation Methodology : Top-Down Approach

Figure 9 Data Triangulation

Figure 10 Assumptions of the Research Study

Figure 11 Millimeter Wave Scanners Projected to Dominate the Market During the Forecast Period

Figure 12 North America Expected to Grow at the Highest CAGR in the Market

Figure 13 Class A Airport Full Body Scanner Market Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Contracts & Agreements has Been the Key Growth Strategy

Figure 15 Attractive Market Opportunities in the Market, 2016-2021

Figure 16 Millimeter Wave Scanner Dominates the Market

Figure 17 U.K. Accounted for the Largest Share in 2016

Figure 18 North America Accounted for the Largest Share in the Market in 2016

Figure 19 Active Scanner to Dominate the Millimeter Wave Airport Full Body Scanner Market Globally

Figure 20 North America Expected to Be the Fastest-Growing Market

Figure 21 Airport Full Body Scanners : Market Segmentation

Figure 22 Number of Deaths From Terrorist-Attacks Between 2010 and 2015

Figure 23 Total Number of Seizures From Different Transportation Modes in 2014

Figure 24 Supply Chain: Distribution Through Third Party Agencies is the Most Preferred Strategy Followed By Key Organizations

Figure 25 Value Chain Analysis: Major Value is Added During the Manufacturing and Assembling Phase

Figure 26 Porter’s Five Forces Analysis

Figure 27 Market, By Technology, 2016 & 2021 (USD Million)

Figure 28 Millimeter Wave Scanner Market, By Region, 2016 & 2021 (USD Million)

Figure 29 Millimeter Wave Scanner Market, By Sub Type, 2016 & 2021 (USD Million)

Figure 30 Backscatter X-Ray Scanner Market, By Region, 2016 & 2021 (USD Million)

Figure 31 Market, By Airport Class, 2016 & 2021 (USD Million)

Figure 32 Class A Airport Full Body Scanner Market, By Region, 2016 & 2021 (USD Million)

Figure 33 Class B Airport Full Body Scanner Market, By Region, 2016 & 2021 (USD Million)

Figure 34 Class C Airport Full Body Scanner Market, By Region 2016 & 2021 (USD Million)

Figure 35 Market: Geographic Snapshot (2016-2021)

Figure 36 North American Full Body Scanner Market Snapshot: U.S. Commanded the Largest Market Share in 2016

Figure 37 European Full Body Scanner Market Snapshot: U.K. Expected to Command the Largest Market Share in 2016

Figure 38 Asia-Pacific Full Body Scanner Market Snapshot: Australia Commanded the Largest Market Share in 2016

Figure 39 RoW Full Body Scanner Market Snapshot: South Africa Estimated to Command the Largest Market Share in 2016

Figure 40 Companies Adopted Contracts as Key Strategy During the Period (2013-2015)

Figure 41 Brand Analysis : Market

Figure 42 Product Portfolio : Key Market Player

Figure 43 Smiths Group PLC : Company Snapshot

Figure 44 SWOT Analysis: Smiths Group PLC

Figure 45 L-3 Communications : Company Snapshot

Figure 46 SWOT Analysis: L-3 Communications

Figure 47 American Science & Engineering Group : Company Snapshot

Figure 48 SWOT Analysis: American Science & Engineering Group

Research Methodology:

Airport full body scanner and its subsegment was arrived by referring to varied secondary sources, such as Hoovers, Bloomberg Businessweek, Factiva, annual reports, and publications, among others. Furthermore, market triangulation was performed with the help of statistical techniques using econometric tools. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to acquire the final quantitative and qualitative data. This data was consolidated with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the airport full body scanner comprises airport authorities, airport full body scanner manufacturer, service providers, software providers, and end users.

Airport full body scanner Insights

The key players in the airport full body scanner market include Smiths Group PLC (U.K), L-3 Communications Holdings, Inc. (U.S), American Science & Engineering Group (U.S.), Rapiscan Systems Ltd.(U.S.) , Tek84 Engineering Group LLC(U.S.) , Millivision Inc. (U.S.) CST Digital Communications (South Africa), and Safran Morpho (France), among others.

Key Target Audience:

- Security Systems Manufacturers

- Airport Authorities

- Sub-component Manufacturers

- Technology Support Providers

- Security Systems leasers

- Airport Operator

Scope of the Report:

This research report categorizes the airport full body scanner market into the following segments and subsegments:

Airport full body scanner market, By Technology

-

Millimeter Radio-Wave Scanner, By sub type

- Passive Scanner

- Active Scanner

- Backscatter X-Ray Scanner

Airport full body scanner market, By Class

- Class A

- Class B

- Class C

Airport full body scanner market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Customizations Available for the Report:

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

- Market Share analysis of Top 5 Players

- Volume Analysis of Full body Scanner

Growth opportunities and latent adjacency in Airport Full Body Scanner Market

We would like to get more information about full body X-rays for security at our airport, including the positive and negative aspects for humans. We currently have less information regarding the products and effects. Thank you.