Barrier Resins Market by Type (PVDC, EVOH, PEN), Application (Food & Beverage, Pharmaceutical & Medical, Cosmetics, Agriculture, Industrial), and Region (Asia-Pacific, North America, Europe, South America, Middle East & Africa) - Global Forecast to 2026

Updated on : March 20, 2024

Barrier Resins Market

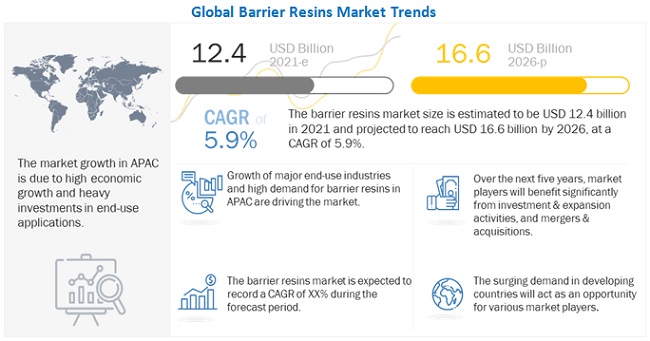

The global barrier resins market was valued at USD 12.4 billion in 2021 and is projected to reach USD 16.6 billion by 2026, growing at 5.9% cagr from 2021 to 2026. The market growth is being led by the ease of use and customization of barrier resins products. APAC region is the largest market for barrier resins.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Barrier resins Market

The outbreak of the novel coronavirus or COVID-19 was declared a pandemic by the World Health Organization (WHO) in 2020. The virus outbreak wreaked havoc on the global economy, with the lockdown of international borders and the shutdown of economic activities across countries to prevent the spread of COVID-19 resulting in a severe impact on industries across the world.

The global economy has become substantially more interconnected. The adverse consequences of various steps related to the containment of COVID-19 are evident from global supply chain disruptions, weaker demand for imported products and services, and the increase in unemployment rate. Risk aversion has increased in the financial market, with all-time low interest rates and sharp declines in equity and commodity prices. Consumer and business confidence have also reduced significantly. The latest forecasts by multiple sources predict a 2%–4% decrease in the global GDP in 2020. Based on these forecasts, the global economy is expected to recover from 2021, but for some countries, including the US, Germany, and Italy, recovery is predicted to take longer. However, in this fast-changing environment, the full impact of the pandemic on the global economy may not be entirely known. MarketsandMarkets uses three scenario-based approaches (epidemiology, health response, and economic response) to assess the economic impact and recovery period at the global level. Countries are likely to have different impacts and recovery periods.

Barrier Resins Market Dynamics

Driver: Growing use of barrier resins in major end-use industries

The growth for advanced manufacturing processes supported with technological innovation, and increased consolidation of the players have resulted in invention of several drugs, which are directly boosting the pharmaceutical packaging industry. This has boosted the growth of barrier resins, globally. Barrier resins, such as PVDC and EVOH, are primarily used for the protection of pharmaceutical products such as pouches, labels of bottled medicines, and push-through packs against light, moisture, oxygen, biological contamination, mechanical damage, and counterfeiting.

Restraint: Volatility in raw material prices leading to the fluctuation in demand

Plastic resins are derived from raw materials such as naphtha, natural gas, mono ethylene glycol, and crude oil. Polyethylene resin is mainly derived from crude oil across the globe, whereas, in the case of the US, natural gas is primarily used. Mono Ethylene Glycol (MEG) is the key raw material for polyethylene terephthalate resins. According to the US Energy Information Administration (EIA), the average natural gas spot price was USD 2.22 per million Btu in 2020, which was significantly lower than USD 2.82 per million Btu in 2019.

Opportunity: Growth in the packaging industry in emerging economies.

Growing economies specially in the APAC region are shifting towards urbanization. The lifestyle changes are supporting the growth of packaged food. The developing countries are focused towards developing more and more industries and the laws and regulations in the developing countries are more flexible as compared to the developed economies such as Europe and USA.

Challenge: Increasing demand for sustainable and bio-degradable resins.

The major challenges for resin manufacturers are the increasing prices and stringent regulations set by various governments. Fluctuations in raw material prices are also a restraining factor for the market. There is growing demand pf bio-based and sustainable barrier resins. The packaging industry is seeking ways to reduce waste.

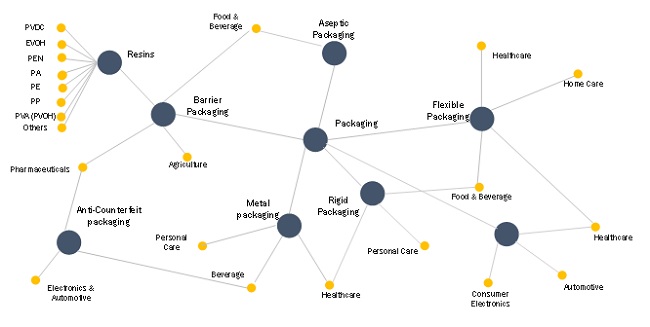

Barrier Resins Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Food & Beverage packaging industry was the largest market in the year 2020.

Food & beverage industry has been the largest consumer of barrier resins and is expected to grow in a similar manner. It is majorly used in the packaging of food & beverage products such as canned milk, meat, fish, beer, wine, canned vegetables & fruits, and carbonated soft drinks. The use of barrier resins for films in this industry helps eliminate the use of glass and cans; thereby reducing the overall weight of packaging and making the product easy to handle. The use of barrier resins elongates the shelf life, long lasting flavor and quality, prevent air and odor from penetrating the package, and protect sensitive vitamin contents. Barrier resins provide lightweight and durable packaging. Barrier resins can be customized based on the requirement and are easily moldable. The introduction of organic barrier resins is expected to result in increased demand of barrier resins. There is a growing concern about sustainability and plastic waste, which has resulted in restricted use of some barrier resins in the developed countries, the G7 summit held in 2021 also talked about the environmental impact of various industries which use plastics. Organic barrier resins are getting popular in the packaging industry and among consumers. There are various bio-based barrier resins available in the market, for instance, green materials such as sugarcane and bioplastics whose acceptance by a manufacturer as well as consumer may be a challenge. However, polylactic acid (PLA) is suitable for packing small quantities of products like salads. Coca-Cola’s PlantBottle is one such new entry, which may be sustainable and eventually change the scenario for all products packaged in bottles.

The three fastest-growing segments in the market are EVOH, PET, and PA.

EVOH due to its high barrier resistance against oxygen and moisture (required mainly in food packaging applications), is boosting the barrier resins market. In the recent years, there has been significant research on the mechanisms and effects of water absorption by EVOH, leading to a better understanding of its performance in various food processing environments. PET is completely recyclable and can be easily reprocessed into many other products for many different applications. BOPET is an advanced form of PET. Polyvinyl alcohol also known as PVA or PVOH is a crystal-clear, water-soluble thermoplastic derived from polyvinyl acetate through partial or complete hydroxylation. Its physical, chemical and mechanical properties depend on the degree of hydroxylation.

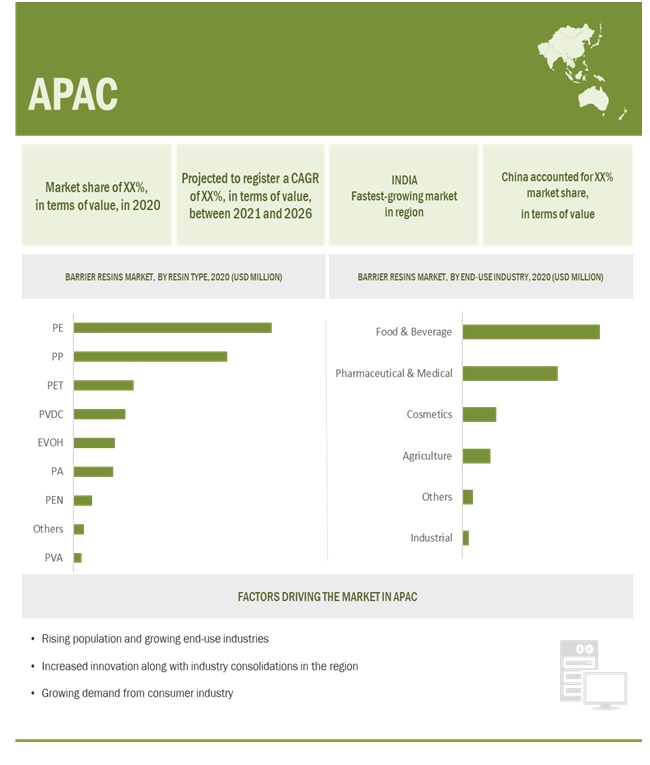

APAC is the largest market in all end-use industries due to the presence of major developing economies and large populations.

APAC is the largest market for barrier resins, accounting for a share of 42.5%, in terms of value, in 2020. The growing packaging industry and the increasing demand in the agriculture sector are the factors driving the barrier resins market in the region.

In 2020, China was the largest market for barrier resins in the region, with a share of 48.6%. The growing food & beverage industry in China is driving the market in packaging applications. Japan was the second-largest market in 2020. India is expected to witness the highest CAGR in the region during the forecast period. Factors such as the rising disposable incomes, changing lifestyles, growing middle-class population, and rising demand for packed goods are likely to drive the demand for packaging, which, in turn, will support the growth of the barrier resins market in India.

Barrier Resins Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019-2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Type |

|

Regions covered |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

The major market players, LyondellBasell Industries (US), Kuraray Co Ltd. (Japan), Exxon Mobil Corporation (US), and The Dow Chemical Company (US). |

This research report categorizes the barrier resins market based on type, resin type, end-use industry, and region.

Barrier resins, By Resin type:

- Flexible packaging

- Rigid packaging

Barrier resins, By Resin type:

- Polyvinylidene chloride

- Ethylene vinyl alcohol

- Polyethylene naphthalate

- Polyamide

- Polyethylene terephthalate

- Polyethylene

- Polypropylene

- Polyvinyl alcohol

- Others (PS, PVC, EVA& bio-based)

Barrier resins, By End-Use Industry:

Barrier resins, By Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In April 2017, Asahi Kasei construct a new plant for plastic compounds in China

- In February 2020, Kuraray Co., Ltd. establish a new monosol production facility for PVA water-soluble films in Poland as demand grows for packaging film for unit dose detergents, pharmaceuticals, and other products.

Frequently Asked Questions (FAQ):

What is the current size of the global barrier resins market?

The global barrier resins market is estimated to be USD 12.4 billion in 2021 and is projected to reach USD 16.6 billion by 2026, at a CAGR of 5.9%.

Who are the major players of the barrier resins market?

Companies such as LyondellBasell Industries, Kuraray Co Ltd., Exxon Mobil Corporation, and The Dow Chemical Company are the major players in the market.

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including new product launches, mergers & acquisitions, partnership & agreement, investments & expansions, and joint ventures are expected to help the market grow. Several mergers & acquisitions and investments are made on increasing the production capacity of barrier resins manufacturers for different industries. There is continuous development in enhancing barrier resins and improving sustainability.

Which segment has the potential to register the highest market share for barrier resins?

Food & beverage was the largest industry of barrier resins, in terms of both volume and value, in 2020. The increased demand of packaged and convenience food in the developing countries and the COVID-19 pandemic led to the growth of the market.

Which is the fastest-growing region in the market?

APAC is expected to be the largest and fastest-growing market for barrier resins. APAC is an emerging market in terms of demand for barrier resins. China and India have been the driving forces behind the rapid development of the market in APAC, as well as globally. The growth in these countries is attributed to high economic growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

#

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 BARRIER RESINS MARKET

1.4.1 REGIONS COVERED

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 BARRIER RESINS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP–DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP–DOWN APPROACH

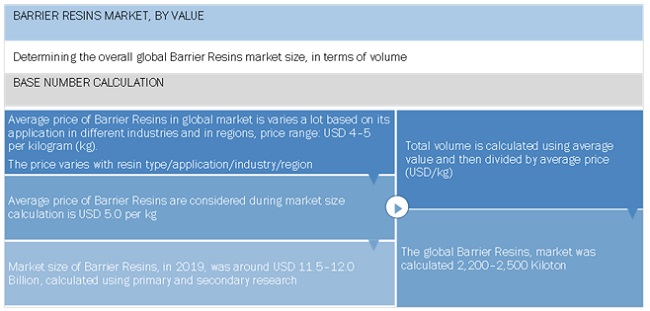

FIGURE 4 BARRIER RESINS MARKET SIZE ESTIMATION, BY VOLUME

FIGURE 5 BARRIER RESINS MARKET, BY REGION

FIGURE 6 BARRIER RESINS MARKET, BY END-USE INDUSTRY

FIGURE 7 MARKET SIZE ESTIMATION: TOP–DOWN APPROACH, BY RESIN TYPE

2.3 MARKET FORECAST APPROACH

2.3.1 DEMAND–SIDE FORECAST

2.4 DATA TRIANGULATION

FIGURE 8 BARRIER RESINS MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 RISK ANALYSIS ASSESSMENT

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

TABLE 1 BARRIER RESINS MARKET SNAPSHOT (2021 VS. 2026)

FIGURE 9 THE POLYETHYLENE SEGMENT DOMINATED THE BARRIER RESINS MARKET IN 2020

FIGURE 10 FOOD & BEVERAGE SEGMENT LED THE BARRIER RESINS MARKET IN 2020

FIGURE 11 APAC TO BE LARGEST AND FASTEST–GROWING REGION FOR BARRIER RESINS MARKET DURING FORECAST PERIOD

TABLE 2 MAJOR PLAYERS PROFILED IN THIS REPORT

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN THE BARRIER RESINS MARKET

FIGURE 12 BARRIER RESINS MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

4.2 BARRIER RESINS MARKET, BY RESIN TYPE

FIGURE 13 POLYETHYLENE RESIN TO BE THE LARGEST SEGMENT BETWEEN 2021 AND 2026

4.3 APAC: BARRIER RESINS MARKET SHARE, BY END-USE INDUSTRY AND COUNTRY

FIGURE 14 CHINA ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2020

4.4 GLOBAL BARRIER RESINS MARKET: MAJOR COUNTRIES

FIGURE 15 INDIA TO EMERGE AS A LUCRATIVE MARKET DURING THE FORECAST PERIOD

4.5 BARRIER RESINS MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 16 BARRIER RESINS MARKET TO WITNESS HIGHER GROWTH IN DEVELOPING COUNTRIES

FIGURE 17 INDIA AND CHINA TO REGISTER HIGHEST CAGR IN APAC DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 VALUE CHAIN ANALYSIS

FIGURE 18 BARRIER RESINS MARKET: VALUE CHAIN ANALYSIS

5.2.1 BARRIER RESINS MARKET: SUPPLY CHAIN ECOSYSTEM

5.2.2 COVID-19 IMPACT ON VALUE CHAIN

5.2.2.1 Action plan against such vulnerability

5.3 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR THE BARRIER RESINS MARKET

5.3.1 DRIVERS

5.3.1.1 Growing use of barrier resins in major end-use industries

5.3.1.2 Enhanced shelf life of packaged food products

5.3.1.3 Urbanization and changes in lifestyle driving the food packaging market

5.3.1.4 Growing demand from emerging economies

5.3.1.4.1 Demand for a longer shelf life of food products

5.3.1.4.2 Increasing demand for customer-friendly packaging

5.3.1.4.3 Rising number of retail chains in developing countries

5.3.1.4.4 Downsizing of packaging

5.3.2 RESTRAINTS

5.3.2.1 Susceptibility to degradation

5.3.2.2 Volatile raw material prices

5.3.3 OPPORTUNITIES

5.3.3.1 Biodegradable barrier resins

5.3.3.2 Increasing use of agricultural films

5.3.3.3 Growing applications of barrier films in the electronics industry

5.3.4 CHALLENGES

5.3.4.1 Issue related to recycling of barrier resins

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS: BARRIER RESINS MARKET

TABLE 3 BARRIER RESINS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 INTENSITY OF COMPETITIVE RIVALRY

5.4.2 BARGAINING POWER OF BUYERS

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 THREAT OF NEW ENTRANTS

5.5 MACROECONOMIC INDICATORS

5.5.1 INTRODUCTION

5.5.2 GDP TRENDS AND FORECAST

TABLE 4 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE

5.6 COVID-19 IMPACT ANALYSIS

5.6.1 COVID-19 ECONOMIC ASSESSMENT

5.6.2 MAJOR ECONOMIC EFFECTS OF COVID-19

5.6.3 EFFECTS ON GDP OF COUNTRIES

FIGURE 21 GDP FORECAST OF G20 COUNTRIES IN 2020

5.6.4 SCENARIO ASSESSMENT

FIGURE 22 FACTORS IMPACTING ECONOMY OF SELECT G20 COUNTRIES IN 2020

5.7 AVERAGE PRICING ANALYSIS

FIGURE 23 AVERAGE PRICE COMPETITIVENESS IN BARRIER RESINS MARKET

5.8 BARRIER RESINS ECOSYSTEM

FIGURE 24 BARRIER RESINS ECOSYSTEM

5.8.1 YC AND YCC SHIFT

5.9 OPERATIONAL DATA AND KEY INDUSTRY TRENDS

5.9.1 PHARMACEUTICAL SALES GLOBALLY 2017–2020

5.9.2 PACKAGED FOOD SALES GLOBALLY 2017–2019

5.10 BARRIER RESINS PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 PUBLICATION TRENDS

FIGURE 25 PUBLICATION TRENDS, 2017–2021

5.10.3 INSIGHT

5.10.4 JURISDICTION ANALYSIS

FIGURE 26 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2017–2021

5.10.5 TOP APPLICANTS

TABLE 5 BARRIER RESINS: NUMBER OF PATENTS, BY COMPANY, 2017–2021

5.11 POLICY AND REGULATIONS

TABLE 6 COUNTRY–WISE CERTIFICATION OR APPROVING AUTHORITIES FOR FOOD PACKAGING

FIGURE 27 COMPLIANCE TESTING OF FOOD PACKAGING MATERIALS

5.12 TRADE ANALYSIS

5.12.1 IMPORT–EXPORT SCENARIO OF BARRIER FILMS MARKET

TABLE 7 IMPORT–EXPORT TRADE DATA FOR SELECT COUNTRIES, 2019

5.13 CASE STUDY ANALYSIS

5.14 TECHNOLOGY ANALYSIS

5.14.1 POLYAMIDE (PA)

5.14.2 POLYVINYL ALCOHOL (PVA OR PVOH)

5.14.3 ETHYLENE VINYL ALCOHOL (EVOH)

5.14.4 POLYETHYLENE

TABLE 8 TABLE PROCESS COMMONLY USED TO MANUFACTURE POLYETHYLENE RESIN

5.14.5 POLYPROPYLENE

TABLE 9 TABLE PROCESS COMMONLY USED TO MANUFACTURE POLYPROPYLENE RESIN

6 BARRIER RESINS MARKET, BY TYPE (Page No. - 75)

6.1 INTRODUCTION

6.1.1 FLEXIBLE PACKAGING

6.1.1.1 The focus is shifting toward the development of bio-based resins and ease of decomposition of the barrier layers

6.1.2 RIGID PACKAGING

6.1.2.1 The industry trends are shifting toward flexible packaging

7 BARRIER RESINS MARKET, BY RESIN TYPE (Page No. - 77)

7.1 INTRODUCTION

TABLE 10 BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 11 BARRIER RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

FIGURE 28 PE SEGMENT ACCOUNTED TO BE THE LARGEST SEGMENT OF THE BARRIER RESINS MARKET DURING THE FORECAST PERIOD

7.1.1 POLYVINYLIDENE CHLORIDE (PVDC)

7.1.1.1 The market growth is driven by the food packaging industry

TABLE 12 PVDC BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 13 PVDC BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.1.2 ETHYLENE VINYL ALCOHOL (EVOH)

7.1.2.1 The market is driven by the superior barrier properties of EVOH

TABLE 14 EVOH BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 15 EVOH BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.1.3 POLYETHYLENE NAPHTHALATE (PEN)

7.1.3.1 The market is driven by the PEN bottles used in the beverage industry

TABLE 16 PEN BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 PEN BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.1.4 POLYAMIDE (PA)

7.1.4.1 The market continues to grow due to the versatile uses and excellent barrier properties

TABLE 18 PA BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 19 PA BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.1.5 POLYETHYLENE TEREPHTHALATE (PET)

7.1.5.1 PET is in demand in various end-use industries due to its recyclability

TABLE 20 PET BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 PET BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.1.6 POLYETHYLENE (PE)

7.1.6.1 LDPE is the most inexpensive plastic film

TABLE 22 PE BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 23 PE BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.1.7 POLYPROPYLENE (PP)

7.1.7.1 Properties of PP films can be enhanced and modified to suit the demand

TABLE 24 PP BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 PP BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.1.8 POLYVINYL ALCOHOL (PVA/PVOH)

7.1.8.1 PVA/PVOH are water-soluble and toxin-free

TABLE 26 PVA BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 27 PVA BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.1.9 OTHERS (PS, PVC, EVA, AND BI0–BASED)

TABLE 28 OTHER BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 29 OTHER BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8 BARRIER RESINS MARKET, BY END-USE INDUSTRY (Page No. - 89)

8.1 INTRODUCTION

FIGURE 29 FOOD & BEVERAGE TO REMAIN THE LARGEST SEGMENT DURING THE FORECAST PERIOD

8.2 FOOD & BEVERAGE

8.2.1 PROTECTED AND CONVENIENCE FOOD PACKAGING ARE THE DRIVING FORCES OF GROWTH

TABLE 30 BARRIER RESINS MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 BARRIER RESINS MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2019–2026 (KILOTON)

8.3 PHARMACEUTICAL & MEDICAL

8.3.1 INCREASED DEMAND FOR MEDICAL PRODUCTS DURING THE PANDEMIC DROVE THE DEMAND

TABLE 32 BARRIER RESINS MARKET SIZE IN PHARMACEUTICAL & MEDICAL, BY REGION, 2019–2026 (USD MILLION)

TABLE 33 BARRIER RESINS MARKET SIZE IN PHARMACEUTICAL & MEDICAL, BY REGION, 2019–2026 (KILOTON)

8.4 COSMETICS

8.4.1 FOCUS ON INNOVATIVE PACKAGING SOLUTIONS TO DRIVE THE DEMAND

TABLE 34 BARRIER RESINS MARKET SIZE IN COSMETICS, BY REGION, 2019–2026 (USD MILLION)

TABLE 35 BARRIER RESINS MARKET SIZE IN COSMETICS, BY REGION, 2019–2026 (KILOTON)

8.5 AGRICULTURE

8.5.1 APAC IS THE LARGEST MARKET FOR AGRICULTURAL PRODUCTS

TABLE 36 BARRIER RESINS MARKET SIZE IN AGRICULTURE, BY REGION, 2019–2026 (USD MILLION)

TABLE 37 BARRIER RESINS MARKET SIZE IN AGRICULTURE, BY REGION, 2019–2026 (KILOTON)

8.6 INDUSTRIAL

8.6.1 COMPATIBILITY OF BARRIER RESINS WITH CHEMICAL PACKAGING IS INCREASING THEIR DEMAND

TABLE 38 BARRIER RESINS MARKET SIZE IN INDUSTRIAL, BY REGION, 2019–2026 (USD MILLION)

TABLE 39 BARRIER RESINS MARKET SIZE IN INDUSTRIAL, BY REGION, 2019–2026 (KILOTON)

8.7 OTHERS

TABLE 40 BARRIER RESINS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 41 BARRIER RESINS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2019–2026 (KILOTON)

9 BARRIER RESINS MARKET, BY REGION (Page No. - 98)

9.1 INTRODUCTION

FIGURE 30 APAC TO BE THE FASTEST–GROWING BARRIER RESINS MARKET, 2021–2026

TABLE 42 BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 43 BARRIER RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

9.2 APAC

FIGURE 31 APAC: BARRIER RESINS MARKET SNAPSHOT

TABLE 44 APAC: BARRIER RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 45 APAC: BARRIER RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 46 APAC: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 47 APAC: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 48 APAC: BARRIER RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 49 APAC: BARRIER RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

9.2.1 CHINA

9.2.1.1 Growing demand for processed & semi-processed food to drive the market

TABLE 50 CHINA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 51 CHINA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.2 INDIA

9.2.2.1 Growth in the demand for FMCG and convenience products to increase the demand for barrier resins

TABLE 52 INDIA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 53 INDIA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.3 JAPAN

9.2.3.1 Increasing use of plastic films in food & beverage packaging and agriculture support the market growth

TABLE 54 JAPAN: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 55 JAPAN: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.4 SOUTH KOREA

9.2.4.1 Increasing demand for packaged food and blister packaging in the pharmaceutical industry to drive the demand

TABLE 56 SOUTH KOREA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 57 SOUTH KOREA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.5 INDONESIA

9.2.5.1 Rising consumer spending and growing food & beverage industry to boost the market

TABLE 58 INDONESIA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 59 INDONESIA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.6 THAILAND

9.2.6.1 Rising use of barrier films in consumer goods to boost the market

TABLE 60 THAILAND: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 61 THAILAND: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.7 MALAYSIA

9.2.7.1 Rising consumer awareness for healthier food to drive the market

TABLE 62 MALAYSIA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 63 MALAYSIA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.8 TAIWAN

9.2.8.1 Rising consumer spending to drive the demand

TABLE 64 TAIWAN: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 65 TAIWAN: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.9 VIETNAM

9.2.9.1 Rising income and lifestyle changes to boost the market

TABLE 66 VIETNAM: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 67 VIETNAM: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.10 REST OF APAC

TABLE 68 REST OF APAC: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 69 REST OF APAC: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3 NORTH AMERICA

FIGURE 32 NORTH AMERICA: BARRIER RESINS MARKET SNAPSHOT

TABLE 70 NORTH AMERICA: BARRIER RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: BARRIER RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 72 NORTH AMERICA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 74 NORTH AMERICA: BARRIER RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: BARRIER RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

9.3.1 US

9.3.1.1 The largest consumer of barrier resins in the region

TABLE 76 US: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 77 US: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.2 MEXICO

9.3.2.1 Demand for packaging to influence the market

TABLE 78 MEXICO: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 79 MEXICO: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.3 CANADA

9.3.3.1 Increasing food production favoring the market growth

TABLE 80 CANADA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 81 CANADA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4 EUROPE

FIGURE 33 EUROPE: BARRIER RESINS MARKET SNAPSHOT

TABLE 82 EUROPE: BARRIER RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 83 EUROPE: BARRIER RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 84 EUROPE: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 85 EUROPE: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 86 EUROPE: BARRIER RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 87 EUROPE: BARRIER RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

9.4.1 GERMANY

9.4.1.1 Germany has the largest plastics industry in the region

TABLE 88 GERMANY: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 89 GERMANY: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.2 FRANCE

9.4.2.1 A net exporter of agrifood and seafood products

TABLE 90 FRANCE: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 91 FRANCE: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.3 UK

9.4.3.1 One of the top five plastic film producers in Europe

TABLE 92 UK: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 93 UK: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.4 ITALY

9.4.4.1 One of the key markets for agricultural films in the region

TABLE 94 ITALY: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 95 ITALY: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.5 RUSSIA

9.4.5.1 Packaging demand in major end-use industries is driving the market growth

TABLE 96 RUSSIA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 97 RUSSIA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.6 TURKEY

9.4.6.1 Largest producer and exporter of agricultural products globally

TABLE 98 TURKEY: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 99 TURKEY: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.7 SPAIN

9.4.7.1 Agriculture films to drive barrier resins market in Spain

TABLE 100 SPAIN: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 101 SPAIN: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.8 THE NETHERLANDS

9.4.8.1 Agriculture exports to drive barrier resins market in the Netherlands

TABLE 102 NETHERLANDS: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 103 NETHERLANDS: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.9 REST OF EUROPE

TABLE 104 REST OF EUROPE: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 105 REST OF EUROPE: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5 SOUTH AMERICA

FIGURE 34 SOUTH AMERICA: BARRIER RESINS MARKET SNAPSHOT

TABLE 106 SOUTH AMERICA: BARRIER RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 107 SOUTH AMERICA: BARRIER RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 108 SOUTH AMERICA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 109 SOUTH AMERICA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 110 SOUTH AMERICA: BARRIER RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 111 SOUTH AMERICA: BARRIER RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

9.5.1 BRAZIL

9.5.1.1 Export of food materials to support market growth

TABLE 112 BRAZIL: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 113 BRAZIL: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5.2 ARGENTINA

9.5.2.1 Expansion of end-use industries to drive the market

TABLE 114 ARGENTINA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 115 ARGENTINA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5.3 COLOMBIA

9.5.3.1 Expansion of end-use industries to drive the market

TABLE 116 COLOMBIA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 117 COLOMBIA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5.4 REST OF SOUTH AMERICA

TABLE 118 REST OF SOUTH AMERICA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 119 REST OF SOUTH AMERICA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.6 MIDDLE EAST & AFRICA

FIGURE 35 MIDDLE EAST & AFRICA: BARRIER RESINS MARKET SNAPSHOT

TABLE 120 MIDDLE EAST & AFRICA: BARRIER RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 121 MIDDLE EAST & AFRICA: BARRIER RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 122 MIDDLE EAST & AFRICA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 123 MIDDLE EAST & AFRICA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 124 MIDDLE EAST & AFRICA: BARRIER RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 125 MIDDLE EAST & AFRICA: BARRIER RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

9.6.1 GCC COUNTRIES

9.6.1.1 Packaged foods to drive the market

TABLE 126 GCC COUNTRIES: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 127 GCC COUNTRIES: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.6.2 AFRICA

9.6.2.1 Private sector investments to drive the market

TABLE 128 AFRICA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 129 AFRICA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.6.3 REST OF MIDDLE EAST & AFRICA

TABLE 130 REST OF MIDDLE EAST & AFRICA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 131 REST OF MIDDLE EAST & AFRICA: BARRIER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 149)

10.1 OVERVIEW

FIGURE 36 INVESTMENT & EXPANSION WAS THE MOST PREFERRED STRATEGY BY THE LEADING PLAYERS BETWEEN 2018 AND 2021

10.2 MARKET SHARE ANALYSIS

TABLE 132 BARRIER RESINS MARKET: DEGREE OF COMPETITION

FIGURE 37 BARRIER RESINS: MARKET SHARE ANALYSIS IN 2020

10.2.1 MARKET RANKING ANALYSIS

TABLE 133 RANKING OF KEY PLAYERS

10.3 REVENUE ANALYSIS OF KEY PLAYERS IN THE PAST FIVE YEARS

10.4 COMPANY EVALUATION QUADRANT, 2020

10.4.1 STAR

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE

10.4.4 PARTICIPANTS

FIGURE 38 BARRIER RESINS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

10.5 SME MATRIX, 2020

10.5.1 PROGRESSIVE COMPANIES

10.5.2 DYNAMIC COMPANIES

10.5.3 STARTING BLOCKS

10.5.4 RESPONSIVE COMPANIES

FIGURE 39 BARRIER RESINS MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2020

10.6 STRENGTH OF PRODUCT PORTFOLIO

10.7 BUSINESS STRATEGY EXCELLENCE

10.8 COMPETITIVE SCENARIO

10.8.1 MARKET EVALUATION FRAMEWORK

TABLE 134 STRATEGIC DEVELOPMENTS, BY KEY COMPANIES

TABLE 135 MOST FOLLOWED STRATEGY

TABLE 136 GROWTH STRATEGIES ADOPTED, BY KEY COMPANIES

10.8.2 MARKET EVALUATION MATRIX

TABLE 137 COMPANY PRODUCT FOOTPRINT

TABLE 138 COMPANY REGION FOOTPRINT

TABLE 139 COMPANY INDUSTRY FOOTPRINT

10.9 STRATEGIC DEVELOPMENTS

10.9.1 MERGERS & ACQUISITIONS

TABLE 140 MERGERS & ACQUISITIONS, 2017–2021

10.9.2 INVESTMENTS & EXPANSIONS

TABLE 141 INVESTMENTS & EXPANSIONS, 2017–2021

10.9.3 NEW PRODUCT LAUNCHES

TABLE 142 NEW PRODUCT LAUNCHES, 2017–2021

10.9.4 JOINT VENTURES, AGREEMENTS, AND PARTNERSHIPS

TABLE 143 JOINT VENTURES, AGREEMENTS, AND PARTNERSHIPS, 2017–2021

11 COMPANY PROFILES (Page No. - 168)

11.1 KEY COMPANIES

(Business Overview, Products Offered, Recent Developments, MnM View, Key strengths/Right to win, Strategic choices, Weaknesses and competitive threats)*

11.1.1 ASAHI KASEI CORPORATION

TABLE 144 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

FIGURE 40 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

TABLE 145 ASAHI KASEI CORPORATION: OTHER DEVELOPMENTS

11.1.2 KURARAY CO. LTD.

TABLE 146 KURARAY CO. LTD.: COMPANY OVERVIEW

FIGURE 41 KURARAY CO. LTD.: COMPANY SNAPSHOT

TABLE 147 KURARAY CO. LTD.: NEW PRODUCT LAUNCH

TABLE 148 KURARAY CO. LTD.: OTHER DEVELOPMENTS

11.1.3 EXXON MOBIL CORPORATION

TABLE 149 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

FIGURE 42 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

TABLE 150 EXXON MOBIL CORPORATION: NEW PRODUCT LAUNCH

TABLE 151 EXXON MOBIL CORPORATION: OTHER DEVELOPMENTS

11.1.4 THE DOW CHEMICAL COMPANY

TABLE 152 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

FIGURE 43 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

TABLE 153 THE DOW CHEMICAL COMPANY: NEW PRODUCT LAUNCH

TABLE 154 THE DOW CHEMICAL COMPANY: DEALS

TABLE 155 THE DOW CHEMICAL COMPANY: OTHER DEVELOPMENTS

11.1.5 LYONDELLBASELL INDUSTRIES

TABLE 156 LYONDELLBASELL INDUSTRIES: COMPANY OVERVIEW

FIGURE 44 LYONDELLBASELL INDUSTRIES: COMPANY SNAPSHOT

TABLE 157 LYONDELLBASELL INDUSTRIES: NEW PRODUCT LAUNCH

TABLE 158 LYONDELLBASELL INDUSTRIES: DEALS

TABLE 159 LYONDELLBASELL INDUSTRIES: OTHER DEVELOPMENTS

11.1.6 SABIC

TABLE 160 SABIC: COMPANY OVERVIEW

FIGURE 45 SABIC: COMPANY SNAPSHOT

TABLE 161 SABIC: NEW PRODUCT LAUNCH

TABLE 162 SABIC: DEALS

TABLE 163 SABIC: OTHER DEVELOPMENTS

11.1.7 BOREALIS AG

TABLE 164 BOREALIS AG: COMPANY OVERVIEW

FIGURE 46 BOREALIS AG: COMPANY SNAPSHOT

TABLE 165 BOREALIS AG: NEW PRODUCT LAUNCH

TABLE 166 BOREALIS AG: DEALS

TABLE 167 BOREALIS AG: OTHER DEVELOPMENTS

11.1.8 MITSUBISHI CHEMICAL CORPORATION

TABLE 168 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

FIGURE 47 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

TABLE 169 MITSUBISHI CHEMICAL CORPORATION: DEALS

TABLE 170 MITSUBISHI CHEMICAL CORPORATION: OTHER DEVELOPMENTS

11.1.9 E.I DUPONT DE NEMOURS AND COMPANY

TABLE 171 E.I. DUPONT DE NEMOURS AND COMPANY: COMPANY OVERVIEW

FIGURE 48 E.I. DUPONT DE NEMOURS AND COMPANY: COMPANY SNAPSHOT

11.1.10 SINOPEC

TABLE 172 SINOPEC: COMPANY OVERVIEW

FIGURE 49 SINOPEC: COMPANY SNAPSHOT

11.2 OTHER PLAYERS

11.2.1 BRASKEM S.A.

TABLE 173 BRASKEM S.A.: COMPANY OVERVIEW

TABLE 174 BRASKEM S.A.: NEW PRODUCT LAUNCH

TABLE 175 BRASKEM S.A.: DEALS

TABLE 176 BRASKEM S.A.: OTHER DEVELOPMENTS

11.2.2 TENJIN LIMITED

TABLE 177 TENJIN LIMITED: COMPANY OVERVIEW

11.2.3 KUREHA CORPORATION

TABLE 178 KUREHA CORPORATION: COMPANY OVERVIEW

11.2.4 SOLVAY S.A.

TABLE 179 SOLVAY S.A.: COMPANY OVERVIEW

11.2.5 LG CHEM

TABLE 180 LG CHEM: COMPANY OVERVIEW

11.2.6 HANWHA TOTAL PETROLEUM

TABLE 181 HANWHA TOTAL PETROCHEMICAL: COMPANY OVERVIEW

11.2.7 TORAY INDUSTRIES

TABLE 182 TORAY INDUSTRIES: COMPANY OVERVIEW

11.2.8 ARKEMA

TABLE 183 ARKEMA S.A.: COMPANY OVERVIEW

11.2.9 MITSUI CHEMICALS, INC.

TABLE 184 MITSUI CHEMICALS: COMPANY OVERVIEW

11.2.10 FORMOSA PLASTICS CORPORATION

TABLE 185 FORMOSA PLASTIC CORPORATION: COMPANY OVERVIEW

11.2.11 INEOS

TABLE 186 INEOS: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Key strengths/Right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 ADJACENT/RELATED MARKETS (Page No. - 218)

12.1 INTRODUCTION

12.2 LIMITATION

12.3 BARRIER FILMS MARKET

12.3.1 MARKET DEFINITION

12.3.2 BARRIER FILMS MARKET, BY MATERIAL

12.3.2.1 Introduction

TABLE 187 BARRIER FILMS MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

12.3.2.2 Polyethylene (PE)

12.3.2.3 Polypropylene (PP)

12.3.2.4 Polyethylene Terephthalate (PET/BOPET)

12.3.2.5 Polyamide (PA)

12.3.2.6 Organic Coatings

12.3.2.7 Inorganic Oxide Coatings

12.3.2.8 Others

12.3.3 BARRIER FILMS MARKET, BY END-USE INDUSTRY

12.3.3.1 Introduction

TABLE 188 BARRIER FILMS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

12.3.3.2 Food & Beverage Packaging

12.3.3.3 Pharmaceutical Packaging

12.3.3.4 Agriculture

12.3.3.5 Others

12.3.4 BARRIER FILMS MARKET, BY REGION

12.3.4.1 Introduction

TABLE 189 BARRIER FILMS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.3.4.2 APAC

12.3.4.3 North America

12.3.4.4 Europe

12.3.4.5 South America

12.3.4.6 Middle East & Africa

13 APPENDIX (Page No. - 226)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

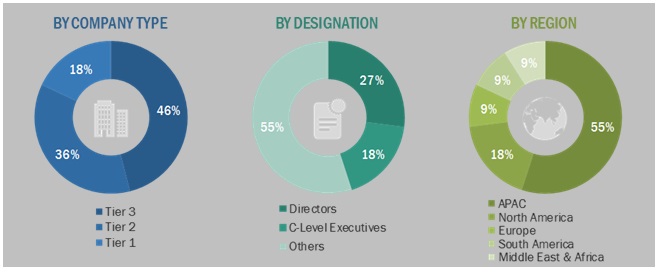

The study involves four major activities in estimating the current market size of barrier resins. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The barrier resins market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in applications, such as food & beverage packaging, pharmaceutical & medical, cosmetics, agriculture, industrial, and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the barrier resins market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Barrier resins Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all the segments and sub-segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market was validated using both the top-down and bottom-up approaches; it was then verified through primary interviews. Hence, for every data segment, there were three sources — the top-down approach, the bottom-up approach, and expert interviews. The data was assumed to be correct only when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the barrier resins market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market size by type, by resin type and end-use industry

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze the micromarkets1 with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as investment & expansion and merger & acquisition, new product development, and joint venture & partnership in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Note: Core competencies1 of companies are determined in terms of their key developments, and key strategies adopted by them to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the barrier resins market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Barrier Resins Market