Cosmetic Antioxidants Market by Source (Natural, Synthetic), Type (Vitamins, Enzymes, Polyphenols), Function (Anti-aging, Hair Conditioning, UV Protection), and Application (Skin Care, Hair Care, Make-up)- Global Forecast to 2028

Updated on : July 17, 2025

Cosmetic Antioxidants Market

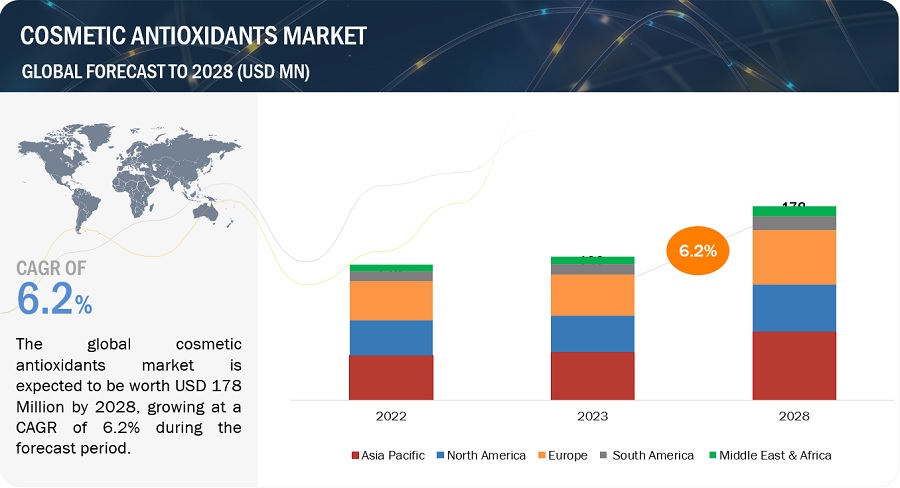

The global cosmetic antioxidants market was valued at USD 132 million in 2023 and is projected to reach USD 178 million by 2028, growing at 6.2% cagr from 2023 to 2028. Cosmetic antioxidants are active ingredients used in various formulations to manufacture cosmetics products. These antioxidants are widely used in cosmetic products owing to their anti-aging, anti-wrinkle, anti-inflammatory, UV protection, and moisturizing functions. The main purpose of these antioxidants is to inhibit oxidation reactions to prevent the production of free oxygen radicals, which prevent the degradation of proteins and lipids in cosmetic products. Cosmetic antioxidants also help in protecting skin cells from damage caused due to pollution. They are used to decelerate the aging process and minimize sunspots and fine lines.

To know about the assumptions considered for the study, Request for Free Sample Report

Cosmetic Antioxidants Market Dynamics

Driver: Changing lifestyle across the globe

The rising disposable income and improving consumers' living standards have resulted in the emergence of the lifestyle segment of cosmetics. Improvement in the current lifestyles of individuals is favoring the cosmetics market. The young generation has a significant budget to spend on beauty products. This generation prefers premium skincare and hair care products that make them more appealing aesthetically. Furthermore, the growing trend of selfies and social media drives the make-up market.

Urbanization and lifestyle changes are leading to changes in consumer preference for cosmetic products. Consumers stay updated about the ingredients used in cosmetic products. This trend is evident in developed countries. Consumers from the US, Germany, the UK, and other developed nations prefer premium cosmetic products with natural ingredients that are effective and deliver immediate results. All these factors contribute to the growth of the cosmetic antioxidants market.

Restraints: Concerns about the safety of chemically derived antioxidants

Chemically derived antioxidants such as Butylated hydroxyanisole (BHA), butylated hydroxytoluene (BHT), and propyl gallate are commonly used in cosmetics to prevent rancidity. However, there are concerns about their safety. Studies have suggested that BHA and BHT may be carcinogenic and can cause allergic reactions. Similarly, propyl gallate has also been linked to allergic reactions. On the other hand, natural antioxidants derived from plants and food sources are considered safer alternatives, although their efficacy in preventing rancidity may be lower. Evaluating the safety of synthetic antioxidants requires considering factors such as concentration, the type of product, and individual sensitivity. When assessing the safety of chemically derived antioxidants in cosmetics, consider the concentration in the product, the type of application, and individual sensitivity. Products with higher concentrations pose a greater potential risk, particularly when applied to the skin or lips. Consulting with a doctor or dermatologist can provide personalized guidance if you have concerns about the safety of chemically derived antioxidants.

Opportunities: Potential use of microbiome in cosmetics

There are few companies designing health-enhancing skincare products that contain live bacteria, bacteria extracts, or ingredients meant to enhance skin microbe activity. They are trying to nurture beneficial microbes to treat skin conditions such as acne and eczema as well as minor skin issues such as dryness and wrinkles. The topic remains debatable amongst cosmetic manufacturers about its potency. Still, a number of start-up companies are already incorporating bacteria into skin creams which will help to rebalance the bacteria that live on the human body and deliver healthier and radiant skin. Personal care manufacturers suggest a strong connection between a balanced microbiome and healthy skin. They also find it a good opportunity to invest in this new field.

Challenges : Increase in counterfeit cosmetic products

Accompanying the ease of online shopping is the surge of counterfeit cosmetic products sold across the world. The rapid expansion of counterfeit cosmetics poses a public health risk for consumers all over the world. Counterfeit cosmetic products contain paint thinner and poisonous metals, such as lead and mercury, which can cause irritation, chemical burns, and swelling. Fraudulent cosmetics are becoming a serious global issue. According to the CFSAN Adverse Event Reporting System (CAERS) of the U.S. Food and Drug Administration (FDA), from 2019 to 2022, the FDA received 13,402 instances of consumers reporting adverse effects related to cosmetics.

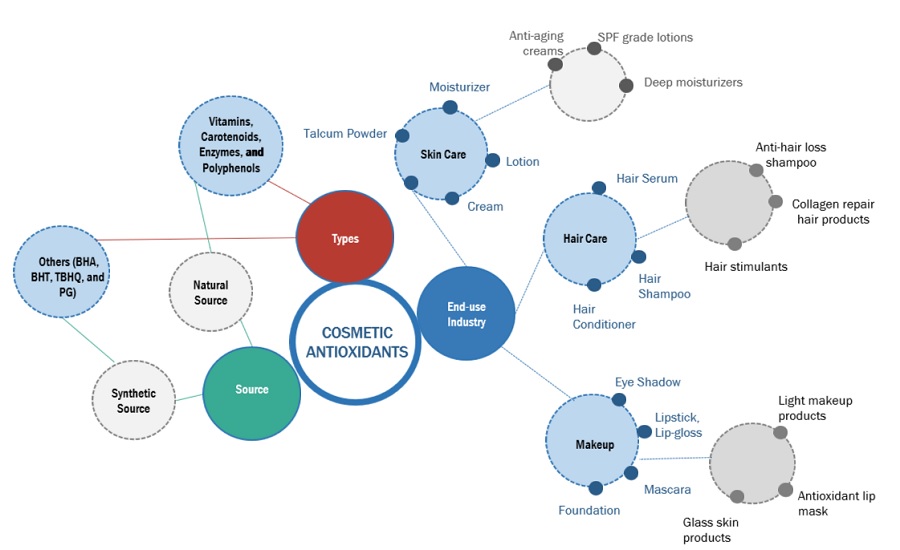

Cosmetic Antioxidants Market Ecosystem

The cosmetic antioxidants ecosystem includes companies manufacturing antioxidants based on vitamins, polyphenols, carotenoids, enzymes, and synthetics. The sources of these cosmetic antioxidants can be both natural and synthetic. These cosmetic antioxidants are manufactured by companies such as BASF SE (Germany), Koninklijke DSM N.V. (Royal DSM) (Netherlands), Wacker Chemie AG (Germany), Eastman Chemical Company (US), Clariant AG (Switzerland), Croda International Plc (UK), Ashland Inc. (US), Seppic (France), BTSA Biotecnologías Aplicadas, S.L. (Spain), and Evonik Industries AG (Germany). The cosmetic antioxidants are then added to cosmetic products like skin creams, lotions, hair shampoos, conditions, lip balms, and others. Cosmetic antioxidants help in the protection of both the cosmetic ingredients as well as the skin. The major end users are cosmetic manufacturing companies such as Unilever (UK), Procter & Gamble (US), Johnson & Johnson Services, Inc. (US), L'Oréal Group (France), and Estee Lauder, Inc. (US). The use of cosmetic antioxidants in this ecosystem is mainly driven by the increasing aging population, growth in the lifestyle segment, and male personal products.

Based on the source, the natural source was the largest segment of the cosmetic antioxidants market, in terms of value, in 2022.

Natural antioxidants are obtained entirely from natural sources such as plants or animals. These antioxidants include tocopherols, ascorbic acid, and rosemary extract, among others. Tocopherols are the most common natural antioxidants and are widely used in various cosmetic products. The increasing preference of the masses toward natural and herbal cosmetic products has increased the adoption of natural antioxidants in cosmetics.

Based on type, vitamins were the largest segment of the cosmetic antioxidants market, in terms of value, in 2022.

Vitamin E is a well-known lipid-soluble antioxidant that is useful for the human body and skin. Vitamin E is the generic name for tocopherols. Vitamin E and its compounds, such as tocopheryl acetate and tocopheryl linoleate, are used in various cosmetic formulations. Vitamin E occurs naturally in human skin. However, it gets depleted due to aging or constant exposure to the sun. Vitamin C is a water-soluble vitamin. It is also known as ascorbic acid. Vitamin C and its salts are easily found in plant tissues. Vitamin A, also known as retinol, is a skin-restoring and wrinkle-smoothing antioxidant. It is used in sunscreens, anti-aging creams, and hair conditioners. The addition of vitamin A in cosmetic products results in healthy skin cells and protects the skin against damage caused by ultraviolet radiation.

Based on function, anti-aging was the largest segment of the cosmetic antioxidants market, in terms of value, in 2022.

Anti-aging cosmetic products help reduce the appearance of fine lines and pigment evenings and provide a smooth skin texture. These products require cosmetic ingredients, such as vitamin A, biotin, coenzyme Q10, glycolic acid, green tea, and other vitamins, that help reduce signs of aging. Cosmetic antioxidants are widely used in cosmetic products such as serums, face creams, and lotions, among others, as anti-aging ingredients. These antioxidants help increase collagen and hydrate the skin.

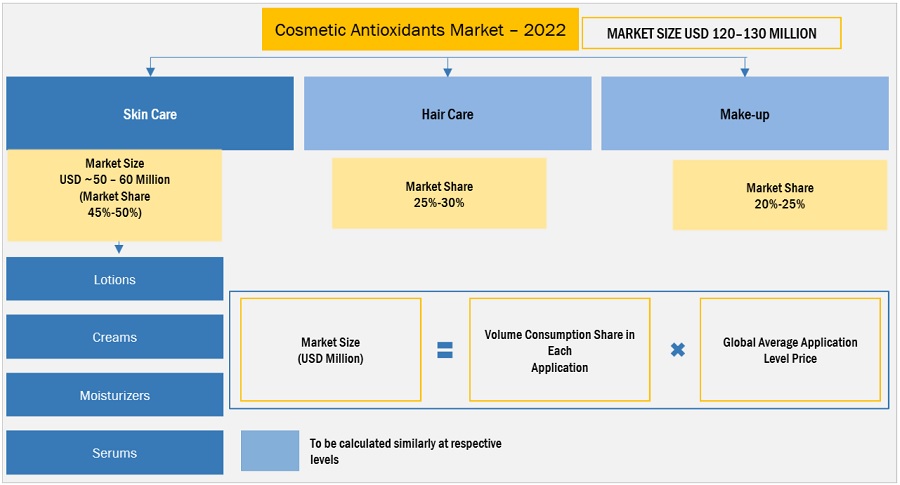

Based on application, skin care was the largest segment of the cosmetic antioxidants market, in terms of value, in 2022.

Cosmetic antioxidants are used in skincare and hair care products to deliver the proposed benefits. The skin care application accounted for the larger market share, in terms of value, of the global cosmetic antioxidants market in 2022. It is estimated to have high demand due to growing aspirations to have younger skin and even skin tone and aging population growth. The increasing impact of global warming, with a rise in excess heat levels, is surging the demand for sun protection and moisturizing agents.

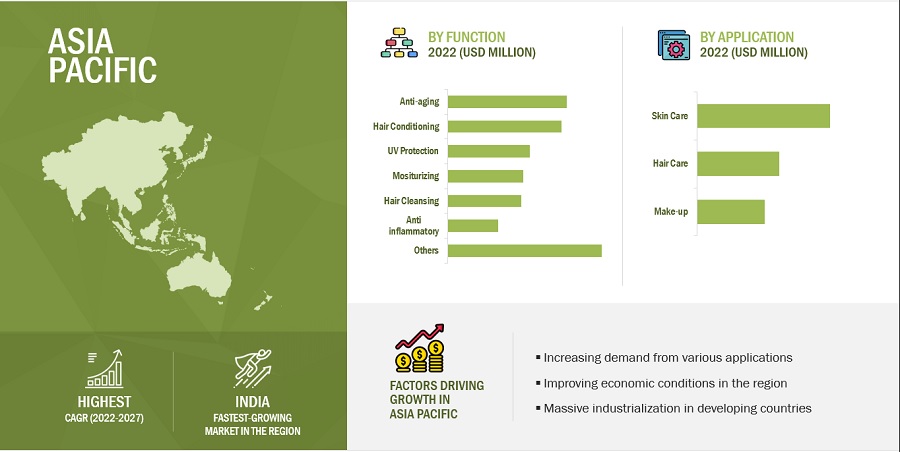

Asia Pacific accounted for the largest market share of the cosmetic antioxidants market, in terms of value, in 2022.

The cosmetics industry in the Asia Pacific is flourishing due to a rise in the number of working women, increased spending of the masses on cosmetic products, and the growth of the young population in the region. Increasing population, improving standard of living, and rising e-commerce activities have increased the demand for cosmetic products in the region. Emerging economies such as China and India are high-growth markets for skin care, hair care, and make-up products in the region, owing to the economic growth of these countries and increased consumer spending on cosmetic products.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market are Evonik Industries AG (Germany), Croda International Plc (UK), BASF SE (Germany), Eastman Chemical Company (US), and Wacker Chemie AG (Germany), among others. These are the key manufacturers that secured a major market share in the last few years.

Please visit 360Quadrants to see the vendor listing of Top 20 Personal Care Ingredients Companies, Worldwide 2023

Cosmetic Antioxidants Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million) |

|

Segments Covered |

Source, Type, Function, Application, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

The key players profiled in the report are Evonik Industries AG (Germany), Croda International Plc (UK), BASF SE (Germany), Eastman Chemical Company (US), Wacker Chemie AG (Germany), and others. |

This report categorizes the global cosmetic antioxidants market based on source, type, function, application, and region.

On the basis of Source, the cosmetic antioxidants market has been segmented as follows:

- Natural

- Synthetic

On the basis of Application, the cosmetic antioxidants market has been segmented as follows:

- Skin Care

- Hair care

- Make-up

On the basis of Type, the cosmetic antioxidants market has been segmented as follows:

- Vitamins

- Carotenoids

- Polyphenols

- Enzymes

- Synthetic

On the basis of Function, the cosmetic antioxidants market has been segmented as follows:

- Anti-aging

- Anti-inflammatory

- UV Protection

- Moisturizing

- Hair Cleansing

- Hair Conditioning

- Others

On the basis of region, the cosmetic antioxidants market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In May 2023, BASF partnered with BEAUTYSTREAMS to further expand its D’lite digital service for the personal care industry. The collaboration involved monthly trend reports from BEAUTYSTREAMS, providing valuable insights into current developments across the personal care market. These reports complemented the quantitative analyses provided by D’lite, offering a comprehensive view of the industry.

- In August 2022, BASF announced the innovation partnership with a China-based start-up, “Ingredi.” Through this partnership, BASF contributes its expertise in demonstrating how to add natural ingredients into personal care formulations and will market these products globally to its customers.

- In July 2023, The company acquired Novachem, an Argentinian sustainable cosmetic actives innovator, to strengthen its portfolio of sustainable cosmetic active ingredients. Novachem's innovative and scientifically proven portfolio of biotechnological, natural, and sustainable cosmetic actives will enhance Evonik's System Solutions offerings.

- In November 2022, Evonik and Intercos Group signed a direct supply agreement. Through this agreement, Evonik will provide Intercos with raw materials, including active ingredients, emulsifiers, and cosmetic oils, through a direct sales channel. The partnership aimed to strengthen cooperation and exchange in the cosmetics industry while committing to the development of more efficacious, safer, and sustainable products.

- In September 2022Eastman Chemical Ltd entered into a distribution agreement with DKSH, a Swiss company. DKSH will be growing Eastman's personal care business in the existing markets and expanding into new markets as a distributor of Eastman across the entire Asia Pacific region.

Frequently Asked Questions (FAQ):

Which are the major players in the Cosmetic antioxidants market?

The key players profiled in the report include The key players in this market are Evonik Industries AG (Germany), Croda International Plc (UK), BASF SE (Germany), Eastman Chemical Company (US), and Wacker Chemie AG (Germany).

Who are the top 5 players in the market?

Evonik Industries AG (Germany), Croda International Plc (UK), BASF SE (Germany), Eastman Chemical Company (US), and Wacker Chemie AG (Germany)are the major service providers of the cosmetic antioxidants market.

What are the drivers and opportunities for the cosmetic antioxidants market?

The cosmetic antioxidants market is driven by the rise in the aging population, increasing disposable income, and changing lifestyles of consumers. Self-expression and appearance are of utmost importance in today’s fast-paced social media-driven world, thereby driving the demand for cosmetic products, which in turn, is fueling the demand for antioxidants.

What are the various strategies key players are focusing on within The cosmetic antioxidants market?

New acquisitions, expansion, and partnerships are some of the strategies adopted by key players to expand their global presence.

What are the major factors restraining the cosmetic antioxidants market growth during the forecast period?

The pandemic has changed consumer behavior to focus more on self-care, DIYs, and deep nourishing products. As most of the time, people are inside their houses behind their masks, the use of make-up like lipstick or lip color has decreased. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in aging population- Rise in online purchase of cosmetics- High demand for customized cosmetic products- Rising disposable income and improving living standardsRESTRAINTS- Availability of advanced medical treatments in developed countries- High cost of natural antioxidants- Safety concerns about chemically derived antioxidantsOPPORTUNITIES- Rising demand for male cosmetics- Potential use of microbiome in cosmeticsCHALLENGES- Stringent regulations reshaping cosmetic antioxidants market- Increase in counterfeit cosmetic products

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND USERS

-

6.2 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR COSMETIC ANTIOXIDANTS MARKET

-

6.3 ECOSYSTEM MAPPING

-

6.4 TECHNOLOGY ANALYSISTECHNOLOGICAL ADVANCEMENTS IN COSMETIC ANTIOXIDANTS

-

6.5 CASE STUDY ANALYSISMAJESTEM DRYPURE BY CRODA TO PROVIDE ANTI-AGING BENEFITS

-

6.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.7 PRICING ANALYSISAVERAGE SELLING PRICE, BY APPLICATIONAVERAGE SELLING PRICE, BY REGION

-

6.8 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

6.9 REGULATORY LANDSCAPEREGULATIONS RELATED TO COSMETIC ANTIOXIDANTSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 KEY CONFERENCES AND EVENTS, 2023–2024

-

6.11 PATENT ANALYSISAPPROACHDOCUMENT TYPESJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 NATURALINCREASING AWARENESS ON USE OF GREEN PRODUCTS TO DRIVE MARKET

-

7.3 CHEMICALLY DERIVEDCOST-EFFECTIVENESS AND EASY AVAILABILITY OF CHEMICAL ANTIOXIDANTS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 VITAMINSHEALTH BENEFITS OF VITAMINS TO DRIVE MARKETVITAMIN EVITAMIN CVITAMIN A

-

8.3 CAROTENOIDSUSE OF CAROTENOIDS IN SUNSCREEN LOTIONS AND CONDITIONERS TO FUEL MARKET

-

8.4 POLYPHENOLSSKIN CALMING PROPERTIES OF POLYPHENOLS TO DRIVE MARKET

-

8.5 ENZYMESDEMAND FOR ANTI-INFLAMMATORY AND ANTI-AGING SKIN CREAMS TO DRIVE MARKET

-

8.6 OTHER TYPESBUTYLATED HYDROXY ANISOLEBUTYLATED HYDROXYTOLUENETERT-BUTYLHYDROQUINONEPROPYL GALLATE

- 9.1 INTRODUCTION

-

9.2 HAIR CONDITIONINGGROWING DEMAND FOR HAIR CONDITIONERS AND SERUMS TO DRIVE MARKET

-

9.3 ANTI-AGINGPREMATURE SKIN AGING TO FUEL DEMAND FOR ANTIOXIDANTS

-

9.4 MOISTURIZINGMOISTURIZING PROPERTIES OF VITAMINS TO FUEL DEMAND FOR SKIN AND HAIR CARE PRODUCTS

-

9.5 UV PROTECTIONDEMAND FOR SUNSCREEN LOTIONS TO FUEL MARKET

-

9.6 ANTI-INFLAMMATORYANTI-INFLAMMATORY PROPERTIES OF POMEGRANATE EXTRACTS TO BOOST MARKET

-

9.7 HAIR CLEANSINGINCREASING ENVIRONMENTAL POLLUTION TO FUEL DEMAND FOR CLEANSERS

- 9.8 OTHER FUNCTIONS

- 10.1 INTRODUCTION

-

10.2 SKIN CARERISING DEMAND FOR GROOMING & COSMETIC PRODUCTS TO DRIVE MARKET

-

10.3 HAIR CAREHIGH DEMAND FOR GREEN TEA AND VITAMIN SUPPLEMENTS TO FUEL MARKET

-

10.4 MAKE-UPINCREASED DEMAND FOR COLOR COSMETICS AND MINERAL POWDERS TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICASIA PACIFIC COSMETIC ANTIOXIDANTS MARKET, BY SOURCEASIA PACIFIC COSMETIC ANTIOXIDANT MARKET, BY APPLICATIONASIA PACIFIC COSMETIC ANTIOXIDANTS MARKET, BY TYPEASIA PACIFIC COSMETIC ANTIOXIDANT MARKET, BY FUNCTIONASIA PACIFIC COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY- China- Japan- India- South Korea

-

11.3 NORTH AMERICARECESSION IMPACT ON NORTH AMERICANORTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY SOURCENORTH AMERICA COSMETIC ANTIOXIDANT MARKET, BY APPLICATIONNORTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY TYPENORTH AMERICA COSMETIC ANTIOXIDANT MARKET, BY FUNCTIONNORTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY- US- Canada- Mexico

-

11.4 EUROPERECESSION IMPACT ON EUROPEEUROPE COSMETIC ANTIOXIDANTS MARKET, BY SOURCEEUROPE COSMETIC ANTIOXIDANT MARKET, BY APPLICATIONEUROPE COSMETIC ANTIOXIDANTS MARKET, BY TYPEEUROPE COSMETIC ANTIOXIDANT MARKET, BY FUNCTIONEUROPE COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY- Germany- UK- France- Italy- Russia- Spain

-

11.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA COSMETIC ANTIOXIDANTS MARKET, BY SOURCEMIDDLE EAST & AFRICA COSMETIC ANTIOXIDANT MARKET, BY APPLICATIONMIDDLE EAST & AFRICA COSMETIC ANTIOXIDANTS MARKET, BY TYPEMIDDLE EAST & AFRICA COSMETIC ANTIOXIDANT MARKET, BY FUNCTIONMIDDLE EAST & AFRICA COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY- Turkey- Saudi Arabia- UAE

-

11.6 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICASOUTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY SOURCESOUTH AMERICA COSMETIC ANTIOXIDANT MARKET, BY APPLICATIONSOUTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY TYPESOUTH AMERICA COSMETIC ANTIOXIDANT MARKET, BY FUNCTIONSOUTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY- Brazil- Argentina

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 RANKING OF KEY MARKET PLAYERS, 2022

- 12.4 MARKET SHARE ANALYSIS

- 12.5 REVENUE ANALYSIS OF KEY COMPANIES

- 12.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

12.7 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.8 COMPETITIVE BENCHMARKING

-

12.9 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSBASF SE- Business overview- Products offered- Recent developments- MnM viewEVONIK INDUSTRIES AG- Business overview- Products offered- Recent developments- MnM viewCRODA INTERNATIONAL PLC- Business overview- Products offered- Recent developments- MnM viewWACKER CHEMIE AG- Business overview- Products offered- MnM viewEASTMAN CHEMICAL COMPANY- Business overview- Products offered- Recent developments- MnM viewASHLAND INC.- Business overview- Products offered- Recent developmentsCLARIANT AG- Business overview- Products offered- Recent developmentsSEPPIC- Business overview- Products offeredKONINKLIJKE DSM N.V. (ROYAL DSM)- Business overview- Products offered- Recent developments- MnM viewBTSA BIOTECNOLOGIAS APLICADAS S.L.- Business overview- Products offered- MnM view

-

13.2 OTHER PLAYERSTHE LUBRIZOL CORPORATIONMERCK & CO., INC.ADMJAN DEKKERPROVITAL S.A.YASHO INDUSTRIES LIMITEDNEXIRAASH INGREDIENTS, INC.BLUE CALIFORNIASYMRISE AGVANTAGE SPECIALTY CHEMICALSINTERNATIONAL FLAVORS & FRAGRANCES INC.INNOVACOSCIREBELLESALVONA

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 PERSONAL CARE INGREDIENTS MARKETMARKET DEFINITIONMARKET OVERVIEWPERSONAL CARE INGREDIENTS MARKET, BY REGION- Europe- Asia Pacific- North America- Middle East & Africa- South America

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 COSMETIC ANTIOXIDANTS MARKET: RISK ASSESSMENT

- TABLE 2 WORLD POPULATION INDEX (MEDIAN AGE), BY COUNTRY, 2022

- TABLE 3 GROSS ADJUSTED HOUSEHOLD DISPOSABLE PER CAPITA INCOME, 2019 AND 2022 (USD)

- TABLE 4 COSMETIC ANTIOXIDANTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020–2028 (USD BILLION)

- TABLE 6 COSMETIC ANTIOXIDANTS MARKET: ECOSYSTEM

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 9 AVERAGE SELLING PRICE BY KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/KG)

- TABLE 10 AVERAGE SELLING PRICE OF COSMETIC ANTIOXIDANTS, BY REGION, 2021–2028 (USD/KG)

- TABLE 11 IMPORT OF COSMETIC ANTIOXIDANTS, BY REGION, 2017–2021 (USD MILLION)

- TABLE 12 EXPORT OF COSMETIC ANTIOXIDANTS, BY REGION, 2017–2021 (USD MILLION)

- TABLE 13 COSMETIC ANTIOXIDANTS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 14 PATENT COUNT

- TABLE 15 PATENTS BY L’OREAL GROUP

- TABLE 16 PATENTS BY PROCTER & GAMBLE

- TABLE 17 TOP 10 PATENT OWNERS IN US, 2012–2022

- TABLE 18 COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 19 COSMETIC ANTIOXIDANT MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 20 COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017–2021 (TON)

- TABLE 21 COSMETIC ANTIOXIDANT MARKET, BY SOURCE, 2022–2028 (TON)

- TABLE 22 NATURAL: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 23 NATURAL: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 24 NATURAL: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (TON)

- TABLE 25 NATURAL: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (TON)

- TABLE 26 CHEMICALLY DERIVED: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 27 CHEMICALLY DERIVED: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 28 CHEMICALLY DERIVED: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (TON)

- TABLE 29 CHEMICALLY DERIVED: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (TON)

- TABLE 30 COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 31 COSMETIC ANTIOXIDANT MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 32 COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017–2021 (TON)

- TABLE 33 COSMETIC ANTIOXIDANT MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 34 VITAMINS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 35 VITAMINS: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 36 VITAMINS: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 37 VITAMINS: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 38 CAROTENOIDS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 39 CAROTENOIDS: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 40 CAROTENOIDS: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 41 CAROTENOIDS: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 42 POLYPHENOLS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 43 POLYPHENOLS: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 44 POLYPHENOLS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (TON)

- TABLE 45 POLYPHENOLS: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (TON)

- TABLE 46 ENZYMES: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 47 ENZYMES: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 48 ENZYMES: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 49 ENZYMES: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 50 OTHER TYPES: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 51 OTHER TYPES: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 52 OTHER TYPES: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 53 OTHER TYPES: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 54 COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017–2021 (USD MILLION)

- TABLE 55 COSMETIC ANTIOXIDANT MARKET, BY FUNCTION, 2022–2028 (USD MILLION)

- TABLE 56 COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017–2021 (TON)

- TABLE 57 COSMETIC ANTIOXIDANT MARKET, BY FUNCTION, 2022–2028 (TON)

- TABLE 58 HAIR CONDITIONING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 59 HAIR CONDITIONING: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 60 HAIR CONDITIONING: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 61 HAIR CONDITIONING: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 62 ANTI-AGING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 63 ANTI-AGING: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 64 ANTI-AGING: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 65 ANTI-AGING: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 66 MOISTURIZING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 67 MOISTURIZING: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 68 MOISTURIZING: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 69 MOISTURIZING: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 70 UV PROTECTION: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 71 UV PROTECTION: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 72 UV PROTECTION: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 73 UV PROTECTION: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 74 ANTI-INFLAMMATORY: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 75 ANTI-INFLAMMATORY: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 76 ANTI-INFLAMMATORY: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 77 ANTI-INFLAMMATORY: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 78 HAIR CLEANSING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 79 HAIR CLEANSING: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 80 HAIR CLEANSING: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 81 HAIR CLEANSING: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 82 OTHER FUNCTIONS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 83 OTHER FUNCTIONS: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 84 OTHER FUNCTIONS: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 85 OTHER FUNCTIONS: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 86 COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 87 COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 88 COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 89 COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 90 SKIN CARE: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 91 SKIN CARE: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 92 SKIN CARE: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 93 SKIN CARE: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 94 HAIR CARE: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 95 HAIR CARE: MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 96 HAIR CARE: MARKET, BY REGION, 2017–2021 (TON)

- TABLE 97 HAIR CARE: MARKET, BY REGION, 2022–2028 (TON)

- TABLE 98 MAKE-UP: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 99 MAKE-UP: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 100 MAKE-UP: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (TON)

- TABLE 101 MAKE-UP: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (TON)

- TABLE 102 COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 103 COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 104 COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017–2021 (TON)

- TABLE 105 COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022–2028 (TON)

- TABLE 106 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 107 ASIA PACIFIC: COSMETIC ANTIOXIDANT MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MARKET, BY SOURCE, 2017–2021 (TON)

- TABLE 109 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2028 (TON)

- TABLE 110 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 113 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 114 ASIA PACIFIC: MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY TYPE, 2017–2021 (TON)

- TABLE 117 ASIA PACIFIC: MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 118 ASIA PACIFIC: MARKET, BY FUNCTION, 2017–2021 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MARKET, BY FUNCTION, 2022–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MARKET, BY FUNCTION, 2017–2021 (TON)

- TABLE 121 ASIA PACIFIC: MARKET, BY FUNCTION, 2022–2028 (TON)

- TABLE 122 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 123 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (TON)

- TABLE 125 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 126 CHINA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 127 CHINA: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 128 CHINA: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 129 CHINA: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 130 JAPAN: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 131 JAPAN: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 132 JAPAN: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 133 JAPAN: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 134 INDIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 135 INDIA: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 136 INDIA: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 137 INDIA: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 138 SOUTH KOREA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 139 SOUTH KOREA: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 140 SOUTH KOREA: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 141 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 142 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 143 NORTH AMERICA: COSMETIC ANTIOXIDANT MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: MARKET, BY SOURCE, 2017–2021 (TON)

- TABLE 145 NORTH AMERICA: MARKET, BY SOURCE, 2022–2028 (TON)

- TABLE 146 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 147 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 149 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 150 NORTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 151 NORTH AMERICA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 152 NORTH AMERICA: MARKET, BY TYPE, 2017–2021 (TON)

- TABLE 153 NORTH AMERICA: MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 154 NORTH AMERICA: MARKET, BY FUNCTION, 2017–2021 (USD MILLION)

- TABLE 155 NORTH AMERICA: MARKET, BY FUNCTION, 2022–2028 (USD MILLION)

- TABLE 156 NORTH AMERICA: MARKET, BY FUNCTION, 2017–2021 (TON)

- TABLE 157 NORTH AMERICA: MARKET, BY FUNCTION, 2022–2028 (TON)

- TABLE 158 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 159 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 160 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (TON)

- TABLE 161 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 162 US: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 163 US: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 164 US: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 165 US: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 166 CANADA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 167 CANADA: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 168 CANADA: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 169 CANADA: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 170 MEXICO: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 171 MEXICO: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 172 MEXICO: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 173 MEXICO: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 174 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 175 EUROPE: COSMETIC ANTIOXIDANT MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 176 EUROPE: MARKET, BY SOURCE, 2017–2021 (TON)

- TABLE 177 EUROPE: MARKET, BY SOURCE, 2022–2028 (TON)

- TABLE 178 EUROPE: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 179 EUROPE: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 180 EUROPE: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 181 EUROPE: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 182 EUROPE: MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 183 EUROPE: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 184 EUROPE: MARKET, BY TYPE, 2017–2021 (TON)

- TABLE 185 EUROPE: MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 186 EUROPE: MARKET, BY FUNCTION, 2017–2021 (USD MILLION)

- TABLE 187 EUROPE: MARKET, BY FUNCTION, 2022–2028 (USD MILLION)

- TABLE 188 EUROPE: MARKET, BY FUNCTION, 2017–2021 (TON)

- TABLE 189 EUROPE: MARKET, BY FUNCTION, 2022–2028 (TON)

- TABLE 190 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 191 EUROPE: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 192 EUROPE: MARKET, BY COUNTRY, 2017–2021 (TON)

- TABLE 193 EUROPE: MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 194 GERMANY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 195 GERMANY: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 196 GERMANY: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 197 GERMANY: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 198 UK: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 199 UK: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 200 UK: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 201 UK: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 202 FRANCE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 203 FRANCE: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 204 FRANCE: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 205 FRANCE: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 206 ITALY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 207 ITALY: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 208 ITALY: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 209 ITALY: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 210 RUSSIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 211 RUSSIA: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 212 RUSSIA: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 213 RUSSIA: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 214 SPAIN: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 215 SPAIN: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 216 SPAIN: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 217 SPAIN: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 218 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANT MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: MARKET, BY SOURCE, 2017–2021 (TON)

- TABLE 221 MIDDLE EAST & AFRICA: MARKET, BY SOURCE, 2022–2028 (TON)

- TABLE 222 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 225 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 226 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2017–2021 (TON)

- TABLE 229 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 230 MIDDLE EAST & AFRICA: MARKET, BY FUNCTION, 2017–2021 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: MARKET, BY FUNCTION, 2022–2028 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: MARKET, BY FUNCTION, 2017–2021 (TON)

- TABLE 233 MIDDLE EAST & AFRICA: MARKET, BY FUNCTION, 2022–2028 (TON)

- TABLE 234 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (TON)

- TABLE 237 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 238 TURKEY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 239 TURKEY: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 240 TURKEY: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 241 TURKEY: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 242 SAUDI ARABIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 243 SAUDI ARABIA: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 244 SAUDI ARABIA: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 245 SAUDI ARABIA: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 246 UAE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 247 UAE: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 248 UAE: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 249 UAE: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 250 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 251 SOUTH AMERICA: COSMETIC ANTIOXIDANT MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 252 SOUTH AMERICA: MARKET, BY SOURCE, 2017–2021 (TON)

- TABLE 253 SOUTH AMERICA: MARKET, BY SOURCE, 2022–2028 (TON)

- TABLE 254 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 255 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 256 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 257 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 258 SOUTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 259 SOUTH AMERICA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 260 SOUTH AMERICA: MARKET, BY TYPE, 2017–2021 (TON)

- TABLE 261 SOUTH AMERICA: MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 262 SOUTH AMERICA: MARKET, BY FUNCTION, 2017–2021 (USD MILLION)

- TABLE 263 SOUTH AMERICA: MARKET, BY FUNCTION, 2022–2028 (USD MILLION)

- TABLE 264 SOUTH AMERICA: MARKET, BY FUNCTION, 2017–2021 (TON)

- TABLE 265 SOUTH AMERICA: MARKET, BY FUNCTION, 2022–2028 (TON)

- TABLE 266 SOUTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 267 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 268 SOUTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (TON)

- TABLE 269 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 270 BRAZIL: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 271 BRAZIL: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 272 BRAZIL: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 273 BRAZIL: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 274 ARGENTINA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 275 ARGENTINA: COSMETIC ANTIOXIDANT MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 276 ARGENTINA: MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 277 ARGENTINA: MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 278 STRATEGIES ADOPTED BY KEY COSMETIC ANTIOXIDANTS MANUFACTURERS

- TABLE 279 COSMETIC ANTIOXIDANTS MARKET: DEGREE OF COMPETITION

- TABLE 280 COSMETIC ANTIOXIDANT MARKET: SOURCE FOOTPRINT

- TABLE 281 COSMETIC ANTIOXIDANTS MARKET: APPLICATION FOOTPRINT

- TABLE 282 COSMETIC ANTIOXIDANT MARKET: REGION FOOTPRINT

- TABLE 283 COSMETIC ANTIOXIDANTS MARKET: KEY STARTUPS/SMES

- TABLE 284 COSMETIC ANTIOXIDANT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 285 COSMETIC ANTIOXIDANTS MARKET: PRODUCT LAUNCHES (2020–2023)

- TABLE 286 COSMETIC ANTIOXIDANT MARKET: DEALS (2020–2023)

- TABLE 287 COSMETIC ANTIOXIDANTS MARKET: OTHER DEVELOPMENTS (2020–2023)

- TABLE 288 BASF SE: COMPANY OVERVIEW

- TABLE 289 BASF SE: DEALS

- TABLE 290 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 291 EVONIK INDUSTRIES AG: DEALS

- TABLE 292 EVONIK INDUSTRIES AG: OTHER DEVELOPMENTS

- TABLE 293 CRODA INTERNATIONAL PLC: COMPANY OVERVIEW

- TABLE 294 CRODA INTERNATIONAL PLC: DEALS

- TABLE 295 CRODA INTERNATIONAL PLC: OTHER DEVELOPMENTS

- TABLE 296 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 297 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 298 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 299 ASHLAND INC.: COMPANY OVERVIEW

- TABLE 300 ASHLAND INC.: PRODUCT LAUNCHES

- TABLE 301 ASHLAND INC.: DEALS

- TABLE 302 CLARIANT AG: COMPANY OVERVIEW

- TABLE 303 CLARIANT AG: DEALS

- TABLE 304 SEPPIC: COMPANY OVERVIEW

- TABLE 305 KONINKLIJKE DSM N.V. (ROYAL DSM): COMPANY OVERVIEW

- TABLE 306 KONINKLIJKE DSM N.V. (ROYAL DSM): DEALS

- TABLE 307 BTSA BIOTECNOLOGIAS APLICADAS S.L.: COMPANY OVERVIEW

- TABLE 308 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- TABLE 309 MERCK & CO., INC.: COMPANY OVERVIEW

- TABLE 310 ADM: COMPANY OVERVIEW

- TABLE 311 JAN DEKKER: COMPANY OVERVIEW

- TABLE 312 PROVITAL S.A.: COMPANY OVERVIEW

- TABLE 313 YASHO INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 314 NEXIRA: COMPANY OVERVIEW

- TABLE 315 ASH INGREDIENTS, INC.: COMPANY OVERVIEW

- TABLE 316 BLUE CALIFORNIA: COMPANY OVERVIEW

- TABLE 317 SYMRISE AG: COMPANY OVERVIEW

- TABLE 318 VANTAGE SPECIALTY CHEMICALS: COMPANY OVERVIEW

- TABLE 319 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY OVERVIEW

- TABLE 320 INNOVACOS: COMPANY OVERVIEW

- TABLE 321 CIREBELLE: COMPANY OVERVIEW

- TABLE 322 SALVONA: COMPANY OVERVIEW

- TABLE 323 PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 324 PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 325 PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 326 PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 327 EUROPE: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 328 EUROPE: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 329 EUROPE: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 330 EUROPE: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 331 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 332 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 333 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 334 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 335 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 336 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 337 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 338 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 339 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 340 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 341 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 342 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 343 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 344 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 345 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 346 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- FIGURE 1 COSMETIC ANTIOXIDANTS MARKET SEGMENTATION

- FIGURE 2 COSMETIC ANTIOXIDANTS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION - APPROACH 1 (SUPPLY-SIDE): COMBINED MARKET SHARE OF MAJOR PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION - APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL TYPES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 BOTTOM-UP (DEMAND-SIDE): PRODUCTS SOLD AND THEIR AVERAGE SELLING PRICE

- FIGURE 6 COSMETIC ANTIOXIDANTS MARKET: DATA TRIANGULATION

- FIGURE 7 SUPPLY-SIDE MARKET CAGR PROJECTIONS

- FIGURE 8 DEMAND-SIDE MARKET GROWTH PROJECTIONS

- FIGURE 9 ANTI-AGING TO BE LARGEST FUNCTION OF COSMETIC ANTIOXIDANTS MARKET IN 2022

- FIGURE 10 NATURAL SOURCE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 11 VITAMINS SEGMENT TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 SKIN CARE TO BE LARGEST APPLICATION OF COSMETIC ANTIOXIDANTS DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 INCREASING APPLICATION AREAS OFFER GROWTH OPPORTUNITIES FOR COSMETIC ANTIOXIDANTS MARKET

- FIGURE 15 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 SKIN CARE AND CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 17 ANTI-AGING LED COSMETIC ANTIOXIDANTS MARKET IN MOST REGIONS

- FIGURE 18 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 PORTER’S FIVE FORCES ANALYSIS: COSMETIC ANTIOXIDANTS MARKET

- FIGURE 21 COSMETIC ANTIOXIDANTS MARKET: SUPPLY CHAIN

- FIGURE 22 COSMETIC ANTIOXIDANTS MARKET: FUTURE REVENUE MIX

- FIGURE 23 COSMETIC ANTIOXIDANTS MARKET: ECOSYSTEM MAP

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 26 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE APPLICATIONS

- FIGURE 27 AVERAGE SELLING PRICE OF COSMETIC ANTIOXIDANTS, BY REGION, 2021–2028

- FIGURE 28 COSMETIC ANTIOXIDANTS IMPORT, BY KEY COUNTRY (2013–2022)

- FIGURE 29 COSMETIC ANTIOXIDANTS EXPORT, BY KEY COUNTRY (2017–2021)

- FIGURE 30 PATENTS REGISTERED IN COSMETIC ANTIOXIDANTS MARKET, 2012–2022

- FIGURE 31 PATENT PUBLICATION TRENDS, 2012–2022

- FIGURE 32 LEGAL STATUS OF PATENTS FILED IN COSMETIC ANTIOXIDANTS MARKET

- FIGURE 33 MAXIMUM PATENTS FILED IN JURISDICTION OF US

- FIGURE 34 L'OREAL GROUP REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2012 AND 2022

- FIGURE 35 NATURAL SOURCE TO LEAD COSMETIC ANTIOXIDANTS MARKET DURING FORECAST PERIOD

- FIGURE 36 VITAMINS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 ANTI-AGING FUNCTION TO DOMINATE COSMETIC ANTIOXIDANTS MARKET DURING FORECAST PERIOD

- FIGURE 38 SKIN CARE APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO BE FASTEST-GROWING COSMETIC ANTIOXIDANTS MARKET DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET SNAPSHOT

- FIGURE 41 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET SNAPSHOT

- FIGURE 42 EUROPE: COSMETIC ANTIOXIDANTS MARKET SNAPSHOT

- FIGURE 43 RANKING OF TOP FIVE PLAYERS IN COSMETIC ANTIOXIDANTS MARKET, 2022

- FIGURE 44 EVONIK INDUSTRIES AG ACCOUNTED FOR LARGEST SHARE OF COSMETIC ANTIOXIDANTS MARKET IN 2022

- FIGURE 45 REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS

- FIGURE 46 COSMETIC ANTIOXIDANTS MARKET: COMPANY FOOTPRINT

- FIGURE 47 COMPANY EVALUATION MATRIX: COSMETIC ANTIOXIDANTS MARKET

- FIGURE 48 STARTUP/SME EVALUATION QUADRANT: COSMETIC ANTIOXIDANTS MARKET

- FIGURE 49 BASF SE: COMPANY SNAPSHOT

- FIGURE 50 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 51 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

- FIGURE 52 WACKER CHEMIE AG: COMPANY SNAPSHOT

- FIGURE 53 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 54 ASHLAND INC.: COMPANY SNAPSHOT

- FIGURE 55 CLARIANT AG: COMPANY SNAPSHOT

- FIGURE 56 KONINKLIJKE DSM N.V. (ROYAL DSM): COMPANY SNAPSHOT

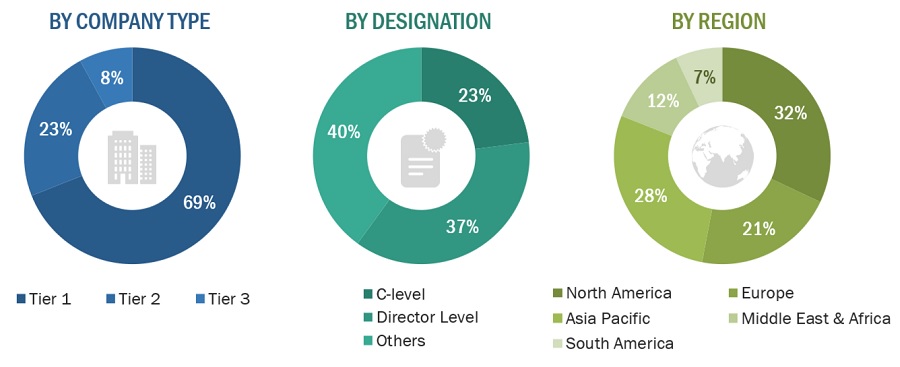

The study involved four major activities in estimating the market size for cosmetic antioxidants. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The Cosmetic antioxidants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the automotive, medical, electronics, and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Evonik Industries AG |

Director of Marketing |

|

Croda International Plc |

Manager- Sales & Marketing |

|

BASF SE |

Sales Manager |

|

Eastman Chemical Company |

Production Manager |

|

Wacker Chemie AG |

Sales Manager |

MARKET SIZE ESTIMATION

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Cosmetic antioxidants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Cosmetic Antioxidants Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Cosmetic Antioxidants Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the cosmetic antioxidants industry.

Market Definition

According to Cosmetic Association Europe, “Cosmetic antioxidants are ingredients used in cosmetic formulations to increase the shelf life of cosmetic products and protect human cells against damage. These antioxidants can be found in a wide range of skincare products, including moisturizers, serums, and creams, and are often combined with other beneficial ingredients to provide comprehensive skincare benefits. Cosmetic antioxidants work by neutralizing free radicals, preventing them from causing damage to the skin cells.

Key Stakeholders

- Cosmetic antioxidants manufacturers

- Cosmetic antioxidants distributors

- Cosmetic antioxidants suppliers

- Government and research organizations

- Investment banks and private equity firms Venture capital firms

- Wastewater treatment equipment manufacturers, dealers, and suppliers

- Water testing and packaging vendors

Report Objectives

- To define, describe, and forecast the global cosmetic antioxidants market size in terms of volume and value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the growth of this market

- To estimate and forecast the market size based on source, type, function, and application

- To forecast the size of the market based on five major regions–Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and to provide a competitive landscape for market leaders.

- To analyze recent developments such as agreements, mergers & acquisitions, expansions, and new product launches in the market

- To strategically profile the key market players and comprehensively analyze their core competencies2 and market share

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cosmetic Antioxidants Market