Betaine Market by Type (Synthetic Betaine and Natural Betaine), Form (Betaine Anhydrous, Cocamidopropyl Betaine, Betaine Monohydrate), Application (Food & Beverages, Animal Feed, Cosmetics, Detergents), and by Geography - Global Forecast to 2020

Betaine is one of the rapidly-growing markets in the food & beverages market. The rise in awareness about the nutritional value of betaine when used in dietary supplements as well as its multi-functional usage such as surfactant and methyl donor are the key factors driving its demand. The increasing popularity of energy and sports drinks, in which betaine is used has further extended the scope for the betaine market. It helps in enhancing physical performance, especially strength, power, and muscle endurance and leads to a better immune system. Betaine is also used as a surfactant in cosmetics and personal care products due to its moisturizing and water-retention properties. It is also used in detergents and reagents. As an animal feed additive it performs the function of methyl donor and helps to improve the metabolism of animals

The betaine market is categorized into type, form, application, and region. On the basis of type, it is segmented based on synthetic betaine and natural betaine. On the basis of form it is segmented into betaine anhydrous, cocamidopropyl betaine, betaine monohydrate, and others (which include betaine HCL, betaine citrate, and betaine aspartate). On the basis of application, it segmentation is segmented into food & beverages, animal feed, cosmetics, detergents, and others (which include pharmaceuticals and reagents). The market has also been segmented on the basis of region into North America, Europe, Asia-Pacific, Latin America, and the Rest of the World (RoW).

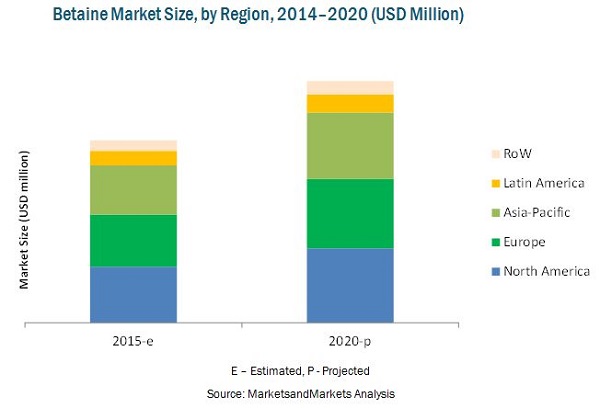

The betaine market is projected to reach USD 3.89 Billion by 2020, at a CAGR of 5.8% during the forecast period. In 2014, the market was dominated by North America, followed by Europe. The Asia-Pacific market is projected to grow at the highest CAGR with rapid growth in the betaine market in developing countries such as China and India. The growing awareness about health benefits of betaine and increasing use of betaine in personal care products in this region are also driving the market.

This report includes market size in terms of value (USD million) and volume (MT). Both “top-down” and “bottom-up” approaches were used to arrive at the market sizes and obtain the market forecast. Extensive secondary research was conducted to understand the market insights and trends, which was further validated through primary interviews. The report provides both, qualitative and quantitative analysis of the betaine market, the competitive landscape, and the preferred development strategies of key players.

The key players were observed to prefer new product launches & developments, acquisitions, and expansions as strategies to garner a larger share in the market. The report also analyzes the market dynamics, and issues faced by leading players.

Target Audience:

- Betaine raw material suppliers and distributors

- Betaine traders, distributors, and dealers

- Food and feed manufacturers

- Biotechnology-based organizations

- Industry associations

- Betaine end users

- Research and consulting firms

Customization Options:

Following customization options are offered with this report:

-

Trend Data

- Usage of betaine in food & feed, and other industries that can be altered according to the requirements of manufacturers

- Exhaustive analysis of products and process-related technologies that will be cost-effective and will open up new opportunities in the betaine market

- A number of approaches used for analyzing trends in both supply and intake of food and nutrients

- Detailed analysis of applications, in terms of evolving needs, substitutes available, and impact analysis

-

Competitive Intelligence

- Scrutiny of the diversification of opportunities prevailing in the current business scenario

- Identification of the new products and technological concepts that are driving the market

- Comprehensive study to increase production and benefits of improved accuracy, in the manufacturing process of betaine

- Competitive benchmarking of the leading players in the industry

-

Perception Matrix

- Expert opinions about the varied product portfolios of the leading companies

- Acceptance of the products from customers and a detailed study about the product alternatives available to them

Betaine has a wide range of applications in the food industry as it helps in the dietary functions and is used in nutraceuticals to prevent heart and liver diseases. Betaine is also accepted as an anti-stressing agent and is found to improve athletic performance. It is naturally found in vegetables such as beets, broccoli, and spinach, which are considered rich sources of protein and calcium. With the increasing R&D initiatives, the market is gradually recognizing the significance of betaine in food and feed products. The health benefits of betaine are estimated to increase the number of applications of betaine in the global market. Betaine find applications in diverse industrial markets such as food & beverages, animal feed, cosmetics, detergents, and others such as pharmaceuticals and reagents.

The global betaine market is segmented on the basis of type into synthetic betaine and natural betaine. On the basis of form, the market has been segmented into betaine anhydrous, cocamidopropyl betaine, betaine monohydrate, and others (including betaine HCL, betaine aspartate, and betaine citrate). The market is segmented on the basis of application into food & beverages, animal feed, cosmetics, detergents, and others (including pharmaceuticals and reagents). The market has also been segmented on the basis of region into North America, Europe, Asia-Pacific, Latin America, and the Rest of the World (RoW); and has been further segmented on the basis of their key countries. This report includes market sizes in terms of value (USD million) and volume (MT).

The global market size of betaine is projected to reach about USD 3.89 Billion by 2020 at a CAGR of 5.8% from 2015 to 2020, with the increasing use of betaine in the personal care industry. Furthermore, rising opportunities in emerging markets such as India, China, and Brazil are anticipated to augment the market size of betaine over the forecast period. In 2014, North America was the largest market for betaine. The market in the Asia-Pacific region is projected to grow at the highest CAGR during the forecast period followed by North America.

The betaine market is fragmented with the leading companies driving the market growth with investments and expansions. The report further provides qualitative analyses of the prominent market players and their preferred development strategies. Key players such as Associated British Food Plc (U.K.), BASF SE (Germany), E. I. du Pont de Nemours and Company (U.S.), Nutreco N.V. (The Netherlands), Solvay S.A. (Belgium), American Crystal Sugar Company (U.S.), Amino GmbH (Germany), Kao Corporation (Japan), Stepan Company (U.S.), and Sunwin Chemicals (China) have been profiled in the report. The leading players have adopted new product developments, acquisitions, expansions & investments, agreements/ joint ventures as their key development strategies.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered in the Report

1.3.2 Currency

1.4 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Market Share Estimation

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Assumptions

2.4.1 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunity for Betaine Manufacturers

4.2 Betaine Market : Regionwise Analysis

4.3 Betaine Market in North America

4.4 Global Betaine Market, By Type

4.5 Market, By Application

4.6 Market Attractiveness

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 Betaine Market, By Type

5.3.2 Market, By Form

5.3.3 Market, By Application

5.4 Related Markets

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Increasing Application in the Personal Care Industry

5.5.1.2 Growing Potential for Betaine in the Feed Segment

5.5.1.3 Health Benefits of Betaine Consumption at Recommended Dosages

5.5.2 Restraints

5.5.2.1 Restricted Use of Betaine in the European Union

5.5.3 Opportunities

5.5.3.1 Increasing Application in Nutraceuticals, Dietary Supplements & Sports Drinks

5.5.3.2 Introduction of Betaine as an Anti-Stress Agent in Feed

5.6 Burning Issues

5.6.1 Side Effects of Excess Betaine Consumption

5.6.1.1 Health Effects in Humans

5.6.1.2 Heat Stress in Animals

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.1.1 Betaine as Surfactant in Detergents & Personal Care Products

6.1.2 Food Applications

6.1.3 Dietary Supplements, Sport Drinks & Nutraceuticals

6.1.3.1 Dietary Supplements

6.1.3.2 Sports & Energy Drinks

6.1.3.3 Nutraceuticals

6.1.4 Feed Application for Animal Nutrient

6.2 Factors of Betaine That Limit Its Application in Dietary Supplements

6.3 Betaine Market: Value Chain Analysis

6.4 Betaine Market: Porters Five Forces Analysis

6.4.1 Intensity of Competitive Rivalry

6.4.2 Bargaining Power of Suppliers

6.4.3 Bargaining Power of Buyers

6.4.4 Threat of Substitutes

6.4.5 Threat of New Entrants

6.5 Regulatory System for Betaine Consumption

6.5.1 Fda Regulations

6.5.2 European Regulations

7 Betaine Market, By Type (Page No. - 53)

7.1 Introduction

7.2 Synthetic Betaine

7.3 Natural Betaine

8 Betaine Market, By Form (Page No. - 60)

8.1 Introduction

8.2 Betaine Anhydrous

8.3 Cocamidopropyl Betaine

8.4 Betaine Monohydrate

8.5 Other Forms

9 Betaine Market, By Application (Page No. - 70)

9.1 Introduction

9.2 Betaine in Food & Beverages

9.2.1 Dietary Supplements

9.3 Betaine in Animal Feed

9.4 Betaine in Cosmetics

9.5 Betaine in Detergents

9.6 Betaine in Other Applications

10 Betaine Market, By Region (Page No. - 82)

10.1 Introduction

10.2 North America

10.2.1 North America: Betaine Market, By Type

10.2.2 North America: Market, By Form

10.2.3 North America: Market, By Application

10.2.4 U.S.: Betaine Market, By Application

10.2.5 Canada: Market, By Application

10.2.6 Mexico: Market, By Application

10.3 Europe

10.3.1 Europe: Betaine Market, By Type

10.3.2 Europe: Market, By Form

10.3.3 Europe: Market, By Application

10.3.4 U.K.: Betaine Market, By Application

10.3.5 Germany: Market, By Application

10.3.6 France: Market, By Application

10.3.7 Italy: Market, By Application

10.3.8 Spain: Market, By Application

10.3.9 Rest of Europe: Betaine Market, By Application

10.4 Asia-Pacific

10.4.1 Asia-Pacific: Betaine Market, By Type

10.4.2 Asia-Pacific: Market, By Form

10.4.3 Asia-Pacific: Market, By Application

10.4.4 China: Market, By Application

10.4.5 Australia: Market, By Application

10.4.6 Japan: Market, By Type

10.4.7 Rest of Asia-Pacific: Betaine Market, By Type

10.5 Latin America

10.5.1 Latin America: Betaine Market, By Type

10.5.2 Latin America: Market, By Form

10.5.3 Latin America: Market, By Application

10.5.4 Brazil: Market, By Application

10.5.5 Argentina: Market, By Application

10.5.6 Rest of Latin America: Market, By Application

10.6 RoW

10.6.1 RoW: Betaine Market, By Type

10.6.2 RoW: Market, By Form

10.6.3 RoW: Market, By Application

10.6.4 South Africa: Market, By Application

10.6.5 Others in RoW: Market, By Application

11 Competitive Landscape (Page No. - 143)

11.1 Overview

11.2 Maximum Developments in Europe

11.3 Maximum Developments in 2015

11.4 Competitive Situation & Trends

11.4.1 New Product Launches

11.4.2 Expansions & Investments

11.4.3 Acquisitions

11.4.4 Agreements/Joint Ventures

12 Company Profiles (Page No. - 149)

12.1 Introduction

(Overview, Products Offered, Recent Developments, SWOT Analysis, and MNM View)*

12.2 Associated British Foods PLC

12.3 BASF SE

12.4 E.I. Dupont De Nemours & Company

12.5 Nutreco N.V.

12.6 Solvay S.A.

12.7 American Crystal Sugar Company

12.8 KAO Corporation

12.9 Stepan Company

12.10 Amino Gmbh

12.11 Sunwin Chemicals

*Details on Overview, Products Offered, Recent Developments, SWOT Analysis, and MNM View might not be captured in case of unlisted companies.

13 Appendix (Page No. - 172)

13.1 Discussion Guide

13.2 Company Developments

13.2.1 Expansions

13.2.2 Acquisitions

13.2.3 Partnerships

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (112 Tables)

Table 1 Accepted Dosage of Betaine in Food & Beverages

Table 2 Results of Betaine Consumption Testing

Table 3 Betaine Market Size, By Type, 2013-2020 (USD Million)

Table 4 Market Size, By Type, 2013-2020 (MT)

Table 5 Synthetic Betaine Market Size, By Region, 2013-2020 (USD Million)

Table 6 Synthetic Betaine Market Size, By Region, 2013-2020 (MT)

Table 7 Natural Betaine Market Size, By Region, 2013-2020 (USD Million)

Table 8 Natural Betaine Market Size, By Region, 2013-2020 (MT)

Table 9 Market Size, By Form, 2013–2020 (USD Million)

Table 10 Market Size, By Form, 2013–2020 (MT)

Table 11 Betaine Anhydrous Market Size, By Region, 2013–2020 (USD Million)

Table 12 Betaine Anhydrous Market Size, By Region, 2013–2020 (MT)

Table 13 Cocamidopropyl Betaine Market Size, By Region, 2013–2020 (USD Million)

Table 14 Cocamidopropyl Betaine Market Size, By Region, 2013–2020 (MT)

Table 15 Betaine Monohydrate Market Size, By Region, 2013–2020 (USD Million)

Table 16 Betaine Monohydrate Market Size, By Region, 2013–2020 (MT)

Table 17 Other Betaine Forms Market Size, By Region, 2013–2020 (USD Million)

Table 18 Other Betaine Forms Market Size, By Region, 2013–2020 (MT)

Table 19 Market Size, By Application, 2013-2020 (USD Million)

Table 20 Market Size, By Application, 2013-2020 (MT)

Table 21 Market Size for Food & Beverages, By Region,2013-2020 (USD Million)

Table 22 Market Size for Food & Beverages, By Region, 2013-2020 (MT)

Table 23 Market Size for Animal Feed, By Region, 2013-2020 (USD Million)

Table 24 Market Size for Animal Feed, By Region, 2013-2020 (MT)

Table 25 Market Size for Cosmetics, By Region, 2013-2020 (USD Million)

Table 26 Market Size for Cosmetics, By Region, 2013-2020 (MT)

Table 27 Market Size for Detergents, By Region, 2013-2020 (USD Million)

Table 28 Market for Detergents Size, By Region, 2013-2020 (MT)

Table 29 Market Size for Other Applications, By Region,2013-2020 (USD Million)

Table 30 Market Size for Other Applications, By Region, 2013-2020 (MT)

Table 31 Market Size, By Region, 2013-2020 (USD Million)

Table 32 Market Size, By Region, 2013-2020 (MT)

Table 33 North America: Betaine Market Size, By Country, 2013–2020 (USD Million)

Table 34 North America: Market Size, By Country, 2013–2020 (MT)

Table 35 North America: Market Size, By Type, 2013–2020 (USD Million)

Table 36 North America: Market Size, By Type, 2013–2020 (MT)

Table 37 North America: Market Size, By Form, 2013–2020 (USD Million)

Table 38 North America: Market Size, By Form, 2013–2020 (MT)

Table 39 North America: Market Size, By Application,2013–2020 (USD Million)

Table 40 North America: Market Size, By Application, 2013–2020 (MT)

Table 41 U.S.: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 42 U.S.: Market Size, By Application, 2013–2020 (MT)

Table 43 Canada: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 44 Canada: Market Size, By Application, 2013–2020 (MT)

Table 45 Mexico: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 46 Mexico: Market Size, By Application, 2013–2020 (MT)

Table 47 Europe: Betaine Market Size, By Country, 2013–2020 (USD Million)

Table 48 Europe: Market Size, By Country, 2013–2020 (MT)

Table 49 Europe: Market Size, By Type, 2013–2020 (USD Million)

Table 50 Europe: Market Size, By Type, 2013–2020 (MT)

Table 51 Europe: Market Size, By Form, 2013–2020 (USD Million)

Table 52 Europe: Market Size, By Form, 2013–2020 (MT)

Table 53 Europe: Market Size, By Application, 2013–2020 (USD Million)

Table 54 Europe: Market Size, By Application, 2013–2020 (MT)

Table 55 U.K.: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 56 U.K.: Market Size, By Application, 2013–2020 (MT)

Table 57 Germany: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 58 Germany: Market Size, By Application, 2013–2020 (MT)

Table 59 France: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 60 France: Market Size, By Application, 2013–2020 (MT)

Table 61 Italy: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 62 Italy: Market Size, By Application, 2013–2020 (MT)

Table 63 Spain: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 64 Spain: Market Size, By Application, 2013–2020 (MT)

Table 65 Rest of Europe: Betaine Market Size, By Application,2013–2020 (USD Million)

Table 66 Rest of Europe: Market Size, By Application, 2013–2020 (MT)

Table 67 Asia-Pacific: Betaine Market Size, By Country, 2013–2020 (USD Million)

Table 68 Asia-Pacific: Market Size, By Country, 2013–2020 (MT)

Table 69 Asia-Pacific: Market Size, By Type, 2013–2020 (USD Million)

Table 70 Asia-Pacific: Market Size, By Type, 2013–2020 (MT)

Table 71 Asia-Pacific: Market Size, By Form, 2013–2020 (USD Million)

Table 72 Asia-Pacific: Market Size, By Form, 2013–2020 (MT)

Table 73 Asia-Pacific: Market Size, By Application, 2013–2020 (USD Million)

Table 74 Asia-Pacific: Market Size, By Application, 2013–2020 (MT)

Table 75 China: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 76 China: Market Size, By Application, 2013–2020 (MT)

Table 77 Australia: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 78 Australia: Market Size, By Application, 2013–2020 (MT)

Table 79 Japan: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 80 Japan: Market Size, By Application , 2013–2020 (MT)

Table 81 Rest of Asia-Pacific: Betaine Market Size, By Application,2013–2020 (USD Million)

Table 82 Rest of Asia-Pacific: Market Size, By Application, 2013–2020 (MT)

Table 83 Latin America: Betaine Market Size, By Country, 2013–2020 (USD Million)

Table 84 Latin America: Market Size, By Country, 2013–2020 (MT)

Table 85 Latin America: Market Size, By Type, 2013–2020 (USD Million)

Table 86 Latin America: Market Size, By Type, 2013–2020 (MT)

Table 87 Latin America: Market Size, By Form, 2013–2020 (USD Million)

Table 88 Latin America: Market Size, By Form, 2013–2020 (MT)

Table 89 Latin America: Market Size, By Application,2013–2020 (USD Million)

Table 90 Latin America: Market Size, By Application, 2013–2020 (MT)

Table 91 Brazil: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 92 Brazil: Market Size, By Application, 2013–2020 (MT)

Table 93 Argentina: Betaine Market Size, By Application, 2013–2020 (USD Million)

Table 94 Argentina: Market Size, By Application, 2013–2020 (MT)

Table 95 Rest of Latin America: Betaine Market Size, By Application,2013–2020 (USD Million)

Table 96 Rest of Latin America: Market Size, By Application,2013–2020 (MT)

Table 97 RoW: Betaine Market Size, By Country, 2013–2020 (USD Million)

Table 98 RoW: Market Size, By Country, 2013–2020 (MT)

Table 99 RoW: Market Size, By Type, 2013–2020 (USD Million)

Table 100 RoW: Betaine Market Size, By Type, 2013–2020 (MT)

Table 101 RoW: Market Size, By Form, 2013–2020 (USD Million)

Table 102 RoW: Market Size, By Form, 2013–2020 (MT)

Table 103 RoW: Market Size, By Application, 2013–2020 (USD Million)

Table 104 RoW: Market Size, By Application, 2013–2020 (MT)

Table 105 South Africa: Betaine Market Size, By Application,2013–2020 (USD Million)

Table 106 South Africa: Market Size, By Application, 2013–2020 (MT)

Table 107 Others in RoW: Betaine Market Size, By Application,2013–2020 (USD Million)

Table 108 Others in RoW: Market Size, By Application, 2013–2020 (MT)

Table 109 New Product Launches, 2013-2015

Table 110 Expansions & Investments, 2012–2015

Table 111 Acquisitions, 2011–2015

Table 112 Agreements/Joint Ventures, 2012–2015

List of Figures (100 Figures)

Figure 1 Research Design

Figure 2 Key Data From Secondary Sources

Figure 3 Key Data From Primary Sources

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation& Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Breakdown & Data Triangulation

Figure 8 Food & Beverages Application Segment of the Betaine Market to Grow at the Highest Rate

Figure 9 Synthetic Betaine to Dominate the Global Market, By Type

Figure 10 Betaine Anhydrous to Be the Most Attractive Investment Option for Manufacturers

Figure 11 China, Australia, and Japan are Estimated to Be the Fastest-Growing Betaine Market

Figure 12 Attractive Growth Opportunities in the Market for Manufacturers

Figure 13 Betaine Market: Asia-Pacific to Grow at the Highest CAGR Between2015 and 2020

Figure 14 U.S. Emerges as the Largest Consumer of Betaine in North America

Figure 15 Natural Betaine to Grow at A Higher CAGR in Terms of Both Value and Volume From 2015 to 2020

Figure 16 Application in Cosmetics Dominated the Betaine Market in 2014

Figure 17 Asia-Pacific to Grow at the Fastest Pace in the Global Market

Figure 18 Betaine Market Evolution

Figure 19 Betaine Content in Natural Sources

Figure 20 Market Segmentation

Figure 21 Market Segmentation, By Type

Figure 22 Market Segmentation, By Form

Figure 23 Market Segmentation, By Application

Figure 24 Increased Application in Personal Care and Animal Feed Industry to Lead the Global Betaine Market in Future

Figure 25 GDP of Leading Countries, 2013

Figure 26 Global Betaine Market : Value Chain Analysis

Figure 27 Global Betaine Market : Porters Five Forces Analysis

Figure 28 Market, By Type

Figure 29 Synthetic Betaine Segment to Dominate Global Betaine Market By 2020

Figure 30 Asia-Pacific Market is Projected to Grow at the Highest Pace InThe Global Synthetic Betaine Segment By 2020

Figure 31 Betaine Content in Food Products

Figure 32 North America Held the Largest Share in Global Natural Betaine Segment, 2014

Figure 33 Market, By Form

Figure 34 Cocamidopropyl Betaine Held the Largest Share in the Global Betaine Market, 2014

Figure 35 North America Led the Betaine Anhydrous Market, 2014

Figure 36 Asia-Pacific to See the Fastest Growth in the Cocamidopropyl Betaine Form Segment

Figure 37 North America Accounted for the Highest Share in the Betaine Monohydrate Market, 2014

Figure 38 North America is Projected to Register the Fastest Growth Between 2015 & 2020

Figure 39 Market, By Application

Figure 40 Cosmetics Held Largest Share in Betaine Market, 2014

Figure 41 Asia-Pacific to See Fastest Growth in Food & Beverages Segment,2015–2020

Figure 42 Asia-Pacific Led the Betaine in Animal Feed Segment, 2014

Figure 43 Europe Registered the Largest Share in Betaine in Cosmetics Market, 2014

Figure 44 Asia-Pacific is Projected to Register the Fastest Growth Between2015 and 2020

Figure 45 North America to Lead Betaine in Other Applications Market, 2014

Figure 46 Market in Asia-Pacific is Expected to Grow Significantly Due to Increasing Demand From Emerging Economies

Figure 47 Regional Snapshot: Mexico and China O Be the Most Attractive Markets for Betaine Manufacturers

Figure 48 North American Betaine Market Snapshot: U.S. Accounting ForThe Largest Share

Figure 49 U.S. Led the North America Betaine Market in 2014

Figure 50 Synthetic Betaine Held Largest Share in the North American Betaine Market in 2014

Figure 51 Cocamidopropyl Betaine is Expected to Dominate the North American Market in 2020

Figure 52 Cosmetics Accounted for the Largest Share in the North American Betaine Market in 2014

Figure 53 Cosmetics is Projected to Lead the U.S. Betaine Market in 2020

Figure 54 Cosmetics to Dominate the Canadian Betaine Market in 2020

Figure 55 Food & Beverages to Grow at the Fastest Pace From 2014 to 2020

Figure 56 U.K. is Expected to Be the Fastest Growing Market for Betaine in Europe From 2014 to 2020

Figure 57 Synthetic Betaine Held Largest Share in the European Betaine Market in 2014

Figure 58 Cocamidopropyl Betaine Held Largest Share in the European Betaine Market in 2014

Figure 59 Cosmetics to Lead the European Market From 2014 to 2020

Figure 60 Cosmetics Led the U.K. Betaine Market in 2014

Figure 61 Food & Beverages to Witness the Fastest Growth in Germany By 2020

Figure 62 Cosmetics is Expected to Dominate the Betaine Market in France From 2014 to 2020

Figure 63 Cosmetics to Hold Largest Share in the Betaine Market in Italy By 2020

Figure 64 Cosmetics to Lead the Betaine Market in Spain By 2020

Figure 65 Cosmetics Dominated the Betaine Market in 2014

Figure 66 Asia-Pacific Betaine Market Snapshot: China Accounting for the Largest Market Share

Figure 67 Japan is Expected to Be the Fastest Growing Market for Betaine By 2020

Figure 68 Synthetic Betaine Dominated the Asia-Pacific Betaine Market in 2014

Figure 69 Asia-Pacific Betaine Market to Be Dominated By Cocamidopropyl Betaine in 2020

Figure 70 Food & Beverages to Witness the Fastest Growth in Asia-Pacific From 2014 to 2020

Figure 71 Cosmetics Held Largest Share in the Chinese Betaine Market in 2014

Figure 72 Cosmetics to Grow at the Fastest Rate in the Australian Betaine Market By 2020

Figure 73 Food & Beverages to Witness Highest Growth From 2014 to 2020

Figure 74 Cosmetics Led the Rest of Asia-Pacific Betaine Market in 2014

Figure 75 Brazil is Expected to Dominate the Betaine Market in Latin America By 2020

Figure 76 Synthetic Betaine to Lead the Latin American Betaine Market From2014 to 2020

Figure 77 Cocamidopropyl Betaine to Dominate the Latin American Betaine Market By 2020

Figure 78 Food & Beverages to Witness the Fastest Growth in Latin America From 2014 to 2020

Figure 79 Cosmetics to Dominate the Brazil Betaine Market By Application By 2020

Figure 80 Cosmetics Held the Largest Share in Betaine Market in Argentina in 2014

Figure 81 Cosmetics is Projected to Be the Largest Application Segment in the Rest of Latin American Countries in 2020

Figure 82 South Africa is Expected to Lead the RoW Betaine Market From2014 to 2020

Figure 83 Synthetic Betaine to Be the Largest Betaine Market in RoW By 2020

Figure 84 Cocamidopropyl Betaine to Dominate the RoW Betaine Market By Form By 2020

Figure 85 Cosmetics to Lead the RoW Betaine Market By Application in 2020

Figure 86 Cosmetics to Be the Largest Betaine Market in South Africa in 2020

Figure 87 Cosmetics to Dominate this Market By Application in the “Others in RoW” Market in 2020

Figure 88 Key Companies Preferred Partnerships & Joint Ventures Strategy(2010-2015)

Figure 89 Investments & Expansions: the Key Strategy, 2010–2015

Figure 90 Europe is the Most Active Region During 2010–2015

Figure 91 Most Developments Observed in 2015

Figure 92 Geographic Revenue Mix of Top Five Market Players

Figure 93 Associated British Foods PLC: Company Snapshot

Figure 94 BASF SE: Company Snapshot

Figure 95 E.I. Du Pont De Nemours & Company: Company Snapshot

Figure 96 Nutreco N.V.: Company Snapshot

Figure 97 Solvay S.A.: Company Snapshot

Figure 98 American Crystal Sugar Company: Company Snapshot

Figure 99 KAO Corporation: Company Snapshot

Figure 100 Stepan Company: Company Snapshot

Growth opportunities and latent adjacency in Betaine Market