Probiotics in Animal Feed Market

Probiotics in Animal Feed Market by Source (Bacteria, Yeast & Fungi), Livestock (Poultry, Swine, Ruminants, Aquaculture, Pet, and Other Livestock), Form (Liquid, Dry), Strain Specificity, Function, Distribution Channel, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The probiotics in animal feed market is projected to expand from USD 5.40 billion in 2025 to USD 8.27 billion by 2030, at a CAGR of 8.9% during the forecast period. The global probiotics in animal feed market is flourishing, with rising demand and growing concerns over sustainable and antibiotic-free livestock production. Probiotics are being added to animal feed to improve gut health, improve immunity, improve feed efficiency, and reduce disease outbreaks. Rising farmer awareness, advancing microbiology, and antibiotic-resistance regulations are motivating further adoption. The trends in animal feed probiotics are particularly strong in the poultry, swine, and aquaculture sectors, as developing nations foster broad take-up levels allowing a wealth of market opportunity.

KEY TAKEAWAYS

-

by LivestockBased on livestock, the market is categorized into poultry, swine, ruminants, aquaculture, pets, and other livestock species such as equine. Poultry represents the largest and most established application area, driven by the global shift toward antibiotic-free broiler and layer production. Aquaculture, however, is emerging as the fastest-growing segment as fish and shrimp producers increasingly rely on probiotics to improve water quality, feed conversion ratios, and disease resistance. The pet segment also shows strong premiumization trends fueled by rising consumer focus on digestive and immune health for companion animals.

-

by SourceThe probiotics in animal feed market is segmented into bacteria-based and yeast & fungi-based sources. Bacterial probiotics primarily include Lactobacilli, Bifidobacteria, and Streptococcus thermophilus, which are widely recognized for their strong ability to colonize the gut and promote digestive health. Yeast & fungi sources such as Saccharomyces cerevisiae and Saccharomyces boulardii offer higher heat stability during feed processing, making them especially suitable for pelletized feed and ruminant nutrition. Overall, bacteria dominate the market due to broader application and stronger clinical support, while yeast-based probiotics are gaining momentum in high-temperature processing environments.

-

By FormThe market by form includes dry and liquid probiotics. Dry formats such as powders, premixes, and encapsulated granules dominate due to better shelf life, easier handling, and resilience during feed manufacturing processes like extrusion and pelleting. Liquid probiotics are growing in specific segments, particularly aquaculture and early-stage livestock rearing, where administration through water or spray systems offers convenience and faster absorption. Dry forms remain preferred in large-scale feed production, while liquids see demand in targeted and high-value applications.

-

by Strain SpecificityBy strain specificity, the market is divided into single-strain and multi-strain probiotics. Single-strain products are utilized for targeted functional benefits such as pathogen inhibition or improved digestion of specific nutrients. In contrast, multi-strain probiotics are gaining significant adoption as they offer synergistic effects, leading to broader improvements in gut microbiome stability, immunity, and performance outcomes. As producers increasingly focus on comprehensive livestock health solutions, multi-strain formulations are expected to expand their market share.

-

By FunctionFunctionally, probiotics are used to improve nutrition, gut health, yield, immunity, and overall productivity in livestock species. The biggest growth driver is the shift toward enhancing gut integrity and reducing dependency on antibiotic growth promoters (AGPs), aligning with global regulatory restrictions and consumer expectations. In addition to supporting digestion, probiotics are valued for boosting immune response, improving weight gain, and enhancing reproductive performance — all of which translate into stronger farm profitability and improved product output such as meat, milk, and eggs.

-

By Distribution ChannelDistribution channels include direct sales to distributors, direct sales to livestock farmers and integrated feed producers, and other niche channels such as online platforms or veterinary networks. Distributors hold the largest share, especially in developing regions where they play a key role in logistics and technical support. However, the rise of vertically integrated livestock operations is accelerating the adoption of direct-to-farm sales, enabling tailored probiotic solutions. Additionally, e-commerce platforms are gaining relevance in the pet probiotics segment, enhancing accessibility for small-scale consumers.

-

By RegionThe market is analyzed across North America (U.S., Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, and other European countries), Asia Pacific (China, India, Japan, Australia & New Zealand, and other APAC countries), South America (Brazil, Argentina, and rest of South America), and the Rest of the World (Middle East and Africa).

-

Competitive LandscapeThe probiotics in animal feed market is led by major global companies such as Evonik Industries (Germany), ADM (US), dsm-firmenich (Switzerland), Novonesis (Denmark), and International Flavors & Fragrances Inc. (US), which hold strong competitive positions due to advanced R&D capabilities, diversified probiotic offerings, and robust global distribution networks. These top players continue to reinforce their market leadership through investments in novel microbial strains, capacity expansion, and solutions aligned with the global shift toward antibiotic-free livestock production. Overall, the competitive landscape is moderately consolidated, with these leading companies leveraging scale, technological innovation, and species-specific product development to drive growth, while regional and niche players enhance market dynamism through localized expertise and tailored applications.

The probiotics in animal feed market is experiencing robust growth driven by the rising focus on livestock health, improved gut performance, and the global move away from antibiotic growth promoters. Probiotics are increasingly recognized as essential functional feed additives that enhance digestion, boost immunity, and improve overall productivity in poultry, swine, ruminants, aquaculture, and companion animals. Expansion in intensive livestock farming, coupled with greater awareness of animal welfare and food safety, is accelerating the adoption of scientifically validated microbial solutions. Additionally, advancements in strain development and encapsulation technology, along with the expansion of direct-to-farm distribution channels, are widening product accessibility. As producers seek sustainable and cost-effective performance enhancers, the market for animal feed probiotics continues to evolve with strong innovation pipelines and growing demand across both developed and emerging regions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The probiotics in animal feed market is undergoing a major transformation as livestock producers shift from conventional feed additives to advanced, microbiome-driven performance solutions. Regulatory restrictions on antibiotic growth promoters (AGPs), combined with increasing disease pressure and growing demand for residue-free animal protein, are accelerating the adoption of probiotics across poultry, swine, ruminants, and aquaculture production systems. Feed manufacturers and integrators are prioritizing high-survivability strains such as Bacillus and Lactobacillus, while multi-strain synbiotic formulations are gaining traction due to their stronger immunity benefits and productivity uplift. Innovation in delivery formats — including heat-resistant spores, microencapsulation technologies, and water-soluble liquid dosing — is helping ensure greater strain longevity, especially throughout pelleting and high-temperature processing. Customers are increasingly expecting specificity, with species-focused probiotic solutions targeting gut integrity in poultry, post-weaning performance in swine, methane reduction in ruminants, and survival rate improvements in aquaculture. Downstream, livestock producers are experiencing measurable enhancements in feed conversion ratios, reduced morbidity and mortality, lower veterinary costs, and improved meat, milk, and egg output — strengthening business sustainability. At the same time, global buyers and consumers are pushing for cleaner labels, traceable supply chains, and environmentally responsible farming, positioning probiotics as a critical enabler for future-ready protein production. As a result, revenue models in the animal feed industry are shifting rapidly, with probiotics expected to become one of the dominant value-driving additive categories over the coming years.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for antibiotic alternatives

-

Growing demand for high-quality meat, dairy & poultry products

Level

-

High costs of quality probiotics

-

Variability in effectiveness across animal species & farm conditions

Level

-

Increasing demand in developing countries due to growing livestock sector

-

Development of multi-strain and customized species-specific solutions

Level

-

Maintaining stability and viability of probiotics in feed processing

-

Strong competition from alternative feed additives (prebiotics, enzymes)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

DRIVERS: Rising demand for antibiotic alternatives

The worldwide move from antibiotic growth promoters (AGPs) in livestock farming is driving the adoption of probiotics as sustainable and viable alternatives. A research paper published by Frontiers in January 2024 found that escalating utilization of AGPs is generating increasing concern over antimicrobial resistance (AMR). The research demonstrated that probiotics including many of the strains of Lactobacillus and Bifidobacterium will inhibit the pathogens Clostridium perfringens, and Salmonella while enhancing gut health, immunity, and nutrient absorption. Probiotics aid in supporting the gut barrier and pre-existing beneficial microbiota, which will assist in controlling infections and provide improvements to growth performance. The results clearly demonstrate the important contributions of probiotics moving towards sustainable livestock practices based on responsible use of antimicrobials.

RESTRAINTS: High costs of quality probiotics

The expense of high-quality probiotics continues to be a major factor inhibiting uptake, especially for small-scale and resource-poor farmers. Quality probiotic formulations require sophisticated production technologies to ensure microbial viability, shelf life, and effectiveness under variable feed processing and storage conditions after production. Increased costs of production and quality control mean that these products are typically more expensive than traditional additives. This is a major challenge for smallholders working on tight margins who may not see a short-term return on their investment or the value in moving to probiotic-rich feed. The financial hurdle may keep these products from entering developing markets even though the benefits of probiotics to animal health are well-known to be long-term.

OPPORTUNITIES: Increasing demand in developing countries due to growing livestock sector

The livestock sector within developing nations is ever-expanding and growing particularly fast in segments such as poultry, swine, and dairy therefore increasing feed probiotics demand. Additionally, as animal farming is intensifying in countries, such as China, India and Vietnam, the emphasis on improving animal health, productivity, and sustainability—the major elements influencing probiotic adoption in feed formulations—are stronger than ever. Probiotics are essential for improving gut health, immunity, nutrient absorption in animal production, which is significant in developing countries as they strive for food production on a large-scale basis, while managing the reduction of antibiotic usage. With a combined total of 230.58 million tonnes of milk produced in 2022-23, an increase of 3.83% from the previous year, India’s Department of Animal Husbandry and Dairying (2023-24) reports further growth in animal care by producing 8.90% more cow milk in 2020 and working towards even more significant production increases in future years. In 2023, the USDA reported China’s beef production to grow by 2.7% in 2024 to reach 7.7 million tonnes, demonstrating a growing global understanding of the need for probiotics in livestock systems to support higher productivity and health outcomes.

CHALLENGES: Maintaining stability and viability of probiotics in feed processing

One of the primary obstacles in the animal feed probiotics market is retaining the stability and viability of the probiotic strains through the processing and storage of animal feed. During processing and pelleting, high temperatures (often over 80°C) and pressure can impact sensitive probiotic organisms and their efficacy by the time they are consumed by animals. Despite these conditions, probiotics must remain viable throughout the transport and storage conditions. This challenge is faced by many producers and consumers when the environmental conditions change. Many of the probiotic strains cannot tolerate the acidic environment of the animal’s digestive tract, which can impede their ability to survive or colonize the gut, limiting the health benefits intended.

probiotics animal feed market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops science-backed probiotic feed additives such as GutCare® designed to improve gut microbiota balance, reduce harmful pathogens, and enhance feed efficiency in poultry and swine. | Strengthens livestock performance, reduces dependency on antibiotic growth promoters (AGPs), and enhances farm profitability through efficiency gains. |

|

Offers multi-strain probiotics and tailored nutrition solutions that support digestion, nutrient utilization, and stress management in animals across poultry, swine, and ruminants. | Expands integrated nutrition portfolio, increases brand value in sustainable animal farming, and boosts global market penetration. |

|

Provides advanced microbial solutions targeting immunity improvement, productivity enhancement, and improved gut integrity for dairy cattle and poultry. | Enhances competitive advantage through innovation leadership, supports premium pricing, and strengthens customer trust in scientific-performance solutions. |

|

Delivers next-generation microbial probiotics designed to enhance digestive resilience, improve feed conversion, and support healthier animals in intensive farming systems. | Differentiates through strong biotechnology expertise, drives adoption in high-growth markets like aquaculture, and boosts margins with high-value microbial solutions. |

|

Supplies targeted probiotic formulations that enhance gut health, maintaining a stable microbiome to improve immunity and reduce disease outbreaks in livestock and pets. | Grows presence in value-added feed additives, diversifies revenue streams beyond flavors & ingredients, and supports expansion into companion animal nutrition. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Some of the prominent companies in this market include well-established and financially sound manufacturers of probiotics in animal feed. These companies have been operational in the market for more than a decade and have diversified portfolios, the latest technologies, and excellent global sales and marketing networks. Some of the prominent companies in this market include Evonik Industries AG (Germany), ADM (US), dsm-firmenich (Switzerland), Novonesis (Denmark), and International Flavors & Fragrances Inc. (US).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

By livestock

The poultry segment represents the largest market share by livestock in the probiotics in animal feed market because of the level of consumption, short production cycles, and the increasing demand for antibiotic alternatives. The USDA report (May 2023) highlighted the significant growth in US poultry production between 2013 and 2022. Broilers (+22 percent) and eggs (+10 percent) dominated the increases in US poultry production from 2013 to 2022 in need of food. In 2022, the poultry sector sales totaled USD 76.9 billion in sales, a 67 percent increase from 2021. Broiler sales reached a 60 percent increase, turkey sales were up 21 percent, while egg sales soared by 122 percent from 2021. Globally, this growth is being driven by increased preference for poultry meat, rising export demand, and the expansion of feed-efficient poultry production systems.

By form

The dry segment accounts the largest market share by form in the probiotics in animal feeds market, largely because of its shelf life, storage, and reduced cost of shipping. Under pelleting and processing conditions, dry probiotics are a clear preference for feed manufacturers as well. They are stable and allow for the greatest survivability of specific strains, while still providing steady growth in demand. Growth is driven by large-scale suppliers wanting bulk feed production, but still looking for increasingly scalable integration of probiotics enabling opportunities for large-scale sales. Dry probiotics are convenient for feed manufacturers to mix with premixes and compound feeds and mitigate major issues with gut health and productivity of livestock species in various parts of the world.

REGION

Asia Pacific is estimated to lead the market during the forecast period.

In the probiotics in animal feed market, Asia Pacific has the largest market share, as a result of having the largest livestock population in the world, high level of urbanization, and a rising demand for meat and dairy production. China, India, and Vietnam have quickly invested in animal health & nutrition to enhance productivity and resilience. The region's regulatory activities, and growing awareness of antibiotic-free production systems and rising awareness for natural, health and quality assurance for meat production systems have supported the market growth. Additionally, increased investments in modern farming systems and the expansion of feed mill capacity will ultimately drive manufacturers to offer more next-generation, species-specific probiotics relevant to a mixed agriculture region.

probiotics animal feed market: COMPANY EVALUATION MATRIX

The probiotics in animal feed market is shaped by a diverse mix of global leaders and specialized regional players that compete through innovation, product performance, and strong distribution capabilities. Major multinational companies focus on developing advanced microbial solutions that promote antibiotic-free livestock production, enhance gut health, and improve overall animal productivity, enabling them to secure strong presence across key livestock sectors such as poultry, swine, ruminants, and aquaculture. Continuous investments in strain development, technology advancements, and capacity expansion further strengthen their leadership. Meanwhile, emerging biotechnology-focused firms bring agility by delivering tailored, species-specific, and cost-efficient probiotic products, contributing to increased innovation and broader adoption of probiotics in both developed and emerging agricultural markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Evonik Industries AG (Germany)

- ADM (US)

- dsm-firmenich (Switzerland)

- Novonesis (Denmark)

- International Flavors & Fragrances Inc. (US)

- Alltech (US)

- Kemin (US)

- Orffa (Netherlands)

- Lallemand Inc. (Canada)

- Lesaffre (France)

- Church & Dwight Co., Inc (US)

- Phibro Animal Health Corporation (US)

- Sanzyme Biologics (India)

- Virbac (France)

- International Animal Health Products (Australia)

- Provita Animal Health (Ireland)

- Advanced Aqua Biotechnologies (India)

- Zeigler Feeds (US)

- Unique Biotech Limited (India)

- CanBiocin Inc. (Canada)

- Indogulf Company (US)

- Pellucid Lifesciences Pvt. Ltd. (India)

- AnimalBiome (US)

- Native Microbials (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 5.40 Billion |

| Revenue Forecast in 2030 | USD 8.27 Billion |

| Growth Rate | CAGR of 8.9% from 2025-2030 |

| Actual data | 2020–2030 |

| Base year | 2024 |

| Forecast period | 2025–2030 |

| Units considered | Value (USD Billion), Volume (KT) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Source: Bacteria (Lactobacilli, Bifidobacteria, Streptococcus Thermophilus), and Yeast & Fungi (Saccharomyces Cerevisiae, Saccharomyces Boulardii, Other Yeast & Fungi Sources) by Livestock: Poultry, Swine, Ruminants, Aquaculture, Pet, and Other Livestock. by Form: Dry, and Liquid. by Strain Specificity: Single-Strain Probiotics, and Multi-Strain Probiotics. by Function: Nutrition, Gut Health, Yield, Immunity, and Productivity. by Distribution Channel: Direct Sales to Distributors, Direct Sales to Livestock Growers and Feed Integrators, and Other Distribution Channels. |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

WHAT IS IN IT FOR YOU: probiotics animal feed market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Animal Feed Manufacturers & Integrators | 1. Probiotic strain performance benchmarking by livestock species (poultry, swine, ruminants, aquaculture) 2. Customized formulation guidance based on dry or liquid formats | 1. Improved feed efficiency and animal productivity 2. Scientific-backed product differentiation |

| Veterinary & Animal Health Organizations | 1. Comparative evaluation of immunity enhancement and disease resistance benefits 2. Case study insights on reducing antibiotic usage | 1. Strengthened preventive healthcare strategies 2. Better animal welfare outcomes and lower mortality |

| Regulatory Bodies & Quality Assurance Authorities | 1. Region-specific regulatory landscape mapping for probiotic strains (US, EU, APAC) 2. Safety validation guidelines — GRAS & microbial contaminant limits 3. Labeling compliance framework for functional claims | 1. Standardized regulation enforcement 2. Improved market transparency & product reliability 3. Strengthened food chain safety across regions |

| Distributors & Supply Chain Stakeholders | 1. Market access evaluation and product positioning strategies by species segment 2. Competitive benchmarking for regional advantage | 1. Stronger channel partner engagement 2. Increased adoption through informed decision-making 3. Faster market expansion and revenue growth |

RECENT DEVELOPMENTS

- March 2025: IFF launched its Enviva PRO three-strain Bacillus probiotic for swine in order to better support piglet gut health at the critical point of weaning. The advent of the product there fore also dedicated an addition to IFF's animal nutrition portfolio. It gave the company the opportunity to tap into the increased demand for effective science-based products within livestock while allowing swine producers to increase animal welfare, productivity, and profitability.

- March 2025: Orffa's partnership with Florates strengthened its foothold in the probiotics in animal feed market by adding rapid, non-intrusive gut health diagnostics, giving producers access to live microbiome data for fast interventions, feed plan redesign, and improved animal outcomes, elevating Orffa's part in delivering sustainable, databased livestock management plans.

- July 2023: BOVAMINE DEFEND Plus - a science-based probiotic for feedlot cattle – was launched in the US. This product adds to the company's cattle health portfolio by providing a presentation that is also sustainable and enhances digestion and immunity. This continued growth of Chr. Hansen's ruminant probiotic portfolio reinforces the company’s commitment towards sustainable animal nutrition and establishes it as a leader in probiotic and sustainable solutions for livestock nutrition.

- July 2022: Kemin Industries launched ENTEROSURE, the next generation probiotic that fights intestinal diseases in poultry and livestock. At the 2022 Food Ingredients Europe held in Dubai, Kemin officially launched ENTEROSURETMM, which promotes a healthy microbiome, supports gut resilience and animal productivity, and provides a one-stop solution amidst tightening restrictions on antibiotics and rising raw material prices.

- November 2021: ADM acquired Deerland Probiotics & Enzymes, which adds capabilities in the animal feed probiotics space with leading probiotic, prebiotic and enzyme technologies. Using Deerland's stable spore probiotics, ADM can leverage Deerland's expertise to further its pet nutrition and livestock feed offerings in the face of increased demand for gut health and immunity, as well as overall animal wellness globally.

Table of Contents

Methodology

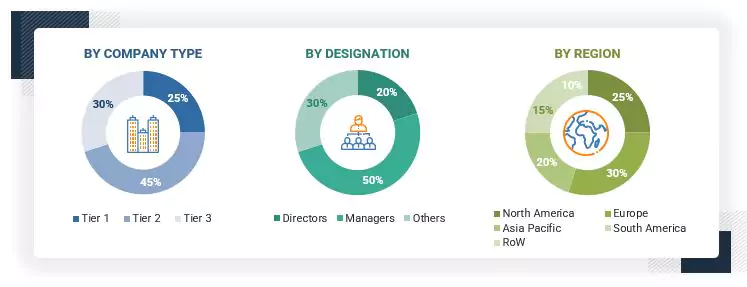

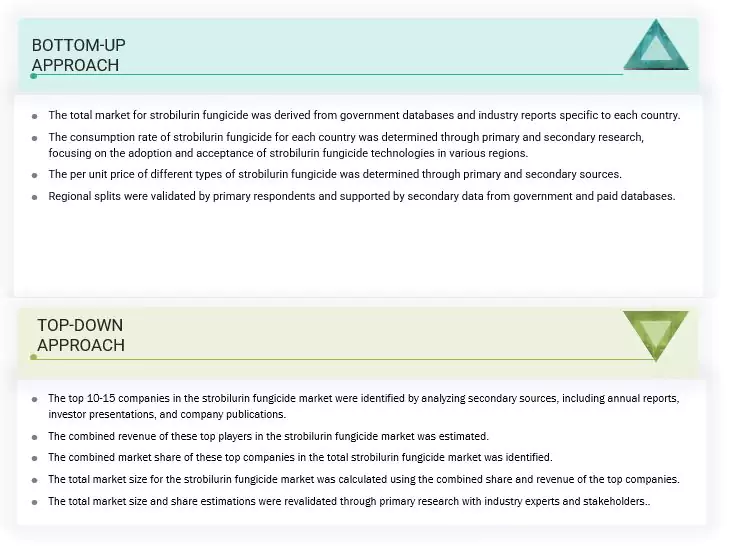

The study involved two major approaches in estimating the current size of the probiotics in animal feed market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as the International Probiotics Association (IPA), American Feed Industry Association (AFIA), annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to identify and collect information.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

The market comprises several stakeholders in the supply chain: suppliers, manufacturers, and end-use product manufacturers. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the manufacturing of probiotics in animal feed market. The primary interviewees from the demand side include feed mills, livestock growers, feed integrators, and co-operatives of the feed industry.

After the complete market engineering (which included calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and to verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, key players, competitive landscape of probiotics in animal feed supplied by different market players, and key market dynamics, such as drivers, restraints, opportunities, industry trends, and key player strategies.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024,

as per the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD

100 million ≤ Revenue ≤ USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Evonik Industries AG (Germany) |

R&D Expert |

|

ADM (US) |

Sales Manager |

|

DSM-Firmenich (Switzerland) |

Manager |

|

International Flavors & Fragrances Inc. (US) |

Sales Manager |

|

Sanzyme Biologics (India) |

Marketing Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the market's total size. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the markets were identified through extensive secondary research.

- The probiotics in animal feed market was determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the probiotics in animal feed market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Probiotics in Animal Feed Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall probiotics in animal feed market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

The Food and Agriculture Organization of the United Nations (FAO) and World Health Organization (WHO) Working Group define probiotics as “live micro-organisms which, when administered in adequate amounts, confer a health benefit on the host. However, there are several types, including bacteria or non-bacterial; spore-forming and non-spore-forming; multi-species or single-species; and allochthonous or autochthonous; those are that are or aren’t likely to be found in an animal’s gastrointestinal tract (FAO/WHO, 2001).”

The probiotics in animal feed market is defined as the segment of the animal nutrition industry focused on the production, distribution, and use of live beneficial microorganisms—primarily bacteria and sometimes yeasts or fungi—added to animal feed to enhance gut health, immunity, productivity, and overall well-being of livestock such as poultry, swine, ruminants, aquaculture species, and pets. According to the Food and Agriculture Organization (FAO) and World Health Organization (WHO), probiotics are “live micro-organisms which when administered in adequate amounts confer a health benefit on the host,” and in the context of animal feed, these microorganisms are used as natural alternatives to antibiotics, supporting sustainable and efficient animal farming practices. The market encompasses a wide range of stakeholders, including manufacturers, feed processors, livestock producers, veterinarians, and regulatory authorities, all working towards improving animal health and productivity through the adoption of probiotic feed additives.

Stakeholders

- Raw material suppliers of probiotics used in animal feed

- Intermediate stakeholders, including distributors, retailers, associations, and regulatory bodies

- Manufacturers and traders of probiotics used in animal feed

- Manufacturers and processors of animal feed and farmers

- Trade associations and industry bodies

- Government organizations, research organizations, and consulting firms

- Importers and exporters of probiotics incorporated animal feed

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- European Food and Fermentation Cultures Association (EFFCA)

- International Scientific Association for Probiotics and Prebiotics (ISAPP)

- International Probiotics Association (IPA)

- American Feed Industry Association (AFIA)

- United States Department of Agriculture (USDA)

- Organisation for Economic Co-operation and Development (OECD)

Report Objectives

- Determining and projecting the size of the market for probiotics in animal feed, with respect to its source, livestock, form, strain specificity, function, distribution channel and regional markets

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Understanding the market trends with respect to the function of probiotics in animal feed and distribution channels

- Providing detailed information about the key factors influencing the market growth

- (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for major countries related to the market for probiotics in animal feed

- Analyzing the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Service Matrix, which gives a detailed comparison of the service portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of European probiotics in animal feed market into key countries.

- Further breakdown of the Rest of Asia Pacific probiotics in animal feed market into key countries.

- Further breakdown of the Rest of South American probiotics in animal feed market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the probiotics in animal feed market?

The probiotics in animal feed market is estimated to be USD 5.40 billion in 2025 and is projected to reach USD 8.27 billion by 2030, registering a CAGR of 8.9% during the forecast period.

Which are the key players in the market, and how intense is the competition?

Evonik Industries AG (Germany), ADM (US), dsm-firmenich (Switzerland), Novonesis (Denmark), and International Flavors & Fragrances Inc. (US) are some of the key market players. The market for probiotics in animal feed is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing.

Which region is projected to account for the largest share of the probiotics in animal feed market?

Asia Pacific leads the animal feed probiotics market share due to its extensive livestock population, increasing demand for meat consumption, regulations allowing additives, and an increased focus on sustainable methods of animal farming and livestock management.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the probiotics in animal feed market?

Increasing demand for antibiotic alternatives, increasing knowledge of animal gut health, regulatory developments on natural additives, livestock productivity, and consumer demand for meat with no residues are some of the factors that are leading to the growth in the probiotics in animal feed market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Probiotics in Animal Feed Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Probiotics in Animal Feed Market