Beverage Packaging Market by Packaging Type (Bottle, Can, Pouch, Carton), Material Type (Glass, Plastic, Metal, Paper & Paperboard), Product Type (Alcoholic Beverages, Non-Alcoholic Beverages, Dairy Beverages), and Region - Global Forecast to 2026

Beverage packaging Market Growth Analysis, 2026

To know about the assumptions considered for the study, download the pdf brochure

Beverage packaging Market Dynamics

Driver: Rising beverage consumption in emerging economies

The increasing global population and rising disposable income in developing economies are creating new avenues for packaged beverages. According to the Brewers Association, the total value of the beer market was USD 94.1 billion in 2020, whereas the total craft beer market was estimated at USD 22.2 billion. The alcohol per capita (15+) consumption (in liters) was recorded at 8.6 liters in 2010, which increased to 8.8 liters in 2016, according to the WHO. The increasing urban population, coupled with the changing lifestyle, has led to an increase in total packaged beverage consumption in emerging economies such as India. The data provided by the World Bank shows that around 30.58% of the total population of India resided in urban areas in 2009, which increased to 34.47% in 2019. According to a study published in the Lancet journal, alcohol consumption in India increased by 38% from 4.3 to 5.9 liters per capita during 2010 - 2017. The large population in emerging economies such as India and China is expected to drive the beverage packaging market.

The increasing health awareness among youths has increased the demand for packaged juices, energy drinks, and health drinks, providing immense opportunities for manufacturers to increase their sales. Furthermore, the increase in tourism, easy availability of bottled water, and preference for a healthy lifestyle on the go have also increased the demand for bottled water and flavored water infused with vitamins, natural flavors, or nature-identical flavoring substances such as basil, lemon, mint, orange, hibiscus, and fruits.

Restraint: Stringent environmental legislation

Packaging waste harms the ecosystem as it takes decades to decompose. Governments across the globe are addressing this issue by imposing strict laws that the beverage packaging industry is subjected to follow. For instance, governments in Europe take various steps to deal with packaging waste and recycling issues. One such legislation of the European Commission is ‘European Parliament and Council Directive 94/62/EC of 20 December 1994 on Packaging and Packaging Waste.’ This directive provides measures aimed at limiting the production of packaging waste and promoting recycling, reuse, and other forms of waste recovery.

Opportunity: Increasing use of biodegradable and renewable raw materials

The increasing awareness of environmental safety among consumers and the rising adoption of eco-friendly products provide manufacturers of beverage packing products with immense opportunities. According to a study conducted by National Retail Federation, 69% of participants in North America are ready to pay a premium price for recycled products, while 80% of participants want to know the origin of the products they buy. Bioplastics are polymers obtained from renewable sources, such as corn starch, woodchips, vegetables, and fatty oils.

Bacardi Limited, in 2020, announced that it would be using 100% biodegradable plastic packaging made with plant-based oils for all its brands by 2023. Thus, the shift of beverage brands to bioplastic bottles from conventional materials for packaging their beverages provides new opportunities for players in the beverage packaging market.

Challenge: High cost of sustainable packaging

Consumers demand sustainable solutions for beverage packaging, keeping in view health and environmental issues linked with the use of synthetic polymers. Beverage packaging companies try to ensure the quality and safety of products with their available resources, but the sustainability factor increases the overall cost of production and thus, affects the overall profitability. The increasing cost of final packaging might affect sales. Therefore, this two-way challenge pressurizes companies to find a middle path that balances various dimensions of sustainability and cost management.

By packaging type, the bottle segment is estimated to hold the largest share of the beverage packaging market.

The beverage packaging market includes five major packaging types: bottle, can, pouch, carton, and others. The others segment includes bulk and draught containers for a large volume of packaging. Packages are used according to the beverages that are served. Alcoholic beverages are served in bottles and cans, whereas non-alcoholic drinks are mostly served in bottles. The increasing consumption of non-alcoholic beverages is anticipated to rise the demand for bottles in beverage packaging. Bottles also offer great convenience in carrying and storage making them a preferable choice by consumers. These factors are projected to foster the demand for bottle packaging in the global beverage packaging market.

In June 2022, the sustainable beverage packaging company Petainer was purchased by the US-based private equity firm Ara Partners. Petainer, a UK-based company, creates and produces high-performance, environmentally friendly PET packaging bottles for clients in the soft drink, beer, water, and other CPG industries. The business specializes in circular applications, recycled PET, and bottles with multiple uses.

By material type, the metal segment is estimated to grow at a higher growth rate in the beverage packaging market.

The resilience and convenience offered by metal packaging are encouraging the growth of the segment. The metal used for beverages can be aluminum or steel. In the case of non-alcoholic beverages, both are used for packaging. The chemical compatibility of the product and packaging material type is critical to the quality of the product. Aluminum and steel are inert in terms of reactivity with non-alcoholic beverages; hence, the most suited material type for their packaging. Metal cans are also used for beer packaging. Can packaging for beer is growing as it has advantages over a glass of eliminating the damage from light and oxidation and keeping the beer fresh for a longer duration. Metal cans and bottles are the popular ways in which beverages are served to customers.

By product type, the dairy beverage segment is projected to grow at the fastest CAGR in the beverage packaging market until 2026.

Dairy beverages occupy a significant space in the global beverage market and the growing segment of the global beverage market. Dairy drinks are considered ideal as they provide a natural nutritional base to consumers. However, the market for dairy-based beverages remains small, but the demand for these products is expected to witness robust growth in the near future. Packaging plays a vital role in dairy beverages, as it adds value to the brand and attracts the customer. Dairy processors and packaging companies are continuously challenged to create more eco-friendly products that offer convenience to consumers and enable product differentiation to brand owners. These factors are anticipated to propel the growth of the global beverage packaging market, during the review period.

The dairy segment is observing acquisitions as a growth strategy from top players in the beverage packaging market. In January 2022, Faerch purchased PACCOR, a manufacturer of sustainable protective packaging for the dairy and ice cream industries. The acquisition reinforces Faerch's overall strategy for achieving circularity in food packaging and will accelerate the required material conversion toward sustainable packaging solutions in the European dairy sector, which is the largest segment in rigid food packaging.

To know about the assumptions considered for the study, download the pdf brochure

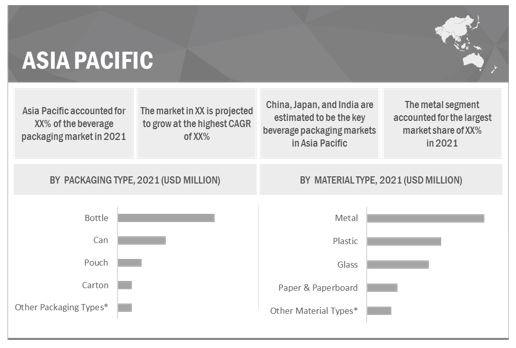

The increasing demand for beverages such as carbonated soft drinks, beer, and wine, amongst others, in the Asia Pacific countries, drives the region’s growth rate at a higher pace.

Asia Pacific is one of the emerging regions for the beverage packaging market. Countries such as China, India, Japan, Thailand, Indonesia, Australia, and New Zealand are considered for the purpose of the study. Therefore, the growth of the market is expected to be high in this region. Many types of packaging are preferred in the region, such as flexible, rigid plastic, paper, glass, and metal packaging. The demand from the beverage industry is growing due to the rise in population. Global players such as Ball Corporation (US) and Crown Holdings Inc (US) are entering the Asia Pacific market by developing new manufacturing plants in the region. This led to the rise of the packaging market for beverages. High Industrial growth, urbanization, environmental concerns, and lower production of fresh food & beverage products are driving the growth of processed food & beverage products, consequently fueling the demand for beverage packaging in this sector.

Top Companies in Beverage Packaging Market

Drink packaging companies providing packaging formats to the beverage industry include major players such as Amcor Group GmbH (Switzerland), O-I Glass, Inc. (US), Crown Holdings, Inc (US), Ardagh Group S.A. (Ireland), Verallia SA (France), Tetra Pak Group (Switzerland), Ball Corporation (US), Vidrala S.A. (Spain), Toyo Seikan Group Holdings, Ltd. (Japan), and CPMC Holdings Limited (China). These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Please visit 360Quadrants to see the vendor listing of Top 21 Sustainable Packaging Companies, Worldwide 2023

Beverage Packaging Market Report Scope

|

Report Metric |

Details |

|

Beverage Packaging Market size value in 2021

|

USD 148.1 billion |

|

Revenue forecast in 2026 |

USD 189.0 billion |

|

Growth Rate |

CAGR of 5.0% |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Billion) and Volume (Billion Liter) |

|

Segments covered |

Packaging Type, Material Type, Product Type, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

Amcor Group GmbH (Switzerland), O-I Glass, Inc. (US), Crown Holdings, Inc (US), Ardagh Group S.A. (Ireland), Verallia SA (France), Tetra Pak Group (Switzerland), Ball Corporation (US), Vidrala S.A. (Spain), Toyo Seikan Group Holdings, Ltd. (Japan), and CPMC Holdings Limited (China). |

Beverage Packaging Market Segmentation

This research report categorizes the beverage packaging market based on material type, packaging type, product type, and region.

On the basis of packaging type, the market has been segmented as follows:

- Bottle

- Can

- Carton

- Pouch

- Other packaging type

On the basis of material type, the market has been segmented as follows:

- Metal

- Plastic

- Glass

- Paper & paperboard

- Other material type

On the basis of product type, the beverage packaging market has been segmented as follows:

- Non-alcoholic beverages

- Alcoholic beverages

- Dairy beverages

On the basis of region, the market has been segmented as follows

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In June 2022, SIG, a Swiss aseptic packaging supplier, completed the acquisition of Scholle IPN, a flexible packaging business. SIG and Scholle IPN reached an agreement in February of this year to buy each other for an enterprise value of USD 1.53 billion and an equity value of USD 1.2 billion. Scholle IPN, with its headquarters in Northlake, Illinois, offers sustainable packaging systems and solutions for the food, beverage, retail, institutional, and industrial markets.

- In March 2021, Ardagh Group S.A. and Bragg Live Food Products partnered to introduce a new 16oz glass bottle for its line of apple cider vinegar beverages

- In December 2020, Amcor Group GmbH partnered with Nutrea to offer its rupro protein juice in a newly developed hot-fill Polyethylene Terephthalate (PET) bottle

- In December 2020, Vetropack Holding Ltd completed the acquisition of Moldovan Glassworks. This would help the company strengthen its market position in Europe

Frequently Asked Questions (FAQ):

What is the projected market value of the global Beverage Packaging Market?

The global beverage packaging market size is projected to reach USD 189.0 billion by 2026.

What is the estimated growth rate (CAGR) of the global Beverage Packaging Market for the next five years?

The global beverage packaging market is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2021 to 2026.

What are the major revenue pockets in the Beverage Packaging Market currently?

The beverage packaging market is divided into North America, Europe, Asia Pacific, South America, and Rest of World (RoW) based on the regional area. During the review period, the Asia Pacific region is anticipated to have the largest market share due to the increase in population and disposable income. The demand for beverage packaging is increasing in this sector due to rapid industrialization and urbanization, growing middle-class income, and concerns over the environment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION OF BEVERAGE PACKAGING MARKET (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 INCLUSIONS & EXCLUSIONS

1.5 REGIONS COVERED

1.6 PERIODIZATION CONSIDERED

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2020

1.8 VOLUME UNIT CONSIDERED

1.9 STAKEHOLDERS

1.1 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION – SUPPLY-SIDE (1/2)

FIGURE 4 MARKET SIZE ESTIMATION – SUPPLY-SIDE (2/2)

FIGURE 5 MARKET SIZE ESTIMATION – DEMAND-SIDE

2.2.1 MARKET SIZE ESTIMATION NOTES

FIGURE 6 BEVERAGE PACKAGING MARKET SIZE ESTIMATION – TOP-DOWN APPROACH

FIGURE 7MARKET SIZE ESTIMATION – BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

FIGURE 9 SCENARIO-BASED MODELLING

2.6.1 COVID-19 HEALTH ASSESSMENT

FIGURE 10 COVID-19: GLOBAL PROPAGATION

FIGURE 11 COVID-19 PROPAGATION: SELECT COUNTRIES

2.7 COVID-19 ECONOMIC ASSESSMENT

FIGURE 12 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.7.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 13 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 14 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 15 MARKET, BY TYPE, 2021 VS. 2026 (USD BILLION)

FIGURE 16 MARKET, BY MATERIAL, 2021 VS. 2026 (USD BILLION)

FIGURE 17 MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD BILLION)

FIGURE 18 MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 BRIEF OVERVIEW OF THE MARKET

FIGURE 19 GROWING DEMAND FOR SUSTAINABLE PACKAGING AND INCREASING CONSUMPTION OF HEALTHY BEVERAGES IS PROJECTED TO DRIVE THE MARKET

4.2 ASIA PACIFIC BEVERAGE PACKAGING MARKET, BY MATERIAL TYPE AND COUNTRY

FIGURE 20 METAL SEGMENT TO DOMINATE THE ASIA PACIFIC MARKET IN 2020

4.3 MARKET, BY PRODUCT TYPE AND REGION

FIGURE 21 NON-ALCOHOLIC SEGMENT TO DOMINATE THE MARKET ACROSS REGIONS IN 2020

4.4 MARKET, BY KEY COUNTRY

FIGURE 22 CHINA TO BE THE MOST LUCRATIVE MARKET

4.5 MARKET, BY REGION

FIGURE 23 ASIA PACIFIC PROJECTED TO DOMINATE THE MARKET ACROSS REGIONS BY 2026 (USD BILLION)

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASING GLOBAL POPULATION

TABLE 2 POPULATION COMPARISON, 2009-2019

FIGURE 24 POPULATION GROWTH TREND, 1950–2050

5.2.2 GROWING URBANIZATION

TABLE 3 URBAN POPULATION PERCENTAGE, 2019

5.3 MARKET DYNAMICS

FIGURE 25 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Rising beverage consumption in emerging economies

FIGURE 26 ALCOHOL PER CAPITA CONSUMPTION, 2018 (LITER)

FIGURE 27 US WINE CONSUMPTION, 2009-2018 (GALLON)

5.3.1.2 Innovative packaging increases product appeal

FIGURE 28 SURVEY: PERCENTAGE OF CONSUMERS PREFERRING SUSTAINABLE PRODUCTS

5.3.1.3 Rising demand for convenient and sustainable packaging for beverages

5.3.2 RESTRAINTS

5.3.2.1 Stringent environmental legislations

5.3.3 OPPORTUNITIES

5.3.3.1 Increasing use of biodegradable and renewable raw materials

FIGURE 29 RECYCLED PLASTIC FROM MUNICIPAL SOLID WASTE, US, 2000 – 2018 (THOUSAND TON)

5.3.3.2 Emerging economies are encouraging growth

5.3.3.2.1 Concentrating on the untapped market

FIGURE 30 INCREASE IN GDP, 2015 – 2019 (USD BILLION)

5.3.3.2.2 Transforming unpackaged into packaged

5.3.4 CHALLENGES

5.3.4.1 High cost of sustainable packaging

5.3.4.2 Infrastructural challenges in developing countries

5.4 IMPACT OF COVID-19 ON MARKET DYNAMICS

6 INDUSTRY TRENDS (Page No. - 68)

6.1 INTRODUCTION

6.2 YC-YCC SHIFT

FIGURE 31 YC -YCC SHIFT FOR THE MARKET

6.3 VALUE CHAIN ANALYSIS

FIGURE 32 BEVERAGE PACKAGING MARKET: VALUE CHAIN ANALYSIS

6.4 PEST ANALYSIS

6.4.1 POLITICAL FACTORS

6.4.1.1 Government Initiatives & Regulations

6.4.2 ECONOMIC FACTORS

6.4.2.1 Fluctuating Raw Material Prices

6.4.2.2 Rise in Population with High Disposable Income

6.4.3 SOCIAL FACTORS

6.4.3.1 Environment Risk Awareness

6.4.3.2 Human Health Concerns

6.4.4 TECHNOLOGICAL FACTORS

6.4.4.1 R&D Initiatives

6.5 ECOSYSTEM MAP

FIGURE 33 MARKET: MARKET MAP

TABLE 4 MARKET ECOSYSTEM

6.5.1 RAW MATERIAL SUPPLIERS

6.5.2 MANUFACTURERS

6.5.3 END USER COMPANIES

6.6 SUPPLY CHAIN ANALYSIS

FIGURE 34 BEVERAGE PACKAGING MANUFACTURERS BEVERAGE PACKAGING MANUFACTURERS (B2B PLAYERS): SUPPLY CHAIN

6.6.1 RAW MATERIAL SOURCING

6.6.2 MANUFACTURING

6.6.3 DISTRIBUTION, MARKETING & SALES

6.7 TRADE ANALYSIS OF BEVERAGE CANS AS A COMMODITY ACROSS MAJOR COUNTRIES

TABLE 5 TRADE DATA FOR CAN-BASED FORMATS FOR THE BEVERAGE INDUSTRY (2020)

6.8 TECHNOLOGY ANALYSIS

6.9 ANALYSIS FOR BEVERAGE-BASED PACKAGING

6.9.1 MICRO PACKAGING

6.9.2 THE ASEPTIC TREND

6.9.3 PLANT-BASED PET BOTTLES

6.9.4 3D BRANDING

6.9.5 SLEEVE-LABELS

6.10 ANALYSIS FOR BEVERAGES

6.10.1 FLOW-THOUGH SORTATION

6.10.2 VOICE TECHNOLOGY

6.10.3 INDUSTRIAL INTERNET OF THINGS AND AUGMENTED REALITY

6.11 ANALYSIS FOR CANS

6.11.1 INTUITIVE OPENING

6.11.2 ENHANCING BEVERAGES

6.11.3 INCREASING CONVENIENCE

6.12 PATENT ANALYSIS

FIGURE 35 LIST OF MAJOR PATENTS FOR BEVERAGE PACKAGING

TABLE 6 KEY PATENTS FILED IN THE BEVERAGE PACKAGING MARKET, 2018–2021

6.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

6.13.1 THREAT OF NEW ENTRANTS

6.13.2 THREAT OF SUBSTITUTES

6.13.3 BARGAINING POWER OF SUPPLIERS

6.13.4 BARGAINING POWER OF BUYERS

6.13.5 INTENSITY OF COMPETITIVE RIVALRY

6.14 PRICING ANALYSIS

6.14.1 AVERAGE SELLING PRICE TREND OF BEVERAGE CANS IN THE BEVERAGE INDUSTRY, 2016-2020

FIGURE 36 PRICE TREND

6.15 CASE STUDY ANALYSIS

TABLE 8 AMCOR GROUP GMBH

TABLE 9 CROWN HOLDINGS, INC.

TABLE 10 VERALLIA S.A.

7 REGULATIONS (Page No. - 86)

7.1 NORTH AMERICA

7.1.1 UNITED STATES

7.1.2 CANADA

7.1.2.1 Food Packaging Regulations

7.1.2.2 Premarket Assessments

7.1.2.3 Letters of No Objection

7.1.2.4 Duration of No Objection Status

7.1.2.5 Guidance Documents/Guidelines

7.1.2.6 Packaging Materials Used in Federally Registered Establishments

7.1.2.7 Food Directorate Listings for Polymers

7.1.3 MEXICO

7.2 EUROPE

7.2.1 UK

7.2.2 GERMANY

7.2.3 FRANCE

7.3 ASIA PACIFIC

7.3.1 CHINA

7.3.2 JAPAN

7.3.3 INDIA

7.3.4 AUSTRALIA & NEW ZEALAND

7.4 SOUTH AMERICA

7.4.1 BRAZIL

7.4.2 ARGENTINA

8 BEVERAGE PACKAGING MARKET, BY PACKAGING TYPE (Page No. - 95)

8.1 INTRODUCTION

FIGURE 37 BOTTLE SEGMENT ACCOUNTED FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 11 MARKET SIZE, BY PACKAGING TYPE, 2015-2018 (USD BILLION)

TABLE 12 MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 13 MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 14 MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

8.1.1 COVID-19 IMPACT ON THE MARKET, BY PACKAGING TYPE

8.1.1.1 Realistic scenario

TABLE 15 REALISTIC SCENARIO: MARKET SIZE, BY PACKAGING TYPE, 2018–2021 (USD BILLION)

8.1.1.2 Optimistic scenario

TABLE 16 OPTIMISTIC SCENARIO: MARKET SIZE, BY PACKAGING TYPE, 2018–2021 (USD BILLION)

8.1.1.3 Pessimistic scenario

TABLE 17 PESSIMISTIC SCENARIO: MARKET SIZE, BY PACKAGING TYPE, 2018–2021 (USD BILLION)

8.2 BOTTLE

8.2.1 LUXURY APPEAL OFFERED BY GLASS BOTTLES TO DRIVE THE GROWTH OF THE BOTTLE SEGMENT

TABLE 18 MARKET SIZE IN BOTTLE, BY REGION, 2015-2018 (USD BILLION)

TABLE 19 MARKET SIZE IN BOTTLE, BY REGION, 2019–2026 (USD BILLION)

TABLE 20 MARKET SIZE IN BOTTLE, BY REGION, 2015–2018 (BILLION LITER)

TABLE 21 MARKET SIZE IN BOTTLE, BY REGION, 2019–2026 (BILLION LITER)

8.3 CAN

8.3.1 LEAK-PROOF FEATURES AND HIGH DURABILITY TO ENCOURAGE THE GROWTH OF THE SEGMENT

TABLE 22 MARKET SIZE IN CAN, BY REGION, 2015-2018 (USD BILLION)

TABLE 23 MARKET SIZE IN CAN, BY REGION, 2019–2026 (USD BILLION)

TABLE 24 MARKET SIZE IN CAN, BY REGION, 2015–2018 (BILLION LITER)

TABLE 25 MARKET SIZE IN CAN, BY REGION, 2019–2026 (BILLION LITER)

8.4 POUCH

8.4.1 CONVENIENCE IN STORING AND DISPOSING TO DRIVE THE GROWTH OF THE POUCH SEGMENT IN THE MARKET

TABLE 26 MARKET SIZE IN POUCH, BY REGION, 2015-2018 (USD BILLION)

TABLE 27 MARKET SIZE IN POUCH, BY REGION, 2019–2026 (USD BILLION)

TABLE 28 MARKET SIZE IN POUCH, BY REGION, 2015–2018 (BILLION LITER)

TABLE 29 MARKET SIZE IN POUCH, BY REGION, 2019–2026 (BILLION LITER)

8.5 CARTON

8.5.1 INCREASE IN THE DEMAND FOR SUSTAINABLE PACKAGING PRODUCTS TO SUPPORT THE GROWTH OF THE CARTON SEGMENT

TABLE 30 BEVERAGE PACKAGING MARKET SIZE IN CARTON, BY REGION, 2015-2018 (USD BILLION)

TABLE 31 MARKET SIZE IN CARTON, BY REGION, 2019–2026 (USD BILLION)

TABLE 32 MARKET SIZE IN CARTON, BY REGION, 2015–2018 (BILLION LITER)

TABLE 33 MARKET SIZE IN CARTON, BY REGION, 2019–2026 (BILLION LITER)

8.6 OTHER PACKAGING TYPE

8.6.1 GROWING DEMAND FOR BULK PRODUCTS IN SHORTER FORMATS TO DRIVE THE GROWTH

TABLE 34 MARKET SIZE IN OTHER PACKAGING TYPE, BY REGION, 2015-2018 (USD BILLION)

TABLE 35 MARKET SIZE IN CARTON, BY REGION, 2019–2026 (USD BILLION)

TABLE 36 MARKET SIZE IN OTHER PACKAGING TYPE, BY REGION, 2015-2018 (BILLION LITER)

TABLE 37 MARKET SIZE IN OTHER PACKAGING TYPE, BY REGION, 2019–2026 (BILLION LITER)

9 MARKET, BY MATERIAL TYPE (Page No. - 110)

9.1 INTRODUCTION

FIGURE 38 METAL SEGMENT IS PROJECTED TO ACCOUNT FOR THE LARGEST SHARE IN THE MARKET, BY MATERIAL TYPE, DURING THE FORECAST PERIOD

TABLE 38 MARKET SIZE, BY MATERIAL TYPE, 2015–2018 (USD BILLION)

TABLE 39 MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD BILLION)

TABLE 40 MARKET SIZE, BY MATERIAL TYPE, 2015–2018 (BILLION LITER)

TABLE 41 MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (BILLION LITER)

9.1.1 COVID-19 IMPACT ON THE MARKET, BY MATERIAL TYPE

9.1.1.1 Realistic scenario

TABLE 42 REALISTIC SCENARIO: MARKET SIZE, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

9.1.1.2 Optimistic scenario

TABLE 43 OPTIMISTIC SCENARIO: MARKET SIZE, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

9.1.1.3 Pessimistic scenario

TABLE 44 PESSIMISTIC SCENARIO: MARKET SIZE, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

9.2 GLASS

9.2.1 RECYCLABILITY AND INCREASING USE IN PREMIUM PACKAGING IS PROJECTED TO DRIVE THE GLASS SEGMENT

TABLE 45 BEVERAGE PACKAGING MARKET SIZE FOR GLASS, BY REGION, 2015–2018 (USD BILLION)

TABLE 46 MARKET SIZE FOR GLASS, BY REGION, 2019–2026 (USD BILLION)

TABLE 47 MARKET SIZE FOR GLASS, BY REGION, 2015–2018 (BILLION LITER)

TABLE 48 MARKET SIZE FOR GLASS, BY REGION, 2019–2026 (BILLION LITER)

9.3 PLASTIC

9.3.1 EASY AVAILABILITY AND LOW COST MAKE PLASTIC PREFERABLE PACKAGING MATERIAL TYPE FOR BEVERAGE MANUFACTURERS

TABLE 49 MARKET SIZE FOR PLASTIC, BY REGION, 2015–2018 (USD BILLION)

TABLE 50 MARKET SIZE FOR PLASTIC, BY REGION, 2019–2026 (USD BILLION)

TABLE 51 MARKET SIZE FOR PLASTIC, BY REGION, 2015–2018 (BILLION LITER)

TABLE 52 MARKET SIZE FOR PLASTIC, BY REGION, 2019–2026 (BILLION LITER)

9.4 METAL

9.4.1 RESILIENCE AND CONVENIENCE OFFERED BY METAL PACKAGING IS ENCOURAGING THE GROWTH OF THE SEGMENT

TABLE 53 MARKET SIZE FOR METAL, BY REGION, 2015–2018 (USD BILLION)

TABLE 54 MARKET SIZE FOR METAL, BY REGION, 2019–2026 (USD BILLION)

TABLE 55 MARKET SIZE FOR METAL, BY REGION, 2015–2018 (BILLION LITER)

TABLE 56 MARKET SIZE FOR METAL, BY REGION, 2019–2026 (BILLION LITER)

9.5 PAPER & PAPERBOARD

9.5.1 RISE IN DEMAND FOR ECO-FRIENDLY PACKAGING PRODUCTS TO DRIVE THE GROWTH OF THE PAPER & PAPERBOARD SEGMENT

TABLE 57 MARKET SIZE FOR PAPER & PAPERBOARD, BY REGION, 2015–2018 (USD BILLION)

TABLE 58 MARKET SIZE FOR PAPER & PAPERBOARD, BY REGION, 2019–2026 (USD BILLION)

TABLE 59 MARKET SIZE FOR PAPER & PAPERBOARD, BY REGION, 2015–2018 (BILLION LITER)

TABLE 60 MARKET SIZE FOR PAPER & PAPERBOARD, BY REGION, 2019–2026 (BILLION LITER)

9.6 OTHER MATERIAL TYPE

TABLE 61 BEVERAGE PACKAGING MARKET SIZE FOR OTHER MATERIAL TYPE, BY REGION, 2015–2018 (USD BILLION)

TABLE 62 MARKET SIZE FOR OTHER MATERIAL TYPE, BY REGION, 2019–2026 (USD BILLION)

TABLE 63 MARKET SIZE FOR OTHER MATERIAL TYPE, BY REGION, 2015–2018 (BILLION LITER)

TABLE 64 MARKET SIZE FOR OTHER MATERIAL TYPE, BY REGION, 2019–2026 (BILLION LITER)

10 MARKET, BY PRODUCT TYPE (Page No. - 128)

10.1 INTRODUCTION

FIGURE 39 MARKET SIZE, BY PRODUCT TYPE (2021 VS. 2026)

TABLE 65 MARKET SIZE, BY PRODUCT TYPE, 2015-2018 (USD BILLION)

TABLE 66 MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

TABLE 67 MARKET SIZE, BY PRODUCT TYPE, 2015–2018 (BILLION LITER)

TABLE 68 MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (BILLION LITER)

10.1.1 COVID-19 IMPACT ON THE MARKET, BY PRODUCT TYPE

10.1.1.1 Realistic scenario

TABLE 69 REALISTIC SCENARIO: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD BILLION)

10.1.1.2 Optimistic scenario

TABLE 70 OPTIMISTIC SCENARIO: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD BILLION)

10.1.1.3 Pessimistic scenario

TABLE 71 PESSIMISTIC SCENARIO: MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD BILLION)

10.2 ALCOHOLIC BEVERAGES

10.2.1 INCREASE IN CONSUMPTION OF ALCOHOLIC BEVERAGES, PARTICULARLY IN THE ASIA PACIFIC REGION, TO ENCOURAGE THE GROWTH OF THE SEGMENT

10.2.2 BEER & CIDER

10.2.3 WINES

10.2.4 SPIRITS

10.2.5 WHISKY

10.2.6 RUM

10.2.7 VODKA

10.2.8 OTHER ALCOHOLIC BEVERAGES

TABLE 72 BEVERAGE PACKAGING MARKET SIZE FOR ALCOHOLIC BEVERAGES, BY REGION, 2015-2018 (USD BILLION)

TABLE 73 MARKET SIZE FOR ALCOHOLIC BEVERAGES, BY REGION, 2019–2026 (USD BILLION)

TABLE 74 MARKET SIZE FOR ALCOHOLIC BEVERAGE, BY REGION, 2015–2018 (BILLION LITER)

TABLE 75 MARKET SIZE FOR ALCOHOLIC BEVERAGES, BY REGION, 2019–2026 (BILLION LITER)

10.3 NON-ALCOHOLIC BEVERAGES

10.3.1 INCREASE IN HEALTH AWARENESS IS ANTICIPATED TO DRIVE THE GROWTH OF THE SEGMENT

TABLE 76 MARKET SIZE FOR NON-ALCOHOLIC BEVERAGES, BY REGION, 2015–2018 (USD BILLION)

TABLE 77 MARKET SIZE FOR NON-ALCOHOLIC BEVERAGES, BY REGION, 2019–2026 (USD BILLION)

TABLE 78 MARKET SIZE FOR NON-ALCOHOLIC BEVERAGES, BY REGION, 2015–2018 (BILLION LITER)

TABLE 79 MARKET SIZE FOR NON-ALCOHOLIC BEVERAGES, BY REGION, 2019–2026 (BILLION LITER)

10.4 DAIRY BEVERAGES

10.4.1 HIGH NUTRITIONAL VALUE OF DAIRY BEVERAGES IS PROJECTED TO DRIVE THE GROWTH OF SEGMENT

10.4.2 WHITE MILK

10.4.3 FLAVORED MILK

10.4.4 OTHER LIQUID DAIRY PRODUCTS

TABLE 80 MARKET SIZE FOR DAIRY BEVERAGES, BY REGION, 2015–2018 (USD BILLION)

TABLE 81 DAIRY BEVERAGE: MARKET SIZE, BY REGION, 2019–2026 (USD BILLION)

TABLE 82 DAIRY BEVERAGE: MARKET SIZE, BY REGION, 2015–2018 (BILLION LITER)

TABLE 83 DAIRY BEVERAGE: MARKET SIZE, BY REGION, 2019–2026 (BILLION LITER)

11 BEVERAGE PACKAGING MARKET, BY REGION (Page No. - 141)

11.1 INTRODUCTION

FIGURE 40 US IS ESTIMATED TO HOLD THE LARGEST SHARE IN THE GLOBAL MARKET IN 2021

TABLE 84 MARKET SIZE, BY REGION, 2015–2018 (USD BILLION)

TABLE 85 MARKET SIZE, BY REGION, 2019–2026 (USD BILLION)

TABLE 86 MARKET SIZE, BY REGION, 2015–2018 (BILLION LITER)

TABLE 87MARKET SIZE, BY REGION, 2019–2026 (BILLION LITER)

11.1.1 COVID-19 IMPACT ON THE MARKET, BY REGION

11.1.1.1 Realistic scenario

TABLE 88 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.1.1.2 Optimistic scenario

TABLE 89 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.1.1.3 Pessimistic scenario

TABLE 90 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

TABLE 91 NORTH AMERICA: MARKET SIZE FOR BEVERAGE PACKAGING, BY COUNTRY, 2015–2018 (USD BILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2018 (BILLION LITER)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (BILLION LITER)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY MATERIAL TYPE, 2015–2018 (USD BILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD BILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY MATERIAL TYPE, 2015–2018 (BILLION LITER)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (BILLION LITER)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2015–2018 (USD BILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2015–2018 (BILLION LITER)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (BILLION LITER)

11.2.1 US

11.2.1.1 Increase in consumption of bottled mineral and fortified water is driving the growth of the market

FIGURE 42 US: SALES OF BOTTLED WATER, 2015–2019 (BILLION GALLON)

TABLE 107 US: BEVERAGE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 108 US: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 109 US: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 110 US: MARKET SIZE, BY TYPE, 2019–2026 (BILLION LITER)

11.2.2 CANADA

11.2.2.1 Increase in consumer preference for clean label food products to encourage the production of sustainable beverage packaging

TABLE 111 CANADA: MARKET SIZE FOR BEVERAGE PACKAGING, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 112 CANADA: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 113 CANADA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 114 CANADA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION LITER)

11.2.3 MEXICO

11.2.3.1 Demand for convenient packaging solutions and an increase in the export of beverages to support the market to gain a moderate pace

TABLE 115 MEXICO: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 116 MEXICO: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 117 MEXICO: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 118 MEXICO: MARKET SIZE, BY TYPE, 2019–2026 (BILLION LITER)

11.3 EUROPE

TABLE 119 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2018 (USD BILLION)

TABLE 120 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 121 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2018 (BILLION LITER)

TABLE 122 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (BILLION LITER)

TABLE 123 EUROPE: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 124 EUROPE: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 125 EUROPE: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 126 EUROPE: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

TABLE 127 EUROPE: MARKET SIZE, BY MATERIAL TYPE, 2015–2018 (USD BILLION)

TABLE 128 EUROPE: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD BILLION)

TABLE 129 EUROPE: MARKET SIZE, BY MATERIAL TYPE, 2015–2018 (BILLION LITER)

TABLE 130 EUROPE: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (BILLION LITER)

TABLE 131 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2015–2018 (USD BILLION)

TABLE 132 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

TABLE 133 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2015–2018 (BILLION LITER)

TABLE 134 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (BILLION LITER)

11.3.1 GERMANY

11.3.1.1 Increase in consumption of non-alcoholic beverages is projected to drive the demand for beverage packaging

FIGURE 43 GERMANY: EXPORT SHARE OF THE FOOD & DRINK INDUSTRIES, 2019

TABLE 135 GERMANY: BEVERAGE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 136 GERMANY: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 137 GERMANY: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 138 GERMANY: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.3.2 UK

11.3.2.1 New product launches in the beverage industry are driving the growth of the market

TABLE 139 UK: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 140 UK: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 141 UK: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 142 UK: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.3.3 FRANCE

11.3.3.1 Increasing consumption of alcoholic beverages to drive the demand for market in the country

TABLE 143 FRANCE: MARKET SIZE FOR BEVERAGE PACKAGING, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 144 FRANCE: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 145 FRANCE: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 146 FRANCE: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.3.4 ITALY

11.3.4.1 Rise in demand for fruit juices is projected to drive the growth of the market in the region

TABLE 147 ITALY: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 148 ITALY: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 149 ITALY: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 150 ITALY: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.3.5 SPAIN

11.3.5.1 Rise in consumption of beer is supporting the growth of the market in the country

TABLE 151 SPAIN: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 152 SPAIN: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 153 SPAIN: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 154 SPAIN: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.3.6 REST OF EUROPE

11.3.6.1 Increase in various beverages production and consumption is anticipated to fuel the growth of the market in the region

TABLE 155 REST OF EUROPE: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 156 REST OF EUROPE: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 157 REST OF EUROPE: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 158 REST OF EUROPE: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.4 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: CHINA IS THE MOST LUCRATIVE MARKET

TABLE 159 ASIA PACIFIC: BEVERAGE PACKAGING MARKET SIZE, BY COUNTRY/REGION, 2015–2018 (USD BILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2019–2026 (USD BILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2015–2018 (BILLION LITER)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2019–2026 (BILLION LITER)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 165 ASIA PACIFIC: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 166 ASIA PACIFIC: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

TABLE 167 ASIA PACIFIC: MARKET SIZE, BY MATERIAL, 2015–2018 (USD BILLION)

TABLE 168 ASIA PACIFIC: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 169 ASIA PACIFIC: MARKET SIZE, BY MATERIAL, 2015–2018 (BILLION LITER)

TABLE 170 ASIA PACIFIC: MARKET SIZE, BY MATERIAL, 2019–2026 (BILLION LITER)

TABLE 171 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2015–2018 (USD BILLION)

TABLE 172 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

TABLE 173 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2015–2018 (BILLION LITER)

TABLE 174 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (BILLION LITER)

11.4.1 CHINA

11.4.1.1 Increase in consumption of non-alcoholic beverages is driving the growth of the market

FIGURE 45 TOP 5 COUNTRIES IN TERMS OF BOTTLED WATER SALES, 2019 (USD BILLION)

TABLE 175 CHINA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 176 CHINA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 177 CHINA:MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 178 CHINA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.4.2 INDIA

11.4.2.1 Increase in population and consumption of alcoholic beverages is encouraging the growth of the market

TABLE 179 INDIA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 180 INDIA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 181 INDIA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 182 INDIA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.4.3 JAPAN

11.4.3.1 Focus of the government on encouraging the production of sustainable packaging to drive the market growth

TABLE 183 JAPAN: BEVERAGE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 184 JAPAN: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 185 JAPAN: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 186 JAPAN: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.4.4 AUSTRALIA & NEW ZEALAND

11.4.4.1 Rise in demand for convenient & sustainable packaging and growth in production of spirit-based alcoholic beverages

TABLE 187 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 188 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 189 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 190 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.4.5 REST OF ASIA PACIFIC

11.4.5.1 Increase in the presence of beverage manufacturers and changes in lifestyle to fuel the market growth

TABLE 191 REST OF ASIA PACIFIC: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 192 REST OF ASIA PACIFIC: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 193 REST OF ASIA PACIFIC: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 194 REST OF ASIA PACIFIC: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.5 SOUTH AMERICA

TABLE 195 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2018 (USD BILLION)

TABLE 196 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 197 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2018 (BILLION LITER)

TABLE 198 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (BILLION LITER)

TABLE 199 SOUTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 200 SOUTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 201 SOUTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 202 SOUTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

TABLE 203 SOUTH AMERICA: MARKET SIZE, BY MATERIAL TYPE, 2015–2018 (USD BILLION)

TABLE 204 SOUTH AMERICA: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD BILLION)

TABLE 205 SOUTH AMERICA: MARKET SIZE, BY MATERIAL TYPE, 2015–2018 (BILLION LITER)

TABLE 206 SOUTH AMERICA: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (BILLION LITER)

TABLE 207 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2015–2018 (USD BILLION)

TABLE 208 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

TABLE 209 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2015–2018 (BILLION LITER)

TABLE 210 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (BILLION LITER)

11.5.1 BRAZIL

11.5.1.1 High demand for health-enriching alcoholic beverages

TABLE 211 BRAZIL: BEVERAGE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 212 BRAZIL: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 213 BRAZIL: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 214 BRAZIL: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.5.2 ARGENTINA

11.5.2.1 High consumption of sugar-sweetened beverages

TABLE 215 ARGENTINA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 216 ARGENTINA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 217 ARGENTINA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 218 ARGENTINA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.5.3 REST OF SOUTH AMERICA

11.5.3.1 Growth of the food colors market to remain slow with the high dependence on food product imports

TABLE 219 REST OF SOUTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 220 REST OF SOUTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 221 REST OF SOUTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 222 REST OF SOUTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.6 REST OF THE WORLD (ROW)

TABLE 223 ROW: MARKET SIZE, BY REGION, 2015–2018 (USD BILLION)

TABLE 224 ROW: MARKET SIZE, BY REGION, 2019–2026 (USD BILLION)

TABLE 225 ROW: MARKET SIZE, BY REGION, 2015–2018 (BILLION LITER)

TABLE 226 ROW: MARKET SIZE, BY REGION, 2019–2026 (BILLION LITER)

TABLE 227 ROW: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 228 ROW: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 229 ROW: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 230 ROW: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

TABLE 231 ROW: MARKET SIZE, BY MATERIAL TYPE, 2015–2018 (USD BILLION)

TABLE 232 ROW: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD BILLION)

TABLE 233 ROW: MARKET SIZE, BY MATERIAL TYPE, 2015–2018 (BILLION LITER)

TABLE 234 ROW: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (BILLION LITER)

TABLE 235 ROW: MARKET SIZE, BY PRODUCT TYPE, 2015–2018 (USD BILLION)

TABLE 236 ROW: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

TABLE 237 ROW: MARKET SIZE, BY PRODUCT TYPE, 2015–2018 (BILLION LITER)

TABLE 238 ROW: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (BILLION LITER)

11.6.1 AFRICA

11.6.1.1 Rapid increase in urbanization and change in consumer trends to drive the market growth

TABLE 239 AFRICA: BEVERAGE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 240 AFRICA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 241 AFRICA: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 242 AFRICA: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

11.6.2 MIDDLE EAST

11.6.2.1 Increase in consumer preference for canned beverages to drive the growth of the market

TABLE 243 MIDDLE EAST: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (USD BILLION)

TABLE 244 MIDDLE EAST: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 245 MIDDLE EAST: MARKET SIZE, BY PACKAGING TYPE, 2015–2018 (BILLION LITER)

TABLE 246 MIDDLE EAST: MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (BILLION LITER)

12 COMPETITIVE LANDSCAPE (Page No. - 225)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS OF THE PACKAGING COMPANIES SUPPLYING FORMATS TO BEVERAGE COMPANIES

TABLE 247 MARKET: DEGREE OF COMPETITION

12.3 RANKING OF THE MAJOR BEVERAGE COMPANIES ACROSS FORMATS

12.4 KEY PLAYER STRATEGIES

12.5 REVENUE ANALYSIS OF KEY PLAYERS SUPPLYING PACKAGING FORMATS TO BEVERAGE COMPANIES, 2016-2020

FIGURE 46 REVENUE ANALYSIS, 2016–2020 (USD BILLION)

12.6 COVID-19-SPECIFIC COMPANY RESPONSE

12.6.1 AMCOR GROUP GMBH

12.6.2 O-I GLASS, INC.

12.6.3 CROWN HOLDINGS, INC.

12.6.4 ARDAGH GROUP S.A.

12.6.5 VERALLIA SA

12.7 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.7.1 STARS

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE PLAYERS

12.7.4 PARTICIPANTS

FIGURE 47 BEVERAGE PACKAGING MARKET: COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

12.7.5 PRODUCT FOOTPRINT

TABLE 248 COMPANY, BY MATERIAL FOOTPRINT

TABLE 249 COMPANY, BY TYPE FOOTPRINT

TABLE 250 COMPANY, BY REGION FOOTPRINT

12.8 COMPETITIVE EVALUATION QUADRANT (START-UP/SME)

12.8.1 PROGRESSIVE COMPANIES

12.8.2 RESPONSIVE COMPANIES

12.8.3 DYNAMIC COMPANIES

12.8.4 STARTING BLOCKS

FIGURE 48 MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UP/SMES)

12.9 COMPETITIVE SCENARIO

12.9.1 NEW PRODUCT LAUNCHES

TABLE 251 MARKET: PRODUCT LAUNCHES, JULY 2017- MARCH 2021

12.9.2 DEALS

TABLE 252 MARKET: DEALS, AUGUST 2017– MARCH 2021

12.9.3 OTHER DEVELOPMENTS

TABLE 253 MARKET: OTHER DEVELOPMENTS, MARCH 2018- MARCH 2021

13 COMPANY PROFILES (Page No. - 245)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

13.1 KEY PLAYERS ACROSS PACKAGING FORMATS

13.1.1 AMCOR GROUP GMBH

TABLE 254 AMCOR GROUP GMBH: BUSINESS OVERVIEW

TABLE 255 AMCOR GROUP GMBH: PRODUCTS OFFERED

TABLE 256 AMCOR GROUP GMBH: NEW PRODUCT LAUNCHES

TABLE 257 AMCOR GROUP GMBH: DEALS

13.1.2 O-I GLASS, INC.

TABLE 258 O-I GLASS, INC.: BUSINESS OVERVIEW

TABLE 259 O-I GLASS, INC.: PRODUCTS OFFERED

TABLE 260 O-I GLASS, INC.: DEALS

TABLE 261 O-I GLASS, INC.: OTHERS

13.1.3 CROWN HOLDINGS, INC.

TABLE 262 CROWN HOLDINGS, INC: BUSINESS OVERVIEW

TABLE 263 CROWN HOLDINGS, INC: PRODUCTS OFFERED

TABLE 264 CROWN HOLDINGS, INC: DEALS

TABLE 265 CROWN HOLDINGS, INC: OTHERS

13.1.4 ARDAGH GROUP SA.

TABLE 266 ARDAGH GROUP S.A.: BEVERAGE PACKAGING MARKET BUSINESS OVERVIEW

TABLE 267 ARDAGH GROUP S.A.: PRODUCTS OFFERED

TABLE 268 ARDAGH GROUP S.A.: NEW PRODUCT LAUNCH

TABLE 269 ARDAGH GROUP S.A.: DEALS

TABLE 270 ARDAGH GROUP S.A.: OTHERS

13.1.5 VERALLIA SA

TABLE 271 VERALLIA SA: BUSINESS OVERVIEW

FIGURE 57 VERALLIA SA: COMPANY SNAPSHOT

TABLE 272 VERALLIA SA: PRODUCTS OFFERED

TABLE 273 VERALLIA SA: DEALS

TABLE 274 VERALLIA SA: OTHERS

13.1.6 TETRA PAK GROUP

TABLE 275 TETRA PAK GROUP: BUSINESS OVERVIEW

TABLE 276 TETRA PAK GROUP: PRODUCTS OFFERED

TABLE 277 TETRA PAK GROUP: DEALS

TABLE 278 TETRA PAK GROUP: OTHERS

13.1.7 BALL CORPORATION

TABLE 279 BALL CORPORATION: BUSINESS OVERVIEW

FIGURE 60 BALL CORPORATION: COMPANY SNAPSHOT

TABLE 280 BALL CORPORATION: PRODUCTS OFFERED

TABLE 281 BALL CORPORATION: DEALS

TABLE 282 BALL CORPORATION: OTHERS

13.1.8 VIDRALA S.A.

TABLE 283 VIDRALA S.A.: BEVERAGE PACKAGING MARKET BUSINESS OVERVIEW

FIGURE 61 VIDRALA SA: COMPANY SNAPSHOT

TABLE 284 VIDRALA S.A.: PRODUCTS OFFERED

TABLE 285 VIDRALA S.A.: DEALS

13.1.9 TOYO SEIKAN GROUP HOLDINGS, LTD.

TABLE 286 TOYO SEIKAN GROUP HOLDINGS, LTD.: BUSINESS OVERVIEW

FIGURE 62 TOYO SEIKAN GROUP HOLDINGS, LTD.: COMPANY SNAPSHOT

TABLE 287 TOYO SEIKAN GROUP HOLDINGS, LTD.: PRODUCTS OFFERED

TABLE 288 TOYO SEIKAN GROUP HOLDINGS, LTD.: OTHERS

13.1.10 CPMC HOLDINGS LIMITED

TABLE 289 CPMC HOLDINGS LIMITED: BUSINESS OVERVIEW

FIGURE 63 CPMC HOLDINGS LIMITED: COMPANY SNAPSHOT

TABLE 290 CPMC HOLDINGS LIMITED: PRODUCTS OFFERED

TABLE 291 CPMC HOLDINGS LIMITED: DEALS

TABLE 292 CPMC HOLDINGS LIMITED: OTHERS

13.2 START-UPS/SMES ACROSS PACKAGING FORMATS

13.2.1 VETROPACK HOLDING LTD

TABLE 293 VETROPACK HOLDING LTD: BUSINESS OVERVIEW

FIGURE 64 VETROPACK HOLDING LTD: COMPANY SNAPSHOT

TABLE 294 VETROPACK HOLDING LTD: PRODUCTS OFFERED

TABLE 295 VETROPACK HOLDING LTD: DEALS

13.2.2 BERRY GLOBAL GROUP, INC.

TABLE 296 BERRY GLOBAL GROUP, INC.: BUSINESS OVERVIEW

FIGURE 65 BERRY GLOBAL GROUP, INC.: COMPANY SNAPSHOT

TABLE 297 BERRY GLOBAL GROUP, INC.: PRODUCTS OFFERED

13.2.3 CAN-ONE BERHAD

TABLE 298 CAN-ONE BERHAD: BUSINESS OVERVIEW

TABLE 299 CAN-ONE BERHAD: PRODUCTS OFFERED

TABLE 300 CAN-ONE BERHAD: DEALS

13.2.4 CAN-PACK S.A.

TABLE 301 CAN-PACK S.A.: BEVERAGE PACKAGING MARKET BUSINESS OVERVIEW

TABLE 302 CAN-PACK S.A.: PRODUCTS OFFERED

TABLE 303 CAN-PACK S.A.: DEALS

TABLE 304 CAN-PACK S.A: OTHERS

13.2.5 ENVASES UNIVERSALES

TABLE 305 ENVASES UNIVERSALES: BUSINESS OVERVIEW

TABLE 306 ENVASES UNIVERSALES: PRODUCTS OFFERED

TABLE 307 ENVASES UNIVERSALES: DEALS

13.2.6 UNIVERSAL CAN CORPORATION

13.2.7 AKSHAR PRODUCTS

13.2.8 AS FOOD PACKAGING GREENDALE

13.2.9 VARAKKA ENTERPRISES

13.2.10 CEYLON BEVERAGE CAN (PVT.) LTD.

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 300)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

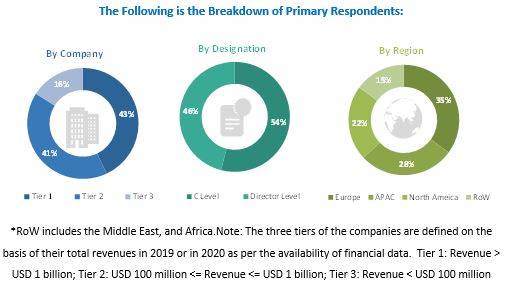

The study involves four major activities to estimate the current beverage packaging market size. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. These findings, assumptions, and market size was validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, in order to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The beverage packaging market comprises several stakeholders such as manufacturers, importers & exporters, traders, distributors, suppliers of beverage packaging; food safety authorities; food technologists; food product manufacturers; raw material suppliers; and regulatory bodies such as the Food and Agriculture Organization (FAO), the Environmental Protection Agency (EPA), the Food Safety Council (FSC), government and research organizations, and trade associations and industry bodies. The demand-side of this market is characterized by the rising awareness of shelf life extension among beverage manufacturers. The supply-side is characterized by advancements in technology and increased convenience in packaging. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Beverage Packaging Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The value chain and market size of the beverage packaging market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for key opinions from leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives:

- To define, segment, and project the global beverage packaging market size

- To understand the structure of the market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per a client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe, Rest of Asia Pacific, and Rest of South America.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Beverage Packaging Market