The study involved four major activities in estimating the market size for surfactants. Intensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

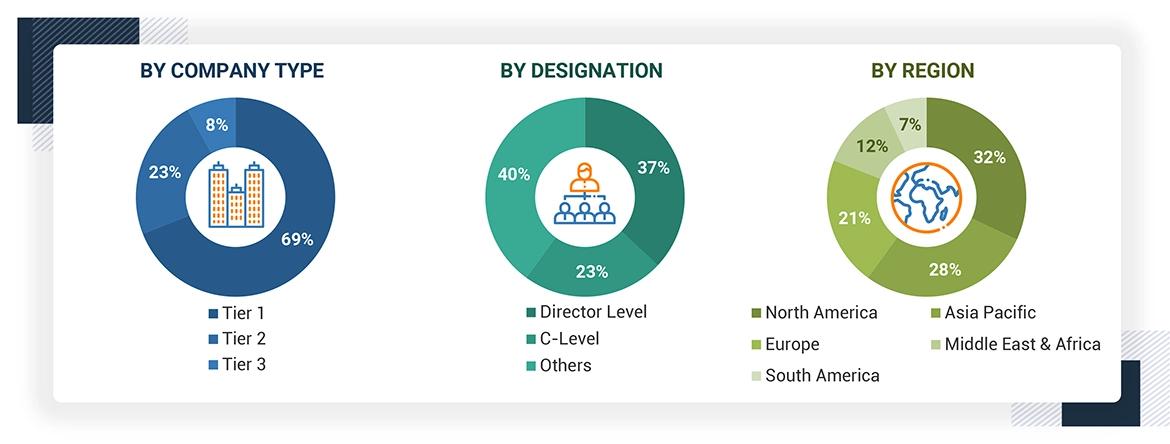

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The surfactants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized from key opinion leaders in various applications for the surfactants market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

|

COMPANY NAME |

DESIGNATION |

|

BASF SE |

Global Strategy & Innovation Manager |

|

Stepan Company |

Director |

|

Dow Inc. |

Project Manager |

|

Evonik Industries AG |

Regional Manager |

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

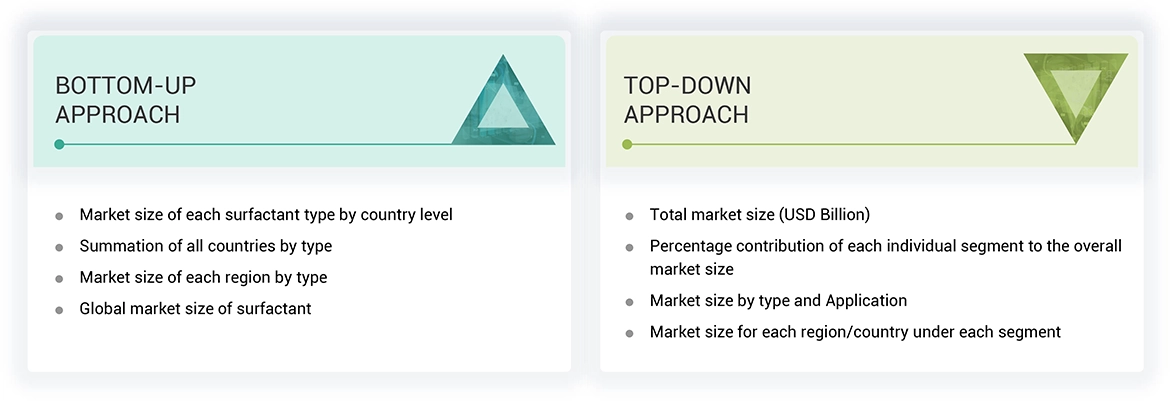

Both top-down and bottom-up approaches were used to estimate and validate the total size of the surfactants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry have been identified through extensive secondary research.

-

The supply chain of the industry has been determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into respective segments and subsegments. To realize the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the surfactants industry.

Market Definition

The surfactants market involves the manufacture and sale of surfactants designed primarily for use in home care, personal care, industrial & institutional cleaning, textile and other applications. These surfactants primarily lower the surface tension between two liquids, or between a liquid and a solid, or between a gas and a liquid. Surfactants offer advantages such as improved liquid spreading, stabilized emulsions, foam creation or defoaming, enhanced wetting and surface coating, hydrophobic substance dissolution, efficient cleaning, biocompatibility, and extended product stability.

Stakeholders

-

Surfactants manufacturers

-

Raw material manufacturers

-

Government planning commissions and research organizations

-

Industry associations

-

End-use applications

-

R&D institutions

Report Objectives

-

To analyze and forecast the size of the Surfactants market in terms of volume and value

-

To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

-

To define, describe, and segment the Surfactants market based on substrate, type, and applications

-

To forecast the size of the market segments for regions such as Asia Pacific, North America, Europe, South America, and the Middle East & Africa

-

To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

-

To identify and analyze opportunities for stakeholders in the market

-

To strategically profile key players and comprehensively analyze their core competencies

Peter

Jul, 2022

Specific requirement on non-ionic surfactants market for US.