Agricultural Surfactants Market by Type (Non-Ionic, Anionic, Cationic, Amphoteric), Application (Herbicides, Fungicides), Substrate Type, Crop Type (Cereals & Grains, Pulses & Oilseeds, Fruits & Vegetables) and Region - Global Forecast to 2028

Agricultural Surfactants Market Analysis

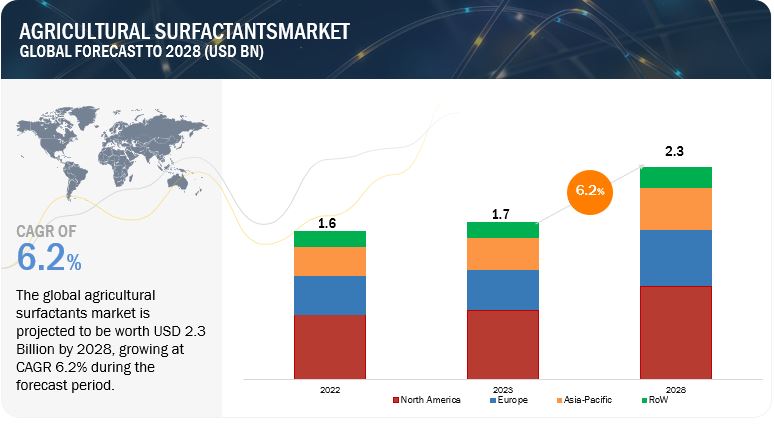

From 2023 to 2028, the global agricultural surfactants market is expected to rise at a remarkable compound annual growth rate (CAGR) of 6.2%. This rising trend is expected to boost market value from $1.7 billion in 2023 to $2.3 billion by the end of 2028.

The robust growth of the global market is intricately linked to the steady expansion of global crop production, as highlighted by the Food and Agriculture Organization of the United Nations (FAO). The increase in global crop production by 1.3% to reach 9.5 billion tonnes in 2021 underscores the intensifying need for optimizing agricultural inputs for enhanced yields. Agricultural surfactants play a pivotal role in this context, as they improve agrochemical efficiency, leading to more effective pest and weed control. This, in turn, contributes to increased crop yields and quality. Additionally, the escalating global population's demands for food necessitate higher productivity from existing agricultural land, further driving the adoption of surfactants to maximize the impact of agrochemical applications. As precision agriculture techniques become more prevalent and sustainable practices gain traction, the use of surfactants is poised to continue its upward trajectory, serving as a linchpin in meeting the world's growing food production requirements.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Agricultural Surfactants Market Growth Insights

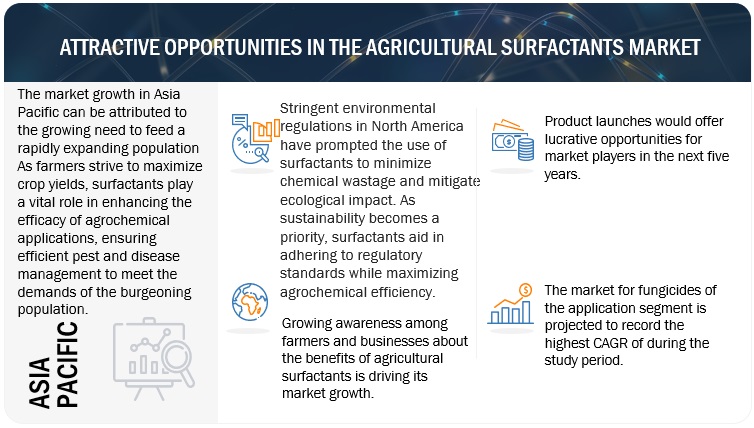

Drivers: Rise in demand for green solutions

The surge in demand for environmentally sustainable solutions is propelling substantial growth in the agricultural surfactants market. As concerns over ecological impact escalate, farmers and agribusinesses are seeking greener alternatives to conventional chemical inputs. Agricultural surfactants, with their ability to enhance the efficiency of agrochemicals and reduce chemical wastage, align perfectly with this shift towards eco-friendly practices. These surfactants enable precise and targeted application of pesticides and fertilizers, minimizing runoff and environmental contamination. The push for green solutions is driving research and development efforts toward the formulation of biodegradable and low-toxicity surfactants, further bolstering their appeal. As sustainability becomes a cornerstone of modern agriculture, the market is experiencing substantial growth due to its pivotal role in fostering environmentally responsible practices.

Restraint: Use of genetically modified seeds

The utilization of genetically modified (GM) seeds is imposing a degree of constraint on the expansion of the market. Genetically modified crops often possess intrinsic traits that provide them with enhanced resistance to pests and diseases, reducing the need for external chemical applications, including those aided by surfactants. This shift towards GM crops has led to a partial displacement of conventional crop varieties that necessitate more intensive chemical management.

As GM crops gain prominence, the demand for agrochemicals, including surfactants, may experience a relative decrease in specific markets. Moreover, the introduction of traits directly into the seed may negate the necessity for certain agrochemical applications altogether, limiting the potential applications of surfactants.

While the agricultural surfactants market remains robust due to their relevance in many contexts, the growing prevalence of GM crops alters the landscape by redefining pest and disease management practices. As a result, the market's expansion trajectory may encounter some constraints in regions or sectors where genetically modified seeds are more prevalent.

Opportunity: Production of bio-based surfactant products

The production and adoption of biobased surfactants present a significant opportunity within the agricultural surfactants market, driving its growth in a sustainable direction. Biobased surfactants, derived from renewable sources such as plant oils and microbes, align seamlessly with the increasing demand for eco-friendly solutions in agriculture. These surfactants offer distinct advantages, including higher biodegradability, lower environmental impact, and reduced toxicity compared to their synthetic counterparts.

As environmental consciousness rises, consumers, regulators, and industries alike are prioritizing sustainable practices. Biobased surfactants address this demand by providing effective agrochemical delivery while minimizing harm to ecosystems. This shift towards greener alternatives complements evolving farming practices, where precision and minimal ecological disruption are paramount.

With consumers increasingly favoring products with lower environmental footprints, the growth of biobased surfactants is driving market expansion by meeting both performance and sustainability criteria in the agricultural sector.

Challenge: Growth of environmental concerns against the usage of agrochemicals

The growth of environmental concerns is placing a significant restraint on the agricultural surfactants market. As awareness of ecological impacts intensifies, there's mounting pressure on agricultural practices to align with sustainability goals. Traditional agrochemical applications, including surfactant usage, are under scrutiny due to their potential contributions to soil and water pollution, affecting ecosystems and human health.

Regulatory bodies worldwide are imposing stricter guidelines and restrictions on agrochemical usage to mitigate environmental degradation. This has led to a shift towards more eco-friendly alternatives, challenging the conventional use of surfactants in some cases. Additionally, the perception of chemical-intensive agriculture as detrimental to ecosystems and biodiversity is influencing consumer preferences and shaping market dynamics.

As sustainable farming gains traction, the market must navigate this shift by adapting formulations, production methods, and marketing strategies to align with environmental expectations. Balancing the need for effective pest and disease management with reduced ecological impact presents a complex challenge that necessitates innovation and collaboration across the industry to address the growing concerns and ensure a sustainable future for agriculture.

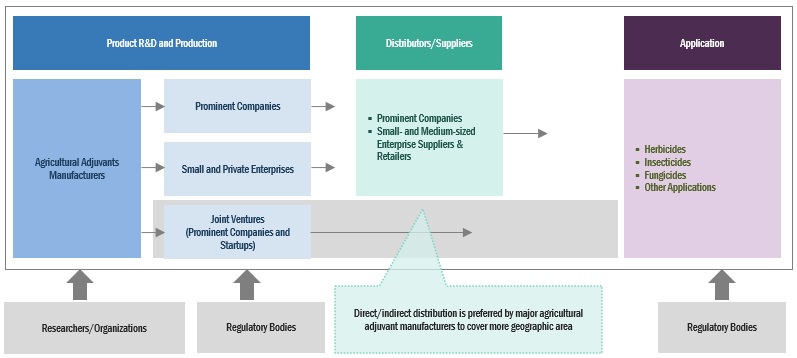

Agricultural Surfactants Market Ecosystem

Agricultural Surfactants Market by Crop Type Insights

Based on crop type, the cereals & grains segment is estimated to hold the largest market share during the forecast period of the market.

Cereals and grains hold the largest share of the agricultural surfactant market due to their widespread cultivation and economic significance. These staple crops encompass a vast portion of global agricultural production, serving as a fundamental source of food, feed, and industrial raw materials. According to the Food and Agriculture Organization of the United Nations (FAO), the total cereals and grains production in 2021 was 2,819 million tonnes. This is an increase of 1.6% from the total production recorded in 2020. Given their extensive leaf surfaces and expansive cultivation areas, effective pesticide coverage is essential for managing pests, diseases, and weeds. Agricultural surfactants play a pivotal role in optimizing pesticide efficiency by improving adhesion, spreading, and absorption on cereal and grain surfaces.

Furthermore, the demand for higher crop yields to feed the growing global population accentuates the importance of precision agrochemical application. Surfactants enhance the efficacy of pesticides, leading to increased yields and quality of cereals and grains. As modern farming practices evolve, the need for agrochemical optimization becomes increasingly critical, positioning cereals and grains as key beneficiaries of surfactant technology and driving their dominance in the agricultural surfactant market. The abundant availability of sugarcane bagasse, especially in regions with significant sugar production, provides a cost-effective and renewable resource for agricultural surfactants production. Additionally, utilizing bagasse can help address waste management challenges associated with its disposal, contributing to a more circular and environmentally responsible approach. By tapping into the potential of sugarcane bagasse, the agricultural surfactants market can benefit from increased feedstock availability, improved cost-efficiency, and a stronger sustainability profile, ultimately driving its growth and market adoption.

Agricultural Surfactants Market by Application Insights

Based on application, the fungicides segment is anticipated to witness the highest growth in the market.

Fungicides in the agricultural surfactants application sector are witnessing the fastest growth due to several pivotal factors. Fungal diseases pose substantial threats to crop yields and quality, necessitating effective management strategies. Agricultural surfactants significantly enhance the performance of fungicides by improving their coverage, adhesion, and penetration on plant surfaces, ensuring comprehensive protection against fungal pathogens. With shifting weather patterns and increased global trade, the risk of fungal outbreaks has surged, intensifying the demand for reliable disease management tools.

Furthermore, the environmental and regulatory push for reduced chemical usage aligns with the role of surfactants in optimizing fungicide efficiency. Their ability to aid targeted and efficient applications aligns with sustainable farming practices. As the agricultural sector prioritizes precision and eco-conscious approaches, fungicide-associated surfactants stand out as essential tools for combating fungal diseases, contributing to their rapid growth in the global market.

Agricultural Surfactants Market by Substrate Type Insights

Based on substrate type, the bio-based segment is projected to experience the highest growth during the forecast period of the market.

Biobased surfactants are poised to experience the highest growth in the market due to their alignment with two pivotal trends: sustainability and performance. As environmental concerns and regulations intensify, the demand for eco-friendly solutions in agriculture rises significantly. Biobased surfactants, derived from renewable sources, exhibit reduced environmental impact, enhanced biodegradability, and lower toxicity compared to traditional synthetic counterparts.

Moreover, the performance of biobased surfactants has been advancing, bridging the gap with synthetic alternatives. Researchers are continuously innovating to optimize their properties, ensuring compatibility with various agrochemical formulations and target crops. As modern farming practices evolve towards precision agriculture and sustainable approaches, biobased surfactants offer a strategic solution for effective pesticide delivery, reduced chemical wastage, and improved overall agrochemical performance. This dual synergy of environmental responsibility and performance enhancement positions biobased surfactants for rapid growth, making them a focal point in driving the evolution of the agricultural surfactants market.

Agricultural Surfactants Market by Regional Insights

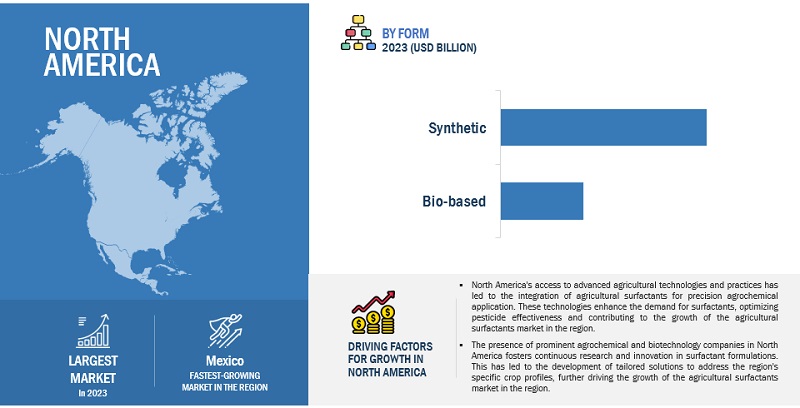

The North America market is projected to contribute the largest share of the agricultural surfactants market.

North America's dominance in the market can be attributed to a convergence of key factors. The region's advanced agricultural practices, coupled with a strong emphasis on maximizing crop yields, have driven substantial demand for surfactants that enhance the efficiency of agrochemical applications. North American farmers and agribusinesses are at the forefront of adopting cutting-edge precision agriculture techniques, necessitating precise and effective chemical application that surfactants facilitate.

Furthermore, the presence of prominent agrochemical and biotechnology companies within North America fuels research and development efforts, leading to the continuous innovation of surfactant formulations tailored to the region's diverse crop and pest profiles. Stringent environmental regulations in the region have also accelerated the adoption of surfactants to reduce chemical wastage and environmental impact.

The North American market's robust growth is further bolstered by the region's economic strength, technological advancements, and the focus on sustainable agricultural practices. The alignment of these factors positions North America as a leader in agricultural surfactant adoption, enabling it to maintain the largest market share within the global agricultural surfactants industry.

Top Companies in Agricultural Surfactants Industry

CHS Inc. (US), BASF SE (Germany), Solvay (Belgium), Corteva Agriscience (US), Evonik (Germany), Croda International Plc (UK), Nufarm (Australia), CLARIANT (Switzerland), and Stepan Company (US)are among the key players in the global market. To increase their company's revenues and market shares, companies are focusing on launching new products, developing partnerships, and expanding their production facilities. The key strategies used by companies in the agricultural surfactants market include strategic acquisitions to gain a foothold over the extensive supply chain and new product launches as a result of extensive research and development (R&D) initiatives.

Agricultural Surfactants Market Report Scope

|

Report Metric |

Details |

|

Agricultural Surfactants Market Estimated Size (2023) |

US $1.7 Billion |

|

Projected Market Valuation (2028) |

US $2.3 Billion |

|

Value-based CAGR (2023-2028) |

6.2% |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Type, By Substrate Type, By Application, By Crop Type, and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

|

Agricultural Surfactants Market Segmentation:

Market By Type

- Non-ionic

- Anionic

- Cationic

- Amphoteric

Market By Substrate Type

- Synthetic

- Bio-based

Market By Application

- Herbicides

- Fungicides

- Insecticides

- Other Applications

Market By Crop Type

- Cereals & Grains

- Pulses & Oilseeds

- Fruits & Vegetables

- Other Crop Types

Market By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Note 1 Other applications include fertilizers, biostimulants, plant regulators, and nematicides.

Note 2: Other crop types include sugarcane, plantation crops, and turf & ornamentals.

Agricultural Surfactants Market News

- In February 2022, CLARIANT (Switzerland) launched Vita, its latest innovation featuring 100% bio-based surfactants and polyethylene glycols. Tailored for natural formulations with an emphasis on achieving a robust Renewable Carbon Index (RCI), Vita enabled manufacturers to optimize bio-based carbon content in crop formulations.

- In August 2021, CHS Inc. (US) introduced Last-Chance Pro to increase herbicide uptake, translocation, and efficacy.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share of the agricultural surfactants market?

The North American region accounted for the largest share, in terms of value, of USD 0.6 billion, of the global agricultural surfactants market in 2023 and is expected to grow at a CAGR of 6.2%.

Which region is projected to account for the highest growth in the agricultural surfactants market?

Asia Pacific is projected to experience the highest growth in terms of value, with a CAGR of 7.7%.

What is the current size of the global agricultural surfactants market?

The agricultural surfactants market is estimated at USD 1.7 billion in 2023 and is projected to reach USD 2.8 billion by 2028, at a CAGR of 6.2% from 2023 to 2028.

Which are the key players in the market?

The key players in this market include CHS Inc. (US), BASF SE (Germany), Solvay (Belgium), Corteva Agriscience (US), Evonik (Germany), Croda International Plc (UK), Nufarm (Australia), CLARIANT (Switzerland), and Stepan Company (US).

What are the factors driving the agricultural surfactants market?

The agricultural surfactants market is driven by the need for enhanced agrochemical efficiency optimizing pesticide applications for improved pest and disease management. Growing awareness of environmental sustainability compels the adoption of surfactants to reduce chemical wastage and minimize ecological impact. Additionally, the rise of precision agriculture and the demand for higher crop yields further fuel the market's expansion.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSPOPULATION GROWTH AND DECREASE IN ARABLE LANDINCREASE IN FARM EXPENDITURE

-

5.3 MARKET DYNAMICSDRIVERS- Adoption of precision farming and protected agriculture- Increase in demand for green solutionsRESTRAINTS- Strict regulations regarding use of synthetic surfactants- Rising use of genetically modified seedsOPPORTUNITIES- Production of sustainable bio-based surfactant products- Development of cost-effective production techniquesCHALLENGES- Rising environmental concerns

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGPACKAGINGDISTRIBUTIONMARKETING AND SALES

- 6.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.4 TARIFF AND REGULATORY LANDSCAPENORTH AMERICA- US- CanadaEUROPE- UK- GermanyASIA PACIFIC- AustraliaREST OF THE WORLD- South Africa

-

6.5 PATENT ANALYSIS

- 6.6 TRADE ANALYSIS

-

6.7 PRICING ANALYSISAVERAGE SELLING PRICE TRENDS

-

6.8 ECOSYSTEM ANALYSISDEMAND SIDESUPPLY SIDE

-

6.9 TECHNOLOGY ANALYSISMICROBIAL BIOSURFACTANTSBIOSURFACTANT MICROEMULSION SYSTEMS

-

6.10 CASE STUDIESEVONIK DEVELOPED SUSTAINABLE SURFACTANTS TO ENCOURAGE ENVIRONMENTALLY FRIENDLY CROP PROTECTIONWILBUR-ELLIS DEVELOPED NON-IONIC SURFACTANTS TO IMPROVE DEPOSITION QUALITY OF ORGANIC PRODUCTS

-

6.11 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.13 KEY CONFERENCES & EVENTS

- 7.1 INTRODUCTION

-

7.2 NON-IONICRISING DEMAND FOR EXPERTLY FORMULATED ADJUVANT FORMULATIONS TO DRIVE GROWTH

-

7.3 ANIONICRISING ADOPTION OF ANIONIC AGRICULTURAL SURFACTANTS TO IMPROVE ADHESION IN PESTICIDE FORMULATIONS TO BOOST GROWTH

-

7.4 AMPHOTERICRISING NEED TO IMPROVE EFFICACY OF PESTICIDES, HERBICIDES, AND FERTILIZERS TO PROPEL MARKET EXPANSION

-

7.5 CATIONICPOPULARITY OF CATIONIC SURFACTANTS DUE TO THEIR PH-SENSITIVE NATURE TO FACILITATE MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 HERBICIDESDEMAND FOR INCREASED EFFICIENCY OF LEAF CUTICLES TO DRIVE USE OF SURFACTANTS IN HERBICIDES

-

8.3 FUNGICIDESFOCUS ON STRENGTHENING PERFORMANCE OF FUNGICIDES TO DRIVE MARKET

-

8.4 INSECTICIDESRISING DEMAND FOR LIMITING USE OF CHEMICALS IN INSECTICIDES TO ENCOURAGE ADOPTION OF SURFACTANTS

- 8.5 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 CEREALS & GRAINSGROWING EMPHASIS ON CROP PROTECTION AND ENHANCEMENT TO DRIVE USE OF SURFACTANTS IN CEREALS AND GRAINSCORNWHEATOTHER CEREALS & GRAINS

-

9.3 OILSEEDS & PULSESRISING DEMAND FOR EDIBLE OILS AND PROTEIN-RICH PULSES TO BOOST MARKET

-

9.4 FRUITS & VEGETABLESINCREASING GLOBAL CONSUMPTION OF FRUITS AND VEGETABLES TO ENCOURAGE MARKET GROWTH

- 9.5 OTHER CROP TYPES

- 10.1 INTRODUCTION

-

10.2 SYNTHETICINCREASING ADOPTION OF SYNTHETIC SURFACTANTS AS EMULSIFYING AGENTS IN PESTICIDES TO BOOST MARKET

-

10.3 BIO-BASEDDEMAND FOR RENEWABLE BIOLOGICAL SUBSTRATES DUE TO RISING HEALTH CONCERNS TO PROPEL MARKET

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAUS- Adoption of precision farming techniques to boost demand for agricultural surfactantsCANADA- Focus on organic farming to spur adoption of agricultural surfactantsMEXICO- Demand for sustainable farming solutions to drive market

-

11.3 EUROPEGERMANY- Demand for solutions that amplify pesticide efficacy to drive marketFRANCE- Growing focus on crop protection to boost marketUK- Demand for sustainable agricultural solutions to boost popularity of agricultural surfactantsITALY- Rising adoption of integrated pest management solutions to fuel marketSPAIN- Popularity of sustainable farming practices to amplify demand for agricultural surfactantsREST OF EUROPE

-

11.4 ASIA PACIFICCHINA- Rapid modernization of agriculture to drive market expansionINDIA- Focus on large-scale farming practices to boost market growthJAPAN- Technological innovations in agriculture to fuel adoption of agricultural surfactantsAUSTRALIA & NEW ZEALAND- Demand for agrochemical efficacy to encourage market growthREST OF ASIA PACIFIC

-

11.5 SOUTH AMERICABRAZIL- Strong commercial appeal for crop benefits to propel market growthARGENTINA- Rising need to optimize pesticide efficacy to boost growthREST OF SOUTH AMERICA

-

11.6 REST OF THE WORLDAFRICA- Focus on food security to accelerate demand for agricultural surfactantsMIDDLE EAST- Growing emphasis on desert agricultural practices to amplify demand for agricultural surfactants

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- 12.4 MARKET SHARE ANALYSIS FOR KEY PLAYERS

-

12.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERSCOMPETITIVE BENCHMARKING

-

12.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHES

-

13.1 KEY PLAYERSCORTEVA AGRISCIENCE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEVONIK INDUSTRIES- Business overview- Products/Solutions/Services offered- MnM viewSOLVAY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCLARIANT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNUFARM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCRODA INTERNATIONAL PLC- Business overview- Products/Solutions/Services offered- MnM viewSTEPAN COMPANY- Business overview- Products/Solutions/Services offered- MnM viewHELENA AGRI-ENTERPRISES, LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWINFIELD UNITED- Business overview- Products/Solutions/Services offered- MnM viewKALO- Business overview- Products/Solutions/Services offered- MnM viewWILBUR-ELLIS COMPANY LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBRANDT, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNOURYON- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 STARTUPS/SMESPRECISION LABORATORIES, LLCGARRCO PRODUCTS, INC.INNVICTISLANKEM LTD.INDOFIL INDUSTRIES LIMITED

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 AGRICULTURAL ADJUVANTS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.4 CROP PROTECTION MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.1 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.2 CUSTOMIZATION OPTIONS

- 15.3 RELATED REPORTS

- 15.4 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2022

- TABLE 2 AGRICULTURAL SURFACTANTS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 GM CROPS & BIOPESTICIDES: SUBSTITUTION POTENTIAL OF SYNTHETIC PESTICIDES FOR VARIOUS CROPS

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LIST OF MAJOR PATENTS PERTAINING TO AGRICULTURAL SURFACTANTS MARKET, 2016–2023

- TABLE 10 IMPORT VALUE OF AGRICULTURAL SURFACTANTS, BY KEY COUNTRY, 2022 (USD THOUSAND)

- TABLE 11 EXPORT VALUE OF AGRICULTURAL SURFACTANTS, BY KEY COUNTRY, 2022 (USD THOUSAND)

- TABLE 12 GLOBAL AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2020–2022 (USD MILLION PER KT)

- TABLE 13 GLOBAL AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2020–2022 (USD MILLION PER KT)

- TABLE 14 OATS: GLOBAL AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2020–2022 (USD MILLION PER KT)

- TABLE 15 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 16 IMPACT OF PORTER’S FIVE FORCES ON AGRICULTURAL SURFACTANTS MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY SUBSTRATE TYPES

- TABLE 18 KEY BUYING CRITERIA FOR SUBSTRATE TYPES

- TABLE 19 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 20 AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 21 AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 22 AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 23 AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 24 NON-ICONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 NON-ICONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 NON-ICONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 27 NON-ICONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 28 ANIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 ANIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 ANIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 31 ANIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 32 AMPHOTERIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 AMPHOTERIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 AMPHOTERIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 35 AMPHOTERIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 36 CATIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 CATIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 CATIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 39 CATIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 40 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 43 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 44 HERBICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 HERBICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 HERBICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 47 HERBICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 48 FUNGICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 FUNGICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 FUNGICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 51 FUNGICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 52 INSECTICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 INSECTICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 INSECTICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 55 INSECTICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 56 OTHER APPLICATIONS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 OTHER APPLICATIONS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 OTHER APPLICATIONS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 59 OTHER APPLICATIONS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 60 AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 61 AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 62 AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019–2022 (KT)

- TABLE 63 AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 64 CEREALS & GRAINS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 CEREALS & GRAINS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 CEREALS & GRAINS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 67 CEREALS & GRAINS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 68 OILSEEDS & PULSES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 OILSEEDS & PULSES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 OILSEEDS & PULSES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 71 OILSEEDS & PULSES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 72 FRUITS & VEGETABLES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 FRUITS & VEGETABLES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 FRUITS & VEGETABLES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 75 FRUITS & VEGETABLES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 76 OTHER CROP TYPES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 OTHER CROP TYPES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 OTHER CROP TYPES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 79 OTHER CROP TYPES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 80 AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 81 AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 82 AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 83 AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 84 SYNTHETIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 SYNTHETIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 SYNTHETIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 87 SYNTHETIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 88 BIO-BASED: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 BIO-BASED: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 BIO-BASED: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 91 BIO-BASED: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 92 AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 95 AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 96 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 99 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 100 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 103 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 104 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019–2022 (KT)

- TABLE 107 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 108 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 111 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 112 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 115 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 116 US: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 117 US: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 118 US: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 119 US: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 120 US: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 121 US: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 US: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 123 US: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 124 US: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 125 US: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 126 US: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 127 US: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 128 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 129 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 130 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 131 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 132 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 133 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 134 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 135 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 136 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 137 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 138 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 139 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 140 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 141 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 142 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 143 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 144 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 145 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 147 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 148 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 149 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 150 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 151 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 152 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 153 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 154 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 155 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 156 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 157 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 158 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 159 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 160 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 161 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 162 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019–2022 (KT)

- TABLE 163 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 164 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 165 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 166 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 167 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 168 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 169 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 170 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 171 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 172 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 173 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 174 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 175 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 176 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 177 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 178 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 179 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 180 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 181 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 182 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 183 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 184 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 185 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 186 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 187 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 188 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 189 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 190 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 191 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 192 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 193 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 194 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 195 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 196 UK: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 197 UK: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 198 UK: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 199 UK: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 200 UK: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 201 UK: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 202 UK: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 203 UK: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 204 UK: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 205 UK: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 206 UK: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 207 UK: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 208 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 209 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 210 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 211 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 212 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 213 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 214 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 215 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 216 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 217 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 218 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 219 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 220 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 221 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 222 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 223 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 224 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 225 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 226 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 227 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 228 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 229 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 230 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 231 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 232 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 233 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 234 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 235 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 236 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 237 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 238 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 239 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 240 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 241 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 242 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 243 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 244 KEY CROPS CULTIVATED, BY COUNTRY

- TABLE 245 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 246 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 247 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 248 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 249 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 250 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 251 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 252 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 253 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 254 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 255 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019–2022 (KT)

- TABLE 256 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 257 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 258 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 259 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 260 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 261 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 262 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 263 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 264 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 265 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 266 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 267 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 268 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 269 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 270 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 271 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 272 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 273 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 274 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 275 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 276 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 277 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 278 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 279 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 280 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 281 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 282 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 283 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 284 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 285 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 286 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 287 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 288 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 289 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 290 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 291 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 292 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 293 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 294 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 295 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 296 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 297 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 298 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 299 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 300 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 301 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 302 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 303 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 304 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 305 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 306 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 307 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 308 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 309 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 310 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 311 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 312 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 313 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 314 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 315 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 316 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 317 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 318 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 319 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 320 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 321 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 322 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 323 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 324 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 325 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 326 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 327 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 328 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 329 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 330 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 331 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 332 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 333 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 334 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 335 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019–2022 (KT)

- TABLE 336 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 337 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 338 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 339 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 340 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 341 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 342 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 343 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 344 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 345 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 346 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 347 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 348 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 349 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 350 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 351 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 352 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 353 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 354 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 355 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 356 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 357 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 358 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 359 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 360 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 361 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 362 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 363 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 364 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 365 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 366 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 367 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 368 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 369 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 370 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 371 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 372 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 373 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 374 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 375 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 376 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 377 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 378 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 379 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 380 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 381 ROW: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 382 ROW: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 383 ROW: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019–2022 (KT)

- TABLE 384 ROW: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 385 ROW: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 386 ROW: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 387 ROW: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 388 ROW: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 389 ROW: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 390 ROW: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 391 ROW: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019–2022 (KT)

- TABLE 392 ROW: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 393 ROW: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 394 ROW: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 395 ROW: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 396 ROW: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 397 ROW: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 398 ROW: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 399 ROW: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 400 ROW: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 401 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 402 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 403 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 404 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 405 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 406 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 407 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 408 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 409 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 410 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 411 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 412 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 413 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 414 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 415 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 416 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 417 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 418 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 419 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019–2022 (KT)

- TABLE 420 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 421 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (USD MILLION)

- TABLE 422 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (USD MILLION)

- TABLE 423 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019–2022 (KT)

- TABLE 424 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023–2028 (KT)

- TABLE 425 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 426 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- TABLE 427 COMPANY FOOTPRINT, BY TYPE

- TABLE 428 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 429 COMPANY FOOTPRINT, BY REGION

- TABLE 430 LIST OF KEY STARTUPS/SMES

- TABLE 431 COMPETITIVE BENCHMARKING (BY TYPE, APPLICATION, AND REGION)

- TABLE 432 AGRICULTURAL SURFACTANTS MARKET: PRODUCT LAUNCHES, 2021–2022

- TABLE 433 AGRICULTURAL SURFACTANTS MARKET: DEALS, 2021

- TABLE 434 CORTEVA AGRISCIENCE: BUSINESS OVERVIEW

- TABLE 435 CORTEVA AGRISCIENCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 436 BASF SE: BUSINESS OVERVIEW

- TABLE 437 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 438 EVONIK INDUSTRIES: BUSINESS OVERVIEW

- TABLE 439 EVONIK INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 440 SOLVAY: BUSINESS OVERVIEW

- TABLE 441 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 442 SOLVAY: DEALS

- TABLE 443 CLARIANT: BUSINESS OVERVIEW

- TABLE 444 CLARIANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 445 CLARIANT: PRODUCT LAUNCHES

- TABLE 446 CHS INC.: BUSINESS OVERVIEW

- TABLE 447 CHS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 448 CHS INC.: PRODUCT LAUNCHES

- TABLE 449 NUFARM: BUSINESS OVERVIEW

- TABLE 450 NUFARM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 451 CRODA INTERNATIONAL PLC: BUSINESS OVERVIEW

- TABLE 452 CRODA INTERNATIONAL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 453 STEPAN COMPANY: BUSINESS OVERVIEW

- TABLE 454 STEPAN COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 455 HELENA AGRI-ENTERPRISES, LLC: BUSINESS OVERVIEW

- TABLE 456 HELENA AGRI-ENTERPRISES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 457 WINFIELD UNITED: BUSINESS OVERVIEW

- TABLE 458 WINFIELD UNITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 459 KALO: BUSINESS OVERVIEW

- TABLE 460 KALO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 461 WILBUR-ELLIS COMPANY: BUSINESS OVERVIEW

- TABLE 462 WILBUR-ELLIS COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 463 WILBUR-ELLIS COMPANY: PRODUCT LAUNCHES

- TABLE 464 BRANDT, INC.: BUSINESS OVERVIEW

- TABLE 465 BRANDT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 466 NOURYON: BUSINESS OVERVIEW

- TABLE 467 NOURYON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 468 MARKETS ADJACENT TO AGRICULTURAL SURFACTANTS MARKET

- TABLE 469 AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2019–2022 (USD MILLION)

- TABLE 470 AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 471 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2016–2019 (USD MILLION)

- TABLE 472 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2020–2025 (USD MILLION)

- TABLE 473 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2016–2019 (KT)

- TABLE 474 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2020–2025 (KT)

- FIGURE 1 RESEARCH DESIGN

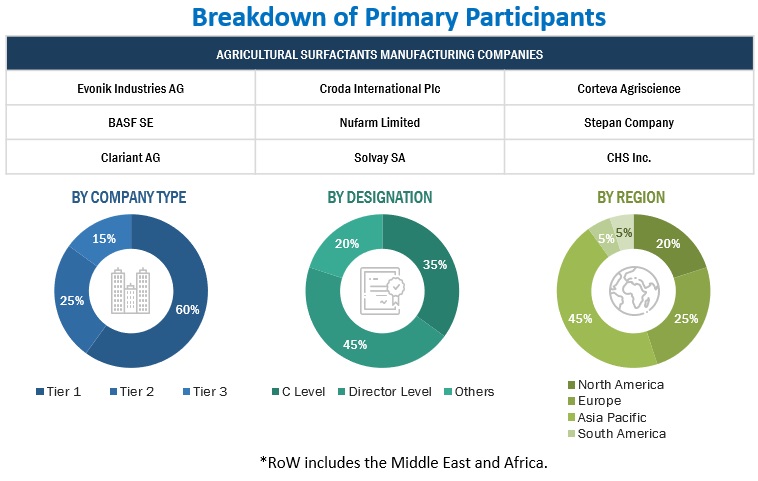

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- FIGURE 4 MAJOR RECESSION INDICATORS

- FIGURE 5 GLOBAL INFLATION RATE, 2011–2021

- FIGURE 6 GLOBAL GROSS DOMESTIC PRODUCT, 2011–2021 (USD TRILLION)

- FIGURE 7 RECESSION INDICATORS AND THEIR IMPACT ON AGRICULTURAL SURFACTANTS MARKET

- FIGURE 8 GLOBAL AGRICULTURAL SURFACTANTS MARKET: CURRENT FORECAST VS. RECESSION FORECAST

- FIGURE 9 AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 AGRICULTURAL SURFACTANTS MARKET: REGIONAL SNAPSHOT

- FIGURE 14 NEED FOR ADOPTING HIGH-QUALITY PESTICIDES IN AGRICULTURE SECTOR TO DRIVE MARKET

- FIGURE 15 NON-IONIC SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 16 US TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 17 NON-IONIC SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 18 SYNTHETIC SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 19 HERBICIDES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 20 CEREALS & GRAINS SEGMENT TO LEAD MARKET IN 2023

- FIGURE 21 HERBICIDES SEGMENT TO DOMINATE NORTH AMERICAN AGRICULTURAL SURFACTANTS MARKET BY 2028

- FIGURE 22 POPULATION GROWTH, 1950–2025 (BILLION)

- FIGURE 23 PER CAPITA ARABLE LAND, 1960–2025 (HA PER CAPITA)

- FIGURE 24 SHARE OF TOTAL ON-FARM PRODUCTION EXPENDITURE

- FIGURE 25 AGRICULTURAL SURFACTANTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 VALUE CHAIN ANALYSIS

- FIGURE 27 REVENUE SHIFT FOR AGRICULTURAL SURFACTANTS MARKET

- FIGURE 28 TOTAL PATENTS GRANTED, 2013–2022

- FIGURE 29 TOTAL PATENTS GRANTED, BY KEY REGION

- FIGURE 30 ECOSYSTEM MAP

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY SUBSTRATE TYPES

- FIGURE 32 KEY BUYING CRITERIA FOR KEY SUBSTRATE TYPES

- FIGURE 33 NON-IONIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 HERBICIDES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 35 CEREALS & GRAINS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 36 SYNTHETIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 37 REGIONS EMERGING AS NEW HOTSPOTS IN AGRICULTURAL SURFACTANTS MARKET

- FIGURE 38 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET SNAPSHOT

- FIGURE 39 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS, 2020–2022 (USD BILLION)

- FIGURE 40 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 41 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 42 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

- FIGURE 43 BASF SE: COMPANY SNAPSHOT

- FIGURE 44 EVONIK INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 45 SOLVAY: COMPANY SNAPSHOT

- FIGURE 46 CLARIANT: COMPANY SNAPSHOT

- FIGURE 47 CHS INC.: COMPANY SNAPSHOT

- FIGURE 48 NUFARM: COMPANY SNAPSHOT

- FIGURE 49 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

- FIGURE 50 STEPAN COMPANY: COMPANY SNAPSHOT

This research study involved the extensive use of secondary sources directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the agricultural surfactants market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

This research study of agricultural surfactants market involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect valuable information for a technical, market-oriented, and commercial study of the agricultural adjuvants market.

In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the agricultural adjuvants market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the agricultural adjuvants market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the formulation, adoption stage, functions, crop types, application, and regional trends. Stakeholders from the demand side, such as dealers, distributors, farmers, and government authorities who are using agricultural adjuvants, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of agricultural adjuvants and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

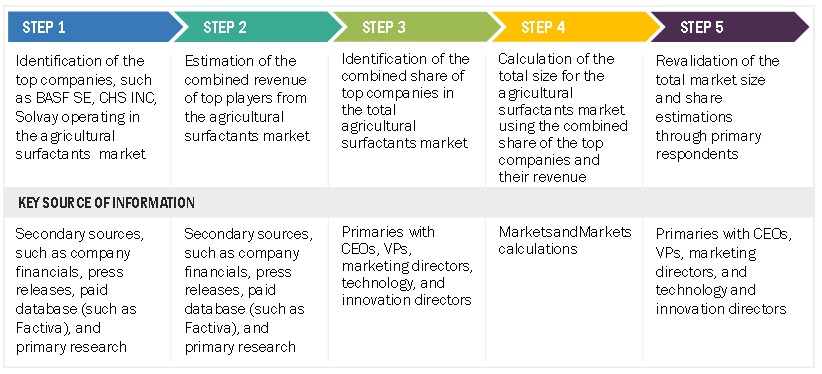

Agricultural Surfactants Market Size Estimation

The following approaches represent the overall market size estimation process employed for the purpose of this study.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

Top-down Approach:

- The key players in the industry and the market were identified through extensive secondary research.

- The revenues of major agricultural surfactant manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, the final market size of the agricultural surfactants market has been arrived at.

To know about the assumptions considered for the study, Request for Free Sample Report

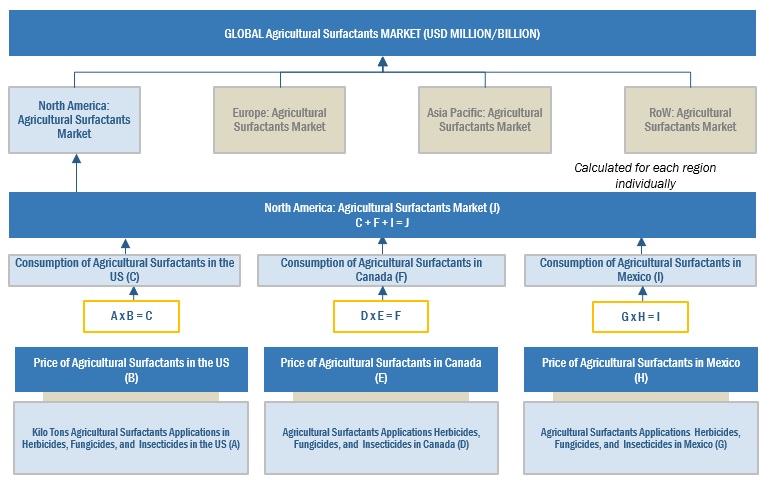

Bottom-up Approach:

- Based on the share of agricultural surfactants for each application at regional and country levels, the market sizes were analyzed. Thus, with a bottom-up approach to the application at the country level, the global market for agricultural surfactants was estimated.

- Based on the demand for applications, offerings of key players, and the region-wise market share of major players, the global market for applications was estimated.

- Other factors considered include the penetration rate of agricultural surfactants, the demand for sustainable crop protection solutions, consumer awareness, functional trends, the adoption rate, patents registered, and organic & inorganic growth attempts.

- From this, market sizes for each region were derived.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the agricultural surfactants market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Agricultural Surfactants Market Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into various segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying a range of factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Agricultural Surfactants Market Definition

According to UPL, agricultural surfactants are activators that improve performance by enhancing surface contact, decreasing runoff, and improving leaf penetration. Non-ionic surfactants, anionic surfactants, and cationic surfactants are the three types of surfactants, with the first two being utilized on crops. Non-ionic surfactants lower the surface tension of water molecules, allowing droplets to cover a larger surface area of the leaf. Anionic surfactants, on the other hand, interact with water to improve foaming and spreading.

The University of Georgia states that ‘Surfactants are adjuvants that facilitate and accentuate the emulsifying, dispersing, spreading, wetting, or other surface modifying properties of liquids.’ There are different chemistries of agricultural surfactants such as Ethoxylated fatty amines (Cationic), Alkylphenol ethoxylate-based surfactants (non-ionic), Alcohol ethoxylate-based surfactants (non-ionic), and Silicone-Based Surfactants as proposed by USDA.

Stakeholders

- Manufacturers of pesticides, fertilizers, and other crop inputs

- Key manufacturers of surfactants

- Pesticide traders, distributors, and suppliers

- Raw material and intermediate traders and suppliers in the agricultural adjuvants market

- Manufacturers and suppliers related to seed treatment and the seeds industry

- Concerned government authorities, commercial R&D institutions, and other regulatory bodies

- Regulatory bodies such as

- US Food and Drug Administration (FDA)

- European Commission (EC)

- European Food Safety Authority (EFSA)

- United States Department of Agriculture (USDA)

- Food Standards Australia New Zealand (FSANZ)

- United States Environmental Protection Agency (USEPA)

- Pest Management Regulatory Agency (PMRA)

- Government agencies and NGOs