Building Management System Market by Software (Facility, Security, Energy, Emergency, Infrastructure Management), Service (Professional, Managed), Application (Residential, Commercial, Industrial), and Geography - Global Forecast to 2023

The building management system market size was valued at USD 6.65 billion in 2016 and is expected to reach USD 19.25 billion by 2023, at a CAGR of 16.71% between 2017 and 2023.

Governments across the globe have taken due cognizance of the benefits of effective management of the buildings and their potential savings. They have been incremental in bringing forward various legislations and initiatives to drive the development and adoption of building management system (BMS) technologies. For the study, the base year considered is 2016, and the forecast provided is between 2017 and 2023.

The Building Management System (BMS) Market is experiencing robust growth, driven by the increasing demand for energy-efficient solutions, stringent regulatory frameworks for green buildings, and the rising adoption of IoT-enabled smart technologies. Key growth drivers include the integration of renewable energy sources, advancements in wireless communication technologies, and the growing need for automation in commercial and industrial buildings to enhance operational efficiency. Latest trends shaping the BMS market include the adoption of AI and machine learning for predictive maintenance, the use of cloud-based BMS for real-time monitoring, and the emphasis on occupant comfort and safety. These factors collectively contribute to the expanding scope and innovation in the BMS industry.

Building Management System Market Dynamics

Drivers

- Significant cost benefits to industrial, commercial, and residential users

- Simplified building operation and maintenance

- Increasing demand for energy-efficient and eco-friendly buildings

- Growing integration of IoT

Restraints

- High implementation costs

- Lack of technically skilled workers

Opportunities

- Integration of analytics in building management

- Growing demand from the emerging economies

Challenges

- Lack of awareness regarding the BMS in various geographies

Significant cost benefits to industrial, commercial, and residential users

Traditionally, operating cost was one of the major concerns for building owners as they had to incur huge expense in the maintenance of the building because of lack of advanced technology. A simple business consideration for using BMS is being more energy-efficient. As reducing energy consumption directly transcends into reduced energy spending, power saving helps improve the business profitability. Ensuring the BMS operating in peak energy demand conditions will enable to improve system efficiency and reduce operating costs. Effectively designed and managed BMS enable abundant opportunities for improvements in energy efficiency by enabling building operators and managers in providing an optimal working environment consistent with maintaining a building’s energy efficiency rating; enabling early identification of equipment failure; identifying unusual patterns of energy usage; monitoring the effectiveness of energy management plans; and so on. Availability of a complete set of information about building enables the building manager to rectify issues through consultation or engineering solutions. Similarly, it also extends the operational life of equipment and systems in the building through reducing loads and operating hours, which results in the reduced maintenance and capital costs with less consumption of embedded energy through equipment replacement and upgrades.

Building automation can help automate the HVAC and lighting systems, saving 5–30% of the overall energy consumption of the building. The commercial deployments such as data centers consume 25–50 times as much power as an average office and spend 40–50% of all power to run the HVAC and other cooling systems. These large numbers for energy spending indicate more opportunities for energy efficiency and higher savings using BMS. Additional cost saving from preventive maintenance also adds to the benefit of the building manager. The average payback period for return on investment (ROI) from an initiative of the BMS-integrated systems is 3–8 years.

The prime objectives of this report can be summarized in the following points.

- To define, describe, and forecast the building management system market based on the software, service type, application, and geography

- To forecast the market size of various segments, in terms of value, with respect to four regions, namely, the Americas, Europe, APAC, and RoW

- To strategically analyze the micromarkets with respect to the individual growth trends, prospects, and contributions to the total BMS market

- To identify and analyze the market dynamics such as drivers, restraints, opportunities, and challenges specific to the market

- To provide the value chain analysis of the ecosystem of building management systems

- To analyze the opportunities for stakeholders in the building management system market and detail the competitive landscape of the market leaders

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

- To analyze various development strategies such as joint ventures, mergers and acquisitions, and product launches, and R&D implemented by the players in the building management systems market

The BMS market was valued at USD 6.65 billion in 2016 and is expected to reach USD 19.25 billion by 2023, at a CAGR of 16.71% between 2017 and 2023. The major factors that drive the market for building management systems are significant cost benefits to industrial, commercial, and residential users, simplified building operations and maintenance, increasing demand for energy-efficient and eco-friendly buildings, and growing integration of IoT. The growing integration of IoT with building automation systems (BASs) is also driving the growth of the building management market based on software. The smart devices that are integrated for the purpose of building automation and management are expected to be more self-governing and intelligent in terms of sharing data with BASs and with the cloud.

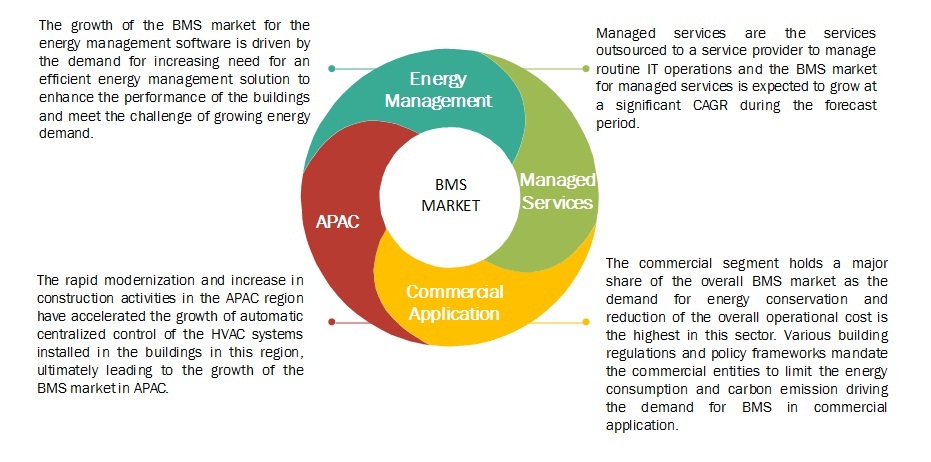

The building management system market based on service types has been segmented into professional services and managed services. Professional services held the largest share in the market in 2016. As the adoption of building management solutions across the globe increases due to the regulatory push, amended policy framework, operational efficiencies, cost containment, sustainability benefits, and changing business dynamics, the demand for professional services increases.

The building management systems market based on software has been further divided into facility management, security management, energy management, emergency management, and infrastructure management software. The market for the energy management software is expected to grow at the highest CAGR during the forecast period. Buildings are the largest consumers of electricity globally. With the increase in the global economy and enhancing the standard of living, the consumption of energy resources is increasing, which, in turn, increases the demand for building energy management systems.

The building management system market has been segmented on the basis region into the Americas, Europe, APAC, and RoW. Europe is expected to hold the largest share of the total building management system market in 2016. The region has been an early adopter of the BMS, which has boosted the demand for BMSs in this region, leading to a higher share in the market. Some of the major players in the market such as Johnson Controls International PLC (Ireland), Schneider Electric (France), Legrand (France), Ingersoll-Rand Plc (Ireland), Robert Bosch GmbH (Germany), and ABB (Switzerland) are based in this region. The presence of a large number of players in the region is serving as a factor driving the market.

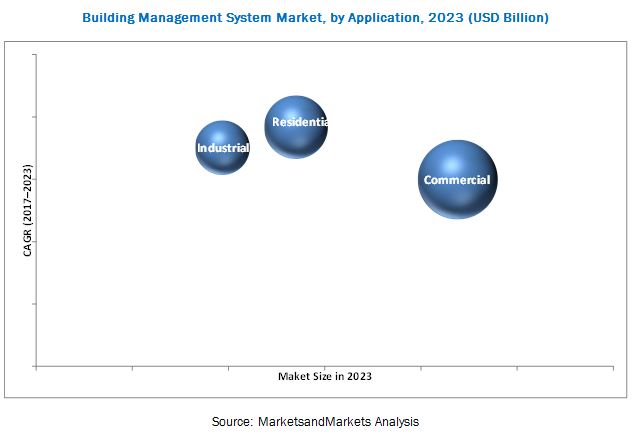

BUILDING MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2023 (USD BILLION)

Source: MarketsandMarkets Analysis

The building management system market has been segmented on the basis of application into commercial, residential, and industrial. The commercial application holds a major share of the overall building automation system market as the demand for energy conservation and reduction of the overall operational cost is the highest in this vertical. Various building regulations and policy frameworks mandate the commercial entities to limit the energy consumption and carbon emission driving the demand for building management systems in the commercial application.

Significant cost benefits to industrial, commercial, and residential users due to adoption of building management system driving the market

Residential

With the advent of Internet of Things (IoT) and smart connected homes, there is a surge in the management of the residential premises. Large residential complexes have been frontrunners in adopting the building management systems. Building management systems ease management of various resources in the building and enable intelligent management of infrastructure facilities such as parking premises, water management areas, and waste management areas. Installation of the building management systems also enables improved safety and security to the building managers along with the overall energy savings.

Commercial

Commercial building segment includes office buildings, retail and public assembly buildings, educational institutes, hospitals and healthcare facilities, airport and railways, others which include nonmanufacturing commercial buildings. Office buildings are among the prominent end users of the building management systems in the commercial sector. Building management in office buildings mainly includes HVAC control systems, lighting control systems, and security and access control systems. These are also the sources of high power consumption, and managing these sources helps in cutting down the critical operational expenditures.

Industrial

Industrial facilities include factories, production plants, distribution facilities, warehouses, and other infrastructure buildings which support manufacturing and production functions. The segment is expected to adopt smart building solutions to attain energy and cost savings, higher productivity, enhanced identity and access management, and optimized surveillance. Manufacturing and industrial buildings have their own set of requirements for different manufacturing processes and storage purposes. They are equipped with the solutions based on highly sophisticated technology ranging from air-conditioning units to controlled ventilation and smart lighting systems, which contributes highly to the overall energy consumption. Reducing energy expenditures is very critical for industrial and manufacturing facilities as they directly contribute to the operational and capital expenditures of the company, and can affect the profitability. This has driven the demand for the management systems to manage and curb down the expenditures effectively.

Critical questions the report answers:

- What are the opportunities for the various players present now and planning to enter at various stages of the value chain?

- Honeywell International (US), Siemens (Germany), and Johnson Controls International (Ireland) have been aggressive partnering with building automation system hardware offering start-ups, how will this impact the growth rate of the BMS market and who will have the un-due advantage?

Lack of technically skilled workers and high initial implementation costs pose a restraining block in the building management system market. The deployment of BMSs requires certain conditions and technical requirements to be met, and these conditions could be internal, operational, or external such as understanding of computer software, networking, and applications; designing; and testing the system. Maintenance and servicing require trained and skilled personnel to ensure that BASs run smoothly and have a longer lifespan. In the absence of these conditions, the implementation of building management solutions and services become difficult.

The key players in the building management system market are Honeywell International Inc. (US), Siemens AG (Germany), Johnson Controls International PLC (Ireland), Schneider Electric SE (France), United Technologies Corp. (US), IBM Corporation (US), Ingersoll-Rand Plc (Ireland), and Delta Controls (Canada).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in the Global Building Management System Market

4.2 Market, By Software

4.3 Market in Europe, By Software/Service Type and Application

4.4 Analysis of Market Based on Country

4.5 Market Size, By Application

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Value Chain Analysis

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Significant Cost Benefits to Industrial, Commercial, and Residential Users

5.3.1.2 Simplified Building Operation and Maintenance

5.3.1.3 Increasing Demand for Energy-Efficient and Eco-Friendly Buildings

5.3.1.4 Growing Integration of Iot

5.3.2 Restraints

5.3.2.1 High Implementation Costs

5.3.2.2 Lack of Technically Skilled Workers

5.3.3 Opportunities

5.3.3.1 Integration of Analytics in Building Management

5.3.3.2 Growing Demand From the Emerging Economies

5.3.4 Challenges

5.3.4.1 Lack of Awareness Regarding the Bms in Various Geographies

6 Market, By Software (Page No. - 44)

6.1 Introduction

6.2 Facility Management

6.2.1 Lighting Control

6.2.2 HVAC Control

6.3 Security Management

6.3.1 Video Surveillance

6.3.2 Access Control

6.4 Energy Management

6.5 Emergency Management

6.6 Infrastructure Management

7 Market, By Service Type (Page No. - 54)

7.1 Introduction

7.2 Professional Services

7.3 Managed Services

8 Market, By Application (Page No. - 60)

8.1 Introduction

8.2 Residential

8.3 Commercial

8.3.1 Office Buildings

8.3.2 Retail and Public Buildings

8.3.3 Educational Institutes

8.3.4 Hospitals and Healthcare Facilities

8.3.5 Airports and Railways

8.3.6 Others

8.4 Industrial

9 Geographic Analysis (Page No. - 67)

9.1 Introduction

9.2 Americas

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.2.4 Rest of the Americas

9.3 Europe

9.3.1 France

9.3.2 Germany

9.3.3 Italy

9.3.4 UK

9.3.5 Rest of Europe

9.4 APAC

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 Rest of APAC

9.5 RoW

9.5.1 Middle East

9.5.2 Africa

10 Competitive Landscape (Page No. - 89)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Scenario

10.4 Vendor Dive Overview

10.4.1 Vanguards

10.4.2 Dynamic

10.4.3 Innovator

10.4.4 Emerging

10.5 Competitive Benchmarking

10.5.1 Analysis of Business Strategy Parameters for Major Players in Market (25 Companies)

10.5.2 Analysis of Product Offering Parameters for Major Players in Market (25 Companies)

Top 25 Companies Analyzed for This Study are - Honeywell International Inc.; Johnson Controls International PLC; Schneider Electric SE; Siemens AG; United Technologies Corp.; ABB Ltd.; Azbil Corporation; Delta Controls; Larsen & Toubro Limited.; Mitsubishi Electric Corporation; Robert Bosch GmbH; Singapore Technologies Electronics Limited; Dexma Sensors, S.L.; Eagle Technology; Legrand Sa; Lutron Electronics Co., Inc.; Technovator International Limited.; Airedale International Air Conditioning Ltd; Buildingiq, Inc.; Distech Controls Inc.; Gridpoint, Inc.; Lucid

11 Company Profiles (Page No. - 96)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

11.1 Introduction

11.2 Johnson Controls International PLC

11.3 Honeywell International Inc.

11.4 Siemens AG

11.5 Schneider Electric SE

11.6 United Technologies Corp.

11.7 IBM Corporation

11.8 Ingersoll-Rand PLC

11.9 Delta Controls

11.10 Crestron Electronics, Inc.

11.11 Buildingiq, Inc.

11.12 Startup Ecosystem

11.12.1 Introduction

11.12.2 Lucid

11.12.3 Distech Controls Inc.

11.12.4 Gridpoint, Inc.

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 128)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (61 Tables)

Table 1 Building Management System Market, By Software and Service Type, 2014-2023 (USD Billion)

Table 2 Market, By Software, 2014–2023 (USD Million)

Table 3 Market for Software, By Region, 2014–2023 (USD Million)

Table 4 Market for Software, By Application, 2014–2023 (USD Million)

Table 5 Market for Facility Management, By Region, 2014–2023 (USD Million)

Table 6 Market for Facility Management, By Type, 2014–2023 (USD Million)

Table 7 Market for Facility Management for Lighting Control, By Region, 2014–2023 (USD Million)

Table 8 Market for Facility Management for HVAC Control, By Region, 2014–2023 (USD Million)

Table 9 Market for Security Management, By Region, 2014–2023 (USD Million)

Table 10 Market for Security Management, By Type, 2014–2023 (USD Million)

Table 11 Market for Security Management for Video Surveillance, By Region, 2014–2023 (USD Million)

Table 12 Market for Security Management for Access Control, By Region, 2014–2023 (USD Million)

Table 13 Market for Energy Management, By Region, 2014–2023 (USD Million)

Table 14 Market for Emergency Management, By Region, 2014–2023 (USD Million)

Table 15 Market for Infrastructure Management, By Region, 2014–2023 (USD Million)

Table 16 Market, By Service Type, 2014–2023 (USD Million)

Table 17 Market for Service Type, By Region, 2014–2023 (USD Million)

Table 18 Market for Service Type, By Application, 2014–2023 (USD Million)

Table 19 Market for Professional Services, By Type, 2014–2023 (USD Million)

Table 20 Market for Professional Services, By Region, 2014–2023 (USD Million)

Table 21 Market for Professional Services, By Application, 2014–2023 (USD Million)

Table 22 Market for Managed Services, By Region, 2014–2023 (USD Million)

Table 23 Market for Managed Services, By Application, 2014–2023 (USD Million)

Table 24 Market, By Application, 2014–2023 (USD Billion)

Table 25 Market for Residential, By Software and Service Type, 2014–2023 (USD Million)

Table 26 Market for Residential Application, By Region, 2014–2023 (USD Million)

Table 27 Market for Commercial, By Type, 2014–2023 (USD Million)

Table 28 Market for Commercial, By Software and Service Type, 2014–2023 (USD Million)

Table 29 Market for Commercial, By Region, 2014–2023 (USD Million)

Table 30 Market for Industrial, By Software and Service Type, 2014–2023 (USD Million)

Table 31 Market for Industrial, By Region, 2014–2023 (USD Million)

Table 32 Market, By Geography, 2014–2023 (USD Billion)

Table 33 Market in Americas, By Country, 2014–2023 (USD Million)

Table 34 Market in Americas, By Software and Service Type, 2014–2023 (USD Million)

Table 35 Market in Americas, By Application, 2014–2023 (USD Million)

Table 36 Market in Americas, By Software, 2014–2023 (USD Million)

Table 37 Market in Americas, By Service Type, 2014–2023 (USD Million)

Table 38 Market in Americas for Facility Management, By Type, 2014–2023 (USD Million)

Table 39 Market in Americas for Security Management Software, By Type, 2014–2023 (USD Million)

Table 40 Market in Europe, By Country, 2014–2023 (USD Million)

Table 41 Market in Europe, By Software and Service Type, 2014–2023 (USD Million)

Table 42 Market in Europe, By Application, 2014–2023 (USD Million)

Table 43 Market in Europe, By Software, 2014–2023 (USD Million)

Table 44 Market in Europe, By Service Type, 2014–2023 (USD Million)

Table 45 Market in Europe for Facility Management, By Type, 2014–2023 (USD Million)

Table 46 Market in Europe for Security Management, By Type, 2014–2023 (USD Million)

Table 47 Market in APAC, By Country, 2014–2023 (USD Million)

Table 48 Market in APAC, By Software and Service Type, 2014–2023 (USD Million)

Table 49 Market in APAC, By Application, 2014–2023 (USD Million)

Table 50 Market in APAC, By Software, 2014–2023 (USD Million)

Table 51 Market in APAC, By Service Type, 2014–2023 (USD Million)

Table 52 Market in APAC for Facility Management, By Type, 2014–2023 (USD Million)

Table 53 Market in APAC for Security Management, By Type, 2014–2023 (USD Million)

Table 54 Market in RoW, By Country, 2014–2023 (USD Million)

Table 55 Market in RoW, By Software and Service Type, 2014–2023 (USD Million)

Table 56 Market in RoW, By Application, 2014–2023 (USD Million)

Table 57 Market in RoW, By Software, 2014–2023 (USD Million)

Table 58 Market in RoW, By Service Type, 2014–2023 (USD Million)

Table 59 Market in RoW for Facility Management, By Type, 2014–2023 (USD Million)

Table 60 Building Management System Security Market in RoW for Management Software, By Type, 2014–2023 (USD Million)

Table 61 Market Ranking of the Top Players in Market, 2016

List of Figures (37 Figures)

Figure 1 Building Management System Market: Research Design

Figure 2 Process Flow of Market Size Estimation

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Commercial Application Expected to Hold the Largest Size of Market By 2023

Figure 7 Professional Services to Hold Largest Share of Market Till 2023

Figure 8 Market for Energy Management Software to Exhibit Strongest Growth Potential During Forecast Period

Figure 9 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 10 Significant Cost Benefits and Growing Demand From Emerging Economies Expected to Boost Demand for Building Management Systems During Forecast Period

Figure 11 Facility Management Software to Hold Largest Size of Market By 2023

Figure 12 Market Expected to Be Dominated By Software and Commercial Application in 2016

Figure 13 US to Hold Largest Share of Market in 2017

Figure 14 Market for Residential Application Expected to Witness Highest CAGR During the Forecast Period

Figure 15 Value Chain Analysis: Major Value Added By Software Developers

Figure 16 Significant Cost Benefits to Industrial, Commercial, and Residential Users Drive Building Management Market

Figure 17 Market for Energy Management to Grow at Highest CAGR During the Forecast Period

Figure 18 Market for Managed Services to Grow at Higher CAGR Between 2017 and 2023

Figure 19 Commercial Application to Hold Largest Size of Market By 2023

Figure 20 Market, By Geography

Figure 21 Market in China to Grow at Highest CAGR During Forecast Period

Figure 22 Americas: BMS Snapshot (2016)

Figure 23 Europe: BMS Market Snapshot (2016)

Figure 24 APAC: BMS Market Snapshot (2016)

Figure 25 RoW: BMS Market Snapshot (2016)

Figure 26 New Product Launches as the Key Growth Strategy Adopted By Companies Between January 2016 and April 2017

Figure 27 Market: Market Evaluation Framework

Figure 28 Companies Adopted Product Launches as Key Strategy to Increase Market Share

Figure 29 Dive Chart

Figure 30 Johnson Controls International PLC: Company Snapshot

Figure 31 Honeywell International Inc.: Company Snapshot

Figure 32 Siemens AG: Company Snapshot

Figure 33 Schneider Electric SE: Company Snapshot

Figure 34 United Technologies Corp.: Company Snapshot

Figure 35 IBM Corporation: Company Snapshot

Figure 36 Ingersoll-Rand PLC: Company Snapshot

Figure 37 Buildingiq, Inc.: Company Snapshot

The sizing of the building management system market has been done by the top-down and bottom-up approaches. The bottom-up approach has been employed to arrive at the overall size of the building management systems market from the revenues of key players (companies) and their share in the market. Calculations based on the number of different building management systems that are installed in different premises and the demand from all major countries is further added, and finally the volume is multiplied by the average selling price of each building management system subscription/license to arrive the overall market size. In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation), through percentage splits from secondary and primary researches. For the calculation of specific market segments, the most appropriate parent market size has been used to implement the top-down approach.

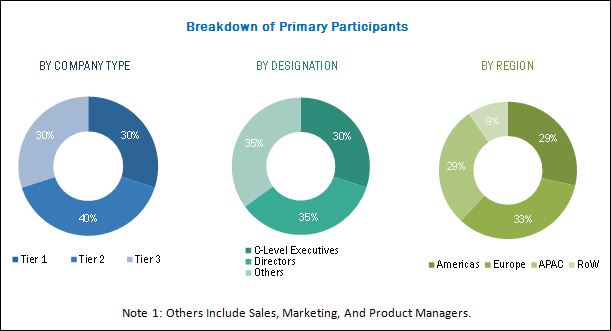

In the process of determining and verifying the building management systems market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key opinion leaders. The break-up of the profiles of primary participants is given in the chart below.

BREAKDOWN OF PRIMARY PARTICIPANTS

Note 1: Others include sales, marketing, and product managers.

“To know about the assumptions considered for the study, please download the pdf brochure.”

The building management system ecosystem comprises major players such as Honeywell International Inc. (US), Siemens AG (Germany), Johnson Controls International PLC (Ireland), Schneider Electric SE (France), United Technologies Corp. (US), IBM Corporation (US), Ingersoll-Rand Plc (Ireland), and Delta Controls (Canada).

Please visit 360Quadrants to see the vendor listing of Building Management System

Building Management System Market Report Scope:

|

Report Metric |

Details |

|

Report Name |

Building Management System Market |

|

Base year |

2016 |

|

Forecast period |

2017–2023 |

|

Forecast units |

Value in terms of USD million and billion |

|

Segments covered |

Product, System Type, Software & Services, Function, Industry, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Honeywell International Inc. (US), Siemens AG (Germany), Johnson Controls International PLC (Ireland), Schneider Electric SE (France), United Technologies Corp. (US), IBM Corporation (US), Ingersoll-Rand Plc (Ireland), and Delta Controls. |

All these companies have their own R&D facilities and extensive sales offices and distribution channels. The products of these companies can be used across various industries for respective applications. The report provides the competitive landscape of the key players, which indicates their growth strategies in the building management systems market.

Major Market Developments

- In October 2018, Honeywell announced its plan to acquire Transnorm, leading provider of warehouse automation solutions

- In April 2018, Johnson Controls acquired the assets of Triatek, a leading manufacturer of innovative airflow solutions for critical environments across the globe.

- In March 2018, Schneider Electric and AVEVA created a joint venture to form a global leader in engineering and industrial software with scale and relevance in key markets as well as an unmatched set of solutions covering all aspects of digital asset management from process simulation to design, construction and manufacturing operations management and optimization.

Target Audience:

- Raw material suppliers

- BMS designers, developers, and suppliers

- BAS equipment integrators, suppliers, and service providers

- Application software providers

- Government bodies such as regulating authorities and policy makers

- BMS-related associations, organizations, forums, and alliances

- Research institutes and organizations

- Market research and consulting firms

“The study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years (depending on the range of the forecast period) for prioritizing the efforts and investments.”

Scope of the Report:

The markets covered in this report has been segmented as follows:

By Software

- Facility Management

- Security Management

- Energy Management

- Infrastructure Management

- Emergency Management

By Service Type

- Professional Services

- Managed Services

By Application

- Residential

- Commercial

- Industrial

Geographic Analysis

Americas

- US

- Canada

- Mexico

- Rest of Americas (Brazil, Argentina, Colombia, and Chile)

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe (Ireland, Poland, Switzerland, Sweden, the Netherlands, and Austria)

APAC

- China

- Japan

- India

- Rest of APAC (Australia, South Korea, the Philippines, and Thailand)

RoW

-

Middle East

- Africa

Growth opportunities and latent adjacency in Building Management System Market

Get the PAM for BMS for Mexico, calculated 130 million, including all services and software and hardware, and engineering

I want Data on BMS market in Africa.

I'd like to know more about facility management software, and also about the trends in USA and outside Europe

All about Building Management System market trend worldwide or specifically in Asia Pacific or ASEAN countries.

BMS, BAS, KNX, Fire Alarm, HVAC, Cooling Towers, Lighting Control, ACMV, Pressurized Fans, AHUs, Dampers & etc.