Well Casing & Cementing Market by Type (Casing, Cementing), Service (Casing pipe, equipment & services, Cementing equipment & services), Operation (Primary, Remedial), Application (Onshore, Offshore), Well, and Region Global Forecast to 2024

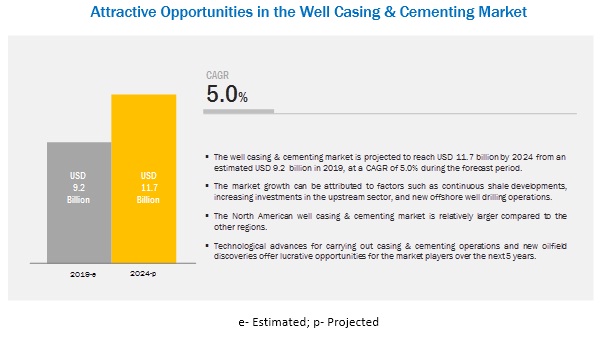

[207 Pages Report] The global well casing & cementing market is projected to reach USD 11.7 billion by 2024 from an estimated USD 9.2 billion in 2019, at a CAGR of 5.0% during the forecast period. Increasing drilling operations have increased the demand for well casing & cementing.

By type, the casing segment is expected to make the largest contribution to the well casing & cementing market during the forecast period.

The report segments the well casing & cementing market, by type, into casing and cementing. The well casing segment is projected to hold the largest market share by 2024. The casing equipment is mainly used to support the well as the raw side of the well would collapse without support. The different types of casing include conductor casing, surface casing, intermediate casing, production casing, and liner. They are used according to the nature of the well. Casing is done at multiple levels, which makes it an expensive procedure. Thus, casing accounts for a larger market share in the well casing & cementing market.

By application, the offshore segment is expected to grow at the fastest rate during the forecast period.

The offshore segment is expected to grow at the fastest rate during the forecast period. The growth of this segment is primarily driven by the cost reduction and digitalization of the oil & gas offshore projects. This would ultimately create new revenue pockets for the well casing & cementing market during the forecast period. New oilfield discoveries in offshore regions are expected to increase the drilling operations, especially in North America, due to their planned exploration and drilling projects for the coming years. Such developments in the offshore are driving the well casing & cementing market.

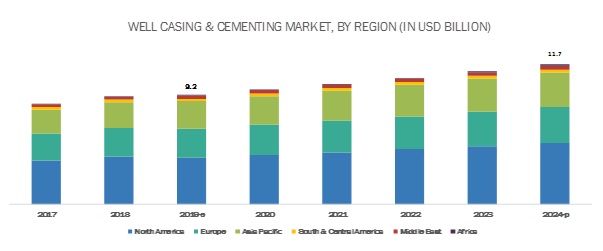

North America is expected to be the largest market during the forecast period.

North America, Europe, South & Central America, Asia Pacific, Middle East, and Africa are the major regions considered for the study of the well casing & cementing market. North America is estimated to be the largest market from 2019 to 2024. The market is driven by the growth in unconventional resources in the US and Canada and demand from the onshore & offshore fields in the Gulf of Mexico. The Gulf of Mexico is one of the major sources of conventional oil & gas in the North American region.

Key Market Players

The major players in the global well casing & cementing market are Halliburton (US), Schlumberger (US), BHGE (US), Weatherford (US), NOV (US), Tenaris (Luxembourg), Vallourec (France), TMK Group (Russia), Trican (Canada), Nabors Industries (Bermuda), Franks International (Blackhawk Specialty Tools) (Netherlands), Innovex Downhole Solutions (US), and Centek Group (UK).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, service type, operation type, application, well type, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, the Middle East, Africa, and South & Central America |

|

Companies covered |

Halliburton (US), Schlumberger (US), BHGE (US), Weatherford (US), NOV (US), Tenaris (Luxembourg), Vallourec (France), TMK Group (Russia), Trican (Canada), Nabors Industries (Bermuda), Franks International (Blackhawk Specialty Tools) (Netherlands), Innovex Downhole Solutions (US), and Centek Group (UK) |

This research report categorizes the well casing & cementing market on the basis of type, service type, operation type, application, well type, and region.

On the basis of type, the well casing & cementing market has been segmented as follows:

- Casing

- Cementing

On the basis of service type, the well casing & cementing market has been segmented as follows:

- Casing Equipment & Services

- Casing pipes

- Conductor casing

- Surface casing

- Intermediate casing

- Production casing

- Liner

- Casing supporting equipment & services

- Float equipment

- Casing collar

- Centralizer

- Scratchers

- Liner systems

- Others (casing slips/spiders, power casing tongs, elevator, and services)

- Casing pipes

- Cementing equipment & services

- Cement head

- Wiper plug

- Stage tools

- Others (cementing unit, pumping unit, and services)

On the basis of operation type, the well casing & cementing market has been segmented as follows:

- Primary Cementing

- Remedial Cementing

- Others (Others includes stage cementing and inner string cementing)

On the basis of application, the well casing & cementing market has been segmented as follows:

- Onshore

- Offshore

On the basis of well type, the well casing & cementing market has been segmented as follows:

- Vertical

- Horizontal

On the basis of region, the well casing & cementing market has been segmented as follows:

- North America

- Asia Pacific

- South & Central America

- Europe

- Middle East

- Africa

Recent Developments

- In April 2019, Weatherford inaugurated a consolidated facility in Egypt to boost revenues and reduce costs. The new facility is a cost-effective initiative, which is expected to save USD 1.5 million per year.

- In March 2019, Tenaris acquired IPSCO Tubulars from the TMK Group. This acquisition helped Tenaris expand its product portfolio and enhanced its position and local manufacturing presence in the US market.

Key Questions Addressed by the Report

- The report identifies and addresses the key segments of the well casing & cementing market, which would help manufacturers and service providers review the growth in demand.

- The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

- The report will help key players understand the strategies of their competitors better and make better strategic decisions.

- The report addresses the market share analysis of key players in the well casing & cementing market, and with the help of this, companies can enhance their revenues in the respective markets.

- The report provides insights about emerging geographies for well casing & cementing, and hence, the entire market ecosystem can gain a competitive advantage.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

What are the trends that could be witnessed over the next five years?

New oilfield discoveries with increased focus on offshore exploration and production activities, along with advancements in regard to the providing integrated solutions to the upstream operators. That is the companies are now able to provide both equipment and services by harnessing the advantages of the acquired companies. These are the trends that could be witnessed in the next five years.

Which of the well casing & cementing market by type will dominate by 2024?

The casing segment, by type will dominate the well casing & cementing market by 2024, owing to an increase in demand for casing activities from new wells that are being drilled at the higher rate, globally.

Which of the application segments will have the maximum opportunity to grow during the forecast period?

The offshore segment, by application will have the maximum opportunity to grow during the forecast period, as offshore oil exploration & production activities have been drastically increasing, owing to the increased oil demand from developing regions.

Which will be the leading region with the largest market share by 2024?

The North American region is expected to be the leading region by 2024, as the region has the largest shale reserves, which makes it a lucrative market for drilling activities and for oilfield service providers.

How are the companies implementing organic and inorganic strategies to gain increased market share?

The companies are emphasizing on contracts & agreements and expansions to increase their share in the well casing & cementing market.

Table of Contents

1 Introduction (Page No. - 22)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Countries Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 26)

2.1 Research Methodology Scope

2.2 Key Influencing Factors/Drivers

2.2.1 Well Count

2.2.2 Rig Count

2.2.3 Crude Oil Prices

2.3 Market Size Estimation

2.3.1 Ideal Demand-Side Analysis

2.3.1.1 Assumptions

2.3.1.2 Calculation

2.3.2 Supply-Side Analysis

2.3.2.1 Assumptions

2.3.2.2 Calculation

2.3.3 Forecast

2.4 Primary Insights

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 40)

4.1 Attractive Opportunities in the Well Casing & Cementing Market During the Forecast Period

4.2 Well Casing & Cementing Market, By Region

4.3 North American Well Casing & Cementing Market, By Type & Country

4.4 Well Casing & Cementing Market, By Application

4.5 Well Casing & Cementing Market, By Well Type

4.6 Well Casing & Cementing Market, By Operation Type

4.7 Well Casing & Cementing Market, By Type

4.8 Well Casing & Cementing Market, By Equipment & Service Type

4.8.1 Well Casing & Cementing Market, By Casing Equipment & Service Type

4.8.1.1 Casing Equipment & Service Market, By Casing Pipe

4.8.1.2 Casing Equipment & Service Market, By Casing Supporting Equipment & Service

4.8.2 Cementing Market, By Cementing Equipment & Service Type

5 Market Overview (Page No. - 47)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Continuous Shale Developments Likely to Drive the Market

5.2.1.2 Revitalizing Oil Prices Expediting Upstream Investments

5.2.1.3 New Offshore Well Drilling in Europe and Africa

5.2.2 Restraints

5.2.2.1 Decreasing Oil Demand From Europe

5.2.3 Opportunities

5.2.3.1 Technological Advancements in Carrying Out Well Drilling Processes

5.2.3.2 New Oilfield Discoveries Creating Immense Opportunities

5.2.4 Challenges

5.2.4.1 Complying With International Regulations and Standards

5.3 Supply Chain Overview

5.3.1 Key Influencers

5.3.1.1 Casing Pipe Manufacturers

5.3.1.2 Casing & Cementing Equipment Manufacturers

5.3.1.3 Casing & Cementing Service Providers

5.3.1.4 Service Integrators

5.3.1.5 Oilfield Operators

6 Well Casing & Cementing Market, By Type (Page No. - 55)

6.1 Introduction

6.2 Casing

6.2.1 North America to Be the Largest Market for Casing

6.3 Cementing

6.3.1 Cementing Market is Driven By Shale Development in the Americas

7 Well Casing & Cementing Market, By Equipment & Service Type (Page No. - 59)

7.1 Introduction

7.2 Casing Equipment & Services

7.2.1 Casing Pipe

7.2.1.1 Conductor Casing

7.2.1.1.1 North America to Be the Largest Market for Conductor Casing Owing to Development of Shale Reserves

7.2.1.2 Surface Casing

7.2.1.2.1 Increasing Offshore Drilling in Asia Pacific to Provide Lucrative Opportunities to Service Providers

7.2.1.3 Intermediate Casing

7.2.1.3.1 Europe to Be the Second Largest Market for Intermediate Casing

7.2.1.4 Production Casing

7.2.1.4.1 Drilling Activities in Ultra-Deep-Water Reserves to Drive the Production Casing Segment

7.2.1.5 Liner

7.2.1.5.1 Complexity in Carrying Out E&P Activities at Unconventional Reserves Expected to Drive the Liner Segment

7.2.2 Casing Supporting Equipment & Services

7.2.2.1 Float Equipment

7.2.2.1.1 Asia Pacific to Be the Second Largest Market for Float Equipment

7.2.2.2 Casing Collar

7.2.2.2.1 Well Complexity and Developments in Unconventional Reserves Provide Lucrative Opportunities to Casing Collar Oems

7.2.2.3 Centralizer

7.2.2.3.1 Increase in Horizontal Drilling Drives the Centralizer Market

7.2.2.4 Scratcher

7.2.2.4.1 Increase in Drilling Activities in Unconventional Reserves Drives the Scratcher Market

7.2.2.5 Liner System

7.2.2.5.1 Increase in Offshore Drilling Activities From Unconventional Reserves to Drive the Liner System Market

7.2.2.6 Others

7.3 Cementing Equipment & Services

7.3.1 Cementing Head

7.3.1.1 Increase in Offshore Drilling to Drive the Cementing Head Segment

7.3.2 Wiper Plug

7.3.2.1 North America Dominates the Wiper Plug Segment

7.3.3 Stage Tool

7.3.3.1 Increase in Multi Stage Cement Jobs to Drive the Stage Tool Market

7.3.4 Others

8 Well Casing & Cementing Market, By Operation Type (Page No. - 76)

8.1 Introduction

8.2 Primary Cementing

8.2.1 Increasing Activities in E&P to Drive the Primary Cementing Market

8.3 Remedial Cementing

8.3.1 Well Complexity at Unconventional Reserves Drives the Remedial Cementing Market

8.4 Others

9 Well Casing & Cementing Market, By Well Type (Page No. - 81)

9.1 Introduction

9.2 Horizontal Well

9.2.1 North America to Dominate Horizontal Drilling Activites

9.3 Vertical Well

9.3.1 Asia Pacific to Lead Vertical Drilling

10 Well Casing & Cementing Market, By Application (Page No. - 85)

10.1 Introduction

10.2 Onshore

10.2.1 Onshore Shale Development in North America to Provide Opportunities for Service Providers

10.3 Offshore

10.3.1 Europe Dominates the Offshore Drilling Activities

11 Well Casing & Cementing Market, By Region (Page No. - 90)

11.1 Introduction

11.2 North America

11.2.1 By Type

11.2.2 By Equipment & Service Type

11.2.2.1 By Casing Equipment & Service

11.2.2.1.1 By Casing Pipe

11.2.2.1.2 By Casing Supporting Equipment & Service

11.2.2.2 By Cementing Equipment & Service

11.2.3 By Application

11.2.4 By Operation Type

11.2.5 By Well Type

11.2.6 By Country

11.2.6.1 US

11.2.6.1.1 Shale Development in the US is Driving the Well Casing & Cementing Market

11.2.6.1.2 By Application

11.2.6.2 Canada

11.2.6.2.1 Continuous Onshore Oil Production Activities Will Boost the Demand for Well Casing & Cementing

11.2.6.2.2 By Application

11.3 Europe

11.3.1 By Type

11.3.2 By Equipment & Service Type

11.3.2.1 By Casing Equipment & Service

11.3.2.1.1 By Casing Pipe

11.3.2.1.2 By Casing Supporting Equipment & Service

11.3.2.2 By Cementing Equipment & Service

11.3.3 By Operation Type

11.3.4 By Well Type

11.3.5 By Application

11.3.6 By Country

11.3.6.1 Russia

11.3.6.1.1 E&P Activities in the Russia's Far East Region are Driving the Well Casing & Cementing Market in Russia

11.3.6.1.2 By Application

11.3.6.2 Norway

11.3.6.2.1 New Discoveries in Offshore Norwegian Continental Shelf are Likely to Boost the Market

11.3.6.2.2 By Application

11.3.6.3 UK

11.3.6.3.1 Development of Offshore Fields Will Drive the Well Casing & Cementing Market in the UK

11.3.6.3.2 By Application

11.3.6.4 Germany

11.3.6.4.1 Increasing Rig Count in Onshore Locations is Leveraging the Well Casing & Cementing Market

11.3.6.4.2 By Application

11.3.6.5 Rest of Europe

11.3.6.5.1 By Application

11.4 Asia Pacific

11.4.1 By Type

11.4.2 By Equipment & Service Type

11.4.2.1 By Casing Equipment & Service

11.4.2.1.1 By Casing Pipe

11.4.2.1.2 By Casing Supporting Equipment & Service

11.4.2.2 By Cementing Equipment & Service

11.4.3 By Operation Type

11.4.4 By Well Type

11.4.5 By Application

11.4.6 By Country

11.4.6.1 China

11.4.6.1.1 Deep-Water Drilling Activities and Shale Exploration & Production are Likely to Drive the Chinese Well Casing & Cementing Market

11.4.6.1.2 By Application

11.4.6.2 Thailand

11.4.6.2.1 Rising Crude Oil Production From Offshore Fields Located in the Gulf of Thailand is Driving the Well Casing & Cementing Market

11.4.6.2.2 By Application

11.4.6.3 India

11.4.6.3.1 Redevelopment of Oilfields Would Drive the Need for Casing & Cementing Operations

11.4.6.3.2 By Application

11.4.6.4 Indonesia

11.4.6.4.1 The Developments in Offshore Fields Expected to Drive the Offshore Well Casing & Cementing Market

11.4.6.4.2 By Application

11.4.6.5 Australia

11.4.6.5.1 The Development of the Untapped Shale Reserves in Australia is Driving the Australian Well Casing & Cementing Market

11.4.6.5.2 By Application

11.4.6.6 Malaysia

11.4.6.6.1 Rising Focus on New Offshore Discovery Will Leverage Opportunities for the Malaysian Well Casing & Cementing Market

11.4.6.6.2 By Application

11.4.6.7 Rest of Asia Pacific

11.4.6.7.1 By Application

11.5 Middle East

11.5.1 By Type

11.5.2 By Equipment & Service Type

11.5.2.1 By Casing Equipment & Service

11.5.2.1.1 By Casing Pipe

11.5.2.1.2 By Casing Supporting Equipment & Service

11.5.2.2 By Cementing Equipment & Service

11.5.3 By Operation Type

11.5.4 By Well Type

11.5.5 By Application

11.5.6 By Country

11.5.6.1 Kuwait

11.5.6.1.1 The Government's Plan to Increase Oil Production Will Create Opportunities for Well Casing & Cementing Operations

11.5.6.1.2 By Application

11.5.6.2 Saudi Arabia

11.5.6.2.1 Increasing Offshore Drilling Activities in Saudi Arabia are Driving the Market

11.5.6.2.2 By Application

11.5.6.3 UAE

11.5.6.3.1 Discovery of New Gas Fields in the UAE is Likely to Boost the Well Casing & Cementing Market

11.5.6.3.2 By Application

11.5.6.4 Iraq

11.5.6.4.1 Onshore Well Drilling Activities in Iraq Create Opportunities for Well Casing & Cementing

11.5.6.4.2 By Application

11.5.6.5 Qatar

11.5.6.5.1 Huge Untapped Oil & Gas Reserves Offer Lucrative Opportunities for Well Drilling Activities

11.5.6.5.2 By Application

11.5.6.6 Rest of the Middle East

11.5.6.6.1 By Application

11.6 South & Central America

11.6.1 By Type

11.6.2 By Equipment & Service Type

11.6.2.1 By Casing Equipment & Service

11.6.2.1.1 By Casing Pipe

11.6.2.1.2 By Casing Supporting Equipment & Service

11.6.2.2 By Cementing Equipment & Service

11.6.3 By Operation Type

11.6.4 By Well Type

11.6.5 By Application

11.6.6 By Country

11.6.6.1 Argentina

11.6.6.1.1 Shale Development is the Major Driving Factor for Argentina Well Casing & Cementing Market

11.6.6.1.2 By Application

11.6.6.2 Venezuela

11.6.6.2.1 Stabilizing Crude Oil Prices to Revitalize the Exploration & Production Activities in Venezuela

11.6.6.2.2 By Application

11.6.6.3 Brazil

11.6.6.3.1 Rising Brazilian Onshore Well Count is Expected to Drive the Well Casing & Cementing Market

11.6.6.3.2 By Application

11.6.6.4 Mexico

11.6.6.4.1 Rising Investments in Shale Production Likely to Drive the Mexican Well Casing & Cementing Market

11.6.6.4.2 By Application

11.6.6.5 Rest of South & Central America

11.6.6.5.1 By Application

11.7 Africa

11.7.1 By Type

11.7.2 By Equipment & Service Type

11.7.2.1 By Casing Equipment & Service

11.7.2.1.1 By Casing Pipe

11.7.2.1.2 By Casing Supporting Equipment & Service

11.7.2.2 By Cementing Equipment & Service

11.7.3 By Operation Type

11.7.4 By Well Type

11.7.5 By Application

11.7.6 By Country

11.7.6.1 Algeria

11.7.6.1.1 Upcoming Drilling Projects in Algeria Likely to Drive the Well Casing & Cementing Market

11.7.6.1.2 By Application

11.7.6.2 Nigeria

11.7.6.2.1 Rising Exploration Activities in Nigeria Will Boost the Well Casing & Cementing Market

11.7.6.2.2 By Application

11.7.6.3 Angola

11.7.6.3.1 Pre-Salt Discovery in the Kwanza Basin to Drive Drilling Activities

11.7.6.3.2 By Application

11.7.6.4 Rest of Africa

11.7.6.4.1 By Application

12 Competitive Landscape (Page No. - 149)

12.1 Overview

12.2 Competitive Leadership Mapping, 2018

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

12.3 Market Share, 2018

12.4 Competitive Scenario

12.4.1 New Product Launches

12.4.2 Contracts & Agreements

12.4.3 Mergers & Acquisitions

12.4.4 Expansions

13 Company Profiles (Page No. - 158)

(Business Overview, Products Offerings, Recent Developments, MnM View)*

13.1 Baker Hughes, A GE Company

13.2 Halliburton

13.3 Schlumberger Limited

13.4 Weatherford

13.5 National Oilwell Varco

13.6 Tenaris

13.7 Vallourec

13.8 TMK Group

13.9 Trican Well Service Ltd.

13.10 Franks International (Blackhawk Specialty Tools)

13.11 Nabors Industries Ltd.

13.12 Innovex Downhole Solutions

13.13 Centek Group

*Details on Business Overview, Products Offerings, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 199)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Available Customizations

14.5 Author Details

List of Tables (134 Tables)

Table 1 Rig to New Well Ratio

Table 2 Well Casing & Cementing Market Snapshot

Table 3 Top Countries With Significant Technically Recoverable Shale Resources, as of 2018

Table 4 Well Casing & Cementing Market, By Type, 20172024 (USD Million)

Table 5 Casing: Well Casing & Cementing Market, By Region, 20172024 (USD Million)

Table 6 Cementing: Well Casing & Cementing Market, By Region, 20172024 (USD Million)

Table 7 Well Casing & Cementing Market Size, By Equipment & Service Type, 20172024 (USD Million)

Table 8 Well Casing & Cementing Market Size, By Casing Equipment & Services Type, 20172024 (USD Million)

Table 9 Well Casing & Cementing Market Size, By Casing Pipe, 20172024 (USD Million)

Table 10 Conductor Casing: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 11 Surface Casing: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 12 Intermediate Casing: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 13 Production Casing: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 14 Liner: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 15 Well Casing & Cementing Market Size, By Casing Supporting Equipment & Service Type, 20172024 (USD Million)

Table 16 Float Equipment: Well Casing & Cementing Market Size, By Region, 20172024 (USD Thousand)

Table 17 Casing Collar: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 18 Centralizer: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 19 Scratcher: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 20 Liner System: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 21 Others: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 22 Well Casing & Cementing Market Size, By Cementing Equipment & Services, 20172024 (USD Million)

Table 23 Cementing Head: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 24 Wiper Plug: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 25 Stage Tool: Well Casing & Cementing Market Size, By Region, 20172024 (USD Thousand)

Table 26 Others: Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 27 Well Casing & Cementing Market, By Operation Type, 20172024 (USD Million)

Table 28 Primary Cementing: Well Casing & Cementing Market, By Region, 20172024 (USD Million)

Table 29 Remedial Cementing: Well Casing & Cementing Market, By Region, 20172024 (USD Million)

Table 30 Others: Well Casing & Cementing Market, By Region, 20172024 (USD Million)

Table 31 Well Casing & Cementing Market, By Well Type, 20172024 (USD Million)

Table 32 Horizontal: Well Casing & Cementing Market, By Region, 20172024 (USD Million)

Table 33 Vertical: Well Casing & Cementing Market, By Region, 20172024 (USD Million)

Table 34 Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 35 Onshore: Well Casing & Cementing Market, By Region, 20172024 (USD Million)

Table 36 Offshore: Well Casing & Cementing Market, By Region, 20172024 (USD Million)

Table 37 Well Casing & Cementing Market Size, By Region, 20172024 (USD Million)

Table 38 North America: Well Casing & Cementing Market Size, By Type, 20172024 (USD Million)

Table 39 North America: Well Casing & Cementing Market Size, By Equipment & Service Type, 20172024 (USD Million)

Table 40 North America: Well Casing & Cementing Market Size, By Casing Pipe, 20172024 (USD Million)

Table 41 North America: Well Casing & Cementing Market Size, By Casing Supporting Equipment & Service, 20172024 (USD Million)

Table 42 North America: Well Casing & Cementing Market Size, By Cementing Equipment & Service, 20172024 (USD Million)

Table 43 North America: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 44 North America: Well Casing & Cementing Market Size, By Operation Type, 20172024 (USD Million)

Table 45 North America: Well Casing & Cementing Market Size, By Well Type, 20172024 (USD Million)

Table 46 North America: Well Casing & Cementing Market Size, By Country, 20172024 (USD Million)

Table 47 North America: Onshore Well Casing & Cementing Market Size, By Country, 20172024 (USD Million)

Table 48 North America: Offshore Well Casing & Cementing Market Size, By Country, 20172024 (USD Thousand)

Table 49 US: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 50 Canada: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 51 Europe: Well Casing & Cementing Market Size, By Type, 20172024 (USD Million)

Table 52 Europe: Well Casing & Cementing Market Size, By Equipment & Service Type, 20172024 (USD Million)

Table 53 Europe: Well Casing & Cementing Market Size, By Casing Pipe, 20172024 (USD Million)

Table 54 Europe: Well Casing & Cementing Market Size, By Casing Supporting Equipment & Service, 20172024 (USD Million)

Table 55 Europe: Well Casing & Cementing Market Size, By Cementing Equipment & Service, 20172024 (USD Million)

Table 56 Europe: Well Casing & Cementing Market Size, By Operation Type, 20172024 (USD Million)

Table 57 Europe: Well Casing & Cementing Market Size, By Well Type, 20172024 (USD Million)

Table 58 Europe: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 59 Europe: Well Casing & Cementing Market Size, By Country, 20172024 (USD Million)

Table 60 Europe: Onshore Well Casing & Cementing Market Size, By Country, 20172024 (USD Million)

Table 61 Europe: Offshore Well Casing & Cementing Market, By Country, 20172024 (USD Million)

Table 62 Russia: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 63 Norway: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 64 UK: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 65 Germany: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 66 Rest of Europe: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 67 Asia Pacific: Well Casing & Cementing Market Size, By Type, 20172024 (USD Million)

Table 68 Asia Pacific: Well Casing & Cementing Market Size, By Equipment & Service Type, 20172024 (USD Million)

Table 69 Asia Pacific: Well Casing & Cementing Market Size, By Casing Pipe, 20172024 (USD Million)

Table 70 Asia Pacific: Well Casing & Cementing Market Size, By Casing Supporting Equipment & Service, 20172024 (USD Million)

Table 71 Asia Pacific: Well Casing & Cementing Market Size, By Cementing Equipment & Service, 20172024 (USD Million)

Table 72 Asia Pacific: Well Casing & Cementing Market Size, By Operation Type, 20172024 (USD Million)

Table 73 Asia Pacific: Well Casing & Cementing Market Size, By Well Type, 20172024 (USD Million)

Table 74 Asia Pacific: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 75 Asia Pacific: Well Casing & Cementing Market Size, By Country, 20172024 (USD Million)

Table 76 Asia Pacific: Onshore Well Casing & Cementing Market Size, By Country, 20172024 (USD Million)

Table 77 Asia Pacific: Offshore Well Casing & Cementing Market Size, By Country, 20172024 (USD Million)

Table 78 China: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 79 Thailand: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 80 India: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 81 Indonesia: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 82 Australia: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 83 Malaysia: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 84 Rest of Asia Pacific: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 85 Middle East: Well Casing & Cementing Market, By Type, 20172024 (USD Million)

Table 86 Middle East: Well Casing & Cementing Market, By Equipment & Service Type, 20172024 (USD Million)

Table 87 Middle East: Well Casing & Cementing Market, By Casing Pipe, 20172024 (USD Million)

Table 88 Middle East: Well Casing & Cementing Market, By Casing Supporting Equipment & Service, 20172024 (USD Million)

Table 89 Middle East: Well Casing & Cementing Market, By Cementing Equipment & Service, 20172024 (USD Thousands)

Table 90 Middle East: Well Casing & Cementing Market, By Operation Type, 20172024 (USD Million)

Table 91 Middle East: Well Casing & Cementing Market, By Well Type, 20172024 (USD Million)

Table 92 Middle East: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 93 Middle East: Well Casing & Cementing Market, By Country, 20172024 (USD Million)

Table 94 Middle East: Onshore Well Casing & Cementing Market, By Country, 20172024 (USD Million)

Table 95 Middle East: Offshore Well Casing & Cementing Market, By Country, 20172024 (USD Million)

Table 96 Kuwait: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 97 Saudi Arabia: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 98 UAE: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 99 Iraq: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 100 Qatar: Well Casing & Cementing Market, By Application, 20172024 (USD Thousand)

Table 101 Rest of the Middle East: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 102 South & Central America: Well Casing & Cementing Market, By Type, 20172024 (USD Million)

Table 103 South & Central America: Well Casing & Cementing Market, By Equipment & Service Type, 20172024 (USD Million)

Table 104 South & Central America: Well Casing & Cementing Market, By Casing Pipe, 20172024 (USD Million)

Table 105 South & Central America: Well Casing & Cementing Market, By Casing Supporting Equipment & Service, 20172024 (USD Million)

Table 106 South & Central America: Well Casing & Cementing Market, By Cementing Equipment & Service, 20172024 (USD Million)

Table 107 South & Central America: Well Casing & Cementing Market, By Operation Type, 20172024 (USD Million)

Table 108 South & Central America: Well Casing & Cementing Market, By Well Type, 20172024 (USD Million)

Table 109 South & Central America: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 110 South & Central America: Well Casing & Cementing Market, By Country, 20172024 (USD Million)

Table 111 South & Central America: Onshore Well Casing & Cementing Market, By Country, 20172024 (USD Million)

Table 112 South & Central America: Offshore Well Casing & Cementing Market, By Country, 20172024 (USD Million)

Table 113 Argentina: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 114 Venezuela: Well Casing & Cementing Market, By Application, 20172024 (USD Thousand)

Table 115 Brazil: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 116 Mexico: Well Casing & Cementing Market, By Application, 20172024 (USD Thousand)

Table 117 Rest of South & Central America: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 118 Africa: Well Casing & Cementing Market, By Type, 20172024 (USD Million)

Table 119 Africa: Well Casing & Cementing Market, By Equipment & Service Type, 20172024 (USD Million)

Table 120 Africa: Well Casing & Cementing Market, By Casing Pipe, 20172024 (USD Thousands)

Table 121 Africa: Well Casing & Cementing Market, By Casing Supporting Equipment & Service, 20172024 (USD Thousands)

Table 122 Africa: Well Casing & Cementing Market, By Cementing Equipment & Service, 20172024 (USD Thousands)

Table 123 Africa: Well Casing & Cementing Market, By Operation Type, 20172024 (USD Thousands)

Table 124 Africa: Well Casing & Cementing Market, By Well Type, 20172024 (USD Million)

Table 125 Africa: Well Casing & Cementing Market, By Application, 20172024 (USD Million)

Table 126 Africa: Well Casing & Cementing Market, By Country, 20172024 (USD Million)

Table 127 Africa: Onshore Well Casing & Cementing Market, By Country, 20172024 (USD Thousands)

Table 128 Africa: Offshore Well Casing & Cementing Market, By Country, 20172024 (USD Million)

Table 129 Algeria: Well Casing & Cementing Market Size, By Application, 20172024 (USD Million)

Table 130 Nigeria: Well Casing & Cementing Market Size, By Application, 20172024 (USD Thousand)

Table 131 Angola: Well Casing & Cementing Market Size, By Application, 20172024 (USD Thousand)

Table 132 Rest of Africa: Well Casing & Cementing Market Size, By Application, 20152022 (USD Million)

Table 133 Product & Service Offerings

Table 134 Developments By Key Players in the Market, 20162019

List of Figures (55 Figures)

Figure 1 New Wells Drilled, 2017

Figure 2 Crude Oil Price vs. Rig Count (2013-2019)

Figure 3 Crude Oil Price Trend (2014-2019)

Figure 4 Market Share Analysis, 2018

Figure 5 North America Dominated the Well Casing & Cementing Market in 2018

Figure 6 Casing Segment, By Type, is Expected to Hold the Largest Share During the Forecast Period

Figure 7 Casing Pipe Segment, By Equipment & Service Type, is Expected to Lead the Well Casing & Cementing Market During the Forecast Period

Figure 8 Offshore Segment is Expected to Grow at A Higher Cagr During the Forecast Period

Figure 9 Primary Cementing Segment is Expected to Lead the Well Casing & Cementing Market During the Forecast Period

Figure 10 Horizontal Well Segment is Expected to Lead the Well Casing & Cementing Market During the Forecast Period

Figure 11 Contracts & Agreements is the Major Strategy Adopted By Players for Well Casing & Cementing Market

Figure 12 Continous Shale Developments & Increasing Investments in the Upstream Sector are Driving the Well Casing & Cementing Market, 20192024

Figure 13 North America is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 14 Casing Segment and the Us Dominated the North American Well Casing & Cementing Market in 2018

Figure 15 Onshore Segment is Projected to Dominate the Well Casing & Cementing Market in 2024

Figure 16 Horizontal Well Segment is Expected to Dominate the Well Casing & Cementing Market During the Forecast Period

Figure 17 Primary Cementing Segment, By Operation Type, is Expected to Dominate the Well Casing & Cementing Market During the Forecast Period

Figure 18 Cementing Segment, By Type, is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 19 Casing Pipe is Expected to Dominate the Well Casing Equipment & Service Type Market During the Forecast Period

Figure 20 Intermediate Casing Pipe Segment is Expected to Dominate the Casing Pipe Market During the Forecast Period

Figure 21 Casing Collar is Expected to Dominate the Casing Supporting Equipment & Service Market During the Forecast Period

Figure 22 Cement Head Segment is Expected to Dominate the Cementing Market During the Forecast Period

Figure 23 Well Casing & Cementing Market: Drivers, Restraints, Opportunities, and Challenges

Figure 24 Crude Oil Prices vs. Rig Count and New Drilled Wells (20142018)

Figure 25 Europe Oil Consumption Trend, (20142040)

Figure 26 Well Casing & Cementing Market Supply Chain

Figure 27 Casing Segment is Expected to Lead the Well Casing & Cementing Market From 2019 to 2024

Figure 28 Casing Pipe Segment is Expected to Dominate the Well Casing & Cementing Market From 2019 to 2024

Figure 29 Casing Pipe Segment is Expected to Grow at the Highest Cagr From 2019 to 2024

Figure 30 Intermediate Casing Segment Accounted for the Largest Market Share of the Casing Pipe Segment in 2018

Figure 31 Casing Collar Subsegment Accounted for the Largest Market Share of the Casing Supporting Equipment & Services Segment in 2018

Figure 32 Cementing Head Subsegment Accounted for the Largest Market Share of the Cementing Equipment & Services Segment in 2018

Figure 33 Primary Cementing is Expected to Lead the Well Casing & Cementing Market From 2019 to 2024

Figure 34 The Horizontal Well Segment is Expected to Lead the Well Casing & Cementing Market From 2019 to 2024

Figure 35 The Onshore Well Segment is Expected to Lead the Well Casing & Cementing Market From 2019 to 2024

Figure 36 Rising Rig Count is Driving Offshore Well Casing & Cementing Market

Figure 37 Well Casing & Cementing Market Size, By Region, 20192024 (USD Million)

Figure 38 Norway is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 39 Regional Snapshot: North America Well Casing & Cementing Market, 2018

Figure 40 Regional Snapshot: Europe Well Casing & Cementing Market Size, 2018

Figure 41 Key Developments in the Well Casing & Cementing Market, 20162019

Figure 42 Competitive Leadership Mapping (Overall Market)

Figure 43 Market Share Analysis, 2018

Figure 44 Baker Hughes, A GE Company: Company Snapshot

Figure 45 Halliburton: Company Snapshot

Figure 46 Schlumberger: Company Snapshot

Figure 47 Weatherford: Company Snapshot

Figure 48 National Oilwell Varco: Company Snapshot

Figure 49 Tenaris : Company Snapshot

Figure 50 Vallourec: Company Snapshot

Figure 51 TMK Group: Company Snapshot

Figure 52 Trican Well Service Ltd.: Company Snapshot

Figure 53 Franks International: Company Snapshot

Figure 54 Blackhawk Specialty Tools: Company Snapshot

Figure 55 Nabors Industries Ltd.: Company Snapshot

This study involved 4 major activities in estimating the current size of the well casing & cementing market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. Thereafter, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global well casing & cementing market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

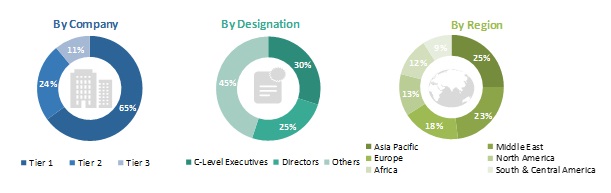

Primary Research

The well casing & cementing market comprises several stakeholders, such as end-product manufacturers and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as drilling service providers, upstream operators, and others. The supply-side is characterized by casing pipe manufacturers, casing & cementing equipment providers, casing & cementing service providers, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global well casing & cementing market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas upstream sector.

Report Objectives

- To define, describe, and forecast the global well casing & cementing market on the basis of type, well type, service type, operation type, application, and region

- To provide detailed information on the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and industry-specific challenges

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze major tools and equipment used for well casing & cementing services

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the market size of segments with respect to major regions, namely, North America, South & Central America, the Middle East, Europe, Asia Pacific, and Africa

- To strategically profile key players and comprehensively analyze their respective market share and core competencies

- To track and analyze developments in the well casing & cementing market, such as new product launches, expansions, mergers & acquisitions, and contracts & agreements

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Well Casing & Cementing Market