CNG & LPG Vehicle Market by Vehicle Body Type (Passenger Cars, Three-wheelers & Commercial Vehicles) Fuel Type (CNG & LPG), By Kit type (Venturi & Sequential), By Fitting (OE & Aftermarket), by Engine System Type and by Region - Global Forecast to 2026

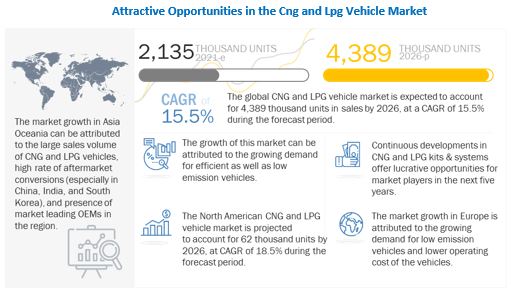

[257 Pages Report] The global CNG & LPG vehicle market size is projected to grow from 2,135 thousand units sales in 2021 to 4,389 thousand units sales by 2026, at a CAGR of 15.5%. Factors such as growing demand for low emission commuting and governments supporting CNG and LPG vehicles through subsidies & tax rebates have compelled the manufacturers to provide CNG and LPG vehicles around the world.

Increasing investments by governments across the globe to develop CNG and LPG infrastructure and incentives offered to buyers will create opportunities for OEMs to expand their revenue stream and geographical presence. The market in Asia Pacific is projected to experience steady growth owing to the high demand for cost efficient and low-emission vehicles, while the North American market is the fastest growing market due to the government initiatives and growing high-performance Commercial vehicle segment. However, the low presence of CNG and LPG fueling stations, higher costs involved in initial investments, and performance constraints could hamper the growth of global CNG and LPG Vehicle market.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact On the CNG and LPG Vehicle Market:

The production and sales of new vehicles had come to a halt across the globe as the whole ecosystem had been disrupted in the initial outbreak of COVID 19. OEMs had to wait until lockdowns were lifted to resume production, which affected their businesses. Hence, vehicle manufacturers had to adjust the production volume. Also, component manufacturing was suspended, and small Tier II and Tier III manufacturers faced liquidity issues. The automotive industry is highly capital-intensive and relies on frequent financing to continue operations. Thus, the production suspension during the outbreak and lower demand had an unprecedented impact on CNG and LPG vehicle manufacturers.

Due to the COVID-19 pandemic, many countries had imposed a complete lockdown of more than two months, which, in turn, has impacted vehicle production. Manufacturing units around the world were shut down, and vehicle sales have taken a huge hit. However, the majority of the automakers resumed vehicle production with limited production and necessary measures. Contitions improved in the latter months, but overall most manufacturers had lower sales for CNG and LPG vehicles in 2020.

Although most OEMs did not report any major losses, there were few OEMs, which suffered from the outbreak. For instance, Honda’s sales went down by more than 15% during the third quarter of 2020, while operating profit fell by around 13% overall during the whole year. The combined annual sales of Japanese automakers fell by around 7.3%. Volkswagen’s sales fell during the first few quarters, but it recovered by the 4th quarter of 2020. The company suffered a reduction in sales of CNG and LPG vehicles as customers began to shift towards Electric Vehicles during the pandemic.

Market Dynamics:

Driver: Low operating cost compared to petroleum vehicles

The operating cost of CNG and LPG vehicles is much less compared to petroleum vehicles. Nowadays when petrol prices are on the rise due to its increased demand and less reserves, alternative fuels like CNG and LPG are more economical especially for people who drive more. This is because the initial cost of CNG or LPG easily gets covered by the amount saved in a few years depending on how much the user drives their vehicle. The petroleum prices have increased drastically over the years, however CNG and LPG prices have increased at a much lower amount. This may be one of the important drivers to increase the market share of CNG and LPG Vehicles in the coming Future. A CNG vehicle can drive around 21 KM/ KG of fuel while Diesel can drive around 17 KM/ L while, petrol can be used on an average of 15 KM/ L. Thus, CNG and LPG Vehicles can drive a lot more at a lower cost thus reducing vehicles cost of operations.

Restraint: Higher maintainence cost and initial investment cost compared to petroleum vehicles

CNG and LPG Vehicles tend to be priced higher than regular petrol vehicles. This is due to the extra components added in these vehicles. As some parts of these vehicles get damaged faster compared to petrol vehicles (parts which are more susceptible to over-heating) due to lack of lubrication in most of these vehicles, these vehicles need much more regular maintenance over the years and thus costs more in long term. Furthermore, the parts need to be replaced from time to time compared to petrol vehicles which usually have a longer life for such parts. Thus, only people who drive a lot every month prefer using CNG and LPG vehicles. For instance, fleet providers may use CNG as they can drive a lot daily for their services. CNG and LPG Vehicles are cost effective only when the vehicles are extensively driven.

Opportunity: Rising concerns of countries around the world for lower emission fuel vehicles

The rising concerns for reducing emissions by countries all around the world may lead to increase in growth of low emission fuel vehicles like CNG and LPG Vehicles. European countries have declared the ambition to reduce emissions in the coming decades and may be a major market for these vehicles in the coming years. Asian countries have already been supporting the growth of alternative fuel vehicles like CNG and LPG for reduction in emissions and cost due to import of petrol. As the present vehicles can be easily changed to CNG or LPG fuel systems and at an affordable price, we can expect an explosive growth in CNG and LPG vehicle market and aftermarket in the coming years.

Challenge: Improper Drainage causes cylinder damage

CNG and LPG systems have various challenges which need to be addressed. With increasing technology, many such challenges have been mitigated. However, some key challenges still need to be addressed. One such problem is improper drainage that can cause unnecessary cylinder damage. NPFA 52 requires the shield systems to be able to drain solids and liquids away from the cylinder. This means that holes are drilled at certain intervals. However, it has been discovered that many suppliers of kit services provide no allowance for drainage that is provided in the company fitted systems.

The OEM-fitted segment is expected to be the fastest-growing segment during the forecast period

OEM/factory-fitted CNG and LPG vehicles currently have much lower sales compared to the aftermarket conversions. This is because the cost of factory-fitted CNG or LPG vehicles is much higher than that of the petrol variant of the same vehicle and getting a CNG or LPG kit fitted on it for aftermarket conversion. However, the price difference may reduce over the years with growing economies of scale. This may lead to a lowering in the cost of company fitted vehicles. OEM fitted vehicles also have various advantages, such as personalization for the vehicle (for top vehicle models) and the warranty provided with the vehicle when buying it, which are the main reasons for their increasing sales. Some locally available part providers may have warranty or cylinder-related problems, especially if the parts are not from certified kit companies.

Sequential Kit segment is expected to be the fastest-growing segment during the forecast period

Sequential kits have a faster growing demand compared to venturi kits due to their offering of higher fuel economy and better control on emissions in vehicles. The market for sequential kits is projected to register a higher growth rate in North America and Europe due to the increasing trend of emission reduction in commercial vehicles and stringent emission laws in various countries of these regions. Asia Oceania is also expected to witness a significant growth in sales of sequential kits due to the increasing demand for CNG and LPG converted passenger and commercial vehicles in the region.

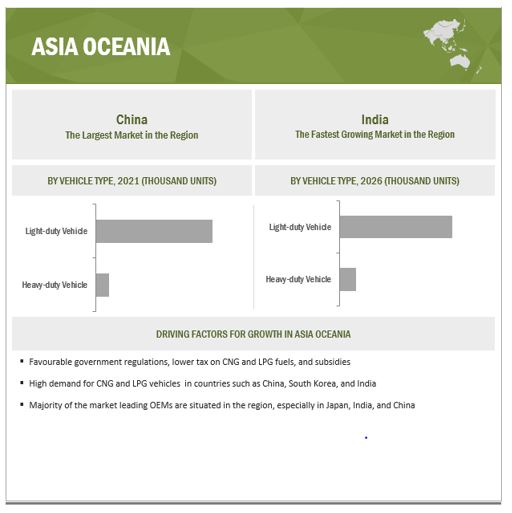

The Asia Oceania market is projected to hold the largest share by 2026

Asia Oceania is currently the world’s largest market for CNG and LPG vehicles. Countries like China, India, South Korea, and Thailand have the largest share of the market in the region. China is the largest market in the region due to its government policies to support the adoption of low emission fuel vehicles and the low cost of vehicle conversions. India is the second-largest market for CNG and LPG vehicles and also the fastest-growing market in the region. This is because of the country’s high taxes on petrol, which increases the demand for alternative fuel vehicles. The government’s new vehicle scrappage policies will also grow the number of CNG vehicles exponentially besides lowering the cost of aftermarket conversion in the country. South Korea and Thailand are also big markets for CNG and LPG vehicles due to government support and stringent emission norms. In Japan and Indonesia, emission norms are increasingly stringent, providing growth opportunities for the CNG and LPG vehicle market. These countries have also been trying to reduce the imports of petroleum. Thailand and Japan are among the fastest-growing markets in the region due to higher adoptability of CNG and LPG bi-fuel and dual fuel vehicles and government support for reducing emissions.

Key Market Players

The major players in the global CNG & LPG Market include Suzuki Motor Corporation (Japan), Honda Motor Company (Japan), Hyundai Motor Group (South Korea), Volkswagen AG (Germany) and Ford Motor Company (US). These companies offer extensive products and solutions for the CNG and LPG vehicle industry; and have strong distribution networks at the global level, and they invest heavily in R&D to develop new products.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Volume (Thousand Units) |

|

Segments covered |

Fuel Type, Vehicle Type, Vehicle Body Type, Engine System Type, Intake System Type, Kit Type, Fitting Type and Region. |

|

Geographies covered |

Asia Oceania, Europe, North America, and RoW |

|

Companies Covered |

Suzuki Motor Corporation (Japan), Honda Motor Company (Japan), Hyundai Motor Group (South Korea), Volkswagen AG (Germany), Ford Motor Company (US). |

This research report categorizes the CNG and LPG vehicle market based on Fuel Type, Vehicle Type, Vehicle Body Type, Engine System Type, Intake System Type, Kit Type, Fitting Type and Region.

Based on the Fuel Type:

- CNG

- LPG

Based on the Vehicle Body Type:

- Passenger Vehicles

- Commercial Vehicles

- Three-wheelers

Based on the Vehicle Type:

- Light-duty Vehicle

- Heavy-duty Vehicle

Based on the Engine System Type:

- Dedicated Fuel

- Bi-fuel

- Dual Fuel

Based on the Intake System Type (LPG):

- Converter-mixer System

- Vapor Phase Injection (VPI)

- Liquid Phase Injection (LPI)

- Liquid Phase Direct Injection (LPDI)

Based on the Fitting Type:

- OEM/Factory-fitted

- Aftermarket

Based on the Kit Type:

- Venturi

- Sequential

Based on the region:

-

Asia Oceania

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Spain

- Russia

- Turkey

- United Kingdom

-

RoW

- Brazil

- Argentina

- Iran

- South Africa

Recent Developments

- In December 2020, Ford Motor Company showcased its 4th generation self-driving platform with better sensors, cleaning tech, and batteries and available in a hybrid option with different fuel variants.

- In November 2020, Honda Motor Company showcased the 9th generation Civic model’s prototype, which is expected to be on sale in the 2nd half of 2021.

- In September 2020, Hyundai launched a new Tucson model with best in segment features and class-leading capabilities. It is the 4th generation of the Tucson model and is compatible with different types of fuels. A hybrid version is also available.

- In July 2020, Ford Motor Company launched the Ford Bronco Sport, a rugged small SUV equipped with standard 4x4 configurations for rugged terrains. The vehicle runs on an EcoBoost engine.

- In March 2020, Volkswagen launched T-Roc, an SUV equipped with its TSI engine, 1.5L EVO (Dual Fuel Engines). Highly fuel-efficient and equipped with six airbags, ABS, ESC, tire pressure monitoring system, and reverse camera, the SUV is certified 5 Star in terms of safety.

- In March 2020, Fiat Chrysler Automobiles launched its Ram 1500, which features a V8 engine with 428 hp and uses CNG as fuel for Europe’s stringent emission laws.

- In December 2019, Honda Motor Company launched the 7th generation Honda City, first in Thailand, then in India, Malaysia, and the Philippines. The Vehicle is available in Hatchback and Sedan variants.

- In October 2019, Honda Motor Company unveiled the 4th generation Jazz in Japan. It is a hybrid vehicle that can be made compatible with CNG.

- In May 2019, Fiat Chrysler Automobiles launched its Grand Siena CNG in Brazil. The vehicle has 5th generation CNG kits installed and comes with a 520L trunk.

- In March 2019, Ford Motor Company launched the Ford Figo’s CNG version with a 1.2 L engine and better features, like a 6-speed torque converter, 6.5-inch touchscreen system, etc.

- In May 2018, Suzuki Motor Corporation launched its 2nd generation Ertiga, first in Indonesia, then in countries like Brunei, India, the Philippines, South Africa, and Thailand. In India, it was launched after taking care of BS6 norms.

Frequently Asked Questions (FAQ):

What is the current size of the global CNG and LPG vehicle market?

The global CNG and LPG Vehicle market is estimated to be 2,135 thousand units in 2021 and projected to reach 4,389 thousand units by 2026, at a CAGR of 15.5%

Who are the winners in the global CNG and LPG vehicle market?

Companies like Suzuki Motor Corporation (Japan), Honda Motor Company (Japan), Hyundai Motor Group (South Korea), Volkswagen AG (Germany) and Ford Motor Company (US). These companies offer extensive products and solutions for the CNG and LPG vehicle industry; and have strong distribution networks at the global level, and they invest heavily in R&D to develop new products.

What is the Covid-19 impact on CNG and LPG vehicle manufacturers?

Most Top CNG and LPG Vehicle Manufacturers incurred losses due to sales reduction during the pandemic in the initial months. The sales recovered in the latter years, however, overall the companies suffered varying amount of losses.

What are the new market trends impacting the growth of the CNG and LPG vehicle market?

IoT in alternate fuel vehicles, Bi-fuel vehicles , 3D Printing, connected vehicles are the key market trends or technologies which will have a major impact on the CNG and LPG vehicle market in the future.

What are the different engine systems used in the CNG and LPG vehicle market?

CNG and LPG vehicles currently available in the market can be classified based on engine system type into three types (Dedicated fuel system, Bi-fuel system, Dual fuel system). Dedicated fuel systems use only CNG or LPG as their fuel. They have certain disadvantages due to the non-availability of fuel in many places, the possibility of other fuel-related problems, etc. Due to these concerns, CNG and LPG vehicles were less popular before the development and introduction of bi-fuel and dual-fuel vehicles. Many of the disadvantages of CNG and LPG vehicles became negated due to the presence of another fuel like petrol or diesel, which are more widely available. CNG and LPG bi-fuel and dual fuel vehicles are now available in large numbers, especially in Asia and some European Middle Eastern countries. Countries like China, India, Japan, South Korea, Argentina, Spain, Iran etc. are major markets for this market. In this chapter, the CNG and LPG vehicle market has been segmented by engine system type into dedicated fuel, bi-fuel, and dual fuel. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITIONS

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR CNG AND LPG VEHICLE MARKET

1.4 CNG AND LPG VEHICLE MARKET SCOPE

FIGURE 1 CNG AND LPG VEHICLE MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 CNG AND LPG VEHICLE MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 CNG AND LPG VEHICLE MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.5 CNG AND LPG VEHICLE MARKET SIZE ESTIMATION

2.5.1 BOTTOM-UP APPROACH

FIGURE 6 CNG AND LPG VEHICLE MARKET SIZE ESTIMATION METHODOLOGY FOR CNG AND LPG VEHICLE MARKET: BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 7 CNG AND LPG VEHICLE MARKET SIZE ESTIMATION METHODOLOGY FOR CNG AND LPG VEHICLE MARKET: TOP-DOWN APPROACH

2.5.3 FACTOR ANALYSIS FOR CNG AND LPG VEHICLE MARKET SIZING: DEMAND AND SUPPLY SIDE

2.6 CNG AND LPG VEHICLE MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.7 FACTOR ANALYSIS

2.8 RESEARCH ASSUMPTIONS & LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 9 CNG AND LPG VEHICLE CNG AND LPG VEHICLE MARKET: CNG AND LPG VEHICLE MARKET DYNAMICS

FIGURE 10 CNG AND LPG VEHICLE MARKET, BY REGION, 2021–2026 (UNITS)

FIGURE 11 HEAVY-DUTY VEHICLE SEGMENT EXPECTED TO REGISTER HIGHER CAGR THAN LIGHT-DUTY VEHICLE SEGMENT DURING FORECAST PERIOD

FIGURE 12 COVID-19 IMPACT ON CNG AND LPG VEHICLE MARKET, 2018–2026

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN CNG AND LPG VEHICLE MARKET

FIGURE 13 INCREASING DEMAND FOR EFFICIENT & LOW EMISSION COMMUTING TO DRIVE MARKET

4.2 MARKET, BY REGION

FIGURE 14 ASIA OCEANIA ESTIMATED TO BE LARGEST MARKET IN 2021

4.3 MARKET, BY FUEL TYPE

FIGURE 15 LPG SEGMENT EXPECTED TO REGISTER HIGHER CAGR THAN CNG SEGMENT DURING FORECAST PERIOD

4.4 MARKET, BY VEHICLE BODY TYPE

FIGURE 16 COMMERCIAL VEHICLE SEGMENT EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.5 MARKET, BY VEHICLE TYPE

FIGURE 17 HEAVY-DUTY VEHICLE SEGMENT EXPECTED TO REGISTER HIGHER CAGR THAN LIGHT-DUTY VEHICLE SEGMENT DURING FORECAST PERIOD

4.6 MARKET, BY FITTING TYPE

FIGURE 18 OEM/FACTORY-FITTED SEGMENT EXPECTED TO HIGHER CAGR THAN AFTERMARKET SEGMENT DURING FORECAST PERIOD

4.7 MARKET, BY KIT TYPE

FIGURE 19 SEQUENTIAL SEGMENT EXPECTED TO REGISTER HIGHER CAGR THAN VENTURI SEGMENT DURING FORECAST PERIOD

4.8 MARKET, BY ENGINE SYSTEM TYPE

FIGURE 20 DEDICATED FUEL SEGMENT EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.9 MARKET, BY INTAKE SYSTEM TYPE

FIGURE 21 LIQUID PHASE DIRECT INJECTION (LPDI) SEGMENT EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 CNG AND LPG VEHICLE MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Significant increase in vehicle production and sales globally

FIGURE 23 GLOBAL VEHICLE SALES, 2010–2019 (MILLION UNITS)

5.2.1.2 Lower operational cost compared to petroleum vehicles

TABLE 2 US: NATIONAL AVERAGE RETAIL FUEL PRICES OF CONVENTIONAL AND ALTERNATIVE FUELS

FIGURE 24 LNG & GAS PRICING

5.2.1.3 Rising petrol prices in the international market

TABLE 3 US: PETROL AVERAGE PRICING TREND OVER THE PAST FEW YEARS

5.2.2 RESTRAINTS

5.2.2.1 Higher maintenance and initial vehicle costs compared to petroleum vehicles

5.2.2.2 Less CNG and LPG fuel availability in many regions

TABLE 4 CNG, LPG, AND LNG STATIONS WORLDWIDE

5.2.3 OPPORTUNITIES

5.2.3.1 Rising concerns worldwide about vehicle emissions

FIGURE 25 WORLDWIDE EMISSIONS DATA, 2019

5.2.3.2 Availability of dual fuel options in vehicles

TABLE 5 TOP SELLING CNG OR LPG VEHICLE MODELS WORLDWIDE

5.2.4 CHALLENGES

5.2.4.1 Improper drainage causing cylinder damage

5.2.4.2 Improper protection of exhaust and other heat-producing components

TABLE 6 MARKET: IMPACT OF MARKET DYNAMICS

5.3 PORTER’S FIVE FORCES

FIGURE 26 PORTER’S FIVE FORCES: MARKET

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 RIVALRY AMONG EXISTING COMPETITORS

TABLE 7 MARKET: IMPACT OF PORTER’S 5 FORCES

5.4 MARKET ECOSYSTEM

FIGURE 27 MARKET: ECOSYSTEM ANALYSIS

TABLE 8 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 28 SUPPLY CHAIN ANALYSIS: MARKET

5.5.1 CNG AND LPG PROVIDERS

5.5.2 TIER I SUPPLIERS

5.5.3 OEMS

5.5.4 END USERS

5.6 AVERAGE SELLING PRICE TREND

TABLE 9 MARKET: PRICE RANGE ANALYSIS FOR CNG PASSENGER VEHICLE SEGMENT, 2020 (USD)

FIGURE 29 PRICING ANALYSIS OF PASSENGER VEHICLES ACROSS VARIOUS REGIONS, 2020 (USD)

5.7 TECHNOLOGY ANALYSIS

5.7.1 BI-FUEL VEHICLES

FIGURE 30 PARTS OF BI-FUEL VEHICLE TRANSMISSION SYSTEM

5.7.2 IOT IN ALTERNATIVE FUEL VEHICLES

5.7.3 3D PRINTING TECHNOLOGY

5.7.4 CONNECTED VEHICLES

5.8 PATENT ANALYSIS

5.9 CASE STUDY

5.9.1 A CASE STUDY ON USING NATURAL GAS FOR REGIONAL TRANSPORT TRUCKS

5.10 REGULATORY OVERVIEW

5.10.1 US

TABLE 10 EXISTING REGULATIONS, SUBSIDIES, AND TAX STRUCTURE IN US

5.10.2 CHINA

TABLE 11 EXISTING REGULATIONS, SUBSIDIES, AND TAX STRUCTURE IN CHINA

5.10.3 INDIA

TABLE 12 EXISTING REGULATIONS, SUBSIDIES, AND TAX STRUCTURE IN INDIA

5.10.4 JAPAN

TABLE 13 EXISTING REGULATIONS, SUBSIDIES, AND TAX STRUCTURE IN JAPAN

5.10.5 SOUTH KOREA

TABLE 14 EXISTING REGULATIONS, SUBSIDIES, AND TAX STRUCTURE IN SOUTH KOREA

5.10.6 IRAN

TABLE 15 EXISTING REGULATIONS, SUBSIDIES, AND TAX STRUCTURE IN IRAN

5.10.7 ITALY

TABLE 16 EXISTING REGULATIONS, SUBSIDIES, AND TAX STRUCTURE IN ITALY

5.10.8 GERMANY

TABLE 17 EXISTING REGULATIONS, SUBSIDIES, AND TAX STRUCTURE IN GERMANY

5.11 COVID-19 IMPACT ANALYSIS

5.11.1 INTRODUCTION TO COVID-19

5.11.2 COVID-19 HEALTH ASSESSMENT

5.12 COVID-19 ECONOMIC ASSESSMENT

5.12.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

5.12.2 COVID-19 IMPACT ON AUTOMOTIVE INDUSTRY

5.12.3 OEM ANNOUNCEMENTS

TABLE 18 OEM ANNOUNCEMENTS

5.12.4 IMPACT ON AUTOMOTIVE PRODUCTION

5.13 MARKET, SCENARIOS (2020–2025)

FIGURE 36 MARKET – FUTURE TRENDS & SCENARIO, 2020–2026 (THOUSAND UNITS)

5.13.1 MOST LIKELY SCENARIO

TABLE 19 MOST LIKELY SCENARIO, BY REGION, 2021–2026 (THOUSAND UNITS)

5.13.2 OPTIMISTIC SCENARIO

TABLE 20 OPTIMISTIC SCENARIO, BY REGION, 2021–2026 (THOUSAND UNITS)

5.13.3 PESSIMISTIC SCENARIO

TABLE 21 PESSIMISTIC SCENARIO, BY REGION, 2021–2026 (THOUSAND UNITS)

6 CNG AND LPG VEHICLE MARKET, BY ENGINE/SYSTEM TYPE (Page No. - 88)

6.1 INTRODUCTION

FIGURE 37 DEDICATED FUEL SEGMENT EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 22 MARKET, BY ENGINE/SYSTEM TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 23 MARKET, BY ENGINE/SYSTEM TYPE, 2021–2026 (THOUSAND UNITS)

6.2 OPERATIONAL DATA

TABLE 24 POPULAR CNG AND LPG OEMS AND KIT PROVIDERS GLOBALLY

6.2.1 ASSUMPTIONS

TABLE 25 ASSUMPTIONS: BY ENGINE/SYSTEM TYPE

6.3 RESEARCH METHODOLOGY

6.4 DEDICATED FUEL

6.4.1 GOVERNMENT INCENTIVES TO DRIVE ADOPTION OF DEDICATED FUEL SYSTEM VEHICLES

TABLE 26 DEDICATED FUEL: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 27 DEDICATED FUEL: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

6.5 BI-FUEL

6.5.1 EASY FUEL SWITCHING TO ENCOURAGE BI-FUEL SYSTEM VEHICLES GROWTH

TABLE 28 BI-FUEL: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 29 BI-FUEL: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

6.6 DUAL FUEL

6.6.1 FAVORABLE GOVERNMENT POLICIES TO INCREASE GROWTH OF DUAL FUEL VEHICLE SEGMENT

TABLE 30 DUAL FUEL: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 31 DUAL FUEL: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

6.7 KEY PRIMARY INSIGHTS

FIGURE 38 KEY PRIMARY INSIGHTS

7 CNG AND LPG VEHICLE MARKET, BY FITTING TYPE (Page No. - 96)

7.1 INTRODUCTION

FIGURE 39 OEM/FACTORY-FITTED SEGMENT EXPECTED TO REGISTER HIGHER CAGR THAN AFTERMARKET SEGMENT DURING FORECAST PERIOD

TABLE 32 MARKET, BY FITTING TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 33 MARKET, BY FITTING TYPE, 2021–2026 (THOUSAND UNITS)

7.2 OPERATIONAL DATA

TABLE 34 POPULAR CNG AND LPG OEMS AND KIT PROVIDERS WORLDWIDE

7.2.1 ASSUMPTIONS

TABLE 35 ASSUMPTIONS: BY FITTING TYPE

7.3 RESEARCH METHODOLOGY

7.4 OEM-FITTED/FACTORY-FITTED

TABLE 36 TOP OEM/FACTORY-FITTED VEHICLE MODELS SOLD IN ASIA

7.4.1 OEM/FACTORY-FITTED VEHICLES TO GROW FASTER DUE TO GROWING DEMAND OF GREEN VEHICLES

TABLE 37 OEM/FACTORY-FITTED: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 38 OEM/FACTORY FITTED: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

7.5 AFTERMARKET

7.5.1 GOVERNMENT REGULATIONS TO BENEFIT AFTERMARKET CONVERSIONS ACROSS VARIOUS COUNTRIES

TABLE 39 AFTERMARKET: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 40 AFTERMARKET: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

7.6 KEY PRIMARY INSIGHTS

FIGURE 40 KEY PRIMARY INSIGHTS

8 CNG AND LPG VEHICLE MARKET, BY FUEL TYPE (Page No. - 103)

8.1 INTRODUCTION

FIGURE 41 PETROL VS AUTOGAS (LPG)

FIGURE 42 BY FUEL TYPE, LPG SEGMENT PROJECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD (2021–2026)

TABLE 41 MARKET, BY FUEL TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 42 MARKET, BY FUEL TYPE, 2021–2026 (THOUSAND UNITS)

8.2 OPERATIONAL DATA

TABLE 43 CNG & LNG STATIONS IN EUROPE

8.2.1 ASSUMPTIONS

TABLE 44 ASSUMPTIONS: BY FUEL TYPE

8.3 RESEARCH METHODOLOGY

8.4 CNG

TABLE 45 COMPETITIVENESS OF AUTOGAS AGAINST COMPRESSED NATURAL GAS (CNG)

8.4.1 LOW COST OF OPERATIONS TO DRIVE CNG VEHICLE MARKET

TABLE 46 CNG: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 47 CNG: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

8.5 LPG

TABLE 48 AUTOGAS MARKET DATA (LPG DATA)

8.5.1 EUROPE AND NORTH AMERICA TO ENCOURAGE AUTOGAS ADOPTION

TABLE 49 LPG: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 50 LPG: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

8.6 KEY PRIMARY INSIGHTS

FIGURE 43 KEY PRIMARY INSIGHTS

9 CNG AND LPG VEHICLE MARKET, BY INTAKE SYSTEM TYPE (LPG VEHICLES) (Page No. - 112)

9.1 INTRODUCTION

FIGURE 44 LPDI SYSTEM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD (2021–2026)

TABLE 51 MARKET, BY INTAKE SYSTEM TYPE (LPG), 2018–2020 (THOUSAND UNITS)

TABLE 52 MARKET, BY INTAKE SYSTEM TYPE (LPG), 2021–2026 (THOUSAND UNITS)

9.2 OPERATIONAL DATA

TABLE 53 POPULAR CNG AND LPG OEMS AND KIT PROVIDERS WORLDWIDE

9.2.1 ASSUMPTIONS

TABLE 54 ASSUMPTIONS: BY INTAKE SYSTEM TYPE (LPG VEHICLES)

9.3 RESEARCH METHODOLOGY

9.4 CONVERTER-MIXER SYSTEM

9.4.1 LOW COST OF CONVERSION TO BOOST MARKET

TABLE 55 CONVERTER-MIXER SYSTEM: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 56 CONVERTER-MIXER SYSTEM: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

9.5 VAPOR PHASE INJECTION (VPI) SYSTEM

9.5.1 EUROPE TO BE LARGEST MARKET FOR VAPOR PHASE INJECTION (VPI) SYSTEM

TABLE 57 VPI SYSTEM: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 58 VPI SYSTEM: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

9.6 LIQUID PHASE INJECTION (LPI) SYSTEM

9.6.1 HIGHER FUEL EFFICIENCY AND BETTER EMISSION CONTROL TO INCREASE MARKET

TABLE 59 LPI SYSTEM: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 60 LPI SYSTEM: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

9.7 LIQUID PHASE DIRECT INJECTION (LPDI) SYSTEM

9.7.1 LOWEST OPERATIONAL COST TO INCREASE MARKET

TABLE 61 LPDI SYSTEM: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 62 LPDI SYSTEM: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

9.8 KEY PRIMARY INSIGHTS

FIGURE 45 KEY PRIMARY INSIGHTS

10 CNG AND LPG VEHICLE MARKET, BY KIT TYPE (Page No. - 121)

10.1 INTRODUCTION

FIGURE 46 BY KIT TYPE, SEQUENTIAL SEGMENT EXPECTED TO REGISTER HIGHER CAGR THAN VENTURI SEGMENT DURING FORECAST PERIOD

TABLE 63 MARKET, BY KIT TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 64 MARKET, BY KIT TYPE, 2021–2026 (THOUSAND UNITS)

10.2 OPERATIONAL DATA

TABLE 65 POPULAR CNG AND LPG KIT PROVIDERS WORLDWIDE

10.2.1 ASSUMPTIONS

TABLE 66 ASSUMPTIONS: BY KIT TYPE

10.3 RESEARCH METHODOLOGY

10.4 VENTURI

10.4.1 LOW COST OF CONVERSIONS AND LOWER OPERATING COST TO DRIVE CNG AND LPG KIT MARKET

TABLE 67 VENTURI: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 68 VENTURI: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

10.5 SEQUENTIAL

10.5.1 HIGHER FUEL ECONOMY TO INCREASE DEMAND FOR SEQUENTIAL KITS

TABLE 69 SEQUENTIAL: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 70 SEQUENTIAL: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

10.6 KEY PRIMARY INSIGHTS

FIGURE 47 KEY PRIMARY INSIGHTS

11 CNG AND LPG VEHICLE MARKET, BY VEHICLE BODY TYPE (Page No. - 128)

11.1 INTRODUCTION

FIGURE 48 COMMERCIAL VEHICLE SEGMENT EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 71 MARKET, BY VEHICLE BODY TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 72 MARKET, BY VEHICLE BODY TYPE, 2021–2026 (THOUSAND UNITS)

11.2 OPERATIONAL DATA

TABLE 73 POPULAR CNG AND LPG VEHICLE PROVIDERS GLOBALLY

11.2.1 ASSUMPTIONS

TABLE 74 ASSUMPTIONS: BY VEHICLE BODY TYPE

11.3 RESEARCH METHODOLOGY

11.4 PASSENGER CAR

11.4.1 GROWING DEMAND FOR LOW EMISSION AND LOW OPERATIONAL COST FUELS

TABLE 75 PASSENGER CAR: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 76 PASSENGER CAR: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

11.5 COMMERCIAL VEHICLE

11.5.1 EUROPE AND NORTH AMERICA TO ENCOURAGE CNG AND LPG FOR COMMERCIAL VEHICLES

TABLE 77 COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 78 COMMERCIAL VEHICLE: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

11.6 THREE-WHEELER

11.6.1 ASIA OCEANIA IS THE LARGEST CNG AND LPG THREE-WHEELER MARKET

TABLE 79 THREE-WHEELER: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 80 THREE-WHEELER: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

11.7 KEY PRIMARY INSIGHTS

FIGURE 49 KEY PRIMARY INSIGHTS

12 CNG AND LPG VEHICLE MARKET, BY VEHICLE TYPE (Page No. - 136)

12.1 INTRODUCTION

FIGURE 50 HEAVY-DUTY VEHICLE SEGMENT PROJECTED TO REGISTER HIGHER CAGR THAN LIGHT-DUTY VEHICLE SEGMENT DURING FORECAST PERIOD

TABLE 81 MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 82 MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

12.2 OPERATIONAL DATA

TABLE 83 POPULAR CNG AND LPG VEHICLE PROVIDERS WORLDWIDE

12.2.1 ASSUMPTIONS

TABLE 84 ASSUMPTIONS: BY VEHICLE TYPE

12.3 RESEARCH METHODOLOGY

12.4 LIGHT-DUTY VEHICLE

12.4.1 GROWING DEMAND FOR LOW EMISSION PASSENGER VEHICLES TO BOOST THIS SEGMENT

TABLE 85 LIGHT-DUTY VEHICLE: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 86 LIGHT-DUTY VEHICLE: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 87 NGV PASSENGER CAR MODELS IN EUROPE

TABLE 88 LIGHT COMMERCIAL VEHICLE MODELS FOR EUROPE

12.5 HEAVY-DUTY VEHICLE

12.5.1 EUROPEAN AND NORTH AMERICAN GOVERNMENTS TO ENCOURAGE CNG AND LPG FOR HEAVY-DUTY VEHICLES

TABLE 89 HEAVY-DUTY VEHICLE: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 90 HEAVY-DUTY VEHICLE: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 91 BUS MODELS IN EUROPE

TABLE 92 TRUCK MODELS FOR EUROPE

TABLE 93 LIGHT VEHICLES, BUSES, AND TRUCKS IN USE IN EUROPE

12.6 KEY PRIMARY INSIGHTS

FIGURE 51 KEY PRIMARY INSIGHTS

13 CNG AND LPG VEHICLE MARKET, BY REGION (Page No. - 148)

13.1 INTRODUCTION

FIGURE 52 ASIA OCEANIA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

TABLE 94 MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 95 MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

13.2 ASIA OCEANIA

FIGURE 53 SIGNIFICANT LOWER TAX AND GOVERNMENT INCENTIVES FOR CNG AND LPG VEHICLES TO DRIVE MARKET IN ASIA OCEANIA

FIGURE 54 ASIA OCEANIA:CNG AND LPG VEHICLE MARKET SNAPSHOT

TABLE 96 ASIA OCEANIA:CNG AND LPG VEHICLE MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 97 ASIA OCEANIA:CNG AND LPG VEHICLE MARKET, BY COUNTRY, 2021–2026 (THOUSAND UNITS)

13.2.1 CHINA

13.2.1.1 Gazprom-China deal expected to boost demand

TABLE 98 CHINA:CNG AND LPG VEHICLE MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 99 CHINA:CNG AND LPG VEHICLE MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.2.2 INDIA

13.2.2.1 Vehicle Scrappage Policy and Green Tax for High Emission Vehicles in India

TABLE 100 INDIA:CNG AND LPG VEHICLE MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 101 INDIA: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.2.3 JAPAN

13.2.3.1 Stringent emission standards to lead to CNG and LPG vehicle market growth

TABLE 102 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 103 JAPAN: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.2.4 SOUTH KOREA

13.2.4.1 OEMs to work with government to build required infrastructure for CNG and LPG vehicles

TABLE 104 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 105 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.2.5 INDONESIA

13.2.5.1 Government schemes and subsidies to improve market

TABLE 106 INDONESIA: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 107 INDONESIA: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.2.6 THAILAND

13.2.6.1 OEMs to work with government to build required CNG and LPG vehicles infrastructure

TABLE 108 THAILAND: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 109 THAILAND: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.3 EUROPE

FIGURE 55 EUROPE: MARKET, BY COUNTRY, 2021-2026 (THOUSAND UNITS)

TABLE 110 EUROPE: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 111 EUROPE: MARKET, BY COUNTRY, 2021–2026 (THOUSAND UNITS)

13.3.1 TURKEY

13.3.1.1 Government measures and policies to increase demand for LPG vehicles

TABLE 112 TURKEY: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 113 TURKEY: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.3.2 ITALY

13.3.2.1 Major OEMs and aftermarket kit companies to develop CNG and LPG vehicle market

TABLE 114 ITALY: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 115 ITALY: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.3.3 RUSSIA

13.3.3.1 High adoption of CNG and LPG vehicles expected due to favorable government policies

TABLE 116 RUSSIA: MARKET, BY VEHICLE TYPE, POINT, 2018–2020 (THOUSAND UNITS)

TABLE 117 RUSSIA: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.3.4 SPAIN

13.3.4.1 Government and OEMs working together for growth of market

TABLE 118 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 119 SPAIN: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.3.5 GERMANY

13.3.5.1 Growing demand for alternative fuel vehicles to grow market

TABLE 120 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 121 GERMANY: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.3.6 FRANCE

13.3.6.1 Government initiatives to boost CNG and LPG vehicle market

TABLE 122 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 123 FRANCE: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.3.7 UK

13.3.7.1 Government initiatives to boost market in short term

TABLE 124 UK: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 125 UK: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.4 NORTH AMERICA

FIGURE 56 NORTH AMERICA: MARKET SNAPSHOT

TABLE 126 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 127 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (THOUSAND UNITS)

13.4.1 CANADA

13.4.1.1 Government support for CNG and LPG infrastructure to boost demand

TABLE 128 CANADA: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 129 CANADA: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.4.2 US

13.4.2.1 Inclination towards innovation, technology, and development of safe and comfortable automobiles to boost demand

TABLE 130 US: CNG AND LPG VEHICLE MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 131 US: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.4.3 MEXICO

13.4.3.1 Favorable government regulations to boost demand

TABLE 132 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 133 MEXICO: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.5 REST OF THE WORLD

FIGURE 57 REST OF THE WORLD MARKET, BY COUNTRY, 2021 VS 2026

TABLE 134 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 135 REST OF THE WORLD: MARKET, BY COUNTRY, 2021–2026 (THOUSAND UNITS)

13.5.1 BRAZIL

13.5.1.1 Government support for CNG infrastructure to boost demand

TABLE 136 BRAZIL: CNG AND LPG VEHICLE MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 137 BRAZIL: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.5.2 SOUTH AFRICA

13.5.2.1 Government policies and participation of OEMs to boost demand

TABLE 138 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 139 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.5.3 ARGENTINA

13.5.3.1 Favorable government regulations to boost demand

TABLE 140 ARGENTINA: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 141 ARGENTINA: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

13.5.4 IRAN

13.5.4.1 High demand to boost CNG vehicle market

TABLE 142 IRAN: MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 143 IRAN: MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

14 COMPETITIVE LANDSCAPE (Page No. - 181)

14.1 MARKET EVALUATION FRAMEWORK

FIGURE 58 MARKET EVALUATION FRAMEWORK

14.2 OVERVIEW

FIGURE 59 RIGHTS TO WIN - DETAILS ON KEY DEVELOPMENTS BY LEADING PLAYERS

14.3 MARKET SHARE ANALYSIS FOR MARKET

TABLE 144 MARKET SHARE ANALYSIS FOR OE MARKET, 2020

FIGURE 60 MARKET SHARE ANALYSIS FOR OE, 2020

14.4 MARKET EVALUATION FRAMEWORK: REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 61 TOP PUBLIC/LISTED PLAYERS DOMINATING MARKET IN LAST 5 YEARS

14.5 MARKET RANKING ANALYSIS FOR MARKET

FIGURE 62 MARKET RANKING ANALYSIS, 2020

14.6 COMPETITIVE SCENARIO

14.6.1 NEW PRODUCT LAUNCHES

TABLE 145 PRODUCT LAUNCHES, 2017–2020

14.6.2 DEALS

TABLE 146 DEALS, 2017–2020

14.6.3 EXPANSIONS, 2017–2020

TABLE 147 EXPANSIONS, 2017–2020

14.7 COMPETITIVE LEADERSHIP MAPPING FOR CNG AND LPG VEHICLE MARKET

14.7.1 STARS

14.7.2 EMERGING LEADERS

14.7.3 PERVASIVE

14.7.4 PARTICIPANTS

FIGURE 63 MARKET: COMPETITIVE LEADERSHIP MAPPING FOR VEHICLE MANUFACTURERS, 2020

TABLE 148 MARKET: COMPANY PRODUCT FOOTPRINT, 2020

TABLE 149 MARKET: COMPANY APPLICATION FOOTPRINT , 2020

TABLE 150 MARKET: COMPANY REGION FOOTPRINT, 2020

FIGURE 64 MARKET: COMPETITIVE LEADERSHIP MAPPING FOR CNG/LPG PARTS/KIT MANUFACTURERS, 2020

14.8 WINNERS VS. TAIL-ENDERS

TABLE 151 WINNERS VS. TAIL-ENDERS

15 COMPANY PROFILES (Page No. - 202)

15.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

15.1.1 FORD MOTOR COMPANY

TABLE 152 FORD MOTOR COMPANY: BUSINESS OVERVIEW

FIGURE 65 FORD MOTOR COMPANY: COMPANY SNAPSHOT

TABLE 153 FORD MOTOR COMPANY: PRODUCTS OFFERED

TABLE 154 FORD MOTOR COMPANY: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 155 FORD MOTOR COMPANY: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ SUPPLY CONTRACTS/AGREEMENTS/MERGERS & ACQUISITIONS

15.1.2 SUZUKI MOTOR CORPORATION

TABLE 156 SUZUKI MOTOR CORPORATION: BUSINESS OVERVIEW

FIGURE 66 SUZUKI MOTOR CORPORATION: COMPANY SNAPSHOT

TABLE 157 SUZUKI MOTOR CORPORATION: PRODUCTS OFFERED

TABLE 158 SUZUKI MOTOR CORPORATION: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 159 SUZUKI MOTOR CORPORATION: PARTNERSHIPS/COLLABORATIONS/ JOINT VENTURES/SUPPLY CONTRACTS/AGREEMENTS/MERGERS & ACQUISITIONS

15.1.3 HONDA MOTOR COMPANY

TABLE 160 HONDA MOTOR COMPANY: BUSINESS OVERVIEW

FIGURE 67 HONDA MOTOR COMPANY: COMPANY SNAPSHOT

TABLE 161 HONDA MOTOR COMPANY: PRODUCTS OFFERED

TABLE 162 HONDA MOTOR COMPANY: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 163 HONDA MOTOR COMPANY: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/AGREEMENTS/MERGERS & ACQUISITIONS

15.1.4 HYUNDAI MOTOR GROUP

TABLE 164 HYUNDAI MOTOR GROUP: BUSINESS OVERVIEW

FIGURE 68 HYUNDAI MOTOR GROUP: COMPANY SNAPSHOT

TABLE 165 HYUNDAI MOTOR GROUP: PRODUCTS OFFERED

TABLE 166 HYUNDAI MOTOR GROUP: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 167 HYUNDAI MOTOR GROUP: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ SUPPLY CONTRACTS/AGREEMENTS/MERGERS & ACQUISITIONS

15.1.5 VOLKSWAGEN AG

TABLE 168 VOLKSWAGEN AG: BUSINESS OVERVIEW

FIGURE 69 VOLKSWAGEN AG: COMPANY SNAPSHOT

TABLE 169 VOLKSWAGEN AG: PRODUCTS OFFERED

TABLE 170 VOLKSWAGEN AG: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 171 VOLKSWAGEN AG: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ SUPPLY CONTRACTS/AGREEMENTS/MERGERS & ACQUISITIONS

FIGURE 70 VOLKSWAGEN AG: BRAND REVENUE DISTRIBUTION

15.1.6 FIAT CHRYSLER AUTOMOBILES

TABLE 172 FIAT CHRYSLER AUTOMOBILES: BUSINESS OVERVIEW

FIGURE 71 FIAT CHRYSLER AUTOMOBILES: COMPANY SNAPSHOT

TABLE 173 FIAT CHRYSLER AUTOMOBILES: PRODUCTS OFFERED

TABLE 174 FIAT CHRYSLER AUTOMOBILES: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 175 FIAT CHRYSLER AUTOMOBILES: PARTNERSHIPS/COLLABORATIONS/ JOINT VENTURES/SUPPLY CONTRACTS/AGREEMENTS/MERGERS & ACQUISITIONS

15.1.7 GENERAL MOTORS

TABLE 176 GENERAL MOTORS: BUSINESS OVERVIEW

FIGURE 72 GENERAL MOTORS: COMPANY SNAPSHOT

TABLE 177 GENERAL MOTORS: PRODUCTS OFFERED

TABLE 178 GENERAL MOTORS: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 179 GENERAL MOTORS: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ SUPPLY CONTRACTS/AGREEMENTS/MERGERS & ACQUISITIONS

15.1.8 LANDI RENZO S.P.A.

TABLE 180 LANDI RENZO: BUSINESS OVERVIEW

FIGURE 73 LANDI RENZO S.P.A.: COMPANY SNAPSHOT

TABLE 181 LANDI RENZO S.P.A.: PRODUCTS OFFERED

TABLE 182 LANDI RENZO S.P.A.: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ SUPPLY CONTRACTS/AGREEMENTS/MERGERS & ACQUISITIONS

15.1.9 TOMASETTO ACHILLE

TABLE 183 TOMASETTO ACHILLE: BUSINESS OVERVIEW

TABLE 184 TOMASETTO ACHILLE: PRODUCTS OFFERED

TABLE 185 TOMASETTO ACHILLE: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ SUPPLY CONTRACTS/AGREEMENTS/MERGERS & ACQUISITIONS

15.1.10 WESTPORT FUEL SYSTEMS

TABLE 186 WESTPORT FUEL SYSTEMS: BUSINESS OVERVIEW

FIGURE 74 WESTPORT FUEL SYSTEMS: COMPANY SNAPSHOT

TABLE 187 WESTPORT FUEL SYSTEMS: PRODUCTS OFFERED

TABLE 188 WESTPORT FUEL SYSTEMS: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 189 WESTPORT FUEL SYSTEMS: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ SUPPLY CONTRACTS/AGREEMENTS/MERGERS & ACQUISITIONS

15.1.11 TOYOTA MOTOR CORPORATION

TABLE 190 TOYOTA MOTOR CORPORATION: BUSINESS OVERVIEW

FIGURE 75 TOYOTA MOTOR CORPORATION: COMPANY SNAPSHOT

TABLE 191 TOYOTA MOTOR CORPORATION: PRODUCTS OFFERED

TABLE 192 TOYOTA MOTOR CORPORATION: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 193 TOYOTA MOTOR CORPORATION: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ SUPPLY CONTRACTS/AGREEMENTS/MERGERS & ACQUISITIONS

15.1.12 TATA MOTORS LIMITED

TABLE 194 TATA MOTORS LIMITED: BUSINESS OVERVIEW

FIGURE 76 TATA MOTORS LIMITED: COMPANY SNAPSHOT

TABLE 195 TATA MOTORS LIMITED PRODUCTS OFFERED

TABLE 196 TATA MOTORS LIMITED: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 197 TATA MOTORS LIMITED: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ SUPPLY CONTRACTS/AGREEMENTS/MERGERS & ACQUISITIONS

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

15.2 OTHER PLAYERS

15.2.1 GREAT WALL MOTORS

15.2.2 GUANGZHOU AUTOMOBILE INDUSTRY GROUP

15.2.3 SAIC MOTOR CORPORATION

15.2.4 FAW GROUP

15.2.5 BAIC GROUP

15.2.6 DONGFENG MOTOR GROUP

15.2.7 MAHINDRA & MAHINDRA

15.2.8 EICHER MOTORS

15.2.9 BAJAJ GROUP

15.2.10 MAZDA MOTOR CORPORATION

15.2.11 MITSUBISHI MOTORS

15.2.12 NISSAN MOTOR COMPANY

15.2.13 SUBARU CORPORATION

15.2.14 DONGXU

15.2.15 NIKKI CO., LTD.

15.2.16 DAIMLER AG

15.2.17 RENAULT

15.2.18 AB VOLVO

15.2.19 PSA GROUP

15.2.20 CNH INDUSTRIAL NV

15.2.21 AC SPOLKA

15.2.22 KION GROUP

15.2.23 ATIKER GROUP

15.2.24 DEERE AND COMPANY

15.2.25 PACCAR

15.2.26 AGILITY FUEL SOLUTIONS

15.2.27 CUMMINS

15.2.28 QUANTUM FUEL SYSTEMS

15.2.29 AGRALE

15.2.30 MACROPOLO SA

15.2.31 IRAN KHODRO

15.2.32 SAIPA

15.2.33 IGT MOTORS

16 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 250)

16.1 BI-FUEL SYSTEM, PASSENGER CAR, AND LIGHT COMMERCIAL VEHICLE ARE THE SEGMENTS FOR MANUFACTURERS/SUPPLIERS TO FOCUS ON

16.2 EMERGING MARKETS CAN BE A KEY FOCUS AREA FOR CNG AND LPG VEHICLE MANUFACTURERS

16.3 CONCLUSION

17 APPENDIX (Page No. - 251)

17.1 KEY INSIGHTS OF INDUSTRY EXPERTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.4 AVAILABLE CUSTOMIZATIONS

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

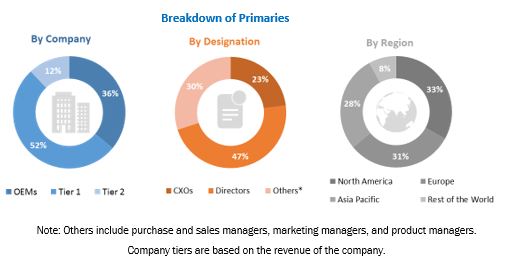

The study involved four major activities in estimating the current size of the CNG and LPG vehicle market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of CNG and LPG vehicle manufacturers, International Energy Agency (IEA), Federal Transit Administration (FTA), Regional Transportation Authority (RTA), country-level vehicle associations and trade organizations, and the US Department of Transportation (DOT)], CNG and LPG vehicle related magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, government organizations websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global CNG and LPG vehicle market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across three major regions, namely, Asia Pacific, Europe, North America. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total market size. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To analyze the CNG and LPG vehicle market and forecast its size, in terms of volume (thousand units), from 2018 to 2026

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To segment the market and forecast its size, by volume (thousand units), based on fuel type (CNG and LPG)

- To segment the market and forecast its size, by volume (thousand units), based on vehicle type (light-duty vehicle and heavy-duty vehicle)

- To segment the market and forecast its size, by volume (thousand units), based on vehicle body type (three-wheeler, passenger car, and commercial vehicle)

- To segment the market and forecast its size, by volume (thousand units), based on kit type (venturi and sequential)

- To segment the market and forecast its size, by volume (thousand units), based on fitting type (OEM/factory-fitted and aftermarket)

- To segment the market and forecast its size, by volume (thousand units), based on engine/system type (dedicated, bi-fuel, and dual fuel)

- To segment the market and forecast its size, by volume (thousand units), based on intake system type (converter-and-mixer system, VPI, LPI, LPDI)

- To segment the market and forecast its size, by volume (thousand units), based on region {Asia Oceania, Europe, North America, and Rest of the world (RoW)}

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, expansions, partnerships, collaborations, and other activities carried out by key industry participants.

CNG Cars & Its impact on CNG & LPG Vehicle Market

CNG (compressed natural gas) vehicles run on compressed natural gas that is stored in high-pressure tanks in the vehicle. CNG vehicles are a subset of the CNG & LPG vehicle market, which includes any vehicle that runs on compressed natural gas (CNG). CNG vehicles are a subset of the CNG & LPG vehicle market that are typically designed to run on compressed natural gas. CNG vehicles are becoming more popular due to lower operating costs, lower emissions, and improved fuel economy when compared to traditional gasoline or diesel-powered vehicles.

Several factors, including environmental regulations, fuel prices, and government incentives, are driving the growth of the CNG cars market. As countries around the world seek to reduce their reliance on fossil fuels and reduce emissions, interest in alternative fuel vehicles such as CNG and LPG vehicles is growing.

By extending the reach of CNG Cars services, companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Increased demand: As CNG cars become more popular due to their lower operating costs, reduced emissions, and better fuel economy compared to traditional gasoline or diesel-powered vehicles, the demand for CNG vehicles is likely to increase.

- Government incentives: Governments around the world are offering incentives to encourage the adoption of alternative fuel vehicles, including CNG cars.

- Infrastructure development: As the demand for CNG cars increases, there will be a need for additional infrastructure to support these vehicles.

- Competition with LPG vehicles: While CNG cars are part of the CNG & LPG vehicle market, they compete with LPG vehicles for market share.

The top players in the CNG Cars market are Fiat Chrysler Automobiles, Ford Motor Company, General Motors, Honda Motor Co., Ltd., Hyundai Motor Company, Suzuki Motor Corporation, Tata Motors, Toyota Motor Corporation, Volkswagen AG, Volvo Group.

Some of the key industries that are going to get impacted because of the growth of CNG Cars are,

1. Energy industry: The rise of CNG cars will increase the demand for natural gas, which is the primary fuel source for these vehicles.

2. Automotive industry: The growth of the CNG & LPG vehicle market will impact the automotive industry, as car manufacturers will need to adapt to meet the demand for CNG cars.

3. Infrastructure industry: As mentioned earlier, the growth of CNG cars will require the development of additional infrastructure to support these vehicles.

4. Environmental industry: CNG cars are often seen as a more sustainable and environmentally friendly alternative to gasoline or diesel-powered vehicles.

5. Government policies: Governments around the world are implementing policies to reduce their carbon footprint and promote the adoption of sustainable transportation options.

Speak to our Analyst today to know more about, "CNG Cars Market"

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- CNG and LPG vehicle market, by fuel type, at the country-level (For countries covered in the report)

- CNG and LPG vehicle market, by fitting type, at the country-level (For countries covered in the report)

Company information

- Profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in CNG & LPG Vehicle Market