Compressor Control System Market by Component (Controlling: (PLC and SCADA) & Networking), Application (Oil & Gas, Refining, Petrochemical, Power Generation, Metals & Mining, Water & Wastewater and Fertilizer), and Geography - Global Forecast to 2022

The global compressor control system market is estimated to reach USD 6.39 Billion by 2022, at a CAGR of 4.7% between 2016 and 2022. A tilt towards the non-oil and gas segments such as water & wastewater, metals & mining, and fertilizers would boost the demand for compressors. The introduction of new products in the global compressor control systems market is expected to contribute toward its growth in the years to come. The base year considered is 2015 and the market forecast provided is between 2016 and 2022. The compressor control system market is segmented based on application, component, and geography.

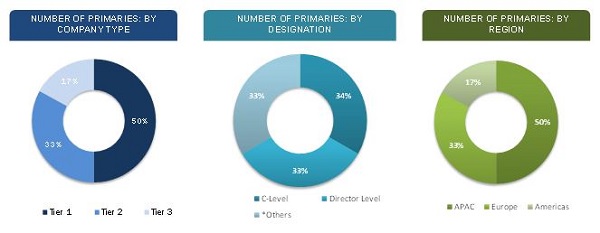

The market size forecast for compressor control systems was derived using top-down and bottom-up methods. In the bottom up approach, the market size, in terms of volume, for each type of compressor control systems was calculated with their average selling price and then each type was mapped with the applications in each industry. The summation of revenue of all the types and industries led to the overall market size. In the top-down approach, the top companies in the market are analyzed and their product portfolio is studied to arrive at the global market size of the compressor control system market. This overall market is analyzed by percentage contribution of individual segments. After arriving at the overall market size, the total market is split into several segments and subsegments which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, Directors and executives.

According to MarketsandMarkets, the compressor control systems market is expected to grow at a CAGR of 4.7% between 2016 and 2022, from USD 4.60 Billion in 2015 to USD 6.39 Billion by 2022. The compressor control system market has a high growth potential in various applications; however, those in industries such as oil & gas, refining, and petrochemical has been remarkable, and this is one of the prime drivers, owing to which the market is emerging globally. Some other industries such as power generation, metals & mining, fertilizers, automobile, and cement are also expected to be large application areas for the compressor control system market in the near future.

The application of compressor control systems is expected to increase across various industrial segments in the coming years. Moreover, manufacturers are focused on increasing the efficiency and the overall performance of their plants, which is further expected to escalate the demand for compressor control systems. They increase the pressure of the natural gas through heat and allow it to be transported from the production facility through the supply chain to end users. Compressors are widely used in the oil & gas industry in various core activities, starting from the initial treatment of crude oil/natural gas to transporting it through pipelines. Reciprocating and centrifugal compressors are most prevalent in the oil & gas industry.

Compressor control systems have become a central component in the processes of many industries, such as oil & gas, refining, petrochemical, power generation, metals & mining, fertilizers, and so on. In these processes, the profitability is dependent on the efficiency and functionality of compressor controls. Owing to the number of technological advancements, engineering excellence, and diverse industrial requirements, a variety of compressors and controllers have been developed. Companies undertake continuous R&D to manufacture improved compressor control products.

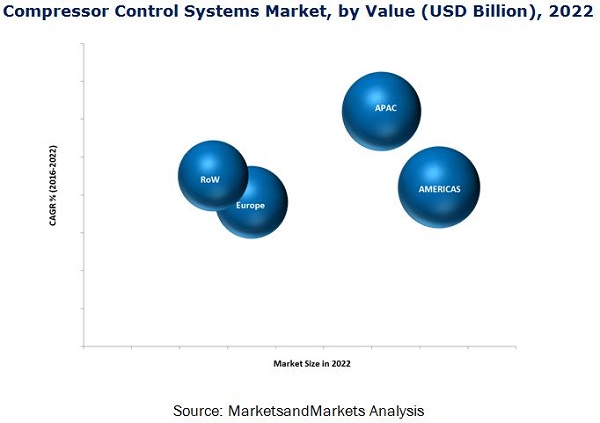

The Americas is estimated to hold a large share of the global compressor control system market over the next couple of years owing to the all-time high, new exploration activities along with the ones related to the Shale gas. The market in APAC is expected to grow at the highest CAGR during the forecast period. The availability of technically skilled manpower, coupled with cheap labor is enticing many multinational companies to either establish manufacturing facilities or enter into joint ventures with indigenous suppliers in emerging economies in the region. The increase in the production capacity in petrochemical, oil & gas, and power generation plants is expected to spur the growth of compressor control systems in this region.

The factors restraining the market are the high initial cost and timely maintenance of the compressor control systems, along with the volatility in oil & gas prices. Less R&D investments by the existing players in the last couple of years could impact the overall growth of the market. Further, fluctuations in the prices of raw materials can restrict the growth of the compressor control system market.

Companies always aim to create requirement-specific products, improving the quality and designs, and reducing the product development cycle time & costs Acquisitions and expansions are the key strategies adopted by players to achieve growth in the market. Apart from this, companies adopt strategies such as partnerships, agreements, and contracts to expand their product offerings and increase their market share.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.1.2.3 Assumptions

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.3 Market Breakdown and Data Triangulation

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Compressor Control System Market

4.2 Oil & Gas Industry Held the Largest Share in 2015

4.3 The Compressor Control System Market in APAC Expected to Grow at the Highest Rate During the Forecast Period

4.4 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Component

5.3.2 By Controlling Component

5.3.3 By Networking Component

5.3.4 By Application

5.3.5 By Geography

5.4 Markets Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Product Quality Specifications for Critical Industrial Processes are Likely to Drive the Compressor Control System Market

5.4.1.2 Advancements in Technology and Innovation are Fuelling the Growth of the Compressor Control System Market

5.4.1.3 Large-Scale Application in Industries Such as Oil & Gas, Refining, and Petrochemical is Majorly Driving the Global Market of the Compressor Control System

5.4.1.4 Massive Investment in the Power and Water Segment is Expected to Emerge as the Second Biggest Source for Compressor Installation

5.4.1.5 Decommissioning of Aging Power Stations

5.4.1.6 Market for Spare Parts Would Have A Strong Impact on the Growth of the Compressor Control System Market in the Future

5.4.1.7 Energy-Efficient and Compact Compressors Provide Several Opportunities

5.4.2 Restraints

5.4.2.1 Less Research and Development Expenditure Incurred By the Existing Players in the Last Couple of Years May Impact the Overall Growth of the Market

5.4.2.2 Volatility in the Raw Material Prices

5.4.3 Opportunities

5.4.3.1 Application in New Industries is Likely to Encourage the Market Growth

5.4.3.2 Flexible Regulatory Environment for the Compressor Control System Market

5.4.4 Challenges

5.4.4.1 Stringent Environmental Specifications, Epa Regulation, and Imo Emission Levels Agreement

5.4.4.2 Major Players Dominating the Market Can Be A Challenge to Small Industries

5.4.4.3 Developed Countries Like U.S, Canada and Germany Dominating the Market

5.4.5 Burning Issues

5.4.5.1 Volatility in Oil and Natural Gas Prices

5.4.5.2 Other Avenues for New Orders and Revenue Growth

6 Industry Trends (Page No. - 55)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain: Oil and Gas Industry

6.4 Supply Chain: Gas Turbine-Based Power Station

6.5 Porter’s Five Forces Analysis

6.5.1 Intensity of Competitive Rivalry

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Buyers

6.5.4 Bargaining Power of Suppliers

6.5.5 Threat of New Entrant

7 Compressor Control Systems Market, By Component (Page No. - 64)

7.1 Introduction

7.2 Controlling Components

7.2.1 PLC

7.2.2 Supervisory Control and Data Acquisition (SCADA)

7.2.2.1 Advantages of SCADA

7.2.2.1.1 Operation Efficiency

7.2.2.1.2 Performance Enhancement

7.2.2.1.3 Productivity

7.2.3 Others

7.2.3.1 Transmitters

7.2.3.2 Valves

7.2.3.3 Actuators

7.2.3.4 Drives

7.2.3.5 Motors

7.3 Networking Components

7.3.1 Switches

7.3.2 Gateways & Nodes

7.3.3 Others

8 Compressor Control System Market, By Application (Page No. - 76)

8.1 Introduction

8.2 Oil & Gas

8.2.1 Liquefied Natural Gas (LNG)

8.2.2 Piped Natural Gas (PNG)

8.2.3 Shale Gas

8.2.4 Others

8.3 Refining

8.3.1 Hydrocracking

8.3.2 Hydro Treating

8.3.3 Fluid Catalytic Cracking Unit (FCCU)

8.3.4 Continuous Catalytic Reforming (CCR)

8.3.5 Steam Methane Reforming (SMR)

8.3.6 Others

8.4 Petrochemical

8.4.1 Ethylene

8.4.2 Methanol

8.4.3 Nitrogen Plants

8.4.4 Others

8.5 Power Generation

8.5.1 Gas-Based

8.5.2 Combined Cycle Power Plant (CCPP)

8.5.3 Coal Gasification

8.5.4 Biofuels

8.5.5 Others

8.6 Metals & Mining

8.6.1 Utility

8.6.2 Oxygen/Nitrogen

8.6.3 Boil-Off Gas

8.6.4 Synthesis Gas

8.6.5 Others

8.7 Fertilizers

8.7.1 Ammonia

8.7.2 Urea

8.7.3 Others

8.8 Water & Wastewater

8.9 Others

8.9.1 Automotive

8.9.2 Cement

9 Geographic Analysis (Page No. - 114)

9.1 Introduction

9.2 Pestle Analysis

9.2.1 Political Factors

9.2.2 Economical Factors

9.2.3 Social Factors

9.2.4 Technological Factors

9.2.5 Environmental Factors

9.2.6 Legal Factors

9.3 Americas

9.3.1 North America

9.3.1.1 Presence of Advanced Infrastructure in North America

9.3.1.2 Power Sector has A Large Application of Compressor Control Systems in North America

9.3.1.3 U.S.

9.3.1.4 Canada

9.3.1.5 Mexico

9.3.2 South America

9.3.2.1 Liberal Policies for Foreign Players

9.3.2.2 Brazil

9.3.2.3 Others

9.4 Europe

9.4.1 Applications in the Petrochemical Industry to Fuel the Growth of Compressor Control System Market in the European Region

9.4.2 U.K

9.4.3 Germany

9.4.4 France

9.4.5 Italy

9.4.6 Spain

9.4.7 Rest of Europe

9.5 APAC

9.5.1 Majority of the Demand is Fueled By End-User Industries Such as Oil & Gas Among Others

9.5.2 India

9.5.3 China

9.5.4 Japan

9.5.5 Rest of APAC

9.6 Rest of the World

9.6.1 Middle East

9.6.2 Africa

9.6.2.1 Increased Activity in the Metals & Mining Sector is Encouraging Compressor Control System Market

10 Competitive Landscape (Page No. - 139)

10.1 Introduction

10.2 Market Ranking for Compressor Control System Market, 2015

10.3 Competitive Scenario

10.4 Major Projects for Market in U.S.

10.5 Developments

10.5.1 New Product Launches

10.5.2 Partnerships, Agreements, and Collaborations

10.5.3 Acquisitions and Mergers

11 Company Profiles (Page No. - 150)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

11.1 Introduction

11.2 ABB Ltd.

11.3 Dresser-Rand

11.4 GE Electric Co.

11.5 Rockwell Automation, Inc.

11.6 Siemens AG

11.7 Emerson Electric Co.

11.8 Compressor Controls Corporation

11.9 Schneider Electric SE

11.10 John Wood Group PLC

11.11 Ingersoll Rand PLC.

11.12 Atlas Copco

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 195)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (100 Tables)

Table 1 Market Segmentation: By Controlling Component

Table 2 Market Segmentation: By Networking Component

Table 3 Market Segmentation: By Application

Table 4 Market Segmentation: By Geography

Table 5 Massive Investment in the Power and Water Segment is Propelling the Growth of the Compressor Control Market

Table 6 The Increasing Number of New Entrants in the Market Could Restrict the Growth of the Existing Players

Table 7 Applications in the New Industry Verticals Encouraging the Market Growth

Table 8 Major Players Dominating the Market Can Be A Challenge to the Small Industries

Table 9 Falling Oil Prices Have Negative Impact on Compressor Suppliers

Table 10 Compressor Control Systems Market, By Component Type 2013–2022 (USD Billion)

Table 11 Market, By Controlling Component, 2013–2022 (USD Billion)

Table 12 Compressor Control System Market Size for Controlling Components, By Region, 2013–2022 (USD Billion)

Table 13 Compressor Control System Market, By Networking Component, 2013–2022 (USD Billion)

Table 14 Market Size for Networking Components, By Region, 2013–2022 (USD Billion)

Table 15 Compressor Control Systems Market, By Application, 2013–2022 (USD Billion)

Table 16 Market Size for Oil & Gas Application, By Sub- Application, 2013–2022 (USD Million)

Table 17 Compressor Control System Market Size for Oil & Gas Application, By Region, 2013–2022 (USD Million)

Table 18 Market Size for LNG Sub-Application, By Region, 2013–2022 (USD Million)

Table 19 Compressor Control System Market Size for PNG Sub-Application, By Region, 2013–2022 (USD Million)

Table 20 Market Size for Shale Gas Sub - Application, By Region, 2013–2022 (USD Million)

Table 21 Market Size for Others, By Region, 2013–2022 (USD Million)

Table 22 Market Size for Refining Application, By Sub - Application, 2013–2022 (USD Million)

Table 23 Market Size for Refining Application , By Region, 2013–2022 (USD Million)

Table 24 Market Size for Hydrocracking Sub - Application, By Region, 2013–2022 (USD Million)

Table 25 Compressor Control System Market Size for Hydro Treating Sub-Application, By Region, 2013–2022 (USD Million)

Table 26 Compressor Control System Market Size for FCCU, By Region, 2013–2022 (USD Million)

Table 27 Market Size for CCR, By Region, 2013–2022 (USD Million)

Table 28 Market Size for SMR, By Region, 2013–2022 (USD Million)

Table 29 Compressor Control System Market Size for Others, By Region, 2013–2022 (USD Million)

Table 30 Market Size for Petrochemical Application, By Sub- Application, 2013–2022 (USD Billion)

Table 31 Market Size for Petrochemical Application, By Region, 2013–2022 (USD Million)

Table 32 Compressor Control Systems Market Size for Ethylene Sub - Application, By Region, 2013–2022 (USD Million)

Table 33 Market Size for Methanol Sub - Application, By Region, 2013–2022 (USD Million)

Table 34 Compressor Control System Market Size for Nitrogen Plant, By Region, 2013–2022 (USD Million)

Table 35 Market Size for Others, By Region, 2013–2022 (USD Million)

Table 36 Market Size for Power Generation Application, By Region, 2013–2022 (USD Million)

Table 37 Market Size for Power Generation Application, By Sub - Application, 2013–2022 (USD Billion)

Table 38 Market Size for Gas-Based, By Region, 2013–2022 (USD Million)

Table 39 Market Size for CCPP, By Region, 2013–2022 (USD Million)

Table 40 Market Size for Coal Gasification, By Region, 2013–2022 (USD Million)

Table 41 Market Size for Biofuels, By Region, 2013–2022 (USD Million)

Table 42 Others Market Size, By Region, 2013–2022 (USD Million)

Table 43 Compressor Control System Market Size for Metal & Mining Application, By Sub-Application, 2013–2022 (USD Million)

Table 44 Market Size for Metals and Mining Application, By Region, 2013–2022 (USD Million)

Table 45 Compressor Control System Market Size for Utility, 2013–2022 (USD Million)

Table 46 Market Size for Oxygen/Nitrogen Sub - Application, By Region, 2013–2022 (USD Million)

Table 47 Compressor Control Systems Market Size for Boil-Off Gas , By Region, 2013–2022 (USD Million)

Table 48 Compressor Control Systems Market Size for Syngas , By Region, 2013–2022 (USD Million)

Table 49 Market Size for Others, By Region, 2013–2022 (USD Million)

Table 50 Market Size for Fertilizer Application, By Sub-Application, 2013-2022 (USD Million)

Table 51 Market Size for Fertilizer Application, By Region, 2013–2022 (USD Million)

Table 52 Compressor Control Systems Market Size for Ammonia Sub - Application, By Region, 2013–2022 (USD Million)

Table 53 Compressor Control Systems Market Size for Urea (Co2) Sub - Application, By Region, 2013–2022 (USD Million)

Table 54 Market Size for Others Sub - Application, By Region, 2013–2022 (USD Million)

Table 55 Market Size for Water & Wastewater Application, By Region, 2013–2022 (USD Million)

Table 56 Compressor Control Systems Market Size for Others Application, By Sub- Application, 2013–2022 (USD Million)

Table 57 Compressor Control Systems Market Size for Others Application, By Region, 2013–2022 (USD Million)

Table 58 Compressor Control System Market Size for Automotive Sub - Application, By Region, 2013–2022 (USD Million)

Table 59 Compressor Control Systems Market Size for Cement Sub - Application, By Region, 2013–2022 (USD Million)

Table 60 Compressor Control Systems Market: Pestle Analysis

Table 61 Compressor Control Systems Market Size, By Region, 2013–2022 (USD Billion)

Table 62 Americas Market Size, By Component, 2013–2022 (USD Billion)

Table 63 Market in North America , By Application, 2013–2022 (USD Million)

Table 64 Market in North America, By Country, 2013–2022 (USD Billion)

Table 65 Compressor Control Systems Market in South America, By Application, 2013–2022 (USD Million)

Table 66 Compressor Control System Market in Europe, By Application, 2013–2022 (USD Million)

Table 67 Market in Europe, By Component, 2013–2022 (USD Billion)

Table 68 Compressor Control Systems Market in Europe, By Country, 2013–2022 (USD Billion)

Table 69 Compressor Control Systems Market in APAC, By Application, 2013–2022 (USD Million)

Table 70 Market in APAC, By Component, 2013–2022 (USD Billion)

Table 71 Compressor Control Systems Market in APAC, By Country, 2013–2022 (USD Billion)

Table 72 Market in RoW, By Application, 2013–2022 (USD Million)

Table 73 Compressor Control Systems Market in RoW, By Component, 2013–2022 (USD Billion)

Table 74 Compressor Control System Market in RoW, By Region, 2013–2022 (USD Billion)

Table 75 List of Major Compressor Station Projects in U.S.

Table 76 New Product Launches, 2013–2015

Table 77 Partnerships, Agreements, and Collaborations, 2013–2015

Table 78 Acquisitions and Mergers, 2013–2015

Table 79 ABB Ltd.: Key Financial Statements (USD Million)

Table 80 ABB Ltd.: Key Financial Ratios

Table 81 Dresser-Rand: Key Financial Statements (USD Million)

Table 82 Dresser-Rand: Key Financial Ratio

Table 83 General Electric Co.: Key Financial Statements (USD Million)

Table 84 General Electric Co.: Key Financial Ratios

Table 85 Rockwell Automation, Inc.: Key Financial Statements (USD Million)

Table 86 Rockwell Automation, Inc.: Key Financial Ratio (USD Million)

Table 87 Siemens AG: Key Financial Statements (USD Million)

Table 88 Siemens AG: Key Financial Ratio

Table 89 Emerson Electric Co.: Key Financial Statement (USD Million)

Table 90 Emerson Electric Co.: Key Financial Ratio

Table 91 Compressor Controls Corporation: Key Financial Statements (USD Million)

Table 92 Compressor Controls Corporation: Key Financial Ratio

Table 93 Schneider Electric SE: Key Financial Statement (USD Million)

Table 94 Schneider Electric SE: Key Financial Ratio

Table 95 Wood Group: Key Financial Statement (USD Million)

Table 96 Wood Group: Key Financial Ratio

Table 97 Ingersoll Rand PLC.: Key Financial Statements (USD Million)

Table 98 Ingersoll Rand PLC.: Key Financial Ratios

Table 99 Atlas Copco: Key Financial Statements (USD Million)

Table 100 Atlas Copco: Key Financial Ratios

List of Figures (96 Figures)

Figure 1 Market Segmentation: Compressor Control Systems Market

Figure 2 Research Design

Figure 3 Research Methodology

Figure 4 Market Size Estimation Methodology : Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Approach

Figure 7 Global Compressor Control Systems Market is Expected to Grow at A Moderate CAGR

Figure 8 Controlling Component Held the Largest Share in the Compressor Control Systems Market Between 2016 and 2022

Figure 9 Global Compressor Control System Market Size, By Application, 2015–2022 (USD Billion)

Figure 10 Global Compressor Control Systems Market Size, By Country, 2016–2022 (USD Billion)

Figure 11 APAC is Expected to Grow at the Highest CAGR During 2016 and 2022

Figure 12 Controlling Components Held the Largest Share in the Compressor Control Systems Market in 2015

Figure 13 North America Accounted for the Largest Market Share in 2015

Figure 14 U.S., Followed By China, Held the Largest Market Share in 2015

Figure 15 APAC, Followed By Europe, Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 16 Compressor Control System Market Segmentation

Figure 17 Massive Investment in the Power and Water Segment Expected to Spur the Demand for the Market

Figure 18 Largest Reserve Holder of Crude Oil, 2015

Figure 19 Largest Reserve Holder of Natural Gas, 2015

Figure 20 Global Prospects for Gas-Fired Power Generation, Installed Capacity 2010, 2020, and 2030

Figure 21 Volatility in World Crude Oil Prices

Figure 22 Major Value Added During the System Integration Stage

Figure 23 Oil and Gas Industry Supply Chain

Figure 24 Combined Cycle Gas Turbine-Based Power Station Supply Chain

Figure 25 Compressor Control Systems Market: Porter Five Forces Analysis, 2015

Figure 26 Compressor Control System Market: Porter’s Five Forces Analysis

Figure 27 Intensity of Competitive Rivalry: High Competition in the Market Due to the Presence of A Large Number of Players

Figure 28 Threat of Substitutes Expected to Be Moderate Due to High Consumer Switching Costs

Figure 29 Bargaining Power of Buyers Expected to Have A Moderate Impact Owing to the Availability of Customized Compressor Control Solutions

Figure 30 Bargaining Power of Suppliers Expected to Be Moderate Due to High Supplier to Buyer Ratio

Figure 31 Impact of New Entrants Expected to Be Low in the Market Due to High Capital Investments

Figure 32 Compressor Control Market Segmentation, By Component

Figure 33 Controlling Component Market is Expected to Grow at A High CAGR During the Forecasted Period

Figure 34 Compressor Control Market Segmentation, By Controlling Component

Figure 35 Compressor Control Systems Market for Controlling Component is Expected to Grow at High CAGR During the Forecast Period

Figure 36 Compressor Control System Market Size for Controlling Components, By Region, 2016 vs 2022 (USD Billion)

Figure 37 Compressor Control Market Segmentation, By Networking Component

Figure 38 Compressor Control Systems Market Size, By Networking Component, 2016 vs 2022 (USD Billion)

Figure 39 Compressor Control System Market Size for Networking Components, By Region, 2016 vs 2022 (USD Billion)

Figure 40 Compressor Control Systems Market, By Application

Figure 41 Market Size, By Application, 2016–2022 (USD Billion)

Figure 42 Oil and Gas Application

Figure 43 Compressor Control System Market Size for Oil & Gas Application, By Region, 2016 vs 2022 (USD Million)

Figure 44 Compressor Control Systems Market Size for Refining, By Region, 2016 vs 2022 (USD Million)

Figure 45 Basic Overview of the Hydrocracking Process

Figure 46 Compressor Control System Market Size for FCCU, By Region, 2016 vs 2022 (USD Million)

Figure 47 Compressor Control Systems Market Size for SMR, By Region, 2016 vs 2022 (USD Million)

Figure 48 Market Size for Petrochemical Application, By Region, 2016 vs 2022 (USD Million)

Figure 49 Working of A Methanol Plant

Figure 50 Compressor Control Systems Market Size for Power Generation Application, By Region, 2016 vs 2022 (USD Million)

Figure 51 Power Generation Industry Market Segmentation

Figure 52 Metals and Mining Market Segmentation

Figure 53 Compressor Control System Market Size for Metal and Mining Application, By Region, 2016 vs 2022 (USD Million)

Figure 54 Compressor Control System Application in the Fertilizer Industry

Figure 55 Compressor Control System Market Size for Fertilizer Application, 2016 vs 2022 (USD Million)

Figure 56 Water & Wastewater Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 57 Compressor Control Systems Market Segmentation of Other Industries

Figure 58 Compressor Control Systems Market Size for Other Application, 2016 vs 2022

Figure 59 Compressor Control System Market, By Geography

Figure 60 Market: Geographic Snapshot (2016–2022)

Figure 61 Compressor Control Systems Market: Country-Wise Growth (2016– 2022)

Figure 62 Segmentation: Americas

Figure 63 Americas: Market Snapshot

Figure 64 North America: Market Segmentation

Figure 65 South America: Market Segmentation

Figure 66 Europe: Market Segmentation

Figure 67 Europe: Market Snapshot

Figure 68 Oil Demand Met By the European Economic Area (EEA) Production

Figure 69 Natural Gas Demand Met By the European Economic Area (EEA ) Production

Figure 70 APAC : Market Segmentation

Figure 71 APAC: Market Snapshot

Figure 72 Rest of the World: Market Segmentation

Figure 73 Middle East: Crude Oil Reserves, 2015 (Billion Barrels)

Figure 74 Companies Adopted Product Innovation as the Key Growth Strategy During 2013–2016

Figure 75 Rank Analysis of the Top OEM Players in the Compressor Control Systems Market, 2015

Figure 76 Market Rank Analysis of the Top System Integrators in the Compressor Control System Market, 2015

Figure 77 Battle for the Market Share: Acquisitions Was the Key Strategy

Figure 78 Market Evaluation Framework—New Product Launches Drive Growth and Innovation Between 2013 and 2016

Figure 79 Geographic Revenue Mix of Top 5 Market Players

Figure 80 ABB Ltd.: Company Snapshot

Figure 81 ABB Ltd.: SWOT Analysis

Figure 82 Dresser-Rand: Company Snapshot

Figure 83 Dresser-Rand: SWOT Analysis

Figure 84 GE Electric Co.: Company Snapshot

Figure 85 SWOT Analysis: General Electric Co.

Figure 86 Rockwell Automation, Inc.: Company Snapshot

Figure 87 Rockwell Automation, Inc.: SWOT Analysis

Figure 88 Siemens AG: Company Snapshot

Figure 89 Siemens AG: SWOT Analysis

Figure 90 Emerson Electric Co.: Company Snapshot

Figure 91 Emerson Electric Co.: SWOT Analysis

Figure 92 Compressor Controls Corporation: Company Snapshot

Figure 93 Schneider Electric SE: Company Snapshot

Figure 94 Wood Group : Company Snapshot

Figure 95 Ingersoll Rand PLC.: Company Snapshot

Figure 96 Atlas Copco: Company Snapshot

In the process of determining and verifying the market size for several segments and subsegments gathered through the secondary research, extensive primary interviews were conducted with key opinion leaders. The break-up of the profiles of primary participants is given in the chart below:

To know about the assumptions considered for the study, download the pdf brochure

The value chain of compressor control systems includes research & development, assembly & manufacturing, supply, system integration, distribution, marketing & sales, and end user industries. The report provides the competitive landscape of key players which indicates their growth strategies in the compressor control system market. The report provides the profiles of major companies in the comprmarket. The key players in the compressor control system market are General Electric Co. (U.S.), Schneider Electric (France), Siemens AG (Germany), Wood Group Plc (U.K.), Atlas Copco (Sweden), and Ingersoll Rand (Ireland).

The report also covers the factors affecting the market dynamics such as drivers, restraints, opportunities, and challenges. Apart from the in-depth view on the market segmentation, the report also includes the critical market data and qualitative information regarding compressor control systems, along with qualitative analyses such as the Porter’s five forces analysis, value chain analysis, and market breakdown analysis.

Target Audience:

- Original Device Manufacturers (ODMs)

- System Integrators

- Electronic Hardware Equipment Manufacturers

- Assembly and Packaging Vendors

- Technical Universities

- Government Research Agencies And Private Research Organizations

- Research Institutes And Organizations

- Market Research And Consulting Firms

- End-User Industries

Scope of the Report:

The market covered in this report has been segmented as follows:

Compressor Control Systems Market, by Application:

- Oil & gas

- Refining

- Petrochemical

- Power Generation

- Metals & Mining

- Fertilizers

- Water & Wastewater

- Others (Cement and Automotive)

Compressor Control System Market, by Component:

By Controlling Component

- PLC

- SCADA

- *Others

By Networking Component

- Switches

- Gateways & Nodes

- *Others

Compressor Control System Market, by Geography:

- Americas

- Europe

- APAC

- RoW

Available customizations:

- Types of compressor controls, by Country can be provided, in terms of value

- Further breakdown of the compressor control system market, by Country not covered in the report (up to 5)

- Country-wise breakup for types of compressor control systems

- Detailed analysis and profiling of additional players (up to five)

Growth opportunities and latent adjacency in Compressor Control System Market