Computer Assisted Coding Market by Software (Natural Language Processing, Structured Input, Integrated Systems), Service (Support, Education & Training), Application (Automated Encoding, Clinical Coding Audit, Management Reporting) - Global Forecast to 2022

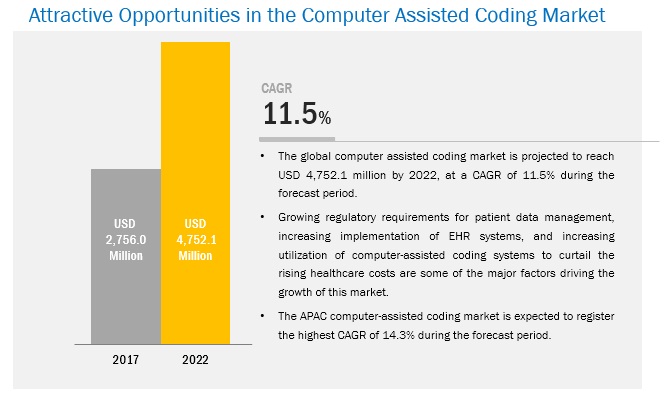

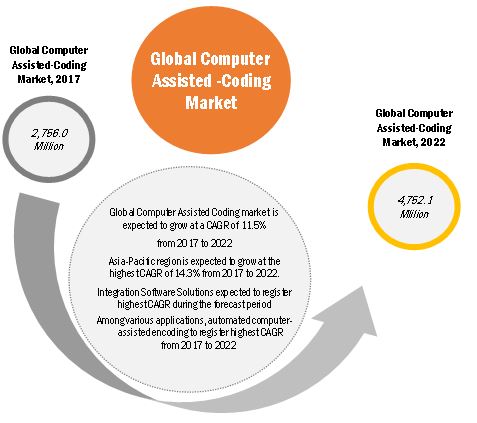

[242 Pages Report] The global computer-assisted coding market is valued at USD 2.76 billion in 2017 and is expected to register a CAGR of 11.5% to reach to USD 4.75 billion by 2022. The growth of the market can be attributed to the transition to ICD-10 coding standards from ICD-9 in North America, the growing demand for CAC solutions, the growing need within the global healthcare system to curtail increasing healthcare costs, improve coding accuracy, and streamline the revenue cycle management procedures. The computer-assisted coding market is expanding with the emergence of new products and applications. These computer assisted coding solutions being used in many applications such as automated computer-assisted encoding, management reporting & analytics, and clinical coding auditing. The base year considered for the study is 2016, and the forecast has been provided for the period between 2017 and 2022.

Market Dynamics

Drivers

- Growing adoption of CAC solutions in North America due to the implementation of ICD-10 standards

- Increasing implementation of EHR systems

- Increasing utilization of CAC solutions to curtail the rising healthcare costs

- Growing regulatory requirements for patient data management

- Growing focus on physician computer-assisted coding in outpatient settings

Restraints

- High implementation and maintenance costs

- Lack of on-site CAC support and in-house CAC domain knowledge

Opportunities

- Untapped emerging markets

- Natural language processing-enabled CAC solutions

- Growing adoption of cloud-based solutions

Challenge

- Reluctance to adopt CAC solutions among healthcare providers in emerging markets

Implementation of ICD-10 Drive the Global Computer Assisted Coding Market

Many hospitals, especially in North America, are adopting CAC systems to manage the increasing load of coding resulting from the adoption of ICD-10 standards. Major health plans like Medicare have reported a smooth transition to ICD-10 due to rigorous testing for over six years. The ICD-10 coding system requires the use of 72,000 procedure codes and 68,000 CM codes, as opposed to the 4,000 and 14,000 codes, respectively, in the ICD-9 system. The requirement of managing a high volume of codes in the ICD-10 system is in turn driving the demand for automation.

The US is expected to dominate the global CAC market due to the mandated switchover to ICD-10 coding standards in October 2015. This transition may result in a decline in coders’ productivity, thereby resulting in lower profitability for hospitals. The implementation of CAC systems can resolve this issue as they enable healthcare organizations to work more efficiently while complying with procedural coding standards as per ICD-10 guidelines. This trend is expected to provide a strong stimulus to the growth of the CAC market in North America in the coming years.

Increasing Consolidations in the Market - Opening New Avenues for Growth in Computer-Assisted Coding Market

Over the last three years, leading players have focused on expanding their presence by acquiring small, regional/local players. For instance, in 2014, 3M HIS (US) acquired Treo Solutions (US) to expand its real-time data analytics and payment redesign businesses. This acquisition helped 3M in broadening its end-user base for its 360 Encompass System. Product portfolio expansion, product integration, and geographic expansion are some of the key objectives behind such acquisitions. The acquisition of smaller players in the high-growth Asian and Central & Eastern European markets is also a key area of focus for market players. This is because having a direct presence in these countries will prove to be considerably beneficial once developed markets become saturated.

Apart from acquisitions, leading market players are pursuing the strategy of partnerships with small and medium-sized companies in order to offer innovative and comprehensive solutions to their customers. The growing focus on improving the interoperability of CAC solutions is a key factor driving partnerships in this market.

The following are the major objectives of the study.

- To define, describe, and forecast the global computer-assisted coding market on the basis of product and service, mode of delivery, application, end user, and region.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, challenges, and trends)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market players

- To forecast the size of the computer-assisted coding market, in five main regions, namely, North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa

- To profile key players in the global computer-assisted coding market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as expansions, partnerships, and alliances; mergers and acquisitions; new product/technology developments; and research and development activities of the leading players in the market

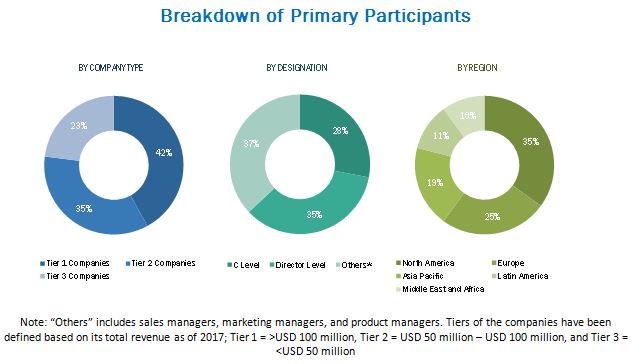

During this research study, major players operating in the computer assisted coding market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The computer assisted coding market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the computer assisted coding market are 3M Health Information Systems (US), Optum (US), McKesson Corporation (US), Nuance Communications (US), Cerner Corporation (US), Dolbey Systems (US), Precyse Solutions (nThrive) (US), Craneware (UK), Artificial Medical Intelligence (US), and TruCode (US). Other players include Quest Diagnostics (US), Streamline Health Solutions (US), M-scribe Technologies (US), eZDI Inc. (US), Alpha II LLC. (US), ID GmbH & Co. KGaA (Germany), ZyDoc (US), Coding Strategies (US), Patient Code Software (US), and Flash Code (US) among others.

Major Market Developments

- 3M Company (US) launched the 3M 360 Encompass System – Professional computer assisted coding software in 2016.

- 3M Company (US) acquired Semfinder (Switzerland), a medical coding technology company, provided 3M with important new coding technology to help accelerate the availability of the 3M 360 Encompass System in countries adopting electronic medical records in 2016.

- In 2016, Optum (US) collaborated with Quest Diagnostics (US), a provider of diagnostic information services, to deliver improved health systems solutions to all segments of the healthcare marketplace.

Target Audience

- Computer-assisted coding software vendors

- Computer-assisted coding service providers

- Healthcare IT solution providers

- Hospitals and clinics

- Academic medical centers

- Nursing homes

- Assisted living facilities

- Healthcare insurance providers

- Market research and consulting firms

- Venture capitalists and investors

Computer Assisted Coding Market Report Scope

Global Computer-assisted Coding Market, by Product & Service

-

Computer-assisted coding solutions

- Standalone computer-assisted coding software

- Integrated computer-assisted coding software

-

Computer-assisted coding services

- Support & maintenance services

- Education & training Services

Global Computer-assisted Coding Market, by Mode Of Delivery

- Web-based

- Cloud-based

- On Premises

Global Computer-assisted Coding Market, by Application

- Automated computer-assisted encoding

- Management reporting & analytics

- Clinical code auditing

Global Computer-assisted Coding Market, by End User

- Payers

-

Providers

- Hospitals

- Physicians/Clinics

- Clinical laboratories & diagnostic centers

- Academic medical centers

- Other healthcare institutions*

*Other Healthcare Institutions (Nursing Homes, Rehabilitation Centers, and Clinical Research Organizations)

Global Computer-assisted Coding Market, by Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Spain

- Italy

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- Australia

- Rest of Asia-Pacific

-

Rest of the world

- Latin America

- Middle East and Africa

Critical questions which the report answers

- What are new application areas which the computer assisted coding companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in Rest of APAC, Latin America, and Middle East and Africa based on product

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global computer-assisted coding market is projected to reach USD 4.75 billion by 2022 at a CAGR of 11.5% during the forecast period. The growth of the market can be attributed to the transition to ICD-10 coding standards from ICD-9 in North America, the rising demand for CAC solutions, the growing need within the global healthcare system to curtail increasing healthcare costs, improve coding accuracy, and streamline the revenue cycle management procedures. However, high implementation and maintenance expenses for computer-assisted coding and lack of on-site CAC support and in-house CAC domain knowledge are likely to hinder the growth of the computer-assisted coding market to some extent.

Computer assisted coding software are used to improve maximize the revenue of organisation by reducing coding errors and maximizing claims reimbursement cycle. Some commonly used computer assisted coding software includes standalone and integrated software. Standalone software is used only for encoding and integrated software is integrated with EHR/EMR, encoder system, voice/text/speech recognition software, CDI, transcription system, and other HIM applications.

The computer assisted coding market has been segmented, on the basis of software and service. The software segment is subsegmented into standalone software and integrated software. The market for integrated computer-assisted coding software segment is expected to grow at the highest CAGR between 2017 and 2022. The growing need for optimized computer-assisted coding software for seamless workflow and successful Data Integration within healthcare provider systems contribute to the rapid growth of the market.

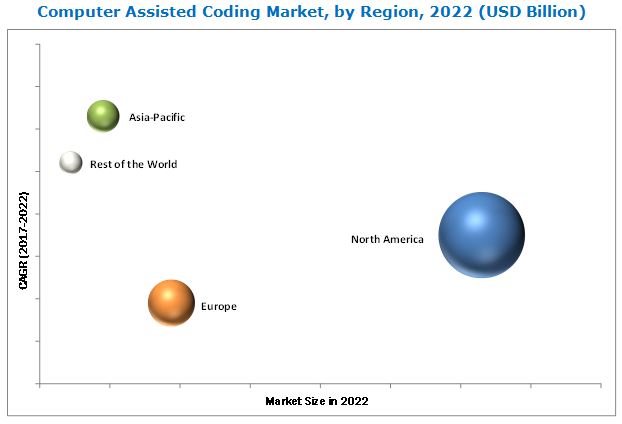

The computer assisted coding market in APAC is expected to grow at the highest CAGR during the forecast period. The growth of this region is primarily driven by the escalating demand to reduce the burden of the healthcare systems, curtail healthcare delivery costs, increasing implementation of Healthcare IT solutions, and the various government initiatives for enabling efficient, affordable, and on-time delivery of quality care. As a result, APAC holds a significant share of the overall computer assisted coding market.

Applications such as automated computer-assisted encoding, management reporting & analytics, and clinical coding auditing drive the growth of computer assisted coding market

Automated Computer-assisted Encoding

Automated computer-assisted encoding is one of those applications enables compliance with regulatory standards for clinical coding, thus ensuring that the information exchanged between different healthcare organizations is consistent, comparable, and meaningful.

Management Reporting & Analytics

The healthcare IT industry is facing challenges to make data accessible, sharable, and actionable. The management reporting and analytics modules of computer-assisted coding are designed to enable coding and revenue managers to monitor and track coding processes throughout the workflow. These tools help in tracking the various stages of coding procedures such as case assignment, recording the point and time of modifications to original coding, and the duration for which the chart was open. With analytics tools, coding data can be examined and used more efficiently in making critical decisions.

Clinical Coding Auditing

Clinical coding auditing reduces regulatory compliance risks by identifying potential patterns for fraud and enables healthcare organizations to maximize reimbursement by improving coding accuracy. Clinical coding audits include a statistical audit, subset audit, percentage audit, and a complete audit. They are aimed at providing a more comprehensive overview of the areas of concern using a more extensive data set. The complete clinical code audit uses all relevant data available to ensure a thorough audit. However, there are a number of solutions in the market that provide customizable auditing options, enabling users to define specific parameters for the information to be used. Such solutions help accelerate the auditing process.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for computer assisted coding software?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The high implementation and maintenance costs and lack of on-site CAC support and in-house CAC domain knowledge are major factor restraining the growth of the market. The American Health Information Management Association (AHIMA) states that the cost of the hardware, initial licensing fees, ongoing maintenance fees, and the requisite IT support for CAC systems can cross USD 500,000 a year for a small health system (1,000 beds). Even though smaller hospitals generally pay less in licensing fees for the software, the per-chart coding cost is usually higher. Also, services and maintenance, which include software upgradation as per changing user requirements, represent a recurring expenditure for healthcare organizations. This has adversely affecting the affordability of various computer assisted coding solutions for organisations.

Key players in the Computer Assisted Coding Market include 3M Health Information Systems (US), Optum (US), McKesson Corporation (US), Nuance Communications (US), Cerner Corporation (US), Dolbey Systems (US), Precyse Solutions (nThrive) (US), Craneware (UK), Artificial Medical Intelligence (US), and TruCode (US). Other players include Quest Diagnostics (US), Streamline Health Solutions (US), M-scribe Technologies (US), eZDI Inc. (US), Alpha II LLC. (US), ID GmbH & Co. KGaA (Germany), ZyDoc (US), Coding Strategies (US), Patient Code Software (US), and Flash Code (US) among others. These players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce new computer assisted coding solutions in the market.

Table of Contents

1 Introduction (Page No. - 22)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 26)

2.1 Research Approach

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Market Share Estimation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 38)

4.1 Growth Potential of the Computer-Assisted Coding Market

4.2 Asia-Pacific: Computer-Assisted Coding Market, By Application

4.3 Global Market: Regional Growth Opportunities

4.4 Global Market, Regional Mix

4.5 Global Market: Developed vs Developing Markets

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Growing Adoption of CAC Solutions in North America Due to the Implementation of ICD-10 Standards

5.2.1.2 Increasing Implementation of Ehr Systems

5.2.1.3 Increasing Utilization of CAC Solutions to Curtail the Rising Healthcare Costs

5.2.1.4 Growing Regulatory Requirements for Patient Data Management

5.2.1.5 Growing Focus on Physician Computer-Assisted Coding in Outpatient Settings

5.2.2 Market Restraints

5.2.2.1 High Implementation and Maintenance Costs

5.2.2.2 Lack of On-Site CAC Support and In-House CAC Domain Knowledge

5.2.3 Market Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Natural Language Processing-Enabled CAC Solutions

5.2.3.3 Growing Adoption of Cloud-Based Solutions

5.2.4 Market Challenges

5.2.4.1 Reluctance Among Healthcare Providers in Emerging Markets to Adopt CAC Solutions

5.2.4.2 High Implementation Cost of Integrated CAC Systems

5.2.5 Market Trend

5.2.5.1 Increasing Consolidation in the Market

6 Industry Insights (Page No. - 54)

6.1 Introduction

6.2 Evolution of Computer-Assisted Coding in the U.S.

6.3 Coding Guidelines

6.3.1 North America

6.3.2 Europe

6.3.3 Asia-Pacific

6.4 Coding Compliance & CAC

6.5 Clinical Documentation Improvement (CDI)

7 Global Computer-Assisted Coding Market, By Product and Service (Page No. - 59)

7.1 Introduction

7.2 Software

7.2.1 Standalone Software

7.2.1.1 Natural Language Processing Software

7.2.1.2 Structured Input Software

7.2.2 Integrated Software

7.3 Services

7.3.1 Support and Maintenance

7.3.2 Education and Training

8 Global Computer-Assisted Coding Market, By Mode of Delivery (Page No. - 74)

8.1 Introduction

8.2 Web-Based Solutions

8.3 On-Premise Solutions

8.4 Cloud-Based Solutions

9 Global Computer-Assisted Coding Market, By Application (Page No. - 82)

9.1 Introduction

9.2 Automated Computer-Assisted Encoding

9.3 Management Reporting and Analytics

9.4 Clinical Coding Auditing

10 Global Computer-Assisted Coding Market, By End User (Page No. - 88)

10.1 Introduction

10.2 Hospitals

10.3 Physician Practices

10.4 Academic Medical Centers

10.5 Clinical Laboratories and Diagnostic Centers

10.6 Other Healthcare Providers

10.7 Payers

11 Global Computer-Assisted Coding Market, By Region (Page No. - 98)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.3 Europe

11.3.1 Germany

11.3.2 U.K.

11.3.3 France

11.3.4 Italy

11.3.5 Spain

11.3.6 Rest of Europe

11.4 Asia-Pacific

11.4.1 Japan

11.4.2 China

11.4.3 Australia

11.4.4 Rest of Asia-Pacific

11.5 Rest of the World

11.5.1 Latin America

11.5.2 Middle East and Africa

12 Competitive Landscape (Page No. - 171)

12.1 Introduction

12.2 Market Share Analysis

12.3 Competitive Leadership Mapping

12.3.1 Visionary Leaders

12.3.2 Innovators

12.3.3 Emerging Companies

12.3.4 Dynamic Differentiators

12.4 Competitive Benchmarking

12.4.1 Business Strategy Excellence (25 Players)

12.4.2 Strength of Product Portfolio (25 Players)

*Top 25 Companies Analyzed for This Studies are - 3M Health Information Systems, Optum, Inc., Mckesson Corporation, Nuance Communications Inc., Cerner Corporation, Dolbey Systems, Inc., Artificial Medical Intelligence, Precyse Solutions, LLC, Trucode, M*Modal IP, LLC, Streamline Health Solutions LLC, Craneware PLC., EPIC Systems Corporation, Athenahealth Inc., Quest Diagnostics, M-Scribe Technologies, LLC, Ezdi, Inc, Coding Strategies, Inc., Alpha Ii, LLC, Id GmbH & Co. KGaA., Imedx, Zydoc, Hrs Coding Elevated, Group One Health Source, One Voice

13 Company Profiles (Page No. - 177)

(Overview, Products Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments)*

13.1 3M Company

13.2 Optum, Inc.

13.3 Nuance Communications, Inc.

13.4 Cerner Corporation

13.5 Mckesson Corporation

13.6 Dolbey Systems, Inc.

13.7 Artificial Medical Intelligence, Inc.

13.8 Craneware PLC.

13.9 Athenahealth, Inc.

13.10 Streamline Health Solutions, Inc.

13.11 Trucode

13.12 M*Modal IP LLC

13.13 Quest Diagnostics Incorporated

13.14 EPIC Systems Corporation

13.15 Precyse Solutions, LLC (Nthrive, Inc.)

*Details on Marketsandmarkets View, Overview, Products Offered, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 231)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (202 Tables)

Table 1 Global Computer-Assisted Coding Market Snapshot

Table 2 Impact Analysis: Market Drivers

Table 3 Impact Analysis: Market Restraints

Table 4 Impact Analysis: Market Opportunities

Table 5 Impact Analysis: Market Challenges

Table 6 Key Collaborations & Partnerships By Leading Market Players (2014–2017)

Table 7 Coding of Diagnosis and Procedures in Europe

Table 8 Global Computer-Assisted Coding Market, By Product and Service, 2015–2022 (USD Million)

Table 9 Global Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 10 Global Computer-Assisted Coding Software Market, By Country, 2015–2022 (USD Million)

Table 11 Standalone Computer-Assisted Coding Offerings By Key Market Players

Table 12 Global Standalone Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 13 Global Standalone Computer-Assisted Coding Software Market, By Country, 2015–2022 (USD Million)

Table 14 Global CAC Natural Language Processing Software Market, By Country, 2015–2022(USD Million)

Table 15 Global CAC Structured Input Software Market, By Country, 2015–2022(USD Million)

Table 16 Integrated Computer-Assisted Coding Offerings By Key Market Players

Table 17 Global Integrated Software Market, By Country, 2015–2022 (USD Million)

Table 18 Global Computer-Assisted Coding Services Market, By Type, 2015–2022(USD Million)

Table 19 Global Computer-Assisted Coding Services Market, By Country, 2015–2022 (USD Million)

Table 20 Global CAC Support and Maintenance Services Market, By Country, 2015–2022 (USD Million)

Table 21 Global CAC Education and Training Services Market, By Country, 2015–2022 (USD Million)

Table 22 Global Computer-Assisted Coding Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 23 Web-Based Solution Offerings By Key Market Players

Table 24 Web-Based Computer-Assisted Coding Market, By Country, 2015–2022 (USD Million)

Table 25 On-Premise Solution Offerings By Key Market Players

Table 26 Global On-Premise Computer-Assisted Coding Market, By Country, 2015–2022 (USD Million)

Table 27 Cloud-Based Solution Offerings By Key Market Players

Table 28 Cloud-Based Computer-Assisted Coding Market, By Country, 2015–2022 (USD Million)

Table 29 Global Computer-Assisted Coding Market, By Application, 2015–2022 (USD Million)

Table 30 Automated Computer-Assisted Encoding Market, By Country, 2015–2022 (USD Million)

Table 31 Management Reporting and Analytics Market, By Country, 2015–2022 (USD Million)

Table 32 Clinical Coding Auditing Market, By Country, 2015–2022 (USD Million)

Table 33 Global Computer-Assisted Coding Market, By End User, 2015–2022 (USD Million)

Table 34 Global Market for Healthcare Providers, By Country/Region, 2015–2022 (USD Million)

Table 35 Global Market for Healthcare Providers, By Type, 2015–2022 (USD Million)

Table 36 Global Market for Hospitals, By Country/Region, 2015–2022 (USD Million)

Table 37 Global Market for Physician Practices, By Country/Region, 2015–2022 (USD Million)

Table 38 Global Computer-Assisted Coding Market for Academic Medical Centers, By Country/Region, 2015–2022 (USD Million)

Table 39 Global Market for Clinical Laboratories & Diagnostic Centers, By Country/Region, 2015–2022 (USD Million)

Table 40 Global Market for Other Healthcare Providers, By Country/Region, 2015–2022 (USD Million)

Table 41 Global Market for Healthcare Payers, By Country/Region, 2015–2022 (USD Million)

Table 42 Global Market, By Region, 2015–2022 (USD Million)

Table 43 North America: Computer-Assisted Coding Market, By Country, 2015–2022 (USD Million)

Table 44 North America: Market, By Product & Service, 2015–2022 (USD Million)

Table 45 North America: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 46 North America: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 47 North America: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 48 North America: Computer-Assisted Coding Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 49 North America: Market, By Application, 2015–2022 (USD Million)

Table 50 North America: Market, By End User, 2015–2022 (USD Million)

Table 51 North America: Market for Providers, By Type, 2015–2022 (USD Million)

Table 52 U.S.: Macroeconomic Indicators for the Computer-Assisted Coding Market

Table 53 U.S.: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 54 U.S.: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 55 U.S.: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 56 U.S.: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 57 U.S.: Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 58 U.S.: Market, By Application, 2015–2022 (USD Million)

Table 59 U.S.: Market, By End User, 2015–2022 (USD Million)

Table 60 U.S.: Market for Providers, By Type, 2015–2022 (USD Million)

Table 61 Canada: Macroeconomic Indicators for the Computer-Assisted Coding Market

Table 62 Canada: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 63 Canada: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 64 Canada: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 65 Canada: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 66 Canada: Computer-Assisted Coding Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 67 Canada: Market, By Application, 2015–2022 (USD Million)

Table 68 Canada: Market, By End User, 2015–2022 (USD Million)

Table 69 Canada: Market for Providers, By Type, 2015–2022 (USD Million)

Table 70 Europe: Computer-Assisted Coding Market, By Country, 2015–2022 (USD Million)

Table 71 Europe: Market, By Product & Service, 2015–2022 (USD Million)

Table 72 Europe: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 73 Europe: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 74 Europe: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 75 Europe: Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 76 Europe: Computer-Assisted Coding Market, By Application, 2015–2022 (USD Million)

Table 77 Europe: Market, By End User, 2015–2022 (USD Million)

Table 78 Europe: Market for Providers, By Type, 2015–2022 (USD Million)

Table 79 Germany: Macroeconomic Indicators for the Computer-Assisted Coding Market

Table 80 Germany: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 81 Germany: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 82 Germany: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 83 Germany: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 84 Germany: Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 85 Germany: Computer-Assisted Coding Market, By Application, 2015–2022 (USD Million)

Table 86 Germany: Market, By End User, 2015–2022 (USD Million)

Table 87 Germany: Market for Providers, By Type, 2015–2022 (USD Million)

Table 88 U.K.: Macroeconomic Indicators for the Computer-Assisted Coding Market

Table 89 U.K.: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 90 U.K.: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 91 U.K.: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 92 U.K.: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 93 U.K.: Computer-Assisted Coding Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 94 U.K.: Market, By Application, 2015–2022 (USD Million)

Table 95 U.K.: Market, By End User, 2015–2022 (USD Million)

Table 96 U.K.: Market for Providers, By Type, 2015–2022 (USD Million)

Table 97 France: Macroeconomic Indicators for the Computer-Assisted Coding Market

Table 98 France: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 99 France: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 100 France: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 101 France: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 102 France: Computer-Assisted Coding Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 103 France: Market, By Application, 2015–2022 (USD Million)

Table 104 France: Market, By End User, 2015–2022 (USD Million)

Table 105 France: Market for Providers, By Type, 2015–2022 (USD Million)

Table 106 Italy: Macroeconomic Indicators for the Computer-Assisted Coding Market

Table 107 Italy: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 108 Italy: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 109 Italy: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 110 Italy: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 111 Italy: Computer-Assisted Coding Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 112 Italy: Market, By Application, 2015–2022 (USD Million)

Table 113 Italy: Market, By End User, 2015–2022 (USD Million)

Table 114 Italy: Market for Providers, By Type, 2015–2022 (USD Million)

Table 115 Spain: Macroeconomic Indicators for the Computer-Assisted Coding Market

Table 116 Spain: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 117 Spain: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 118 Spain: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 119 Spain: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 120 Spain: Computer-Assisted Coding Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 121 Spain: Market, By Application, 2015–2022 (USD Million)

Table 122 Spain: Market, By End User, 2015–2022 (USD Million)

Table 123 Spain: Market for Providers, By Type, 2015–2022 (USD Million)

Table 124 RoE: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 125 RoE: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 126 RoE: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 127 RoE: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 128 RoE: Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 129 RoE: Computer-Assisted Coding Market, By Application, 2015–2022 (USD Million)

Table 130 RoE: Market, By End User, 2015–2022 (USD Million)

Table 131 RoE: Market for Providers, By Type, 2015–2022 (USD Million)

Table 132 APAC: Computer-Assisted Coding Market, By Country, 2015–2022 (USD Million)

Table 133 APAC: Market, By Product & Service, 2015–2022 (USD Million)

Table 134 APAC: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 135 APAC: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 136 APAC: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 137 APAC: Computer-Assisted Coding Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 138 APAC: Market, By Application, 2015–2022 (USD Million)

Table 139 APAC: Market Systems Market, By End User, 2015–2022 (USD Million)

Table 140 APAC: Market for Providers, By Type, 2015–2022 (USD Million)

Table 141 Japan: Macroeconomic Indicators for the Computer-Assisted Coding Market

Table 142 Japan: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 143 Japan: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 144 Japan: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 145 Japan: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 146 Japan: Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 147 Japan: Computer-Assisted Coding Market, By Application, 2015–2022 (USD Million)

Table 148 Japan: Market, By End User, 2015–2022 (USD Million)

Table 149 Japan: Market for Providers, By Type, 2015–2022 (USD Million)

Table 150 China: Macroeconomic Indicators for the Computer-Assisted Coding Market

Table 151 China: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 152 China: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 153 China: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 154 China: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 155 China: Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 156 China: Computer-Assisted Coding Market, By Application, 2015–2022 (USD Million)

Table 157 China: Market, By End User, 2015–2022 (USD Million)

Table 158 China: Market for Providers, By Type, 2015–2022 (USD Million)

Table 159 Australia: Macroeconomic Indicators for the Computer-Assisted Coding Market

Table 160 Australia: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 161 Australia: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 162 Australia: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 163 Australia: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 164 Australia: Computer-Assisted Coding Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 165 Australia: Market, By Application, 2015–2022 (USD Million)

Table 166 Australia: Market, By End User, 2015–2022 (USD Million)

Table 167 Australia: Market for Providers, By Type, 2015–2022 (USD Million)

Table 168 India: Macroeconomic Indicators for the Computer-Assisted Coding Market

Table 169 RoAPAC: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 170 RoAPAC: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 171 RoAPAC: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 172 RoAPAC: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 173 RoAPAC: Computer-Assisted Coding Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 174 RoAPAC: Market, By Application, 2015–2022 (USD Million)

Table 175 RoAPAC: Market, By End User, 2015–2022 (USD Million)

Table 176 RoAPAC: Market for Providers, By Type, 2015–2022 (USD Million)

Table 177 RoW: Computer-Assisted Coding Market, By Region, 2015–2022 (USD Million)

Table 178 RoW: Market, By Product & Service, 2015–2022 (USD Million)

Table 179 RoW: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 180 RoW: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 181 RoW: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 182 RoW: Computer-Assisted Coding Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 183 RoW: Market, By Application, 2015–2022 (USD Million)

Table 184 RoW: Market, By End User, 2015–2022 (USD Million)

Table 185 RoW: Market for Providers, By Type, 2015–2022 (USD Million)

Table 186 Latin America: Macroeconomic Indicators for the Computer-Assisted Coding Market

Table 187 Latin America: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 188 Latin America: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 189 Latin America: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 190 Latin America: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 191 Latin America: Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 192 Latin America: Computer-Assisted Coding Market, By Application, 2015–2022 (USD Million)

Table 193 Latin America: Market, By End User, 2015–2022 (USD Million)

Table 194 Latin America: Market for Providers, By Type, 2015–2022 (USD Million)

Table 195 Middle East and Africa: Computer-Assisted Coding Market, By Product & Service, 2015–2022 (USD Million)

Table 196 Middle East and Africa: Computer-Assisted Coding Software Market, By Type, 2015–2022 (USD Million)

Table 197 Middle East and Africa: Standalone Software Market, By Type, 2015–2022 (USD Million)

Table 198 Middle East and Africa: Computer-Assisted Coding Services Market, By Type, 2015–2022 (USD Million)

Table 199 Middle East and Africa: Market, By Mode of Delivery, 2015–2022 (USD Million)

Table 200 Middle East and Africa: Market, By Application, 2015–2022 (USD Million)

Table 201 Middle East and Africa: Market, By End User, 2015–2022 (USD Million)

Table 202 Middle East and Africa: Market for Providers, By Type, 2015–2022 (USD Million)

List of Figures (40 Figures)

Figure 1 Global Computer-Assisted Coding Market

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Computer-Assisted Coding Software to Dominate the Market During the Forecast Period

Figure 7 Integrated CAC Software Segment Will Continue to Dominate the Market During the Forecast Period

Figure 8 Automated Computer-Assisted Encoding Application Segment to Register the Highest Growth During the Forecast Period

Figure 9 Providers End-User Segment to Show Highest Growth in the Coming Years

Figure 10 Hospitals End-User Segment Among Providers to Show Highest Growth in the Coming Years

Figure 11 North America Dominated the Global Computer-Assisted Coding Market in 2016

Figure 12 Attractive Growth Opportunities in the Global Market

Figure 13 Automatic Computer-Assisted Encoding Accounted for A Major Share of the Computer-Assisted Coding Market in the APAC Region

Figure 14 The U.S. Commands Over Half of the Global Computer-Assisted Coding Market

Figure 15 North America to Dominate the Global Market in the Forecast Period

Figure 16 Developing Markets to Register A Higher Growth in the Forecast Period

Figure 17 Global Market: Drivers, Restraints, Opportunities, Challenges, & Trends

Figure 18 CAC-Compliance Outcome

Figure 19 Global Market, By Product and Service, 2017 and 2022

Figure 20 Integrated CAC Software Accounted for the Largest Share of the Computer-Assisted Coding Market in 2016

Figure 21 Cloud-Based Solutions Segment to Witness the Highest Growth Rate During the Forecast Period

Figure 22 Automated Computer-Assisted Encoding to Dominate the Global Computer-Assisted Coding Market in 2017

Figure 23 Providers—Largest End-User Segment in the Global Market

Figure 24 Hospitals—Largest End-User Segment Among Providers in the Global Market

Figure 25 Global Market, By Region, 2017 and 2022

Figure 26 Global Computer-Assisted Coding Market: Geographic Snapshot

Figure 27 North American CAC Market Snapshot

Figure 28 Europe: CAC Market Snapshot

Figure 29 Asia-Pacific: CAC Market Snapshot

Figure 30 Global Market Share Analysis, By Key Player, 2016

Figure 31 Competitive Leadership Mapping: Computer-Assisted Coding Market

Figure 32 3M Company: Company Snapshot (2016)

Figure 33 Optum, Inc.: Company Snapshot (2016)

Figure 34 Nuance Communications, Inc.: Company Snapshot (2016)

Figure 35 Cerner Corporation: Company Snapshot (2016)

Figure 36 Mckesson Corporation: Company Snapshot (2016)

Figure 37 Craneware PLC.: Company Snapshot (2016)

Figure 38 Athenahealth, Inc.: Company Snapshot (2016)

Figure 39 Streamline Health Solutions, Inc.: Company Snapshot (2016)

Figure 40 Quest Diagnostics Incorporated: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Computer Assisted Coding Market